3 Best Cruise Line Stocks to Buy Now

- Norwegian Cruise Line Holdings Ltd (NYSE:NCLH)

- Lindblad Expeditions (NASDAQ:LIND)

- The Walt Disney Co (NYSE:DIS)

Three best cruise line stocks to buy now include an exotic adventure-tourism agency, a media and entertainment giant and the third-largest cruise line in the world.

Cruise lines have been some of the hardest-hit stocks over the past two years due to the COVID-19 pandemic. While the original strain of COVID-19 shut down the industry, successive waves of Delta and Omicron variants have forced companies to implement multiple stop-start operations on the road to recovery.

As a result, most cruise lines remain at a fraction of their pre-COVID-19 original share price, while many other industries have experienced a quick rebound. However, the discounted share prices in the cruise line industry are a blessing rather than a bane for investors, since the industry is on the brink of its own rally.

At the end of 2021, Cruise Lines International Association (CLIA), an industry trade association, reported over 75% of its members’ ocean-going capacity had returned to service. The CLIA expects nearly 100% ocean-going capacity by the end of July 2022.

Global passenger numbers are projected to return to 95% of its 2019 levels, up from 17 million in 2021 to reach an estimated 95 million in 2022. The rally is due to the industry’s resilient and robust consumer base that gives cruise lines the potential for long-term success. In addition, 80% of cruise line travelers report a willingness to travel again, matching pre-pandemic levels.

Similar shocks have slowed the industry in the past. Resurgence of COVID-19 cases have repeatedly hampered reopening efforts by cruise lines. However, this recovery possesses different energy. The Omicron variant of COVID-19 is “outcompeting” the more dangerous but less contagious Delta variant, giving hundreds of millions of people worldwide an additional layer of natural immunity against the virus.

It is no longer just cruise lines attempting to lift restrictions. National governments across the globe, ranging from Israel to the United Kingdom, have begun pursuing return to normalcy policies. At home, even states with the most stringent COVID-19 policies have begun lifting mask

Cruise lines have laid largely dormant over the last two years, but the light at the end of the tunnel is getting much stronger for investors. Multiple industry stocks have received triple-digit revenue growth and double-digit return projections for 2022. By picking the right cruise line stocks, savvy investors have the opportunity to generate returns similar to growth stocks, while retaining the safety of investing in a traditional mature industry with large barriers to entry.

3 Best Cruise Line Stocks to Buy Now: #3

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH)

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) is an American cruise line founded in 1966 and headquartered in Miami, Florida. The company operates 28 ships across three brands: Norwegian, Oceania and Regent Seven Seas. Norwegian is the third-largest cruise line worldwide by passenger count and has a market capitalization (market cap) of $8.5 billion.

[Exclusive: Daymond John, “The People's Shark,” reveals where he's investing]

Norwegian has seen its revenue plummet by 86.7% over the past 12 months and by 69.% over the last three years. NCLH also has seen its stock drop by 15.1% over 12 months due to the emergence of the Delta and Omicron variants. NLCH’s change in share price is graphed below along with a 50-day moving average.

However, evaluating a cruise line by its performance over the last few years is untenable. The global cruise line industry has seen limited action due to the spread of COVID-19 and its variants, a factor in which the companies have little control. With the industry seemingly on the brink of returning to normalcy, 16 new cruise ships by CLIA members are due to set sail in 2022 to meet increasing demand. Financial figures from recent years are unreliable for future projections; Norwegian presents cruise line investors with the best opportunity to capitalize on the coming rebound.

Norwegian has historically been one of the largest and most profitable cruise lines globally. From 2014 to 2019, the company experienced a compound annual growth rate (CAGR) of 15.6% in revenue and a CAGR of 22.4% in net income. Pre-COVID-19, Norwegian maintained a 9.0% market share in the industry.

The company pioneered the idea of freestyle cruising, which ditched the idea of dress codes and formal nights for a more relaxed atmosphere. The flexibility of freestyle cruising has allowed Norwegian to readily appeal to families and younger travelers since its founding, a reputation that remains with the company.

For investors, Norwegian’s main appeal is the company’s aggressive approach towards reopening. The company is set to be one of the first cruise lines back to near-normal operations. Chief Executive Officer Frank Del Rio announced in October 2021 that all 28 ships in Norwegian’s fleet would be back in operation by April 2022. The company is forecast to experience a 31,668.1% surge in sales for Q2 2022 as it returns to relative normalcy

However, Norwegian also maintains one of the strictest COVID-19 safety protocols of any cruise line. Guests are required to present proof of vaccine and a negative COVID-19 test, as well as submit to an antigen test on arrival. Although possessing stringy COVID-19 policies is not full proof, it does give the company the best chance to resist the turbulent reopenings and re-closings that have hampered the travel industry during the pandemic.

Norwegian’s commitment to freestyle cruising and aggressive approach towards combating COVID-19 has allowed the company to garner sky-high projections for the coming months. The company is projected to see a 753.2% increase in revenue and return to profitability with an earnings per share (EPS) of $1.42 in 2022. The cruise line has placed orders for seven additional ships of its new Prima class cruise liners to meet increasing demand in the coming decade.

Although Norwegian was one of the cruise lines that garnered potential bankruptcy concerns in 2020 due to COVID-19 causing the travel industry to grind to a halt, it primarily has quashed most of those fears. Norwegian maintains a cash stockpile of $1.9 billion and a manageable current ratio, a measure of a company’s ability to cover near-future liabilities, of 1.1. With Norwegian ripe for rebound and possessing a healthy balance sheet, the light at the end of the tunnel has become bright for its investors.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $30.00, 49.8% higher than its latest closing price of $20.03, earning NLCH a “BUY” recommendation from Stock Rover and a place among our three best cruise line stocks to buy now.

[“The People's Shark” is Helping Everyday Americans Discover the Next Huge Startup]

3 Best Cruise Line Stocks to Buy Now: #2

Lindblad Expeditions (NASDAQ:LIND)

Lindblad Expeditions (NASDAQ:LIND) is a New York-based tourism and adventure-services company. Lindblad offers interactive trips, primarily centered around cruises, to exotic locations around the globe to connect consumers to nature, wildlife and history. The company possesses a market cap of $843 million and owns 10 expedition ships, with another five chartered seasonally.

Lindblad Expeditions was founded in 1979 as Special Expeditions. It initially offered expeditions primarily centered around Antarctica and the Galapagos Islands. The company experienced modest growth in its first few decades, adding trips to Canada, Alaska and Baja, California, in the 1980s and permanently stationing ships in the Galapagos in the late 1990s. However, the turn of the 21st century brought about a sharp increase in consumer interest towards the environment, and Lindblad quickly took off.

To capitalize on growing worldwide interest in green initiatives, Lindblad Expeditions signed a strategic alliance with National Geographic in 2004. The partnership remains strong to this day, with all 10 ships owned by Lindblad bearing the National Geographic name. In 2013, the company performed an initial public offering (IPO) and acquired Orion Expedition Cruises before joining the NASDAQ in 2015.

Lindblad Expedition has increased its fleet capacity by 70% since its 2015 IPO, including a 40% expansion in 2021. However, we have only just begun to enter Lindblad’s growth stage. The global adventure tourism market, valued at $112.2 billion in 2020, is forecast to balloon to $1.2 trillion by 2028, equaling a CAGR of 20.1%. Lindblad’s unique partnership with National Geographic’s 912 million consumers provides access to a significant portion of the adventure tourism market worldwide.

The company has a smaller customer base than major cruise lines like Royal Caribbean (NYSE:RCL) or Carnival (NYSE:CCL). However, adventure tourism to Antarctica or French Polynesia attracts a loyal consumer group that many tourism-related companies are eager to obtain. Plus, 40% of Lindblad’s guests are repeat customers, and travelers possess a median net worth of over $2 million.

Long-term customers are the most important source of revenue for nearly every company. Satisfied customers buy or use a company’s product at higher rates, are less sensitive to price fluctuations, provide referrals and are less expensive than finding new clients. Lindblad’s unique and dedicated consumer base enables it to be an attractive investment despite being more niche than other cruise lines.

Lindblad is projected to see its revenue skyrocket by 160.4% in 2022 as the global economy recovers from the COVID-19 pandemic. Expedition bookings are already up by 51% year-on-year compared to the same time of 2021. The company will only see increased interest in the coming decades as citizens around the globe become more dedicated to environmentalism. Generation Z has quickly proven to be the most environmentally conscious generation ever, even in emerging markets like China and India.

LIND has seen growth by 9.3% over the past 12 months, graphed below alongside a 50-day moving average.

Like other cruise lines and travel companies, COVID-19 hit Lindblad Expeditions hard. The company saw its 2019 revenue of $343 million plummet to $82 million in 2020 and $82 million in 2021. The company had yet to report 2021 revenue by press time.

Lindblad has managed to counter its drop in sales by raising its balance sheet cash from $102 million in 2019 to $156 million in 2020. Using debt to finance a company’s operations can be risky. Still, Lindblad has managed to keep its current ratio steady at 0.9. Lindblad’s projected rebound and growth in 2022 should ease any fears of potential insolvency.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $20.25, 22.6% higher than its latest closing price of $16.52, earning LIND a “BUY” recommendation from Stock Rover and a place among our three best cruise line stocks to buy now.

[Daymond John: “I'm Investing $100K into These Small Businesses”]

3 Best Cruise Line Stocks to Buy Now: #1

The Walt Disney Co (NYSE:DIS)

The Walt Disney Co. (NYSE:DIS), commonly known as Disney, is an international media and entertainment corporation headquartered in Burbank, California. Founded in 1923 by film producer and animator Walt Disney, the company rapidly emerged as a powerhouse in the entertainment industry. Led by aggressive acquisition strategies, Disney has since reached a market cap of $258.3 billion with over a dozen major subsidiaries in its portfolio, including Pixar, Hulu, Marvel Entertainment and 20th Century Fox, among others.

Although Disney’s cruises may fall under the shadow of its movies and theme parks, they have become an integral part of the entertainment giant’s brand and cash flow. Disney’s cruise ships provide an opportunity for consumers to interact and bond with the company’s iconic characters and images in a way not available in other venues.

As a sign of Disney’s commitment to the cruise industry, the Disney Wish, the new flagship of Disney Cruise Lines, is set to begin its maiden voyage on July 19, 2022. The ship, possessing a multitude of Disney-themed attractions, from Marvel-themed dining experiences to a Star Wars lounge, is a testament to the entertainment giant’s ability to bring its characters from the screen into life.

The mix of traditional entertainment of shows and exotic islands combined with iconic Disney characters from blockbuster shows and movies, provides a way for Disney Cruise Lines to differentiate itself from its competitors. It is no coincidence that Walt Disney ranks the highest in customer satisfaction among cruise lines.

Disney also provides a buffer against the uncertainty of COVID-19. The company has two business segments. Disney’s Parks, Experiences and Products business segment, which includes theme parks and cruises, only accounts for approximately 25% of the company’s revenue. Media and Entertainment Distribution, the business segment responsible for shows and movies, has had an 18.8% growth in revenue since the end of 2019, in large part due to its streaming platforms.

Disney Plus and Hulu have seen their combined subscriber count jump by 284.5% since Q1 of 2020. However, Disney’s streaming success is not confined to Media and Entertainment Distribution.

Walt Disney’s main asset is its brand. The appeal of its theme parks and cruises primarily arises from the connections individuals make with the Disney brand through its characters, shows and movies. The company currently possesses the seventh most valuable brand in the world, ahead of McDonald’s, Nike and even Louis Vuitton. The success of its streaming platforms has allowed Disney’s brand to grow by 18% in 2020 (most recent available data). For comparison, the brand values of Apple (Nasdaq: AAPL) and Walmart (NYSE: WMT) saw 17% and 12% increases in the same year, respectively.

The additional success of recent shows and movies since 2020 like The Mandalorian, Spider-Man: No Way Home and WandaVision has only bolstered Disney’s brand. Furthermore, the company’s original content is only expected to expand as the streaming wars between Walt Disney, HBO and Netflix Inc. (NASDAQ: NFLX) heat up. As a result, Disney Cruise Lines should expect a significant trickle-down effect from the success of its Media and Entertainment Distribution by way of new customers as soon as this summer with tourism expected to recover. DIS is expected to see its sales rise by 26.2% in 2022.

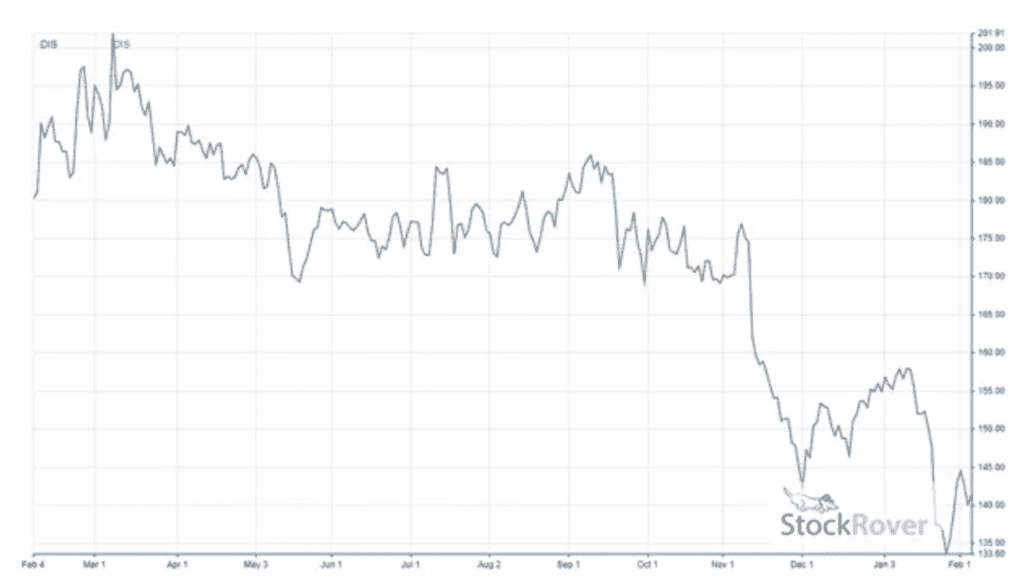

DIS has seen its share price drop by 20.9% over the trailing 12 months due to lower-than-expected Disney Plus subscriber numbers in 2021. However, the platform remains red hot and is expected to surpass Netflix for the number one spot in the streaming industry for subscribers by 2025. Disney’s stock movements over the past year are shown below alongside a 50-day moving average.

A discounted cash flow (DCF) analysis, using Stock Rover, values the stock at $197.13, 40.8% higher than its latest closing price of $140.03, earning DIS a “STRONG BUY” recommendation from Stock Rover and a place among our three best cruise line stocks to buy now.

[Daymond John: America’s Comeback Summit – “I’m Investing 100K in This”]