Bitcoin’s scintillating rally in 2021 shows its rapid evolution from being a mere buzzword to a powerful digital currency. The cryptocurrency is up more than 99% year to date and has surpassed $1 trillion in market capitalization.

Bitcoin’s rally is also helping the underlying blockchain technology gain prominence. Blockchain is actually an electronic distributed ledger. It is relatively faster in closing a transaction as the need for manual processing and authentication by intermediaries is eliminated as it deploys a distributed consensus.

Moreover, as blockchain uses distributed consensus, it is difficult to alter data on the system without alerting the entire network. This makes the system enormously secure.

Both bitcoin and blockchain present significant investment opportunities. Let’s dig deep.

Bitcoin’s Growing Acceptance

Bitcoin has shown promises of becoming a widely-accepted digital currency, thanks to recent endorsements by institutional investors. Tesla’s (TSLA) investment of $1 billion in bitcoin and its plan to accept the digital currency as a payment instrument for its cars have been a game changer for the cryptocurrency.

[Alert: Get in Position Now for the Beginning of the Next 1,000% Crypto Superboom]

Moreover, Twitter’s CEO Jack Dorsey along with rapper Jay Z recently launched a bitcoin development fund by investing 500 bitcoins. Square (SQ) , which is also headed by Dorsey, recently bought $50 million worth of bitcoin. Further, Square peers Paypal and Mastercard have been taking initiatives to embrace the digital currency.

Further, the world’s largest institutional holder of the digital currency – Grayscale Bitcoin Trust – plans to convert the trust into an exchange-traded fund (ETF). Additionally, Coinbase Global, the largest U.S. cryptocurrency exchange, is set to trade publicly through direct listing on Apr 14. Both these developments are expected to boost bitcoin’s attractiveness among investors.

Of late, banking giants J.P. Morgan and Goldman Sachs have shown interest in dealing with bitcoin. Markedly, bitcoin faces significant regulatory pressure around the world. Central banks have been reluctant to approve bitcoin’s legitimacy, primarily due to its volatility, which has hindered crypto’s potential to gain mass adoption. In fact, the Securities and Exchange Commission has so far declined to approve a bitcoin ETF due to volatility and lack of price transparency.

Banks, among financial institutions, generally face significant regulatory scrutiny because of their role in the economy. This has been a major reason behind their reluctancy in accepting bitcoin. In fact, during 2017 rally, J.P. Morgan CEO Jamie Dimon famously called bitcoin a ‘fraud,’ and “worse than tulip bulbs,” referring to the Dutch tulip bubble burst in the 1600s. Hence, likely change in stance by banking majors bodes well for bitcoin’s future in the long haul.

In fact, the pandemic has raised the need for an alternative currency. Bitcoin has been benefiting from solid adoption by millennials and Gen X, who are looking to hedge against coronavirus-induced weakness in traditional currencies, including U.S. dollar as well as inflation.

[Discover: The Top Cryptocurrencies to Buy, and When to Buy them, for Maximum Crypto Profits]

Blockchain Growth Prospects Aplenty

Blockchain is enabling enterprises and government agencies to tackle prominent issues, including data tracing, security, visibility and management, and supply chain supervision.

The technology is being utilized to enhance smart payment systems, secure financial transactions, advance shipping and transportation, modernize government agencies and institutions, and even detect critical illnesses.

Markedly, per Fortune Business Insights report, the worldwide global market for blockchain is forecast to witness a CAGR of 56.1% between 2020 and 2027 and reach $69.04 billion. Moreover, according to PwC, blockchain has the “potential to add $1.76 trillion to the global economy by 2030.”

Top Picks

Here we discuss four stocks that are well-poised to gain from the growth opportunities presented by bitcoin as well as blockchain’s growing prominence. These stocks sport a Zacks Rank #1 (Strong Buy) or 2 (Buy).

Marathon Digital Holdings

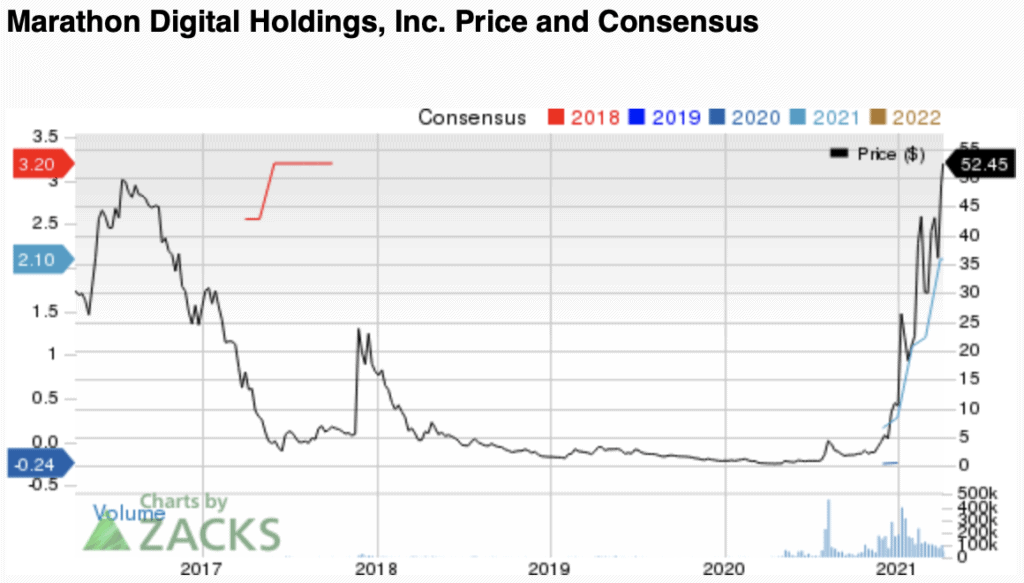

Marathon Digital Holdings (MARA) produced 196 newly minted bitcoins in the first quarter of 2021, increasing total bitcoin holdings to 5,134.2 that has a market value of roughly $301.9 million, as of Mar 31, 2021.

This Zacks Rank #1 company’s active mining fleet at the end of the reported quarter consisted of nearly 6,800 miners, generating approximately 0.71 Exahash per second (EH/s).

[Read: Why demand for cryptos is exploding – plus 8 cryptos you must avoid like the plague]

Moreover, Marathon recently announced a North American bitcoin mining pool, which will be in compliance with the U.S. cryptocurrency regulations, thanks to technology licensed from DMG Blockchain. The pool will be accepting new miners beginning June 2021.

The Zacks Consensus Estimate for its 2021 earnings has been revised upward by 75% in 60 days’ time to $2.10 per share.

Riot Blockchain

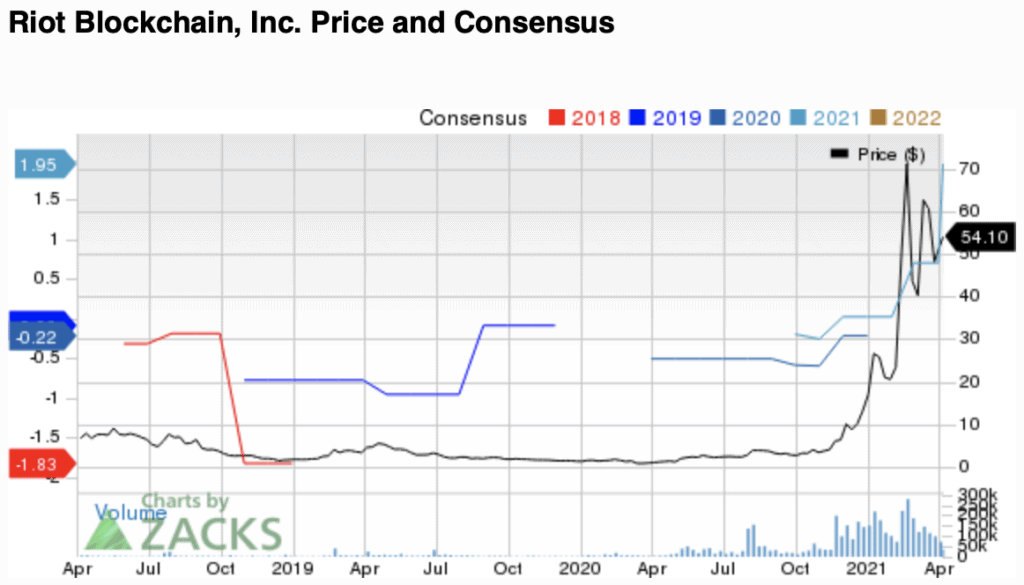

One of the first publicly-traded blockchain companies, Riot Blockchain (RIOT) is riding on its efforts to expand and upgrade mining capabilities, securing the most energy efficient miners currently available. This Zacks Rank #2 company produced 302 newly mined bitcoin in the fourth quarter of 2020. In January and February 2021, Riot produced 125 and 179 newly-mined bitcoin, respectively.

Markedly, in February, Riot achieved an estimated hash rate capacity of 1.06 EH/s with the deployment of the newly received 2,002 S19 Pro Antminers. The company is on track to triple its current deployed capacity by the fourth quarter of 2021.

Additionally, Riot’s focus on reducing the cost of bitcoin production is expected to boost profitability.

[Alert: Get in Position Now for the Beginning of the Next 1,000% Crypto Superboom]

The Zacks Consensus Estimate for its 2021 earnings has been revised upward by 178.6% in 60 days’ time to $1.95 per share.

NVIDIA

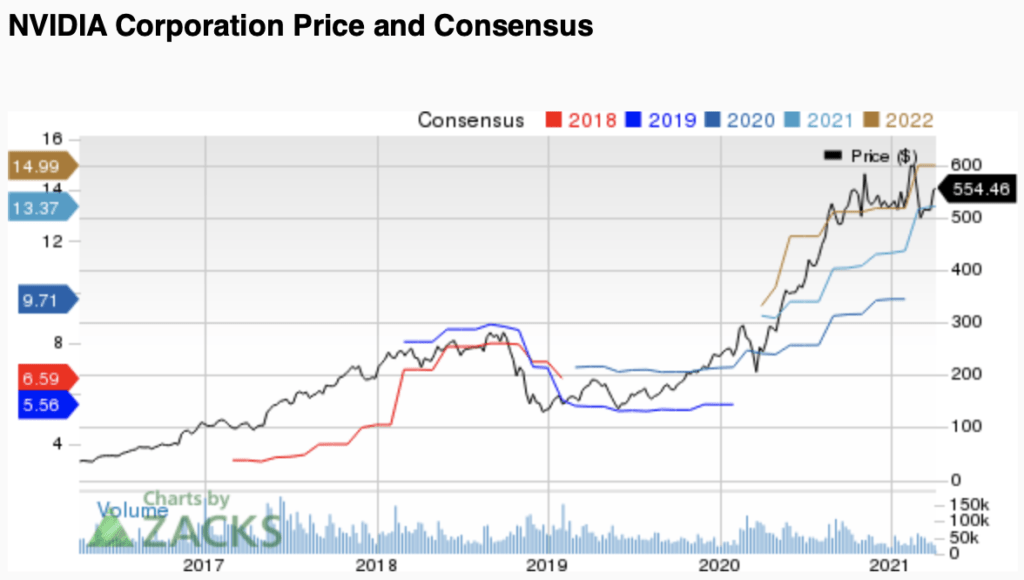

Another Zacks Rank #2 company, NVIDIA (NVDA), is benefiting from strong demand for mining cryptocurrencies. Markedly, crypto mining contributed revenues between $100 million and $300 million in fourth-quarter fiscal 2021.

The company recently launched Cryptocurrency Mining Processor (CMP), a product line for professional mining. CMPs enables improved airflow while mining and also have a lower peak core voltage and frequency, which improve mining power efficiency. For the first quarter of fiscal 2021, NVIDIA expects CMP to contribute revenues of $50 million.

The consensus mark for fiscal 2022 earnings stands at $13.37 per share, having moved 15.1% north over the past 60 days.

Microsoft

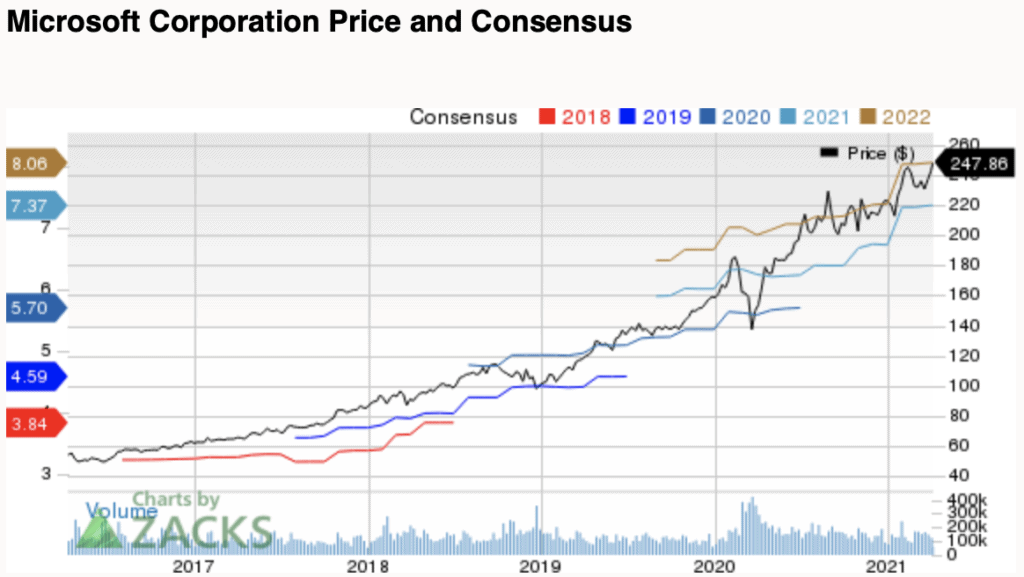

Finally, Microsoft’s (MSFT) endeavors with blockchain technology are noteworthy. The company’s Azure Blockchain Service is a fully-managed ledger service that provides support for the Ethereum Quorum ledger using the Istanbul Byzantine Fault Tolerance (IBFT) consensus mechanism.

[Discover: The Top Cryptocurrencies to Buy, and When to Buy them, for Maximum Crypto Profits]

Last year, Microsoft and Ernst & Young LLP announced the expansion of the former’s blockchain-based solution for gaming rights and royalty management.

Moreover, in March 2021, Microsoft’s Decentralized Identity team launched the ION Decentralized Identifier (DID) network on the Bitcoin mainnet. The network uses bitcoin’s blockchain to create digital IDs for authenticating identity online.

The Zacks Consensus Estimate for this Zacks Rank #2 company’s fiscal 2021 earnings has been revised upward by 0.4% in 60 days’ time to $7.37 per share.

[See Also: The Four Altcoins to Buy NOW for 1,000% and Beyond]