Cryptocurrencies may not be perfect, but don't let anyone tell you they're not viable.

If they weren't, central banks, governments, and Wall Street insiders wouldn't be panicking.

And they are panicking.

In May, the Chinese government issued a public warning about trading and mining crypto. And earlier this month, Beijing started sprawling efforts to shut down cryptomining operations just hours after popular internet companies began censoring searches for three of the nation's largest crypto exchanges.

Those moves were a long-time coming when you consider China banned banks from handling Bitcoin and other digital currencies in 2013.

Clearly policymakers back then thought they could snuff the currency out in its crib, but in the eight years since, crypto has only grown more valuable, more popular, and more widely accepted.

And its most recent surge — which came in the wake of yet another global financial crisis and another round of global currency devaluation — has instilled even more fear among entrenched interests.

So the government is redoubling its efforts.

The Chinese government says it’s cracking down on Bitcoin because of environmental concerns.

But who does it think it's kidding with that one?

When has the world's largest emitter of greenhouse gases ever cared about that?

To the contrary, China has a notoriously poor environmental record. One fifth of the country's water is so polluted it has no functional use. And its thick clouds of smog are so hazardous they cause roughly 300,000 premature deaths a year.

So for China to say it's banning Bitcoin due to environmental concerns is a joke. And a cruel one at that.

No, the real reason China is banning crypto is because it's terrified.

For decades China has been undermining the dollar and quietly positioning its currency, the renminbi/yuan, to replace it as the world's dominant currency.

Crypto jeopardizes that whole plan.

[Breakthrough: Small Blockchain Companies Addressing Major Needs are Set to Soar]

That's why Beijing is simultaneously scrambling to distribute its own version of the yuan. And that's why it's trying to eliminate the competition.

China isn't alone, either.

Nearly 90% of the world's central banks are now developing digital currencies.

And that includes the U.S.

Indeed, researchers at the Massachusetts Institute of Technology and the Federal Reserve Bank of Boston are developing a prototype for a digital dollar.

But I've got news for you: That's not going to save it.

Nothing will.

The greenback's days as the world's top reserve currency are numbered.

That's just the reality, and it's not news.

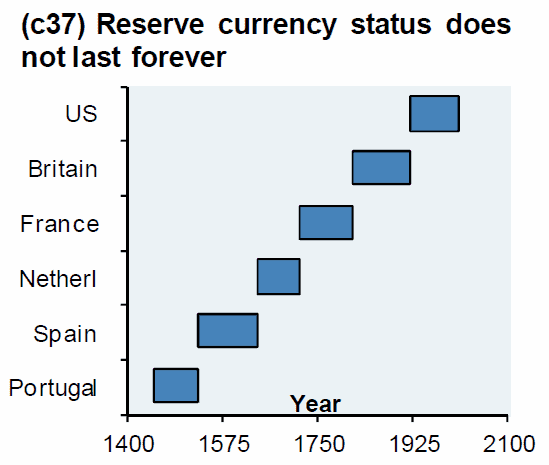

No currency keeps its place as the world's primary reserve in perpetuity.

That's a unique status that's been passed on from the pound sterling, the franc, the Dutch guilder, the Spanish silver dollar, and so on and so forth, going all the way back to Byzantine coins and the drachma of Athens.

Typically, currency primacy only lasts 80 to 100 years. So it’s about right that people today are eyeing dollar alternatives.

It's not just about the cycle, either.

[Prediction: Over the next 12-24 months, these 4 altcoins will blow past the coveted 1,000% Mark]

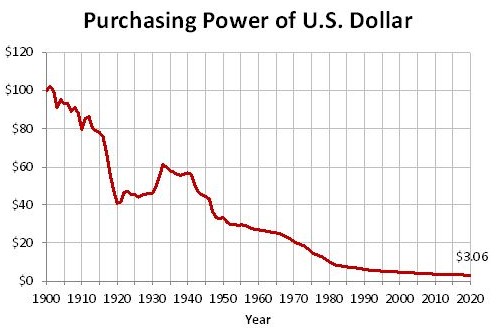

The dollar has been thoroughly abused.

It's lost 97% of its purchasing power since 1900. That means having $3 in 1999 would be like having $100 today.

Again, this is what makes the case against crypto so laughable.

In further justifying its anti-crypto efforts, China also said digital currency has “no real support value” and that it's “extremely easy” to manipulate.

Really? Unlike the yuan that China keeps artificially low to boost its exports? Or the dollar which is backed by nothing and printed to infinity by the Federal Reserve?

That criticism of crypto could be leveled against literally any fiat currency.

Every country on earth has been systematically devaluing its money for decades now — whether it's to make their goods cheaper for foreign consumers, to inflate away their massive debt burdens, or to spend its way out of a recession.

It's this open secret — that government-backed money isn't really worth anything — that led to crypto's rise in the first place.

Except crypto also has the added benefits of being digital, borderless, and untraceable.

So you can fight it all you want, but its rise is inevitable.

Heck, it's already happened.

[Learn More: How to Maximize Your Profits from this Massive Crypto Event]

It might not replace fiat currency writ large — the same way fiat currency didn't kill gold — but it's here to compete, like it or not.

That's why you might as well embrace it.

El Salvador did. It's made Bitcoin a form of legal tender.

That led Nigel Green, the CEO of $12 billion wealth advisor DeVere Group, to comment:

Some larger, more powerful countries are trying to quash or slow the inevitable shift to borderless, digital currencies, but this small Central American nation has embraced the biggest one of them all. El Salvador has made history, and we can expect other developing countries to follow.

And indeed other Latin American countries have signaled their support for similar adoption measures.

That only makes sense. They've labored under the delusion and oppression of elite Western power brokers for far too long.

We all have.

Fight on,

Jason Simpkins

[Exclusive: The Four Altcoins to Buy NOW for 1,000% and Beyond]