China has jumped to a position of leadership in the electric-vehicle market. It did so by making its roads a paradise for electric vehicles…

Plenty of charging stations, access, and preferential treatment have made China the best place in the world to own an electric vehicle today. And it wants that to be true going forward, too.

The Chinese government says it wants electric vehicles to account for 25% of total vehicle sales by 2025.

That's a target of 6.3 million new energy vehicles (NEVs) sold each year – a 365% increase from last year. And that's assuming China's total vehicle sales stay the same.

To get there, the government is pulling out all the stops…

Today, I'll show you the full extent of what China is doing… and what it means for investors.

Like the U.S., China has given discounts to individuals buying electric vehicles. It's the simplest way to incentivize buyers. But the $9,200 manufacturer incentives that kickstarted China's electric-vehicle market were just the tip of the iceberg.

That's because the government also realized that few people would buy electric cars if they didn't have anywhere to charge them.

So, in September 2015, the National Development and Reform Commission (“NDRC”) said it would order the State Grid Corporation of China to build a nationwide charging-station network. It was to be capable of fulfilling the power demand of nearly 5 million electric vehicles by 2020.

This includes a nationwide network of charging outlets that cover residential areas, business districts, public spaces, and intercity highways.

[Revolutionary: New Battery Tech Expected to Create an Energy Market Surge of 20,300%]

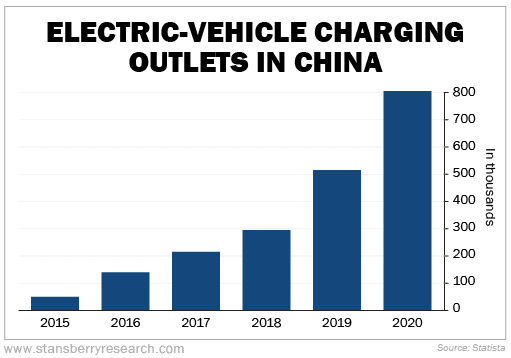

As of last year, China had already installed more than 809,000 public charging outlets. Take a look…

By the end of June, China had grown that figure to 923,000 public charging piles. And that doesn't even count the hundreds of thousands of private charging piles in homes and private offices.

With roughly 4.5 million electric vehicles on China's roads as of last year, this means there are about five electric vehicles for every publicly available charger in the country.

That compares with about 100,000 charging outlets for the 1.8 million electric vehicles running in the U.S. last year – or a ratio of 18-to-1.

That means China's electric-car population could triple instantly and still have public charging that's as easily accessible as in the U.S. today.

But China is adding new public chargers at a rate of 19,000 every month in 2021. And all this supporting infrastructure is coming at a time when Beijing is making it easier than ever for car owners to shift to electric…

[Breakthrough: Ride Energy Market From a $250 Billion Niche Into a $51 TRILLION Industry]

You see, in 2016, China's Traffic Management Bureau (the country's version of the Department of Motor Vehicles) announced the introduction of new “green license plates.” These would clearly differentiate NEVs from normal gas-powered vehicles.

Cars with these green license plates enjoy preferential policies. It's much more dramatic than anything you see in the U.S. But remember, China wants this industry to succeed… And with these incentives, it's making sure that its citizens get on board.

A green license plate means you're exempt from a common traffic regulation that bans the use of cars one day each week, depending on your plate number. In other cities, a green license plate means you can use the bus lane during rush hour.

But perhaps the most effective way the Chinese government supports the electric-vehicle market is the vehicle quota system, which was implemented in heavily congested cities in 2011.

In Beijing, for instance, the government continues to limit the number of new gas-powered cars to just 40,000 a year.

It's estimated that every time a new license plate becomes available, 2,000 people are waiting in line for it… and the wait can run as long as five years.

[This Tech Will Mint More New Millionaires than Crypto, Pot Stocks and FAANG… COMBINED!]

With such strong government support, a booming network of charging stations, and competitive prices, NEV sales in China will continue to soar.

This has been a hot sector in recent years. But the boom is just getting started. So for long-term investors, China's NEV market is a place to consider right now.

Good investing,

Brian Tycangco