Table of Contents:

- Introduction

- Who is Keith Kohl

- A historic reshaping of global power markets is occurring…

- Russian Invasion of Ukraine Disrupting Global Energy Supply

- Many Years of Severe Underinvestment in New Oil and Gas Production

- The Aggressive Global Push for Renewables and the Shuttering of Fossil Fuel Plants and Pipelines

- America’s Powerhouse LNG Producer

- The LNG Tanker King

- The Hidden LNG Safety Line

- The Permian Playbook: 3 Stocks Set to Profit From America’s $5.9 Trillion Basin

- The Easiest, Most Profitable Way to Invest in the Ultimate Commodity: Water

- See you inside

“Get ready for blackouts from London to LA, as… energy prices [skyrocket]”

— Business Insider

Brace yourself for…

Black Winter

A perfect storm is triggering the biggest global crisis the world has ever seen.

This blackout could happen on February 17…

These 3 simple moves are the ONLY way to protect your livelihood and your wealth…

It’s been 27 cold days since the message first appeared on your thermostat:

“ENERGY EMERGENCY — LOCKED AT 66 DEGREES”

The government is regulating your thermostat due to the energy crisis.

You can no longer turn it up past 66 degrees. They are in control of the heat level inside your home.

You go outside to collect the firewood you’ll need to burn in your fireplace for the day to keep your family from freezing.

A terrible feeling fills your gut.

It sets in on you that this is your new normal.

When you get back inside, you flip the TV on to watch the news…

And you see that the crisis is escalating fast.

A headline flashes on the screen that says:

“ALERT: A Mandatory Blackout Will Begin at 8 p.m.”

As you digest the news that the government is forcing rolling blackouts to conserve energy…

Panic starts to suddenly set in.

“What if they shut off the electricity to my home permanently?”

“Will we get through this alive?”

Now, I know this may not seem like an ordinary story…

In fact, it could be a nightmare.

But the story I’ve told is on its way to becoming a reality for hundreds of millions of people this winter.

Don’t believe me? Just see it for yourself…

Business Insider warns everyone to:

Forbes sounds the alarm:

Oilprice.com reports:

Nearly every economy is facing sky-high power prices and fuel shortages that could cause life-threatening blackouts.

Millions could freeze or starve to death in the coming “Black Winter.”

In fact, Belgium’s prime minister recently warned that the next “5 to 10 winters will be difficult” for Europe due to the crisis…

And all of this isn’t simply due to Russia’s invasion of Ukraine.

A number of factors have converged to create the biggest global energy shortage in history.

- Putin has shut down Russia’s largest pipeline to Europe, which is Europe’s main supplier of natural gas.

- The price of natural gas — the main fuel that heats homes and powers electric grids — soared to record highs last summer.

- OPEC is slashing its oil production right as strategic petroleum reserves are drying up.

- And much more…

This epic energy catastrophe is triggering panic and social unrest throughout the world.

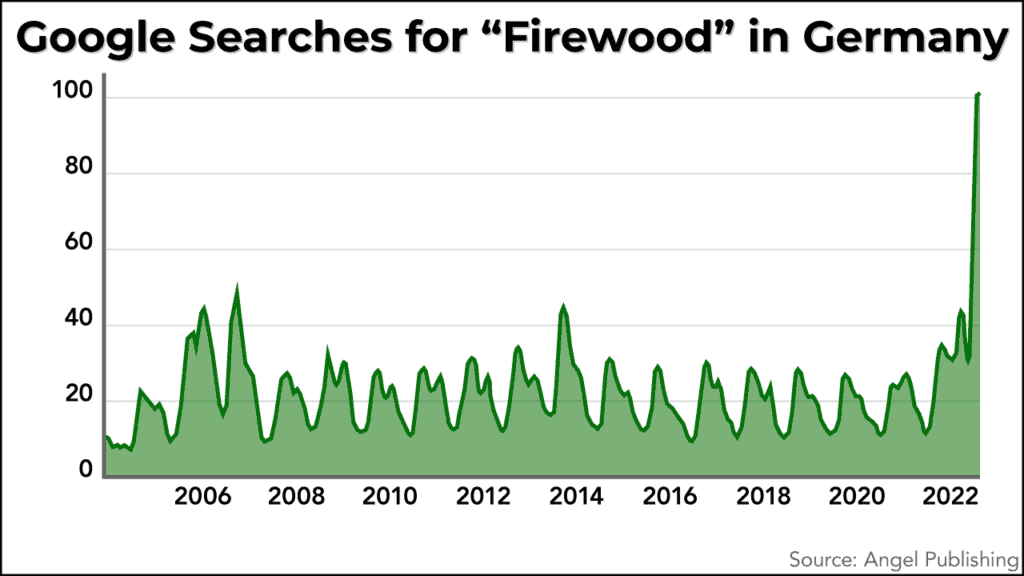

In Germany, Google searches for “firewood” are soaring as citizens brace for a shortage of gas that heats half of all homes:

As firewood supply dwindles, citizens are snatching two-by-fours from hardware stores to burn and buying fireplaces in droves, but wait times for one are a year or longer due to supply chain disruptions.

In France, schools will not be turning on the heat this winter. Instead, they’ll burn firewood to keep students warm and conserve natural gas.

In the United Kingdom, the government warns that millions of residents could lose power for three hours every day this winter, threatening residents who rely on medical equipment.

The Swiss government announced that it may begin jailing people who heat their homes over 66 degrees this winter.

Can you imagine going to prison for turning up your thermostat on a cold winter night?

Make no mistake: “Black Winter” is coming…

Hitting every continent…

Affecting every family…

Mark my words: NO ONE is safe from what is coming in the next couple months.

And according to my research, it could all culminate on February 17.

On this day,over 70 nations will be at the highest risk of global blackouts.

It will be the biggest, most concerning, and most profitable story of the decade…

Easily surpassing any major crisis we have seen before…

And in just a moment, I’ll explain how you can prepare yourself for what’s coming…

But also how to position yourself to come out of this as rich as possible.

Because as Putin turns off the gas taps…

OPEC slashes oil production…

And energy demand far outpaces supply…

A historic reshaping of global power markets is occurring…

One that will mint an entire new generation of millionaires and even billionaires…

In short, the world has turned to American oil and gas to fill the gaps in global energy supply.

Countries are paying RECORD amounts of cash to get their hands on the energy treasure trove that’s beneath our feet…

And a handful of stocks are already on the move because of it…

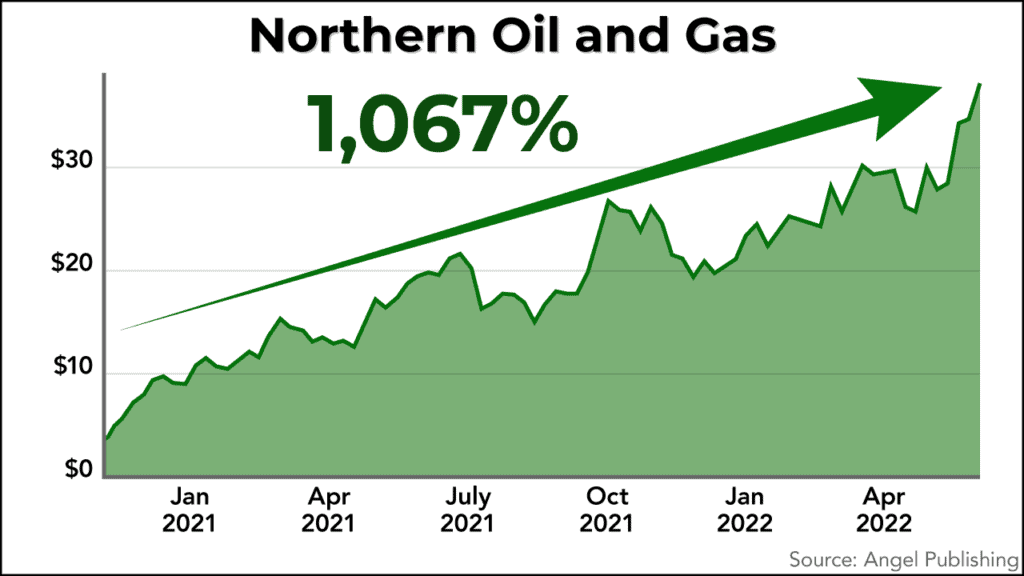

Like Northern Oil and Gas (NYSE: NOG).

Shares of this company have risen from $3.35 to $39.10.

That’s a peak gain of 1,067%…

Good enough to turn every $1,000 you invest into $11,670.

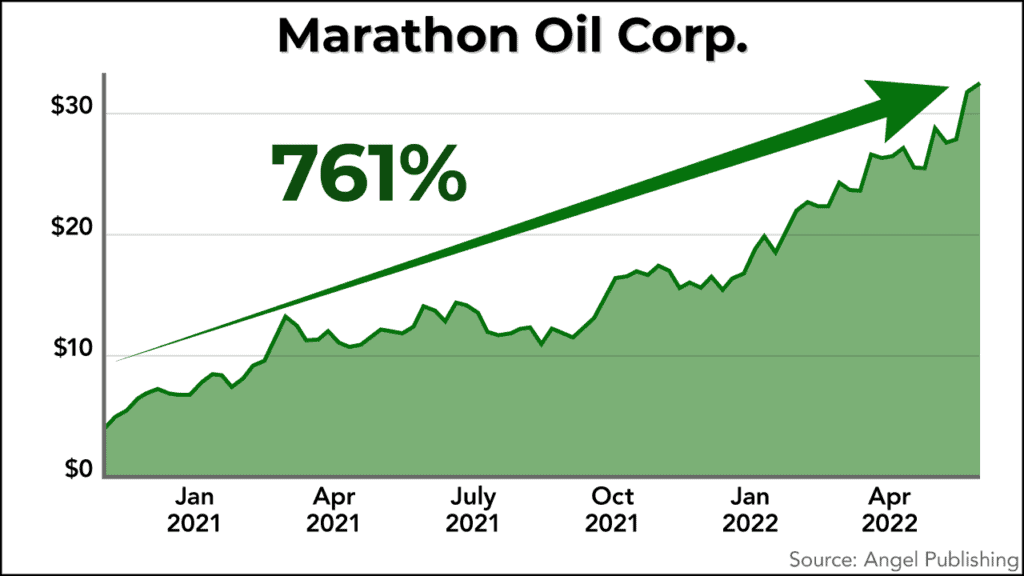

Or take Marathon Oil Corp. (NYSE: MRO)…

Whose shares have jumped from $3.86 to as high as $33.24.

That’s a 761% profit.

That multiplies an investment stake of $3,000 into $25,830 — enough to make a full payment on a new car.

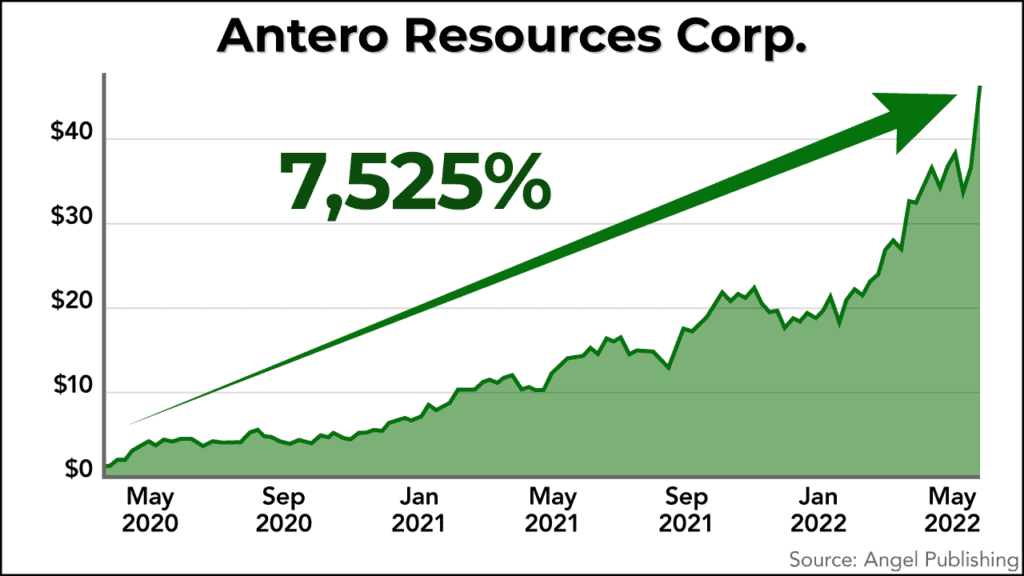

Then there’s Antero Resources Corp. (NYSE: AR)…

Shares traded for just $0.64… before surging as high as $48.80…

For a gain of 7,525%.

Enough to turn every $5,000 into $381,250 in profits.

That’s a pretty large sum that’ll cushion your retirement stash.

But this is just the start of this new American wave of energy wealth that’s forming.

The best investors in the world — including Warren Buffett — are loading up on these investments like never before.

Over the next few minutes, I’ll tell you more about the forces that got us into this dangerous situation today, and how you could benefit even in this time of extreme economic turmoil.

I believe we are just moments away from a global crisis unlike anything we’ve seen in our entire lifetimes…

This is why you MUST take what I will be telling you today extremely seriously…

The global energy market is more intertwined right now than it ever has been before.

Think of it like a giant spider web…

A disruption in one part of the world creates ripple effects all across the globe.

And it’s already beginning to start now…

As Bloomberg reports:

European governments are urging citizens and businesses to limit their gas usage in order to avoid blackouts this winter.

They’re mandating cold showers, halting factory production, turning off street lights and even traffic lights, restricting the use of heat in offices and retail shops, banning cryptocurrency mining, and more.

In Denmark, you aren’t allowed to take a hot shower for longer than five minutes.

France has cut off hot water to some buildings, and has banned offices from turning their thermostats above 64 degrees.

Spain has banned offices from turning the heat up higher than 66 degrees.

Retail stores must reduce lighting by 30%.

Europe’s biggest banks are also preparing backup generators to prevent ATMs and online banking from going dark this winter.

But like I said, the story is NOT isolated to Europe anymore…

With global markets more interconnected than ever before…

This energy supply shock is quickly spilling over into every part of the world, regardless of how wealthy it is.

- Power is so scarce in California that people are being told they can’t recharge their electric vehicles.

- Energy companies locked the thermostats of 22,000 residents in Colorado.

- The island of Sri Lanka is forcing rolling blackouts every 13 hours, causing hospitals to suspend major surgeries.

- South Africa’s state power utility is implementing its highest level of nationwide power cuts, forcing citizens to go up to nine hours per day without electricity.

- China has ordered all factories in a major manufacturing region to shut down for a week to ease pressure on the strained electric grid, a move that could intensify global supply chain disruptions.

- New York and New England are rationing heating oil as fears rise that families will be left in the cold this winter.

Which brings me to today… and to the reason why I prepared this message…

My warning goes against just about everything the media have been feeding you for the past several years about oil, gas, and the global energy markets.

Understanding what is about to happen could not just protect your portfolio from the shock I believe global energy shortages are about to send through the world’s financial markets…

But it could also set you up to make huge returns as “Black Winter” spreads across the globe.

In short, there are THREE reasons for this huge crisis that’s unfolding right now…

“Black Winter” Trigger #1:

Russian Invasion of Ukraine Disrupting Global Energy Supply

Up until 2021, Europe depended on Russia for almost HALF of its entire natural gas supply… which it NEEDS to run its factories, generate electricity, and heat homes.

And — as you can imagine — Putin hasn’t taken too kindly to all the sanctions Europe has imposed on Russia due to its invasion of Ukraine.

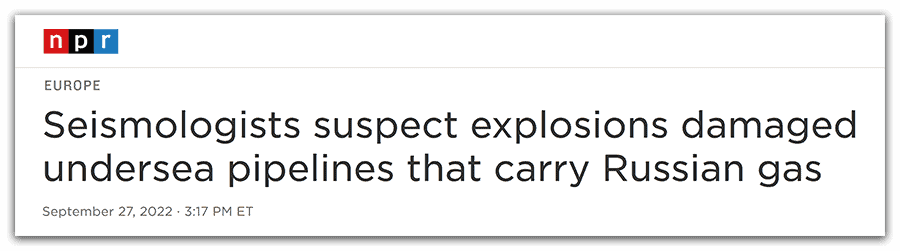

Not only has Russia completely shut down Nord Stream 1 — its main gas pipeline to Europe — because it claimed it needed “repairs”…

But it’s also being accused of intentionally damaging the pipeline in a move to disrupt supplies even further.

The explosion sent gas prices soaring 11%.

This is Russia’s revenge for all the sanctions leveled against it. And sadly, it’s working.

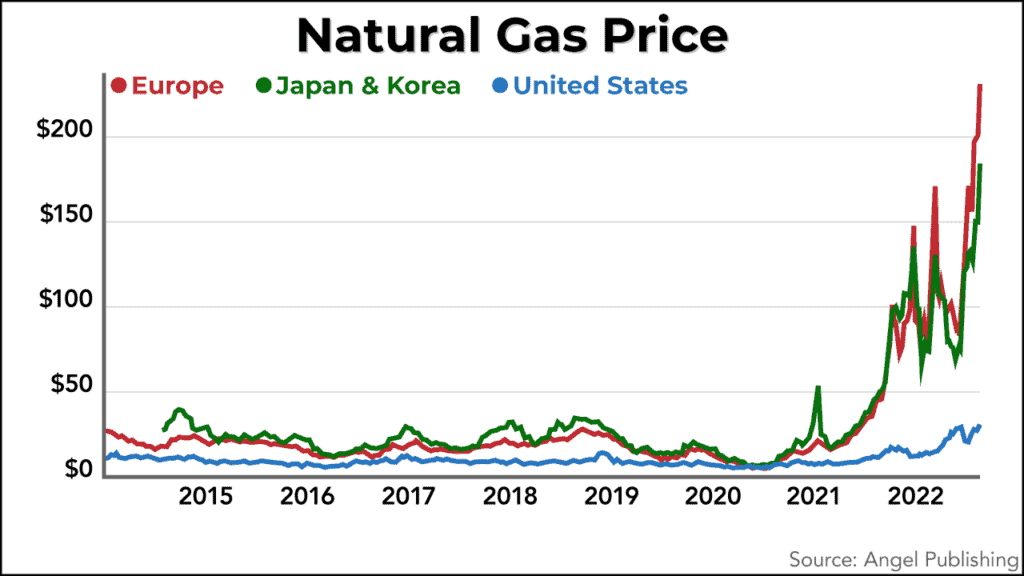

Russia’s continued restriction of natural gas supply has sent prices skyrocketing to new highs…

And has sparked fuel shortages across the globe.

Countries are so desperate for supply that an international bidding war for gas has erupted…

As Forbes says, “The UK has been outbidding Pakistan for liquefied natural gas. Cargoes bound for poor Pakistan were literally changing mid-route and going to the UK because the British were willing to pay more.”

And a recent headline from Bloomberg says, “India pays record amounts for LNG to replace lost Russian supply.”

With gas going to the highest bidder, it almost guarantees that prices will move much higher.

And I’ll show you how this explosive situation could make you a fortune in just a moment…

But we can’t lay all the blame for this at Putin’s feet. He’s only part of the reason the world is facing blackouts and a crippling energy shortage.

“Black Winter” Trigger #2:

Many Years of Severe Underinvestment in New Oil and Gas Production

Natural resources like oil, gas, and coal require massive upfront investments to bring these resources out of the ground.

And these commodity-producing industries have suffered a record lack of capital investment over the years.

Back in 2014, over $700 billion was invested into the oil and gas sector.

Fast-forward to 2021, and the amount invested was just $341 billion.

New investment has been cut by more than half, despite demand being higher today than it was then.

Joseph McMonigle, Secretary General of the International Energy Forum, warns:

“Two years in a row of large and abrupt underinvestment in oil and gas development is a recipe for higher prices and volatility later this decade. The energy crisis in Europe and Asia this winter is a preview of what we can expect in the years ahead.”

In fact, we’re witnessing major oil and gas companies plow more money into renewable energy sources than into new oil and gas projects.

That’s because these companies face mounting pressures from the general public, investors, and the government to support the global transition to renewable energy.

As a result, oil and gas companies are struggling to attract new investment capital.

Which means cutting back significantly on investments in new production, even as prices soar to record highs.

In fact, the Democrats just introduced new legislation that would completely prohibit big banks from financing new fossil fuel projects!

In short, many years of underinvestment during the attempt to transition away from fossil fuels has done absolutely nothing to decrease the global demand for oil and gas…

And instead has left global supplies unable to satisfy the world’s surging demand.

But the movement to end fossil fuel use is barreling ahead, no matter how many trillions of dollars it costs.

“Black Winter” Trigger #3:

The Aggressive Global Push for Renewables and the Shuttering of Fossil Fuel Plants and Pipelines

Global leaders, universities, and even a few Fortune 500 companies have sold the world on a single idea…

That one day we’ll all be driving EVs and the electricity from wind and solar will be the foundation of a wonderful green economy.

That day may come, but it’s DECADES away. Not months or even years.

And just how much will this mandated transition to renewables cost?

Get a load of this incredible statistic:

Matching the energy value of just two months’ worth of natural gas that Europe consumes would require building $40 TRILLION worth of batteries…

Which would take all the world’s battery factories a combined 400 years to produce!

Sounds unrealistic, right?

But politicians have persuaded everyone that we’re moving to a renewable-based energy system even though the need for traditional energy sources has never been greater.

As BP’s chief economist says:

“There is a growing mismatch between societal demands for action on climate change and the actual pace of progress, with energy demand and carbon emissions growing at their fastest rate for years.”

And CNBC reports:

“Despite all the capacity additions in renewables generation, the amount of power currently generated by renewables is still not enough to meet this increased demand.”

Despite this reality, politicians are smothering the fossil fuel industry and spending absurd amounts of cash on “green energy.”

President Biden has made it his mission to block any policy that goes against his clean energy agenda.

He’s shutting down cheap and abundant energy resources that our nation can’t live without:

“Keystone Pipeline Halted After Biden Blocked Permit” — BBC

“Biden Shutting Down Line 5 Pipeline Could Send Gas Prices Surging” —Newsweek

“Biden Administration Cancels Oil and Gas Drilling Leases in Alaska and Gulf of Mexico” — The New York Times

Biden has done more damage to the industry than any president in U.S. history in terms of shutting down oil and gas pipelines, blocking approval of new projects, and even capping the number of refineries in operation.

But here’s the thing…

The crusade on fossil fuels is even more aggressive in Europe

Europeans have been working for years now to build up their “green energy” economy.

And in doing so, they’ve largely quit investing in new oil and gas production…

And have injected billions into renewables like wind and solar power.

So far, Germany alone has spent over $170 BILLION on its renewable energy program.

The only problem is that wind and solar aren’t reliable sources of energy like natural gas…

So in recent years, Europe has imported Russian gas to make up for its energy shortfall.

As a result, Europe became completely dependent on Russian fuel while it was phasing out coal and nuclear power plants.

And now, it is left totally unprepared as Putin shuts off the taps.

Energy costs have skyrocketed. And citizens are now paying the price.

As Bloomberg reports, “Rising energy prices are feeding through to household bills and the cost of everything from making food to heating glass.”

And the crisis has forced a shocking pivot in Europe’s renewable power agenda.

For instance, Germany is restarting two nuclear energy reactors and reopening 27 coal plants…

Greece, the Netherlands, and the Czech Republic are also reopening shuttered coal plants and resuming coal mining in places where it had been halted…

As these nations all face a frigid “Black Winter.”

European leaders are warning their citizens that they must lower energy use or face blackouts.

The United Kingdom, France, Poland, Bulgaria, Denmark, the Netherlands, Austria, and the Czech Republic are all set to face shortages this winter…

Soaring energy costs have created economic catastrophe and social unrest throughout the globe.

Nations everywhere are STARVING for natural gas… and they’re paying top dollar for it!

As Bloomberg says:

“Natural gas is the world’s hottest commodity. It now rivals oil as the fuel that shapes geopolitics. It’s at the heart of a dawning era of confrontation between the great powers, one so intense that in capitals across the West, plans to fight climate change are getting relegated to the back-burner.”

Like I mentioned, countries are so desperate that an international bidding war for gas has broken out.

There is just not enough of it to go around to keep the lights on, so it’s going to the highest bidder.

And that’s where this massive investment opportunity comes in…

One that could make you fantastically wealthy as this crisis plays out.

And it has to do with one word:

AMERICA.

Why?

See, America has been quietly building a natural gas empire…

One that puts Russia to shame!

In fact, the U.S. is the world’s largest producer of natural gas, despite Biden’s efforts to suffocate the industry.

America produces more gas than Russia… more than Saudi Arabia… and nearly four times more gas than China.

The U.S. is swimming in natural gas.

Europe, on the other hand, produces essentially none, yet 25% of its energy consumption is gas.

That’s why, for decades, natural gas prices have typically been much higher in Europe than in the U.S.

But up until now, getting the gas to Europe wasn’t easy.

That’s because the single best way to transport gas is through pipelines.

And there is no pipeline that links America to Europe.

So in order to ship natural gas overseas, it must be converted from regular natural gas into liquefied natural gas (also known as LNG).

Then the LNG gets loaded into huge specialized ships that transport it across the globe.

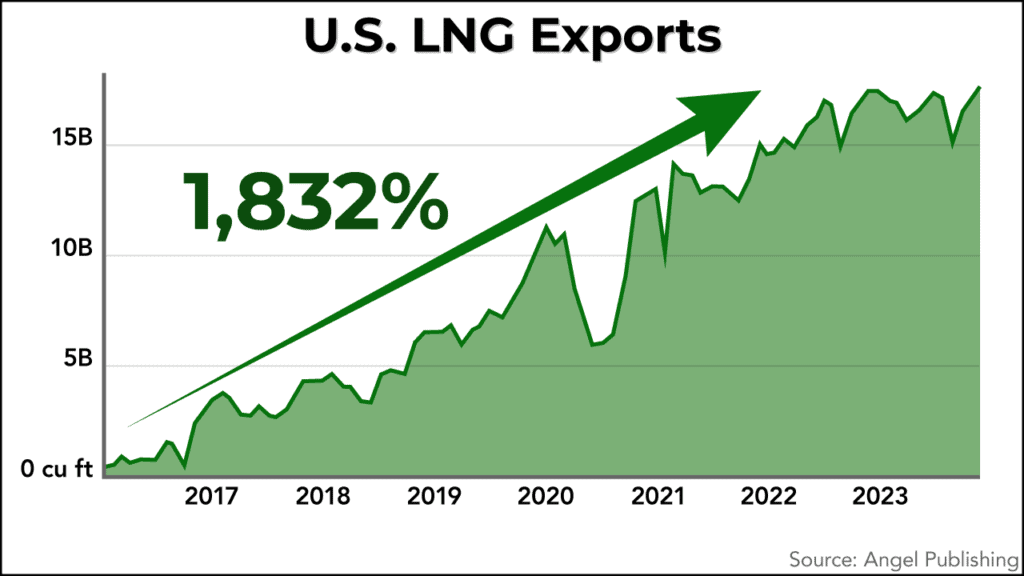

Ever since 2016, when America made its first overseas shipments of LNG…

The U.S. has rapidly become an LNG powerhouse.

Shipments from the U.S. have grown a stunning 1,832% in just the past six years.

America is now the largest exporter of LNG in the world, surpassing Qatar and Australia.

In other words, the U.S. is now the world’s biggest supplier of natural gas.

You can think of America as an EMT, coming to the rescue of energy-deprived nations everywhere.

That’s something Putin didn’t see coming. And it also presents you with a huge profit opportunity…

Because the price of gas remains cheap in the U.S… and is higher just about everywhere else.

Asia is paying six times more than America for natural gas.

In Europe, the price is seven times higher.

Citigroup expects Europe not to see any relief from soaring natural gas prices until the end of the decade.

And with global demand for LNG projected to nearly DOUBLE by 2040…

These big price differences between the U.S. and the rest of the world will remain intact for many years to come.

Countries are begging to tap into America’s cheap, unlimited gas resources as they face a crippling energy shortage this winter…

Fortune says:

“Europe is ready to outbid the rest of the world for natural gas in the race to secure winter energy supply.”

Dr. Robert Johnston, a research scholar at Columbia University, says:

“Rising global LNG demand points to a strong future for US LNG exports… as Europe and Asia compete to pay top dollar for shipments.”

Bloomberg says:

“India pays record amounts for LNG to replace lost Russian supply.”

Nations have no choice but to pay record amounts to secure supply of LNG.

Can you see why this is such a huge opportunity for the U.S., with its abundant supply of cheap gas —and the companies capable of exporting it?

That’s why I’ve isolated THREE stocks with massive potential.

Let me tell you about them now…

“Black Winter” Boom Stock #1:

America’s Powerhouse LNG Producer

This first company produces LNG for shipment all over the world…

It owns a massive LNG terminal, a multibillion-dollar facility that turns gas into liquid that can be moved overseas.

And it’s one of the largest LNG production facilities in the world.

As all of Europe pivots away from Russian gas imports, customers are flocking to this company in droves.

For instance, the day after Russia invaded Ukraine, a French energy giant signed a five-year LNG supply deal with this firm.

Its shipments to Europe are surging…

And the company’s bottom line are surging right along with it…

With revenues more than DOUBLING over the last year.

But it’s only the beginning…

As the war rages on and customers around the world seek to end their reliance on Russian gas…

This company is in the right place at THE perfect time.

“Black Winter” Boom Stock #2:

The LNG Tanker King

In order to move LNG overseas to gas-starved nations, you can’t just load it onto any boat.

It requires specialized ships for safe transport, which are known as tankers.

In fact, a single tanker ship of LNG can provide a month’s worth of heat for nearly 1 million people.

And that brings us to the second company I have my eye on…

The companies that own these ships capable of transporting this precious cargo will reap a massive reward during this crisis.

And I expect this ONE company to be the biggest beneficiary of them all.

Why?

Because it owns a massive state-of-the-art fleet of LNG tanker ships… the youngest fleet in the entire industry!

Better still, these ships have a combined 54 years’ worth of LNG deliveries on backlog!

This will provide the company with reliable, growing revenue streams for decades to come.

The company has been making money hand over fist. It’s sitting on record cash with over $280 million in the bank.

Better still, it LOVES to put that money directly into the pockets of its shareholders.

The firm has raised its dividend by a stunning 1,150% in just the past three years, which I believe is poised to soar even higher.

“Black Winter” Boom Stock #3:

The Hidden LNG Safety Line

This American company is perfectly positioned to capitalize not just on Europe’s growing need for LNG…

But also on the growing gas needs of South America, the Middle East, and Asia.

That’s because it owns a stunning 20% of the world’s fleet of LNG ships.

Plus, it owns plants that turn LNG back into regular gas for customers across the globe…

With facilities across the world, from South America to India.

And its revenues have DOUBLED in just the past year.

The best part?

Most investors — and most of Wall Street — have no clue this firm even exists.

Why? Because this company just recently went public.

That gives you the chance to scoop up shares at these ultra-low prices right now, before the rest of the market catches wind of it.

And before it’s on the front page ofthe Wall Street Journal.

Mark my words: You will NOT see another investment opportunity like this again in our lifetime.

These are the plays you could make to safeguard your wealth and grow it exponentially, no matter how chaotic the economy gets.

I’ve put all the details on these three companies and the coming LNG boom inside a special report you can claim today.

I’m calling this report “Black Winter: 3 LNG Stocks Set to Soar on the Global Energy Crisis.”

And it could be your key to not just protecting your money but also safely growing it as this crisis turns the world upside down.

But in order to position yourself for the biggest gains…

It’s critical that you act by February 17.

That’s the day when natural gas prices peak — on average — every year around the world…

Which could ignite the shares prices of these three stocks.

I’ll guide you through everything so you can get in on them and start to profit, BEFORE this market absolutely explodes.

This is truly a once-in-a-lifetime opportunity in my eyes.

Hi, my name is Keith Kohl.

I’m the chief investment strategist for Angel Publishing’s hugely successful Energy Investor advisory service.

I’ve built my career helping thousands of individuals grow their wealth through my high-caliber energy plays that simply cannot be found anywhere else.

In fact, my readers have had the chance to profit off of EVERY major U.S. oil and gas play in my lifetime.

The Permian Basin, Eagle Ford, and Haynesville in Texas…

The Marcellus Shale in Pennsylvania…

And, of course, one of my most successful plays, North Dakota’s Bakken Formation.

But don’t take my word for it.

Just look at some of the notes my readers have sent me over the years:

Mike L. from Tampa, Florida, wrote:

Keith: I’d like you to know how much I’ve appreciated your coverage over the years. I sold my position in NOG for gains of 261%, a third of my position in BEXP for gains of 361% (and bought the wife a new car), and sold the rest of BEXP for long-term gains of 743%. Now holding a large position in your newest pick with unrealized gains of 365%. Thanks again!

Henry S. wrote me and said:

Keith, I took your advice and bought BEXP. Since then it went up 1,200% for me… Never sold it until last week. So thanks a lot! Best regards.

And we also have Cheryl B.:

Hello Keith, I wanted to let you know that thanks to your calls over the last three years, I’ve safely paid off my daughter’s entire four-year college tuition. Keep the picks coming.

I love getting notes like these.

But I can confidently say one thing.

The coming LNG boom is shaping up to be the largest, most aggressive energy boom the world has ever seen.

That’s why I’m reaching out to you today.

This is, without a doubt, one of the biggest, most exciting investment opportunities I’ve seen in my lifetime.

America’s rise to the top of the LNG world has been meteoric.

And these three plays I’ve identified are the ones set to profit from the world’s voracious appetite for American LNG.

I’ve been pounding the table about oil and gas for years, but this really takes the cake.

We’ve had an amazing run of profits in oil and gas over the past few years, with winners like these:

- 103% on Petrobank Energy and Resources

- 100% on Northern Oil and Gas

- 95% on Magellan Petroleum Corp.

- 99% on Enbridge

- 121% on Crescent Point Energy

- 124% on PowerShares DB Crude Oil

- 140% on UTS Energy Corp.

- 159% on Kodiak Oil & Gas

- 215% on American Oil and Gas

- 574% on Brigham Exploration

And that's just to name a few.

But compared with the opportunity staring us in the face today, that all felt like a warm-up round.

To put it simply, the world absolutely can’t operate without oil and gas.

This massive energy crisis that the world now finds itself in has made that clear.

And with American LNG set to fill all the world’s energy needs…

There’s never been a better time to be an energy investor.

That’s why I’m offering you a chance to join us and start receiving Energy Investor research TODAY.

I’ve been sharing my research and delivering massive winners to my readers in the energy space since back in 2007.

That was the year the International Energy Agency (IEA) dropped a bombshell on investors when it stated: “Some $20 trillion of investment in supply infrastructure is needed to meet projected global demand.”

Now, I don’t always trust the IEA. It’s in the pocket of global government, and one of its main goals is to gloss over the simple fact that the world has already run out of cheap oil. It does this to keep people from panicking.

But this time — saying $20 trillion is needed for oil and gas production — the IEA was right on target.

Twenty-trillion dollars — that’s the size of the opportunity we’re investing for.

In short, the global demand for oil and gas isn’t going anywhere — it’s only INCREASING.

And that’s why some of the smartest investors in the world are backing up the truck.

For instance, Warren Buffett has just invested a whopping $47 BILLION into the oil and gas sector.

With me by your side, guiding you every step of the way, you can rest easy knowing you’ll have a shot at not just cashing in on the growing global demand for oil and gas…

But also building a rich, lasting legacy of wealth for you and your family.

And that’s why I want to get this report into your hands ASAP.

This is an opportunity I’ve never seen before in my lifetime and likely will never see again…

The kind of opportunity where early investors could see a lifetime of returns generated in only a few short years.

When you sign up for Angel Publishing’s Energy Investor, you’ll immediately gain access to my special report, “Black Winter: 3 LNG Stocks Set to Soar on the Global Energy Crisis.”

I’ve done everything I can to show you how serious this opportunity is.

Now the choice is in your hands.

The World’s BEST Energy Research for Only $0.27 a Day!

My goal at Energy Investor has always been to deliver my readers the best research and recommendations in the energy sector.

And I believe I accomplish that year after year.

My readers have had the chance to score huge wins like 286%, 478%, and even 574% over and over.

The proven ability to uncover life-changing wealth in the stock market is a valuable skill, and there’s no doubt I could name my price for a membership to Angel Publishing’s Energy Investor.

The fact is top energy hedge funds will charge thousands a year in fees… and they’ll take part of your profits, too.

But you won’t pay anywhere near that much for Energy Investor.

You won’t pay thousands of dollars.

You won’t even pay $500.

If you act now, you can lock in a special price of only $49 for the entire year.

That works out to $0.14 a day… less than the cost of a cup of coffee.

Why is it so cheap?

To put it simply, the U.S. is building an American gas empire… which has transformed it into the world’s top LNG supplier.

And I want everyday Americans to have the opportunity to profit from this massive wealth-creation event.

So I’ve made access to this research as cheap as possible.

But that’s not all.

When you join Angel’s Energy Investor today, you’ll receive:

- Monthly issues, each with at least one new opportunity to profit from America’s energy revolution: I’m always uncovering opportunities like the ones you’ve seen today — opportunities for both income and investment profit. And you will receive a full write-up of my most lucrative finds each month.

- Investment updates: If I ever need to share a development with you, you’ll receive an immediate update straight to your email. It could be time for us to sell a stock and take our profits, or it could be a way you can increase your potential payout by taking a specific action. Whatever it is, you’ll never be left in the dark. I promise to always keep you updated.

- 24/7 portfolio access: To help make getting richer as easy as possible, I compile every opportunity into a portfolio you always have access to. You just need to log in to the members-only website, and you’ll have every open position in front of you, including your buy date, current profits, and much more.

- Special reports: Occasionally, an opportunity is so urgent and lucrative that I’m forced to write up a special report I can immediately send to my readers. If that happens, I’ll have it sent to your email. And if an opportunity still has room to pad your retirement account, you can find the special report in a dedicated section of your Energy Investor members site.

- Archives: If you ever want to look back at a past investment thesis or even just read my past work, you can. I keep each issue in a handy archive you have fast access to.

- Free subscription to Energy and Capital: By joining Energy Investor, you’ll also get a free subscription to Energy and Capital automatically added on to your benefits. Every week, you’ll have full access to analysis from my fellow analysts and me on news and other investing opportunities that can help you build your wealth in today’s market.

- A friendly member services team at your service: Should you ever have questions, you can call our team and get live help Monday through Friday between 9:00 a.m. and 5:00 p.m. ET. It doesn’t matter how big or small — if you have any issues, they’re ready to help you.

And that’s not all…

I’m Also Throwing in TWO Bonus Reports

Bonus Report No 1: “The Permian Playbook: 3 Stocks Set to Profit From America’s $5.9 Trillion Basin” — a $99 value, yours FREE.

As I said earlier, the global push for renewable energy has completely stalled new investments in oil and fossil fuel production…

All at a time when the world needs more oil than ever before.

Right now, demand is far outpacing supply across nearly the whole world.

We are about to experience an oil supply shock far more troubling than the oil shortages of the 1970s, when oil prices doubled and then quadrupled…

Which is why everyone is so desperate for a new source of oil to free themselves from the Russian energy stranglehold.

And there’s ONE oil basin that could comfortably fill the gap…

As Forbes says, it “may become the world’s most productive oil field.”

This one oil patch is set to break records for its mammoth production!

And it’s not buried beneath the sand of some OPEC nation or in a far-off Russian state.

This basin is right here in America… in our own backyard!

Experts predict that there are 46 BILLION barrels of oil yet to be pulled from this basin…

Which could soon be worth up to $5.9 TRILLION!

And I’ve identified THREE key companies that could turn HUGE profits as they fill the global need for American oil.

In this special report, I’ll show you how to set yourself up for huge profits.

Bonus Report No 2: “The Easiest, Most Profitable Way to Invest in the Ultimate Commodity: Water” — a $99 value, yours FREE.

It’s one of the Earth’s most precious, irreplaceable resources.

And it’s even more important to our existence than oil or natural gas.

But what most folks don’t realize is that the world’s supply of clean water is getting scarcer every day.

According to the United Nations, roughly 66% of the world’s population is projected to face water scarcity by 2025.

Scientists around the globe have warned us that climate change, population growth, and the huge demand for resources are all leading up to a perfect storm.

As Dr. Ismail Serageldin, former vice president of the World Bank, says, “Many of the wars of the 20th century were about oil but wars of the 21st century will be about water.”

Inside this special report, I’ll show you exactly how to get in now on what could be the world’s single most profitable investment…

I’d like for you to have immediate access to this opportunity. So I’m including this report, absolutely free, with your no-risk trial.

And, of course, you’ll instantly receive our special report, “Black Winter: 3 LNG Stocks Set to Soar on the Global Energy Crisis.”

Due to the looming energy crisis, these stocks won’t stay cheap for long, so be sure to read the report as soon as it lands in your inbox.

The minute you receive my report, you’ll learn these stocks’ ticker symbols and the best ways to play them.

I’m so confident in my research that I’m willing to give you a 180-day money-back guarantee.

That’s six full months!

If you’re convinced you can’t make any money with my research or should you decide that Energy Investor simply isn’t for you, just call our member services team, and they will issue you a full refund.

Even if you cancel your subscription, all the information I give you is yours to keep.

That’s right — you keep everything.

But I urge you, if you want to position yourself to potentially make enormous returns in a matter of months from the global LNG boom…

Then you need to act right now. “Black Winter” is coming. Millions face deadly blackouts due to the energy shortage.

That’s why these stocks are starting to appear on investors’ radars now, and some big moves are coming soon.

I urge you to start building your American gas fortune today.

The opportunity is right in front of you. I urge you to seize it now.

The choice is yours. I hope you make the right one.

Simply click the button below that says “Subscribe Now,” complete the secure invitation form, and you’ll be in!

See you inside,

Keith Kohl,

Investment Director, Energy Investor

Angel Publishing LLC, a general interest newsletter is not liable for the suitability or future investment performance of any securities or strategies discussed. Please note that we are not a registered investment firm or broker/dealer. Only a registered broker or investment adviser may advise you individually on the suitability and performance of your portfolio or specific investments.

Readers are advised that the material contained herein should be used solely for informational purposes. As a publisher of a financial newsletter of general and regular circulation, we cannot tender individual investment advice. We urge you to always conduct your own research and due diligence and obtain professional advice before making any investment decision.

We will not be liable for any loss or damage caused by a reader's reliance on information obtained on our web sites. Our readers are solely responsible for their own investment decisions. Historical investment return examples given are hypothetical, and not to be taken as representative of any individual's actual trading experience. Please click here to see our Details and Disclosures