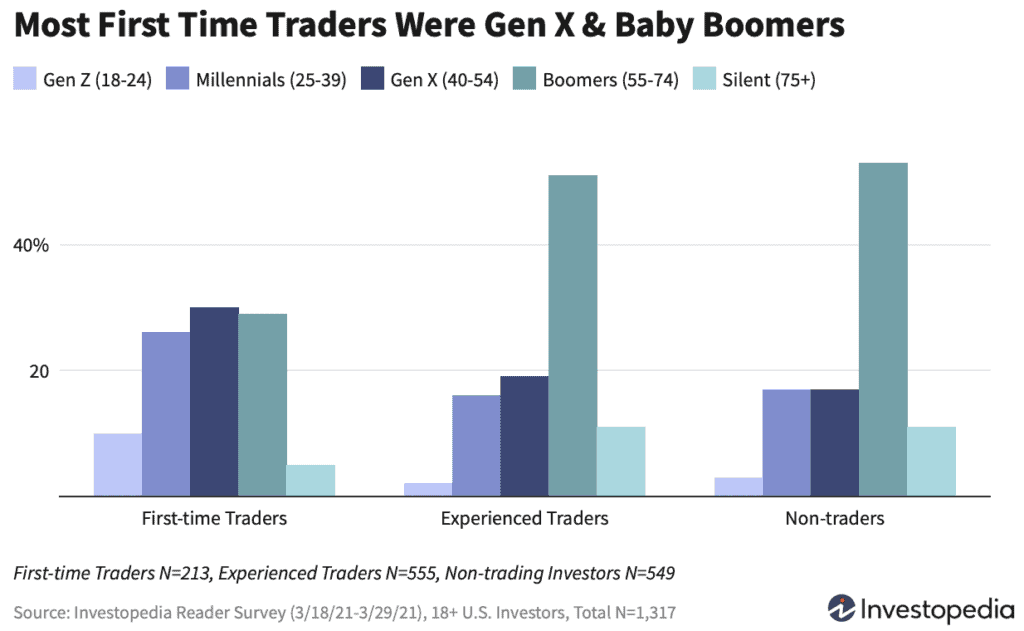

The millions of new investors and traders who joined the stock market in the past year may not be who the majority of financial media think they are. Images of young men and women home from college using their stimulus checks to trade meme stocks may be overblown. According to Investopedia’s recent survey of its daily newsletter readers, nearly 60% of those who said they just started trading in the past year are between 40 and 74 years old. Thirty-six percent are under 40, but only 4% are between 18 and 24.

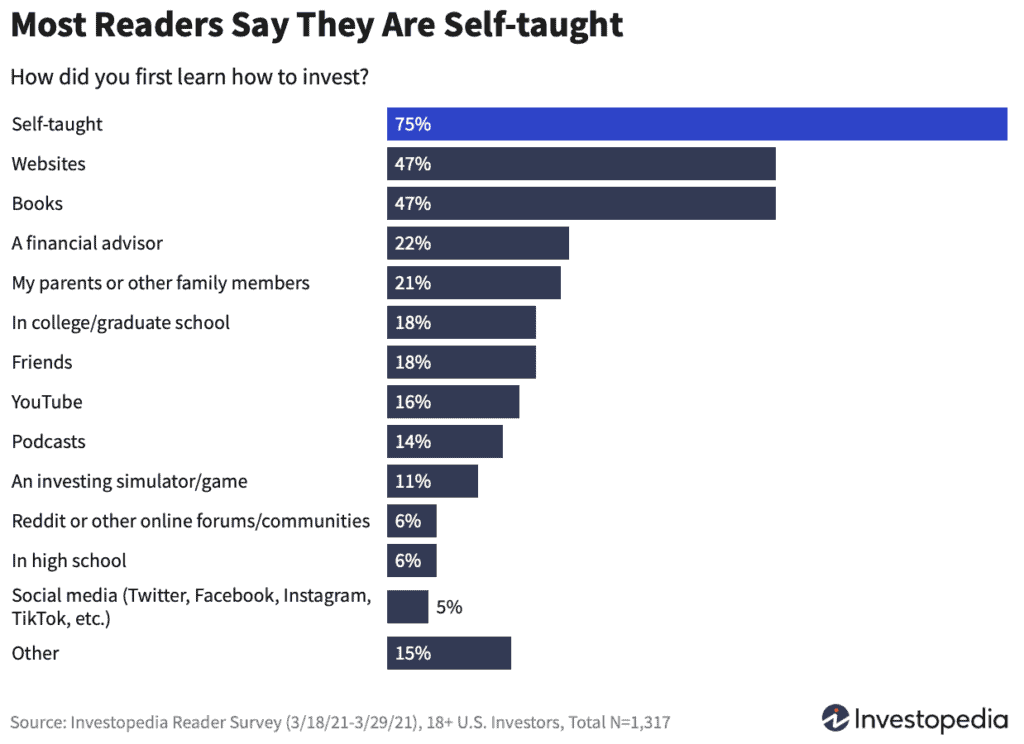

Most of the 1,300 respondents to the survey describe themselves as self-taught, with 47% saying they use websites and books to educate themselves about investing and trading. Twenty-two percent say they learn from their financial advisors, while only 6% say they learn from Reddit online forums. Only 5% say they first learned from social media, including TikTok and Twitter.

[Warning: New Fed Policy to Impact 9,500 Stocks]

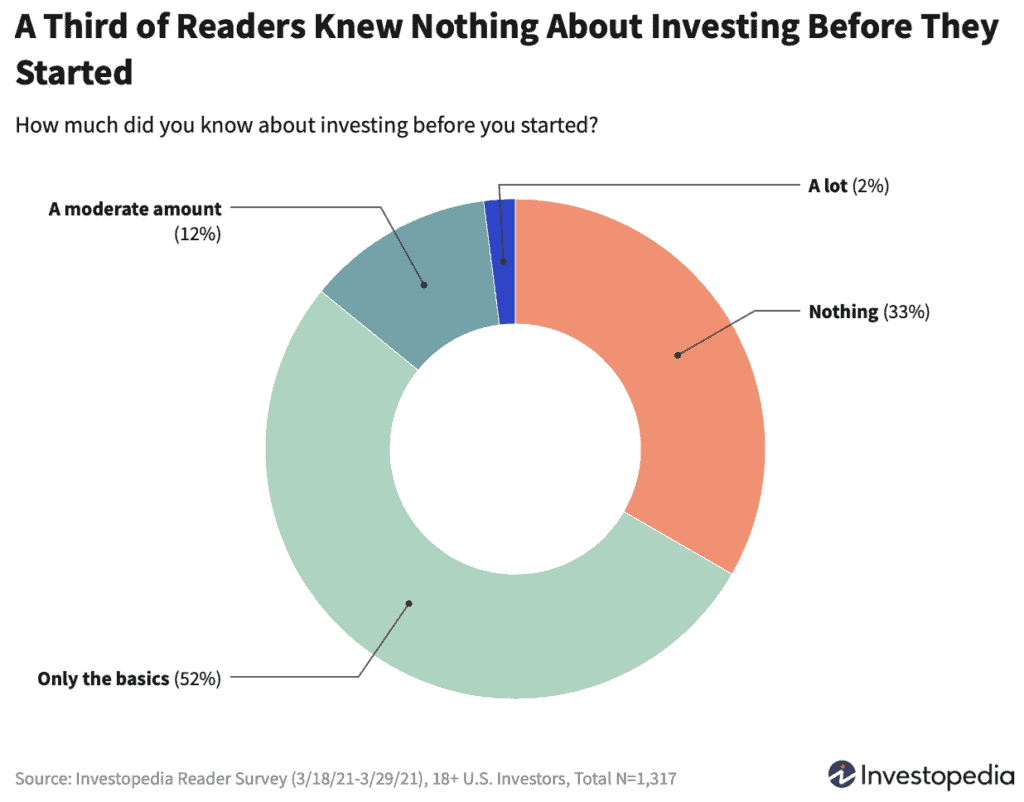

A little over half of investors and traders admit to knowing only the basics about investing before they started. Forty-nine percent have relatively little capital at risk with $50,000 or less invested, while 19% have over $500,000 in the market.

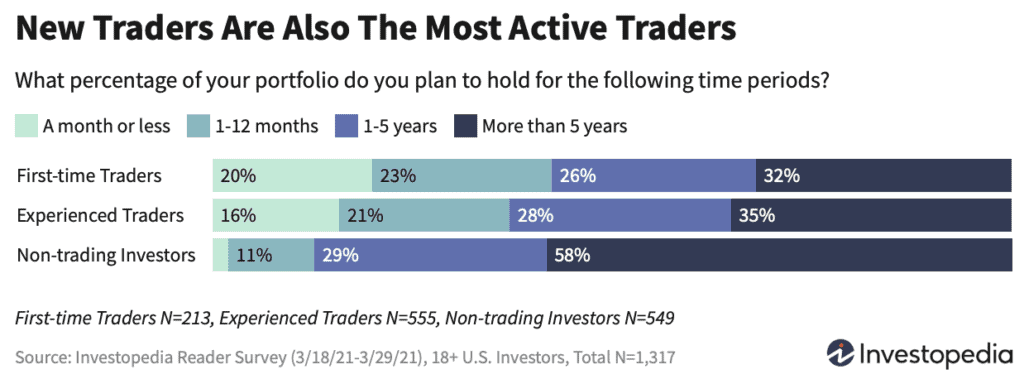

Sixty percent of respondents said they trade less than $5,000 per week, but most say they are turning over 20% of their portfolio every month. This indicates that many of these new investors are not building positions in particular securities as much as they are churning their portfolios.

[Exposed: These Are The Worst Stocks of 2021?]

While 86% of respondents, which include both new and experienced investors, claim to have made gains in the past year (Who likes to admit to losing money, anyway?), 53% of new investors admitted to suffering losses. One-third of all respondents said they made at least $50,000 investing and trading in the past 12 months.

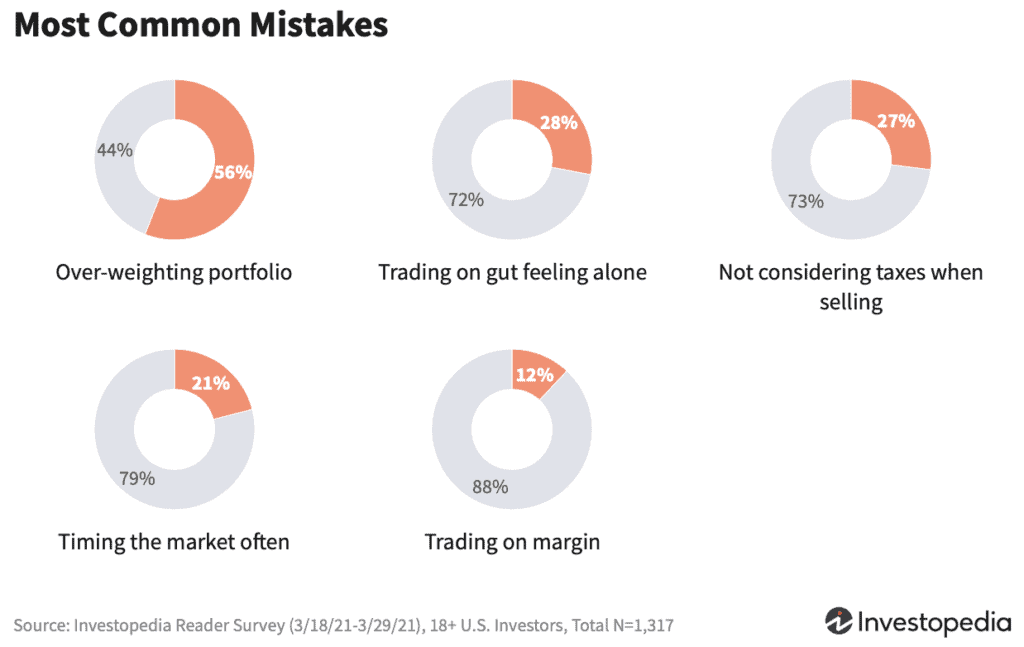

Mistakes? They’ve made a few. Who hasn’t? From trying to time the market, to trading on a “gut feeling”, to trading on margin (gulp!), here are a few of the mea-culpas from our readers:

New Traders’ Most Common Mistakes

- Timing the market: Two-thirds try to time the market at least sometimes

- 20% say they do it often

- Over-weighting: 56% say more than half their portfolio is in one stock or asset class

- Too reactive: 28% of new traders made a trade on a gut feeling alone

- Trading on margin: 12% traded on margin in the past year

- 77% of those say they knew what they were doing

[Alert: Most investors are not aware of what this will mean for their investments]

Even after the 75% run for the S&P 500 since market bottom on March 23, 2020, 40% of all respondents claim to be bullish, while newer investors and traders (47%) describe themselves that way. Forty-one percent of the rookies say cryptocurrencies like Bitcoin are among their favorite investments, but when it comes to stocks, they too like popular companies like Tesla (TSLA) and meme-wonder GameStop (GME). Our readers’ overall favorite stocks to outperform in 2021 look a lot like the ones they preferred in 2020: Tesla, Amazon (AMZN), and Apple (AAPL).

Investopedia surveyed over 1,300 of its newsletter readers to ask new traders and experienced investors to share how and why they started, where they get trade inspiration, and how well they’ve fared over the past year in the markets.