What Investors Must Urgently Do to Ride

The New Bitcoin Bull Market That’s Now Underway

In the last bull-market cycle, our high-rated cryptos rose 20x, 54x, 102x and 234x.

Here’s everything you’ll need to harness the new cycle to its full potential.

Martin Weiss: Thank you so much for joining our Zoom conference!

I’m Martin Weiss, founder of Weiss Ratings, the first and only rating agency to cover cryptocurrencies.

We’re waiting right now for Juan Villaverde to join this conference as well. Stand by. He should be logging on momentarily.

But before he does, let me tell you why it’s so urgent that you meet him.

To my knowledge, he’s the only crypto analyst in the world who called the beginning of the last bull market practically to the day.

Just three days after he made that call, Bitcoin and other cryptos hit rock bottom, and that was the beginning of the largest bull market of any asset class on the planet.

On the day Juan made that call, investors who understood that risk and were glad to buy at bargain prices, could’ve seen our list of high-rated coins surge dramatically.

Bitcoin rose 20-fold.

Ethereum surged 54 times.

Cardano jumped 102 times, and …

One of our highest-rated cryptos skyrocketed 234 times.

All in a typical three-year bull market cycle!

If you missed that opportunity, don’t look back, because …

Now, Juan has declared the beginning of a brand-new bull market cycle.

Like the last one, he predicts it will continue for approximately three full years.

Like the last one, he predicts it could again generate some of the best returns for investors of any asset class on the planet.

And today, in the short time we have together …

- Juan will demonstrate how he picks the bottoms and tops in the market, and how average investors can do it, too.

- We will cover the cryptos that our ratings have identified as the most likely big winners in this new bull-market cycle.

- We will lay out five basic steps investors can follow, plus —

Hold on! Here he comes now. Hey, Juan! We got your big bottom signal, when Bitcoin was making its recent big bottom.

We then got your signal that the new bull market is under way.

And now I have a whole batch of questions from investors, plus a few of my own.

Ready to give us your answers?

Juan: Yep, all set, fire away, Martin.

Martin: OK, before you joined, I was telling everyone about that memorable crypto buy signal you gave back in December 2018. So, let’s start there, OK? Tell us the exact date.

Juan: Dec. 12, 2018. Then Bitcoin bottomed on Dec. 15, 2018, three days later.

Martin: Which, of course, was the bottom of the bull market that lasted nearly three years, right?

Juan: That’s right.

Martin: For reference, give us the data on how much your favorite coins rose from the bottom to the peak.

Juan: I was three days early. I did not pick the exact, exact bottom. So, the numbers I have here are from the day that I made the call, not from the actual bottom itself.

From that day, Dec. 12, 2018, Bitcoin went up 20x, Ethereum rose 54x, Cardano rose 102x.

Martin: And one crypto we had selected skyrocketed 234x. So, if we put that into dollar terms, and you had a $10,000 initial investment, it could’ve grown to as much as what? $2,348,000?

Juan: Right, the exact figure at the top of the market was $2,333,746.

You should know, though, that I did not pick the exact top. I waited for confirmation, which came after the first significant correction. Then I issued a series of sell signals.

Martin: That’s what you did. Now, let me ask you, what do you think most investors did at that time?

Juan: I would guess that most poeple missed the big bottom in 2018.

Martin: Why do you think most people missed it?

Juan: For the same reason they're probably going to miss it this time around. Everybody's too negative, pessimistic. They think it's going to go to zero.

Martin: And that includes not only cryptocurrency. It includes web3, it includes artificial intelligence, AI.

Juan: Yes! AI can help bad actors forge government documents, including government currency.

AI is going to be able to wreck our systems unless we have a secure, trusted, verifiable way to check the validity of data.

And the only way you can do that is with the blockchain.

Martin: So behind the scenes, you have all these amazing crypto advances and tech innovations, but …

Juan: But everybody said, “Oh, it’s the end of crypto. This is it.”

Martin: So, when they say it’s “the end of crypto,” it really means to you the end of that particular bear market and the beginning of a new bull market.

Juan: Absolutely! If you contrast what people are saying with what prices are doing, you notice a discrepancy.

Martin: OK, that’s just the setup for a new bull market. What else do you look for?

Juan: I don’t start looking for the bottom until it’s time.

Martin: So, at the end of the day, it’s about time.

Juan: Markets can look pretty chaotic when you just look at prices.

“Oh, high volatility!”

“We don’t know where it’s going!”

“Look at all these horrible headlines!”

But, if instead of doing that you tune out all the noise, stop reading the headlines, and just count time, you’re going to notice that markets are actually pretty regular.

Crypto, in particular!

Because so far, the pattern is year-long bear markets — about 12 months, give or take a month.

So, you start at the prior top, you count 12 months. And the low is going to be around that time.

In spite of all the headlines, in spite of “the world coming to an end,” the bottom is always around a year from the top.

Martin: You tune out all the garbage, and just listen to the beat of the market.

Juan: And then you start to notice that markets are not that chaotic. It’s actually pretty orderly when you look at the time element.

Martin: Since we’re talking about the rhythm of time, tell us about the time markers you see ahead in the market for Ethereum, Bitcoin and any other coin that you’re tracking closely.

Juan: OK, this is a chart of Bitcoin in 2018.

The dashed line is when I called the bottom, it’s Dec. 12, 2018.

The solid line is the actual bottom.

Martin: And the only people still holding Bitcoin are what they call HODLers, right?

Juan: Ha-ha. We call them “diamond hands” now, Martin. The name changed.😄

Martin: So, let’s move ahead and see what happens after you give the second signal.

Juan: It’s a few days before this pop, the tall green bar in the chart. I remember this pop was epic because Bitcoin went up about 20% on a single day. It was a huge move.

Then, it almost tripled in a few months.

Moving forward in time, we're in bull market territory. Now things are looking good. After the COVID crash, Bitcoin is back above $10,000 in late July of 2020.

And this is when we load up the truck.

At this point, we’re fully invested.

Now we have one final leg up. Bitcoin goes all the way up to $70,000 in November.

Just like in the last cycle, it didn’t make it all the way up to the round number of $20,000; the peak was just under $20,000. And in this cycle, it was just under $70,000.

Martin: Interesting historical fact. As you say that, I’m wondering what the next big round number is going to be, but we’ll save that for later.

Juan: Now, I’m going to draw another line, because I want to be clear about what happens as I call the top.

The catalyst for calling of the top was the Fed. I was writing about it in 2021, saying, “I think the Fed is going to hike, and that’s going to kill the bull.”

Sure enough, the Fed announces they’re going to hike in November. And the market tumbles immediately.

Martin: Prior to this, we were of the theory that, if we followed prior market cycles, there would be a final hyperbolic blow-off, right?

Juan: That was our base case. However, we had this orange line I just drew.

Martin: It doesn’t give a damn about theories. It doesn’t give a damn about what you might think is going to happen, hyperbolic, or not. It just says this is it, or not.

Juan: Correct, and it said, sadly, “Bull market over.”

Martin: Throughout this period, other crypto analysts, who are permabulls, continually look for the big bottom, and they say,

‘“Oh, now this is the bottom.”

“No, THIS is the bottom.”

And every time, they take it on the chin. That’s where people start getting more and more discouraged. It's like the boy who cried wolf. They don’t believe anybody anymore.

Martin: As Bitcoin hit a low level and flatlined, you don’t call a bottom because the bear market is not one year old yet. It’s only six months old. So, you’re not even looking for a big bottom yet.

Juan: Exactly, it’s not time yet. That doesn’t happen until November.

Martin: So, now, let’s skip forward to when you get the big signal.

Juan: It’s January 12. But everybody’s saying, “Oh, it’s the death of crypto. Genesis is going to default. The entire industry’s going to go under.”

But I’m watching the downtrend line.

When Bitcoin busts through that line, it’s the big signal

It tells our model that you can rule out any crash, and you can rule out any incoming sell-off. The market is stable. The bear market is over.

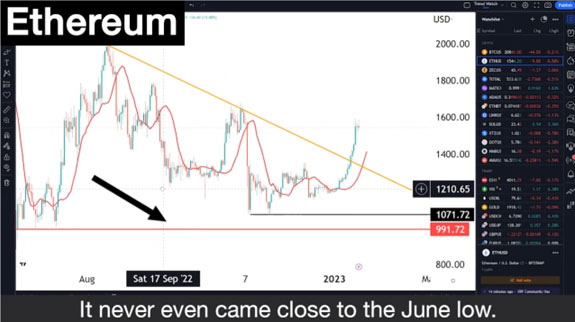

Martin: But the actual “buy” signal you sent out was for Ethereum. Can you show us the Ethereum chart?

Juan: Ethereum has a few differences that are very noteworthy:

First, it never even came close breaking below the June low.

Even though FTX was crashing and collapsing, and everyone was saying “the industry’s going to die” …

Ethereum does not make new lows.

It looks much more solid.

In this bull market, Ethereum will not only outperform again, but it will also establish itself as a new crypto benchmark.

Martin: Could you explain that for us?

Juan: Ethereum went through a major upgrade in September of 2022.

It transitioned to proof of stake (a system for minting cryptocurrencies without consuming massive amounts of time and energy like Bitcoin mining).

Even though a lot of people said this would never happen, it did happen. It gave a catalyst in the midst of a bear market. ETH rallied strongly on the back of that news.

Martin: That has never happened before in a bear market.

Juan: Not only that. This never happened with an altcoin. Period. This is the first time that a major altcoin does this.

Martin: So, big picture, what’s obvious to me from this discussion is this:

Give us some clues regarding how you go about timing the market and how investors can do something similar.

Juan: The way to do it is to count time. You count the number of days between low and low.

And this is what we do.

Martin: Between low and low. Not between top and top?

Juan: Between top and top is not as regular. You can still do it, but the way it’s set up in the model is from low to low.

For that, I have identified four main cycles:

- 20-day cycle. Every 20 days, crypto markets make a low.

- 80-day cycle. Following that, if you add up four of those 20-day cycles, you have an 80-day cycle. This is what is known in the model as a trading cycle. This is what we trade around. We base trends on the 80-day cycle, and it’s very important.

- 320-day cycle. If you take four of those 80-day cycles, you get one 320-day cycle. This is nearly a yearly cycle, also very prominent in crypto.

But it’s not like a Swiss clock. You can’t just set it to 80 days, forget it, and check back in 80 days later.

There’s some variance in the duration of each cycle.

Four-year cycle. This includes one bear year and three bull years.

I have it down to a science of sorts, but there’s a lot more that goes into it than just counting time.

So, this is why around big bottoms, I break it down into two signals:

My first signal is a heads-up. It’s time to accumulate. It looks like the big bottom is in, near or already passed, and then …

My second signal is the confirmation which is the most important and that tells us that yes, the first signal is now confirmed. We are in a new bull market.

Martin: What’s your forecast for this next cycle that has just begun? First, focus on the similarities, and we can cover the differences at another time.

Juan: The similarities are what you would expect:

Similarity #1. Super high volatility: Crypto assets are known for that, especially to the upside. And I’ve seen no signs that that’s going to change.

Similarity #2. Once the signal is confirmed, the market will not trade below that price ever. That is the most important thing.

When I say a new bull market cycle is beginning, that means the big bottom we just confirmed will never be crossed.

It means I expect this bull run to continue for three years.

Similarity #3. A select group of altcoins at the beginning is going to outperform Bitcoin by orders of magnitude. And then toward the end of the bull market, every altcoin will outperform Bitcoin.

Martin: I get it. In the beginning of the bull market, you have to be careful and select only the ones that have the really best technology, right? But once the frenzy begins …

Juan: People will buy anything with low market cap, simply because it’s crypto. When you enter the frenzy stage, anything that’s crypto and has a silly name … boom! It goes up more than Bitcoin.

Martin: At that point, are you going to join the crowd and buy some of that crap? Or are you going to stay away from it?

Juan: No, we’re going to stay away from it.

We’re going to buy things that we think can fly high but are also good fundamentally speaking.

Martin: That leads me to the next big topic …

Which Cryptos Will Be the Top Winners?

Which major crypto assets do you believe have the best chance of being among the top winners in this new bull market?

Juan: The six names that I’ve got on my list are Bitcoin, Ethereum, plus four others.

They’re all very liquid.

They’re very easy to trade, and …

I predict they will be among the biggest winners in this new bull market.

But this list can change. Or I could be wrong.

So, investors can’t just buy and forget. The more research they do, the better. Just be sure to use reliable sources, and ideally objective sources that rely on objective data.

Martin: Absolutely, very important!

Now, a few days ago, you and I texted about altcoins, and we were talking about Ethereum. But then you changed the subject to another altcoin.

It’s not a blue-chip recognized name, like Ethereum or Bitcoin, but it’s also not a shitcoin.

Martin: Ha-ha. That’s the official name nowadays, isn’t it? It’s not a dirty word anymore. It’s the actual term in the crypto dictionary.

Juan: Correct! So my main point is that it’s a mid-cap coin with, I think, a remarkable future ahead of it.

Martin: Why is that?

Juan: Number one is it’s not an altcoin competing with Ethereum.

It’s probably the only one that builds on Ethereum.

All the competition, all the other smart-contract platforms — and there are many — are trying to steal market share from Ethereum.

They’ve had some success, but it’s very hard to beat a crypto’s network effect.

Once it has an established network, it’s very hard to steal it.

That’s what Ethereum has — the biggest community in all of crypto.

You can develop better technology, but you’re not going to steal that community. Very, very difficult to do.

This new crypto, however, is symbiotic to Ethereum.

It’s attached to Ethereum. It makes it faster and cheaper. This is what I like.

Another thing that I like is that it’s a great platform to build NFTs on, and over the past year, they’ve partnered with many big brands to develop NFTs on their platform.

A lot of people think, “An NFT is just an image with value attached to it and overpriced.”

But the NFTs I’m talking about here are what I call utility NFTs.

They’re NFTs that people want to buy because they get something out of it. It’s not just bragging rights.

They join a community that they want to be part of. It could be discounts. It could be tickets to the Super Bowl. It could be anything.

No matter what, the NFT marketplace is potentially the biggest we’ve ever seen in crypto.

Martin: Our colleague here at Weiss, Marija Matić, just sent us the list of companies that this crypto is partnering with.

Juan: Yes! It includes Adobe, Adidas, MasterCard, Meta, Reddit, Starbucks, the NFL, Walt Disney and many others.

Martin: Hey, these are mainstream, well-known brands.

Juan: This crypto project has everything I like.

It has great technology, and it’s getting a lot better.

It trades very well.

It has great prospects for mass adoption.

And team is just amazing. I know some of them personally. We’ve chatted online. And I can see they have their eyes on the ball.

They really know what they’re doing. They understand how to scale crypto. They understand what makes it appealing to brands, like the big brands they’re partnering with for NFTs.

Their marketing team, their tech team, everything is just top of the line.

One of my favorite projects!

The “Super Ethereum” (SuperETH for short)

Martin: OK. So, if you don’t mind, I’m going to call this crypto the Super Ethereum, or SuperETH for short.

But first I want to go back to Bitcoin and Ethereum to ask you a very important question.

From the day you called the last big bottom through the end of that three-year boom market, Bitcoin rose 20x and Ethereum rose 54x.

So, the question is, do you predict Bitcoin and Ethereum will again deliver that kind of performance this time around?

Juan: No. Why do you look so surprised?

Martin: I’m not surprised. We’ve talked about this before, but I’m wondering why they won’t do as well, and what to do about it.

Juan: The reason is pretty simple.

These assets were not as liquid back then. So, as they get more liquid and growing more in size, their moves get smaller.

It didn’t take as much capital to move them, but now, it’s going to take a lot more.

Martin: That’s a good thing.

Juan: Exactly! The risk-adjusted return is very good for Bitcoin, for Ethereum, for these established names.

Martin: But if you want to have a crack at the kind of big high rises that we saw, then what?

Juan: That’s why we have some of the newer names in our mix as well, and that’s why I said, “Hey, listen, this list is what we have today.” We may include other names in the list as the market develops.

Martin: OK. On the short list of top coins to buy, we have Bitcoin.

We have the SuperETH we just talked about, plus we have two other altcoins.

When we first talked about them a few days ago, I double-checked, and I’m pleased to see that all of them get a good Weiss Rating.

This means a lot to me. In fact, I want to talk about the other two names, but before that, before we do that, please give us some insight into the science behind what you do.

Juan: We have our Crypto Ratings Model that we use to select what we think are the best assets. And then we use the Crypto Timing Model to pick the best timing to trade.

Our Crypto Ratings Model Covers 3 Three Main Areas:

If all of these three factors line up, we pick the asset to trade.

Our Crypto Timing Model Is Based on the Cycles:

- The 20-day cycle

- The 80-day cycle

- The 320-day cycle

- The four-year cycle

And we use all four cycles in combination to pick the times to buy and sell.

Martin: Each of these models, I must say, was a massive undertaking by you, Juan, by our data scientists, our developers, in other words, computer programmers.

Martin: It’s all about giving investors a sense of why we developed our Crypto Timing Model, and why we feel …

Juan: Right, and that’s what I do with the service that I run. I use the same data that I showed you here. I use the exact same models, same calculations and all of the things that we discussed here today — the exact same tools.

Martin: Great! Anymore charts you want to share on your screen right now?

Juan: No, but there’s another critical points that I’d still like to make.

Martin: OK, stand by, because right now, I want to talk about some great reports you and your team have written about each of these opportunities …

So, viewers can download them as soon as we’re done with this Zoom conference today.

As the founder of Weiss Crypto Ratings, I’m very proud of what you guys have done, and it gives me great pleasure to brag about your work.

Juan: Sure.

Martin: It all begins with the Weiss Crypto Ratings. One crypto commentator wrote,

Forbes, CNBC, Fortune, Motley Fool and many others told their readers about the importance of the Weiss Crypto Ratings.

And crypto blogs all over the world have praised our Weiss Ratings experts for their uncanny accuracy in pinpointing the best cryptos to buy and the right time to buy them.

Now, this bull market is giving investors a brand-new opportunity — among the biggest investment opportunities I’ve personally seen since I founded this research and ratings company more than a half century ago.

Clearly, this is an investment class that has already generated some of the greatest percentage gains of any sector of any economy on the planet, and it’s an investment class that we predict could again greatly outperform other asset classes.

So, for investors who have extra money to invest, and even to lose, who are ready to jump on this opportunity, all our work leads us to the prediction that this is probably the best time in the cycle to buy what could again be one of the best performing asset classes in the world.

Of course, each investor may choose a different path, but here are the five steps that we believe make the most sense overall.

Step 1: Avoid the Garbage Coins

We currently rate over 1,000 cryptocurrencies, and the overwhelming majority do not get good grades.

Among the worst, let me name seven right here and now:

- Ardor

- Filecoin

- Holo

- Hyperion

- Kusama

- Mina Protocol

- Wanchain

These are just examples. So, I think crypto investors should also carefully review the complete list in our special report, “166 Cryptos to Dump Now.”

Personally, I wouldn’t touch them with a 10-foot pole, and the data we have tells us that they’re a pile of garbage and hype.

Just by avoiding these kinds of low-rated cryptos, I think investors can cut their risk by a pretty wide margin.

Of course, with any investment, eliminating all risk is impossible, which is especially true for cryptocurrencies.

That’s why I say it’s so important for crypto investors to focus on the few that are at, or near the top of, our Weiss Ratings list.

If there ever was a time folks considered buying cryptocurrencies in the past, but decided not to buy, and then live to regret it, I firmly believe this is the time to make up for that lost opportunity.

On the flip side, if there ever was a time that folks did buy but paid crazy high prices and then lost a lot of money, I say this is the time to potentially recoup those losses, or better.

We’re here to do everything we can to help crypto investors avoid those kinds of traps and take advantage of what we firmly believe are some of the lowest prices you’ll see in the three-year bull market cycle, which leads me to …

Step 2: Build a Stake in Bitcoin

As you probably know, Bitcoin is fast becoming the world’s leading escape hatch.

It’s one of the most popular havens for anyone afraid of the crazy things that governments do …

Sending money like drunken sailors …

Printing money like mad men, and …

Invading the freedom of private individuals, obstructing the growth of private enterprise, or worse.

So, it should come as no surprise that a growing number of investors — and even institutions — are fed up with government excesses and overreach.

In our view, that alone is a strong argument for Bitcoin.

Even if we discard every prediction about the market, I feel we can make a very strong argument that Bitcoin is a vital asset simply because of its history as a long-term, immutable store of value that’s …

Not under the boot of any central bank, or any government!

The big question we always ask is not whether to own Bitcoin. It’s when to own Bitcoin.

To help investors figure that out, Juan and his team have a second special report for you to download right now, “The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence.”

In this report, Juan teaches investors …

- How to time the entire Bitcoin cycle …

- How to recognize when the three-year bull market cycle is still in its early stages, like it is now, and it’s still a good time to buy, and later …

- How to recognize when it’s ending, and it’s a good time to sell.

If investors can better understand just those two critical points, I think that alone could make a tremendous difference in the results.

But in this guide, Juan goes beyond that.

He also demonstrates how he uses the 80-day cycle to help pick intermediate bottoms and intermediate tops in the Bitcoin market.

So, if investors miss the big bottom, or they want to buy more along the way, this can help them identify new buying opportunities.

And here’s the key …

Bitcoin is the benchmark, and almost all other cryptos follow in the same time horizon as Bitcoin.

Just saying “buy Bitcoin” is a no-brainer, and anyone can do that.

But do they know when to sell Bitcoin?

That’s what I feel 90% of investors get wrong.

And I think that simple extra bit of intelligence alone — when to sell — can make the difference between a great victory and a crushing failure.

“The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence” can be the key to making that difference for investors.

Step 3: Learn All About the Crypto That Rose 234x

Download your third bonus report, “This Crypto Rose 234x: Can It Happen Again?”

I know, making gains of 234x may sound crazy, and it’s certainly not typical, but in the last three-year bull market, 234x gains is exactly what we saw with one of our high-rated coins.

In this report …

- We name the coin that soared 234x …

- We show you how it achieved the huge 234X gains in the last three-year bull market …

- We give you our forecast for its performance in this new three-year bull market that has just started. Plus …

- We provide a list of other cryptos that we feel are among the best candidates for large gains.

Just bear in mind, picking super winners like this one with 20/20 hindsight is a lot easier than picking them for the future.

And like Juan said, do not expect the next Bitcoin bull market to be as spectacular as the previous one.

That’s another reason why I think our crypto ratings are so important:

We cover over 1,000 digital assets.

We take a deep dive into their technology.

We look at their real-world adoption and their market performance.

We crunch terabytes of data with a strict discipline that has nothing to do with hype, nothing to do with greed, nothing to do with fear.

And with all that work, I think we do a pretty good job of finding some diamonds in the rough.

Juan has the track record to prove it, and I’ll tell you more about that in a second.

Step 4: Seriously Consider Buying the “SuperETH” Coin

As Juan explained, there are plenty of struggling projects trying to compete with Ethereum.

This one is probably the only one that builds on Ethereum, and it’s already ramping up in a big way.

Juan provides all the details in his bonus report, “SuperETH: The Coin Running Circles Around Ethereum While Powering Its Growth.”

In this report, he explains …

- Why its technology is far superior to any other Ethereum type crypto …

- How it benefits directly from the growth of Ethereum, and vice versa …

- Its prospects for mass adoption by millions of users …

- Why getting all those big brands for their NFTs is so important and how it’s helping them grab up market share …

- Precisely how and when crypto investors should buy this crypto, including …

- How much to allocate in their portfolio compared to their other crypto investments.

Then, as with all our materials, it’s up to each person to make their own decisions in the context of their individual goals and risk tolerance.

I think this SuperETH crypto is especially exciting, but we’ve saved the most exciting opportunity of all for last. Ready? Here goes.

Step 5: Hop on the Biggest Tech Megatrend of Our Era, ARTIFICIAL INTELLIGENCE

We’re not talking about AI that’s developed by traditional tech companies.

When investors buy the shares in those companies, they’re also investing in a bunch of products that have nothing to do with AI.

In fact, if some of those big tech companies have, say, 10% of their business in AI-related products, that’s probably a lot.

The other 90% — or much more — have nothing to do with AI.

So, if an investor wants pure AI, we don’t think that’s the best path to follow.

Instead, we feel the most direct and rapid path to AI is via the crypto world — cryptos that give investors a direct, virtually pure, stake in high-powered AI, and nothing but high-powered AI.

So, here’s what we’ve done at Weiss Ratings …

We’ve created a task force of researchers dedicated to AI in the crypto world.

We’ve pored through scores of projects, and we picked out the one AI-related crypto, which we believe has the best chance of becoming the outstanding winner.

And all the details are in our bonus report, “AI Wonder: The #1 Artificial Intelligence Crypto in the World Today.”

In it, we reveal …

- How, among all the high-rated cryptos on our list of all types, it’s already the number one performer so far this year …

- Why we predict its rise could be just the beginning of a multi-year growth explosion …

- The vast diversity of AI projects it has already undertaken successfully …

- 3 new promising projects that it’s launching right now.

- How just one or two of these projects could help propel its value higher.

- Guidelines for how to fit this into a model crypto portfolio, where, when and how much to invest.

That’s four cryptos, all with high Weiss Ratings, all highly recommended by Juan and team.

Should investors put all their money in these four cryptos? No, of course not.

But with the profit potential we see ahead, investors shouldn’t have to invest a lot of money to achieve results that can make a difference.

Read our reports. Then decide whether it’s the right move for you and how much you’re comfortable investing.

No promises, or guarantees, but in every past three-year bull market …

It should have been sufficient for investors to put up just a few hundred dollars, and …

Still have the opportunity to see a significant positive impact on their overall portfolio.

In that sense, we predict the opportunity investors have today will be very similar, and I think the five simple steps I’ve just reviewed could make it a lot easier to avoid the pitfalls along the way.

Five simple steps, each explained in our five bonus reports!

Now, we sell these reports separately for $79 each, but you get them at zero cost when you accept a trial to our flagship newsletter dedicated to cryptocurrencies.

I’m talking about …

Juan Villaverde’s Weiss Crypto Investor

Each month, Juan and his coeditor, Nilus Mattive, bring you fresh, hot moneymaking opportunities.

Remember, Juan is the crypto researcher and advanced mathematician who’s the main architect of our Crypto Ratings Model, of our Crypto Timing Model.

He’s the man who picked the bottom in Bitcoin in December of 2018, after which select cryptos rose 20 times, 54 times, 102 times even 234 times.

And he’s a trader with a truly stellar real-time track record.

I know this because my data team and I have reviewed all of the cryptocurrency recommendations he’s made in our investment and trading services from the very first day we published them early in 2018 until the last day of January, 2023.

Assuming subscribers acted on Juan’s trading recommendations after we sent them via email or text, we estimate those investors would’ve seen the following results:

- 49 winning trades with an average gain of 319%.

- 25 losing trades with an average loss of 36%.

That provided subscribers the opportunity to harness two powerful advantages.

Advantage #1. Nearly twice as many winning trades as losing trades.

Advantage #2. The average gain on each winner was 8.8x larger than the average loss on each loser.

That adds up to …

74 Trades with an Overall Average Gain of 198.9% on Each Trade

I repeat: 74 trades and an average gain per trade of 198.9%.

That includes all his crypto trades, whether open or closed, and whether winners or losers.

And get this:

In his monthly Weiss Crypto Investor, Juan alerts subscribers to crypto trades that he believes could be among the best long-term plays going forward.

Plus, he also warns about hyped-up cryptos that may look good on the surface, but based on the Weiss Crypto Ratings should be avoided like the plague.

Each month, subscribers get Juan’s latest forecasts about the broad crypto market, plus the hottest recommendations they can review to position themselves for maximum potential gains.

Normally, one year of Weiss Crypto Investor is $129, which I think is a bargain, given the wealth of info it contains.

But I don’t want you to pay even that much.

Provided you respond on this page, you can take $80 off. Just click here, and we’ll send you 12 monthly issues for just $49.

That’s …

Less Than 14 Cents Per Day!

What’s more, when you join now, we’ll also give you immediate access to download all five of our bonus reports with the specific instructions on the five steps we’ve told you about today.

All as my “thank you” for giving Weiss Crypto Investor a try!

I believe that’s pretty much all you need to get started immediately.

Still, in the fast-moving world of crypto, I also think it’s important to stay up-to-date with the latest news daily.

So, with that in mind, you will also get a subscription to our Weiss Crypto Daily.

This is the free e-letter we publish six days a week.

The crypto world moves faster than practically any other market on the planet.

So, in our Weiss Crypto Daily, our crypto experts …

- Keep investors on the cutting edge of all things crypto.

- Alert subscribers to up-and-coming opportunities.

- Warn about the scams and misinformation.

- Provide our unbiased responses to the breaking crypto news of the day.

Plus, I have one more important gift I think you’ll absolutely love, and that’s absolutely priceless.

We give subscribers free access to special video interviews with our crypto experts, exploring crypto trends and profit opportunities that are often not available from any other source.

They review the latest news and changes on our crypto ratings.

They cover the latest on our Crypto Timing Model, and the latest on our recommended coins, plus much, much more. Just listen to what others are saying.

Try Weiss Crypto Investor for 12 full months.

If you’re not absolutely thrilled with the results you achieve, just let us know, and we’ll rush you a full refund, no questions asked.

We’ll give you back every penny you’ve paid for your membership, and you can still keep all five of your special reports and all the issues that we’ve sent you, my gift to you.

And you can do that even if you cancel on the very last day.

Click here and join now for just 14 cents a day.

Then instantly download all five bonus reports.

- The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottom and Big Tops with Confidence (sold separately for $79).

- 166 Cryptos to Dump Now (sold separately for $79).

- This Crypto Rose 234X: Can It Happen Again? (sold separately for $79 value).

- SuperETH: The Coin Running Circles Around Ethereum While Powering Its Growth (sold separately for $79).

- AI Wonder: The #1 Artificial Intelligence Crypto in the World Today (sold separately for $79).

So, you get five special reports worth $79 each, or $395 for the five.

You get 12 monthly issues of Juan’s “Weiss Crypto Investor,” normally $129.

You get over 300 daily updates to our “Weiss Crypto Daily” e-letter, which I think is priceless.

Plus, you get special video interviews with our experts, also priceless.

In sum, you get a total value of $524, but your total all-in cost today is just $49.

You save a whopping $475, provided, that is, you respond on this page, and while this offer is still available.

My friend, we’re living in a unique moment in time, a moment when a new crypto bull market has just been born, and when the very nature of money and its technology is undergoing drastic change, usually for the better.

If you don’t want to be just an observer sitting on the sidelines …

If you want to be a part of this great money revolution …

Try Weiss Crypto Investor for one full year.

If you’re not thrilled with the results, just let me know. And I’ll rush you a full refund, even if it’s the very last day of your membership, and …

You can still keep all your gifts. My way, and Juan’s way, of saying “thank you” for giving Weiss Crypto Investor a try.

Hey, Juan, are you still there? What’s that last point you wanted to make?

Juan: Here’s the main point: The Bitcoin bottom is behind us, based on our timing model. So, I predict that there’s no better opportunity to buy it in the future. You will never again see prices as low as they are today.

Martin: Thank you, Juan.

And thank you, our viewers, for joining us today.

Good luck and God bless!

Weiss Crypto Investor

© All rights reserved | 11780 US Highway 1, Palm Beach Gardens, FL 33408-3080 | 877-934-7778