Stock Market Legend Reveals the REAL Reason Stocks Are Tanking Under Biden…

How a Radical New Ideology Is Destroying the Stock Market

“It’s Not Just Ruining Companies… It’s Dividing Our Country to a Breaking Point.” – Billionaire Corporate CEO

Hi, everyone. Alexander Green here… Chief Investment Strategist at The Oxford Club.

Most people know me as a “stock market optimist.”

I emphatically told people to buy stocks after every major crash of the last 25 years… in 2002 after the dot-com bust, in 2009 at the bottom of the financial crisis, and in March 2020, immediately following the coronavirus crash.

But today I want to share something with you that is very troubling.

As you likely know, the Biden administration has been terrible for the stock market.

Inflation hit a 40-year record. Energy prices skyrocketed. And profits collapsed.

2022 was the worst year for the stock market since the great financial crisis in 2008.

Household wealth dropped $13.5 trillion from January to September alone, the second-worst destruction on record.

Globally investors lost $30 trillion last year.

Now… most investors rightfully point to inflation, poor energy policy, higher interest rates and runaway government spending as the culprits behind this massive destruction of wealth.

But there is something else going on…

Something MUCH bigger that could hurt us not just for the next year or two… but permanently alter the American way of life.

If it continues, it will make America far less wealthy, far less competitive and far less powerful on the global stage.

It could crush pensions and 401(k)s across the country.

I consider this new phenomenon to be the single biggest threat to your money today.

In fact, one whistleblower, the CEO of a major corporation, brought this threat to light, calling it “the defining scam of our time.”

He says it robs us of our money… and threatens the very foundation of American democracy.

He calls it “a new invisible force at work in the highest ranks of corporate America.”

He says it’s “not just ruining companies… it’s dividing our country to a breaking point.”

And he is correct.

This scam involves the richest and most powerful people in the world… the CEOs of major corporations, government leaders, university presidents, and the heads of major foundations and pension funds.

Today I’m going to reveal this disaster in full to you.

Because it has major implications for your wealth.

The performance of the stock market is being radically altered by what is going on. And if you want to grow your wealth going forward… you need to take three specific steps to immediately protect your money.

Because while hundreds of investments are going to lose BIG money going forward… there are three specific investments that are going in the exact opposite direction.

These three investments were all UP last year, while the market tanked.

And I believe they offer 10-bagger potential in the years ahead.

I want to share those with you today.

So let’s get right into it…

How America Has Changed Over the Past Decade

In order to understand the new threat facing our country, you have to appreciate what made America the greatest nation on Earth in the first place.

No matter what Ivy League academics say these days, our nation’s founding was revolutionary. It was the first country to truly put political power in the hands of the people.

Our Declaration of Independence is a timeless statement of inherent rights, the true purposes of government and the limits of political authority.

Our core beliefs are enshrined in the Constitution and Bill of Rights, the longest-serving foundation of liberty in history.

Our nation’s growth and prosperity under our capitalist system have been extraordinary.

In the American capitalist system, entrepreneurs are given free license to innovate and create. Profit was never something to apologize for. Rather it was viewed as proof that the businessman offered customers something more valuable than the money they traded.

As a result, our economy became the world’s largest, bigger than the second (China) and third (Japan) combined.

The fact is… no nation in history has done more to generate wealth and eradicate poverty than the United States of America.

And yet… something has fundamentally changed… that could alter the trajectory of our country forever.

It’s something our audience has certainly seen.

But I don’t think they understand the full scope of how truly damaging it is.

Not only is it a threat…

But as I’ll prove to you in the next few minutes… it is the single most dangerous attack on your money in the world today.

This movement could ruin our economy and destroy stock market returns… for years to come.

In fact, it’s already doing so.

But let me start at the beginning.

Our University System Is Pumping Out Millions of Angry, Intolerant, Ignorant, Self-Righteous Social Justice Warriors… Who Hate Capitalism and Everything It Stands For

The money-destroying phenomenon I’m talking about began with our public school and university system.

Our university system was once the envy of the world.

We produced intelligent, thoughtful, problem-solving students well suited to succeed in a free market capitalist system.

But over the years, the opposite has become true.

A dominant force of “woke” academics and biased journalists in the United States now labor around the clock to deliver a negative picture of American business and anyone who has worked hard to amass serious wealth.

For example, the University of California has banned phrases like “America is the land of opportunity” and “the most qualified person should get the job.”

Stanford even banned the use of the word “American” altogether!

At Columbia, an Ivy League institution, professors teach students that “capitalism causes mental illness.”

One professor indoctrinates students with the belief that alcohol and drug abuse is not their fault… but rather just a natural outcome of living in a capitalist society.

At UCLA, a giant group of students recently took over and occupied a professor’s classroom in protest… because they felt his spelling and grammar corrections were racist microaggressions that made them feel “unsafe.”

How are kids supposed to learn to succeed in the real world when they can’t even handle a basic spell-check without shouting racism?

But it’s being pushed on them every day.

The relentless drumbeat in academia and the media has convinced millions around the country – and around the world – that the U.S. is a shameful and flawed nation.

They teach our kids that they are victims of exploitation and greedy corporations. That they cannot succeed no matter how hard they work. And that their main goal should be to become activists… not to live successful, productive lives.

Instead of the intelligent problem solvers we want in our workforce, our education system is pumping out angry, intolerant, ignorant, self-righteous social justice warriors who identify purely as victims.

This is the education our kids are receiving.

And then they’re put out into the real world.

Now… this is where it gets troubling.

You see… up until now most of this crazy thinking was largely confined to our schools.

Business leaders – the adults in the room – would knock some sense into these kids once they entered the workforce.

But now we’ve reached a tipping point.

In many cases, the inmates are running the asylum.

Millions of graduates from our university indoctrination camps are increasingly infecting the ranks of our biggest publicly traded companies… all the way up to the boardroom.

And they are successfully pushing a destructive version of woke ideology called Woke Capitalism.

What exactly is Woke Capitalism?

“It’s Not Just Ruining Companies. It’s Polarizing Our Politics. It’s Dividing Our Country to a Breaking Point.”

– CEO of the Biggest Biotech IPO Ever

Well, traditional shareholder capitalism holds that the purpose of any given business is to produce a profit… and use those profits to reward shareholders.

It’s been the single greatest anti-poverty program and wealth creator of all time.

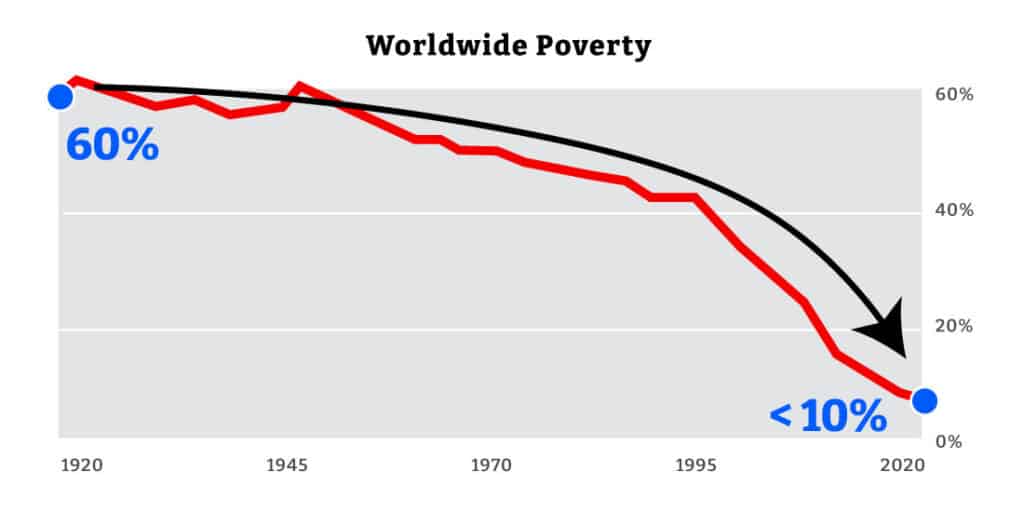

100 years ago, 60% of people worldwide lived in extreme poverty.

Today, less than 10% do.

Life expectancy was 54 years. Now it’s 87.

In 1910, only 2% of people – the ultra-rich – had electricity.

Today, virtually 100% do.

100 years ago, there were no refrigerators or air-conditioning units.

Today, you’d have a hard time finding a house without one.

It’s capitalism that drove all this innovation.

Now, the anti-capitalists will say its all about selfishness, greed and exploitation.

But in fact, the opposite is actually true.

In business, you succeed by focusing on the customer and delivering a product that your customers want.

Fail to do that, and you won’t be in business for long.

If you cut corners on quality, your customers will leave. If you undervalue your key employees, they will take their talents elsewhere.

But if you build great products, treat your customers and employees well, and reward investors… your company is likely to succeed.

And the beauty of American capitalism is that anyone can own a stake in the world’s great businesses… and you can do so at the click of a mouse on your computer.

This is why America has been so successful.

The stock market has allowed everyone who buys shares to participate in the growth of the business.

It’s the reason that if you put $100 into the stock market 100 years ago… it would be worth almost $2 million today.

But with Woke Capitalism, the whole system is changing.

The goal of Woke Capitalism is not to expand wealth but to expand the victim class… to virtue signal… and to shut down any dissent.

As Vivek Ramaswamy, presidential candidate and author of Woke, Inc., put it, “Being woke means obsessing about race, gender and sexual orientation.”

For example, Goldman Sachs recently declared that they won’t take any company public unless it meets a diversity quota on the board.

Listen… you build a business – or any organization for that matter – on merit, not on diversity quotas that have nothing to do with individual ability.

But Goldman Sachs admits they are no longer primarily focused on investing purely in great companies…

Rather, now skin color and sexual identity come first.

And this “identity over competency” ideology is taking over our economy.

This is not a small thing.

It is a nation-defining change that I believe will make our country far less competitive and will hurt many individual stocks deeply in the long run.

Woke Capitalism leads to conflict.

It leads to anger and boycotts.

It upsets customers, employees and suppliers.

And most importantly, it leads to far worse stock market returns.

Woke Capitalism is in fact perhaps the defining reason stocks have taken a dramatic turn downward under the Biden administration.

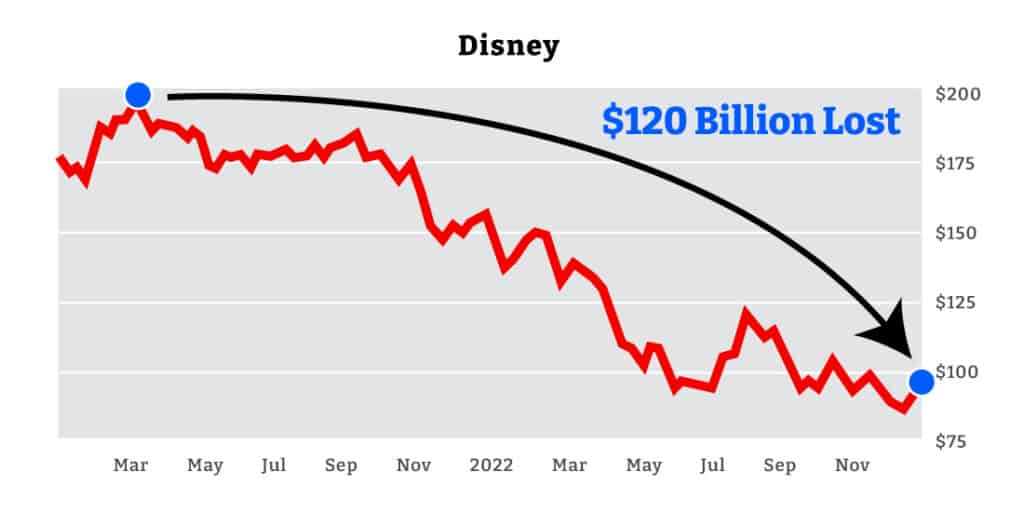

How Woke Capitalism Led to a $120 Billion Loss at Disney

Disney is the perfect example of what I’m talking about.

The company was once the definition of a great American company that embraced wholesome family values.

It made billions for its investors.

But now it has completely reversed course.

For the last two years, Disney has been named the “worst of the woke.”

In nearly every movie they put out, many of which are completely bombing, the company is pushing woke politics on young children.

Check out this clip from a Disney kid’s show indoctrinating kids on the idea that racism and white supremacy are sins America still has not atoned for.

Is this type of divisive political message appropriate for kids?

Or how about Disney’s battle against the Florida law that simply banned instruction on sexuality to kids in kindergarten through third grade?

Who would have thought we’d live in a world where it’s controversial to say sexual topics shouldn’t be taught to kindergartners!

And yet that’s what Disney is advocating.

The company is so caught up in Woke Capitalism they even banned the words “boys and girls” and “ladies and gentlemen” from their theme parks.

That’s how crazy this has gotten.

And it is killing their bottom line.

In 2022 alone, Disney stock dropped by almost HALF… wiping out $120 billion in shareholder value.

Its movies are bombing despite massive budgets. The streaming service is losing billions.

And don’t forget ESPN, which is owned by Disney. They are getting hammered too.

ESPN decided that sports needed to be injected with woke political agendas.

The NBA, for example, put advertisements for Black Lives Matter on the court during games aired by ESPN.

Never mind that Black Lives Matter leaders actively encouraged the burning and looting of businesses across the country… and advocated defunding the police, which led to a spike in homicides nationwide.

Or even that the leaders of Black Lives Matter used donations to buy themselves lavish mansions.

Despite all that, the NBA proudly put the BLM logo on the floor during games.

People tuning in to sports games didn’t exactly want to have a political agenda pushed in their faces.

And so ESPN’s ratings have plummeted. Their subscribers are canceling by the millions.

The company has lost 24 million subscribers since 2011.

But this is what Woke Capitalism does.

When you stop caring about your customers… and you stop rewarding shareholders… and instead focus purely on your political agenda… the business suffers.

The company is turning their backs on the millions of parents who don’t want their kids focused on agendas like white supremacy and sexual politics…

And millions of sports fans who don’t want political agendas shoved down their throats during a game.

What’s worse… Disney shareholders are paying the price.

The stock peaked at nearly $200 at the beginning of 2021 when Biden took office… But by the end of 2022, it had been cut in HALF!

You want to know why investors lost big in 2022?

Woke Capitalism is one of the biggest reasons.

And it’s only getting worse and worse… pushing its way into every facet of our lives.

Long term, it is the single biggest threat to American prosperity.

Now you might be thinking…

Disney is one company. I can stop watching their movies. I can quit going to their theme parks. And I don’t have to own Disney stock. Can’t we just avoid a woke company like Disney and move on?

I wish that were true, but it’s so much bigger than just Disney.

Corporations across the spectrum are being infected by Woke Capitalism.

Coca-Cola, for example, held diversity training where they told workers to be “less white.”

Google manipulated its search engine to hurt Republicans during the midterm. And they recently fired an engineer who dared to say that Google had more male engineers because more male students got degrees in the STEM fields.

Before Elon Musk took over, Twitter actively worked with Democratic politicians to hide stories like the Hunter Biden laptop that could hurt the left.

Nike embraced Colin Kaepernick as a spokesperson, offending veterans across the country.

Then they canceled a shoe with the Betsy Ross flag on it at his request.

Or look at DirectTV. They took conservative news sources like Newsmax and OAN off the air.

And DirecTV’s parent company AT&T went on to lose $10 billion in value.

This is everywhere.

And all of these stocks took a beating as a result.

Sometimes it’s companies that aren’t even necessarily pushing a woke agenda.

The Woke Ideology Is Even Tanking Good Companies

Target is a great example of this.

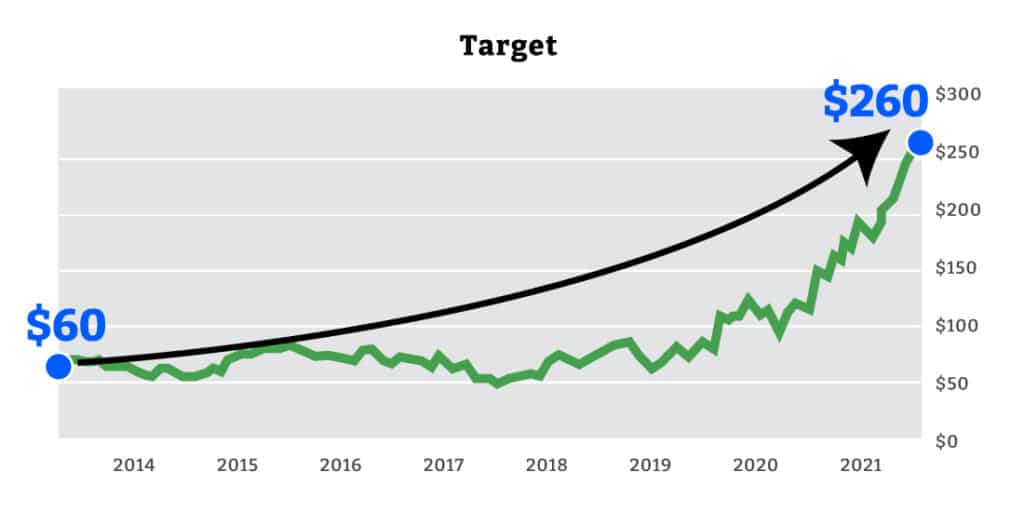

In 2014, I wrote about Target.

At the time, it was doing what a company should… working to reward shareholders.

It was opening 120 new stores in Canada and the United States. Sales had increased for five years. I was expecting a big jump in net income.

And here’s the stock chart showing what Target’s stock did next.

Over seven years, the stock went from around $60 to a peak of $260!

Shareholders made big money.

Until early 2021, that is. When Biden took office.

That’s when the stock’s trajectory reversed.

Why exactly?

Well, let me share with you a stunning fact.

In their last earnings release, Target revealed they had lost $400 MILLION due to mass shoplifting and looting.

And they expected that number to jump to $600 million going forward.

$600 MILLION!

It is CRUSHING their margins.

And this is a direct result of attorneys general and prosecutors in liberal states, like California, New York, Oregon and others.

They’ve decriminalized shoplifting. They won’t punish looters. They believe that people have the right to take anything they want.

Because business is inherently bad.

It’s all part of the woke ideology we’re seeing across the country.

People are being taught in schools that capitalism is immoral. So, logically, if capitalism is immoral, then stealing from a business must be moral.

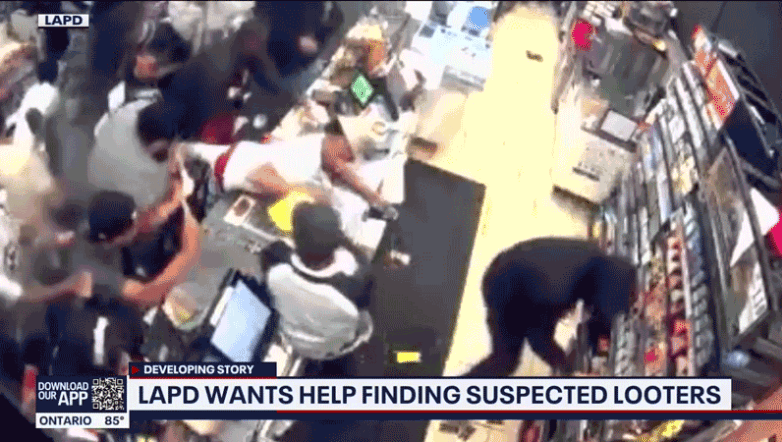

Look at some of these videos of people stealing from Target. They don’t even try to hide what they are doing.

There’s a guy struggling with security to get his big-screen TV out the door.

There are people just yanking purses off the shelves.

There are mass shoplifting events organized on social media to involve hundreds of people.

In Seattle, 35 people were caught ransacking Target for thousands of dollars’ worth of stolen liquor and home goods.

The police caught them afterward.

And were they charged?

Of course not. Because the police’s hands are tied. The shoplifters were released with a trespass warning. Not even a ticket.

No doubt they were out robbing other stores again days later.

And who pays the price for all of this?

People who own the stock!

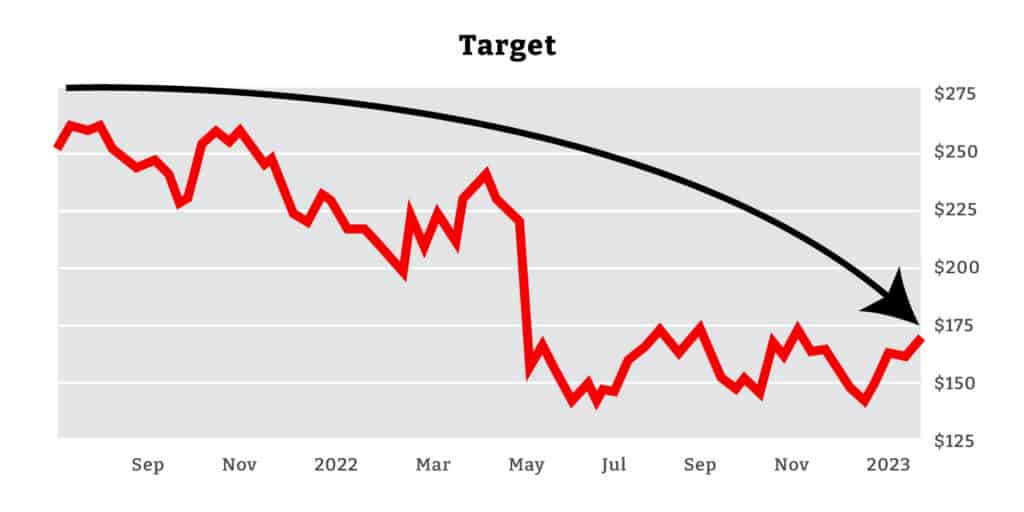

Remember I showed you how well Target stock had done until Biden got in charge?

Well, here’s how it’s done since.

The stock has cratered because they are suffering hundreds of millions of dollars in losses due to the woke agenda pushed by Biden and liberal prosecutors in blue states.

And this is bigger than Target. Retailers are shutting down store∂cs across states like California and New York.

Walgreens is having to shut down store after store in San Francisco because shoplifters were just loading up carts with goods and walking right out the front door.

Then days later the items show up at flea markets in Oakland for sale at a big discount

And because of California’s laws, there’s almost nothing Walgreens can do to stop this.

It’s happening everywhere in the retail sector.

Walmart’s CEO publicly stated that they would have no choice but to close stores and raise prices because they are losing so much to the criminals.

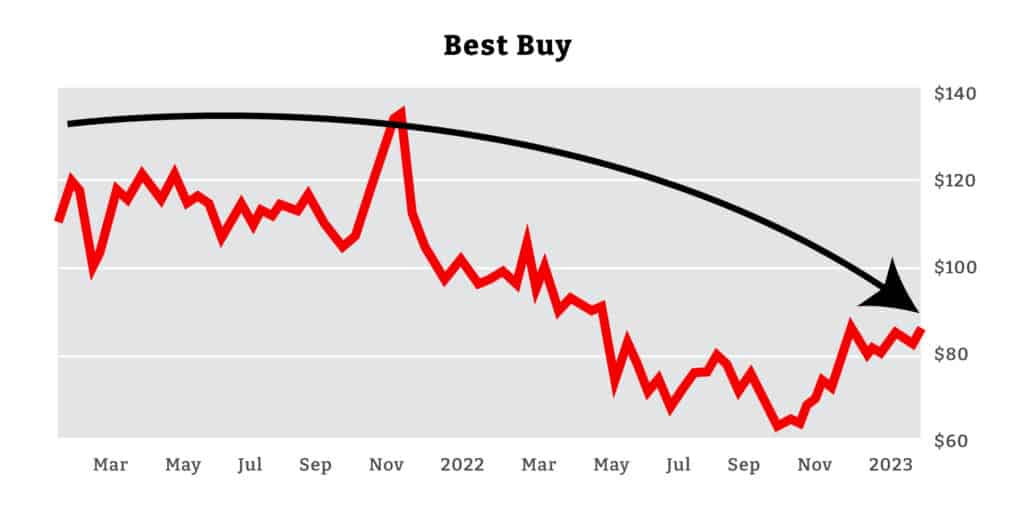

Best Buy’s CEO said his staff are traumatized by organized gangs running in and ransacking the shelves.

He says the company is taking a big hit to their profits, which is stopping them from hiring new employees.

There have been mass looting events virtually everywhere. At 7-11 stores. Neiman Marcus. Nordstrom. Pharmacies. Grocery stores.

And again, it’s shareholders who are footing the bill.

Best Buy’s stock has been crushed since Biden came in.

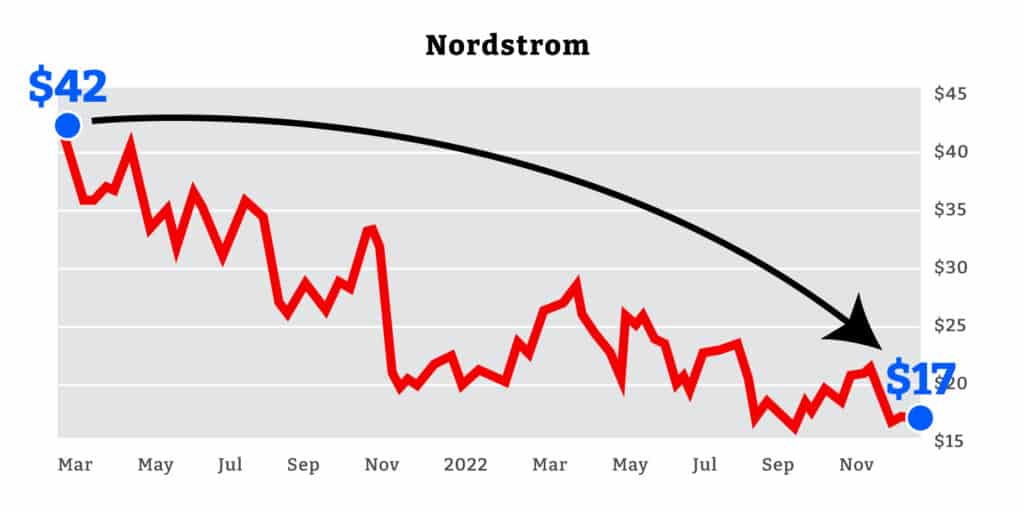

Nordstrom plummeted from a peak of $42 to less than $17 at the end of 2022.

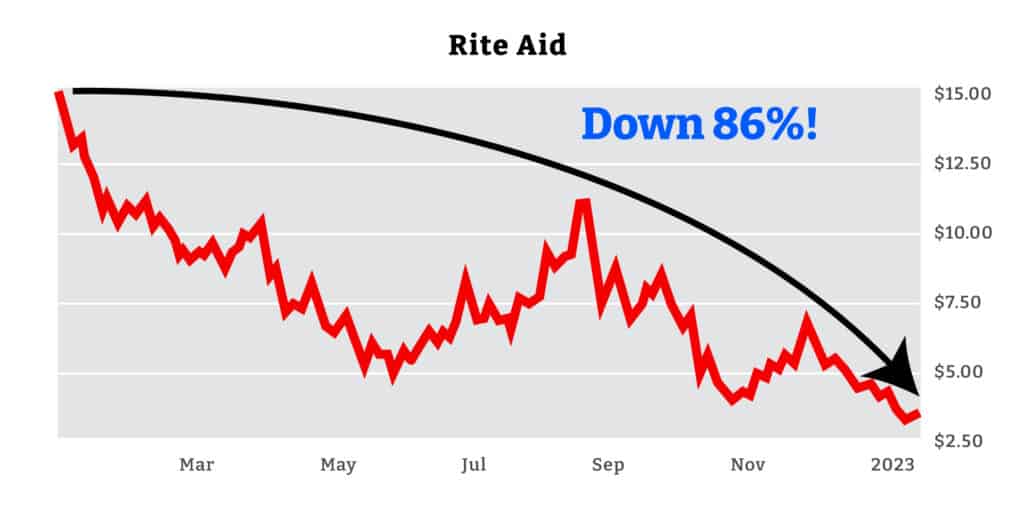

Rite Aid went down 86%!

Rite Aid directly said it was the “environment that we operate in, particularly in New York City” that’s causing the massive losses.

One store alone lost $200,000 in just two months due to retail theft!

This is exactly what you get when you decriminalize shoplifting and blame all your problems on business.

Retail stocks get crushed.

And we’ve already seen how hard tech stocks have been hit because of their adoption of Woke Capitalism.

But it’s so much bigger than tech and retail.

I haven’t even touched on the most potentially dangerous element of Woke Capitalism.

There is a very scary movement taking place right now that could impact every single stock that trades publicly.

I’m talking about something called ESG.

ESG: The Most Potentially Damaging Idea in the Stock Market Today

It stands for environmental, social justice, and corporate governance.

ESG is essentially a new policy the biggest asset managers in the world are adopting.

Here’s how it works.

Instead of looking for great companies that are developing exciting new products and producing big profits… asset managers are now deciding what stock to invest in based on how much the company pushes an environmental agenda. And how much it advocates for social justice issues. And by counting up the number of women or people of color on the board.

This poisonous and frankly racist philosophy, that skin color and sexual identity are the only ways to judge people’s character and talents, has now spread from faculty lounges to the highest levels of Wall Street investment firms.

And BlackRock CEO Larry Fink is perhaps the biggest pusher of this ESG nonsense.

BlackRock is the world’s largest asset manager. They control $8 trillion in assets and invest on behalf of hundreds of public pension funds and millions of Americans in their 401(k)s.

But Larry Fink has shifted his focus from rewarding shareholders… to pushing extreme ESG measures with the goal of fighting climate change and increasing diversity.

The objective of money managers, of course, should not be to remake the world but to maximize returns for shareholders.

But BlackRock is doing the opposite.

And the investors in BlackRock are the ones who suffer.

According to Bloomberg, “The 10 largest ESG funds by assets have all posted double-digit losses.”

The majority are underperforming the market badly.

And it’s easy to see why.

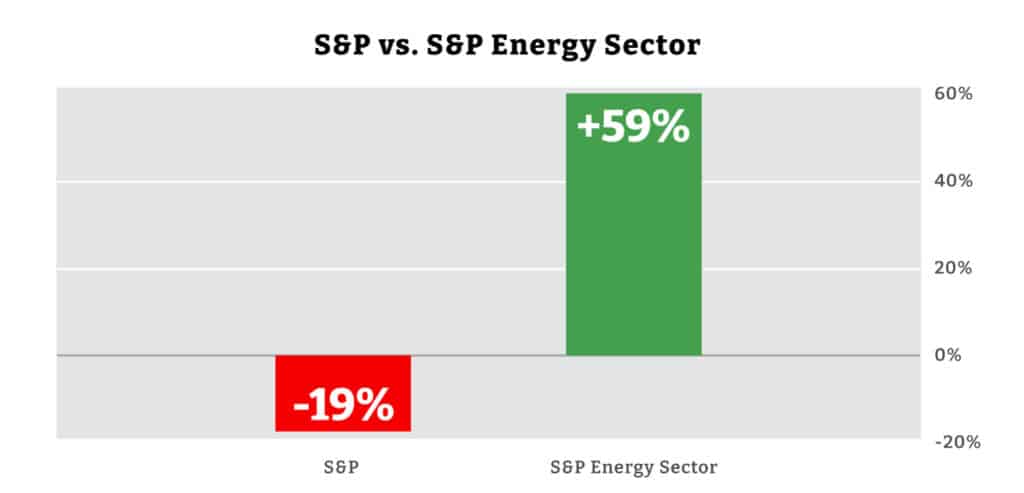

Fund managers with a strong ESG tilt, for example, have often entirely avoided the fossil fuel industry.

That is a particularly boneheaded move.

While the S&P fell 19% in 2022, the S&P energy sector soared 59%… by far the best performer for the year.

But BlackRock largely missed out on those energy gains by pushing their climate change agenda.

Not only that… but by refusing to invest in fossil fuel companies, BlackRock is actively driving energy prices higher, which is hurting millions of Americans.

And it’s killing Americans’ 401(k)s and pension funds too.

For instance, pension returns were so bad in Texas and other states that the Texas attorney general and 18 other states sent a complaint to BlackRock stating that they were in violation of their fiduciary duty to put shareholders first.

But will BlackRock get punished?

I doubt it.

Because here’s the thing… the Biden administration is fully supporting BlackRock and the other asset managers pushing the ESG agenda.

In fact, Biden isn’t satisfied with BlackRock ruining investor returns with their ESG focus… he wants to make ESG mandatory for the entire market!

Recently the SEC proposed a new set of rules that would require ESG disclosures for every single publicly traded company.

This would be a total and complete disaster.

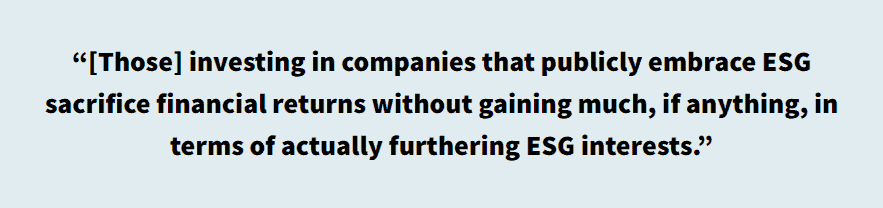

Even the Harvard Business Review admits, “ESG funds certainly perform poorly in financial terms.”

Even more ironic, a Columbia University and London School of Economics study found that companies in ESG portfolios didn’t improve labor conditions or help the environment either!

Sanjai Bhagat, professor of finance at the prestigious Leeds School of Business, sums it up with this perfect conclusion…

That is exactly what’s happening.

Your financial returns are being sacrificed in the name of their agenda.

And here’s the worst part…

Everything I’ve shared with you today… the companies focused on race and sexual politics over profits… the retail companies getting hammered because of prosecutors who won’t enforce the law… the rules forcing companies to focus on climate and social justice instead of innovation and creativity…

All of it is getting worse, not better.

Our universities are pumping out millions of people indoctrinated with these ideas year after year.

Our best and brightest are no longer that.

Instead they are angry and vindictive.

And they are filling the ranks of our most important companies… pushing their political agenda.

Again, this is why I am telling all of our Oxford Club members to make some big changes to their portfolios going forward.

It is time to take a stand and send a message.

We aren’t going to let these pushers of Woke Capitalism control our money anymore.

We’re not going to own shares in these woke companies going forward. We are going to move into better investments… the kind run by people who care about shareholder value.

And the great thing is… with the steps I have in mind… I am convinced we are going to make a whole lot more money than ever before.

So let’s get into it.

Let me explain the three steps I believe all Americans should make with their money right now.

Step #1: Get Your Money OUT of All Woke Companies Right Now

The first move I am recommending is obvious, but very important nonetheless.

You need to move all of your money OUT of woke companies right away.

I just published a message to all members stating that they should get out of BlackRock stock and all BlackRock funds. And I’ve offered alternative anti-woke funds that still believe the shareholder comes first.

BlackRock no longer cares about the shareholder. They only care about pushing their political agenda.

We need to show them that, as investors, we aren’t going to stand for that.

We’re going to take our money and hit them where it hurts.

I also recommend dumping shares of Disney, if you haven’t already.

Until the company proves it can get back to wholesome family entertainment, the stock is likely to deliver more and more losses.

Other woke stocks to avoid include Nike, Starbucks and certainly Facebook, now trading under Meta Platforms.

But there are plenty more.

And a lot you wouldn’t expect.

Many investors simply don’t realize that stocks they hold are no longer working in their best interest.

So I’ve done the research to uncover which ones you absolutely want to dump right away.

I’ve created a report: “The 25 Super-Woke Companies You DO NOT Want in Your Portfolio.”

And I’m making that available to you today.

So that’s step #1.

Protect yourself by getting out of the woke companies that are destroying shareholder value.

Step #2: Buy These America-First Stocks Now

The second step is getting into companies that are still focused on making money for their investors.

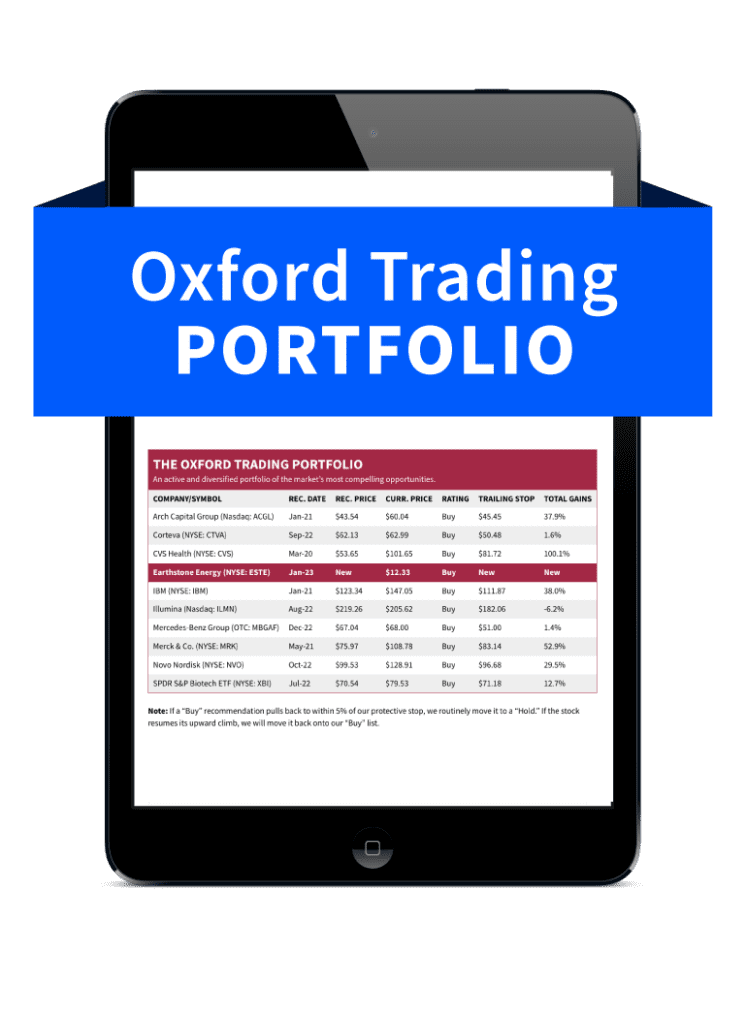

We have an entire group of stocks in our Oxford Trading Portfolio that I believe are going to outperform going forward.

My investment philosophy is this…

If you invest in companies that believe in the American capitalist system… you are going to do quite well.

So I target companies that innovate and develop breakthrough products.

I want companies that consistently grow sales quarter after quarter.

And I want companies – this part is VERY important – that reward shareholders with big dividends and capital gains.

Our Oxford Trading Portfolio is loaded with these kinds of stocks.

And it’s worked out quite well for us.

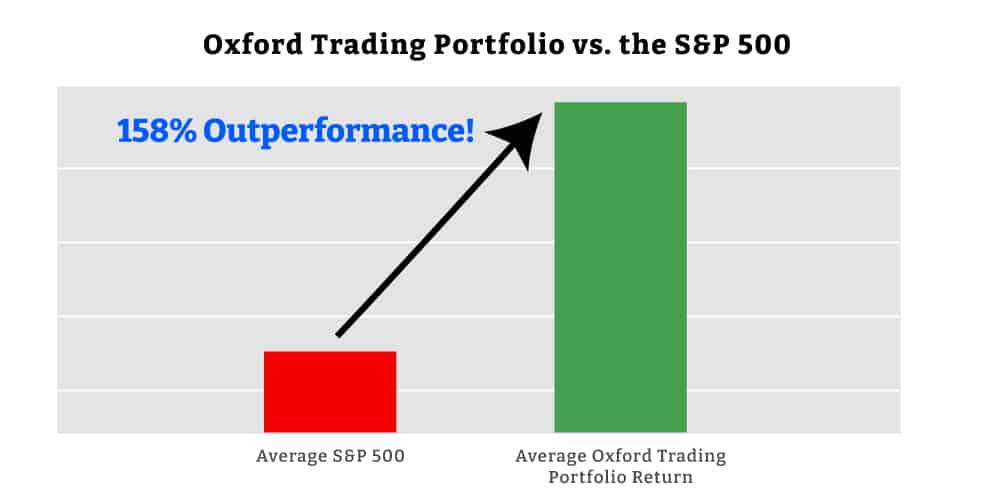

Since the year 2001, when I became the Chief Investment Strategist, our Oxford picks have outperformed the market by 158%.

But there are three new stocks I am recommending to our members now. And I believe these could have even bigger 10-bagger potential in the years ahead.

These are three of the best companies you could add to your portfolio right now.

The first, you won’t be surprised to know, is an energy company.

America’s #1 Energy Stock

And unlike the woke companies we’ve talked about today, this company is proud to provide Americans with the energy we need to make our lives possible.

The company runs 120,000 miles of energy pipelines delivering 30% of our nation’s oil and natural gas.

The pipelines deliver energy virtually everywhere… to 41 states, from Arizona and North Dakota to New York and Florida.

Their operations include the transportation of natural gas, petroleum, diesel, jet fuel, gasoline, propane and ethane.

The company fills 5.6 million cars with gasoline each day. It puts jet fuel in planes for over 7,000 airline flights.

Their natural gas powers 103 million homes annually.

But this only scratches the surface of everything this company does for America.

Because of the woke media, people don’t realize what a blessing fossil fuels are in our lives.

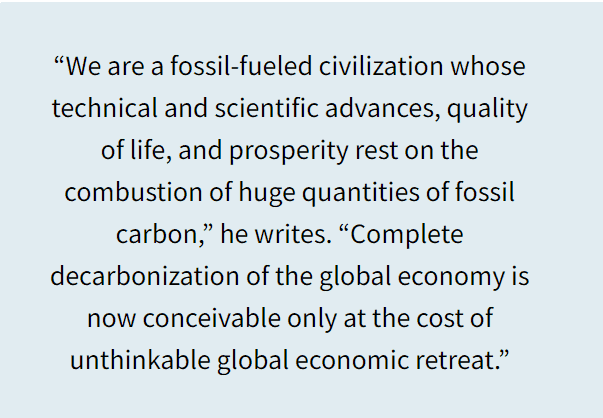

I was reading a book recently called How the World Really Works by Canadian author Vaclav Smil.

That’s what Biden wants.

Unthinkable global economic retreat.

But this company I’m recommending to members now is the type of company that actually runs our country.

They provide fuel used in the production of shoes and clothing… food and farming… medical devices… cellphones… transportation…

It’s just about everything.

And while the woke stocks I showed you today are collapsing, this company is thriving.

Revenue is up about 125% since 2020.

Net income is up over $5 billion since then as well.

And what are they doing with that money?

Rewarding shareholders.

The company just increased its cash distribution once again to start the year.

It now pays a hefty dividend of approximately 10%…

Plenty of income to beat Biden’s inflation.

And the capital gains are substantial as well. While most stocks were down, this stock was up dramatically in 2022.

Yet it’s still cheap. The stock trades for less than $20.

Its share price is only 10 times earnings… about half as cheap as the average S&P stock.

It’s so cheap, in fact… that the chairman of the company recently put $17 million of his own money into the stock.

Why would he do that?

Because he also recognizes that the stock is highly undervalued.

And you won’t be surprised to learn that billionaire David Tepper, owner of the Carolina Panthers, has also picked up 10 million shares of this stock.

Tepper is famous for earning $7 billion in profits by targeting undervalued stocks in the aftermath of the 2008 financial crisis.

He knows how to spot a great opportunity in times of chaos.

And he’s loading up on this one stock.

Investors today need to follow suit.

It’s time to stand up to the Woke Capitalists… take our money away from them and put it into companies like this that actually care about shareholders.

And that’s just the first of my three new recommendations.

The Company Relaunching America’s Steel Industry

The second company I’m recommending is one working to bring back what once was a symbol of American economic strength.

Steel.

At the end of World War 2, America was the strongest steel producer in the world.

But over the years, America’s steel industry was left to rot.

Steel plants were shuttered.

Towns were deserted.

And many lost their livelihoods.

However, one company is now fighting to restore America’s steel dominance.

They produce high-quality steel for infrastructure, commercial buildings, residential housing, and agriculture.

You can find their steel in the Humvees that protect our soldiers overseas.

The company’s steel can be found in the massive AT&T stadium in Dallas where the Cowboys play.

It’s used in essential highways, bridges and buildings all over the world.

The company’s steel can even be found at the Pentagon!

And business is BOOMING.

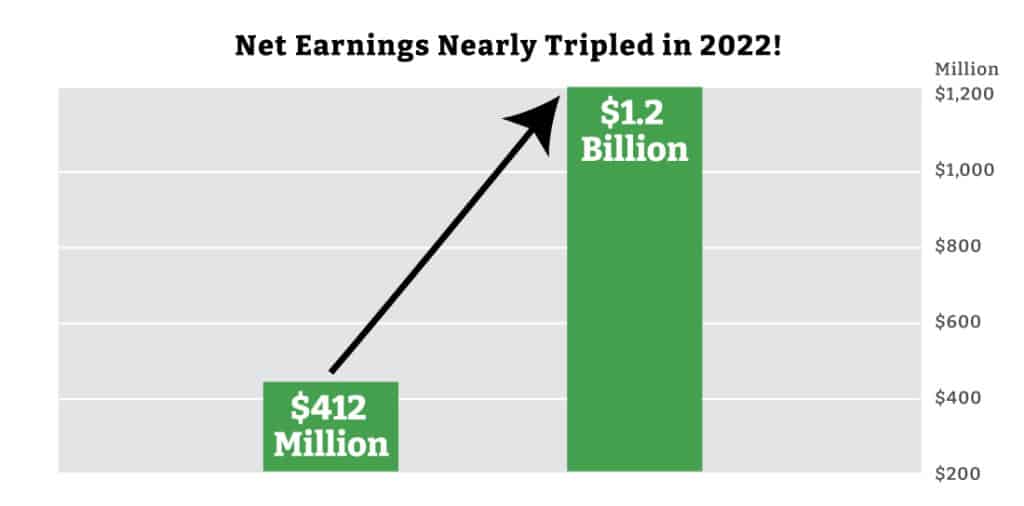

Net earnings nearly tripled in 2022 from $412 million to $1.2 billion.

And just like my first stock, this company cruised higher in 2022 despite the chaos.

It’s a must-have in your portfolio if you want to continue making money in the years ahead.

And finally, I have one more stock I’m recommending today.

The Company Actually Solving America’s Woke Education Crisis

My last company is doing perhaps the most important work in America right now.

They are fighting to fix our education system.

The company is offering an alternative to the woke madness. And it’s educating students on the real-world skills needed to be successful in work and life.

Parents are desperate for this kind of solution.

And they are flocking to one of the few education options that aren’t an indoctrination camp.

The New York Times surprisingly did a report on this.

They wrote that there has been “a boom in conservative Christian schooling, driven nationwide by a combination of pandemic frustrations and rising parental anxieties around how schools handle education on issues including race and the rights of transgender students.”

The frustration of parents nationwide is leading to a boom for education companies like the one I am recommending.

In 2022, while most stocks were down, this stock was soaring.

It beat consensus estimates for earnings per share and revenue.

It has a Perfect 10 Smart Score ranking on TipRanks… indicating a strong potential to outperform going forward.

And Yahoo Finance reports that the company’s intrinsic value by itself is potentially 69% above the share price.

These are the types of companies I’m going to be recommending going forward.

Companies that are growing sales dramatically by doing the type of real work that made America the greatest nation on Earth.

You can get instructions on how you could profit on each in my new report “Three America-First Companies Set to Dominate the Market.”

Plus, in our Oxford Trading Portfolio, which all of my subscribers have access to, I’ll be targeting many more of these types of companies in each issue going forward.

We’re getting our money out of the hands of the Woke Capitalists.

And we’re putting it in companies that are getting the real work done here in America.

So those are my first two steps.

But I have one more that I am asking my subscribers to take.

Step #3: Put Some of Your Portfolio Into These Three High-Yield, Low-Risk Investments Outside of Stocks and Bonds

2022 was an incredibly tough year for investors.

Not only were stocks down big, but bonds were too.

This is why I’m recommending my subscribers take at least a portion of their portfolios out of stocks and bonds… and put it into three high-yield, low-risk investments that can actually increase your returns.

Let me give you a couple of highlights on each one.

- The first is an investment that has outperformed stocks over the last 20-, 25- and 50-year periods. At the same time, most of these investments are far less volatile than the S&P. Some are even half as volatile.

And the yields are out of this world – up to 17% in the best cases. - The second is an investment that U.S. News & World Report says are “favorites among the income investing crowd because of the reliable paydays they offer.” Many offer yields in the 7% to 8% range, but the top ones can go as high as 17% or better.

Not only that but the capital gains can be strong as well. While the S&P was down 19% in 2022… this set of investments on the whole was up 33%.

And as Investopedia confirms, this type of investment’s “steady growth” leads to “low risk.” - The final investment outside of stocks is one that has been favored by the richest people in America for decades.

For example, it allowed Peter Thiel to grow $500,000 into $1.7 billion in just six years.

But now, through a special type of investment, you can access the same types of opportunities. The yields and the capital gains here can be out of this world.

For instance, of the top 20 of these investments currently, every one pays income yields between 11% and 20% annually.

Again, for these investments I’ve put together a report detailing each one called “The Three Best High-Yield, Low-Risk Investments Outside of Stocks.”

So in total that’s three reports I can share with you today.

- “The 25 Super-Woke Companies You DO NOT Want in Your Portfolio”

- “Three America-First Companies Set to Dominate the Market”

- “The Three Best High-Yield, Low-Risk Investments Outside of Stocks”

How do you get everything today and all my best anti-woke stocks and investments going forward?

Just by joining me in my monthly newsletter, The Oxford Communiqué.

A Community of Freedom Seekers…

The Oxford Communiqué is a letter I put together to connect with wealth builders all over the country who care about their families and are tired of seeing America turn its back on the values that made it great…

We believe that America IS the land of opportunity.

We are not ashamed to say that the “most qualified person should get the job.”

We believe in the Bill of Rights.

And we believe nothing is more important than the right to free speech.

We also believe that anyone can achieve success through hard work…

And we agree wholeheartedly with Dr. Martin Luther King Jr… that people should be judged by the content of their character, not the color of their skin or their sexual identity.

We believe that business should turn a profit… and reward shareholders in the process.

We believe that political agendas have no place in business.

And most of all… we believe that those of us who worked hard and saved our money… deserve a fair return on our investments.

And that’s my goal when I write the latest edition of The Oxford Communiqué each month – to help our members achieve financial freedom by increasing their retirement wealth.

With each monthly issue of the Communiqué, I’ll share all my insights on the economy, interest rates, business developments and, of course, my favorite stocks with the most upside potential.

I’ll explain why revenues are booming. We’ll watch company insiders to see if they are buying. And we’ll ensure each company is focused on rewarding shareholders… not pushing a political agenda.

I want you to receive my Oxford Communiqué issues as part of everything I’m offering today.

I can help you navigate the markets through just about anything.

With more than three decades of experience as a research analyst, professional money manager and one of the country’s best-known financial writers, I can help you navigate whatever the markets throw at us in the weeks and months ahead.

We’ve Helped Our Members Thrive During Every Major Market Downturn

I know this, because we’ve managed to avoid or mitigate nearly every major market downturn of the last 25 years.

For instance… in February 2000, at the height of the dot-com craze, we sent out a special report to members, warning…

The Nasdaq peaked exactly one month later, in March.

And from there, over the next 2 1/2 years, the Nasdaq lost 78% of its value.

But our members were safe.

In January of 2008, nearly nine months before the financial crisis struck, we warned our members that…

We actually posted an average gain of 28% on our 46 closed plays while the markets crumbled around us.

Then in 2009, we called the exact bottom of the market. I sent out a message to members that read…

The stock market went on to jump 65% between the market bottom in March and the year’s end.

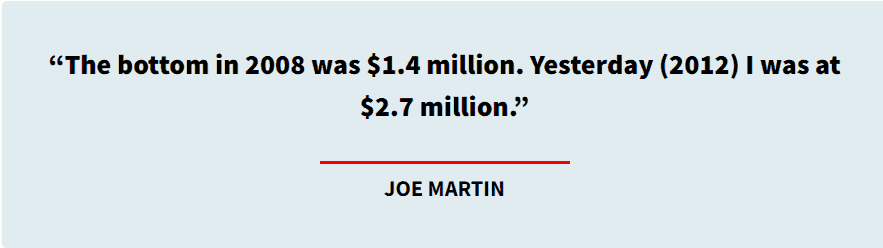

Member Joe Martin of California wrote to tell us he made more than $1.3 million thanks to our market calls.

We’ve received many stories like this over the years from Oxford Communiqué subscribers…

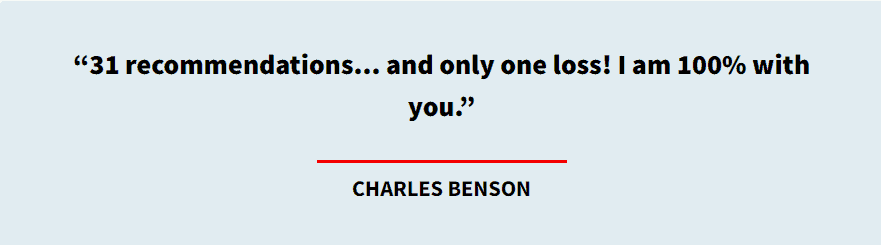

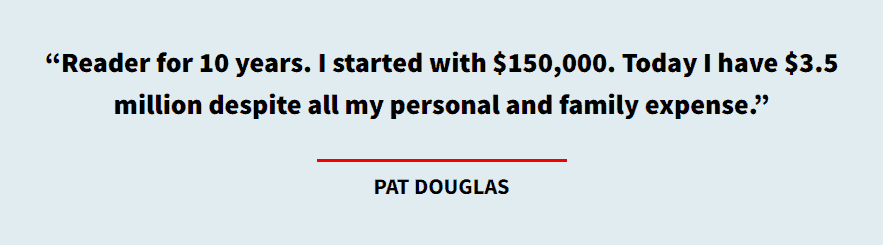

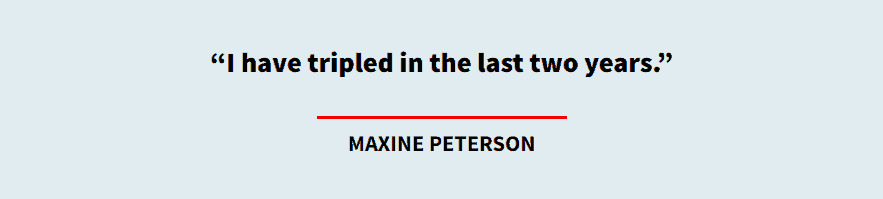

Thousands of Success Stories

Here are just a few notes reflecting the best success stories at our organization.

We had a member named Charles who reported only one loss on 31 recommendations.

There was Pat, who started with $150,000 and grew it to $3.5 million over 10 years.

Maxine tripled in two years… while Ervin grew his portfolio 200-fold over decades.

Or how about Sam, who estimates he would have saved $500,000 by finding us earlier!

Of course, nothing is guaranteed in investing. We’ve had winners and losers just like everyone else.

But all told, our Oxford Trading Portfolio has more than doubled the market for over 20 years.

So no matter what your investing level… the key is taking control of your finances and growing that money now.

And I have no doubt The Oxford Communiqué and the principles we follow will help you down that road today.

In fact, we’ve even put together multiple portfolios to ensure you have exactly the tools you need to succeed in any market.

Communiqué Subscribers Get Access to All Five of My Best Model Portfolios

You’ll receive access to…

- The Oxford Trading Portfolio: The flagship portfolio of the Communiqué. It’s better than doubled the market for over 20 years.

- The Gone Fishin’ Portfolio: A simple “set it and forget it” portfolio that requires only 20 minutes to rebalance it once per year.

- The Oxford All-Star Portfolio: Made up of investments managed by the all-time greats, like Warren Buffett and Carl Icahn.

- The Ten-Baggers of Tomorrow Portfolio: With more speculative stocks that have the best upside potential.

- The Fortress Portfolio: This last one is designed to be recession-proof, with ultimate safety in mind.

Once you are a subscriber to The Oxford Communiqué, you’ll have access to all five portfolios. You can choose which one fits your goals best.

And I have one more added bonus for you today…

PLUS Added Bonus Today: Get a Free Copy of My New York Times Bestseller Beyond Wealth: The Road Map to a Rich Life! (Value: $21)

My book Beyond Wealth, a New York Times bestseller, shows you how to live a rich life.

I’d like to send you a free copy of Beyond Wealth today along with everything else.

You’ll receive the book and everything else just for joining our organization.

Become a Part of One of the Most Prestigious Financial Clubs in the Country

As I’ve told you, we are a financial club.

Our newsletter’s motto is “Great profits in the company of good friends.”

Our mission is to help you become wealthier in every aspect of your life.

As soon as you join The Oxford Communiqué, you are a full member of our Club, with all the privileges that entails.

You’ll receive…

- Access to all of our model trading portfolios: the Oxford Trading Portfolio, the Gone Fishin’ Portfolio, the Oxford All-Star Portfolio, the Ten-Baggers of Tomorrow Portfolio and the Fortress Portfolio

- Weekly model portfolio updates with key new information regarding our recommendations

- Oxford Insight emails with behind-the-scenes intelligence from the Oxford Club team, as well as The Oxford Club’s global network of associates/li>

- Special Reports like “The Oxford Club Guide to Gold” and “23 Cash Rebate Programs Hidden in the Tax Code”

- Password-protected access to the members-only website, newly designed with a more personalized approach for you

- Personal invitations to our five-star member events in beautiful locations like Whistler, British Columbia, where we held a recent Private Wealth Seminar

- Access to our Pillar One Advisors, including experts in collectibles, real estate, tax law, insurance and more.

You’ll also receive every one of the reports, books and special bonuses I’ve lined up for you today, including…

- “The 25 Super-Woke Companies You DO NOT Want in Your Portfolio” (Value: $199)

- “Three America-First Companies Set to Dominate the Market” (Value: $597)

- “The Three Best High-Yield, Low-Risk Investments Outside of Stocks” (Value: $299)

- Beyond Wealth: The Road Map to a Rich Life (Value: $21)

In total, the value of your package comes out to $1,116.

And we’ll send you all of it the moment you decide to join the Communiqué.

Listen… I’m on a mission.

I see how our great country is changing.

I see the restrictions on free speech.

I see how we are bombarded every day with the woke message… at schools, in the media and now in business.

And I believe now is the time to stand up together and declare that we aren’t going to take it anymore.

I am certain that we can take that stand together.

And in the process, invest in great companies that reflect our values.

Over the years, I’ve given investment recommendations to hundreds of thousands of people.

We’ve more than doubled the market for over 20 years in my Oxford Trading Portfolio since I became the Chief Investment Strategist.

I’m proud of our track record.

And it’s only by identifying great stocks that believe in rewarding shareholders that we are able to outperform over so many years.

I know we can do that for you.

And I don’t want anything holding you back.

Which is why I’m giving you the chance to join me with The Oxford Communiqué at the lowest price possible today.

Just $249 for a full year.

It’s as good a deal as there is in the investment world.

After all, we’re crushing the performance of hedge funds that charge clients tens of thousands of dollars.

But having said all that, again – I want everyone to have a chance to share in our success.

So to make this as easy a decision as possible for you, here’s what my publisher has decided to do.

We want to give you a risk-free subscription to The Oxford Communiqué today for just $49 – our absolute lowest price.

And here’s the final kicker.

I’m going to back all this up with a 365-day, 100% money-back guarantee.

You’ll have 12 months to use and review everything I’ve talked about today.

You’ll see how well each of my America-first companies performs.

You’ll be able to try the three high-yield, low-risk investments outside of stocks.

You can start profiting from any of the stocks in my Oxford Trading Portfolio.

No matter how much you make in profits, here is my promise to you…

You can call us up at any time and for any reason over the next year and we will give you a full, 100% refund of your money – no matter what. PLUS, you get to keep every single thing you received today.

It’s a bold promise.

But that’s how confident we are.

I can’t imagine how I could make this offer any better.

And I want to close with one quick word.

I think this is a very dangerous time for investors who don’t understand what is happening.

With Biden in charge, Woke Capitalism is infecting dozens of major corporations.

And investors are paying the price.

You need to get your money out of these land mines right away.

And put that cash to work in companies that believe in American capitalism… that aren’t afraid to turn a profit and reward shareholders.

I’m recommending these changes to my 200,000-plus followers now.

And I hope you will follow suit today.

I’ve heard so many success stories from people who have joined us.

Like the recent one we received from Benjamin McCormick, who said…

Your success story could be next.

I look forward to helping you see the chance to achieve the same experience.

For those watching at home, just click on the big “Yes! I Want My Anti-Woke Profit Package” button below.

It will take you to a secure order form where you can review all the benefits of Club membership.

Thank you for your time. I look forward to welcoming you to the Club.

Sincerely,

Alexander Green

Editor, The Oxford Communiqué

February 2023

© 2023 The Oxford Club, LLC. 105 W. Monument St, Baltimore, MD 21201. Legal Notices: Visit our Disclaimer page to view important information that will help you not only use our research appropriately but also understand the benefits and limitations of our work. You can also view our company's privacy policy and terms and conditions. February 2023.