Table of Contents:

- Introducing Brad Thomas

- Nothing but doom and gloom from the mainstream media…

- I don’t blame you for being skeptical

- My BIG SECRET to building wealth

- One of the safest ways to generate income today

- I discovered it by going broke

- The Real-Time Revolution: How to Earn Endless Income on America’s Fastest Growing Companies

- Retail Riches: Get Paid from 95 of the Biggest Private Companies in America

- Instant access to my research

— Presented by Wide Moat Research —

President Trump’s advisor who went broke reveals how he got rich again…

‘Endless’ Income

REVEALED: The shocking connection shared by hundreds of the

fastest-growing companies in North America right now… And how to

put yourself in this profit stream so every time they get paid, you get paid.

Kim:

Hi, my name is Kim Moening.

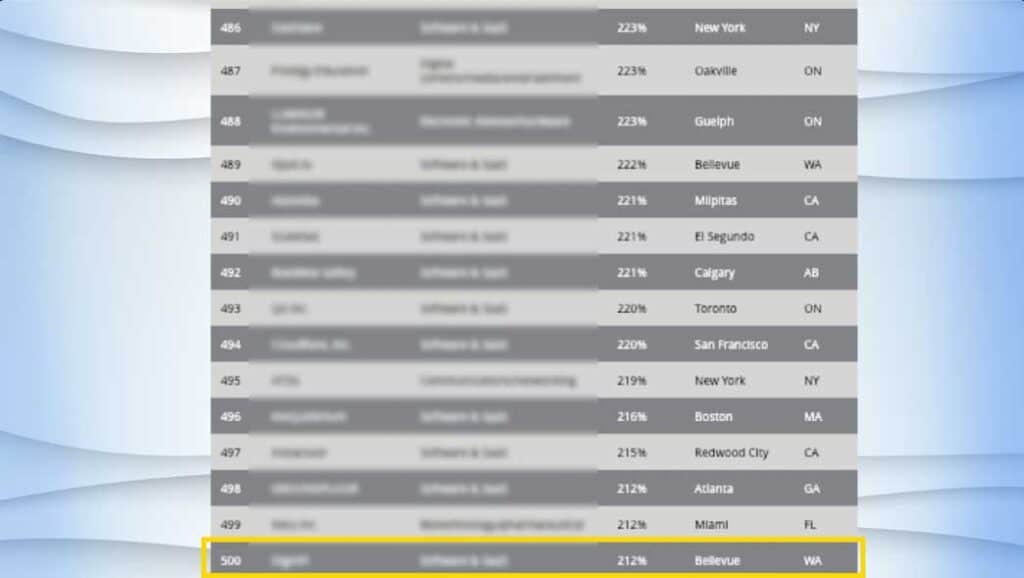

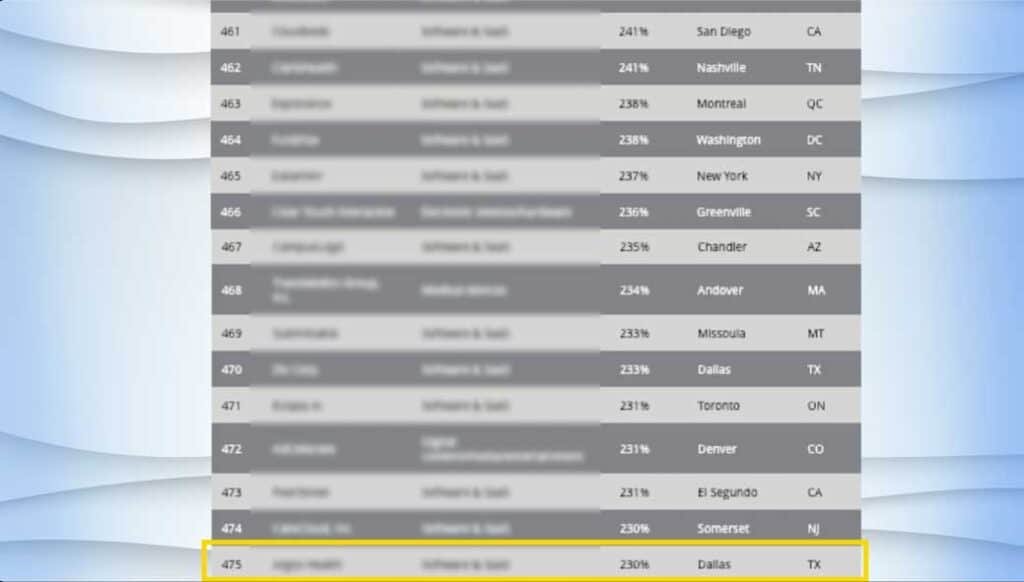

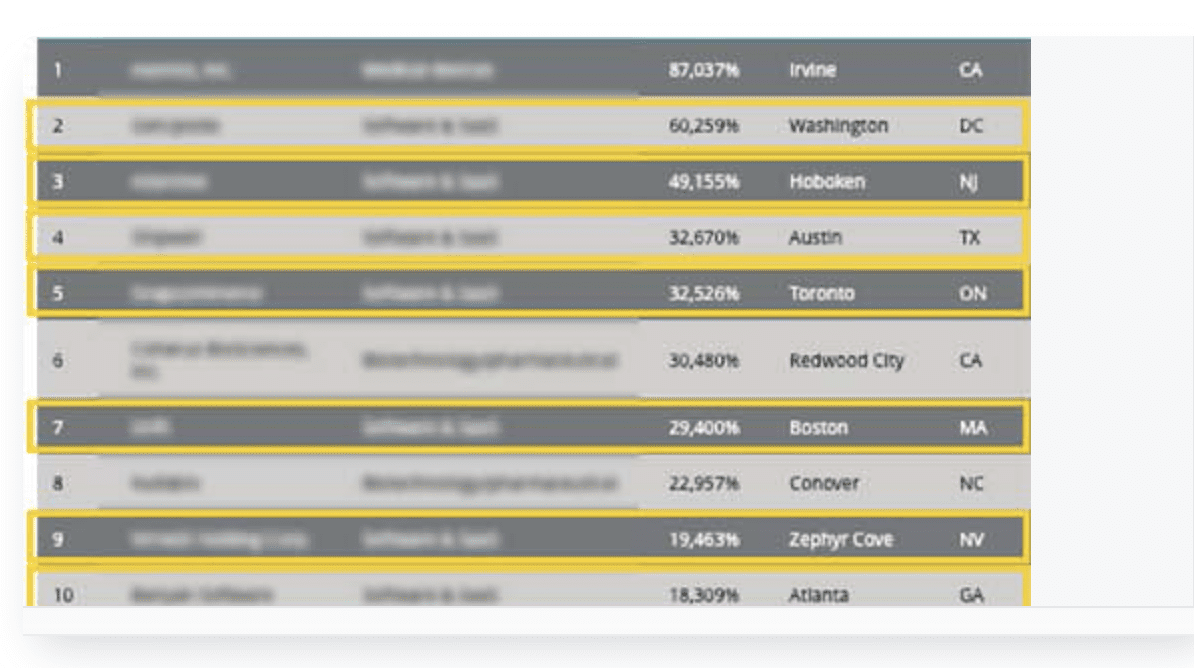

And this is a list of the 500 fastest-growing companies in North America right now.

My guest tonight says a secret in this list…

Helped him make back his millions after he lost it all.

And now – for the first time ever – he’s going to reveal how anyone can follow in his footsteps to collect thousands of dollars every single month.

Brad Thomas, welcome. Thank you so much for joining us.

Brad:

My pleasure. Thank you for having me.

Kim:

Brad, before we dive in, I want to let our viewers know we vetted your background before inviting you on.

And you check all the boxes…

You’ve negotiated over a billion dollars in deals with Walmart, McDonald’s, and hundreds more companies, both big and small.

You’re a frequent guest on Fox News, CNN, Kiplinger, NPR, Forbes, and many more.

And you’ve even been an advisor to President Donald Trump.

But I gotta say…

It was this document that really sets you apart.

It contains perhaps the most valuable piece of research ever sent in by a guest.

And I’ve interviewed some of the best financial minds of our time… hedge fund managers, Wall Street executives, you name it.

So that’s saying a lot.

This one piece of information just blew my mind.

So let’s go ahead and start right there…

What is it about this document that makes it possible to make money from hundreds of America’s fastest-growing companies… all from just one ticker.

Brad:

Sure.

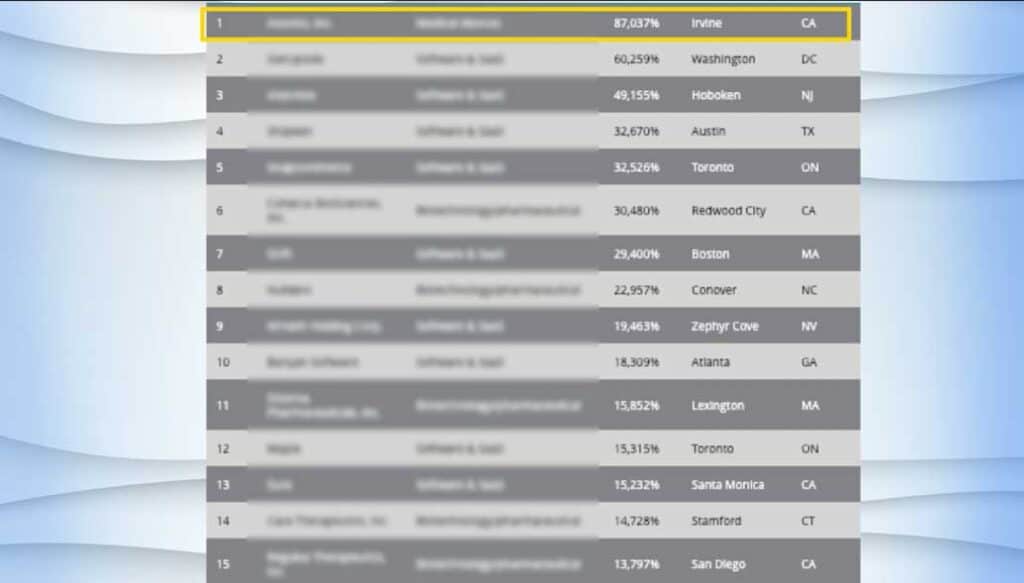

So this document was created by Deloitte.

They are one of the most respected market research firms in the world.

And it lists the 500 fastest-growing companies in America… in terms of revenue growth over the last 3 years.

Can we put it up on the screen?

Kim:

Sure, here we go…

It’s up.

Brad:

Ok.

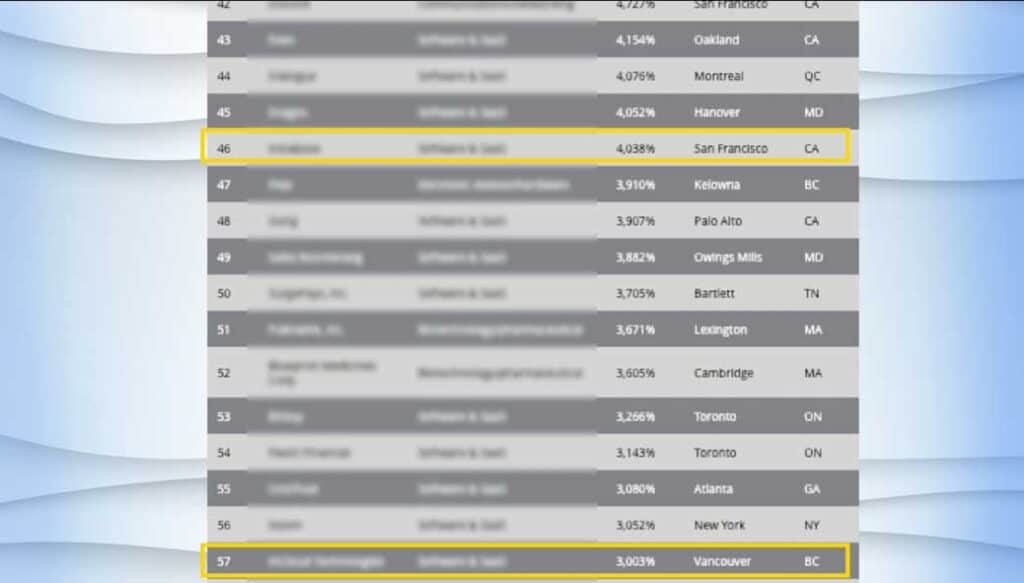

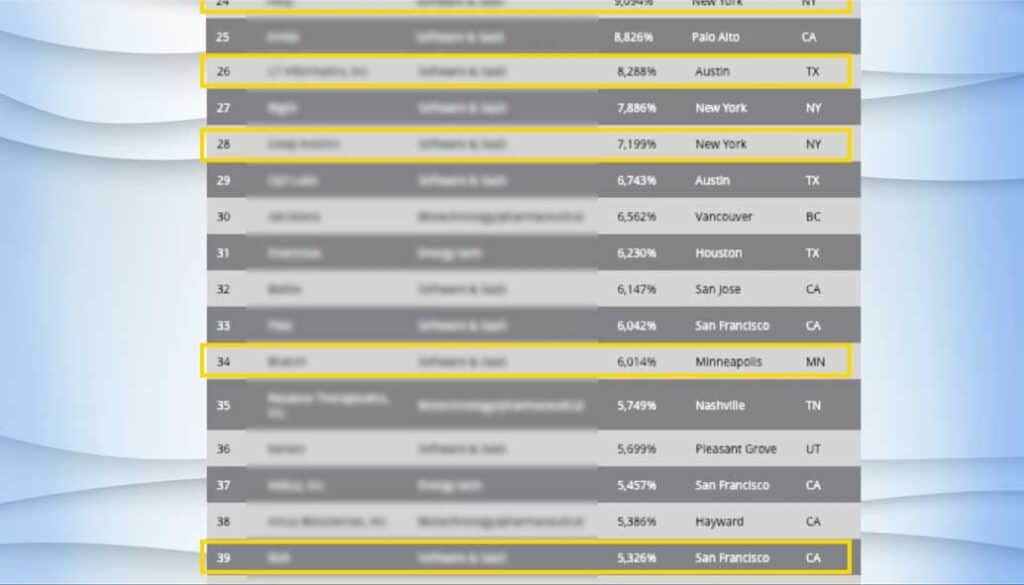

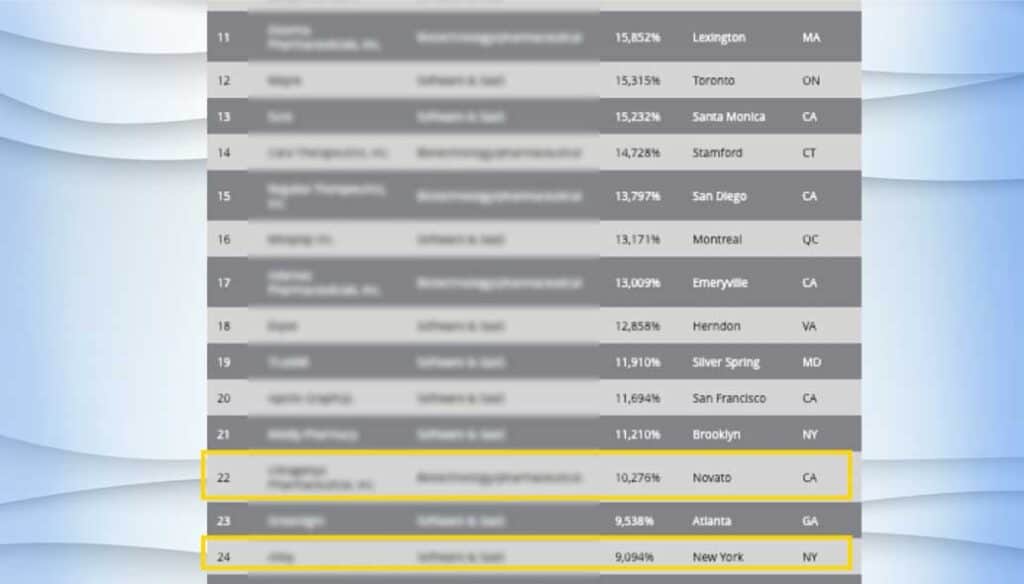

We’re going to start at the bottom here. And as you can see the first gain… the smallest gain is 212%.

And we’re going to quickly scroll up here. But notice how everything just keeps getting bigger.

230%.

250%.

270%.

There are over 100 companies here with gains over 200%.

And the numbers keep rising.

Now we’re at the 300% gains.

Dozens of companies here too.

400%.

Kim:

Ok, let me interrupt here for a moment…

You’ve already shown us hundreds of companies with revenue that grew 3X… 4X… 5X. But you’ve got their names blurred out.

What’s going on here Brad?

Who are these companies? How are they making so much money so fast?

And more importantly… How can this help people watching at home build their wealth?

Brad:

Don’t worry. We’ll get to that soon.

But I want to show you this full list first.

Because something big is going on in this list.

But NOBODY is talking about it. And the only way you’re going to grasp just how massive this opportunity is… is if I first show you this full list.

And listen…

I typically charge a lot of money for this type of insight and analysis.

You can usually only get it as a paid-up subscriber to my Intelligent Income Investor service. But this is simply too important. So I want to lay out everything here today free of charge.

Kim:

Ok, that sounds fair enough.

Brad:

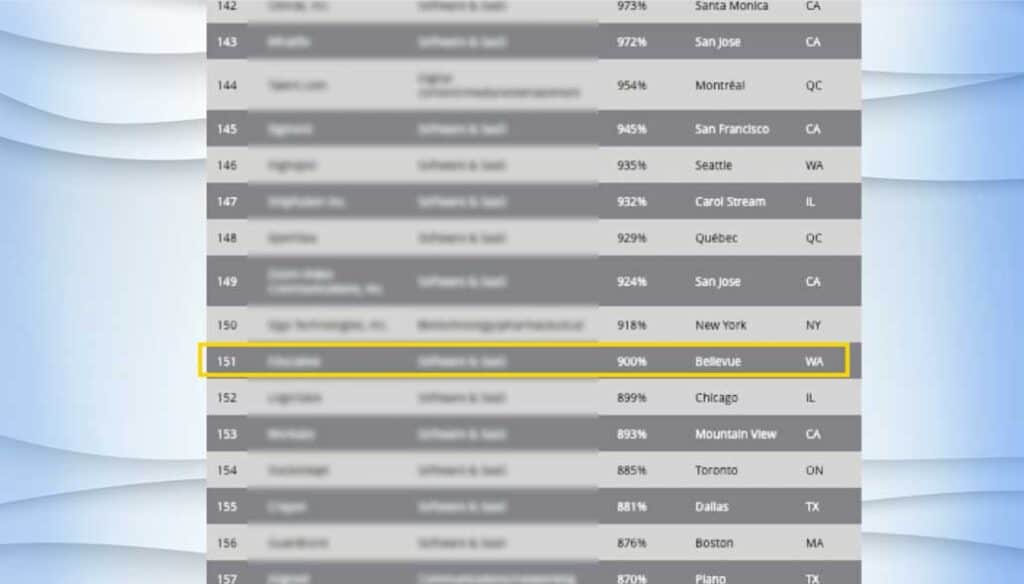

Ok, so now we’re at 500%.

600%.

700%.

800%.

900%.

Kim:

We’re in the thousands now.

Brad:

And it keeps going…

2,000%.

3,000%.

Ok, we’re finally moving a bit quicker…

4,000%.

5,000%.

6,000%

7,000%

8,000%.

9,000%

10,000%.

And if we zoom all the way up to the top?

87,037%

Kim:

Brad, when you first sent me this list my jaw hit the floor.

500 companies. With growth starting at 212%. And going all the way up to 87,037%?!

I mean, it’s been nothing but doom and gloom from the mainstream media all year long. But even in the best years, gains like these are almost unheard of.

But here you are showing 500 companies making money like crazy…

I had no clue.

Brad:

And you’re not alone.

Even though these are the cream of the crop…

The fastest growing companies in North America…

Outside of a handful of insiders nobody knows they exist. Even the biggest ones.

I mean, I’m going to give you a few of the names on the list. Tell me if they ring a bell…

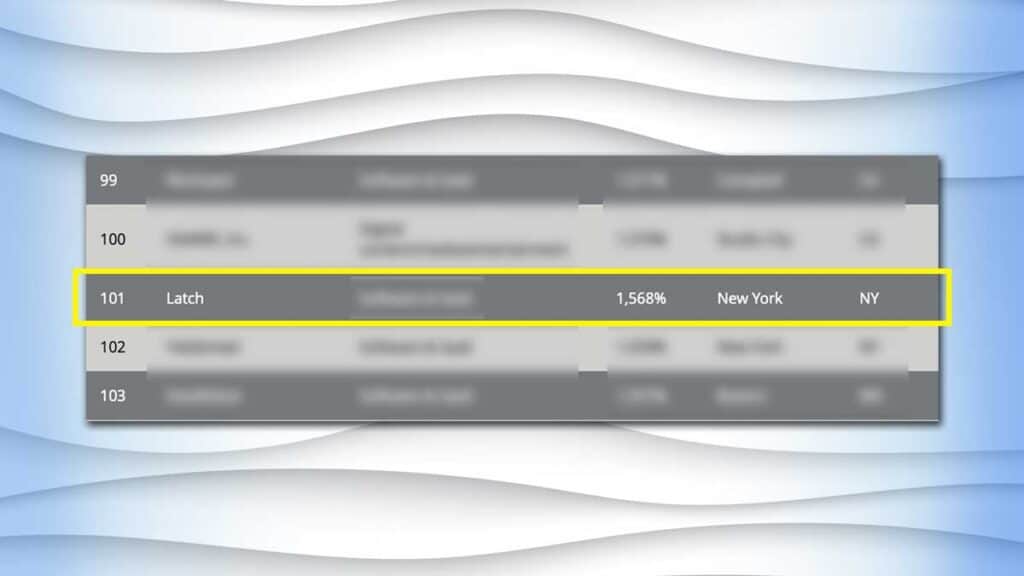

Have you heard of Latch? They gained 1,568%.

Kim:

Um… I’ve never heard of them.

Brad:

Or how about Semperis… a 2,723% gain?

Kim:

Definitely not.

Brad:

Chime in if any of these sound familiar…

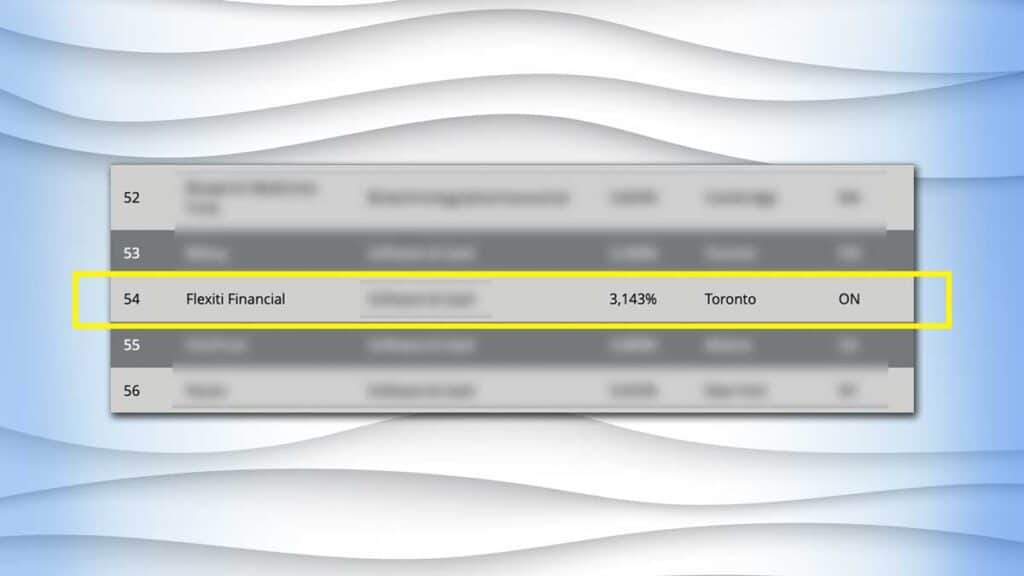

Flexiti. 3,143%.

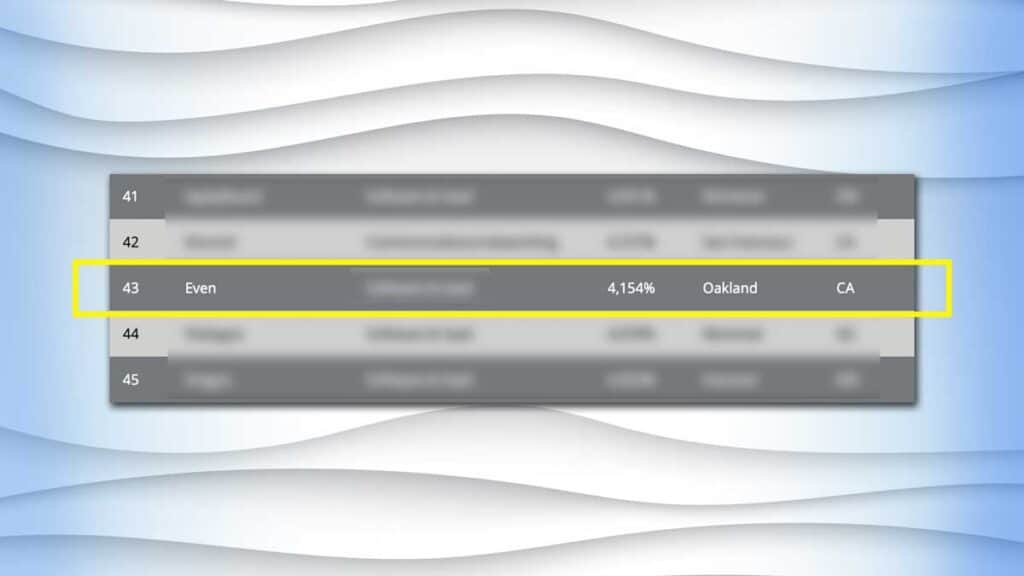

Even. 4,154%

Kenect. 5,699%

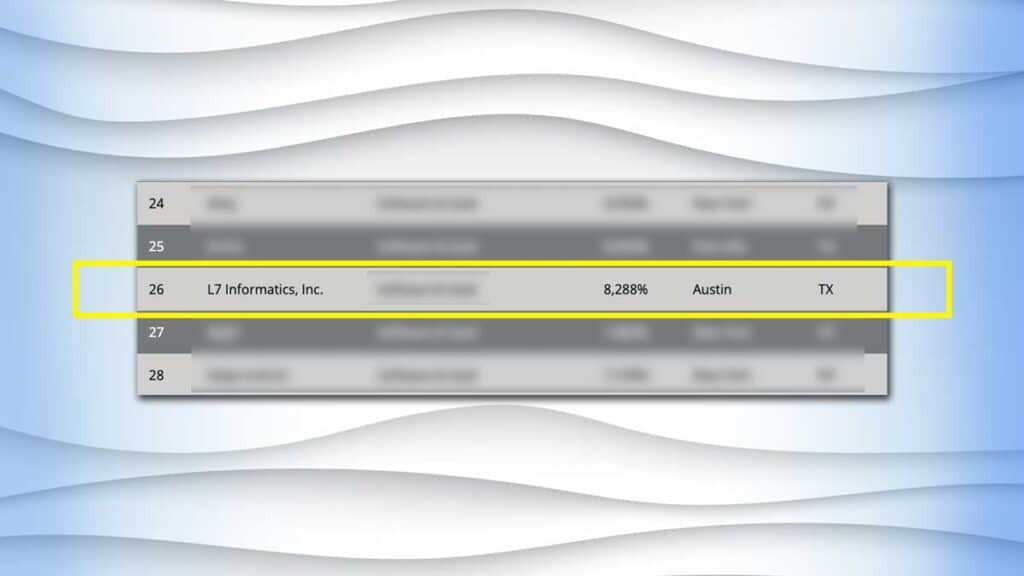

L7. 8,288%

Kim:

Not a one.

Brad:

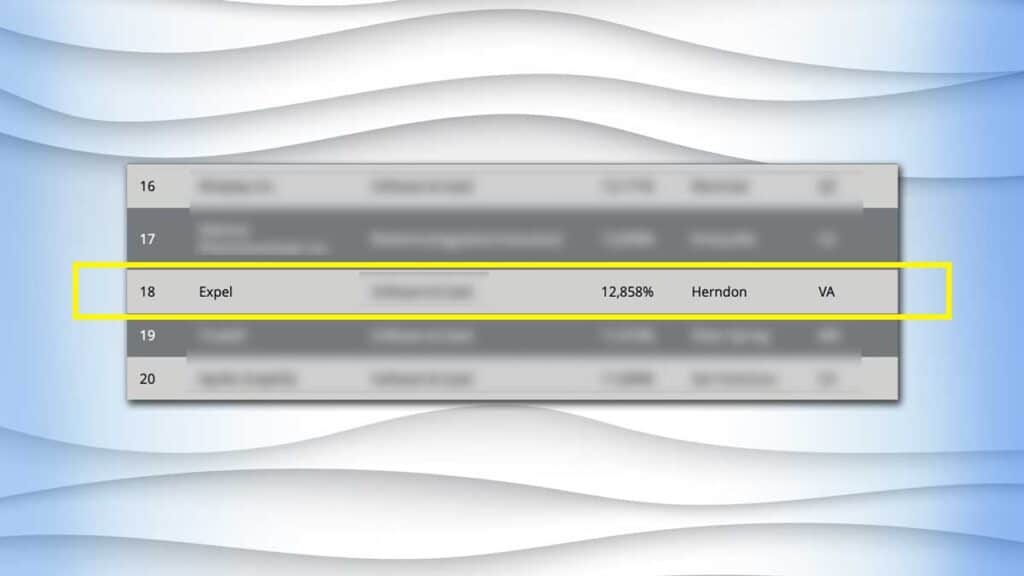

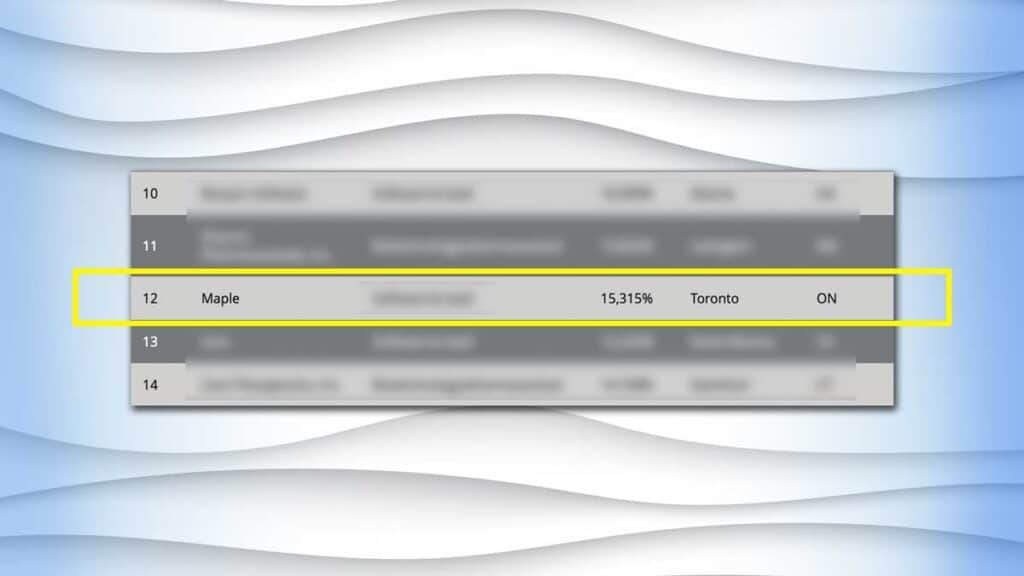

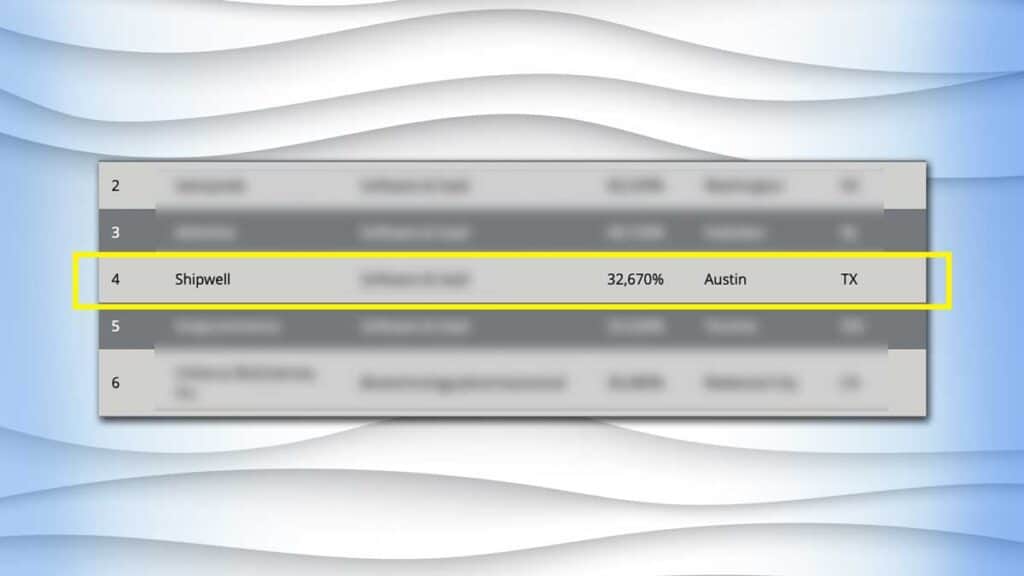

Expel. 12,858%

Maple. 15,315%

Shipwell. 32,670%.

Kim:

No. No. And no. I’ve never heard of any of them.

Brad:

And why not?

Surely gains of this size deserve media attention.

Kim:

I think so. I’d love to hear more about companies growing like this.

Brad:

But what do you hear on the news?

Nothing but bad news. War. Inflation. Crisis after crisis.

Which is why I bet not 1 in a thousand investors know these fast-growing firms exist. Much less how much money they are making.

And that’s why I’m here Kim. To bring you the in-depth analysis you can’t get from the mainstream media.

Today, I’m going to share with you a major revelation…

Understand: for 99.99% of people, what I’m about to tell you is a complete secret. Frankly it’s a secret to all but the most connected insiders on Wall Street.

And it’s more important – much more important – than the sheer number of triple digit… quadruple digit… and five-figure revenue growth gains on this list.

Kim:

More important than a list of 500 companies growing like crazy? In the midst of what’s probably the worst stock market in 50 years?

Ok Brad.

You’ve got my attention.

What’s the secret?

Brad:

Quite simply…

If you dig through this list of 500 companies with a fine tooth comb, like I have…

You’ll start to notice a pattern.

And this pattern is key.

Because it’s this pattern that gives you the ability to make money from hundreds of these companies… all through just one ticker.

In fact, every time these companies make money… YOU make money… today, tomorrow and for the rest of your life.

Kim:

Ok Brad, my BS detector is starting to go off.

I’m going to need some more details about that.

If I understand you correctly…

Here’s what you’re saying.

You’re saying it’s possible to – let’s call it “piggyback” – off hundreds of the fastest growing companies in America… tiny private companies that nobody knows about… that are essentially “off limits” to new investors…

And make money every time they make money?

Forgive my skepticism, but that just seems impossible. I’m sure a lot of folks at home are thinking that exact same thing right now.

Brad:

Kim, you hit the nail on the head.

And I don’t blame you for being skeptical.

Because it WAS impossible until very recently.

It’s only possible now because of that pattern I uncovered… that very few people are aware of.

You see…. because of this pattern a unique kind of company has figured out a way to tap into the increasing revenue streams of these fast-growing firms … take a huge cut… and pass along 90% of the cash to regular investors.

Kim:

Wait?

90% of the cash goes to investors?

Brad:

That’s right.

90%

And that’s why this is so lucrative.

Because with all of these companies making so much money – so fast – there is a lot of money to go around.

And once you see how it works – I think you’ll be excited.

Kim:

Ok Brad, you got some big shoes to fill with that promise you just made… can you show us what this pattern is? And how it works?

Brad:

Yeah, let’s do it.

And regardless of anything else I say, here’s the key piece of information I want everyone to take away tonight.

Get a piece of paper. Write it down. This will change your life.

So here’s the one thing that makes it all work.

When I started digging into this list of 500 companies, I was stunned to find this one surprising pattern.

Get this…

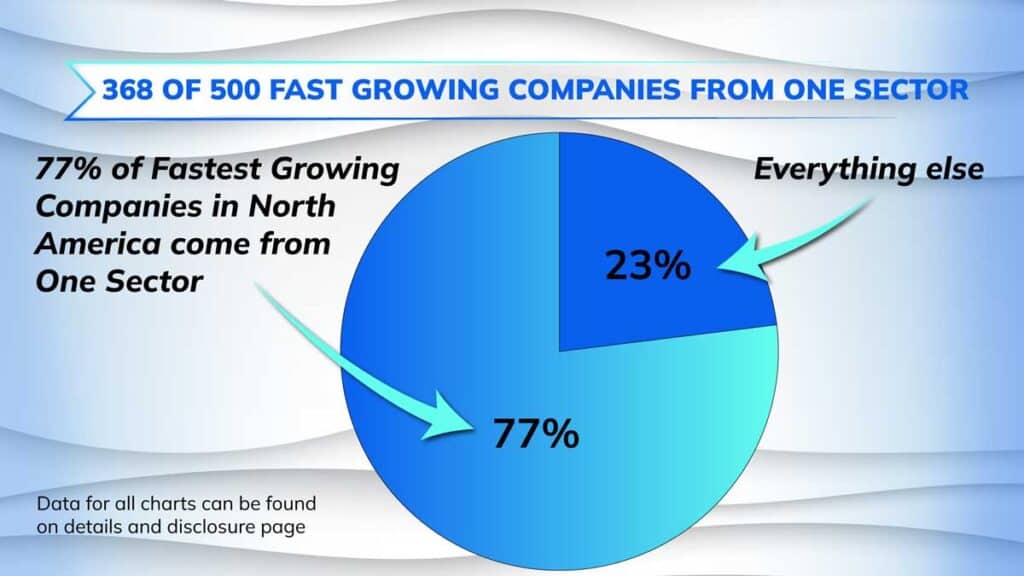

Out of these 500 companies… a whopping 368 hail from just one tiny sector of the economy.

Kim:

Whoa ok.

Let me make sure the audience got that Brad.

Out of these 500 fastest growing companies…368 come from just one sector?

Brad:

Precisely.

That’s the pattern.

Take a look.

Let’s pull up that list of 500 companies again…

Kim:

Sure.

Ok.

It’s up.

Brad:

In this version I’ve highlighted all of the companies that come from just this one sector.

And look…

I’m just going to quickly scroll through here.

Look at how many companies there are.

Kim:

One after another, almost all of them are highlighted.

It’s almost like…

Like the whole screen is highlighted yellow.

Brad:

In all, 368 companies…

With revenues increasing two… three… four… five hundred percent… a thousand percent… two thousand percent… 10,000% and much more…

Kim:

That’s just insane.

I would have never imagined so many fast-growing companies would come from just one sector.

Brad:

And that’s the pattern.

That’s what makes this unique way to collect income possible.

So many companies… making so much money… so fast… and ALL of them come from just one sector. In what amounts to a horrible year for the broader markets.

Kim:

It’s simply amazing.

And folks, that’s the key piece of Brad’s research that blew my mind.

Because we did the math on that.

If you take ALL the companies in North America… and there’s a lot…

Tech companies. Crypto companies. Retail. Healthcare. Real estate. Financial. Energy. The whole shebang… everything…

And then you look at just the fastest growing ones – the ones that can make you the most amount of money in the shortest amount of time possible – incredibly 368 out of 500… a full 77% of those companies operate in just one tiny sector of the economy.

Said another way…

This one tiny sector is responsible for 3 out of every 4 of the fastest-growing companies in North America right now.

It’s just incredible.

Brad:

It is incredible isn’t it.

And when you think about that in terms of investing your money, let me give you an analogy to put it into perspective…

I’m 6’2” tall.

And I love playing basketball. I’ve played a lot of pick-up games in my life. And you know who always gets picked first?

Kim:

In basketball? Oh. That’s easy… tall guys like you, Brad.

Brad:

That’s exactly my point.

All things being equal, in basketball you pick the tall guys first.

And it doesn’t take a genius to see why.

If you’ve got a bunch of Shaquille O'Neal's playing against average joes… who are you going to bet on Kim?

Kim:

If I had to bet, the tall guys of course.

Brad:

Well, investing in the stock market is no different.

You may want to write this down…

If you’re going to bet, and don’t fool yourself… that’s what investing is – an educated bet – you should put your money on companies with the most obvious advantage.

And what’s the most obvious advantage in business?

Kim:

Well based on what you just showed me. Making lots of money very fast, right?

Brad:

Bingo.

I’m oversimplifying here…

But if we put it in absolute terms, which would you rather do?

Bet on companies that are LOSING money at a rapid pace? Or bet on companies that are accumulating maximum wealth in minimum time?

Kim:

That’s easy.

Well, of course I’d pick the latter.

Brad:

Do this… and you’ll win FAR more than you lose… and that folks is my BIG SECRET to building wealth.

Kim:

Brad, that’s usually easier said than done, though.

But when I saw this list, it totally flipped the script.

It changed everything about how I think about investing my own money.

Because if so many fast-growing companies are coming from just one sector… it immediately made me think, do I have any money invested there?

Am I catching this huge tailwind?

Or am I missing out on this big opportunity?

Brad:

And that’s the key point here.

When you dive into the details of what’s happening in this one tiny sector – like I have – you’ll find every single one of these 368 companies shares a key trait.

It’s the pattern Kim.

And it’s by exploiting this pattern that you’re able to collect income from hundreds of these fast-growing companies so you can make money right now.

Kim:

That sounds great Brad.

But why?

Why take your approach instead of directly investing in these companies?

I mean… you just showed us hundreds of firms that are growing like crazy.

I want a piece of that.

Brad:

You can’t Kim.

You can’t get a piece of the action.

Most of the companies on this list are private. They are owned by Wall Street insiders. Which means you can’t invest in them.

And what’s worse…

These fast-growing companies are increasingly making so much money, well, for the most part they don’t need… nor do they want… new outside investors.

Kim:

I want to hear more about that why they aren’t taking investors.

But to get this straight…

You’re saying we’re locked out for good?

Brad:

Well even if you could directly invest in these private companies, you’d likely have to tie up your money for years… even a decade or more… before seeing a single dime in return.

Kim:

No thanks!

Brad:

And even then, it’s a total crapshoot.

Kim, do you know how many startups fail?

Kim:

I never thought about it. Half of them?

Brad:

Not even close.

I did the research on this.

And get this…

Founder Equity reports that 17 of every 20 companies backed by venture capitalists fail.

Kim:

17 out of 20? I don’t like those odds at all.

Brad:

It’s definitely not for the faint of heart.

And even if you have deep pockets there is no guarantee of success.

For example…

Even billionaire Mark Cuban admits he hasn’t made a single dime from his investments on the hit show Shark Tank.

And he’s backed 85 tiny startups with $20 million of his own money.

Kim:

$20 million down the drain?

I guess he can afford to lose that kind of money. But I sure can’t.

Brad:

I don’t think many people can afford to gamble like that with their retirement savings.

I mean…

Here’s the bottom line – The chances of catching a ride on one of these shooting stars is slim to none.

Which is why I’m not suggesting you invest in any single company.

But instead, I want to show you how to tap into the income streams of hundreds of the fastest-growing private companies in America… to generate thousands of dollars in income.

I think that’s a much better approach than trying to “get lucky” and pick the next 100-bagger.

Leave that to the billionaire venture capital investors who have millions to risk… and can afford to wait years to find out if they were right.

I’d rather cash checks NOW.

Kim:

I’m with you there.

So that begs the question…

What is the tiny sector of the economy that produces so many fast-growing companies?

This must be related to high-tech companies, right? Like Microsoft, Amazon, or Google?

Brad:

The only thing it has related to these tech giants is how fast those companies grew.

For example…

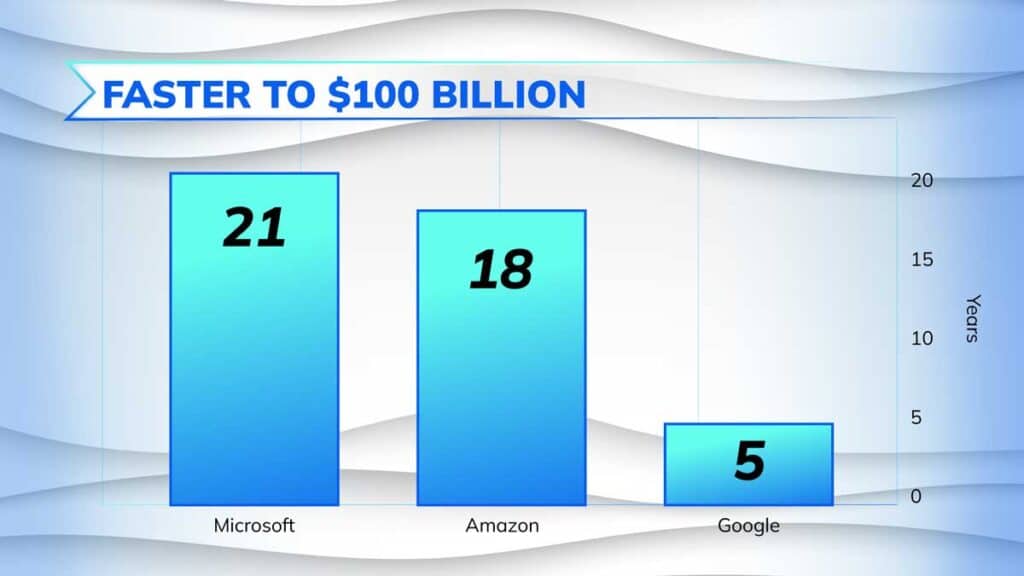

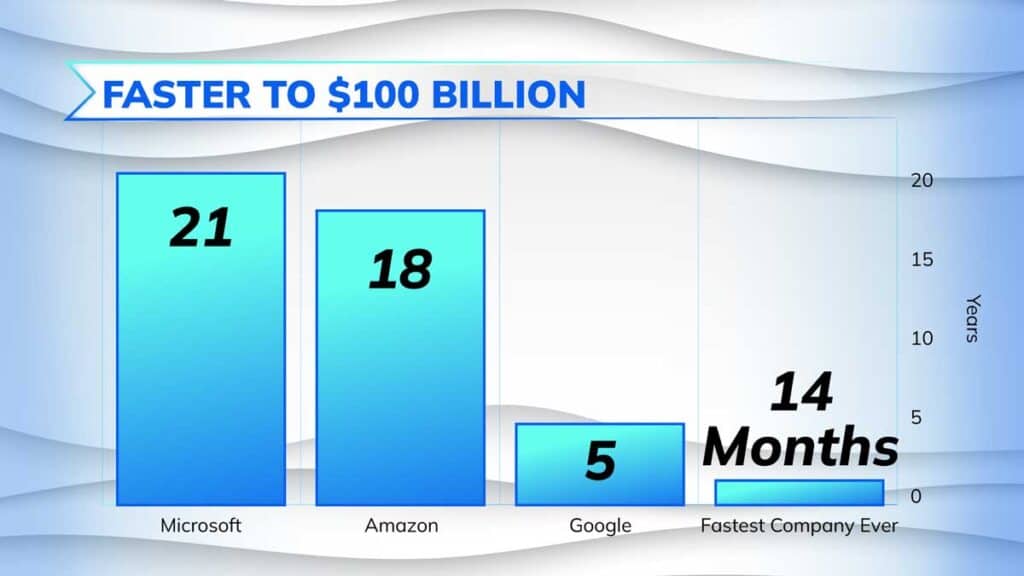

It took 21 years for Microsoft to grow to a $100 billion market cap.

Amazon got there in 18 years.

But Google hit $100 billion even faster. Just a little over 5 years.

Do you see a pattern there?

Kim:

Hmmm… one thing that jumps out is… it seems to be happening faster and faster.

Brad:

Exactly.

And now, private companies are scaling to dizzying heights even faster.

In fact, the fastest of these fast-growing companies in history hit $100 billion in just 14 months!

Kim:

Whoa! From 21 years… to 5 years… to 14 months? That’s got to be the fastest path to $100 billion in history?

Brad:

It’s incredible right?

But again. I am NOT recommending you invest in any one of the 500 companies on this list. Even as lucrative as that can be, as I showed you there is a lot of risk involved. Nothing is ever guaranteed.

The primary goal of my service is to fast-track your retirement, not put it at risk.

Kim:

But with gains this big… you’ve got to be talking about something highly technical Brad?

Is this about artificial intelligence?

Brad:

Not at all.

There’s nothing high-tech about this play.

Kim:

Hmm… ok, but there’s a lot of money involved. So it has to be financially related?

Is this in the financial sector? Or wait… is it about cryptocurrency?

Brad:

No.

And it’s nothing else that’s on most people’s radar. Not biotechnology. Not electric cars. Not energy. Not the metaverse.

And nothing else you’ll typically hear on the nightly news.

Which I find odd. Because this sector has been a crucial component in my business dealings for decades… I’ve watched it from the start.

And even though its growth is going exponential right now, it’s all but completely invisible to most people.

I bet not 1 in 1,000 investors know it exists… much less how much money is involved.

Kim:

So how much money are we talking about?

Brad:

Well, to give you a quick example…

One of these companies operates in a typical looking building in New Jersey.

Here’s a picture of it…

It doesn’t look like anything out of the ordinary, right?

Kim:

Looks like a typical office building. I wouldn’t give it a second look.

Brad:

Nothing special, right?

It could easily be a bunch of cubicles. But get this. $4 trillion dollars moves through this building every single day.

Kim:

$4 trillion dollars a day?!

What are they moving Brad? Are we talking drugs here? You’re not suggesting we start dealing drugs are you?

Brad:

You’d think that would be the only way to make that much money so quickly.

But no. There’s nothing illegal about this. And it’s much more lucrative.

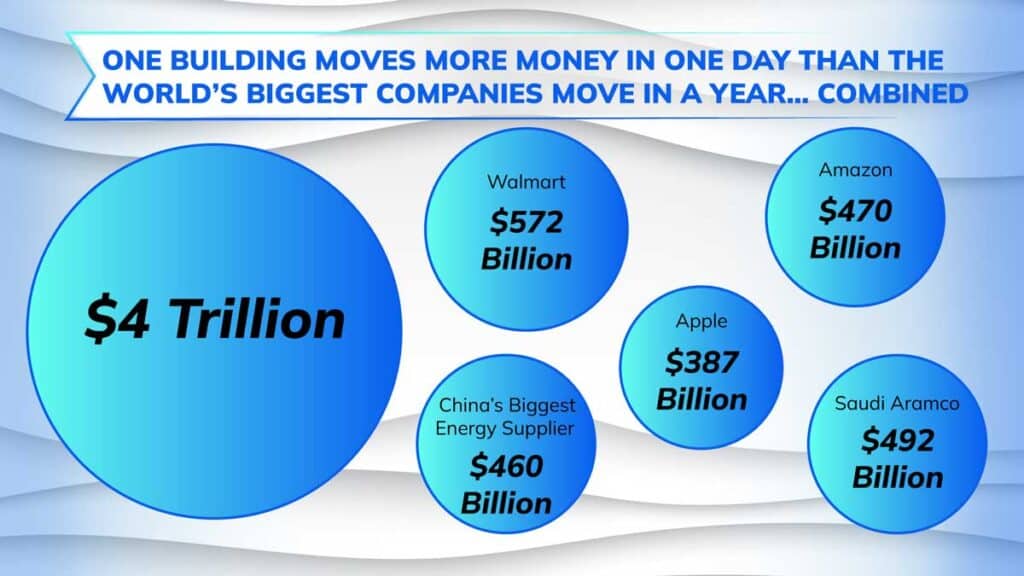

To put it into perspective, let’s compare the $4 trillion a day to the revenue of some of the biggest companies in the world.

I’ve made a list. Can we put that up.

Kim:

Ok, here’s the list.

Brad:

So Walmart rakes in about $572 billion.

Amazon, roughly $470 billion.

China’s biggest energy supplier pulls down $460 billion.

Oil giant Saudi Aramco generates $492 billion.

And Apple is up to $387 billion this year.

I could go on…

But if we take these 5 huge companies….

More money moves through this one building in New Jersey… in one day … than all of these companies make in an entire year COMBINED.

So you asked how much money we’re talking about? There’s a lot of money moving around here.

Kim:

That may be the understatement of the century Brad.

$4 trillion isn’t just a lot of money. That’s a Mount Everest sized pile of money on the move every day.

And you’re saying the viewers at home can grab some of this wealth for themselves?

Brad:

That’s exactly what I’m saying.

And it’s the sheer size of this money mountain – as you put it – that I believe also makes it one of the safest ways to generate income today.

Kim:

Wait a second, Brad.

Doesn’t big money also come with big risks?

Brad:

Well of course, all investments carry risk. Nothing in life is guaranteed. But the single best way to reduce risk is through diversification.

And that’s the core of the strategy I’ll show you today.

Because again, I’m not recommending you invest directly in any single one of these 500 companies.

By following my approach you’ll be putting yourself in the profit stream of hundreds of them. And every time they get paid, you get paid.

And all it takes is a single ticker.

Kim:

Wow. One ticker. And we can cash-in on hundreds of the fastest-growing private companies in America? I gotta say. You’re right, I am getting pretty excited here.

Brad:

It is exciting. I’ve put all the details of this ticker into a new report. I’ll explain how to get that later.

But we still haven’t even scratched the surface…

Because that building I showed you above that moves $4 trillion a day?

This is just one building of hundreds around the world that are involved in this.

Kim:

Wait. Hundreds? There are hundreds of buildings just like this one?

Brad:

That’s right.

Here’s a map of them…

Kim:

Look at all of them.

They’re all over the place.

The United States. Asia. South America. Africa. Europe. These building are everywhere.

Brad:

But here’s the thing.

Everything is about to get a lot bigger.

Kim:

Bigger than $4 trillion a day?

Brad:

Yes, we’re still in the very early stages.

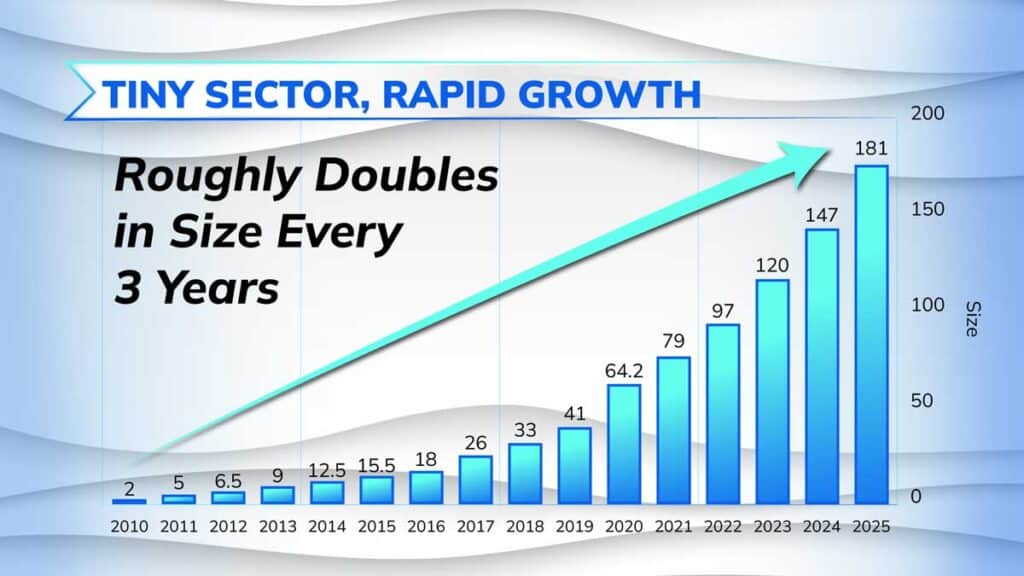

Like I said earlier, this sector practically didn’t exist until a few years ago. But it’s dominating everything right now because it’s growing like wildfire.

This sector has approximately doubled in size every 3 years. And it’s expected to keep up that rapid pace of growth.

We have a chart of that. Can we take a look…

Kim:

So you’re saying it’s not too late? There’s still time to get in?

Brad:

Well the best time to get in is always when trends start.

And while this has rapidly picked up steam in the last few years…

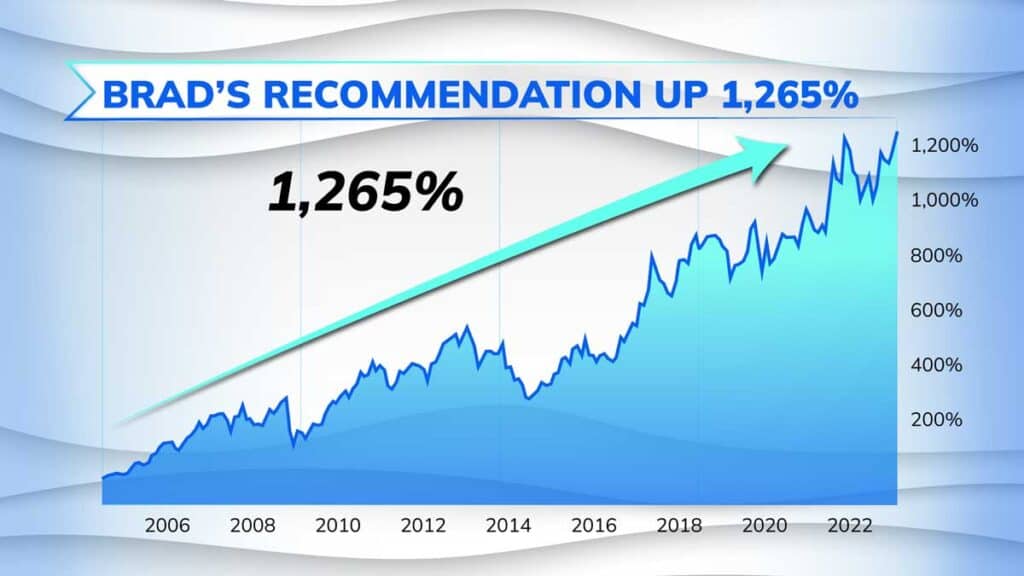

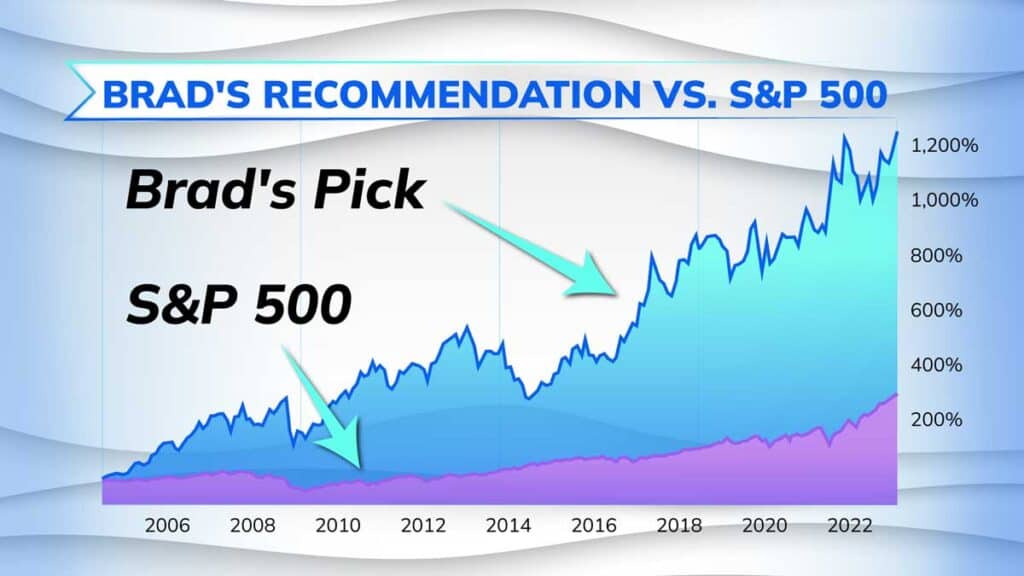

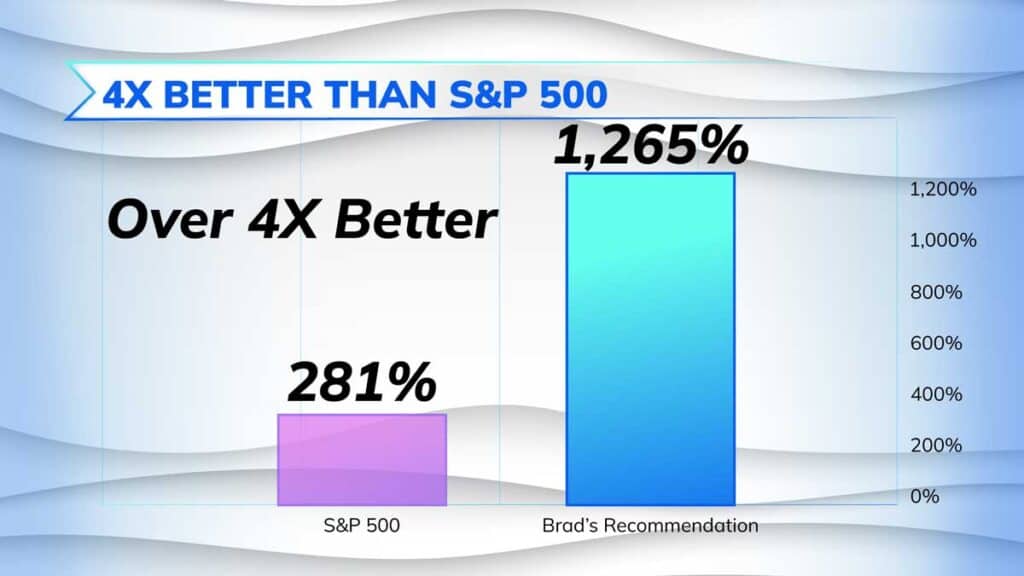

If you got in at the very beginning on the ticker I’m recommending today you’d be up as high as 1,265%.

And that doesn’t include all the extra income it churned out in the form of dividends.

During the same time the S&P 500 only gained 281%.

Kim:

That’s not even close Brad!

That’s at least, what, 4 times better?

Brad:

More than 4 times better.

But like I said, it’s just the beginning.

Because with the 2X projected growth of this sector in front of us…

I predict this one ticker could continue to vastly outperform the S&P 500 over the coming years… and maybe even be the best investment in your portfolio for years to come.

And if you think this is something you can drag your heels on, understand…

Nobody else is.

With the growth projected to continue the biggest players in Wall Street are diving in head first.

Kim:

Like who Brad?

Brad:

Everybody.

Goldman Sachs invested $1.5 billion.

Blackrock is the world’s biggest asset manager and they’re going even bigger.

They invested $10 billion saying it will provide a source of “perpetual capital.”

And JP Morgan spent $2 billion investing in this trend just in 2021… and plans to spend $10 billion more.

Kim:

Wow. It does sound like everyone is getting involved.

Brad:

And that’s just the beginning…

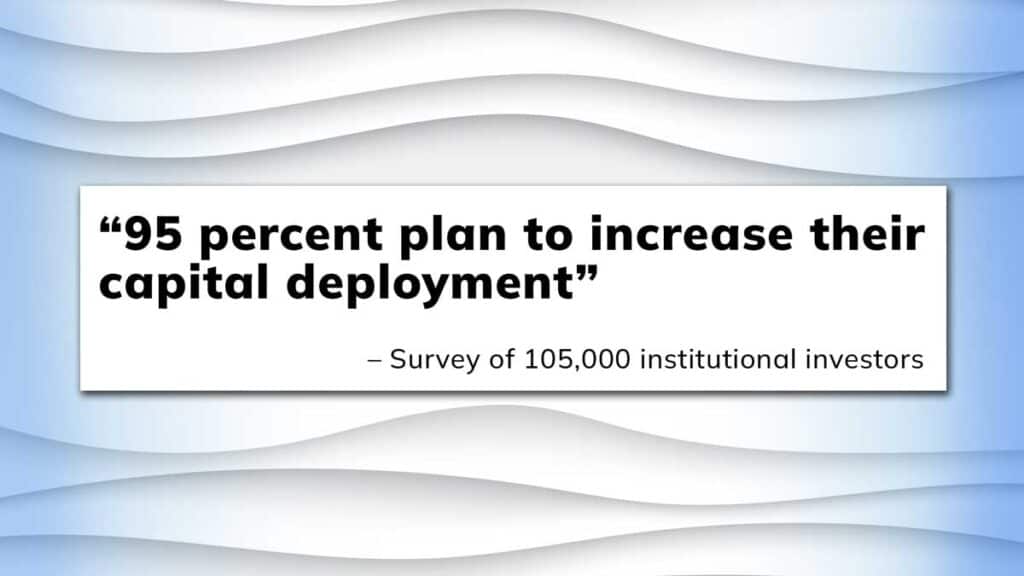

In a recent survey of 105,000 large institutional investors… a full 95% reported they are planning on increasing investment in this sector.

And they are not alone.

Apple is spending $1.4 billion.

Google says they are going to invest $9.5 billion in 2022 alone.

And Amazon has already spent $34 billion.

Kim:

That sure does sound like everyone is diving in head first.

I’ve never heard of anything like that.

Brad:

Yeah, and I could keep going…

But other than these insiders, nobody is paying attention to this. Because there is nothing seemingly exciting about this…

I mean, I showed you the picture of the building earlier. It doesn’t look like anything special.

Kim:

It really doesn’t.

I wouldn’t take a second glance at it.

Brad:

Exactly my point.

While the media has everybody hypnotized into seeking riches in whiz-bang technologies that may or may not pan out sometime in the future…

NOBODY is paying attention to the trillions of dollars moving through these non-descript buildings right now.

But look, I’m not here to blame anyone.

Why would anyone pay attention to yet another warehouse going up in some side-street of an industrial district?

But that lack of is costing them untold millions of dollars.

And will cost a heck of a lot more in the future. While the people who do know what I’m about to show you… they’re the richest people in the world… or… well on their way.

That’s why I wanted to share the pattern shared by all these fast-growing companies today… for free.

Because in terms of enjoying a stress-free retirement with all the income you could want or need…I believe it’s the single most important overlooked piece of information in America today.

Kim:

Brad, I’ve got to say – that’s generous of you.

And that’s why we invited you on. You’re one of the few people who is gracious enough to share information like this with “regular folks” who are just attempting to make sense of the market.

On that note, let’s get into this income strategy.

How does it work? And how did you discover it?

Brad:

Well, it’s funny. I discovered it by going broke.

Kim:

Oh, ok wait…

Going broke?

Brad:

Yes.

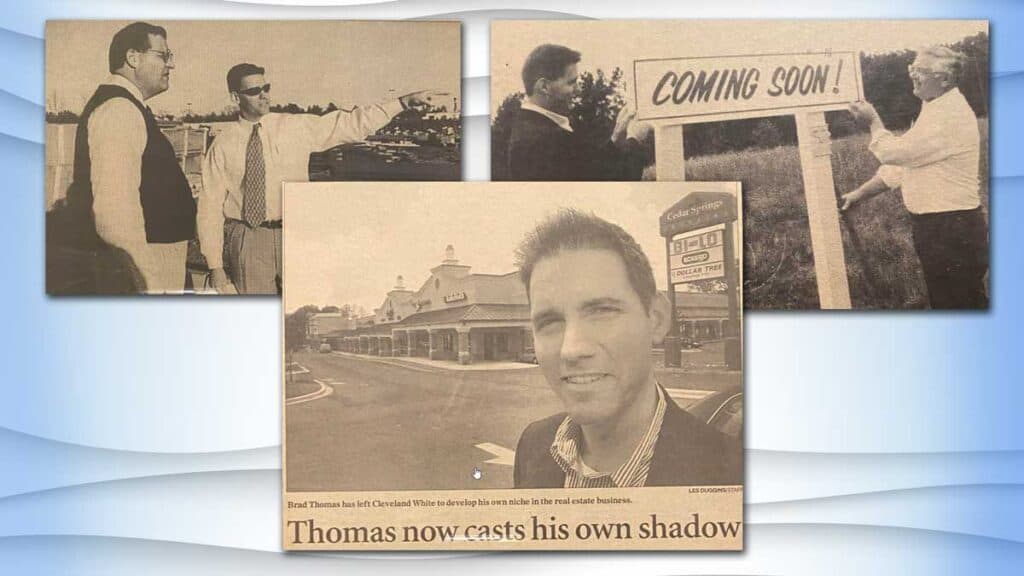

You see, I got rich the first time in commercial real estate.

That’s what eventually led to a relationship with Donald Trump.

I’m going to show my age here… but this was back in the days of intense national expansion from companies like Blockbuster Video, Athlete’s Foot, Advance Auto Parts, and Dollar General.

I built for them and others, constructing both free-standing properties and strip malls.

I did over $1 billion in deals with the biggest companies in the world. And came to own multiple properties and multiple franchises.

Kim:

Sounds like a great living.

Brad:

It was. At the peak I owned over $100 million in property. And I was collecting over 100 rent checks a month.

But then the real estate bubble burst in 2008 and I lost almost everything: My properties, my franchises, my career, my millions.

Kim:

I remember when that happened. It was just awful. Almost everyone was walking around in a daze.

Brad:

I’ll tell you Kim…

I remember walking onto a property I once owned… a supermarket… and looking at a bag boy and thinking to myself, “he’s got more money than I do.”

Kim:

Ouch. That must have hurt.

Brad:

It was a huge punch in the gut.

But that wasn’t even the worst of it.

Kim:

Losing everything wasn’t the worst of it?

Brad:

Not by a long shot. You see, I had five young kids at the time. And the anxiety of not knowing if I was going to be able to put food on the table… if I wasn’t going to be able to feed my family…

I mean, I grew up in a small-town in South Carolina. Now I’m not a hillbilly. But we weren’t exactly rolling in the dough.

And this might not sound politically correct, but where I’m from, you’re not a man if you can’t provide for your family. There’s a stigma attached to it. And I felt it. I went through some dark times.

Kim:

I’m from South Carolina too. I know how it is.

So what changed?

Brad:

Well, it’s funny what desperation can do.

Over all those years of developing real estate I noticed those warehouses going up. I just never gave them any thought.

But after losing everything my mind started searching for opportunities. And I started looking at these buildings a little more closely and it was like a light bulb went off.

And that was all it took.

I made back everything I lost and then some.

Kim:

That’s an incredible story Brad.

You told me this before we got on camera, but one thing I’m jealous of is that you own not one… but two Porsches.

Brad:

Well you’re gonna make me blush.

And thank you Kim.

But I don’t want to misrepresent what happened though. It’s true I lost everything in what seemed like an instant. But I didn’t build it all back overnight.

Please don’t think of anything I’m sharing today as a “get-rich-quick” scheme.

Yes, there is an opportunity to make real money here… but “get-rich-quick” is a terrible mindset to invest with…

It’s my job to not only provide you with opportunities to generate a sizable and stable income, but also protect your money AT ALL COSTS.

The primary goal of my research service Intelligent Income Investor is safe and consistent returns every single month.

And if my “get-rich-slow-and-steady” method for doing things turns you off – then… and I mean this with all respect… I’m probably not the right guy for you.

Kim:

Well, Brad I’m sure you scared a few people away by saying that.

But I appreciate your honesty.

Brad:

Don’t get me wrong… I want people who follow me to make lots of money, but…

I don’t want them to go through what I went through.

I don’t want them up all night, staring at the ceiling engulfed in anxiety… worrying about their future like I was.

I want people to get rich and sleep well at night.

Kim:

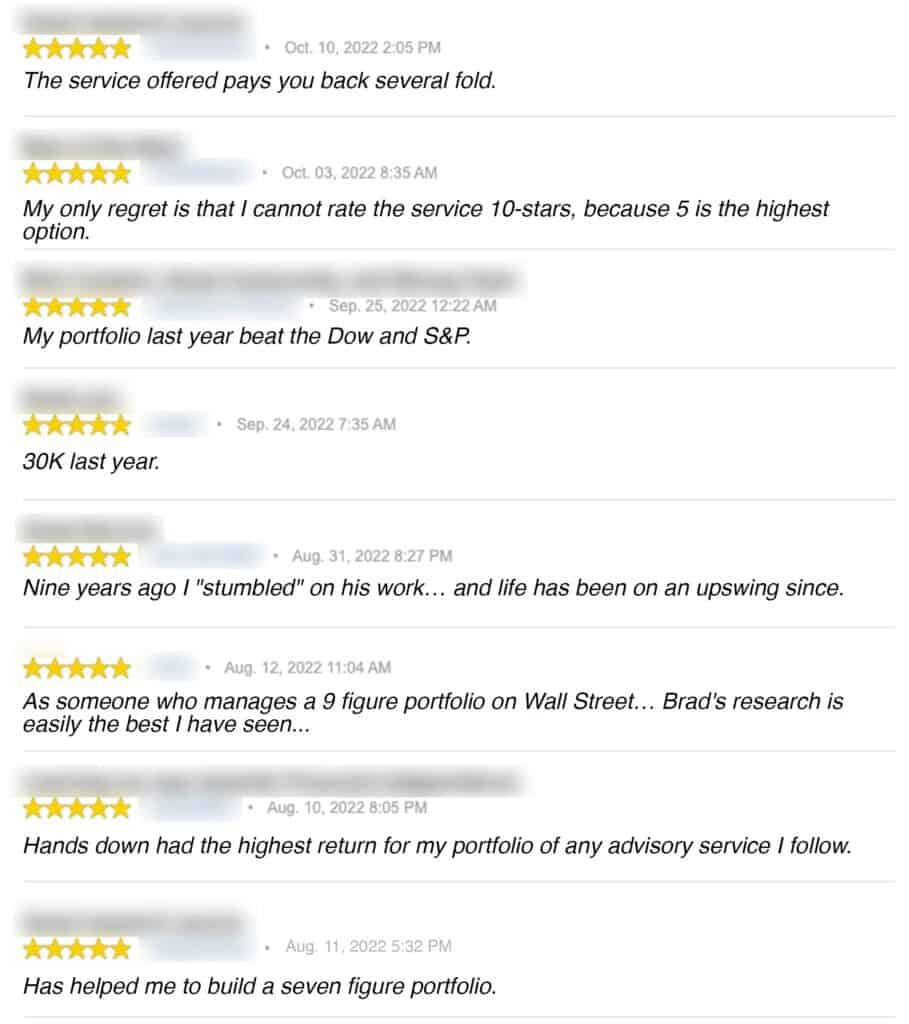

And by the following you’ve amassed Brad it looks like you’ve achieved that goal.

On the financial advice website SeekingAlpha, Brad is the #1 most popular contributor. And has over 373 five-star reviews from readers.

That’s a lot.

We’ve put a few on the screen, but we’re just going to read a few…

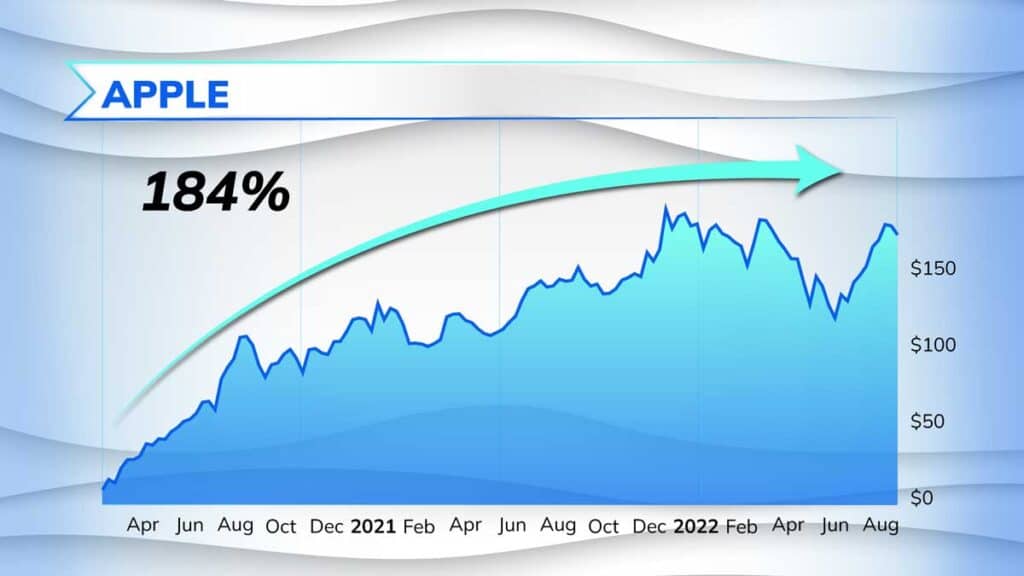

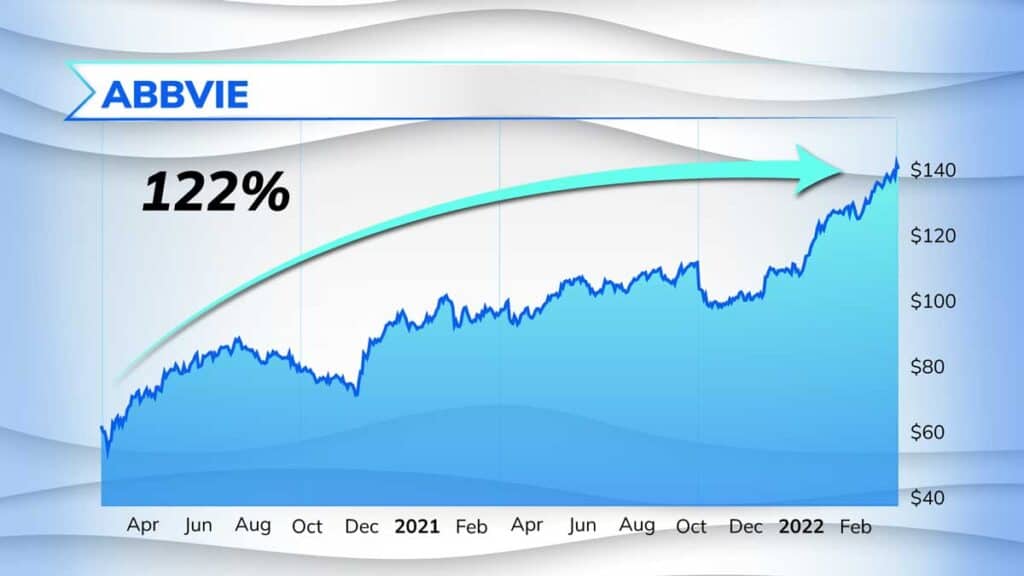

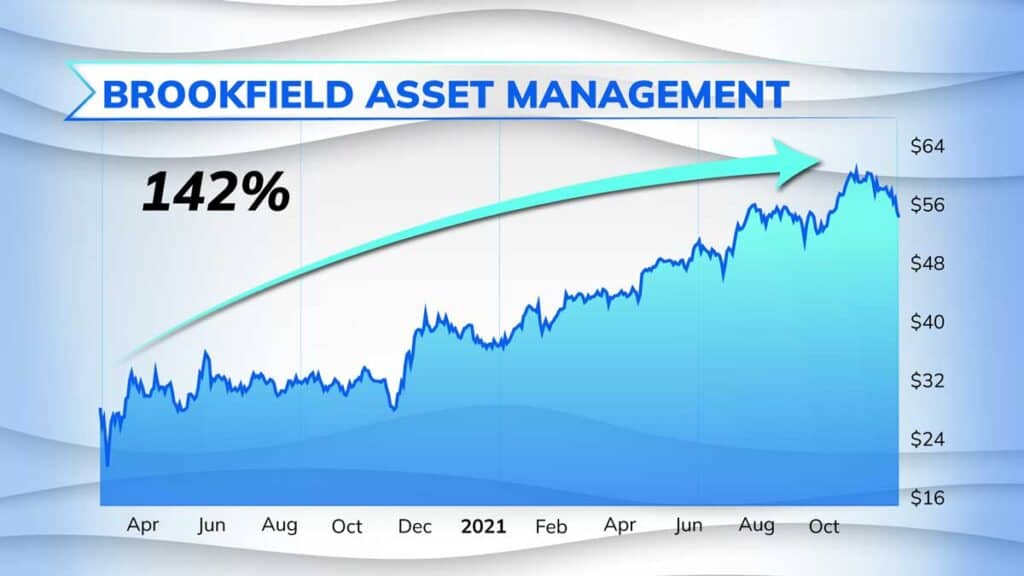

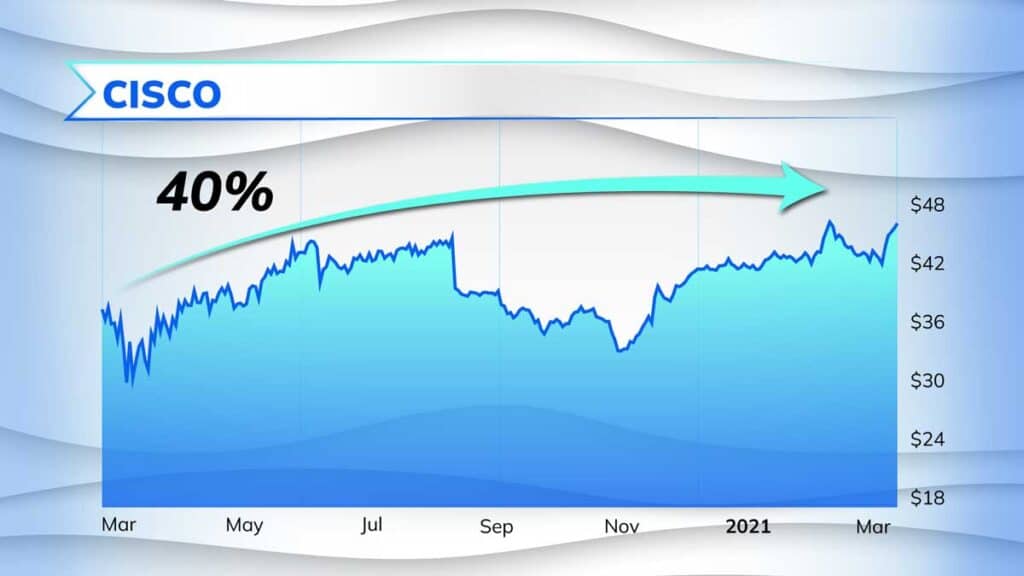

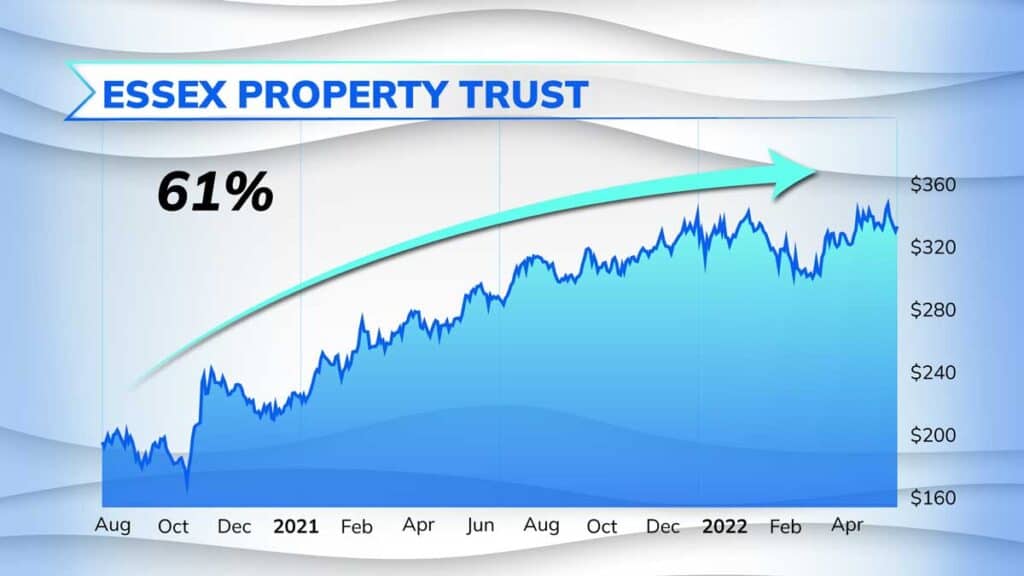

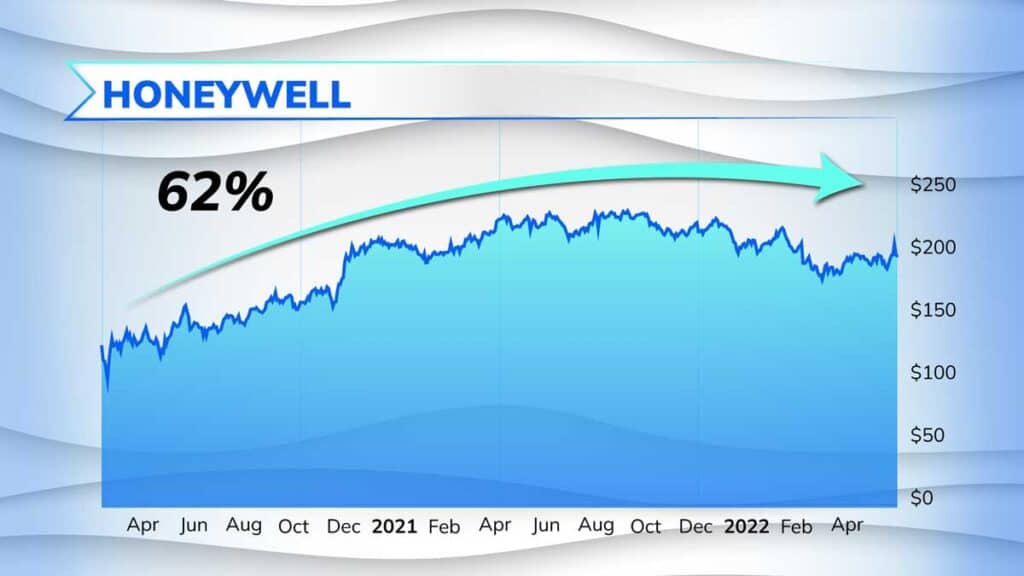

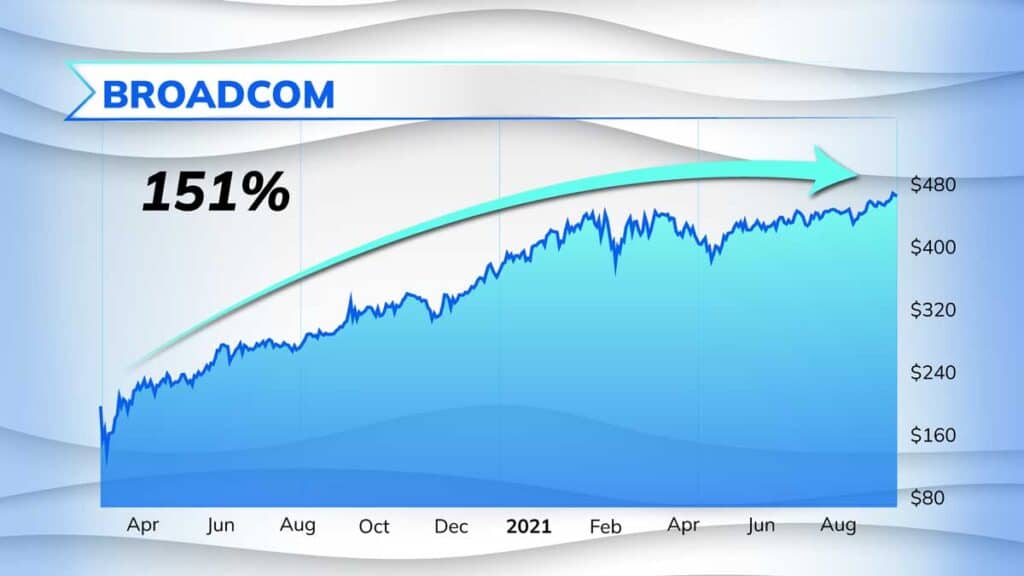

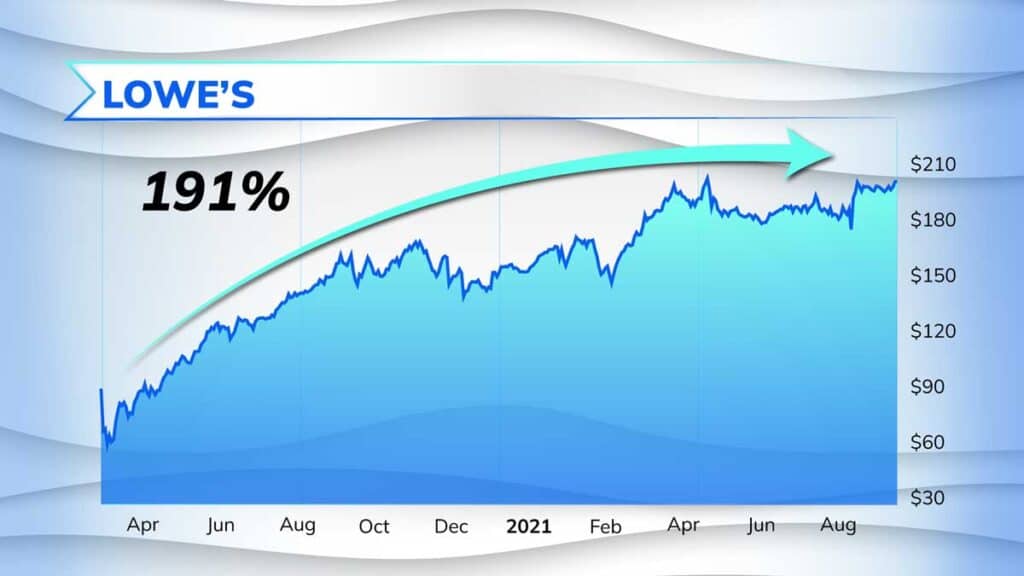

And that’s because many of Brad’s recommendations have delivered simply stunning returns like…

184% on Apple.

122% on Abbvie.

142% on Brookfield Asset Management.

40% on Cisco.

61% on Essex Property Trust.

62% on Honeywell.

151% on Broadcom.

191% on Lowes.

And many more open recommendations with double and triple digit gains that we won’t mention here because that would not be fair to paying subscribers.

Brad:

I’m very happy with our track record.

But here’s the thing…

While all those gains are incredible…

It’s nothing compared to what I believe is coming.

And here’s why…

Everything is accelerating.

These fast-growing firms are growing faster than ever.

As a result, they grow to massive proportions before going public. Which means insiders make a killing. While regular investors miss out on the biggest gains.

And that’s why there is not much time to act…

Because if history is any indication, I fear anyone who doesn’t act now is going to be locked out forever.

Kim:

That doesn’t sound good Brad.

What do you mean by locked out?

Brad:

Have you heard of the term Unicorn Kim?

Kim:

The mythical creature that looks like a horse with wings and a horn?

Or the term for companies with a private market valuation of $1 billion or more?

Brad:

Right, the second one.

But in a private company sense the term unicorn WAS mythical until recently.

They didn’t exist until 2005.

But since then they’ve been multiplying like rabbits. Forbes reports today there are more than 1,000 unicorns.

And here’s why that’s a problem…

I’ll use perhaps the most famous example of a unicorn. Facebook.

They didn’t go public until after hitting a market cap of $100 billion.

Kim:

$100 billion?! That’s bigger than most large cap companies.

Brad:

You’re right. I counted.

There are only 71 companies in existence today with a market cap north of $100 billion.

Which means all that wealth Facebook generated before it went public was kept in house – for the insiders.

And they made an absolute fortune.

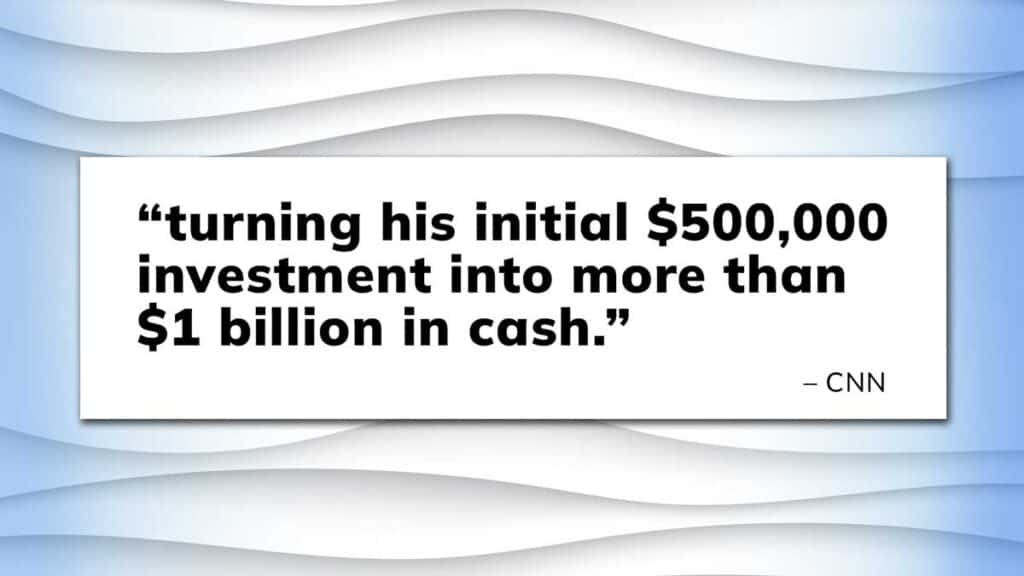

In fact, CNN reported one insider turned his “initial $500,000 investment into more than $1 billion in cash.”

That’s a 200,000% gain.

Kim, that turns every dollar invested into $2,000.

Think about that…

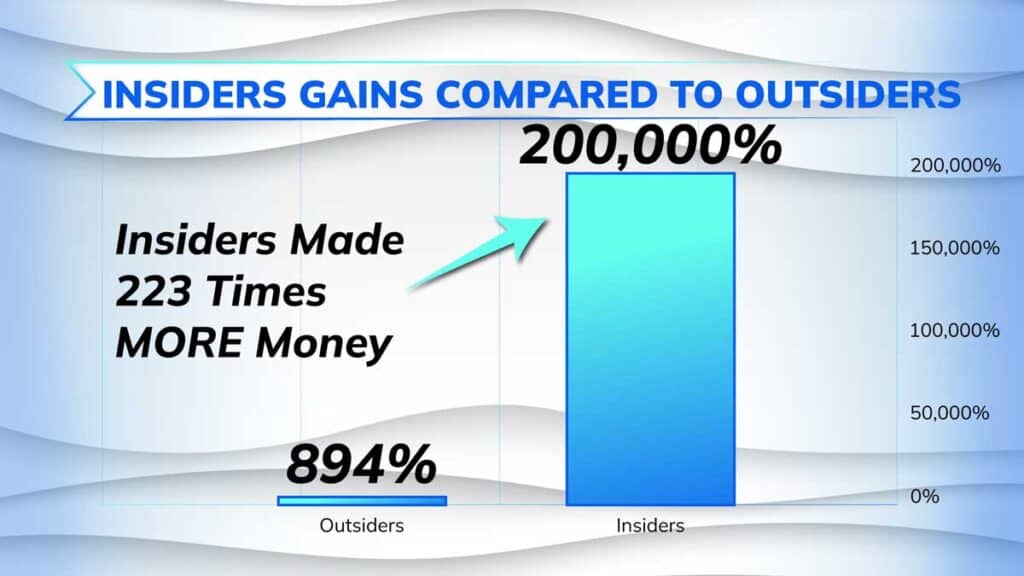

Facebook IPO’d at $38.

Which means if you did everything perfectly… if you bought at the IPO… and sold at the peak… at most you’d have the chance to make 894% gains.

Meanwhile insiders made 200,000%!

Kim:

894% vs. 200,000%! That’s outrageous.

Brad:

It’s crazy right.

In other words, insiders had the chance to make 223 times MORE MONEY than people like you and me.

Does that seem fair to you?

Kim:

Absolutely NOT.

What you’re saying is I’d have to perfectly time the market just to make a small fraction of what the insiders make?

How can regular investors like me compete?

Brad:

And that’s why I’m warning that time is of the essence here.

Because it’s only going to be worse from here.

Kim:

Brad. Stop. Just stop.

You’re going to give me an aneurysm.

You just told me I missed out on 1000 of the fastest growing companies in the world. How can it get any worse?

Brad:

Because the fast-growing companies in this sector are so lucrative… They are staying private even longer.

I mean, if we just look at the tech sector…

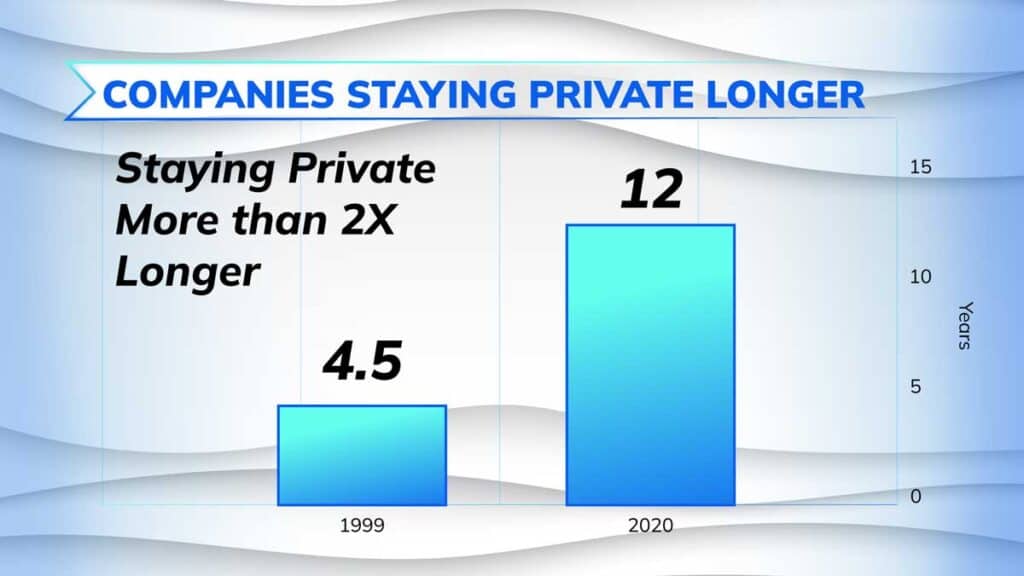

A University of Florida study found that in 1999, the average age for a company to go public was just 4.5 years.

By going public early, it allowed public investors to get in early and enjoy the ride up.

Kim:

But I assume that’s not happening anymore?

Brad:

Right.

By 2020, it took the average company 12 years to go public.

And like I just showed you, a lot of those companies had already grown to unicorns before they went public.

Kim:

Which means the biggest gains went to insiders.

Brad:

You’re catching on.

And that’s why I’m saying investors will be locked out forever if they don’t act now.

This unicorn trend is growing.

In fact, there were 340 new unicorns last year according to a Forbes report.

That’s more unicorns than in the previous 5 years… combined.

Kim:

So this trend is speeding up? That’s the reason behind the urgency?

Brad:

That’s why time is of the essence here.

Because the pick of fast-growing publicly traded companies is growing smaller by the day.

In fact, the fastest of the fast-growing companies even have a name.

They’re called hyperscalers.

Because they can scale to these dizzying heights with outrageous speed.

And unless you can figure out a way to make money from these fast-growing private hyperscale companies – like I have – the odds of you making a profit in the stock market grow worse by the day.

Kim:

Unicorns. Hyperscalers. Ok Brad, please enough with the suspense…

So, what exactly is this sector? And why are the companies in it growing so fast?

Brad:

Ok, we’ll answer those questions in order…

I call it the “real-time” sector.

And perhaps the best way to explain why companies in this sector are growing so fast is with an example.

Kim, have you ever used a navigation app on your phone like Google Maps, Apple Maps, or Waze.

Kim:

Oh of course. I use it whenever I need directions.

Brad:

You and hundreds of millions of other people around the world.

And for good reason…

Why carry around a stack of folding maps and a magnifying glass to look for routes when you can just tap in an address on your phone?

Kim:

It’s a no brainer.

Brad:

Now here’s what’s really cool about these apps.

They used to just provide directions.

But have you noticed how these apps can reroute you – in real-time – when there is an accident ahead?

Kim:

Oh yeah, it’s great. It’s convenient. I love it.

Brad:

Google maps introduced this feature in 2015.

And over the years it’s gotten better…

Now Google Maps can even tell you if there’s a speed trap ahead. So you can slow down and avoid a costly ticket.

Kim:

I gotta say. I love that feature. I’ll be honest. It’s saved me a few times.

Brad:

Me too.

And it’s all made possible by the increasing amount of real-time data that’s available.

In this case, the rapid transmission of real-time data helps drivers avoid a lot of headaches on the road.

Like traffic accidents that just happened.

Or cops setting up speed traps ahead.

And it’s this increasing amount of real-time data… combined with the ability to reach hundreds of millions of customers like that… that makes is possible for these new crop of companies to exist.

Kim:

So those 368 companies on the list of 500 you showed earlier…

That’s why these firms can grow so fast? Because they have increased access to real-time data?

Brad:

That.

And they solve problems people want solved right now.

For example, look at Waze… the navigation app.

They pioneered the use of real-time data for traffic.

It’s one of those 1,000 unicorns I mentioned earlier. It was launched in 2006. Google bought it seven years later for $1.3 billion.

The founders profited to the tune of hundreds of millions.

And get this… over 100 insiders walked away with over a million dollars each.

Imagine becoming a millionaire in 7 years.

Kim:

For most people it would take a lifetime to accumulate that much wealth.

Brad:

Right.

But in this case, it was only possible for insiders because Waze never went public. They grew bigger and bigger, so insiders kept all the profit to themselves.

But again let me stress…

My strategy does not involve investing in private companies. That’s too risky for the average investor.

Instead it’s by tapping into the income stream of these hyperscalers – the money involved with sending and receiving all this real-time data – that makes it possible to collect thousands of dollars from all of these companies.

Kim:

I want to get into the details of your strategy.

But I have to push back here Brad.

Earlier you said this isn’t about high tech companies. But the example you just gave is about Google. I hope you’re not suggesting Google isn’t a high tech company?

Brad:

Of course Google is a high tech company.

But GPS navigation in Google maps isn’t high tech anymore.

It was invented in the 1970’s.

It’s been around for decades.

You can’t say that about all the new experimental technology coming out – like genetic editing, artificial intelligence, blockchain and more.

Compared to that, GPS is practically stone age-technology.

Kim:

You have a point.

Brad:

And that’s why this is so exciting to me.

This is NOT about gambling on the latest high-tech buzzword that has a one-in-a-million chance of succeeding.

This is about low-tech.

This is about companies that are combining old-school tried and true technology we know works and has worked for decades…

With the ever growing availability of “real-time data”…

To collect income that I predict will grow bigger day after day… month after month… year after year… as this sector keeps growing like crazy, just like it has for the past decade.

And doing it all from just one ticker.

It’s something that’s never been possible before, until now.

Kim:

So how is the company behind this ticker involved?

Brad:

It’s the only reason these small firms can grow so big, so fast.

In short, it supercharges data transfer time.

It’s what makes ordinary data “real-time.”

These fast-growing companies can’t exist without it.

Which is why thousands of firms – both big and small – use this company’s services.

And it’s why I’m suggesting you buy this ticker immediately. Because it puts you smack-dab in the middle of income stream of hundreds of companies that rely on “real-time” data.

Kim:

Ok, you mentioned GPS and real-time traffic data. Can you give me some other examples?

Brad:

Sure… consider the pacemaker.

Invented in the 1950’s, it’s a tried-and-true device that can help a weak heart keep beating. It’s saved millions of lives.

But get this…

By adding simple sensors to a pacemaker, it’s now possible for them to sense when a heartbeat starts to go awry. And it can send this data – in “real-time” – to first responders.

Kim:

Wow. It sounds like a lifesaver.

Brad:

It is.

And it’s remarkably easy to do now.

You just marry two pieces of tried and true tech… the pacemaker and the sensor…

And then plug it into this “real-time” network…

And BOOM… you’ve got a new valuable service that millions of people will gladly pay for.

Because let me ask you… if you had a heart condition, would you pay for a service that tracked your heart in real-time? That could save your life should you have a heart attack?

Kim:

Absolutely. If it saved my life it would be worth every penny.

Brad:

And those people will continue to pay for this service FOREVER.

Think of it like your cell-phone.

Kim, how long have you owned a cell-phone?

Kim:

Oh gee… probably for 20 years now. Maybe more.

Brad:

Are you ever going to get rid of it?

Kim:

I don’t see how I could at this point. Besides using the phone to make business calls and stay in touch with family and friends, I use it for everything. It’s got my email. My calendar.

Brad:

It’s too valuable, right?

Your cell phone is a source of real-time information that’s too valuable to go without.

Now let me ask you…

Kim, how much is your monthly cell phone bill?

Kim:

I don’t even know anymore. I’ve had it on autobill for years. So maybe $100 bucks a month?

Brad:

Wow you’re lucky.

With my family of 7, I’m stroking a $600 check to AT&T every month.

Kim:

$600! Phew.

Brad:

But you made my point for me.

It’s so important you pay for it without even thinking about it.

And think about it…

$100 bucks a month. That’s $1,200 a year. Over a decade that’s what… 12 grand.

So in the 20 years you’ve had a cell phone, that means you’ve paid $24,000 to your cell phone provider.

Kim:

Wow. $24,000. I never really thought about it that way.

Brad:

And that’s why investing in this “real-time” revolution is so lucrative and predictable.

You’ve paid just one company, your cell phone provider, $24,000 to provide you with real-time information.

But as you saw in the list above, hundreds of new “real-time” companies are coming on-line right now.

And just like cell phone companies… In a lot of cases once they get a customer they’ve got an income stream for life.

The result?

All of these companies make reliable, predictable income month after month after month.

And that’s why I’m pounding the table on this one ticker.

Because it supercharges data transfer time. It’s what makes hyperscale companies possible in the first place.

And by investing in this one ticker you’ll put yourself smack dab in the middle of the income stream of hundreds of hyperscale companies that exist right now…

And potentially thousands of hyperscale companies that will be coming online in the future… as this trend picks up steam.

Companies that you otherwise would NOT be able to profit from. Because as I also showed you… they are increasingly staying privately held for longer and longer.

Kim:

Ok, then sign me up Brad. What’s the name and ticker of that company?

Brad:

That information is reserved for my paid subscribers. But I’ve put all the details inside a special report that I’d like to give everyone access to.

It’s called: The Real-Time Revolution: How to Earn Endless Income on America’s Fastest Growing Companies.

Kim:

And I’ve got the details of that report for our viewers.

In this report Brad will give you all the details on this company, including its name and ticker symbol.

This company puts you smack dab in the income stream of hundreds of real-time companies.

And so you can investigate this trend further for yourself, you’ll get details on how this real-time revolution is quickly touching every aspect of our lives.

And as a special bonus in this report, you’ll get the names of the 500 fastest growing companies in America Brad showed you earlier. Every single one.

Everything you need to help you jump on this opportunity of a lifetime before it picks up any more steam.

And for viewers who want to get that report now, a link just popped up below this video. If you click it, you’ll be taken to a new page where you can review everything and get your hands on this report.

So Brad, I want to know more about how this works? How can these companies get so much real-time data?

Brad:

Well, that brings up a little bit of the dark-side of what is going on here.

Kim:

Dark side? Everything sounded great up until now. You’re telling me there is a down-side to this?

Brad:

Well I want to make sure viewers get the full picture here. And the truth is, right now, we are being surrounded by an ever-growing list of devices that collect data in real-time.

Cell phones. Computers. Cameras. Drones. Sensors in your car, your place of work, your home, and in some cases, even inside your body.

All these devices are constantly collecting data that companies then use to turn a profit.

Kim:

That’s kind of scary when you put it that way Brad.

Brad:

You may not like it. You may think it’s an invasion of your privacy. But whatever your personal feelings are about it, you need to put them aside.

Because it is an unstoppable trend.

Remember this graph I showed you earlier?

What that shows is how much data is created and stored every year.

And as you can see, it’s growing at an exponential pace… almost doubling every 3 years.

Kim:

I mean that’s truly exponential growth. And that’s why you’re saying it’s an unstoppable trend.

Brad:

That’s right.

You can dislike it.

You can say it’s an invasion of privacy.

You can chuck your cell phone in a river and go live in the woods to try and escape it.

But Kim, you can’t stop it.

You can’t stop it.

Your only choice is… will you choose to ignore this information or will you use it to your benefit?

That’s a personal decision. And whatever direction you choose, I respect it.

But with or without you, the world will keep turning. You can move with it. Or you can be left behind.

Either way, the list of companies that rely on real-time data is growing. They make a lot of money. And you can grab a piece of that ever growing pie.

Plus, a lot of those companies are doing a lot of good.

I already gave you examples of how real-time data combined with GPS saves drivers time and money… and how pacemakers combined with real-time data saves lives.

But that barely scratches the surface…

Have you heard about all these hackers breaking into company computer systems… and holding them ransom for millions of dollars?

Kim:

Yeah, I have heard of that. It’s a huge crisis.

Brad:

In just one example hackers took control of The University of California San Francisco Health computer system. They paid over one million to get their data back.

Kim:

That’s just awful.

Brad:

But get this…

Expel Security – they’re on the list of the 500 fastest-growing companies – provides real-time security data scanning and can catch a hack and fix it in 3 minutes.

Pricing for this service starts at $11,000 a year. But to prevent a hack that could cost millions, is it worth it?

Kim:

Well the company is growing like crazy, so obvious people are paying for that service.

Brad:

That’s right.

And here’s another example…

By 2028 the entire city of Los Angeles wants to become the world’s first “smart city.”

They envision kiosks that can translate languages in real-time, so visitors can speak in any language. They want to install timed stop lights so traffic flows better all over the city. And all police officers will have body cameras that transmit data real time to help fight crime.

Kim:

I’ve already police officers with those body cameras.

Brad:

And then there’s the EV trend.

Elon Musk said the key to Tesla’s future is self-driving electric vehicles. Even going so far as to say Tesla would be “worth basically zero” without it.

Well, a car can’t drive itself without real-time data.

Traffic lights. Other cars on the road. Kids running out into the road. A car that drives itself requires all this real-time data or people die.

I could go on. But I think you get the point.

The real-time revolution is coming. And it’s coming fast.

Bottom line: unless you believe modern society is going back to the stone age then this trend of data collection is only going to get bigger from here.

The biggest gains lie ahead.

Kim:

Brad, I think a light bulb just went off for me.

This explains why earlier you mentioned the building that moves $4 trillion dollars in wealth every day. And how thousands more are popping up around the world.

The world needs all these new buildings to handle the increasing amount of real-time data.

Brad:

Are you for hire? Can I get you on my team of analysts?

You are absolutely correct.

The important thing to understand is – we’re on the brink of a technological shift, unlike anything we’ve seen since the dawn of the internet.

Most people – other than a handful of insiders – don’t get it.

That’s why I want to make sure people know what’s happening…

And how to take advantage of it.

That’s why I revealed my research today for free. I wanted everyone to understand – at a fundamental level – exactly why the world’s fastest-growing companies are growing so fast.

It’s only with this deep understanding that I believe you’ll be able to make money in these crazy markets.

Because let’s face it…

And Kim, I’m going to talk directly to viewers here.

We are NOT in the same market we were a year ago.

Depending on who you ask we are either in a recession or quickly approaching one. Inflation is running rampant with no end in sight.

And we just lived through the worst stock market in 50 years.

Whatever approach you had to investing, to earning income, to saving for retirement last year… forget about it.

Because today is different.

And if the information I shared today gave you some new insight into what is happening in the world right now – and if you are still watching this interview, it must have… because why else would you still be here…

Then I suggest you get the full story in my new report The Real-Time Revolution: Endless Income on America’s Fastest Growing Companies.

Kim:

Brad, I’m sure a lot of folks are going to want to get their hands on this report.

So I’m going to take a second and pass along instructions – on how you can get it instantly.

It’s simple. This report is available right now to new members of Brad’s income advisory service The Intelligent Income Investor.

The minute you request access, you’ll get The Real-Time Revolution: Endless Income on America’s Fastest Growing Companies.

It includes why the Real-Time Revolution is kicking into high gear right now…

Why it’s giving birth to – as Brad showed you today – 77% of North America’s fastest-growing companies right now…

And the name and ticker symbol of the company at the center of it all.

It’s right in the middle of the income stream of hundreds of these fast-growing companies.

And with this trend poised to grow 2 times bigger over the next 3 years… just like it has for years… Brad predicts this single stock could easily double from here… while generating thousands of dollars in income depending on your stake.

Plus as a bonus in this report, you’ll get the names of every single one of the 500 fastest-growing companies in America.

In short, you’ll get EVERYTHING you need to get up to speed.

Brad, what is the Intelligent Income Investor for the folks at home?

Brad:

Kim, Intelligent Income Investor is my flagship service. It’s where I analyze what’s going on in the markets – and each month delivers the best income opportunities to my subscribers.

The whole point of Intelligent Income Investor is to give you an understanding of the big picture – what’s going on in the financial world and how you can profit without putting your retirement nest egg at risk.

Simply put, we give you actionable advice.

And unlike the mainstream media, we accept ZERO outside advertising. So there is zero conflict of interest. We are beholden to no one but our readers.

Kim:

I really wish I had something like this when I was starting out… Because Brad, we are up against it these days.

I mean… after the year we just had, I’ve lost the equivalent of an annual salary in my personal investing accounts.

And I know I’m not alone.

I don’t know how I’m going to stop the losses, much less make that money back.

And with inflation at historic highs, I doubt whatever I get from my social security check when I retire will cover much.

It feels like I’m getting attacked from all angles.

Brad:

It’s a full-frontal assault on your wealth. And for the average investor? With a job. A family. All the pressures of life. It’s impossible.

That’s why so many people feel overwhelmed right now.

But if you don’t trust the media to tell you the facts… and you don’t trust the government to take care of you… you’re going to love Intelligent Income Investor.

I’ve made it my life’s work to help make investing fun, simple, and most of the time, profitable.

Because I know how hard it is for most people.

I know what it's like to literally have nothing in the bank… to be facing down a stack of bills and five hungry children – and wonder how you’re going to keep the lights on and feed your family.

Kim, I didn’t start out wealthy.

And after I made millions I lost it all and had to start at the bottom again.

It wasn’t easy clawing my way back to the top.

And getting rich doesn’t happen overnight. But take it from a guy who has been broke twice in his life… you are not alone.

The so-called “American Dream” it’s not so easy to achieve anymore.

Because you can’t just work hard and save money.

Warren Buffett put it best when he said, “If you don’t find a way to make money when you are asleep, you will work until you die.”

Take it from one of the most successful investors in history.

You’ve got to invest wisely… that’s the only way to get ahead.

And you’ve got to do it in a way that doesn’t leave you stressing about money every other moment of the day. You gotta enjoy life!

But it’s not easy…

Most people… even if they’re making $200,000 a year – and save every penny left over – they’d be lucky to amass $1 million for retirement.

And with inflation raging…

Life is getting more expensive by the day.

Kim:

I’m glad you said that because I’ve had those same worries. It seems like the price of everything is going up nowadays.

But you’re doing the opposite.

I understand you’ve secured a discount for anyone watching this broadcast that subscribes today.

And Brad…

I was already surprised at how little you charge for access to your research.

If the price were $2,000 per year…

Or even $1,000 per year… it would be a bargain.

And yet, anyone who acts today will receive a discount from the already low Intelligent Income Investor retail price of $199.

Brad:

Yes and we’ll circle back to that.

And even that is a moot point because everyone is covered by my 100% money back guarantee.

But one thing I want to mention first is – with Intelligent Income Investor my hope is that we can help people improve their lives and in turn, they’ll stick with me for the long haul. I don’t come out ahead unless you’re making money – it’s as simple as that.

Which is why I want to give everyone who joins today another bonus report…

Kim:

Really? Another bonus report? That’s very generous. Tell us about it Brad.

Brad:

Again, it’s about a unique way to collect income from private companies.

But this report is not about collecting income from small, fast-growing private companies.

It’s about collecting income from the biggest profit generating machines on the planet. Big brand name companies you see every day and spend money at… but that do not trade on the stock market.

I’m talking about well-established legacy brands that churn out so much money for their owners that they don’t need or want retail investors.

This was my bread-and-butter income strategy during my first career in real estate.

Kim:

What kind of companies are you talking about here Brad?

Brad:

A good example is Chick-fil-a, the fast-food giant that practically invented the double drive through because they have so many customers.

Kim, have you ever seen a drive through lane at a Chick-fil-a that’s not packed to the brim with cars?

Kim:

Seen it? You can’t miss it. You can see the lines from miles away.

Brad:

It’s almost like the great wall of china. I bet you could see it from outer space.

I’m joking of course…

But what a great business. They are private so we can’t get numbers, but they’ve got around 2,600 locations in 47 states.

Kim:

They must be making money hand over fist.

Brad:

And no wonder the owners say no thanks to retail investors.

You can buy a franchise. But then you’re not an investor. You’re a business owner managing a bunch of teenagers frying chicken.

Kim:

I’ve got a couple of teenagers at home. No thanks!

Brad:

And that’s not what I’m recommending you do.

Because I’ve discovered a single stock that lets you profit from the income stream of hundreds of big privately held companies like Chick-Fil-A.

I’m talking about Bass Pro Shops. Dunkin Donuts. Aspen Dental. Discount Tire. LA Fitness. Panera Bread. Waffle House. And hundreds more.

These companies have been operating in front of your eyes for decades.

And every day thousands of customers spend money at these retail establishments.

But the mainstream media ignores this consistent income stream because these companies do not have publicly traded stock tickers.

But when you take a risk-free subscription to Intelligent Income Investor…

I’ll also give you my free report called Retail Riches: Get Paid from 95 of the Biggest Private Companies in America.

It will walk you step by step though how to profit from 95 of the biggest and best-known privately held companies in the country. All through a regular brokerage account.

Kim:

So no frying chicken, right? That’s fascinating. I can’t wait to check it out. If you’re wondering how to get started…

You can get everything Brad mentioned today 100% risk-free.

And I know we’ve covered a lot today.

So let me quickly recap everything you’ll get when you take a risk-free trial to Brad’s research:

You get 12 months of Intelligent Income Investor. Including Brad’s best investment ideas delivered on the first Monday of each month. That’s a $199 value.

And you Brad’s two new free reports including…

The Real-Time Revolution: Endless Income from America’s Fastest-Growing Companies which includes the one ticker in the profit stream of hundreds of hyperscalers. A $199 value.

And Retail Riches: Get Paid from 95 of the Biggest Private Companies in America. A $99 value.

If you have any questions at all about your subscription — aside from personal advice — Brad’s team is standing by ready to help.

In addition, you’ll get full support from his U.S. based support team.

Call or email them anytime if you have any questions about your subscription…

Plus, you’ll get access to Brad’s model portfolio, which in total includes 24 open stock recommendations.

All this valuable research can be found on the members-only website. So everything is easy to find… right at your fingertips. From monthly issues… to updates… everything.

You'll even get priority notification via email and text message each time Brad uncovers a new investment opportunity.

That’s a total value of $597.

Which is an incredible bargain considering the retail price of Intelligent Income Investor is $199.

But today, you won’t pay anywhere near that.

Because the whole point of this interview is to help as many people as possible.

We don’t want anyone to feel excluded… or feel like this kind of life-changing advice is out of reach.

So today, Brad has done something — I think to say it’s generous would be an understatement.

He’s secured an additional 75% discount from his publisher.

Which takes the price all the way down to $49.

That’s about 4 bucks a month. The equivalent of a cup of coffee in most places. For access to elite research that’s proven to transform the lives of everyday Americans.

It’s an absurdly good deal.

Brad:

I agree, Kim. And that’s no accident. The whole point of Intelligent Income Investor is to give my readers the kind of insights I’d want — if our roles were reversed.

And to do it in such a way that it doesn’t break the bank.

Kim:

Wow… that is beyond generous…

And folks, your subscription is 100% risk-free.

You get 60 days to go through everything.

You can go through everything you’ve seen today.

And during that time if you are not completely thrilled, just contact our U.S.-based Customer Service and cancel your subscription and you’ll get a full refund for the cost of your subscription, no questions asked.

You don’t have to return anything. Keep everything you received — as Brad’s way of saying, “Thanks.”

So you should see a link up on your screen now.

You can click this button, and you’ll be taken to a secure order form where you can read all about this deal, including all the benefits of being a member of Intelligent Income Investor.

If you want to find out the names of Brad’s recommendations – which I know I do and I know you do too – you absolutely want to click that button right now.

Anything else, Brad?

Brad:

Let me say one last thing…

There’s this great quote from Amazon’s Jeff Bezos.

I’m going to paraphrase here, but he said people want to know what he thinks is going to change in the next 10 years.

But he says that’s not the question he thinks about.

He thinks people should be asking themselves… and invest in… the things that are NOT going to change in the next 10 years.

Bezos says that is a much more valuable question. Because you can build a business strategy around the things that are stable over time.

As an example, he points to Amazon.

He knows customers want low prices. He knows customers want fast delivery. And he knows that’s going to continue to be true 10 years from now.

Nobody is saying, “Gee Jeff I love Amazon. I just wish your prices were higher and it took longer to get my stuff.” Impossible. It’s not gonna happen.

So that’s what you have to ask yourself.

Is human innovation going to stop?

We learned to wield fire. We invented the wheel. We went to outer space.

But in 2022 is this all going to grind to a halt?

Or is humanity going to do what it’s done for millenia? Are we going to keep pushing, looking for innovative solutions to the world’s problems?

I’m going to bet on humanity, Kim.

I’m going to bet the best and brightest are going to continue to make the world a better place. That’s why I showed you what some of these companies are doing today.

These companies are making the world a better place.

And hundreds of them are simply exploding higher….

For gains of 200%…

500%…

1,000%…

10,000%…

And even over 87,000%…

And that’s why I believe the Real-Time Revolution is just getting started.

And why I believe if you take a stake in the company I’m recommending today, you could collect endless income from the fastest-growing companies in America… every day… for the rest of your life.

Now, what you do with this information is up to you.

You can act on it.

Or you can choose to ignore it.

But I urge you to click on the link and make your decision soon.

I’ve shown you how everyone on Wall Street is getting involved. How the pace of growth is picking up. And how these companies are staying private longer… effectively locking out the average investor from the biggest profits.

I don’t know how much longer the window of opportunity will be open.

And if you miss this, there won’t be another chance.

But there is one thing I’m certain of…

All this is going to happen with or without you.

I want to thank you for your time today.

For instant access to my research just click the button to get started.

October 2022

Disclosures & Details | Terms of Use | Privacy Policy | Ad Choices | Do Not Sell My Info

© 2022 Wide Moat Research. All Rights Reserved.