This week, I read through the most recent investment commentary from Orbis Investment Management.

Orbis is a top-notch firm.

Founded in 1989, Orbis’ flagship fund has beaten the market by 4.4% annually since inception.

That’s a massive level of outperformance…

For perspective, a $10,000 investment that earns 14.4% for 30 years turns into $732,798.

Meanwhile, a $10,000 investment that earns 10% (4.4% less) over that same 30 years ends up being worth just $198,374.

That is the power of compound interest at work, folks!

I’m not here to pump Orbis’ tires (although I’m a big fan).

Instead, there was something in that most recent quarterly commentary that you as an investor should be aware of…

The Most Underweight U.S. Stocks That Orbis Has Ever Been

I’ve written recently about how valuations of stocks in the S&P 500 are getting really stretched.

[Warning: New Fed Policy to Impact 9,500 Stocks]

Apparently, the folks at Orbis are feeling the same way…

Orbis is currently the most underweight shares of U.S. companies relative to the MSCI World Index that it has ever been in the three-decade history of the firm.

Only twice before has Orbis positioned its main fund in a way that it is so underweight a certain group of stocks…

- At the inception of the fund in 1989, it carried a 0% weighting in Japan. That allowed Orbis to completely avoid the collapse of the Japanese stock market bubble.

Note that the MSCI global benchmark that Orbis compares itself with had a 40% weighting in Japan at this point. So Orbis really went against the grain as a global investment manager by having no Japanese exposure. - In 1999, Orbis had virtually 0% exposure to technology, media and communications stocks. Again, this proved very intelligent, as it allowed Orbis to completely avoid the tech bubble popping in 2000.

This was also a very contrarian position to take because while Orbis had a 0% weighting in tech stocks, its benchmark had an almost 40% weighting.

A Better Option

Only twice before has Orbis been this underweight a group of stocks. In both of those instances, it would have been very smart to follow its lead.

I’m therefore inclined to think that underweighting U.S. stocks, as Orbis is currently doing, is probably a pretty solid idea today.

A couple of charts convince me further of that…

[Exposed: These Are The Worst Stocks of 2021?]

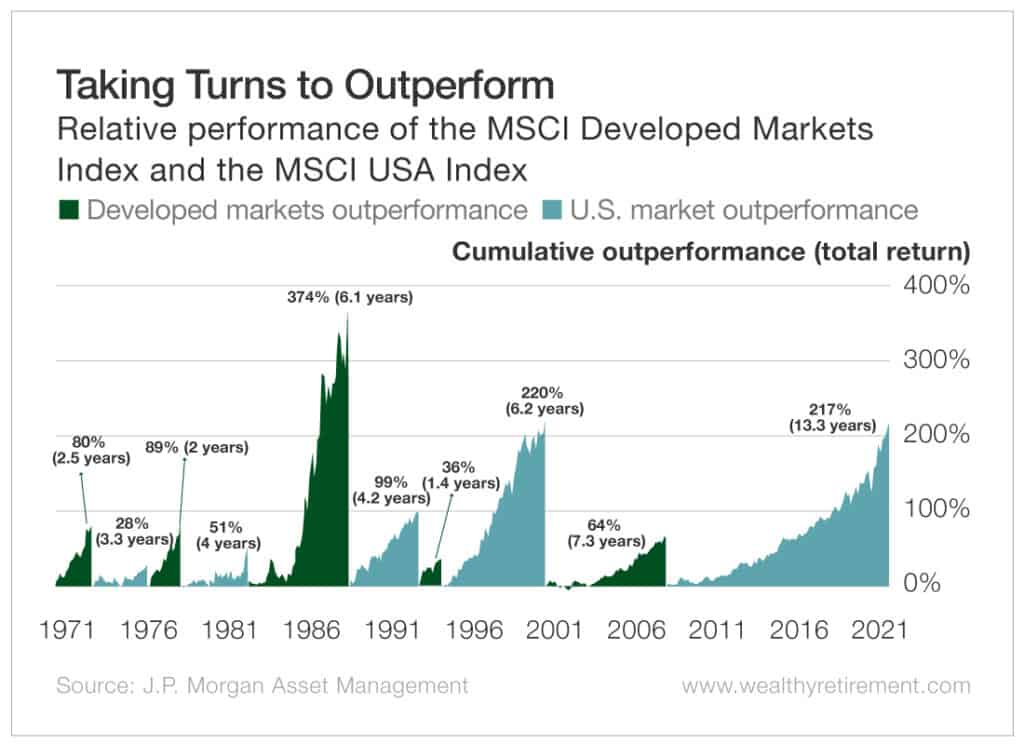

The first chart shows how, dating back to 1971, U.S. and international stocks have switched back and forth between periods of outperformance.

Today, we are more than 13 years into a cycle of U.S. market outperformance. We are long overdue international stocks having another turn.

The second chart shows the discount at which international stocks trade relative to U.S. stocks on a price-to-earnings basis.

Currently, the valuation discount on international stocks is at more than 25%. That is by far the widest discount in recent memory.

But I don’t think the driver of this big discount is that international stocks are screaming bargains. I think it is more an issue of U.S. stocks being very expensive.

Either way, international stocks appear likely to offer better future returns to investors today.

Orbis Investment Management is certainly positioned that way.

I wouldn’t bet against it…

Good investing,

Jody

[Alert: Most investors are not aware of what this will mean for their investments]