Table of Contents

- Introduction

- Who is Tony Sagami?

- Real estate markets exploding like fireworks…

- Weiss Ratings was ranked #1 in profit performance in The Wall Street Journal

- Three catalysts have aligned to launch the real estate market through the roof…

- The average investor can jump in for pennies on the dollar

- The #1 Real Estate Play of the Decade

- Quick-Start Guide to the Greatest Real Estate Boom of Our Lifetime

- Fast Track to Farmland Riches

- Work-From-Home Winners

- 17 Ways to Profit in the Hidden Side of the Real Estate Surge

- Join Disruptors and Dominators Today…

Tony Sagami, America’s #1 Disruption Investor Reveals …

The Biggest Wealth Disruption to Hit America in 175 Years

Last time it happened gains of 469% were delivered in a matter of months. This time it’s on track to be even bigger

Kenny Polcari: America is witnessing the biggest disruption to sweep across the country’s real estate market in 175 years.

And this time it’s not just the usual suspects like New York, L.A. or San Francisco at the epicenter of this disruption. It’s happening in small cities like Boise, Meridian, Spokane and Austin that are upending the entire $43 trillion real estate sector as we know it.

It’s in America’s heartland, where home prices have exploded over 50%.

Houses that once went for $600,000 are turning into million-dollar moonshots.

The headlines of recent months tell the story, and they’ve been everywhere!

Markets Now: “Housing Is the Economy’s Energizer Bunny: It Keeps Going and Going.”

Bloomberg Businessweek says, “Yes, Real Estate Prices Are Soaring, and no, It’s not a Bubble.”

Markets Now runs with the headline, “The Housing Market Is So Hot, Buyers Are Paying $1 million over the Asking Price.”

That’s right. In the space of just three months, over 310 homes have sold for $1 million over the asking price.

And 146 new “million-dollar cities” were added in 2021 alone.

Look at these homes! I repeat: Each one of them went for MORE than $1 million over the asking price!

Millionaires are being minted left and right on the back of this unprecedented disruption.

Jaw-dropping numbers of everyday folks are flooding into states like Idaho, Montana and Tennessee to secure THEIR chunk of this multi-trillion-dollar honeypot.

Not since the 1840s, when 400,000 pioneers crossed the prairies, have we seen internal migration on the scale that we are seeing right now.

Record demand has turbocharged home prices to stratospheric heights,

as the University of Pennsylvania’s Professor Wachter recently said …

“This is supply and demand on steroids.”

So, it’s no wonder that, starting in 2021, big banks, big hedge funds and big-money billionaires have barreled in with both feet.

Goldman Sachs (GS) put aside $300 million on just one single real estate venture.

Morgan Stanley (MS) raised $3.1 billion to exclusively focus on real estate bets.

Amazon (AMZN)’s founder Jeff Bezos is all in on a company that’s set to buy over 25,000 properties.

It’s winner take all, and the stakes could not be higher.

This is the greatest real estate boom we’ve seen in centuries past, and all the signs tell us it promises to be the greatest we’ll see for decades to come.

But make no mistake, thousands, and perhaps millions, of investors could miss out on this boom, potentially cheating themselves and their families out of the chance to turn a small stake into a not-so-small fortune.

And that’s why I’m coming to you directly from Palm Beach, Florida …

To show you the number one way to tap into this real estate boom for mere pennies on the dollar.

Kenny: Hi, my name’s Kenny Polcari. I’ve been in the investment business for a long time. I worked on the floor of the New York Stock Exchange (NYSE) for 35 years. I serve as a Chief Market Strategist to a firm with over $1 billion in assets, and even spent more than a decade as a governor of the NYSE.

But I’ve never seen anything like the opportunity I’m about to reveal to you right now.

Joining me today is America’s #1 Disruption Investor.

He was named “Portfolio Manager of The Year” by Thompson Financial — not just once, but twice.

And he has made his name by being super early on stocks in disruptive trends.

His name is Tony Sagami, and he is joining us on this urgent broadcast to go public with the all-time sensitive details on today’s incredible opportunity.

Not only will he reveal the single best way to profit from the historic disruption rippling across the $43 trillion real estate market, but he’ll also rip back the curtain on multiple ways to corner the real estate market that probably not even one in 1,000 investors are even seeing.

Whether you’re a seasoned trader with lots of money or a new investor just starting out of the gate …

The strategies Tony Sagami will reveal will allow anyone to tap into the real estate market with any amount of money … putting investors into a position to continue to benefit in the months ahead.

Kenny: Hi, Tony, it’s nice to see you again, and I’m glad I’m going to have this opportunity just to talk. But you know what I think is important is tell me a little bit about your background? Where were you born? Just to tell me a little bit about who Tony Sagami is.

Tony: I kind of have a really roundabout trail on how I got to Wall Street. I was born in Japan. My father was an American soldier stationed in Japan after WW2, during the occupation. And my mother was a waitress at a noodle shop that was pretty close to the army base.

My father would go there, eat some noodles and look at this beautiful Japanese girl. He couldn’t speak Japanese, she couldn’t speak English, but they fell in love.

Kenny: Somehow, they spoke the same language.

Tony: They got married and I was born six months later. When I was about one and a half, he got transferred back to the U.S., and we followed him.

Like a lot of wartime marriages, it didn’t last, and they end up getting divorced. But then my mother remarried Ken Sagami, who adopted me. He is the vegetable farmer in western Washington who raised me from two years old until the end of his life.

You know, they got Toys “R” Us so if they’d had a Dads “R” Us store and I went in and picked the perfect dad, I would have picked him. He was a great guy. Just a great guy. Except he worked us like dogs on the farm!

Kenny: Well, that’s OK, though.

Tony: Yeah. But you know that’s why that work ethic that all farm kids tend to have is probably the number one reason I’m successful.

Kenny: Because he drove it home.

Tony: Yeah, we had to work hard. Even in farming you learn a lot about investing. For example, one of the most important things we do in the spring is soil prep. It’s kind of like investing. I think the prep is your research. You’re reading boring things like reports and 10-Qs — that’s like soil prep to me.

That’s something that people don’t do anymore. But I still do it habitually because that’s the way I was taught to invest.

Kenny: But that’s what makes you who you are. Especially now at Weiss Ratings, that’s what gives you that position and that experience, the know-how.

Tony: That’s how Weiss Ratings came about. I had my own software company in the 90s that designed momentum analysis tool. It was very popular among professional investors.

I was probably one of the first people in the U.S. to bring computerized investing to Wall Street. I was an early pioneer.

It was that software that was originally at the root of the Weiss Ratings — we had safety ratings and performance ratings, and that’s what my software did very well.

Kenny: Fast forward to today, let’s talk about what’s going on in the world, the trouble that we are seeing all over the place — what’s happening in Eastern Europe, the war between Russia and Ukraine. How is that going to disrupt the food and supply chain, commodities, real estate?

“You can see real estate markets exploding like fireworks.”

Tony Sagami: Just look around you. Right here in Palm Beach County. In thousands of cities and towns across the U.S., almost everywhere you go, you can see real estate markets exploding like fireworks — and its effects are ripping through every corner of the U.S. economy.

I saw the headlines you highlighted a moment ago. But I believe all these headlines are just a smokescreen for …

Kenny: For what?!

Tony: Something much, MUCH bigger.

I call it “Primetime Disruptors” — companies that may not be in the headlines, but they are making those headline-grabbing stories possible.

Not just now, not just for the next few months but — if history is any indication — for years to come. This could be the beginning of a supersized, multi-year boom.

The last time I saw a housing boom of this size was back in 2002-2006 …

And many stocks in that sector that I’m now calling “Primetime Disruptors” went ballistic.

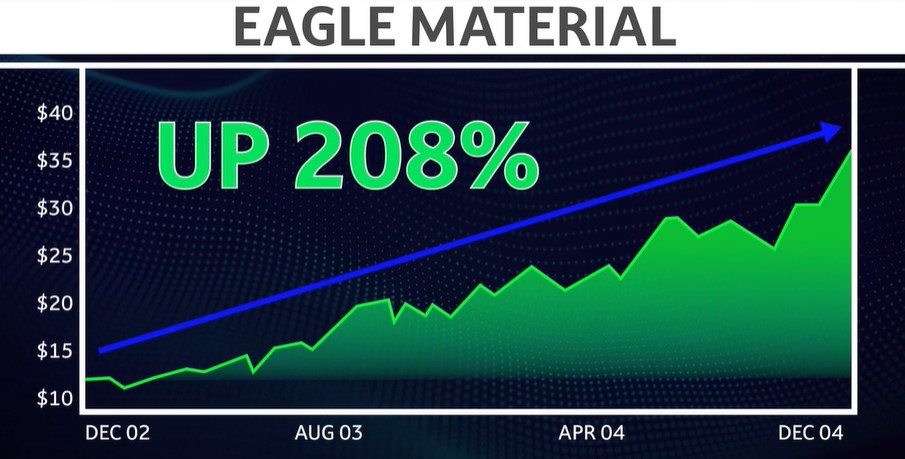

Eagle Materials (EXP) went up by 208%.

Cavco Industries (CVCO) jumped by 304%.

Meritage Homes (MTH) exploded by over 469% — that’s more than enough to quintuple investors’ money.

That would have been enough to transform a $5,000 stake into almost $30,000.

Kenny: Those are great examples. But suppose I just bought the average stock that met the same criteria as these.

Tony: Then you could still have more than doubled your money.

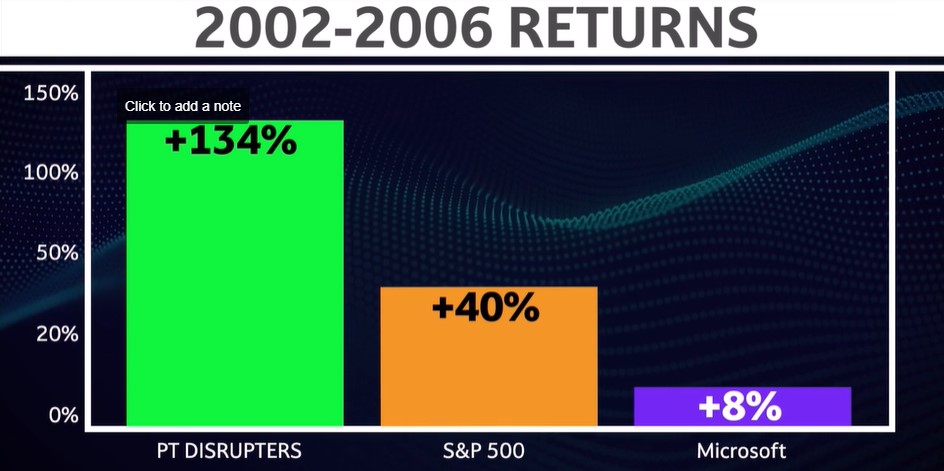

The average “Primetime Disruptor” in the same sector (real estate) during the exact same time frame, was up 134%.

Plus, I want to tell you something else that’s even more important …

Kenny: Hold on a second, Tony! How much did the S&P 500 Index go up during that same time period?

Tony: Good question.It did pretty well, actually. But it lagged far behind these real estate-related companies. From August 2002 to early 2006, the S&P 500 was up 40%.

And even many tech giants were far behind. Microsoft (MSFT) barely eked out an 8% return.

Kenny: So, these “Primetime Disruptors” you’ve mentioned have outpaced the market?

Tony: As much as 11 times over. And those were just three of the dozens of examples I could show you from that time period.

But the other important thing I wanted to tell you is why I believe there’s a big difference this time around.

In this cycle, the disruption we’re facing is much larger and much more SUSTAINABLE. Unlike last time, it’s not driven by excess leverage and crazy mortgage schemes. It’s driven by powerful, LONG-LASTING, global forces of supply and demand.

And that’s what makes it truly UNPRECEDENTED!

Kenny: Ok, but it’s caused by what?

Tony: Well, it’s caused by a major, long-term supply crunch, the “work-from-home” revolution, the mass migration in America and a record-smashing $5 trillion printed by the Federal Reserve in the space of just two years.

Kenny: Don’t keep me in suspense. Give us your prediction right now!

Tony: I predict that the kind of gains you saw in 2006 will pale in comparison to today’s opportunity. And equally important, it will pale in terms of how long it will last. I predict this boom will continue for most of the rest of this decade, until the late 2020s.

But my research tells me that the truly big price explosion is happening now, and it’s in the early stages. So, getting in just a couple of months late to this boom would be a terrible mistake.

That’s why I urge everyone watching this to pay very close attention because

I think the next few minutes could be absolutely life changing.

Not only will I reveal what Primetime Disruptors are about … I’ll show you how their returns have been outpacing the triple-digit profits of Meta Platforms (FB), Amazon (AMZN) and even Tesla (TSLA) …

I’ll reveal how investors can dip their toe in the water for less than $100 and why I believe anyone who’s serious about capturing the maximum level of gains should seriously consider taking action as soon as today.

But that’s not all …

I’ll also show you how folks can be among the first in line on one Primetime Disruptor that I predict will soon be running laps around its competitors.

In fact, I think this could be among the single best calls since I was named “Portfolio Manager of The Year” by Thompson Financial years ago.

Kenny: Hold that thought for one second, Tony.

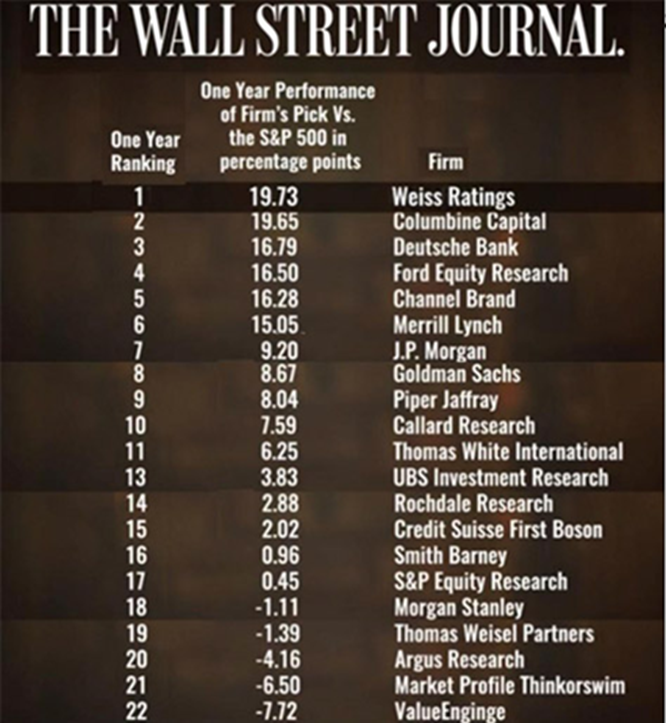

For anyone who isn’t familiar with Weiss Ratings, we’re talking about a firm that’s invested millions of dollars into creating and fine-tuning one of the best-performing stock rating systems in America.

Tony Sagami has been a key player in developing the Weiss stock ratings from its earliest days in the early 2000s.

Financial outlets like Barron’s have called it a “leader” in its field.

And among all the major research firms reviewed …

Weiss Ratings was ranked #1 in profit performance in The Wall Street Journal.

That’s right, the Weiss Ratings was ranked above Wall Street heavy hitters like Goldman Sachs, JPMorgan and UBS Investment Research …

Beating out research organizations that cater to over $5 trillion in assets under management and a who’s-who list of high-net-worth players.

And for anyone who has used the Weiss stock ratings, that #1 ranking shouldn’t come as no surprise.

Weiss Ratings is 100% independent. It never takes a dime from the rated companies, and its sole purpose is to help average investors avoid the garbage stocks and make money with the best of the best.

So, it should come as no surprise that, over the years, Weiss’ buy-rated stocks have turned into some of the most lucrative stock market opportunities …

Nike (NKE) up 2,386%

Intuit (INTU) up 3,241%

O'Reilly Automotive (ORLY) up 3,625%

NetEase (NTES) … up 5,708%

Intuitive Surgical (ISRG) up 6,833%

And there are many more!

This is from the day each stock first received a “buy” rating from Weiss, starting in 2004 through year end 2021.

And they were NOT the absolute best performers on their list. Others soared even more. Plus, if investors bought just the average performer on Weiss buy-rated list, they’d still be looking at an average return of 1,166%. That would be enough to turn an initial $100,000 investment into more than $1.2 million today.

Kenny: But let’s not dwell on the past. What’s far more important right now is the names we’re adding to that kind of list today.

Especially the select few Primetime Disruptors that I predict will lead the charge.

The way I see it, right now …

“… three catalysts have aligned to launch the real estate market through the roof.”

Catalyst #1. A record-low supply of available housing.

Catalyst #2. A record-high demand, driven by mass migration inside the U.S. on a scale not seen since the 1840s.

And catalyst #3. A level of Fed money printing that has smashed all prior records.

I’ll explain each of these three catalysts in a moment. But first, I want you to visualize the big picture: All three are converging right now, and I predict they will continue to do so for years to come.

This means the current explosion we’re seeing in housing ISN’T a one-time deal. It’s the beginning of a sweeping, long-term trend.

Kenny: And you’re confident of this because …

Tony: Because the last time those pieces aligned, we had one of the greatest housing booms of all time, and my research tells me this is far bigger … and more importantly, far more sustainable.

Remember: the last time around, many Primetime Disruptors shot up by triple digits …

Kenny: You mentioned Meritage Homes, which surged over 469%.

Tony: Well, here’s the thing, Kenny — it’s happening again. Right now, as we speak.

Kenny: The housing market is on a tear.

Tony: Yes, and many of the stocks in the sector that I refer to as Primetime Disruptors have been going ballistic.

Just look at what we’ve seen since 2020!

Century Communities (CCS) soared 597% in just a little over a year.

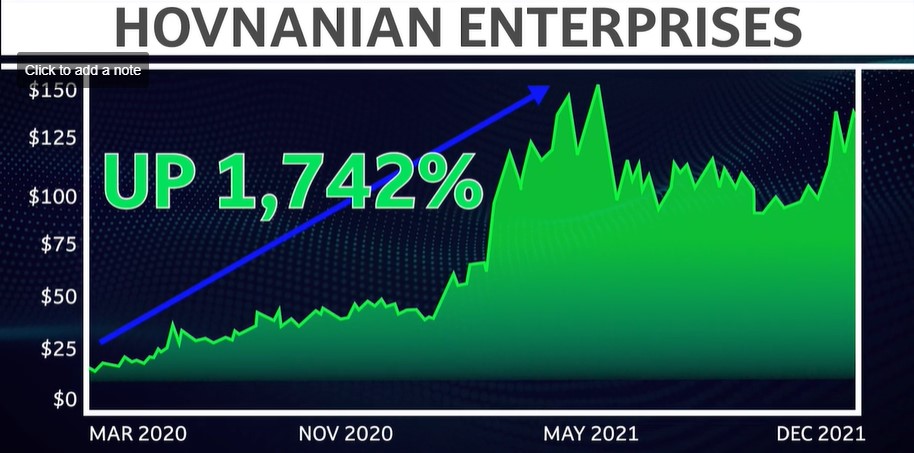

Hovnanian Enterprises (HOV) went on 1,742% moon shot through the roof!

Enough to transform a $10,000 stake into over $174,000 — in just 22 months!

Kenny, you and I have been around long enough to know it’s not every day that you see gains of 1,700% that quickly.

But even if you just look at the average stock in the real estate sector, you’ll see gains well in excess of 200% since April of 2020.

And what makes this move more timely is that those gains were achieved at a time that I believe this real estate boom was just in the early stages, which means the ball is still rolling on this one.

Kenny: It doesn’t sound like it’s a good time to get caught sitting on your hands.

Tony: That’s an understatement.

Kenny: For anyone who is still unsure what Primetime Disruptors are, would you share specifics on exactly how the real estate boom is going to drive their prices to such record levels?

Tony: Sure. But for any of it to make sense, what you first need to realize is how huge the U.S. real estate market truly is.

As of year-end 2021, it was worth $43.4 trillion, and home prices increased 23.4% from the year before.

In dollar terms, that 23.4% translates to almost $8 trillion in added value. What’s more, those prices are accelerating at the fastest pace since the 1970s. Frank Nothaft, the chief economist at CoreLogic, calls it “a dramatic acceleration in home price growth to levels we haven’t seen in decades.” This is historic.

Kenny: You’re not the only one saying it. I have a list here of some of the biggest hedge funds, banks and research firms — all predicting …

“This year’s housing growth will match last year’s record-setting pace.”

Goldman Sachs, Zillow, CoreLogic and Fannie Mae expect this year will bring even higher returns. And real estate consulting CEO John Burns, a man with more knowledge of real estate trends than anyone else I know, predicts double-digit growth this year as well.

Tony: They’re right except for one thing. According to my research, it’s going to be even bigger than 2021.

Kenny: And the way this boom is already affecting everyday Americans in the real world is simply unbelievable. Earlier, you showed me some examples of that.

Tony: Yes! Look at this: A couple in their mid-30s out in the Californian suburbs, trying to find a place to buy.

They had to make God knows how many offers and counteroffers for a home they wanted to buy listed at $899,000.

A bidding war forced them to keep pumping up their offers from $1.075 million to $1.1 million.

Finally, their offer of almost $1.2 million was accepted only AFTER they penned a sob-story, heartfelt letter to the owner.

That’s almost $300,000 more than the asking price.

Tony: This is happening right now all across America.

Kenny: I see it too. I think everyone does. Here in Florida, practically everywhere. But it seems to me that all this action creates a problem for regular folks.

When a high-value home hits the market, and the owner gets dozens of offers within hours, the only people who get in are the few who can afford to pay almost anything. Not families, not even individual investors.

Tony: Investment funds, Wall Street institutions …

Kenny: That’s right! And with all these Wall Street fat cats jumping in, average regular Americans are being locked out.

Many people simply don’t have the money for the big down payments that banks are asking for today on new mortgages.

Tony: Nothing new to my family, that’s for sure. When I was a kid, my father used to take us out to the farm, and he’d wave his hand across the horizon, point to the field and say,

“This land … this land and nothing more is my retirement plan.”

Like many farmers in those days, or even today, he didn’t have a 401(k). He didn’t have a pension plan, he was on his own.

When he got older, no matter how hard he tried, he just couldn’t farm with the same gusto he had when he was younger. So, he went to the zoning board in our town to get permission to subdivide some outer parts of his land to sell and take out a little money. But he hated doing it, and the so-called zoning board HATED him for even asking.

They trampled him. They destroyed his dreams and eviscerated his retirement plans.

So, I know from personal experience just how tough it is to go up against the big guys. I know that regular people without money or connections often have the deck stacked against them.

“But what if there was a way for regular folks to make money with nearly every uptick in this real estate boom without needing a six-figure bankroll?”

Kenny: This doesn’t have anything to do with flipping properties, does it?

Tony: Actually, you never have to touch a single property.

Ken: Stock options?

Tony: Nope! Nothing to do with stock options, either. I’m strictly talking about investing in companies that pass my screens to qualify as a Primetime Disruptor.

They’re the “backdoor” way that lets anyone profit from the real estate boom. And like we said, the best part is anyone can test the waters with as little as $100.

With just a couple of mouse clicks, you can buy a stake in a Primetime Disruptor on the front lines of this $43 trillion real estate disruption.

See, in this real estate boom, speculating and flipping property is mostly the personal playground of America’s top 1%.

“But now, the average investor can jump in for pennies on the dollar.”

Let me show you what I mean with one exceptional stock in this sector — Floor & Décor Holdings (FND).

Kenny: Is this the kind of stock you’d call a Primetime Disruptor?

Tony: In retrospect, absolutely! Back in April 2020, this stock was trading for just $27 a share.

Fast forward a couple of years, with average home prices up 28%, this stock has surged as much as 381%.

That’s right. Compared to what real estate buyers could have made in the average home, investors who simply bought this stock could have made nearly 14 times more.

Kenny: That’s above-average outperformance.

Tony: Correct.

Kenny: OK. So, let’s say I invested $1 million in average homes, and let’s say you invested that same amount of money in this stock. How might that have turned out?

Tony: Or let’s say you bought the homes for a million.

Kenny: OK.

Tony: And let’s say I bought the same stock.

Kenny: OK.

Tony: To get to the same $280,000 gain you made, guess how much I would have had to invest?

Kenny: A lot less!

Tony: Only $72,500.

Kenney: Or you could have invested as little as you wanted, right? But if I’m a real estate investor buying individual properties, I don’t have that choice. Either I pay the price, or I don’t get it. Period.

Tony: Thanks for pointing that out. Big difference! But I also wanted to point something else out — some research our team has done to give all this some perspective.

Kenny: Go for it.

Tony: Take a look at this chart of the world’s second largest cryptocurrency, Ethereum (ETH).

After its bull run started in late 2020, it was up 515% by May of 2021.

But then look what happened – over the next two months, it was down over 53%.

That’s enough to dwindle a $10,000 investment down to $4,600.

With that type of volatility, you aren’t just risking your investment account, you’re risking an aneurysm.

Kenny: I get it. You’re saying that with Primetime Disruptors like these, investors could have landed crypto-like returns WITHOUT crypto-like volatility! Is that the point?

Tony: Exactly the point! Just from the Q2 of 2020 to Q4 of 2021, several stocks with similar characteristics to my current picks of Primetime Disruptors delivered gains that put virtually every other investment class to shame.

M/I Homes (MHO) up 387%

Conifex Timber (CFF.TO) up 278%

Freeport-McMoRan (FCX) exploded 679%

Kenny: Those are 4 times, 5 times and 8 times opportunities in just one single year!

Tony: Right.

Which is why I dropped everything to fly out here to Palm Beach for this landmark interview with you. I wanted to make sure that average investors don’t miss out on what I see coming down the pike.

Kenny: Tony, I’ve taken a hard look at your track record in the investment industry with stretches back 40 years.

As we said at the outset, Thompson Financial rated you the “Portfolio Manager of The Year” two years in a row.

Not the best growth stock manager, not the best market timer manager, but the best manager overall!

To our knowledge, no one else has ever achieved that feat. And you did it in markets that were not nearly as good as they are today. So, the big question I have for you right now is: What do you believe is unique about your approach to investing?

Tony: First of all, I don’t mess around with convoluted strategies, and I don’t use speculative instruments like futures or options. I don’t trade in and out of hot stocks, either. My approach is all about good, old-fashioned stock picking.

Kenny: I think you’re being a little bit modest, Tony. Let me cite some of the examples you recommended: Block (formerly Square) (SQ) when it was trading at just over $32 per share. Last time I checked, it was up 394%.

You also recommended Apple (AAPL) right before it surged a massive 423%. That’s enough to turn every $10,000 invested into more than $52,000.

And the record also shows that you were among the first analysts to recommend Zoom (ZM) before it exploded by over 800%!

Tony: May I take a moment to put those examples into context?

Kenny: Sure.

Tony: Add up all the closed trades I recommended since I started this monthly research service, and all the open positions that are still held at the end of last year.

Kenny: OK. And you want to give us the average gain? How do they perform?

Tony: Yes, it was an average gain of 73.4%.

Kenny: Including the losing trades?

Tony: Yes, the whole thing, warts and all. I want to make sure everyone has the total picture.

Kevin: I think it’s a great picture, Tony. Heck, I’d be glad if I made 25% on an average trade! And you’ve done three times better than that?!

Tony: I can’t take all the credit. The Weiss Ratings help a lot.

Kenny: But what got you here? Sometimes, when I call you, you’re having breakfast in Bangkok. Other times, you’re in between lunch in L.A. and dinner in Dubai. Does that globe-trotting have something to do with your investing success?

Tony: Hey! Don’t include me in that jet set crowd or ANY crowd for that matter. But my many months and years overseas give me a chance to see our country from afar and from the perspective of foreign investors. And guess what they ask me all the time? They want to know how they can move their money to the United States, especially real estate because that’s what all their savvy friends are doing. They’re scared of what they see happening overseas. So, they’re moving big bucks into the U.S.

Kenny: I like the fact that you’re still so focused on America. I like the fact that Tony Sagami is …

Tony: Just a regular farm boy from rural Washington State.

Kenny: Yeah, that too. But what I wanted to say is that Tony Sagami is a man whose guidance over the years has affected the lives of thousands, if not tens of thousands, of people all across the United States. Would that be a fair statement?

Tony: I think so and I’m absolutely delighted to do so. Because my ultimate job isn’t just to spot this or that profitable trade. I want to put it all together in a way that’s truly sustainable for the long term.

Kenny: Good. So, let’s say I buy a Primetime Disruptor today. What exactly would I be investing in? And why is it any different from what we hear about from major financial media — the people on CNBC or Bloomberg or even in The Wall Street Journal?

Tony: There’s barely been a whisper about my Primetime Disruptors on major media. Primetime Disruptors are a special breed of stocks that have mostly flown under the radar. From the very beginning, the talking heads have grossly underestimated the raw power of this housing boom. From the very beginning, they’ve grossly underestimated the sheer insanity of the Fed’s money printing — the sheer intensity of the inflation that’s now driving choice properties even further into the stratosphere.

So, they’ve missed out on the companies that are cashing in on both of these megatrends — the real estate boom and the inflation.

Kenny: You’re talking about …

Tony: Building supply companies, homebuilder companies, construction companies. I’m not talking about the obvious ones, I’m talking about the Primetime Disruptors.

Kenny: But what about all the big headlines in the media?

Tony: Sure, sure. They rave about home prices smashing records in Maine, Montana and Idaho or Sylvester Stallone splurging $35 million on a new Palm Beach mansion down the street.

Kenny: But not the Primetime Disruptors?

Tony: No. Not usually. My picks of Primetime Disruptors are companies that have been turning the $43 trillion real estate disruption into real profits for investors. These are the companies that I predict will transform people’s lives. But all the big media can say is, “Bah! That’s too boring for OUR prime time.”

What they don’t seem to realize is that when home prices rise, stocks that match my criteria as a Primetime Disruptor have jumped.

I showed you how that worked out with Floor and Décor. Now let me show you what I mean with this chart.

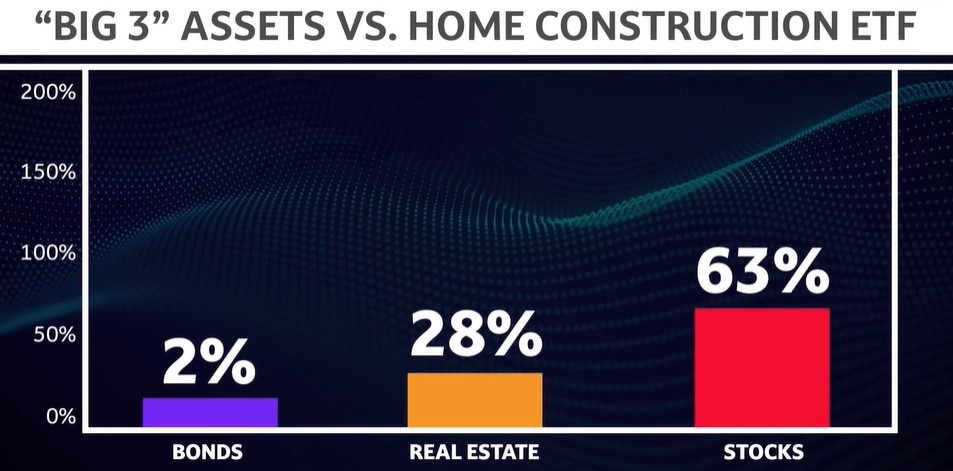

What you see here is the performance of the three big asset classes over the last few years: Bonds, stocks and real estate. The first bar shows the yield you can make with Treasury bonds, which are paying a little more than 2%.

Kenny: And with inflation going through the roof, bond investors are basically losing at least 5% a year.

Tony: Exactly. The second column shows real estate prices. As I mentioned before, over the last couple of years, they grew about 28%.

The third column shows the performance of the broad stock market — in this case, the Dow Jones Industrial Average.

As you can see it increased by 63%.

Kenny: Not bad, right? It more than doubled the gains of real estate.

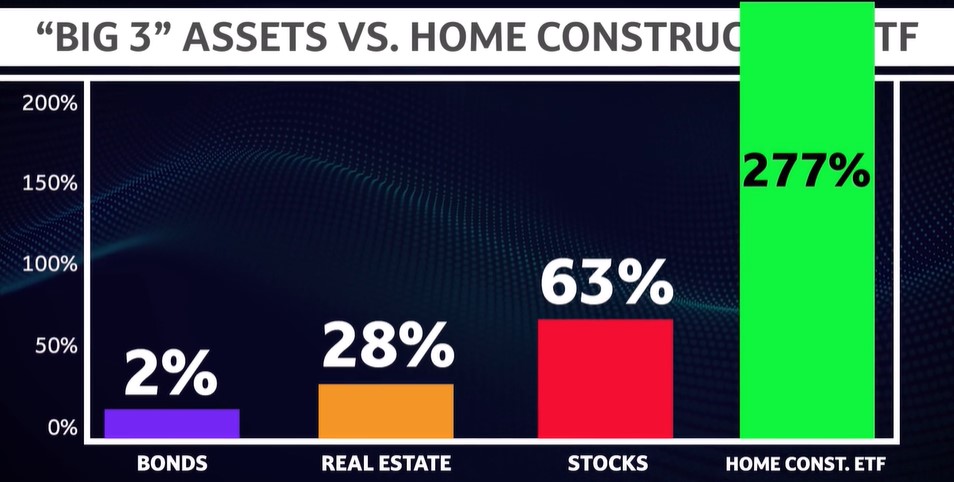

Tony: Right, but now let me add this last bar to the chart. This shows you how the U.S. Home Construction ETF stacks up. Remember, this is the average.

Kenny: It includes both the good and the bad.

Tony: Right. This last bar also includes companies that are still struggling or have yet to get off the runway. As you can see, its return was 277%.

Kenny: Even with their eyes blindfolded, if investors would have bought a diversified basket of real estate stocks like this one, they could have made enough to more than triple their money.

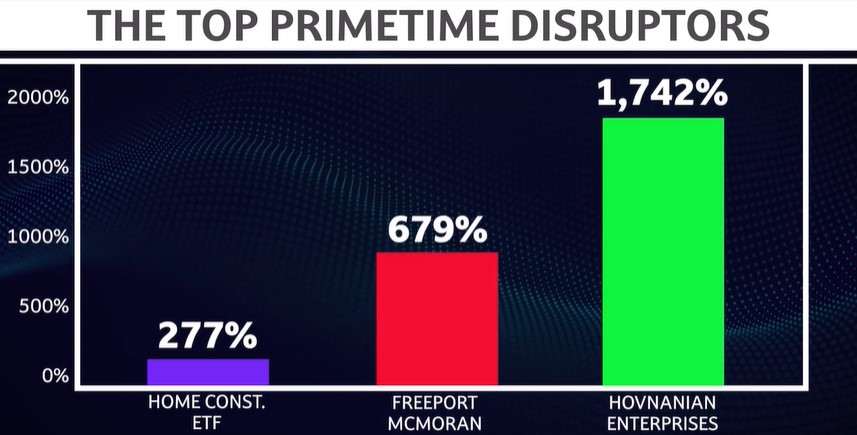

Tony: Precisely! But now let me tell you about the more successful companies, the kind I call Primetime Disruptors.

These are stocks that anyone can invest in, provided you know where to look.

As I said, the U.S. Home Construction ETF rose by 277%.

But if you think that’s good, take a look at Freeport-McMoRan up 679% or Hovnanian Enterprises, up 1,742%.

And I want to stress: All my research tells me that it’s still early in this megatrend.

Kenny: Starting when though?

Tony: Starting right now.The flow of new capital I see coming into the market tells me the timing couldn’t be better.

Even as we speak, some of the smartest and most well-connected investors are shifting their fortunes into Primetime Disruptors.

I’m talking billionaires like Warren Buffett, Bill Gates, Jeff Bezos, David Einhorn and many more.

Kenny: So, are you saying they’re driving this move?

Tony: No. They’re CAPITALIZING on the move. What’s driving it is the megatrends that are probably far more powerful than all the billionaires in the world combined. But there’s no denying that time and again, the smart-money billionaires have been among the first in line to some of the most lucrative disruptive events of this millennium.

Jeff Bezos put $250,000 into Google in 1998, and that $250,000 investment is worth over $8.2 billion today.

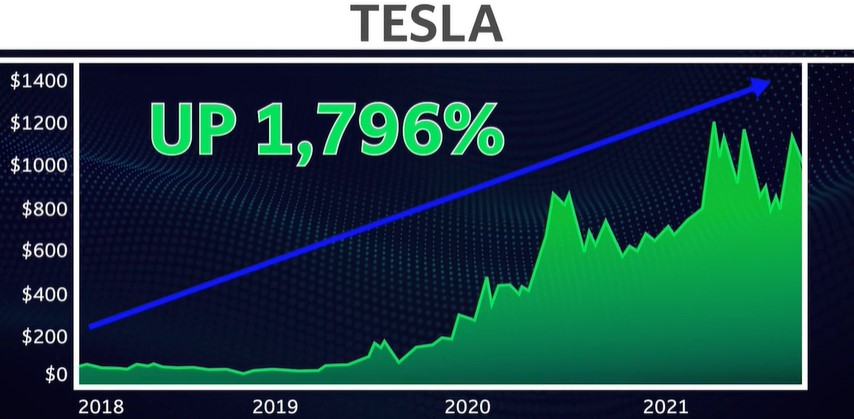

Or look at Cathie Wood, founder of the $60 billion ARK Investments. She was literally years ahead of the curve on electric vehicles (EVs).

Back in August 2018, she was pounding the table about Tesla — before its profits surged a whopping 1,796%.

So, when I see billionaires jumping in early on trailblazing investments, it tells me that my prediction of another massive profit wave is on target.

Kenny: No one I know can consistently predict the future.

Tony: Nor can I. But I’ve learned that I CAN rely on my research, and I can also get some independent validation of my research by watching what smart investors are actually doing in the market.

Not long ago, for example, billionaire investor David Einhorn said the largest position in his portfolio is what I would call a Primetime Disruptor.

Meanwhile, Warren Buffett hasn’t simply snapped up billions of shares of companies in this sector. He’s been buying dozens of them outright — companies like Acme Brick, Johns Manville and dozens more.

They have access to the same charts we have. They can crunch the same numbers as I do. So, I’d be shocked if they don’t see what I see and know what I know.

You’ve seen what could be achieved just by catching just one Primetime Disruptor at the right time.

So, mark my words Kenny: Ten years from now, I bet all of us will be looking back at this period of time and see the full disruptive power of Primetime Disruptors.

Just like Amazon disrupted the world of online shopping, just as Tesla disrupted the Electric Vehicle space, and just as new kinds of cryptocurrencies are flipping the entire financial industry on its head.

I believe there’s one Primetime Disruptor that’ll soon be talked about in the same breath as all those giant successes.

And this is important, so it bears repeating: You don’t need to be a billionaire. You don’t even have to spend hundreds of thousands of dollars on a piece of property. Anyone can tap into this opportunity for any amount, even for just $100.

Kenny: Tony, all that’s well and good. But since the moves in these Primetime Disruptors are tied to the U.S. real estate market, I want to know: How can you be sure that this housing boom really has legs?

What guarantees are there that this real estate boom isn’t just a bubble that could pop next year or even next month?

Tony: There’s no such thing as guarantees in this business. But the hard data tells me this real estate boom will continue for most of the decade. I’ll give you the details in just a minute. But first, the big picture.

DEMAND: The demand for housing is off the charts on a scale we haven’t seen in decades.

The CEO of Tricon Residential, one of the largest home rental companies, recently said, “We get 6,000 calls a week for a home, and we’ve only got 200 available.”

Or consider this chart from the National Association of Realtors, which shows that the available supply of homes for sale is just a hair above historic lows.

Kenny: From that chart, it looks like it’s around 25% of what it was in 2006.

Tony: Which means the number of homes for sale would need to almost quadruple to get us back to those levels. Bloomberg explained it this way:

The University of Pennsylvania’s Business School — the #1-ranked business school in the U.S. — says this housing boom is not a bubble. I’m referring mostly to Benjamin Keys, Professor of Real Estate at Wharton, who has gone on record to say “this strong housing boom has got years left to run.”

I agree. Unlike we’ve seen in previous housing booms, the data tells me this one isn’t built on sand; it’s built on hard granite.

If I’m right, it means that, once you spot the right Primetime Disruptor to invest in, the wind will be in your sails.

But not all of them are going to be big winners. Some will lag behind, some could lose money.

Kenny: So, how can investors avoid the duds?

Tony: That’s where Weiss Ratings comes in. Consider Armstrong Flooring (AFIIQ). The Weiss Ratings gave this stock one of its lowest ratings.

And, sure enough, from April 2020, this stock is down over 17%.

So, while other stocks in this arena are smashing records and up by triple digits, the Weiss Ratings flagged this one as a stock to avoid.

That’s just my first screen. The rest depends on three key catalysts we cited earlier.

Just one of these catalysts would be enough to create a housing boom. But all three coming together at the same time and the same place is what tells me this real estate boom will be bigger, last longer and create more millionaires than any other real estate boom in U.S. history.

Catalyst #1. Surging demand chasing dwindling supply.

According to Morgan Stanley strategists, there’s a shortage of up to 5 million homes in the U.S. today.

And as you know, Kenny, it’s a basic law of economics that when demand goes up AND supply goes down, prices absolutely MUST rise.

Catalyst #2. The mass migration from urban centers to the suburbs and rural areas.

Not to mention the COVID lockdowns, which kickstarted the largest mass migration inside the U.S. not seen in 175 years.

And this brings me to the third, and perhaps the most important catalyst — the record level of Fed money printing.

It’s a no-brainer. More money chasing fewer goods. No wonder inflation is smashing new records on a monthly basis!

The price of lumber recently hit a high of $1,600 per thousand board feet. That’s over three times what it averaged prior to 2020.

Remember, stocks in this sector rely on these building materials.

So, when the price of lumber jumps more than threefold in mere months, these stock values often jump in tandem.

And in some cases, even higher:

Conifex Timber went up by 278% in 22 months.

Summit Materials (SUM) more than tripled investors’ money across the span of a year.

Lumber Liquidators exploded 282% within the space of 22 months.

In fact, the average gains posted by this class of stocks was a very respectable 225%.

Kenny: This reminds me of the FAANG stocks Wall Street never stops raving about. Heavyweights like Meta, Amazon and Alphabet (GOOGL). These guys did very well Over the last couple of years, they were up 127%, 75% and 67%, respectively.

Tony: Yeah, but the stocks I’ve told you about blew those guys out of the water. And keep in mind, those weren’t even my favorite Primetime Disruptors. As I’ll reveal in a few seconds,

Kenny: OK. So, we’ve seen this opportunity is real, we’ve seen that it’s possible, and now we’ve seen how you do it.

Now, how can average investors get started?

Tony: It couldn’t be easier. I’ve written a special report with simple, step-by-step instructions that explain exactly how to buy my #1 Primetime Disruptor today.

It’s called “The #1 Real Estate Play of the Decade.”

In this report, I break down in clear-as-day language everything investors need to get started.

I reveal the stock’s name its ticker symbol, how you should size your position and the recommended entry price.

You’ll even discover the little-known way this company plans to capture over $4 billion by exploiting one of Wall Street’s hottest investment trends.

And why owning its shares ALSO means you get a stake in tech companies at the cutting edge of not one, not two but three industries.

And the one sneaky thing it’s doing right now, this minute, to unleash a fortune of pent-up profits.

Remember, this company is at the epicenter of the $43.4 trillion real estate boom.

It’s a homebuilder that I predict could far outperform nearly all others in this sector.

They’re in 23 states across the country, they own over 300,000 homesites in the best real estate markets — in states like Florida, Idaho, Tennessee and many more — in precisely the places where people are flooding into.

And it’s paying off in droves.

They already have a backlog of orders for 22,000 homes worth $9.5 billion, and their profits skyrocketed by 150%.

I expect we’ll soon see those numbers translated into its share price.

And here’s where it gets even better: I recently learned that one legendary hedge fund has bought over 10 million shares, which translates to $1.1 billion!

Kenny: So, I’m guessing there’s some urgency here now?

Tony: SOME urgency? Are you kidding me? With everything going on today?! No one can say exactly what’s going to happen tomorrow. But I’m afraid we only have a small window of opportunity to make money on this stock before it rips higher. Right now, that window is wide open. But if the stock begins to take off, the best opportunity could be long gone for good.

But don’t worry, I’m not going to send investors on their way with just one report and one stock. I’ve also gone one step further and paired it with another valuable resource — your “Quick-Start Guide to the Greatest Real Estate Boom of Our Lifetime.”

This report is virtually for anyone. It’s for folks who are new to real estate market, it’s for seasoned investors and it’s for everyone in between.

Inside this report, I provide a complete roadmap to profiting from this real estate boom this year, in 2023, 2024 and beyond.

I lay out all the steps investors need to take right this minute to gear up for what I predict will be the greatest, largest, most sustainable wins.

PLUS, you’ll also discover:

A little-known change Washington lawmakers are making right now that could inject another burst of energy into the spectacular rise of Primetime Disruptors.

How the end of the five-day office workweek will turbocharge demand for housing and why it could be the most powerful real estate chart you’ll see all year.

Kenny: It looks like you’ve invested a lot of time, money and energy into producing these reports.

Tony: I did. The things is, I realize that for a lot of people, it’s simply easier to simply stay on the same path they’ve been on all these years — investing in index funds like the S&P 500 or the tech giants like Facebook, Microsoft or Google; following the crowd and doing what everyone else is doing.

But the fact is, you cannot expect extraordinary results by investing in an ordinary way.

So, when opportunity on the scale of Primetime Disruptors comes along — which have already delivered an average return of 277% in just the past year — then I think you want to have a stake in it.

Scratch that. You NEED to have a stake in it.

And I think this special report is the single best resource that shows you how to make that happen.

Kenny: So, if I want to get these reports right now, what do I have to do?

Tony: It’s simple. If you’re ready to grab today’s opportunity by the horns, all you need to do is join me in my investment research service, “Disruptors and Dominators.”

This is my service dedicated exclusively to big disruptive trends, like Amazon disrupting the online shopping space for gains of 24,000% or like Tesla disrupting the electric vehicle industry and surging over 28,000%.

I cannot guarantee results, and the opportunity for profits always comes with risk. But I can say with confidence that “Disruptors and Dominators” is the ONLY place that’s guaranteed to give you ALL the details on my #1 Primetime Disruptor, a company at the epicenter of the $43 trillion disruption ripping through the real estate market.

Kenny: So, help me out, can you tell me more about how this service works?

Tony: Every month, I dive into the details on a disruptive opportunity that I see on the horizon. Unlike other analysts, I don’t limit myself strictly to any specific industry, because disruptions can happen ANYWHERE — not just real estate, but biotech, edge computing even space exploration.

Inside every issue, I recommend at least one new opportunity, which I think gives investors the best balance between high-level profit and reduced downside risk.

These are the undiscovered gems that could greatly increase the odds for riding the kinds of Primetime Disruptors we’ve talked about.

Plus, Members also get access to my live model portfolio, which discloses all my open positions and closed positions.

Kenny: OK, so if I join you in “Disruptors and Dominators,” I get access to the special reports and …

Tony: Kenny, let me interrupt you right there, because I’m going to up the ante.

When you join “Disruptors and Dominators,” you won’t just receive those two special reports … if you give this a try right now, I’ll also give you immediate access to three more exclusive bonus reports … three more ways to grab a stake in this amazing real estate boom.

The first is my extra bonus report, “Fast Track to Farmland Riches.”

This real estate boom just hasn’t sent home prices soaring, the price of farmland has also gone through the roof. And it’s turning into one of the best performing assets you can own.

Kenny: Because of the huge surge in food prices, we’ve seen since the start of the war in Ukraine?

Tony: Even BEFORE anyone had a clue about the war in Ukraine!

And I’m not the only one that’s been on top of this trend. Look at Bill Gates. Did you know he has become one of the biggest farmland owners in the country?

But here’s the thing: I’ve uncovered a backdoor way to invest in farmland for a fraction of what others are paying.

From everything I can see, investors truly have an unusual opportunity here. And to my knowledge, the ONLY place to get the details is inside my special report.

The second one is “Work-From-Home Winners.” In this report, I detail how recent changes across the globe have turbocharged another breed of breakthrough companies — companies at the leading edge of the work-from-home revolution.

All my research suggests that if you know where to look, this is one of the few other sectors beyond housing that has the potential to deliver extraordinary gains.

My third extra bonus you can download immediately is my new exclusive report called “17 Ways to Profit in the Hidden Side of the Real Estate Surge.”

- It pulls back the curtain on 17 different ways investors can multiply their money — all with companies that most people don’t associate with real estate, but which have almost always seen surging profits as the housing market boomed.

- All the details on a home furnishing company that’s tapping into every cent this real estate boom has to offer.

- Why a tractor-related company could serve up the best bang for bucks when it comes to real estate investing.

- How even fridge, microwave and dishwasher makers are set to become a whole lot richer.

Kenny: I’ve seen an advanced draft of this. To me, it’s like a treasure map that shows investors precisely where to find the most likely winners. From everything I see happening, it looks like there’s a solid chance you could soon be hitting even more home runs.

Tony: Yes, that’s part of my mission of “Disruptors and Dominators” … to help everyday folks make the most money in the shortest possible time with the least risk. And I think that the ongoing real estate boom comes as close to anything I’ve seen to doing just that.

But I’m also here to help investors diversify beyond just the real estate boom and do so in a way that’s balanced that can help protect their wealth from the dangers we see in the world today.

Kenny: That’s very important. How much does “Disruptors and Dominators” cost? I’m guessing a membership isn’t cheap.

Tony: Ha! You know, everything you’ve said today was right on the money except on this one last thing. You’re off target because, actually it’s very inexpensive, very inexpensive.

That’s the good thing about working with Weiss Ratings. I’ve known the founder, Dr. Weiss, for 30 years. He and I work together really well because we share the same mission of helping average, retired or hard-working Americans.

So, when I said, “Let’s slash the cost to just pennies a day,” he was 100% on board.

Kenny: I think that’s great.

Tony: Yeah! You’re going to be thrilled when you find out the incredible deal he and I worked out. But to me, this is not about how much money it costs.

Kenny: It’s about how much money you can make!

Tony: Exactly! Remember, history has shown that stocks like my Primetime Disruptors have already delivered great performance.

So you’ll understand why I think $500 per year would still make this the steal.

But folks who take me up on my offer today won’t pay anywhere near $500. Not even close.

Today, I’m offering a full-year membership to “Disruptors and Dominators” for the rock-bottom price of $59.

That comes out to just 16 cents a day.

Kenny: That’s not exactly anything that’s going to break the bank. But why so cheap?

Tony: Well, in our view, the best kind of advertising is let people see my actual work and experience the results for themselves. And we want to make sure money doesn’t stand in the way of anyone’s decision to take advantage of this opportunity. That is why we’ve slashed it to just a few pennies a day. But that’s not all.

We’re also putting our money where our mouth is and backing up everything up with a 100% money-back guarantee.

Kenny: A 100% money-back guarantee? I like that. But if I join, how long do I get to try it out and still get all my money back? Can you give me 30 days, is it 60 days?

Tony: No, I’m going to give you the whole year, 365 days, if you join right now and download my free reports. Act on my recommendations if you so decide … seriously consider taking advantage of all the opportunities I send you over the next 12 months. Then, at the end your membership, even on the very last day if you wish, or you’re unhappy for any reason whatsoever, let us know and we’ll give you a full refund.

Kenny: Every penny, all $59?

Tony: Yes, 100%.

Kenny: Suppose I want to keep your four reports?

Tony: Please do. Consider them my gift to you, my way of thanking you for giving “Disruptors and Dominators” a try. Let me shoulder the risk. That’s how confident I am in the power of my research.

Kenny: So are you going to provide a link or a website where investors can go to get more info about “Disruptors and Dominators”?

Tony: Sure. All you need to do is hit that “Subscribe” button below. You’ll be taken to a special web page that details all the benefits you’ll get when you join me today. And then in a few minutes, you can gain immediate access to all five of my bonus reports.

Kenny: OK. So, your staff gave me a list of everything folks get when they join, some of which, by the way, you didn’t even mention yet, Tony. Can I summarize it now?

Tony: Please, please.

Kenny. When you join today, you’ll receive:

– 12 monthly issues of “Disruptors and Dominators” for which investors currently pay $129

– You get “The #1 Real Estate Play of the Decade” — a $79 value

– You’re also going to get the “Quick-Start Guide to the Greatest Real Estate Boom of Our Lifetime,” also a $79 value

– You’ll get an extra bonus — “Fast Track to Farmland Riches” — retail price $79

– You get his second extra bonus — “Work From Home Winners” — a $79 value

– Not to mention, Tony’s third extra bonus — “17 Ways to Profit in the Hidden Side of the Real Estate Surge” again another $79 value.

That’s a total value of $524 — all yours for just $59. Your total savings and discounts add up to an impressive $465.

And that doesn’t even include all the extra benefits you get.

For example, to keep you posted on fast-moving changes in news, you’ll also receive our e-letter, Weiss Ratings Daily. Six days a week, you get urgent alerts and updates from Tony Sagami and his team. That’s 312 issues in all.

Plus, one more thing: ANYTIME you have a question — about Tony Sagami’s reports, about his research or about his recommendations — you get access to his editor mailbag, which you can access online 24 hours a day, seven days a week.

ALL backed by the Weiss Ratings iron-clad, 365-day, money-back guarantee! All of it yours to keep, even if you ask for all your money back on the very last day of the one-year membership!

It’s not every day that investors can get exclusive access to innovative ways to tap into the real estate boom for just 16 cents a day. Click the button below this screen if you want to be among the first.

Thanks for watching and thanks for your interest today. And thank you, Tony, for everything you do for investors.

Tony: My pleasure. Thank YOU, Kenny, for your enthusiasm.

Kenny: Well, click that button below and join Tony’s “Disruptors and Dominators” family today.

Disruptors and Dominators

© All rights reserved | 11780 US Highway 1, Suite 201, Palm Beach Gardens, FL 33408-3080 | 877-934-7778