Table of Contents

- Introduction

- Dylan Jovine: An outsider from the start

- The Biggest Risk to Retirees In 70 Years

- Inflation is Just Starting…

- You Will Be $552 a Month Poorer by December 31, 2022

- The Stock Market Sinks 37% During Times of Inflation

- The 1970's All Over Again…

- The Return of Stagflation

- A Chinese Attack on Taiwan…

- How to Make Money from Disaster

- Sell Stocks in 3 Sectors ASAP, Buy These Sectors Instead

- The Next Steps You Need to Take

- There's One Place on Earth You Can Get This New Report

- A Quick Recap Before Getting Started

“It's the biggest danger we have apart from a nuclear war.“

– Charlie Munger

Income Destruction:

Why “Safe” Investors May Lose Everything Within the Next 6 Months

Dear Friend,

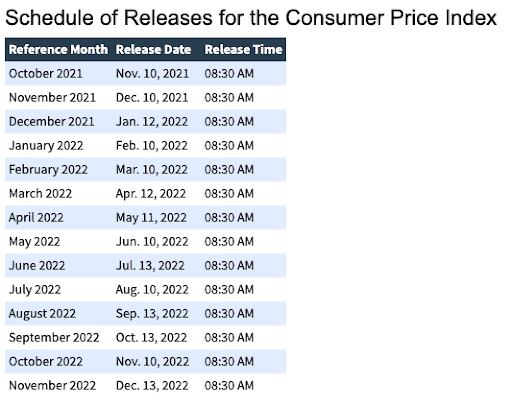

On June 10, 2022, the U.S. Government is going to make an announcement that could radically alter your retirement.

Certain stocks and cryptocurrencies could drop by 80%.

Bonds and funds could drop even further.

Even your social security check could be worth 21% less.

In other words, many investments you rely upon – and have planned your retirement on – will no longer be safe.

How is this possible?

Well, on June 10, 2022, the U.S. Government will make an announcement that will affect America’s income markets in a way this country has never experienced before.

Like a Category 5 Hurricane, this announcement will tear through the stock and bond markets…stunning investors and retirees alike.

Those who aren’t prepared for it could lose everything.

It is not yet a widely known fact…but in the highest financial circles, word is starting to spread.

“It’s not going to be a pretty outcome,” said investing legend Carl Icahn, who’s worth $20 billion.

Two of America’s largest banks – Goldman Sachs and J.P. Morgan – have quietly warned their richest clients to prepare for it.

But the mainstream media reports on financial disasters after they happen. So by the time most people realize what’s at stake, it will already be too late.

“It's one of the biggest risks to retirement,” according to CBS MarketWatch.

That’s why the world’s biggest investors have begun to prepare for this day.

Billionaire Seth Klarman recently sold 19 stocks in anticipation.

Billionaire David Tepper recently sold 28 stocks in anticipation.

Billionaire George Soros recently sold 56 stocks in anticipation.

Now, why would the Government do something that would cripple the markets?

Jim Cramer says they had no choice because they were dealt, “an insanely bad hand.”

You see, recent developments in the labor markets have placed them in a position where they must act fast…

The Government has indicated it will choose what it considers the lesser of two evils…

As Bond King Bill Gross recently said, “I think they have to be very careful.”

Since this news came to light, we’ve identified 128 investments we believe are in immediate danger.

There’s a good chance you own at least one of these through a brokerage account, mutual fund, 401k, or other retirement account.

In a moment, I’ll share 3 of the most at-risk with you.

That way you can get out of them now – before it’s too late.

And give you the time you need to take advantage of the handful of opportunities that will flourish from this move – way before anyone else figures it out.

And I don’t just mean “safe” places to just park your money while the dust settles.

I’m talking about specific investment opportunities that could double within a month of two of this event happening as scared money rushes in.

I’ll give you three names that could soar 1,000% or more as billions of dollars abruptly shift out of once-safe investments…

I know that sounds unbelievable…but I’ll show you the facts a bit later.

I’ll also show you how professional managers have already begun moving millions into these types of plays…

Money management giants like Blackrock, Bank of America and Morgan Stanley.

But right now, it’s vital that you protect yourself.

And to do that, you need to understand why this event, which I’ve dubbed “Income Destruction,” is about to happen…and how it will redefine the rules of income investing.

I know what I’m saying is a little bit out there.

After all, folks have been crowding into dividend-paying stocks, bonds and funds ever since the Fed began driving interest rates down to zero.

You don’t have to believe me now – just review the facts and you make the decision whether this makes sense.

But first, it’s important for you to know who I am and why I’ve spent four weeks working 24/7 to get this to you.

An Outsider From The Start

My name is Dylan Jovine.

I started my career on Wall Street in 1991.

But I didn’t start at an “establishment” firm like Goldman Sachs or J.P. Morgan. I grew up poor, went to city college, and wore black t-shirts every day. No Wall Street firm would hire me. I was too much of an outsider.

Thankfully, I got my big break from another Wall Street “outsider” – Peter Jacquith. He’s one of the bankers who became famous for saving New York City from bankruptcy in the 1970’s. He started a boutique firm after leaving Lazard Freres’ & Company.

It was an opportunity I would not take for granted. I may not have had the connections other people had.

But nobody was going to work harder than I did.

I managed accounts. But I fell in love with researching stocks.

Studying a stock was like reading a short history book about the town the company was in, the people that worked there and the products they made. I loved it. I couldn’t believe people got paid to do this.

Within three years, I earned a reputation for picking stocks right before they were taken over.

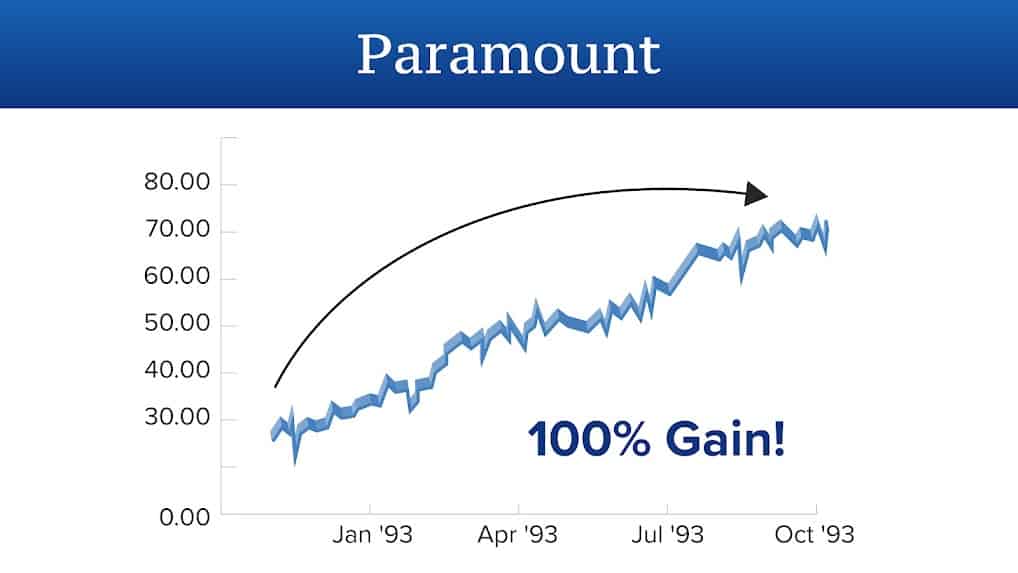

Stocks like Paramount which was bought out by Viacom three months after I recommended it for a 100% gain.

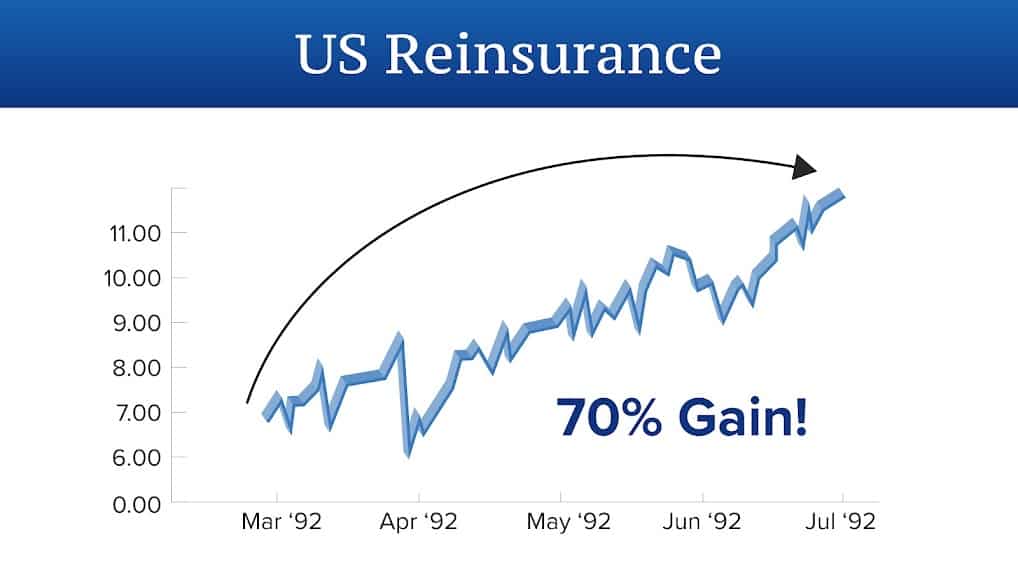

Or the 70% gains we made when US Reinsurance was acquired six months after I recommended it.

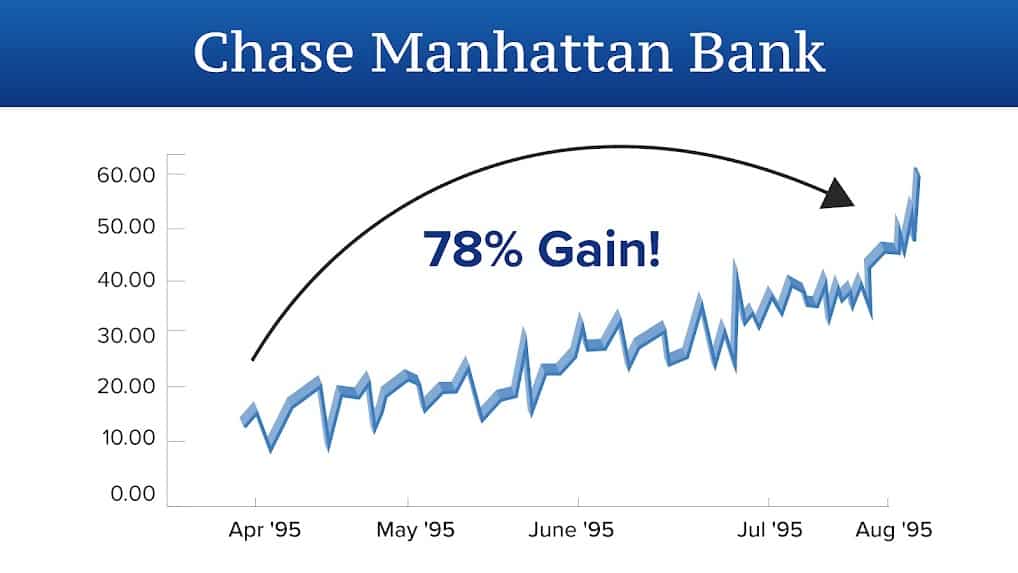

Or the 78% gains we booked when Chase Manhattan Bank was acquired by Chemical Bank.

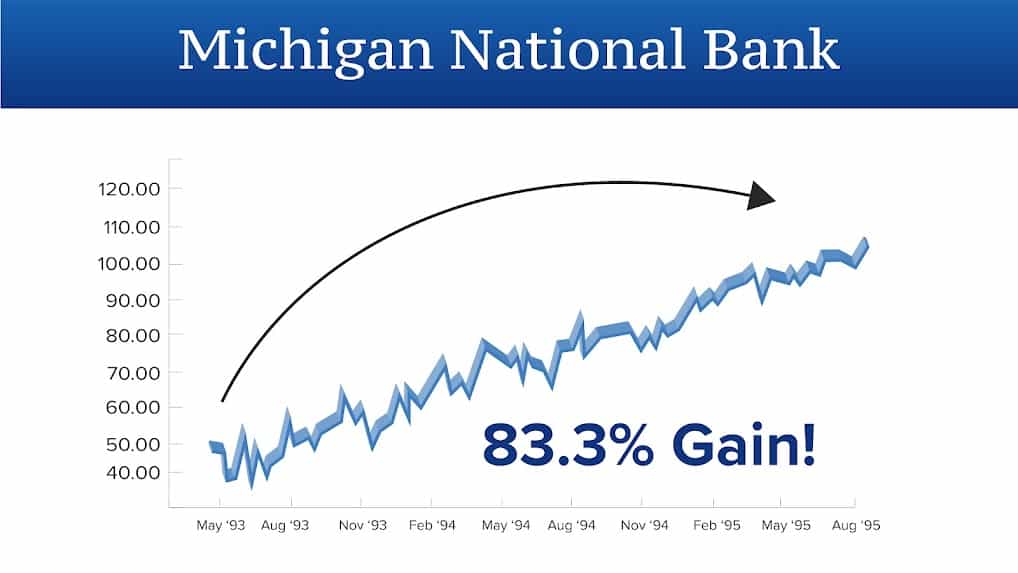

Or the 83.3% gains? we made when Michigan national Bank was acquired for $110.

Remember, this is the early 1990’s – before the internet bull market of the 1990’s.

And here I am, this 23-year-old kid, picking takeover after takeover.

By 1996, my clients bankrolled me to start my own brokerage firm.

And that’s how, at just 24 years old, I became one of the youngest people in American history to launch a registered broker-dealer and market-maker.

Our office was at 100 Wall Street, below…

I Saw The 2018 Crash Coming A Year Before It Happened

Because of what I accomplished at such a young age, Wall Street took notice.

But it wasn’t until I predicted the 2008-09 financial crisis a year before it happened that the general public took notice.

That’s when I was invited onto television to share my opinion.

My message was simple:

The stock market at 6,500 is like walking into your dealership when everything is on sale marked 90% off!

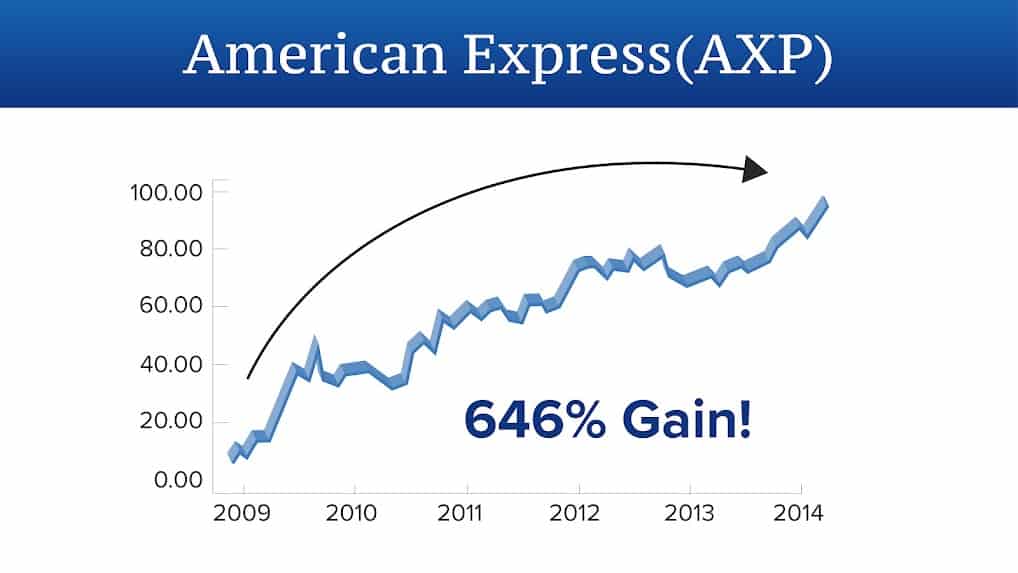

Like the 624% returns we booked after buying American Express at $14.24 a share.

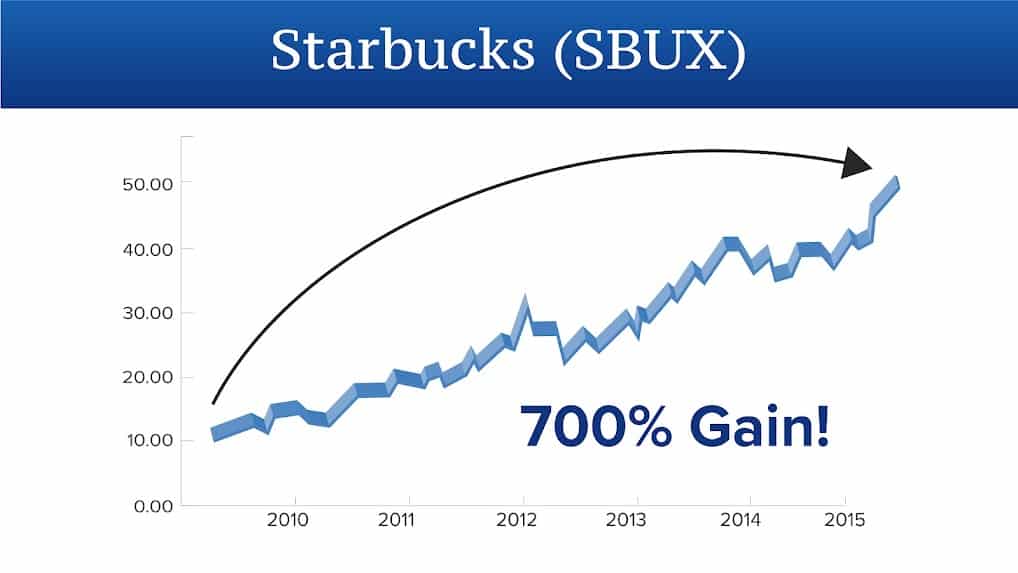

Or the 700% profits with Starbucks, which I bought at $8, which then soared to a high of $56.

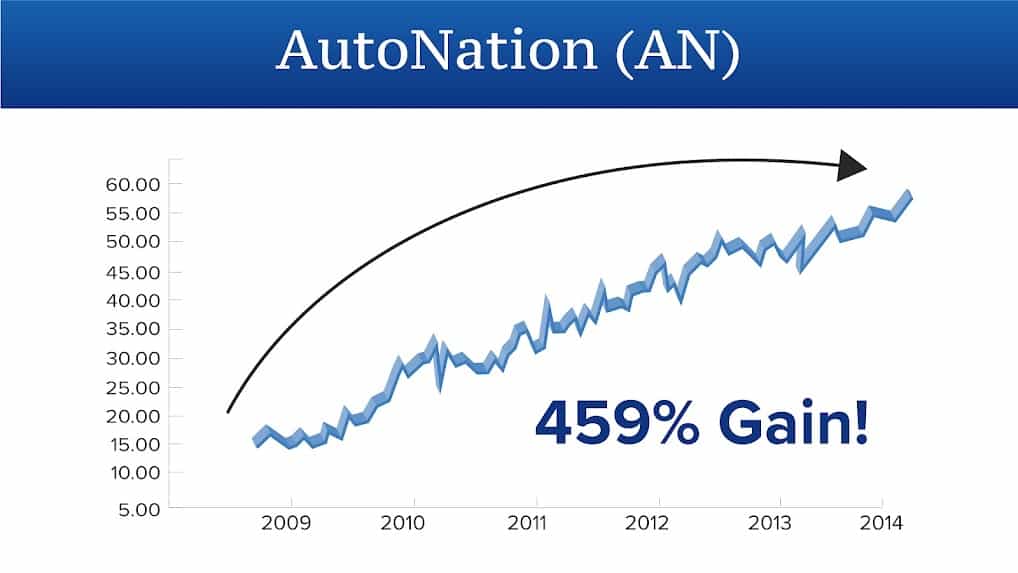

Or the 459% profits we found buying shares of AutoNation between $10 – $11 a share.

Or the 235% gains that came from those who bought FactSet Research with us at $63.23.

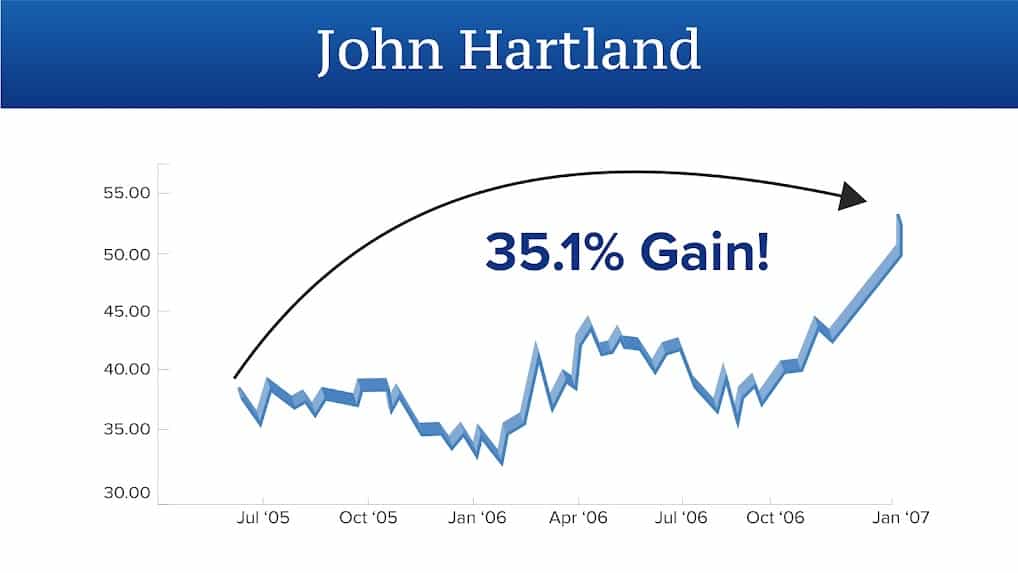

Or John Harland which was taken over six months after I recommended it, giving investors a 35% gain.

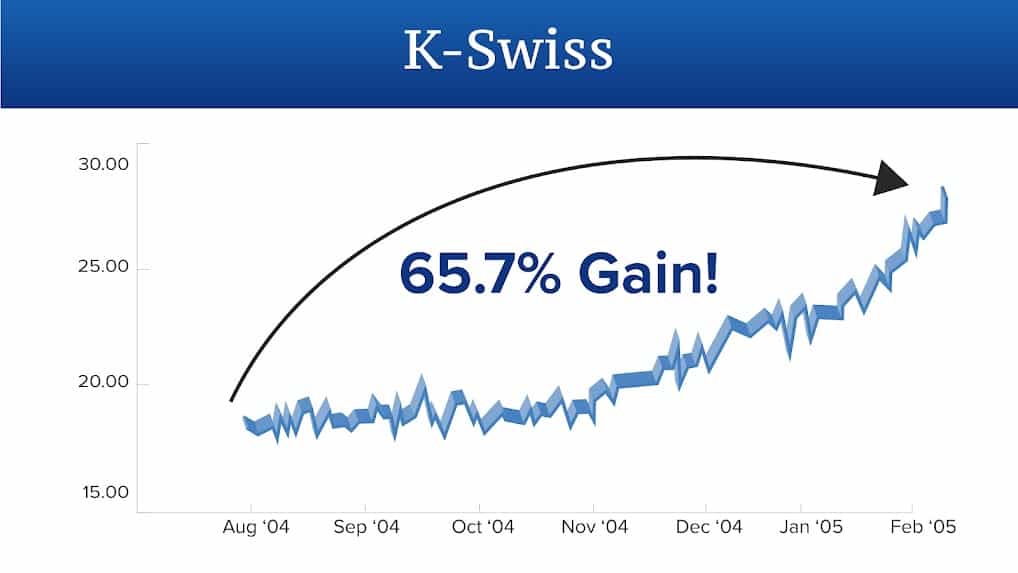

Or shares of K-Swiss, which gave my clients a 65% gain.

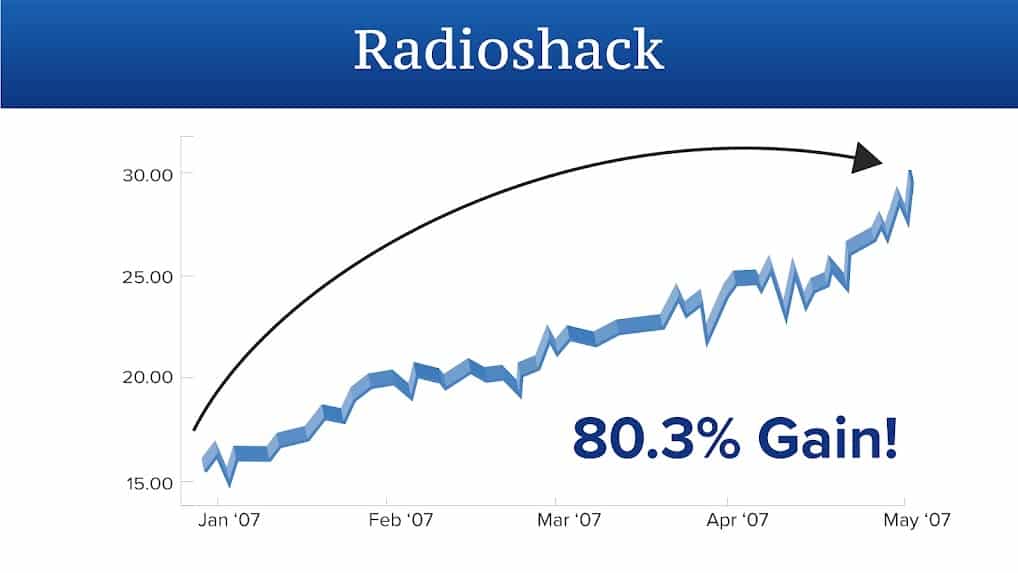

And remember RadioShack? I brought investors 80% profits after the stock soared from $16 to $29.

Or the 40% gains we earned when Hilton Hotels was taken over.

I’m grateful that I was able to help so many people profit from the 2008 crash.

But the coming China-Taiwan conflict has me more concerned than ever before

When China attacks Taiwan, you could wake up one morning to find your portfolio down 50%.

In a moment, I’m going to tell you exactly what to do when this happens.

And I’ll show you my “red-flag” list – this is a list of XX investments that will be hit the hardest (I can email it to you as well. Stay tuned to the end).

Finally, I’ll show you what I think is the absolute most important thing for you to do to keep yourself safe during this crisis…and make a lot of money in the process.

The Biggest Risk to Retirees In 70 Years

To put it bluntly, you have not been told the truth about the danger inflation poses to your retirement plans. And it starts at the top.

The Federal Reserve spent all last year downplaying the inflation threat. They called it “transitory.”

They didn’t want you to know the truth because the Fed Chairman was up for reelection.

Wall Street has been downplaying the inflation threat.

They don’t want you to know the truth because they’re using you to sell their positions.

And of course, the mainstream media has been trying to downplay the inflation threat.

They don’t want you to know the truth because older people vote.

And the last thing this administration wants is for angry senior citizens going out to vote.

They know it will cost Biden the midterm elections in November.

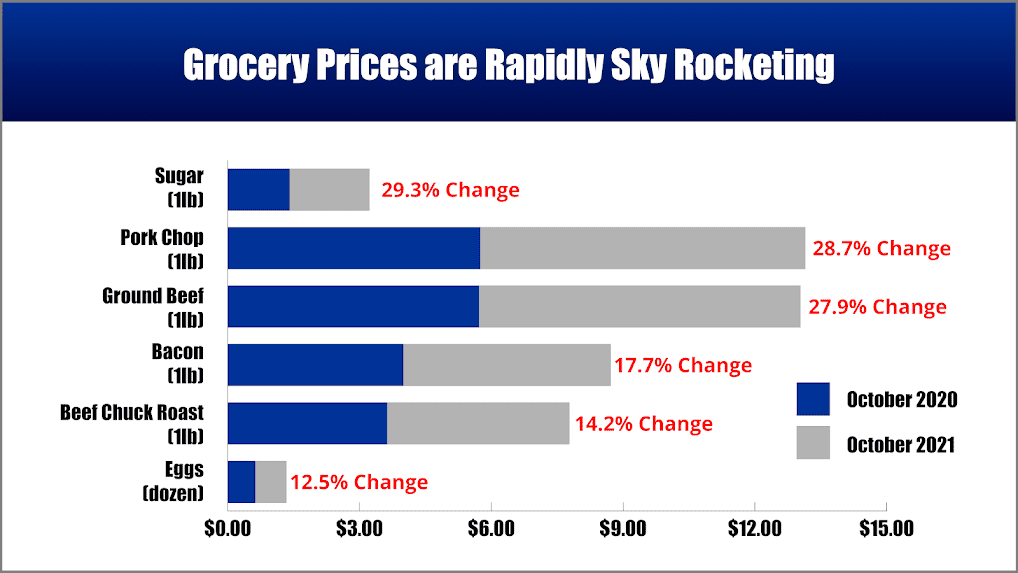

But they couldn’t downplay it any longer. Higher prices mugged us each week at the grocery store.

So let’s start with what we now know.

We now know that the inflation rate went up 7% in 2021.

That means that every $1 you had last year is worth $0.93 cents today.

Put another way, you’ve already been hit with an “invisible tax” of $276 each month.

That’s about $9.20 cents a day you’ve already lost.

But there’s a bigger story that you’re not being told.

And it starts with the simple fact that…

Inflation is Just Starting…

Last year, the FED wanted you to believe that inflation was just “transitory.” That it was only going to be here for a few months.

But inflation doesn’t work that way. I’ve looked at data going back to 1929.

It has never once showed up for just one year.

For the past century, every time inflation has jumped above 5% it has stuck around for an average of 2 ½ years.

For example…

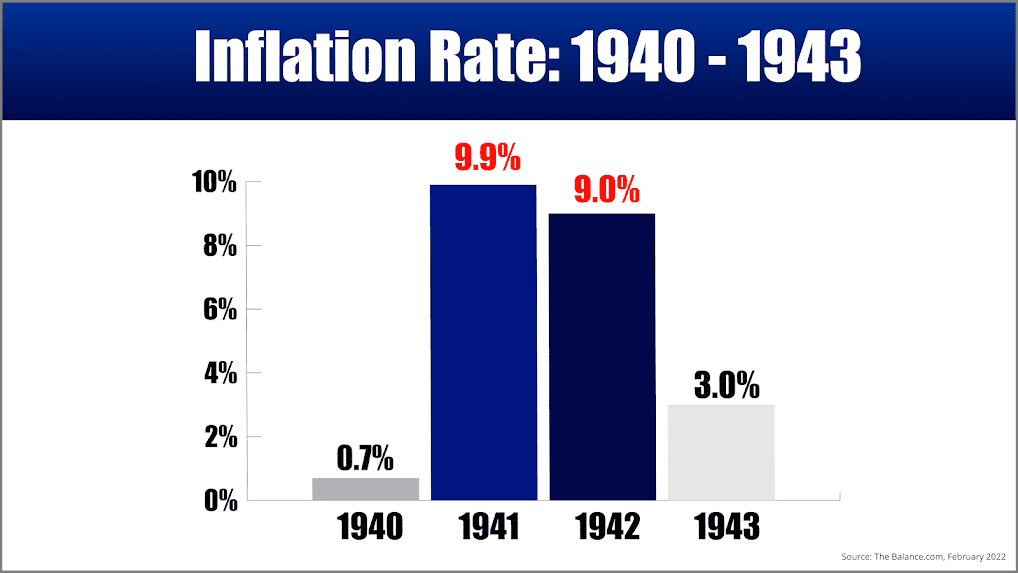

In 1940, inflation was at 0.7%. But then it spiked for two years to over 9%.

Inflation spiked because of increased government spending after Pearl Harbor was attacked and we entered WW II.

Now we haven’t entered a war. But the government spent a huge amount to combat Covid pandemic, so it’s similar.

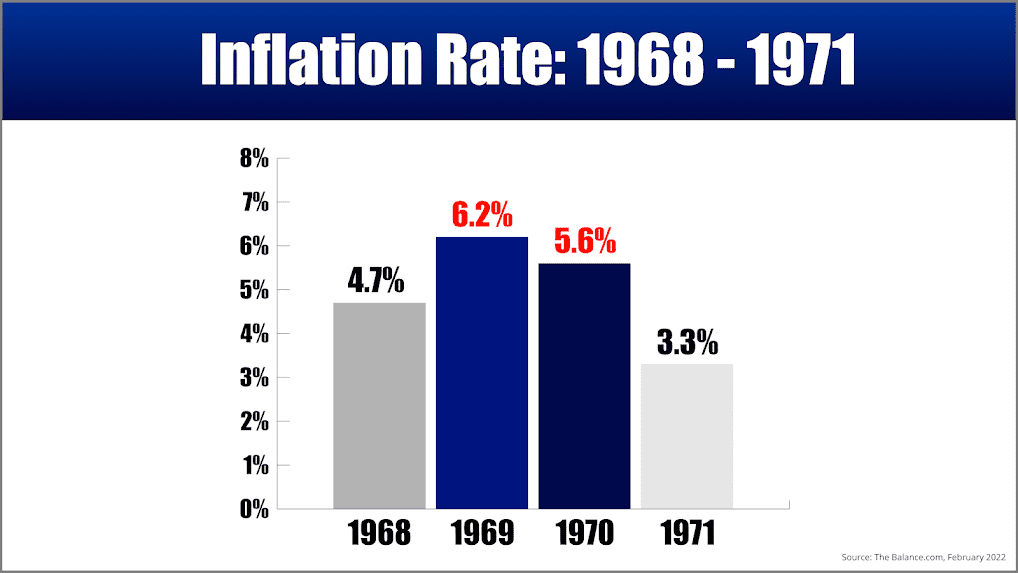

In 1968, the inflation rate was 4.7%. Still high by today’s standards, but lower than the dangerous level of 5%. But then it spiked for two years.

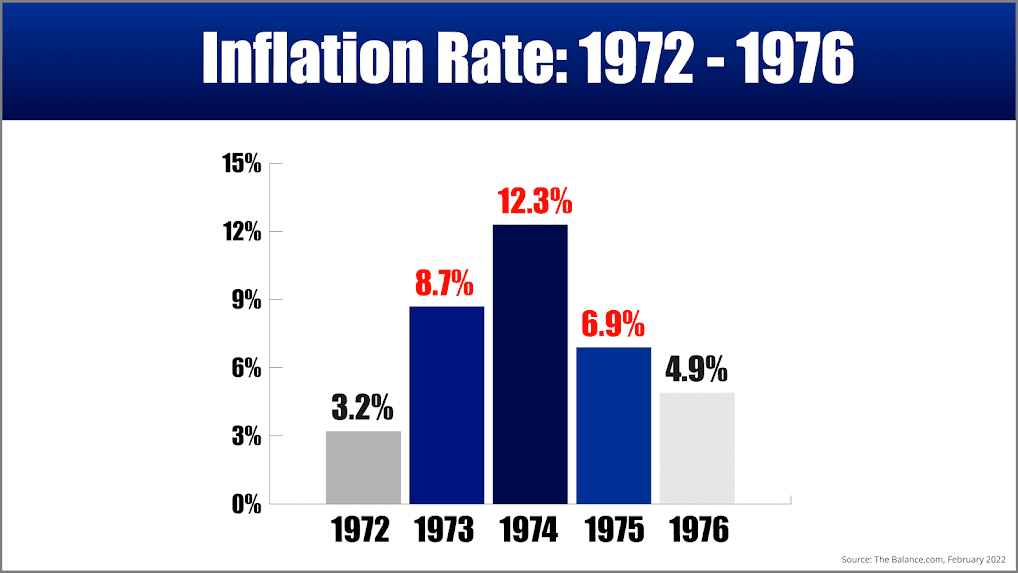

In 1972, the inflation rate was 3.2%. But then it spiked to 8.7% and stayed above 5% for three full years.

I’ve gone through almost one hundred years of data.

And there’s one thing that has become perfectly clear: once inflation appears, it stays for an average of 2 1/2 years.

It’s like the guest that never leaves.

But why? Why does inflation stay so long?

Inflation Comes in Waves

It’s because inflation comes in waves.

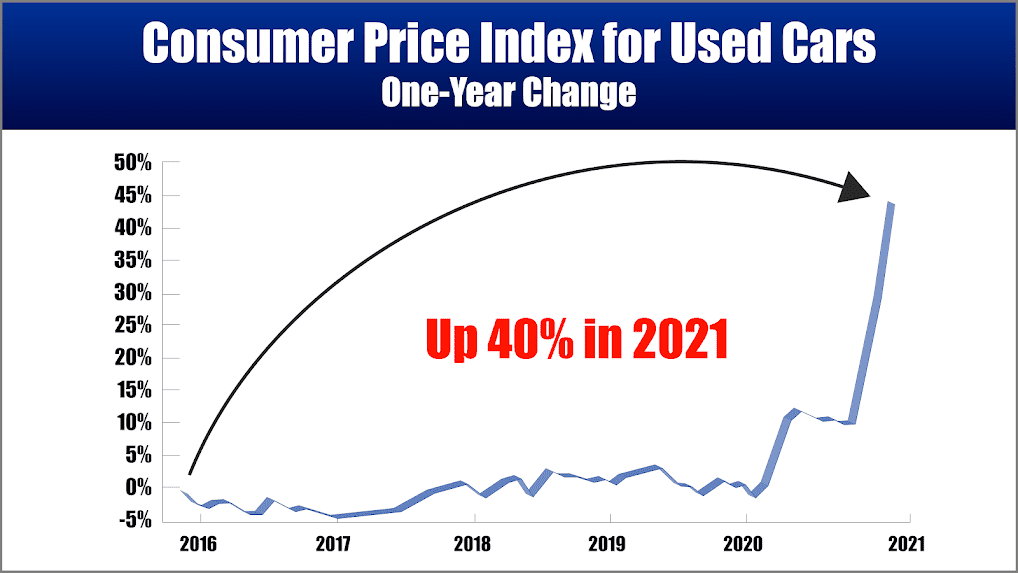

Take used car prices, for example. Last year they jumped a shocking 40%.

That initial increase shows up in the inflation rate for last year, 2021.

But this year, car insurers have to raise prices to cover those more expensive used cars.

Think about it…

If your car gets stolen, they have to replace it with a car of equal value. And they’re going to need to give you a rental car, which also costs more money.

But it doesn’t just stop there. It moves from sector to sector like termites moving through an old house.

Because used car prices are so high, people often choose to stick with their current cars longer.

But used cars break down a lot.

So, people take them to their mechanic more often. That means mechanics are now busier than ever, which allows the busy mechanics to raise their prices.

On and on and on it goes…

And this second wave of inflation is underway right now….

It’s happening in every industry on earth. And most of its hidden.

Cereal maker Kellogg is raising prices again in 2022 because of rising prices…

Goodyear Tire & Rubber is raising prices…

Technology seller CDW is raising prices…

My point is just like a house infested with termites; inflation is everywhere.

What does all this mean to you?

You Will Be $552 a Month Poorer by December 31, 2022

In 2021, the 7% inflation rate was like a “hidden tax” that cost you an extra $276 a month.

But data over the past century proves that we should expect a similar inflation rate in 2022 also.

In other words, you’re bound to be hit with another “hidden tax” of at least $276 a month this year.

That means you’ll be at least $552 a month poorer by December 31st of this year.

You Will Be $690 a Month Poorer by June 30, 2023

But remember, history proves that inflation stays for an average of 2 ½ years.

If history is any judge, this bout of inflation won’t run its course until the middle of 2023.

So, by June 30th of 2023, you could very realistically be $690 a month poorer than you are right now.

What spending would you cut if you had $690 less each month?

Would you be forced to turn off the air conditioner on certain days in the summer? Or maybe the heater in the winter?

Would you buy cheaper foods? Take fewer medicines? Drive less often?

Or would you be forced to pick up a job? Downsize your house? Get a roommate?

If you’re a software engineer, you can go out and just get a job at a higher wage.

But seniors lived on a fixed income. They can’t just run out and get a job at a tech firm.

They rely on Social Security to increase payments each year to make up for inflation.

This so-called Cost-of-Living Adjustment (COLA) increased payments by 5.9% this year alone.

But there’s a problem with that too…

Cost-of-Living Adjustments Are Based on Fake Data

You see, annual COLA increases are based on the Consumer Price Index (CPI).

But the CPI methodology has been updated over the years to discount actual inflation levels.

For example, today’s CPI doesn’t even include housing prices.

Let that sink in for a moment….

Housing prices jumped 19.5% last year and the CPI doesn’t even include that.

According to economist Peter Schiff, if the CPI still included housing prices, it would be growing at around 11% rather than 6.8%.

The government uses this and other clever tricks to get away with paying you less for Social Security.

So, in a very real sense, seniors are going to have to make do with less money.

But unfortunately, that’s just half the story.

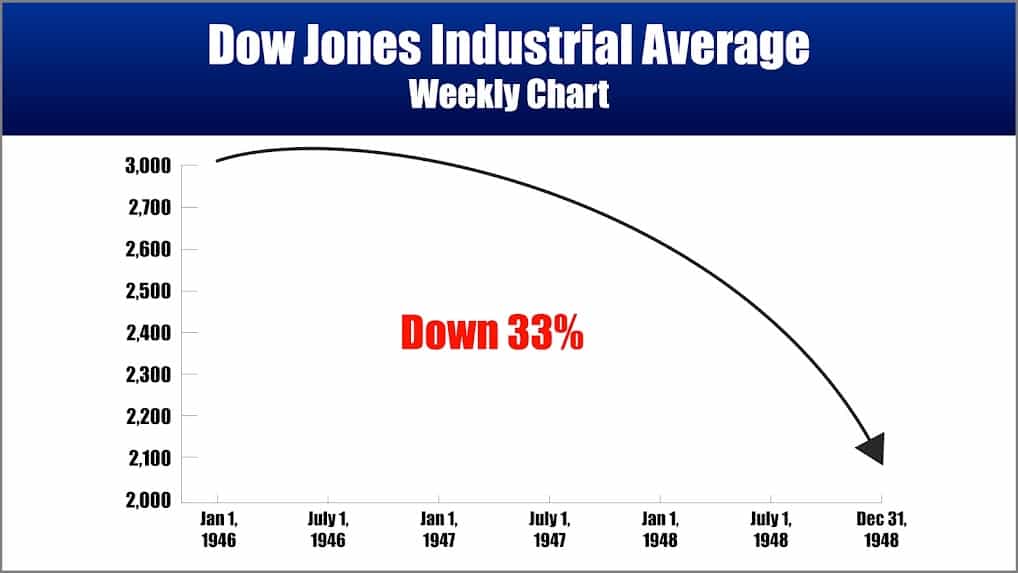

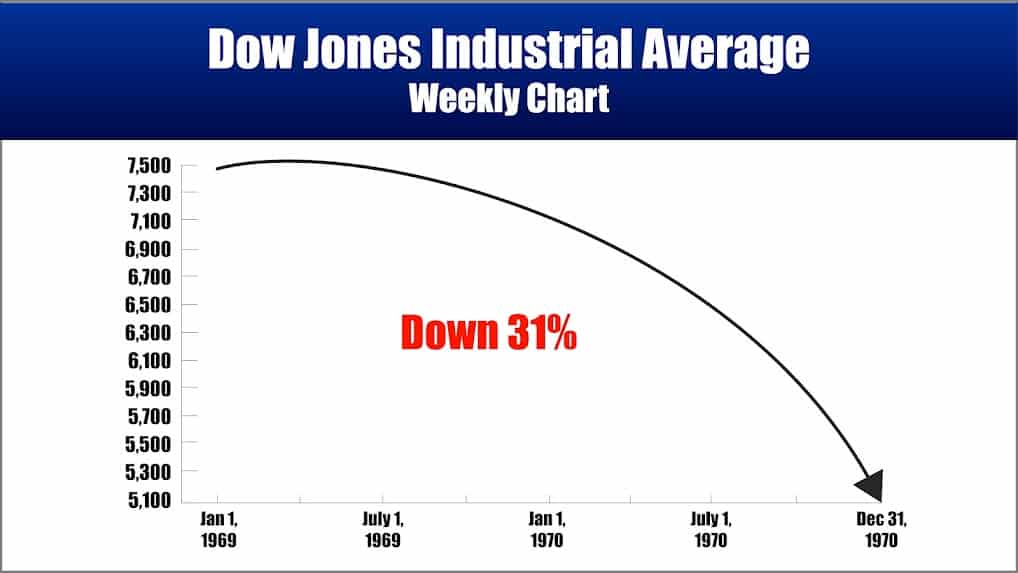

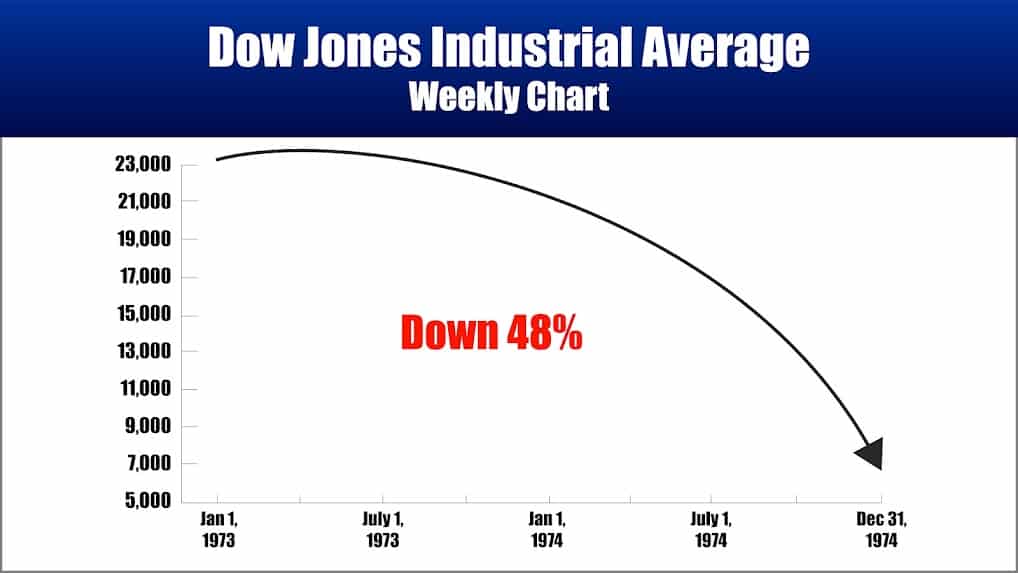

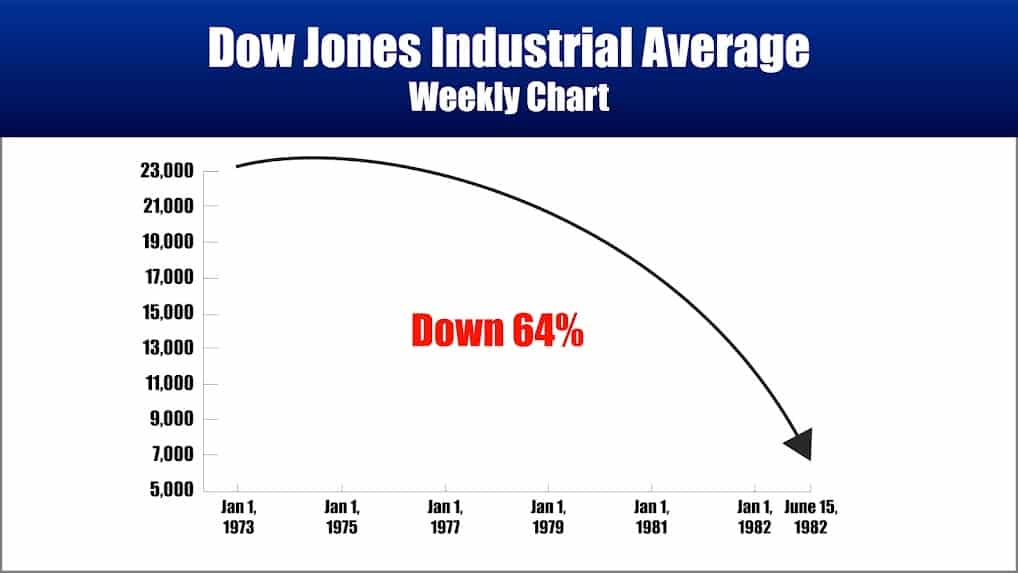

The Stock Market Sinks 37% During Times of Inflation

How can you expect your retirement portfolio to hold up during this inflation?

During the past 100 years, the stock market has gone down an average of 37% during periods of inflation.

And it doesn’t happen quickly. It seems to happen painfully, in slow motion.

For example…

During the inflation of 1946 – 1948, the stock market sank 33%.

During the inflation of 1969 – 1970, the stock market sank 31%.

During the inflation of 1973 – 1974, the stock market sank 48%.

So, in a very real sense, you will continue to get poorer during the next 12-18 months.

And that’s our base case scenario: 2 ½ years inflation that will make you $690 poorer and a stock market decline of between 30 – 40%.

But there’s a way this could even get worse. Much worse.

Let me explain…

The 1970's All Over Again…

History repeats itself, often in startling ways. And often when you least expect it.

You see, what really concerns me about this round of inflation was the size of the spike.

Inflation spiked 5% points in 2021. That’s a big spike.

A spike that large has only happened once in the past 70 years: in 1973.

Between 1972 and 1973 the inflation rate spiked from 3.4% to 8.7%, an increase of 5.3%.

What came next was a financial horror show. And it lasted for a whole decade:

From 1973 and 1981, inflation averaged 9.25% a year.

And the stock market sank 64% that decade, dropping from 6,593 in Jan of 1973 to a low of 2,352 in June of 1982.

Don’t think it can happen here? Think again.

St. Louis Federal Reserve President James Bullard himself warned that inflation could get out of control.

What does he mean by “out of control”?

The last time inflation spiked 5%, it spread quickly to local city and state governments.

Just like it spread to my hometown of New York City in the 1970’s.

The inflation and economic malaise forced the city to cut spending.

They had to lay off city workers, like the sanitation department.

They had to cut after-school programs, which brought up crime rates.

And they couldn’t afford a proper police department, which led to more drugs, vandalism, theft and looting.

It got so bad that the White House tried to get the country focused on beating inflation with the famous “Whip Inflation Now” buttons.

And President Jimmy Carter gave his now-infamous inflation speech.

June 10, 2022: The Return of Stagflation

What you have to watch out for on June 10 are the CPI numbers. during the next twelve months are the monthly CPI numbers.

They tell us how much consumer prices jump in any given month.

They are released on the eighth business day of every month.

And this will be the first month they reflect the Russia – Ukraine war.

If they jump more than expected, the Federal Reserve will be forced to take drastic action at their next meeting on June 10. They would have to raise rates at a dangerously fast rate.

That would slow down the economy, which could tip us into recession.

That would mean we have both slow growth and recession, which is exactly what happened during the 1970’s.

It was called “Stagflation.”

And if this lasts for the next ten years, like it did in the 1970’s, retirement as you know it is over. Period.

It's All Happening at the Worst Time

Excessive government spending causes inflation to spike. It’s that simple.

It happened during WW II, where massive government spending for the war drove inflation higher.

It happened during the Vietnam War, where massive government spending for that war drove inflation higher.

And it happened during Covid, where massive government spending for the pandemic drove inflation higher.

Unfortunately for us, our enemies seem more emboldened than ever before.

As I write this, most people are focused on the Russian threat to Ukraine and Eastern Europe. But I think that’s a diversion.

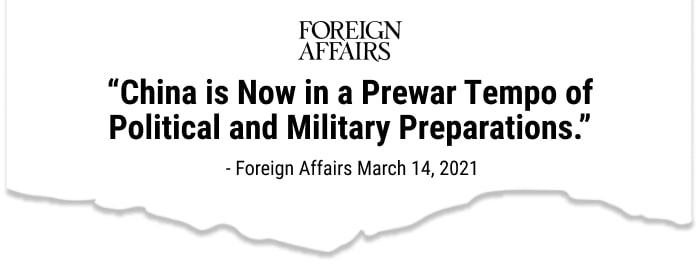

Russia is taking your attention away from what their partner China is doing in the South China Sea…

China is the Real Threat, Russia is a Diversion

Right now, there’s a military showdown playing out between China and the U.S. over Taiwan.

China has one goal: take control of Taiwan.

And it’s getting closer to invading Taiwan every day.

An invasion could happen any day.

The stakes couldn’t be higher…

Taiwan makes 66% of the semiconductors that power the world’s computers, smartphones, televisions – even the brake sensors in our cars.

A Chinese Attack on Taiwan Would Cut the Stock Market in Half

The stock market would crash, as firms like Apple, IBM and Google would see their sales cut by 66% or more.

Prices for phones, cars and computers would double or triple overnight…

World governments would scramble to hold onto chips critical to the military.

China could threaten to withhold chip shipments for anyone who doesn’t approve of their decision to invade Taiwan. China would control the world.

Inflation Would Spike to 10%

Inflation averaged 6% during both the Vietnam War and the first Iraq War. (It didn’t even rise during the second one).

But China isn’t Vietnam or Iraq.

To begin, China is a near-peer competitor.

This is not Saddam Hussein invading Kuwait. China doesn’t have old Soviet tanks.

They now have the biggest navy on earth.

That would make it very difficult for us to even get our aircraft carriers to Taiwan to help provide relief.

And they’ve just spent the last two decades building an A2/AD (anti-access / area denial) missile shield all around Taiwan.

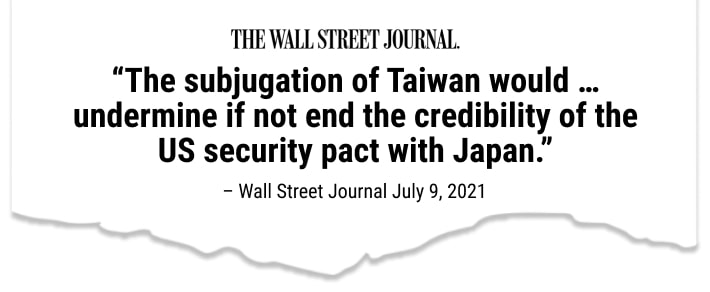

Secondly, a Chinese takeover of Taiwan would put US credibility on the line.

If our allies believe we can’t defend them from China, we will lose them.

And finally, a Chinese invasion of Taiwan could spiral into World War III in a heartbeat.

The Japanese Deputy Prime Minister said as much recently –

It could drag the Unites States, Japan, Australia, India and South Korea into war as quickly as Europe slid into World War I.

That’s why a better comparison would be Germany during WW II.

And just like when we fought Germany, the U.S. government would have to spend massive amounts of money to fight China.

And that fiscal spending would cause inflation to spike to 10%, just like it did when we entered World War II.

Now make no mistake about it – a Chinese attack on Taiwan would carry a terrible cost in terms of human lives.

But you would wake up one morning and see your retirement cut in half with the inflation rate above 10%.

That’s literally what’s in front of us.

But the biggest risk you face is not being prepared.

The good news is that I’m here to help you do just that.

And I’ve made a career of seeing around corners.

Here’s a recent example…

How to Make Money from Disaster

In early 2020, the stock market crashed 40% because of the Covid pandemic.

March was the worst of it. It was like a stampede out of stocks.

One billionaire hedge-fund manager went on CNBC and cried, “hell is coming” as he wiped away tears.

But I kept my cool.

On March 12, 2020, I wrote an article titled, “4 Steps to Profit from this Market Panic.”

Right at the height of the market crash, I urged readers to buy saying…

Because of my experience and my ability to see these opportunities before they appear…

My readers kept their cool. Because we kept our cool, we were able to pocket huge returns like…

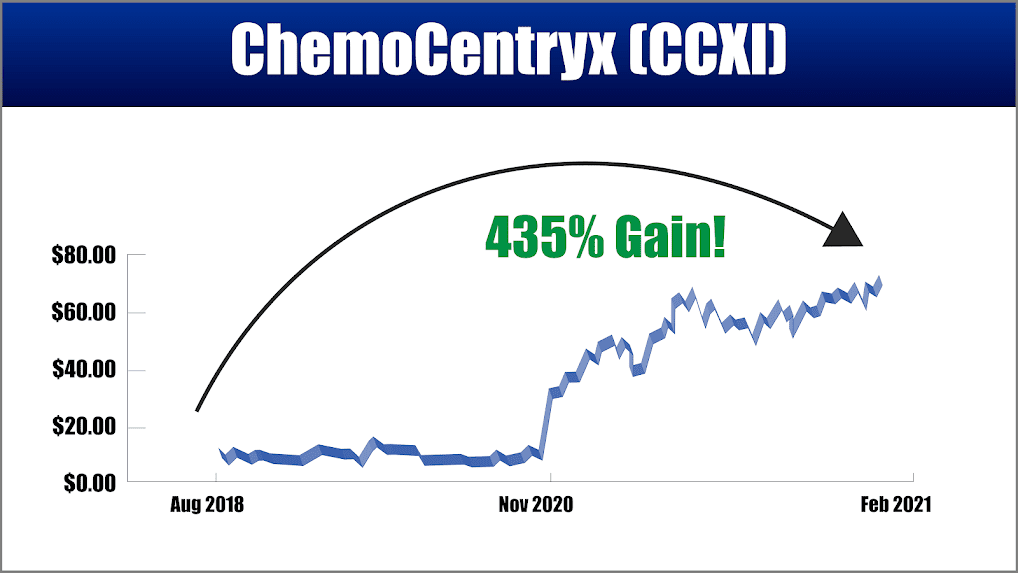

ChemoCentryx: 435% Gain

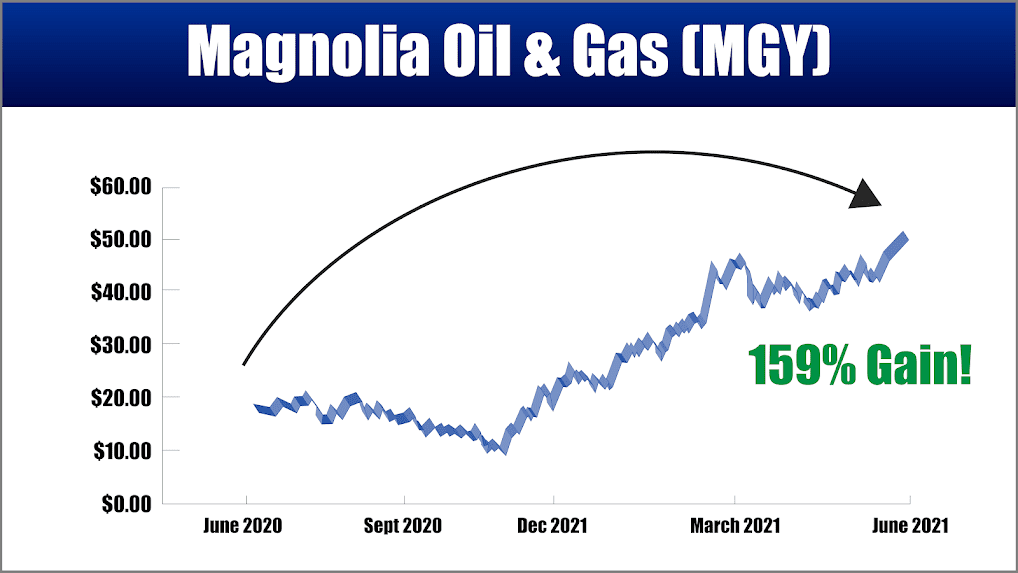

Magnolia Oil & Gas: 159% Gain

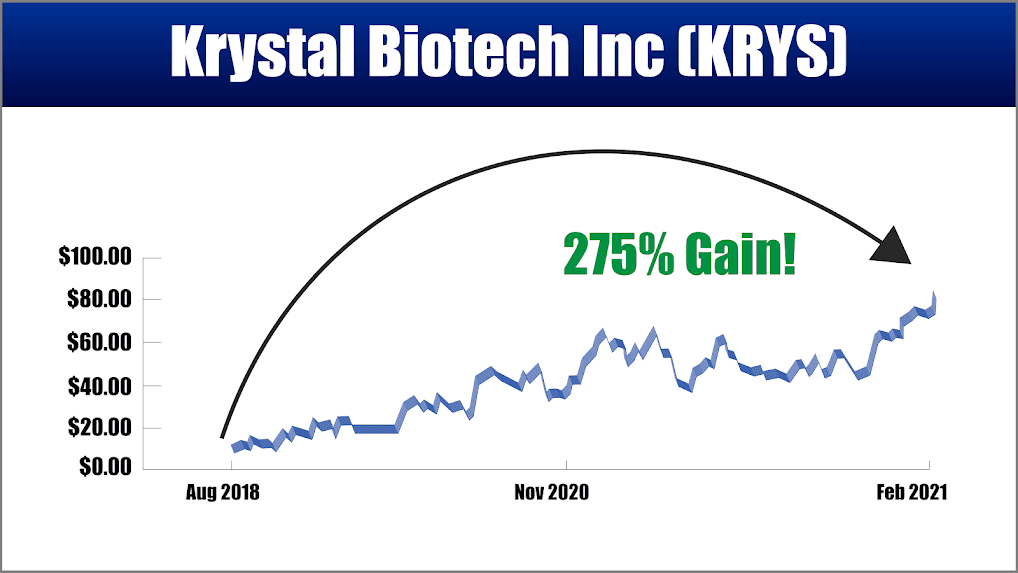

Krystal Biotech: 275% Gain

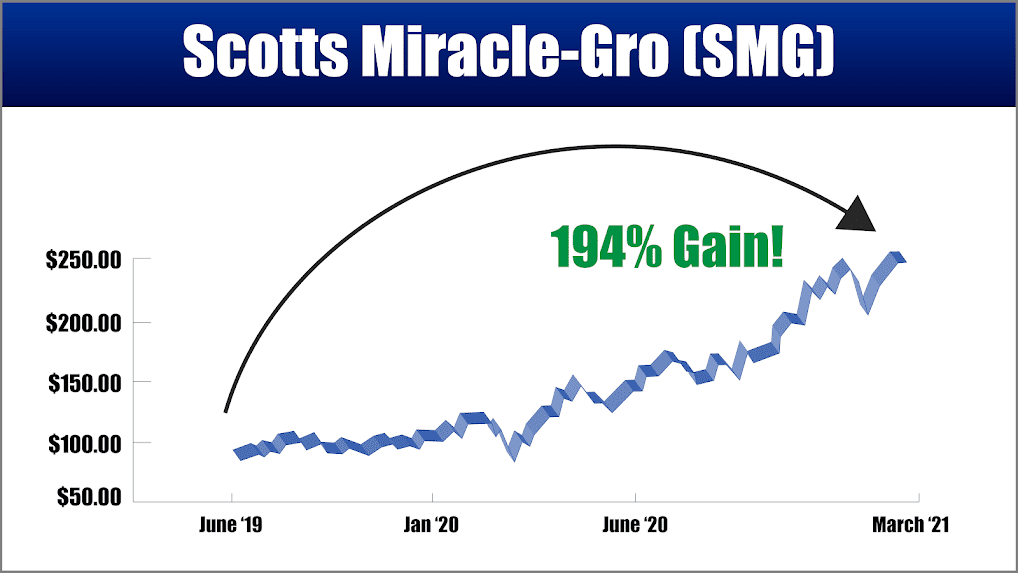

Scotts Miracle Gro: 194% Gain

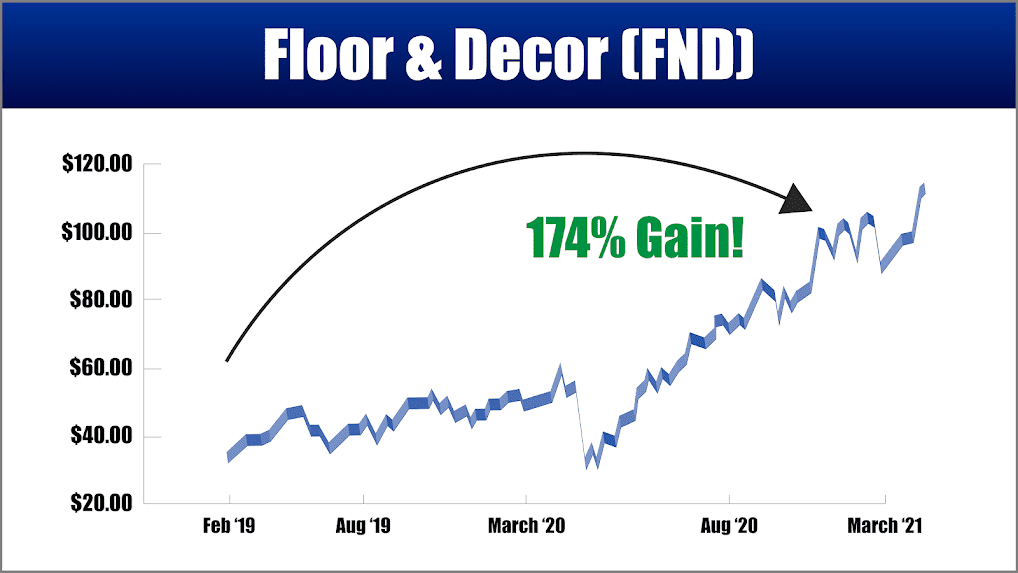

Floor & Décor: 174% Gain

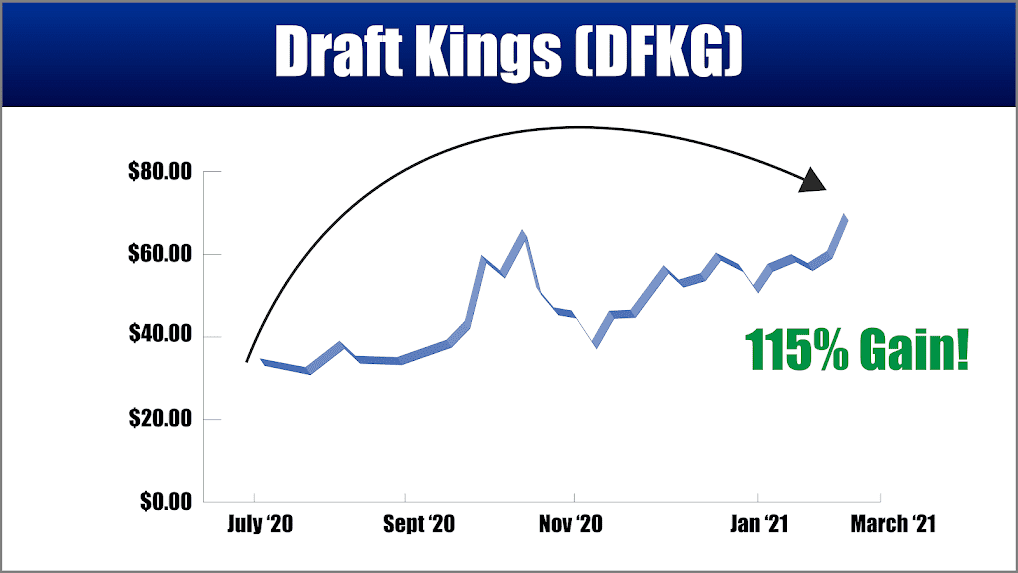

DraftKings: A 115% gain.

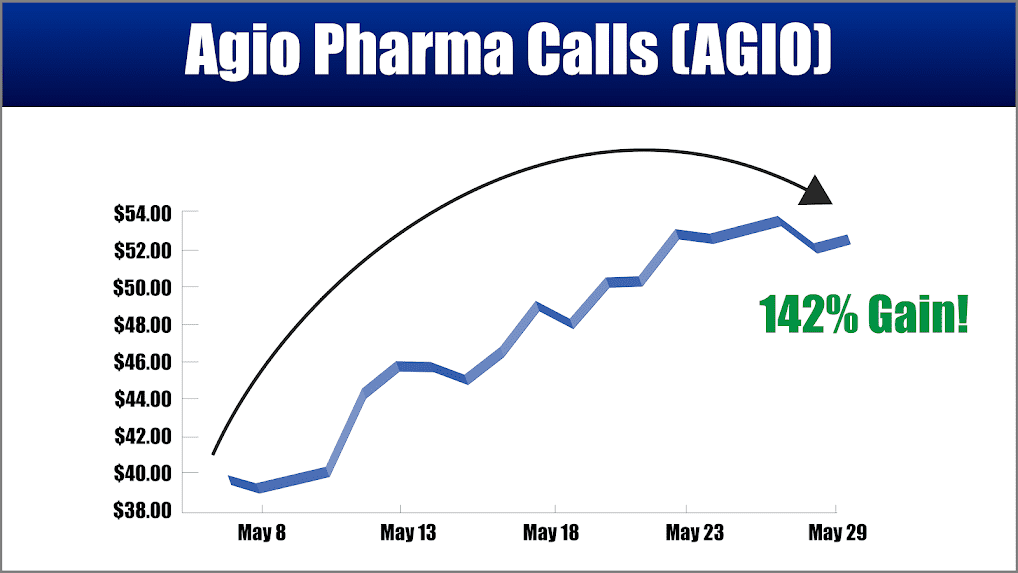

Agio Pharma Calls: 142% Gain

Keep in mind, these aren’t hypothetical examples…

My readers had the opportunity to get into these trades and make a lot of money in a short amount of time.

That’s why I’ve been so grateful to receive such wonderful testimonials…

In a moment, I’ll show you how you can protect your financial security…and put yourself in a position to make money.

Stocks my research shows will be the best picks for the coming turbulence.

Inflation is one of the greatest destroyers of capital. There’s no reason to think this bout of inflation won’t last for some years.

Here’s what I recommend you doing immediately…

Step 1: Sell Stocks in 3 Sectors ASAP

The first thing you must do is check your exposure to inflation-sensitive stocks.

Look into your 401k, IRA and any other retirement accounts you have. If you have any mutual funds, see what you’re invested in. Log into your brokerage account.

I’ve found 3 sectors that would be first to get crushed.

And I’ve come up with a “red flag list.”

Bottom line: there are 128 investments in these sectors you simply must get rid of.

These are the sectors most at risk:

Healthcare, communication services and consumer discretionary.

We don’t have a ton of space to give you the full list. If you’d like a hard copy, I’ll tell you what to do in just a moment.

That brings us to step two…

Step 2: Buy These Sectors Instead

Many investors historically have turned to safe-haven assets such as commodities in times of economic and political turmoil.

One way to gain exposure is by owning companies in the metals and mining industry, which are involved in the exploration, extraction, and sale of metals and other minerals.

These materials are used in a wide range of applications in jewelry making, industry, technology, aviation, aerospace, and more.

Another way is to own stocks in energy firms. They benefit greatly from the rise in oil and gas prices.

Specifically, I’ve found three great opportunities to put yourself in a position to make money right now.

And over the next few years, as traditional stocks get crushed, these can offer great protection.

I put all of these names in a special report for you, titled “The End of Retirement: How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

Inside this report, you’ll learn everything you need to know about this event…

- You’ll have access to my red flag list.

- You’ll learn about the absolute best ways to protect your portfolio

- Plus, you’ll learn about two other ways to boost your wealth as this crisis continues

Remember when I told you that the stock market drops 37% during periods of inflation?

Well, there are a couple of strong exceptions to the rule.

Thanks to a rarely used law, instead of losing value during times of inflation, these investments grow … no matter what!

You’ll find all the details in my report, which you’ll get free of charge.

Before I show you how to get your copy…let me tell you about the third and final step you should take right away….

Step 3: Hunt For Special Situations

And yet – as great as the gains to be had with commodities and energy firms, the best potential may be with special situations that the general public doesn’t know about.

Take laser missiles.

The world today is more dangerous than it’s been at any time since the fall of the Soviet Union.

China is trying to flip the international order, just like Germany did in 1914. And they just formed an alliance with Russia to make it happen.

That’s why the U.S. Navy is putting laser weapons on their ships.

These lasers will give these ships the ability to dazzle or blind enemy drones or become anti-missile defense systems.

If laser weapons were just going into one branch of the military, the opportunity would be massive.

General Dynamics investors turned every $1,000 investment into a $115,000 when the Navy started putting their Tomahawk missiles on all their ships.

But remember, this opportunity is at least four times bigger.

It’s not about developing a weapon for one branch of the military. We need them for all four branches.

- Our Navy ships patrolling the South China Sea are at risk…

- Our Army bases in the Middle East are at risk…

- Our Marine Corp bases in Japan are at risk…

- Allies like South Korea & Japan that have our THAAD missile defense systems are at risk…

We have no choice. We have to be able to defend ourselves.

We have to begin buying weapons like this.

That’s why the U.S. government has made it a top priority. They’ve already budgeted billions of dollars to these weapons.

The implications of this are mind-boggling…

Missile defense systems like the Patriot would become a thing of the past. Future generations would learn about them by reading about them in the history books.

It’s a newer and faster way of fighting war.

And were just at the beginning of this revolution.

And this is just the beginning of what looks to be a very profitable ride for early investors.

A person only gets one opportunity in life to be able to predict the future with such a high degree of certainty.

We know the Pentagon is going to spend billions of dollars developing these weapons…

…and more importantly, we know who they’re spending it with.

It’s just a matter of time before word gets out and Main Street catches on to what’s really happening here.

By the time that happens it’ll be too late.

In other words, you need to prepare for this before your neighbor does.

If your neighbor tells you about it first, it’ll be too late.

The Next Steps You Need to Take

So far, I’ve covered the three steps you need to take right away to plan for this crisis:

Step 1: Check my red-flag list. Make sure you don’t own any of the names on it.

Step 2: Get exposure to precious metal investments that will flourish as inflation stays for two more years out.

Step 3: Buy select defense contractors and American semiconductor stocks…because there will be opportunities to make 4, 5 – even ten times your money or more.

To give you an edge, I’ve put all the details in the special report called “The End of Retirement: How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

This report details everything we discussed and gives you the exact moves you have to make to protect yourself – and put yourself in a position to make money.

I will give it to you for free at the end of this letter.

During the almost thirty years I’ve been doing this, I’ve consistently made a lot of money by being two steps ahead of the crowd.

A few triple-digit winners include:

- American Express which increased 660%

- ChemoCentryx which rose 435%

- FactSet Research which gained 235%

- AutoNation which soared 420%

- And Starbucks which moved up 700%

But here’s the thing…

As remarkable as these gains are…

They don’t compare to what’s in front of us right now.

There will be a number of ways to profit in the coming years. But first we must take steps to protect your financial security.

This is the first step.

Again, my report “The End of Retirement: How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

The report is yours – absolutely free.

The World has Entered a New Cycle of Inflation

I want you to have this report for free because there doesn’t seem to be anyone else preparing you for this.

You see, the world is entering a new cycle of inflation. And it’s the biggest threat to your retirement in 70 years.

And this is the biggest story you’re not being told. It’s the very definition of urgent, and not one Wall Street firm is warning their clients about this.

It’s almost surreal. I feel the same way I did before the housing market crashed.

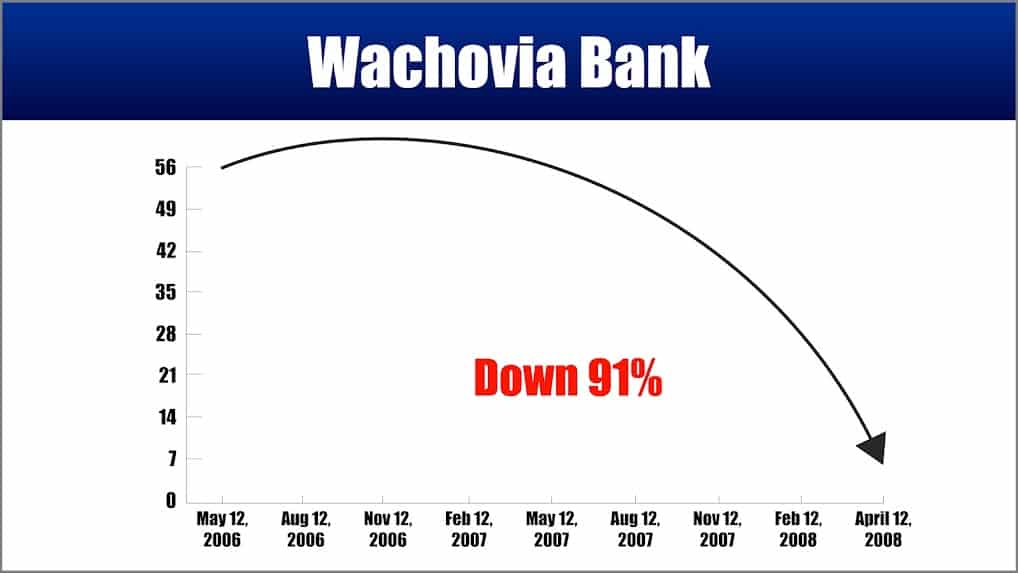

I began warning folks on June 10, 2006, almost two years before the market crashed.

My first target was Wachovia Bank. The stock was selling at $55.82.

Within two years the stock collapsed to $5.54 a share, a loss of over 90%.

And that was just the tip of the iceberg.

On June 9, 2006, I warned customers that the entire stock market was going to drop.

At the time I wrote –

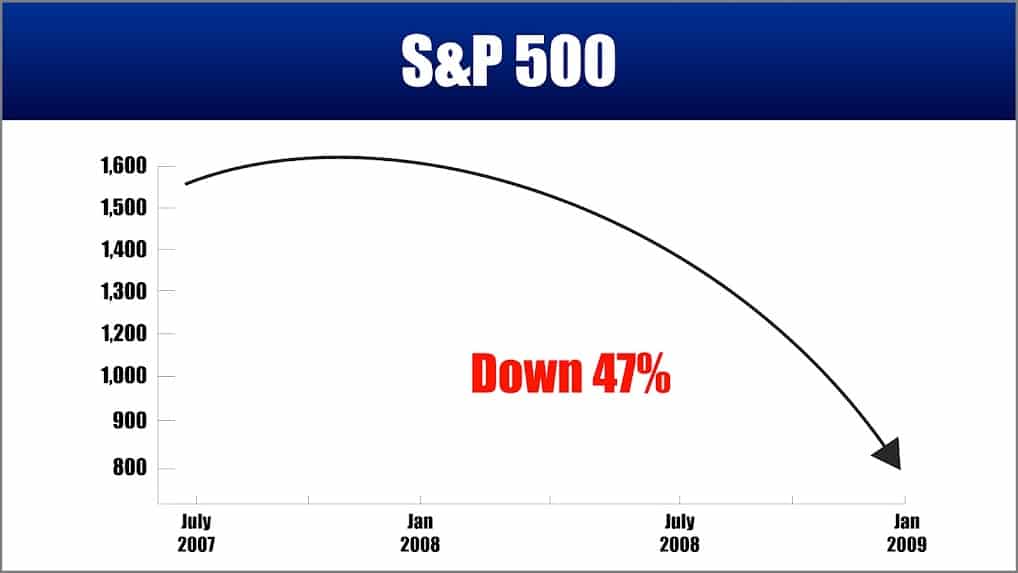

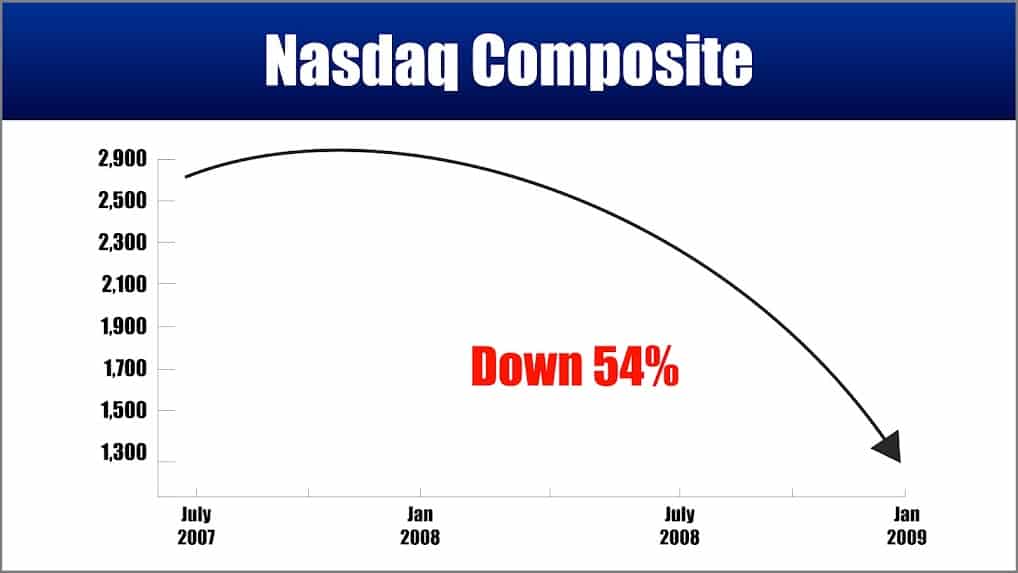

A year later, the Dow Jones Industrial Average began to drop 45%.

The S & P 500 dropped 47%…

And the Nasdaq Composite dropped 54%…

My point is I have a proven history of being ahead of the crowd.

And I haven’t seen one credible source warning you about this. It’s mind-boggling.

That’s why I had to tell this story. In my almost 30 years in the markets, I’ve never seen such a financially dangerous time. And nobody is talking about it!

But what truly makes this opportunity so unique is the urgency behind it.

This is happening right now and in real time.

That’s exactly why I rushed to get you this urgent report, “The End of Retirement: How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

There's One Place on Earth You Can Get This New Report, It's Called…

I’ve put this new report together for members of my exclusive VIP service, Behind the Markets.

We hunt elephants at Behind the Markets, not mice.

The focus of this unique service is simple: we hunt for stocks at the tip of life-changing trends.

Stocks that are so far ahead of their competitors, they can change a market….

Stocks with lower share prices…small market capitalizations…rapidly growing revenue…

Stocks that could potentially put 1,000% gains in your pocket…and change your life.

As soon as you become a member of Behind the Markets, you become part of my “inner circle” – just like my mother – and you’ll get access to every single investment opportunity I discover each month.

As a member of Behind the Markets, you’ll receive:

● Our Brand-new Report “The End of Retirement? How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

This blockbuster 100-page report will outline the exact three steps you need to take right away to plan for this crisis:

Step 1: It includes my red-flag list. This way you can immediately check your 401k, IRA, mutual funds, brokerage accounts to make sure you don’t own any of the stocks most likely to get crushed as inflation continues.

Step 2: It includes my top list of precious metals stocks, which tend to flourish during times of inflation.

Step 3: It includes my top defense contractors and energy stocks …because there will be opportunities to make 4,5 – even ten times your money or more.

● You can expect 1-2 new recommendations from me each month.

Each recommendation will include a 30-page report on the company as well as easy-to-follow instructions for you if you choose to execute the trade.

And since we mostly recommend common stocks, these trades will be easy enough for any beginner to do.

● You will get Sell Alerts for the opportunity to bank maximum profits.

All we need to do is to wait to hear from me, so you’ll know EXACTLY when it’s time to sell and take profits. This way we can avoid riding a stock up only to ride it all the way back down with no gains to show for it.

That’s why I won’t recommend selling a position until the trend is officially over.

● You will have unlimited access to the Behind the Markets member's website.

That’s because all Behind the Markets members will access an exclusive website that you can log into at your convenience.

There you can access all past and present alerts, updates and a few other goodies I discuss below.

This way, you’ll have a 360-degree view of every open position as well as record of all the trades we’ve already closed.

You’ll know to the minute how much money Behind the Markets is making for you.

● You will have VIP concierge service ready to help you FIVE DAYS A WEEK.

We have a fully staffed team of professionals who are here solely to help you get the most of out of this opportunity.

They’re located right here in South Carolina, so you’ll be able to call or email them MON – FRI from 10 AM – 7 PM EST from with any questions you may have about your membership.

But most importantly, once you join Behind the Markets, you get access to yours truly – me.

Like my own family and friends, from now on you’ll know about the big opportunities early, when the rest of the smart money learns about them. By the time the general public starts buying shares, it will be us selling our stock to them.

You’ll also know EXACTLY what to buy or what to sell or what to do if inflation gets out of hand, just like my readers did after the market crashed in 2009.

I want to protect you from what’s coming.

Helping you protect your financial security and achieve immense wealth is my mission.

In short, you get to access a brain that has made millions for myself and for other people during the past three decades.

Which is why I’ve kept the cost of Behind the Markets at the lowest possible level.

However, I am a businessman so I’m not going to make an offer that makes me lose money making this offer to you. That’s why I’m offering you this service for the same amount it costs my business to get this to you.

Just $199.

And frankly, I believe it’s a steal at that price.

“The End of Retirement? How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.” is worth $997!

I’ve put ten years of research and reflection into this report, as well as weeks and weeks writing it.

But more importantly, while we wait for these events to unfold, I’ll give you opportunities to make money that you’ve never even imagined before.

I don’t know about you, but I’ve been around long enough to know how rare that is.

Look: As I mentioned earlier, this is about feeding more than my wallet. It’s about feeding my soul. And the best way for me to do that is to help as many people as I can.

And I grew up on welfare and food stamps. So I will never forget the value of a dollar.

Introductory Offer

So, to make it as easy as possible for you to join here’s what I’ll do…

We’ve lowered the price of Behind the Markets for the first 1,000 people who respond today to just $39.

That comes out to ten cents a day.

That’s means I’m going to lose $160 on each and every order. The plan is that you get so much out of Behind the Markets that you stay a loyal customer forever.

And finally, just to prove how confident I am, let me remove any last shred of doubt about this investment.

Try Behind the Markets free for 30 days. Take the month to review the service. Profit from as many of the open positions as you can.

If I do not meet or exceed your expectations, just call customer service and you’ll get a 100% full refund. No questions asked.

PLUS, you can keep the free report you get today.

Join me while we navigate this crisis.

Sign up for Behind the Markets and let me share with you what it is I do best each month, just like I do with my friends and family.

I promise you to do my best to honor the name of this service by taking you behind the daily markets and showing you profit opportunities before the rest of the world finds out about them.

Thank you so much for viewing this important presentation.

I sincerely hope you’ll take me up on this offer.

I’m confident you’ll look back one day and think that joining Behind the Markets was one of the best financial moves you ever made.

But there’s something else I want to pass on to you.

Something that may prove to as valuable to you as any profitable trade we make together:

Your Free Bonus Report #1:

“Hypersonic Missiles: The Small Defense Contractor Quietly Revolutionizing Warfare.”

Value: $297

This report details how a small defense contractor is using hypersonic missiles to give the United States and our allies the edge against Russia and China.

I will give it to you for free at the end of this letter.

Again, the Hypersonic Glide Missile revolution is in its infancy. Most people I talk to have never even heard of it – yet.

You’ll learn the name of the company, its stock symbol and why its new weapons are so revolutionary.

Just this report alone gives you the chance to earn life-changing profits.

Your Free Bonus Report #2:

Income Collapse: How to Buck the Trend and Boost Your Monthly Income with New Investments

Value: $179

As inflation rears its ugly head, you’re going to need better ways to boost your income.

That’s why we wrote this report.

It shows you EXACTLY how you can begin doubling your monthly income – using a secret system to find SAFE alternative notes with target returns of 10% – 15% per year.

(Most brokers won’t share this income strategy with you. But you can learn all about it in this NEW report.)

Your Free Bonus Report #3:

Herbert Royalties: How to Collect Entertainment Royalties While You Sleep

Value: $199

Collecting royalties while doing nothing has to be one of the best – and easiest – ways to get rich.

It used to be that only the rich and famous were able to collect these royalties. People like Stephen King, Michael Jordan or Bill Gates.

But what might shock you is that now there IS a way for anybody to tap into a pool of growing royalties…wealth that piles up by itself…that, ultimately, could be worth more than the entire Beatles catalog, all the commercial rights to “Happy Birthday,” and the total value of the Rolling Stones catalog…combined.

And the best part? This brand-new report will show you how to get your piece of this royalty bonanza in less than five minutes.

Let Me Quickly Recap What You Can Expect From Behind the Markets

1. My Best New Recommendation Every Month: You’ll get the benefit of the best investment experience money can buy in 12 monthly issues of Behind the Markets – e-mailed directly to your inbox. Once you get the email, simply call your broker or place your trade online. Value: $199

2. FREE REPORT: “The End of Retirement? How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”– You’ll get this invaluable free bonus report right away, as soon as you join. Even if you cancel, it’s yours to keep! Value: $997

3. 3 ADDITIONAL FREE Bonus Reports: You’ll get an extra 3 FREE bonus reports right away, as soon as you join. Even if you cancel, they are yours to keep! Value: $675

4. 30-DAY 100% Money-Back Guarantee: Because I want you to profit from my advice without fear and without hesitation, I’m backing up my claims with an unconditional guarantee: Try Behind the Markets risk free. If you don’t like the service in the first 30 days for any reason whatsoever, every dime you paid toward your membership will be returned to you. The report is yours to keep.

Total Value: $1,871!

All available for the low price today of just $39.

You Owe it to Your Family to Act

That’s because inflation is the greatest risk to your wealth in more than 70 years ….and I want you to be among the few who have the opportunity to make the kind of money that can change the way you live your life.

And it starts with the special report titled, “The End of Retirement? How to Protect Yourself from the Greatest Crisis Facing Retirees in 70 Years.”

Those who act now could see their wealth protected for generations.

Those who don’t act now could suffer greatly.

I hope you seriously consider this offer.

I believe in my heart of hearts it will be one of the best financial moves you ever make.

To get started, simply click the link below, which will take you to a secure order form.

Your order will be processed immediately, and you’ll have access to this urgent report in a matter of minutes.

I look forward to having you on board.

“The Buck Stops Here,”