A small but significant percentage of the clients of US bank Goldman Sachs say that Bitcoin would cross the six-figure mark in the coming years, the bank said in a report released Thursday.

Why Goldman clients like Bitcoin

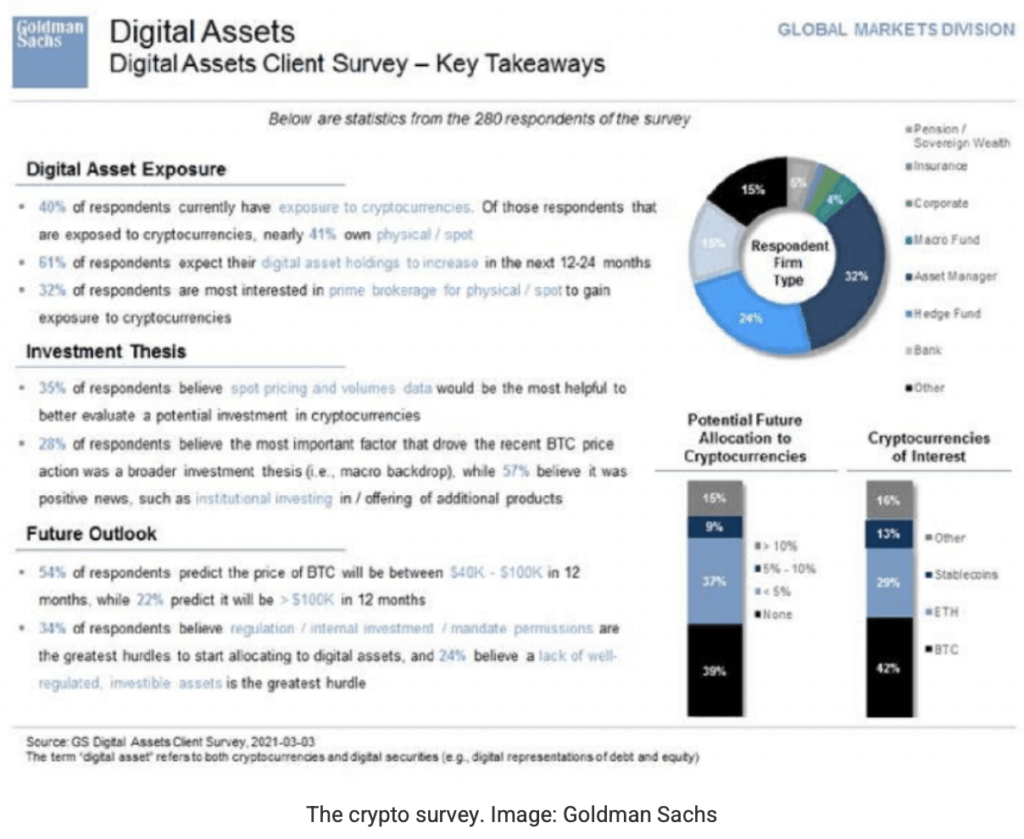

From the 280 respondents of a survey titled “GS Digital Assets Client Survey,” the bank found that over 22% of its client felt Bitcoin would cross the $100,000 mark in the next 12 months while a majority (54%) said it would trade between the $40,000-$100,000 level.

42% of the respondents were invested in Bitcoin while 29% held Ethereum. 16% said they held ‘other’ altcoins, and the remaining were exposed to stablecoins.

40% of all respondents, in addition, said they were exposed to the crypto market, mainly via derivatives, and just 41% of those respondents via “spot” holdings, while 61% said they felt their crypto holdings would rise in the next 12-24 months.

In terms of the investment thesis, 28% of all respondents said the global macro backdrop led to the recent run of Bitcoin while an overwhelming 57% said that institutional adoption and Bitcoin products were the cause, as they led to greater trust in the asset.

[Breakthrough: Small Blockchain Companies Addressing Major Needs are Set to Soar]

Move comes as desk launched

Goldman has, so far, largely maintained its distance from Bitcoin and other cryptocurrencies. Last year, the bank’s former CEO, Lloyd Blankfein, stated that the asset was a highly risky bet and that he would be hyperventilating” at the recent ‘success of Bitcoin.’

But the bank’s opinion seems to have changed with high Bitcoin prices. Goldman (re)started its trading desk last week for institutional clients citing “high demand”—two years after initially offering and quickly closing down the service in 2018.

The desk would trade Bitcoin futures and non-deliverable forwards for clients from next week, a person familiar with the matter said earlier this week, adding that Goldman was also exploring the potential for a Bitcoin exchange-traded fund (ETF).

It’s not like the road ahead is fully clear for Bitcoin, however. 34% of the survey takers feared government regulations and mandates are the biggest “obstacles” to Bitcoin’s growth, while 24% said that the lack of a well-regulated, accessible, and investible instrument would be the greatest hurdle for Bitcoin in the coming months.

[Prediction: Over the next 12-24 months, these 4 altcoins will blow past the coveted 1,000% Mark]