There’s $2 trillion in cash headed straight into the US economy, and today we’re going to grab a share, both in the form of price gains and dividends.

I’m talking about the latest stimulus plan that’s made its way through the House of Representatives.

While plenty of folks fret over the rise in public debt this $1.9-trillion plan brings—and that’s a real concern—it’s a problem for another day. The cash is needed to get the economy through to the other side of the current crisis.

And pretty well all of this package is set to get spent through direct payouts to people and organizations that will spend it, with the headline item being $1,400 in stimulus checks (or about $1.1 trillion in all) going to taxpayers. There’s also $400 billion headed to businesses and $400 billion going to healthcare, part of which will be used to speed up vaccine distribution, helping get us back to normal sooner.

There are three sectors of the market that are best positioned to grab this coming wave of spending, and all are still underappreciated by mainstream investors.

[Exclusive: The Clock Just Started on the Biggest Stock Market Event in Twenty Years]

Stimulus Winner No. 1: Banks

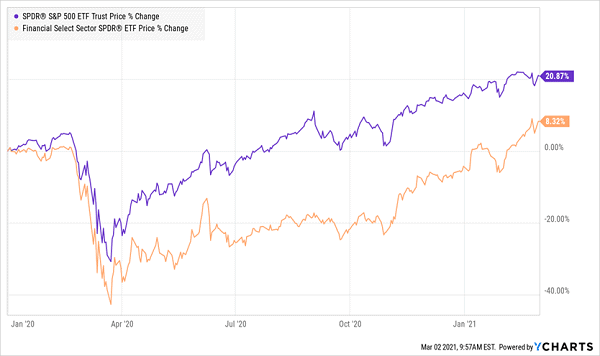

Throughout the pandemic, banks have been forced to keep up their reserve capital just in case a deluge of defaults and bankruptcies hit them as a result of lockdowns, social distancing and consumers’ lack of confidence. That’s why the financial sector, shown below by the Financial Select Sector SPDR ETF (XLF), is barely up from the start of 2020.

Finance Stocks Are Still Attractive

If the stimulus package is successful in getting us back to normal faster, banks will be able to deploy all of their reserve capital faster and have fewer bankruptcies to worry about.

Also helping banks’ balance sheets is the $400 billion set to go to businesses, helping stave off more bankruptcies and defaults. Investors are just now waking up to this, as you can see in the recent pop in XLF above, but finance stocks, and XLF, still have plenty of room to run.

[Alert: Rare convergence of 3 economic triggers is about to set off a buying frenzy in tech stocks]

Stimulus Winner No. 2: Retailers

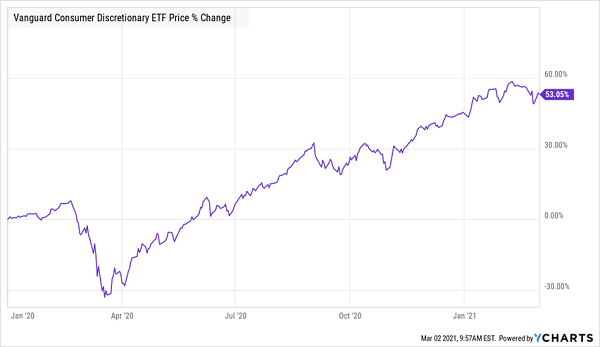

Another big winner is the retail sector, with those $1,400 checks likely to be spent on a variety of consumable items, which is why the Vanguard Consumer ETF (VCR) and its constituents, like Nike (NKE), Starbucks (SBUX) and Target (TGT), look set to run higher from here.

This is why VCR is now a more desirable fund to pick up for the Biden stimulus effect than the SPDR S&P Retail ETF (XRT), which got way overbought in recent weeks.

VCR Still Undervalued, Despite Big Rise

While VCR’s 53% return since the start of 2020 sounds like a lot, remember that there is still a lot of pent-up demand for the goods and services provided by the companies in the fund’s portfolio. One of its biggest holdings, Booking.com (BKNG), is perfectly positioned to see strong earnings growth in the second half of 2021, which is likely to drive this fund up further.

Stimulus Winner No. 3: Municipal Bonds

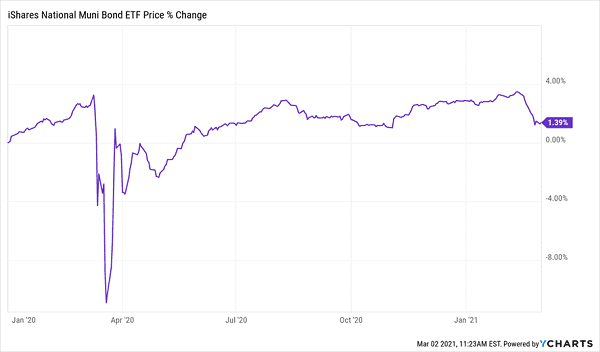

The third group set to benefit from the stimulus is one of the most overlooked: municipalities, which have been struggling due to a lack of revenue from hard-hit taxpayers. The stimulus is a bandage that will help municipalities for the next few months.

But that’s not the only way municipal bonds, or “munis,” win. Keep in mind that hospitals can, and often do, issue municipal bonds, and hospitals are one beneficiary of the stimulus package (namely the $400 billion earmarked for healthcare). This will help make their bonds even safer.

Munis Underperform Despite Their Positive Outlook

Obviously, their lower risk and tax-free dividends are two reasons why muni bonds, shown above by the performance of the iShares Municipal Bond ETF (MUB), tend to underperform the broader S&P 500 over the long term. But less than 2% price gains in a bit more than a year is low even for munis, which is why this corner of the market is way underpriced and very ready for some long-overdue gains.

[Exclusive: The Clock Just Started on the Biggest Stock Market Event in Twenty Years]