50-year Wall Street Legend issues severe stock warning:

“A New Wave of Crashes Will Rock the US Stock Market”

We're about to witness a historic stock market shakeup that could soon create devastating losses for some investors – see what's coming and how you need to prepare immediately.

Hi, my name is Amy Gamper.

I’m here at the request of analyst… innovator… and Wall Street legend, Marc Chaikin.

He’s stepping forward today to issue a dire warning. One that could be the deciding factor in what you’re able to achieve financially in the coming months.

To our knowledge, he’s the only person sharing this warning with regular people.

That’s because the data he’s sharing today has historically been off-limits to everyday Americans, who will likely be impacted most by what’s unfolding…

Marc has been one of the most influential contributors to financial strategy and technology in the last 50 years of stock market history.

Before Robinhood… Morningstar… or even Bloomberg…

Marc worked with some of the most famous hedge funds on Wall Street – ultimately designing and building a proprietary stock-ranking system that is still used by hundreds of banks, hedge funds, and brokerages to this day.

He invented the “The Chaikin Money Flow Indicator,” which is featured on every Bloomberg and Reuter’s terminal on the planet.

In fact, if you’ve ever used an online broker to manage your money, you’ve likely already benefitted from Marc’s work without even knowing it.

You may also be one of the more than 1 million people across 148 countries who follow his repeatedly accurate market analysis and predictions.

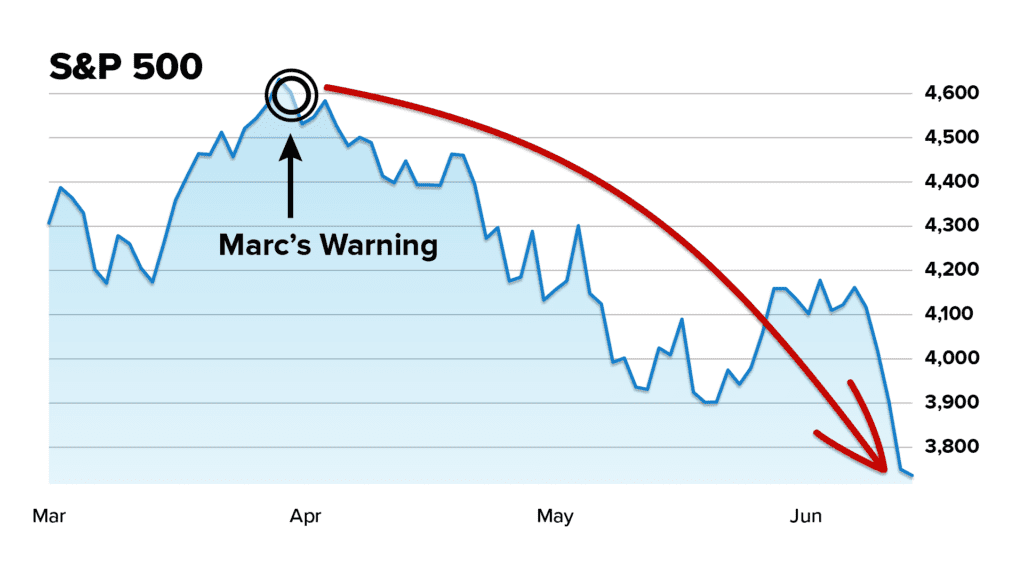

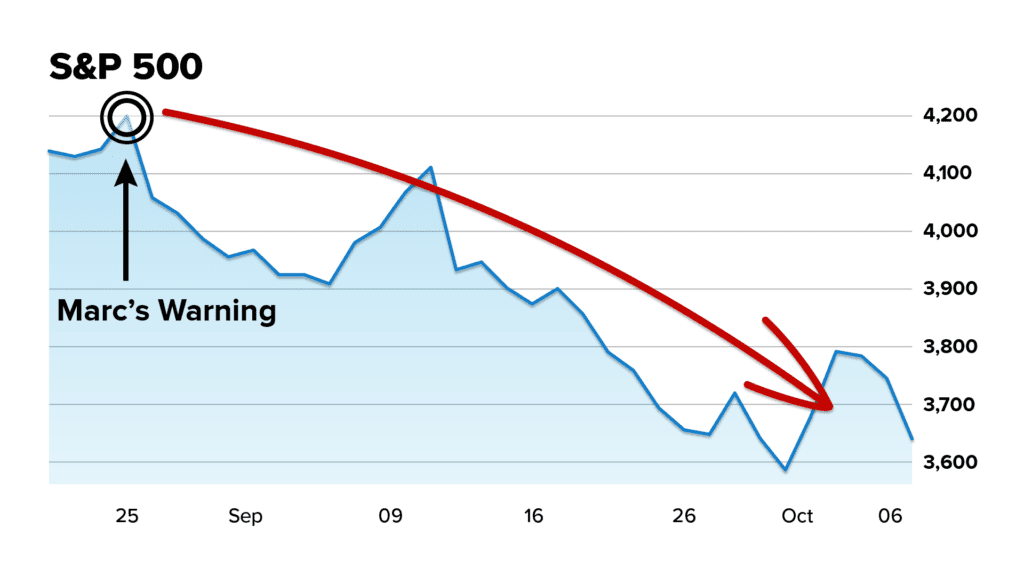

In fact, the software Marc designed and built to predict the future behavior of stocks – accurately predicted nearly every twist and turn in U.S. stocks in 2022.

Including the selloffs in both May and September – both weeks in advance.

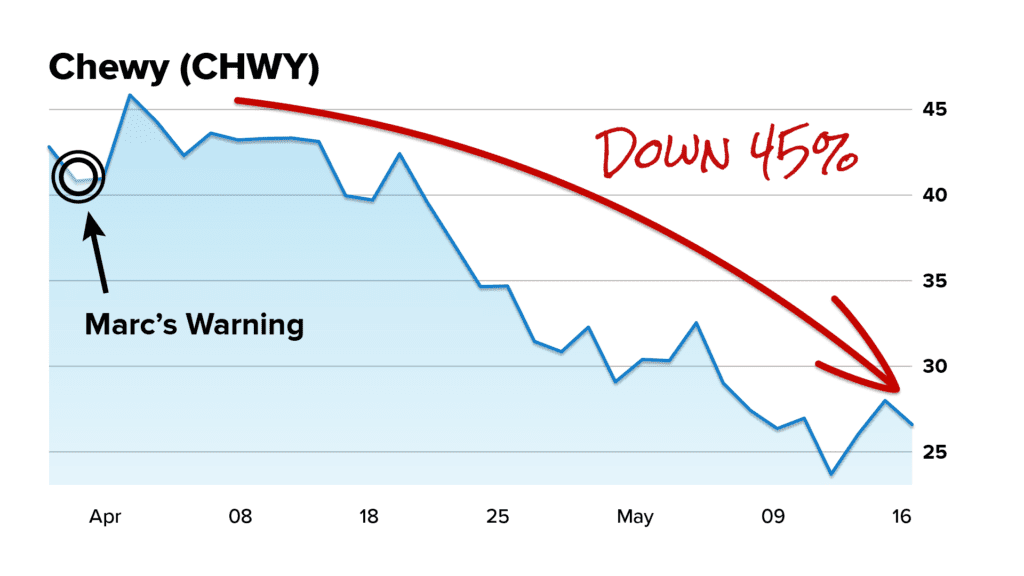

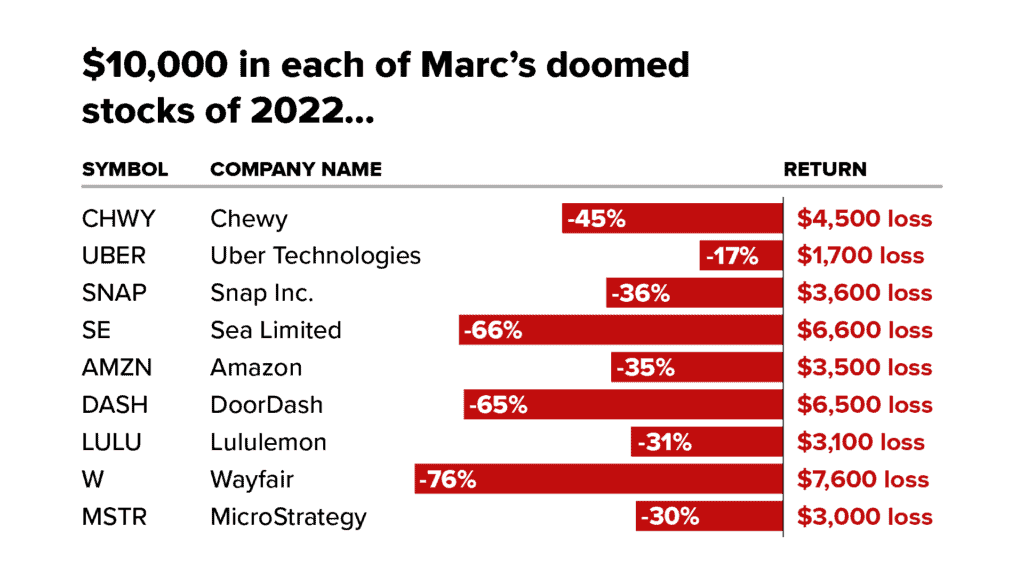

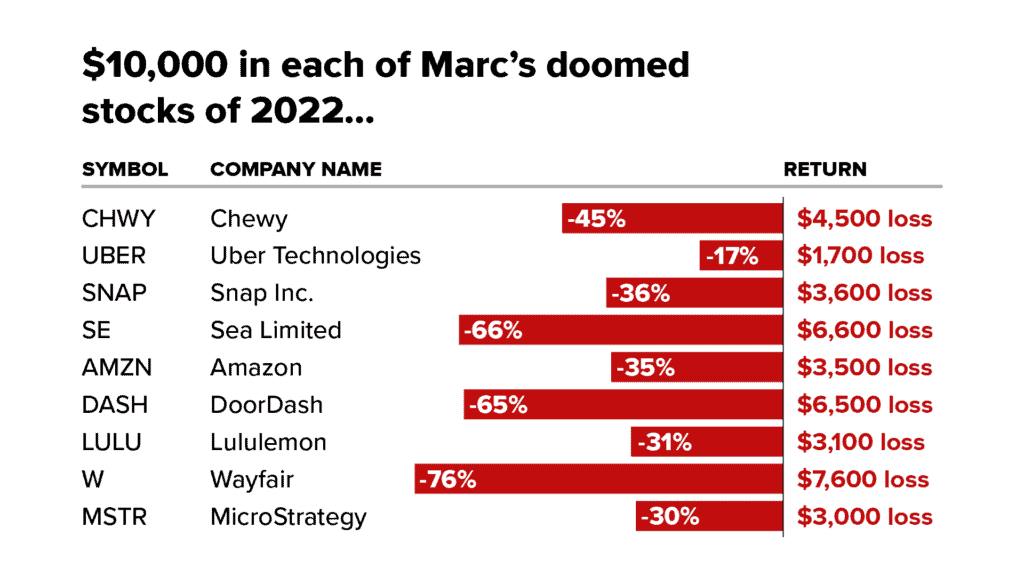

And, each of the NINE individual stocks he issued formal warnings for went on to fall in price.

Like beloved pet brand, Chewy, which collapsed more than 45% after Marc sounded the alarm.

Tech company Sea Limited, which plunged 66%.

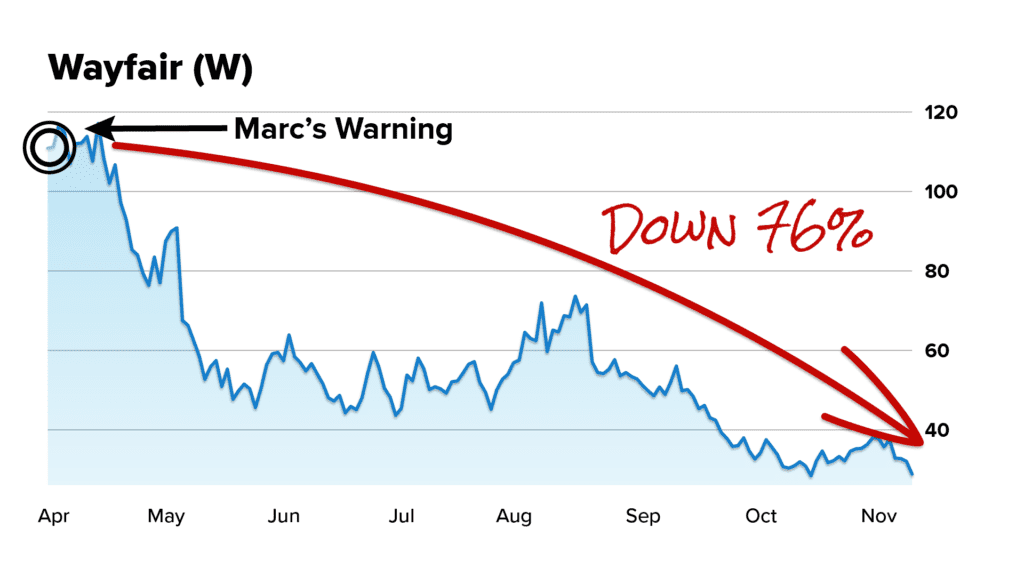

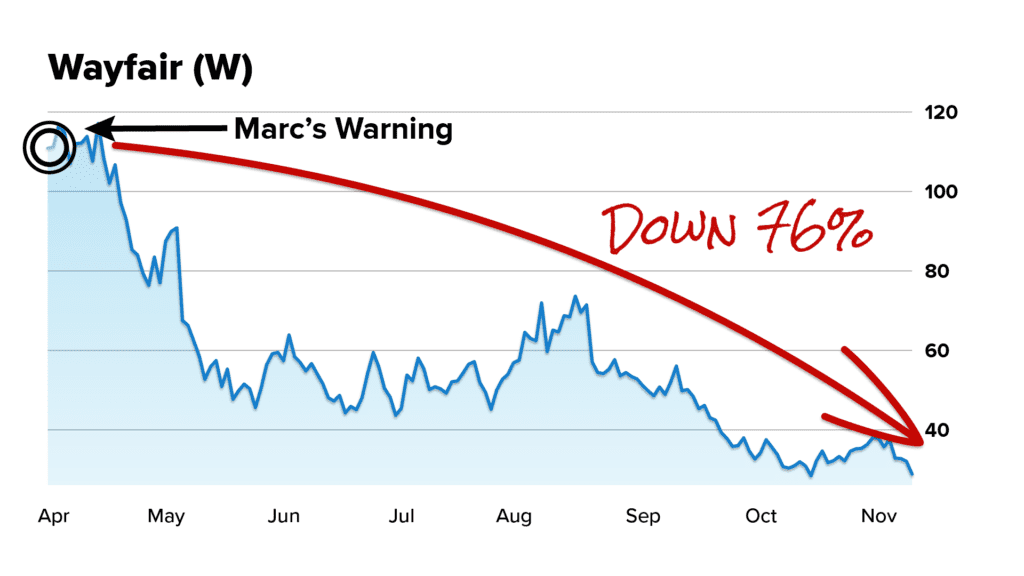

And Wayfair, which plummeted over 76% after Marc’s warning.

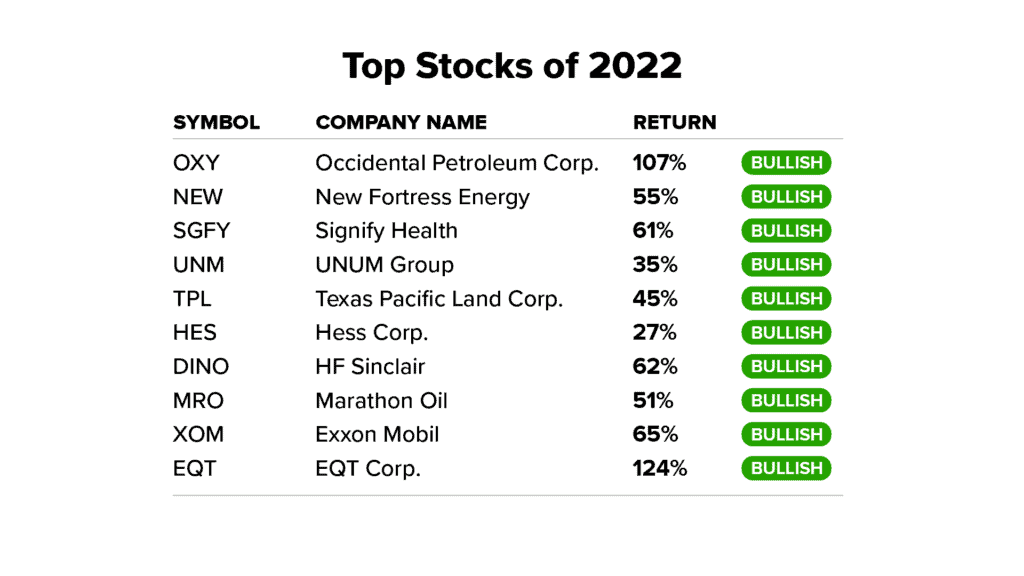

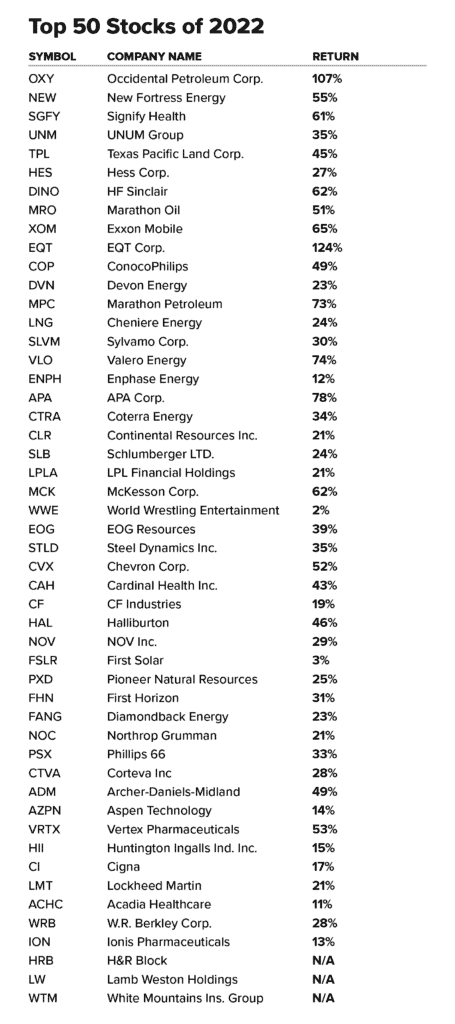

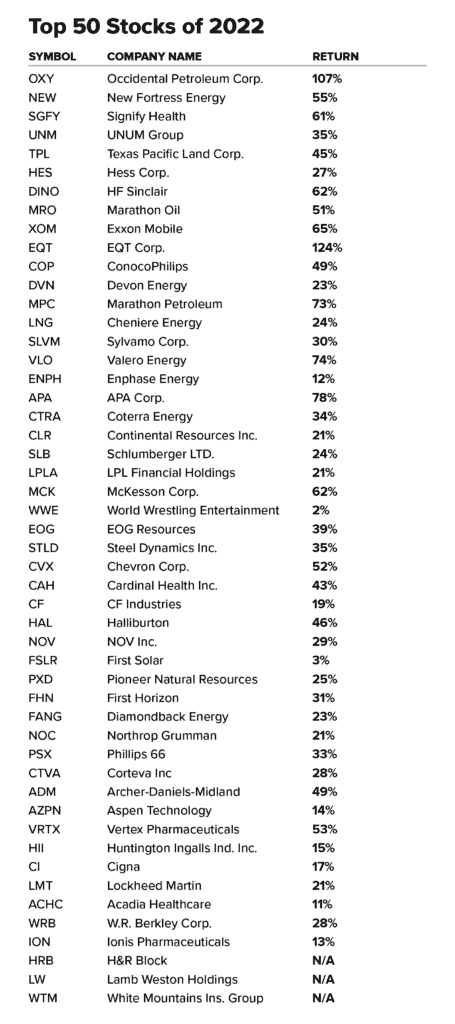

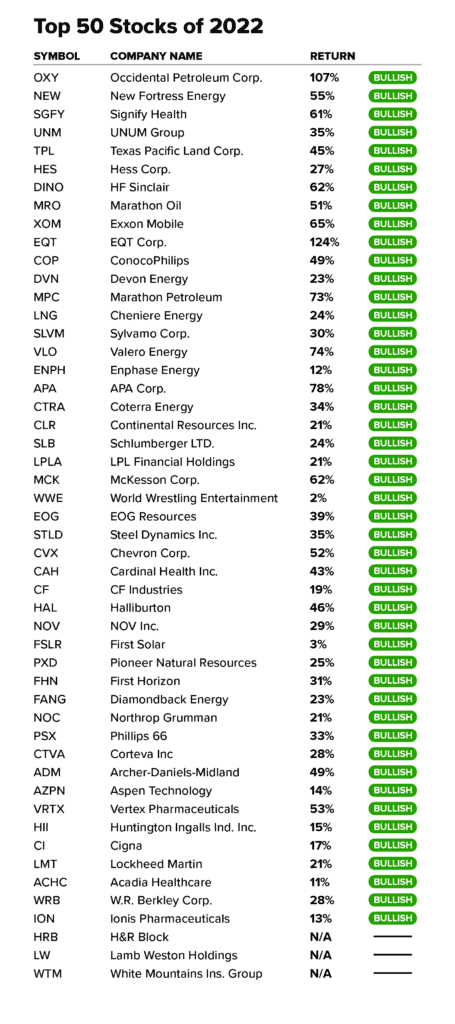

Meanwhile, his software also signaled BUY on all 10 of the top-ten best-performing stocks of 2022:

Can you imagine the impact that these gains could have had on your finances – during a year when American investors LOST $9 trillion in the stock market?

With results like these, it’s no surprise that you may recognize Marc from his countless appearances on Fox Business or CNBC over the years.

However you got to us today – we’re glad you’re here.

Because as Marc will soon explain, a major financial shakeup is playing out in U.S. stocks.

As a result, he says, in as little as 90 days, the market will look very different than it does right now.

And it will likely affect every decision you make with your money from this point forward.

Marc is joining me today to tell you about it.

Marc's Agenda

- The real reason stocks are swinging wildly right now

- Where the market is headed next

- The simple step to take right now to get ready

- FREE BONUS:

Marc's #1 stock to buy and #1 stock to avoid

You’ll walk away knowing exactly what’s going on… what to expect in the U.S. stock market in the next 90 days as a result… and the concrete steps to take right now with your money, to place your portfolio in the best possible position.

Along the way, he’ll give you the name and ticker of a stock that could soon dominate financial news headlines.

Remember Doordash’s sudden and disastrous crash in 2022? Not only did Marc predict that… but he says what’s coming for this next company could be even worse.

It's the #1 stock to avoid right now… and there's a good chance you own it.

I'm excited to get started. And to have you here, Marc

MARC:

Hi Amy, it’s good to be here. And thanks for helping me break my story. I think we’re reaching folks just in time.

Investors are scared right now… there is a lot of uncertainty in the markets… and I wanted a chance to explain what’s really going on.

AMY:

Great, well, to that point, I’m going to hand the mic to you, Marc, with a very simple question – what the heck is going on with U.S. stocks right now?

MARC:

Well, Amy, this is bound to ruffle some feathers.

But I can’t ignore what my software is telling me right now.

It’s a pattern I haven’t seen in years, and it could have disastrous implications if you ignore it.

Which is why the actions you take in the next 90 days could either save or doom your wealth.

It all comes down to a massive market shakeup, that is already sending shockwaves through U.S. stocks.

And investors have no idea what to make of it.

Since the COVID crash in 2020, the blueprint for investing has been pretty simple.

Everything from tiny microcaps you’ve never heard of… to big household names went up, up, and up.

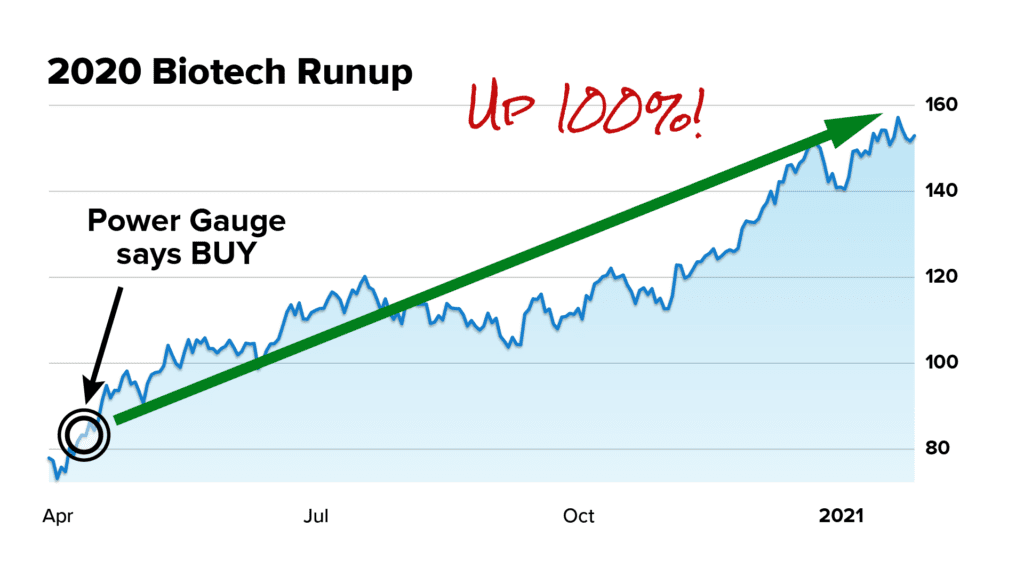

In fact, the investment software I invented after over 50 years on Wall Street has been lighting up with these opportunities since April 2020.

So we’ve been able to predict and play this pretty perfectly.

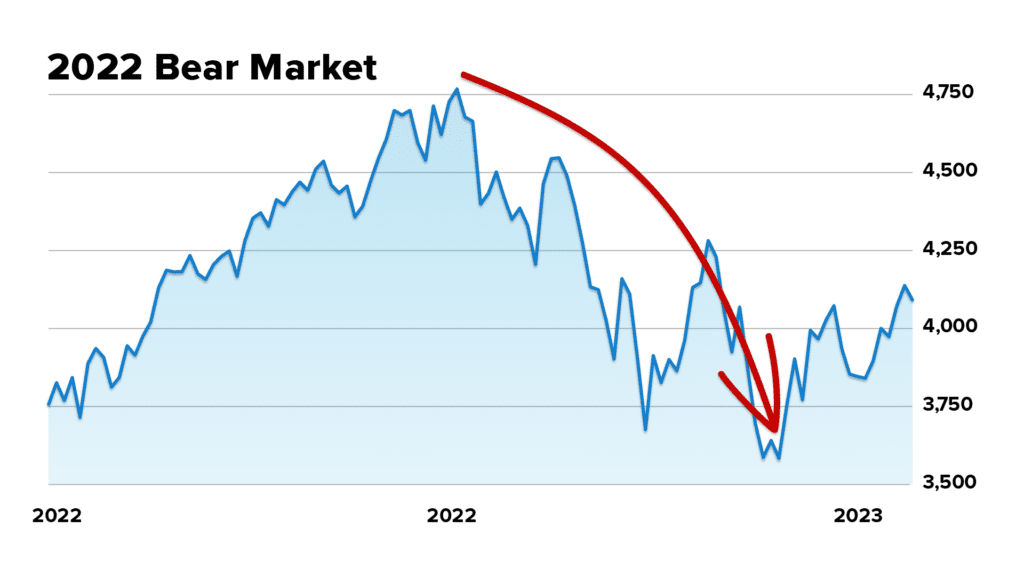

But then… 2022 hit.

Bringing with it geopolitical tension… sky-high prices… and rising interest rates.

That relatively smooth ride to all-time highs came to a stop.

And ushered in the worst year for U.S. stocks since 2008.

My software saw how to avoid the fallout. More on that in a minute.

My point is, until 2022, as long as you had money in the markets, you were doing everything right.

AMY:

Now things have changed.

MARC:

Yes – and can’t you sense it? Doesn’t it worry you?

Investors haven’t been this scared about stocks since the early months of the pandemic. And they have good reason to be scared.

We saw a fast, breathtaking recovery after the 2020 crash. It was the fastest bear market in history.

You could have recovered your losses in a matter of weeks.

This time… the losses lingered…

…As a result, plenty of financial minds – even people I respect – are calling for a devastating crash this year.

A 50 to 60% decimation of wealth. 2008 territory.

But that’s actually NOT why I’m here today.

There’s a different financial story no one’s telling right now that’s keeping me up at night.

I can see it in a way that most everyday investors can’t, because my software is picking up on it.

And it’s showing me an extreme setup I haven’t seen in years – since well before the 2020 crash.

You need to understand this, and prepare for what’s coming, as soon as possible.

Because what was once an easy ride with a clear investing roadmap has gotten much harder to read.

And I’m worried millions of American investors are about to drive straight off a cliff.

They’ll make every investing mistake in the book – including missing out on one of the biggest wealth-building opportunities in recent history.

That’s why I’m here today.

To tell you that your suspicions are correct: On both a fundamental and technical level, the U.S. stock market is a wildly different animal than it was even just three months ago.

And it’s time to pull over, take your hands off the wheel, and see what’s really going on.

Because there’s a big shift coming in the next 90 days.

AMY:

But you’re saying you’re not calling for a massive crash today?

MARC:

No. I’m not.

Because the next great market crash isn’t just around the corner. It isn’t starting today or tomorrow.

It’s already here.

And when it comes to your financial playbook for the next 90 days, this changes everything.

AMY:

Is this you sounding the alarm that it’s time for everyone watching to sell all their stocks?

MARC:

If there’s one thing you take away from today, let it be this:

Now is NOT the time to pull out of the markets entirely and run for the hills.

If you do that, you’ll likely lose money.

While a full-blown stock market crash is already playing out, it’s NOT what you may typically expect when you hear the term “stock market crash.”

You see, before the big selloff… before inflation hit record highs… and the Fed started hiking interest rates…

A very specific and little-known type of market crash was already ravaging our stock market.

I’m here to prove it to you. And more importantly, show you what happens next.

AMY:

Okay, will you tell us about this different kind of crash?

MARC:

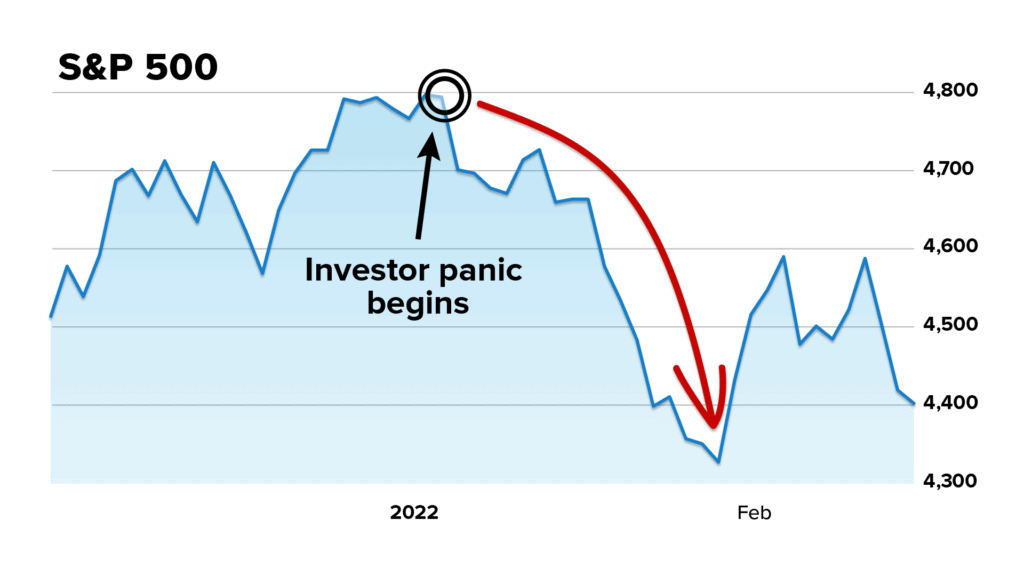

Well, most people – regular investors – started worrying about a crash in the beginning of 2022.

It makes sense. Folks typically start to panic when the overall market falters.

But that’s just not the way I see the market… and not the way most professional investors see the market.

This isn’t a story I’ve told…

But since the day I started at the brokerage firm Shearson Hammil on October 7, 1966, I learned to completely dismiss the idea that the stock market is one big entity that’s either up, or down.

That’s how most regular investors and the mainstream financial media think and talk about the market.

And that’s why we see such joy or panic when “the market” is having a good or bad day, week, or month.

But I, along with the thousands of financial advisors and high net-worth investors who have followed my work for the past decade, know the stock market isn’t just one big thing.

It’s actually 11 different, smaller things.

11 different sectors that are all connected – and unconnected – in specific ways.

11 Key Sectors of the Market

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Information Technology

- Materials

- Real Estate

- Utilities

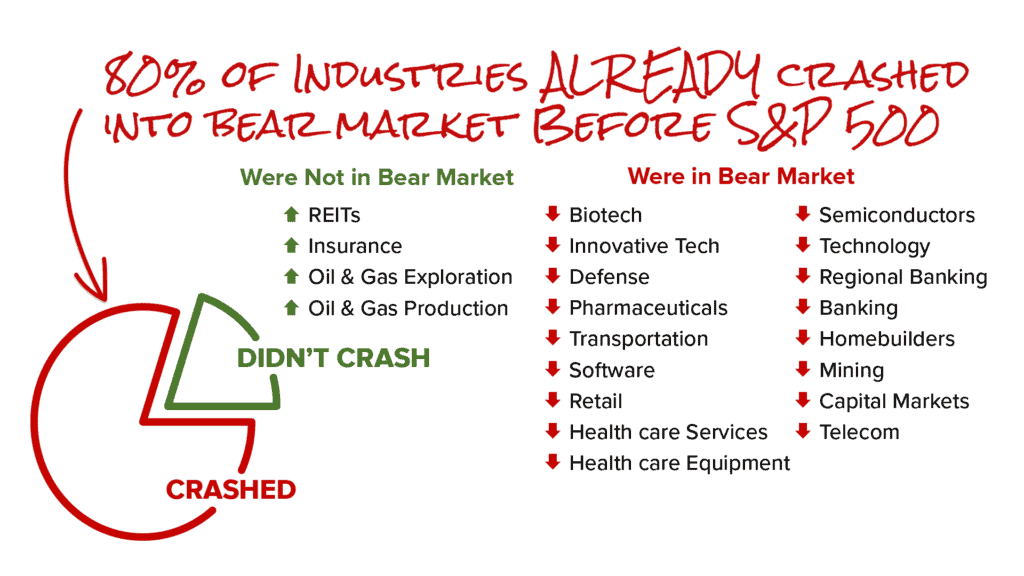

Within those 11 sectors… there are things called industry groups.

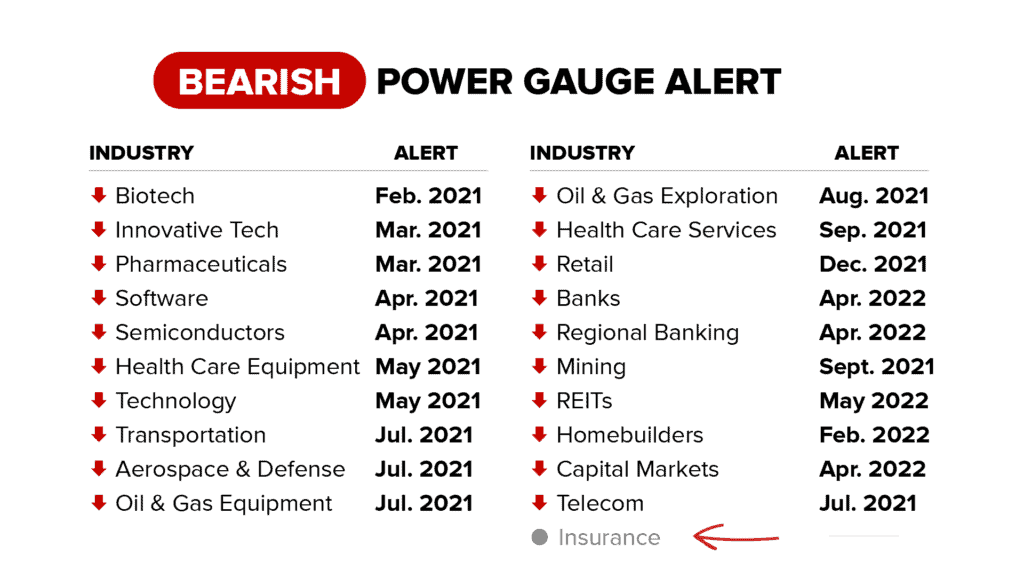

There’s 21 of them in total that we monitor. You can see them listed on your screen now… things like Banks… Biotech and Telecom…

21 Industry Groups of the Market

- Banks

- Insurance

- Regional Banking

- Mining

- Oil & Gas Exploration & Production

- Oil & Gas Equipment & Services

- REITs

- Software & Services

- Homebuilders

- Pharmaceuticals

- Technology

- Health Care Services

- Aerospace & Defence

- Transportation

- Capital Markets

- Semiconductors

- Biotech

- Health Care Equipment

- Innovative Technology

- Retail

- Telecom

Now, you can immediately see why most regular investors just completely ignore this.

It’s a lot to study and remember.

Most people buy a stock with no clue which sector or industry group it’s in.

They’re more focused on things like earnings… growth… etcetera.

But this is actually a big mistake.

AMY:

I mean, I get it. Who has the time and energy to study 11 sectors and 21 industries…

MARC:

Well, you actually don’t have to! Listen, you don’t need to memorize a name from that list of industries. Tune all of that out.

This is what you need to know. It might actually be the most important lesson I ever learned on Wall Street.

Studies have shown that 50% of a stock’s performance can be attributed to its industry.

50%.

That means choosing the right industry is literally half the battle when deciding what to buy… and what not to buy.

This is what directed all of my buying and selling decisions while I was on Wall Street.

Whoever could see the biggest threats and opportunities in the market first… and correctly determine how they would ripple through specific industries… had a huge advantage.

This is how George Soros looked at the market when I worked with him.

He passed it down to the great Stanley Druckenmiller, who worked with Soros before starting his own hedge fund.

Even Bill Gross, the former manager of the biggest bond fund in the world, uses this approach.

And this is how the biggest modern hedge funds work.

Like Citadel, which was the second best-performing hedge fund of 2022, in spite of the bear market.

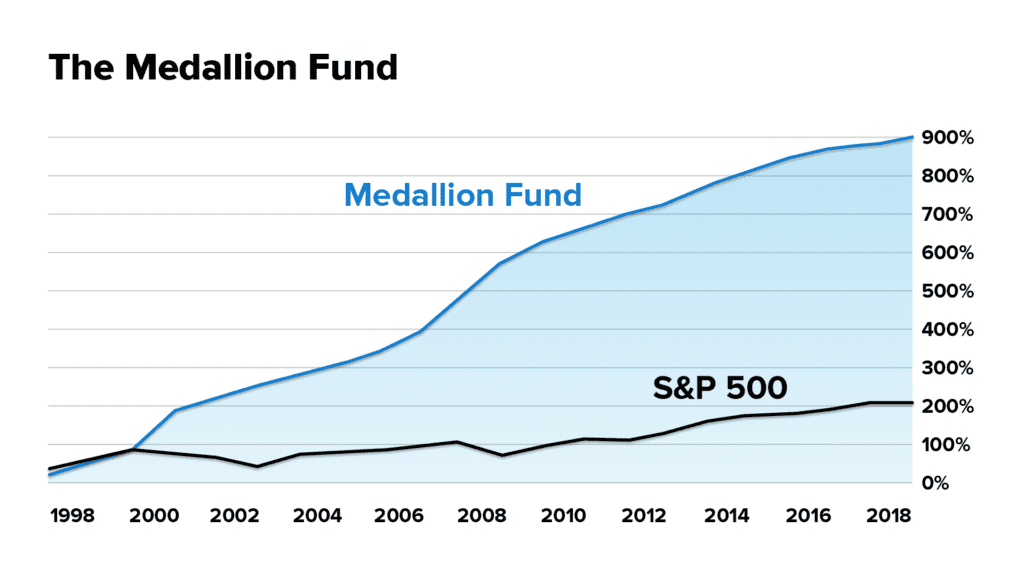

The Medallion fund does this too…

And it is one of the most successful funds of all time. If not the most successful.

It’s returned 66% annually since 1998 – delivering nearly 7 times better returns than the overall market.

What’s Medallion’s secret?

They don’t pay attention to specific stock stories.

Instead they search for elusive patterns… across sectors and industries…. that regular investors simply cannot see.

Medallion’s pretty open about this secret to their success. But if you’re interested, you can confirm these figures, and all of the research I’m sharing with you today on our details and disclosures page, linked below.

My point is: This is how I learned to invest, and how I manage my own investments, to this day.

For the most part, I don’t worry too much about the overall market.

I almost exclusively track industries.

And like the Medallion fund, it allows me to see patterns and catalysts that everyone is completely missing.

AMY:

Like a very different kind of market crash?

MARC:

Exactly.

Most people are looking at the stock market right now, and worrying about a devastating market crash.

But if you’re looking at the market like I do, like a hedge fund manager would…

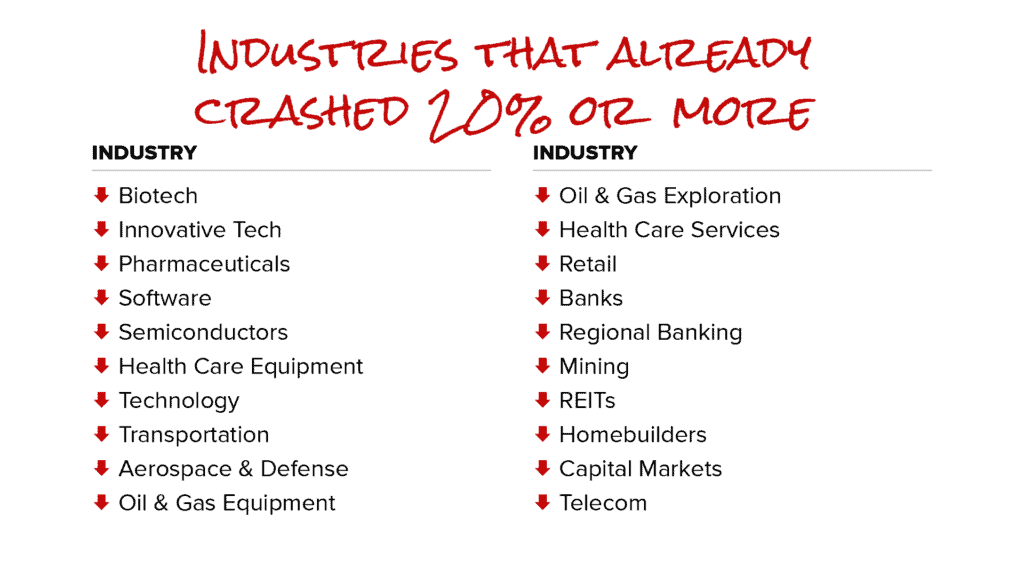

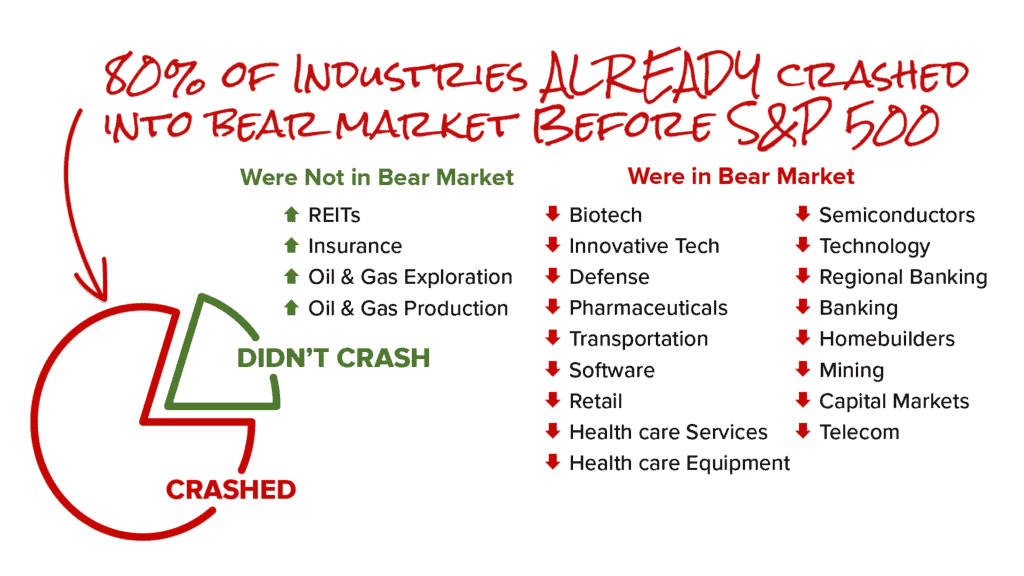

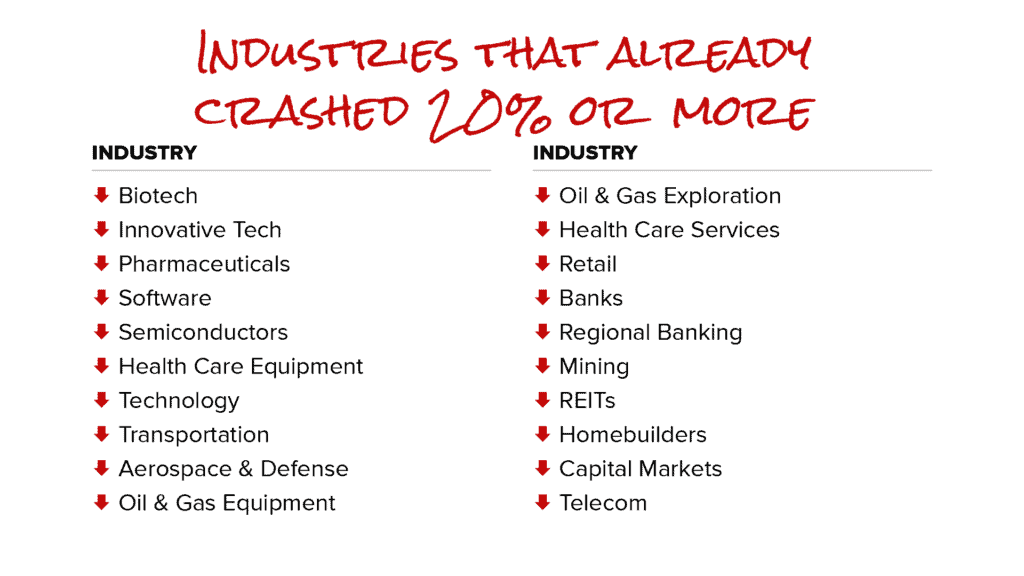

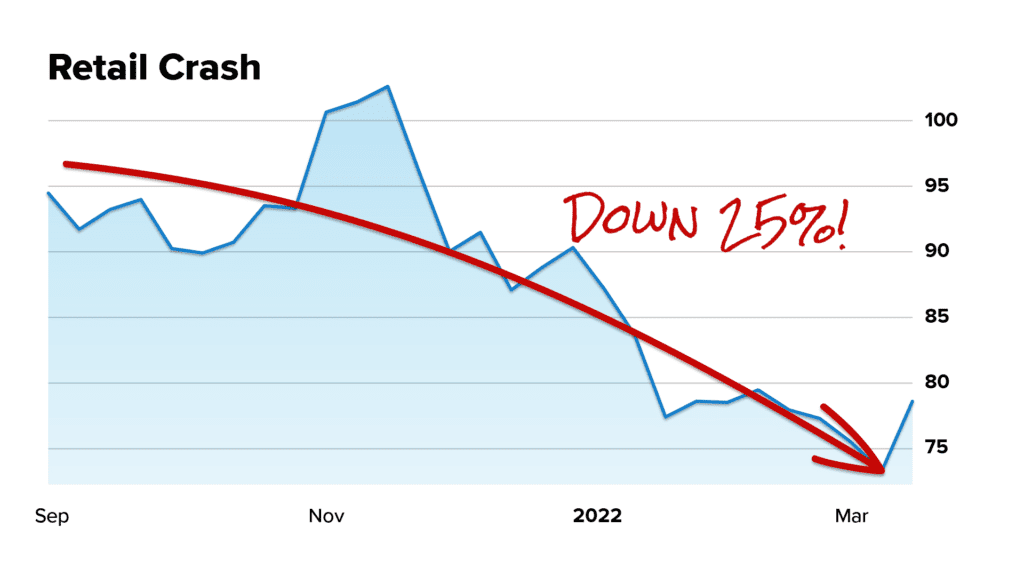

You’d see that the majority of industries already crashed 20%… 30%… in some cases 60% a long time ago.

Well before the bear market officially started in 2022.

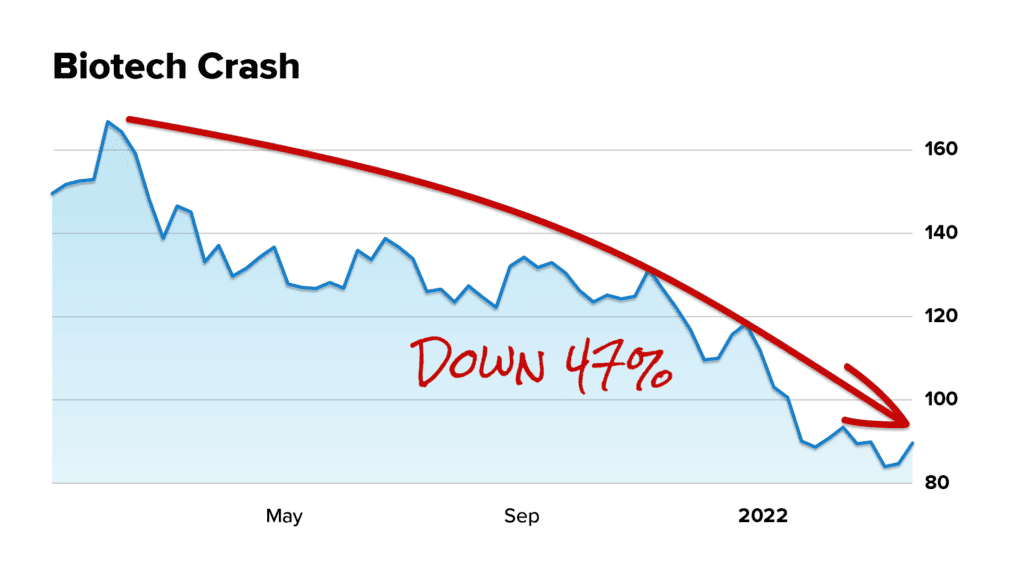

In fact, some industries entered an official bear market as far back as February 2021.

That’s when the biotech industry first entered a bear market.

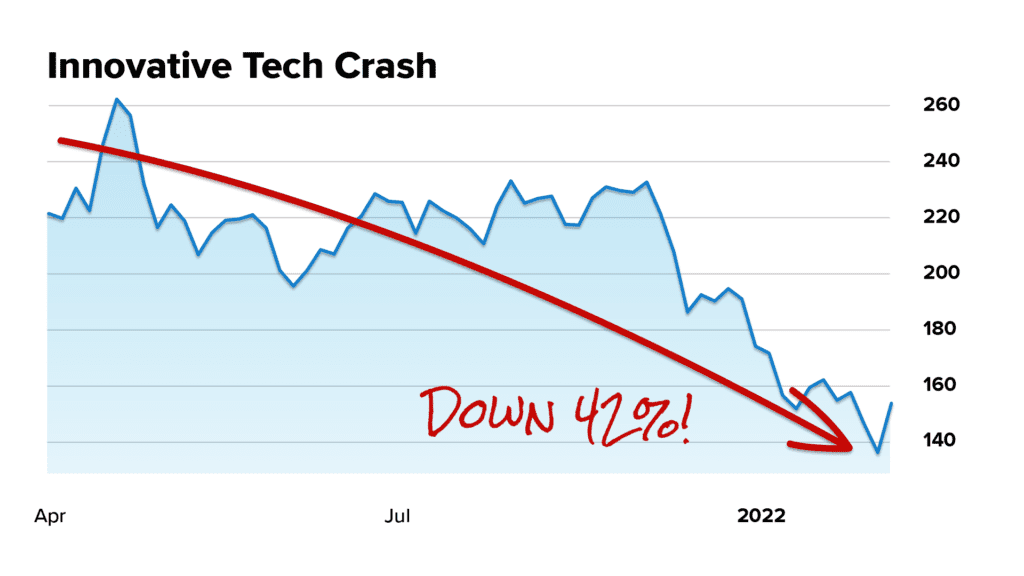

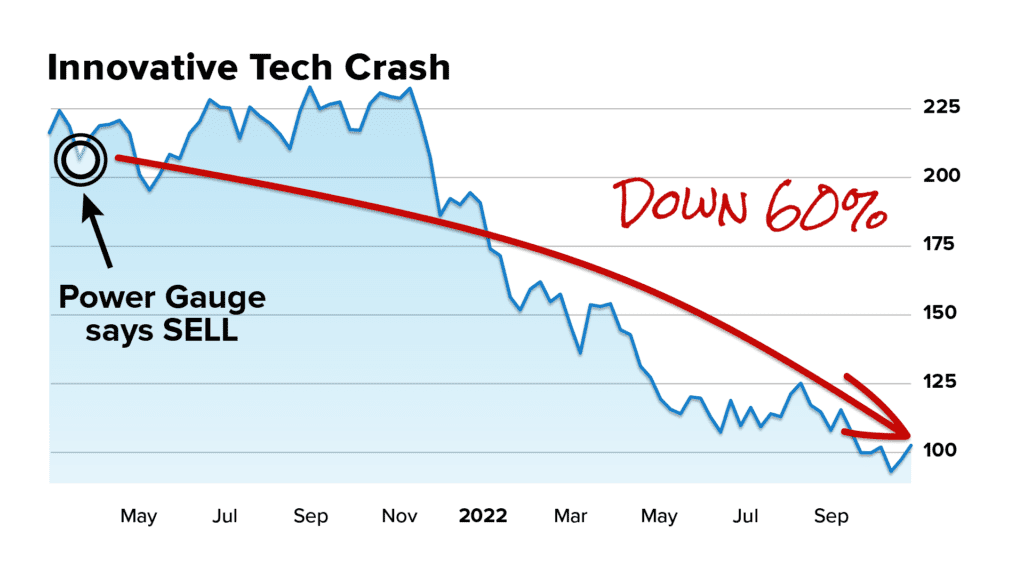

Meanwhile, innovative technology crashed into a bear market all the way back in May 2021.

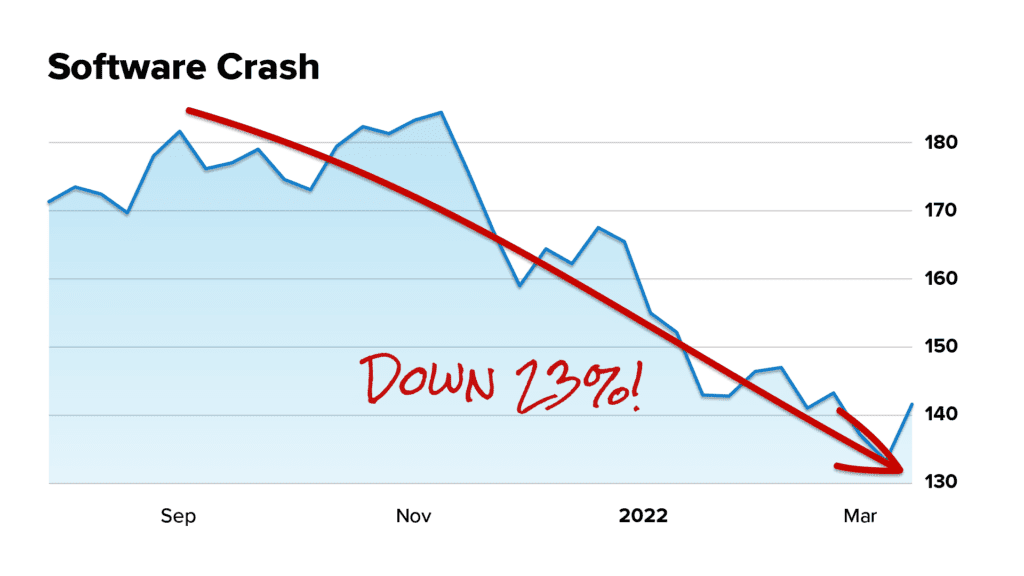

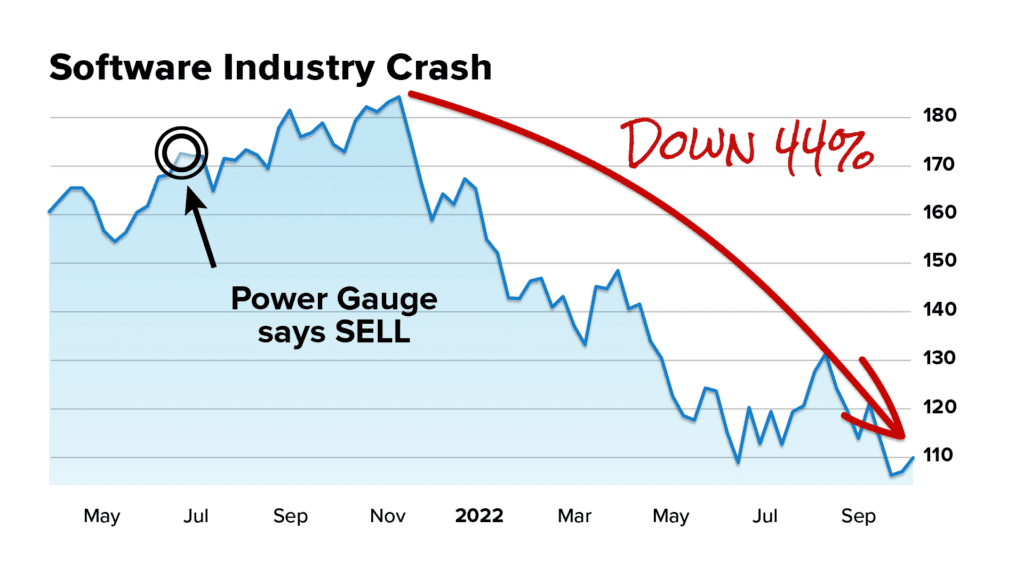

The software industry entered a bear market in January 2022.

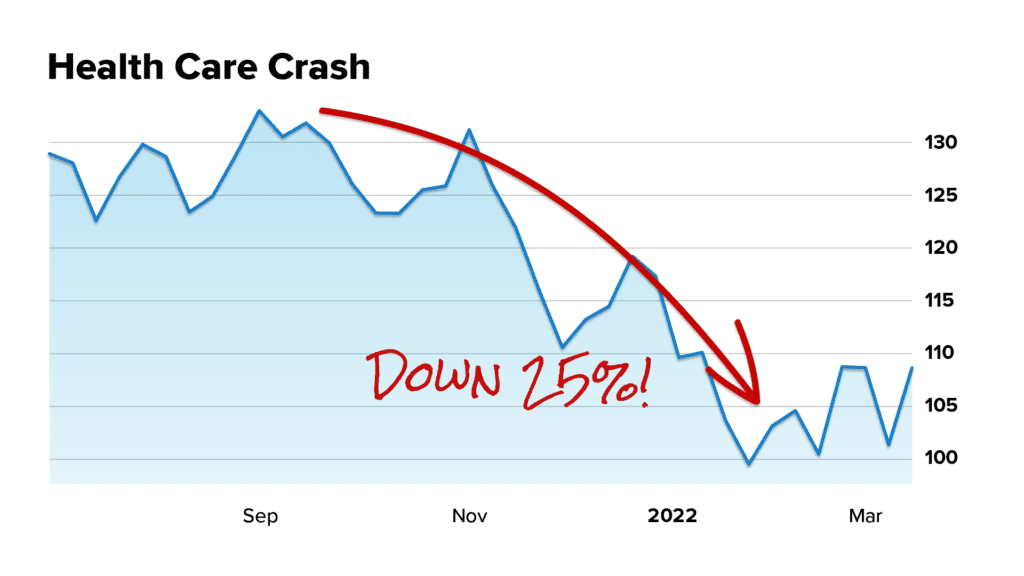

As did both health care services AND equipment stocks…

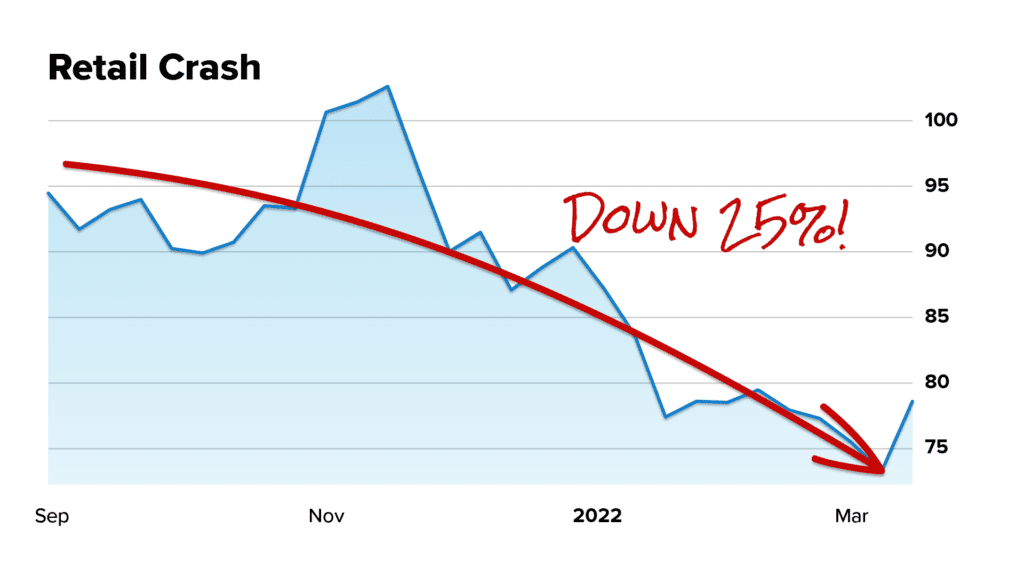

Retail…

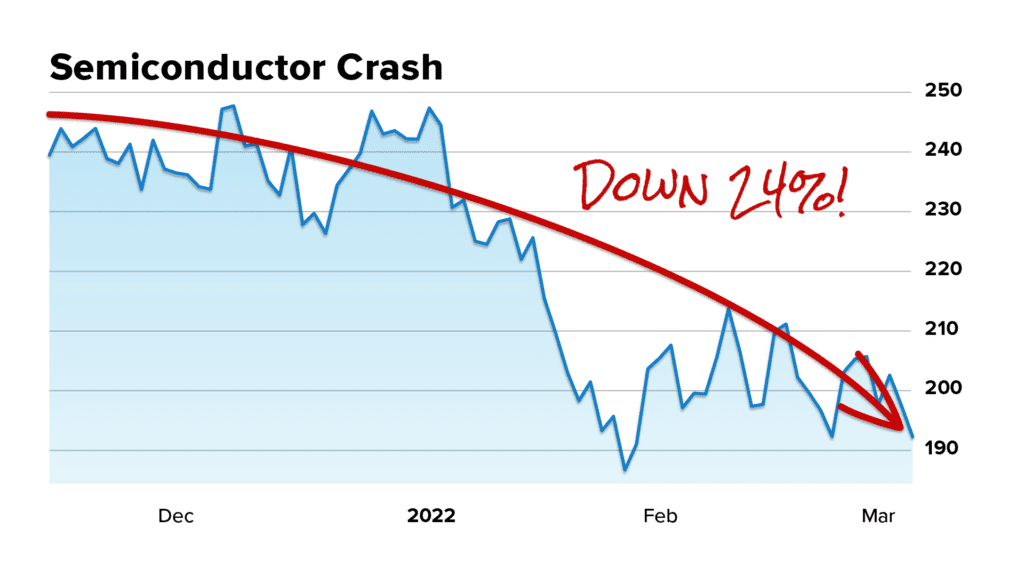

And even the semiconductor industry.

A lot of stocks within these industries have done even worse.

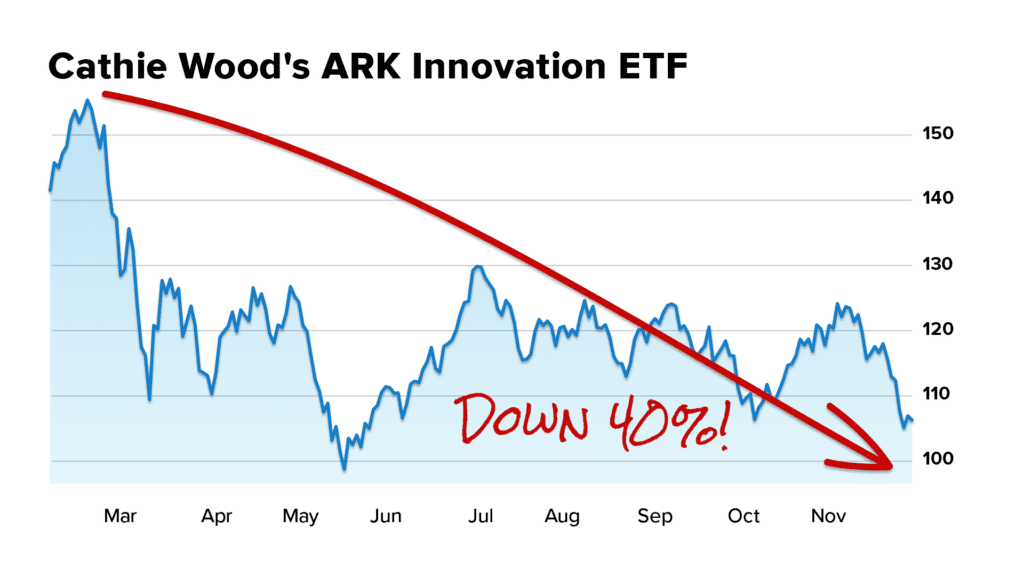

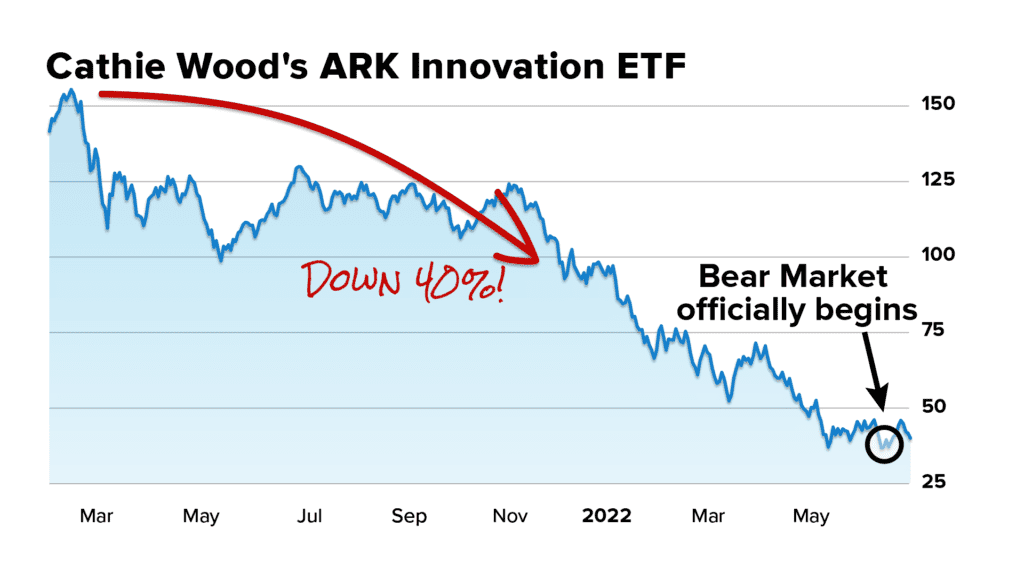

You’ll remember that beloved stocks in the Innovative Tech industry took a very publicized beating. Just look at what happened to Cathie Wood’s Ark Innovation Fund, made up of what were once the hottest tech stocks…

It was down 40% by mid-November 2021.

Remember… and this is VERY important… that was long BEFORE the S&P officially entered a bear market in June 2022.

In other words, this corner of the tech market crashed long before anyone was really worried about a broader crash, war overseas, anything like that.

So while people have been glued to the S&P 500, waiting to see if we’re still in correction or bear market territory on any given day…

We’ve already seen hundreds of stocks in weak industry groups suffer big crashes – for years now.

AMY:

What percent of sectors and industries crashed 20% before the overall market?

MARC:

This is pretty bizarre to look at, Amy.

But 80% of industries that we monitor had already crashed 20-60% into a bear market… before the S&P ever did.

In other words, nearly all of our market’s industries have already been in a bear market – for over a year. Some for over two years!

That’s one heck of a market crash, my friends. It just doesn’t look like the ones you may be used to.

AMY:

You said it’s a different kind of crash?

MARC:

Yes. It’s called a “Rolling Crash.”

A rolling market crash spreads across the market over time, like a wave.

It sends specific industries crashing, before spilling over into the next.

It acts like a snowball, getting bigger and picking up speed as it races down the hill.

And the only way to not get run over by that snowball, is to know where the crash is rolling next.

AMY:

Have there been other “rolling market crashes” in the past?

MARC:

Absolutely.

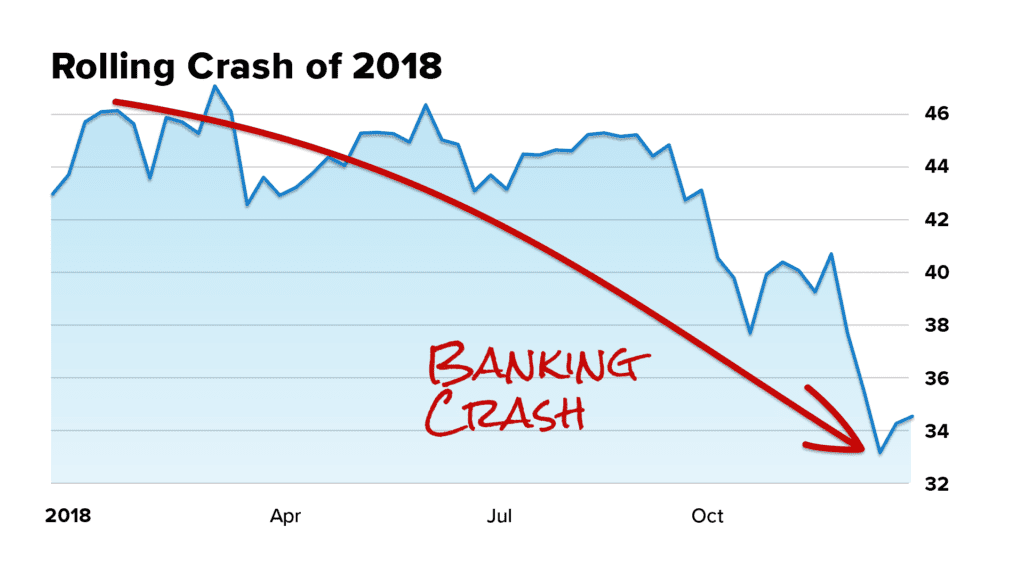

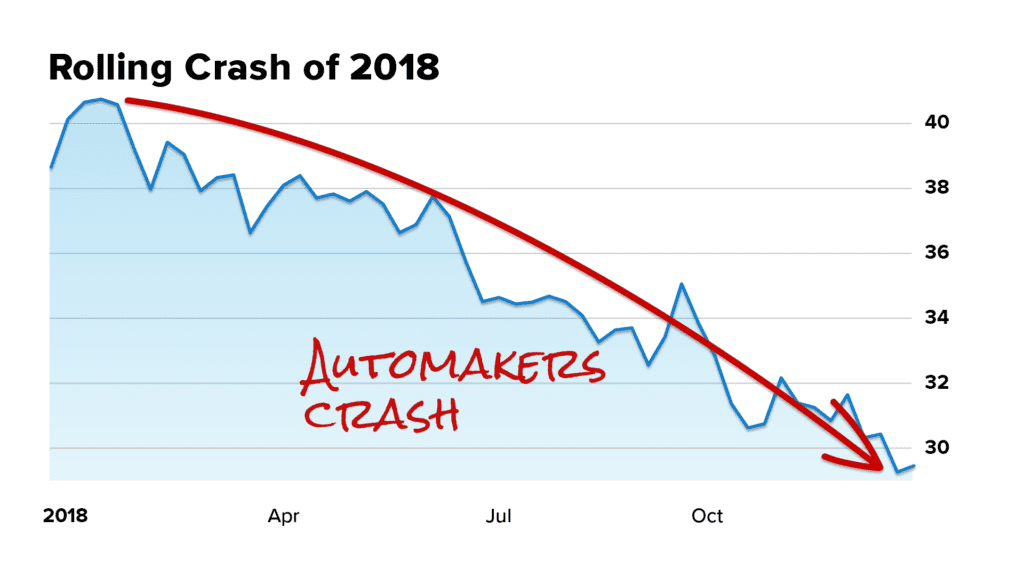

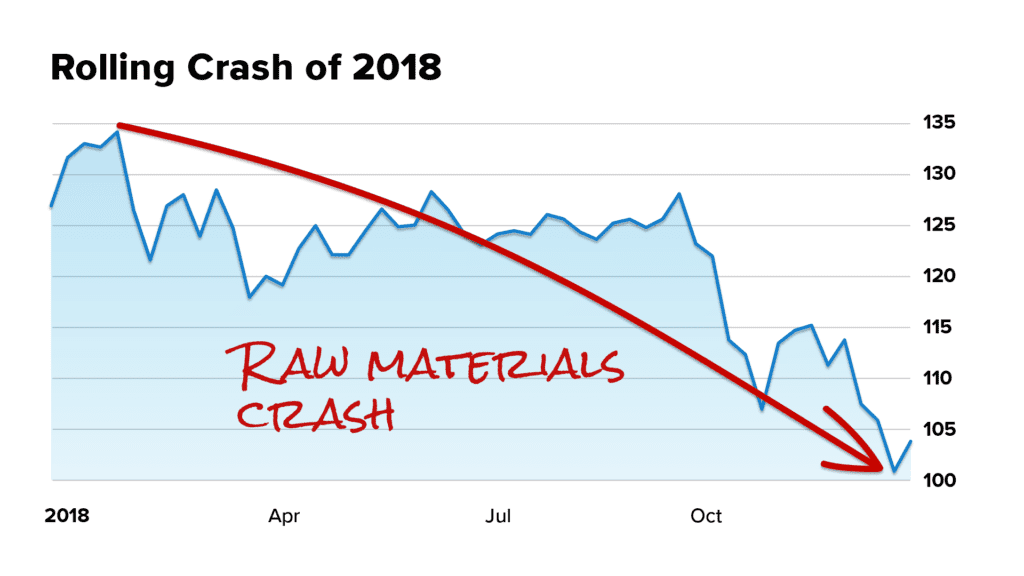

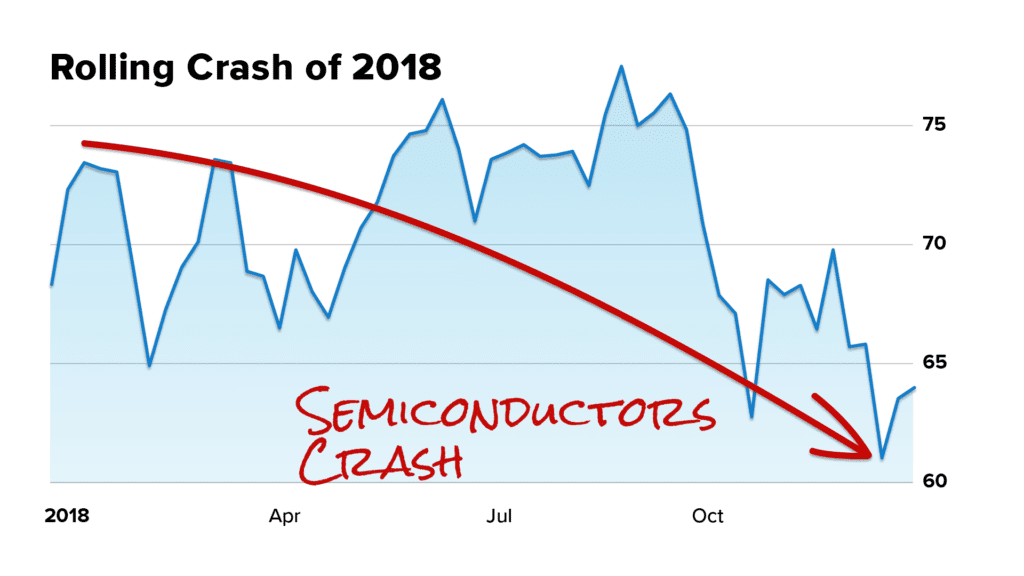

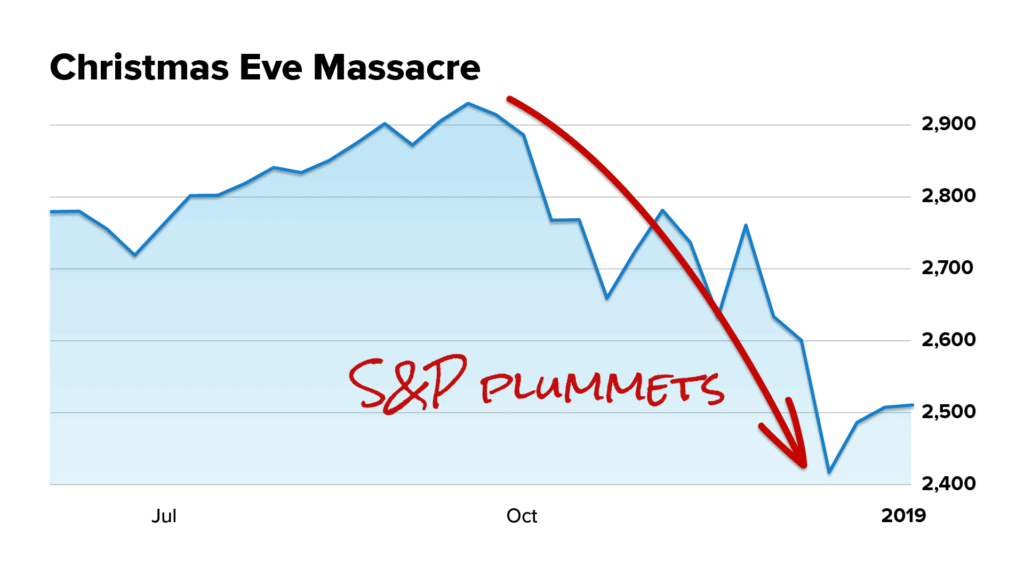

The last one was in late 2018. Stocks were still chugging higher overall, while the average stock in the S&P 500 was down 18%.

Investors were worried about war with China… and talks of a big interest rate hike – sound familiar?

The crash rolled from the banking industry… to automakers… to raw materials… to the semiconductor industry…

And it all culminated in a big market-wide plunge, when stocks nearly entered bear market territory on Christmas Eve.

I called it the Christmas Eve Massacre at the time. Because for investors with money in the wrong stocks… it felt like there was blood in the streets.

AMY:

That does sound eerily similar to what we’re seeing today. It feels like we’re living on a knife’s edge – no one can decide if things are about to get better… or much, much worse.

MARC:

Yes, the parallels are quite clear when you analyze the market on an industry level.

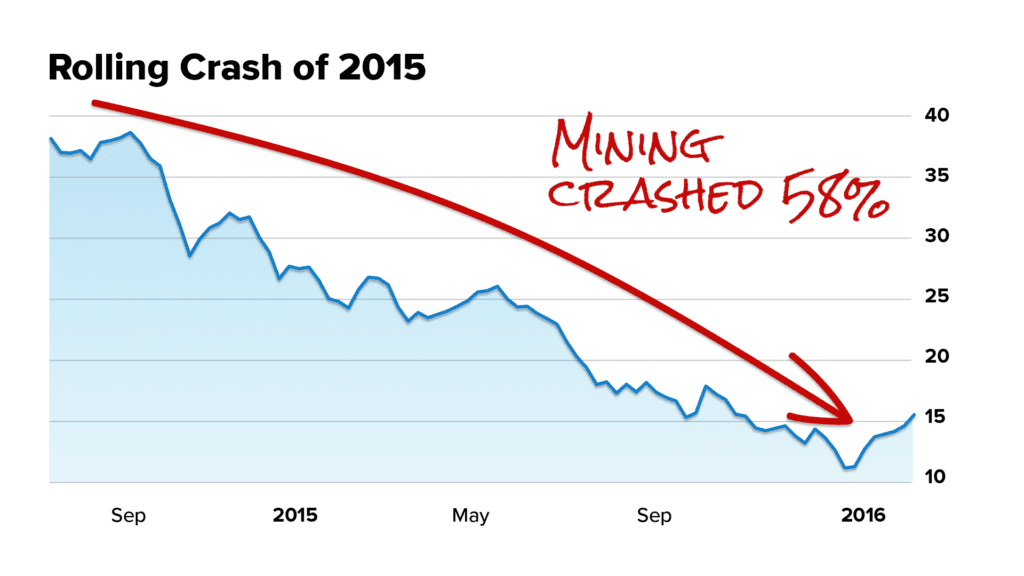

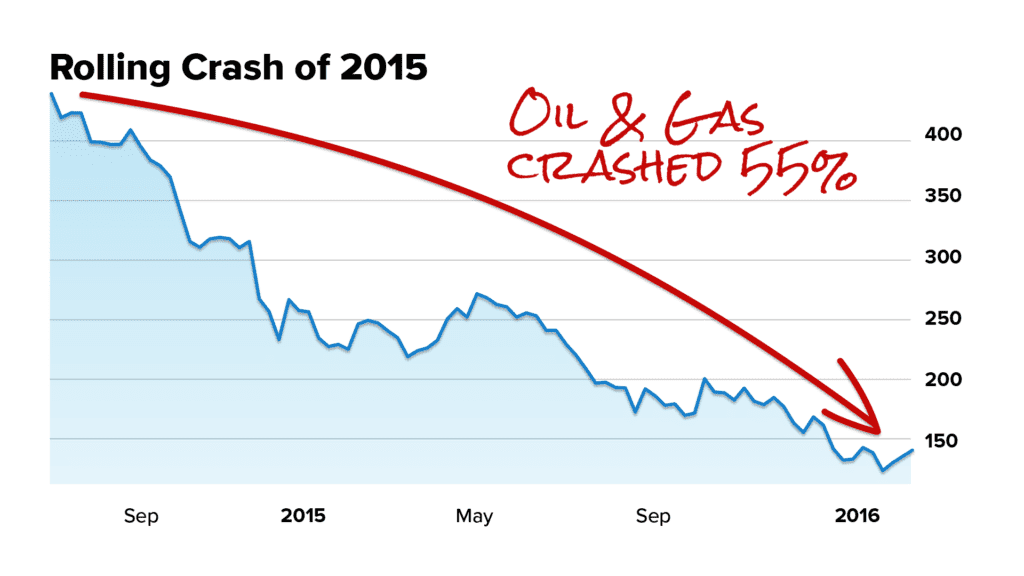

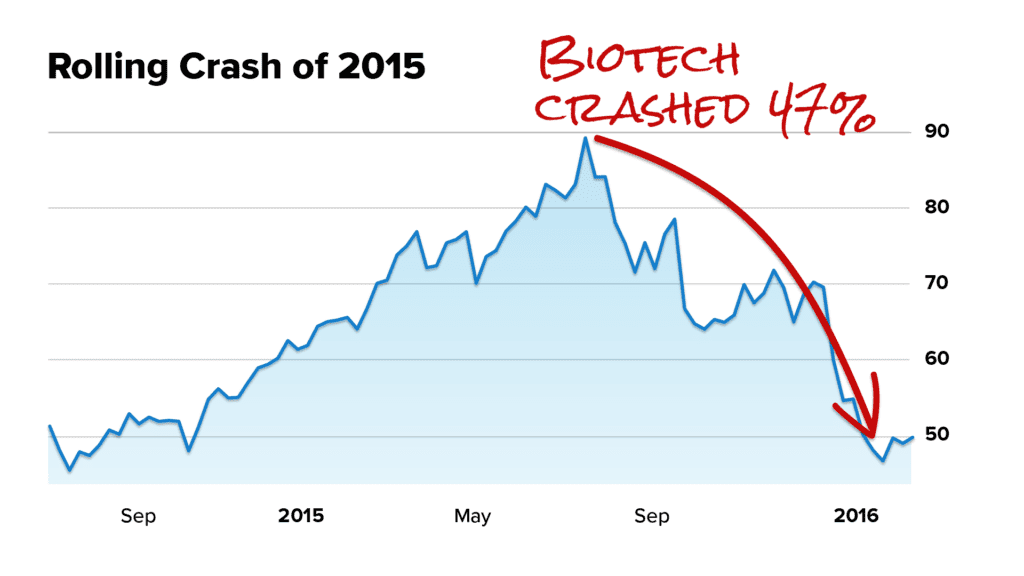

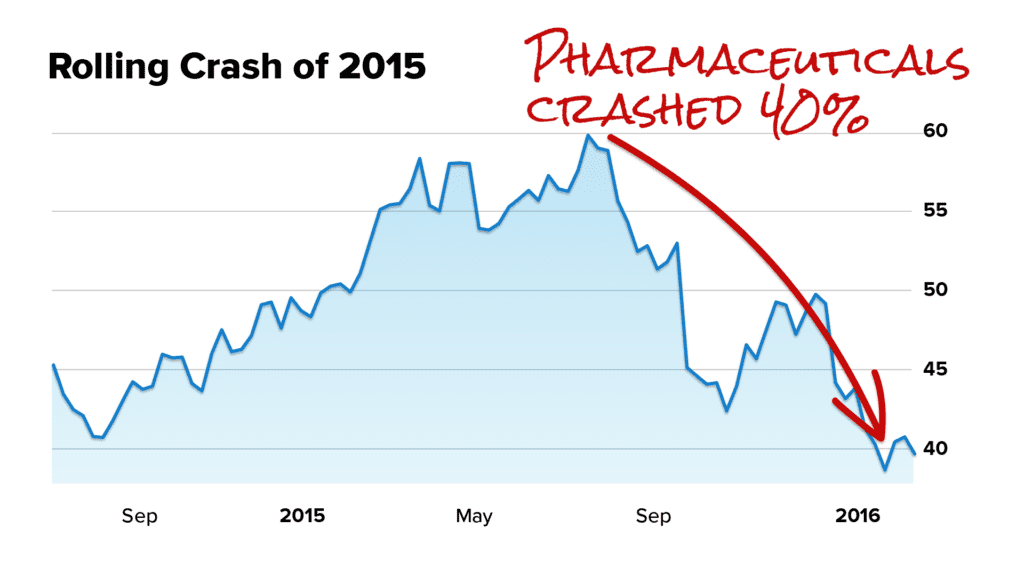

We saw another Rolling Crash on a smaller scale in 2015.

There was a flash crash in Chinese stocks… the price of oil plunged…

And when you zoom into the industry level, do you see how the Rolling Crash spread from industry to industry in just under a year?

The Mining Industry collapsed 58%.

The crash then rolled to the entire Oil & Gas Industry, which cratered 55%.

Followed by a 47% crash in the Biotech Industry…

A 40% crash in the Pharmaceuticals Industry…

In the end, the S&P itself only dropped 15%.

But the months leading up to it were still a terrifying, painful time for investors, who were blindsided by massive losses.

AMY:

I think that’s the exact experience most investors have had recently.

MARC:

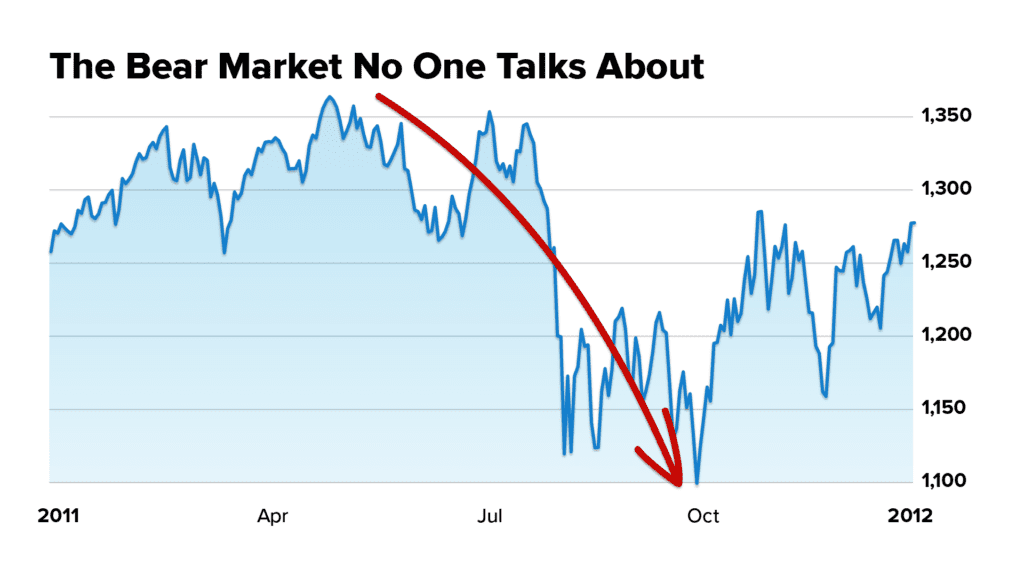

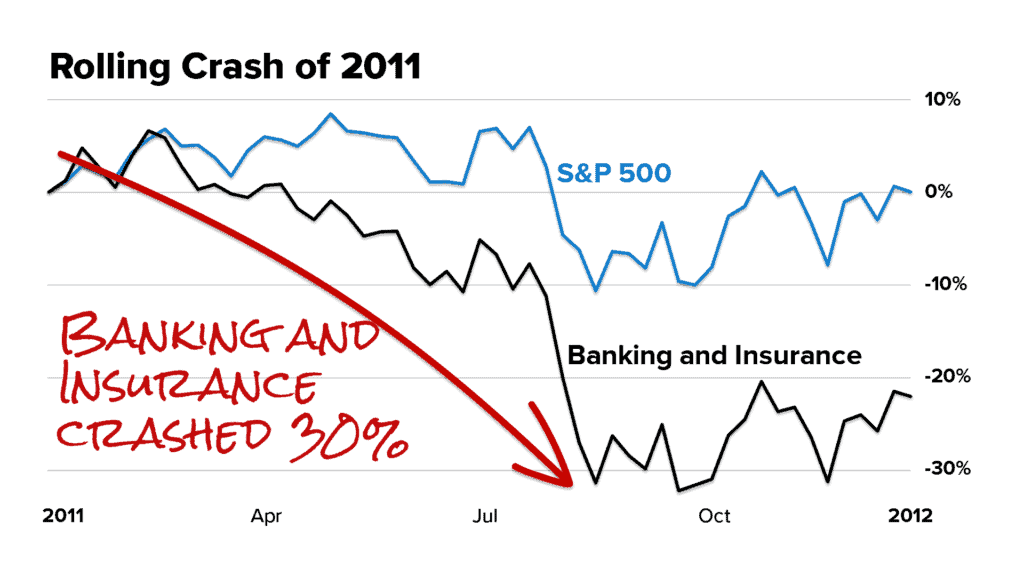

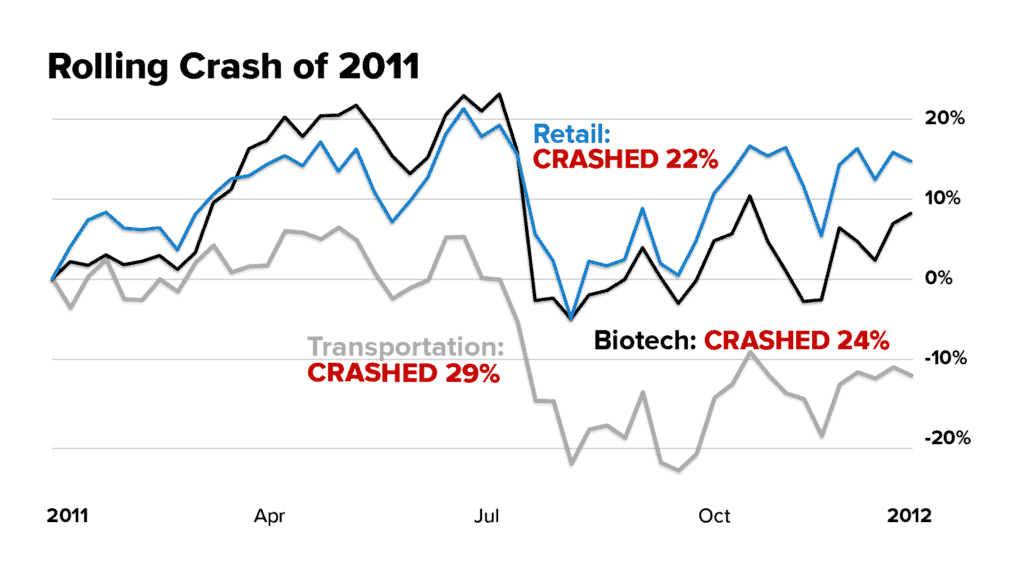

We even saw the same phenomenon happen in 2011, when markets quickly plunged after the United States’ credit rating downgrade.

I’ve seen this period called “the bear market nobody talks about.”

Overall, stocks crashed 19%.

But before and after the overall market fell, a far more devastating Rolling Crash was spreading across specific industries.

The Banking and Insurance Industries both cratered more than 30%.

While the Transportation, Biotech, and Retail industries didn’t peak until as much as five months later – and then crashed 20-30%.

It’s crazy to think about… but if you’re 20 or older, you’ve actually already lived through four of these Rolling Crashes.

But they’ve been around much longer.

They’re a natural result of the stock market growing bigger and more complex.

One of the earliest “rolling crashes” or “rolling bear markets” on record was in the late 60s.

AMY:

Right around when you first started on Wall Street.

MARC:

Yes, I cut my teeth, so to speak, in a market environment very similar to this one. So I had to learn very quickly how to navigate the dangers… and find the opportunities it presents.

Right now, we’re seeing both in my software – dangers and opportunities.

So if you’ve ever wondered at the end of a year – why didn’t I do better? Or, “Why does everyone seem to be making more money than me?”

This is why… because 99% of investors have no idea how to even identify a rolling crash. Let alone protect themselves and even potentially profit from it.

So, to recap:

The good news is that you can STOP worrying about the day of the next big crash.

It’s here.

And it’s already sent a wave of 20 to 60% losses through the vast majority of our stock market.

The bad news is that you have a very narrow window of time to prepare for what comes next.

Because I’ll say upfront: things are about to get a whole lot worse for some stocks.

And I think 99% of investors will be totally blindsided by the U.S. stock market in just the next 90 days as a result.

Potentially even devasted.

At the same time… they’ll likely miss out on a little-known wealth-building opportunity that could essentially erase all of the heartache and losses of the past year.

Over and over throughout history, we see this same opportunity emerge during a critical “inflection point” in a Rolling Crash.

And as you’re about to see, this moment can deliver the kind of gains most people spend their whole lives chasing.

IF you know exactly when and what to buy.

I’m planning to share one of my favorite stocks to help you take advantage of this, for free, in the next few minutes.

AMY:

That sounds great, Marc. But first, I want to know: How are you able to pick up on this Rolling Crash, when so many investors have been blindsided?

MARC:

It’s simple – I have something most investors don’t. And it’s helped me not only chart the movement of this Rolling Crash… but accurately predict where it’s headed next – well in advance.

AMY:

I assume you’re talking about the Power Gauge.

MARC:

That’s right.

AMY:

If you aren’t familiar, the Power Gauge is the culmination of Marc’s nearly half a century working with some of the most prestigious hedge funds in history, run by the likes of Steve Cohen, Michael Steinhardt, Paul Tudor Jones, and George Soros.

Marc's Legendary Wall Street Colleagues

- Steve Cohen

- Michael Steinhardy

- Paul Tudor Jones

- George Soros

It’s a one-of-a-kind system that can actually predict the future behavior of over 5,000 different stocks – using the same stock-rating system Marc helped design for professional investors, traders, and analysts over five decades.

Each stock in the market is assigned a rating of Bullish, Neutral, or Bearish.

And when that rating changes… it’s your signal that something BIG is happening to a stock – and it’s time to act.

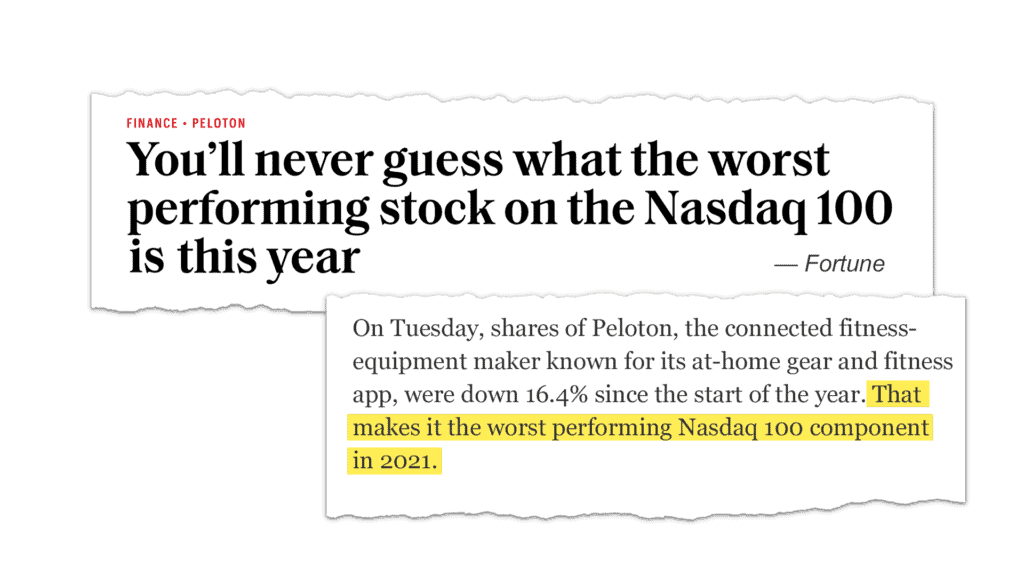

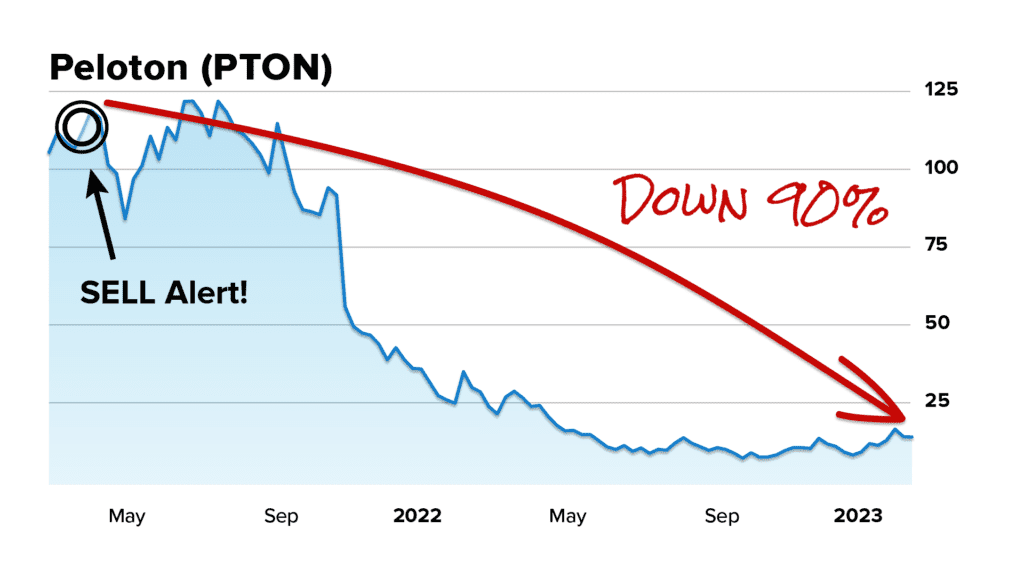

For example, it would have steered you clear of one of the single worst-performing tech stocks in recent memory: Peloton.

MARC:

Oh yeah. The rest of the world was surprised by poor Peloton. This one stock has caused such an outsized amount of pain.

AMY:

But Marc, you and your Power Gauge followers could have avoided all of that pain. Because the Power Gauge issued a Bearish rating for Peloton in the early days of 2021.

That’s essentially a sell signal: “Warning: Danger Ahead” for this specific stock.

And sure enough, the stock collapsed 90%.

I have to ask… how did the Power Gauge know that Peloton was about to crash? It was such a beloved stock at the time.

MARC:

The simple answer is that’s what I designed the algorithm that runs the Power Gauge to do.

It’s designed to know what any individual stock is going to do next.

I programmed it to scan the market every day, and issue a Bearish, Bullish, or Neutral rating for over 5,000 different stocks and funds.

The Power Gauge is how I knew to issue formal warnings for some of the worst-performing stocks of 2022.

I mean, just look at what a $10,000 investment in each of these companies could have cost you.

But my Power Gauge users didn’t have to feel any of that pain.

AMY:

Wow.

With results like that, you can see why the Power Gauge earned wealthmanagaement.com’s 2019 award for Best Research Product, beating out both Morningstar and Bloomberg…

Why Marc was invited to help create three new indices for the Nasdaq… here he is actually ringing the opening bell…

And why CNBC’s Jim Cramer once said: “I learned a long time ago not to be on the other side of a Chaikin trade.”

MARC:

I’m certainly proud of those results. And Jim’s kind words.

But given the crash that’s been rolling across the U.S. stock market…

And the critical inflection point we’re fast approaching…

There’s something very different I need to show you today.

It’s little-known function of the Power Gauge.

That’s going to be our secret weapon to navigating the massive shift I’m calling for in the next 90 days.

AMY:

A secret weapon?

MARC:

That’s right. As I just showed you, the Power Gauge works great when you’re wondering whether to buy, sell, or hold an individual stock.

It can separate the winners from the losers in any portfolio.

But that’s not ALL it can do.

In a Rolling Crash… we don’t just see individual stocks go “Bearish” in the Power Gauge and crash.

Instead, we’ve seen entire industries fall right off a cliff.

So if you’re only zoomed in on individual stocks right now – you’re going to end up completely blindsided by major moves playing out on the industry level.

Major moves that, as I’m about to show you, are entirely predictable.

So while of course it's great to know if one of your stocks is about to soar or crash…

The simple truth is that you need a bigger and better approach right now.

AMY:

One that accounts for the Rolling Crash that’s devastated specific industries.

MARC:

Correct.

Which is why I took the same algorithm we use to evaluate individual stocks…

And applied it to industries… to generate a Bullish, Neutral, or Bearish rating for entire groups of stocks.

In other words, instead of using the Power Gauge to just predict the performance of a single stock over the next 90 days…

We can also use it to predict the performance of an entire industry over the next 90 days…

Determine if it’s about to experience a crash… or is even poised for a big runup…

And issue a Bearish, Bullish, or Neutral Rating for the entire industry.

The Power Gauge is constantly scanning every corner of the stock market – looking for signs of weakness or opportunity.

This is how we’ve been able to predict the path of the Rolling Crash thus far.

AMY:

And it’s how you can determine what stocks and industries are going to do next?

MARC:

Precisely.

Let me show you this in action.

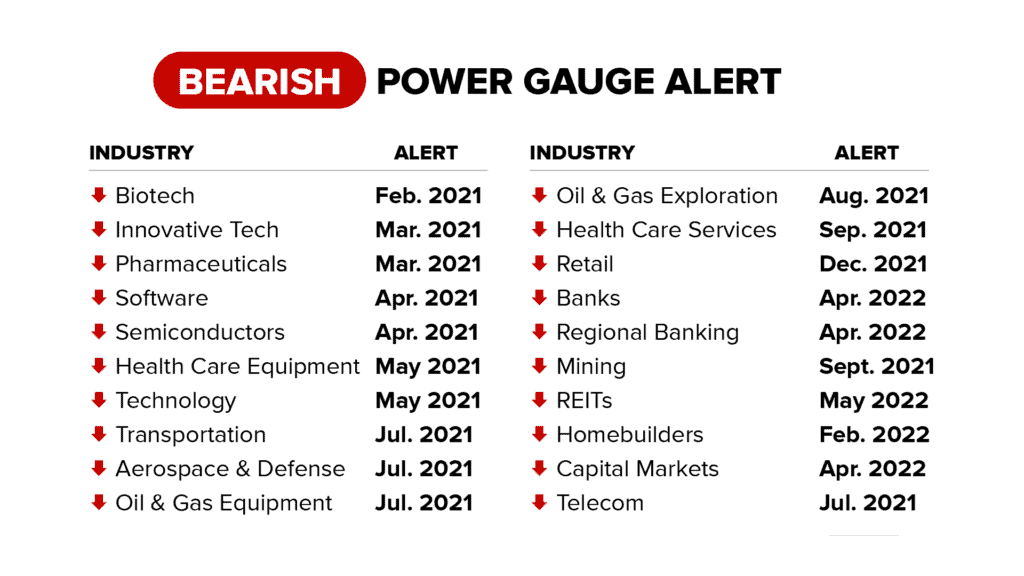

On March 26th, 2021 the entire Innovative Tech industry went Bearish in the Power Gauge.

This is around the same time the media was calling Cathie Wood and her ARK Innovation Fund the “breakout stars” of the ETF world.

Others called her “the new market oracle.”

But if you’d known about Innovative Tech’s Bearish Rating in the Power Gauge… then you would have known what was about to happen to some of her favorite stocks.

Sure enough, the entire industry fell nearly 60% after the Power Gauge sounded the alarm.

AMY:

That’s incredible. But what about the specific stocks within that industry? What did the Power Gauge tell you about them?

MARC:

Well that’s the best part, Amy.

We know that individual stocks tend to do much better or worse than the industry as a whole.

And we actually rank which stocks are poised to outperform their industry… and which stocks are poised to underperform their industry.

In other words: We know the best of the best stocks in any given industry. And the worst of the worst.

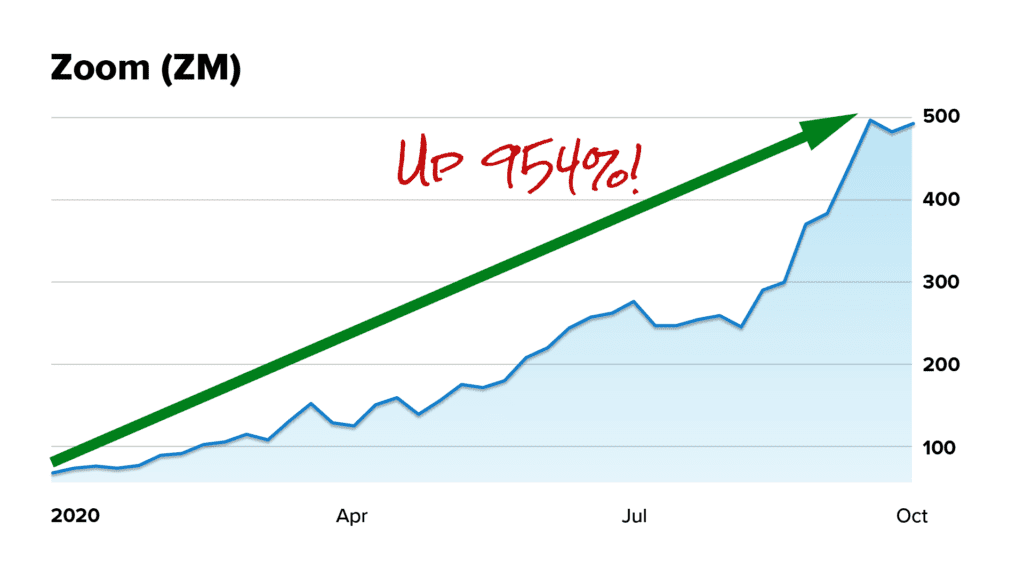

So let’s say you’re one of the many investors who bought Zoom after the 2020 crash.

In the early days of the pandemic, you couldn’t go a day without hearing about this stock that was leading the pivot to remote work.

It skyrocketed nearly 1,000% in 2020 alone.

But in March 2021, if you’d checked the Power Gauge, you would have seen that it’s issued a Bearish rating for the entire Innovative Tech Industry.

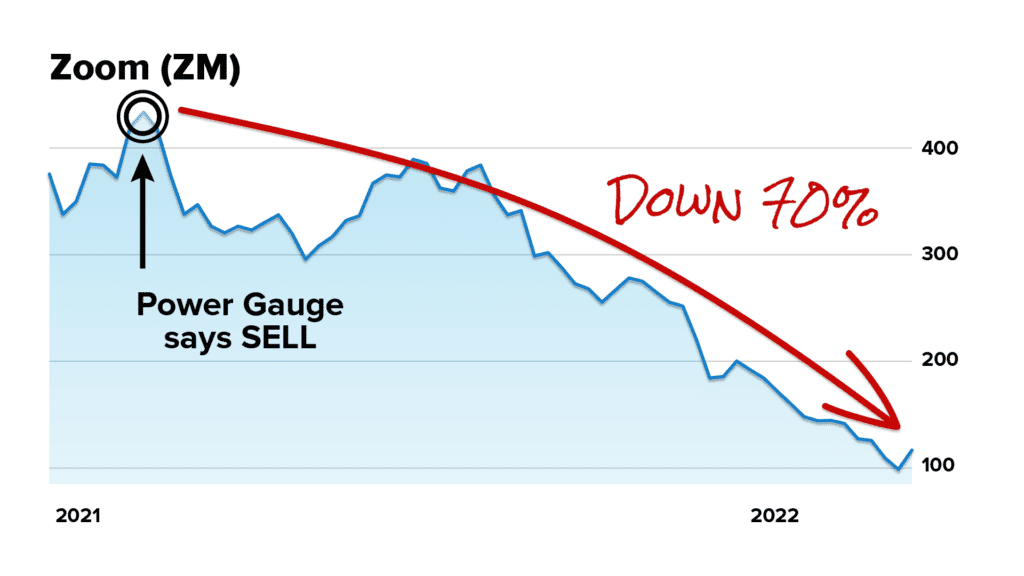

In fact, the Power Gauge has automatically ranked the worst individual stocks in the industry.

And Zoom is one of them!

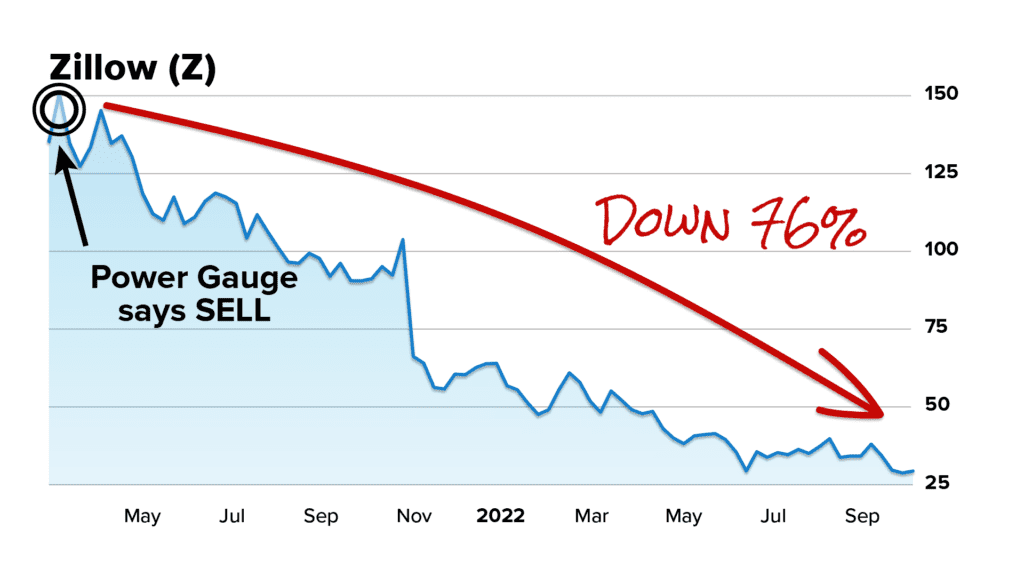

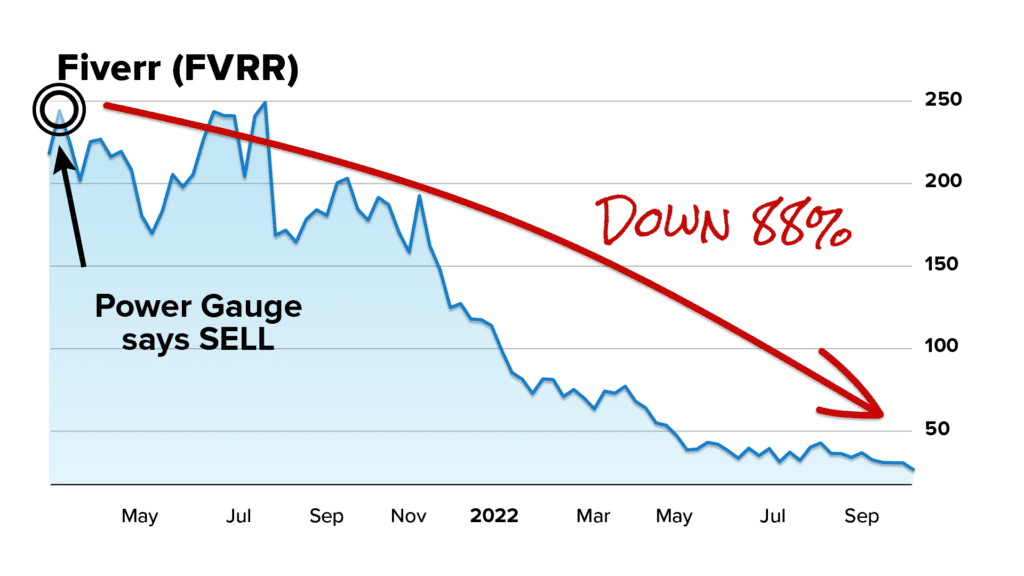

So, with the Power Gauge, you would not only have known to sell Zoom before it fell over 70%.

But also Zillow before it fell 76%.

And Fiverr before it fell 88%.

AMY:

Wow. Folks holding those stocks have been so disappointed.

MARC:

I know. So just imagine knowing weeks, and often months in advance, which industries could come crashing down…

And the exact stocks that are poised to face the worst damage?

That’s what happened in the Software industry in April 2021. The entire industry was downgraded to “Bearish”– and it ultimately fell 44%.

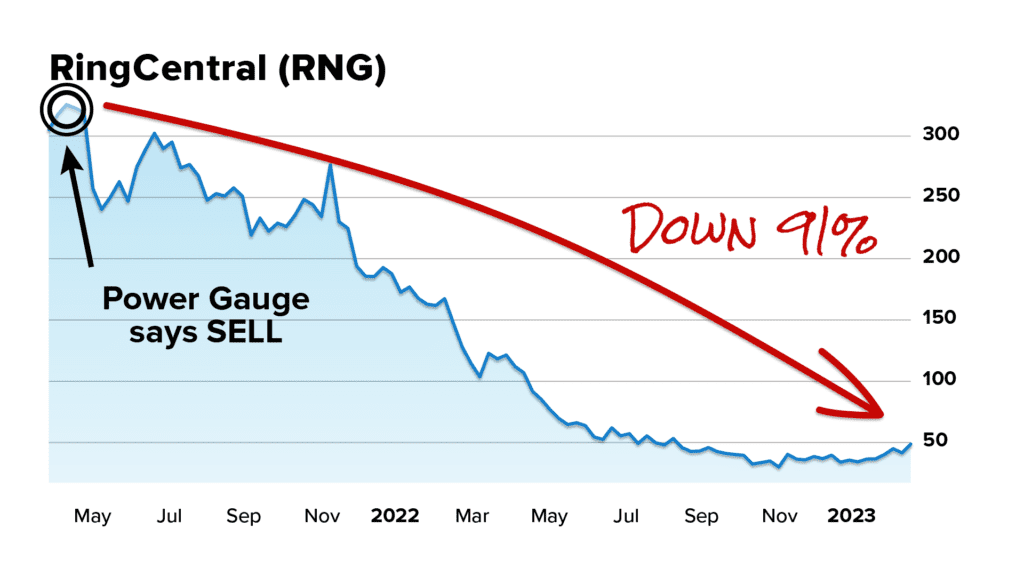

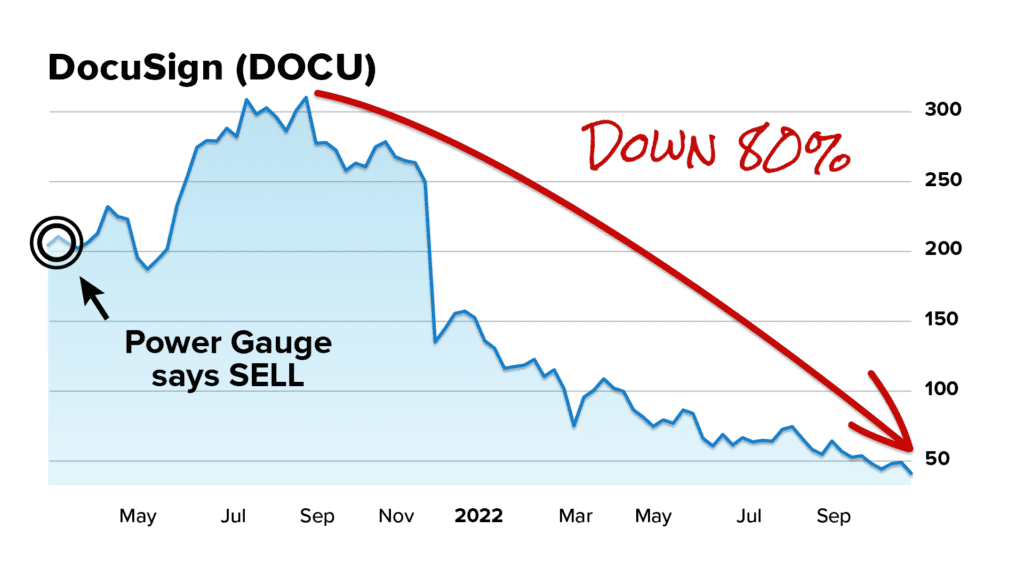

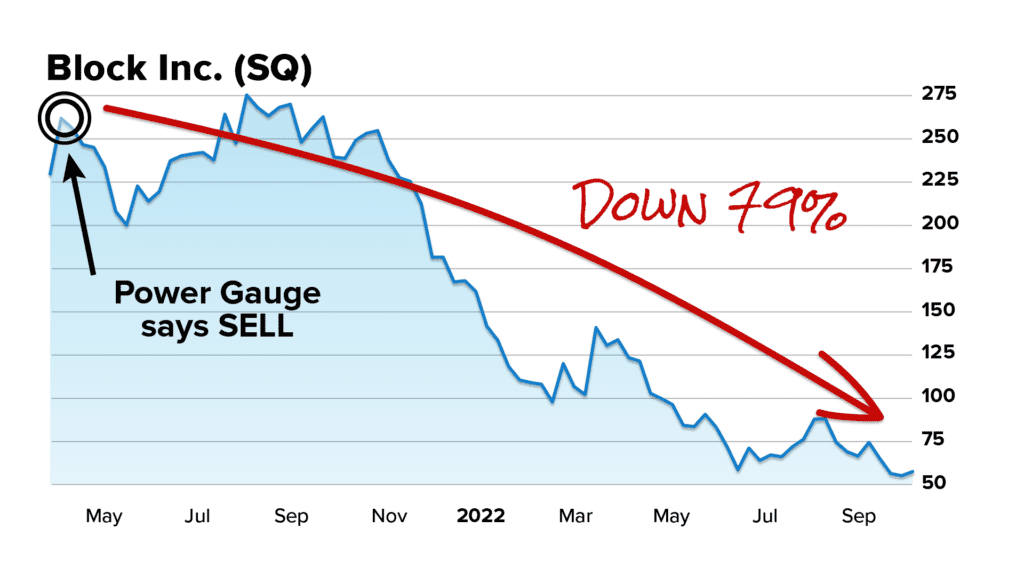

But well-known stocks within the industry did much worse. And with the Power Gauge, you would have instantly known the exact tickers headed for destruction… the worst of the worst.

Like Communication platform RingCentral before it crashed 91%…

DocuSign before it fell 80%.

And fintech company, Block Inc. before it crashed 79%…

AMY:

So when you know the worst stocks… in the worst industries… you have an extraordinary advantage.

MARC:

That’s right.

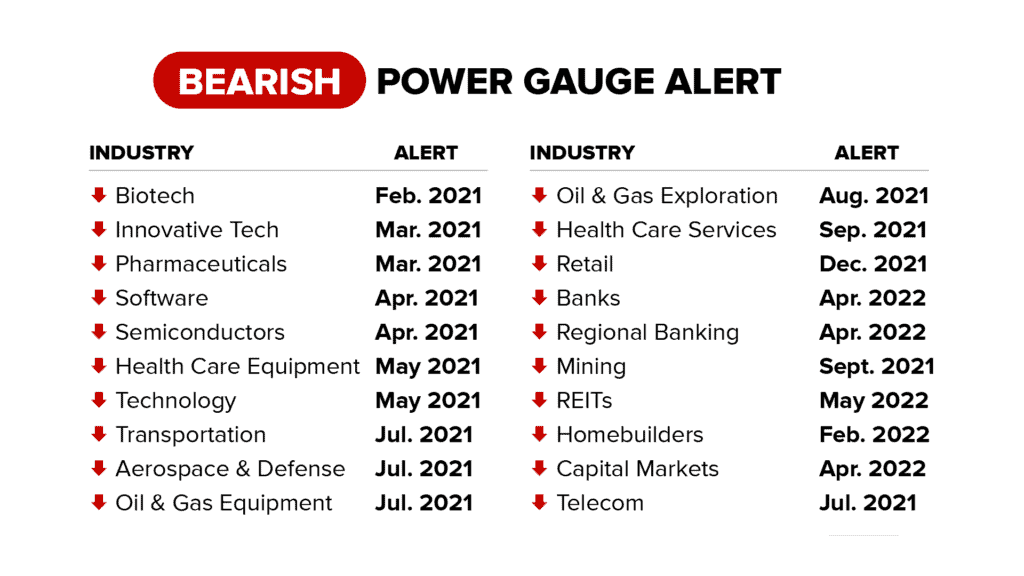

All told, here are all of the industries affected by the Rolling Crash so far – meaning they’ve crashed 20% or more.

And here’s when the Power Gauge sounded the alarm.

As you can see – my system accurately timed them all, and would have alerted you to get out before the biggest losses.

Now just to be clear, these doomed stocks obviously weren’t recommendations.

I just wanted to show you the type of results you could have seen by checking the Power Gauge.

It’s funny Amy, I have a friend who studies and predicts earthquakes for a living.

And what he does actually reminds me a lot of my work with the Power Gauge.

I designed it to function like his seismograph – the highly-sensitive scientific instrument that he uses to sense when and where an earthquake is headed, in advance.

But instead of earthquakes…

The Power Gauge detects big shifts in the stock market.

It can sense the first tremors of a stock crash…

Or even the early vibrations of an extraordinary bull run…

And then show you the most vulnerable, and most promising, individual stocks. So you instantly know what to buy, and what to sell.

AMY:

You just touched on another part of this story I want to talk about, Marc.

At this point, we’ve covered that the fear and volatility we’re experiencing right now is due to a Rolling Crash that’s been sweeping through U.S. stocks.

And we’ve shown how the Power Gauge has predicted which industries are about to crash, and the specific stocks that have seen the biggest losses. The worst of the worst.

But what about the best of the best?

We know hundreds of stocks have suffered 20%-50% crashes in recent months.

But what about the other stocks that have gone up?

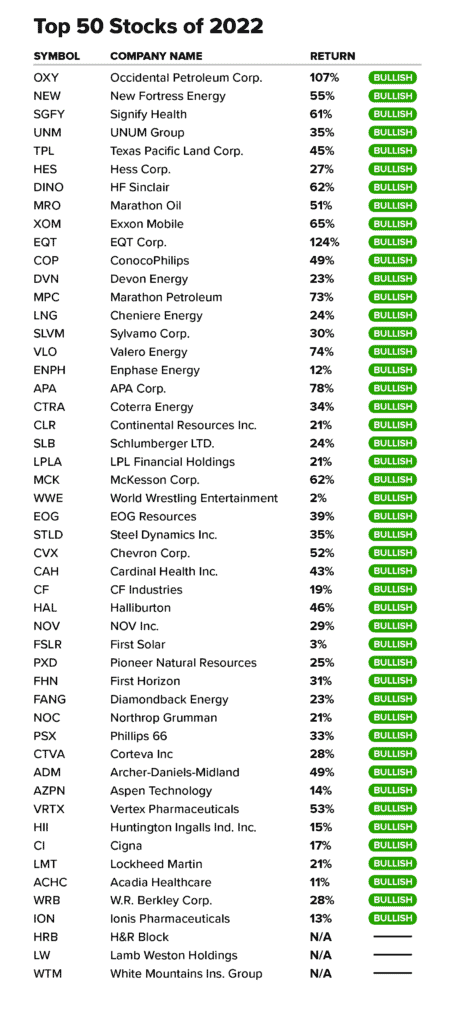

Here’s a list of the top 50 best-performing stocks of 2022.

And even with a Rolling Crash devastating most industries…

Investors still had the potential to make money in the right stocks! Take a look…

Did the Power Gauge pick up on these runups – these “best of the best” stocks?

MARC:

I’m glad you pulled up all those examples.

It’s no wonder most investors are confused!

I look at the market on any given day, and still see dozens of stocks in the green…

And dozens of stocks in the red.

It almost feels like we’re living a “tale of two markets” – one that’s suffering the effects of this brutal Rolling Crash.

And one that’s experiencing an incredible runup, yielding those gains you just showed us.

You see this overwhelming sea of red and green and may wonder how it’s possible… and what the heck is going on!

But when you look at this through the lens of the Power Gauge, the picture becomes very clear.

Remember, 80% of industries were hit by the Rolling Crash leading up to the start of the 2022 bear market. Scary stuff.

But that means 20% of the market avoided the Rolling Crash.

Even during the worst days of the crash, these were the industries that charged far ahead of the overall market.

Instead of a Rolling Crash, they experienced a Rolling Runup.

That’s a wave of wealth rolling over specific industries, one after the other…

Sending the top stocks in those industries soaring.

AMY:

You’re saying that entire industries have gone bullish in the Power Gauge, even when most stocks were crashing?

MARC:

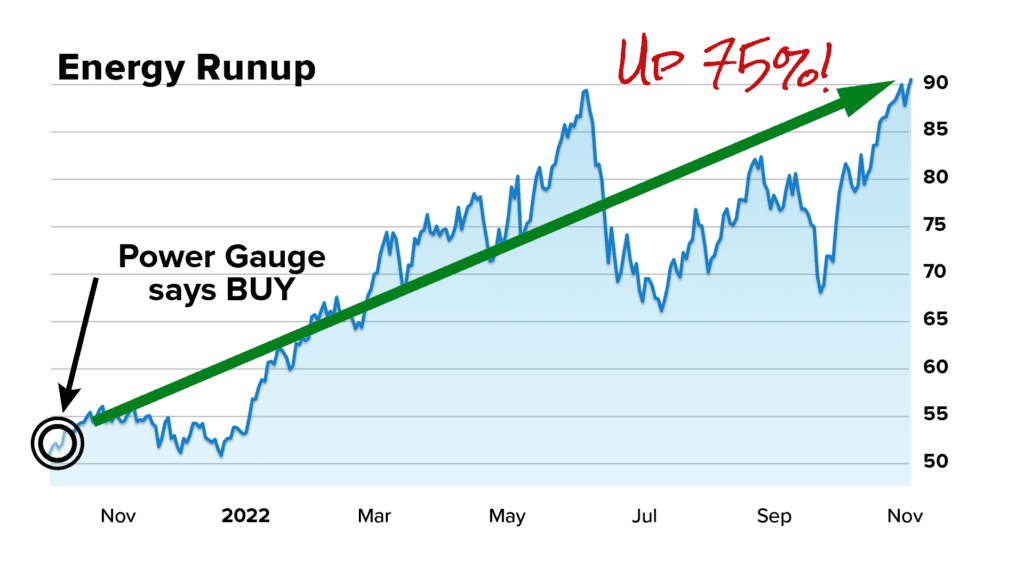

Yes. That’s precisely what’s happened to the entire Energy Sector.

Even with the recent volatility… it’s been experiencing a massive runup.

It soared 75% after the Power Gauge issued a Bullish rating in October 2021.

And we were able to pinpoint the top stocks that were about to experience a wave of wealth.

AMY:

The best of the best.

MARC:

That’s right.

In fact, let’s take another look at the 50 best-performing stocks of 2022. Notice anything special about them?

AMY:

I see a LOT of energy stocks.

MARC:

That’s right. They almost all are.

And I’m happy to report that the Power Gauge issued a bullish BUY signal for 47 out of 50.

AMY:

47 out of 50? What is that… a 90% hit rate?

MARC:

94%, to be exact.

Can you imagine the impact that multiple 50% and 100% winners would have had on a portfolio during the Rolling Crash? When it feels like everyone you know is losing money.

Of course, all investment carries risk, even when the overall market is soaring. And past performance doesn’t guarantee future success… we’re quants, not fortunetellers.

But isn’t it amazing how the Power Gauge was picking up on those these energy winners BEFORE any major escalations between Russia and Ukraine sent oil prices over $100 a barrel?

AMY:

Definitely. Speaking of, are you recommending any of the stocks on this list right now?

MARC:

I actually officially recommended a few of these stocks to a group of my followers a while back. Out of respect for my paid-up subscribers, I won’t share their names and tickers. What I will say is that while many of them still look solid in the Power Gauge, for the most part, their runups have already happened.

I’ve narrowed down a shortlist of companies I think are poised to see big gains, starting now. I’m even going to name one for free in a moment.

I showed you those winning stocks to prove that there has been a tremendous opportunity to build your wealth… even as specific sectors and industries have crashed.

And there will continue to be tremendous opportunities moving forward.

It all comes down to knowing the best stocks, in the best industries.

And that’s precisely what I designed the Power Gauge to show you.

AMY:

So even with everything that’s going on in the world, are you saying that you’re bullish right now?

MARC:

I’ll let you in on a little secret…

I’m almost never entirely bullish.

Or bearish, for that matter.

The idea of market bulls and bears comes from the same fallacy that has investors treating the stock market as ONE big thing.

It’s either always up, or always down.

You should either be all in, or all out.

If you continue to think like this… you’re going to get hit by every crash, and miss out on every runup, for the rest of your investing life.

Instead, you have to think about it like this:

There are always specific stocks in specific industries that you should be avoiding…

And there are always specific stocks in specific industries that you should own – for the greatest potential returns in any market environment.

Even during a big crash.

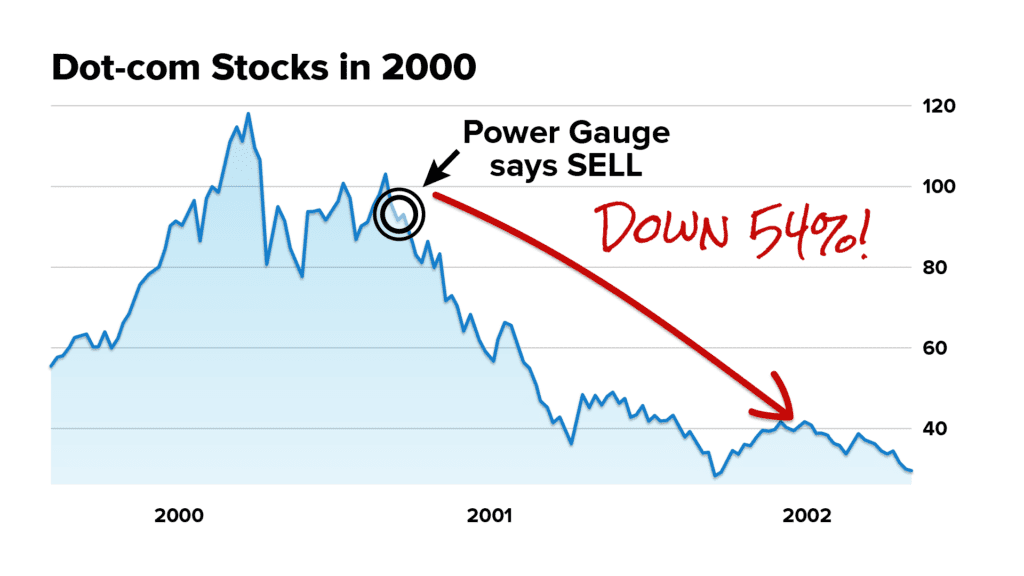

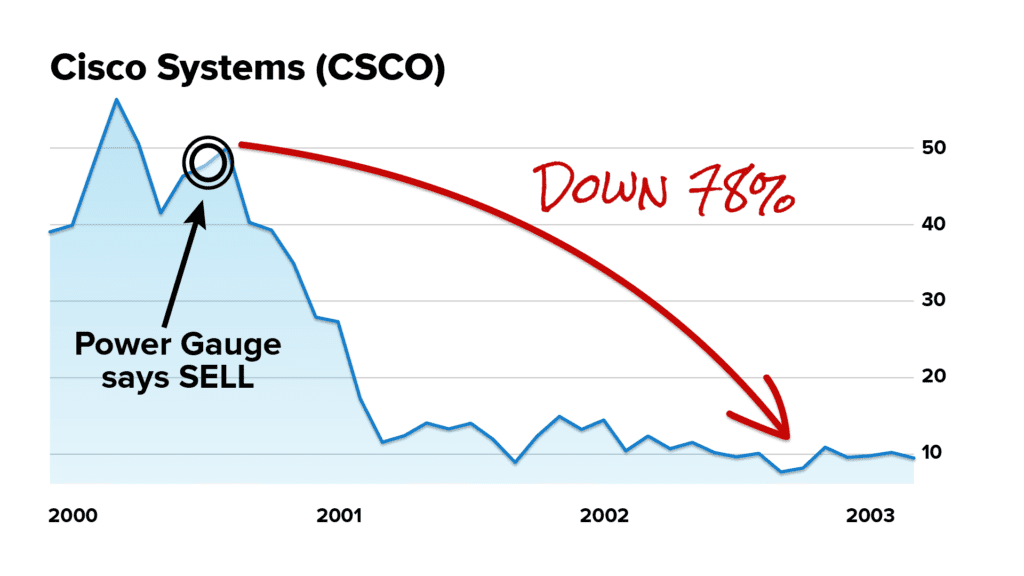

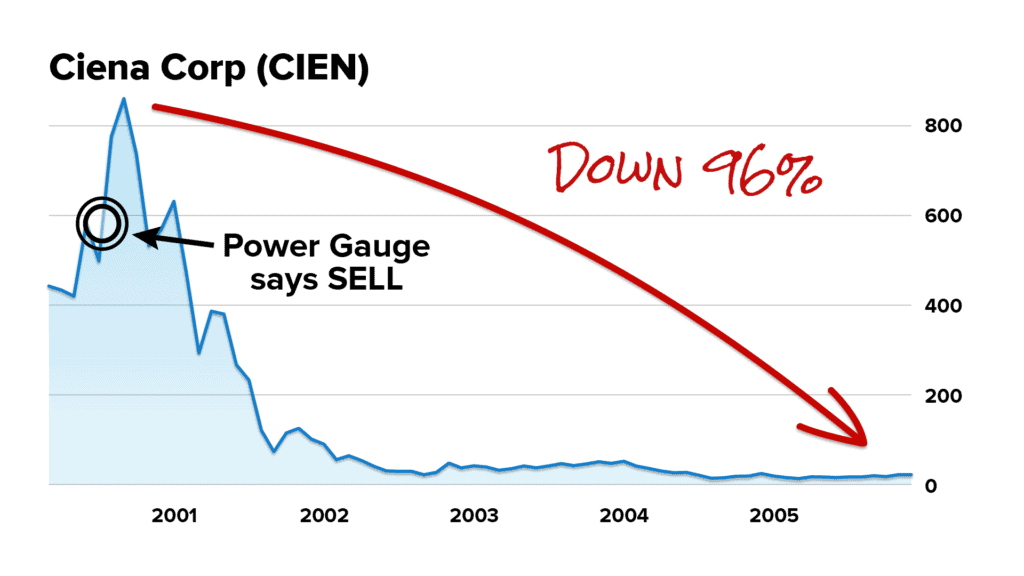

Let me show you a very extreme case, and how we would have navigated it using the Power Gauge.

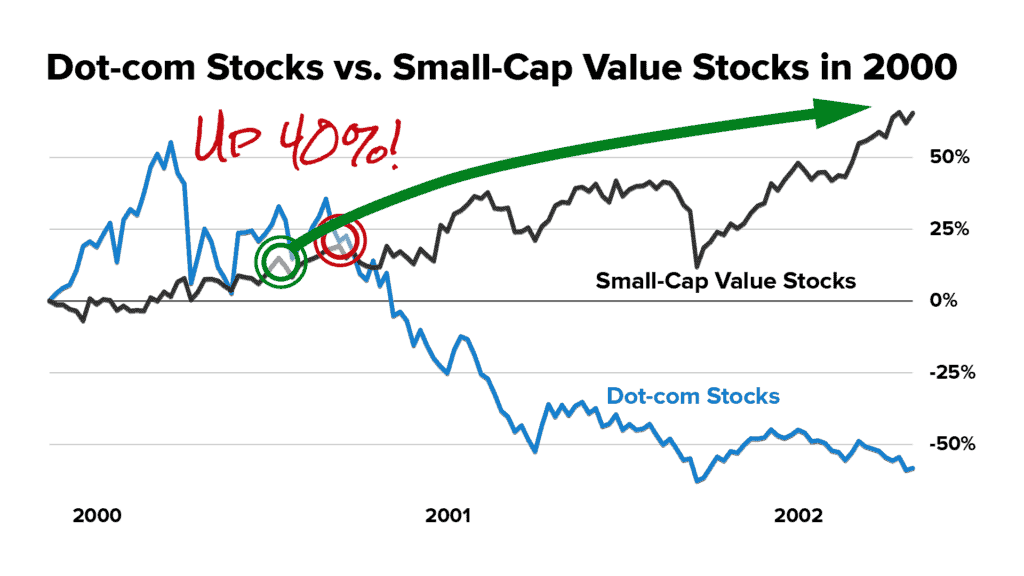

While I didn’t officially launch any of my software until 2011, we have all of the market data from the 2000 crash.

I prepared some backtested examples to show you how the Power Gauge would have performed.

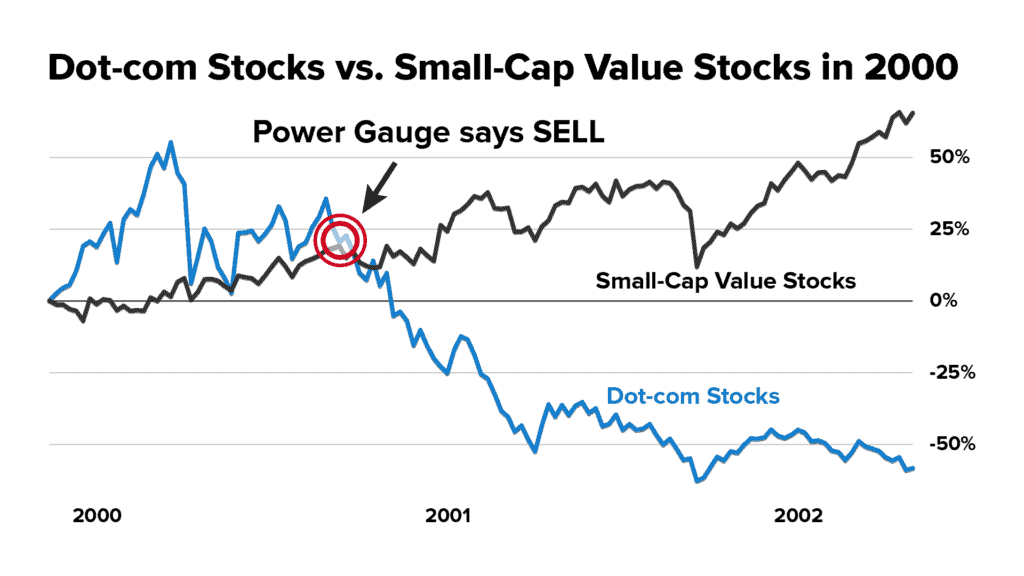

First up – we know the tech sector felt the brunt of the destruction in 2000.

The Power Gauge would have seen it coming…

And issued a Bearish warning right here… before the entire tech sector crashed 54%.

AMY:

You would have essentially known the dotcom crash was coming.

MARC:

Well, a more accurate way to put it is that the Power Gauge would have detected this huge bearish shift in tech.

And then it would have alerted you to take any profits on the worst of the worst stocks – the dotcom companies headed for total destruction.

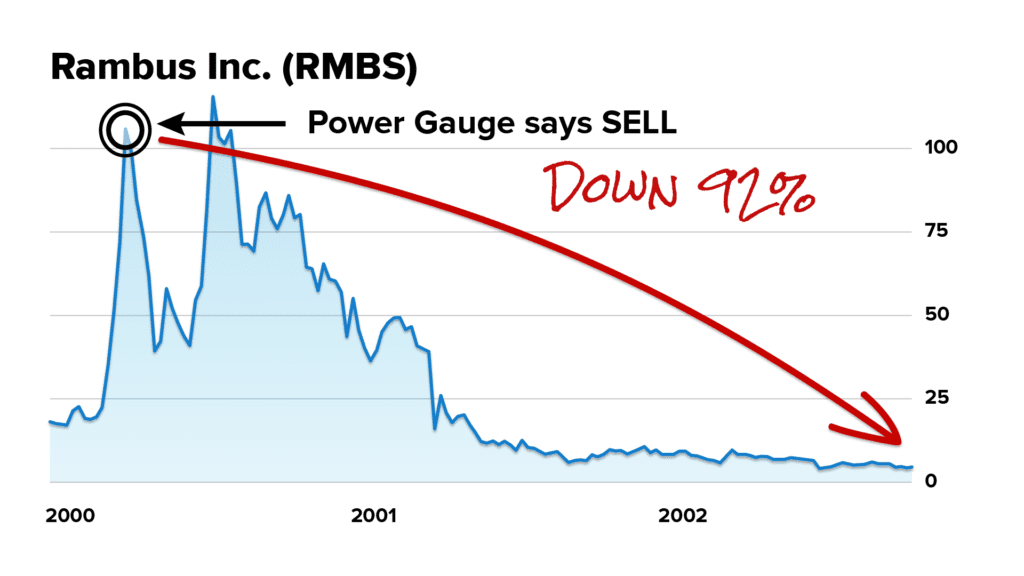

Like Cisco Systems before it plunged 78%…

Telecom company, Ciena Corporation, before it crashed 96%…

And chipmaker Rambus Inc., before it dropped 92%.

AMY:

So, thanks to the Power Gauge, you could have avoided big tech losses during the greatest tech wipeout in history.

Now what do you do? Where do you put your money when the entire stock market feels like a minefield?

MARC:

Here’s the great news, Amy:

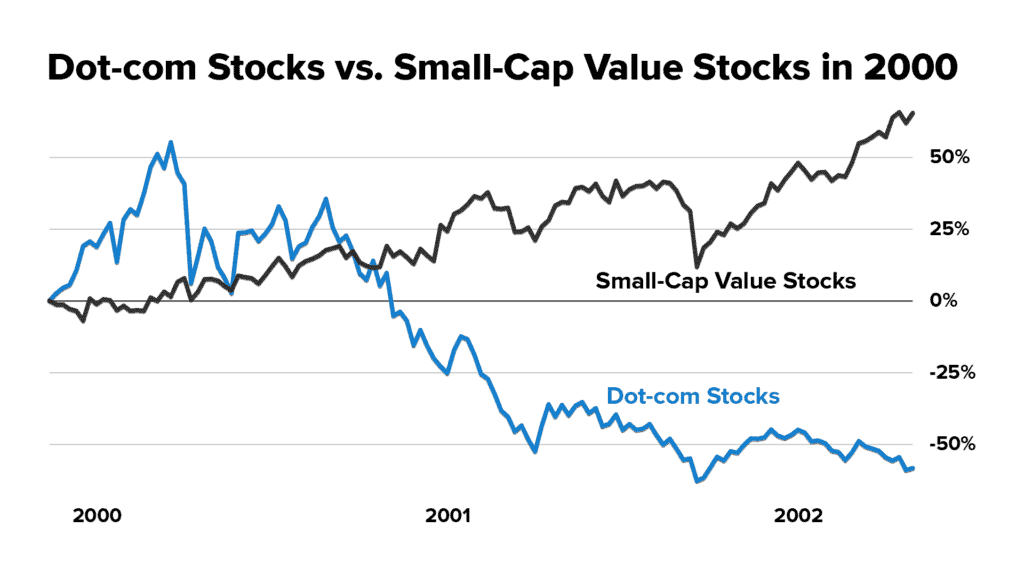

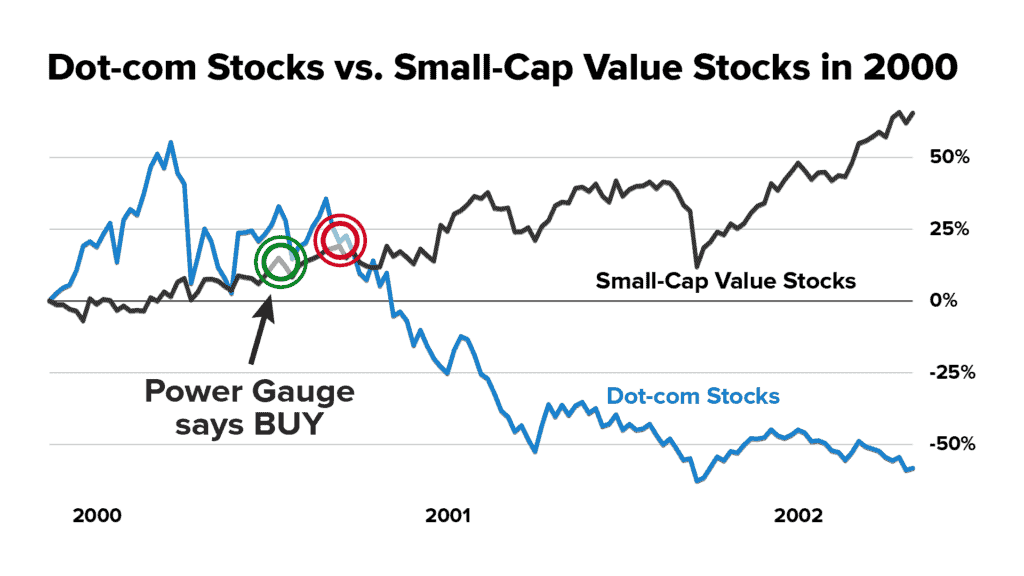

Even as tech stocks crashed, our systems would have picked up on a different part of the market that was on the cusp of a big runup:

Take a look:

As tech stocks cratered…

Small-cap value stocks staged a major breakout.

The Power Gauge would have signaled you to get out of tech right there.

And signaled you to get in to small-cap value stocks, right here.

Before this entire group of stocks went up nearly 40% from 2000 to 2002.

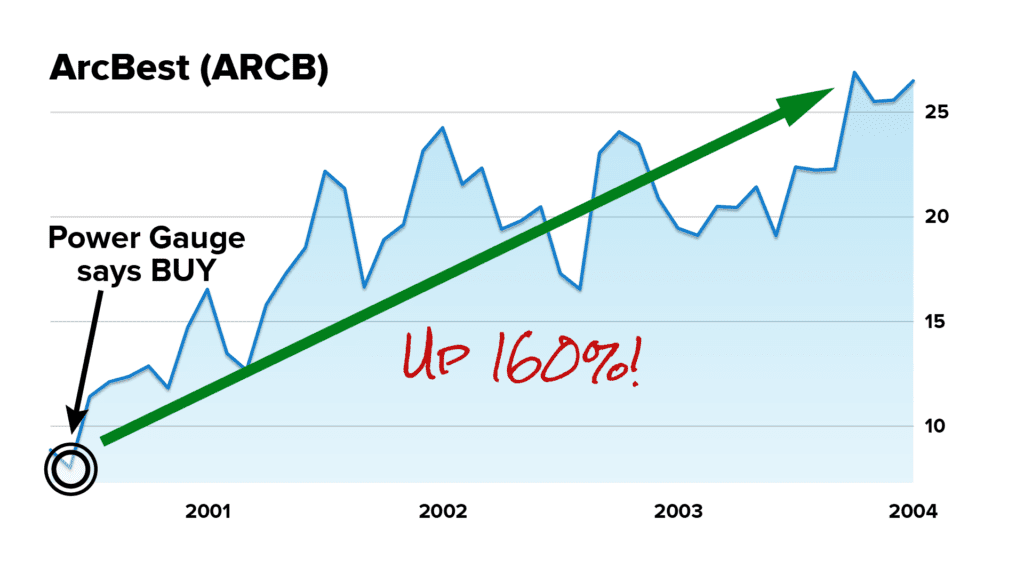

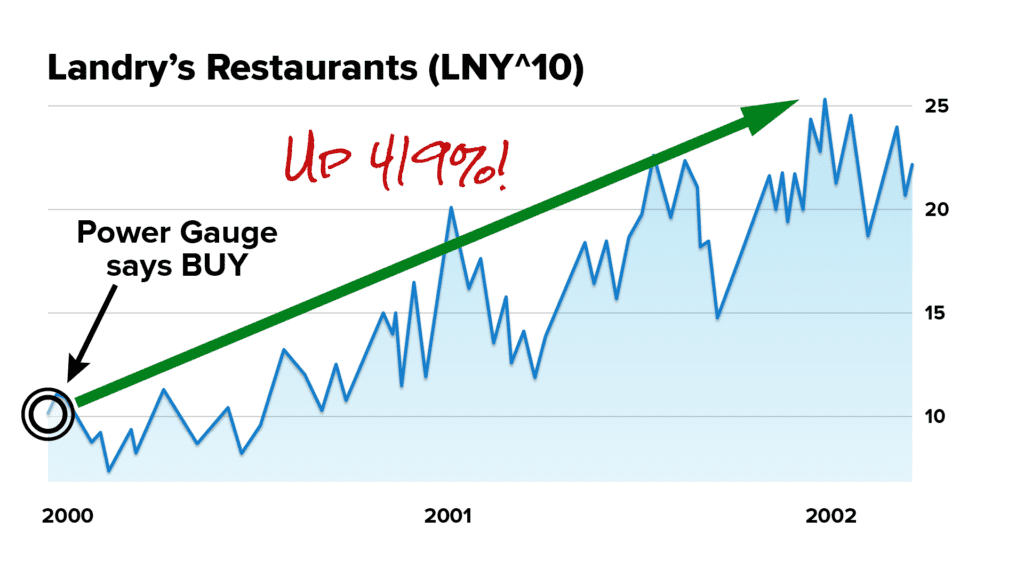

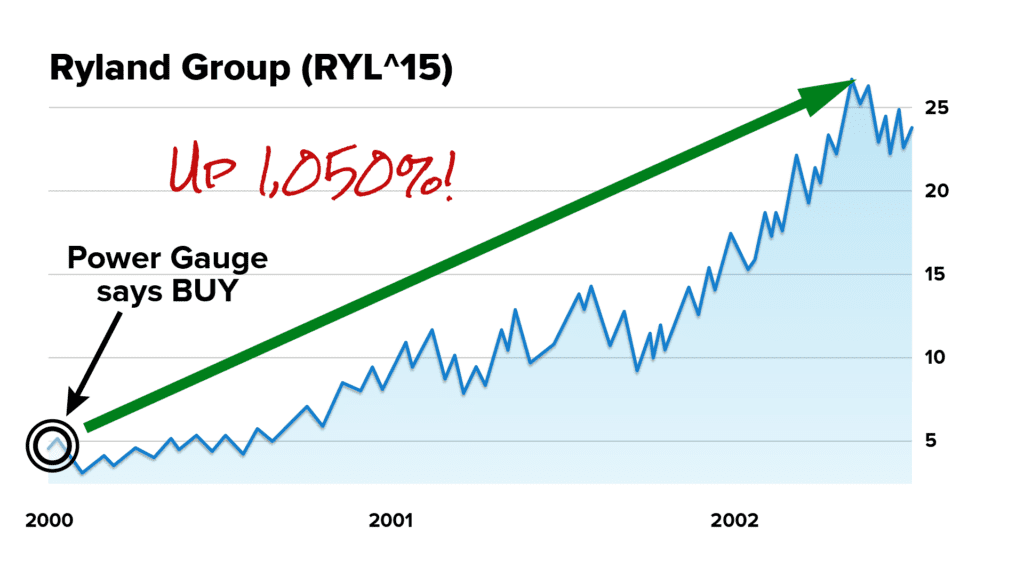

And here are just some of the “best of the best” small-cap value stocks the Power Gauge would have found for you.

Trucking company ArcBest, which soared 160%…

Landry’s Restaurants, which soared 400%…

And homebuilder Ryland Group, which soared 1,050% after it would have gone Bullish in the Power Gauge.

Now of course, these are some of the best examples from our backtest and no guarantee of future performance.

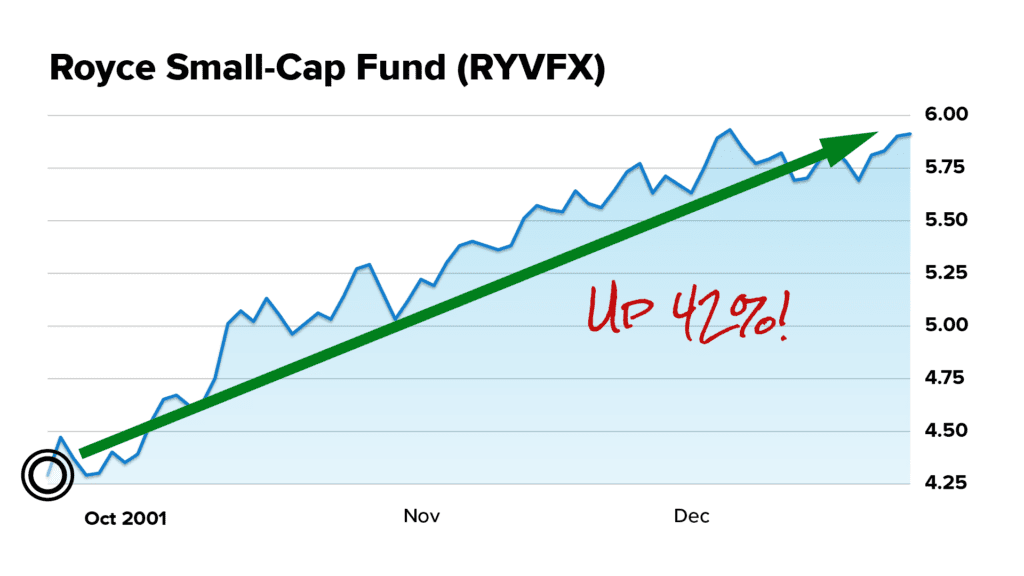

But consider that this was the exact strategy legendary fund manager Chuck Royce used in the wake of the dotcom bust…

And his small-cap value fund was up as much as 42% in 2001, even as tech stocks – and the majority of small-caps – were crashing.

My point is, even in the most dire moments in financial history… there have ALWAYS been ways to grow your wealth.

They just aren’t easy to spot. But the Power Gauge does that part for you.

AMY:

Those are incredible results, Marc.

But I have to ask – how does the Power Gauge perform when everything’s dropping – like in March 2020?

Did your software see it coming?

MARC:

It’s true, the COVID Crash was very hard to navigate for most investors. It came on so suddenly… and it seemed like nowhere in the stock market was safe.

AMY:

Also, most people consider it the result of a “Black Swan” event… so impossible to predict.

MARC:

Yes, that does seem to be the consensus. But that’s the extraordinary thing about the Power Gauge – it detects the undetectable.

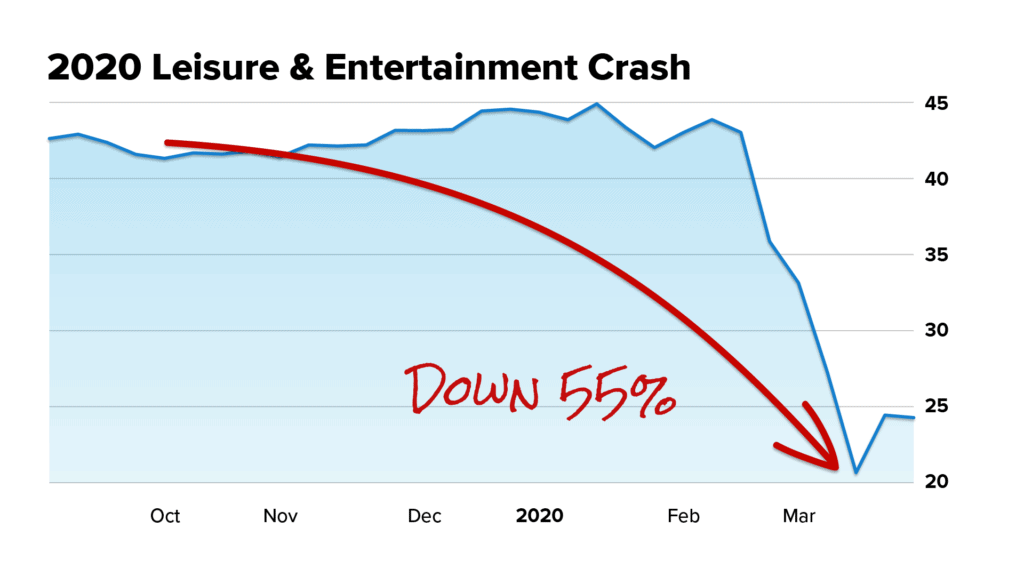

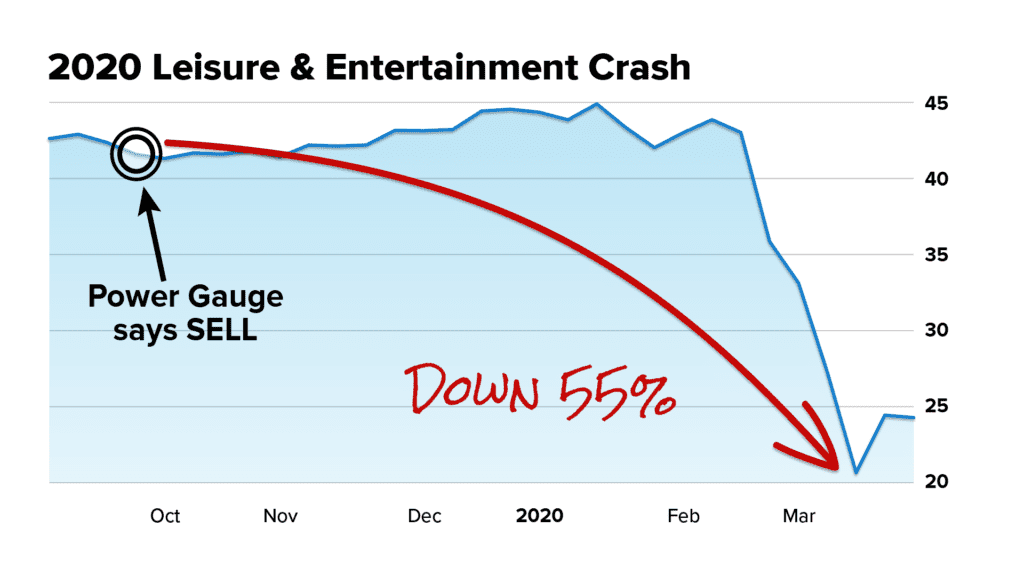

Let’s look at the leisure and entertainment industry. We’re looking at hotel stocks, travel booking stocks, concert venue stocks.

AMY:

The absolute worst companies to be holding when the entire world shuts down.

MARC:

That’s right. The entire industry crashed 55% in February 2020… and didn’t get back to even until over a year later.

But with the Power Gauge, you would have known to sell the worst of the worst leisure and entertainment stocks in your portfolio… all the way back in September 2019.

That’s when the entire industry received a Bearish rating.

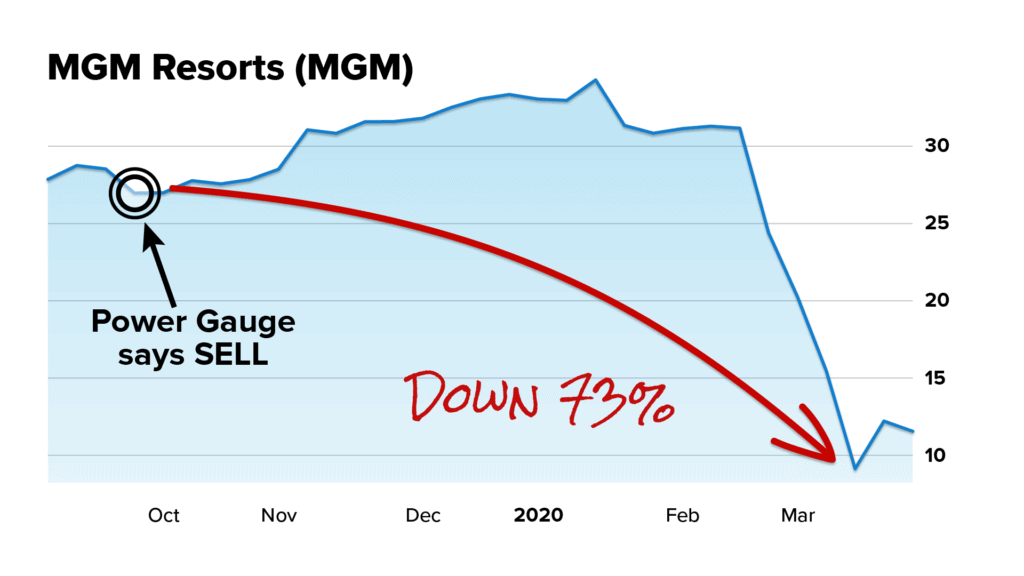

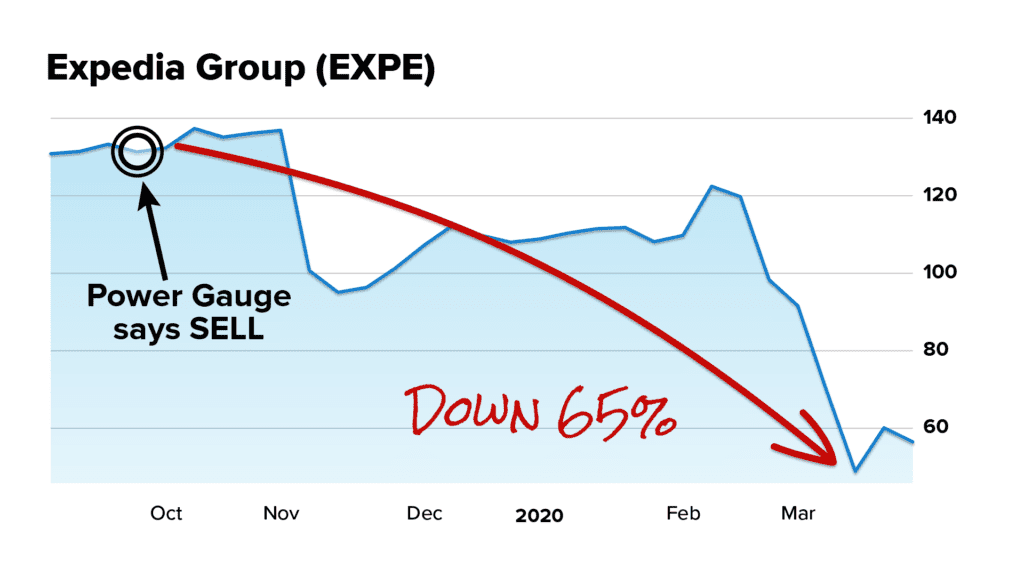

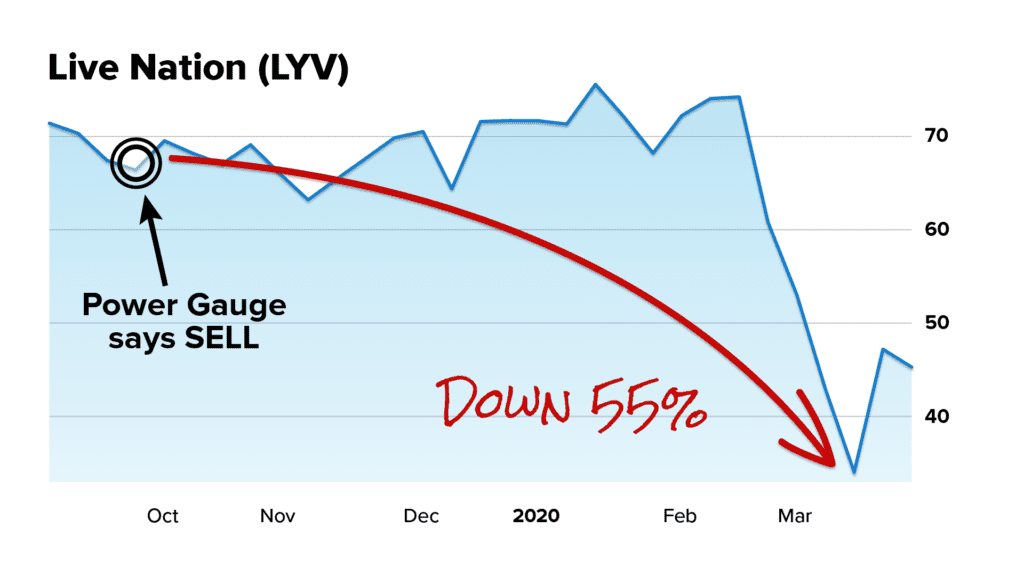

And you would have instantly known to sell stocks like:

Hotel chain, MGM Resorts, before it fell 73%.

Travel booking company, Expedia Group, before it fell 65%.

And global entertainment company, Live Nation, before it fell 55%.

Just imagine going through that crash all over again… without having to worry about all the damage that was done to airlines, cruise ships, all of the cancelled events.

Wouldn’t it have been a completely different experience? Wouldn’t you have slept so much better at night?

AMY:

Absolutely.

But to be honest when I think about financial moments in history when you really needed to sleep better at night, I don’t think about 2020. It was over so fast.

I think about 2008, and the total devastation it caused, for years.

MARC:

I don’t blame you, Amy.

But through our back-testing, I can show you how the Power Gauge would have helped you navigate that crash, and the long bear market that followed.

What sector or industry was the tipping point that triggered the entire crash?

AMY:

Financial stocks.

MARC:

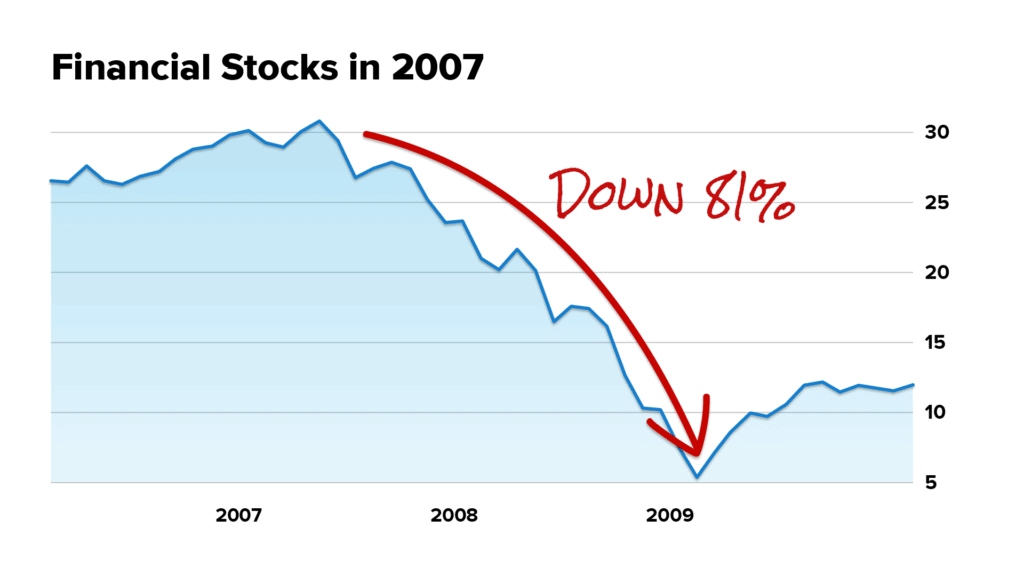

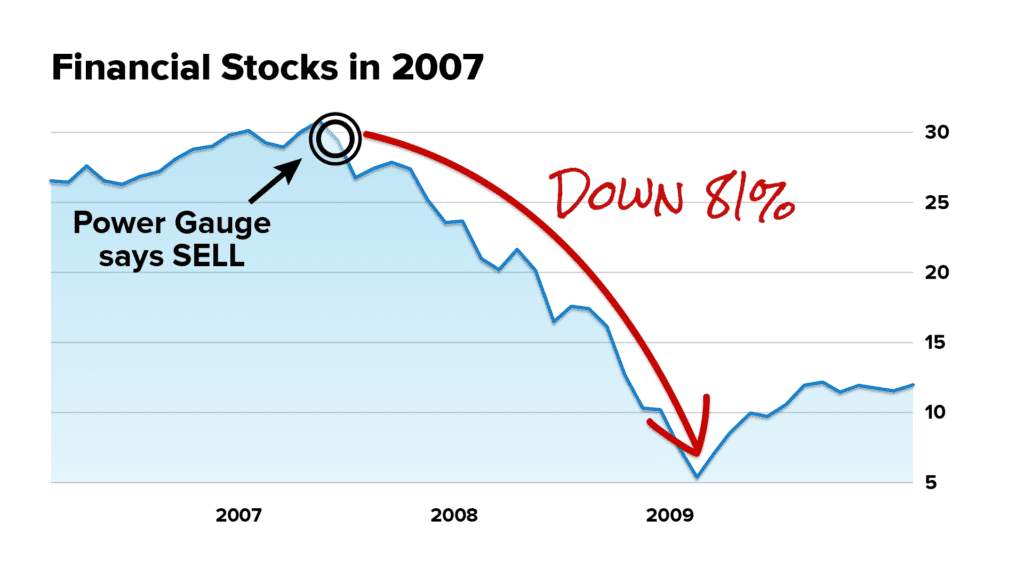

Precisely. Here’s what happened to the entire financial sector from May 2007… through February 2009…

AMY:

That is a very scary chart.

MARC:

It is. But we can dramatically improve it when we circle July 2nd, 2007. That’s when the Power Gauge issued a Bearish rating for the entire financial sector – before it crashed 81%.

AMY:

That’s a definite improvement!

MARC:

And it gets even better.

Just as we saw during 2020 and the recent Rolling Crash…

Certain stocks perform even more poorly than the sector itself.

The Power Gauge is able to find them, and show you how to get out of there before the stocks go into freefall.

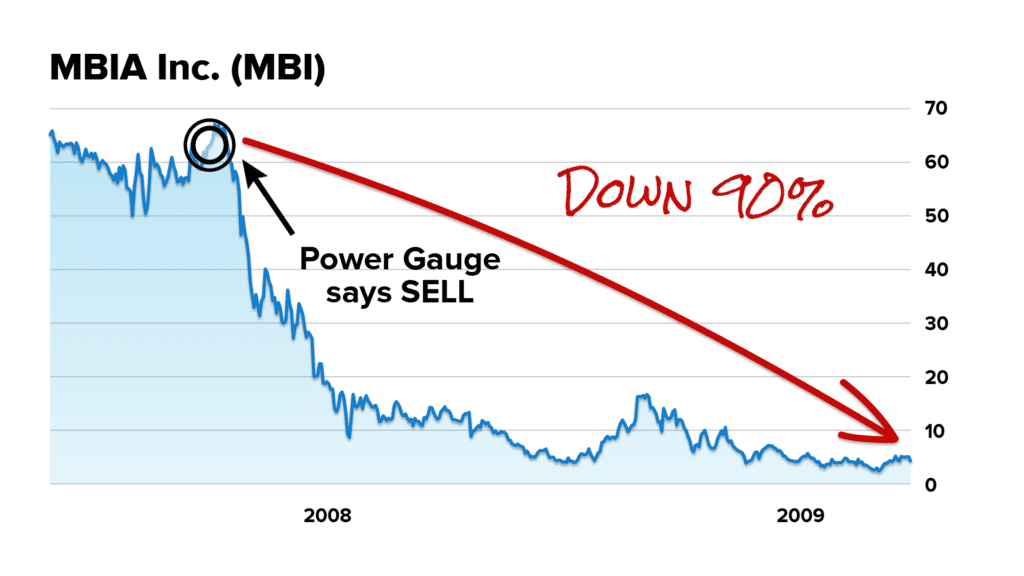

That’s what happened to the world’s largest bond insurer, MBIA Inc. It would have gone Bearish in October 2007… and promptly crashed 90%.

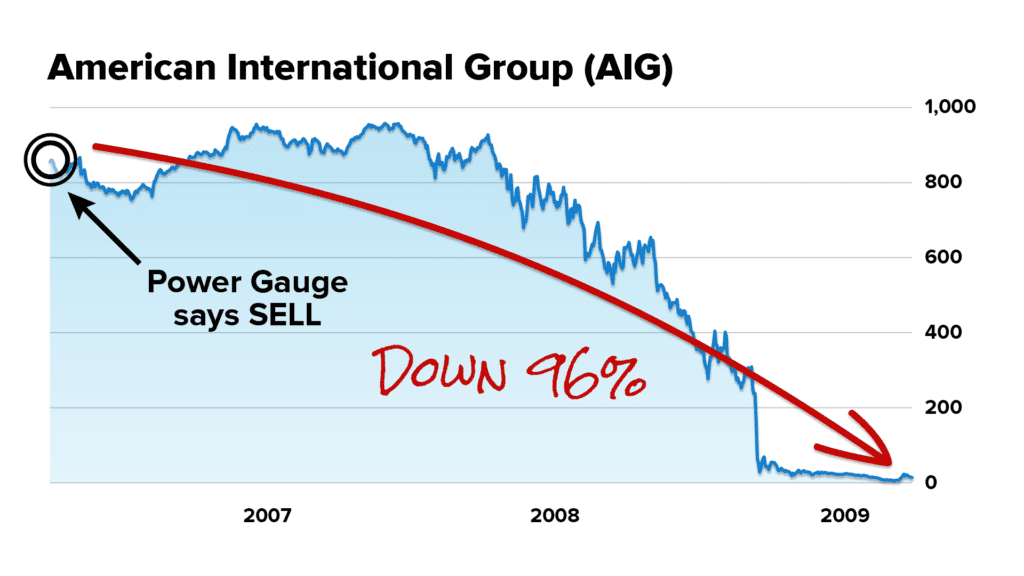

And here’s insurance giant, American International Group, or AIG. This Bearish signal would have shielded you from a 96% loss in this stock.

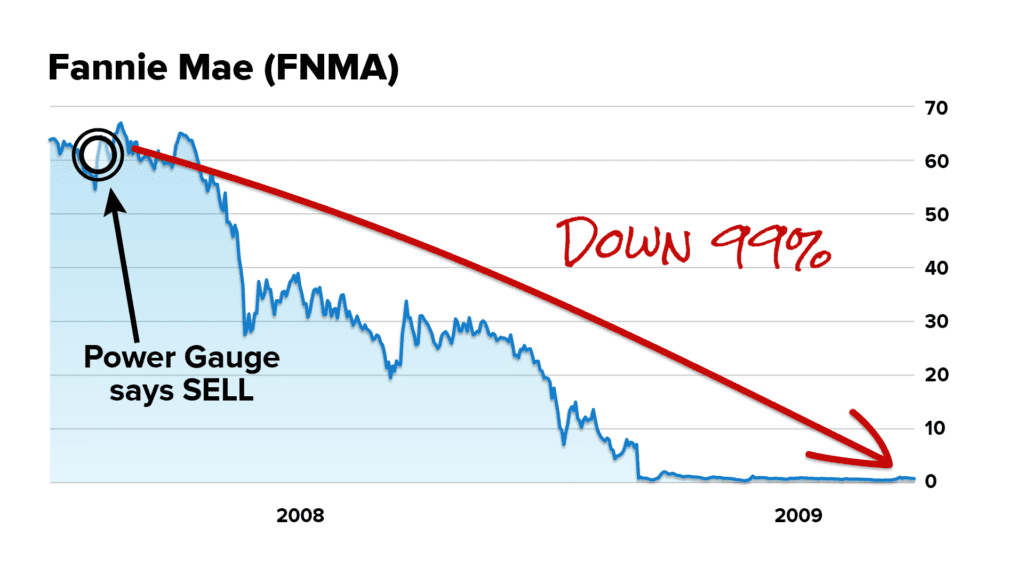

And finally, take a look at one of the most notorious casualties of the entire 2008 crisis: Fannie Mae.

AMY:

Fannie Mae going bankrupt really marked the point of no return.

MARC:

It was an incredibly dark day for millions of Americans.

But we would have seen it coming – and issued a Bearish warning for Fannie Mae, before it crashed 99%.

AMY:

And even during those dramatic crashes – would the Power Gauge have been able to find places to make money?

MARC:

Absolutely. Remember, whenever one or multiple industries are crashing…

AMY:

There are always one or more industries going up.

MARC:

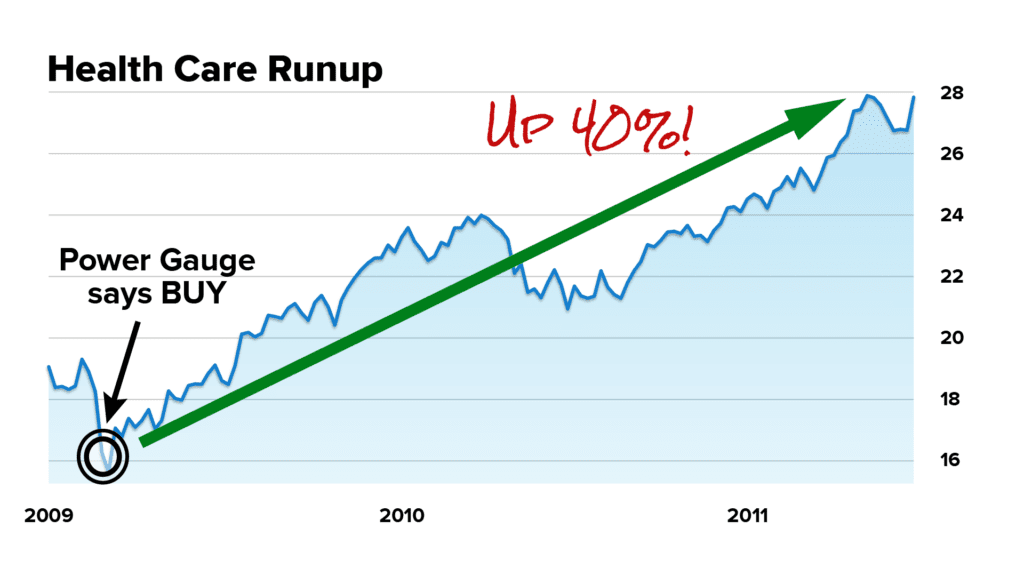

Even in the devastation of the Great Recession, Healthcare stocks roared back relatively quickly.

So quickly, that the Power Gauge would have signaled you to BUY right here… before its extraordinary 40% runup.

And there was even greater opportunity as the dust settled during the COVID crash.

Amy, do you remember what type of stocks led the extraordinary recovery that began in April 2020?

AMY:

Definitely biotech.

MARC:

Well done. Now take a look at this…

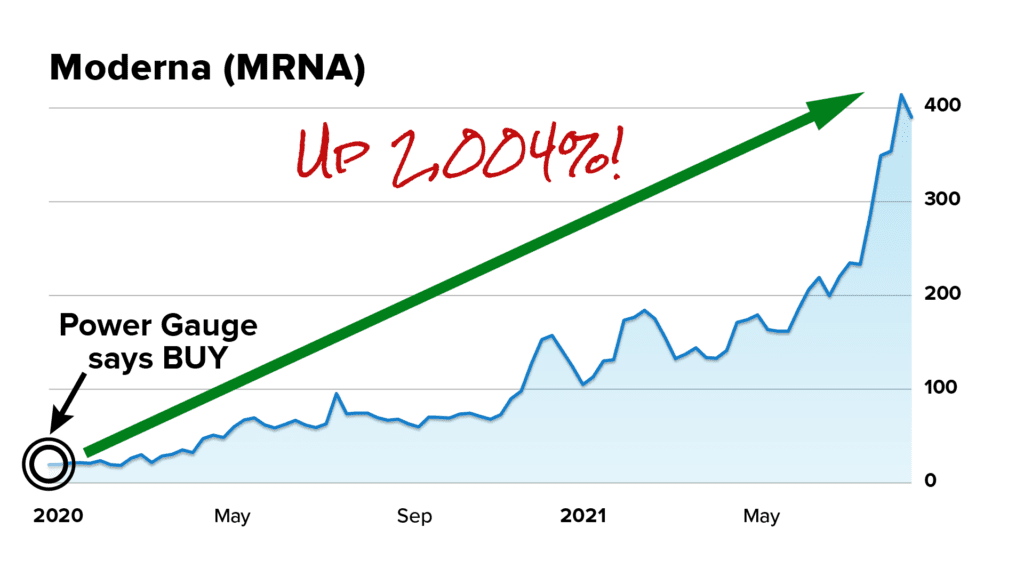

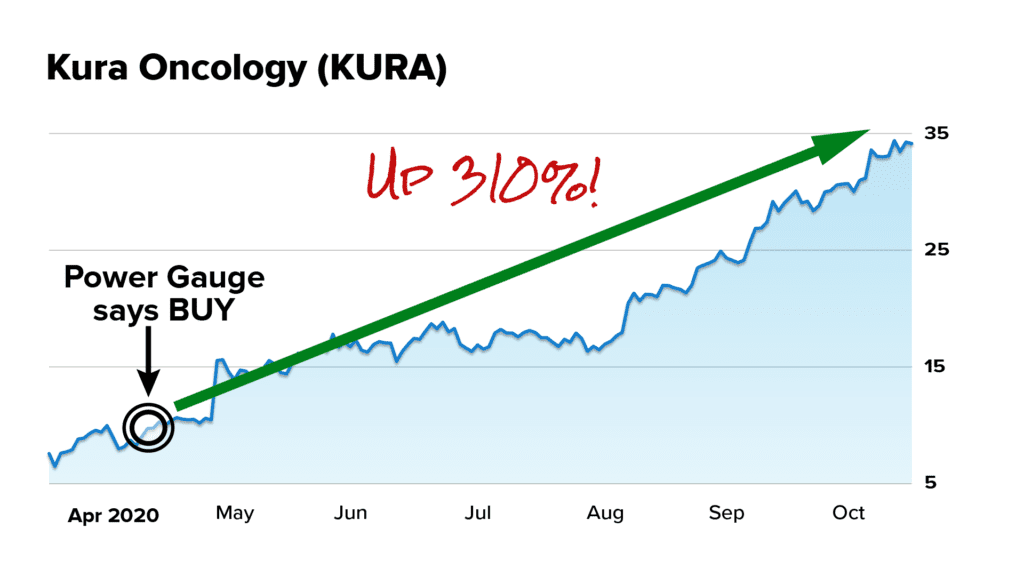

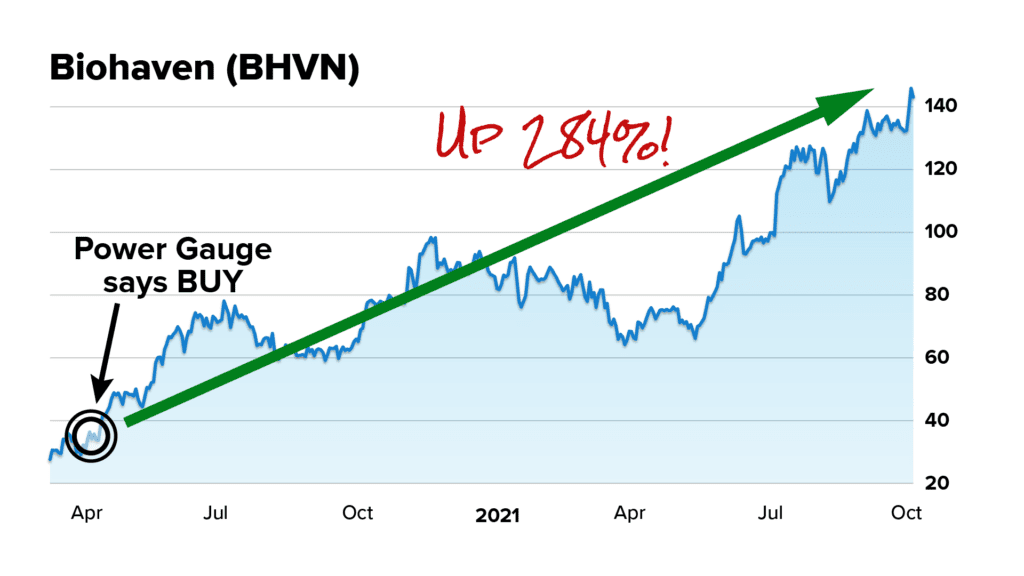

With the Power Gauge, you would have known to get back into the biotech industry in the early days of April 2020.

Including the “best of the best” biotech stocks at the time.

You would have known to get into…

Vaccine-maker Moderna, before it soared as much as 944%.

Kura Oncology, before it skyrocketed as much as 310% in just six months.

And Pharmaceuticals company, Biohaven, before it jumped as much as 284%.

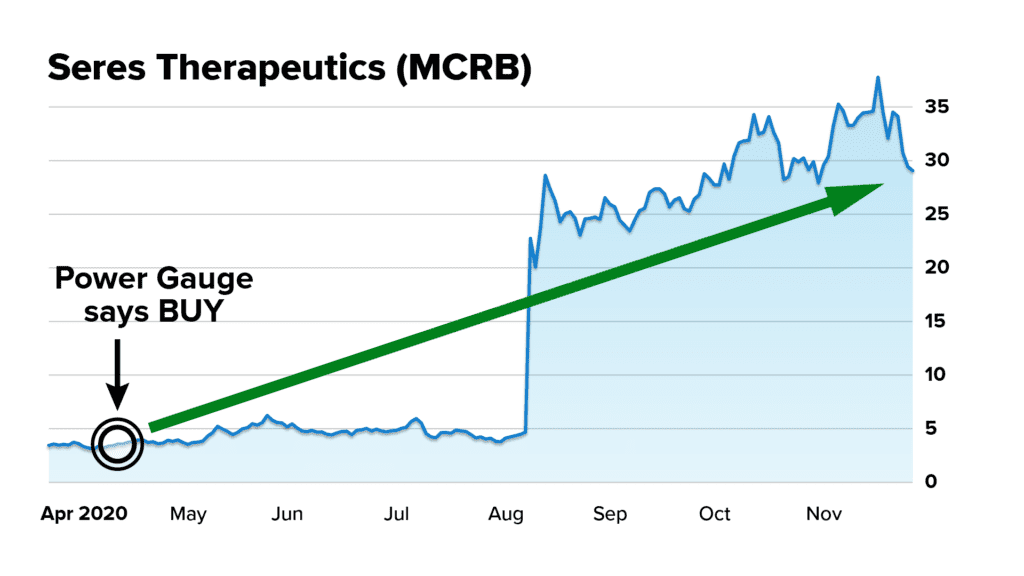

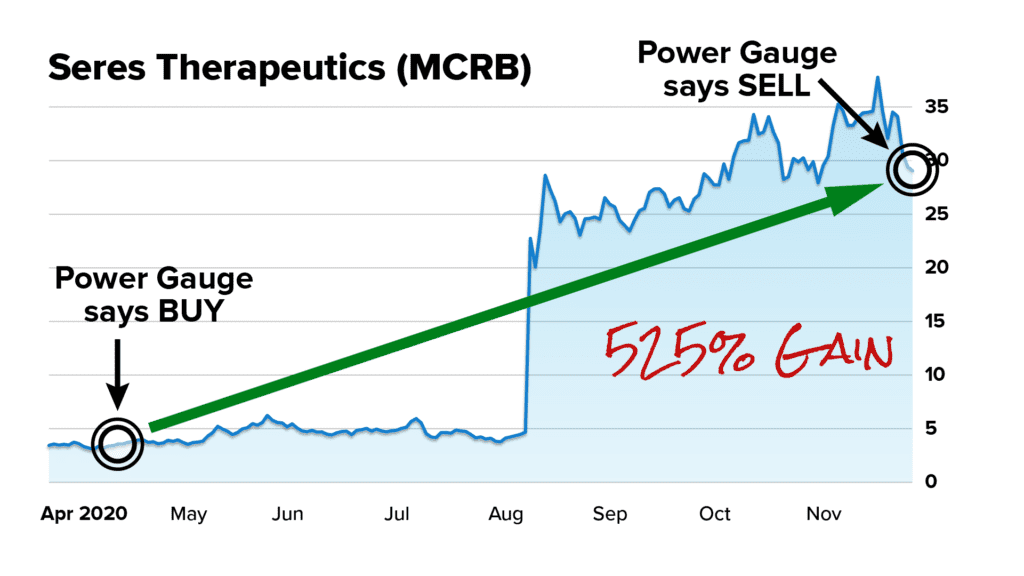

Plus, you have to see what happened with popular biotherapy stock, Seres Therapeutics.

If you had followed all of my systems’ buy and sell signals…

You would have known to buy Seres in April 2020, when it was trading for less than $4…

You would have known to hold on as it went absolutely vertical.

And then you would have received a Bearish “Sell” signal – and known to lock in your 525% gain.

Here’s the bottom line:

No matter what is happening in the markets…

Whether it’s a global pandemic… a catastrophe at the very foundation of our entire economy… a war brewing overseas…

Or a Rolling Crash spreading through the market…

With the Power Gauge on your side, you can see these big shifts coming.

You can avoid the worst of the worst stocks doomed for destruction…

And move your money into the best of the best stocks that are poised for fantastic growth.

AMY:

That all sounds well and good.

But I think we need to address the elephant in the room… what if the recent market swings get even worse?

Will we see a repeat of 2008 or 2020?

MARC:

Well, Amy, I hope this doesn’t sound cavalier.

But it really isn’t going to matter, as long as you know what’s happening in the Power Gauge.

As I showed you today, we can pick up on small market tremors before these major events play out.

Remember, the Power Gauge even signaled BUY on Oil & Gas stocks months before oil soared over $100 a barrel.

So if we do see a big 50-60%+ crash – next week, next month, or next year:

We can tell you what’s likely to get hit hardest… like financial stocks in 2008…

We can tell you which stocks will likely recover fastest… like biotech stocks in 2020…

And we can tell you where there is STILL money to be made while the majority of industries are crashing… like small-cap value stocks in 2000.

So right now, I urge you to stop worrying about the overall market.

Instead, you should be most concerned with knowing where the Rolling Crash is headed next…

AND knowing where the next Rolling Runup is already taking shape.

That’s what your money depends on today.

I’m going to share the name of a stock that I believe is on track to be devastated by the next phase of the Rolling Crash…

Plus a stock that I believe is about to directly benefit from an extraordinary runup. So please have a pen and paper ready.

But to be clear, these two free recommendations are only part of the story.

And what I’m about to say is far more important than a single name and ticker…

Because based on what my systems are telling me…

And despite all of today’s doom and gloom…

I predict the Rolling Crash will soon come to an END.

And it’s time to prepare yourself for what comes next.

AMY:

Wow. How can you be sure?

MARC:

As always, it comes back to the Power Gauge.

Remember, here are all of the industries affected by the Rolling Crash so far.

And here’s when the Power Gauge sounded the alarm.

But here’s the most important part:

Since the Rolling Crash began in early 2021, every single industry we track, except one, has crashed over 20% into a bear market.

That was the insurance industry, by the way. Insurance companies tend to benefit when interest rates rise – so it’s no surprise that 2022 was ultimately a pretty decent year for those stocks.

But in every other industry, the Power Gauge signaled a crash.

And my system was right.

Every single industry besides the Insurance Industry has now crashed anywhere from 20%… to 60%.

That’s a huge signal that the Rolling Crash is coming to a close.

And when it does, the majority of industries are about to shoot UP 30-50% – and give you the chance to make a lot of money in the process.

If you missed out on any of the recovery gains after the COVID crash in 2020 – this could change EVERYTHING for you.

AMY:

30 to 50%?!

MARC:

If history is any guide, yes.

Following the Rolling Crash in 2018, the stock market was up over 30% a year later.

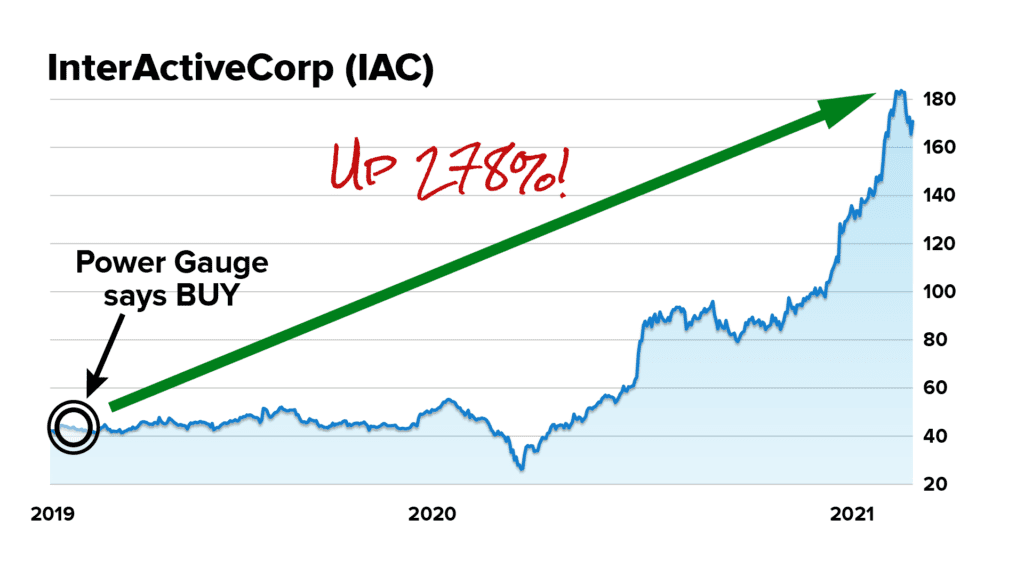

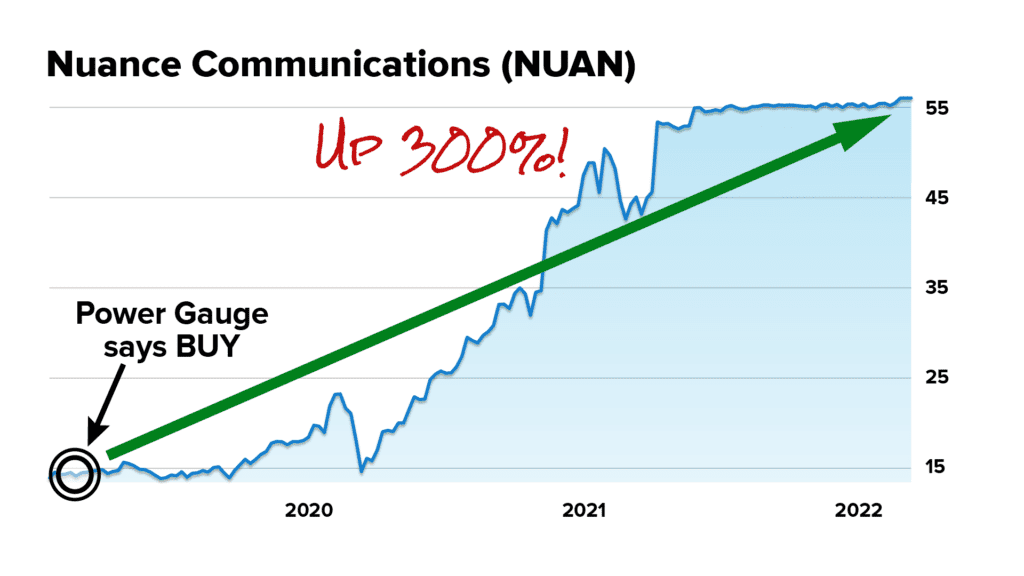

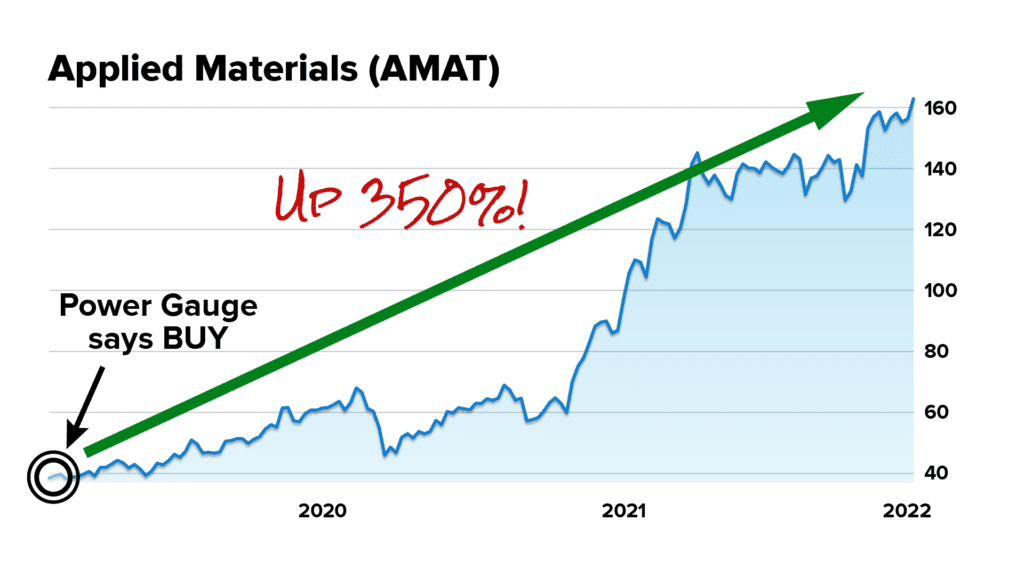

And in that year alone, we would have gotten you into “best of the best” stocks like…

InterActiveCorp, before it shot up 278%

Nuance Communications, which went on soar nearly 300%.

And Applied Materials, before it skyrocketed nearly 350%.

Of course, these are some of our best gains and past performance is no guarantee for how things will play out in the future.

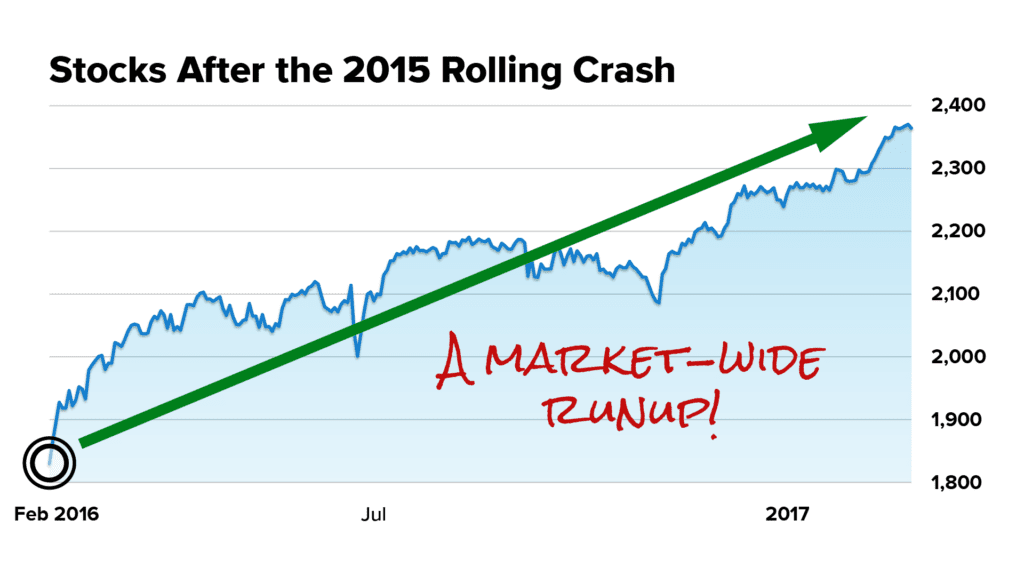

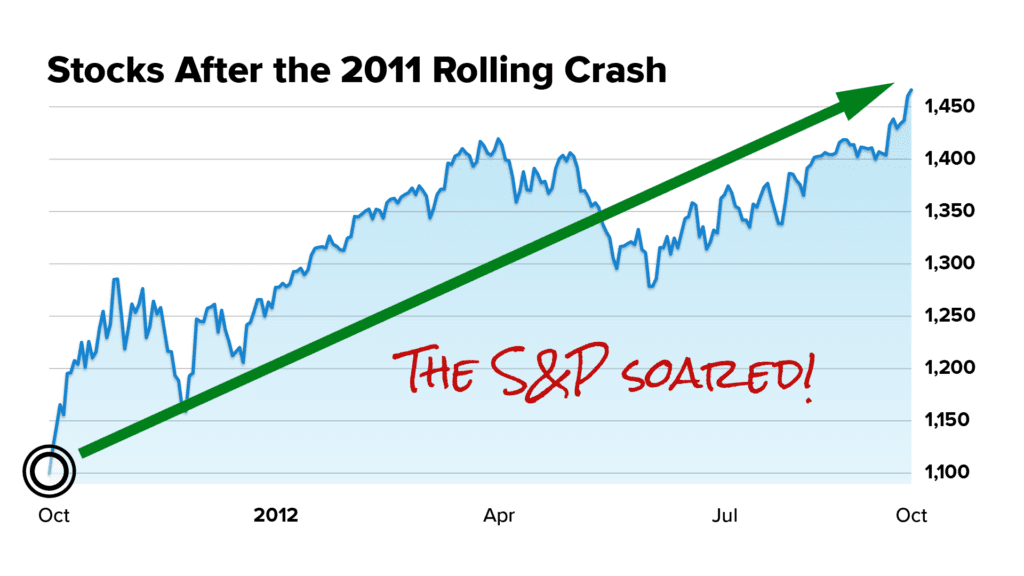

But going back even further, you’ll see the same phenomenon after the Rolling Crashes in 2015 and 2011:

Stocks were up around 30% a year later.

AMY:

That’s one heck of a pattern.

MARC:

It is.

Now a word of caution: some industries will do much better, while others will underperform.

The “worst of the worst” stocks in those underperforming industries will stagnate, and in some cases, absolutely continue to crash.

So we’re going to turn to the Power Gauge to determine the winners and the losers, and most importantly – choose the best and worst stocks from each.

Obviously you can’t throw a dart at any stock in a top industry and expect to make the most money possible. But that’s what the Power Gauge is for.

AMY:

So where does the Power Gauge say the biggest winners will be?

I think I speak for a lot of folks watching when I say this… can’t you just look in the Power Gauge and tell us which of those “best of the best” stocks to buy?

MARC:

Well, as I just showed you, we are approaching an extraordinary inflection point in the financial markets.

Today, you have one shot to take advantage of a historic buying opportunity before most people even know it exists.

It’s your chance to catch up on any of the gains you may have missed out on during the COVID crash recovery…

And you can do it while taking on the least amount of risk… because you’re only looking at the best-performing stocks in the best-performing industries.

I don’t want anyone watching right now to miss out on this.

So yes, I’ve decided to essentially do the “hard part” for you.

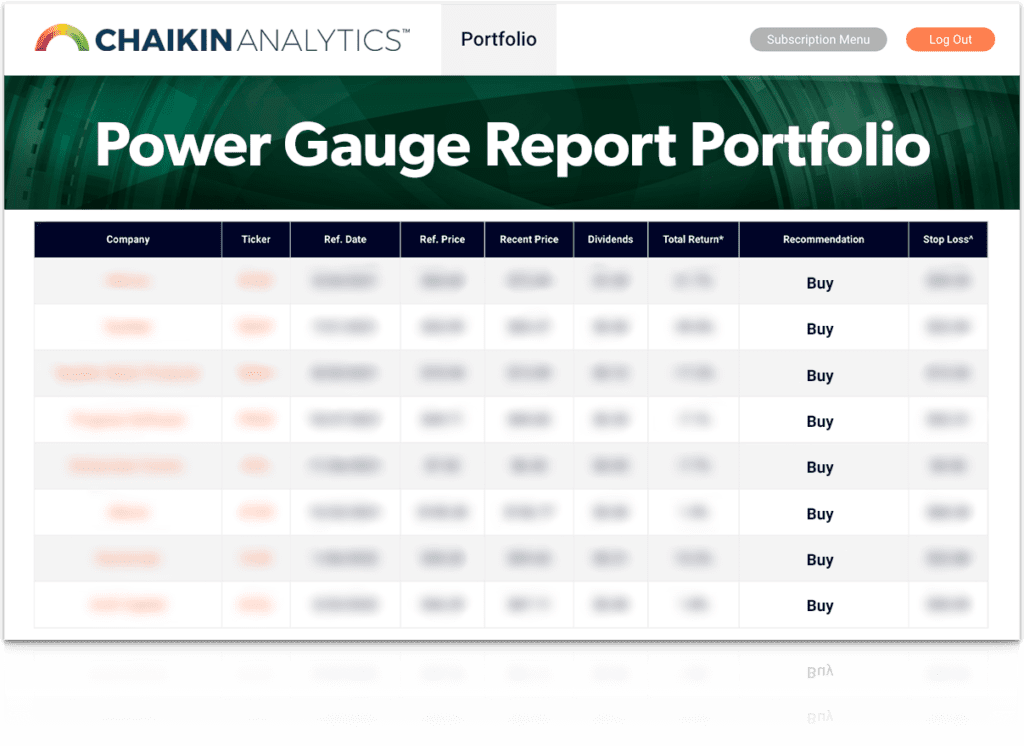

I’ve used the Power Gauge to create an entire model portfolio of stocks to help you take advantage of this exact moment in the markets.

I firmly believe it’s the only investment blueprint in the world that can help you protect your money from the worst of the worst stocks in underperforming industries in the next 90 days…

While also potentially giving you the extraordinary gains I’m predicting as some industries soon begin to soar in the next 90 days.

And it’s all backed by a built-in exit strategy that will help us stay the course… and know the perfect time to lock in any gains.

AMY:

Can you tell us a little more about these recommendations?

MARC:

Absolutely.

Using the Power Gauge, I’ve pinpointed the most promising Industries in the stock market right now – focusing on those with strong Bullish ratings.

And from those Industries, I selected a shortlist of stocks that are positioned for incredible growth.

I’ll say that most of these stocks probably aren’t on your radar right now. I specifically screen for stocks at the beginning of a Rolling Runup.

But I anticipate they’ll be making headlines before long.

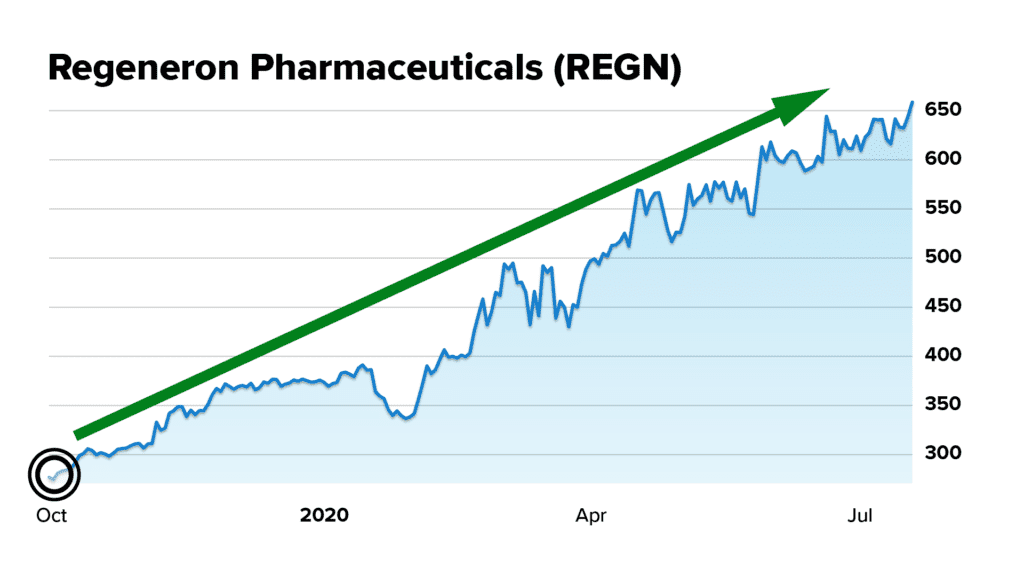

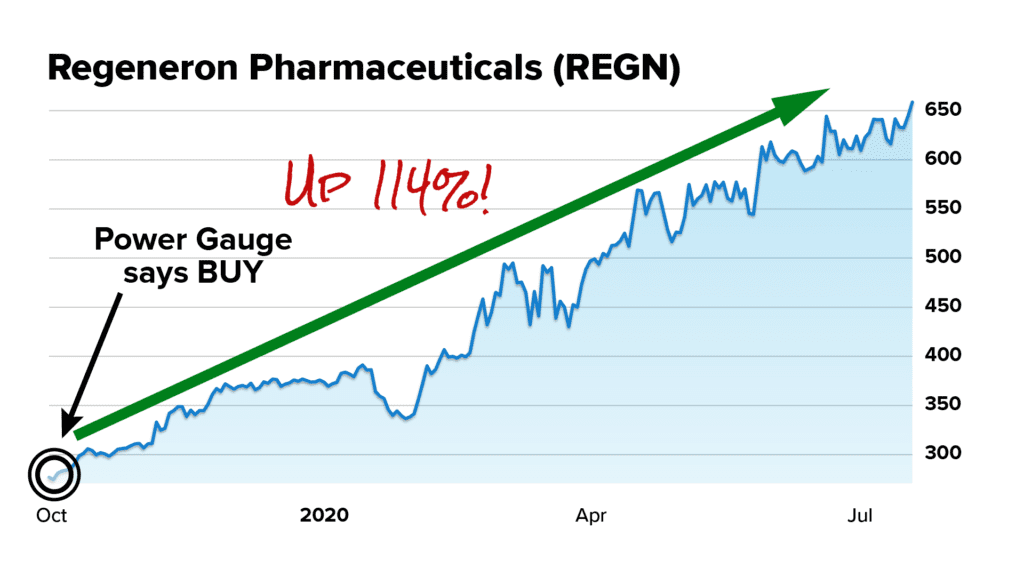

That’s what happened with Regeneron Pharmaceuticals during the COVID pandemic. It took off like a rocket in February 2020.

But Regeneron turned Bullish in the Power Gauge here… all the way back in October 2019.

So you would have known it was a “best of the best” stock and a huge BUY… months before the rest of the world caught on… and Regeneron soared 114%.

And remember – this was during a period where the overall market crashed 30%.

AMY:

That sounds incredible.

And I know you’re planning to give away the name and ticker of a stock that’s also a big BUY right now.

Along with the #1 stock to avoid.

But first, can you explain how folks watching right now can access your new Power Gauge recommendations?

MARC:

Of course.

I only publish this model portfolio of Power Gauge recommendations in one place:

My world-renowned research service, Power Gauge Report.

Every month, I’ll give you an update on the historic Rolling Runup we’re beginning to see in certain “best of the best” U.S. stocks.

And I’ll issue a new recommendation, vetted by the Power Gauge, to help you take advantage of it.

A best of the best stock.

This is ALSO where I’ll signal that it’s time to sell and lock in any profits on our Power Gauge Report recommendations.

And update you if there’s a big “tremor’ in the overall markets that this powerful system has detected.

For example, if I do see a big crash coming in the Power Gauge, this is where I’ll notify you about it.

AMY:

This should come as no surprise after all of the incredible evidence we’ve seen today…

But when it comes to following Marc and his extraordinary system, the consensus is clear:

Once you start investing the Chaikin way, you never go back.

That’s what reader Charles P. told us. He says,

“I successfully manage my retirement account with this. I have tried many programs over the years and have literally spent thousands of dollars. None have been as easy-to-use or reliably accurate. In today’s market, this information is a necessity. I would not invest without it.”

And Marie L. wrote:

“I’m a relative novice to the stock world. However, I was able to exceed my expectations of return during my first year using Chaikin’s work. Thanks to Chaikin I absolutely love delving into the market. Never in a million years did I think the stock market would become my passion in retirement. Chaikin made that happen.”

And of course, don’t forget that Jim Cramer himself is a huge fan of Marc’s work…

“I learned a long time ago not to be on other side of a Chaikin trade.”

He went on to say:

“I want to explain why I love Marc’s stuff. It’s simple, it’s understandable, it’s rational, it’s not emotional, and I use it constantly and I almost never want to go against it.”

* Standard disclaimer: The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Now, with feedback like that, you can see why institutional investors have paid Marc’s firm up to $5,000 each month to access his software and recommendations.

And consider that if you wanted to access Marc’s work through Bloomberg, you would still pay $24,000 a year for the privilege.

But as you just heard, we are approaching an extraordinary turning point in U.S. stocks.

And Marc wants to introduce you to a way of looking at the markets that before now was essentially “off-limits” to regular investors…

So you can perfectly position yourself with his shortlist of new recommendations and warnings from the Power Gauge.

Which is why today, he’s offering you a 100% risk-free trial – at a dramatic discount.

While one full year of Power Gauge Report typically costs $199.

When you act right now, Marc’s instantly knocking as much as 75% OFF the price.

That means you can get a full year of access to Power Gauge Report for as little as $49.

It’s the very best offer he’ll ever make for his work in the Power Gauge.

And by signing up right now, you’ll immediately unlock 12 months of access… for just a quarter of the usual price.

Again, it’s totally risk-free for anyone watching right now.

Within minutes, you’ll have access to your new recommendations, handpicked by Marc using the revolutionary Power Gauge.

And if you’re unhappy for any reason, you can get a FULL CASH REFUND in the next 30 days. No strings attached.

But that’s not all.

Marc is also doing something pretty unusual and pulling out ALL the stops for new subscribers to Power Gauge Report.

So he’s including three additional FREE bonuses when you take him up on today’s extraordinary 75% discount.

Marc, will you briefly explain the first bonus you’re giving away today?

MARC:

I’m happy to.

BONUS #1: 1 FREE year of Power Pulse

If you join with me right now, I'll also give you a year of FREE bonus access to the system itself.

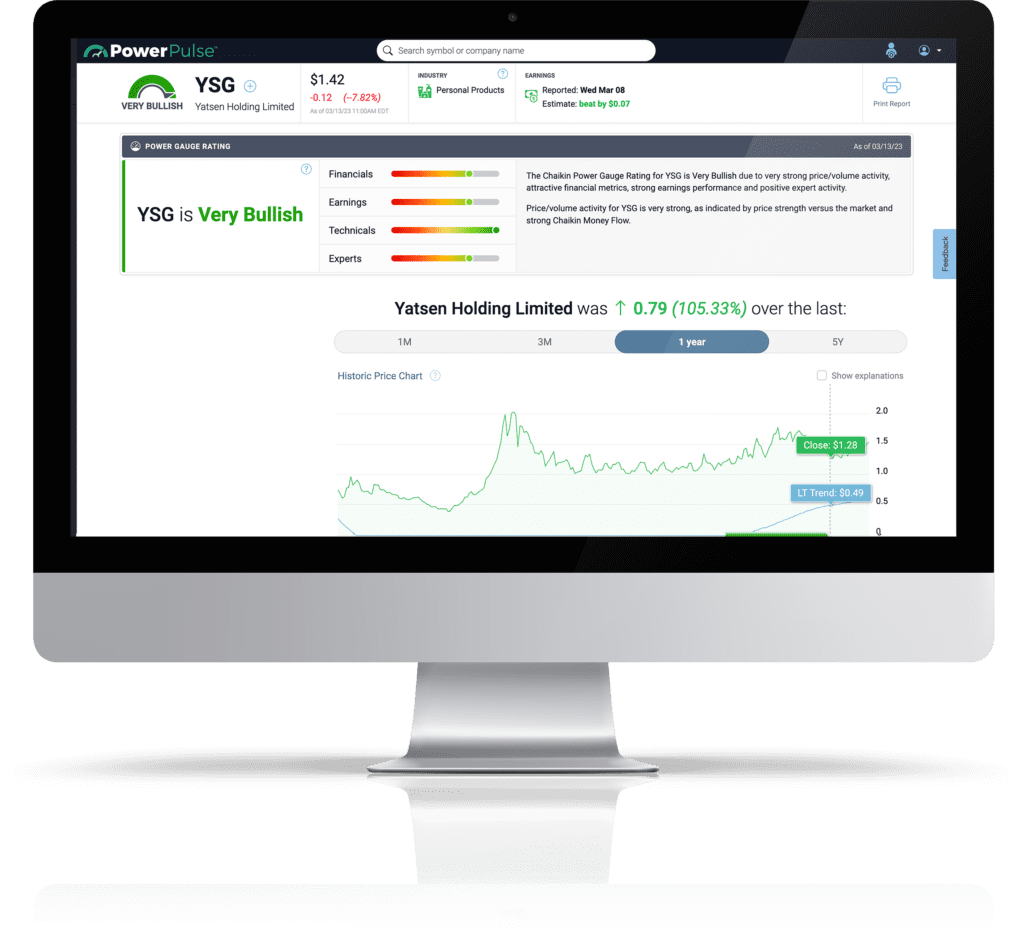

It’s a lite, simple-to-use version of the Power Gauge that we designed specifically for new users, called the Power Pulse.

And for the next 12 months, you can type any ticker into my straightforward system, and immediately know if it’s rated Bullish, Bearish, or Neutral.

The Power Pulse has all the analysis and signals I’ve shown you today…

Just WITHOUT all of the complex tech bells-and-whistles that my institutional clients paid $5,000 a month to access.

This is perfect for regular people who don’t spend hours sitting at their desk all day.

Instead, you can know in 10 seconds or less whether any stock you own or wish to own is a buy, sell, or hold.

And you can access it on your computer, your smartphone – whatever works best for YOUR life and your money.

With the click of a button in the Power Gauge, you could have known the exact time to buy some of the top-performing stocks of 2022.

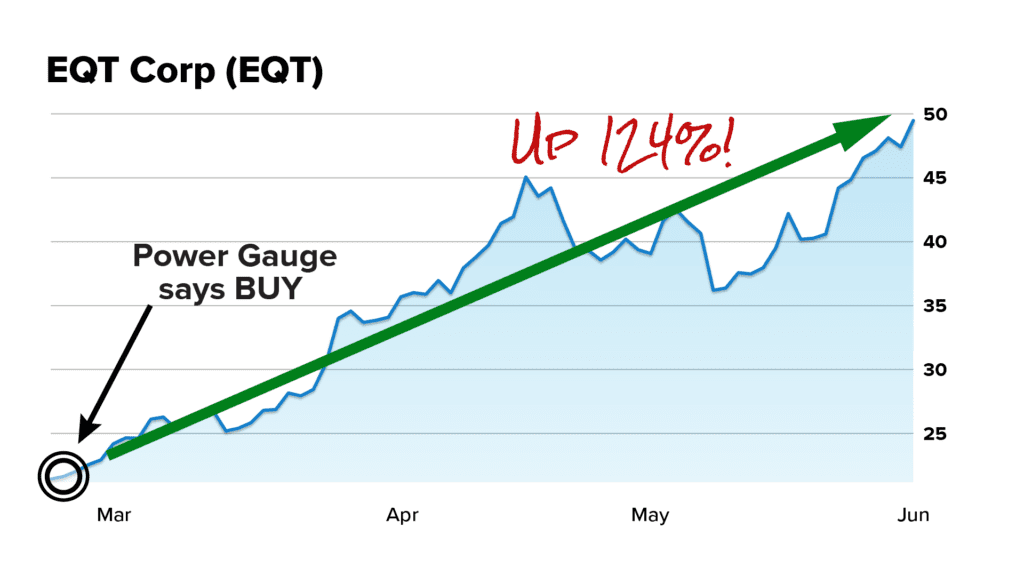

Like natural gas company EQT, before it soared 124% – in less than six months!

Now remember, I’m still doing the hard work for you.

So you’ll never have to go searching for the “best of the best” stocks to buy right now…

They’re all already listed for you in Power Gauge Report.

And if something changes with any of these recommendations, or there’s an action I think you should take, I’ll always email and let you know.

But you can think of the Power Pulse as an added layer of surveillance.

I want to give you everything you need to achieve the best possible results.

So giving you a year of free access to my system was really a “no-brainer” for me.

Remember Amy, the Power Gauge issued bullish signals for 47 of the 50 top-performing stocks of 2022:

Opening up the potential for dozens of extraordinary gains… in the span of a single year.

Remember all of the other stocks that crashed during the same time. But my system flashed BULLISH on so many winners.

So I truly believe this will give you a critical advantage moving forward.

AMY:

Remember, the Power Gauge is the system Marc calls his “life’s work.” It’s attracted decades of media attention and hundreds of thousands of followers.

Like trading guru, John Carter, who is famous for making $1 million in just two days trading Tesla and loves using the Power Gauge.

He writes:

“There’s a lot of hyped-up tools out there, but a single tool that combines 20 fundamental AND technical factors to anticipate a stock’s profit potential got my attention. It’s like an objective ‘awesome meter’ for stocks.”

And user Annie G. told us:

“I am now totally addicted to the Chaikin system… I may need an AA meeting if this doesn’t stop…”

* Standard disclaimer: The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Order right now and Marc will give you FREE ACCESS to this system, when you join his extraordinary research service, Power Gauge Report.

Remember, when you act through today’s special offer – you’re getting an incredible 75% discount…

Including FREE access to Marc’s model portfolio of the “best of the best” stocks to buy right now.

Plus two more incredibly valuable bonuses we haven’t even shared with you yet.

To claim all of your free bonuses while you still can, place your order right now at the button on your screen.

Again, it’s 100% risk-free. You can try this today, access Marc’s research, recommendations and his incredible system, without risking a penny.

If you’re unhappy for any reason, simply contact our friendly Member Services team anytime in the next 30 days, and you’ll get a full, prompt cash refund of everything you paid.

But candidly, we suspect you won’t need a refund, once you see why Cheryl D. told us:

“I am an individual investor and trader. There is not enough time in my day to do the work Chaikin puts before me in minutes. I am “wowed.”

And why Bob Lang, an equities trader and frequent guest on CNBC and Jim Cramer’s Mad Money, once said:

“In all of my years in trading I have tried many different styles and approaches, but [Chaikin] is one system that stands out, head and shoulders, above the rest.”

Okay Marc, we have covered an enormous amount of material here… I think it’s time to get some questions answered – plus your free stock recommendation AND #1 stock to avoid.

Here’s an interesting question to kick things off:

“You’re telling us exactly what to buy today – but can you also tell us exactly what NOT to buy?”

MARC:

That’s a good question. And the second free bonus I’m giving away today actually answers it.

This is perhaps the most valuable and time-sensitive bonus yet.

And I’ll say upfront that this will NOT be available for long… you’ll see why in a moment.

Based on what I’m seeing in the Power Gauge right now, there are still dark days ahead for hundreds of companies in the U.S. stock market.

Which brings me to an important investing lesson that most people don’t learn until they lose tens, if not hundreds of thousands of dollars.

This one idea alone could determine whether you make or lose money in the weeks to come:

The only thing more important than the stocks you own… are the stocks that you don’t.

In other words, avoiding the big losers is more critical to your wealth than picking the big winners.

In fact, if you had invested in the nine stocks I warned about in 2022, you would have lost up to 75% of your capital.

Now, I’ve already assembled your list of the exact stocks to buy in Power Gauge Report.

But if you want the chance to make any money in the stock market from this moment forward…

You must also move your money OUT of the wrong stocks.

Otherwise, you’re in for a very rough time.

Whether you’re able to buy the best stocks, and avoid the worst stocks…

Will decide your wealth for the rest of the year, and likely for years to come.

BONUS #2: Top 5 Stocks to AVOID

Which is why, when you try my work today, I’m also giving you a special report of the top five stocks to AVOID right now – according to the Power Gauge.

For this shortlist of popular stocks, I scanned all of the BEARISH ratings in my system, to isolate the five tickers I predict are headed for the worst destruction.

These are the stocks you absolutely must sell or avoid right now.

Just like Wayfair in 2022, before it fell 76%…

I believe catastrophe awaits all five of the companies listed in this new report.

And after the losses so many Americans have just suffered…

I believe these new warnings could go down as the most important of my career to date.

AMY:

Marc’s new shortlist of the top five stocks to AVOID is yours 100% free when you act right now.

You’ve seen just how powerful his Power Gauge warnings can be – and just how much money they can save you.

So if you haven’t already, please take a minute to click the link on your screen to lock this in, still for as little as just $49.

You’re risking nothing to give this a try and see these critical stock warnings for yourself.

Simply click the button on your screen to get started.

Now let’s get back to the Q&A and your free recommendations, Marc.

Here’s another good question – how will we know when it’s time to take any profits on your recommendations in Power Gauge Report?

MARC:

It’s quite simple – we’ll send you an email when we see in the Power Gauge that it’s time to sell.

AMY:

Great. And do all of these recommendations trade in the U.S.? Can you buy them using any online brokerage?

MARC:

Yes, they all trade in the US! You can buy all of the stocks in our model portfolio in a regular online brokerage account or retirement account. There are no barriers to entry.

AMY:

Excellent. Remember, to access your new “best of the best” recommendations in Power Gauge Report for 75% OFF the normal price, just click the button on your screen.

Alright Marc, here’s a question about your strategy…

Will you ever recommend a really good stock in a bad or mediocre industry?

MARC:

I want to give you the VERY best chance to make the most money possible on my recommendations.

And since 50% of a stock’s performance comes from its industry… it would have to be a pretty extraordinary situation for me to recommend a stock in an industry that’s underperforming in the Power Gauge.

These extraordinary situations DO happen though.

For example, I’ve shown you how the Retail Industry has been hit particularly hard by the Rolling Crash.

Yet when I go in the Power Gauge, I can still see the very best stocks within the Retail industry.

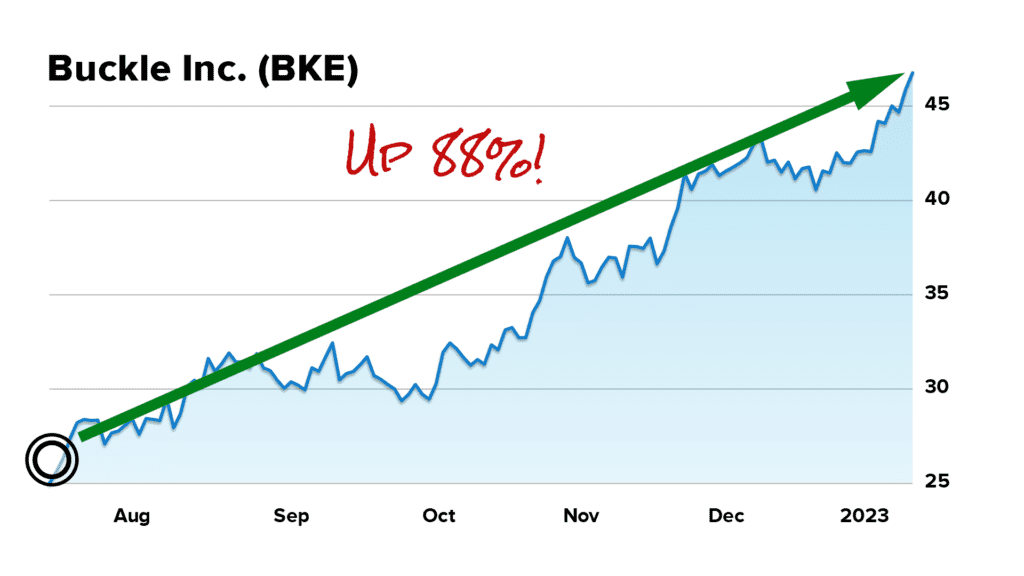

One of them is fashion brand, Buckle, Inc.

While the Retail industry crashed into a painful bear market in 2022…

Buckle is up nearly 90%.

To be clear this isn’t a recommendation, but a great example of how great returns from great stocks in subpar industries can happen.

And if I see one of these situations in the Power Gauge, I’ll bring it to your attention.

But just as a general rule, my FAVORITE stocks with the highest profit potential are going to be from super-strong industries.

And they’re all going to be in one place – Power Gauge Report.

I’m opening the doors like I never have before – to give you the edge you NEED in the coming months.

So you can avoid the minefields… but still have the potential to massively grow your wealth.

I hope you’ll join me.

AMY:

To take Marc up on this extraordinary offer, and lock in a 30-day risk-free trial to his work for 75% OFF the normal price, just click the button on your screen now.

With all that being said, I think it’s time to share your free recommendation… and number one stock to avoid.

Let’s start with your stock to avoid.

MARC:

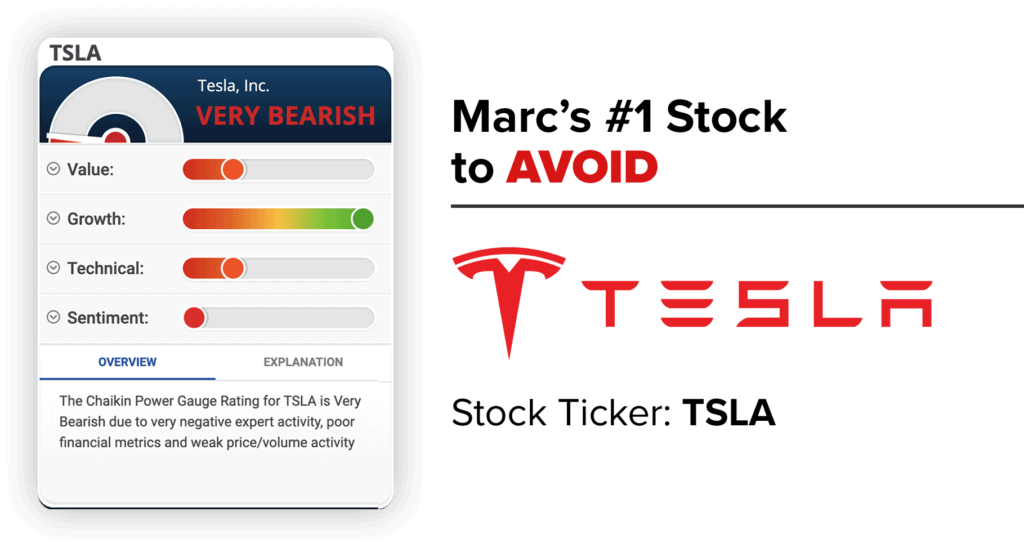

My #1 stock to avoid is Tesla – symbol TSLA. There's a lot of competition in the electric vehicle market and consumers are starting to pull back on their spending given the volatility that we have seen in the markets.

But remember, I’ve actually compiled a list of the top FIVE stocks that I’d encourage you to AVOID in the coming weeks.

Every single one of these companies represents a huge danger to your wealth right now.

For details on how to access it, click the button on your screen.

AMY:

Thanks Marc, and what about your free recommendation?

MARC:

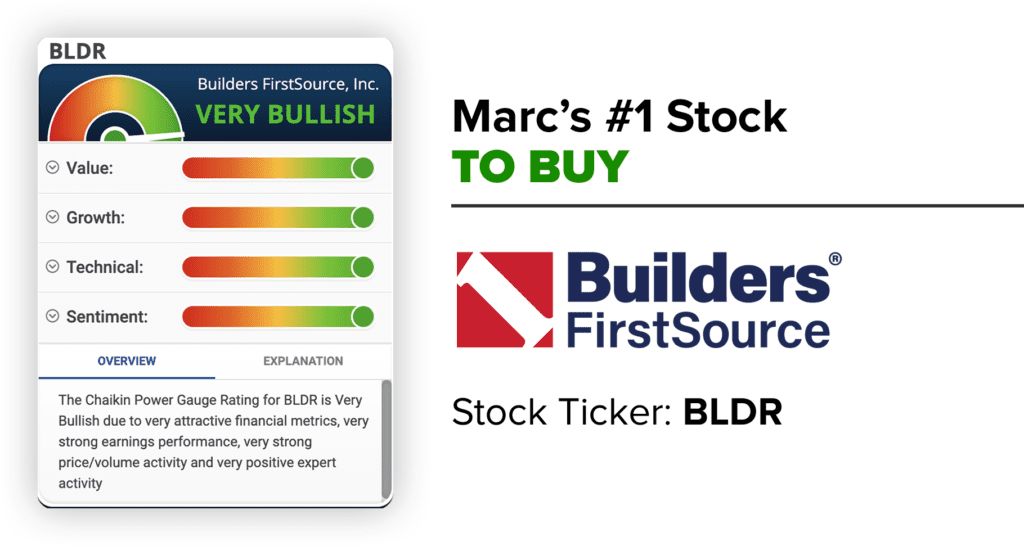

My #1 stock to buy right now is Builders FirstSource, Inc… symbol BLDR. This is a company that supplies the home building industry, the construction industry… do-it-yourselfers.

I think this is a great company, in a great industry.

But for my highest-conviction recommendations right now, you need the shortlist of favorites I just published in Power Gauge Report.

Based on what I’m seeing in my systems, I predict they’ll be among the top-performing stocks of the next 12-24 months.

AMY:

Alright, with that, our presentation is coming to an end.

Wall Street legend Marc Chaikin has just explained the Rolling Crash that’s been dominating today’s stock market…

And the breathtaking Rolling Runup that’s about to send multiple stocks soaring sky-high.

He’s just published a shortlist of those stocks in his world-class investment research service, Power Gauge Report.

Order right now, and you can still get as much as 75% OFF the price.

… plus FREE access to a lite, easy-to-use version of his Power Gauge system, called Power Pulse.

… plus FREE access to his new special report of the five top stocks to AVOID in the dramatic weeks to come…

And there’s actually ONE final bonus…

BONUS #3: Mystery Gift ($2,499 Value)

It’s an exclusive mystery gift we didn’t have a chance to dig into today.

But it could be absolutely transformative for your wealth in the weeks ahead.

Others recently paid as much as $2,499 to access this in person. But you’ll get it free of charge when you act now.

Just click the button below now to see all the details.

It’s an extraordinary offer… for an extraordinary moment in the markets.

But if you want to take advantage… you must act NOW.

You’ll lock in instant access to all of your new recommendations from Marc, your 12 months of access to his predictions, warnings, and research, and even the software platform that he calls his “life’s work.”

All you have to do to get started is click the button on your screen now.

Just remember that all investing carries risk, and you should never risk more than you are willing to lose. The yearly average gain for Power Gauge Report since inception is 7.2%.

As one of Marc’s longtime followers, George W., said…

“Quite honestly, this is hands down the most amazing system that I’ve ever seen. You’ve brought a new excitement back into my trading. Keep up the good work. Also, I’m in the process of cancelling some of my other subscriptions and it feels great. Chaikin is a perfect fit.” – George W.

Another told us:

“After 10+ years in the markets, [Chaikin] is the only [research] that I will have for as long as I trade the markets. It’s a phenomenal service.” – Konstantinos K.

* Standard disclaimer: The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Marc is simply a living legend.

And he’s opening up the doors to his world-renowned research just for you right now, for a QUARTER of the usual price.

With that, please take a moment to place your order and claim the best possible deal by clicking the button on your screen.

Marc, thank you so much for your time and for sharing so much actionable information with everyone watching… and for making this opportunity available like never before.

MARC:

It’s my pleasure. I’m thrilled to welcome my new subscribers and help them get ready for the extraordinary opportunity ahead.

AMY:

On behalf of Chaikin Analytics, I’m Amy Gamper. Take care.

Legal Notices: Here is our Disclosures and Details page. DISCLOSURES ABOUT OUR BUSINESS contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works – both the benefits it might offer you and the inevitable limitations of our products. Although this is not a part of our “Disclosures and Details” page, you can view our company's privacy policy here

Full Disclaimer | Privacy | Terms & Conditions | Ad Choices | Do Not Sell My Personal Information | Cookie Preferences

© 2023 Chaikin Analytics