FedNow's Nationwide Roll Out

IS IMMINENT

As FedNow's launch date draws ever closer, investors could pocket up to $359,339….

But you must take action before July 1

Dear concerned citizen,

If you absolutely love money, listen up…

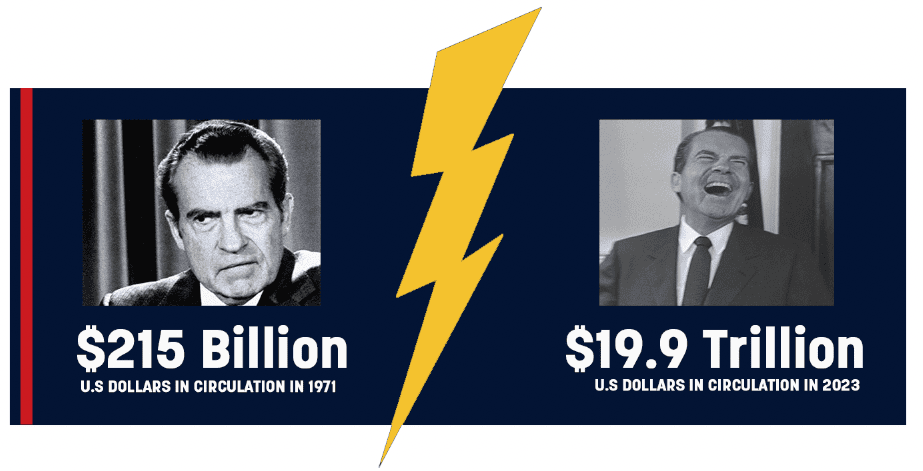

Remember when President Nixon closed the gold window in 1971?

In a move regarded as the most brazen in economic history…

Mr. Nixon unpegged the U.S. dollar from gold, thereby unleashing a limitless fury of dollars into the American (and global) economy.

The Fed’s printing presses have been running wild ever since.

Here, see for yourself…

America is now a nation of unimaginable debt — all thanks to Nixon’s fateful decision.

Thank you, Mr. Nixon!

Yet by ordering the Federal Reserve to kill the gold standard…

Mr. Nixon also sparked a historic wealth event…

He hatched an entire generation of gold millionaires…

Now, 51 years later…

The Federal Reserve is set to rock the world again — with an economic move that makes Mr. Nixon’s “close the gold window” gambit rather small by comparison.

“FedNow is completely revolutionary,” says the Federal Reserve…

“FedNow will have a revolutionary impact,” reports the Financial Times.

“FedNow could transform commerce,” exclaims Fortune.

Transform commerce, you say?

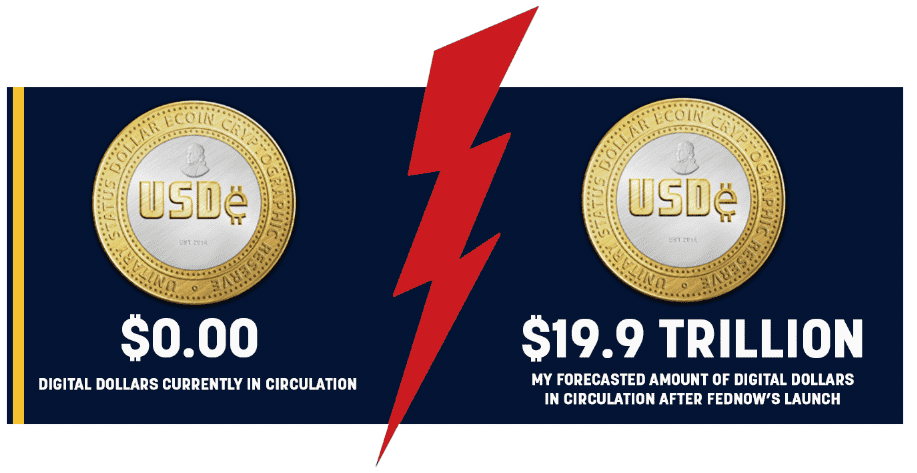

Well, FedNow seeks to digitize the entire American economy — in a single calendar year… beginning in July, when Fed Chairman Powell pushes the “start” button.

So please, don’t get blindsided!

As part of FedNow’s comprehensive “economic digitization” mandate…

Be prepared for FedNow to kill the existing banking system…

Be prepared for FedNow to kill the existing payroll system, and…

Be prepared for FedNow to kill the U.S. dollar as a fiat (paper) currency.

Will history repeat itself for investors?

I’ll let you decide…

Timeline 1971: By flooding the system with an endless trove of physical dollars, Nixon’s actions led directly to the boom in gold prices… thus hatching an entire generation of gold millionaires.

Timeline 2023: By flooding the system with an endless trove of digital dollars, I believe FedNow will lead directly to a digital-dollar boom… thus hatching an entire generation of digital-dollar millionaires…

Wouldn’t you like to own a stock with 265X potential?

Well, looking back through history…

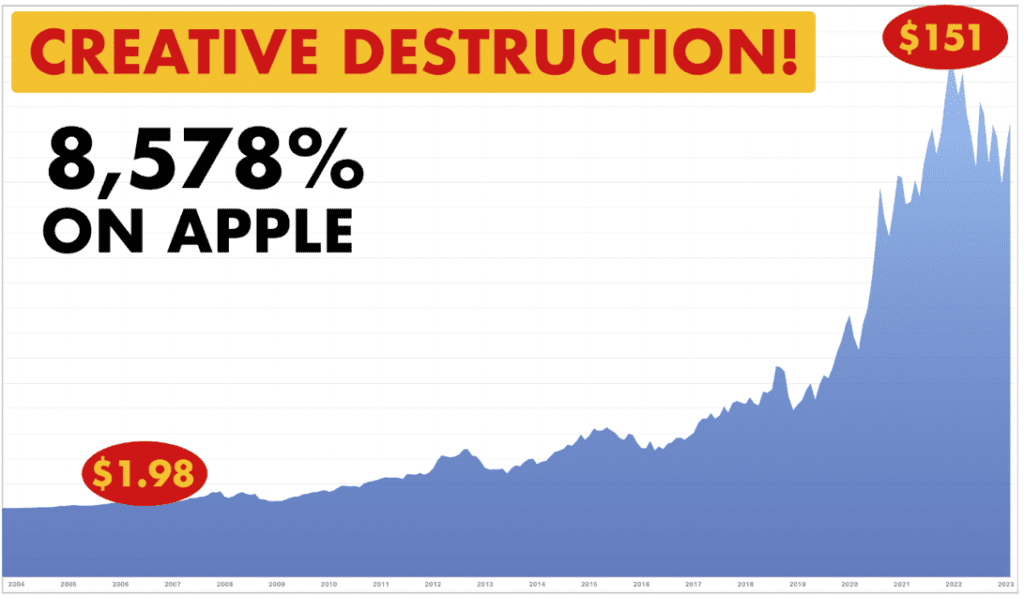

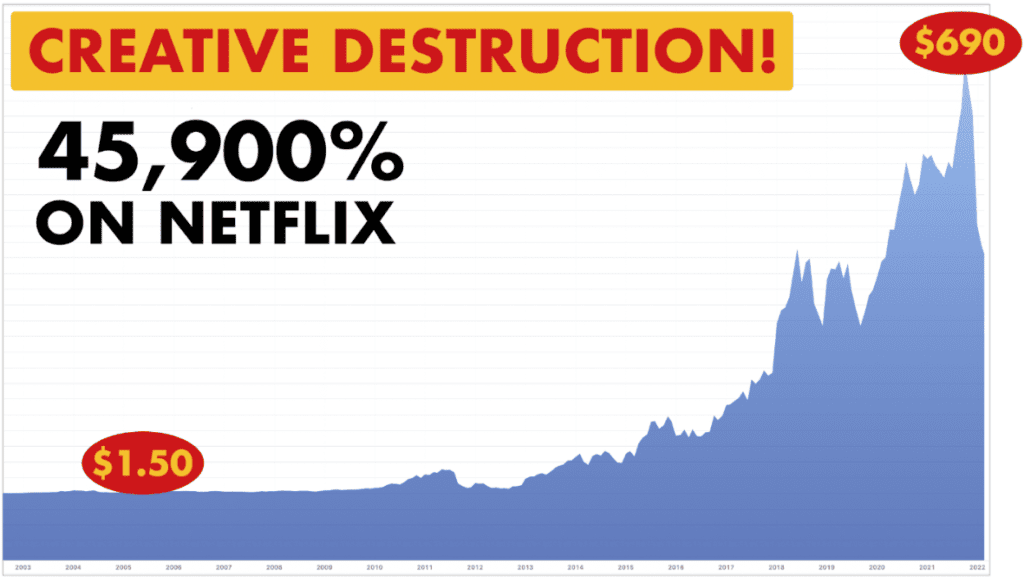

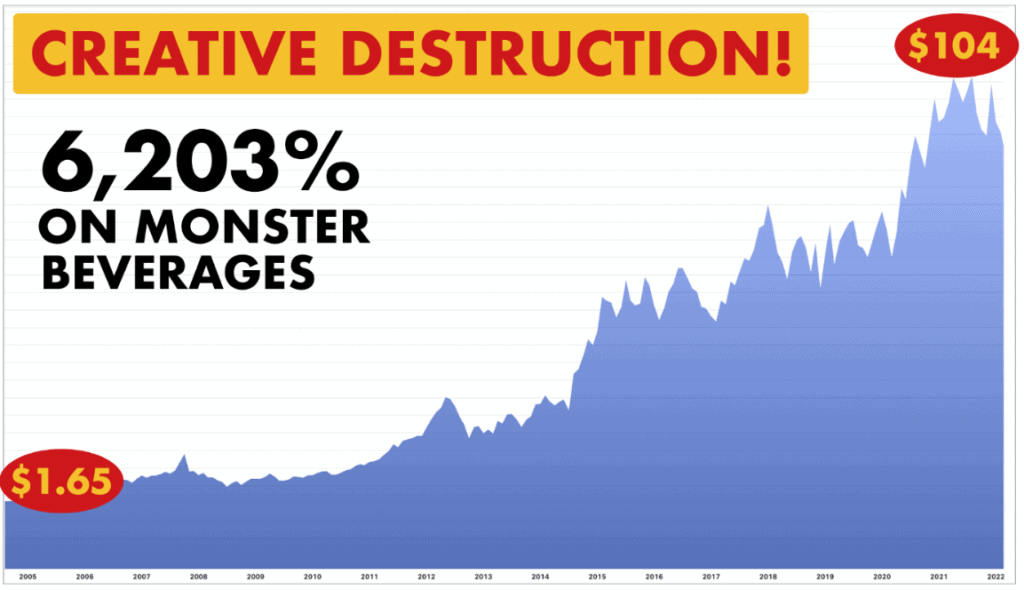

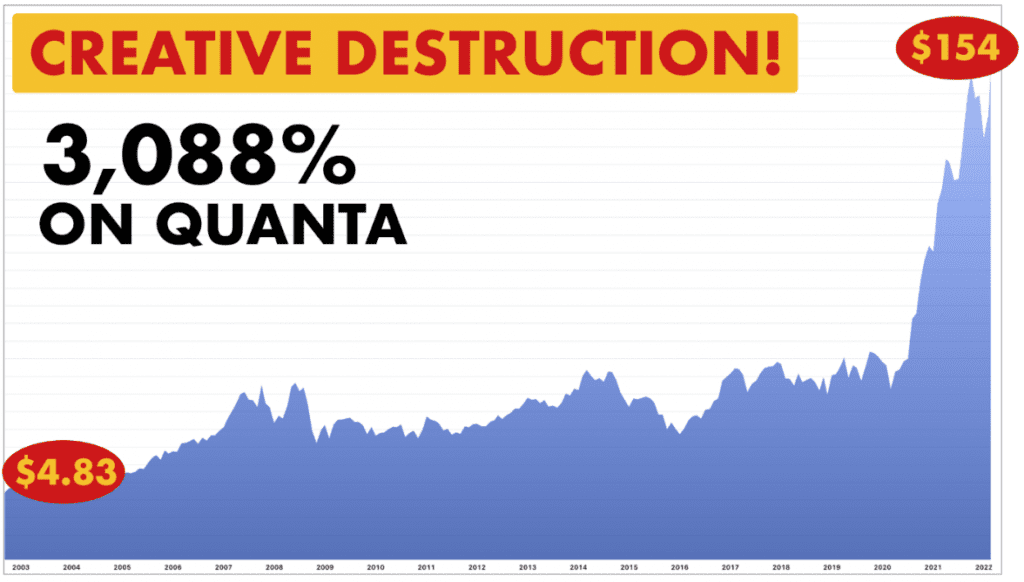

Any deliberate killing of an old product (e.g. paper currencies)… in favor of a radically improved product (e.g. digital currencies) tends to create hyperbolic profits…

Like when Amazon killed Sears, along with other brick-and-mortar retailers…

Or when the iPhone killed the BlackBerry, cellphones, and flip phones…

Or when Netflix killed Blockbuster…

It’s called “creative destruction” — i.e. strategically killing a tired product… killing an aging business model… killing an outdated design… killing a fading brand… killing a waning trend… and replacing it with a better one.

Although incredibly rare throughout history…

Whenever acts of creative destruction are committed…

Profits tend to be stratospheric.

So if you’re an investor, I urge you to pay close attention…

Because I believe the Federal Reserve will soon do what Amazon, Apple, and Netflix did — only infinitely larger in size, scope, and potential profits…

The Fed is about to commit the single greatest act of creative destruction ever.

Remember my seemingly outlandish statement from earlier?

I told you that FedNow would kill three American mainstays, saying…

It’s hard to even imagine such an outcome, right?

Yet thanks to FedNow’s underlying technology…

Not only is it possible to kill the banking system, payroll system, and the paper greenback…

But I believe their death is imminent.

So what technological breakthrough gives FedNow its awesome power?

Introducing atomic settlement — the most radically important… radically influential… and radically advanced technology of the decade…

For the record, the existing U.S. banking system is more than 40-years old… it operates by way of the antiquated clearinghouse model…and transactions take roughly three days to settle.

Now, I realize that 72 hours might not be overly impactful to your life on a day-to-day basis…

But removing three days of (unnecessary) friction from the financial system?

Well, those three days gained will be more significant than you could ever possibly imagine.

So I’ll say it again, friends…

R.I.P. to the existing U.S. banking system…

R.I.P. to the existing U.S. payroll system, and…

R.I.P. to the paper U.S. dollar…

Because the Federal Reserve’s act of creative destruction could kill all three of them.

I vow to share my full profit outlook on FedNow in a moment…

Which could be worth anywhere between $59,890 and $359,339 (per investor ), depending on how much you choose to invest.

Before I do, however, it’s imperative to understand the origins of creative destruction.

The concept of creative destruction — the driving force behind the biggest stock gains of the last 100 years — is credited to renowned economist Joseph Schumpeter. Easily one of the 20th century's greatest minds, Schumpeter defined creative destruction as…

With all due respect to Mr. Schumpeter, I prefer a simpler definition…

Point being, whenever acts of creative destruction are occurring — i.e. Amazon killing malls… Priceline killing travel agencies… Walmart killing mom-and-pop shops… Home Depot killing lumber yards… Uber killing taxis… drones killing tanks… GPS killing maps… or digital currencies replacing paper currencies…

The destruction has so much raw power…

The destruction is so ripe with potential…

The destruction contains so much kinetic energy…

It pushes companies leading the destruction to dizzying heights.

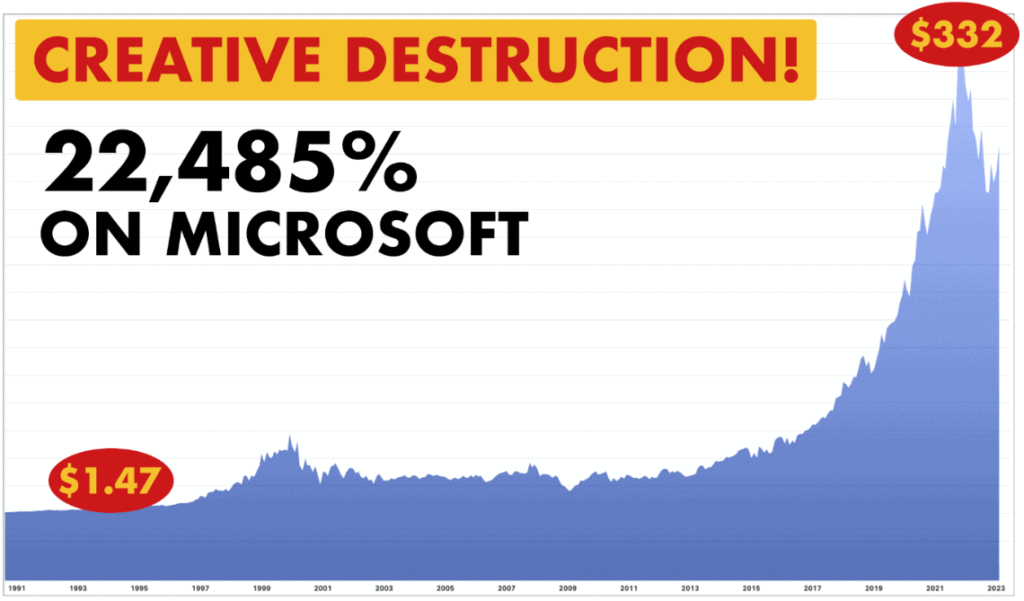

Take the PC revolution of the 80s and 90s, for example…

Through Bill Gates’ act of creative destruction, every Tom, Dick, and Harry was (suddenly) able to operate a computer with a simple click of a mouse… thereby killing the need for typewriters, word processors, and calculators.

Were Microsoft shareholders justly rewarded?

You decide…

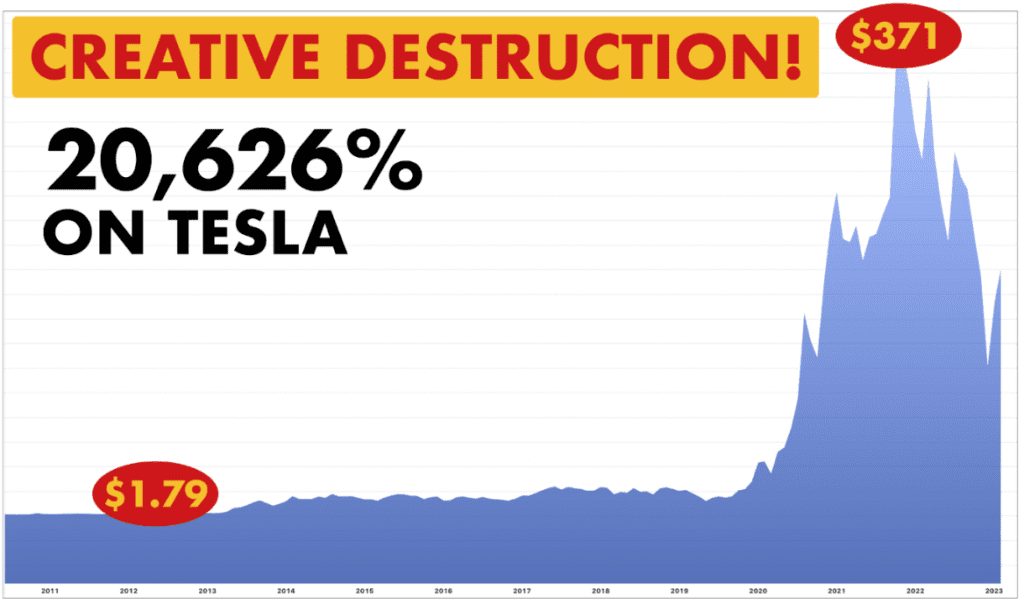

As Elon Musk seeks to kill the combustion engine forever…

Tesla’s shareholders are living a dream.

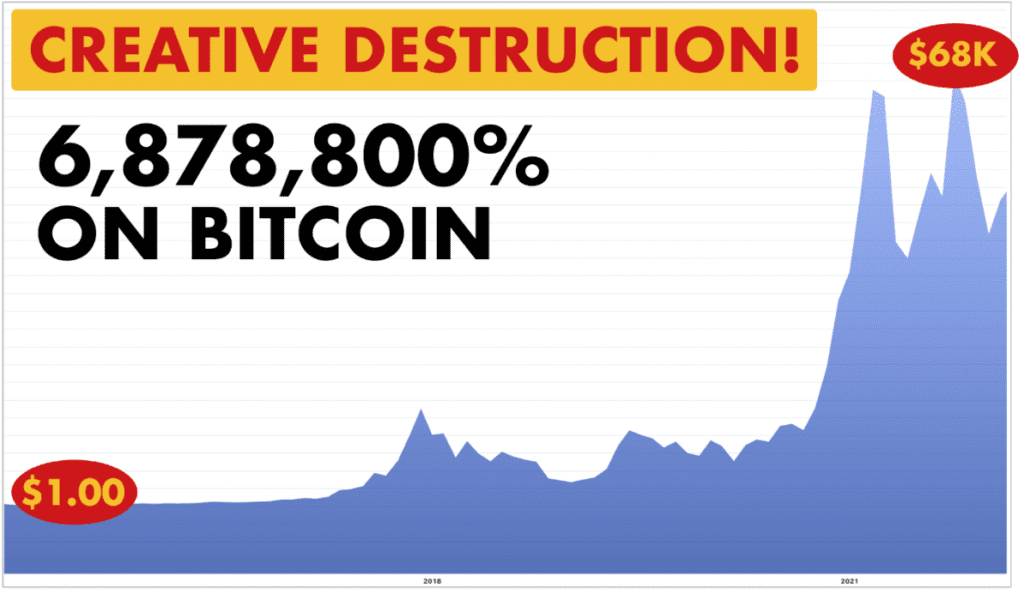

As Bitcoin vies to kill fiat currencies forever…

The world’s foremost cryptocurrency rocketed above $60,000.

Now, this may jolt your system…

But after a careful analysis of all three acts of creative destruction — Microsoft, Tesla, and Bitcoin — I’m convinced that the Federal Reserve’s destructive act could be even bigger.

Why? Because unlike software, EVs, and cryptocurrencies…

Everyone is tethered to their Fed-backed bank accounts…

Everyone is tethered to their Fed-backed payroll or Social Security deposits, and…

Everyone is tethered to the Fed-backed dollar.

Therefore, given that FedNow stands to disrupt every U.S. bank… every U.S payroll deposit… and every U.S. dollar in circulation, which means FedNow will impact the lives of virtually every American citizen above the age of 18…

FedNow’s profit forecasts must be ratcheted higher —aggressively, mind you — to reflect such far-reaching, societal-wide circumstances.

To be clear, that would mean a chance to turn a $225 investment into $59,890 on the low end… and turn a $1,350 investment into $359,339 on the high end.

Now, of course, just because you’re investing alongside the Fed’s historic act of creative destruction doesn’t mean you can’t lose money. No matter how rare and exceptional FedNow’s underlying circumstances might be, every investment comes with some degree of risk.

That said, such enormous returns have happened before — at digital turning points precisely like the ones covered here today, where the low-cost scalability of digital products meet the surging demand from acts of creative destruction.

Still with me?

Great!

It’s time to reveal FedNow’s massive investment opportunity…

“Invest only in what you know,” says Warren Buffett…

Well, in the spirit of Mr. Buffett…

Let’s be vivid in our definition of FedNow…

Beginning with the Federal Reserve’s own description of its era-defining… paradigm-smashing… creatively-destructive banking platform…

Pretty straightforward, right?

Poised to kill the outdated clearinghouse model, FedNow is the Federal Reserve’s first new banking platform in over 40 years.

Here’s how Fortune describes FedNow…

This is a milestone moment, friends.

As Fed Chairman Powell prepares to push FedNow’s “start” button…

An estimated $73 trillion in funds — including over $1 trillion in Social Security payouts… and $8.3 billion in payroll deposits — stand ready to fire across FedNow’s real-time “rails”…

Meaning your money is about to travel faster — atomically faster, if you will — without any transactional delays.

See, through the power of atomic settlement…

FedNow, in effect, removes the “bank float” — i.e. the three-day period typically required for cash deposits to settle or clear.

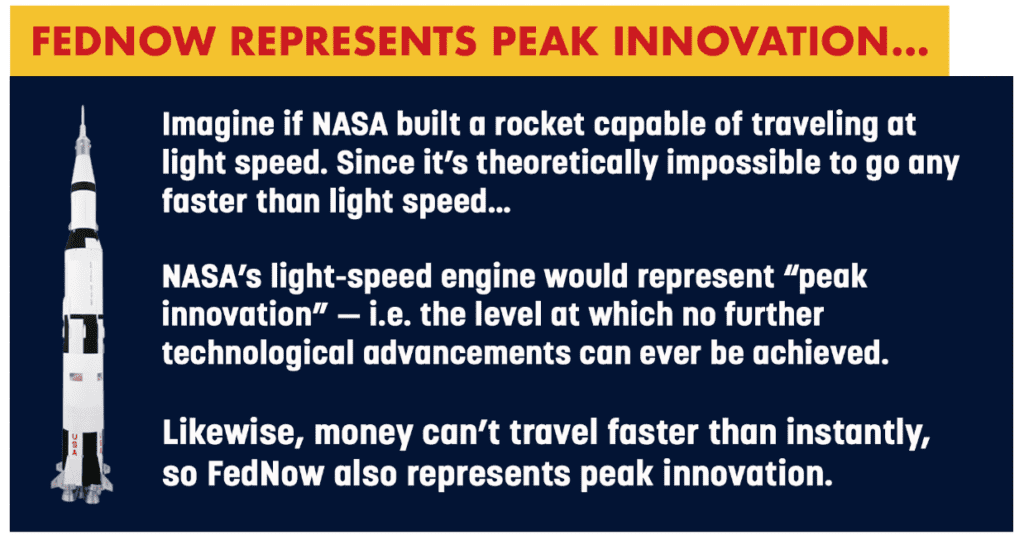

Take paychecks, for example.

Although your account may show a deposit on payday…

Those funds aren’t available to withdraw until they clear, which could take anywhere between two to five days.

The same goes for credit card transactions…

Although most people think that Visa transactions happen instantly…

That is a fallacy, my friends…

Credit card transactions must settle, too.

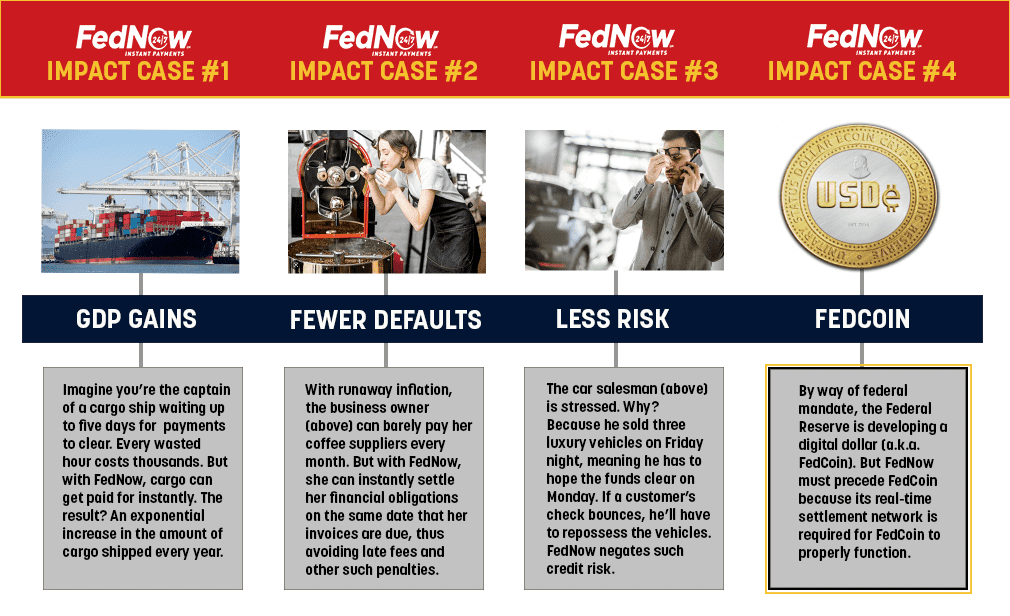

Not only do such transactional delays — i.e. waiting… and waiting… and waiting… and waiting for funds to clear — have a crippling effect on GDP growth…

But “slow money” is antithetical to the concept of a digital economy.

Enter FedNow.

Bottom line, money loves speed.

Therefore, by facilitating an instantaneous (atomic) exchange of funds between parties…

Without any transactional delays…

Without any 1960s-era clearinghouses…

Without any need for funds to “settle”…

FedNow increases the velocity of money — to its maximum level!

Can you now appreciate the moment?

Humankind has been methodically… painstakingly… laboriously… pushing toward a fully digital economy — i.e. a cashless society with instantaneous access to funds — ever since the first coin was forged in 600 BC.

FedNow marks the official beginning of such a digital world.

Although I expect FedNow to increase GDP by $2.7 trillion within its first year of service, FedNow’s residual effect — measured over years… or even decades — is virtually impossible to accurately quantify.

That said, if you’re a “dollar traditionalist”…

This next section might be tough to stomach, as it reads like the greenback’s obituary.

While you’re reading, try to be mindful of the enormous potential for profits.

Rest in Peace U.S. Dollar (1792 – 202X)…

Through its extraordinary act of creative destruction…

The Federal Reserve is set to kill America’s 40-year-old banking system, thereby also killing the existing model for payroll deposits, tax refunds, and Social Security payouts, etc.

But the Federal Reserve has much grander plans for FedNow.

See, in what could be the worst kept secret inside the D.C. Beltway… inside the Oval Office… inside the Pentagon… inside the Capitol rotunda… inside the boardrooms of Fortune 500 companies… and inside the intelligence communities (NSA, CIA, and FBI)…

FedNow’s highest purpose is to kill the U.S. dollar as a fiat (paper) currency.

As Sigmond Freud once said, “The goal of all life is death”…

Born as a fiat currency 231 years ago — by way of the congressional Mint Act of 1792 — I’m about to furnish undeniable proof that FedNow is destined to kill the greenback.

So if you’re an active investor…

I urge you to get positioned for FedNow’s arrival, ASAP…

Because when it comes to acts of creative destruction — the driving force behind the biggest stock gains of the last 100 years — I expect FedNow-related gains to outdo every prior act of creative destruction…

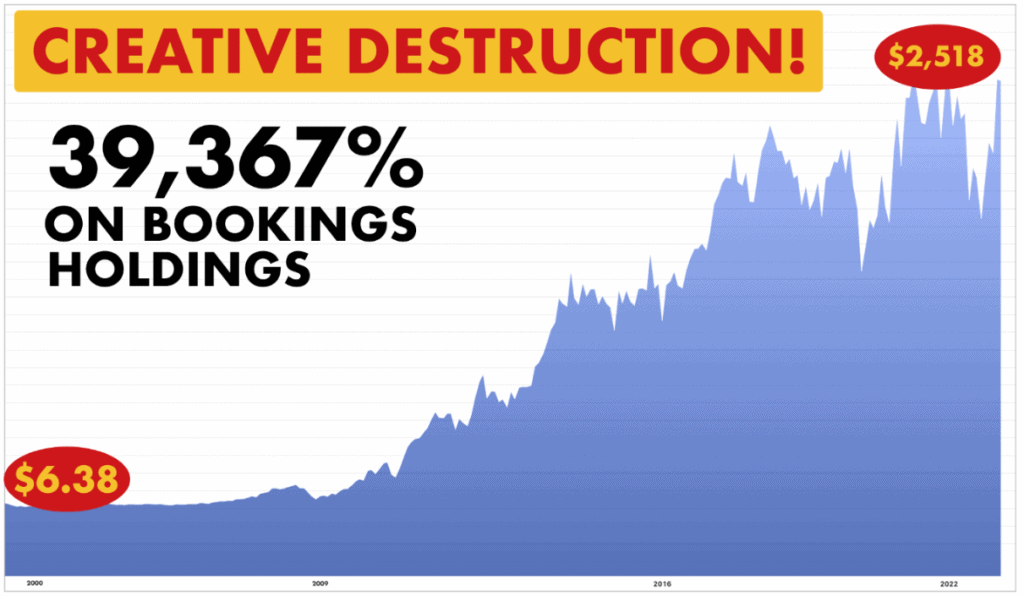

FedNow: It’s bigger than Booking Holdings (Priceline), which killed travel agencies…

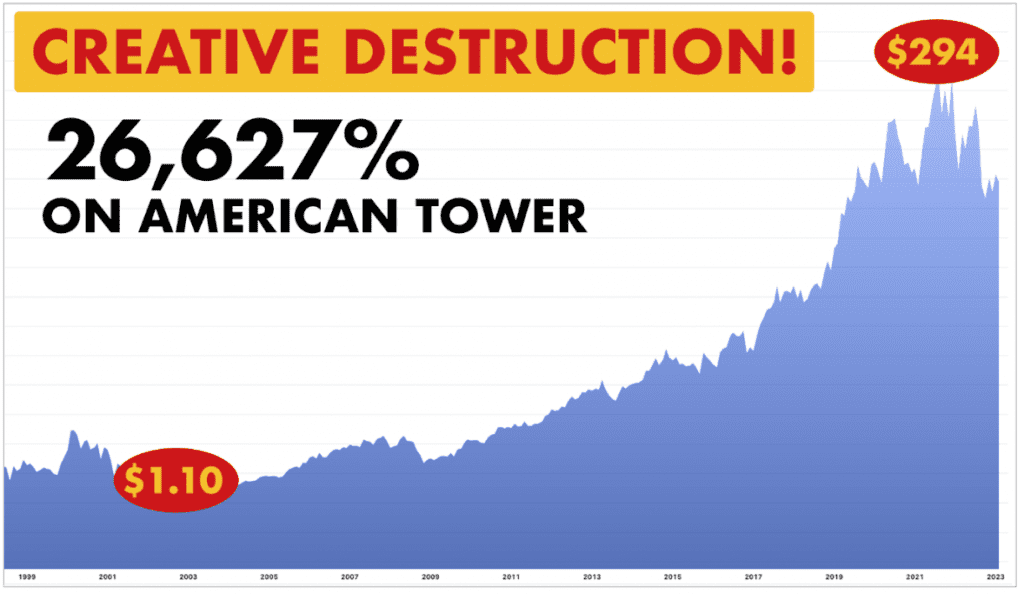

FedNow: It’s bigger than American Tower Corporation, which helped to kill landline telephones…

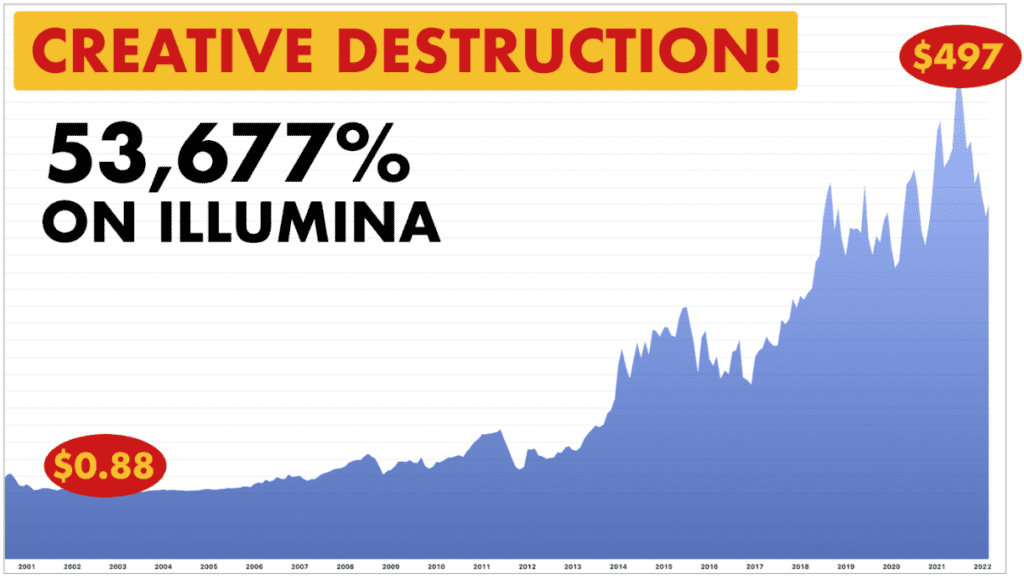

FedNow: It’s bigger than Illumina, Inc., which seeks to kill (brutal) cancer therapies like chemotherapy and radiation…

Given what I’ve told you about FedNow so far…

You’ll probably want to buy every FedNow-related stock on the Nasdaq.

But resist the urge (for now).

Investing is about taking intelligent risks.

The only way to take intelligent risks is by being informed.

For us, being informed means recognizing the Fed’s greater goal here…

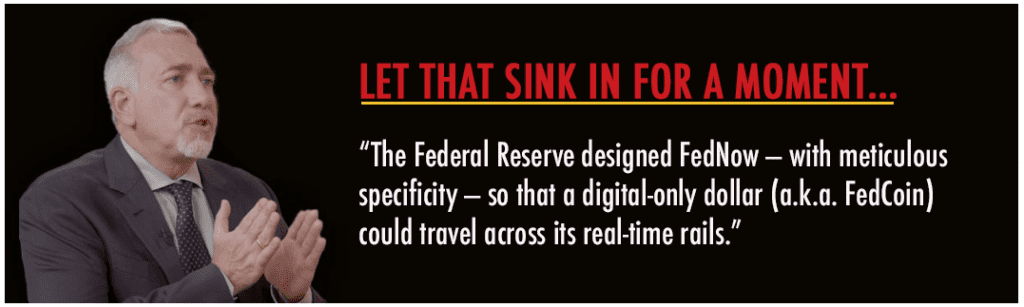

FedNow is a Prelude to FedCoin.

For 80 years running…

The U.S. dollar has ruled the world…

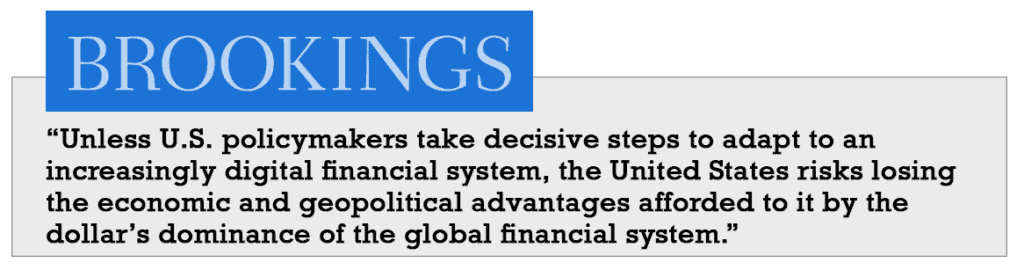

But as the esteemed Brookings Institution puts it…

With Brookings’ stern warning in mind…

Allow me to thread the needle…

Although FedNow isn’t a central bank digital currency (CBDC), per se…

FedNow provides the real-time “rails” upon which a CBDC must function…

Meaning you can’t have a U.S.-backed CBDC — a.k.a. “FedCoin” — without first having FedNow, as the two are inextricably linked.

Or as the U.S. Gold Bureau eloquently puts it…

CoinDesk arrived at virtually the same conclusion…

And this from the news desk at Politico…

The chatter is even spreading throughout Asia…

To be clear…

A U.S.-backed CBDC (FedCoin) must run on a real-time network — one that can process upwards of 1.7 million transactions per second, with 99% of all transactions “settling” in under a second.

Therefore, FedNow must precede FedCoin.

So be prepared, friends…

As America moves toward the death of its existing banking system… moves toward FedNow’s “atomic” settlement network… and moves toward a fully digital U.S. dollar (FedCoin)…

We’re about the witness the most paradigm-smashing… era-defining… societal-shifting act of creative destruction in modern economic history.

This isn’t mere conjecture, friends…

It’s already happening!

Here, take a look at a detailed timeline of events.

Now, I don’t know about you…

But when it comes to moneymaking opportunities…

Especially those with potentially hyperbolic results — i.e. the kind of results that can quickly bump you into a higher tax bracket — I always favor highly predictable outcomes.

Since FedNow’s impact on the financial system is highly predictable… and since FedNow’s impact on the banking system is highly predictable… and since FedNow’s impact on the economy is highly predictable…

FedNow’s investment gains can be projected with far greater accuracy…

Meaning you have a chance to earn a massive “FedNow” windfall.

I’m talking about the potential for profits of $59,890 on the low end (per investor)… and $359,339 on the high end (per investor), depending on how much you choose to invest.

Yet given how the media isn’t saying anything about FedNow…

The task falls squarely to me.

With that in mind, allow me to formally introduce myself…

My name is Andrew Zatlin.

A trained economist, I studied economics as a Research Fellow at Kyoto University, and earned my MBA from University of California, Berkeley.

I refined my skills for the next two decades working in Silicon Valley. Serving in senior roles at NEC Electronics and Cisco, we helped unleash the internet to the masses in the 1990s and 2000s.

During the smartphone boom of the 2010s…

I began work as an independent economic forecaster, developing predictive models to help institutional clients — i.e. some of the most successful banks and hedge funds in the world — stay ahead of the markets.

Not only have I been incredibly successful in this forecasting role…

But my proprietary job data now stands among the most sought-after on Wall Street.

Here, see for yourself…

My biggest break, however, came when I was favorably compared to Brad Pitt.

Yes. Brad Pitt!

Not for my stunning looks, mind you…

But for my uncanny ability to harvest… extract… and manipulate data so that it yields highly accurate projections about the global economy.

See, having total command over raw data — to divine the future… to perform algorithmic magic… to gain “situational awareness” over the movement of money and markets — is almost like having a super-power.

In fact, because I’m able to spin gold from virtually any thread of data…

I’m sort of a modern-day alchemist.

Who else possessed such prophetic powers?

You guessed it!

Brad Pitt in the blockbuster movie “Moneyball.”

Mr. Pitt plays the role of Oakland A’s general manager Billy Beane.

Beane ingeniously uses a data-driven approach to field a highly competitive baseball team on a shoestring budget. Through his use of advanced analytics, Beane revolutionized the way every baseball decision is made.

Since I perform the same kind of wizardry with economic data…

The Wall Street Journal likened my work to the movie…

On the strength of such favorable media coverage…

I decided to launch Moneyball Economics, where I’m able to realize my life-long dream of helping Main Street— ordinary moms and pops — grow their wealth through the financial markets. It thrills me to report that Moneyball Economics has already amassed more than 43,000 like-minded readers.

I’m also regularly featured on big media outlets like Bloomberg.

Yet as gratifying as media exposure can be…

There’s no substitute for due diligence.

Like I said, my days are spent harvesting/applying data to gain an edge over the markets, which I’ve now effectively done with FedNow.

In terms of creative destruction — the driving force behind the biggest stock gains of the last 100 years — I expect FedNow to kill the U.S. banking system… the U.S. payroll system… and the (paper) U.S. Dollar.

Think of it as a creative destruction “trifecta” — one that could far surpass the gains of other famous acts of creative destruction…

Like Monster Beverages, which vies to kill the soda industry…

Or Intuitive Surgical’s “robotic arm,” which vies to kill outdated surgical techniques…

Or electricity producer Quanta Services, which vies to kill coal-fired power plants…

Were you able to catch Quanta’s rocket ride?

Or Intuitive Surgical’s moonshot?

Or Monster Beverage’s windfall gains?

Or any of the other acts of creative destruction featured here?

If not, don’t fret!

See, I’m tracking a small-cap company trading on the Nasdaq for $2.25 — a company whose price isn’t reflecting the enormous value of FedNow… or the potential windfall it stands to make by virtue of FedNow’s launch.

After a thorough and careful analysis…

Not only is the stock deeply mispriced and undervalued at $2.25…

But my research suggests that shares have a 26,518% upside move ahead.

Now, to be clear, these are my projections… my “all in” profit targets… my best-case scenarios. They’re not guarantees. So please don’t confuse the two. Ask any world-class investor, and they’ll tell you that every investment carries some degree of risk.

Look, none of this is surprising to me.

I’ve suspected the Federal Reserve would be eager to digitize the American economy since Bitcoin first rocketed above $10,000.

Yet I also have strict rules when it comes to making official stock recommendations.

In the case of FedNow, certain catalysts had to be present before I’d consider it a breakthrough investment opportunity.

That day is now upon us, friends.

Let’s quickly review the five catalysts that underpin my FedNow investment thesis.

CATALYST #1: FedNow Marks the End of Cryptocurrencies…

Love them or hate them…

Cryptos represent a critically-important model for how government-backed digital currencies should (and shouldn’t) function for the next 50 years…

Which explains why the world’s most influential Central Banks have been studying… learning… and obsessing over cryptos for the last decade.

Their conclusion after 10 years of observation?

Well, the Bank for International Settlements (BIS) — better known as the “Central Bank of Central Banks” — recently issued a stern warning to cryptocurrency developers, saying “if digital currencies are needed, central banks should be the ones to issue them.”

Allow me to translate…

Central Bankers intend to kill cryptocurrencies.

Why? Because cryptocurrencies exist beyond the whims of government bureaucrats… because cryptocurrencies can’t be impacted by the Federal Reserve’s printing presses… because cryptocurrencies aren’t influenced by changes to interest rates… or quantitative-easing measures… or adjusting the money supply…

Therefore, cryptocurrencies must die.

To that end, development of a U.S. central bank digital currency (CBDC) — a.k.a. FedCoin — has already begun. Yet to launch a digital dollar, the Fed needs a banking platform upon which transactions can settle instantaneously.

The launch of FedNow promises to deliver such a real-time platform.

CATALYST #2: FedNow Preserves America’s #1 Status…

America ascended to its position atop the world when the size of its economy surpassed England’s in 1890. Its boldness and valor in World War II further validated the United States’ #1 superpower status, which began the period of “American Exceptionalism.”

To the victor go the spoils.

In America’s case, its biggest “spoil” arrived in 1944. What happened in 1944? Well, the dollar became the world’s reserve currency, which handed the United States virtually limitless economic advantages over the rest of the world.

But nearly 80 years later, China is vying to overtake America.

Not only could China’s economy surpass the size of the U.S. economy by 2030…

But the People’s Bank of China has already relaunched the yuan as a digital currency, meaning China has out-innovated the United States.

In fact, as the global leader in CBDCs…

China’s yuan (e-CNY) recently topped $100 billion in digital transactions.

Listen up, friends…

Being out-innovated by a communist regime isn’t a good look for America.

Fortunately, when FedNow goes live in a couple of months…

It could add roughly $2 trillion in American economic activity per year, thus making it virtually impossible for China’s economy (GDP: $13.4 trillion) to overtake the United States’ economy (GDP: $20.49 trillion) within the next 10 years.

FedNow also provides a glide path for a U.S.-backed CBDC (a.k.a. FedCoin).

Bottom line, to preserve America’s status as the world’s #1 superpower…

FedNow isn’t simply important…

FedNow is an imperative!

CATALYST #3: FedNow will Supercharge the Economy…

Think of the 40-year-old U.S. banking system as the dial-up internet of the late 1990s… and FedNow as the wireless internet that Americans presently enjoy.

The analogy is perfect, friends!

See, lightning-fast internet speeds sparked the online retail boom (Amazon)… the smartphone boom (Apple)… the cloud-computing boom (Microsoft)… the streaming boom (Netflix)… the gene-editing boom (Illumina)… the microchip boom (NVIDIA)… and the cryptocurrency boom (Bitcoin).

No such boom was possible without lightning-fast internet access.

The same goes for lightning-fast access to money…

By (finally) removing the antiquated “bank float” — i.e. the three-day period typically required for cash deposits to become available for withdrawal — FedNow is set to unleash an additional $2.7 trillion through the U.S. economy every year, which means…

🟢 No more container ships sitting in port, waiting for payments to clear…

🟢 No more cargo planes sitting on runways, waiting for payments to clear…

🟢 No more 18-wheelers sitting on loading docks, waiting for payments to clear…

🟢 No more sushi-grade salmon chilling in icehouses, waiting for payments to clear…

🟢 No more coffee beans… bolts of fabric… cosmetic goods… laser-jet printers… protein powder… diet pills… puffy coats… prescription drugs… or whatever else… sitting in storage warehouses, waiting for payments to clear.

By laying the real-time “rails” upon which a fully digital economy can prosper and thrive, FedNow allows the two most powerful economic drivers on Earth — money and speed — to merge into one cohesive force.

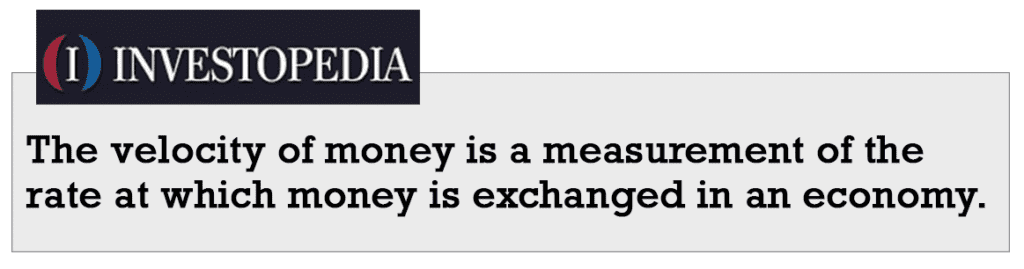

CATALYST #4: FedNow Reduces Default Risk…

Main Street Americans are suffering, folks — from the effects of runaway inflation… from abysmal policymaking at the federal, state, and local levels of government… from the devastating impacts of higher interest rates… from the collapsing U.S. housing market… from the ongoing labor shortage… from out-of-control energy prices, etc.

As a result of such dire economic circumstances, 63% of Americans are now living paycheck to paycheck, which is fiscally unsustainable. When surprise expenses hit, these same folks are forced to tap their savings or plunge into debt.

“Being employed is no longer enough for the everyday American… wage growth has been inadequate, leaving more consumers than ever with little to nothing left over after managing monthly expenses,” notes an article from CNBC.

In such cases, the existing U.S. banking system isn’t all that helpful…

FedNow, however, will ease a bit of the financial pressure.

See, by removing the “float” — i.e. the two-day period it takes deposited funds to settle in a bank account — FedNow gives Main Street Americans instant access to their hard-earned paychecks, which should lessen some of the dependence on credit cards.

Real-time transactions also lessens the risk of overdraft and late fees.

CATALYST #5: FedNow Gives Money and On/Off Switch…

The digital explosion of the last 20 years has gifted us some incredibly simple life pleasures — pleasures we can’t imagine ever losing.

For example, can I interest you in returning to handwritten checks?… or borrowing books from the library? or thumbing through the yellow pages? or making collect calls… or hailing a taxi?… or finding a payphone?… or booking a vacation through a travel agency?… or unfurling maps when you’re lost?

Not a chance!

Yet those same digital pleasures come at an extremely high cost.

See, with every advancement of digital technology…

Our personal sovereignties further erode.

How? Because we leave a digital footprint on virtually every action we take — our smartphone tracks our movements all day… our Google searches reveal our personality biases… our online shopping habits speak to our lifestyle… our streaming movie/music choices can be used to determine our age/gender… so on and so forth.

As George Orwell once said…

Viewed through the lens of population control…

The Federal Reserve’s “economic digitization” mandate is simply the latest means of gaining more power and influence over our lives.

Haven’t taken your fifteenth COVID booster shot yet?

Sorry, we’re switching your money off until you get that shot.

Want to donate money to your church?

Sorry, we’re switching your money off until your church supports abortion.

Trying to buy a book that criticizes the government?

Sorry, we’re switching your money off until you choose better books.

Now, am I a fan of such invasive governmental tactics?

No, I absolutely despise them.

Quite frankly, they’re antithetical to democracy.

Yet could such a reality be coming?

Yes, so I strongly suggest profiting as it happens.

FedNow is economic Darwinism at its finest…

Still need more convincing that killing the existing banking system, payroll system, and the paper greenback serves a higher purpose?

Well, as a renowned economist for over 30 years, I’ve witnessed the power of creative destruction hundreds of times during my career.

Through this firsthand experience — as the #1 ranked economic forecaster on Bloomberg… as an advisor to top-20 hedge funds… and as a pioneer in the financial publishing industry — I can confidently say that my livelihood… my personal investments… my weekly paycheck… my family’s well-being… my mortgage payments…

They all depend on acts of creative destruction.

See, without creative destruction, we’d be forced to live inside a static economy.

The supporting data might shock you…

According to MIT, creative destruction accounts for over 50% of economic productivity.

In terms of GDP, creative destruction is worth roughly $11 trillion to the U.S. economy, and $45 trillion to the global economy.

To anyone who thinks creative destruction and the economy are mutually exclusive…

You’re very… very… very wrong!

Creative destruction and the economy are codependent.

They must exist together.

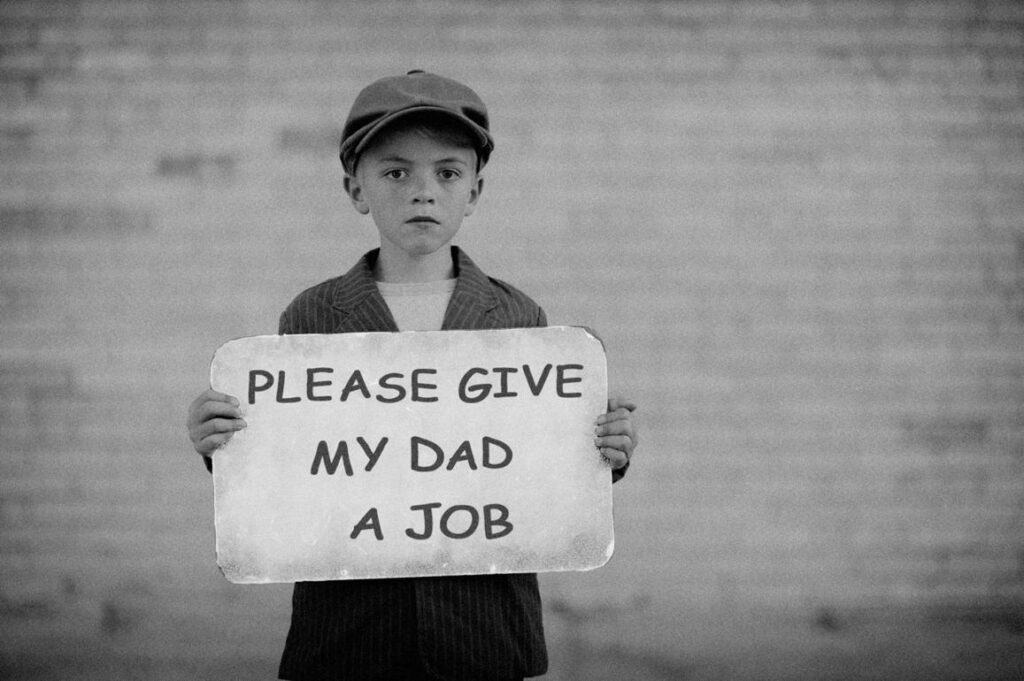

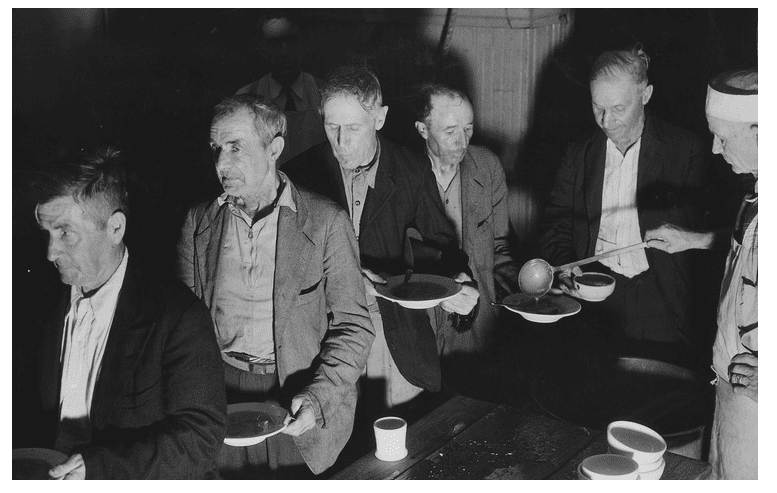

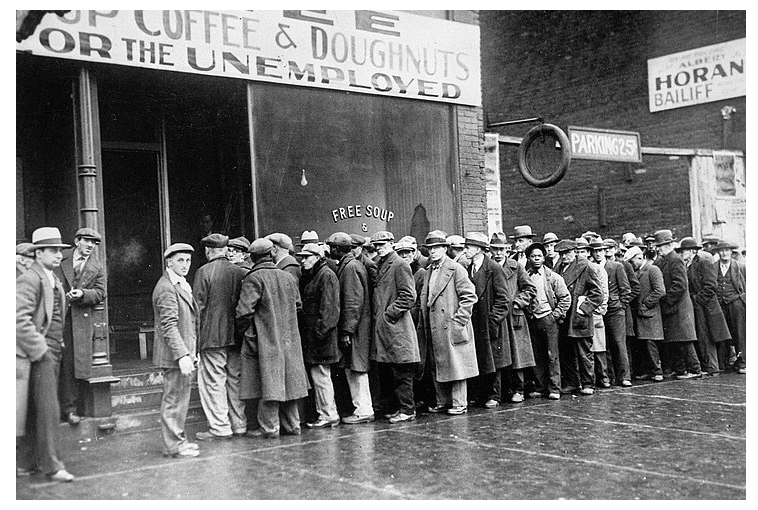

In fact, see these images of the Great Depression?

Scary, right?

Now, I don’t say this lightly… or to be callous… or to offend anyone whose grandparents lived through such a difficult time in U.S. history. But without creative destruction’s impact on jobs, wages, consumer spending, and manufacturing output…

We’d all be in a similar situation, scrounging for our next meal.

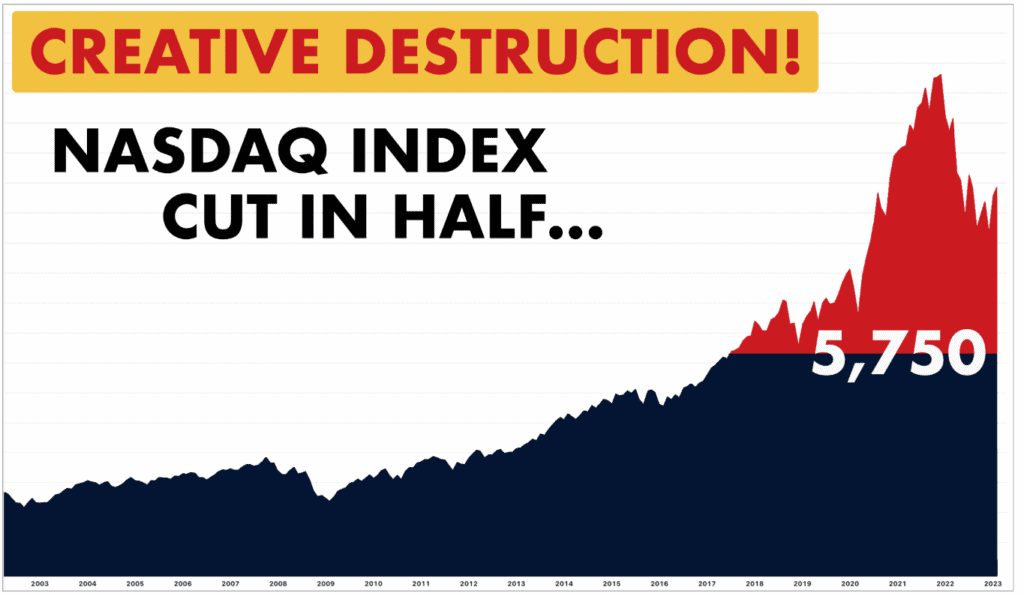

In fact, the Nasdaq trades at around 11,500.

But without acts of creative destruction, the Nasdaq would trade for half that.

Which is why I’m urging you to…

Circle July 1 on your calendar…

The Federal Reserve has been vigilant in its (planned) act of creative destruction.

In tandem with its handpicked banking partners — i.e. financial juggernauts like American Express, Bank of New York Mellon, Capital One, Goldman Sachs, JPMorgan Chase, and Wells Fargo — the Federal Reserve is rolling-out FedNow in three phases…

FedNow PHASE #1: Preparation and Readiness.

Launched in January 2021, this phase ensures that financial institutions are prepared to “go live” with FedNow in mid 2023, without any delays… without any breakdowns… and without any system-wide failures. Given that tens of millions of bank accounts will migrate onto FedNow’s atomic settlement network, every precaution must be taken, which includes the development of a comprehensive “Readiness Guide.”

FedNow PHASE #2: Testing.

Underway now, the testing phase is, well… exactly as described. Its mission is to identify and resolve every “friction point” contained within FedNow’s real-time settlement platform before its wide-scale national rollout. “It’s easy to undersell the amount of complexity and effort that has gone on with this project. But we’re close. As we move toward our launch in mid-2023, we’ve got everything where it needs to be,” says FedNow’s senior VP.

FedNow PHASE #3: National Rollout.

An estimated 95.5% of American households have a checking or savings account at a bank or credit union. Through such banks accounts — which collectively hold roughly $19.56 trillion in cash deposits — we pay our bills… we pay our taxes… we write checks… we buy groceries… we receive our paychecks… we receive inheritances… we receive other sources of income, etc.

Upon FedNow’s national rollout in mid 2023…

Americans will be able to send/receive funds from our bank accounts — 24/7/365 — without any transactional delays. “That’s completely revolutionary in payments,” says FedNow’s chief executive.

By (finally) removing the antiquated “bank float” — i.e. the three-day period typically required for cash deposits to clear and/or settle — FedNow is set to unleash an additional $2.7 trillion through the U.S. economy every year

I want to make sure that you’re ready to profit.

Now, surely I have a few remaining skeptics out there…

And a few others planning to wait and see if the Federal Reserve launches FedNow on schedule, exactly as planned.

Allow me to applaud your caution.

When it comes to investing, nothing can ever be guaranteed.

So a bit of pessimism is very helpful.

Yet it’s also worth sharing a quote from CNBC, because it’s both brilliant and powerful…

Do you suffer from “wait and see” investing?

You wait for a trend or catalyst to start moving the market… wait for the mainstream media to validate it… wait for your brokerage to release a full report… wait for your newspaper’s opinion editor to write about it… and only then do you commit to invest?

Good luck making money; because you’ll need it.

In real-life, “wait and see” investing can potentially cost thousands… hundreds of thousands… heck millions, depending on how many shares you typically buy.

From my experience, the 80/20 rule easily applies here.

A stock’s first leg higher — which occurs before any news hits — is typically the most aggressive, constituting 80% of the overall gains. By that point, the remaining 20% (the leftovers) are split among “wait and see” investors.

In the case of FedNow…

Since money loves speed, it’s time to liberate America from its 40-year-old banking system… to smash it with a sledgehammer… to drive a stake through its heart… to creatively destroy it… to feed it to the vultures.

Although the best time to start buying FedNow-related stocks was yesterday…

By taking action right now…

You can still catch every penny of the financial upside.

I’d like to send you my time-sensitive report, ASAP…

If you’re an active investor looking to crush the market…

Forget artificial intelligence…

Forget self-driving cars…

Forget battery technologies, and…

Forget commercial space travel.

Why? Because there’s no guarantee those technologies will evolve on schedule; especially given the looming recession and mass layoffs.

To the contrary, however…

It would take an act of God to prevent FedNow — along with its underlying “atomic settlement” technology — from replacing America’s existing banking system.

Which is why it’s time to invest alongside FedNow, stat!

Every urgent detail can be found in my brand-new report…

It’s called The FedNow Profit Report.

Inside the pages you’ll get my full analysis of this high-flying moneymaking opportunity, along with my #1 stock for playing the FedNow revolution.

I don’t like binary outcomes, friends.

Especially when it comes to matters of money.

Therefore, I tend to avoid pass/fail scenarios…. when/if scenarios… and approved/rejected scenarios, like how a drug company’s profits hinge on FDA approval.

Such investment scenarios do not entice me.

FedNow, however, is a certainty…

Which means FedNow’s investment gains can be projected with far greater accuracy.

Specifically, I’m tracking a small-cap company trading on the Nasdaq for $2.25 — a company whose stock is dramatically underpriced relative to FedNow’s economic value… making it prime for an upside move when Chairman Powell flips the switch.

In fact, after a thorough and careful analysis…

Not only is the stock deeply undervalued at $2.25…

But my research suggests that shares have a 26,518% upside move ahead.

The mighty banking industry is nervous, friends.

FedNow seeks to reroute roughly $73 trillion in transactions away from the 40-year-old clearinghouse system (run by the banks); toward the Federal Reserve’s brand-new settlement network.

FedNow, therefore, jeopardizes the banking industry’s rulership over the economy.

See, as our habits change in response to FedNow…

The fear among banks is that consumers will dump their traditional checking and savings accounts for digital wallets. Since banks rely on such deposits to fund their loans, a move toward digital wallets would have a catastrophic impact.

Or as Politico warns, “a retail model where the Fed issues digital dollars directly to customers, bypassing banks entirely, could be even more dangerous.”

It’s an existential crisis for banks, friends!

Yet therein lies the opportunity for investors.

Specialty companies like ACI Worldwide (ACIW) are helping banks manage their (inevitable and unavoidable) digital transformations. I expect such companies to report an explosion in profits in the weeks and months ahead.

You’ll find my #1 play in The FedNow Profit Report.

It’s a small-cap company trading for $2.25, however…

My “Moneyball Economics” system values each share above $500.

From the invention of Ford’s assembly line to the evolution of GPS… from the discovery of natural gas fracking to the advent of off-shore oil drilling… from surgical robots to big-box retailers… from ride-sharing apps like Uber to cancer-zapping immunotherapy… from gene editing to wireless internet service…

All of the above (and many, many more) represent acts of creative destruction.

They also could’ve supercharged any portfolio.

But as I told you earlier…

“Given that FedNow stands to disrupt every U.S. bank… every U.S payroll deposit… and every U.S. dollar in circulation, which means FedNow will impact the lives of virtually every American citizen above the age of 18…

“FedNow’s profit forecasts must be ratcheted higher —aggressively, mind you — to reflect such far-reaching, societal-wide circumstances.”

To be clear, that would mean a chance to turn a $50 investment into $59,890 on the low end… and turn a $1,350 investment into $359,339 on the high end.

By taking action ahead of FedNow’s nationwide rollout…

You’ll have an opportunity to catch 99.99% of the stock’s upside.

The FedNow Profit Report is available for immediate download…

The report is yours — FOR FREE — by simply agreeing to take my flagship newsletter, Moneyball’s Sector Alpha Report, for a 30-day test drive.

Go ahead…

Take Sector Alpha for a spin…

Kick the tires a bit…

See if you like it…

In return, I’ll give you immediate access to The FedNow Profit Report.

If I were you, I’d take the deal.

Why? Because having access to an airtight “sector rotation” strategy — i.e. the exact mission of Moneyball’s Sector Alpha Report — is quite possibly the most valuable piece of information presented here today.

Still don’t believe me?

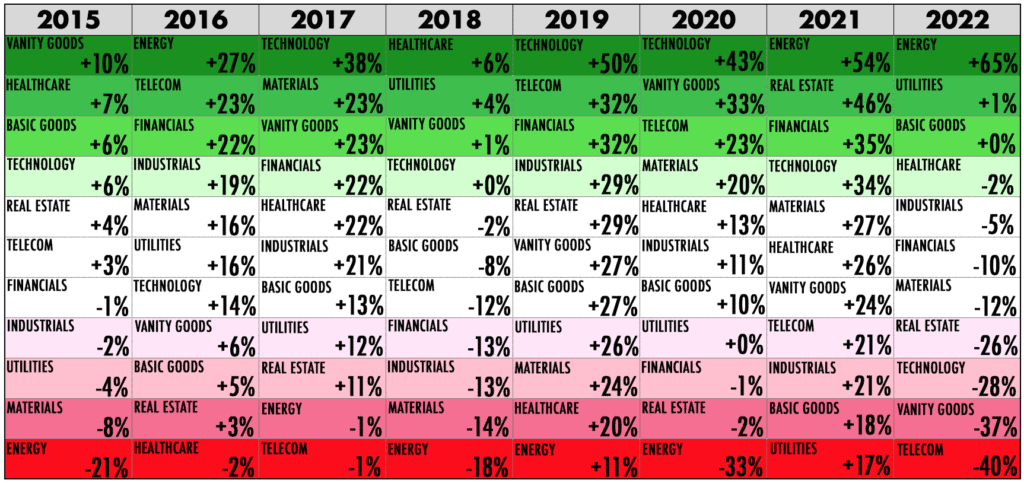

Well, feast your eyes on this…

The lesson couldn’t be more obvious…

If your fortunes were tied to lousy… out-of-favor… mothballed sectors…

You never had a chance!

Yet by employing a solid “sector rotation” strategy — that is, investing alongside stocks in overperforming sectors and avoiding stocks in underperforming sectors — you could’ve been consistently crushing the market.

Here, the numbers are shocking…

Talk about a reversal of fortunes, right?

With a jarring difference of $108,101, simply due to a sector’s hotness/coldness…

I can’t fathom trying to pick stocks without also having a sector bias.

That’d be like going fishing without one of those fancy Fishfinder radar systems!

Take energy, for example, the market’s hottest sector for two years running…

Obsidian Energy is up 658%…

Hallador Energy is up 508%…

Peabody Energy is up 483%.

Armed with a “sector rotation” strategy — pointing directly toward the energy sector — you could’ve minted a small fortune.

Have I piqued your interest?

Good! Because my “Moneyball Economics” system — the same proprietary system that helped me become Bloomberg’s #1 economic forecaster — relies on predictive models that can gauge a sector’s hotness/coldness with shocking accuracy.

I’ve included every urgent detail in a companion report.

The report is called “The Secret to Sector Alpha Profits,” and it’s yours when you agree to take Moneyball’s Sector Alpha Report for a 30-day test spin.

So what’s my #1 sector for the New Year?

Well, I’m happy to report that FedNow’s nationwide rollout — coming in July — couldn’t happen without the hardworking folks in my top sector for 2023…

Which helps explain why gains could run as high as 26,518% in the weeks leading up to FedNow’s big launch.

Yet still, there are no guarantees when it comes to investing. As good as my “sector rotation” strategy is, there’ll be some losers. That’s just life. That’s just investing. Anyone who tells you differently is blowing smoke up your… well, you know what I’m trying to say.

Does it require a leap of faith?

Of course!

Will you regret not taking action?

Most definitely!

As for those with enough wisdom… enough conviction… and enough foresight to buy my #1 FedNow stock at tomorrow’s opening bell…

Congrats! Because you’ve done something truly remarkable…

You’re positioned alongside the biggest act of creative disruption in history — FedNow — while also being mindful of the sector in which you’re investing.

How much does it cost to join Moneyball’s Sector Alpha Report?

This type of premium research isn’t cheap.

The published price of a one-year membership is $299.

But if you act right now, I’m willing to go the extra mile.

See, since inflation continues to crush Americans’ buying power…

I’d like to do my part to help.

So I decided to cut the cost to join Moneyball’s Sector Alpha Report by 67%.

Let me say that again…

To make it easier for you to participate in FedNow’s nationwide rollout…

I’m cutting the standard price by 67%…

Meaning you’ll pay just $99 for a one-year membership to Moneyball’s Sector Alpha Report.

Over the course of your subscription, expect to receive at least 15 to 21 trading recommendations.

Each recommended trade, of course, has the potential to generate outsized profits.

And you’ll only pay the cut-rate price of $99.

To summarize, you’ll get…

🔥 MONTHLY ISSUES (12) of my flagship publication for an entire year, with a brand-new stock recommendation in every issue.

🔥 Full access to my MODEL PORTFOLIO, which is comprised solely of companies operating in thriving sectors — ones that 1) trade on major stock exchanges, 2) have ample trading volume for buy/sell orders to fill, and 3) offer investors the potential for outsized gains.

🔥 I’ll send E-MAIL UPDATES whenever news breaks that impacts any of the companies in our model portfolio. It’s a convenient way to track all of the high-flying stocks that I recommend throughout the year.

🔥 MAIN REPORT: The FedNow Profits Report, which includes my #1 way to play the Federal Reserve’s historic act of creative destruction.

🔥 BONUS REPORT: The Secret to Sector Alpha Profits. Never own another stock in a lousy… out-of-favor… mothballed sector! Inside the pages of this highly specialized report, you’ll find every detail behind my proprietary “sector rotation” strategy.

All for the unprecedented price of just $99!

If my FedNow forecasts prove accurate…

Your first trade could pay for your subscription 200 times over.

I’m also adding an upgrade to your membership (valued at $250) — for free.

This critical upgrade is for those seeking to profit from FedNow’s unique position as the precursor to FedCoin.

Although FedNow isn’t a central bank digital currency (CBDC), per se…

FedNow provides the real-time “rails” upon which a CBDC must function. Meaning you can’t have a U.S.-backed CBDC — a.k.a. “FedCoin” — without first having FedNow, as the two are inextricably linked.

The very same currency revolution is happening in the United Kingdom… in Mexico.. in Canada… in Japan… in France… and in virtually every country of any economic importance.

I want to make sure that you’re ready for the CBDC profit explosion…

Which could be the most profitable enterprise in modern economic history.

By locking-in this membership upgrade…

You’ll have unbridled access to the very latest CBDC-related intelligence — the kind typically reserved for CEOs… fund managers… billionaire sharks… family offices… investment bankers… the DC elite… and America’s wealthiest investors.

Odds are, you’ve never experienced this level of access before.

To begin your membership, just click the link below…

Oh, and don’t worry about losing your subscription fee.

Moneyball’s Sector Alpha Report is designed to be financially-freeing; not stressful.

So take my research for a 30-day test drive…

Cruise it around the block a few times…

Heck, go full-throttle on the expressway…

If you don’t like it….

You’ll get a full refund on your subscription cost.

I mean that sincerely.

Download and review your first two reports — The FedNow Profit Report and The Secret to Sector Alpha Profits.

Then, over the next 30 days…

If you’re not a fan of my research…

One of my friendly membership liaisons is standing by…

To be clear, we DO NOT charge any kind of “processing” or “restocking” fees.

Also, it doesn’t matter what your reason is for canceling.

For example, say you don’t like the font we use…

Or the design of our monthly issues…

If my research isn’t right for you…

For whatever reason…

We’ll grant you a FULL REFUND on your subscription cost at any time over the next 30 days…

No questions asked.

Keep everything you’ve received up to that point, my compliments.

Circle July 1 on your calendar…

First, I told you how President’s Nixon’s “close the gold window” maneuver flooded the system with physical dollars, thereby causing a boom in gold prices. Thanks to Nixon, gold prices doubled 46 times over.

Second, I likened FedNow to Nixon’s dollar/gold gambit. But whereas Nixon flooded the system with physical dollars, FedNow will flood the system with digital dollars… potentiality triggering certain digital-dollar assets to double in price 2,000 times.

After that, I predicted that FedNow’s “atomic settlement” technology would cause the deaths of three American mainstays — the death of the existing banking system… the death of the existing payroll system… and the death of the physical U.S. dollar. Not only do I stand by my prediction, but I believe FedNow will be the greatest act of creative destruction ever.

Then, I cautioned you that America must be leaders (not followers) in digitizing its entire economy, or else risk losing its precarious position as the world’s #1 superpower. By falling behind other countries’ digitization efforts, the greenback could lose its status as the global reserve currency.

Next, I introduced you to central bank digital currencies (CBDCs). Virtually every country of economic importance is developing its own CBDC, including the United States. In America’s case, however, FedNow must precede FedCoin. Why? Because a digital U.S. dollar needs an “atomic settlement” platform upon which transactions can settle instantaneously. FedNow promises to deliver such a platform.

Lastly, I revealed my #1 FedNow stock. It’s a small-cap company trading on the Nasdaq for $2.25 — a company whose price isn’t reflecting the enormous value of FedNow… or the potential windfall it stands to make by virtue of FedNow’s launch.

The company currently trades for only $2.25 per share.

But after careful and thorough review…

I believe every share holds nearly $600 of value…

Meaning the stock could rise by over 26,518%.

So if you’re ready for a chance to turn $1,350 into $359,339…

Or $225 into $59,890…

Or even as little as $50 into $13,309…

You must put your name on Moneyball’s Sector Alpha Report roster, ASAP…

Because when Fed Chairman Powell hits FedNow’s “start” button…

I expect a stampede — like a herd of elephants — into every company favorably impacted by FedNow, coupled with a hyperbolic spike in stock prices.

If that doesn’t motivate you to act quickly…

Nothing will.

Now it’s time for you to make a choice…

I wish I could make it for you…

But that’s something only you can do.

When you click on the link below, you’ll be taken to a secure order form…

That’s where you’ll enter your billing and contact info.

Within moments of submitting your order, you’ll get an email from me with your first two downloadable reports — The FedNow Profit Report and The Secret to Sector Alpha Profits.

Oh, and don’t forget…

I’m also adding a critical upgrade to your membership (valued at $250) — for free.

By locking-in this membership upgrade…

You’ll get access to the very latest CBDC profit intelligence — i.e. the kind of actionable insights that I typically reserve for America’s bicoastal elites (a.k.a. the ritzy hedge-fund crowd).

Yet I’m including this membership upgrade at no additional cost.

I guarantee that you’ve never experienced such a high level of access before.

In it to win it,

Andrew Zatlin

Founder, Moneyball’s Sector Alpha Report

March 2023

For full details and disclosures, please click here. This link contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works — both the benefits it might offer you and the inevitable limitations of our products. The investment results described on this page are not typical. Investing in securities carries a high degree of risk, and you may lose some or all of the investment.

© Moneyball Economics 2023

1125 N. Charles Street, Baltimore, Maryland 21201

Privacy Policy | Terms of Use | Ad Choices | Do Not Sell My Personal Information