In this Article

- Netflix posted its first subscriber loss in over 10 years, with another 2 million sub losses projected for next quarter.

- The company is now pivoting to cracking down on password sharing and contemplating an ad-supported tier.

- These moves seem like desperation, and I think shareholders should worry.

- Should you read anything into the other FAANG stocks?

Amid its first subscriber loss in 10 years, Netflix is (finally) taking aim at password-sharing and is now even contemplating advertising.

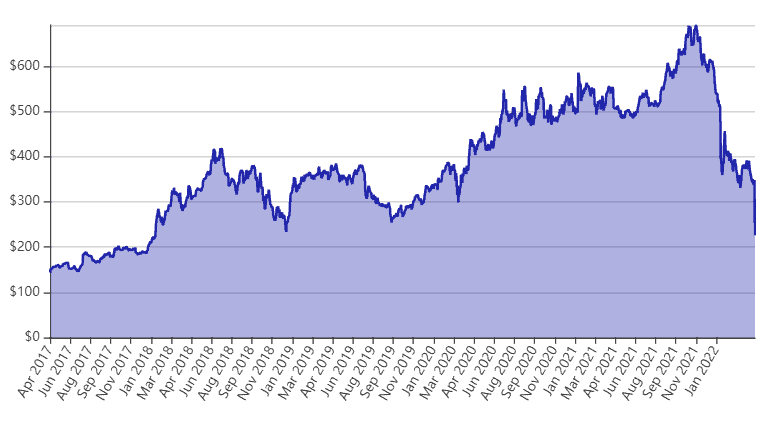

Streaming leader Netflix (NFLX) saw its stock decline by a shocking 25% last night, after it reported first-quarter earnings. This followed another shocking decline following its fourth-quarter earnings report back in January. After starting the year around $600 per share, Netflix plunged to $260 as of after-hours trading on Tuesday night.

While the dip is shocking in and of itself, perhaps even more shocking is the degree to which Netflix executives seem to be panicking. The company all of a sudden spoke about two hugely important changes to its business model to make up for slowing sub growth, which means its subscriber headwinds may continue.

Charging extra for household password-sharing

Admit it, because we've all done it: We've shared Netflix passwords with family. For sure, Netflix's no-hassle model of month-to-month subscriptions, with the ability to cancel at any time, as well as the ability for people in different locations to share their passwords, has served the company well in the past. Customers were delighted with the service, which marked a big step up from their unloved cable company. The practice allowed Netflix to grow subs like wildfire all over the world.

[Exclusive: Daymond John, “The People's Shark,” reveals where he's investing]

However, it now appears Netflix may have saturated a lot of markets, especially the U.S. and Canada. At roughly 75 million paid subscriptions in the U.S. and Canada, Netflix may have exhausted its sub potential in the region. That may especially be true because of password sharers; on its earnings release, management disclosed that over 100 million of its 222 million total subs share passwords with others, of which U.S. and Canadian sharers counted for 30 million.

That's a lot of revenue Netflix is potentially leaving on the table. Now that its sub growth appears to be stalling, management is looking for ways to monetize those nonpaying members. In March, the company began experimenting with several incremental pay models in Latin America, in which paying members can share passwords outside the household for an additional fee that's not quite as high as another subscription.

Smart move? Probably. But it's also a bit worrying when a company has to change a long-standing practice to juice revenue per user. It obviously signals that Netflix is a bit more worried about subscriber growth, which has traditionally been the metric investors have focused on to gauge the business.

And even more shocking: Advertising-supported plans

The shareholder letter didn't discuss it, but the most shocking facet of last night's release happened on the post-earnings call: Founder and CEO Reed Hastings basically admitted that Netflix will now contemplate an ad-supported model.

That's shocking, because I've been following Netflix for a long time, and this is not the first time the question has come up. Yet Hastings has basically always emphatically refused to acknowledge the possibility of an ad-supported tier… until now. On the call with analysts, he said:

One way to increase the price spread is advertising on the low-end plans, and to have lower prices with advertising. And those that have followed Netflix know that I've been against the complexity of advertising, and a big fan of the simplicity of subscription. But as much as I'm a fan of that, I'm a fan of consumer choice. And allowing consumers to have a lower price and are advertising-tolerant, if it's what they want, makes a lot of sense. So that's something we are looking at now, trying to figure out over the next year or two. … But think of us as being quite open to lower prices with advertising as a consumer choice.

While Netflix bulls could say this is a positive, as it could lead to incremental revenue, it's also never a great sign when a company abandons a strategy it's held on to for years. And it's especially worrisome in conjunction with the cracking down on password-sharers.

[Daymond John: America’s Comeback Summit – “I’m Investing 100K in This”]

Of course, this news could be a boon for adtech leaders such as The Trade Desk (TTD). In fact, The Trade Desk CEO Jeff Green predicted all the way back in late 2019 that the streaming content wars would force everyone to use programmatic advertising, even Netflix. On its third-quarter 2019 earnings call, Green said:

As we have seen, platforms such as Netflix are fighting tooth and nail for subscriber growth, while having to issue new debt just to keep pace in the war for premium content. There is only so much subscription demand, and there are new competitors every month with massive established content libraries. It all points to growth in ad-funded models, and I firmly believe that even Netflix will start to experiment with ad-supported services in the future. I believe they'll eventually adopt what others have, giving consumers the choice to pay more and avoid all ads, or pay less and see a few highly relevant ads.

Some might have thought Green, as the CEO of a programmatic advertising juggernaut, was merely talking his book. But it turns out he was pretty prescient about the nature of the streaming wars and media.

Should you read anything into the other FAANG stocks?

While Netflix was traditionally part of the esteemed FAANG stock cohort, I never really thought it fit with the others, since it's basically a media company — albeit an impressive, tech-savvy one. None of the other FAANG stocks are focused solely on streaming media as their main business, so I wouldn't worry about their earnings because Netflix is currently struggling. Streaming media and its high content investment needs is a much different beast than social media, in which users provide the content for free, and it's vastly different from cloud computing, search engines, enterprise software, or e-commerce.

You'll see below I own some Netflix, but I sold most of my shares a long time ago, keeping just a few around for the long haul; however, I'd still be cautious about adding to the stake even down here. The other FAANGs, which are much bigger positions for me, all look like much better buys, even after Netflix's big drop.

[Exclusive: Jeff Clark – “The One Stock Retirement” with the World’s Most Predictable Stock]

Billy Duberstein owns Netflix and The Trade Desk. His clients may own shares of the companies mentioned. The Motley Fool owns and recommends Netflix and The Trade Desk. The Motley Fool has a disclosure policy.