In this Article

These three companies are still reeling from their recent sell-off, but their prospects are as strong as ever.

It's no secret that e-commerce has become a major part of our economy and the world of investing. What might come as a surprise is that while e-commerce sales have increased over time, they accounted for only 13% of total U.S. retail sales in 2021. For the leaders in this space, there's still plenty of market share to capture, and that's just domestically.

When it comes to deciding where to invest, some of the biggest names in e-commerce remain the strongest choices for your portfolio. After the recent earnings reports of Amazon ( AMZN -2.46% ), PayPal ( PYPL -2.72% ), and Shopify ( SHOP -4.18% ), there are compelling reasons to put them at the top of your April stock buying list.

1. Amazon

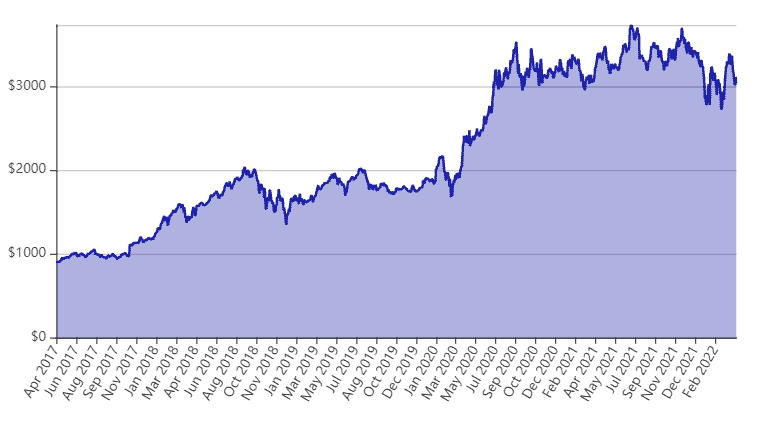

The big news around Amazon of late has been its announced stock split. It's important to remember that stock splits do not increase shareholder value and shouldn't be part of any investing thesis. However, along with the stock split news came an announcement that the company would be buying back $10 billion of its shares. This news is accretive to shareholders as it increases the value of each share held.

These announcements came just over a month after Amazon reported its fourth-quarter and full-year 2021 earnings, which were impressive. Sales increased 22%, operating income was up 9%, and net income rose 57% compared to 2020. Amazon Web Services, the cloud infrastructure segment of Amazon's business, was the star of the year, increasing its revenues by 37% over 2020 and growing to be 13% of overall revenue. The cloud infrastructure market is expected to reach $210 billion in 2022. Amazon is the leader in this space with cloud revenue of $62 billion in 2021, showing just how much room there is to grow in this market.

Amazon's price-to-earnings (P/E) ratio is 48, a lofty multiple for sure. However, Amazon has never been a “cheap” stock, and its current valuation is near the lowest it's ever been. If you believe Amazon's business will continue to grow, now is a good time to buy shares while they are on sale compared to their historical level.

[Exclusive: Bill O’Reilly – The Biggest Healthcare Innovation in Half a Century]

2. PayPal

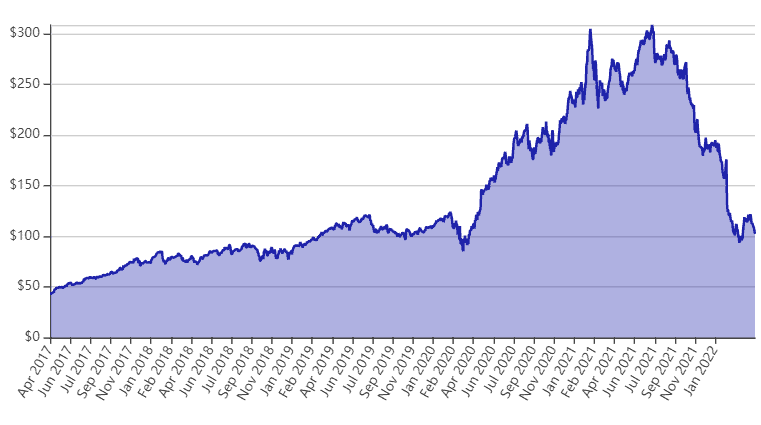

While not an e-commerce retailer, PayPal is a pioneer in online payments. Included on the checkout page of many websites, PayPal has been helping shoppers make transactions for decades. PayPal recently announced an agreement to give shoppers on Amazon.com the option to pay using Venmo, a payment platform owned by PayPal.

PayPal also posted strong year-end results. In 2021, revenue, operating income, and total payment volume grew 17%, 30%, and 31%, respectively. The company's conservative guidance spooked investors after the earnings report, but during the conference call, management stated clearly it was experiencing short-term pain for long-term gain as it intends to put more focus on its higher-value users as they drive higher-margin growth and provide more return on investment.

PayPal's P/E multiple is lower than Amazon's but still not cheap at 30. But, much like Amazon, the recent market sell-off has brought PayPal's valuation down more than 70% off its high. If you believe that PayPal is positioned to get past the conservative user guidance, now is a good time to buy shares.

[Don't Miss: Jeff Clark – “The One Stock Retirement” with the World’s Most Predictable Stock]

3. Shopify

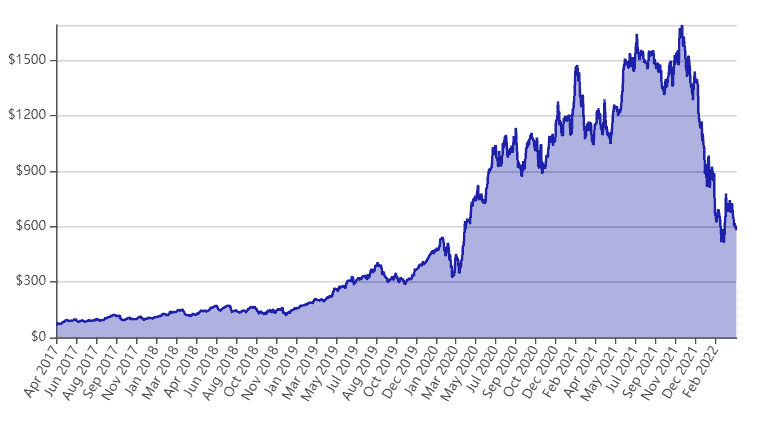

Even though it's Shopify's upcoming stock split that has the company in the news, the fact is that Shopify is a leader in the e-commerce space with a long growth runway ahead. Shopify provides the essential infrastructure for businesses to create a website and sell products. If you've ever purchased online from a small or medium-sized business, there's a good chance that the business's website was powered by Shopify.

In the recently reported 2021 fiscal year, Shopify's revenue increased 57% to $4.6 billion. Gross merchandise volume, which is the total value of all transactions processed by Shopify's platform, grew 47% year over year, and gross profit increased 61% compared to 2020. Shopify also added new features that helped drive this performance and highlighted all the ways the company can continue to support its customers. For example, in 2021, Shopify added a feature that allows businesses with a TikTok account to add products that link directly to their website for purchase.

Like Amazon, Shopify's stock split won't add any value for shareholders, and the news hasn't produced any meaningful price appreciation. As a result, shares are still near the cheapest they've ever been, hovering at a price-to-sales (P/S) ratio of 16, near where they were in early 2019. Considering this multiple was 70% higher less than a year ago, now is as good a time as ever to add Shopify to your portfolio or increase your position.

[Read More: Keith Kaplan’s Infinite Income Loop – These Three Stocks Deliver Instant Cash Monthly]