Hello, hello…

Welcome everyone, my name is Rachel Bodden. Thanks for tuning in.

Today’s show is a special one.

Table of Contents

- Intro

- Who is Dave Forest?

- The “W” Next to Certain Stocks

- What are Stock Warrants?

- How Dave Finds These Opportunities

- Aurora Cannabis Warrants

- Look at Micron Warrants

- Stock Warrants Profit Potential

- Dave Forest's Warrants Trading Course

- The Warrant Play Set to Triple or More

- The Gold Spike Action Plan

- The 3-Volume Strategic Profits Library

It starts with an in-depth look at Warren Buffett, the Oracle of Omaha, one of the richest men on the planet, with a net worth of $80 billion.

Today, we’re going to discuss one of his least-known wealth-building techniques…

It’s a strategy that he’s never revealed in-depth to the general public. There’s little record of him covering it in his world-famous annual meetings that attract up to 40,000 enthusiastic Berkshire shareholders. And none of his countless biographers has tackled it head-on…

Now, you might be familiar with well-timed investments Warren Buffett made into stocks like Coca-Cola and Apple…

Or even his investment in Southwest Airlines, which paid him more than $2 billion.

But you probably didn’t realize that two of Buffett’s most lucrative investments of all time weren’t stocks at all.

They were a specific type of private investment that netted him a combined $27 billion — almost twice as much as his return in Coke… and more than 10 times his total return in Southwest Airlines…

Buffett even used this technique to grab 46 million shares of Kraft Heinz for 1 cent apiece.

His stake has since gone up as much as 4,429%.

And what you probably don’t know, but should…

Is that while this private investment was reserved exclusively for the ultra-rich for decades…

It’s now — finally — also available to you and me… starting for as little as 15 cents.

You see, thanks to the code of the Securities and Exchange Commission, the average investor can now take advantage of these once-private deals.

Like OrganiGram, which could have returned 4,271%.

Or Blackbird, which returned 1,416% to investors.

Keep in mind, these aren’t cryptos or options…

And it has nothing to do with trendy pre-IPO investing…

Because these are actual companies producing real goods and services. They’re already bringing in cash.

In a moment, I’ll bring out one of the world’s foremost experts on this type of private investment. He’s become a multimillionaire thanks to this type of play… by using the same type of investment Buffett did.

He’s with a boutique research firm that has an entire division dedicated to studying these exceptional deals.

His name is Dave Forest with Casey Research.

Over the past decade, Casey Research has shown more everyday folks about this type of investment than any other.

The best part is, these private investments can be so cheap, these folks didn’t need Buffett-level money to play them…

Dave Forest himself has invested in a number of these deals.

He bagged a 161% gain in 4 days.

He even founded a company that issued these private deals to John Paulson, a famous billionaire like Buffett.

Dave financed that deal at 5¢… and shares shot as high as $2.37.

So that’s a 46-bagger, enough to turn $500 into $23,000.

In short, Dave Forest has personally profited from these special private deals AND founded a company that issued them to a billionaire. So he’s been on every side of this unique, mega-profitable trade.

And Dave believes this specific investment may be more lucrative than all of the different types of private investments…

- More lucrative than pre-IPO angel investing…

- Bigger than Shark Tank-style venture capital…

- And more profitable than private equity…

Hard to believe, I know…

But that’s the reason many of the world’s smartest billionaires have been feasting on this investment secret for a long time. And I don’t just mean Buffett and Paulson.

For example, billionaire George Soros bought a stake in one of America’s largest online retail giants this way…

Or consider billionaire David Einhorn, whose private investments had him on pace to potentially earn 502% and 1,107%.

So why is this type of private investment virtually unknown outside of the most exclusive circles?

The answer we found surprised us, because we discovered what looks like a concerted effort to prevent “the little guy” from getting in.

As The Globe and Mail writes:

“[this investment] should be on radar screens everywhere, but the few specialists who follow them say they’re terra incognita to most investors.”

When trying to find out more, interested people are often given the cold shoulder…

First, we called one of the world’s largest investment banks — you’d certainly know the name, but we can’t say it on the air…

When we got to their brokerage unit, their rep definitely knew about these deals… but, after admitting he rarely gets questions about how to play them, he tried to steer us away from them.

Another major broker’s help desk claimed to have no idea how their clients could even get into these deals.

But that was fishy too… because that firm’s founder personally issued these same exact private deals to the firm’s own employees.

In his autobiography, he wrote that those deals “would form the foundation of large personal fortunes for many longtime employees.”

That’s why we started to get the feeling that these big banks and brokers wanted to keep these private deals secret… to reserve the 4,000% gains for the big money insiders… and to keep them away from you and me.

But the truth is, you can buy them through your existing brokerage account… if you know the right code…

The world’s largest institutions certainly know it. They’ve been aggressively re-routing capital into this private investment space…

Consider Fidelity, the 80-year-old mutual fund giant. Over 27 million investors and retirees have entrusted Fidelity with their capital.

Yet they tell their clients to keep their money in funds and stocks, while they themselves load up on private deals.

For example, the Johnson family, the family that owns Fidelity, has a secret arm within the company. Called “F Prime,” they only invest in private deals. Clients of Fidelity don’t have access.

“F Prime” took a private stake in the online retailer Alibaba. That investment could have paid as much as 971 times their money. The most Alibaba’s public stock rose was 212%.

The private investment did 450 times as well as the public stock. Yet only the richest folks knew about it.

“F Prime” also made a private investment in pharmaceutical company Ultragenyx. They made about 1,000% — $128 million — before Fidelity clients could even get in.

In short, the family that owns Fidelity keeps the best private deals for themselves — while their clients get the scraps.

“The owners of Fidelity get richer at everyday investors’ expense”

— Reuters

But thanks to SEC Rule 30.52, Main Street Americans are now getting more and more access to these kinds of investments.

In the past, they were reserved exclusively for the 1%.

But today, they’re open to everybody. As long as you know how to find them.

And there’s one specific private investment that may be more profitable than all others…

So, what exactly is this investment?

Why are the world’s elite being tight-lipped out about it?

How did Dave infiltrate their ranks to uncover this profitable secret?

And how can you take advantage of it today, if you choose?

I’d like to welcome Dave Forest to help us answer those questions.

Hey Dave, how are you?

DAVE

I’m doing great Rachel, and I’m glad to be here.

I’d like to welcome everyone who tuned in today.

HOST

So the folks at home, I’m sure, are dying to know what this incredible private investment is. Will you tell us?

DAVE

Yes, absolutely. I want to start out by giving you a hint. Actually two hints. First, it starts with “W.”

Second, that letter — W — is also a code that lets you spot these deals too.

HOST

How do you mean?

DAVE

Well, take a look at these stocks…

Almost all of these are publicly traded stocks…

Like Apple, Amazon, ExxonMobil… you get the picture.

But hidden amongst them are several investments billionaires like Buffett have been able to take advantage of…

Can you spot them?

HOST

I’m at a loss…

DAVE

Just spot the W…

Which ones have a W in them?

HOST

There’s one. There’s another…these W codes look pretty unique.

DAVE

Exactly. Those aren’t stocks. They are what I consider Buffett’s #1 Private Investment.

Now, while they’re quietly listed alongside stocks, they’re most certainly NOT stocks.

HOST

Oh, they must be options then.

DAVE

No — they’re not options either. But I see why you guessed that.

Because these investments can definitely go up as much as some options do. Higher and faster in many cases.

But they’re not options…they’re probably not anything that the audience has heard of before.

They’re essentially private shares that a company issues — and the best part is, they can give you much bigger returns than investing in the company the regular way with stocks.

For starters, let’s take a look at Intel. This household name company makes computer chips. They’re the second biggest semiconductor manufacturer in the world.

Over the past ten years, their shares have risen 238%.

HOST

So if I put $1,000 into it, I could have ended up with about $2,400.

DAVE

That’s right. A solid return for sure.

But here’s the thing — Intel did not offer these private investments.

But look at Advanced Micro Devices, a similar chipmaker.

This company is in the same field as Intel. But they’re smaller; they’re not a household name.

Over the past ten years, their stock did a lot better than Intel’s — going up an impressive 523%.

Not bad at all!

Here’s the crux of the matter: Unlike Intel, Advanced Micro Devices did offer these private investments.

You can see the W code right here.

Do you know what these AMD private investments did, Rachel?

HOST

No, please show me…

DAVE

Our historical backtest shows that the Advanced Micro private investments went up 7,991%.

That’s almost 80 times your money. That means $1,000 grows into $80,000.

HOST

Wow, that’s big — much bigger than the stock’s performance.

DAVE

EXACTLY — these AMD private investments did 15-times better than AMD stock…

And they did over 30-times better than Intel stock…

That’s huge.

But that’s not even the most impressive part.

Because these private investments delivered almost 8,000% in just 6 months.

Remember, the stocks took an entire decade to deliver two- and five-fold returns.

But the private investments could have pumped out 80-fold returns in just 6 months.

In short, the AMD private investments could have paid out 15-times more than the stock in one-twentieth the time.

Once again, see the W there?

HOST

Yes, there’s the W.

But just to clarify, Dave…

Like stocks, these investments are in actual real American companies too?

DAVE

Exactly… like stocks, they’re connected to real companies… and they even trade on a market that runs parallel to the market stocks trade on.

But there are several big things that make these private investments different from stocks…

The first big difference is that these private investments are created by the companies themselves. They’re issued directly to wealthy investors like Warren Buffett.

Common stocks, as you know, slosh around in public — in the open market — bought and sold by everyone from huge, multi-billion-dollar index funds to everyday retirees…

HOST

Ok, but why is that distinction important?

DAVE

It’s important because we’re getting as close as possible to the profit source when the company creates these private investments.

You’re not padding the pockets of all of the middlemen that typically clog conventional stock trades.

But remember, you can buy and sell some of these investments right from your brokerage account — you don’t have to deal with the companies themselves.

And the company has a direct interest in these investments doing well.

Therefore, these special investments go up more as the company’s profits grow. That’s why I like them.

To see this in action — and why it’s important — let’s take a look at another example.

Pan American Silver is a world-class mining company that has one of the largest silver reserves in the world.

In early 2019, Pan American Silver stock went up 82% in 3 months. Pretty darn good.

But Pan American’s private deals shot up 2,233% over the same exact timeframe.

And there’s that W again.

So the Pan American Silver private investments returned 27X what Pan American’s stock did.

That’s why I prefer these special investments over stocks.

HOST

Ok, I can see why Warren Buffett has used a similar strategy.

But that brings up another question: Why would a company issue private shares in their business?

DAVE

Good question.

Let’s look at another example, the tech company Xilinx.

Xilinx makes semiconductors.

As you can probably imagine, creating a new generation of cutting-edge chips requires a lot of capital. Research and development costs a ton of money, and so does fabricating the chips themselves.

So Xilinx has a few ways to raise the money it needs to innovate.

It can go into debt by selling bonds…

It can issue new shares…

Or it can sell a small amount of these private investments to well-connected insiders like Warren Buffett in order to raise capital.

But selling bonds and issuing new shares both involve a bunch of Wall Street middle men who all demand a cut. Underwriters, brokers, investment banks, and exchanges all siphon that crucial money away.

HOST

Ah, I see. So selling these special deals is the only way Xilinx can keep all of the capital to themselves.

DAVE

Right. Including these deals is one of the most efficient, quiet, and discreet ways to raise money.

It’s a textbook win-win deal for the company and the investor.

So that’s a big reason why I prefer these investments.

HOST

How well did that Xilinx deal do?

DAVE

The Xilinx private investments went up 2,117% in 6 months.

Xilinx stock pretty much doubled over that same timeframe. Not bad at all.

But the Xilinx special investments beat out Xilinx stock 21 times over.

And these investments were just as easy to buy as the stock from any online broker.

You just needed to know the right W code.

HOST

Ok, that makes sense, I can see why you like them so much — but just how many of these investments are out there?

DAVE

Good question, Rachel. This will get to just how rare and unique these special investments are.

Before I tell you, why don’t you take a guess?

HOST

I have no idea, Dave. Can you give me some kind of a hint?

DAVE

Ok, here you go. Right now, there are more than 6,100 different stocks on the two major US exchanges, the NYSE and the Nasdaq.

So how many of these special investments do you think there are?

HOST

6,100 stocks… so, let’s take 10% of that. I’m going to say there are 610 different special investments available right now.

DAVE

Good guess — but you’re still too high. There are only 304 different private investments out there right now.

So cut your guess in half — there are just 5% as many of these special investments as there are stocks on the major US exchanges.

HOST

Wow, 304 — that’s not that many at all.

DAVE

But that’s another big reason why almost nobody knows about these investments. You never see them talked about on CNBC or written up in The Wall Street Journal.

And it also explains why billionaires like Buffett, Einhorn, and Soros seem to be the only ones lucky enough to profit from them… even though they can cost as little as 15 cents a pop and you can buy and sell them right through your online brokerage account.

On top of that, it’s incredibly hard, expensive, and time consuming to get any data on these investments.

So even if you know they exist, good luck trying to find out more about them.

Look, I’m not the paranoid type. So I’m not going to say there’s an organized conspiracy to keep this story hidden…

But all that secrecy is a huge shame because these investments can be so profitable, so quickly.

HOST

Well the secret’s out now, Dave.

DAVE

Yes, for sure…

But Rachel, there’s something important I haven’t mentioned yet…

These investments can really take off when a big profit catalyst occurs.

HOST

Well, couldn’t you say the same about any investment?

DAVE

Yes, but not like this.

Consider Viking Therapeutics. It’s a small biotech company developing treatments for fatty liver disease and elevated LDL cholesterol.

Early-stage biotech firms often need capital because developing drugs gets expensive — especially in the later FDA trial stages.

So Viking Therapeutics offered some special investment deals to raise money.

Then the big profit catalyst hit…

Viking’s experimental liver medication had a favorable mid-stage clinical result… and the private investments went on to soar 3,512%.

There’s that W again…

In short, a timely catalyst helped turn the Viking Therapeutics private investments into a 35-bagger.

HOST

That sounds similar to the catalyst that grew Warren Buffett’s Bank of America private investments into a multi-billion dollar windfall.

DAVE

Exactly, Rachel.

After the 2008 financial crisis, Bank of America got hit hard. They had to deal with $83 billion in losses from bad loans plus mounting legal payouts from the subprime mortgage crisis.

So Uncle Warren came along and infused them with sorely needed cash… and in return he got a slew of these private investments.

And then a big profit catalyst hit for Bank of America…

The bank got a $45 billion bailout courtesy of the U.S. taxpayer. This let the company get back on its feet, and it soon made a complete turnaround.

And thanks to that catalyst, Buffett got MUCH richer. The value of his private investments shot up by $12 billion.

HOST

Wow, $12 billion in profits, just like that. I’m sure stockholders in Buffett’s Berkshire Hathaway were happy.

DAVE

They certainly were — but do you know how much one share of Berkshire costs now, Rachel?

HOST

I know they’re super expensive — I’d say about $300,000.

DAVE

You’re really close — the A shares go for around $320,000 a pop right now.

Look, Berkshire Hathaway has been a great long term investment — it has crushed the S&P 500 for decades.

That’s why Warren Buffett is the most famous investor in history — the legendary Oracle of Omaha — and why he’s personally worth $80 billion.

But not many people can afford to get into Berkshire at that price.

These investments, on the other hand — the same ones Buffett used to make $12 billion in a day — they can cost as little as 10¢ — sometimes even 1¢ — a pop.

That’s another big reason why I like them so much. They can be as cheap as a penny!

And that brings us to our second difference — the gains with these investments can be much, much higher than the gains in stocks.

Take Barrick Gold’s private investments, for example. On May 27, 2019, you could’ve bought one for a penny. That’s right, 1¢.

Three months later, on August 28, you could’ve sold for $1.51.

That works out to a 15,000% gain in 3 months.

Turning a $1,000 stake into $150,000.

Barrick’s stock did pretty well over that same timeframe, too — it went up 69%.

But that means that the Barrick special investment shot up 217 times more than the stock did.

And buying the stock would’ve cost you around $12 a share. But like I said, these private investments cost only a penny apiece.

HOST

Wow, when they’re that cheap you can build a substantial stake without putting up too much money. $100 would have gotten you 10,000 of those Barrick special investments.

Now, let’s get into how these incredible profit tools work.

What exactly are these investments?

DAVE

It’s simple, Rachel.

They’re warrants.

HOST

Warrants?

DAVE

That’s right, warrants.

Even though I bet 99% of today’s viewers just heard that name for the first time…

Warrants have been around for about 70 years… but they’ve traditionally been reserved for the wealthiest, savviest investors.

Guys like Warren Buffett… George Soros… and the unknown mathematician who started the very first quant hedge fund.

He never had a down year and pumped out a compounded 23,737% over 3 decades.

That’s right — he used warrants to help him deliver a 237X lifetime return.

Over that same timeframe, the S&P 500 rose 1,008%.

So our mystery man used stock warrants to beat the markets 23 times over!

But even though warrants have been around so long… and they can make you very rich… they weren’t available to “little guy” investors until just a few years ago.

You see, even though these warrants are created on the private market, they almost always end up on the public market. That way, you can easily buy and sell them with a normal brokerage account.

And the way I trade warrants couldn’t be simpler. They’re some of the easiest transactions you’ll ever make. It’s not some complex, risky, and overly technical strategy.

In fact, it’s the easiest way to make a lot of money that I’ve seen in my entire life.

Warrants give individual investors a direct way to profit like Warren Buffett, right from their existing brokerage account, with securities that can cost a dime or less.

HOST

You know Dave, I’ve heard whispers about warrants when I cover industry events and conferences. But it’s always CEOs, asset managers, and insiders talking about them.

It’s just insane to think that you’re showing ordinary folks how to do this.

So let’s dig into your strategy a little more…

Can you give an example of a stock compared to a warrant?

Maybe start with a stock that delivered great gains and then compare that to the private warrants from the same company…

Just make it apples to apples…

DAVE

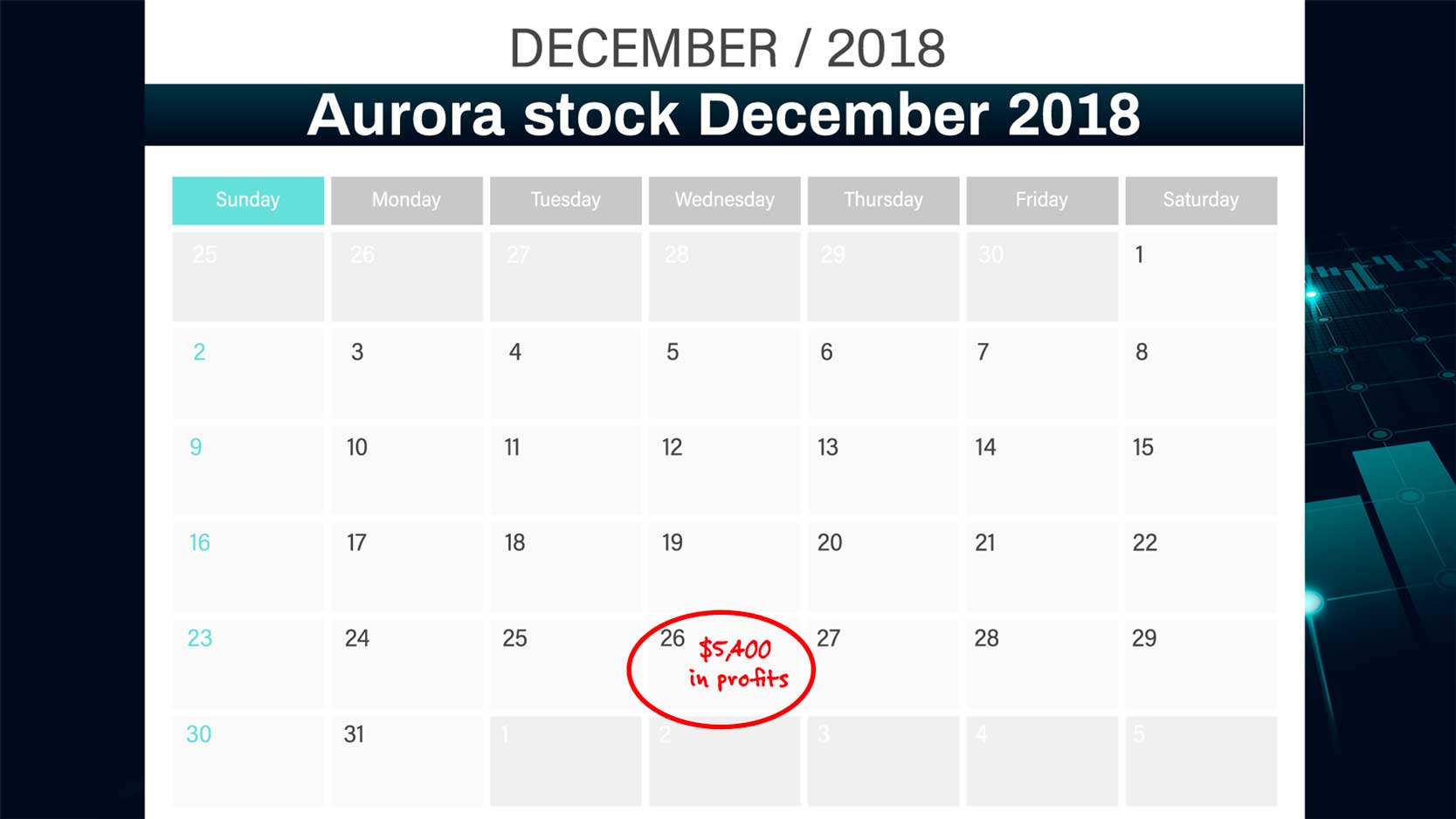

Sure… let’s take a look at Aurora Cannabis, a high-flying marijuana company.

On November 3, 2017, you could’ve put $5,000 into Aurora stock.

13 months later, you could’ve made $5,400 in profits.

Not bad. Just over a double in just over a year.

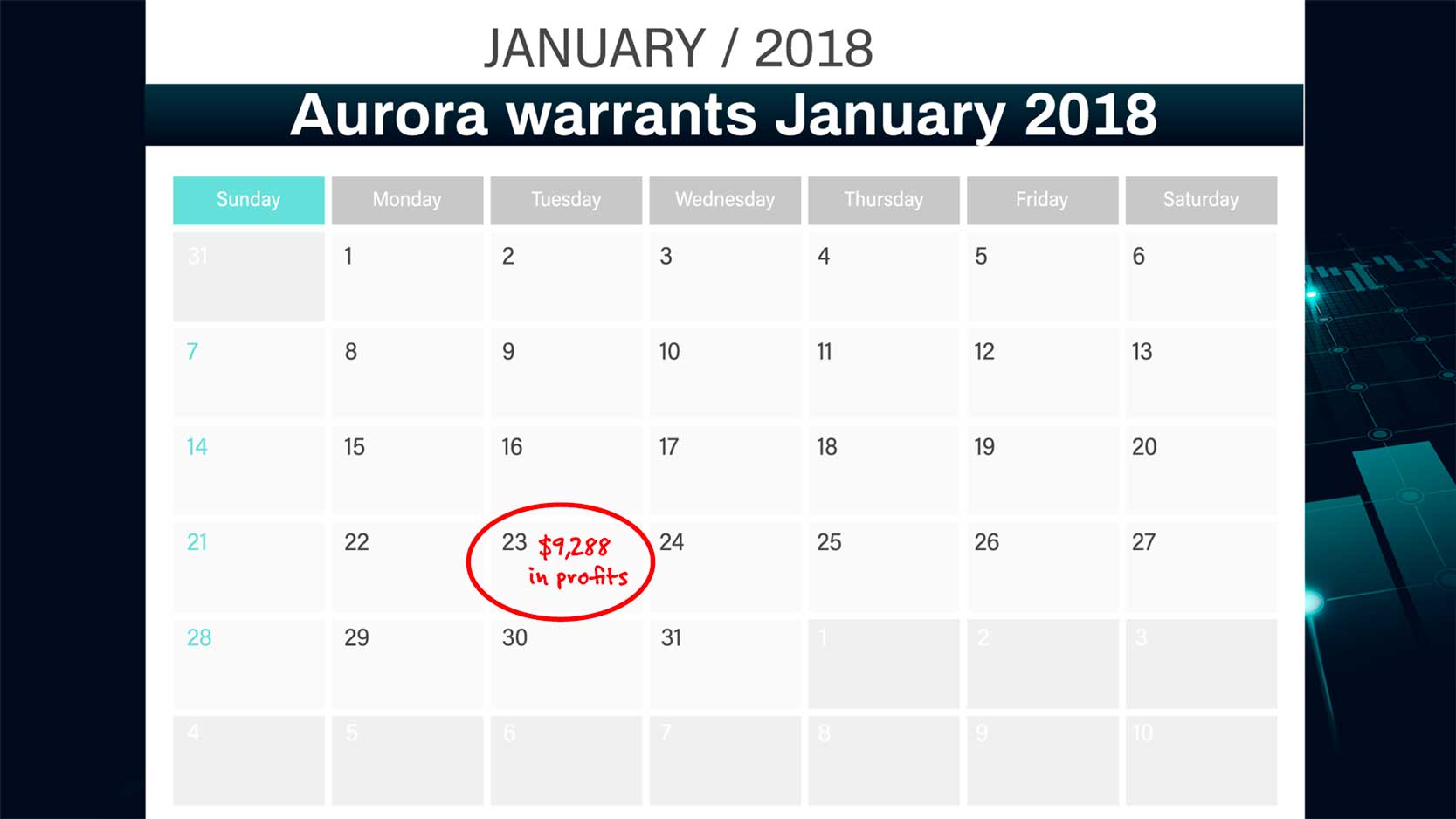

Or, you could’ve bought 1,000 Aurora warrants instead.

For just $650.

In less than 3 months, the Aurora warrants would’ve paid you $9,288 in pure profits.

That means, with warrants, you could’ve banked almost twice the profits…

For about one-tenth the cost…

In one quarter of the time.

With far less risk and far more profit potential.

That’s the no-brainer profit power of warrants.

HOST

That’s amazing. Those Aurora stock warrants shot up 1,529% in what — 80 days…

DAVE

It’s especially amazing when you consider how many actual stocks generate 1,000% or more…

Care to guess?

HOST

Seven or eight…

DAVE

There were NO stocks on any of the major exchanges that did 1,000% or more.

Only a few did 100% or better.

HOST

And you’ve shown us a handful of warrants, already, that have generated 1,000% gains or more.

DAVE

That’s what I’m saying, Rachel! This is truly an incredible, overlooked secret in the financial world. There are fewer and fewer of them these days.

HOST

Dave, can you tell us how you came across these amazing opportunities? I mean, most analysts don’t even know what warrants are… let alone the best way to use them to make the most money.

DAVE

Easy — I’m an insider. Have been for more than twenty years.

I start private companies, secure private financing for those companies, and I’ve even helped take one of them public.

You mentioned the company I helped take public earlier, Rachel, but I’d like to drill into it more because it really shows how much more you can make from these deals versus stocks.

Before that company went public, we offered these private deals at 10¢ apiece. They soared as high as $2.37.

Now, let’s compare that to how the stock performed after we took the company public.

Stockholders who got in early at the IPO and held on could’ve made 492%.

So the private deals could’ve paid out 2,270% while the stock topped out at 492%.

A 492% gain isn’t bad, by any means — everyone I know would grab that gain in a second. I would too.

But 2,270% is much, much better.

In short, the private deals paid out as much as 4 TIMES more than the stock.

So you can see why billionaires like Buffett and Paulson love them. It’s an extreme advantage over normal stocks.

I also trade these private deals in my own portfolio, with promising companies I’m not personally involved in.

They can be super profitable, super fast — so that’s a big reason why I trade them. I recently saw one jump 161% in 4 days.

So let’s face it: They’re also FUN.

To sum it all up, I’m deep in the trenches of the private markets, searching out and pounding out these deals on a daily basis. And I enjoy playing them myself.

HOST

Right — but here’s where my big question pops up…

Why go public with this story?

You could just keep these profitable deals to yourself. You could keep it a secret for the insiders and billionaires…

DAVE

I definitely could. But this is what I do, Rachel.

I’m in the business of helping everyday folks learn how to make money — not the investment banks and promoters on Wall Street.

You saw the profit potential, Rachel — they can pay out thousands of percent.

And anyone can buy them right from their existing brokerage account, as long as they know the right code. I can’t keep quiet about that!

Also, as you saw from the examples we just went through, there are 1,000%+ warrants in many different sectors, not just precious metals.

I’m talking biotech; banking; semiconductors and other tech subsectors; and extremely new industries like marijuana, legal gambling, and esports.

Basically, any company in the aggressive growth stage can access the private markets and raise capital with these deals, issuing warrants.

HOST

What’s a specific example?

DAVE

Consider Micron’s warrants. Micron’s a tech company that makes computer memory devices like USB drives.

In June of 2019, you could’ve bought Micron stock warrants for 12¢ apiece.

Seven weeks later, you could’ve sold them for a 490% gain.

But it could’ve taken you six years to make a 490% gain in Micron stock. Look, that’s a phenomenal result, and I’d love to see many more stocks do that well.

But once again, you gotta love the warrants — they delivered six years of stock gains in just seven weeks.

What would you prefer, Rachel — six years or seven weeks?

HOST

Come on Dave, the answer’s obvious. Of course I don’t want to tie my money up for six years if I can help it.

But I just took a look at my notes and it looks like your Advanced Micro example was actually one of their smaller winners — can you explain that?

DAVE

Right. We took a look at the Advanced Micro warrant a few minutes ago — it went up 7,991%.

But other Advanced Micro warrants did even better than that, if you can believe it.

One shot up 12,500%… another did 44,900%… and the biggest one could’ve paid out an astonishing 52,900%.

That last play would’ve turned $1,000 into $529,000.

And it only took 9 months!

And each of those stock warrants cost just a few cents, so you could’ve bought hundreds of them for just a few bucks.

Warrants are the sexiest, fastest-moving plays in the world, and I just had to expose them to the folks watching today.

There’s no better opportunity for the smart speculator to make big, fast gains.

Now, I have to point out the obvious. Like all investments, warrants carry risk. And even though we’ve seen huge play after huge play today, past performance is no guarantee of future winners.

That’s a fundamental truth of investing.

But look, there’s no reason to keep warrants secret anymore, no reason to reserve these huge profits solely for insiders like myself, Buffett and Soros.

Besides, I’m the first to break this to the general public.

No one — and I mean no one — publishes non-expert research specifically devoted to warrants, so I’m breaking new ground.

You don’t get many chances to do something revolutionary, so I had to run with this.

HOST

I’m excited, so I can imagine today’s viewers are too. Warrants can be dirt cheap and they can go up thousands of percent in months.

But some of these examples really stuck out — they came in very short timeframes, like 2 weeks, a few days, and even 24 hours.

DAVE

Right, in some rare cases warrants can shoot up overnight.

- 255% in 6 days

- 1,333% in 7 days

- 253% in 12 days

- 8,650% in 10 weeks

- 1,500% in a week

- 875% in 8 days

- 322% in 4 days

- 194% in 5 days

- 107% in 5 days

- 420% in 6 days

- 529% in a week

- And 183% in ONE day

HOST

183% in one day?

DAVE

Yes — imagine that — almost tripling your money in one day.

You wake up, get some coffee and make a $1,000 trade.

By dinner time, you’ve turned that into $2,830.

It’s rare, but it’s happened.

The best part is, those warrants cost 3¢ a pop. So you could’ve bought one for 3 thin pennies.

HOST

You needed the right W code for that warrant, though.

If you didn’t have that code, you couldn’t have made 183% in one day.

DAVE

Exactly, you needed that specific W code.

Look, these W codes are a lot like the normal ticker symbols you use to buy and sell stocks.

If you know the right W code, you can punch it into your brokerage account and buy warrants — in about seven seconds. So that’s how warrants are like stocks, they’re easy to buy and sell.

HOST

But there’s a difference, too…

DAVE

Right, there’s a huge difference.

For one, you won’t find any information on them in the big financial websites or print publications like Barron’s and The Wall Street Journal.

Compare that to a well-known stock like Amazon. I plugged the words “Amazon stock” into Google, and I got 1.7 billion results in about half a second.

HOST

Yeah, everyone knows about Amazon.

DAVE

Exactly. In addition to countless in-depth stories about Amazon’s business, I got a detailed stock chart and a bunch of technical metrics like market cap, 52-week high, P/E ratio, and previous close price. It’s so much information that I couldn’t absorb it all in 50 years.

But with warrants, like I hinted at before, there’s virtually no information out there. And the information that is available is geared toward sophisticated, well-heeled professionals like Buffett and Soros.

HOST

Why? Warrants can be so profitable, so quickly, that I’d think they couldn’t stay secret for long.

DAVE

It’s because most of the information on warrants simply stays private — warrants get issued behind closed doors among big-dollar players and the companies themselves.

There’s no reason for them to talk publicly about these lucrative opportunities. Naturally, they want to keep it all to themselves.

So we have a sticky situation.

While warrants are extremely easy to buy, they’re almost impossible to find.

They’re almost impossible to research.

So that’s the biggest problem I challenged myself to fix — it’s why I’m producing the world’s first entry-level research devoted to warrants.

HOST

But is your research suited for complete beginners?

Can someone who just heard about warrants use it?

DAVE

Yes, that’s the whole point, Rachel.

For better or worse, I’ve questioned authority since I was a young boy.

So, considering what I’ve learned about warrants over the past decade on the inside of the gold industry… when it dawned on me that this technique was almost entirely hidden from mom and pop Americans…

I said, “I need to put an end to that!”

So I did.

HOST

Ok Dave, you’ve got me. I’ve known about warrants because I’m a financial reporter, but I’m glad you’re finally revealing them to the general public.

So let me try to sum it all up.

Warrants are cheap — sometimes they cost as little as 3¢, 5¢, or 15¢…

They can multiply in price 5… 10… 100… and even 529 times…

They can shoot up quickly — sometimes in weeks or a few days — and in rare cases, they can skyrocket in just one day…

Despite all of that, they’re still the best-kept secret in money-making.

DAVE

You got it, Rachel…

HOST

I can see why you’re so excited about revealing the incredible profit power of stock warrants. And your excitement is contagious.

Now let’s see where the rubber hits the road, Dave. You said you’ve created a comprehensive course on warrants. It’s a series of 5 training videos that anyone can watch at home.

DAVE

Yes. Anyone with a brokerage account can go from zero to sixty with this course. Shoot, you can do it if you don’t even have a brokerage account, though you’ll need to start one to buy or sell warrants.

And you don’t need anything complex or involved, like a margin account… you don’t need to be an accredited investor or anything like that.

The whole thing couldn’t be easier: my course consists of 5 incredibly detailed yet simple and short videos.

So you can watch the whole thing, sitting right in your favorite chair, and be ready to profit in less than a few hours.

Just like that, you’ll be ready to get rich with warrants.

HOST

Wow, that’s a big first — because no one’s published any “entry level” info on warrants, much less a full training course. So you’re breaking new ground here, Dave.

You’ve got my attention — please tell me a little more about what’s in the videos…

DAVE

Sure thing, Rachel.

The first video is “Warrants 101,” which gives a detailed rundown on what warrants are, how and why they’re created and how they can often shoot up hundreds or thousands of percent.

It shows why they’re the absolute best profit opportunity for the “average Joe”. It’s a quick crash course that gives you the full background you need to start playing warrants.

And the rest of the videos in my training course are hyper-specific “how to” videos.

They show step-by-step instructions on how to use W codes to find warrants in your brokerage account… how to buy and sell warrants with one click… how to quickly track their performance… and more.

The fact is, buying and selling warrants is just as easy as buying and selling stocks. Do it once and you’ll be a pro.

And that’s what my training course sets out to do: To show you how to play what could be Warren Buffett’s #1 investment — right from your home.

These videos will get you up to speed in no time, and you can start profiting from stock warrants today if you want to.

So I’m doing something special today, something outrageous.

Anyone in the audience — and anyone watching this video — can claim my warrants training course.

HOST

Wow, that’s tremendous — but it brings up a question I have, Dave…

So you’re providing this first-ever soup-to-nuts training course for warrants…

It shows the average person — even if they’re a complete beginner — how to buy and sell warrants…

But once someone knows how to profit from warrants, how will they know which warrants to consider getting into?

How will they know which warrant is most likely to shoot up into the thousands of percent?

DAVE

I’m glad you asked, because I’ve got everyone covered there, too.

Because I’ll also reveal the best warrant plays for right now.

Look, we’re at the tail end of an insane, historic bull market. We’ve seen some pullbacks, but the market’s still going up.

So let’s be realistic — as long as the bull market lasts, you’ll do just fine with ETFs, hot tech stocks, and index funds.

You know, the stuff that tracks the overall market — and you’ll probably be able to lock in 10% or more a year, pretty much no problem.

HOST

That’s nothing to sneeze at, but it certainly isn’t sexy…

DAVE

Right. The biggest, fastest gains will come from warrants.

Warrants issued by companies that virtually no one’s heard of, in explosive, growing sectors set to soar even more.

And they can be so cheap, just a few cents apiece sometimes, that you can build a substantial position with a small stake of just a few hundred dollars…

Or whatever you feel comfortable with.

But the point is, you limit your risk to basically zero when you’re playing things this cheap.

And the gains can be so huge, so fast, that stock warrants are the closest thing to a no-brainer for anyone who dabbles in the markets.

That’s the performance I’m aiming for with this warrant that I’m recommending for viewers today.

HOST

So what’s the profit potential for this warrant, Dave?

DAVE

Look, I always try to be careful about big profit predictions…

In truth, it’s incredibly hard to predict what will go up 5, 7, 10 or more times.

But the fact of the matter is this: We’ve seen warrants regularly produce gains that big in the recent past.

Right now, one of my research services has open warrants positions that are up 100%… 200%…

And one’s even up as much as 3,194%.

That one cost just 19¢ to get in! So you could’ve grabbed 100 for $19. 1,000 would’ve run you $190. Once again, that’s why warrants are so awesome. They’re cheap and they can skyrocket, FAST.

Our readers LOVE this.

There’s a reason why stock warrants could be Warren Buffett’s #1 investment… and there’s a reason why they’ve been kept off limits to regular folks until today.

That’s why I put out a revolutionary service called Strategic Investor.

To unleash this profit power to the general public. Finally.

And that’s also why I’ve insisted on letting anyone watching this video try Strategic Investor out on a completely risk-free basis.

That’s the only way to make sure this critical information gets out.

It’s the only way to make sure “main street” gets access to warrants, so they, too, can take advantage of what could be Warren Buffett’s #1 profit tool.

HOST

So you’re leveling the playing field.

DAVE

Exactly.

Look, Rachel. I’ve already made my money — I’ve earned enough to keep my family comfortable for the rest of my life.

But once I got there, I realized that my work wasn’t done… that I had another obligation… to spread the word, to expose this incredible wealth-building power to anyone willing to take the leap.

To be frank, there’s absolutely no reason why warrants should remain a secret, especially since they’ve become so easy for anyone with a brokerage account to buy and sell.

So I made a commitment to expose the billionaires’ advantage to anyone with the courage to try something new. It’s really that simple. And that’s how Strategic Investor came to be.

Every month, I publish an issue of Strategic Investor, with at least one new, deeply-researched specific profit opportunity.

HOST

But you’re not talking about scratching out small profits with these opportunities…

DAVE

No, not at all.

Right now, readers from one of my research services have access to warrants plays that are already up as high as 3,194%. And I wouldn’t be surprised if the two plays I’m discussing today surpass that.

In short, when I get up to bat, I swing for the fences — I will only recommend plays with enormous potential.

And here’s another thing: I’m not looking to wait a year or more to profit. I look for plays that can triple or more — as soon as possible.

That said, Rachel will show you how you can access my complete training course on warrants… along with A FREE warrant play for right now…

Right when this presentation ends, I’ll give everyone the chance to claim all of that for FREE — as a personal thank you for taking a membership to Strategic Investor.

Thank you for spending time with me today.

It’s exhilarating to share the secret of warrants, and it’s exciting to see so many folks interested in this amazing profit tool.

I hope you’ll join me very soon.

Rachel, will you show the folks at home how to claim their benefits right now?

HOST

Thanks, Dave.

I’ll sum up your historic offer for everyone in the live audience and watching at home.

When you start a subscription to Dave’s research service, Strategic Investor, you’ll get a complete education that will let you get started with warrants right away.

It’s worth repeating — to our knowledge, nothing like this exists in the financial publishing world.

So this is a one-of-a-kind moment, and we’re excited to give you this opportunity to join Strategic Investor.

First, you’ll get Dave’s comprehensive 5-video Warrants Master Course.

In simple language, Dave’s course shows you the full story behind warrants, how to use the W codes to locate them in your existing brokerage account…

And, most importantly, how to buy and sell them for the chance at triple and quadruple digit profits.

After enjoying Dave’s Warrants Master Course, you’ll be able to profit from warrants even if you just learned about them in this presentation.

It’s that simple.

Second, you’ll get Dave’s urgent report, The Warrant Play Set to Triple Or More.

As you saw in today’s presentation, warrants can go up a heckuva lot… as high as 52,900%… and very fast too, like 183% in one day.

But Strategic Investor covers more than warrants — it’s also one of the leading stock research services in the world.

In fact, Strategic Investor recommended two of the top 20 stocks of 2019.

I should point out that these stocks aren’t household names like Amazon or Apple — they’re off-radar overperformers.

And that’s why Dave agreed to give you two additional stock research reports.

Your first report is the Gold Spike Action Plan.

In March of 2019, a Strategic Investor analyst predicted that gold would hit $1,500.

Some folks thought he was crazy — at that time, gold was around $1,275 and it had been flat or drifting down for the past 6 years.

But when gold broke through $1,500, he didn’t seem so crazy any more. And gold JUST shot through its all-time high.

Dave thinks gold’s in the first innings of a new bull market, and the price will continue to rise. And that’s why he rushed out the Gold Spike Action Plan.

In this urgent report, Dave reveals the top 5 gold and silver stocks you need to consider right now. If gold keeps going up, these stocks could rise 500% or more.

And you’ll also get the full “Strategic Profits Library.”

In this detailed, 3-volume bundle, Dave reveals the 4 best tech-related stocks for right now.

The tech sector’s on fire, and these 4 cutting edge companies produce the critical components inside every electric car, cellular phone and laptop.

Without these products, tech literally can’t work.

In the “Strategic Profits Library,” Dave shares his in-depth research on these revolutionary companies, including specific buy-up-to guidance.

To sum up, here’s everything you’ll get as a member of Strategic Investor:

- Dave’s 5-video Warrants Master Course

- The Warrant Play Set to Triple Or More

- The Gold Spike Action Plan

- The 3-Volume “Strategic Profits Library”

For those of you at home, as you see, a big “Subscribe Now” button just popped up below this video.

Click on that button to become a risk-free member of Strategic Investor and claim all of your benefits right away.

And you’ll get much more, too, including a one-year subscription to Strategic Investor. That’s 12 monthly issues, each with at least one deeply-researched new profit play.

You’ll also get instant access to the complete Strategic Investor archive, which includes every single monthly issue, special report, urgent update, and how-to-video Dave and his team has ever published.

And your membership comes with access to a world-class customer care team that you can contact if you have any issue accessing your Strategic Investor member benefits. (But please remember, they cannot provide personalized investment advice.)

You get all of this, right now, for trying out a risk-free membership to Strategic Investor.

As you saw in today’s broadcast, just one warrant could deliver you a windfall payout. And it can happen fast — in a few months, or even a few weeks.

Sometimes they can multiply overnight. Like the Maple Gold warrant you saw that shot up 183% in a single day.

Strategic Investor also delivered two of the top stocks in 2019.

Look, Dave just knows how to teach people how to become rich. That’s been proven, time and again.

And someone with that type of proven wealth-building expertise is worth top dollar.

Folks regularly pay up to $4,000 just to access Dave’s other high-end research services.

But he’s going to give you a full Strategic Investor membership for much less.

One full year of Strategic Investor costs just $49 today.

That’s 75% discount from the already low standard price of $199 per year.

Dave’s so excited about warrants — and he wants to share the profitable secret with as many “everyday folks” as possible — that he insisted on cutting the price to the bone, to $49 per year.

That’s about 4 bucks a month — less than a movie ticket or a draft beer.

Consider how much warrants can multiply in price — and you see that you can easily make that $49 — and MUCH more — back in your first play, maybe in one day.GUARANTEE

And the best part is, your Strategic Investor membership is 100% risk-free.

Because you have two months — a full 60 days — to try it out, no strings attached. To see if it’s completely perfect for you.

If your membership isn’t completely perfect, you can cancel for a full refund during that 60 day period. No questions asked, no problems, you’ll get your entire membership fee back should you decide to cancel.

But there’s a catch: We can only accept a very small amount of new members today.

Since this is the first time that research on warrants has become open to the general public, we’re forced to limit how many folks can take advantage of it.

Since only elite investors like Buffett and other big money players have had access to warrants, the overall market for them is pretty small relative to the stock market.

So we have to allow just a small sliver of our viewers — less than 1/100th of 1% — into Strategic Investor on any given day.

That way we can make sure the tiny warrants market can handle new participants.

That said, here’s the most important takeaway of this broadcast: Warrants are the hottest profit opportunities in the world right now.

They can cost as little as 1¢, and they can shoot up so quickly… that just a small stake could make you tens — or even hundreds — of thousands of dollars.

It’s the ultimate low-risk, high-reward setup.

If that sounds interesting, you owe it to yourself to try Strategic Investor. Right away.

Just click the Subscribe Now button below to get started.

Look, you’ve seen how warrants can deliver gains as high as 52,900%. You’ve seen one that paid 183% in a day.

You saw how billionaires like Warren Buffett, George Soros, and David Einhorn use stock warrants to add to their already enormous net worths.

And you saw how you, too, can buy and sell warrants right from your existing brokerage account. It takes just a few minutes and just a few dollars.

Dave even negotiated a special membership offer with a one-time 75% discount.

With a bulletproof guarantee that covers the full price of your membership.

Right now, you have a simple, yet urgent, choice to make.

As I see it, you have 2 options…

Your first option is to do nothing at all. And stay at the same exact place you’re at right now. Which is fine.

If you’ve already got more than enough wealth to do what you want and retire care free… if you’ll never worry about running out of money… if you’re completely comfortable with where you’re at right now…

Then you won’t need to make thousands of percent gains with simple, fast, one-click warrants plays.

But if you DO want the chance to pull in big, quick, painless profits then you have one other option…

Get started with Strategic Investor and let Dave do all of the hard work for you.

Let him send you the best warrants plays with the potential to go up hundreds of percent or even 1,000%. Let him show you how to get started today with his revolutionary video series.

By this time tomorrow, you could be substantially richer, and you’ll be the only one you know who gets the secret of warrants.

Of those two options, which seems like the best, most direct, and surest bet to total financial independence?

Only you can decide.

Are you the type of person who only dreams about surpassing their financial goals…

Or are you someone who takes decisive action?

Since you’ve watched this revolutionary broadcast…

I bet you’re one of the few serious folks ready to seize the outsized wealth and total financial independence that stock warrants can offer.

So I bet you’re ready to take action.

And this is important: the warrant play that Dave will send is set to take off. And take off FAST.

Every day you wait — shoot, even every hour you wait — you could be leaving hundreds or even thousands of dollars on the table.

That’s how quickly warrants can move, as you just saw in a slew of real examples. They’re explosive, and can go up 183% in one single day.

So it’s absolutely critical that you act right now, it’s the most decisive step you can take for your financial future.

Just click the Subscribe Now button below to get started with Strategic Investor right away.

I’m Rachel Bodden, signing off — and thanks for spending your time with us today.

October 2020