In his 1975 essay “The Loser’s Game,” Charles Ellis compares investing to something a little healthier: tennis. He calls professional tennis a “winner’s game” and amateur tennis a “loser’s game.” And that’s not meant to insult anyone.

In a winner’s game, success is determined by the winner. The superior player one-ups his opponent. But in a loser’s game, the outcome of the match is determined by the loser. The stronger player doesn’t necessarily best their opponent, but rather the first player to make a mistake gives away the chance to win. Ellis suggests that investment management transformed from a winner’s game into a loser’s game.

He’s mostly right. I know that it’s possible to earn superior returns through discipline and being a better trader. Investing is still a winner’s game if you do it right and focus on proven factors that work over time, and that is my passion. It’s what my team and I try to do each and every day in Money & Markets.

But it’s also very much a loser’s game in that avoiding costly mistakes is often more important than generating good returns. A lifetime’s work of good trading can be undone by one big, boneheaded mistake.

Remember, if you lose 50% on a trade, you have to earn 100% on the next one in order to get back to breakeven. If you lose 75% on a trade, you have to earn 300%! The bigger your loss, the worse this math gets.

So, while picking winners is critically important, avoiding losers is even more important. We win by not losing.

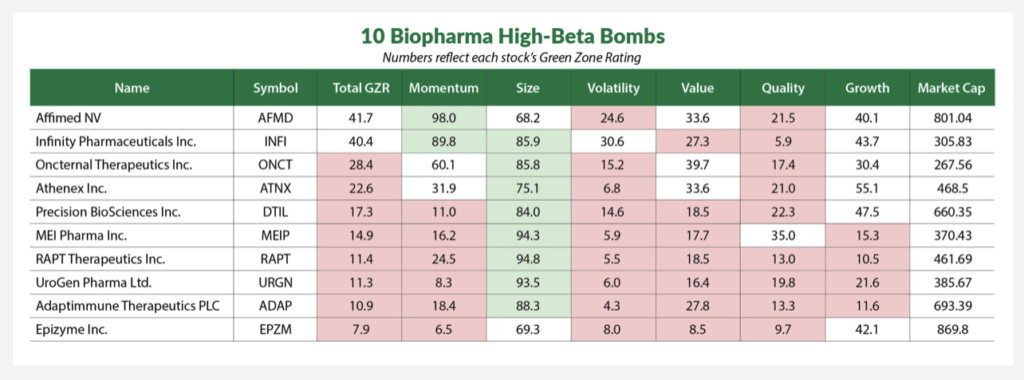

Last week, I wrote about the volatility factor and specifically how avoiding the most volatile 20% of stocks will help you avoid major losses. These “high-beta bombs” are the potential portfolio killers.

Simply staying out of these will go a long way to improving your long-term returns.

I would never choose stocks based on the volatility factor alone. I view this more as a filter for stocks to rule out more than anything else. If given a choice between two stocks that both rank highly on momentum, value, growth, and quality, I’m going to go for the one that has the lower volatility.

This Biotech Buy Is on the Right Side of Volatility

You probably know by now that I’m extremely bullish on biotech and specifically on genomics, or DNA science. I’m not exaggerating when I say that genomics will ultimately have a bigger impact on our lives than even the internet.

But this doesn’t mean we should blindly buy biotech stocks and hope for the best. There will be winners and losers in this space, and I gave you a list of 10 biotech bombs to avoid last week. Each of the 10 stocks were small, highly-volatile stocks that were unprofitable over at least the past five quarters.

[Hot New Tech: This odd-looking machine could be the most transformative innovation in history]

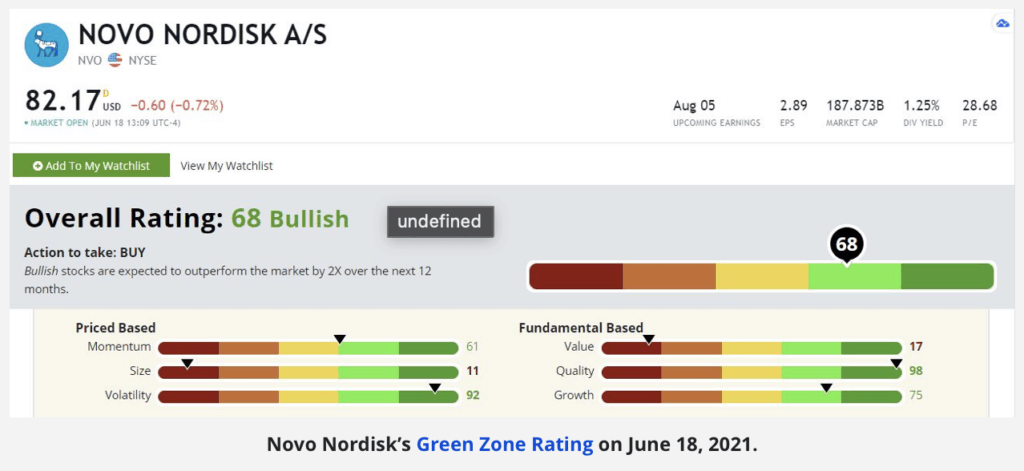

Today, we’re going to contrast those high-beta bombs with a biotech play that checks all the right boxes for us: Novo Nordisk (NYSE: NVO), a Danish blue-chip biopharmaceutical company with an emphasis on diabetes and obesity treatments.

Novo Nordisk rates a 68 on our Green Zone Ratings system, putting it in “Bullish” territory.

As you might expect, the company is profitable, unlike our high-beta bombs, and has an established portfolio of treatments as well as a healthy pipeline of new treatments. The company has multiple diabetes, obesity, growth disorder and hemophilia treatments in Phase 2 and Phase 3 trials and even more in Phase 1.

[Discover: The off the radar Small-Cap Stock at the center of an Era-Defining Technology]

And importantly, it rates highly on our volatility factor at 92. (Remember, a higher score means lower volatility.) The stock is less volatile than all but 8% of the stocks in our universe. It has a beta of just 0.32, meaning its volatility is about a third of the market’s volatility.

Like all companies in this space, Novo Nordisk will have its ups and downs. Certainly, not every new treatment goes on to be a blockbuster. But in a game in which we win by not losing, our odds of success are going to be a lot higher in a steady producer like Novo Nordisk.

This is just one way to play the DNA science mega trend. I’m even more excited about a technology behind my No. 1 genomics stock I call “Imperium.” It is poised to be bigger than electric vehicles, artificial intelligence and the internet-of-things. It’s a technology that stands to have as big an impact as the internet has over the last 20 years!

We’re taking advantage of this mega trend in Green Zone Fortunes. Watch my presentation here to find out how you can join my readers on four different genomics stock recommendations.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets

[Read More: The Microchip Company Powering the 199,000% DNA Mega Trend]