We’re finally seeing the Pfizer (NYSE: PFE) and Moderna (NASDAQ: MRNA) vaccines in action.

We’ve been hearing about these medicines and how they work in the lab. Drug trials showed that around 95% of vaccine patients were safe from COVID-19 infection before the shots rolled out to the public.

But now, we’re finally getting reports on how they work in the real world as they’re being given out across the country.

And the latest results are stellar. We’re seeing that 90% of patients are protected.

That’s a huge victory for the mRNA technology behind these vaccines. Yet, this medical breakthrough has been in the works for a while.

And it’s giving us a clear picture of how we can profit from the future of health care…

WHERE THESE VACCINES COME FROM

Research with mRNA technology dates back as far as the 1990s, when the scientific community was working on the Human Genome Project.

The promises of the breakthroughs in the 1990s and early 2000s are finally being used to help patients. And they’re coming just in time to tackle the largest public health crisis in a century.

[Breakthrough Alert: The Liquid in this Vial Can Treat All 6,000 Genetic Diseases…Combined!]

We don’t need to get into the weeds of how this technology works in the COVID-19 vaccines. You can read this excellent piece in the MIT Technology Review for an in-depth look at the science.

But in short, scientists take one of the smallest identifiable pieces of the coronavirus (through mRNA) and use it to train your immune system to recognize the invader. These vaccines center around this one tiny protein that’s unique to the coronavirus, and no other parts of the virus itself.

Because of this process, Pfizer and Moderna’s shots are much safer than traditional vaccines — which often use entire dead or inactive cells of the virus they’re protecting against.

So, technology is finally catching up with our scientific ambition, and it’s saving lives along the way.

And as technology continues to make waves in health care, we want to be invested.

ADDING THIS TREND TO YOUR PORTFOLIO

We’ve been talking about the future of the health care sector for a while now.

The industry has multiple tailwinds in its favor.

[Discover: Why Big Pharma Firms have Invested Over $1 Billion into this Tiny Biotech]

As Wall Street veteran Charles Mizrahi said:

“Every year in the U.S., the population is getting older and living longer. Health care costs continue to rise each and every year, and now make up close to 18% of Gross Domestic Product. If you’re in the health care business, you have powerful forces pushing your business higher.”

There’s massive demand for health care breakthroughs as baby boomers age and Americans embrace living healthier lives.

Plus, unexpected health crises like the pandemic drive demand for additional breakthroughs as well. The new vaccines from Pfizer and Moderna are evidence of that.

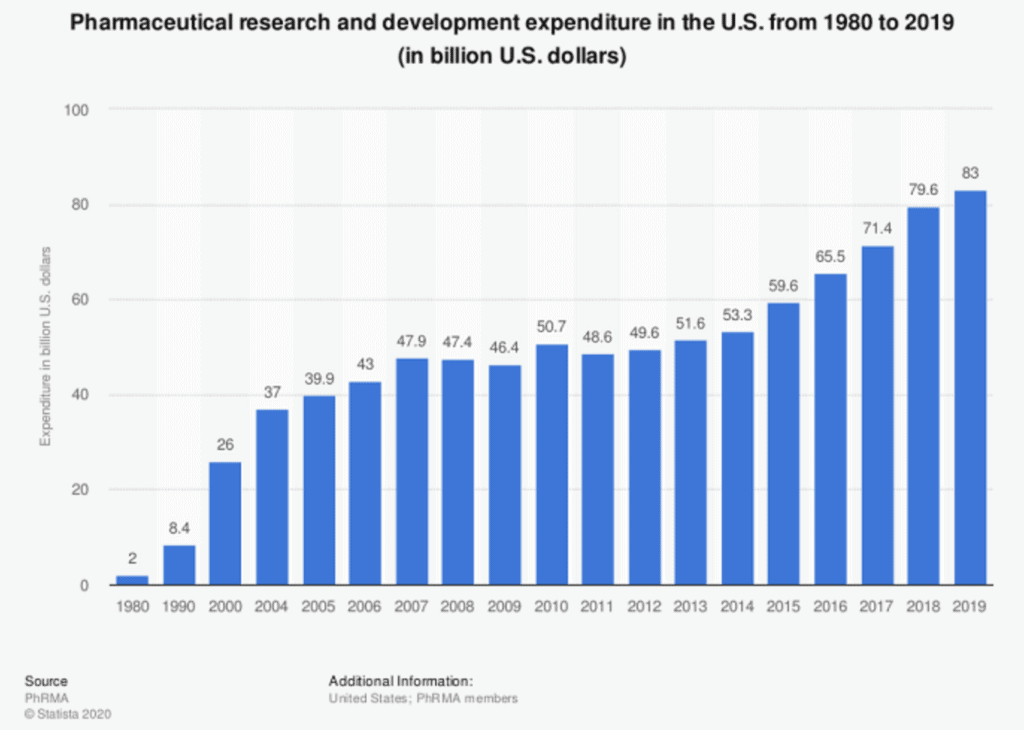

And as all of these tailwinds combine, we are seeing more investment in medications like vaccines in the U.S.:

We expect this to continue. As it does, we’ll see more jobs, more infrastructure and more growth in the health care market.

[Exclusive: Turn $1,000 into $1.57 Million – with “The Holy Grail of Medicine”]

Now, we don’t have crystal balls. We don’t know if mRNA treatments will become the new normal. What we do know is that technology, demand and investment are coming together to boost the health care industry.

This is a quintessential mega trend that will likely continue for years to come.

Investors can get in now with our old favorite, the Vanguard Health Care ETF (NYSE: VHT), is a good way to get in.

It holds a basket of companies such as Pfizer and Moderna that will be key players in the future of health care technology.

But it also holds companies such as pharmacist CVS Health (NYSE: CVS) and insurer UnitedHealth Group (NYSE: UNH), which will benefit from the rising tide of American health spending, too.

This exchange-traded fund (ETF) is up nearly 30% in the past year alone.

The real gains will come from individual companies adopting new health care technologies in the future. And while VHT is a great way to get exposure in your portfolio, investors looking for bigger profits will need to look even deeper.

This trend is gaining traction even outside financial circles. Some of the richest people in the world are jumping in as fast as they can.

Opportunities like this don’t come around often. I hope you take advantage.

Regards,

Annie Stevenson

Managing Editor, American Investor Today

[Discover: Why Big Pharma Firms have Invested Over $1 Billion into this Tiny Biotech]