On Tuesday, the Biden administration announced the first major offshore wind project in the U.S.

When completed, the 84-turbine wind farm near Martha’s Vineyard in Massachusetts should generate enough electricity to power 400,000 homes and businesses, according to estimates from the Bureau of Ocean Energy Management.

This massive project is just the beginning, though. That’s because in March, the Biden administration launched a clean energy initiative calling for 30 gigawatts of offshore wind power by 2030.

The Martha’s Vineyard wind farm will only generate 800 megawatts, which covers less than 3% of the overall goal.

“We’re going to power our economy with clean energy,” says White House National Climate Adviser Gina McCarthy.

Read on to see why investors need to pay attention to wind power right now…

WIND POWER IS GROWING FAST

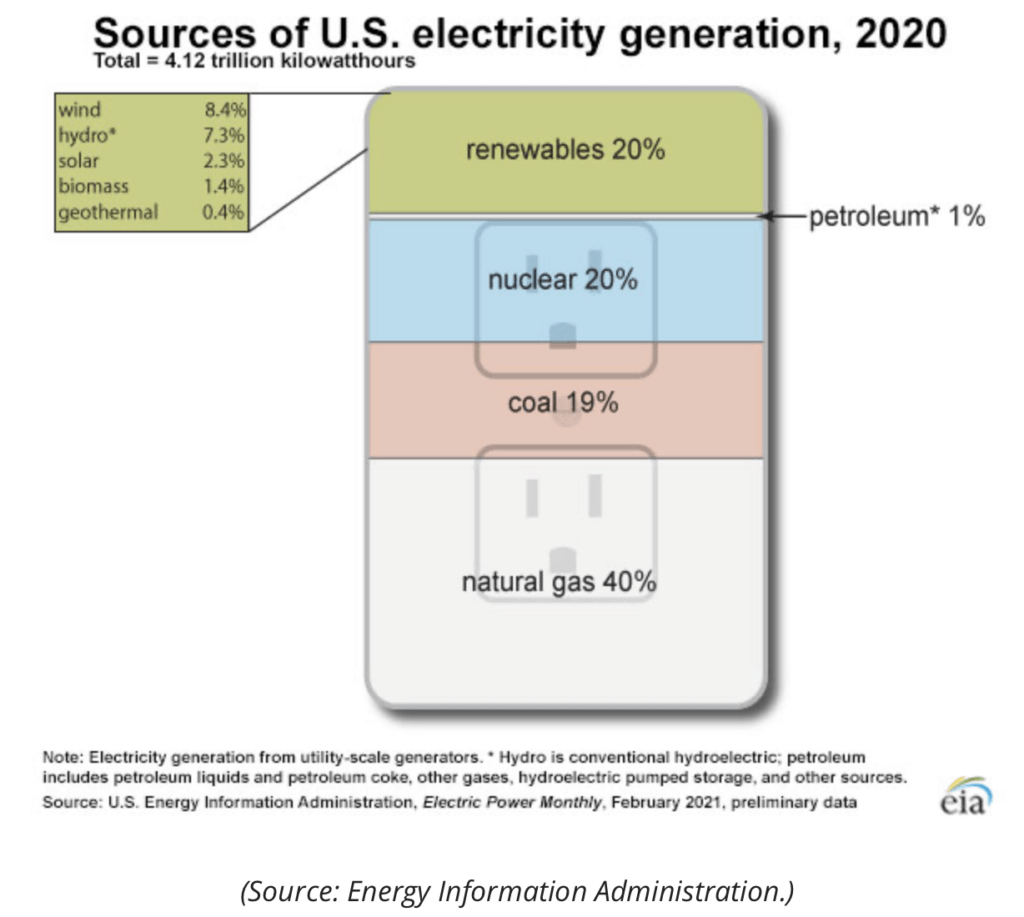

In 2020, natural gas, nuclear power and coal accounted for 79% of U.S. electricity generation, according to the Energy Information Administration.

Renewable energy sources such as wind and solar power made up only 20%.

That’s changing quickly, though.

A new report from the International Energy Agency shows that the amount of global renewable energy capacity added in 2020 was 45% greater than in 2019. And that’s despite construction delays caused by the COVID-19 pandemic.

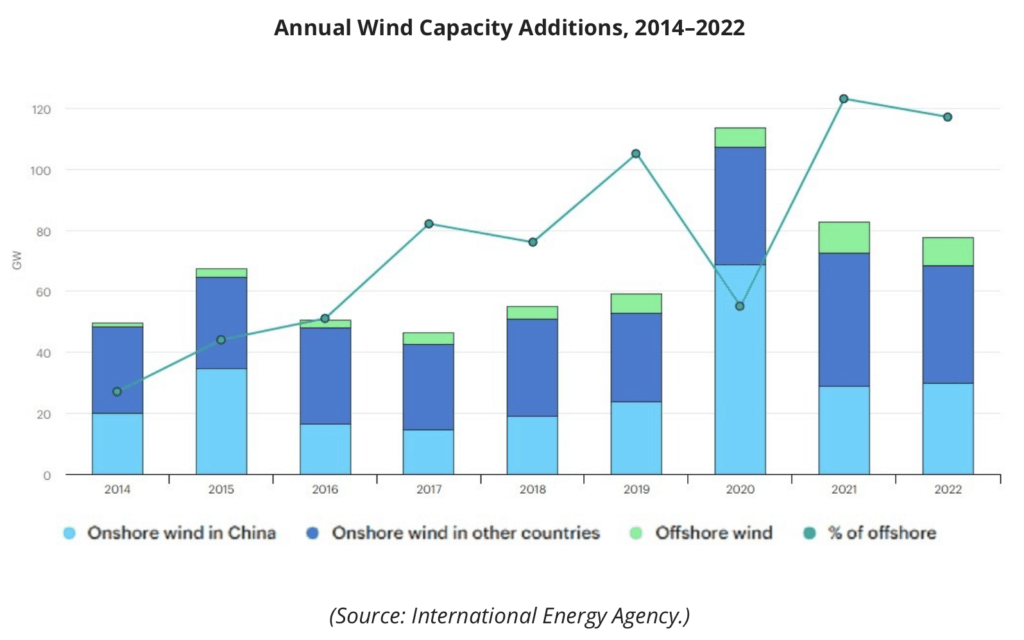

The fastest-growing power source is wind. New global wind power capacity rose 90% between 2019 and 2020.

The blue line in the above chart shows the percentage of wind power that comes from offshore wind farms such as the Martha’s Vineyard project.

Offshore wind was only 5.5% of wind power in 2020. But that number is expected to grow to 12.3% in 2021 and 11.7% in 2022.

IT’S THE PERFECT TIME TO INVEST IN WIND POWER

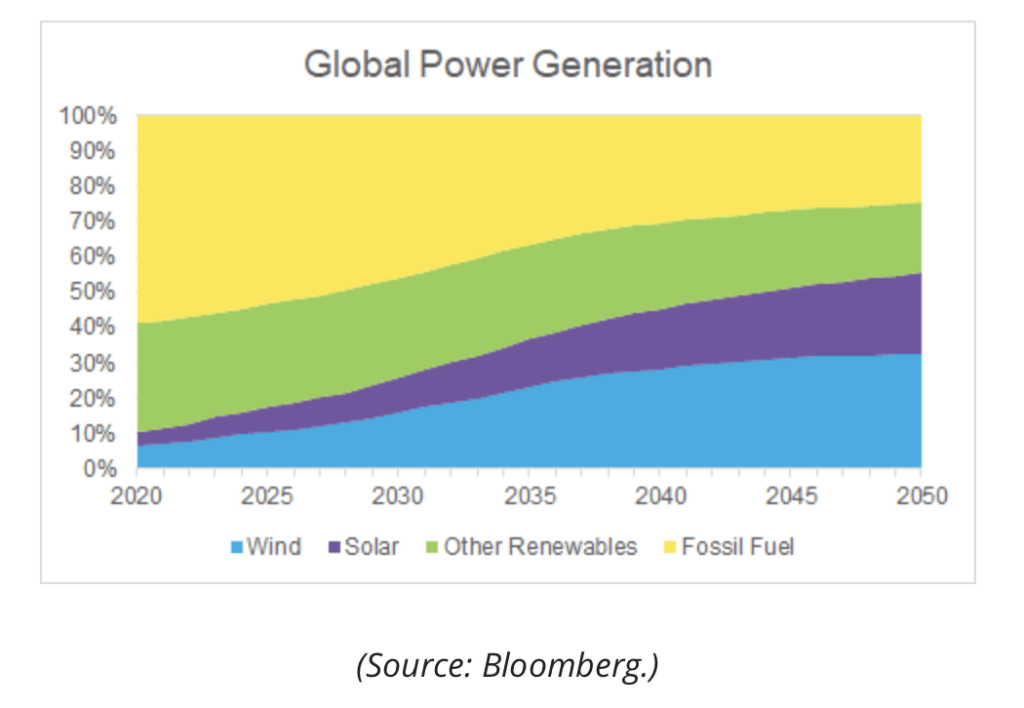

By 2050, wind energy is expected to more than quadruple its market share from 7% to 33% of global power generation.

That’s why Ian King told his readers in May’s Strategic Fortunes newsletter that now is the perfect time to invest in wind power.

His stock recommendation is an undervalued wind power company that could deliver a 103% gain in the next 18 months.

Click here to learn about Ian’s strategy for investing in big, growing industries like wind power.

Regards,

Jay Goldberg

Assistant Managing Editor, Banyan Hill Publishing