A few years ago, Tesla (Nasdaq: TSLA) was the king of the hill when it came to the electric vehicle market.

But by the end of this year, Volkswagen (OTC: VWAGY) – with its ID.3 and ID.4 models – may take over as the largest EV maker.

Competitors in the EV market are certainly becoming more widespread this year. Nearly every car manufacturer has been scrambling to offer electric models to its customers.

Currently, all players are focused on lowering battery costs because an EV’s battery pack is the most expensive part of the car or truck. (It’s typically 30% of the cost of the entire vehicle.)

But simply making EVs with cheaper batteries may not be the best solution to electrifying the transportation industry.

Another technology is shaping up to be the ultimate winner. And it’s based on a fuel that’s also the most abundant element in the universe.

Fuel Cells vs. Battery Packs

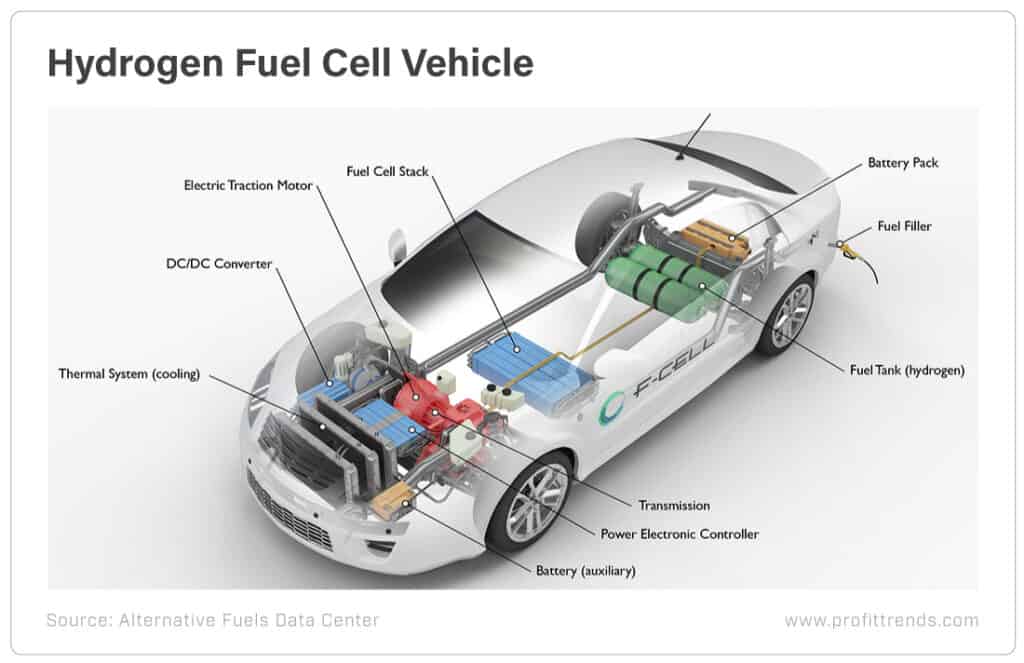

Hydrogen is now being used to power fuel cell EVs.

Let’s go over the differences between a fuel cell EV and a battery EV.

Like their battery-powered counterparts, fuel cell EVs use electricity to power one or more electric motors.

[Alert: New “Tesla Killer” is The Real Deal and Underlying Stock Only Costs a Few Bucks]

A battery EV gets its electricity from a giant battery pack. When it runs out, it has to be recharged.

Today, most battery-powered EVs have a range of 250 to 300 miles. And some high-end EVs, like Tesla’s Model S Plaid, boast ranges of nearly 400 miles on a single charge.

But the fuel cell EVs currently for sale can easily outdistance most battery ones. For example, the Honda Clarity Fuel Cell EV has a range of 403 miles.

Fuel cell EVs use a hydrogen fuel cell to generate electricity. This fuel cell combines hydrogen and oxygen to create electricity and water vapor. It’s a highly efficient electrochemical process.

The hydrogen is stored in one or more fuel tanks. These can easily be refilled in five minutes or less. Fuel cell EVs have a much smaller battery than battery-powered EVs. So overall, the car weighs less, which improves range.

Fuel cell EVs are facing the same adoption obstacles that battery EVs faced 10 years ago, like lack of consumer awareness and refueling infrastructure.

When battery EVs first came out, few people knew about them. And there was very little charging infrastructure.

Tesla decided to fix the infrastructure problem as it was building its cars. It built out its own proprietary charging network wherever it sold its models.

And now other EV manufacturers are building industrywide compatible charging stations by the tens of thousands. The U.S. alone has more than 40,500 charging stations with more than 97,500 public charging outlets as of February 2021.

But today, there are just 300 hydrogen fuel cell vehicles in the U.S and only 48 retail hydrogen refueling stations in the country, most of which are in California.

[Don't Wait: Bloomberg Projects New “Tesla Killer” to Crack the Sky “1,000 Times Over”]

Right Around the Corner

Hydrogen’s other big problem is its price. It costs about $14 per kilogram today.

That’s roughly equal to $5.60 per gallon of gasoline. As hydrogen production ramps up, its cost is expected to drop to $5 per kilogram or less. That would give it a gasoline-gallon equivalent of $2.

Fuel cell EVs have higher driving ranges and lower driving costs than today’s gasoline-powered cars. So they will likely become more popular as hydrogen refueling infrastructure grows.

The Energy Information Administration believes that every 1 million hydrogen fuel cell EVs sold will require another 200 refueling stations. Fuel cell EV original equipment manufacturers are hoping to sell 10 million hydrogen vehicles over the next several years.

That means 2,000 retail refueling stations. They’ll cost about $1.5 billion to install.

Six major car manufacturers – BMW (OTC: BMWYY), Honda (NYSE: HMC), Hyundai (OTC: HYMTF), Mazda (OTC: MZDAY), Nissan (OTC: NSANY) and Toyota (NYSE: TM) – have announced plans to produce fuel cell EVs in the U.S. And Class 7 and Class 8 truck manufacturers Kenworth Trucks, Nikola (Nasdaq: NKLA), Toyota and US Hybrid have announced hydrogen fuel cell truck plans.

[Learn More: Brand New “Tesla Killer” Charges in Minutes Instead of Hours, Silences Doubters]

There’s an excellent chance that fuel cell EVs will become as popular as battery EVs are becoming. And investors may want exposure to the emerging hydrogen infrastructure.

I believe fuel cell EV production and adoption are right around the corner. Remember, new technology is always adopted much faster than anyone thinks it will be.

Good investing,

Dave