In this Article

- Procter & Gamble is a stock you want in your corner when times get tough.

- Enjoy a 3.7% dividend yield with this utility.

- Genuine Parts sees green flags through 2022.

Boost your passive income stream with companies you can count on.

As the bear market intensifies, more sectors of the economy are seeing equity valuations tumble. It's not just industrials, consumer discretionary, communications, and tech anymore. Even stodgy and safe consumer staples are getting hit.

However, certain companies have a track record for outlasting a recession and even raising their dividends through tough times. A Dividend King is an S&P 500 component that has paid and raised its dividend for at least 50 years. At a minimum, that means members of this coveted cohort raised their payouts through most of the high-inflation 1970s, the bear market of the early 1980s, the dot-com bubble burst, the great financial crisis, the worst of the U.S.-China trade war, and the peak of the COVID-19 pandemic. Companies that endured all of those headwinds and still grew shareholder value are the kind of reliable dividend stocks that many investors want to own during times of uncertainty.

Procter & Gamble (PG 0.88%), Northwest Natural Holding Company (NWN 0.35%), and Genuine Parts (GPC 2.15%) are three Dividend Kings that are well positioned to outlast a prolonged bear market. Here's what makes each a great buy now.

P&G is best-in-breed and built to last

Daniel Foelber (Procter & Gamble): Many of the best buying opportunities in the stock market occur when a stock goes down for factors outside of its control or when a stock slips in sympathy because another company in its sector goes down. It happened on Tuesday when Meta Platforms stock was down over 10% at one point and even Alphabet was down over 8%, all because Snap said it was going to miss its numbers and wasn't going to be in the hiring frenzy many thought it would be.

Snap also signaled that advertising spending would be coming down as the economy tightens, which is bad news for Meta Platforms and Alphabet. Even if growth slows, buying stock in quality industry-leading businesses at a discount is usually a good long-term move.

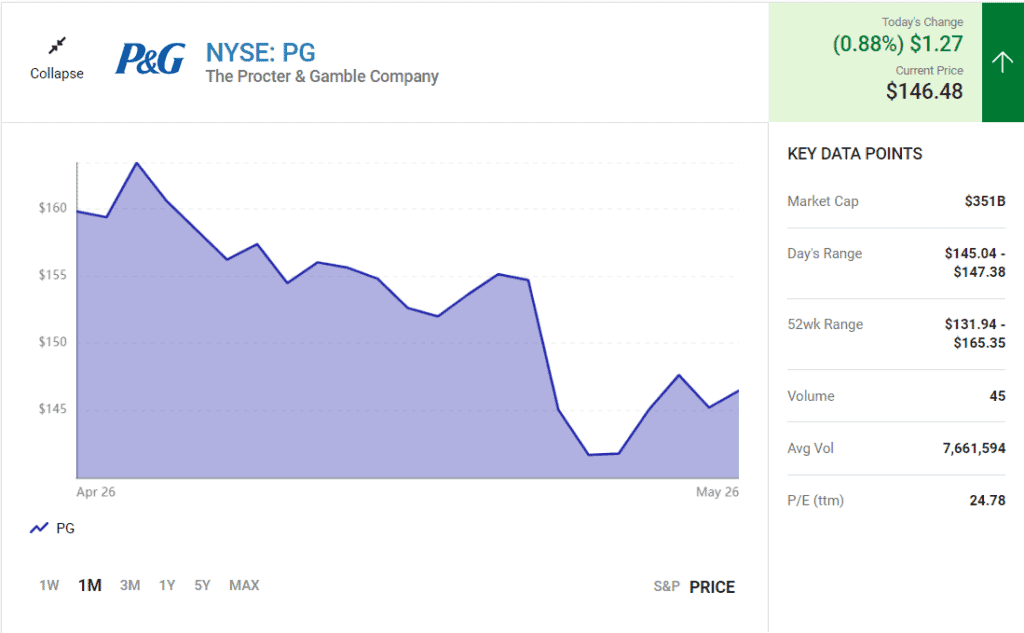

Similarly, when Walmart and Target reported disappointing results last week, Procter & Gamble stock fell in sympathy by over 6% on May 18. The two discount retailers hinted that inventories were too high and customers were cutting back on discretionary spending. Even if you're not interested in Walmart and Target stocks specifically, it's worth paying close attention to what they are saying about the economy.

Consumer spending is weakening, especially on durable goods and discretionary products as folks prioritize essentials like gas and food. That shift, along with tight supply chains and inflation, is leading to lower margins for Target and Walmart. P&G isn't immune from this trend, and it could see customers shift from its name-brand products to private-label value brands. But P&G's product mix is defensive in nature. Therefore, it should be better positioned than most retailers even if margins come down.

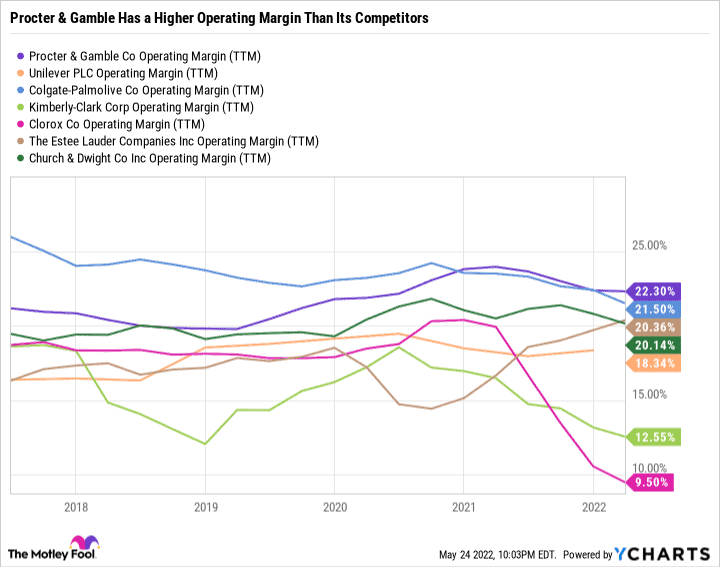

What's more, P&G has a higher operating margin than its competitors — even companies like Estee Lauder, which features higher-margin product categories in cosmetics. So P&G can afford to have its operating margins come down and still do very well.

[The $4 Inflation Stock That Can Change Your Life – Whitney Tilson’s Latest Prediction]

P&G also generates nearly double the free cash flow (FCF) required to support its dividend. There's plenty of room to continue increasing the dividend even if FCF falls. If anything, P&G would probably cut back on share repurchases.

Add it all up, and you have an industry-leading Dividend King with a safe and profitable product mix that will do just fine even in an economic downturn.

Boring but reliable

Lee Samaha (Northwest Natural Holding Company): With a 66-year history of increasing dividends, this gas and water utility is a pretty reliable source of income for its investors. By their nature, utilities aren't particularly exciting businesses, but that might be what investors are looking for right now. The surety of its earnings is backed by its servicing of 2.5 million people with gas in the Pacific Northwest (Oregon and Washington) and ownership of small water and wastewater utilities in the Pacific Northwest, Arizona, and Texas.

[Investing Into the Metaverse with Chris Rowe: 3 Brave New World Stocks]

Management aims to grow its gas customer base by 1.5% a year over the medium term by converting customers to gas and new construction projects. Meanwhile, the water utility side can grow through the opportunistic acquisition of small companies. Through these plans, management aims for 4% to 6% earnings growth over the medium term. If its dividend grows in line with its earnings, then its current dividend per share of $1.93 will increase to $2.46 in five years, meaning the stock will trade on a dividend yield of 4.5% at the current price of about $55. That's a pretty decent yield to aim for in turbulent times.

As the market pumps the brakes, this stock has hit the gas

Scott Levine (Genuine Parts): Having raised its dividend in each of the past 66 years, Genuine Parts, a provider of replacement automotive parts, is one of the most senior members of the group known as Dividend Kings. Shares of Genuine Parts, which offer a 2.8% forward dividend yield, have dropped about 6% since the start of 2022, but it's worth taking a look at its more recent performance. Over the past three months, Genuine Parts' stock has risen 8% while the S&P 500 has plunged about 8%.

What's driving the bulls to hitch a ride with this auto parts stock? For the most part, a strong earnings report is fueling investor enthusiasm. In late April, Genuine Parts reported first-quarter earnings that surpassed analysts' expectations — a celebrated event considering how many companies have announced disappointing quarterly earnings reports. Genuine Parts reported a company record $5.3 billion in revenue for Q1 2022, while analysts expected the company to book sales of $5.06 billion. In addition, the company reported adjusted earnings per share (EPS) of $1.86, beating the consensus estimate among analysts of $1.67. A more auspicious view of the remainder of 2022 also motivated investors to click the buy button. In its Q1 report, management revised the 2022 forecast upward, saying it expects sales growth of 10% to 12%, up from the original guidance of 9% to 11%. For the bottom-line forecast, the company now expects diluted EPS of $7.56 to $7.61, an increase over the original forecast of $7.45 to $7.60.

Despite the stock's recent rise, shares of Genuine Parts remain attractively priced. The stock is trading at 13.9 times operating cash flow, only slightly higher than its five-year average cash flow valuation of 13.3. For investors looking to park a Dividend King in their portfolios, Genuine Parts deserves a real good look.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Daniel Foelber has positions in Walmart Inc. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet (A shares), Alphabet (C shares), and Meta Platforms, Inc. The Motley Fool recommends Target and Unilever. The Motley Fool has a disclosure policy.

Read more from Daniel Foelber, Scott Levine, and Lee Samaha at Fool.com