In this Article

- S&P 500 since January 2020

- The Untouchables Strategy

- Outperforming investing legends like Warren Buffett, Carl Icahn, and Prem Watsa

- Five key traits of Untouchable stocks

Over the last month, fear has flooded back into the markets…

As I write this, the S&P 500 is down 6% in the last 30 days. The tech-heavy Nasdaq isn’t faring much better… down 10% over that same period.

Volatility is rocking the crypto markets as well – with bitcoin down 42% from its all-time highs and 16% in the last month alone.

Meanwhile, the market’s so-called fear gauge, the VIX, is hovering around 30. It started the year just under 17. Anything above 20 indicates fear in the markets….

So things are looking ugly right now…

With inflation at a 40-year record-high, and fears of Fed rate hikes on the horizon… it’s unlikely we’ll see any meaningful relief over the next few months.

And if you’re like most investors, it’s hard to keep a long-term view when your portfolio is getting hammered.

But if you pull back the camera, you’ll see that markets always recover over the long term.

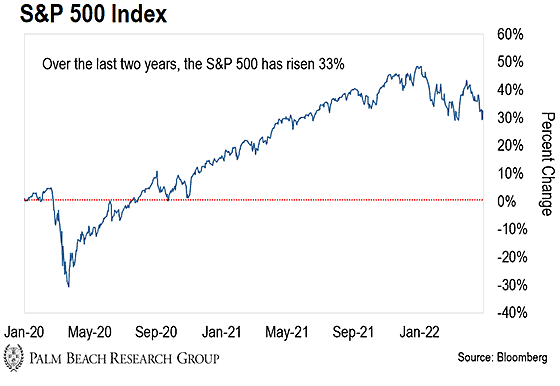

Take a look at the chart below. It shows the percentage gains of the S&P 500 (a proxy for stocks) since January 2020.

As you can see, stocks crashed during the pandemic outbreak in March 2020.

They then rebounded and continued to rise… before stalling recently due to recent inflation fears.

Remember, markets don’t go up in a straight line. And even during epic rallies, we’ll see pullbacks. They’re not fun to go through. But they’re a part of the process.

The median intra-year drawdown in the S&P 500 since 1928 is 13%. So the S&P being down nearly 10% is nothing out of the ordinary. Drawdowns are the norm for stocks, and other risk assets, not the exception.

And it’s just one reason why we want to put you in a position to profit, regardless of market conditions… So today, I’ll share one of our favorite strategies for beating volatility.

It protects your portfolio during crashes and outperforms during rallies… Plus, it has returned 11x the market over the long term.

[Confession: PhD Economist says “Used to think a crash was coming…”]

The Untouchables Strategy

Longtime readers are probably familiar with our “Untouchables” strategy. And right now is the perfect time to consider it.

These are stocks you’ll never want to touch in your portfolio. On top of that, nothing can touch their performance. In other words, they work in any market condition. (That’s why we call them Untouchables.)

Not only do our Untouchable stocks outperform the market over the long term, but they’re also unaffected by extreme drops like the ones we saw when the market ended the year down 37% in 2008 and down 22% in 2002.

To find these exceptional stocks, we studied the two major bear markets over the last two decades… And we combed through 19,000-plus publicly traded stocks in North America using multiple data subscriptions that cost over $50,000 per year combined.

This helps us identify stocks that won’t suffer during significant drawdowns in the market while also easily outperforming over the long term.

And in the end, only 12 made the cut.

These “bulletproof” investments stayed afloat even in the worst downturns. The Untouchables strategy cranked out positive returns in the worst calendar years over the last two decades (and all 22 calendar years).

Take a look at how our strategy performed:

- It was up 25.6% in 2000 when the S&P 500 was down 9.1%.

- It was up 21.7% in 2001 when the S&P 500 was down 11.9%.

- It was up 11.3% in 2002 when the S&P 500 was down 22.1%.

- It was up 4.6% in 2008 when the S&P 500 was down 37%.

- It was up 12.2% in 2018 when the S&P 500 was down 4.4%.

But what about making money over the long run?

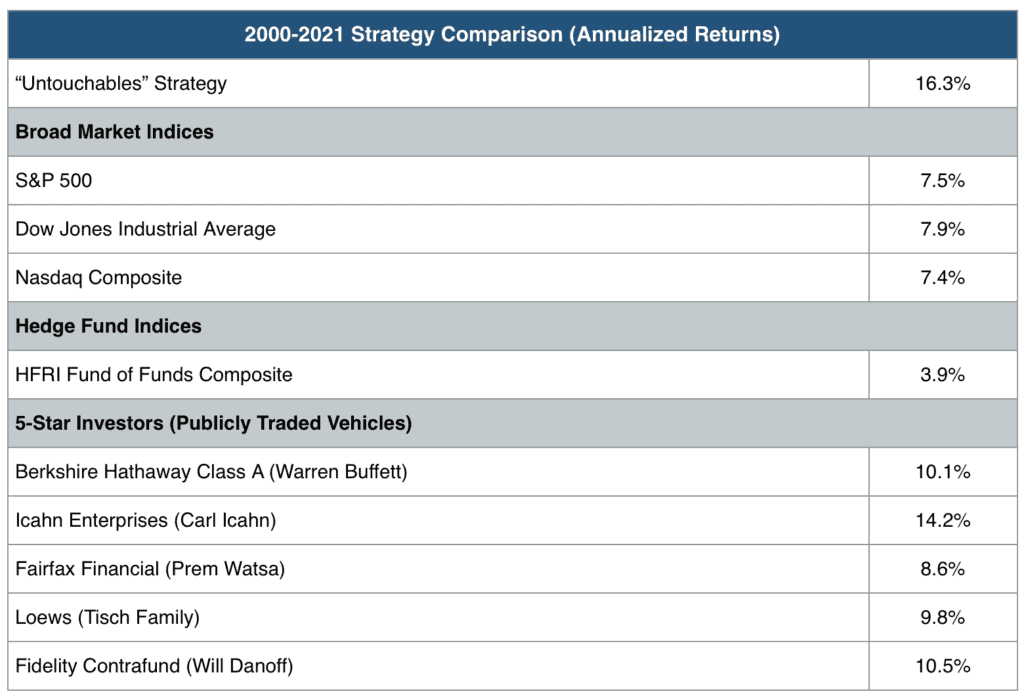

As you can see below, the Untouchables not only outperformed the market… they also outperformed investing legends like Warren Buffett, Carl Icahn, and Prem Watsa.

[Former Goldman Sachs Exec: “America’s problems explained in ONE chart”]

(source: palmbeachgroup.com)

Over the last 21 years, the S&P 500 had a cumulative total return of 394%. Meanwhile, the average Untouchable returned 4,313% – 11x the market – over the same span.

That’s why you’ll never want to touch these stocks.

Don’t Let Volatility Scare You Out of the Market

Today’s market volatility and uncertainty are enough to scare even seasoned investors… But when you look over the long term, the S&P 500 is up 91% over the last five years.

Still, that may be little comfort during the current bout of volatility.

So, if you want to sleep better at night, there’s no better time to bulletproof your portfolio with Untouchables.

If you want to find Untouchable stocks yourself, they share five key traits:

- They have simple business models.

- They pay dividends.

- They have ultra-low volatility.

- They produce positive returns when the broader market declines.

- They outperform the market over the long term.

One example of an Untouchable is Johnson & Johnson (JNJ).

It yields 2.5% – almost double the S&P 500’s 1.5%.

On top of that, the stock is still up over 70% (including dividends) since its March 2020 pandemic bottom.

And as an Untouchable, the company has a history of outperforming when the broader market falls…

In 2000 and 2001, JNJ ended the year 14% higher, while the S&P 500 ended the year down 9% and 12%, respectively…

And in 2008, when the S&P 500 ended the year down nearly 40%, JNJ was only down about 8%.

If history is any guide, Untouchables like JNJ are the types of stocks that’ll do well, no matter where the market is headed… even during the kind of volatility we’re seeing now.

To sleep better at night, make sure you bulletproof your portfolio with Untouchables. They’ll profit in the good times… and protect you in the bad.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

[Exclusive: Nomi Prins – The #1 Stock for America’s Great Distortion]