Technology stocks continued their wild selling through late morning trading Friday, before buyers stepped in to help stop some of the bleeding. The Nasdaq was down around 10% from its mid-February records through late afternoon trading Friday, which put it in correction territory. But it bounced back in a big way to close the day up 1.6%, while the S&P 500 jumped nearly 2%.

Some Wall Street traders are worried that the tech-heavy index could be headed down toward its 200-day moving average, at around 11,616, after it sunk well below its 50-day earlier in the week.

Wall Street has increased its bond selling in anticipation of more government spending and the potential of a vaccine-aided economic boom later this year. The higher yields highlight elevated tech valuations and make the S&P 500’s dividend less appealing.

That said, much of the major selling has been concentrated within the big tech winners of the last year, from Tesla (TSLA) and Shopify (SHOP) to established giants such as Apple (AAPL). The selling is likely a healthy recalibration and a necessary part of every market, especially when we consider that many stocks were up over 100% or more in the last year.

In fact, the S&P 500 is down just around 3% from its Feb. 12 highs, as investors take some of their huge gains and rotate them into underperforming areas. On top of that, U.S. Treasury yields remain ultra-low by historic standards and the bullish outlook for 2021 remains largely in place (also read: An All-Around Improving Earnings Picture).

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

Today we look at two highly-ranked stocks trading for under $25 a share that, for the most part, shrugged off the recent selling to trade near their 52-week highs. These stocks also boast some solid fundamentals that could make them worth buying amid the market volatility…

Mattel, Inc. (MAT)

Prior Close: $20.76 USD (close of regular trading Friday, March 5)

Mattel is a historic toys and games maker with a portfolio that includes Barbie, Hot Wheels, Fisher-Price, and more. MAT topped our Q4 earnings and revenue estimates on February 9, with its sales up 10% for the second quarter in a row. The recent growth marked its strongest in years, as traditional toy and game companies struggle to adapt to the tech-heavy world of video games and smartphones.

Mattel executives said they are seeing higher-than-expected demand, as people try to find new ways to entertain their kids and families during the coronavirus. And MAT’s growth outlook suggests that there could be an active push from some parents for their kids to spend less time on screens in a world where more people are addicted to devices.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]

The company is also ready to roll out some movies and TV Shows. “We gained global market share and continued to transform Mattel into an IP-driven, high performing toy company,” CEO Ynon Kreiz said in prepared remarks.

MAT’s fiscal 2020 revenue climbed 2%, for its first top-line growth in six years. Zacks estimates call for its FY21 sales to jump 5.3% to reach $4.8 billion, with FY22 projected to come in 4% higher. Better yet, Mettel’s adjusted earnings are projected to climb by 40% and 30%, respectively over the next two years.

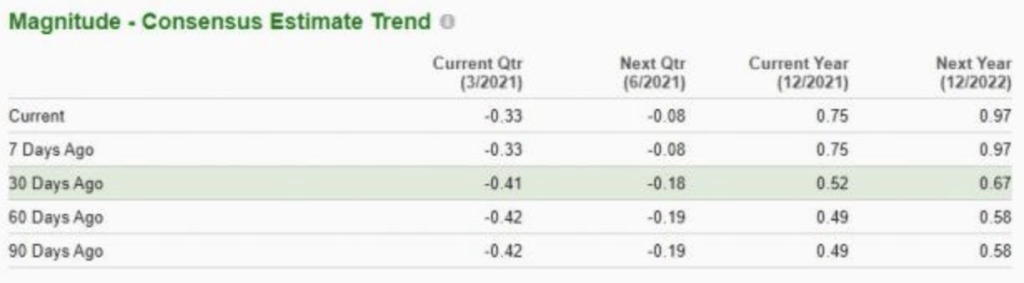

Analysts have raised their earnings estimates on the back of a far stronger-than-projected outlook. MAT’s FY21 and FY22 consensus estimates are both up 45% since its report and even higher since before that.

The EPS positivity helps Mattel grab a Zacks Rank #2 (Buy) at the moment. The stock also sports “A” grades for Growth and Momentum in our Style Scores system, as well as a “B” for Value.

[Learn More: See Why Billionaires are Flocking to this Tiny Niche of the Tech Sector]

MAT shares are up 20% in 2021 and it jumped over 3% during regular hours Friday to close right back near its recent 52-week highs at around $21 a share. This is part of a larger 80% run in the past 12 months that’s seen it double its highly-ranked Toys-Games-Hobbies industry that includes TakeTwo Interactive (TTWO) and Hasbro (HAS).

Despite its outperformance, MAT trades at a solid discount to its industry in terms of forward 12-month sales at 1.4X vs. 5.9X. And the stock still has plenty of potential runway left before it closes in on the $33 a share it traded at in 2016 and the $45 it touched back in 2013.

Ethan Allen Interiors (ETH)

Prior Close: $25.46 USD (close of regular trading Friday, March 5)

Ethan Allen is an interior design company, manufacturer, and retailer in the home furnishings marketplace. The firm's vertically integrated structure aims to provide clients a seamless process from start to finish.

ETH is coming off a rough stretch and its overall sales fell 21% in fiscal 2020 (period ended on June 30). The coronavirus played a significant role in the decline, with its biggest year-over-year sales drop coming amid the height of lockdowns.

But things have started to turn around, with its sales up 2.5% in the second quarter of FY21 (reported on January 28), while its adjusted earnings soared 155% to $0.69 a share. Moving forward, Zacks estimates projected Ethan Allen’s full-year fiscal 2021 revenue will jump nearly 14% to $670 million, with FY22 set to climb another 6%.

[Breakthrough: This Could be the Closest Thing to Buying Amazon When it was $50]

The company’s adjusted earnings are expected to soar 244% this year to hit $1.79 a share, with FY22 projected to come in 6.5% higher. ETH’s positive bottom-line revisions help it land a Zacks Rank #1 (Strong Buy) at the moment, alongside an “A” grade for Growth and “B” for Value in our Style Scores system.

On top of that, Ethan Allen is part of the Retail – Home Furnishings space that rests in the top 6% of our over 250 Zacks industries. This group includes WilliamsSonoma (WSM), RH (RH), Tempur Sealy (TPX), and more. All of these firms stand to benefit from the continued growth of the housing market that exploded during the coronavirus, as people look to find more space.

More importantly, the housing market is finally being driven by millennials, which means it could be ready to climb for years. Plus, many people in the U.S. have increased their savings amid the pandemic, and consumers continue to spend money on home improvement projects.

In a sign of strength, Ethan Allen announced in November that it raised its quarterly cash dividend by 19% to $0.25 per share. Its dividend yield sits at 4% to help it blow away the S&P 500’s 1.5% and the 30-year Treasury’s 2.2%.

ETH’s dividend yield is more impressive considering that it has climbed 90% in the past 12 months. This includes a 37% jump since early December to outpace its highly-ranked industry. The stock popped 2.4% in regular trading Friday to break just above our under $25 threshold, as it bounces back toward its recent 52-week highs.

Like Mattel, the stock has nearly 30% more room to climb before it runs into where it was trading in 2016. The company is also in a sound financial position. “We ended the quarter with a strong balance sheet, including cash on hand of $80 million and no outstanding debt,” CEO Farooq Kathwari said in prepared remarks.

[Buy Alert: Buffett Recently Dumped $800 Million of Apple Stock to Invest in This!]