In this Article:

- Wyndham Hotels & Resorts Inc. (NYSE:WH)

- Booking Holdings Inc (NASDAQ:BKNG)

- Braemar Hotels & Resorts Inc (NYSE:BHR)

The three best hotel stocks to buy now include the world’s largest online travel agency, a multi-billion dollar affordable lodging enterprise and a real estate investment fund specializing in luxury holdings.

Hotels have long been seen as relatively mundane investments — mature, low-risk stocks, often with high dividend yields. The hotel industry is seen as a good investment choice for soon-to-be retirees or individuals seeking short-term investments.

However, private equity firm Blackstone’s 2007 acquisition of Hilton Hotels (NYSE:HLT) for $26.0 billion underscores the potential of undervalued hospitality companies. Despite purchasing the company on the eve of the 2008 financial crisis, the Hilton deal would generate approximately $14.0 billion in profit for the iconic investment firm.

The hotel industry is once again significantly undervalued. COVID-19 has changed the investing characteristics of hotel stocks, causing many in the industry to fall to a fraction of their pre-pandemic share price. However, with nations across the globe easing pandemic restrictions and the travel and tourism encountering a faster and more-robust-than-expected rebound, savvy investors now have a once-in-a-lifetime opportunity to capitalize on undervalued hotel stocks.

Many hotels are emerging from the pandemic flush with cash and running a leaner and more efficient operation. E-commerce has also exploded, which has incentivized more consumers to book online. Many stocks in the industry still possess low ratios and multiples despite double-digit growth projections. Picking the right hotel stocks can yield returns well above the market average.

However, this market will not last forever. An opportunity like this fades quickly. We have highlighted the three best hotel stocks to buy now to help prospective investors narrow their search and capitalize on this unique moment.

3 Best Hotel Stocks to Buy Now: #3

Wyndham Hotels & Resorts Inc. (NYSE:WH)

Wyndham Hotels & Resorts Inc. (NYSE:WH) is an American lodging and hospitality corporation founded in 1981. Headquartered in Parsippany, New Jersey, the company has grown into the largest hotel chain in the Americas. Wyndham operates over 800,000 rooms across its 22 subsidiaries, resulting in a $7.8 billion market capitalization (market cap).

Wyndham primarily focuses in the affordable hospitality segment. Approximately 90% of its offerings are classified as either economy or midscale. The company has grown its offerings tremendously through the savvy acquisition of other travel and tourism companies. Wyndham culminated its 2010s spending spree with a $1.95 billion purchase of LaQuinta Inn in 2018.

Wyndham may not have the same brand recognition as some of its competitors. However, that is by design. The company prefers to operate its business through its subsidiaries. Instead of the Wyndham name, its hotels are mainly labeled as Super 8, Days Inn and Ramada establishments, alongside other brands in its portfolio. By keeping the name of an acquired company, Wyndham is able to continue conveying a sense of value associated with the original brand post-acquisition.

[Don’t Miss: Man Who Called 2020 Crash Warns of Huge Event in 2022]

The COVID-19 pandemic has been the defining obstacle of the hotel industry over the past two years. The elastic demand of the travel and tourism industry meant that hotels saw their bookings and revenue drop significantly as consumers sought ways to cut costs. Stiff COVID-19 regulations also hurt the industry’s profit margins and operating capabilities. Overall, the lodging industry has seen its earnings-per-share (EPS) decline by 18.7% annually over the past three years. Industry revenue has also decreased by 10.1% annually over the same period.

Wyndham’s specialization towards the affordable lodging market has allowed it to weather the pandemic much better than its competitors. Lower-priced hotels outperform higher-priced offerings in a turbulent economy. Budget hotels are able to tap into a more consistent customer base of extended-stay guests and service workers during an economic downturn. Cheaper lodging options are also more attractive when consumers have tighter wallets. Wyndham has seen its sales drop slightly, by 5.7%, on average, over the last three years. However, the company’s EPS, and subsequently, its profits, have increased by 17.0% annually over the same timeframe.

WH has managed to produce a three-year return of 72.4%, outperforming averages for both the S&P 500, up 63.7%, and the lodging industry, gaining 12.6%. The company has seen its share price climb by 20.6% over the trailing 12 months, displayed below alongside a 50-day moving average.

WH is a value stock. As such, the company does not possess high projected growth. Wyndham’s forecasted sales growth is only 0.9% for 2022 and 8.2% in 2023. The company’s main appeal for investors is its low share price relative to its current intrinsic value. Although less flashy than growth stocks, value investments have outperformed growth investments by 93% from 1927 to 2019.

WH’s enterprise value-to-earnings before interest, taxes, depreciation and amortization (EV/EBITDA) of 18.6 sits well below the industry average of 37.1. According to Michael Burry, a legendary value investor, low relative EV/EBITDA is a key indicator of an undervalued company. The company also possesses a robust 15.6% profit margin, which has allowed it to largely avoid taking on additional debt to finance its operations over the past three years, keeping its debt-to-equity ratio stable at 1.9.

Wyndham is a hidden gem of an investment in the travel and tourism industry. The company has an attractive business model for a volatile environment, a low EV/EBITDA ratio and a healthy balance sheet ready to fund further expansions. WH is perfect for investors seeking strong and stable returns for the foreseeable future.

3 Best Hotel Stocks to Buy Now: #2

Booking Holdings Inc (NASDAQ:BKNG)

Booking Holdings Inc (NASDAQ:BKNG), founded in 1996, is an online booking agency that provides hotel reservations, airline bookings, rental cars and other travel services. The company, headquartered in Norwalk, Connecticut, owns and operates numerous travel sites such as Booking.com, Priceline.com, Rentalcars.com and Kayak.com. Booking is the world’s largest travel agency by revenue, with a market cap of $88.7 billion.

As the global economy continues its gradual recovery from COVID-19 and the barriers to international travel are lifted, few businesses are better positioned to profit than Booking Holdings. Booking is the largest online travel agency by a wide margin. The closest competitor, Expedia Group (NASDAQ:EXPE), is less than half its size with a market cap of only $30.0 billion.

The global travel agency is expected to grow by 11.9% annually from 2021 to 2026. However, Booking’s size allows it to employ economies of scale to reduce costs and outperform its competitors. The company operates in over 200 countries and boasts some of the industry’s highest profit margins at 10.6%. Additionally, Booking raised $11.0 billion in cash and cut costs by $300 million annually by slashing its workforce during COVID-19. The company that is emerging from the pandemic is leaner and better positioned than ever for rapid expansion.

[Exclusive: Marc Chaikin Reveals Biggest Stock Prediction of his 50-year Career on Wall Street]

The pandemic has also pushed consumers increasingly towards e-commerce, expanding Booking’s total addressable market. BKNG saw its sales soar by 61.2% over the trailing 12 months as travel and tourism began to return to some semblance of normalcy. However, Booking’s rebound is far from over. The company is forecasted to see its revenue grow by 120.0% year-on-year in Q1 2022 and increase an additional 46.8% for the entire fiscal year.

BKNG has slid in recent weeks due to the Russian-Ukraine conflict, which has caused uncertainty in global travel. As a result, the stock is now down 12.0% over the past year. BKNG’s movement in share price over the past 12 months is shown below.

Russia’s invasion of Ukraine and the continuing war is a significant challenge to the global tourism industry. However, as a growth stock, Booking’s intrinsic value is primarily derived from future free cash flows years in the future. Although the conflict may hurt the company’s bottom line in the short term, it will have little-to-no impact on the long-term valuation of BKNG.

Booking Holdings is a pure growth investment, unlike the other two stocks on this list. As a result, the company possesses a high (share) price-to-earnings (P/E) ratio of 77.2. The S&P 500 average stands at 23.4. However, the growth potential of BKNG is well worth the higher relative share price. With EPS projected to jump by 36.9% in 2022, the forward P/E ratio is expected to drop to a below market average of 18.2. BKNG is an excellent choice for investors seeking the highest potential returns in the hotel industry.

3 Best Hotel Stocks to Buy Now: #1

Braemar Hotels & Resorts Inc (NYSE:BHR)

Braemar Hotels & Resorts Inc (NYSE:BHR), founded in 2013, is a real estate investment trust (REIT) that invests in upscale resort, hotel and vacation properties. Based in Dallas, Texas, Braemar owns and operates 15 properties (3,971 rooms) across nine U.S. states and territories. The company has a market cap of $431 million.

Braemar specializes in high revenue per available per room, or RevPAR, properties. Luxury hotels are similar to casinos in revenue generation. During economic downturns, they often encounter significant drops in revenue and profit. However, during periods of economic prosperity, they are some of the most profitable entities in the travel and tourism industry. Braemar is no exception. The easing of COVID-19 restrictions has caused company revenue to skyrocket by 88.4% over the past year.

BHR’s surge is forecasted to continue as the pandemic restrictions ease. Omicron has “outcompeted” the less contagious Delta variant, providing hundreds of millions of people worldwide with an additional layer of natural immunity against its more dangerous cousin. National governments across the globe, ranging from Israel to the United Kingdom, have begun pursuing a return to normalcy policies. At home, even states with the most stringent COVID-19 policies have begun lifting mask mandates. As a result, the boutique hotel industry, which includes luxury lodgings, is projected to grow by 11.1% annually from 2021 to 2026.

[Game Changer: Log into Marc's $5,000 system today]

Having favorable economic tailwinds is only half the battle. A company still needs to differentiate itself from its competitors and provide value. Braemar’s ace in the hole is its customer service. The company averages an 84% consumer satisfaction rating on TripAdvisor across its properties, the highest among lodging REITs.

Many investors overlook an organization’s customer satisfaction record. Long-term customers are the greatest source of revenue for nearly every company. Satisfied customers buy or use a company’s product at higher rates, are less sensitive to price fluctuations, provide referrals and are less expensive than finding new clients. A 5% increase in customer retention can raise profits by as much as 95%.

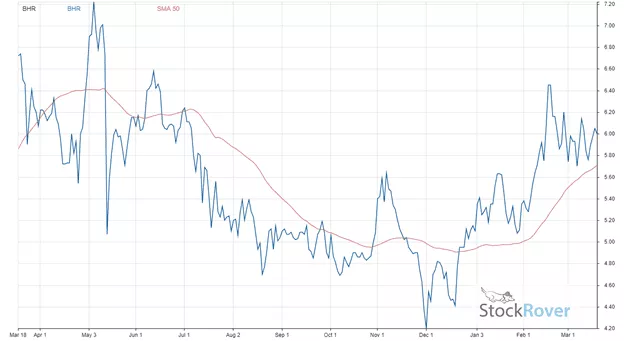

Customer service is essential in the hotel industry, where customer satisfaction is the difference between a flourishing establishment and a bankrupt one. Despite BHR’s 14.2% downturn over the past 12 months, the continued resurgence of the boutique hotel industry and Braemar’s advantage in customer experience makes the stock an attractive investment. The company is forecasted to experience a 57.6% year-on-year jump in sales in Q1 2022 and a 31.0% increase in all of 2022. BHR’s share price movement over the past 12 months is graphed below, along with a 50-day moving average.

Braemar’s recent decline in share price has mispriced the stock relative to its underlying value. Despite the company’s projected sky-high growth, BHR’s (share) price-to-sales (P/S) ratio of 0.7 and EV/EBITDA ratio of 21.1 are below the hotel REIT averages of 3.2 and 27.6, respectively. The company combines the best characteristics of value and growth investments.

All signs conclude that Braemar is set for an impressive year of growth. The company, currently unprofitable, is projected to start generating positive net income by the end of 2022. BHR is the best choice for individuals seeking consistent high growth in their investments.

[Jeff Clark: “The One Stock Retirement” with the World’s Most Predictable Stock]