Table of Contents:

- Introducing Alexander Green…

- Why Putin’s Folly Is His Biggest Mistake of All Time

- Europe Is on the Verge of a Major Prolonged Energy Crisis

- How One Company Is Generating Record Profits by Solving Europe’s Energy Crisis

- The One LNG Company Making Money Hand Over Fist

- This Company Actually Makes MORE Money Because of Rising Interest Rates!

- Insiders Own Almost HALF of This Entire Company!

- The New King of LNG

- The Company Making a Fortune Solving the Food Crisis

- The 900-Pound Gorilla Dominating Gene Sequencing

- The Most Important Financial Decision You Could Make

BIG Prediction: Follow the Steps Below, and in 18 Months, You Will Utter the Following Words…

“Vladimir Putin’s Stupidity Made ME Rich!”

Wall Street Projects One $30 Stock Will Rise to $280 in Just 18 Months… All Thanks to a HUGE Mistake by Russia's President.

BOB:

Hello, I’m Bob Paff.

Welcome to our emergency summit.

We’re holding this event because your money in the U.S. stock market could be in grave danger…

Europe’s energy crisis just became an outright catastrophe.

Russia cut off all gas supplies through the Nord Stream 1 pipeline to Europe.

And Vladimir Putin declared, “We will not supply gas, oil, coal, heating oil. We will not supply anything!”

This is no small thing.

Energy prices have spiraled out of control.

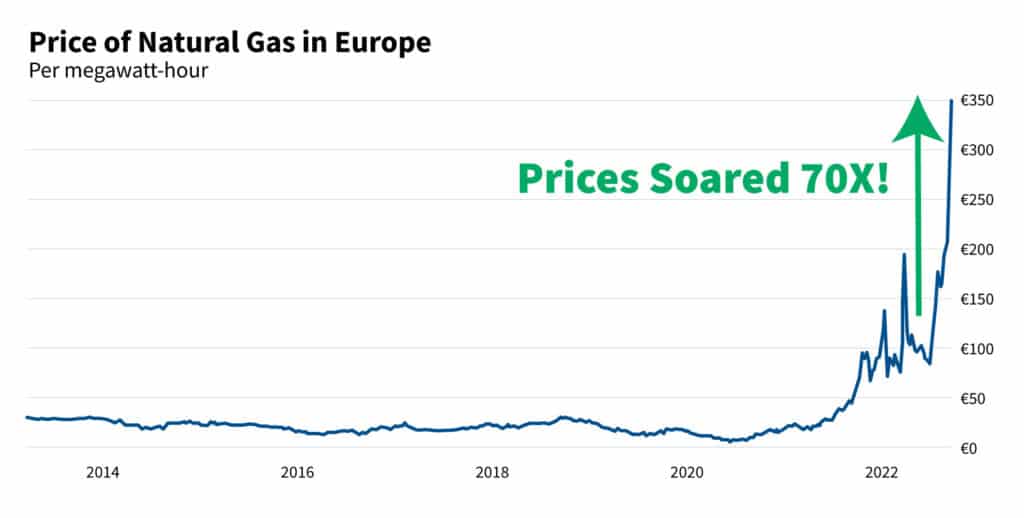

The cost of natural gas in Europe is up nearly 70-fold from its pre-crisis lows.

It is now SO expensive that Goldman Sachs estimates European energy bills will hit $2 trillion… which is almost as much as France’s entire economy is worth!

Skyrocketing utility bills are estimated to make up 15% of Europe’s entire GDP!

This is unprecedented.

And European leaders are panicking… mandating cold showers, halting factory production, requiring lower driving speeds on highways, and restricting use of heat in offices and retail shops.

Morgan Stanley’s chief European equity strategist says an imminent recession is coming.

And investors are pouring out of European stocks.

Withdrawals from European funds just hit their highest level since the Brexit panic.

Even the president of the European Central Bank warns they are looking at a “really dark downside scenario.”

Very dark indeed.

If Europe goes into a deep recession… the American stock market, too, could be hit hard.

And yet…

Here’s what might really surprise you.

My guest today, Oxford Club Chief Investment Strategist Alexander Green, says this situation is going to cost Putin dearly.

He believes Europe will actually come out of this situation in better position than ever before.

Not only that…

It will – in a strange twist of fate – make a small number of informed Americans very rich.

When he told me that, I was completely stunned.

But, of course, Alex has made some incredible calls in the past.

His organization predicted the dot-com collapse. He warned of the coming catastrophe in housing before the financial crisis in 2008. And he called the exact bottom of the market in 2009 and after COVID struck in 2020.

His big predictions have been incredibly accurate.

So I knew we had to get him on for this emergency summit to explain what’s going on in Europe… and why he says it’s one of the biggest investment opportunities he’s ever seen.

With that, let’s bring in Alexander Green.

Alex, thank you for joining us!

ALEX:

It’s great to be here, Bob. Thank you for having me.

Why Putin’s Folly Is His Biggest Mistake of All Time

BOB:

Alex, you’ve made an awful lot of big predictions in the past. But this one might just be your most surprising yet.

So let’s start right there.

What exactly are you predicting will happen with Europe’s energy crisis?

ALEX:

Well, personally I’m calling it “Putin’s folly.”

I believe Vladimir Putin has stepped headfirst into the most epic blunder of his life.

He’s already turned himself and his country into the world’s biggest villains with the invasion of Ukraine.

But his latest mistake is going to be what ends up doing him in for good.

BOB:

And you say this is an opportunity for investors?

ALEX:

It has created perhaps the single most obvious, predictable and potentially profitable opportunity I’ve seen in 40 years in the markets.

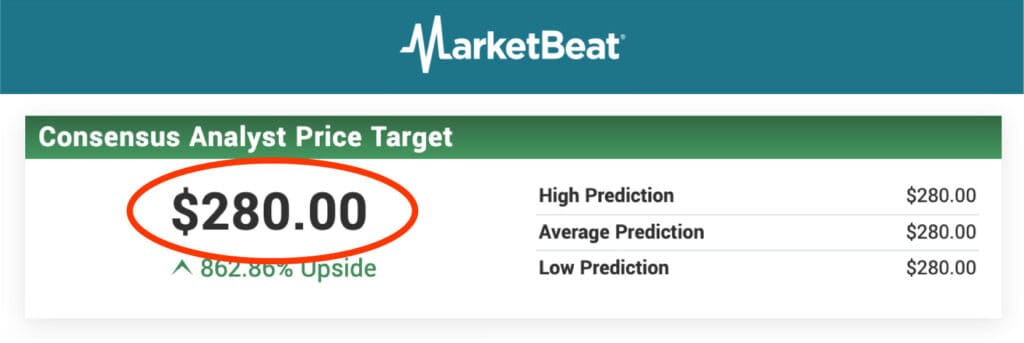

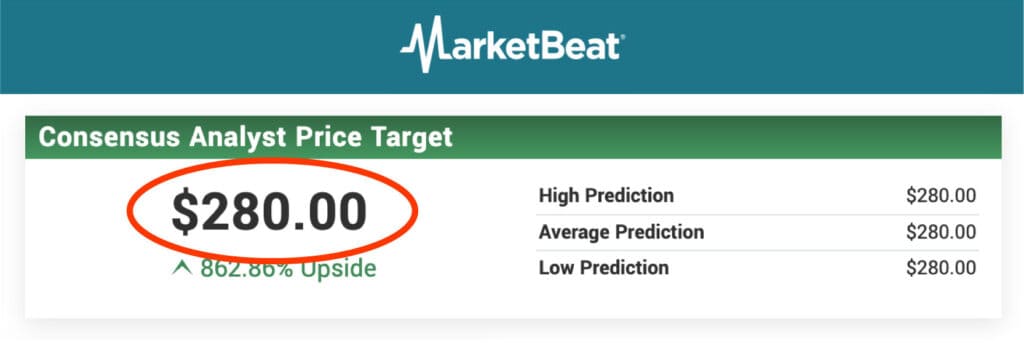

In fact, I’ve already seen Wall Street analysts bump their price targets on this investment to $280… from around $30 today.

My belief is that between a year and 18 months from now… a handful of smart Americans are going to do very well because of this.

We’re talking about nearly tenfold gains in less than 18 months.

Friends will go up to them and ask, “What happened? How are you doing so well in this market?”

And they’ll answer, “Vladimir Putin’s stupidity made me rich!”

BOB:

Wow, that’s truly surprising.

I can’t wait to hear how this is all going to play out.

But let’s start at the beginning.

What exactly is this terrible mistake Putin has made?

ALEX:

Well, his blunder started when he invaded Ukraine and then completely cut off Europe’s energy supplies.

As I’ll explain in a moment, this shut-off has triggered a series of events that will end up destroying Russia.

But first, let me explain how this began.

In September, Putin shut down the Nord Stream 1 pipeline to Germany…

Which is a huge deal, because Russia is the primary supplier of gas for all of Europe.

In 2021, Europe imported 155 billion cubic meters of natural gas from Russia… almost half of Europe’s entire gas supply.

BOB:

That’s why Russia was known as Europe’s gas station.

But why exactly is Europe so reliant on Russia?

ALEX:

Well, the Europeans have been working hard for years to build up their “green energy” economy.

But in doing so, Europe largely stopped developing their own fossil fuels and instead pumped money into renewables like wind and solar power.

The only problem is… wind and solar aren’t reliable like natural gas. So in recent years, Europe has imported Russian gas to make up for their energy shortfall.

But in doing so…

Europe became completely dependent on Russian fuel. And now – for the moment, at least – they are totally unprepared to provide their own energy.

BOB:

And so from the time Russia first threatened to turn off the gas to the time they followed through on it, what happened?

ALEX:

Predictably, energy prices skyrocketed.

And I mean really skyrocketed.

Bob, this number is going to blow you away.

In June 2020, before anyone knew this was coming, the cost of natural gas in Europe was just 5 euros per megawatt-hour.

In 2022, prices peaked at nearly 350 euros per megawatt-hour!

BOB:

So prices are up almost 70-fold?

ALEX:

Yes! And as a result, electricity prices have gone through the roof!

In Germany, for instance, electricity prices hit a record of 1,000 euros per megawatt-hour!

Bob, this is devastating.

Goldman Sachs is warning the repercussions from this will be “even deeper than the 1970s oil crisis.”

BOB:

I thought you said this was going to make some investors very rich!

ALEX:

Don’t worry, we’ll get to that shortly.

Again, this situation is creating quite possibly the single best investment opportunity I’ve seen in my almost 40-year career.

It’s predictable, relatively low-risk… and when I say big… I mean BIG.

I really believe a number of Americans are going to get very rich thanks to Putin’s folly.

But first, I just want our viewers to understand how devastating this situation could be.

Europe Is on the Verge of a Major Prolonged Energy Crisis

The European governments are doing everything they can to keep from completely running out of energy in the months ahead.

BOB:

Like what?

ALEX:

All kinds of things.

In Denmark, they are mandating that hot showers be limited to five minutes.

Finland is requiring slower driving speeds.

In Spain, air conditioning can be used only if temperatures go higher than 81 degrees.

France has cut off hot water to certain buildings. And offices can turn the heat on only if it gets colder than 64 degrees.

Retail stores are required to reduce lighting by 30%.

They are even turning off the lights on legendary monuments like the Eiffel Tower and the Brandenburg Gate in Germany!

BOB:

Wow. And you think it will get even worse?

ALEX:

Without another source of energy to replace Russian gas? Yes, it certainly could.

Everything I’ve mentioned is just the tip of the iceberg.

In some parts of Europe, we’re already seeing major blackouts. Cafés, retail stores and restaurants are shutting down every few hours.

And industry is getting slammed by the higher energy prices.

The metals industry in Europe, for example, is facing what’s being called a “life or death winter” due to electricity and gas costs spiking to over 10 times last year’s levels.

Half of the European Union’s zinc and aluminum production has already been halted.

Another major area of concern is glass production.

As The Wall Street Journal reports, making glass “requires melting sand, soda ash and limestone, and in Europe the energy to create the needed temperatures has largely come from Russian gas.”

Simply put… without natural gas, glass cannot be produced.

And glass is one of the single most important elements in basically every single industry.

We’re talking about windows in people’s homes… car windshields… computer and smartphone screens… construction of skyscrapers… and bottles for food, drinks and medicine.

Audi, for instance, says the glass situation could create another parts shortage in the car industry… which would drive the prices of cars even higher in Europe and the United States.

Volkswagen says that they are stocking up all the glass they can find in preparation.

And they’d better do it fast, because glass prices are already up 90% and could go far higher.

Bob, this is all a major, major problem.

This domino effect… stemming from Putin’s decision to cut off the pipeline… threatens not just the European economy, but the entire world economy.

BOB:

So how is it that this could lead to greater wealth for a few Americans?

And why is this a mistake by Putin?

It seems like he is hitting Europe right where it hurts.

ALEX:

It’s the right question to ask, Bob.

While everything I’ve explained to you is dire… there is a solution to this problem.

What I’ve outlined is what could happen if Russia shuts off Europe’s energy and nothing replaces it.

But what Putin failed to recognize… is that there is a replacement for Russian gas.

It’s a way for Europe to get all the energy they need.

And it’s a way for investors to make a ton of money in a very short period of time.

The answer, in short, is…

America.

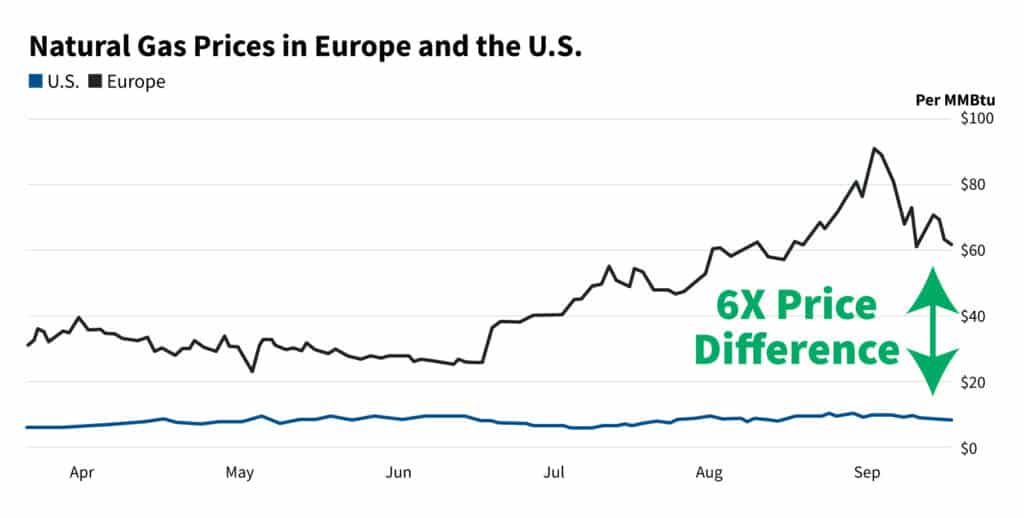

And I can show you why with just one chart.

How Europe Will Solve Its Energy Crisis

This is a chart of the price of natural gas in Europe and the price of natural gas in the United States.

The blue line is the U.S. price, and the black line is the European price.

So, Bob, what do you see?

BOB:

The price in the United States remains incredibly cheap, while in Europe, it’s sky-high.

ALEX:

Exactly right.

What you are looking at is one of the great arbitrage opportunities in the history of the modern global economy.

BOB:

Can you explain what an arbitrage opportunity is for our viewers?

ALEX:

Sure.

An arbitrage is when an item sells very cheaply in one place but is very expensive in another.

Smart investors can buy the product where it’s cheap… sell it where it’s expensive… and turn a profit on the difference.

In this case, natural gas in the United States sells for just $10… while in Europe, it sells for anywhere from $60 to $80.

BOB:

So if you were able to buy natural gas in America and sell it in Europe, you could make more than six times your money?

ALEX:

Exactly.

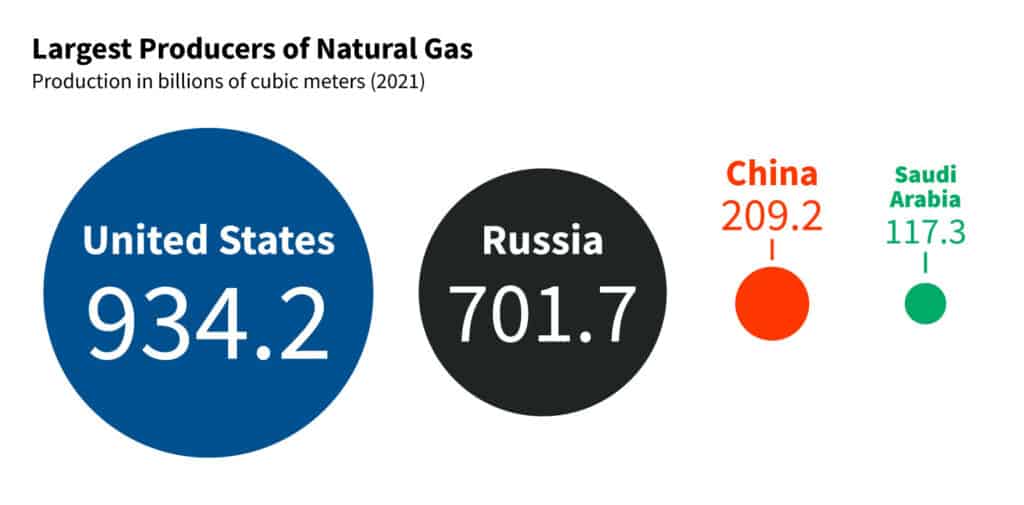

The United States is the world leader in producing cheap natural gas. We produce more than any other country… more than Russia… more than Saudi Arabia… and over four times more than China!

We have nearly unlimited supplies. And we have the technology to pull it out of the ground in massive amounts.

That’s why our gas is so much cheaper than Europe’s… and has been for a very long time.

BOB:

So why doesn’t Europe just buy natural gas from America and, presto… problem solved?

Up Until Now, Buying American Natural Gas Wasn’t Easy

ALEX:

Well, until very recently, it wasn’t that easy.

Natural gas is a gas, after all… It takes up a lot of space. That’s why Russia’s Nord Stream 1 pipeline transports it under the Baltic Sea to Germany directly.

A pipeline is the fastest and easiest way to transport gas from country to country.

But there is no pipeline connecting America to Europe.

Instead, for natural gas to be transported from America to Europe, it must be transformed from regular natural gas into liquefied natural gas, or LNG.

And then that LNG is shipped across the ocean on a ship.

Until the past few years, this was a major challenge.

LNG has to be stored at about minus 260 degrees in order to be held in a liquid form.

That made it very difficult to transport.

Not only that, but when LNG is transported, a substantial amount of it “boils off” by the time you get to your destination.

Much of your cargo (and money) disappears into thin air.

That’s why… up until recently… natural gas had to be provided to Europe by a nearby country like Russia.

It was a whole lot easier to transport it as a gas through pipelines than by sea on a ship.

But there has been a breakthrough.

And I believe this breakthrough is in the process of making one company (and its shareholders) an absolute fortune.

How One Company Is Generating Record Profits by Solving Europe’s Energy Crisis

BOB:

Okay, what has this company done, and just how much money are they making?

ALEX:

Alright… because liquefied natural gas was so difficult to ship in the past, there wasn’t much profitability in transporting LNG from America to Europe.

The old cargo ships turned a profit of only about $15,000 per day… a tiny sum for international shipping.

But a new set of ships designed specifically for transporting LNG has come along… and multiplied the profitability many times over.

These new ships do something very special.

At the port, giant compressors turn the gas into a supercooled liquid at minus 260 degrees.

It’s then pumped into gigantic dome tanks specially designed to maintain that cold temperature.

These domes are so efficient, they don’t even need refrigeration units to cool the LNG during the trip.

The insulation naturally keeps the temperature low for the entire journey.

Think of these domes as huge Yeti coolers… the type that can keep ice cold for days outside of a refrigerator.

And using these dome coolant tanks… just one of these ships can transport 3.6 BILLION cubic feet of natural gas in one trip.

At current prices, that’s nearly a quarter of a billion dollars’ worth!

But it gets better than that.

As I said before, during transportation, liquefied natural gas will boil off when some of it turns from liquid back into a gas.

In the past, that gas would be lost.

But these ships instead have been built to actually capture and RUN on the natural gas that boils off.

This dramatically reduces the cost of the entire journey.

So, Bob, I told you that the old ships made $15,000 per day transporting LNG. What do you think these new ships make?

BOB:

$50,000 per day?

ALEX:

It’s a good guess. But the figure is even bigger.

BOB:

$100,000?

ALEX:

Getting closer.

These new ships are so much more efficient, they actually bring in around $200,000 in profit every day!

And right now, because of the energy crisis in Europe, these ships are picking up loads of liquefied natural gas and turning them into record profits in Europe.

I want to be crystal clear on this next point because it is the most important fact I’ll share today.

Right now, these ships pay $40 million for a full load of liquefied natural gas in America… and when they sell it in Europe, it fetches them over $240 million.

BOB:

In other words, they turn a profit of more than $200 million on every single shipload?

ALEX:

Bingo.

$200 million on one short journey across the ocean.

It’s a massive, MASSIVE profit.

The One LNG Company Making Money Hand Over Fist

BOB:

Wow, I had no idea the profits were so big here.

But, Alex, are there a lot of companies doing this? Or is there one in particular our viewers need to know about?

ALEX:

There are a few companies doing this. But not many. Only a few smart businesspeople saw this situation coming.

And one company in particular prepared for this perfectly.

They actually started building out an armada of 13 state-of-the-art LNG ships between 2018 and 2021.

And now they are one of the only companies ready to supply the natural gas Europe is desperately buying up.

As the CEO of this company says…

“Europe has been gobbling up LNG spot cargos on an unprecedented level.”

The profits are rolling in unlike anything I’ve ever seen.

In the latest earnings release – even before the Nord Stream 1 shut-off – profits have ALREADY grown by an astounding 25-fold since 2020!

That’s 2,400% growth!

BOB:

Unheard of. That’s bigger growth than Netflix, Apple, Microsoft or any of the big tech stocks I can think of.

ALEX:

It blows them out of the water!

And the company is rewarding shareholders like never before.

It Can Pay You Double-Digit Dividend Yields!

The company is paying a monstrous dividend of over 10%… and they are likely to increase it even more in the days ahead!

BOB:

A 10% dividend? That’s certainly a great way to beat inflation. I’d love to get paid a 10% yield on my investments right now.

But don’t high dividend yields usually have a higher risk of getting cut?

ALEX:

Quite often they do.

But I don’t think so in this case, and here’s why…

Remember… all the growth I’ve talked about so far was before Putin even shut off the gas!

So business is now actually getting even better!

And as I’m about to show our audience… the growth I’m about to share with you is not a guess or a projection.

It’s in fact locked in for years to come!

BOB:

Can you explain that, Alex?

How can future growth be “locked in”?

Europe Will NEVER Go Back to Russian Gas

ALEX:

Remember earlier, when I said Putin had made a huge mistake?

Well, here’s what it is.

Western Europe is NEVER going back to Russian gas.

Even if Putin exited Ukraine tomorrow, got down on his knees and begged for forgiveness… there’s no way Europe would ever do business with him again.

Let me read you a quote from Thomas Friedman in The New York Times.

“There is only one cardinal sin in the energy business: Never, ever, ever make yourself an unreliable supplier. No one will ever trust you again. Putin has made himself an unreliable supplier to some of his oldest and best customers, starting with Germany and much of the European Union. They are all now looking for alternative, long-term supplies of natural gas.”

Friedman is spot-on. Europe is never going back to Russian gas.

BOB:

And with the recent sabotage of the Nord Stream 1 pipeline, I think that it’s clearer than ever.

ALEX:

Right. Russia is now totally unreliable. Putin’s folly is going to cost the Russian economy trillions of dollars in lost profits.

But without Russian energy in the future, Europe still is deathly afraid of the problems this energy crisis could cause.

They don’t want to see $2 trillion in energy costs…

They don’t want to have the hot showers turned off… and rolling blackouts… and they certainly don’t want to see a major recession.

BOB:

So without Russian gas, what are they doing to make sure that doesn’t happen?

ALEX:

Instead, they’re buying up every shipload of LNG that comes to port.

And not just in the short term.

This is a very important point I want to share, so everyone should listen closely…

To make sure they never have to go back to Russian gas, the European governments are locking in long-term contracts at fixed prices for years to come!

BOB:

In other words, the company you are telling us about has contracts in place to be Europe’s LNG provider for many years ahead?

ALEX:

Exactly right.

This company has 13 ships delivering LNG around the world.

And 12 of them are now under fixed contracts… with LNG prices locked in for between three and 10 years.

In total, the company has 54 combined years of LNG delivery locked in for the 13 ships they operate.

And these contracts generate more and more increasing sales each quarter.

Just consider this…

The company had profits of just $8.1 million in 2020.

Over the 12 months leading up to Putin’s shut-off… profits hit $202 million.

That’s growth of 2,400%.

But moving forward… now that Russian gas is off the table… we are looking at a company with 13 ships capable of producing $200 million on every journey from America to Europe.

For everyone watching at home, this is easily some of the most predictable future sales growth you can imagine… because the contracts are already in place.

The company right now has 100% contract coverage until mid-2024 at the earliest.

They just signed two ships to seven-year deals that run through 2029.

And another ship is contracted all the way until 2033!

As an investor, we can look at these contracts and determine exactly how much growth to expect in the future.

And it is substantial.

We’re talking about hundreds of millions of dollars in additional revenue growth going forward.

Imagine investing in a company and knowing beforehand that at each earnings release, you are likely to see a big, fat growth figure… plus much higher dividends.

That’s why Wall Street firms like MarketBeat are suddenly pumping their price projections to the moon.

This company trades for about $30 today… but MarketBeat is putting its price target at $280 for the next year to 18 months.

BOB:

So we’re talking about a nearly tenfold gain in just over a year?

ALEX:

That’s what they are projecting.

Like I said, this is one of the most predictable and profitable investment opportunities I’ve ever seen.

But what if natural gas prices go back down?

Would that hurt the company’s profitability?

Why Even Sinking Energy Prices Won’t Hurt This Stock

ALEX:

This is what’s so great about this opportunity.

Yes, natural gas prices could come down… though that is unlikely, with no end in sight to this conflict.

And no matter what happens, it will make a minimal difference for this company.

Because out of 13 ships, 12 of them are locked in at fixed prices.

Only one is on a variable contract.

So even if energy prices were to go down, which I do not expect, this company’s sales growth would continue.

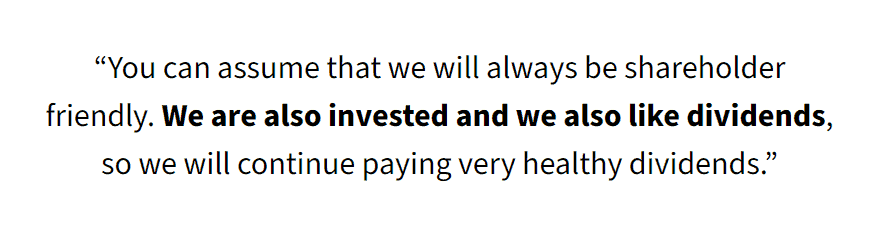

Listen… I signed on to an investor conference call with the CEO and CFO recently.

Investors were asking about future growth and dividends.

The CEO could hardly contain his glee – he is a big shareholder in the business himself.

He told us the business is “immensely profitable”…

And he said…

“We will focus on paying very healthy good dividends for our shareholders.”

They’ve already increased the dividend more than sevenfold… and I expect it could go up much further in the next couple of years.

That’s how good the sales projections look.

BOB:

Wow. This is such a unique situation. This company is looking better and better.

But there must be some risks out there.

What about rising interest rates?

The shipping industry usually carries a good bit of debt to finance the ships. Could rising interest rates hurt this company?

This Company Actually Makes MORE Money Because of Rising Interest Rates!

ALEX:

When it comes to investing, I always say to never bet more than you can afford to lose. There are always risks in the stock market. No company is immune to that.

And Fed moves are one of the risks companies need to be aware of. If interest rates rise, a lot of companies could be hurt by that.

But one of the reasons I love this company so much is its leadership.

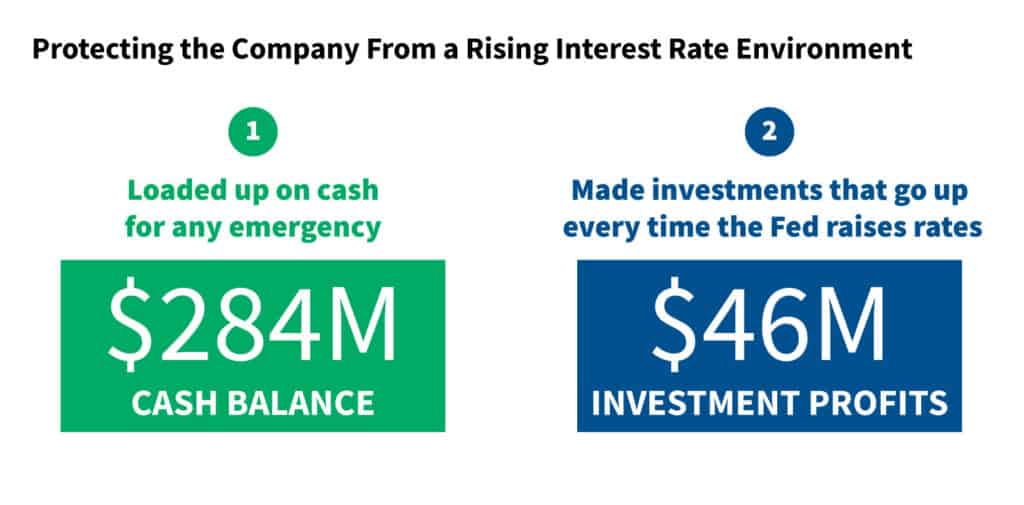

The chief financial officer of this company is a really sharp guy. And he made a brilliant move to protect the company from a rising interest rate environment.

So here’s what they did.

First of all, they loaded up on cash.

The company has a $284 million cash balance ready for any emergency.

Second, they made a series of “hedges” in a set of investments that go up if interest rates rise.

BOB:

And has that paid off?

ALEX:

Oh, yes. Every time the Fed raises rates, these investments go up.

Year to date, the company has made an extra $46 million in profit thanks purely to this smart move by the CFO.

As the CEO said in the conference call I was on…

BOB:

No kidding? $46 million in additional profits! It’s no wonder this stock is booming. These guys are brilliant.

But what about competitors?

Could another company swoop in and steal away some of their business?

This Company Has a MAJOR Advantage Over Its Competitors

ALEX:

That’s another great question.

Anytime one company is making a boatload of money, competitors try to swoop in.

And that can really eat away at the profits.

But I think it’s safe to say that’s not going to happen here.

BOB:

Why is that?

ALEX:

In order to ship LNG from America to Europe… you need one thing.

Ships!

Now, I mentioned earlier that this company built its fleet of state-of-the-art LNG ships between 2018 and 2021.

They understood that LNG was going to be in big demand in the future.

So they made their move early.

And that set them up perfectly to take advantage of the current situation.

But any new competitors who want to get in the LNG business are going to have a much harder time of it.

BOB:

Why do you think that is?

ALEX:

Because they won’t have the new ships to compete!

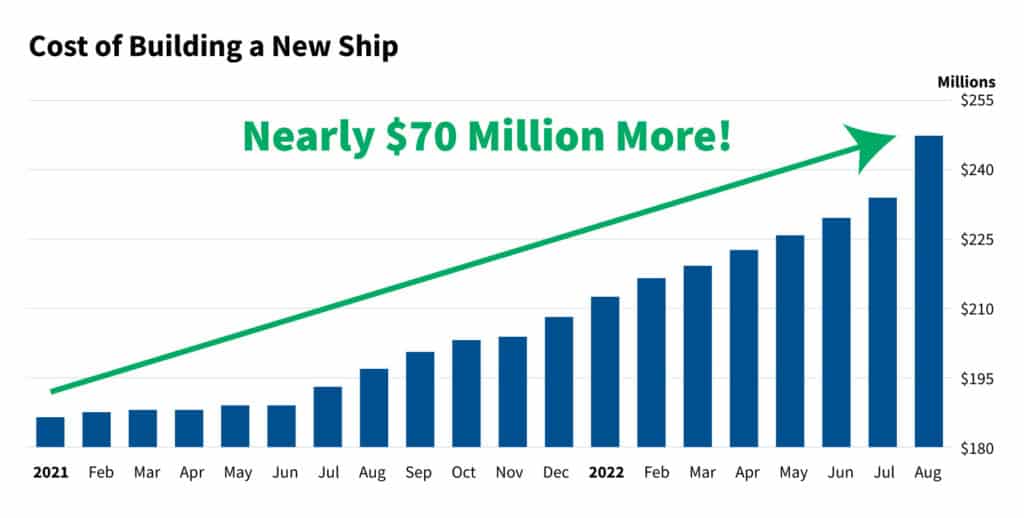

For one, the costs of building these new LNG ships… like the costs of everything else during the pandemic… have skyrocketed.

The cost of building a new ship has gone up by almost $70 million since this company built its ships.

And there are huge backlogs.

A new ship ordered today won’t be ready until 2027!

BOB:

So this company won’t have new competition coming in for years!

ALEX:

Right!

Of course, there are some competitors today… but not nearly enough to fill the massive demand for natural gas.

As I said earlier, 12 of this company’s 13 ships are locked into fixed contracts.

They are already 100% booked through mid-2024. The longest contract goes all the way to 2033.

And it seems clear that the reason Europe was willing to lock in these contracts for years is they know there won’t be new competition coming in for some time.

BOB:

So there isn’t a chance Europe could turn to, say, the Middle East to get natural gas instead?

ALEX:

No, that’s extremely unlikely to happen.

For one, there is no pipeline from the Middle East to Europe… so it also would have to go by boat.

Secondly, America has far more natural gas than the Middle East.

We produce almost eight times more natural gas than Saudi Arabia does.

And finally, natural gas in the Middle East is expensive.

It’s almost as expensive as it is in Europe.

The only place that has cheap natural gas in major quantities is America… so this is where Europe must turn.

BOB:

In other words, you’d say this company’s position as the dominant leader is secure.

Let me ask you this, Alex…

Is the stock getting expensive?

Still Trading at HALF the Valuation of the Average S&P 500 Stock

ALEX:

The stock is moving up. And it’s moving up fairly fast.

It’s gone from about $20 to $30 this year… even as most of the market has tanked dramatically.

BOB:

So have our viewers missed the boat?

ALEX:

Not even close. Because it’s such an unknown company, very few retail investors own it.

Even though it’s up 50%, this stock remains outrageously inexpensive.

In fact, it’s still actually half as expensive as the average S&P 500 stock.

It would have to go to over $60 just to trade at an average valuation.

But that would be if sales stayed flat.

I think it can go much higher than $60 because… as I’ve said… the future growth is locked in.

So while a lot of stocks are delivering poor earnings results, this company is only making more and more money.

And again… as interest rates go higher, this company will make even more money on the investments they made that protect them against rising rates.

I think it could be well over $100 in a less than a year… and it could continue much higher from there.

As I’ve mentioned today, Wall Street analysts have pushed their projections to $280 in the next 18 months.

That’s nearly 10X growth from here.

BOB:

So what is the biggest risk with this stock?

ALEX:

Honestly… it’s waiting too long. The dividend yield is over 10% right now. You want to lock that in as soon as possible.

And the longer you wait, the more likely the stock is to get a lot more expensive.

If the stock moves to $60, the dividend yield would be only 5%.

You don’t want to wait for that to happen.

People are waking up to the immense profitability of this company.

Simply put, I believe this company is about to make quite a few investors very rich.

In fact, I believe it’s poised to hand investors more profits than any other stock on the market over the next year.

And here’s an important point… The people running the business feel the same way!

BOB:

What do you mean?

Insiders Own Almost HALF of This Entire Company!

ALEX:

The insiders have LOADED UP on shares of this company.

Retail investors may not understand the enormity of this opportunity.

But the insiders running the business surely do.

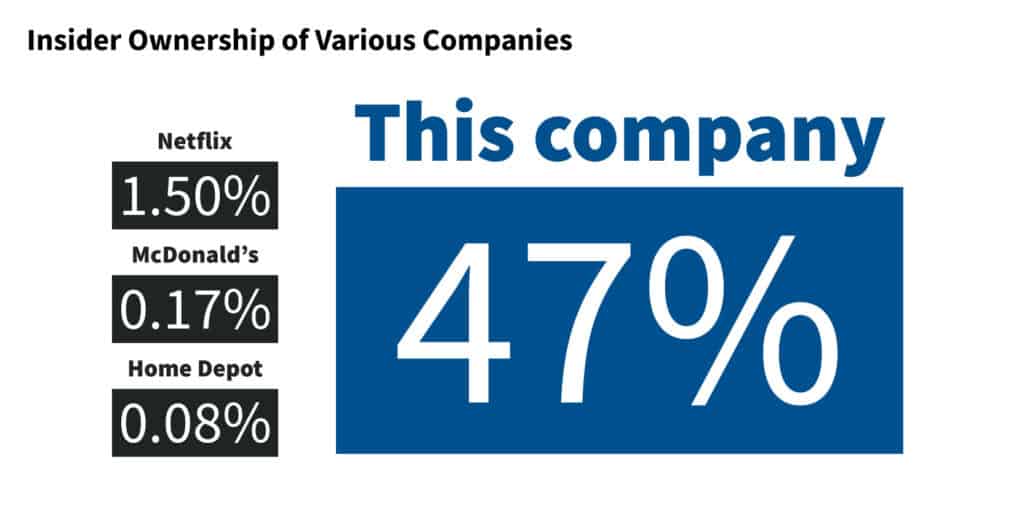

They own a whopping 47% of all outstanding shares!

BOB:

That is a huge number.

ALEX:

To give you some comparison… insiders own only about 1.5% of Netflix.

They own only 0.17% of McDonald’s.

And they own only 0.08% of Home Depot.

This company’s insider ownership blows those companies’ out of the water.

Insiders own almost half of all outstanding shares!

BOB:

Alex, in Forbes’ profile of you, they said you are “a big follower of insider buying.” Why is that so important?

ALEX:

I love companies with large numbers of insiders invested in the company…

Because it means they are incentivized to reward shareholders as much as possible.

Just listen to this quote from the CEO in the recent webcast I was tuned into. He was asked if they planned to raise dividends even more.

And he said…

This is one of the most important lessons for our viewers.

It pays to invest in companies with heavy insider ownership. They want to make money. And when they do… you do.

With 47% insider ownership, this company is a prime example of that.

BOB:

Alex, this makes a ton of sense. Especially at a time like this when stocks have been very volatile, you want companies with strong revenue growth and insiders dedicated to rewarding shareholders.

ALEX:

Absolutely, you do.

For Big Profits, Find the Companies That Benefit From Chaos

Listen… investing during a bull market is fairly easy.

But investing when markets are volatile is much harder. Finding the winners can be very difficult.

But one of the best ways to make big money is to find those companies that are actually benefiting from the chaos.

Look at a company like Moderna.

It’s one I recommended right at the beginning of the pandemic because I saw insiders were loading up on shares.

They realized the company would see a dramatic increase in revenue not in spite of the pandemic, but because of it.

And whatever you might think of Moderna, you can’t deny it was a great investment opportunity.

While it traded at $21 in early March 2020… it was up to $450 just 18 months later!

That turns a $21,000 investment into $450,000.

Or take Merck, for example. Cancer is a terrible thing and we’ve been in a terrible market, but our shares of Merck are up. Why? Because Merck has the world’s leading cancer drug.

And that’s why I am so excited about the company I’m recommending now.

It, too, is set up to benefit from economic chaos.

Rising energy prices could cause a lot of problems in Europe and here in America.

Investors in a lot of stocks could see share prices drop dramatically.

But the bigger the energy crisis gets, the more this one company is set to succeed.

Its future growth is locked in for years to come. And it’s actually trading at an incredible price!

It could be the single most predictable, profitable, income-gushing investment I’ve found in my career.

BOB:

It blows me away, Alex. This is as good as I’ve seen.

So let’s recap everything for our audience.

“The Single Most Predictable, Profitable, Income-Gushing Investment of My 40-Year Career”

– Alexander Green

ALEX:

Okay, here’s the long and short of it.

Vladimir Putin decided, after foolishly deciding to invade Ukraine to begin with, to stop delivering oil, gas, coal and heating oil to Europe…

Europe is in serious trouble providing the energy it needs. And as a result, natural gas prices have skyrocketed.

The cost of natural gas in Europe is now six to eight times higher than it is in America.

And this company can now make $200 million per shipment of LNG to Europe.

Profits are exploding… with 2,400% growth since 2020.

The dividend is up sevenfold… paying out over 10%.

The company has 13 ships delivering LNG… of which 12 are locked into long-term contracts lasting between three and 10 years.

The company also is turning more profits every time interest rates rise… $46 million this year alone.

And best of all, the stock is rising fast but remains incredibly cheap.

It’s just half as expensive as the average S&P 500 stock.

I’ll finish up by reiterating what the CEO said on a recent webcast.

This business is “immensely profitable.”

This is why price projections on Wall Street are predicting a move up for this stock from $30 to $280 in the next 18 months.

BOB:

It truly is one of the best, most unique investment opportunities I’ve ever heard about.

So, Alex, how do people get instructions on how to profit from it?

ALEX:

I’ve put together a brand-new report titled “The New King of LNG.”

Inside the report, you will get the ticker symbol of the company and a complete breakdown of their business, including future sales growth projections… potential dividend growth… and even more reasons I believe this stock should soar.

For example, we haven’t even talked about this company’s business supplying LNG to countries like Japan that also pay top dollar.

I’ll break down how big that opportunity is in the report as well.

My team is preparing this special report to go out as a brand-new recommendation exclusively to subscribers of my Oxford Communiqué.

BOB:

If this is reserved for members of your Communiqué, how does everyone watching right now receive it if they’re not a member?

ALEX:

Good question. Since this opportunity is so big… I’ve decided to do something special.

I’ve made it completely risk-free for our viewers to immediately receive this report by simply joining my Communiqué family

BOB:

Alex… I’m familiar with the Communiqué. I’ve been reading it and benefiting from it for years and years. But can you tell viewers a bit about it?

A Community of Freedom Seekers…

ALEX:

Sure.

The Oxford Communiqué is a monthly publication I put together to connect with wealth builders all over the country who care about their families and recognize the true value of money…

Freedom.

Becoming rich isn’t about seeing a big number in your bank account.

It’s about what that money can do to give you a better life.

Money is the ability to quit working if you want to…

It’s the ability to live in a fully paid-off home in a safe community…

To travel to see your family whenever you want…

To help your children and grandchildren succeed…

To start a business…

To buy a second home at the beach…

The reason to pursue great wealth is to give yourself the freedom to do these things.

And that’s my mission when I write the latest edition of The Oxford Communiqué each month – to help our members achieve true freedom by increasing their wealth.

With each monthly issue of the Communiqué, I’ll share all my insights on the economy, interest rates, business developments and, of course, my favorite stocks with the most upside potential.

I’ll explain why revenues are booming. We’ll watch company insiders to see whether they are buying. And we’ll track Wall Street money flows as they pour into certain stocks.

BOB:

And, Alex, you’ve made some pretty big calls over the years. You’ve found some of the biggest stock winners of all time.

Alex Has Called Three of the Biggest Stock Winners of the Past 15 Years

For example, you wrote a story a few years back about a cancer-fighting company called Varian Medical Systems.

When you first started researching it, it traded for just $23.

And here’s what you wrote at the time:

“This company’s shares meet every one of our criteria for outstanding growth: new products, a big jump in revenues, a fast-growing industry and a big new market for its products.”

In April 2021, Siemens acquired Varian for $177.50 per share.

Investors who recognized this opportunity made a great deal of money.

But they did even better when you recommended Intuitive Surgical.

Back when it was trading for about $2.50 per share (split-adjusted) in 2004, you wrote this:

“It holds a monopoly position in surgical robots. As a result, sales and earnings are making a dramatic turn northward. Gross profits are a whopping 63.2% of sales. And recurring revenues are already more than doubling. Clearly, this is a stock with a great deal of upside potential.”

One of your followers, Dave F., put around $25,000 into the stock.

Today, those shares trade around 80 times higher…

A $25,000 investment would now be worth $2 million!

ALEX:

It’s amazing what one stock can do for you if you find a great one.

BOB:

It truly is.

And here’s one more you wrote about…

Celgene.

It’s another biotech that fights cancer.

Here’s just a piece of what you published:

“With Celgene, investors have a strange and wonderful opportunity. The company is a cutting-edge, new-medicine firm. However, unlike just about any other medical innovator at this stage, Celgene’s speculative ‘new’ compound is already approved by the FDA. And the company is already profitable.”

Again, you had a subscriber to your Communiqué invest in this one.

He held it for 14 years, and the return is incredible. Here’s what he wrote:

Alex, these are amazing stories.

ALEX:

They are. They are some of our top examples. It’s the reason we do what we do.

Finding great stocks can change people’s lives forever.

And in an environment like we are seeing now… with volatile stocks, rising interest rates and soaring inflation… investors need truly great stocks more than ever.

Because here’s the thing…

You can’t predict what the Fed will do next… or some politician… or a dictator in another country.

But if you invest in great companies with huge profit margins… that are inventing breakthrough products… and making huge leaps in sales… you can still succeed as an investor.

And that’s exactly what I’m confident I’ve discovered with the company that’s produced these breakthrough ships that can transport LNG in a whole new way…

It’s led to $200 million profit margins… per trip! It’s paying out massive dividends.

And multiple Wall Street analysts are predicting a move from $30 to $280.

With The Oxford Communiqué, my goal is to give you profit opportunities like this one every single month.

Right now, that kind of guidance is what people need.

BOB:

For everyone watching, I can tell you Alex is perhaps the best person to listen to at times like these.

The Oxford Communiqué Has Helped Members Thrive During Every Major Market Downturn

Alex, you’ve managed to avoid or mitigate nearly every major market downturn of the past 25 years.

For instance… in February 2000, at the height of the dot-com craze, The Oxford Club sent out a special issue to Members, warning…

Over the following three years, the Nasdaq lost 78% of its value, but your readers knew tech stocks were in big trouble.

In January 2008, nearly nine months before the financial crisis struck, you again warned members that…

You actually posted an average gain of 28% on 46 closed plays while the markets crumbled around us.

Then in 2009, you called the exact bottom of the market. You sent out a message to members that read…

The stock market went on to jump 65% between the market bottom in March and the year’s end.

One of your subscribers, Joe Martin, wrote you in 2012 and said that in the four years following your call of the market bottom, he made $1.3 million!

And during COVID, you once again called the exact bottom in March 2020…

You told people to buy stocks that were “highly undervalued and likely to prosper during the pandemic.”

And stocks went on an epic run from there.

It’s your ability to guide members through tough markets that has led hundreds of thousands of people to sign up for The Oxford Communiqué over the years.

Thousands of Success Stories

Here are just a few notes from the best success stories at your organization…

It’s amazing what you’ve done for so many people.

Now, Alex, you’re inviting people to join your Communiqué today.

And when they do so, they’ll receive your brand-new report, “The New King of LNG”…

But what can our viewers expect when they subscribe to the Communiqué?

A Special Package Specially Designed for Volatile Markets

ALEX:

As I mentioned before, new members get a new issue of the Communiqué every month.

But there is much more than that.

We also have five model portfolios for our members to follow depending on their investment goals.

There’s…

- The Oxford Trading Portfolio: This one has returned 101% more than the market since its inception 23 years ago. It’s filled with my favorite companies creating breakthrough technologies and smashing earnings quarter after quarter.

- The Gone Fishin’ Portfolio: This portfolio was designed for retirees who want a proven but simple system that works with a minimal amount of effort.

- The Oxford All-Star Portfolio: Every recommendation in this portfolio tracks the investment wisdom of some of the best investors in the world, like Warren Buffett or Carl Icahn.

- The Ten–Baggers of Tomorrow Portfolio: Think big gains here. We’re targeting ultra-cheap stocks that we hope have the potential to grow 10X in just over a year.

And finally, I just recently introduced…

- The Fortress Portfolio: This one is built around the market sectors proven to continue going up, even during market chaos.

BOB:

And Communiqué members get access to every one of these model portfolios?

ALEX:

Absolutely.

And not just that.

We also have special reports on opportunities in gold, real estate, alternative investments, insurance and much more.

Listen, Bob, here’s what we believe at The Oxford Club.

We believe that nobody will ever care about your wealth and your family more than you do.

And we strive to give you every tool needed to grow your family’s wealth successfully.

BOB:

Well, I have to say, you do an incredible job finding great opportunities.

The company you detailed today is one of the best stories I’ve ever heard.

But do you have any more new stocks coming up for subscribers to your Communiqué?

Bonus #1:

Profit From the Company Solving America’s Food Inflation Crisis

ALEX:

Actually, I do.

I just recommended another new stock to members.

It’s similar to the company I’ve talked about today.

BOB:

How so?

ALEX:

Well, remember, one of the key ways to succeed in tough markets is to find the companies that are actually benefiting from the problems we are seeing.

The first company I talked about is profiting from solving the energy crisis in Europe.

And this next company is profiting by solving the food inflation crisis here in America.

BOB:

That’s a major problem right now.

ALEX:

Absolutely, it is.

Grocery prices haven’t gone up this much in a year since 1979.

A dozen large Grade A eggs, for example, are up a stunning 82.3% from a year ago.

And while that is real trouble for the economy… there is a company that’s making a fortune by developing a technology that can increase food production and bring down prices.

The company is making big money.

Earnings have topped Wall Street estimates by an average of 18% over the past four quarters. And while most stocks sank into a bear market, its shares saw peak gains of nearly 30% over the past year.

Why?

Because this company is positioned to help solve the food problem.

The company uses next-generation technology to help farmers improve crop yields, boost output and reduce the variability of production from year to year, regardless of the weather.

BOB:

How do they do that?

ALEX:

In short, this company introduces special beneficial bacteria into farm fields.

The natural bacteria act as a sort of super-nutrition for crops.

And as a result, farmers can actually produce more food using less land.

Not only that, but these special bacteria allow farmers to reduce chemicals, minimize their environmental footprint, spray less frequently and improve disease resistance.

And the firm is making a whole lot of money in the process.

Annual revenue tops $16 billion. Sales are growing at a double-digit rate year over year.

And profitability is skyrocketing… almost tripling since 2020.

BOB:

Amazing.

I love the way you approach the market.

You don’t let the problems of the world scare you into exiting stocks. Instead, you find the great companies that are succeeding anyway.

ALEX:

Exactly.

And listen, both of these stocks are moving up while the rest of the market is down. That is crucial to succeeding in the markets right now.

That’s why I put together another special report for members of the Communiqué called “The Company Making a Fortune Solving the Food Crisis.”

BOB:

And all our viewers have to do to get a free copy is take a risk-free trial in the Communiqué?

ALEX:

That’s right.

BOB:

Is there anything else you want to add before we show people how to take that risk-free offer?

ALEX:

Actually, there is one more company I’m just recommending to new members now.

Bonus #2:

The Company Dominating the Most Explosive New Market of the Economy

Whenever stocks go through a rough patch, one of the first places I look for safety and continued growth is in healthcare.

BOB:

And why is that?

ALEX:

Because someone who has a heart condition isn’t going to wait until the economy gets better to get treatment.

They are going to get treatment now.

So healthcare stocks historically outperform anytime the market goes through volatility.

Not only that, but we are in the midst of some of the most amazing medical innovations in modern history.

And I have one more company that you definitely want to own going forward.

Sales are growing 39% year over year. Profits are smashing Wall Street’s estimates. And future prospects are the best they’ve ever been.

The company has done this by becoming the world leader in gene sequencing.

Gene sequencing is a process that determines the complete DNA sequence of your personal genome. A small biological sample – a drop of saliva or a single hair – provides all the genetic material needed.

However, the sequence data is enormous. It must be stored electronically, which requires gargantuan computing power and storage capacity.

None of this was possible before the advent of microprocessors. And even after, it was still hideously expensive.

But the cost of sequencing a human genome has dropped from $100 million in 2001 to $10,000 in 2010 to $600 today.

As a result, this company is using the technology to create treatments for all kinds of ailments.

They’re developing products to treat influenza, malaria, tuberculosis and liver ailments – to name just a few.

They are also working on a technology that can detect 50 cancers – and potentially save tens of thousands of lives annually – with a simple blood test.

And this company’s many breakthroughs are spreading all over the globe.

They’re selling their system to academic and government labs worldwide… as well as to corporate customers, including drug developers and other biotech firms… and now sales are moving to hospitals and doctors’ offices.

The company shipped 3,200 sequencing systems last year, bringing the total number of systems worldwide to over 20,000 across 8,000 global customers.

But it gets even better…

Hospitals using these systems also have to pay for the chemical reagents needed to use them… which means EVERY SINGLE ONE of these systems generates recurring revenue for the company.

In fact, 80% of the company’s revenue comes from this recurring revenue stream.

And that’s why sales are exploding.

Revenue is up nearly $1.5 billion since 2020… representing growth of almost 45%.

Wall Street analysts are also predicting further growth of 15% in revenue over the next year…

This is a company that’s going to crush any economic downturn and turn into one of the biggest healthcare wins of all time.

BOB:

And you’ve found companies like this before.

ALEX:

Right, it reminds me a lot of Intuitive Surgical… which has gone up 8,000% over the past 18 years.

That’s the level of potential here.

So I’ve put together a third report called “The 900-Pound Gorilla Dominating Gene Sequencing.”

BOB:

And our audience gets access to all three of these reports, “The New King of LNG,” “The Company Making a Fortune Solving the Food Crisis” and “The 900-Pound Gorilla Dominating Gene Sequencing.”

All they have to do is sign up for the Communiqué, and your team will deliver them all within a few minutes?

ALEX:

That’s correct.

BOB:

Okay, but, Alex… you mentioned earlier that all of this is risk-free. What does that mean exactly?

365 Days to Decide Whether the Communiqué Is Right for You

ALEX:

Well, listen, Bob, I know the value of what we publish.

You shared some of the best success stories our members have had over the years.

And our track record of beating the market handily goes back over two decades.

That’s why… while other businesses give you only a short period – perhaps 30 days – to get a refund… I believe in giving people much longer with us.

I give new members an entire year to decide whether the Communiqué is right for them.

That’s 365 days, so they really get a chance to read our research, make money on the recommendations, track our predictions and more.

We want people to see that in the long run, we care about our members and will do everything to see them succeed.

BOB:

And if you don’t deliver?

ALEX:

Well, if we don’t, then our members ought to have every right to get their money back.

That’s how strongly I believe in the responsibility we have to the people who sign up.

BOB:

So if anyone who signs up today has any regrets at any time over the next year… they can call in and get a full refund?

ALEX:

Absolutely. And I’ll even add to that.

New members can get a refund but still keep everything we’ve sent them, including the three reports they’ll get today.

BOB:

Wow, this truly is as good a deal as you can get. It’s 100% risk-free.

And, Alex, these three stocks you’ve found are so exciting… I can’t imagine anyone out there not at least taking you up on your risk-free offer and getting the details on these stocks.

The one question I’m sure our viewers have… is the price.

An Incredible Discount for New Members of the Communiqué

And for everyone watching at home… I have some very good news.

When I first heard about Alex’s background… and how effective he’s been at picking great stocks… I just assumed that it would cost thousands of dollars per year to get his Communiqué.

But, Alex, I was pleasantly surprised when I saw the retail price to join was only $249 for a year.

That’s less than $1 per day… for the chance to get your research and stock recommendations directly.

That’s laughably cheap.

Look at a member like Pat, who we talked about earlier.

He turned a $150,000 portfolio into $3.5 million – that’s a fully funded retirement – in 10 years following your work.

And all it costs is $249 per year?

Alex, you should be charging a lot more!

ALEX:

Bob, I know that I could charge more, but that’s not interesting to me.

I’m not trying to get rich from this.

I don’t need to. Because I eat my own cooking.

I don’t just tell people to buy great stocks with increasing revenue that are inventing great products… I do it myself!

I bought shares of Apple in 1996 and 1997. I bought Netflix in 2005. And I bought Amazon in 2005.

I still hold every share of those stocks today… they’re up thousands of percentage points each… and they are more than enough to pay for my retirement, my kids’ retirements, and maybe even my future grandkids’ retirements.

I could have personally retired years ago, but I’d rather spend my time showing as many people as I can what it takes to achieve great wealth.

Because it’s truly life-changing.

Financial literacy is really lacking in America.

It’s not taught in schools.

That’s why so many people are playing catch-up in their later years.

I aim to change that.

So I don’t need to, nor do I want to, charge an arm and a leg for my Communiqué.

In fact, I’m doing the opposite today.

New members who join the Communiqué now will be able to get everything we’ve talked about for just $49.

BOB:

Wow. That $200 discount is so generous, Alex.

URGENT:

Action Needed Now

So for everyone watching at home, let me lay out everything you’ll get today.

As a new member of the Communiqué, you’ll get all three reports we’ve discussed.

- “The New King of LNG”

- “The Company Making a Fortune Solving the Food Crisis”

- “The 900-Pound Gorilla Dominating Gene Sequencing”

Plus, you’ll also receive premium access to all Oxford Club Member benefits, including…

- Access to all five of Alex’s model trading portfolios: the Oxford Trading Portfolio, the Gone Fishin’ Portfolio, the Oxford All-Star Portfolio, the Ten-Baggers of Tomorrow Portfolio and the brand-new Fortress Portfolio

- Weekly portfolio updates with key new information regarding Alex’s recommendations

- Oxford Insight emails with behind-the-scenes intelligence from the Oxford Club team, as well as The Oxford Club’s global network of associates

- Special Investor Reports like “The Secrets of the 401(k),” “The Oxford Club Guide to Gold” and “How to Build a Million-Dollar Portfolio From Scratch”

- Password-protected access to the Members-only website, newly redesigned with a more personalized approach for you

- Personal invitations to our five-star Member events in beautiful locations around the world

- Access to our Pillar One Advisors, including experts in collectibles, real estate, tax law, insurance and more.

And you get all of this for less than $0.25 per day!

Not to mention, you get Alex’s full 365-day money-back guarantee.

Folks, there’s a button popping up on your screen right now. All you have to do is click it to take advantage of this incredible offer…

It will take you to a secure order page where you can review everything we’ve talked about.

I can tell you, having looked through the stories from Alex’s members, Communiqué membership is one of the best investments you can make.

So click that button now to get started, and you’ll get access to what Alex has called the most predictable, profitable, income-gushing investment opportunity he’s seen in 40 years.

Alex, is there anything else you’d like to add?

The Most Important Financial Decision You Could Make

ALEX:

Yes, I’d like to remind our audience that there could be a lot more difficulty ahead in the markets.

This energy crisis could be real trouble for the stock market.

It’s not just European stocks that could be hurt.

American stocks could be in real danger.

But I believe the company I’ve found today is a way to make sure your portfolio keeps going up because of the chaos.

Each LNG shipment this company makes could mean $200 million more in profit for them.

They have the contracts locked in for three to 10 years.

Profits are already soaring 2,400%.

The dividend is massive… which could help you defeat inflation.

Best of all… even though this stock is up big this year… it still is absurdly cheap at less than half the valuation of the average S&P 500 stock.

MarketBeat’s price target is now $280 in the next 18 months… and the stock is around $30 today.

That’s nearly a 10X increase.

These opportunities rarely come along… with huge upside, a cheap entry price AND massive income.

It’s moments like these that make all the difference in your future.

So at the very least, I hope everyone watching will sign up and get my new report on this amazing company.

It truly is one of the best I’ve ever seen.

BOB:

I couldn’t agree more.

Okay, everyone, to start your risk-free trial in Alex’s Oxford Communiqué, just click the button below right now.

Or call 866.415.8493 or 443.353.4387 to get started.

Alex, I have to tell you… I’m going to open that report and give it a read myself the moment we’re done here.

I want to thank you so much for being here and giving our audience a chance to make some great money in such a difficult market.

ALEX

It was my pleasure. To everyone watching, welcome to the Communiqué.

Alexander Green

October 2022

© 2022 The Oxford Club, LLC. 105 W. Monument St, Baltimore, MD 21201. Legal Notices: Visit our Disclaimer page to view important information that will help you not only use our research appropriately but also understand the benefits and limitations of our work. You can also view our company's privacy policy and terms and conditions. October 2022.