Table of Contents:

- Introduction

- Who is Eric Fry?

- This “Cluster Effect” Has Sparked At Least Seven Mega-Booms in U.S. History

- When These Superclusters Appear, They Can Make Investors Extremely Rich

- You Simply Can’t Ignore The Billions of Dollars Already Flooding Into This

- You’ve Heard of Moore’s Law… But Have You Heard of Wright’s Law?

- American Building Blocks: Three Resource Plays for The New Revolution

- The New 1,000% Portfolio

- Made in America… Again

- The Purge Portfolio

- Get Full Access to Fry’s Investment Report Now

Brought to you by Investor Place

From “America’s Top Trader” – Brace Yourself For…

“The Revenge of the Heartland”

America’s surprising new “Epicenter of Wealth” could create a whole new class of American millionaires… even as millions more face shock and ruin…

Hi, I’m Eric Fry.

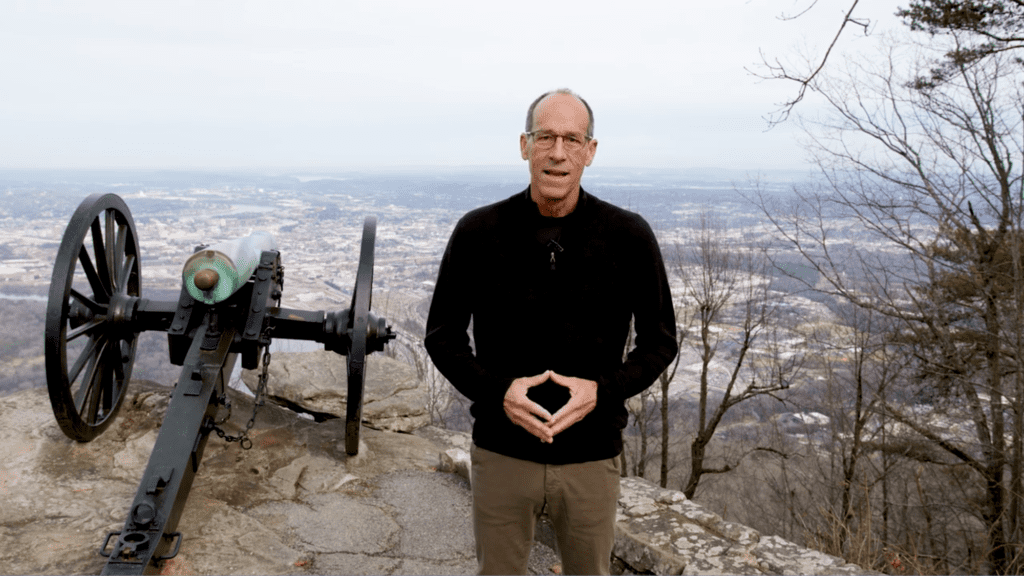

And I’m standing here on top of this mountain…

Because what I’m about to show you, spread out there on the horizon, you see behind me…

Could be ground zero for America’s next great wealth explosion.

Already, the phenomenon that’s happening down there at ground level has one-percenters flocking in from around the country, ready to invest billions of dollars in this incredible phenomenon.

Before they’re done, we could have America’s entire economy remapped……

We could see decades of rapid new growth……

And what’s about to happen could pave the way for thousands of lucky Americans… or even tens of thousands… to join the millionaire class. This phenomenon could even create a few new billionaires.

At the same time, thousands of other middle-class Americas… possibly millions… could also find themselves backed into a corner with no jobs… shrinking nest eggs… and no idea what to do next.

Incredibly, you have a chance right now to choose where you‘ll land.

And over the next few minutes, I'll show you why.

I’ll even give you the name of my #1 stock to own as this powerful megatrend unfolds.

It’s a blockbuster company you may already know.

And I’m convinced it’s the single best way for you to harness the wealth that’s about to pour out of this special new epicenter of American wealth over the months and years ahead.

I’ll give you the ticker symbol and everything right here on camera.

And there’s no catch.

You won’t have to give me your email address or put in your credit card info to get my #1 recommendation. All you need to do is keep watching.

Over the next few minutes, you’ll also hear me reveal details about five more opportunities to make huge profits from this historic phenomenon.

And all five have the potential to show you a 1,000% return or better.

That’s right…

In addition to naming my #1 way to play this megatrend……

I'll also show you five ways you could multiply your initial stake ten times over…

All based on what’s happening right down there at the foot of this mountain.

However, before we get into any of that……

And before I show you what this emerging phenomenon is…

I Should Properly Introduce Myself

Like I said, my name is Eric Fry.

And I want to make this abundantly clear…

When I say, I can show you five little-known stocks that could soar 1,000% or higher…

I’m fully aware of how difficult it is to hit that kind of high-water mark.

Most analysts can go their entire careers without those kinds of returns.

And yet, I’m proud to say I’ve done it 41 times.

I’ve also managed to uncover another 19 investments that have each shot up at least 500%… like Danone, up more than 500%… Shangdong Power, up nearly 700%… Tata Communications, up nearly 800%… and Teck Corp, up more than 900%…

I’ll put that record against anybody else’s on Wall Street.

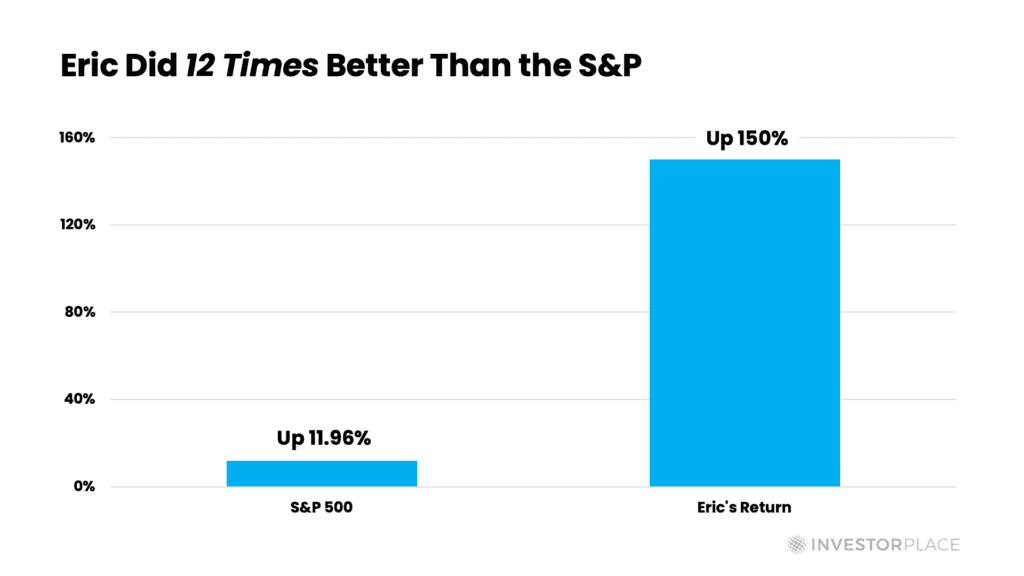

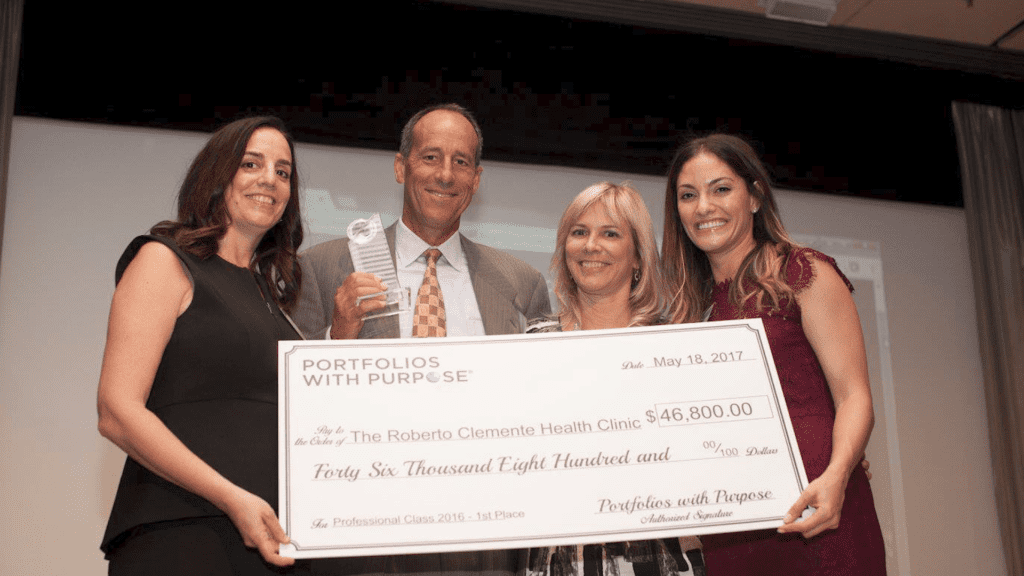

In fact, in 2016, I did just that.

I entered the industry’s most prestigious investment competition… which pitted my recommendations against 650 of the biggest names in the financial business…

Including guys like Bill Ackman, David Einhorn, and Joel Greenblatt…

And I beat all of them with an average annualized return of 150%.

That’s 12 times better than what the S&P did that same year…

As a result, they named me…

“America’s Top Trader”

I can’t deny that I’m proud of that too.

But I’m just as proud of the losses I’ve helped folks avoid.

Like the time in 2000, when I issued a warning about a looming tech stock collapse…

And in 2005, when I predicted on CNBC that the housing market was about to implode…

I also urged folks to dump Fannie Mae and Freddie Mac before they went broke…

I told anybody listening to get out of Cisco before a 75% collapse…

And warned them to dump Flextronics before it dove 71%…

I also warned against a collapse for Providian right before it plunged 91%.

More recently, in late 2021…

I urged folks to cash out of the Ark Innovation ETF , run by the famous go-go portfolio manager Cathy Wood.

The stock has tumbled 69% since then.

I even warned folks to sell Tesla, which has dropped more than 50% since that warning .

In all, I’ve helped to alert investors ahead of crashes for 73 different stocks.

I’m telling you that because I want you to know that I’ve been there.

I’ve analyzed markets now for over 30 years…

I also spent more than a decade as a professional portfolio manager… another few years heading up a research organization with Wall Street legend Jim Grant… and another decade working alongside a billionaire investor.

I’ve studied and tracked just about every kind of market and opportunity you can imagine.

And I’ve been asked to share those insights in Time Magazine , Barron’s, The Wall Street Journal, BusinessWeek, USA Today, the Los Angeles Times, Money magazine, and many others.

I don’t make the kinds of claims I’m about to share with you lightly.

Because, believe me, I know how hard it’s been for you over these rocky times.

And yet, as you're about to see…

I have reasons to believe that you'll soon have another chance to make money right here in America.

Potentially, a lot of money.

With an opportunity so big … and with so much momentum… you could see it play out profitably, not just for a few months… or a year… but for many, many years or even decades to come.

In fact, I don't just believe it…

I'm absolutely confident about this.

What makes me so sure?

Well, for one thing…

This Has Happened At Least Seven Times In U.S. History

A second ago, I promised to give you my #1 recommendation, ticker symbol, and all.

We’ll do that in a moment.

I also promised to give you details about five more ways you could make up to 1,000% returns.

We’ll get to those details too.

I’ll tell you more about this special location we're visiting today…

And you’ll see why what’s happening here isn’t just about my #1 top stock…

Or even the five smart investments that could grow your wealth by ten times or more…

Rather it's about something much bigger.

Something so big, it has the potential to transcend politics… transform the American economy… and even rewrite the course of American history… just like we’ve seen happen at least seven times before.

Before we get into that, , I also need to give you a warning.

Because you see, monumental events like the one we’re about to explore are rarely all upside.

They’re so disruptive they can also come with a cost.

And the transformational shift that’s taking shape right now is no different.

On the one hand, it could help a lot of Americans get substantially richer.

If you get in early enough, it could provide you with not just one opportunity… or five…… but dozens of chances to build your wealth over the years and even decades ahead.

What you’ll see here is just the beginning.…

We could see a whole new class of millionaires emerge from this.

Even billionaires.

On the other hand, what’s coming is so potentially disruptive and such a threat to our status quo it could also leave millions of other Americans behind, especially in our hard-hit middle class.

As this shift takes hold, you could see millions of jobs disappear from one of America’s most iconic industries.

You could see skills that were perfected over decades become obsolete.

You could also see a few conventional, long-trusted investments tank, never to recover.

In short, this transformative event, which is already taking shape right now in the location I’m showing you today… could actually deepen the stark American divide.

Not just politically but economically.

In fact, we should talk about that for a second.

Because you see, when it comes to America’s Great Divide…

I’ve done a lot of observing over the last 30 years as an analyst.

And you know what?

Both Sides Have Got It All Wrong!

I’ve had the chance to meet all kinds of people across America.

I’ve traveled in Red States and Blue States.

And I’ve made friends with both Republicans and Democrats.

I know lots of people who've made fortunes.

And lots of people who live from paycheck-to-paycheck.

On the coasts, for instance, I’ve spent a lot of time in the “Super ZIPs.”

That’s what The Washington Post calls those neighborhoods where folks live in walled-off mansions… drive Teslas and BMWs… and do most of their daily shopping in high-end organic supermarkets.

In fact, not so long ago, I did an exposé about a place called Atherton…

Maybe you’ve heard of it. It’s the wealthy enclave that sits on the outskirts of Silicon Valley.

Some of the homes there go for $30 million. And the biggest struggle some of those families have is whether to get their 8-year-old the newest iPhone.

Meanwhile, I’ve also been through the neighborhoods on the other side of the tracks, just a few miles from Atherton.

Instead of mansions, you see rows of dinged-up trailers… homeless encampments… and parents who work two or three jobs just to get food on the table or try to keep up with the rent.

The income crisis is real, and it’s just completely misunderstood.

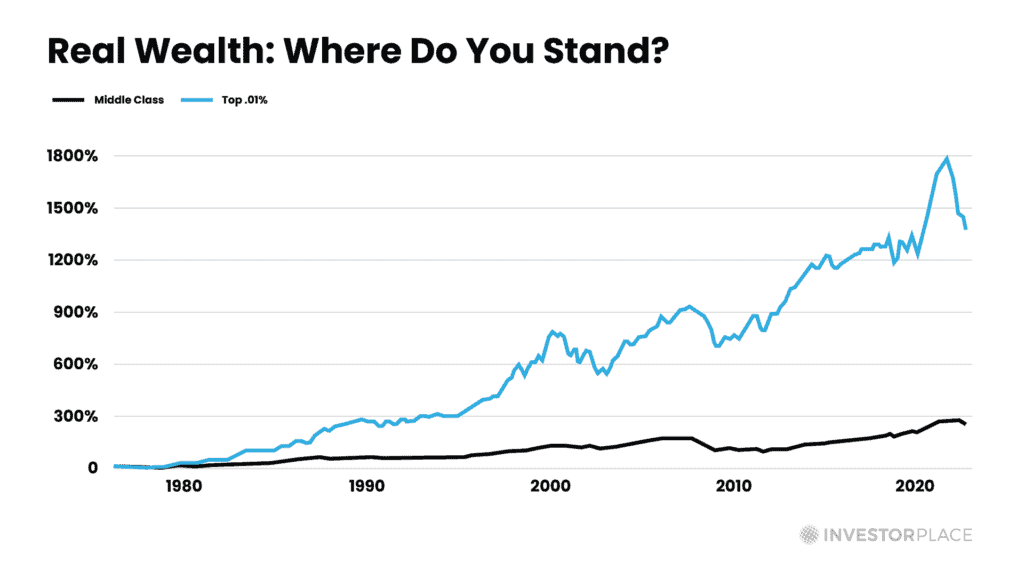

For instance, did you know that – according to CNBC – America’s top 10% now own nearly 90% of the U.S. stock market? And that our richest 1% have more wealth than our entire middle class?

Meanwhile, more than a quarter of regular Americans have zero retirement savings…

Almost half say they also lose sleep worrying about retirement…

And almost 60% say they’re barely scraping by…

Even where I live…

I’ve watched the homeless population soar.

I’ve even gotten to know some of them on a first-name basis.

And, while their stories are heartbreaking, what really shocks me is how institutionalized it all is.

These guys all have food stamps. They have cellphones and Medicaid.

But they still sleep in the streets every night.

It’s just shocking to me that here we are…

Living in the greatest country on Earth…

And with the keys to the most powerful financial engine in history…

Yet a huge number of Americans are either flat-broke or headed in that direction.

And they’ve got no clue what to do about it.

But again…

The reason this keeps happening is because so few actually understand why it happens.

Folks on the left think it’s the result of capitalism’s failures.

They argue for socialist solutions like higher minimum wage, Universal Basic Income, much higher taxes, and healthcare for all…

Meanwhile, many folks on the right point to excessive regulation, misguided subsidies, and punitive taxes, which they argue hobble economic growth.

But, I'm sorry, the truth is…

None Of That Gets To The Root Of America’s Problems

We don’t need socialism.

We don’t need billion-dollar reelection campaigns.

We certainly don’t need more political infighting.

What America really needs to get back on top is much simpler.

Because it's an economic solution.

Specifically, what most of us need is simply a greater fundamental understanding of how our economy actually functions.

You see when America really takes a great leap forward…

Which it’s done many times in the past…

It’s always come down to three simple factors.

Namely, what the real opportunities are…

Who’s investing in those opportunities…

And most importantly…

Where those opportunities can be found.

That’s exactly why I’ve hopped on a plane to fly 1,900 miles to this location…

Because I firmly believe this place you’re about to see – here in the American Heartland — is a potential “ground zero” for America’s next great economic renaissance.

The rich know it.

Some of our biggest cash-rich corporations know it.

And, as you’ll see, some of our biggest financial institutions know it too.

Because, at some level, they all understand one basic truth about getting rich that many other Americans do not.

Which is that the only REAL way to build wealth in our country is… and has always been… to be in the right place at the right time.

And with cash in hand, ready to claim a stake.

It's really that simple.

And that’s exactly the opportunity I see unfolding now.

Today, I want to show you how to be on the right side of it…

So… What Exactly IS Going On?

Before I pull back the curtain, there’s one more key wealth-building phenomenon you need to understand.

It’s called the “Cluster Effect.”

In a nutshell, the “Cluster Effect” is a term economists use to describe not just why booms happen…

But where they’ll happen…

And why, once they gain momentum… those booms can have an accelerated, even exponential, impact when it comes to building wealth.

It’s called a “cluster” event because, more often than not, those booms happen when a handful of related businesses “cluster” in one location.

Pretty soon, they start building a network between them.

That network attracts expertise…

Which breeds innovation…

Which, in turn, attracts money…

Which attracts more talent and breeds more innovation…

And pretty soon, you’ve got a mega-boom on your hands.

Each time these “clusters”… or in the best cases, “superclusters”… emerge, they can force huge technological changes… and even social changes…

That can spread across the entire American economy, even well beyond where those superclusters of innovation first originated.

And that's the thing.

See, America’s “supercluster” booms have also created huge financial opportunities that spread far beyond their humble beginnings.

In the past, these American booms have minted an incredible number of local millionaires…. and quite a few billionaires…

But they’ve ultimately expanded and created new paths to riches for other investors too. Including investors far from where the supercluster first began.

At the same time, “supercluster” booms can be incredibly disruptive. While some get extremely rich, others can get left behind.

With this next boom, the one I’m about to show you, it's no different.

You could land on the right side of it and build wealth.

Or you could get trapped on the wrong side and get shut out.

So…where would you rather land?

I can't decide that for you.

All I can do from this side of the camera is give you the evidence.

And then, you'll have to decide for yourself.

Which evidence?

Like I said earlier…

This “Cluster Effect” Has Sparked At Least Seven Mega-Booms in U.S. History

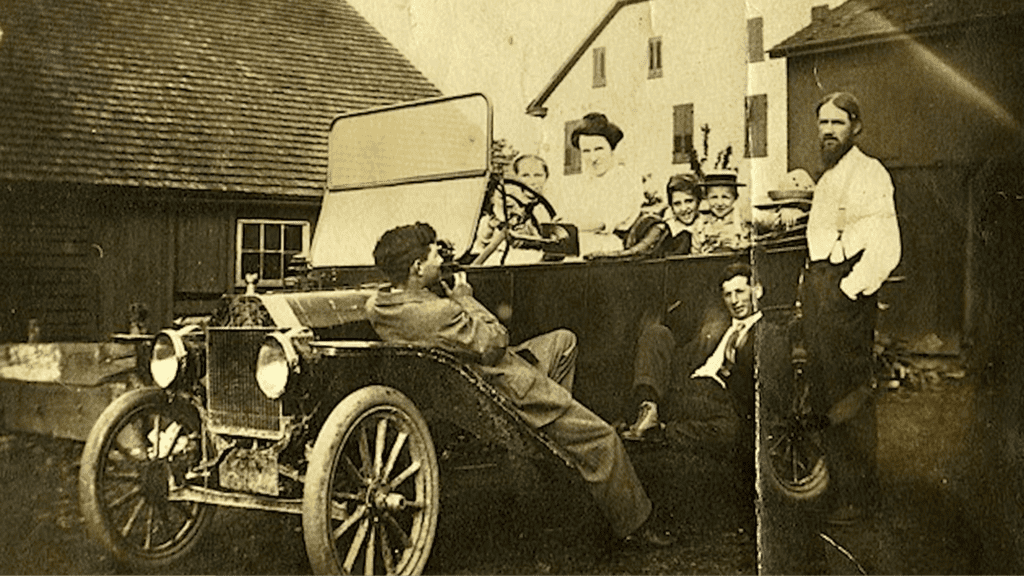

For instance, take what happened in Detroit during the early 1900s…

Keep in mind, long before Henry Ford kickstarted the automotive age… Detroit was little more than a French fur-trading post. After that, it was a tiny town surrounded by Michigan farmland.

But all that changed when the first Model T rolled off the assembly line…

The car caught on…

Money started pouring in…

And so did other car companies…

General Motors… Chrysler… Packard…

In fact, at one point, you could have found over 125 auto companies that called Detroit their headquarters. Not only did it become America’s richest city, but it was also the car capital of the entire world.

Had you lived back then, you could have strolled down streets lined with ornate theaters and opera houses, fancy office buildings, and luxury mansions.

Folks called it the “Paris of the Midwest.”

Henry Ford became so rich he was worth over $200 billion in today’s dollars. That's more wealth than Warren Buffet, Bill Gates, or Jeff Bezos by comparison.

In fact, when Ford Motor Co. went public in 1956, it had the biggest IPO in history.

And it wasn’t JUST the car industry that underwent revolutionary change.

The automotive boom remapped America’s highways.

And it paved the way for countless gas stations… diners… shopping malls, even suburbs…

In fact, the way cars changed our country practically defines how we live today.

Yet, who do you think saw it coming?

Just a few.

But those who did also flocked to where the action was happening… and some of them became extremely rich.

Or take another perfect example of a great American “supercluster” boom…

Before Pittsburgh was the steelmaker for the world, it was Fort Pitt…

A British stronghold during the French and Indian War.

I’ll bet you, not a soul alive back then imagined that, for nearly 100 years, Pittsburgh would make the steel that gave us railroads, skyscrapers, and the weapons that helped us win both world wars.

At its peak, Pittsburgh had more millionaires than New York City.

And out in the nearby suburbs, you’ll still find a street called “Millionaire’s Row,”… which was once lined with the mansions of tycoons like Mellon, Westinghouse, Heinz, and Frick.

Yet again, it was hard for most people…

Even the families who lived there…

To see it coming.

But Pittsburgh didn’t just change Pittsburgh, it transformed America.

And then, you’ve got Houston…

Houston was once just a muddy port town plagued by yellow fever.

Then, in 1901 a Texas drilling rig broke through into a massive oil deposit on Spindletop Hill… and sent a gusher of crude soaring 150 feet into the air.

In Texas terms, Houston was not too far down the highway from Spindletop. And it had a deep seaport which made it perfect for shipping all that new oil.

Soon, Houston was thriving.

It became a beacon for the rest of the world. Rigs went up. So did refineries.

And investors poured in with capital, looking to make their fortunes.

One of the richest was oil baron H.L. Hunt…

At one point, it's said he had four times as much money as the Rockefellers… and nine times more money than all the U.S. presidents put together, from George Washington to Gerald Ford.

Some say that right before he died, he was the richest man on Earth.

Today, Houston is home to over 600 energy exploration and production companies… 1,100 oilfield service companies… and over 180 pipeline companies.

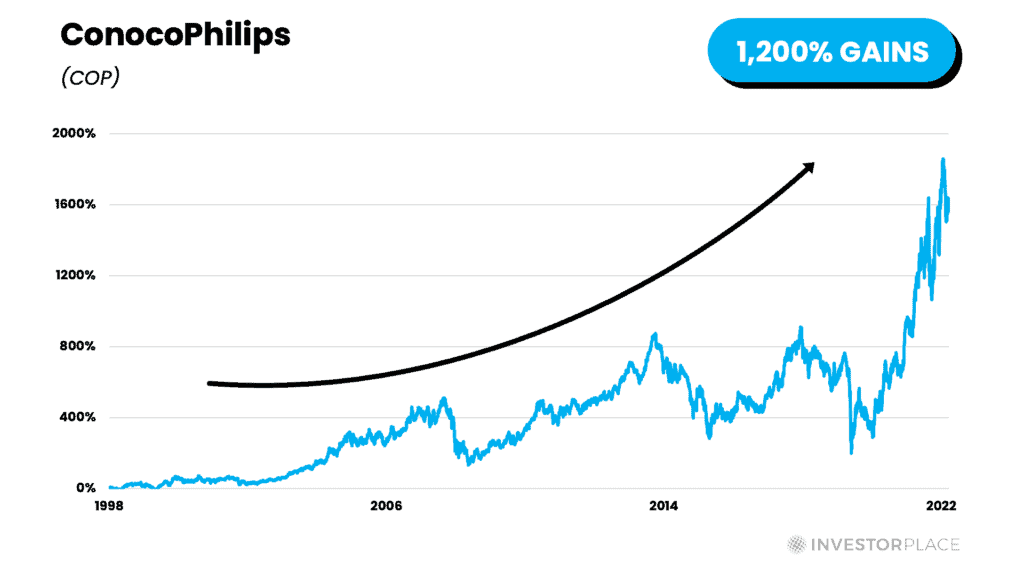

ConocoPhillips is just one of the oil giants with headquarters in Houston. Had you bought shares in that company when it IPO’d back in 1998, today you’d be up more than 1,200% today…

That's nearly double the gain the S&P 500 has produced since then.

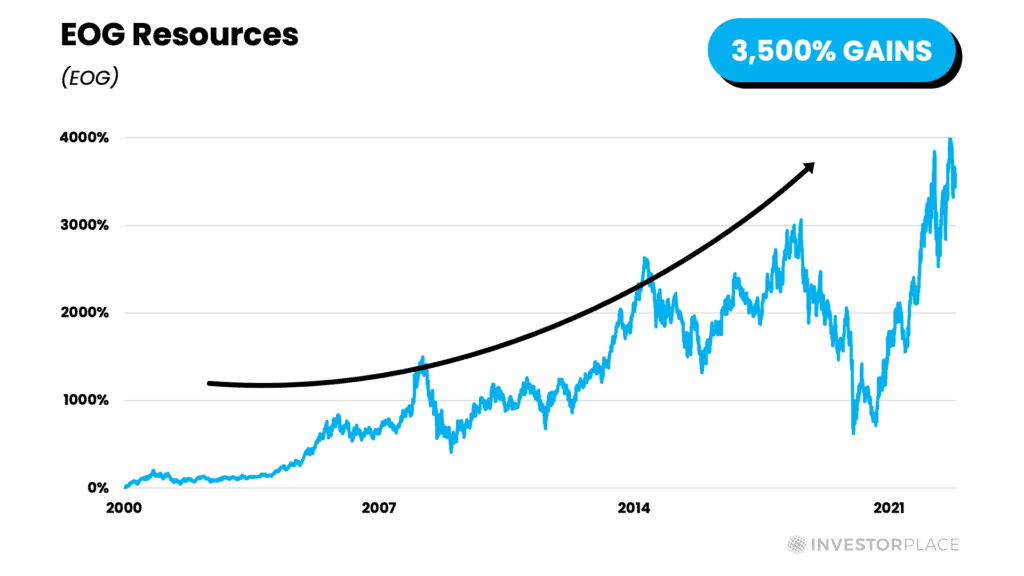

Or how about another Houston company, EOG Resources? Over the last two decades, you could have watched it climb by more than 3,500%…

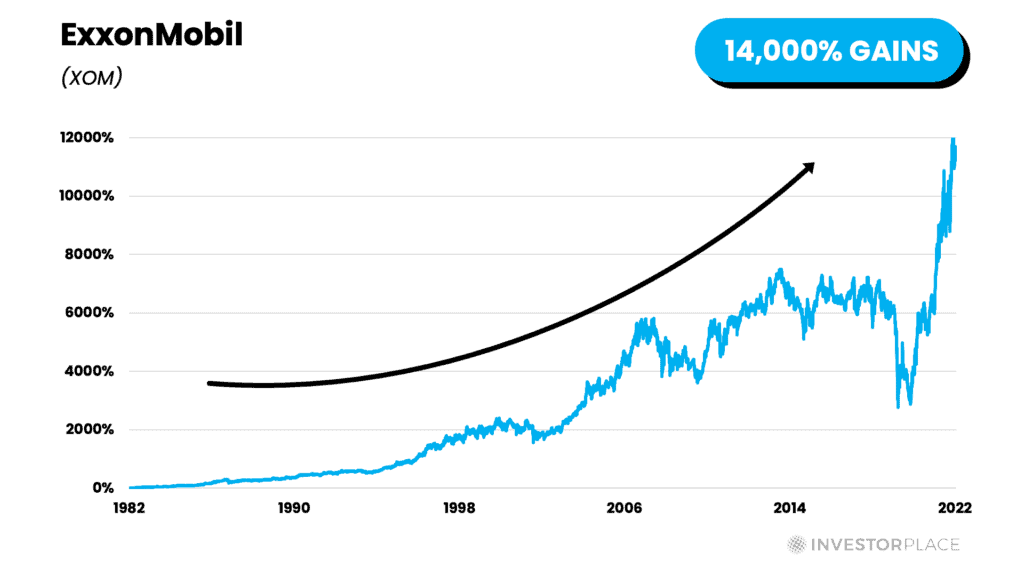

And ExxonMobil?

Over the last 40 years, its stock has skyrocketed an astounding 14,000%.

See what I’m getting at?

And yet again, it’s not just one industry.

With the “cluster effect,” opportunity spreads. For Houston, it paved the way for high-tech companies, engineering firms, healthcare, software, and financial firms… even NASA.

Meanwhile, up north, look at what happened in Boston…

In the square miles surrounding Harvard and MIT, you’ll find over 1,000 biopharmaceutical firms that call the Boston area home.

Some are tiny, others are giants.

And many could have made you richer.

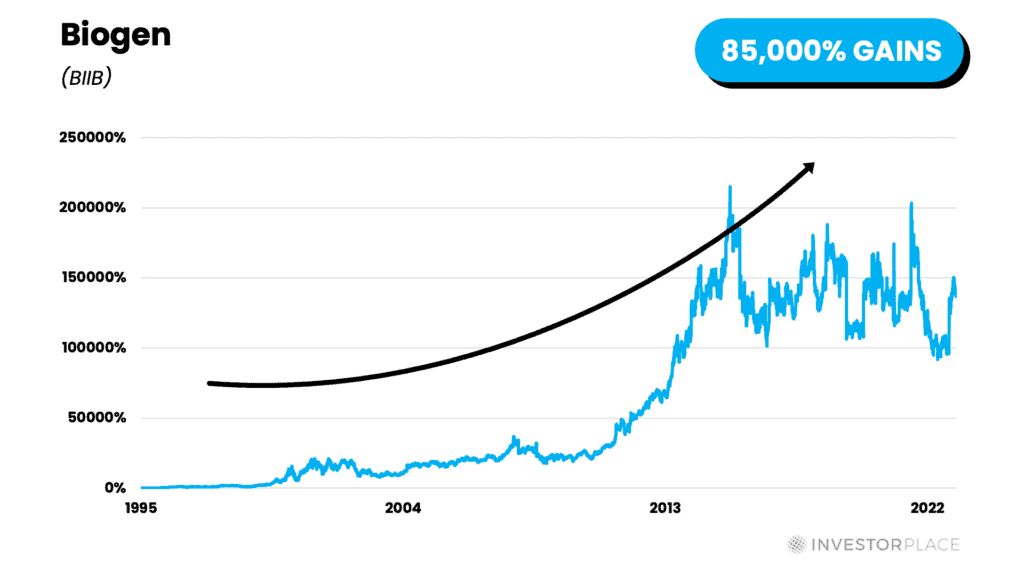

Take Biogen.

The shares of this leading biotech company have jumped – are you ready for this – more than 85,000% since the early 1990s.

To put that number in perspective, a $10,000 investment in Biogen at the end of 1994 would be worth $8.5 million today.

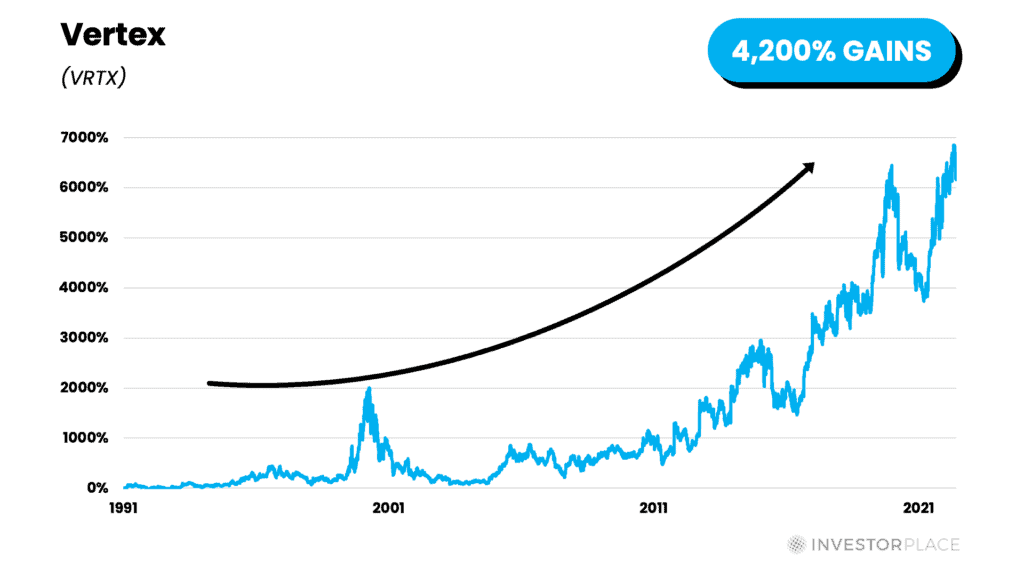

Boston’s Vertex IPO’d in 1991 and has shot up nearly 4,200% since then…

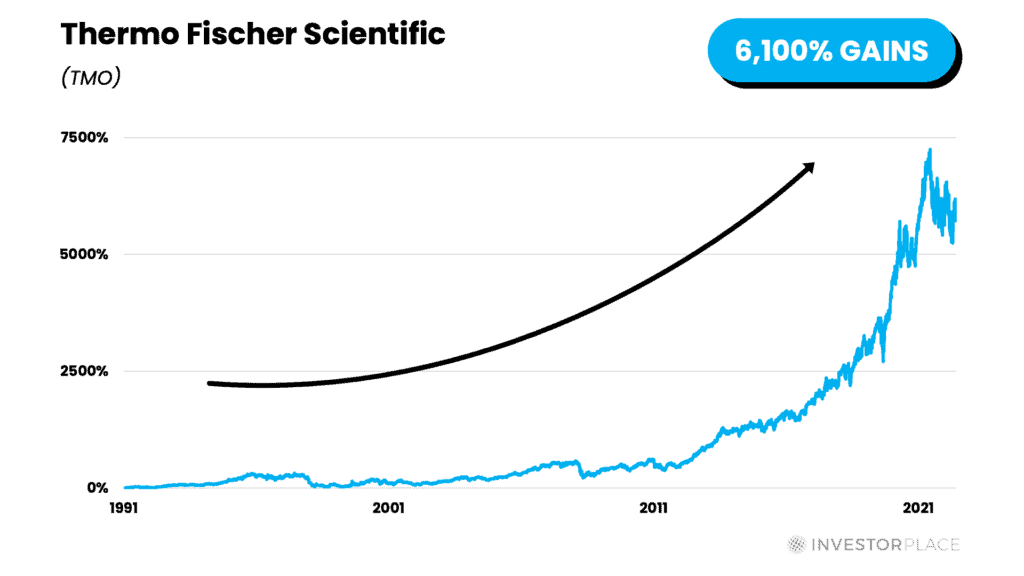

Thermo Fischer Scientific, from nearby Waltham, Massachusetts, is up 6,100% over the same timeframe…

And how about out in California?

Before Silicon Valley became the tech mecca of the world, it was open land filled with fruit orchards.

But fast-forward past a few legendary garage-based startups, and today you'll find that Silicon Valley and the Bay Area are home to at least 30 of the world’s biggest tech firms… plus another 40,000 newer launches… and a staggering pile of wealth.

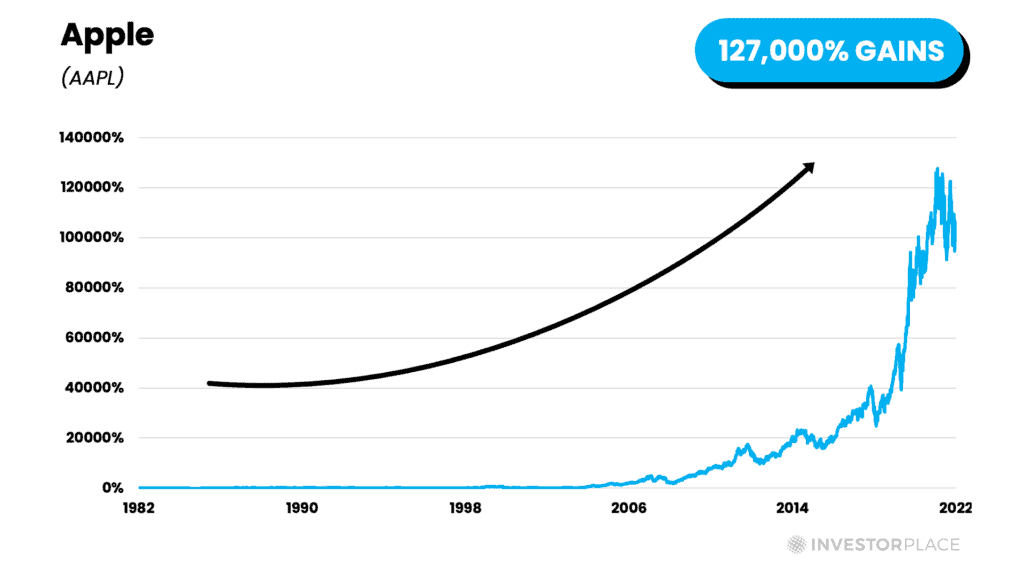

Among them, very few tech stocks have soared more than Apple, which has gained an astronomical 133,000% over the last four decades…

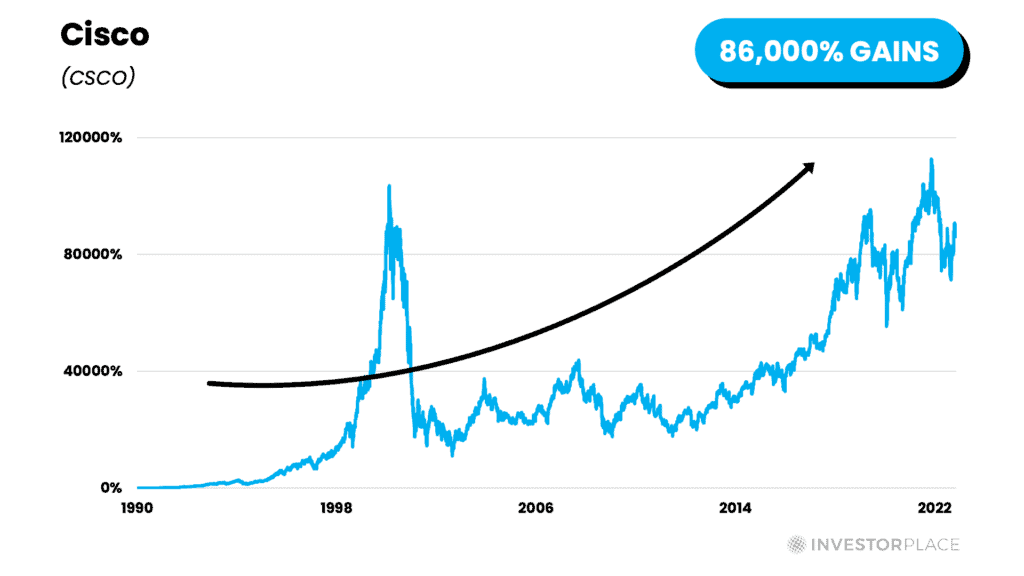

Meanwhile, Cisco has shot up 86,000%…

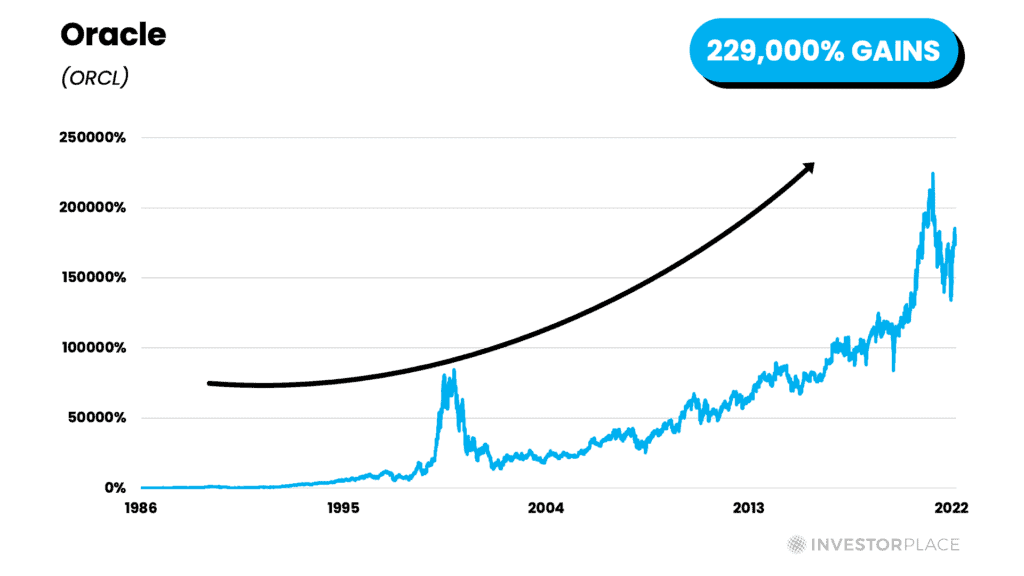

And Oracle is up nearly 229,000%…

Now keep in mind these are some of the market’s best-performing examples. Nothing is ever guaranteed in the market.

However, you see my point.

When one of these “supercluster” regions emerges, it can become a spectacular force that sends wealth flowing outward in all directions.

And it can continuously create new opportunities… in ways nobody imagines… for years or even decades to come.

Even during wartime, recessions, market crashes, and worse.

Consider, for instance, how Silicon Valley didn’t just make fortunes for a few computer geeks. For better or worse, it also led to the transformative power of the iPhone… which unleashed Uber, Airbnb, and an app market worth $6.3 trillion worldwide.

Meanwhile, in Los Angeles…

Not so far from where I live most of the year…

You’ve got the “cluster effect” in full swing, centered around Hollywood.

From way back before the Golden Age of Pictures until now…

We went from sputtering, black-and-white, silent movies… to “talkies”… to billion-dollar blockbusters… and multibillion-dollar movie franchises, some of which can span for 15 or 20 sequels that get distributed worldwide.

Every step of the way, Hollywood created widespread prosperity and enormous fortunes. For proof, simply stay in your seat sometime and watch the full credits scroll at the end of a movie. It’s staggering how many people get paid to make a two-hour piece of entertainment.

And, of course, there’s Wall Street itself…

It’s just eight city blocks long.

And yet, it’s possibly the best example of the “cluster effect” you’ll ever come across.

In the blocks surrounding Wall Street’s trading floor, you’ll find an incredible number of banks and brokers, financial advisory firms… even a branch of the Federal Reserve

Thanks to Wall Street, millions of companies have money to grow, innovate, and rebuild. And millions of Americans have a place to park their retirement accounts.

It’s also a big reason why New York is the richest city on Earth.

In fact, since just the start of the pandemic alone, Wall Street has “minted” 56 new billionaires.

Love it or hate it, the “Street” is now the gateway to capital for tens of thousands of American businesses and the bellwether for the world economy.

The bottom line is…

When These Superclusters Appear, They Can Make Investors Extremely Rich

This “supercluster” phenomenon isn’t a fluke.

It's baked into the American economic cycle.

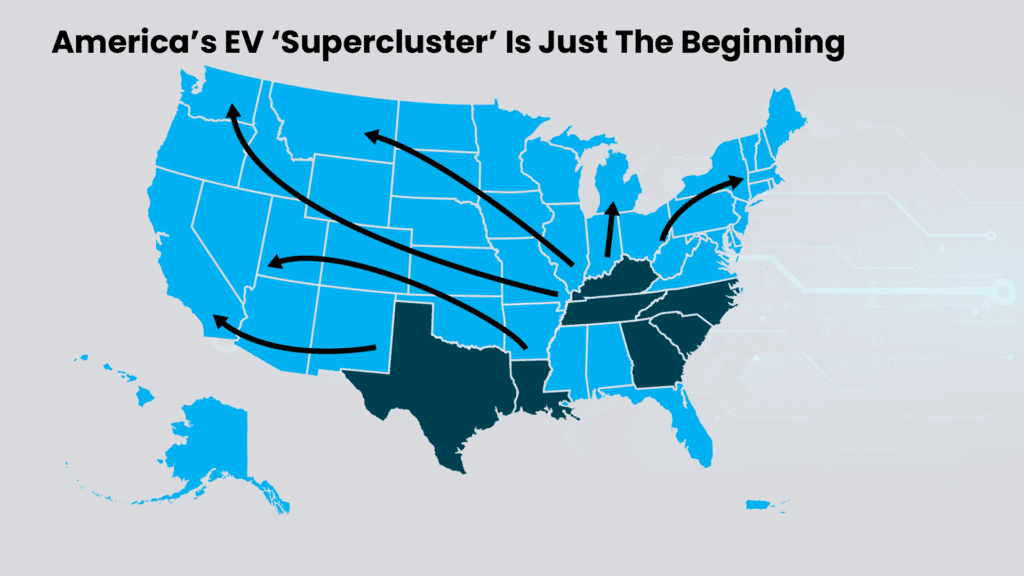

And a brand-new “supercluster” is taking shape.

Only this time, it’s happening in a place that will take a lot of folks by complete surprise. Especially our global elites.

How so?

Take a look at this map…

As you can see, up until very recently, America’s richest zip codes…

That is, our largest “clusters” of wealth…

Have emerged almost entirely on our East and West Coasts.

But that’s what I'm predicting is about to change.

This next new epicenter I want to tell you about is nowhere near Manhattan.

And nowhere near Silicon Valley, either.

Instead, the multiyear mega-boom that could save America is emerging right here… in the American Heartland…

Right down there, in the shadow of what’s called Lookout Mountain.

In other words, investors better buckle their seat belts.

Because…

The “Tale of Two Americas” Is About To Take A Shocking Turn

By now, I hope I've made this point crystal clear.

There’s one big reason there’s a great divide in our country…

It has nothing to do with our political differences, our education gap, or our income gap, as you've been told to believe.

Instead, it comes down to fundamental economics.

And, as you've just seen… geography.

Think about it…

On the one hand, you’ve got the one-percenters. Sure, some of them were born to money. But a large number are self-made millionaires.

And the reason they're rich is not just because they've figured out how to make money… but because they've figured out where to make it.

It’s just like the bank robber Willie Sutton used to say, “You have to go where the money is.”

Or better yet, it’s like the advice from the great hockey player Wayne Gretzky, who used to say that you have to “skate to where the puck is going to be.” Otherwise, you’ll be too late and miss it completely.

That's just as true in business.

More often than not, rich Americans have simply figured out where to go to find the next opportunity. When they get there, they invest hand over fist.

On the flip side, you’ve got parts of America that struggle to survive. And often, it’s because they’re trapped where the money isn’t.

Unfortunately, there’s not much you or I can do about that.

What I can do though, is show you where the smart money is going next…

Which Is Exactly What I Plan To Do For You Today

As promised, we’ll start with my #1 recommendation for this coming boom.

I’ll also give you details on five more moves, each with 10X potential.

But first, there’s just one more warningI need to give you.

And it’s a big one.

You see…

Many Americans will have a tough time accepting what I’m about to show you. They won’t understand it or believe it. They might even feel threatened by it.

Frankly, it’s not my job to change their minds.

And honestly, I don’t know that I could if I tried.

All I can do here is give you the evidence, then you can decide for yourself.

Just keep in mind, as off-radar as this emerging opportunity might still be… it’s not invisible.

Rich investors, massive cash-rich companies, and even some of the biggest financial institutions are already starting to pay attention to this shift…

Even now…

Even in this volatile market.

As you watch this, deals are getting made…

Production facilities are cutting ribbons…

And related startups are appearing like blips on the fringes.

In fact, according to the investment firm Wedbush Securities, one of America’s largest industries could soon invest more than half a trillion dollars in the underlying megatrend driving this boom.

Meanwhile, more than 220 different institutional investors… with over $60 trillion under management… have signaled they're ready to get on board…

Including heavy hitters like Bain Capital, Morgan Stanley, and Berkshire Partners… also Blackstone, Blackrock, and Vanguard…

Meanwhile, as you'll see, companies like Amazon, American Airlines, Siemens, T-Mobile, Verizon, Ford, GM, AT&T, and many more have also announced plans to make huge investments that could ramp up demand…

Even Congress is jumping on the bandwagon.

They've already passed a bi-partisan law that could soon start funneling hundreds of billions of dollars toward this same emerging supercluster of companies.

My point is…

This Is Real. And It’s Coming.

You don’t have a lot of time to deliberate over this.

The longer you wait to act on what you’re about to see, the less money you could make. And the more you’ll risk falling even further behind.

That’s why I’m here on camera right now.

It’s why I’ve traveled with a film crew to this crucial location. And it’s why I’m about to simply give you my #1 recommendation, ticker symbol, and all.

Because I want you to fully understand how seriously I’m taking this.

What you’re about to see isn’t just the story of one great stock opportunity……

Or even a handful of stocks……

This is about a moment in history…… a movement…… one that could once again transform our entire economy.

Some people could get rich.

Others will be left behind.

You have a chance right now to decide where you’ll land.

But I’ve made you wait long enough.

Let’s pull back the curtain and show you what I found…

From Where I Stand, I Can See America 2.0

On Lookout Mountain in the 1700s, Native Americans waged the “Last Battle of the Cherokees”…

During the Civil War, it’s where Confederates set up cannons to rain down fire on the Union Army…

And later, where Union soldiers seized control in the “Battle Above the Clouds”…

Today, when you look in any direction, you’re gazing down at the future of American innovation. Not to mention a huge opportunity for investors.

Why?

Because spread out on this horizon, you’re looking at America’s new technological heartland. And I’m not talking about Silicon Valley.

Instead, I’m talking about the seven U.S. states you can see from this mountain…

Tennessee… Kentucky… Virginia… Georgia… Alabama… and both Carolinas…

Because in each of these states – especially in Kentucky and Tennessee – there’s a new economic “supercluster” of innovation and investment taking shape .

In fact, in the 300 square miles surrounding this mountain…

You’ll find no fewer than 28 different companies, each dedicated to building out the future for electric vehicles and the batteries that power them.

Collectively, they're investing billions of dollars in kickstarting a new era of American ingenuity and prosperity – something I call “Made in America, 2.0.”

Now, right off the bat, I know what you’re thinking.

“EVs are still a fraction of the car market…”

“They’re expensive…”

“They take too long to charge and can’t go far…”

And you’d be right on every count.

Honestly, even though The New York Times just ran a feature story titled…

And even though, in that article…

They showed how, in 2022, high gas prices helped double EVs' share of new car sales…

How battery-powered cars now make up the fastest-growing segment of the auto market…

And how it’s no longer just the rich who are snapping up battery-powered cars…

I still wouldn’t blame you if you had doubts. Lots of people do. In some ways, I still do.

In fact, I wouldn’t be the least bit surprised if some “expert” were to go on TV tomorrow and give us a dozen reasons why the EV boom ISN’T going to happen tomorrow.

Because that’s how every revolution begins.

Just like the time an MIT engineer said – in 1977 – that “nobody would want a computer in their home”…

Or when – in 2007 – Microsoft head Steve Ballmer laughed at the release of the iPhone…

Or way back in 1962, when Decca Records refused to sign the Beatles because “guitar groups are on their way out…”

And yet…

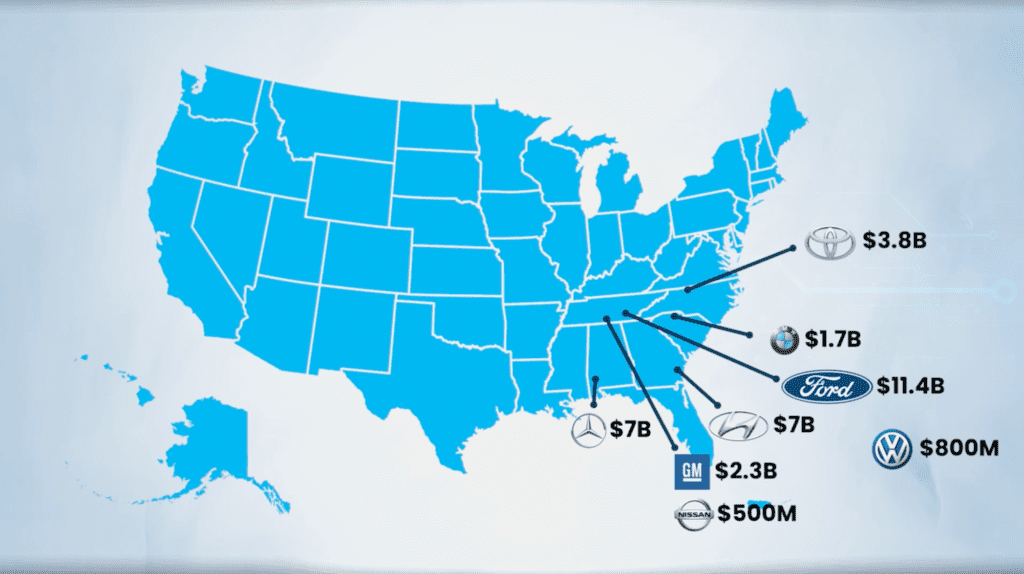

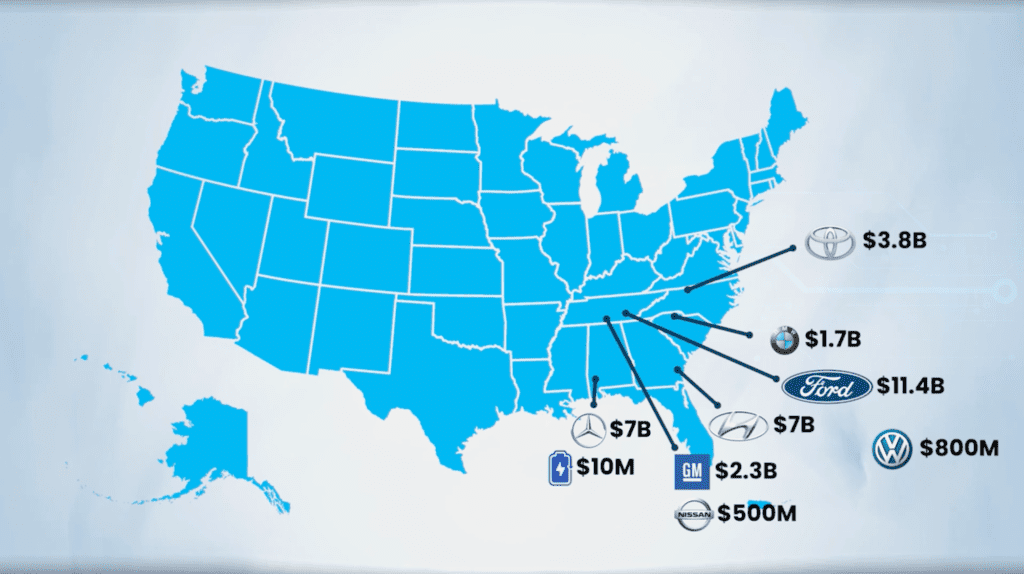

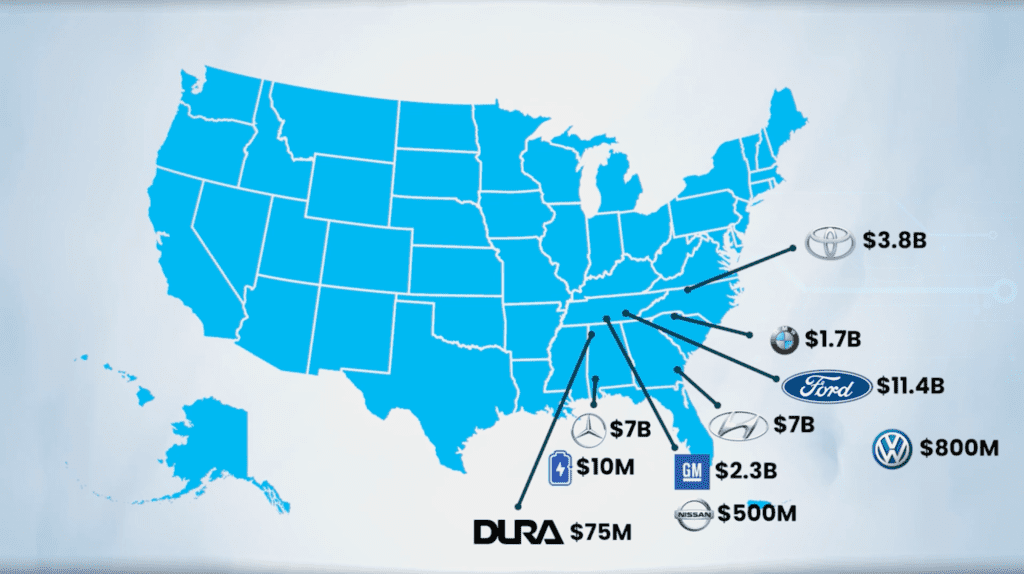

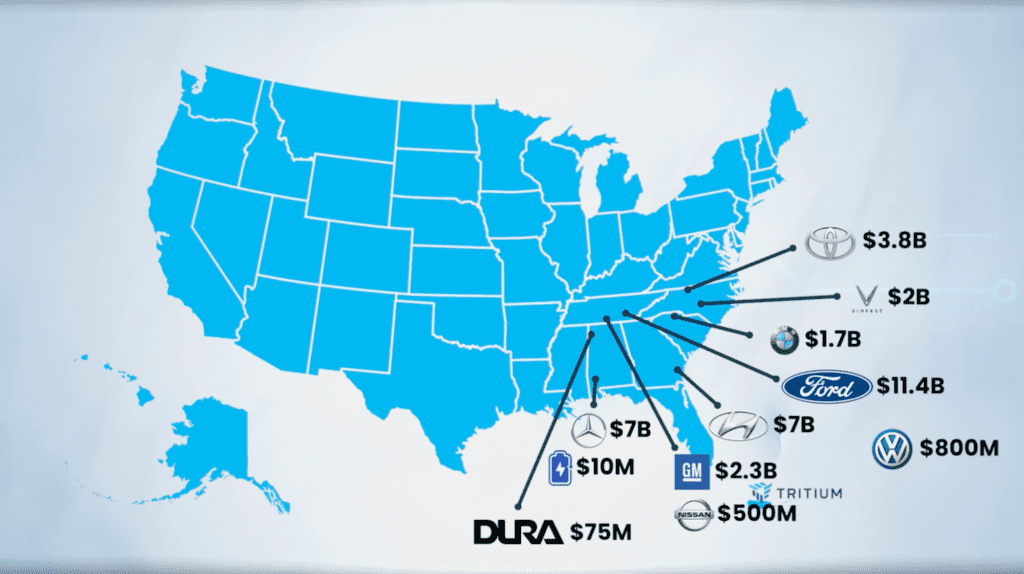

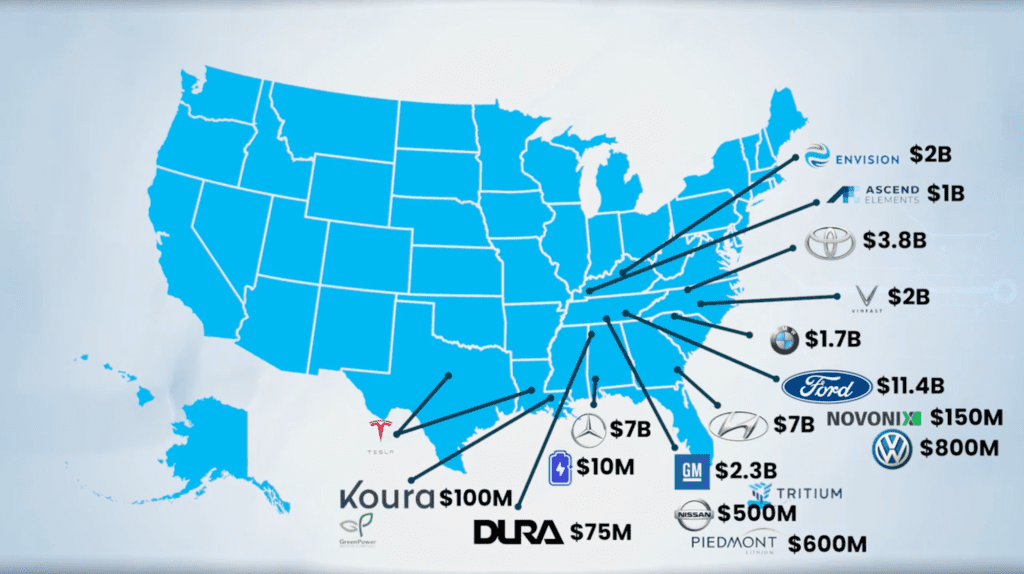

You Simply Can’t Ignore The Billions of Dollars Already Flooding Into This

Check this out…

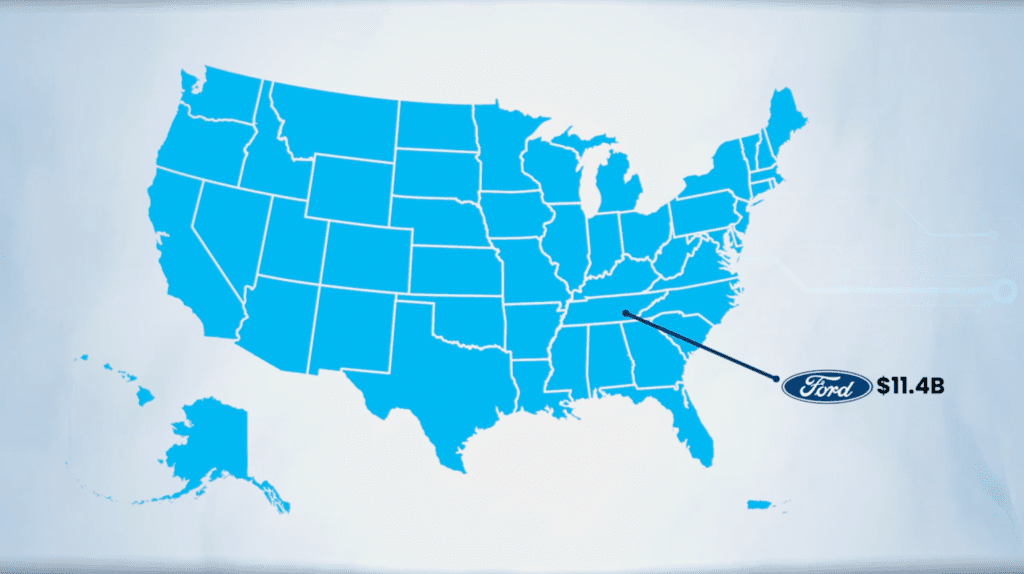

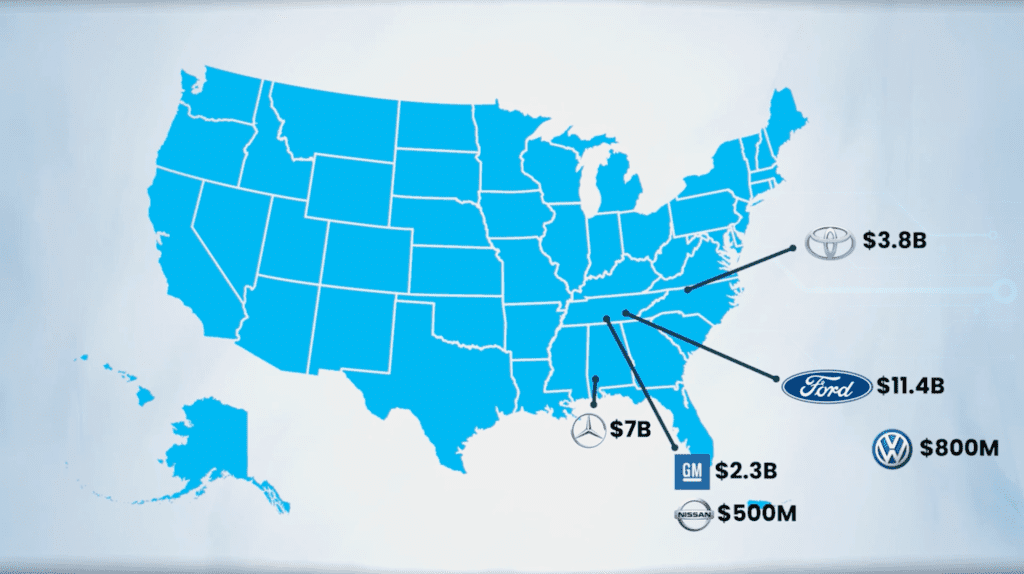

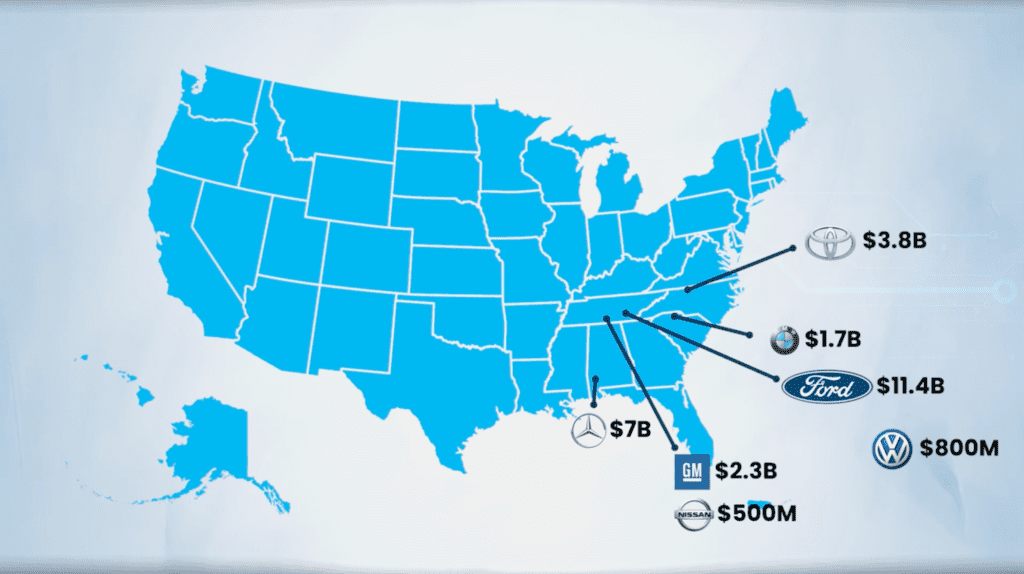

Ford Motor Co. recently inked a deal to spend $11.4 billion to build four EV sites in Kentucky and Tennessee, including a site called Blue Oval City… Ford’s first all-new production plant since 1969.

General Motors has linked up with LG Energy Solutions to build a massive EV battery plant in Spring Hill, Tennessee. At the same site, GM has also launched production on the all-electric Cadillac Lyriq.

In fact, the automaker says that by 2035, it doesn’t plan to sell anything but electric cars. And it plans to make a lot of them – along with the batteries to power them – right here in Tennessee.

Meanwhile, Nissan has built an EV battery plant in Smyrna, Tennessee… Mercedes has opened an EV battery plant in Woodstock, Alabama… and Volkswagen’s first American-made EVs are just starting to roll out of its plant in Chattanooga, Tennessee…

Toyota is about to spend $3.8 billion on an EV battery plant in Greensboro, North Carolina…

BMW is about to spend $1.7 billion on an EV and battery plant in Greer, South Carolina…

And Hyundai just broke ground on a $5.5 billion EV plant in Ellabell, Georgia.

And those are just the companies you’ve heard of.

Li-Cycle Holdings is gearing up to build an EV battery recycling plant in Tuscaloosa, Alabama…

Dura Automotive just opened an EV battery component plant in Muscle Shoals, Alabama…

The Tritium EV charging company is building its first U.S. plant in Lebanon, Tennessee…

A firm called VinFast is building an EV and battery plant in Chatham County, North Carolina…

Ascend Elements is building a $1-billion battery plant in Hopkinsville, Kentucky…

And the list just keeps going…

Piedmont Lithium… Novonix… Koura… Envision AESC… GreenPower…

And yes, even Tesla is deciding right now whether to build a new lithium production facility in nearby Texas or Louisiana.

There are no two ways about it…

This Is A Gold Rush, Folks

This means tens of thousands or even hundreds of thousands of new jobs.

It means a flood of talent and innovation into the region.

One industry research group tallied up $128 billion in new investment just for EV companies, battery companies, and battery recyclers.

But it’s more than that.

I’m convinced this “supercluster” of companies that’s forming in front of our eyes…

It’s also the birthplace of a whole new American Revolution….

A revolution that will revitalize not just these seven states but could revitalize the entire American economic engine.

It could write our next chapter of success stories.

And it could drive American innovation for decades to come.

You see, EVs are just the beginning of this opportunity.

Because building EVs on a scale where they can be practical and affordable for a mass market… which is exactly where all of this is headed… will require innovations in countless technologies that can be used in many other fields.

Computer vision, advanced battery chemistries and miniaturization, next-generation semiconductors, smart power grids , mass-energy storage technology, LiDAR sensors… and 5G-enabled everything.

The explosive new EV supply chain will give birth to dozens of technological marvels. And those marvels will inevitably forge pathways for other radical changes and breakthroughs, even in markets we have yet to imagine.

Because this is how innovation works…

As adoption rates go up… and investment grows… the sheer number of innovative breakthroughs starts to compound and accelerate… even in related industries.

To put this another way…

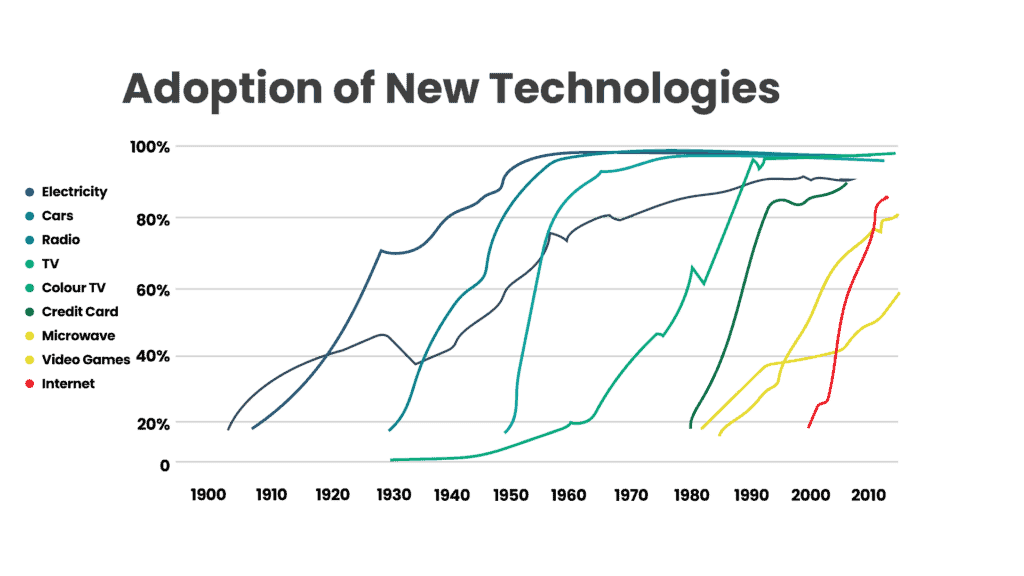

You’ve Heard of Moore’s Law… But Have You Heard of Wright’s Law?

Moore’s Law, of course, is the idea that thanks to constant innovation, computer chips double in processing power every two years.

That’s held true for the last half-century.

But there’s another shockingly consistent “law” you might not know about.

It’s called Wright’s Law, after aviation engineer Theodore P. Wright.

Way back in 1936, Wright’s Law proved there’s more than just science behind these kinds of tech innovation booms.

Instead, Wright described these kinds of booms as self-powering cycles…

Where tech improvements drive investment…

And the investment in more production and expanding markets drive more innovation…

In other words, according to Wright, the more time and money you invest in producing a new technology…

The faster that underlying technology is going to improve.

And the cheaper it’s going to get for everybody to use it.

It’s also known as the “Experience Curve Effect.” And it’s yet another reason why so many industries explode in size and reach when they hit a certain tipping point.

In fact, researchers from MIT and the Santa Fe Institute took a look at Wright’s Law as it applied to 62 different technologies… from airplane tech to gas pipelines and even beer production…

In all 62 industries, this self-feeding loop managed to slash costs… attract investors… and lead to even more accelerated advances and even faster adoption rates for that technology.

So, what does this have to do with a sudden EV industry boom in the Heartland?

As billions of dollars pour in…

And as mass production finally scales up…

That same momentum curve is about to go exponential.

In other words…

You Do Not Want to Miss This

Look, if you want to ask me if this shift is a good idea…

Or whether America is even ready for it…

My honest answer is I don’t really know.

After all, disruptions are never 100% positive. And transitions can be chaotic.

You have to be very careful… and alert.

But as Sam Cooke once sang, “a change is gonna come.”

And it’s going to come whether you like it or not.

You don’t want to get left behind.

That’s why I’ve worked out a plan you can follow.

It’s kind of a roadmap for how this could play out.

Along with exactly what you could do to secure multiple chances to profit.

As promised, part of that plan includes giving you my #1 stock to buy right now.

I’ll also tell you more about five ways you could multiply your money 10-fold on this same megatrend.

But before I get to that, there’s one last thing we should do.

And that’s tackle a couple of burning questions.

For instance…

“Why Now?”

This might surprise you, but Tesla is already 19 years old.

And it’s not even America’s first commercially viable electric car.

That would be the “Electrobat” which came out in 1898.

It used zero microchips, had steel tires, and featured a 1,600-pound battery. It could also go only 25 miles on a charge.

However, it almost became a commercial success. By 1900 there were over 600 Electrobat taxis operating in cities across the U.S.

That same year, Ferdinand Porsche and Ludwig Lohner developed the Lohner-Porsche Elektromobil .

And in 1902, Thomas Edison and Henry Ford collaborated on an electric Studebaker.

Electric vehicles were even pitched as a patriotic way to save gasoline for the military during the First World War…

But batteries weren’t cheap, and back then, not everybody had electricity for recharging. So gas-powered cars won the technology war.

Fast forward to now and it's a whole different ball game.

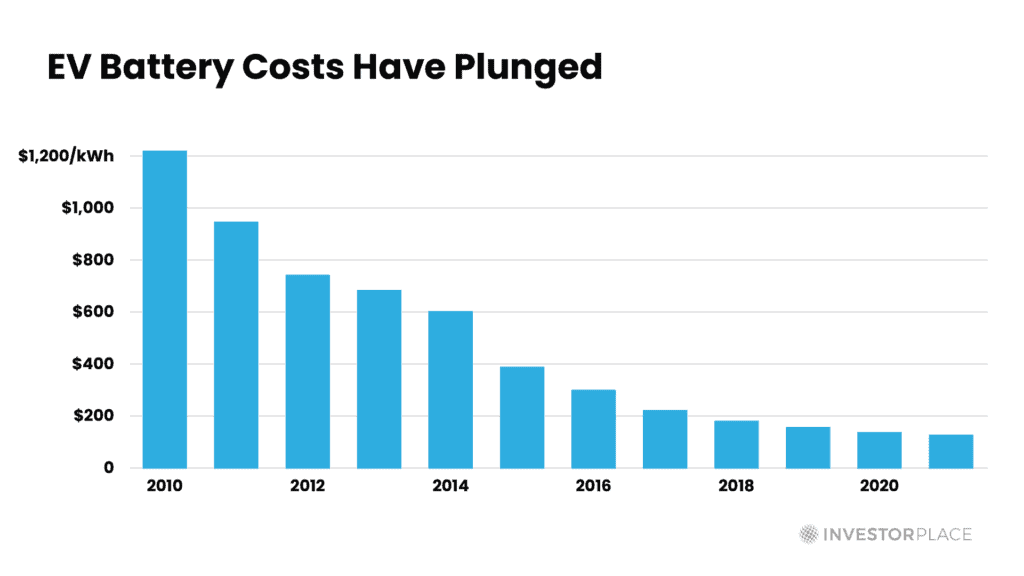

For one thing, just over the last decade, the cost of EV batteries has plunged 90%…

And even Consumer Reports has said…

As I said, the auto industry plans to invest half a trillion in EV development over the next five years.

Imagine what that could mean for battery technologies and how those same innovations could lower prices for customers.

Meanwhile, it’s no secret that American drivers have just gotten slammed by high gas prices.

According to a recent study, EV owners can save up to $10,000 on fuel costs over the life of an EV car.

Add in another $10,000 in savings on lower maintenance costs and zero oil changes…

Plus, up to $7,500 in tax breaks when you buy an EV…

And you can see why sales are suddenly soaring.

And what about long charging times? They’re dropping.

Meanwhile, concerns about “range anxiety” are fading too, as the distances you can drive on a charge are increasing year after year.

Not to mention, all 50 U.S. states – plus DC and Puerto Rico – have announced plans to build charging-station networks big enough to cover up to 75,000 miles of U.S. highways.

Meanwhile, there’s a Massachusetts company that makes portable EV power banks – just like a charger for your phone…

There’s a Canadian startup that’s invented a special kind of parking space that charges an EV wirelessly …

And a group of scientists are developing a way to get nearly unlimited amounts of lithium for batteries from seawater…

Like I Said, This Change Is Coming… Fast and Furious

California just banned new sales of gasoline cars after 2035. New York state just announced the same ban. Another 16 U.S. states are heading in the same direction.

Worldwide, the International Energy Agency expects more than 300 million EVs on the road by the end of the decade.

That’s more than double what they predicted just five years ago.

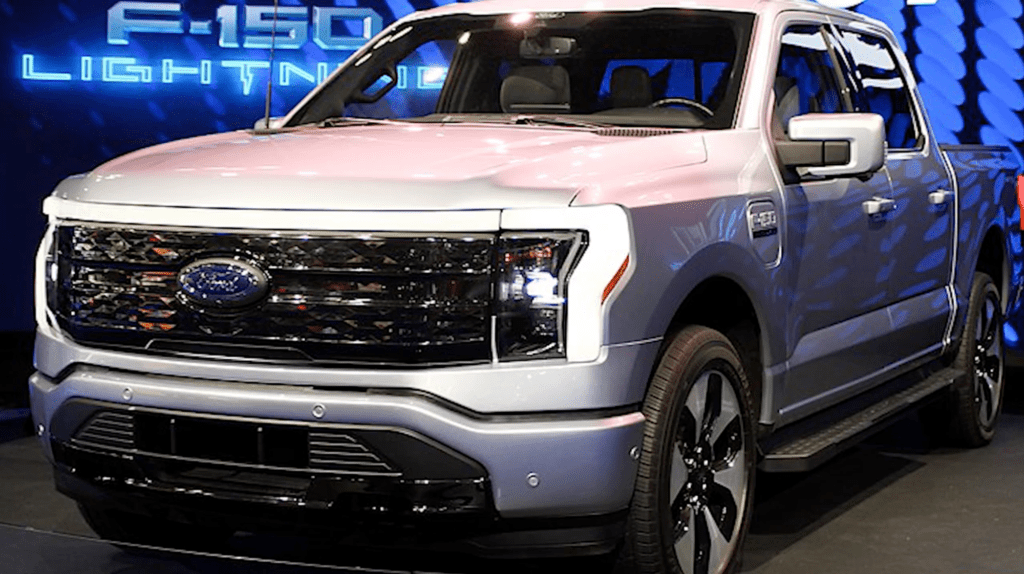

But nothing signals that we’ve passed a turning point better than Ford’s rollout of the F150-Lightning, an all-electric version of its top-selling pickup…

Americans love pickups.

This one can go from 0 to 60 mph in just four seconds.

It’s got the equivalent of a 580-horsepower motor.

And it looks exactly like its regular gas-burning cousin.

You can also use it as a mobile generator to power a work site… a campsite… your house in a storm… even a flatscreen TV while you’re tailgating.

Demand was so high when it came out Ford had to freeze preorders at 200,000.

And this is the vehicle Ford will build in its brand-new $5.6 billion factory in Stanton, Tennessee.

As The New York Times put it…

Again, you don’t want to miss it. And you won’t have to.

My #1 investment I’ll show you is just one way to get yourself in the perfect position, as this next great “supercluster” formation churns out new opportunities.

For now, though, let me answer another burning question you may be asking…

“Why Here?”

It doesn’t hurt that both Texas and Tennessee have no income tax.

Or that all across the seven states we talked about, labor costs are lower, and there’s lots of commercial space and a first-rate transportation network.

So it’s no surprise that the EV market share doubled in the Southeast this year.

But one of the biggest reasons we’re looking at a brand-new manufacturing boom here in the U.S…

This is because Americans are finally sick of seeing “Made in China” stamped on everything they buy. Especially in the wake of our pandemic supply chain crisis.

After decades of shipping off production to everywhere-but-here, Americans from the top down are realizing it’s risky to trust so many foreign suppliers.

So risky, in fact, it's a threat to our national security.

With higher fuel costs, importing goods from overseas has become much more expensive.

Think about all the trucks, trains, planes, and ships that are involved in getting all those car parts… or the finished cars themselves… from overseas.

Now think about how much higher those costs go when fuel prices go up.

It's Like Paying a Hidden Overseas Tax

By the way, this is one of Tesla’s great secrets.

Out of the gate, Elon Musk insisted that Tesla make all its own computer chips… write all its own software… and make all its own EV batteries.

Competitors mocked him for it.

Then the world got slammed by COVID and learned just how dangerous and costly “cheap” global supply chains can be. So now those competitors are racing to deglobalize.

By the way, that's true even in the Federal Government.

From the Pentagon on down, every single agency is now under orders to replace their gas-powered vehicles with – that's right — American-made EVs.

Keep in mind the Federal government collectively has over 645,000 cars, vans, trucks, and other vehicles.

And right now, only 1% of them meet that new requirement.

Think about that.

If the U.S. military were just about to place a multi-billion dollar order for tanks and stealth jets, wouldn't you want to own stock in a maker like Lockheed-Martin?

This is almost the same, only this time, it's the entire Federal government ordering EVs. And, by law, most likely ordering them from this booming new cluster of companies in the American Southeast.

And it doesn't stop there…

See these famous brands?

They all have operations here in the U.S. And they’ve also announced plans to make the leap to EVs and hybrids.

Again, keep in mind that some of these companies operate fleets with tens of thousands of cars, vans, trucks, and other utility vehicles.

You see my point.

These are massive changes underway.

And here's something else…

These EV projects that are clustered in the Southeast will be hungry for raw materials like lithium, copper, nickel, cobalt, and graphite.

American miners can help us get those resources. But not if they have to plow through a lot of red tape to get their mines up and running.

Which is why the new Congress just pledged to give those American miners an extra push by cutting their mining permit approval times in half.

Of course, other changes are coming too.

And not all of them will be good for everybody.

For instance , right now, over four million Americans work in the car industry.

Most of them make or sell cars and car parts for conventional, gas-powered vehicles.

Many of them could lose their jobs as EVs start to dominate.

At the same time, the startups and companies that serve this EV “supercluster” in the heartland could continue to grow. They could also help kickstart the rest of the U.S. economy. And their shareholders could reap those rewards.

When that happens, which side of the fence will you be on?

With all these forces in play, I hope you won’t sit on the sidelines.

You need to take action now if you don’t want to miss this.

So here’s what I strongly urge you to do now…

STEP #1:

Own The Future Of America 2.0 With Just One Stock…

Whether it’s the giant car companies pledging to go all-electric…

or building their multibillion-dollar factories…

Or it’s the hundreds or possibly thousands of EV-related startups that could soon appear…

You’re all but promised to see all kinds of ways you could profit from this megatrend.

But what if you could get started by cashing in with just one stock?

I’m talking, of course, about the #1 stock pick I promised you earlier.

And the name of that pick is… Freeport-McMoRan… with the ticker “FCX.”

That’s right, the U.S.-based mining giant.

Why?

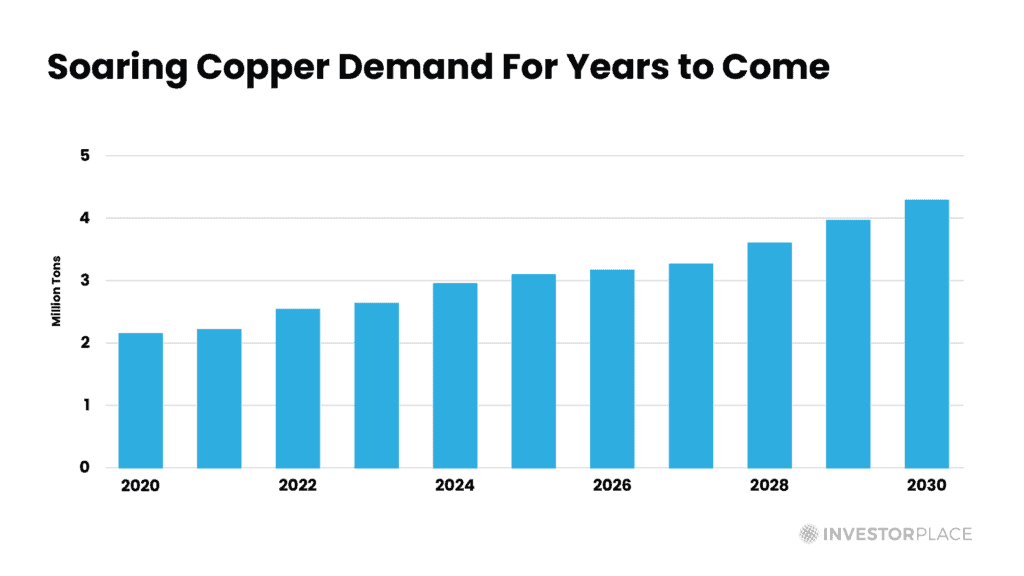

EVs need batteries. Batteries need raw minerals.

In fact, did you know that your average EV contains up to ten times as much copper as a gas-powered car?

Power grids, solar, EV charging stations, and even wind energy won’t work without copper.

Freeport owns and operates five of the six biggest U.S. copper mines… and the company also cranks out more than half of our nation’s total supply.

That makes Freeport America's biggest copper supplier.

It's also one of the biggest copper producers worldwide.

By the way, Freeport is also the world's largest producer of the metal called molybdenum… which is a key element for every renewable energy tech you can think of, from wind and solar to nuclear energy, geothermal, wind, and hydro.

Molybdenum is also a key element for – yep – making EV batteries.

So you can imagine, the company is minting money.

Thanks to the Freeport’s growing production and historically high copper price Freeport’s annual revenues have skyrocketed from $2 billion to $10 billion.

And that's just in the last two years.

Freeport has also slashed its net debt and tripled its dividend.

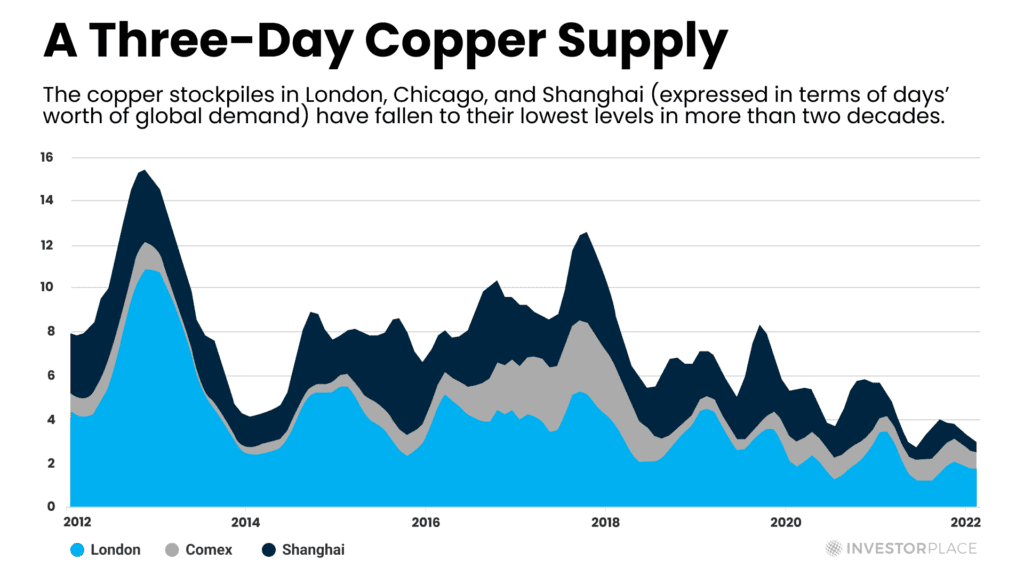

Meanwhile, right now, copper supplies are hitting record lows …

And they're expected to stay low for another decade, especially as demand for copper keeps soaring…

Even if nothing else changes, that supply-demand tension could keep copper prices high for years.

With even more EV demand… more smart grid battery storage… and other renewable energy technologies… owning FCX is a move that could pay you for years to come.

And that’s the key strategy here…

Before we buy the EV companies that are forming this new Southeastern “supercluster,” I’m telling my readers to load up on the companies that supply raw materials for this new revolution.

It’s like owning American oil stocks not long after the arrival of the Model T.

This way, you’ll get a chance to own a stake in the whole industry, no matter which EV company comes out on top.

Besides my #1 stock – FCX – I’ve identified two more recommendations that could profit from soaring demand for battery metals.

And all three stocks pay out dividends, so you can collect income on this next “supercluster” boom alsoa.

You can read all three of these new recommendations in a report I’d love to send you.

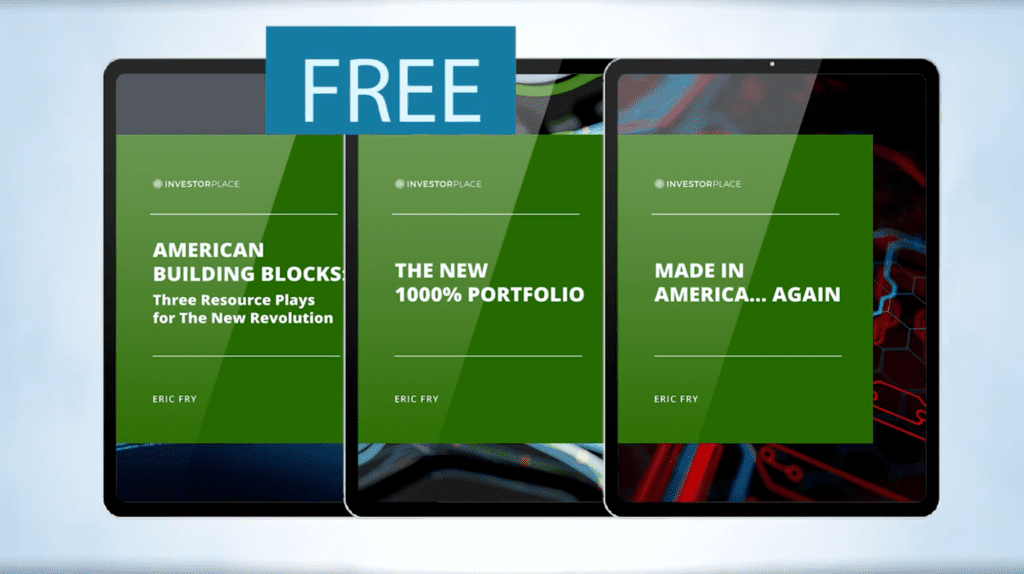

It’s called American Building Blocks: Three Resource Plays for The New Revolution.

Inside you’ll find all you need to know about these three “building block” moves.

Each could give you steady, solid returns for years to come.

Once you’ve done that, you’ll want to move to…

STEP #2:

Buy The Companies That Could 10X Your Money…

I promised to give you details about five companies that could multiply your money ten times over.

Let’s do that now…

This first company uses AI to run “smart” EV-charging grids.

With multiple energy sources hitting power grids these days…

And with all that power getting stored until it's needed…

You need software that's smart enough to manage that energy flow.

This company has an AI-powered system that does exactly that.

It’s already built the largest smart energy storage network in the world.

It’s also already partnered with Fortune 500 companies across the US.

And it’s machine-learning technology is tailor-made for streamlining operations for the vast EV-charging networks already being built across the US.

Demand for this company's product is booming, with an order backlog that's already doubled year-over-year.

This is the first pure smart-energy-network play to go public in the US.

And you can still get shares for under $10.

The second company I want to show you makes synthetic graphite…

You can’t make lithium batteries without graphite. And this company cuts battery costs by making that graphite synthetically instead of mining it.

As I'm sure you know, cutting battery costs is a huge EV priority.

Already, this second company has partnered with Honda, Panasonic, Samsung, and Bosch, just to name a few.

And it's just won a huge $150 million grant from the U.S. government to build a brand-new plant right here in Chattanooga.

Speaking of graphite…

You also need to compress and coat it so it can be packed into the anode post of EV batteries.

This company will do exactly that when its new plant in Louisiana goes into production later this year.

It’s the first plant of its kind outside of China and the only one in the U.S.

What's more, the company’s initial graphite output is nearly sold out already…

Thanks to a four-year purchase contract with a major U.S. EV manufacturer.

Of course, you also need lithium to make batteries…

But so far, here in the US, that’s easier said than done.

Because right now, 80% of the lithium worldwide comes from China.

However, this fourth company I want to reveal to you is building a world-class lithium facility that could change all that.

And it's building that factory 55 miles from Chattanooga.

When it’s finished, this single plant is expected to double U.S.-based lithium production.

Finally, the last company I want to show you specializes in microsensors…

Why microsensors? Here’s why…

EV batteries need all kinds of monitoring to keep your vehicle running smoothly.

This company specializes in a fiber-optic technology, that's ideal for the job.

It also makes 5G network solutions that help make autonomous driving possible.

This company is already an industry leader and has an impressive list of partners…

Including not just car companies but NASA, ConocoPhilips, and Lockheed-Martin.

Like I said before, even the best analysts on Wall Street have a tough time finding 1,000% winners.

But I’m proud to say I’ve done it 41 times during my 30-year career.

I’ve also found 19 more stocks that shot up over 500%.

With these five stocks, I’m confident we can do it again.

They’re all frontline companies… positioned in the heart of the Southeastern EV “supercluster”… but still off-radar enough to give you a chance at big returns.

I can send you my research on all five in a report I call, The New 1,000% Portfolio.

I can send it free, along with the first report I just mentioned, as part of a special invitation.

First, though, you’ll want to know about…

STEP #3:

Grab an Early Stake In America’s Next Great Rebound…

In the wake of the 2022 crash, I hear from a lot of Americans who are worried about a recession. And I get it.

However, keep in mind that Apple released the iPod during a downturn…

Uber and Venmo launched right behind the 2008 crash…

That’s also when Amazon launched the Kindle and Amazon Prime…

In fact, companies that keep innovating during busts average 30% better than the market over the next three to five years, according to McKinsey Research.

That’s why I’ve put together a third report I call Made in America… Again.

I showed you earlier why manufacturing is coming back home after three years of supply chain chaos and political threats from China, Russia, and other overseas competitors.

That’s another reason this new EV “supercluster” is forming in America's Heartland.

In this third report that I want to send you, you’ll discover three more brand-name companies that will innovate new solutions for EV makers… and elevate the whole industry.

From high-tech glass for interactive dashboard displays… to next-generation energy storage to help power the nationwide EV-charging network … to an all-American solution for surging semiconductor demand…

These are companies you’ll want to own for the long haul.

In all, I’ve just shown you details on a total of eleven stocks I want you to think about buying right away.

You don’t have to own all of them.

That’s why I want you to have the reports. So you can see all my research firsthand and make up your own mind.

But there’s another reason I’m so eager to share my research.

See, these are all disruptive opportunities.

And this is an even bigger, disruptive megatrend.

So I expect it to remap whole sectors of the U.S. economy… possibly for decades… just like the other seven “supercluster” events I showed you earlier.

There will be winners and losers.

I want to make sure you’ve got the best chance possible to land on the winning side. That’s why I want you to have all three of these reports…

American Building Blocks…

The New 1,000% Portfolio…

And Made in America Again…

… for free when you accept my invitation to try a no-risk trial subscription to my top-rated financial research letter, called Fry’s Investment Report.

I’m sure you’ve seen lots of solicitations for various investment research letters over the years because I get lots of those too.

But I promise you’ve never seen anything like this.

I say that because, over the last 30 years, I’ve put together what I believe is one of the best track records in the industry… through all kinds of twists and turns in the markets… and all kinds of disruptive trends.

As I said, I’ll put my performance record up against anyone’s, on or off Wall Street.

I doubt very many investors have come close to matching my history of recommending 41 stocks that gained 1,000% or more.

And I don’t know of anyone who’s been able to warn folks as many times as I have about specific stocks that were about to crash, with 73 advance warnings total.

I only say that because I know that if you’re going to follow an analyst, you want to follow someone with a proven long-term track record…

Someone who has beaten some of the world’s most successful professional investors and who's also willing to share that expertise with you.

Since the inception of Fry’s Investment Report…

My average annual return is 42.6% overall. That's more than quadruple the average return on the S&P.

When you accept this invitation, you’ll get access to your three reports immediately.

Then, over the next few months, I’ll share my ongoing take on all these opportunities and more… in your issues of Fry’s Investment Report.

You’ll get to see how to build the perfect portfolio of disruptive companies.

I’ll also keep you updated on all the important developments with every opportunity I recommend.

In short, I’ll be right there every step of the way… month after month… giving you, and my other readers access to all my research, so you can make informed and intelligent decisions about how to grow and protect your nest egg.

Normally, that access would cost you $199 per year.

Obviously, that’s a small price to pay for access to the kinds of investment opportunities I highlight throughout the year… especially when you consider the kinds of returns I’ve managed to show my other readers.

But today, I want to give you a chance to try my flagship research… totally risk-free… at a huge discount to the normal price.

Before we get to those details, though, there’s one more key step I want to share with you to help make sure you’re 100% ready for what we've discussed today.

Remember, in Step #1, I gave you the name of my #1 recommendation to buy right now – with the ticker symbol FCX. Then I showed you even more about how to own the future of this huge trend.

In Step #2, I showed you details about five different ways you could grow your money 10-fold on this same boom.

And in Step #3, we talked about buying the solid innovators that could help push this EV revolution to the next level, sparking a massive “reboot” for America.

This next step, however, is just as crucial.

You see, in times like this, you need to make room for winners by cutting your losses. And by that, I mean you need to trim the dead weight from your portfolio.

That’s why I want to send you a fourth report for free.

It’s called The Purge Portfolio.

The first thing you’ll see inside will be the names and ticker symbols of ten very popular companies that millions of Americans own.

Please make sure you do NOT own these companies yourself.

And do NOT buy them again in the future, no matter how much cheaper they get.

These are seriously flawed stocks for all kinds of reasons…

Either because they’ve got a bad business structure… because they’re crushed by heavy debt loads… or because they’re clinging to completely outdated business models or dying technologies…

Over the years ahead, fast-moving and creative startups could force these companies to underperform or even go bankrupt.

Also, inside this report, you’ll find a simple two-part test you can and should apply to every investment you make, whether that’s today or during the years ahead.

I’m just saying I don’t know of any other analyst who’s accurately predicted the fall or collapse of as many companies as I have. My work on that front was even cited in Barron’s.

To recap, here’s everything you’ll receive as part of this special invitation…

* First, you’ll receive my three special research reports…

American Building Blocks… to show you how to own a stake in this coming Heartland revival no matter which “supercluster companies” come out on top…

The New 1,000% Portfolio… where you’ll find five different opportunities, each with the potential to multiply your money ten times over, while this next phase of the American EV megatrend unfolds…

And Made in America… Again… where you’ll get three more tickers and company names, each one a trusted innovator that could help pull America forward for years to come…

All of these companies could skyrocket thanks to the forces we talked about today. And the 2022 hangover just makes them all the more attractive.

This is a multiyear megatrend. You don’t want to miss it.

* For the next 12 months, you’ll get my regular issues and recommendations as a fully privileged subscriber to Fry’s Investment Report.

* Each new issue will be delivered to you on the second Friday of each month. That way, you’ll have the full weekend to look it over, and you’ll be ready to make a move that Monday morning.

* You’ll also get full access to my online archives at our members-only website. That includes not just past issues… but also all my past research reports… plus a regularly updated look at our model portfolio.

You’ll get full access to my instant alerts, which I send out any time between issues, any time there’s a chance to cash in… an urgent new buy… or a big event in the market you need to know about.

Best of all, you can access all this work totally risk-free at a generous discount off the normal rate. That means instead of paying $199 for a year… you’ll pay a tiny fraction of that price.

I want to do that for you, frankly, because moments like these are incredibly rare in the U.S. market.

As you saw before when I showed you the seven other times we’ve had something like this happen…

The disruptions from those other legendary “cluster” events… Detroit, Houston, Silicon Valley, and the rest… were massive and long-lasting.

It’s possible to make a lot of money when they occur.

It’s also possible to make huge mistakes. Or to completely miss the signposts on the path ahead that are pointing to huge, life-altering opportunities.

The bottom line is I’ve been doing this for a long time. I’ve seen a lot.

I know I can help you land on the right side of these events.

I could even show you how to dramatically improve your financial well-being without taking on crazy risks.

That’s what I do.

I spot huge macroeconomic trends… I break them down into the simplest terms… then I show folks how to seize those opportunities and maximize their returns.

That’s also why I want to get this information in your hands as quickly as possible.

So, the way I see it now, the next step is up to you.

You can choose to ignore what I’ve just shown you. You can pretend it’s not happening. And a year from now… five years from now… ten years from now… you’ll get to see how that turns out.

Or you can take this opportunity to examine my work – it’s not a huge commitment – and see for yourself where this powerful new megatrend is headed.

This is the time to act… to get the facts so you can see what’s coming… and so you can decide what you want to do next. For you. For your family.

And to secure your best financial future.

Here’s one more thing…

If you decide it’s not for you, you can cancel and get a full refund.

You’ll have the full year – 365 days – to make up your mind.

That means that even if you decide to quit my newsletter on the very last day of your subscription, you still get to keep every report and every issue.

And you'll receive a full refund, no questions asked.

You get to try everything risk-free. And I get the chance to prove the quality of my research, so you'll agree to stick around for more.

To get started, just click the button below, and it will take you to a page where you can let me know whether you've decided to join.

The ordering process is completely secure and privacy protected.

Within minutes, you’ll get full access to all four of the special reports we talked about… where I name a total of eleven stocks to own… and another ten stocks to dump.

Just click the button below and you’ll hear from me soon!

Thanks for watching,

Eric Fry

Founding Editor, Fry’s Investment Report

January 2023

For more details, see our disclosures and details page.