Hi, I’m Amy.

In my right hand I hold the keys to a $3 billion opportunity…

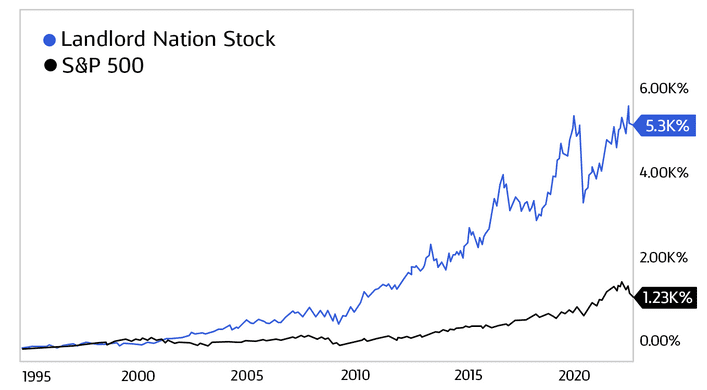

A little known stock that has already outperformed the S&P 5-to-1 over the last 25 years…

And could hand investors yet another windfall over the coming months, even weeks…

No, it’s not a tech stock. It’s not a risky SPAC… And it’s definitely NOT some sort of crypto scam.

You see, with sky-high housing prices, rampant inflation, and mortgage rates on the rise…

One former hedge fund manager is predicting that many hardworking families will be forced out of their homes over the next few years…

And this company…

Stands to earn a fortune on this paradigm shift.

Today, we’ll share with you the ticker, and all of the information surrounding the stock for

absolutely free.

You won’t have to pay a dime.

And that’s because Jeff Zananiri, who helped turn a small $5.1 million dollar hedge fund into over a $700 million behemoth in just over a decade, isn’t looking to squeeze a quick buck out of everyday folks.

In fact, his entire mission is to help the average Joe see real success in the stock market – success that’s usually reserved for the world’s wealthy elite.

But, if you choose to ignore the prediction laid out today…

Don’t be shocked if it comes true… and you miss out.

You see, Jeff is no stranger to nailing specific predictions about the markets…

Actually, just the opposite…

He helped a hedge fund go 10 years straight… Without a single losing quarter…

And even during the worst financial crisis since the Great Depression… He helped the fund earn $1 million dollars in just 30 minutes… On a BANK stock.

But – from what he’s shown me…and the Wall Street insights he’s shared…

Nothing he’s ever done comes even close to today’s opportunity.

Today… We’re going to go on a journey…

You’re going to meet the former hedge fund legend…

You’re going to hear about what could be the biggest housing crisis we’ve ever seen…

Plus, you’ll get the stock ticker of the one company that Jeff believes could earn early investors a killing over the next few years…

So… Turn up the volume… Buckle up…

And get ready to uncover: Landlord Nation.

Host: Jeff, it’s great to have you here today…

Jeff: It’s great to be here, Amy…

What we’re about to cover today could leave a greater impact than ANY U.S. recession in history… And, perhaps, a once-in-a-lifetime opportunity for smart investors.

Host: Jeff, you have quite a track record with predictions like these…

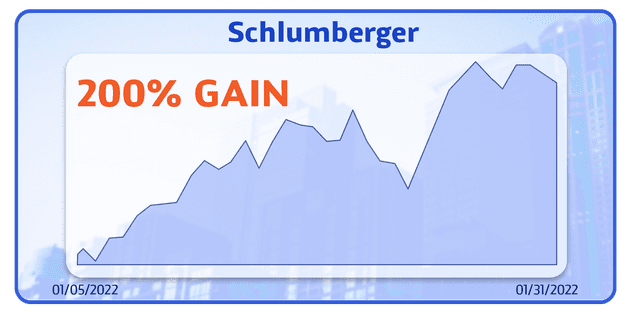

For instance, in January… While the S&P 500 was in a freefall…

You called for the big run on oil stocks…

Your pick on Schlumberger was up 200% in under a month's time…

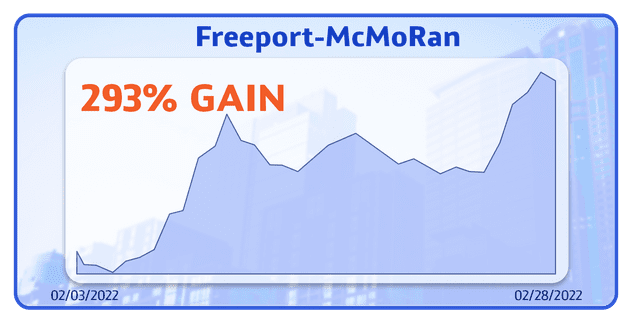

Then you followed it up again, with the big bet on Freeport-McMoRan, the copper company…

And again… As the markets plunged… This stock went haywire!

Those who followed your prediction could have bagged a hefty 293% gain…

Jeff, when you make a prediction… Folks should pay attention.

I mean – heck – your track record in 2022 alone is just uncanny…

Look at some of your top triple digit returns:

134% on LCID

352% on DGX

140% on NUE

166% on GILD

241% on XOM

I can go on… and on… and on…

Jeff: Well, just to be clear… No investment strategy is perfect…

Every good investor knows that there will be losers along the road of success as well…

But I’m grateful to know that my picks have helped even just one or two people around the world…

Host: One or two? Jeff… we have countless folks who have messaged in about your work…

Like Michael who wrote in…

“Doing great Jeff! Up 60% on Citigroup last month and up 18% on this month’s trade… Four months in, and all months positive”

Or John F. whose a musician in Minnesota… he said:

“I started with you four weeks ago… I am up about 60% or $15,000 in four weeks. Thank you guys!”

Then… There’s Judy M. who told us:

“I cashed in three of four winners! Started in October [with $2,800], and over $7,100 in gains so far”

That’s just a few of the best stories…

Jeff: I’m humbled everytime I hear feedback like that…

But nothing I’ve ever done in the past holds a candle to what I have to share today.

Because what my team and I have uncovered could be the biggest downfall of our nation’s history…

I’m talking about a catastrophic event… Even GREATER than the 2008 Recession…

And as I speak… The dominoes are starting to fall.

Host: That sounds pretty scary…

Jeff: Amy, I’m not over here smiling… I’m not popping champagne bottles.

The fact is: If my research is correct… This will be an extremely painful time for a lot of hard working Americans.

Millions could lose their homes… But for investors who take action today… Getting ahead of this great wealth migration…

Well, I believe that they'll be in front of some life-changing market moves…

Host: Based on what you’ve shown me…

We’re looking at a wealth shift so big, it could impact not just your life, but the lives of your kids… and even their kids.

So, tell us more… What’s going on here?

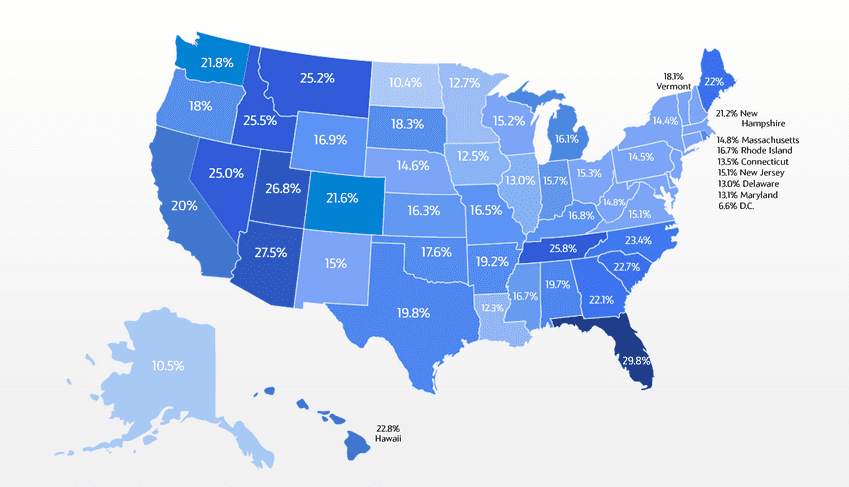

Jeff: Take a look at this map.

Host: Okay… What are we looking at?

Jeff: What you’re seeing is the increase in the price of buying a home… year over year… in each state.

Host: It looks like just about every state is up double digits.

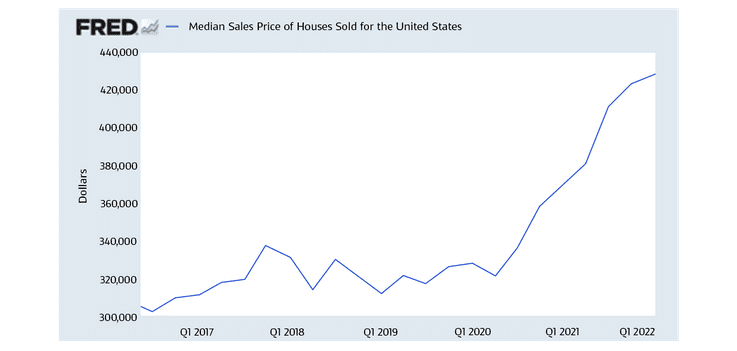

Jeff: According to researchers at New York Life Investments the housing market is coming out of… “The highest growth seen in at least 31 years.”

Today… That $300,000 house down the street is selling for $450… $500 grand.

Which… sounds like a good thing at first…But as I’ll explain… It's a HUGE problem.

Host: How so?

Jeff: A lot of people have no clue… but right now the Federal Reserve is set to make a move that could completely up-root millions of Americans from their homes…

Devastating families… And wreaking havoc on local communities.

And anyone who is retired, or hoping to retire, needs to take action today… Before this nationwide issue could turn disastrous.

Host: Wow Jeff, sounds like there’s a lot to unpack there… And a lot to soak in…

So before we hand over the keys to this $3 billion opportunity…

The company… The ticker… Everything an investor would need…

Let’s take our viewers back to the beginning… Back to where it all started.

Expert Economist:

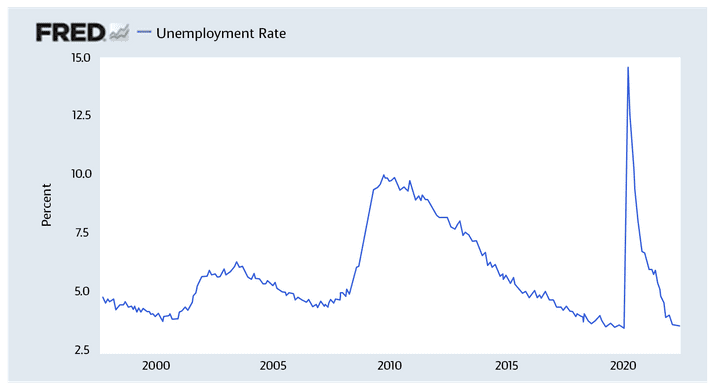

No one could have seen it coming… 2020…

I mean let’s be honest: Worldwide pandemics are something you only hear about in a Hollywood movie.

But when it became reality… Psh… No one really knew how to handle it…

The world shut down. Business revenues plunged as they were forced to lock their doors…

Unemployment skyrocketed to all time highs… Making 2008 look like a minor speed bump on the chart.

Everyone was panicking…………… For about two weeks.

Because on March 15th, 2020…

The Federal Reserve stepped in to “save” the big businesses… Like they always do.

Overnight, they slashed the interest rates by more than 85% …

Making borrowing, and spending money… Dirt. Cheap.

That’s how this housing frenzy started…

Realtor:

Before the pandemic hit… 30 year mortgage rates were sitting around 5%….

So, if you wanted to keep your monthly payment under $2,000 each month, you could afford around a $375,000 dollar house.

Probably a middle income area… Suburbs…

Nothing crazy extravagant or anything… Ya-know? A nice place.

But then when the Fed slashed the rates… Mortgages were a total bargain…

Some folks lock in rates as low as 1.75%.

Now… all of a sudden… for around that same $2,000 monthly payment…

You can afford a $600,000 house.

The dream home. The lake house… Finally get that property with some land.

Same monthly price. Nearly twice the house. It’s a no-brainer.

So, what do you do? It’d be foolish not to take advantage of the opportunity…

What’s so bad about that?

Jeff: All of a sudden it became a better investment to go get a new, bigger home than to save for a rainy day…

Smarter to buy a house that was once wayyy out of your budget than to buy Blue Chip stocks.

Host: That seems really backward.

Jeff: Oh it’s totally backwards…

Realtor: The way people were bidding up houses… I mean…

They were flying off the shelves faster than hot dogs on the 4th of July.

And the stories… the stories were really crazy:

One couple listed their home for $212 (two-twelve)… and within a matter of days sold it for $250k. Unbelievable…

Another family made an offer on a house $100,000 OVER the asking price… and they STILL didn’t get the home.

And this wasn’t just one or two outliers… We’re talking hundreds of thousands of homes sold for $20,000… $30,000 even north of $100,000 over the listing prices.

For realtors it was all gas, no brakes… Just go, go, go.

Jeff: It’s a complete domino effect.

When John upgrades his house for cheap, Larry hears about it and does the same…

Then Tommy sees… so he calls up his realtor…

Next thing you know, Randy’s wife is looking for houses… Bob locks in a second home.

Even homeboy Eric who started his internship 2 weeks ago is buying a house that he couldn’t have come close to affording before the mortgage rates dropped.

Host: It’s a non-stop bidding war on houses.

Jeff: As realtors were “go, go, go” nationwide… So were the home prices.

You can see the prices skyrocketing over the last few years…

Host: With the interest rates so low, the price tags on these homes went straight up…

But is that really a bad thing, Jeff?

Jeff: Honestly… If all that happened was the Fed clipped the interest rates…

And people went on a spending spree for a few years…

Well, things probably wouldn’t have ended up too bad…

But, of course, cutting the rates was only the first step… Then the Fed added gasoline to the fire.

Expert Econimist:

The Fed’s job is to protect the U.S. economy.

Generally speaking… That boils down to handing over bailouts, and stimulus to the big businesses in times of need.

We saw it happen in the 70’s with the Railroads…

We saw it in ‘08 with the banks deemed “too big to fail” …

And of course… In 2020, when everyone was in panic mode…

Out of fear of an economic collapse, the Fed turned the printing presses back on.

But this time… They were a bit “smarter.” [finger quotes]

Instead of handing over trillions of dollars to the big businesses…

They thought: “Let’s give some of it to everyday people. Free money in their pockets. More spending at the mall. More revenues for the businesses. And more tax dollars back to us.”

Makes sense right? And so it began.

March 27, 2020. Less than two weeks after interest rates were slashed… $2.3 trillion dollars flooded the economy.

And the short term benefits were incredible:

A $1,200 direct cash payment

An extra $500 per child

If you were unemployed, add an additional $600 per week to the check

No penalties for early withdrawals on your 401k

A 180 day ban on foreclosures

The government spared no expense. I mean – money really did grow on trees.

Jeff: So now, you have historically low interest rates creating a bidding war on houses…

Combined with trillions of dollars being printed out of thin air from the government…

Then, in December of 2020… Another round of $600 checks went out…

By the beginning of 2021, the economy was roaring.

Unemployment was now teetering back to all time lows… Wages were climbing almost as fast as the housing market…

And the LAST thing this already-overheated economy needed was more free cheese from the government.

But, in an effort to win over supporters, the newly elected President Biden urged that we pump another round into the economy…

$600 checks? Nah… $1,200? Nope. Let’s up the ante… $1,400 per person… Because why not!

Another financial package worth nearly $2 trillion.

Host: That’s a lot of money over the course of just twelve months…

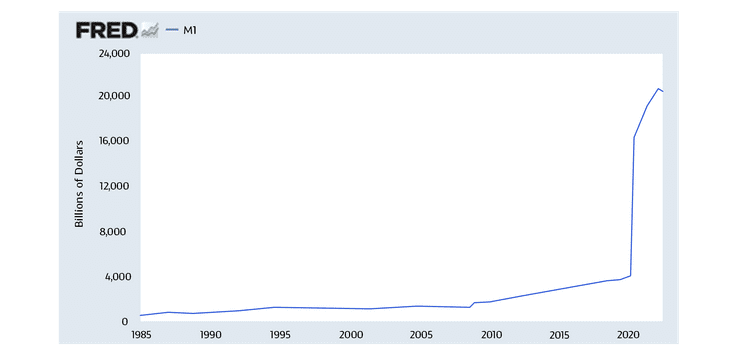

Jeff: Over $6 trillion in total. And if you look at the M1 Money Supply, which tracks the liquid cash in circulation…

You’re looking at an insane 500% increase in the money supply.

Host: That doesn’t sound sustainable at all…

Jeff: It’s not… And now, these massive stimulus packages are crippling us in 2022.

Turn on your TV. Pick up a newspaper… Just look at the damage inflation is causing.

Oil prices are up more than 200%… Lumber prices shot up 300% and hit all-time-highs.

Host: Car prices are sky-high too…

Jeff: Heck – even a dozen eggs at the supermarket is up 76%.

If things don’t change drastically…

Lots of hardworking people could see their investment portfolio completely flatline – for DECADES…

For a lot of retirees… That means not having enough in the account to survive.

Host: Could it really be that bad?

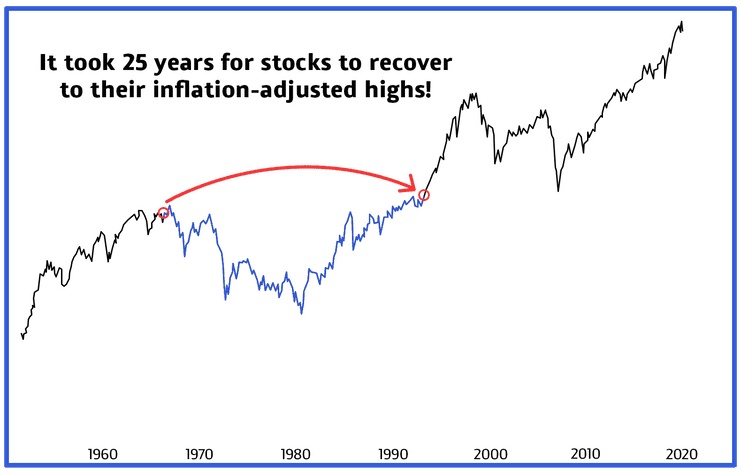

Jeff: Absolutely… Just look at what happened back in the 70’s…

Inflation crushed millions of americans… And for anyone who was retired or about to retire?

It was a total gut punch as the inflation adjusted S&P returns took more than 25 years to recover.

Host: Wow. Could you imagine your retirement being delayed by 25 years…

Jeff: Or worse, having to come out of retirement to work an extra 25 years?

If the Fed lets inflation run rampant like this any longer… People will be devastated.

And accounts will be crushed.

Host: So what is the Fed going to do to keep this from happening again?

Expert Economist:

Alright. Alright. So we printed some money. And now inflation is out of control.

No… *scoffs*… We can’t just go ask for the cash back. It doesn’t work like that.

The only way we can cool off inflation is by slowing down your [points to camera] spending.

When you and your friends stop spending, the demand drops… And then, prices can finally start to normalize.

In March of 2022… We officially pulled the plug on the free money…

And started hiking the interest rates – for the first time in YEARS.

Now, with monthly mortgage rates on their way back up…

People will be less likely to afford homes… And in theory, the bidding war will slow down.

Jeff: So now… We have a massive problem in the housing market.

Think back to the beginning… The example of a homebuyer who wanted around a $2,000 per month mortgage.

Before the pandemic… That would have represented a $375,000 home.

Then… Once rates were cut to nearly zero…

Home buyers went crazy… Bidding up the housing market like there was no tomorrow.

Now, that same $375,000 home could be selling for around $600,000.

Nothing changed about the house.

No upgrades. Nobody added a pool in. It’s in the same middle-class, suburban location.

But now, it’s worth nearly twice as much.

Host: Well, that should be good for homeowners, right?

Jeff: Not so fast Amy. When the Fed began reversing course and hiking interest rates back in March to fight this out-of-control inflation…

People had to start thinking twice about buying a home.

Because right now… That $600,000 valued home that used to run for $2,000 a month during the Covid-era mortgage rates…

Well, now with the Fed hiking rates again, the monthly mortgage payment on that house would run you roughly $3,521.

Host: Hold up… Say that again…

Jeff: The same house. The same location. Nothing changed except for the Fed’s interest rates.

Last year. The mortgage would have been around $2,000 per month.

Today – with the increased rates – it would cost you $3,521 each month.

Host: Jeff, that’s almost an extra $20,000 in interest each year…

Jeff: Exactly… And this phenomenon is going to keep hard working people out of owning homes.

Realtor: It’s almost depressing being a realtor now. You get these young bucks coming in here…

All excited to buy a home… “time to grab my share of the booming housing market” they think…

But when they see the monthly costs now… There’s just a dead shock. Like a [eyes wide open freeze].

Nobody can afford these payments. But what are you going to do?

Uproot your family and move out of town? No way. Your 8 year old just made friends at school.

Move an extra 45 minutes away from the office? With gas prices through the roof… That doesn’t make any sense.

Maybe downgrade to a lower income area? No thanks… Crime rates are sky-high there.

There’s really no good solution right now. These rising interest rates are killing us.

Jeff: With the monthly cost for a mortgage skyrocketing… Millions of Americans could be forced out of owning homes…

And in just a minute, I’ll share how a few smart investors could make a killing on this crisis.

Danielle Park, registered CFA found…

“High home prices have now combined with higher interest rates to drive a 30.5% year-over-year increase in US mortgage payments.”

And Bloomberg reported that:

“American Mortgage Payment Costs Are Now 36% Higher Than a Year Ago”

Host: That’s not good, Jeff.

Jeff: It’s not good for the home buyer… Nor is it good for the homeowner…

And it could be setting up the United States one of the greatest housing doomsdays we’ve ever seen on record… Even worse than 2008.

Host: How do you figure?

Jeff: Before the Great Recession hit… The Fed’s interest rate was at 5.25%.

That came in very handy when the economy tanked.

You see, when the markets crashed, the Fed was actually able to cut rates down to nearly 0% and at least give SOME sort of incentive for home buyers…

Host: So, Jeff, maybe the Fed will come back and cut the rates again… Like they did in 2008?

Jeff: They can’t. In fact… With inflation STILL hitting new highs, they’re doing just the opposite.

In June… They enacted another rate hike.

This one LARGER than any hike we’ve seen since 1994.

So now, even if the housing market were to take a bath…

Mortgages could STILL be too pricey for most folks.

Host: And who would want to pay double for a mortgage on a house while the market is tanking?

Jeff: No one. So now, homebuyers are stuck.

You can’t leave your community – your spouse would kill you.

You can’t afford to stay – the expenses would bankrupt you.

This “lose-lose” scenario is opening up a massive investment window for those who take action right now…

But mark your calendar for September 20th, 2022…

Host: What happens on that date?

Jeff: On that day, the Fed is projected to hike interest rates yet again.

And the markets are already starting to price it in… Ahead of time…

The mortgage rates are continuing to climb, only escalating this crisis…

Honestly, I wouldn’t be shocked if a few months from now… Mortgages are 8… 9… maybe even 10%.

Host: Wow… If that happens, monthly payments would have gone from $2,000… To $3,500… All the way to a whopping $5,265… on the SAME house.

Jeff: Do you know anyone who can afford nearly triple their monthly mortgage payment?

I don’t. And it’s not just me projecting this…

Fox Business agreed, saying… “By the end of [the year]… fixed mortgage rates will only rise.”

And as a result Lawrence Yun, chief economist at the National Association for Realtors told CNN…

“Owning a home… seems increasingly out of reach or unattainable.”

Host: So where’s the opportunity today?

Jeff: It’s in a completely overlooked sector of the real estate market… and that’s the secret behind today’s stock and the $3 billion opportunity at bay…

CNBC reported…

“Millennials and Gen Zers do want to buy homes—they just can’t afford it, even as adults… nearly two-thirds said affordability was the main reason they hadn’t yet purchased a home…”

So what do they do? They turn to alternative housing options…

Realtor: The new way for realtors to make money on the street is to help the potential homebuyers find a home they can rent for the next year or so – you know – until things turn around, if they ever do.

Like we’ve already told you – no one can afford to buy a home right now…

The numbers don’t lie, it’s cheaper to rent than it is to own…

And that goes for pretty much everyone…

Even politicians can’t escape this nation-wide phenomenon…

Nadine Woodward, a Republican mayor, hit a brick wall when trying to find housing for her newly-wed children.

According to her… the bride and groom were forced out of Seattle due to high costs…

So they looked into moving to Spokane… But that was out of the budget too.

Then, Austin, Texas was next on the list – but that was just as expensive as Seattle.

I mean… Just hear the sadness in her words… “I never thought I’d see the day where my adult children couldn’t afford a home.”

Right now… All of the money is in rental properties.

Host: That doesn’t sound like the American dream.

Jeff: The American dream is gone. Long gone. Welcome to Landlord Nation…

The end of home ownership in America. And you can’t escape it…

Newsweek said:

“First-time home buyers are going to be in for a real problem, and it won't change in the slowdown. The next group that suffers the most are baby boomers trying to downsize and looking for move-up buyers, and move-up buyers who can't sell to first-time buyers.”

Host: It’s no surprise SeekingAlpha found: “Demand for rental apartments hit a record high in the first quarter of 2022.”

Jeff: We’re just at the beginning of this wealth building opportunity in the rental space…

Host: But Jeff, I hate to be a skeptic …

But don’t you think that given basic supply and demand principles, we could avoid this crisis?

Think about it… If everyone starts renting… Then there’s far fewer home buyers…

When there’s fewer buyers, then there’s less bids on the housing market…

Once that happens, homeowners will have to start price cutting…

And over time, home prices would come back to an affordable level?

Jeff: In theory, sure… Given the current projected mortgage rates, the housing market would have to sell off 30… 40%… in order for these monthly payments to fit into the average budget.

But, we’re never going to see that happen…

Host: What do you mean?

Jeff: You see, Wall Street – who always seems to make a fortune in a crisis – is sitting on billions and billions of dollars in cash…

The second the housing market starts to drop…

They’ll buy up entire neighborhoods, entire communities in hard cold cash…

Long before it ever becomes affordable to the average Joe.

Host: You really think so?

Jeff: Absolutely… We’re already starting to see it happen.

As of June, nearly 25% of the homes on the market had a price cut…

And while homebuyers are still nowhere to be found, the wealthy elite is going all in…

BlackRock, the $10 trillion dollar investment bank is buying up homes like there’s no tomorrow.

Harrison Street formed a $1.5 billion joint venture in single-family rental communities…

Blackstone acquired Home Partners of America and its 17,000 rental home portfolio.

And JPMorgan Chase, Morgan Stanely, and many more are rushing into the space as well…

And frankly, they don’t care what the interest rates are… It doesn’t matter if the mortgage rates are 2% or 20%…

Host: Why is that?

Jeff: These big institutions have stockpiled so much cash… That they can go into these towns and buy up the whole block outright. No mortgage needed.

Host: Wow. No one is going to be able to compete with that…

Jeff: Nope. Say goodbye to homeownership in America… and hello to Landlord Nation…

Pretty soon, major cities will be completely owned by Wall Street.

In the Atlanta metro area, 42.8% of for-sale homes went to institutional investors…

And 38.8% of the homes in the Phoenix-Glendale-Scottsdale…

Host: These top 1%’rs are going to turn into kings…

It’s going to be fiefdom all over again… The peasants living on the land of the rich.

Jeff: It’s happening all over the place.

Congressman, Al Green noted that: “Private equity companies have bought up hundreds of thousands of single-family homes and placed them on the rental market”

And Chief economist at Redfin, Daryl Fairwetahter admitted…

“Investors are betting on a future of increased inequalitywhere a larger portion of Americans are renters.”

Host: You better bet your bottom dollar Wall Street isn’t going to miss out on this fortune making wealth shift.

Jeff: They never do. And while nothing in investing is 100% certain…

Landlord Nation is as close to a sure-thing as I’ve ever seen in my entire twenty five year career.

Host: But, Jeff, it’s not like I can afford to go buy a rental complex right now…

Jeff: Nope. Not unless your net worth is in the 20… 30 millions and up.

Host: So how can I, and our viewers at home, take advantage of this golden opportunity?

Jeff: I’ve identified one stock that stands to benefit greatly from the Landlord Nation.

It’s a housing company that owns more than 11,000 rental properties worldwide.

And right now, Wall Street is buying up shares of one stock like crazy…

Bank of America owns north of $1 billion of this company…

Blackrock is nearing a $3.7 billion stake.

And Vanguard reportedly bought up $6.4 billion of this stock…

Host: Sounds like you’re not the only one who believes this company stands to earn a boatload… But what makes you so bullish on this stock specifically?

Jeff: Over the last two-plus decades… This stock has been resilient.

It’s already earned investors 5-to-1 better returns than the S&P 500…

North of a 5,300% return when compounded with its monthly dividend.

Host: That’s enough to have taken a small $5,000 investment and turned into over a quarter of a million dollars.

Jeff: $265,000 to be exact.

And I believe this company will continue to hand over windfalls to investors in the months ahead…

You see, over the last few years this company has been quietly expanding… loading up on rental assets.

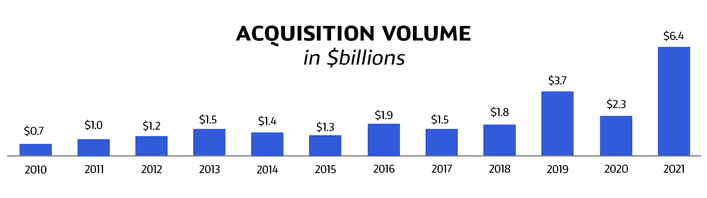

In 2021 alone, they nearly tripled their acquisition volume…

Host: They’re gearing up for Landlord Nation…

Jeff: And honestly, they could earn fortunes – even if the economy tanks…

SeekingAlpha found that… “Roughly 94% of total rent coming from tenants that are resilient to economic slowdowns.”

Host: 94%… Seems like a pretty safe bet to me.

Jeff: But it’s critical that investors take action before September 20th: when the Fed hikes rates again.

Because, based on all of my research… It could severely spike demand in these rental units.

Host: And potentially spike the stock?

Jeff: That’s right Amy…

Revenue trajectories are already going sky high…

Just look at some of the reports coming in already…

Fox Business found that …. “Rents up 30%”

And even Harvard reported…

“The 12th consecutive month of record-high growth. The largest year-over-year increases were in Miami (39%).”

And we’re only at the tip of the iceberg.

Host: So Jeff… What’s the stock’s name?

Jeff: The company name: Realty Income Corp.

bAnd the ticker?

Jeff: The ticker is “O”

Listen, there are a lot of companies out there to choose from… And of course, there will be winners and losers from the Landlord Nation…

You should never invest more than you are willing to risk.

But to make sure you’re fully informed about Realty Income Corp before you jump in…

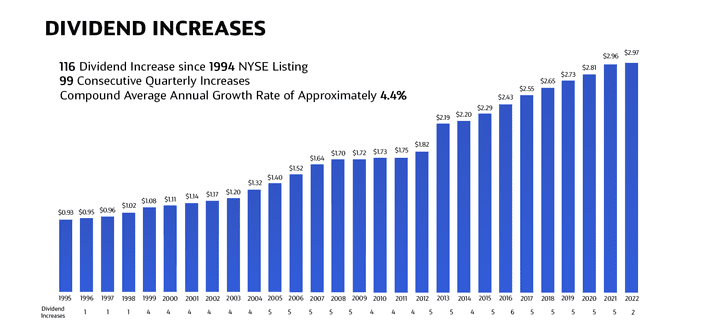

I have prepared a special report that details out everything surrounding this stock… plus their impressive monthly dividend, which they’ve been steadily increasing year over year…

Host: That’s an excellent way for smart investors to earn extra cash flow on TOP of stock returns…

Jeff: But I’m not stopping there..

As a special bonus inside this report… I’ve also included a company that’s, frankly, a rival to Realty Income Corp.

Host: Why would you give two companies in the same space?

Jeff: Think about it… Nobody has a crystal ball with investing.

While I firmly believe that Realty Income Corp could be the “Apple” of the Landlord Nation…

I could never guarantee that…

That’s why I’m including another ticker that I believe could see exponential growth as well.

Host: Tell me a little bit about this stock…

Jeff: This other “Landlord Nation” stock is a much smaller, under the radar company…

Right now it’s only about 1/10th of the size of Realty Income Corp…

And analysts are already projecting that over the next three years, the revenues for this company will grow from $339 million to $642 million…

Host: That’s some explosive growth Jeff…

Jeff: The sky's the limit for this stock… And in my opinion, investing in this company is a no-brainer…

Leonberg Capital’s High Yield Investor said this company has…

“Proven to be one of the most recession-proof equity investments”

In fact, as I speak, while the S&P has been tanking, costing retirees hundreds of billions of dollars in their 401k’s… This stock is already up nearly double digits year to date…

Host: Wow. That’s incredibly rare for a stock to actually be up in 2022…

Jeff: Yep… And Wall Street is taking notice…

Principal Financial group has accumulated nearly 6 million shares

Vanguard owns over 11 million…

And BlackRock has purchased over 13 million shares of this tiny company.

Host: That’s a lot of money behind this tiny stock…

Jeff: Now, based on my research, I believe these two competitors stand to benefit the most from the massive shift to rentals in 2022 and beyond…

And I want you to be able to diversify: Having access to both.

The first one… A “blue chip” of the industry…

And the second one… A high-growth potential pick – just 1/10th the size of its competitor.

I’ve included all of my analysis, and predictions inside a special report called:

Two Rental Stocks That Could Earn A Killing In Landlord Nation

Host: And, Jeff, this isn’t some big technology prototype for the future where we have to wait decades, and decades in hopes that it actually hits the markets…

This is an investment shift that’s happening right now – the rush to rentals in Landlord Nation.

Jeff: Absolutely. Which is why I want to make sure that folks tuning in have everything needed to take advantage of this generational wealth transfer.

You see, there’s another sector of the market that stands to earn investors a windfall too…

According to researchers, over the last two decades… The U.S. is way behind on housing production.

Forbes reported that… “The U.S. built 276,000 fewer homes annually between 2000-2020 compared to the 30 years prior”

That means we’re in a shortage of over 5.5 million homes.

Host: That’s a lot of houses Jeff.

Jeff: Here in my home state of Florida… Apartment complexes and rental units are going up left and right just trying to keep up…

RentCafe reported that “36% of U.S. cities are building larger apartments…”

Yet, even with all of this expansion…

Patrick Carroll, CEO of a major housing development, said…

“Our occupancies are all-time high… we haven't seen any slowdown”

And while rental companies stand to make a killing off of the “Landlord Nation”…

So does this one, little-known, Florida based company.

Host: Tell me more..

Jeff: This company is sitting on over $17 billion dollars worth of land…

The second largest landowner in the state of Florida.

And when these real estate companies continue to build more and more complexes…

Host: They’re going to have to purchase the land.

Jeff: Exactly.

Host: It’s almost like a company buyout.

Jeff: This current real estate crisis we’re in is a HUGE win for this company… In fact this stock has already more than tripled over the last few years…

Host: Enough to have turned a $10,000 investment into over $47,000.

Jeff: And right now… As we’re sharing this broadcast, it’s trading for a massive discount…

Just $39 per share.

According to Simply Wall Street, this stock is “trading at 71% below… its fair value”

And if it returns to its April highs, which I firmly believe could happen…

Well, investors could nearly double their investment… Even in this dreadful economy.

Host: That’s a big-big move.

Jeff: And in my book, it’s a low-risk play…

Think about it… If my analysis is correct… Apartment companies will need the land…

But, if for some reason my analysis is wrong… And the Fed clips rates, sending the housing market soaring again…

Well… Because of the 5.5 million shortage of houses… then Home builders will need the land too!

Host: I love it Jeff. You don’t have to predict a housing crash, which can drain accounts…

We’re talking about a potential win-win opportunity… An investing layup.

Jeff: The time to get into this stock is right now…

In their quarterly update… They announced they’re actively partnering up with not one… not two… but EIGHTEEN homebuilders in Florida.

And insiders at the company are banking on this stock going gangbusters as company executives have a whopping $66 million of their own money invested in shares…

Host: $66 million held by insiders alone? That’s a ton of capital.

Jeff: They clearly believe that the upside for this stock is monstrous… And I do too.

That’s why I’ve outlined everything behind this company in the second report that you’ll get for free today once you take action…

It’s called…

The Hidden Goldmine: My #1 Land Resource In The World Right Now

I’ll give you all of the research behind the stock…

My analysis… My price targets… Everything I believe you need to succeed.

Host: And they’ll get this included today… For free?

Jeff: That’s right.

But I really want to make sure that the investors who get ahead of this catastrophic event have everything needed to build a healthy basket of stocks in their portfolio…

Host: That’s really smart Jeff. You can tell that this isn’t your first rodeo…

Jeff: That’s why today, I’ll also be including another bonus report.

A world-famous builder who has been cranking out record revenue numbers… One after the other…

As a matter of fact… From the bottom of the Covid crash till the beginning of 2022…

This stock has outperformed Amazon… Microsoft… Facebook and hundreds of other headline-making businesses.

Host: Wow – that’s remarkable… Is this a tech-stock?

Jeff: Nope. Much like my hidden goldmine…

I believe this stock could benefit from Landlord Nation regardless of which way things shake out…

This isn’t some volatile startup. This isn’t some high-debt company.

This steady-earning stock has been around since 1954…

And as one of the leading builders in the United States…

I believe as rental expansions continue, this stock will be able to benefit greatly – as their services will be much needed along the way.

Host: Do you think it could triple again?

Jeff: I can’t promise any future outcomes… But I am extremely bullish on this stock.

This company is already miles ahead on the rush to rentals…

Just over this past year, they formed a $4 billion dollar single-family rental business which controls over 300,000 rental homes nationwide.

Host: That’s a hefty market share…

Jeff: They’re in the driver's seat to pocket a chunk of change from Landlord Nation.

Again… Inside this report, you’ll get the stock ticker, the targets, the research… All of it absolutely FREE when you take action today.

I’m calling it…

The Mega-Builder: One Stable Company That Could Benefit Regardless

Host: I love it… That’s a total of four high-powered stocks set to take advantage of the Landlord Nation…

And investors won’t need hundreds of thousands of dollars to get involved!

Jeff: Nope. But to take everything to the next level…

I want to hand over one last stock. This one is one of my all time favorite companies.

Based in Boston, Massachusetts… This stock could have made a lot of investors verified millionaires.

Host: What do you mean?

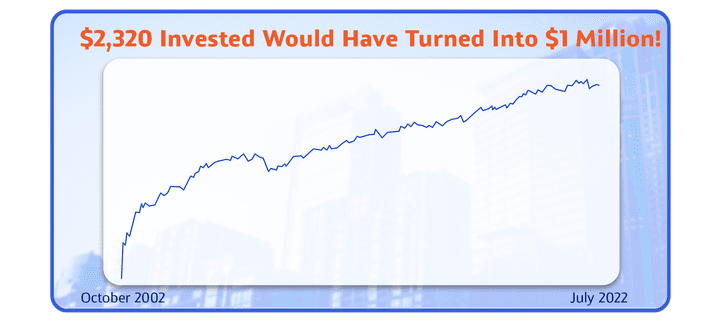

Jeff: Someone who put just an initial stake of $2,320 into this company back in October of 2002…

They’d be sitting on $1 million today.

Host: That’s insane. $10,000… That’d be north of $4 million dollars.

Jeff: Now, don’t get carried away here… Of course, nobody can perfectly time an entry like that… And sitting in an investment that long would take some serious patience…

But these are just the facts… And this powerhouse really did earn investors 43,120% returns over that timeframe.

Host: So… What does this “millionaire-maker” have to do with the Landlord Nation?

Jeff: As communities grow and expand, this company is a necessity for infrastructure…

I’m talking about basic things like cell towers, broadcast communication stations, you name it.

Host: Well that’s an industry that’s not going away anytime soon.

Jeff: Nope… In fact, it’s only growing larger.

This company grossed $9.3 billion just last year alone…

Nearly a 50% growth over the last four years.

And as rental communities expand, so will the need for this essential company.

As a result, analysts are predicting that this stock could outperform the entire industry by a factor of 5X over the next three years…

Host: Wow… 5X… It’s crazy to think that a “millionaire-maker” of a company still has so much room left to go…

Jeff: Now, I’ve included all of the research in another special report that you can get for free today, called:

The “Millionaire-Maker” Of Real Estate: One Company Up More Than 43,100% And Showing No Signs Of Slowing Down

Host: Jeff, you’ve gone above and beyond to make sure that those who take action today receive an incredible amount of value…

In fact… I want in on this once-in-a-lifetime opportunity…

How can I, and our viewers at home, access these reports for FREE?

Jeff: I’ll open the doors to this incredible deal in just a moment…

However, keep in mind – I’ll be limiting the number of folks I grant FREE access to…

Only 199 today to be exact.

But before I cut the curtain on this brand new opportunity…

I want to give ONE final report, this one… Not a stock… But an opportunity even larger.

Host: Just when I think this can’t get any better… What do you have for us?

Jeff: There’s one private startup company that is raising capital to quickly become one of the largest rental home providers in the world…

Amazon owner, Jeff Bezos, and the CEO of Salesforce, Marc Benioff are the two main investors behind it…

Host: Wow. Those are two of the savviest billionaires out there…

But won’t you need millions of dollars to invest alongside those two giants?

Jeff: Nope. Unlike most private offerings, you don’t need to be an accredited investor with $1 million laying around to take advantage of this…

…in fact, you can get started with as little as $100.

Host: Almost everyone could afford that…

Jeff: And the opportunity is huge… As Jerry Howard, the CEO of the National Association of Home Builders said…

The biggest winners in a housing market crisis would be the “same people who can always capitalize on a downturn—the rich.”

Well, today you have a shot to jump in alongside them in this private investment.

Host: What’s the upside?

Jeff: The COO of this company has already reported revenues up 10X over the last year alone…

And while I could never promise any future returns…

Pre-IPO investments like this one have historically paid investors extremely handsomely in the past…

I’m talking about life-changing returns.

Host: Well, even AirBnB, another real estate based platform, put up some mind-boggling numbers on IPO day…

One guy reportedly invested $30,000…

Had he sold on IPO day eleven years later, he would have cashed out $109 million in the bank.

Jeff: The numbers are just insane – a truly rare return on investment.

But even if this platform does one-one hundredth of that number, people could hit a grand slam.

That’s why today, I’m going to also include this report for free: It’s called:

Pre-IPO Fortunes: One Startup That Bezos & Benioff Can’t Get Enough Of

And remember… Early stage investors can get involved with as little as $100.

Host: Jeff, these five opportunities you’ve outlined… Well frankly, they’re second to none.

Jeff: As the Landlord Nation begins to ravish communities across the United States…

It's critical that folks watching right now take action today.

As the market is already pricing in the next interest rate hikes… This crisis is escalating faster than even I originally projected.

Host: There’s no time to waste.

Jeff: If I were you, I wouldn’t let another day go by…

That’s why today… I want you to receive all FIVE of these reports I’ve promised so far, but I don’t want you to pay one cent for any of them.

You can receive everything I’ve promised, with a zero-risk membership to my flagship investment service.

My mission in this premium research service is simple… To help everyday folks safely gain an edge in the markets.

We spend north of $100,000 each year just to keep this service running…

Between the bloomberg terminal, the market XLS account, the team of analysts…

It’s not a cheap operation.

But it’s worth every single penny… You see, what my system is designed to do is analyze hundreds of data points each month across 3,812 stocks…

And isolate the stocks where Wall Street is pouring in billions.

Every single month, I give my members a brand new, high-conviction pick…

…a stock that Wall Street is piling into.

Host: And your recent results…

They’re game-changing. Just look at some of your top results so far in Monthly Money Flows:

69% on BKR in a month’s time

85% on EQR in a month’s time

85% on ORCL in a month’s time

210% on WKHS in a month’s time

423% on COG in a month’s time

And many more double digit winners!

Jeff: Of course, no investment strategy is perfect… We’ve had big winners, small winners, even losers too.

But I am happy to report that so far, through the good times, and the bad times, with a win rate over 50%… and my wins much bigger than my losses…

We’re averaging 24.8% per month on the options trades.

Host: 24.8% per month… is that just the winners only?

Jeff: Nope – that’s including both winners and losers.

Host: Jeff, do you realize… During that same time frame, the S&P 500 is averaging only 1.5% per month…

Jeff: I sure do…

Host: That means your track record so far is 16-times better than the S&P.

Jeff: I put a lot of work into service to make it easy as can be for my members…

Host: Well, it makes perfect sense why some of your best students have been raving about the Monthly Money Flows service:

Zachary T. from Augusta, Georgia said…

“I’ve made doubles, triples, and more… Account has grown 600%… Saved so much time researching”

Edward W. from Cave Creek, Arizona told us about his experience so far, saying:

“$1,591 profit (annualized 152% and 109% on trades)”

And Piaw O. who is trading with you all the way from Australia wrote in…

“Very convincing start for me. Thanks Jeff. More than $1,300… a 90% gain”

Jeff: This service is built to help regular people have the ability to make high conviction investments… Not left screwed with a lame buy and hold strategy on the S&P 500 while the economy drops like a rock…

But instead, always looking to get ahead of the next big money move: Just like today with Landlord Nation.

Host: By teaching folks how to navigate the REAL market…

And find these opportunities, you’ve been able to help out a LOT of people…

Like Rumal A. from Brooklyn, New York said….

“It offers consistent gains… Gain of $852 on EQR… $544 on Micron. Thank you so much for your guidance and appreciate your added value picks which gave my portfolio life.”

Or Reuben K. … He’s actually beating your average returns:

“Average return is 34% trading Monthly Money Flows”

And then there’s Judith M. from Victor, Montana who said…

“I cashed in three or four winners! $2,800 started in October and over $7,100 in gains so far”

Jeff: These were just everyday folks who chose to join me inside Monthly Money Flows.

And thanks to this straightforward, but effective strategy…

They’ve been able to gain confidence in their own trading and investing.

Host: Now, in the past working on Wall Street as a hedge fund manager, I’m sure you were paid hundreds of thousands of dollars for your expertise…

So how much will it cost to join this exclusive group?

Jeff: Nowhere near that.

In fact. It costs less than a quarter per day.

And as soon as you take me up on a risk-free subscription to Monthly Money Flows, I’ll rush you all of the reports that we went over today:

Two Rental Stocks That Could Earn A Killing In Landlord Nation: The Rental Companies That Are Buying Up Real Estate Left & Right To Grab Market Share

The Hidden Goldmine: My #1 Land Resource In The World Right Now: One Florida Based Company Sitting On $17 Billion Dollars & Set To Cash In On Landlord Nation

The Mega-Builder: One Stable Company That Could Benefit Regardless: An American Classic Builder Who Could Land All Of The BIG Builder Deals Even If There’s A Real Estate Recession

The “Millionaire-Maker” Of Real Estate: One Company Up More Than 43,100% And Showing No Signs Of Slowing Down: The Little Known “Tower” Company That Is A Necessity In Any Growing Community

Pre-IPO Fortunes: One Startup That Bezos & Benioff Can’t Get Enough Of: How To Get Involved In This 10X Level Private Investment Today Even With As Little As $100

PLUS: A Brand New Monthly Money Flow Trade Every Single Month: You’ll Get The Ticker, The Analysis, The Options Play For My #1 Money Flow Play At The Beginning Of Every Month – The Stock That Wall Street Is Buying Up In Secret

Exclusive Stock Market And Economic Analysis: The Inside Scoop On How We’ve Been Able To Outperform The S&P 500 By A Factor Of 16X

24/7 Access To The Private Members Portal: Instant Access To The Members Area Where You’ll Get Fast, Easy Access To The Entire Landlord Nation Portfolio, Plus The Ongoing Monthly Picks

NEW: Key Opportunity Flash Meetings: One To Two Times Each Week, When I See An Opportunity Emerging In The Broad Market, I’ll Invite You To A Members-Only Flash Meeting Where You’ll Get More Investment Ideas For FREE

Host: Jeff, that’s a huge value.

Jeff: The Landlord Nation reports alone are worth $985.

Host: Frankly… It could really go for much more…

Some of your services have sold for as much as $1,997 per year in the past.

But even at $1,997 a year, this would be a steal of a deal.

Jeff: I really want to make this decision a no-brainer for folks tuning in right now…

If there’s one thing I want to be remembered for…

It’s for helping as many hardworking people see success in the stock market as possible.

I’ve spent my decades making the rich richer… And watching as the wealth gap grew larger and larger.

Today… I want EVERYONE – whether you have a million dollar account or if you’re just getting started – to have the opportunity to get in ahead of this opportunity…

Because, frankly, if you don’t, it could be crippling to your portfolio, and your future.

So I lowered the price to the absolute minimum…

A price that would just barely cover the costs to keep this page online…

Less than a quarter per day…

Host: That’s like a dollar fifty per week.

You can’t even get a cup of starbucks for that cheap…

Jeff: Like I said… I’m charging the absolutely minimum…

Host: And they’ll get access to you, a 20 year vet – former $700 million hedge fund manager…

They’ll get access to the FIVE stocks set to soar from Landlord Nation…

A sneak peak on the private-investment opportunity with Bezos…

New investment opportunities every single month… Plus all of the bonuses – for a drop-dead low price.

Jeff: That’s right. And the membership will be risk free for the first 199 who take action today…

Honestly, if joining Monthly Money Flows today doesn’t sound like more than a fair deal…

Then you might not be serious enough about your financial future.

But for those who are ready to take action today… and be one of the 199 who receive the urgent Landlord Nation reports completely complimentary…

Well, I want to reward you.

I want to remove all of the risk of the membership fee off of you today and put it back on me.

For the first 199 today, I’ll be including my: 365 Money Back Policy.

At any point over the next 365 days, if you decide Monthly Money Flows isn’t for you…

Then simply call my team and we’ll refund you every last penny.

Host: Hold up… You’re telling me, I can access ALL of this today, and 365 days from now…

After seeing all of the Landlord Nation picks…

And 12 more Monthly Money Flow investments over the course of the year…

I can call in and get ALL of my money back?!

Jeff: That’s right. And I’ll even let you keep the reports as a way of saying “thanks” for giving me a shot.

All you have to do is click the button below me to get started today.

You’ll get complete access to EVERYTHING detailed today, plus my money back guarantee if you’re not satisfied…

Host: Folks, you better act fast… I can’t imagine that this deal will be around for long.

And honestly, based on Jeff’s track record… I’m sure you’ll be hooked once you’re in…

As you’ve seen today, with the Fed hiking rates at the pace they currently are…

Spiking mortgage rates…

Millions of hardworking people could be left with no choice but to rent from Wall Street.

Today, you have a chance to position yourself for this coming shift… All you have to do is click the button below to get started.

So what are you going to do?

You could walk away from today’s broadcast, pretend that everything presented was just a “bad dream”… Live in an alternate reality… And risk getting crushed.

Or, you could heed Jeff’s warning…

See the stock picks that stand to crush it in Landlord Nation…

And get in front of this massive investment window.

The choice is yours… And if you’re on the ledge…

Just hear some of the top stories from people who chose to take action…

Like Linda P. from Broomfield, Colorado who said…

“The very first month with Mosaic… HUGE gain. Also did well on Zoom and Lyft… I feel confident that I will steadily grow my account if I stick to it… I appreciate your time in doing this. I'm in my 60's, I can't stop working (I do love my job though). Keep doing what you're doing and I'm sure it will be worth it”

Or Buck J. wrote in…

“I started my subscription during the January trades and that month alone more than paid for my entire subscription + a LOT more! Thanks!”

And Greg V. from Ararillo, Texas who told us…

“I made 87% on Docusign!”

The time to act is now.

With the 365 Money Back Policy – joining today is a complete no-brainer.

Especially when you consider the value of all the reports and research you’ll be receiving today…

But you must take action NOW.

Remember, this free gift is only available to the first 199 who join today…

Now, Jeff has over 75,000 followers…

So I have no doubt spots will fill up quickly.

Just click the button below to grab instant access today.

Disclaimer: Stated results are typical for given period. Past performance is not indicative of any future results. Trade at your own risk.