One by one, the dominoes keep falling.

Practically daily, investors witness the impact of interest rates on one asset class after another:

- Gold prices have fallen over 16% since last summer, giving back over 60% of 2020’s rally in prices.

- Expensive tech and growth stocks corrected in February.

- Mortgage rates have risen the most in three years. Suddenly that $600,000 house will cost more in monthly payments.

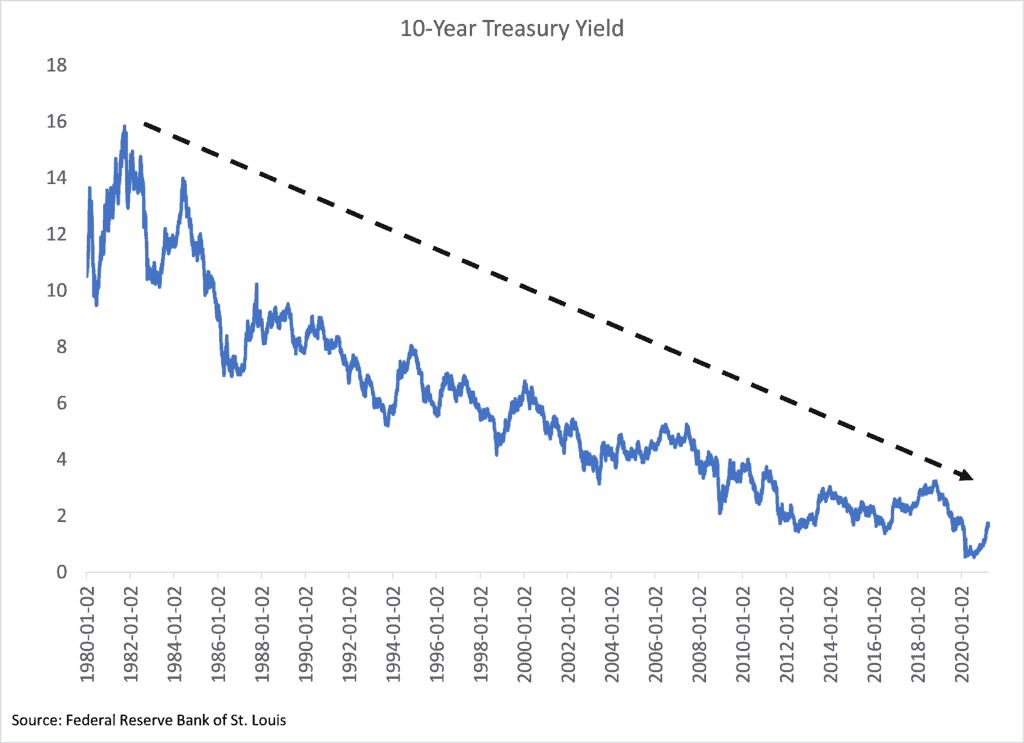

For much of the past 40 years, falling interest rates were a tailwind for these markets. Now the 10-year Treasury yield threatens them all as it tries to end its long-term downtrend as shown below.

But the turmoil isn’t over just yet. There is another domino about to fall.

Retirement!

[Exclusive: Dividend Expert Reveals His Biggest Income Secrets… Free of Charge!]

That’s from the impact of rates on the stocks you hold to produce income. So, if you’re in or near retirement especially, it’s time to rate-proof your portfolio. Here’s how…

KNOW THINE ENEMY

Income-generating stocks are vulnerable to rising interest rates in two ways:

- As a saver, you know there aren’t many ways to generate a decent income in this environment. Declining long-term yields steadily made income-producing stocks more attractive. But the reverse will also be true. Rising rates will lure investor dollars back to fixed-income securities.

- Debt payments. Higher yields mean higher interest payments on debt (like that $600,000 house I mentioned earlier). That also translates to less net income for indebted companies and potentially falling dividend payouts for investors. The bad news is that many high-dividend companies operate in industries with lots of debt on the balance sheet, such as utilities.

But there is one type of income group that is less sensitive to rates. In fact, these stocks thrive when percentage points are ticking up.

FOCUS ON DIVIDEND GROWERS

They outperform ALL OTHER stocks when rates are rising. How? They grow their dividends.

I’m not talking about companies with high dividend yields. I mean companies that continuously grow their dividends.

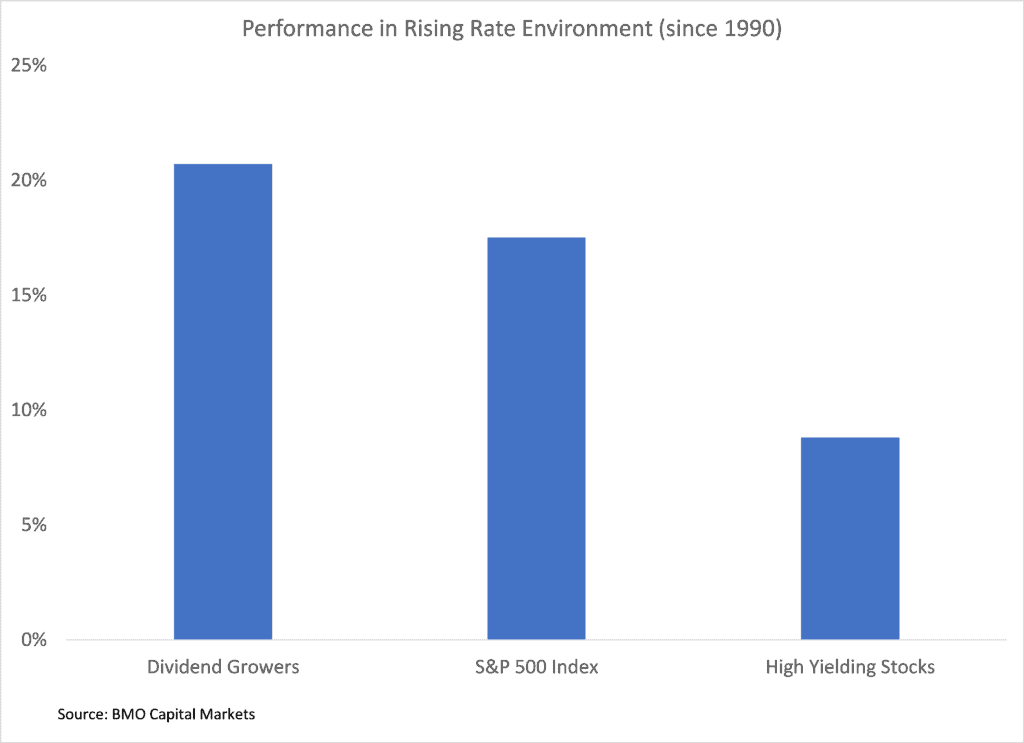

A recent BMO Capital Markets’ study shows that when the 10-year Treasury yield had a sustained increase, dividend growth stocks returned over twice that of stocks with high dividend yields. They even beat the overall return of the stock market during those periods.

That’s because dividend growers offer a unique advantage.

They allow your yield on cost to keep rising. That is, you earn more income compared to the price you originally paid for the stock. It’s one of Ted’s favorite metrics when evaluating a new income opportunity. Plus, a growing dividend signals financial stability, and ongoing opportunities to keep expanding the top and bottom line.

That’s why we’ve packed the Bauman Letter model portfolio with companies that have a history of growing dividends at a fast clip. In fact, five of our model recommendations have grown their dividends by more than 10% per year for the last five years.

[Bonus: The Safest 9% Dividend… Top Three “Extreme Dividend” Stocks, And Much More]

If you are nearing or in retirement, now’s the time to protect your portfolio against rising rates.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter