Table of Contents

- Introduction with Daniela Cambone

- Who is Dan Ferris?

- The definition of a bubble

- This is the moment when you must act

- Prepare, don’t predict

- What’s the solution?

- The “crown jewel” of our research

- The 5-Stock Inflation Protection Portfolio

- The No. 1 Stock on Earth to Beat Inflation

- The World’s Two Most Valuable Assets in a Time of Crisis

- Now it’s up to you

PRESENTED BY STANSBERRY RESEARCH

“CRAZIER THAN 1929”

THE NEXT FINANCIAL DISASTER MAY HAVE ALREADY BEGUN

One of the biggest market bubbles in history is popping. You can do nothing… or take ONE simple step to prepare now.

INSIDE: the easy-to-use portfolio to stop worrying… crush inflation… and multiply the gains of every “defensive” idea you’ve ever heard of.

I’m Daniela Cambone, and I’m honored to be your host for this urgent market briefing.

For more than a decade, I’ve interviewed leading financial minds like billionaires Mark Cuban and Steve Forbes… investing legend Jim Rogers… Shark Tank angel investor Kevin O’Leary… and Congressmen Ron Paul and Newt Gingrich.

But this next interview is one I guarantee you won’t want to miss.

Over the past few years, I’ve spoken to dozens of analysts and experts who’ve been raising the alarm – with increasing urgency – about a dangerously overheated market headed toward disaster.

And this year’s market swings are proving them right.

But my guest today is going further – and stepping forward not just with proof of what could soon happen…

But with a clear-eyed, simple, and potentially lucrative plan for what you can do about it.

A way to protect your savings and prosper in the coming years without selling everything… trying to time the market… or using risky hedges like short selling or put options.

Putting just 10% or 20% of your wealth into this approach could make all the difference in your financial security and peace of mind over the next few years.

And while my guest is expecting both runaway inflation and a painful crash – nothing about his approach is based on perfect timing or flawless market predictions.

His mantra is: “Prepare, don’t predict.”

So if you’re at all worried about what’s about to happen next in the markets… this interview is for you.

You’ll get, for free, the details of a dead-simple, one-step investment approach that could show you a series of triple-digit gains or higher, starting right now.

Using only regular stocks – nothing unusual or complicated.

A way to not just beat inflation – but benefit from it.

You don’t have to change everything you’re doing today.

But if you take a few minutes to position yourself with this approach… you can likely forget about inflation, rising prices, or the worst effects of a market crash for years to come.

But it’s critical that you take action.

Because my guest believes that a painful stock market collapse isn’t just likely…

It may well have already begun.

We’ve already gotten a chilling preview of this collapse.

Starting with the worst January in stocks since the financial crisis.

Then a massive collapse in the most popular investments of the last decade, including big tech.

Then the war in Europe… $130 oil… $5 gas… and massive global supply chain crises.

If stocks have moved back higher by the time you see this – it doesn’t matter. In fact, it’s an even bigger warning sign.

Today, this analyst has agreed to a rare on-camera appearance to show you the proof…

Alert you to the one, CRITICAL mistake you’re probably making today…

And even share one of his best defensive recommendations on camera completely for free.

In fact, even if my guest is completely wrong about an impending crash… he’d still be recommending this exact same approach.

Because it is, by far, one of the best ways to protect your savings and profit from out-of-control inflation, which is already here right now – no predictions required.

If you don’t already know this man, I promise you’re in for a treat.

He’s the analyst behind 24 different winning stock recommendations of at least triple digits to date in his research.

A brilliant and disciplined thinker whose ideas have soared as high as 629%… 319%… and 849%… with a risk profile most can only dream of.

Multimillionaires who could access literally any research in the world have followed his work.

Of course, this man’s impact has gone far beyond recommending winning stock recommendations.

He’s always been willing to speak out against the popular and often dangerous conventional wisdom in the markets. Likely saving millions for those who follow him.

But he says that’s never been more true today.

What he’s about to show you could make all the difference for your safety… freedom… and ability to live the life you want in the coming years… no matter what happens in the markets.

Please, set aside any distractions and pay full attention to this rare interview with the legendary value investor and popular podcast host, Dan Ferris.

And one more thing – we’ll be covering a lot of information and evidence in this interview, so please feel free to fact check anything in our details and disclosures page.

Daniela Cambone:

Dan, welcome. I’m really excited for this.

Dan Ferris:

Dani, thank you. That’s a flattering introduction. Too flattering, maybe.

Dani:

Why do you say that?

Dan:

People that know me know I’m not big on interviews or publicity. I like to be at home with my wife and my dog. I like to play the guitar.

I’m not motivated by being in the spotlight.

But what I am motivated by is my followers… my podcast listeners… and the viewers watching this.

Even if you’ve never met me or even heard of me before… I promise you you’re a part of that.

I consider it a sacred trust to have a platform where I can reach a wide audience.

And what gets me up in the morning is helping you protect yourself in moments like this – help you become wealthy and stay wealthy while avoiding the massive risks in the market. And telling you the hard truths. Even when – especially when – what I have to say is unpopular.

Dani:

And you expect this to be unpopular today?

Dan:

Maybe. My readers and your viewers are way ahead of the average person, so I think they’re receptive.

I actually think my view is very rational, very sensible. It’s supported by history and the facts on the ground.

But, Dani, that sounds lame as hell.

The real story is that my heart is breaking because I believe a lot of people are going to lose nearly everything they’ve saved in the next few years.

People are going to be wiped out.

People are going to have to live with a crappy, stressful retirement… not be able to take care of themselves and their spouses… not be able to give their kids and grandkids the things they dreamed they would.

And it’s completely avoidable.

That’s the story.

It’s not going to happen to ME because I’ve spent an entire lifetime learning how to avoid it and I know what to do in a moment like this.

It doesn’t matter one bit whether my timing is off by two weeks or six months or whatever it may be. I will be protected against what’s coming. And I want everyone to have that.

So I’m happy to stay relatively quiet for years at a time… and just share my best investing ideas with the folks who already know me and my work.

But then there are moments like this.

Moments of EXTREME danger… where millions of people’s finances and retirements hang in the balance in a big, immediate way… and nobody’s telling them the unvarnished truth.

So Dani, I’m doing this today because I HAVE to. I have to do it to be able to live with myself in good conscience. If ONE single person who sees this interview pays attention and follows these ideas… it’s worth it. Because I think this information could save that person’s life. Not their physical life, maybe, but their financial life.

Their ability to have any quality of life in the coming years. And maybe even some actual lives because good luck paying for housing or health care when you’ve lost 90% of everything.

And I don’t think that’s grandiose. It’s not about me being special.

If you were a solider and you could prevent an attack from happening on America, you would do it.

If you worked at a nuclear plant and you knew it was ignoring safety and bound for a meltdown, you’d blow the whistle. You’d do your part.

That’s exactly where we are right now. So I’ve got to say this stuff. I’ve got to.

The nuclear plant is about to melt down. It is. I think it may have already started.

So you can do some simple things now to be safe and protected and save yourself or you can ignore all this and see what happens.

So I’m extremely grateful for this opportunity. Let’s get right into it.

Dani:

Let’s. When you say extreme danger – what do you mean?

Dan:

What we’re seeing today is exactly what a big, long-term TOP in the markets looks and feels like.

We’re watching the bubble burst in front of our eyes, and people are just shrugging at it – which is terrifying.

The attitude in the markets, at least until very recently, has been that it’s impossible to lose.

It’s a mania. “Buy buy buy.”

The drugmaker AstraZeneca is trading for 447 times earnings.

MercadoLibre, the so-called Amazon of South America, 583 times earnings in recent days.

But that’s nothing.

The business software company Workday, a $50 billion company is trading at over 2,000 times earnings.

This is madness.

But stocks only go up, supposedly.

So you have meme stocks like AMC, whose actual business is in steep decline, and was up 2,000% for no reason.

And people think, “Yes, I should buy that.”

Maybe with the rent money or the kid’s college fund.

Same thing for digital assets like NFTs that just get conjured into existence with the click of a button.

Dani, history teaches us what happens in a moment like this.

I can sit here and show you the data and statistics that prove how dangerous this market is.

But forget all that for a moment. Before any of that, just look at the big picture.

When everyone is just desperately gaga to get in… to pour in their savings… to use leverage.

That’s a bubble.

Dani:

It’s basically the definition of a bubble.

Dan:

Textbook. And I’m sure most people watching this have seen this before. You’ve been through it.

But if you haven’t for some reason… or more importantly if you’ve simply forgotten the feeling…

I’m telling you…

THIS IS IT. This is what it feels like.

Dani:

When everyone thinks you can’t lose… that’s exactly when you do lose, in a big way.

Dan:

Yes, exactly.

And the absolutely AMAZING thing, Dani, is we actually got a preview at the beginning of this year.

Believe me, that was a huge blessing.

Dani:

You mean when the market fell sharply from in the first couple months of the year?

Dan:

Yes. Starting right around the beginning of the year for the S&P… and even earlier – like around last Thanksgiving – for the Nasdaq.

Dani:

That was a difficult time. What do you mean a blessing?

Dan:

Usually, you don’t get a warning like that.

It was like a dry run. And even if you don’t remember how you might have felt in 2000 or 2008, I bet you remember how you felt in February.

Then the war broke out in Europe.

And inflation – good God, we’ll talk about that.

The situation just keeps getting WORSE.

Dani:

Yet the market, as you said, seems to shrug it off.

Dan:

Until it doesn’t.

There’s no mystery here about what will happen. This moment is so, so similar to 2008… and 2000… and even 1929.

You know, Jeremey Grantham, the billionaire whose firm manages $64 billion… and who called the 2000 and 2008 bubbles perfectly…

Grantham went on CNBC and said, quote,

And lots of other smart folks are saying more or less the same thing.

For example, Robert Shiller, the Nobel laureate economist, warned that stocks and bonds have never been so overpriced in modern history. Even with the recent market volatility, the famous measure of stock valuations that he created is still near its second highest level since 1881.

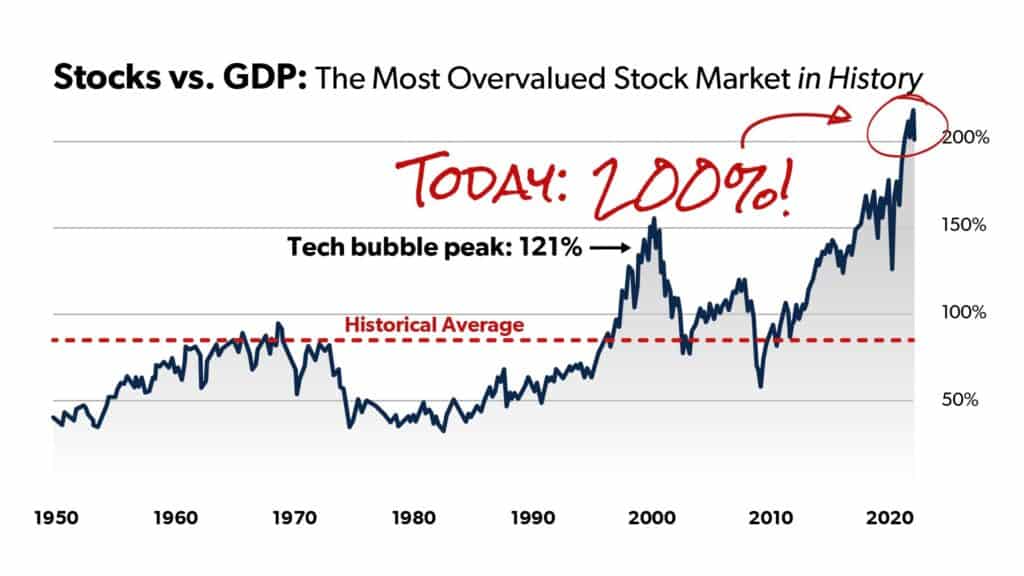

And, to me, this is a big one because it’s deceptively simple.

It’s just the comparison of the total market cap of the S&P 500 to our entire country’s GDP – the value of all the goods and services we produce.

The historical average is around 80%.

Back in the 2000 bubble, when things got way, way out of whack, that number skyrocketed to 121% right before the crash.

Today, it’s at around 200%. Which is very nearly the highest level ever, in history.

What this tells you, in short, is that stocks are way too expensive.

Dani:

That’s an alarming stat. I’ve seen a number of people mention it, but I don’t think it’s getting enough attention.

Dan:

Yeah, one of the smart folks raising the alarm is a guy named Michael O’Rourke, the chief strategist at Jones Trading.

He wrote a note saying:

When smart people are making sure they’re “on record” warning about financial apocalypse – you know things have gotten out of hand. And I’m definitely in the same boat.

So please understand I know I’m not the only one warning about a bubble. I don’t pretend that.

But it needs to be said. In plain English. And people need some help with what to do about it.

Because unfortunately greed is still in control right now.

Nobody even wants to think about bad outcomes.

And just knowing intellectually that this is a bubble doesn’t mean crap if you don’t DO SOMETHING about it.

So the first thing I want to say to your viewers is this: This is it. This is the moment when you must act. Now. Not when stocks are down 50% or 70%.

This is when you take action that saves you from having to feel the way you did in 2008.

And I don’t know, of course, where the market will be when you see this. The volatility’s been so high, and we’ve had some brutal days… weeks… even months here and there.

But until this market falls 80% or more – in my view – the fat lady hasn’t sung.

So please, please do yourself the favor of protecting yourself now.

Dani:

But Dan, I think one of the criticisms you hear is that you’re a perma-bear. That there’s always something to worry about and that certain folks like you – and maybe me – are always going to focus on the negative.

Dan:

For sure.

The short answer is: That’s bullshit.

I literally make my living showing people how to make money in stocks – and have for as long as anyone can remember.

My top open recommendation across my company’s research services is up as much as 849%. A different one’s up as high as 327%.

My average recommendation – and these are on-the-record, published ideas in one of more than thirty newsletters – is up as much as 67%.

In this market!

You can do that without being reckless.

In the long run, you have to, because it only takes one stupid mistake to undo years of smart, careful growth.

And that’s where we are today.

We’ve just experienced more than a decade of the best market conditions you can imagine.

You don’t get a lot of opportunities in life to experience that… and most of us probably never will again.

Whether everything that’s happened is rational or not doesn’t matter one bit. You get to keep the money either way.

But for God’s sake, make sure you keep it!

Dani:

Are you saying to sell everything and get out of the market?

Dan:

No, I’m not. You don’t have to do that.

And you don’t have to go “all in” on my approach, either – not by a long shot.

I think you’d be crazy not to consider doing it with, say, 20%. In fact, I think you’re virtually guaranteed to regret it if you don’t. I don’t think that’s hard to do.

Then, if you want to keep some money in speculations, go for it. But I’d keep that speculation bucket relatively small these days.

Just remember that, big picture, I estimate the downside risk these days is probably 80% or more – and the upside is… what? Maybe another 10%?

Dani:

One of my recent interview guests said the same thing. Egon von Greyerz, who runs Matterhorn Asset Management. Except he said 90% on the downside.

Dan:

Right. So whatever the numbers – if you knew those numbers were correct – whether it’s 70% or 90% downside – versus maybe 10% or 20% upside remaining…

What would you do?

Would you position yourself to try to grab the last 10% of gains that might still be on the table in a 12-year bull market… and just assume you’re going to time everything perfectly?

Or take action now to protect everything you’ve probably made of the last 10-plus years?

And actually be in front of the next cycle when it’s going to be a very different set of assets that are going up?

Dani:

And you’re going to lay that out today… the assets to own that could protect your downside in a crash and be positioned for big gains on the other side?

Dan:

Exactly. And it’s darn close to the opposite of what most investors are doing today. So you can make this shift now and feel really, really good, really confident in my view.

Or you can make it when you’ve given back maybe 50% of everything you’ve gained over the last 10 years.

Maybe more.

But you’ll be acting in a panic. That’s what’s going to happen to most people.

And folks, that’s not going to feel good. I promise you.

This is the moment to take care of your future self. Not in the moment that’s coming when the news stations break into daytime programming to talk about the unfolding crisis – the equivalent of the Lehman Brothers moment in 2008.

Dani:

I love that idea that you can do something to take care of your future self.

Dan:

I do too. And I also know what happens if you don’t do this now. I don’t know the viewers individually, of course. But we know a lot about investor behavior. I’ve spent decades studying it, as have a lot of people a lot smarter than me. And the situation today is like a perfect storm for bad decision making. Most people – the vast majority in my view – are going to make financially fatal mistakes.

But you don’t have to.

This is the moment right now where you can do something – take care of your future self – and get out of that cycle. You can put yourself outside of the mania and the irrationality in a very thoughtful way so you don’t have to worry or be reactionary in any of this.

Dani:

And you’re going to show how to do that today. Not just in a general sense, but in a very detailed and specific way?

Dan:

Absolutely. There’s no magical thinking here. I’m not going to B.S. you about the magic signal that happens when this line crosses that line on the chart.

And I also want to be very, very clear that I am not here to shame you about anything you may have done in the market – good or bad – in the past. In the bull market, or in the last crisis, or whatever.

That kind of attitude it toxic bullshit.

This is about the present.

About something you can do for yourself, very easily, right now.

I’m going to show you the plan. It’s easy to implement. It’s backed up by history in a big, big way.

The only part about it that’s hard is breaking out of the groupthink – the dangerous investor psychology that I mentioned that’s absolutely driving the bus right now.

Dani:

Dan – that’s what you’ve been known for over the years. Contrarian research… poking holes in the narratives – the delusions in a lot of cases – that everyone is 100% sure of.

Dan:

It’s what you’ve always done in your career, too, Dani, so I tip my hat.

And I want to get to the heart of what’s going on – and what you can do – very quickly.

Dani:

I can’t wait to hear the details of your plan. But I do want to press you on something first. There’s a saying that bull markets don’t die of old age. It doesn’t just happen. And the economy is pretty strong by a lot of measures. So if you see a crash coming, why? What’s the catalyst?

Dan:

Dani, I disagree a little, frankly.

First of all, it doesn’t matter what bursts the bubble, or if it’s one thing or a number of things.

What history shows is that we’ll always look back and give a story to what happened, like it was obvious.

We’ll say, oh well it was the bonds in Iceland. But nobody was talking about bonds in Iceland when it mattered… when you could have done something.

Or it was Lehman Brothers. Or it was Greek debt. Or it was the Fed doing this or that.

Folks, I promise you’ll get your narrative when everyone’s looking backward. As humans we crave that, whether the narrative is right or wrong, frankly.

And the smartest people in the world will act like it was obvious all along, even though it wasn’t obvious and they didn’t predict it.

Dani:

I think you’ve said something pretty provocative though… which is that there’s a good chance we’re already in the next great bear market – and that people just don’t realize it yet.

Dan:

I do believe that. And the only reason it should be controversial is because of the ga-ga mentality out there that we talked about. It looks like the market is turning over. We’re just pretending like it’s not happening.

Don’t forget: Bottoms are an event. Tops are a process.

Even the Wall Street Journal came out saying the same thing recently.

This is what they said:

And that’s exactly what we’re seeing already, starting with the most speculative assets… the ones that drove a lot of the mania of the past few years.

SPACs… cannabis… meme stocks… many of the stock market “darlings” of the pandemic… as well as quite a few high-growth tech stocks.

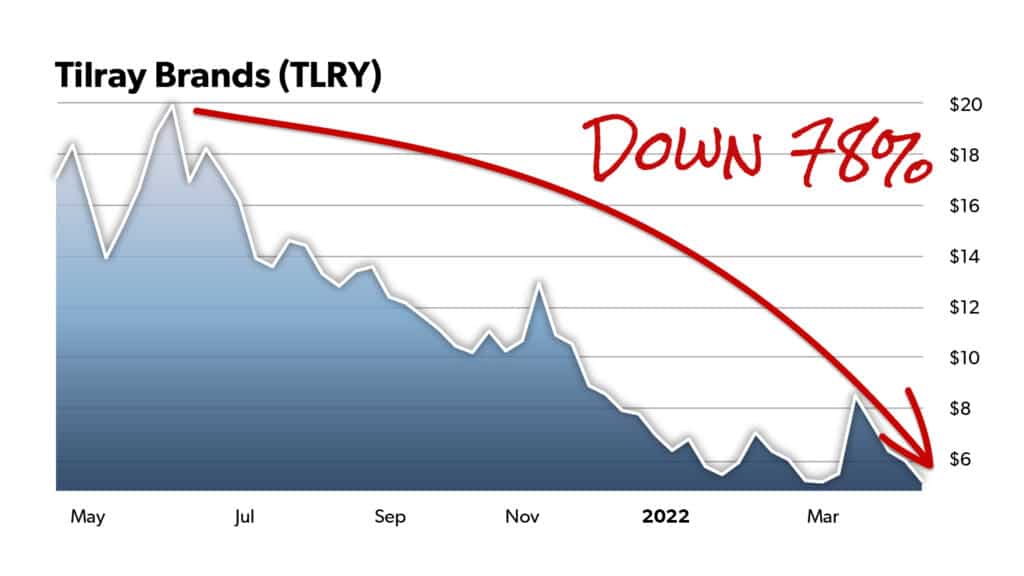

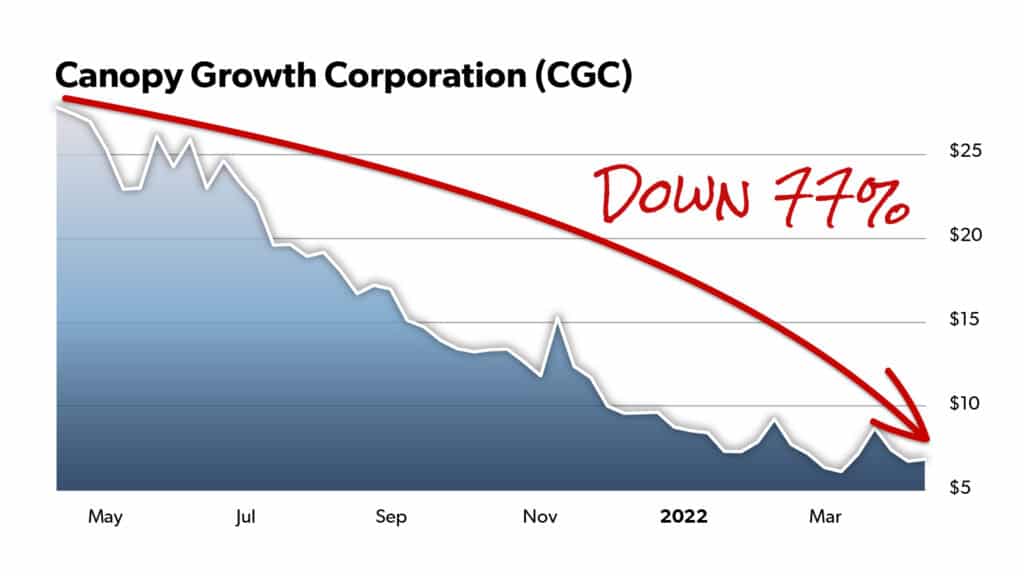

For example, Tilray, the cannabis company, is down 78% in the last year. Canopy Growth, 77%. And that’s just in the last year.

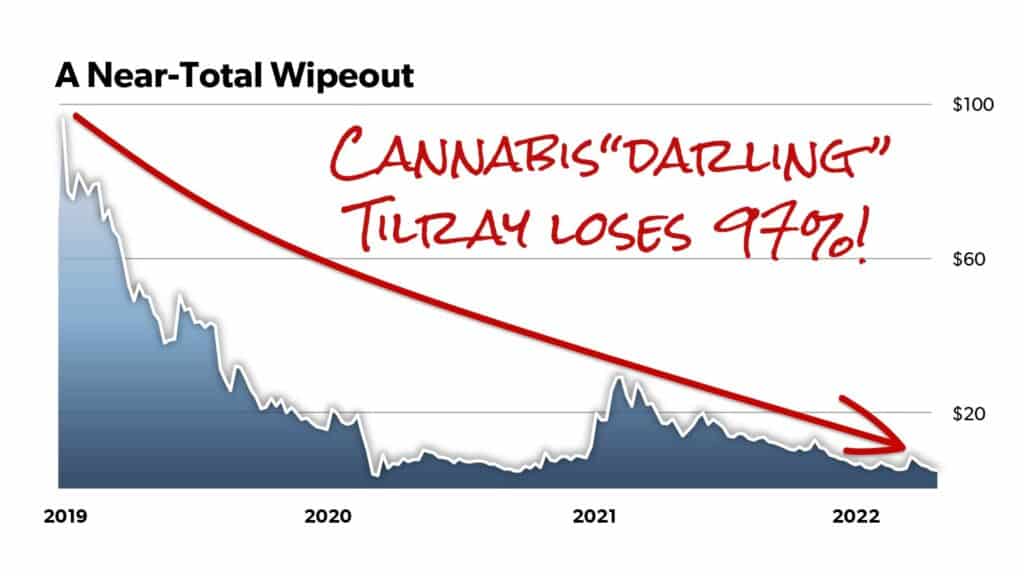

Tilray is down 97% from its all-time high about three years ago – an almost total wipeout.

With SPACs and former SPAC stocks – same thing.

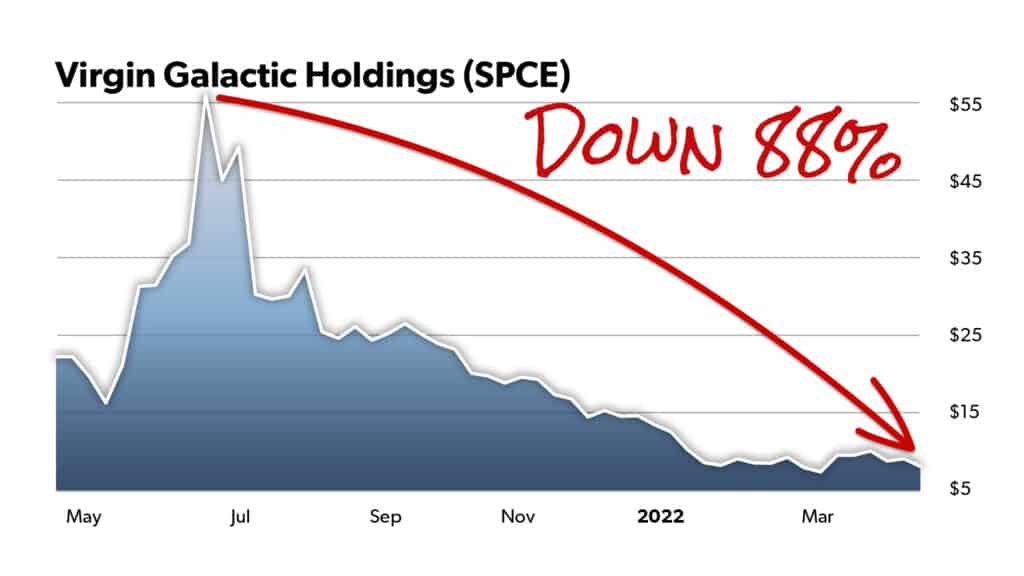

Virgin Galactic is down 88%.

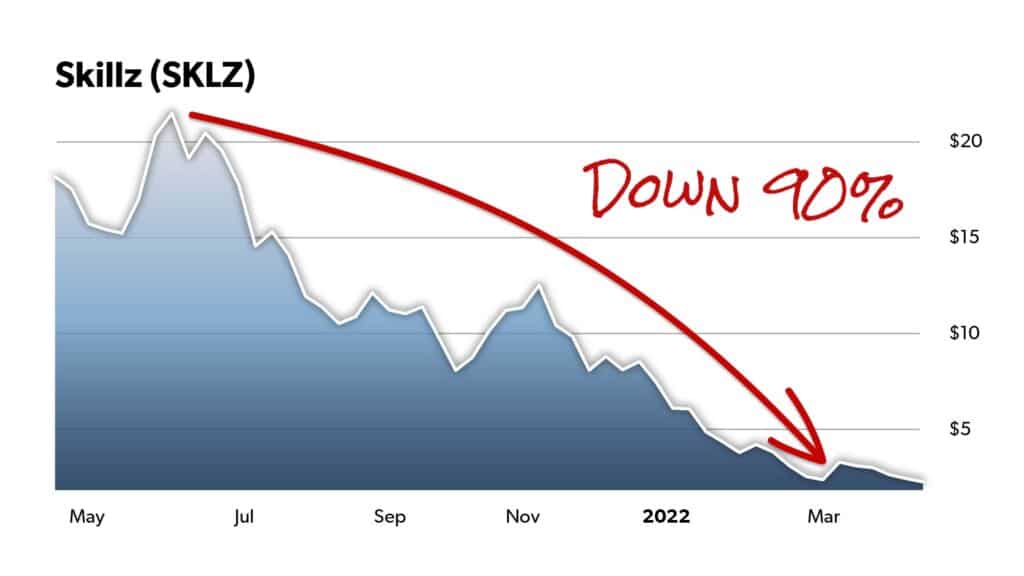

Skillz, another former SPAC in the “hot” online gambling sector, 90%.

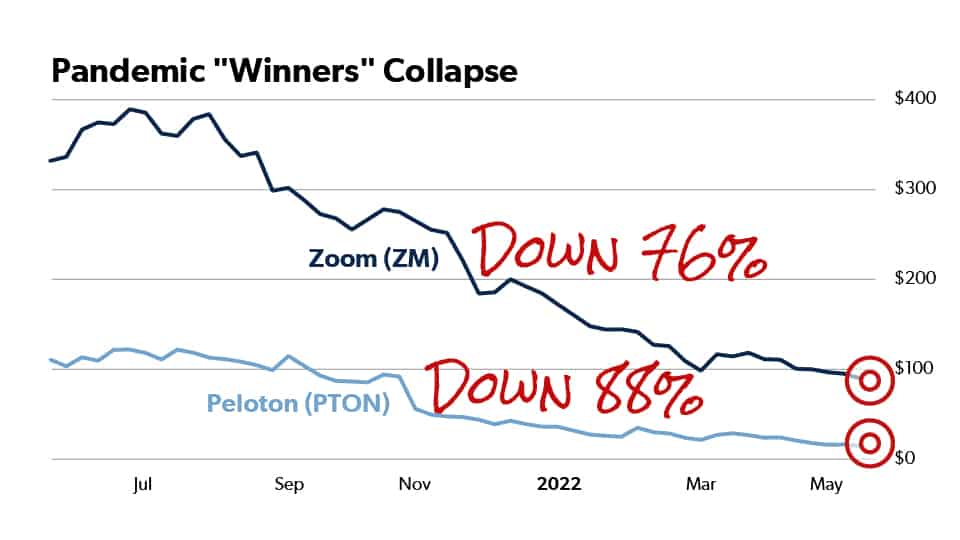

Zoom and Peloton, the supposed pandemic winners… get this. Zoom is down 76% and Peloton is down 88%.

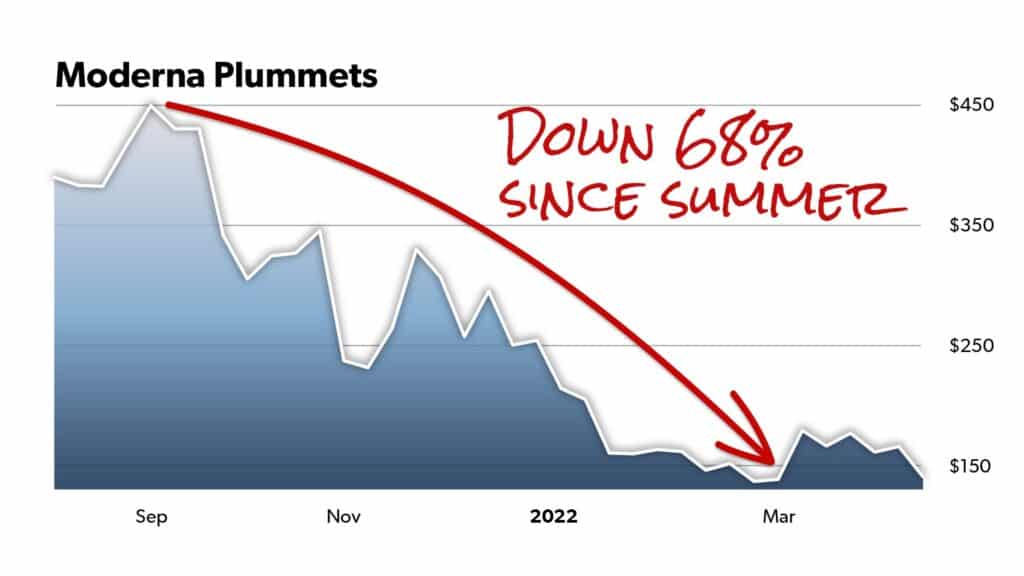

Even Moderna has lost two-thirds of its value.

All in the last year.

Dani:

If you were “buying the dip” on any of those when they were down 10% or 20% or even 30%, you’re in a world of pain.

Dan:

Yes. And it’s always the high-flying garbage that goes first. I don’t think these examples are outliers. They’re just the first to go. They’re showing us what’s coming. It’s a big clue and you ignore it at your peril.

This could be the beginning of the next bear market.

Dani:

And the people who think this is a “buy-the-dip” moment are going to get crushed.

Dan:

Maybe it’s a buyable dip and maybe it’s not. Nobody knows that. But let me ask you this, with stocks more expensive than ever before, do you really think it’s the right moment to try to squeeze another 10% out of Tesla or Zoom?

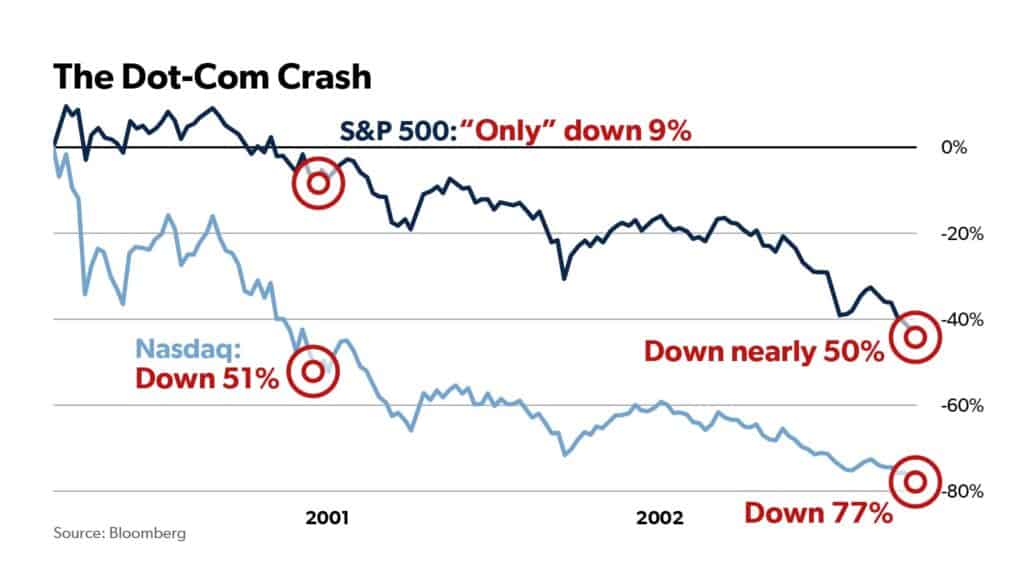

Look back at what happened in the 2000 crash.

The Nasdaq peaked in March of that year.

By December it had been cut in half.

But, even then, everybody thought it was limited to tech.

The S&P 500 was down just 9%. Not even a “correction” by the usual standard.

But over time that changed. Everything fell.

By the time things bottomed out on October 9, 2002, the Nasdaq was down 77% and the S&P 500 was down 44%.

Dani:And you think something similar is playing out right now.

Dan:It’s silly to try to predict anything like this, but the point is you don’t know that something similar isn’t playing out right now, and you won’t until it’s too late.

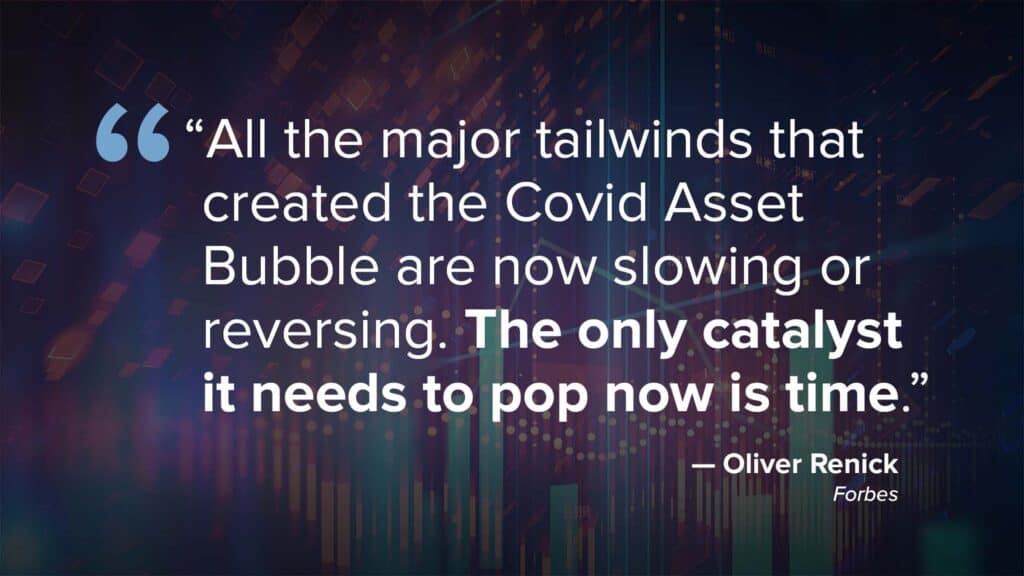

Analyst Oliver Renick said it very well recently in Forbes:

I mean, just statistically, stocks are grossly overvalued.

An easy one is price-to-sales. Bloomberg has good data going back about 30 years.

The S&P peaked around 2x sales before the 2000 crash. Ahead of the 2008 crash, it was even lower – around 1.5x sales.

It’s never, in all that time, been as high as 3x sales, ever, until just recently.

And what we know, based on extensive historical studies, is that when it gets high you can expect low or negative returns for stocks over the next 10 years.

That’s a historical fact.

And this is what most analysts are out there right now riling folks up to buy.

Dani:

There are other folks who are bearish as well.

Dan:

There are and I think it’s clear I’m in agreement. But even then, Dani, I think those folks tend to spend too much time trying to win a prize for pinpointing a cause… you know, “Oh it’s the bonds in Iceland” like I said before.

They’re almost never right. And if they are, they win nothing.

I’m not here for that.

I’m here to tell your viewers to prepare. You said it earlier: Prepare, don’t predict.

Dani:

But you do see, let’s say, potential dangers out there.

Dan:

Of course I do.

I mean, did anyone expect we would be talking about the real possibility of nuclear war in 2022?

But here we are.

And it’s not just the catastrophe in Europe.

Taiwan’s military issued a survival handbook to its citizens in case of a Chinese invasion…

We could see another mutation of Covid that throws us back to the same situation as March 2020.

We’re on the verge of a world food crisis – there’s already riots in some parts of the globe, like Peru, over food insecurity. And we could see a repeat of the 2020 violent riots in the U.S. possibly very soon…

I’m not saying any of this to be dramatic or scary.

And my approach to the markets is NEVER based on trying to guess at world events.

But obviously there’s lots of bad stuff out there. I don’t have to tell you that. And we’re already on very, very thin ice in the markets.

Of course any of these things could send us plunging. And if that happens – watch out.

But forget hypothetical risks.

The biggest one is something we already know is happening.

It’s not a “maybe.” It’s HERE.

Any guesses?

Dani:

Inflation.

Dan:

Exactly.

It’s here. It’s bad.

And, boy, if you ever needed a lesson that there are no “grownups” in charge, politically or economically in this country – you just got it.

These people are either unfathomably stupid… or they’re remorseless liars. And I’m not sure which is worse.

It’s probably a combination of both, unfortunately.

Just to remind you, when inflation started to become a big issue… the so-called experts made a big deal about the word “transitory.”

Fed Chair Jerome Powell was using it as early as August 2021, at least.

It was a way of telling suffering Americans to shut the hell up and stop worrying.

By October, inflation was above 6% … and these clowns were saying stuff like this.

This is from a Bloomberg article:

What on earth does that even mean? Transitory… but for a long time?

It’s the definition of double speak.

I’m sure you know what happened next.

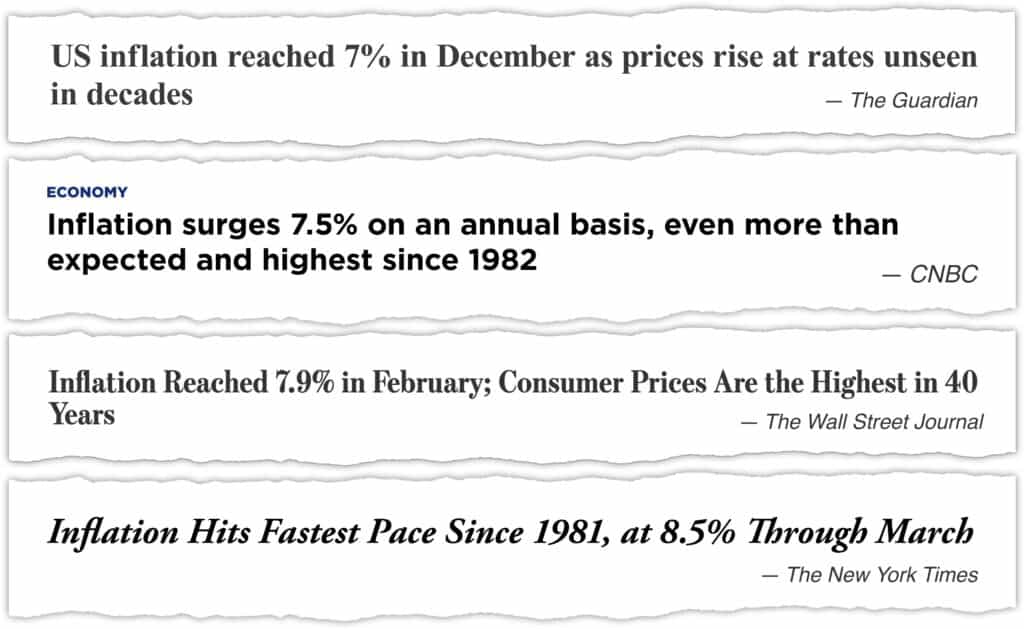

Inflation hit 7% in December…

7.5% in January…

7.9% in February…

And 8.5% in March…

The highest readings in over 40 years!

Gas soared past $5 a gallon in many places.

And Moody’s found that the average American family is having to spend an extra $327 a month, just on basic necessities.

No wonder Former Pimco CEO Mohamad El-Erian went on TV and savaged Powell and his buddies who promised this would all be “transitory” for “the worst inflation call in the history of the Federal Reserve.”

Now, of course, the Fed is saying a series of interest rate hikes will do the trick.

Just keep in mind that they haven’t been right yet about anything. And a lot of very smart economists say they won’t be this time either.

Dani:

It sure hasn’t made anyone in power look good.

Dan:

Again, I think we’re all getting a valuable lesson about who to trust and who has our best interests at heart.

But forget all the stats and figures for a second and just look at your own day-to-day life.

Is this transitory? Is it getting better?

How are gas prices in your neighborhood? Home prices? Food? Cars? I know just about everything I buy is more expensive.

What do you think it’s going to do to our economy when the average U.S. household is out an extra $5,200 that they didn’t budget for?

Can you think of anything more shameful than the fact that this is causing retirees who worked all their lives to have to go back to work…

This isn’t transitory.

This is what the next decade looks like when the money supply is up five-fold since the beginning of 2020.

Dani:

That’s an incredible statistic, isn’t it?

Dan:

It is. And the safe bet – the rational bet – is for significant inflation for a long time.

And I’d much rather expect that and be wrong than the other way around.

Because here’s the key thing. If inflation over the next decade plays out the way I’m expecting, it’s a financial disaster even without a crash.

Think about that, even if I’m completely wrong – and most of your guests are completely wrong – and a crash doesn’t materialize anytime soon… which I seriously doubt, by the way – but even then if growth stocks sort of hold their altitude and the market as a whole is just choppy and moves sideways on average, you’re going to start losing money.

Inflation is going to eat the value of your cash, and it’s going to eat some of the value of every business on the planet.

And that’s why I’m begging you to get some money into the assets I’m recommending. Now. Without delay. It’s crash protection… it’s inflation protection… and it’s set up to soar over the next decade. I believe it’s the trade of the decade, without question.

Dani:

Well, Dan, that’s a great place to pivot.

Because you’ve made the case that stocks are heading south… that the next great collapse may even already be underway right now.

And that the risks of inflation could be very, very damaging even if we somehow miraculously avoid a crash anytime soon.

And I think most importantly you’ve laid out why – no matter what happens next – the time to prepare is now, that you have to do this now and not when its glaringly obvious that we’re in a crisis and maybe 50% of your holdings have already evaporated.

We could keep talking about that all day.

But I don’t want to and I don’t think that’s what my viewers want either.

Dan:

I agree.

Dani:

So, let’s get right to it. What’s the solution?

Considering your outlook, I’m guessing you’re recommending gold.

Dan:

Sure, but that’s just the beginning.

I wouldn’t do this interview just to tell your viewers to own some physical gold.

I think they know that gold has been a store of value since at least the ancient Egyptians, 5,000 years ago.

I think they know it offers protection you can’t find in any asset that can be manipulated or diluted, like most stocks… or in something like Bitcoin, which has been around for about 12 years, by the way.

So I think you should hold some gold bullion or gold through an ETF that’s backed by physical metal.

There are some good ones out there and I’m not talking about G-L-D, which is the largest gold ETF, but based on complex engineering with futures contracts rather than real, physical gold.

So, let me mention a ticker symbol that you can go out today and take advantage of without ever spending a dime on research.

Even if you just did this and nothing else you’d be way ahead compared to most people. The ticker symbol is P-H-Y-S, as in “physical” and it’s a much higher-quality way to own gold in my opinion.

And I’ll go even further here. I’ll basically hand you an approach for the next five years that I believe will put you in a better place than the vast majority of people. Again all of which you can do right now without spending on research from me or anyone else.

Buy some gold. Consider a commodities ETF. Own some land or equities that are backed by things like land in a big, big way – which it’s 100% possible to find but is rarely obvious, by the way. And buy great businesses with pricing power.

Dani:

“Inflation-proof” assets.

Dan:

Yes. This is what I’m here to show you. You absolutely must own the assets that benefit during inflation. That hold their value – first of all. And better yet that actually soar when all of this is happening.

That starts with so-called hard assets like oil… gold… land… timber… Things like our food supply… things like the real, physical mines that keep our world up and running.

Why? Well for one thing, no matter what kind of calamity strikes… we don’t stop needing food. We don’t stop needing energy. These things keep operating and keep generating cash, if they’re run well, or the world stops.

Dani:

Like we saw in the early lockdowns of the pandemic.

Dan:

That’s as close as the world coming to a halt as you’ll probably ever see. And boy did we learn what’s essential and what’s not. The world can live without movie theaters. It can live without restaurants. But it sure as hell can’t live without farms putting food on the shelves… or hydrocarbons keeping the lights on.

Dani:

But if the idea is just to own the essentials… why not do that all the time?

Dan:

It’s not a bad strategy, by any means. But my point isn’t just that these things will be a lot more durable investments in an economic crisis. It’s that we know what happens to their prices in times of inflation. They skyrocket. If it takes five times more dollars to buy a movie ticket, you just don’t go. But if it takes five times more dollars to buy a barrel of oil, the world still needs that. So I sure hope you own the oil company and not the movie theater chain.

Dani:

Dan, you’re giving away a lot here…

Dan:

I think your viewers know this. And if they don’t, I’m glad to do it. If you just do what I’ve said so far – own physical assets, gold, commodity producers, oil, land, things like that – I’m sure you’ll be in a better position than 95% of other folks out there, by a big margin. But be careful. If your so-called hard asset is really a house of cards built on debt, you’re gonna have a bad time. And there’s unfortunately a lot of that out there in commodities, especially today.

If you’re going to do this, the key thing is you do it now, today. Do it with at least a portion of your portfolio. Tech’s not going to go up forever. It’s not. And you don’t buy insurance when the house is already on fire.

Dani:

Dan, your financial research firm is famous for having talked about these ideas for many years.

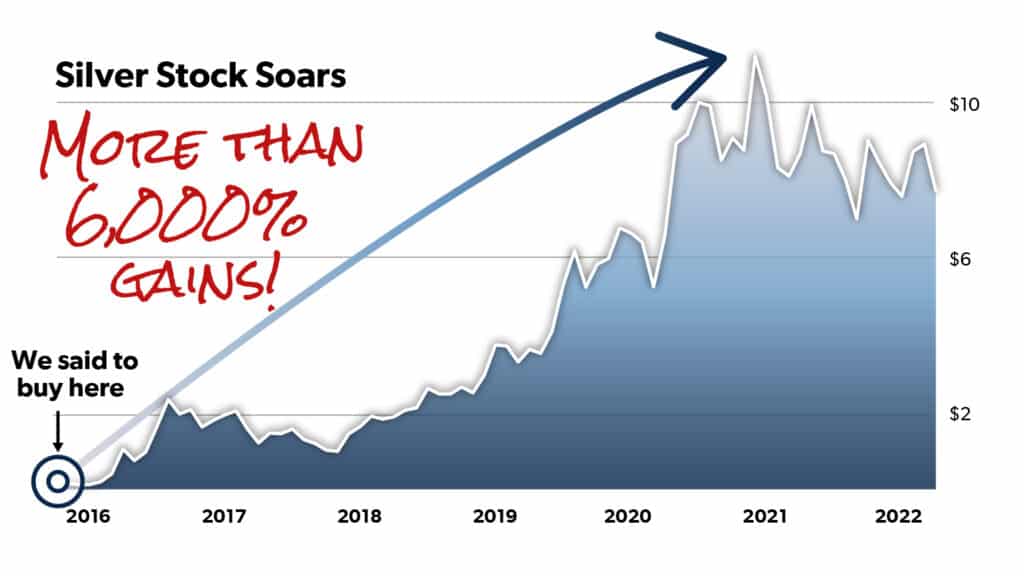

Your company publishes four specialty precious metals publications, which have shown readers gains of 606%… 558%… even, in one case, more than 6,000%.

You’ve personally recommended gains like 248% in resources… as well as open gains of as high as 264% and 182% today.

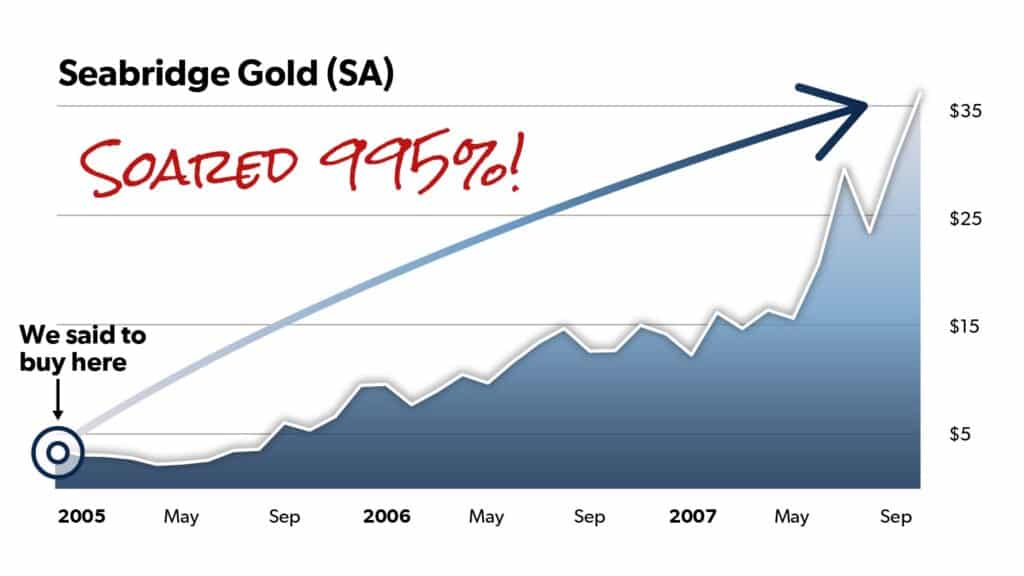

Your company’s PhD economist Steve Sjuggerud is famous for his dead-accurate call on Seabridge Gold, which went on to soar 995% after he recommended it.

And it's not just gold, either.

Your company famously foresaw the shale oil boom in the United States – long before it became widely known by the general public and led readers to triple-digit gains.

Your company even published an open letter to a $20 billion company, Devon Energy, advising them to abandon a disastrous production strategy in Canada. They ultimately took that advice, by the way, but not before wasting billions exactly the way the letter predicted.

Dan:

Yes, we’ve been leaders in this area for years – decades, really.

And there’s one secret in particular behind a lot of those gains you just mentioned, that I’m about to show you.

Our track record on this stuff is unmatched by anyone in the world of finance as far as I know.

And that was without inflation at a 40-year-high.

We’ve helped people make a lot of money.

But that only matters if you do something much more important first, which is to know how to avoid the massive pain and suffering that happens in market crashes like 2000 and 2008…

To protect your savings…

And to put yourself in protective assets in periods of financial crisis.

We nailed that in 2000 and 2008.

And we’re facing the exact same kind of moment right here right now and it’s why I’m here in front of this camera.

And in a few minutes, I want to make an invitation to your viewers to put me and my team in your corner through this crisis with our research.

I’m talking about a set of resources that we’ve designed for this exact moment… that anyone can use very easily… in plain English… that’s a joy to read… and that you can access 100% risk free…

For far less than the cost of a fancy coffee per week. Not per day, mind you, but per week.

But before you even think about that invitation, I’m also going to GIVE you the details of what we’re recommending, for free, right here on camera.

And you can use all these ideas on your own, without spending a cent.

Dani:

Why would you do that?

Dan:

It’s what I said at the outset, Dani.

I believe these ideas could literally save people's lives – their financial lives at least – in the coming months.

They’re that important. So sharing them is a moral necessity.

And I refuse to play some coy game of footsie about what they are and what I think you need to do to protect yourself right now and flourish in the years ahead.

So I’m going to show you what I recommend.

And then my hope, of course, is that you’ll see how valuable our work is and even consider the extraordinary invitation that I’m going to make.

Because I know that you’ve heard me sound the alarm today. You’ve heard what you might consider a pretty pessimistic outlook.

But the reality is that when you understand this approach – the assets that rise during inflation… you’ll see it differently.

You’ll see a massive opportunity today.

This is the kind of moment that you wait an entire lifetime for. Because it’s the very, very rare chance to catch the beginning of a 10- or 15-year cycle.

Dani:

In commodities?

Dan:

Yes. It’s the kind of thing where if you catch it early, a handful of positions could set you up for life. I’ve seen it.

I mean look at some of the moves that have happened already. This is what inflation is doing, and these are just the very earliest signs:

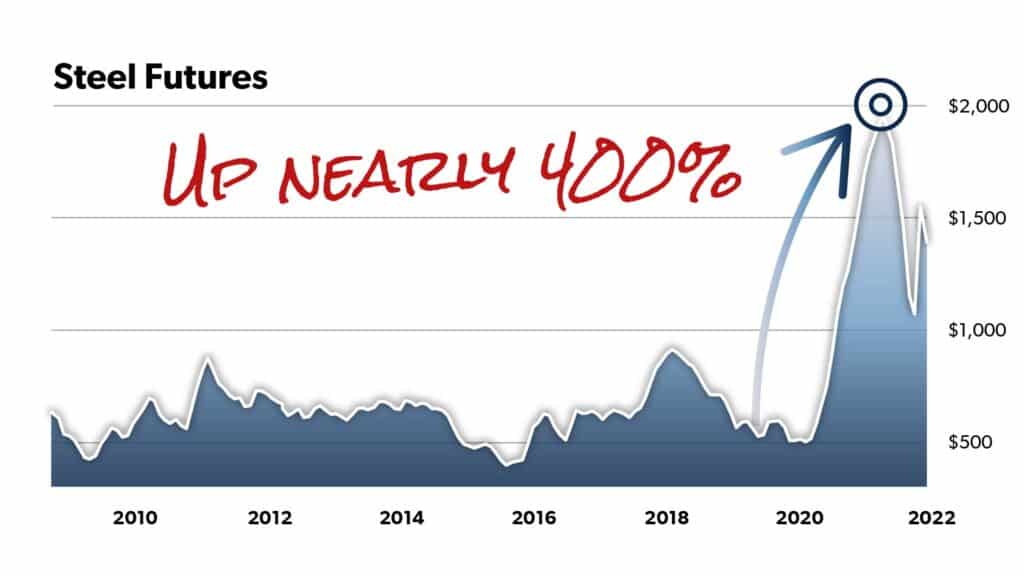

Here’s steel futures – something called hot rolled coil steel:

And here’s what natural gas has done the last few months. Almost 100% increase in just three months mind you:

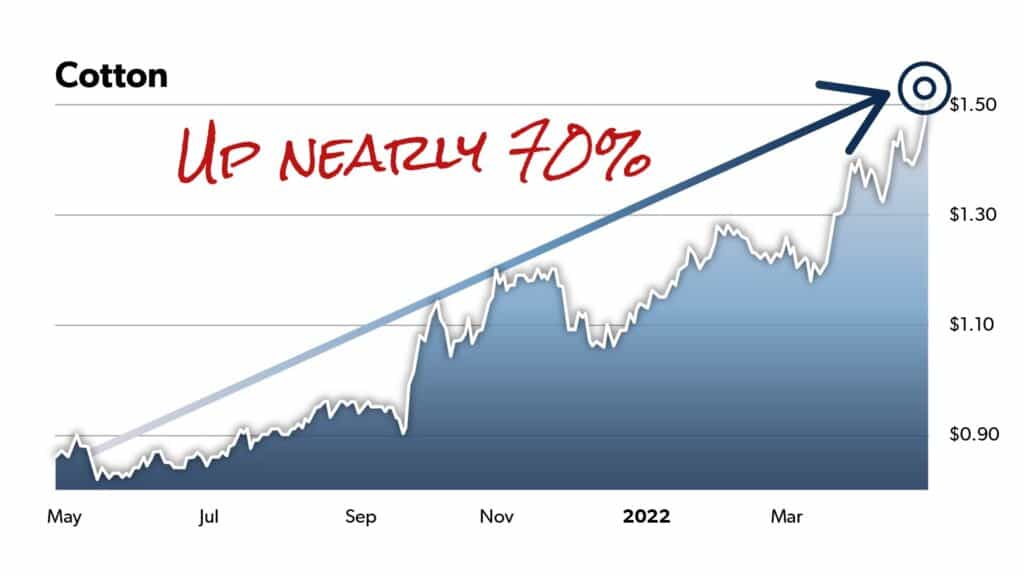

Cotton just hit its highest price in a decade. It’s up about 70% in a year:

And you’re seeing it elsewhere too. One great example is shipping.

The cost to move a single shipping container from Shanghai to Los Angeles hovered just under $2,000 for years.Today it’s over $11,000 – nearly a six-fold jump since the Covid crisis began.

Dani:

We also heard about lumber last year and many others. But if commodities are taking off so fast… is it too late to get in?

Dan:

Absolutely not. These are some individual examples. They show you just the beginning of what’s possible… what’s virtually certain to happen much more widely, in my view.

But as a market, commodities are ridiculously, stupidly CHEAP.

Zoom out and look at the big picture.

This chart shows you the ratio between the S&P GSCI Commodity Index and the Dow – in short, commodities versus stocks – since 1991.

Commodities are the cheapest they’ve been relative to stocks since the lows of the dot-com bubble. Not the housing crisis… the dot-com bubble.

They’re in almost exactly the same place as they were 20 years ago!

And the last time we had this setup they went on a 500% run.

Dani:

You’re expecting the same kind of thing again?

Dan:

Absolutely. This chart is literally showing you the best setup in 20 years.

So where would you rather be, with at least some of your money? Do you think a house of cards like Tesla has another 500% in it? That it’s more likely to go up 500% than the basic building blocks that the world needs to survive… which are the cheapest they’ve been in 20 years… at a time when the price of everything is going up.

My point is: even if you had magic powers and could guarantee me that there’d be no market crash in the next five years, this is still what I’d recommend you do today anyway.

It doesn’t depend on a market crash to work, although it will protect you better than anything else I know of.

Same for inflation. Inflation is going to juice this strategy.

But even if somehow, magically, inflation stays reasonable – I’d still recommend the exact same ideas today.

Dani:

This is so critical for folks to understand. I’m thinking back to the idea of what a favor you can do to your future self by allocating at least a portion of your money to these ideas now. Getting the peace of mind and the potential upside now and not when a crisis is in full swing.

Dan:

So step one is hard assets. Then, there’s a step two that’s critically important, but it comes a little bit later. And I’ll get to that. Right now the key thing is that if you’re sitting on 8 or 10 or 12 years of gains, that you don’t take them for granted. Because what you made in 10 years can disappear in two weeks.

Dani:

Before you get to the second step… hold that thought for a second. How are you approaching hard assets. You’ve said there are much better ideas than just holding physical gold or a broad commodities fund.

Dan:

Here’s the thing. For every commodity… for every hard asset… and frankly for every anything… there’s always the easy and obvious way to play it… and then there’s the way that the smartest guys in the room do it.

A way with the same risk, or in many cases LESS risk, but with 3x higher upside, potentially.

Dani:

Are you talking about using leverage? Buying call options, for example?

Dan:

Heck no. No way. That’s what the Robinhood bozos are doing today and they’re going to get burned.

And if you think I came here to tell your viewers to get involved in complex and risky strategies like buying options, you’re dead wrong.

You don’t need anything like that.

What most people don’t know is that have there are handful of unique stocks that have the qualities I’m talking about baked in.

I’m talking about high-quality businesses that you’d want to own anyway… that are often backed by world-class physical assets… and whose business essentially give you leveraged upside to the prices of things like food… energy… and commodity prices.

So you can get the same kind of upside, potentially, as using options to play this boom… but in simple, ultra high-quality stocks.

Dani:

The kind of stocks you’d be recommending anyway.

Dan:

100%.

And Dani, I’m really excited because this is exactly what we do at Stansberry Research, the company I work for. We’re a financial research firm for regular folks – not banks, not institutions. For individuals like you.

And my team that I’m working with has just put together an entire recommended model portfolio of these exact stocks.

It’s five stocks and every one of them is inflation protection… it’s crash protection… it’s the stuff that’s going to soar in the next great market cycle.

And every one is the kind of overlooked or backdoor play that most people will never find, that gives you potentially 3x more upside than the obvious thing that people will buy, if they’re smart enough even to use this strategy at all.

Dani:

You’re talking a big game, Dan. Can you give an example of a play like that?

For example, oil is obviously soaring.

And I think most people would see that and think of Exxon or Chevron… or of X-L-E, which is a popular fund that tracks the energy sector in general.

But it sounds like you think it’s possible to do better than that?

Dan:

Way better, and it’s not even close.

We’ve identified what we believe is the No. 1 Inflation Protection stock in the world. Hands down.

Dani:

Wow. And this is a regular stock, right? Meaning you don’t have options or anything complicated or obscure like that.

Dan:

Yes.

Dani:

What’s the play? Some kind of driller or explorer?

Dan:

No. Too risky. That might certainly get you higher upside than an ETF or a play like Exxon – but it would come with way more potential downside as well.

Dani:

What else, then?

Dan:

Dani, I hope you understand that we can’t give away this recommendation by name on camera. It’s too valuable.

We consider it one of the best opportunities of the next five years… and one of the best stocks we’ve EVER found in more than 20 years of publishing research.

In this environment, it could climb by hundreds of percent if things go right.

We call it the Best Oil Business on Earth – and with good reason.

Dani:

That’s a big claim.

Dan:

It’s our highest-conviction energy idea today.

And probably better than any similar inflation pick we’ve ever recommended.

And keep in mind, readers of our flagship publication… the one that everyone should start out with… are sitting on a potential triple right now in a similar stock. But it’s not our absolute favorite.

This is.

Honestly, if you just got into this one stock – and forgot everything else I talk about today – I think you’d be 100x better off.

To be clear, we’re not recommending that – and never would.

But if you could wave a magic wand and create the perfect stock for a rise in oil prices… this is pretty darn close to what you’d get.

Nobody knows about it.

And my team thinks it could triple from here without anything extraordinary happening whatsoever.

Longer term, with the turmoil we’re seeing across the world… the supply shortages… and of course what inflation’s doing to oil prices… we think it could be a 10-bagger when all is said and done.

Meaning that even a relatively small investment could make all the difference to your overall situation on the coming years, if you get in.

Dani:

You said this is not a driller… a pipeline company… or anything you typically think about when it comes to oil. What then?

Dan:

It’s a royalty company. One of the best setups we’ve ever found… in what’s probably our favorite type of business that we’ve ever shared with readers.

Dani:

Dan, again that’s a big claim. Let’s slow it down. Can you explain what you mean by a royalty company?

Dan:

Yes. This is so, so important.

A “royalty” is a payment you receive over and over again from a single asset. You can either buy a royalty-paying asset with cash… or you can earn royalties from something you created yourself… like a book.

Once you own a royalty-producing asset, you never have to spend another penny.

And you can keep collecting profits – worth many times more than your original investment – for years, or even decades.

This model has existed since the Middle Ages, when – if you wanted to take anything out of the ground – you had to make a payment to the king. That’s why it’s called a royalty.

What almost nobody knows is that we have something very similar today. And by owning shares of certain companies, you get to be the king and collect the payments.

Dani:Can you give some examples?

Dan:

Sure, the most famous and successful royalty companies have been in resources… particularly gold and oil.

Like the Mesabi Trust (MSB). All it does is collect royalties on the production of iron at a single mine in Minnesota.

But it’s up over 1,100% just since the beginning of 2016.

Then there’s an extraordinary company in Texas. I can’t mention the name because I have to protect it for subscribers.

All it does is own a huge swath of oil-rich land. This is key. It doesn’t do any of the work of building rigs and extracting oil. And it doesn’t take any of the associated risk, either. Instead, it lets other folks do that, and simply collects a stream of royalty payments in exchange.

So while Exxon has 63,000 employees… this company has less than 100, because essentially all they do is cash checks.

And, Dani, this company is up as high as 4,000% since 2011.

Longer term, the gains are astonishing…

If you’d gotten in close to the beginning, in the early 1990s… you’d be up around 60,000%… enough to turn every $5,000 invested into $3 million.

Dani:

Those are incredible numbers. And what you’ve found today is something similar?

Dan:

Precisely. Very similar, but it’s around one-fifth the size. One reason we think the biggest upside is still to come.

Dani:

And this royalty model means it makes money from the upside in oil – if production or prices go up, it gets a bigger cut – but without the massive capital investments involved in drilling and shipping and all that.

Dan:

Right. And without all the other production risks as well – labor… debt… regulatory.

It’s an amazing way to make money in energy, which we’re going to need no matter what happens in the stock market or the economy.

And I hope you can see now why we think it’s the No. 1 play in an environment like this with high inflation.

It captures the upside in a critical resource and basically magnifies it. And does it with very little operational risk.

No investment is ever 100% risk free. But we believe that this stock represents a huge margin of safety, with the chance for such massive upside.

Dani:

Dan – can I clarify something here for the viewers…?

Dan:

Of course.

Dani:

Stansberry Research, the financial publishing company Dan works for as an analyst and where I’m editor-at-large, publishes over 30 research letters.

Our flagship letter is the one that launched the company in 1999 and will always be the “crown jewel” of our research.

It’s where we’re famous for speaking the truth about the markets… the economy… and our country.

Even when – especially when – what we had to say was controversial or unpopular.

This is a storied publication and lots of folks read it because it cuts through the lies and B.S. of the mainstream media in a wildly entertaining fashion.

But this is also where we publish some of our best investing ideas and analysis.

Meaning specific, actionable stock recommendations every month, along with a full recommended model portfolio.

We explain exactly when we recommend you buy and sell… how to protect your wealth with assets like gold and cryptos… how to keep the government out of your life as much as possible.

Most of all, we show you where to find world-class, enduring businesses to grow your wealth as safely as possible… and then make a few smart speculations by getting in early on the great companies of the coming decades.

This research letter is called Stansberry’s Investment Advisory.

And it’s done things this way – never wavering – for more than 20 years… while investing trends have come and gone… and quite a few research letters have come and gone, too.

The reason I’m bringing this up, Dan, is because Stansberry’s Investment Advisory is practically sacred at our company.

And a big part of that is that our commitment is to always, always put subscribers first.

So you’re sharing a huge amount of insights today for free… and even some actionable ideas.

But I’m assuming that this company you’re talking about – the full details of the idea – that’s something that’s reserved for subscribers.

Dan:

That’s 100% correct, Dani – and thank you for clarifying that.

We treat our best ideas – especially ones as extraordinary as this – like precious gems. We have to protect our paying readers and their ability to get in and see the biggest upside.

Dani:

I think we should say here – Stansberry readers have had the chance to make some really nice gains on royalty stocks over the years. Like 335% on Wheaton Precious Metals back in 2011. Some readers logged 248% gains in about a year on a firm called International Royalty.

Dan:

There’s a lot of money to be made in royalties, for sure. In Stansberry’s Investment Advisory, we’ve already seen gains as high as 220% on one royalty company. In just six months, by the way.

Dani:

Triple your money, which is fantastic. But the upside you’re seeing in this opportunity today is a lot bigger than that. What makes it so different?

Dan:

The difference is getting in early and getting in at a dirt-cheap price.

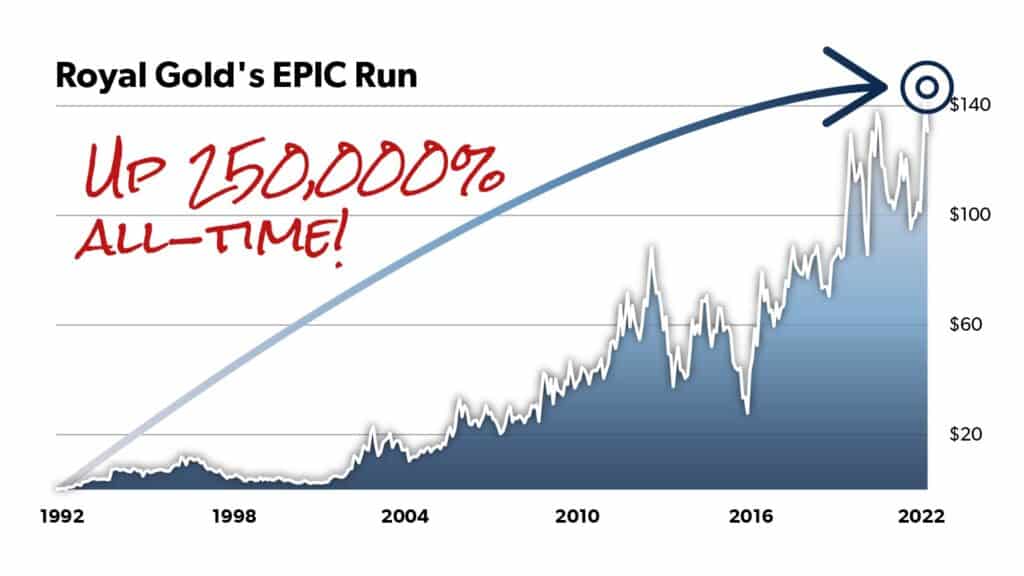

For example, take one of the most famous royalty companies on earth, Royal Gold.

It’s could have nearly doubled your money in the last two years… which is great.

But it’s a pretty big company now. It’s mature.

If you look back at the entire history of Royal Gold… all the way back to the 1990s, you could have gotten in near the beginning for around 3 cents.

All time, the stock is up as much as 250,000%.

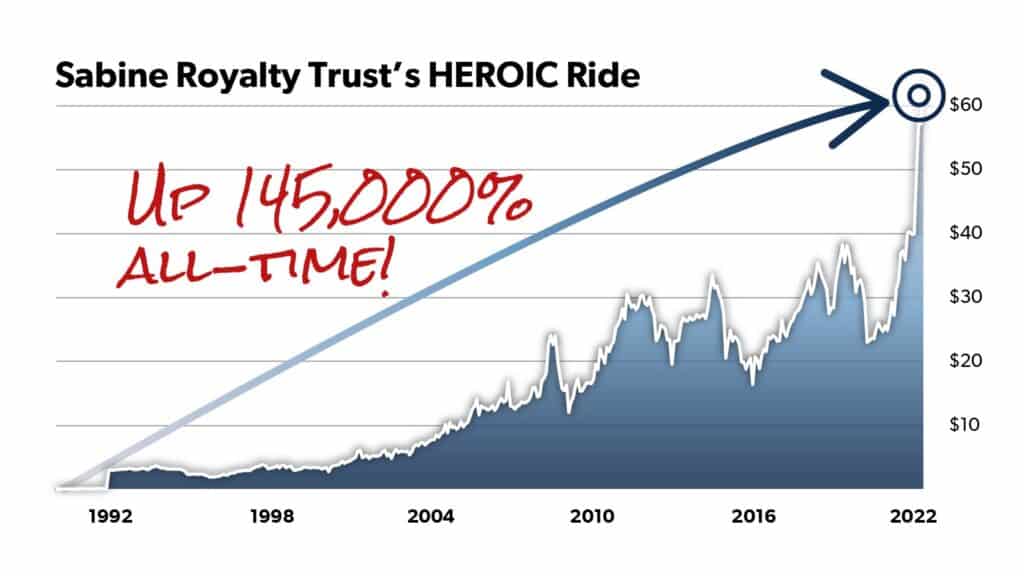

In the oil market, there’s a similar story – Sabine Royalty Trust, which is up 145,000% since the early ’90s.

Now of course those are some of the biggest and most extraordinary gains in all of finance. And they happened over decades. But it shows you what’s possible.

Dani:

You consider this one of the best stocks your firm has EVER uncovered in more than 20 years.

Dan:

I think it’s 10 times better than any commodity play you’ve likely every heard of or considered.

And I think it’s a stock where you can make this one decision to get in and be far better off… far better protected against inflation and the financial turmoil that’s likely coming.

To me, that’s an incredible proposition – to be able to sleep better at night right away.

You don’t have to agree with us about everything, of course. But getting some protection now is just the sane thing to do, no matter what you believe. It’s why I came here today.

And it’s why we’ve put together a dedicated portfolio of these ideas like this one, that’s to be the heart of our research in Stansberry’s Investment Advisory in 2022 and beyond – The 5-Stock Inflation Protection Portfolio.

It’s a completely done-for-you approach to protecting your downside… beating inflation… and seeing massive potential gains in the next cycle that you can buy right now, today.

And I think everyone should.

Dani:

Anchored by what you guys call “the Best Oil Business on Earth.”

Dan:

Yes, we’ve written that up in a subscriber-only report called The No. 1 Stock on Earth to Beat Inflation that I think is some of the best and most important research we’ve ever published. And I would love nothing more than to send it to every person watching this, right away.

But while we love that opportunity, it’s only one of five total stocks that we’re recommending together, all of which have similar qualities in terms of crushing inflation.

This is a top-to-bottom portfolio to protect yourself from the insanity I’ve been talking about and likely beat the overall market by a huge margin over the next few years, with way, way less worry.

And like I said earlier, you don’t have to do it with 100% of your investing money – I’m not saying that.

I think if you did this with even 10% or 20%, you’d be 1,000x better off.

It’s so easy to do. And we’ve designed it so you’re diversified across a bunch of extremely high-quality assets. So please don’t cherry pick. I recommend you buy all five stocks.

Dani:

Even though you’re saying that one of them – the one you call the “Best Oil Business on Earth” – is your favorite?

Dan:

Ha, that’s a tricky question, Dani.

Let me say this.

No, I don’t recommend you only buy that one. I recommend you buy the whole portfolio.

But quite a few readers have joined Stansberry’s Investment Advisory just because of one transformative idea they’ve heard from us.

And then had the chance to discover all the rest of what we do.

And that’s fine with us. More than fine.

You will not go wrong with “the Best Oil Business on Earth” in my opinion.

So if that’s what gets you in the door, great.

Because we charge a pittance for Stansberry’s Investment Advisory. And this one stock could make you three times your money in the coming years.

Then you’ll see everything else we do.

And you’ll be with us and ready for the second phase of all this, which is the absolute field day we’re going to have in high quality asset stocks after the markets have taken a 50% dive.

Keep in mind, the average open recommendation in Stansberry’s Investment Advisory is up 81%.

Last year, 77% of our recommendations were winners, which is a world-class result.

And the average annualized gain was 27.7%. This return measures the results achieved by all of our recommendations in 2021, scaled to a one-year period.

And of course, there are risks. All investments have some degree of risk. Past performance does not indicate future success. We would never recommend investing any amount you aren’t willing to lose.

Dani:

Let’s circle back to that. I want to hear about the rest of the 5-Stock Inflation Protection Portfolio… apart from “the Best Oil Business on Earth.”

Dan:

There are five stocks in total. And besides “the Best Oil Business on Earth” there’s another oil royalty play that’s very similar. It’s neck-and-neck for the best.

These are THE guys you want on your team in the next supercycle. They have nearly 24,000 royalty acres. And all they do is sit back and collect the royalties for years, sometimes decades.

That’s money that flows through with basically no marginal cost – no further investment in anything.

Remember, royalty companies don’t do the work of extracting or producing anything. All they do is collect royalty fees for every barrel of oil that’s pumped from their land which has mineral rights.

There’s also a world-class gold play. Best of the best.

And there’s some other opportunities you might not expect.

Dani:

I imagine it would be nice to be in businesses that you know aren’t going away in any kind of crisis or recession… and that you know can raise their prices along with inflation.

Dan:

Yes, you’ve hit on something really important. Pricing power is critical. There are some great businesses out there with a certain amount of pricing power. But if your product isn’t a necessity, good luck when people are hurting financially. If your product keeps the lights on, or food in people’s bellies, or it’s the irreplaceable tech infrastructure of our world that we need to live and work – and you can raise prices? That’s who’s gonna win.

Dani:

What other types of stocks are in the 5-Stock Inflation Protection Portfolio?

Dan:

They’re not all commodities. One is a large company that I can almost guarantee you wouldn’t think of as an inflation hedge. It’s an elite global business. We cannot live without it. If it disappeared tomorrow, the world economy would have a heart attack.

This is the infrastructure behind keeping your lights on… getting your groceries… your Amazon purchases… you name it.

And the key thing is – when prices go up, this company makes more money.

It’s actually very similar to the royalty model.

But not just in resources. A royalty on practically everything.

And this company owns very valuable assets that connect businesses, banks, governments, and billions of people worldwide every single day. Assets that provide big time protection for the share price, because they don’t just evaporate in tough times, like the financially engineered so-called profits of a lot of companies.

Companies like this one is not easy to create or replace… and the upside could be triple-digit gains over the next few years.

Dani:

Are these famous, well-known stocks you’re talking about?

Dan:

Some you may have heard of, but I bet you’ve never thought about buying. And majority of them – it’s very, very unlikely you’ve heard of or you’ll ever run across on your own. They’re typical of what we do in Stansberry’s Investment Advisory where we find wildly mispriced companies that are often completely off the radar of most investors and even analysts.

Dani:

I’ve got to say… this is all a lot to take in. The inflation expectations… the risk of a crash… and the various ways to protect yourself and play it to come out, in all likelihood, way ahead of everyone else.

Dan:

I get that. But we’ve done the hard part. At Stansberry Research, we spend weeks on every single stock we recommend. And we spend the rest of our time talking to the smartest people in the world and looking at the macro picture, like you do.

Remember, these are the stocks we’d recommend today even if the crash and inflation don’t arrive soon, or aren’t as bad as we think.

But if those things do happen – and I’m sure they will – these stocks are likely going to crush. You’ve got oil covered, you’ve got gold, and you’ve got another two stocks outside of commodities that are going to be a treasure trove, metaphorically speaking, in the coming years.

Dani:

And again, this doesn’t involve assets that are hard to buy, like futures or cryptocurrency or the complexity of things like options.

Dan:

Right. This is a plan to protect your portfolio and stop worrying about the bubble and the headlines starting right now, today.

Just make a plan that includes these five stocks. Buy them and then basically watch them for the next five years. We suspect this one move will make you look like a genius by then, but more likely in under a year.

We’ve done the work of finding the stuff that has the potential to crush inflation. The stuff that is at the beginning of a likely 5-year cycle higher… and not the END of a 12-year bubble that’s going to end in disaster soon.

Dani:

It almost sounds like you’re saying you’d be cheering for inflation if you own these positions?

Dan:

Almost. I’m not going to say that inflation is good for your money… or for business or the stock market or the country. But it absolutely can be good for you, personally, in these positions. It could show you gains like you’ve never seen before.

We think “the Best Oil Business on Earth” could triple your money. Not only that but it’s going to give you a fat dividend along the way. More than 6% at current prices.

That’s pretty spectacular in this zero-interest environment… and almost completely wipes out the effects of high inflation right off the bat.

Quite a few folks would subscribe to Stansberry’s Investment Advisory just to learn about that one name, and we don’t blame them.

But now, today, it’s the crown jewel of a five-stock model portfolio that’s MADE for this moment in time, with looming inflation and looming risk of a crash.

You’ve got to do yourself this favor now.

Dani:

Not when a crash is underway.

Dan:

That’s the biggest and most classic mistake in all of finance. Thinking it won’t happen, or you’ll be able to prepare on the fly. That’s why I spent so long talking about investor psychology. It’s so, so important to do this now.

Positioning with these stocks is so easy. It doesn’t involve timing the market, or buying options, or going out and acquiring raw bullion, or anything tricky. And like I said, if you want to build your own portfolio that includes wildly underpriced investments in oil… gold… insurance… and so on… go for it. I wish you the best.

But without being arrogant I don’t think you’ll build one that’s one-tenth as good as the 5-Stock Inflation Protection Portfolio. And considering the time involved in researching all that, there’s a good chance you won’t do it at all.

This model portfolio of stocks is intended to not only protect your money in the coming months and years, but also potentially double it or better.

Dani:

And this isn’t a one-off thing, correct. In other words, getting access to this portfolio also means getting Stansberry’s Investment Advisory research year-round and essentially putting your smart colleagues on the team for what comes next. I’d guess that a lot of people who are enamored with speculative tech today are going to wish they were ready to pull the trigger on value opportunities on the other side of this turmoil…

Dan:

We can’t wait, Dani.

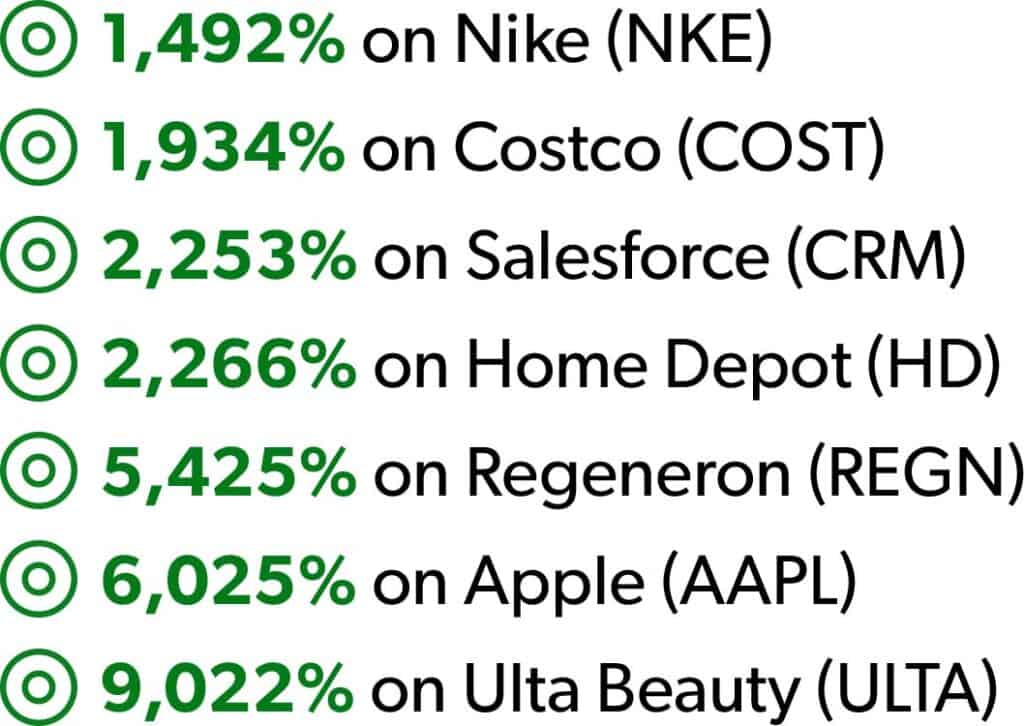

Have you ever gone back and looked at the gains you could have seen by buying world-class brands back in March of 2009?

You could have seen gains as high as…

These are famous brands for the most part. They’re what I call “World Dominators.” None of them were remotely new in 2009. So they’re great examples of how you don’t need to reinvent the wheel and try to gamble on pre-IPO unicorns or unproven technologies to see an absolute fortune in the markets.

But they weren’t obvious, at least to most people. Because if they were obvious, you would have bought them.

We’re going to have a moment like that again. Where the world’s greatest and most cash gushing companies are on sale and have the promise of those same kind of returns again over five or 10 years.

And our strong suspicion is that when you catch that kind of a moment you’ll forget that you ever wasted a minute on speculative investing.

And Stansberry’s Investment Advisory will suddenly be the most popular and in-demand research service across our company and probably beyond.

And we’ll be happy to welcome you in then too – as we always are – but please understand that Stansberry’s Investment Advisory will likely cost a lot more, for obvious reasons.

So that’s the second big part of that strategy and we want you in the door and preparing for it now.

Dani:

Dan, this research sounds like it could easily be worth hundreds if not thousands of dollars.

It’s hard to imagine it couldn’t put that much in your pocket in the coming years with even a small investment in a winning recommendation… especially when the upside could be as high as 3x.

But I’ll be blunt: People are already hurting finically.

As much as this research could help, I think it’s asking too much to take a leap on research that costs hundreds of dollars – or more – to get started.

Dan:

I agree.

And that’s not the case. This research is for everyone.

It’s how we introduce ourselves to you and hopefully welcome you into the Stanberry Research family for years to come.

And that means making it so cheap that anyone can get started without worrying about money – and with ZERO risk.

Stansberry’s Investment Advisory usually costs $199 a year. That’s what many others have paid. And I think it’s an incredible price for immediate access to our 5-Stock Inflation Protection Portfolio… along with everything else we recommend today… our monthly issues… our full website… all of it.

Again, that’s the regular price you can go pay on our website.

But it’s not the price for you if you’re watching this.

If you’ve stayed with us through this interview, I want to set you up with something far better.

Not to mention all the forces I talked about – the massive, massive dangers to your wealth in the markets today… and the resistance that I know a lot of folks will feel when it comes to protecting yourself now and not when the crisis hits.

I don’t want you to hesitate even for a second now. This is the critical moment.

So we want to make it much cheaper – and 100% RISK FREE – for you to join us.

This is exclusively for folks that watched this video.

Dani:

Folks, the team has authorized me to share the full details of that offer with you right away, right now. It gets you instant access to their brand-new special report on The No. 1 Stock on Earth to Beat Inflation… their full 5-Stock Inflation Protection Portfolio… the rest of the Stansberry’s Investment Advisory’s full model portfolio… one full year of access to their research letter Stansberry’s Investment Advisory… and a whole slew of other bonuses as well.

But Dan, first I’d like to thank you for coming forward and sharing this today on behalf of Stansberry Research. It’s been incredibly informative and I think viewers are going to be very eager to take advantage.

Dan:

Thank you, Dani. It’s an absolute pleasure being with you.

Dani:

Folks, I’ve spent thousands of hours with some of the best financial analysts in the world.

But I hope you’re seeing that there’s no one in finance as passionate as Dan and our incredible team at Stasnberry’s Investment Advisory.

And I’ve agreed to share the details of how you can access everything Dan just talked about today, at an exclusive, discounted rate that’s only for folks who watched this interview.

Within minutes, you’ll have access to:

The No. 1 Stock on Earth to Beat Inflation: Our team’s special report on what Dan calls “the best oil business on Earth” – a small royalty stock that could soar hundreds of percent from here. And…

The 5-Stock Inflation Protection Portfolio: Our brand-new report with the full details of all five stocks we recommend you buy to stop worrying about inflation and that will likely see some of the biggest gains in the markets in the coming years. As always, we’ll show you exactly why we recommend these stocks… the maximum price we recommend you pay… and what to expect going forward, including when to sell.

But this model portfolio isn’t the only thing you get when you sign up for our team’s work.

That’s just where you should start.

You also get access to a dozen other recommendations that can grow your money too… some by multiples of 5x or more in the coming years.

And of course, you’ll also get full immediate access to our flagship research letter, Stansberry’s Investment Advisory.

Meaning you’ll be able to read every monthly issue we’ve ever published… and you’ll begin receiving the next 12 brand new issues every month for the next year.

Stansberry’s Investment Advisory is nothing like “research” from investment banks or brokerage firms.

It’s a lot more like a favorite magazine – written in normal English – that you’ll want to sit down and read right away every month. And walk away with brand new recommendations about some of the biggest investing opportunities in the markets.

You’ll receive full access to everything through our world-class website, within minutes.

As Dan mentioned, the normal price to get started is $199 – and this research is a steal at that price. Especially considering we’re sharing the details of one of the best stocks we’ve ever discovered in over 20 years.

But this is not a normal situation.

It’s one of the most dangerous… crucial… and potentially life changing moments we’ve ever seen in the markets.

And we believe that 5-Stock Inflation Protection Portfolio is the simplest, most accessible, and best solution in the world to protecting yourself right now and in the years ahead.

So our team has authorized likely the best deal ever, in the 20-plus year history of Stansberry Research, for access to Stansberry’s Investment Advisory.

Instead of $199, you can get started for as little as $49 today.

That’s 75% OFF the usual price.

More importantly – this offer is 100% risk free.

Meaning we invite you to say “yes” and immediately receive The No. 1 Stock on Earth to Beat Inflation and the full details of our 5-Stock Inflation Protection Portfolio.

Read them over. Print them out if you wish. Look over our full recommended portfolio and past issues.

If you’re not absolutely wowed by the quality of our work, simply let us know and you can receive a full refund for every penny you paid within the first 30 days…

Keeping the research and ideas you’ve already received, with our compliments.

But it’s crucial that you say “yes” today.

This offer is exclusively for folks who watched this interview – and will likely only be online for a limited time. We reserve the right to shut it down at any time.

As soon as you say “yes” below, we’ll send you The No. 1 Stock on Earth to Beat Inflation and the 5-Stock Inflation Protection Portfolio.

But we’d like to send you something else as well. You’ll also get:

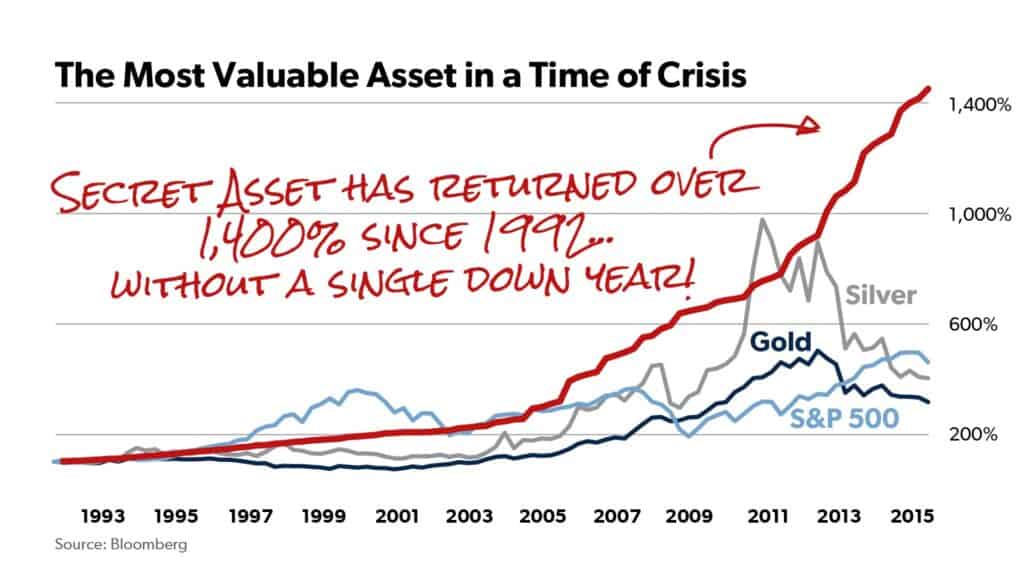

Special Bonus No. 1 – The World’s Two Most Valuable Assets in a Time of Crisis: Shared with special permission from former Goldman Sachs trader (and investing legend) Dr. David Eifrig, this report details two hard asset investments that have crushed everything else including even silver and gold over the long term – and shined during the last two financial crises.

Just look at this chart:

These are investments you can easily make today in the U.S., if you know where to look.

We highly recommend you check them out, and consider getting in and holding on for years as protection against any type of crisis that might unfold in America.

But that’s not all.

You’ll also get full, subscribers-only access to the Stansberry's Investment Advisory Library.

This includes instant access to dozens of reports and books we’ve published. Here’s just one quick example: a 263-page e-book The Battle for America which provides an inside look at the direction our country is heading both financially AND geo-politically. It contains countless numbers of ideas for how to radically improve your investing career, such as: The most profitable and stable form of leveraged investing (page 105)… how to make commodity investing potentially less risky (page 145)… the No. 1 way to invest for retirement (page 189)… a strategy for buying elite businesses at bargain prices (page 205)… and much more.

You’ll also receive Stansberry Digest.

Every weekday, the Stansberry Research editorial team writes up notes on interesting and significant events taking shape in the markets. We take you “inside the room” at Stansberry Research to share the most important news, ideas, and opportunities we're following each day.

And again, this is all on top of your one-year subscription to Stansberry’s Investment Advisory.

For 75% OFF. And completely, 100% risk free.

Keep in mind, even amid the mania in high-risk speculations, the team at Stansberry’s Investment Advisory is responsible for three of the top 10 open recommendations across all our research – more than 30 research services in total.

Winners as high as 878%.

They’ve done this while taking on far less risk than other research services… and ultimately making more consistent gains…

Maybe that’s why Stansberry’s Investment Advisory is the rare research service where we hear glowing feedback from our readers…

Like Tim G., who said:

Prashant M., who wrote:

Jimmy P., who said:

And Francis M., who wrote:

The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

So now it’s up to you.

You can be enjoying full access to Stansberry’s Investment Advisory, their 5-Stock Inflation Protection Portfolio and everything else I’ve mentioned today within minutes.

And I definitely recommend you be among the first to consider taking action on their No. 1 recommendation to beat inflation, “the Best Oil Business on Earth.”

Don’t forget: The time to prepare for the next market downturn – or worse – is now.

If you wait, you could be making one of the biggest mistakes in finance.

That’s why Dan and Stansberry Research came forward today, with a practically done-for-you solution you can get into immediately and stop worrying.

But today you can get ONE full year of Stansberry’s Investment Advisory… the 5-Stock Inflation Protection Portfolio… their No. 1 recommendation of all time… and all the bonuses I mentioned for up to 75% off the usual price.”

To secure your spot, click the Get Started link below. You’ll be taken to a secure order form where you can look over the full details of everything I’ve talked about before placing your order.

Thank you for watching,

Daniela Cambone

Editor-at-Large, Stansberry Research

May 2022

Legal Notices: Here is our Disclosures and Details page. DISCLOSURES ABOUT OUR BUSINESS contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works – both the benefits it might offer you and the inevitable limitations of our products. Although this is not a part of our “Disclosures and Details” page, you can view our company's privacy policy here.