On the surface, Intel Corp. (Nasdaq: INTC) and Dollar Tree Inc. (Nasdaq: DLTR) don’t have much in common.

One is a high-tech chip maker. And one is a low-tech discount retailer.

When you scratch just a bit below their sector and industry group classifications, you’ll see both are constituents of the Nasdaq 100 Index. That has been the place to be over the past 10 or so years.

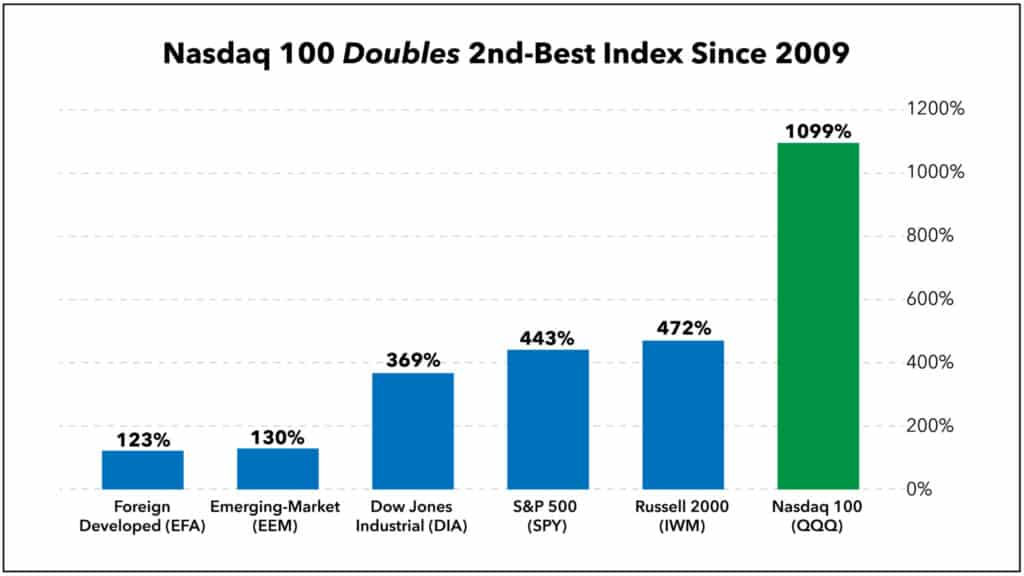

Have a look at the performance of the four major U.S. stock indexes, along with foreign developed (EFA) and emerging-market (EEM) stocks, since the March 2009 bottom:

The Nasdaq 100 has more than doubled the second-best performing index, the small-cap Russell 2000 (IWM) … and is up nearly 10-times more than foreign developed-market stocks (EFA)!

I was listening to an institutional fund of funds capital allocator speak the other day, and he quipped how “diversification hasn’t worked for 10 years … anything you bought outside the Nasdaq 100 has only detracted from the returns of the Nasdaq 100.”

But I digress. Back to Intel and Dollar Tree …

Nasdaq 100 Is as Much “Growth” as It Is “Tech”

Everyone thinks “tech stocks” when they think of the Nasdaq 100.

It’s true that it’s tech-leaning. But the Nasdaq 100 is made up of the 100 largest non-financial stocks that are listed on the Nasdaq exchange.

Stocks from any sector (except financials) can meet that definition. Dollar Tree is a consumer staples stock, not a tech stock … and it’s gladly included in the index.

Two additional labels the Nasdaq 100 has taken on, besides “technology-centric,” are “growth” and “expensive.”

And according to the Green Zone Ratings model I developed … both labels are justified.

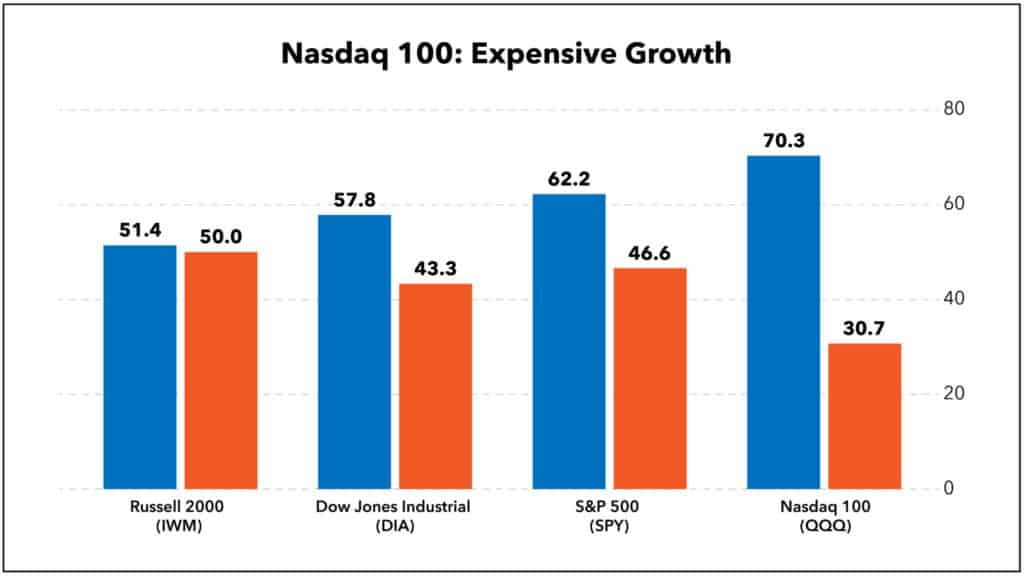

The chart below shows the growth and value ratings of the four U.S. indexes:

In short, the Nasdaq 100 earns the highest growth rating and the lowest value rating. That means Nasdaq 100 stocks are expensive.

Realize though, these are the average Green Zone Ratings of all stocks included in each index.

No one says you must buy the whole index. And that brings us full-circle back to Intel and…

Growth at a Reasonable Price, aka “GARP”

I was curious to know which Nasdaq 100 stocks offer us the best combination of value and growth. I wanted stocks that are:

- Growing at a fast pace.

- Still attractively valued (i.e., “cheap).

To get at those stocks, for each of the Nasdaq 100 stocks I calculated the average of their growth and value scores … and then I ranked the list based on that average, which I’ll call the “GARP Average,” for “Growth At a Reasonable Price.”

This maneuver reveals stocks that offer the best balance between growth and value, since a low rating in either of those factors would pull down that stock’s composite GARP Average.

And, you guessed it … Dollar Tree and Intel emerged in first and second place based on my GARP Average ratings of the 100 stocks in the Nasdaq 100.

Specifically, Dollar Tree and Intel earned Green Zone growth ratings of 95 and 84, respectively.

Consider that Dollar Tree’s earnings-per-share (EPS) have grown an impressive 63% over the last twelve months and that Intel’s EPS grown has averaged 35% over the last three years.

As for valuations, Dollar Tree and Intel earned Green Zone value ratings of 84 and 81, respectively.

Of all the valuation metrics my model considers, both stocks rate the strongest on their price-to-cash flow (P/CF) ratios. Dollar Tree trades at just 13.7-times its cash flow, and Intel at only 8.1-times.

Compare those to the Nasdaq 100 average of 23-times, and you can see how both Intel and Dollar Tree are great cash flow generators … and attractively valued!

Finding Green Zone Gems

I didn’t come up with the Growth At a Reasonable Price (GARP) strategy.

Heck, I didn’t publish the white papers that proved the market-beating potential in the momentum, size … value or quality factors.

But I have been reading research on investment factors for over a decade now. And I ran a multi-million dollar hedge fund based solely on the momentum factor.

So, when I built from scratch the Green Zone Ratings model, I knew just how to build it … to find “gems” that offer the best balance of each of the factors that drive market-beating returns.

Gems like Intel and Dollar Tree … and dozens more that I find in my Green Zone Fortunes and Home Run Profits services.

And speaking of Intel, the chipmaker was one of the biggest stocks of the 1990s. It rose more than 8,000% in 10 years during the internet stock boom. While I still think it is a great GARP buy today, I’m actually targeting a stock trend that has the potential to be bigger than what Intel was a part of decades ago.

I call this new tech “Imperium,” and it is set to disrupt trillion-dollar industries like energy, health care, agriculture and manufacturing. And getting into this tech now could be like getting into internet stocks in the early 1990s. To find out more about “Imperium,” watch my presentation now.

To good profits,

Adam O’Dell