At long last, the skies are clearing.

The return to normalcy is imminent…

And citizens of the world are itching to break free of their quarantine shackles.

The markets jumped on the news that the Johnson & Johnson (NYSE: JNJ) vaccine has been approved for emergency use, as well as the announcement that the U.S. will have the needed supply to vaccinate its adult population by the end of May – two months ahead of schedule.

One industry in particular is reaping the benefits of all this good news…

Our old friend travel and leisure.

“Here Come the Jets”

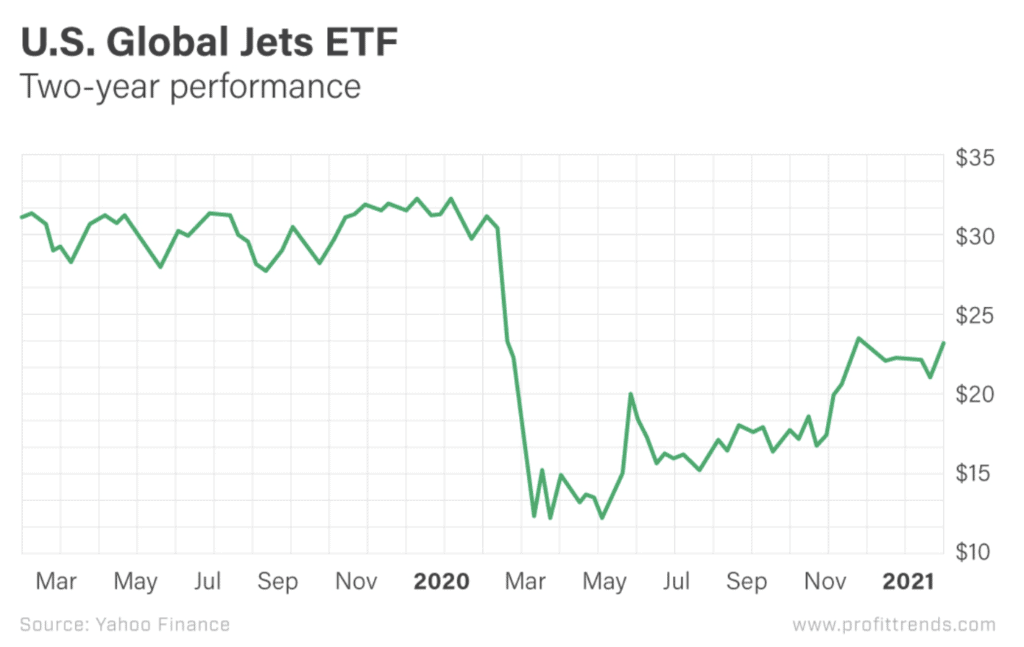

If any price chart can better tell the story of the last two years, I’ve yet to see it.

Here, the chart for the U.S. Global Jets ETF (NYSE: JETS) says it all.

[Alert: Look at this RARE 5100% Chart!]

The markets were flying high in early 2020 until news of the coronavirus brought them crashing to earth.

Over the last 12 months, the price of the U.S. Global Jets ETF has been down as much as 60%. And it ended 2020 with a 29% loss.

The travel and leisure exchange-traded fund (ETF) has remained depressed, trading at a fraction of its all-time high set in early 2018. And the U.S. economy as a whole is stuck in a similar slump.

That’s why first quarter projections aren’t exactly promising.

The ETF’s top four holdings – Southwest Airlines (NYSE: LUV), Delta Air Lines (NYSE: DAL), American Airlines (Nasdaq: AAL) and United Airlines (Nasdaq: UAL) – are all projecting negative first quarter sales growth of between 50% and 60%.

I know… it’s bad.

But things are really supposed to pick up in the second quarter.

[Breakthrough: Warren Buffett made $12 billion with the idea behind this simple technique]

With vaccines being distributed left and right, there’s hope that travel will resume in the spring… and be in full force by summer.

Southwest is expecting year-over-year sales growth of 220%. United and American are both expecting jumps of around 260%. And Delta is expecting a nice boost of 310%!

Just imagine what sales growth numbers like these would do to their stock prices… and, in turn, the price of the U.S. Global Jets ETF.

Of course, there’s always the option to invest in stocks individually. But ETFs offer diversified exposure to multiple companies within a specific sector at a fraction of the risk.

But Wait, There’s More

Airlines aren’t the only travel plays that are poised for a comeback.

Cruise lines are working overtime to get their ships back out to sea.

Just this week, Royal Caribbean Cruises (NYSE: RCL) announced its newest ship, Odyssey of the Seas, will set sail in May with a fully vaccinated crew and passenger list for guests over age 16. Also, it will leave from Israel, which has been praised for its handling of the pandemic and quick vaccine distribution.

[Learn More: these stocks can quickly multiply in price 5x, 10x, 100x, or much higher…]

Similar to their airline counterparts, the major cruise lines are projecting negative first quarter sales growth.

Again… nothing new there.

But, across the board, they’re predicting double-digit growth for 2021 and triple-digit growth for 2022.

Royal Caribbean, Norwegian Cruise Line Holdings (NYSE: NCLH) and Carnival Corporation (NYSE: CCL) are projecting 42.9%, 51.4% and 13.6% revenue growth, respectively, for this year. And they’re expecting 227.7%, 208.0% and 188.3% revenue growth, respectively, for next year.

Are We There Yet?

As your parents used to say on road trips, “We’re almost there!”

I can practically feel the sunshine and taste the piña coladas.

So as airplanes return to the clouds and cruise ships return to the water, travel and leisure stocks will once again have their time in the sun.

And as seasoned trends investors, we know this as the perfect time to pick up a few shares of those depressed companies and ETFs that are absolute steals right now.

Are you planning a trip for the second half of 2021 or beyond? Let me know where you’re going in the comments!

Good investing,

Rebecca

[Breakthrough: Warren Buffett made $12 billion with the idea behind this simple technique]