Table of Contents

- Introduction

- Luke Lango: Voted “#1 stock picker in the world” by TipRanks

- Massive Gains During the Worst Bear Market Conditions?

- The Secret to Finding Undervalued Stocks in Bear Markets…

- The 4th Divergence Event Happening Right Now…

- How to Find Major Divergences in Stocks, Before They Snapback 100% or More

- Revealed: Luke’s #1 Stock for the 4th Divergence Event

- The Fourth Divergence: Three Companies That Could Snap Back 100% or More In Next 12 months

- True Price: The Secret to Finding Undervalued Companies In A Bear Market

- The Divergence Portfolio Purge

- Your’s FREE: The Hottest Technology Opportunity On My Desk Right Now…

- Try out Innovation Investor and get all of the reports

Analyst voted “#1 Stock Picker in the World” in 2020 Issues Public Warning…

THE FOURTH DIVERGENCE

The last three times this rare pattern emerged, multiple stocks DOUBLED within 12 months — during the worst bear markets in U.S. history.

Paul:

Hi, I’m Paul Ghiringhelli.

Thank you for joining us for this special segment of Investing Minute — live from the InvestorPlace headquarters in Baltimore, Maryland.

Your timing could not be any better.

Because – today – you are getting an inside look at a rare event taking place in the stock market as we speak.

Something we have not seen in 14 years.

And if you act now and position yourself ahead of time, you could see extraordinary profits over the next 12 months — regardless of rising inflation, a recession, or even if the broad market crashes.

You may think explosive gains are impossible, given what most folks have seen from stocks this year.

But as my guest tonight will show you, this outcome has happened before…

Not just once. But three times — when multiple stocks explode during periods of extreme market uncertainty.

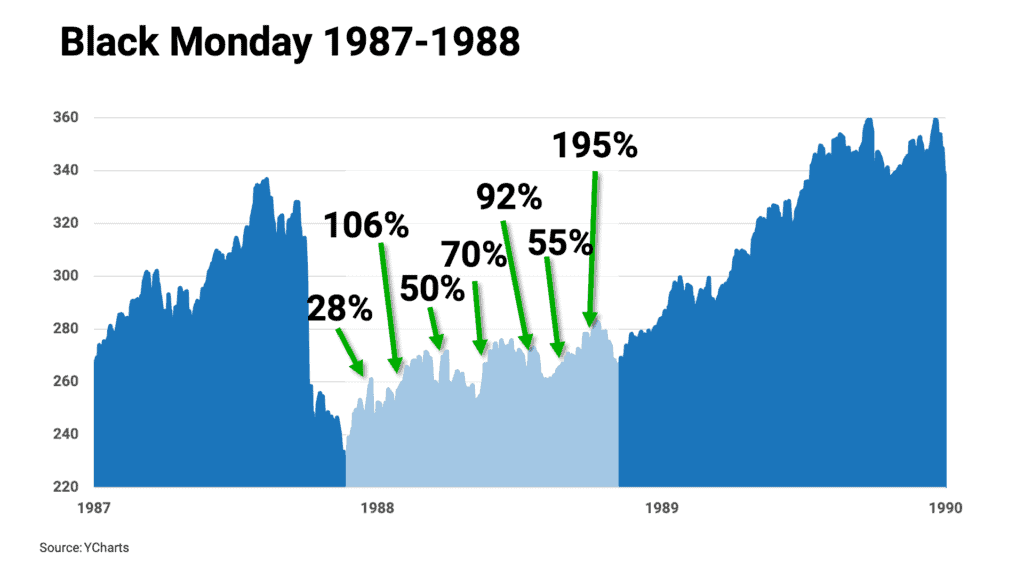

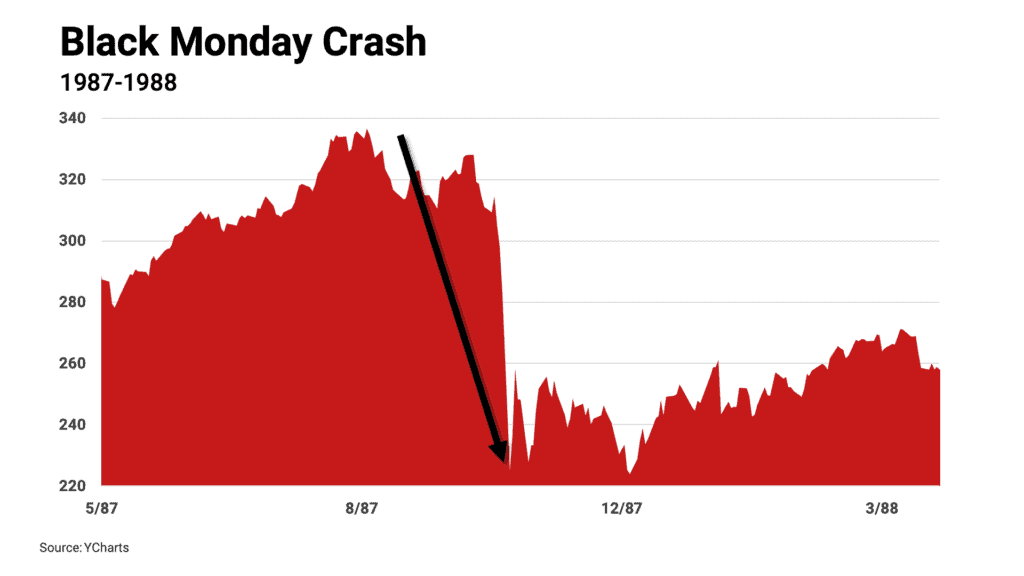

It happened immediately following the Black Monday crash in 1987

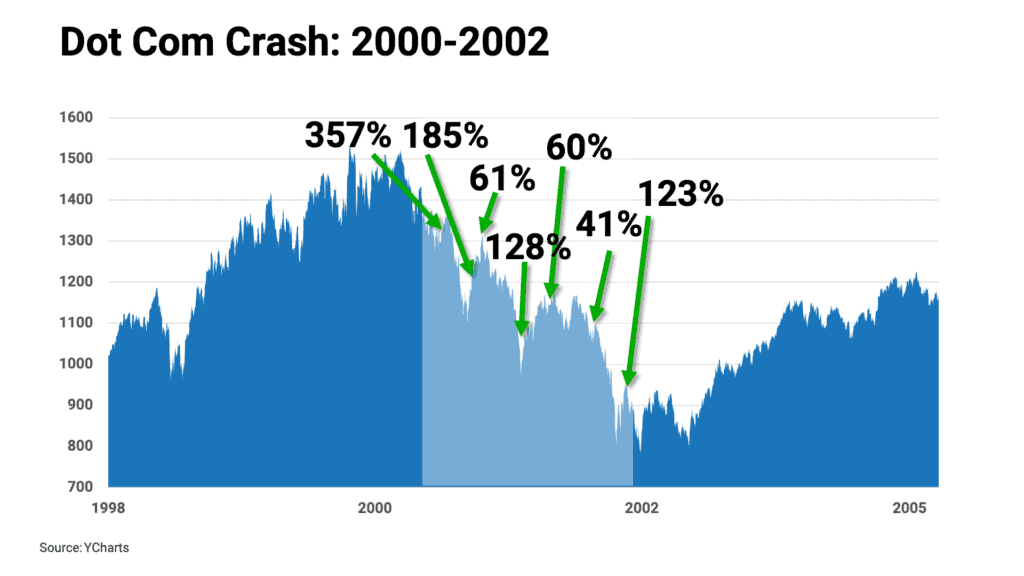

The dot com crash of 2000…

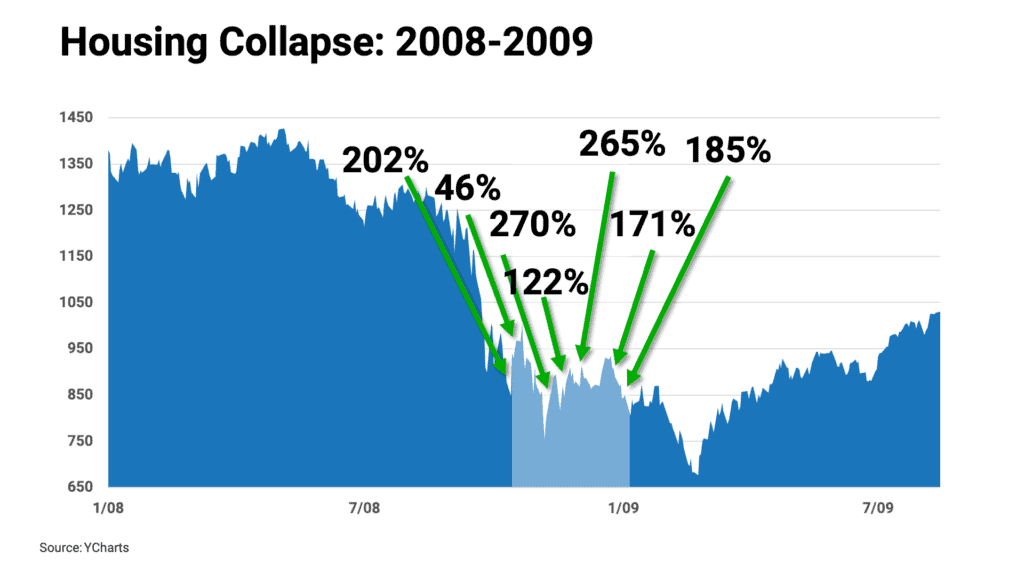

And the housing bubble crisis of 2008.

And for reasons you’ll find out in a moment…

My guest says this rare event is happening again — right now.

That’s why we’ve decided to bring him onto the show today.

It’s critical you understand what’s going on and how to take advantage of this extremely rare situation before it disappears again for another decade or more.

If you've been lying awake at night worrying about your savings nest egg…

If you're sitting on double-digit losses in your portfolio…

Or if you’re wondering if you should get back into the markets while stocks are trading at massive discounts…

Please pay attention to what my guest is about to show you.

This may be the last chance to recoup those recent losses in your portfolio and fast-track your way into a comfortable retirement…

Or be one of the millions of Americans who let this opportunity pass by once again…and live out their golden years filled with regret and frustration.

So grab a pen and paper…

You’re about to find out how you can capture your share of this market event that will go down in history as “The Fourth Divergence.”

Let’s get started.

Paul:

Luke Lango, thank you for joining us.

I appreciate you flying 2,600 miles to be here today.

If what you are saying about this rare event is true — this is going to be quite an interview.

Luke:

My pleasure, Paul. Thanks for inviting me on.

Paul:

Now, I realize this message is urgent…

But before we dig into the details, allow me to quickly introduce you to the folks watching from home who may not be familiar with your work.

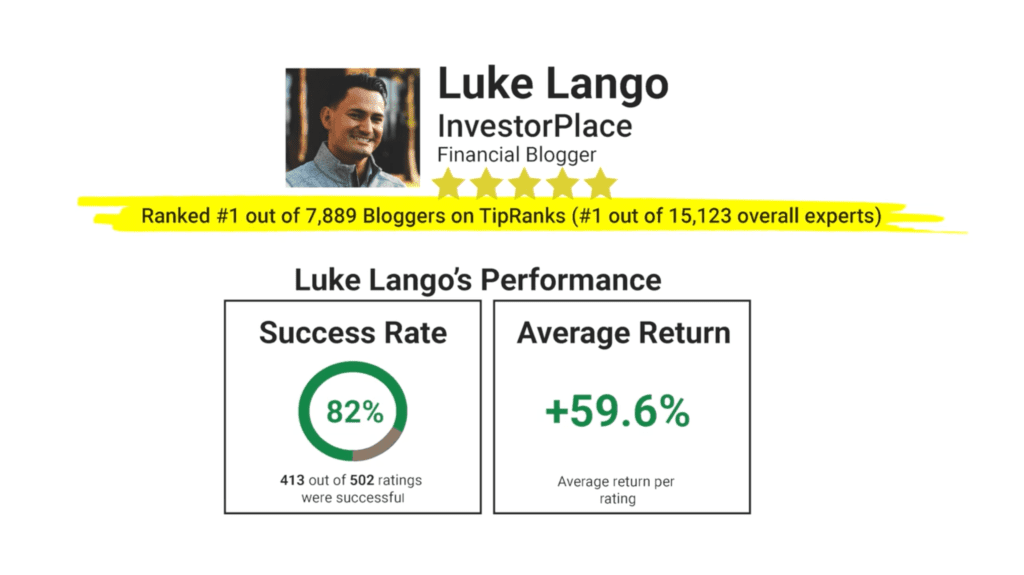

Luke is a senior investment analyst at one of the largest and oldest financial research firms in America.

Luke, after digging through your track record of previous calls, our team discovered something remarkable I think our viewers would appreciate, particularly at a time like this.

Everyone knows it’s easy to pick winning investments when the markets are always moving up.

But unlike most analysts out there, YOUR biggest calls happened when the markets were actually crashing DOWN.

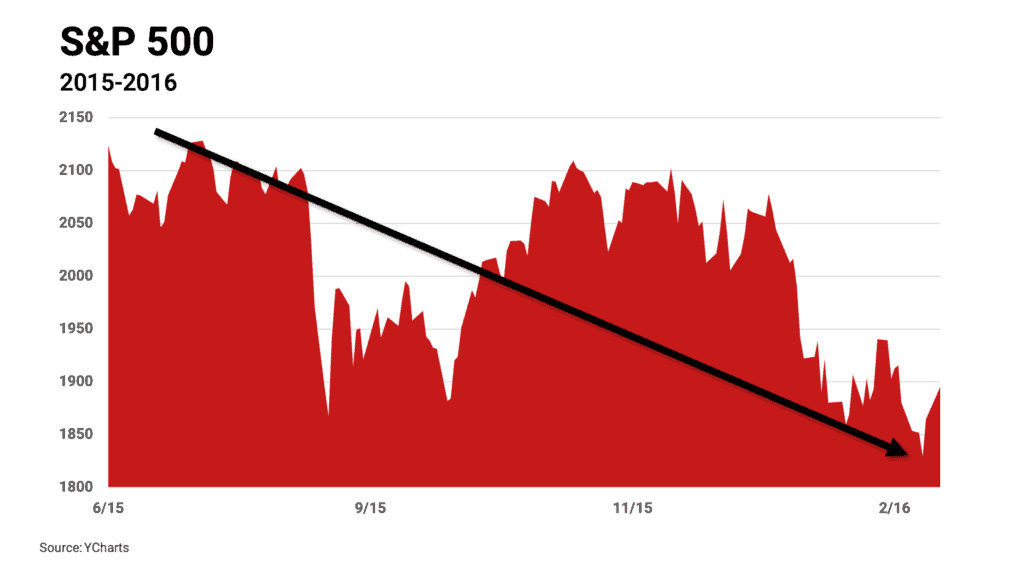

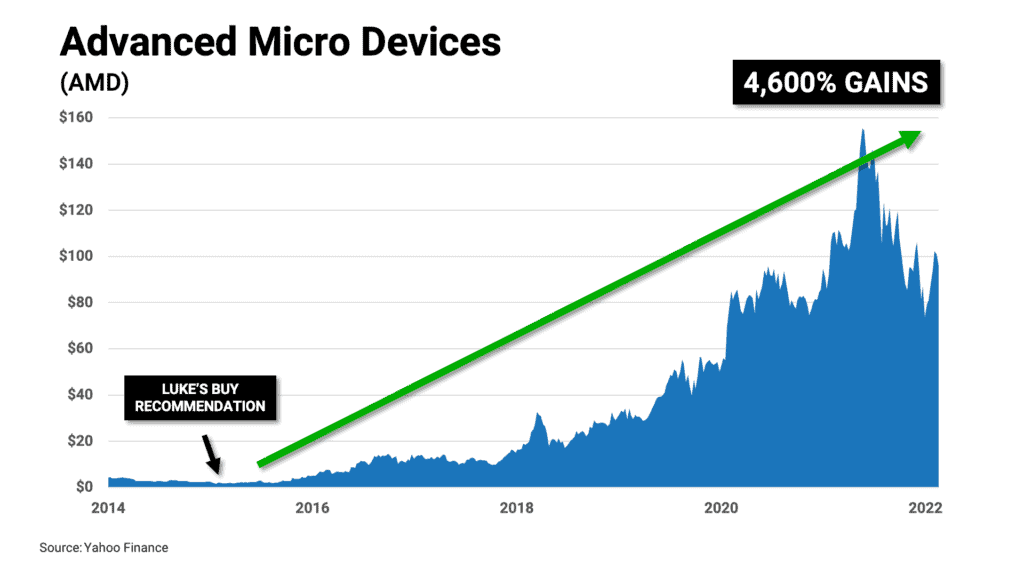

For example, back in 2015, you may remember the major indexes took a massive hit and dropped 13% in a matter of months.

But instead of ducking for cover…YOU urged your readers to do something quite different.

You recommended a little-known chipmaker called AMD, when it was trading for less than $2 a share.

Since you issued that recommendation, shares have soared more than 4,600% — even if you held through the recent crash we’ve seen this year.

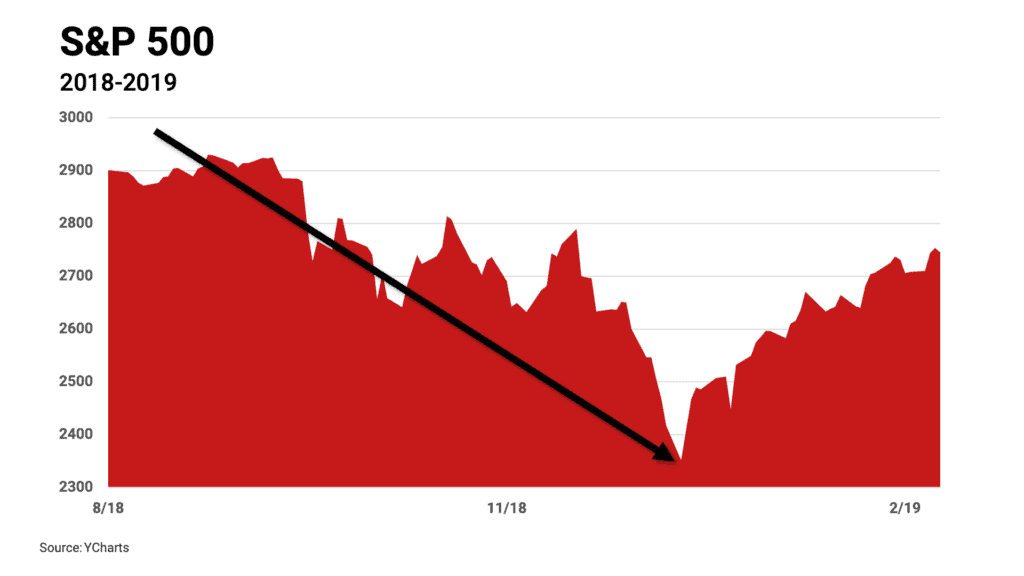

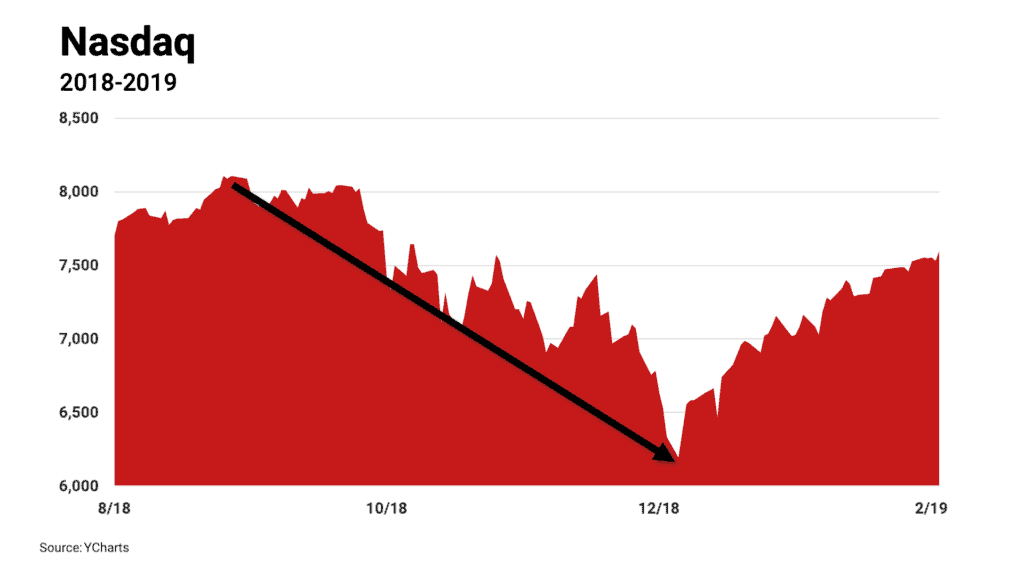

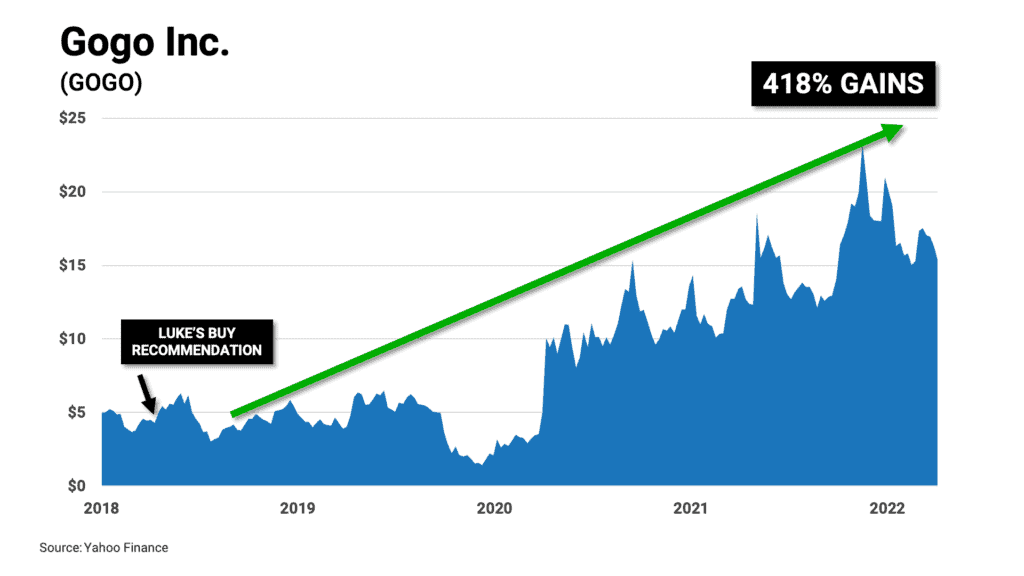

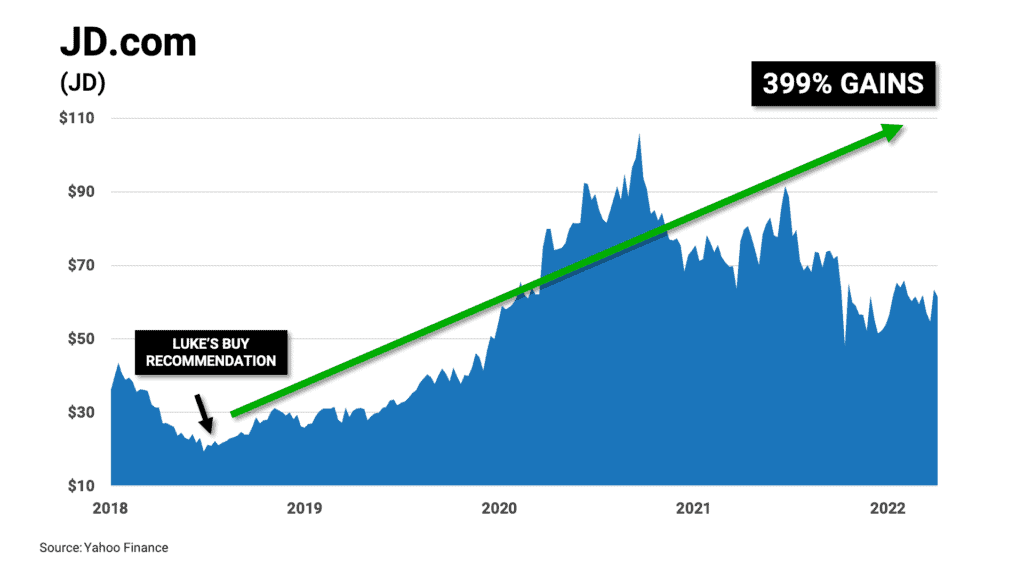

In 2018, when the trade war broke out with China…

The S&P dropped 19%…

And the Nasdaq dropped a stunning 24%…in a matter of months.

Many folks were glued to their TV screens as one bearish headline after another told folks to head for cover…

But again — you did not.

Instead, you urged followers to invest in GOGO — an obscure internet services firm few people had heard of before.

Since then, the stock soared as high as 418%.

And your call on JD.com panned out nearly as well…going up as high as 399%

But 2020 was the year when things got really interesting.

As many of our viewers will remember, in March of 2020, we saw the biggest single day drop in the Dow Jones in 33 years.

Warnings of a global meltdown were spreading in the news…

And Wall Street fund manager Bill Ackman went on CNBC to tell investors that “hell is coming” to America.

Nobody knew what to expect next.

But, yet again, it seems you knew something we didn’t.

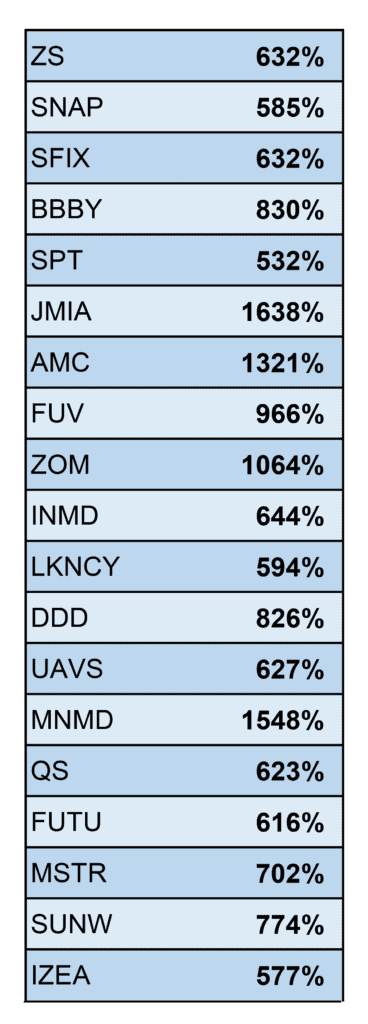

Because instead of running for the hills…you recommended 19 different stocks that went on to soar 500% or more.

We’ve pulled up these calls on screen so folks at home can see.

830% gain on BBBY…

966% on FUV…

1,500% on MNMD…

An absolutely fantastic run, Luke.

By the end 2020, you were voted the “#1 stock picker in the world” by TipRanks — a company that tracks the performance of over 96,000 financial experts, including hedge funds, Wall Street analysts, and more.

And today, in 2022, over 500,000 people now turn to you for your stock market expertise and analysis.

Luke, I have to say…

I’ve interviewed a lot of heavy hitters in this industry over the years…

But I’ve never seen anyone rack up such an impressive list of calls in such a short amount of time.

Most of these calls went AGAINST what the so-called “experts” in the media told investors to do.

And always came at a time when the markets looked worse for wear.

From what I’ve heard so far, it sounds like you could do it all over again – is that right?

Luke:

Paul, that’s exactly right.

I’ve made my career by helping regular folks turn market volatility into an advantage.

And I believe all my previous calls were in preparation for what we’re seeing unfold in the markets right now.

This is a unique phenomenon my team and I have spent the last six months following. We call it: “Divergence.”

As I’ll show you, each time it has appeared — or “opened up” as we like to say — it’s given regular folks a chance to put their retirement goals on hyperdrive.

I’m talking about multiple opportunities to double your investment — at minimum — over the next 12 months, based on what we’ve seen in our back tested models.

But despite all of my best efforts today, I’m afraid millions of Americans will miss the boat and be left behind.

All because of mixed messages and fear pushed by the mainstream news.

Paul:

Wow, I have to say…that’s a lot to take in. Given all the uncertainty in the markets right now, I know many of our viewers feel…well, a bit skeptical.

Luke:

Paul, I know it sounds a bit “out there” at first glance…

But once you see what I’m seeing, you can forget about inflation, a recession, the fed hiking rates, and all of the other things that caused the markets to drop this year.

In fact, you'll be hoping things get even worse.

Because the more people panic, the better this rare opportunity gets.

Paul:

Wait…you’re saying you get more excited the worse things get?

Sounds like you’re planning to short the market.

Luke:

Far from it. I don’t like taking those kinds of risks, Paul. I leave shorting stocks to the Wall Street hedge funds.

I’m looking at something completely different.

You see, what most folks don’t realize is that certain stocks are set to explode not in spite of all the market uncertainty we’re seeing, but because of it.

Paul:

Okay, let me get this straight…

You’re saying you’ve discovered a group of stocks that are set to skyrocket because the market is uncertain?

You’re going to have explain that one, Luke.

Luke:

Absolutely. I think the best way to show you is with a simple picture.

Paul:

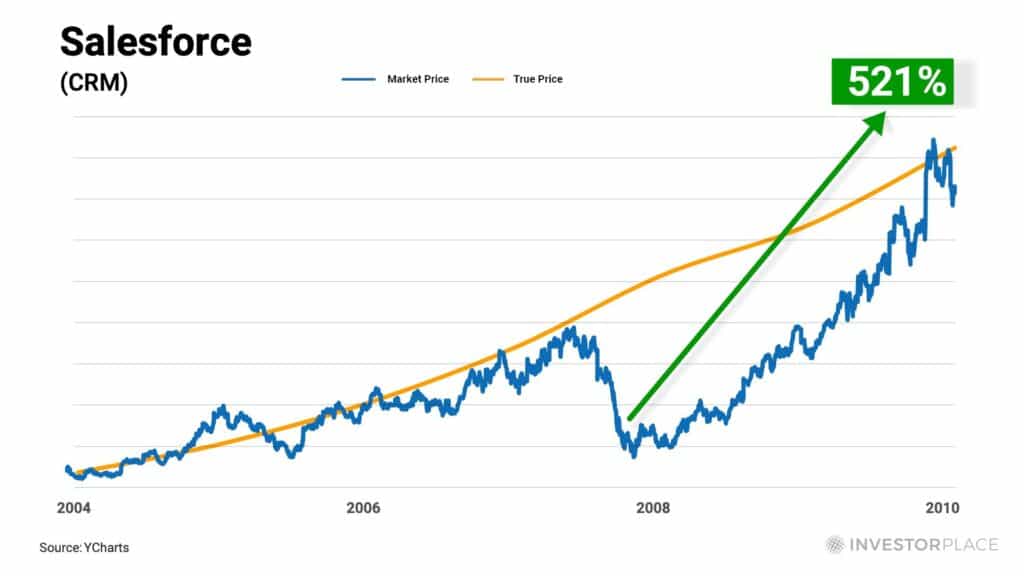

OK great. I believe we have that up on screen now…what are we looking at here?

Luke:

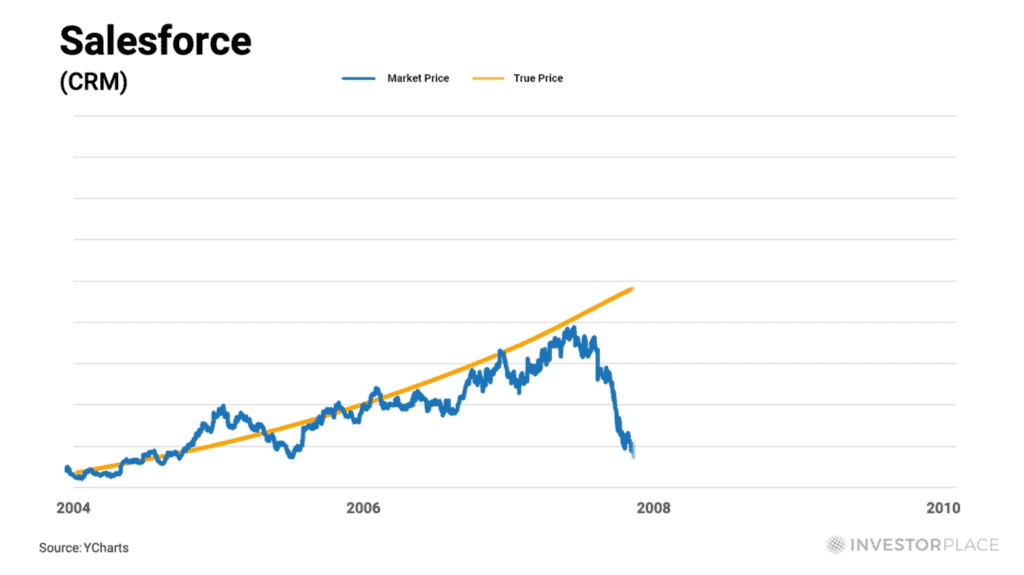

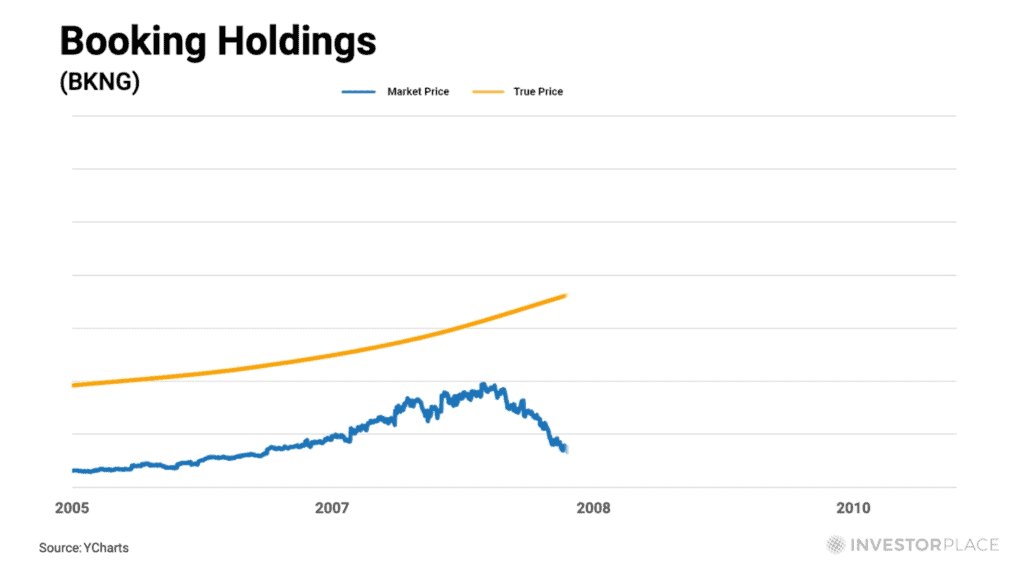

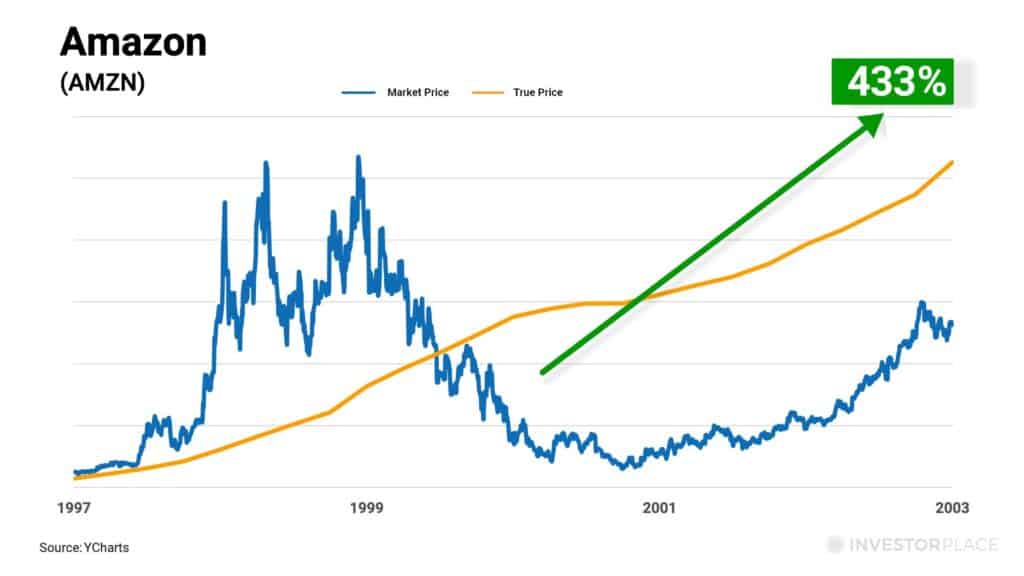

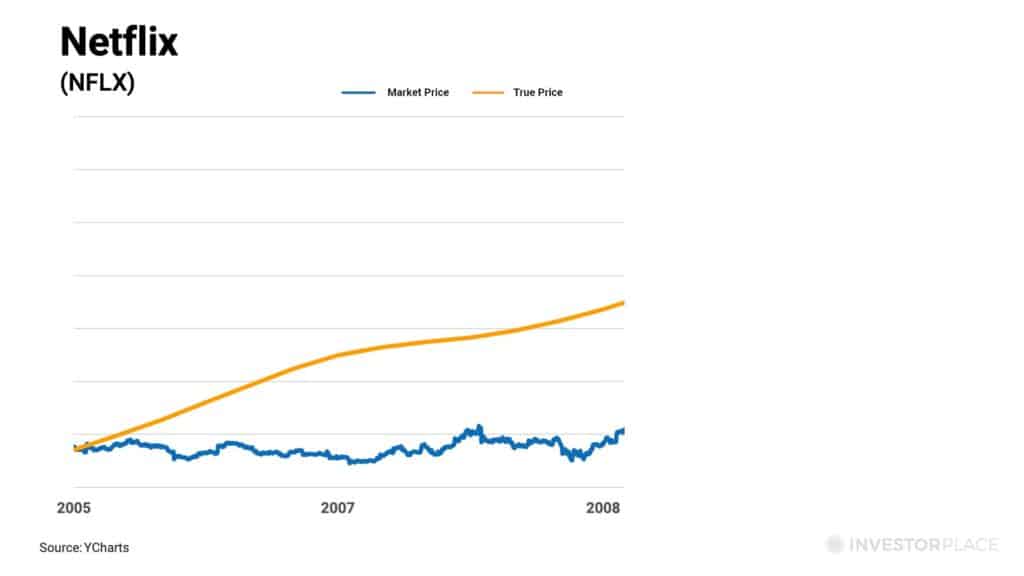

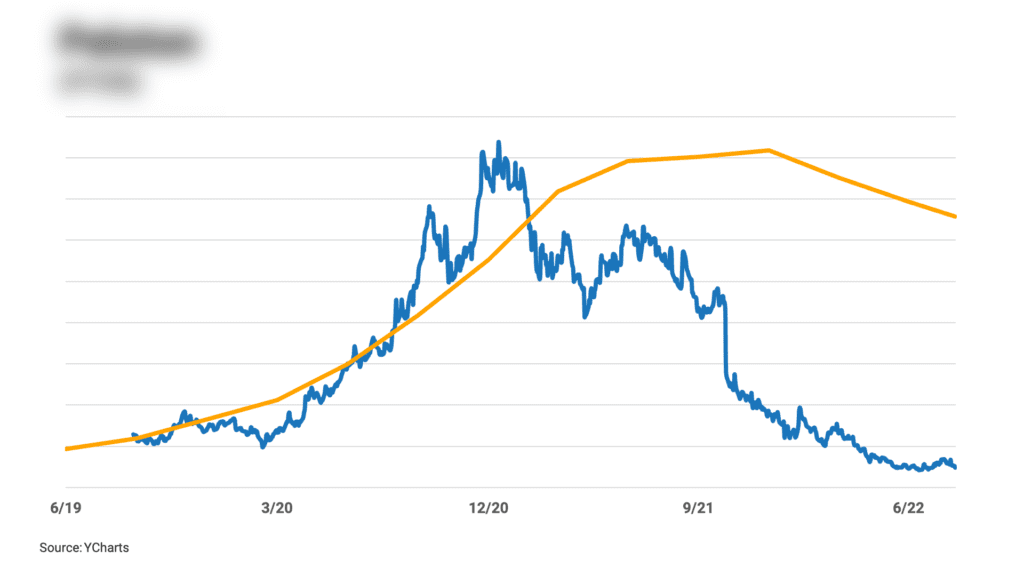

Paul, this is a stock chart from 2008 – the last time we saw this pattern emerge in the markets.

Do you see how these two lines were moving together for years, and then suddenly broke apart?

Paul:

Yes, I see that.

Luke:

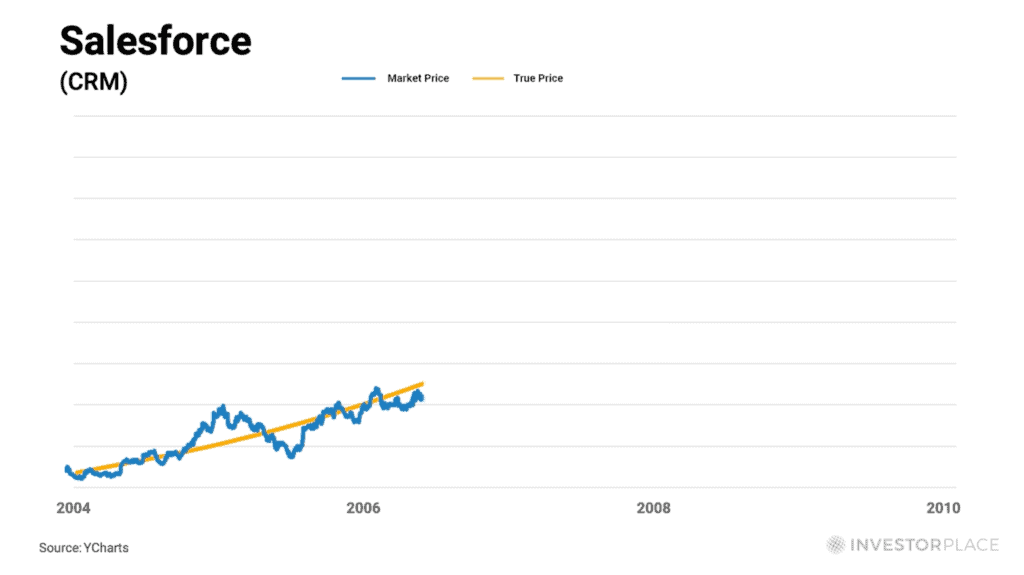

This is a classic example of what I call a Divergence.

The blue represents the market price of the stock. The daily ups and downs we’re all familiar with.

The orange line represents what I call the stock’s “true price” – essentially, what the stock SHOULD be trading for.

When markets are normal, these two lines tend to move together.

But then, something happens in the markets that causes this powerful relationship to diverge. They move in opposite directions.

And that my friend…is an opportunity that only comes around maybe once a decade.

Paul:

OK, but what about this image has you so excited?

Luke:

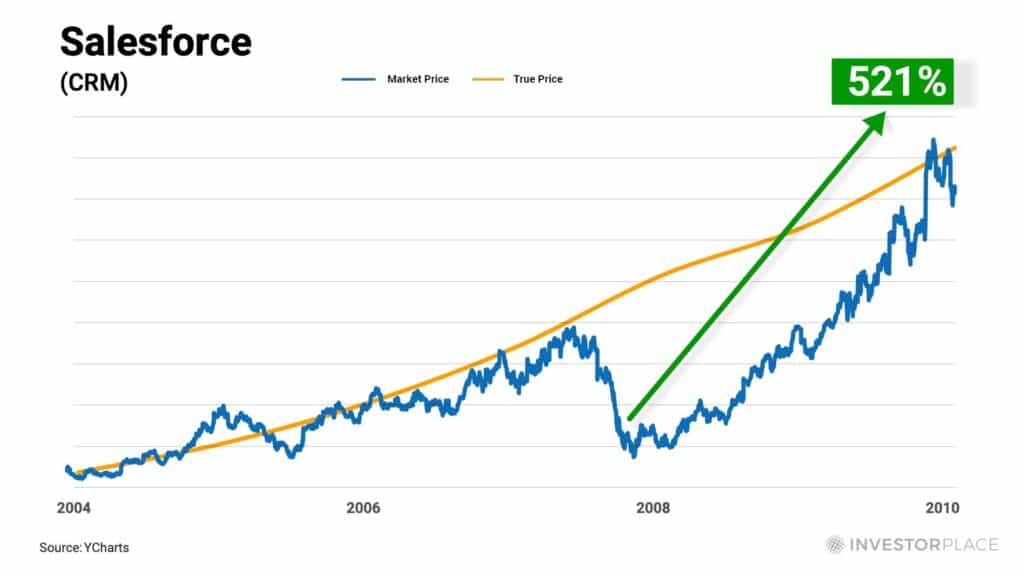

Well, let’s zoom out and see what happened next.

You see that?

Once a divergence showed up in this stock, the market price quickly snapped back to its true price — with massive returns.

You can think of the relationship between these two lines like a rubber band. Whenever it gets stretched out, it quickly snaps back.

And those snapbacks tend to produce abnormal returns — even as the rest of the market is bearish and choppy.

As you can see, once the stock bottomed out, it almost tripled within a year. Then continued to soar 521% over the next two years.

Again – this happened during one of the worst economic crises in U.S. history.

Most people panicked and ran for cover.

But those who knew how to spot this divergence and got in at the right time…could have turned a $5,000 investment into $31,000 – in only 24 months.

Paul:

This is eye-opening, Luke. I don’t think I’ve seen anything like this before.

Luke:

Well, that’s not surprising, Paul. This is a rare situation that has only occurred three times in the last 34 years.

My team and I have spent months doing an in-depth analysis of every divergence since 1987…

We’ve found that when a major crisis causes “peak fear” in the markets…

These divergences appear in multiple stocks…often right before they soar for massive gains.

Our back tested models show these stocks going up as much as 357% in 12 months…

2,150% over five years…

And as high as 11,600% gains in 10 years.

And that’s why I’m here today.

The stock market volatility and uncertainty we’ve seen this year has caused this unique situation to emerge once again.

And while the talking heads in financial media spins the worst possible headlines that scare people out of the markets — which, of course, they’re going to tell you, because fear sells, and it gets clicks…

Folks who pay attention today have a chance to escape the bear market, forget inflation, forget recessions, and put their retirement goals on hyperdrive.

But timing is critical here.

So I’m giving everyone a clear plan on what to do right now.

Paul:

Fantastic. Looking forward to digging in here, Luke.

For folks tuning in from home, Luke is about to reveal his #1 stock to play for this Fourth Divergence event, right here.

He’s agreed to give away this recommendation 100% free, so you won’t need a credit card or submit an email address or anything like that.

The only thing you need to do is stick around as we dig into what’s happening — and what’s to come.

Luke, you mentioned this Divergence only happens during times of peak uncertainty — why is that?

Massive Gains During the Worst Bear Market Conditions?

Luke:

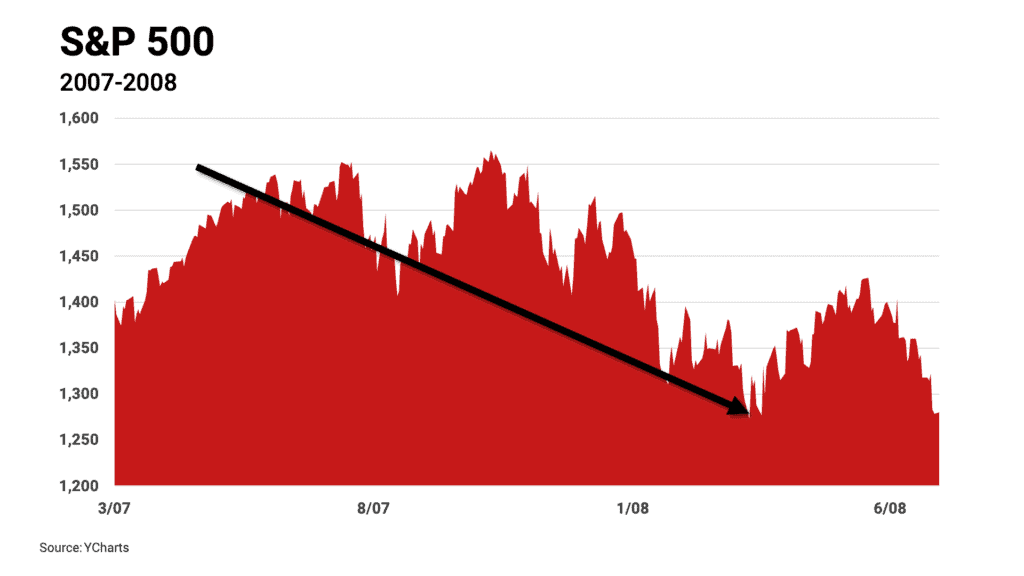

Well, let’s go back to 2008 — the last time we saw this pattern appear in stocks.

As you know, that was an unbelievably bad year for the markets.

Paul:

Of course.

That was the year of the real estate bubble…

The beginning of the “great recession.”

The 2008 crash set a lot of people back in their retirement by years.

Luke:

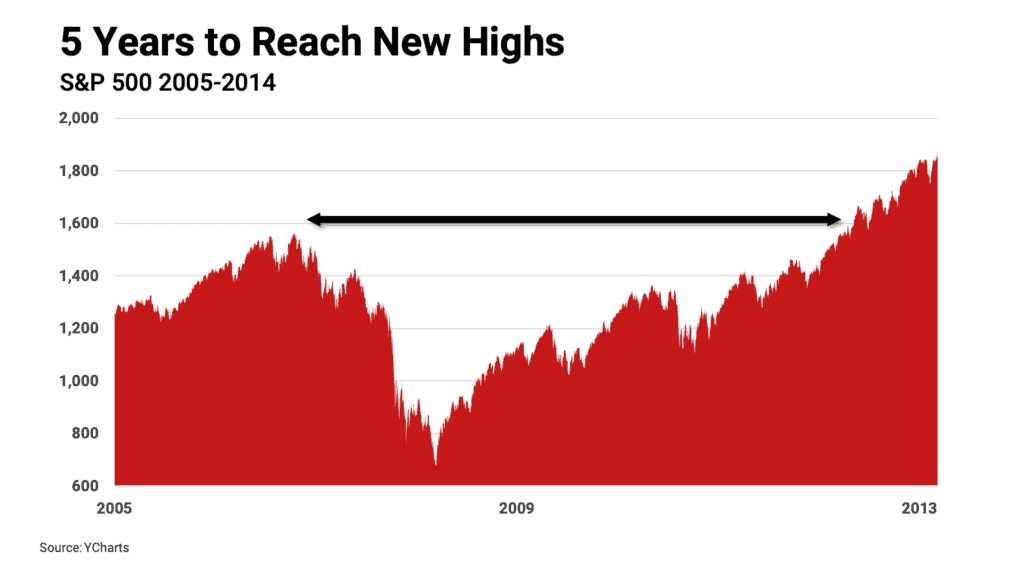

That’s exactly right. The S&P 500 dropped nearly 56%.

It was one of the worst crashes in U.S. history.

A huge chunk of Americans’ retirement accounts was completely wiped out.

Paul:

All thanks to Wall Street reckless, greedy practices…

Luke:

Right.

An everywhere you looked, it was one bad headline after another.

Obviously, many people panicked and sold off their stocks.

But, amidst all this chaos and confusion, multiple stocks started to show a massive Divergence.

Take a look at Booking Holdings.

The market price and the true price moved together for years, as they should.

But then, they suddenly broke apart…moving in opposite directions.

The market price fell 66 percent in less than a year!

To everyone else watching this stock, it looked like a falling knife.

But when you follow the true price, you see a different story altogether.

Take a look.

As you can see, the market price snapped back to its true price — bringing huge returns.

Once it turned around, the stock doubled within 6 months.

Then continued to soar 791% in just 24 months…

And five years later, stock was up more than 2,400%.

We’re talking about turning a $10,000 investment into $250,000 — during the worst economic crisis of the last century.

Now compare that to what most folks did in 2008.

If they held onto an index fund and waited for the markets to recover, it took them 5 years just to make their money back.

Paul:

Luke, any way you slice it… it's incredible to see 2,400% gains — especially following the 2008 crash.

But…it’s easy to a cherry-pick an example with the best case scenario, right? Are there more stocks that soared like this following the 2008 crisis?

Luke:

Good question.

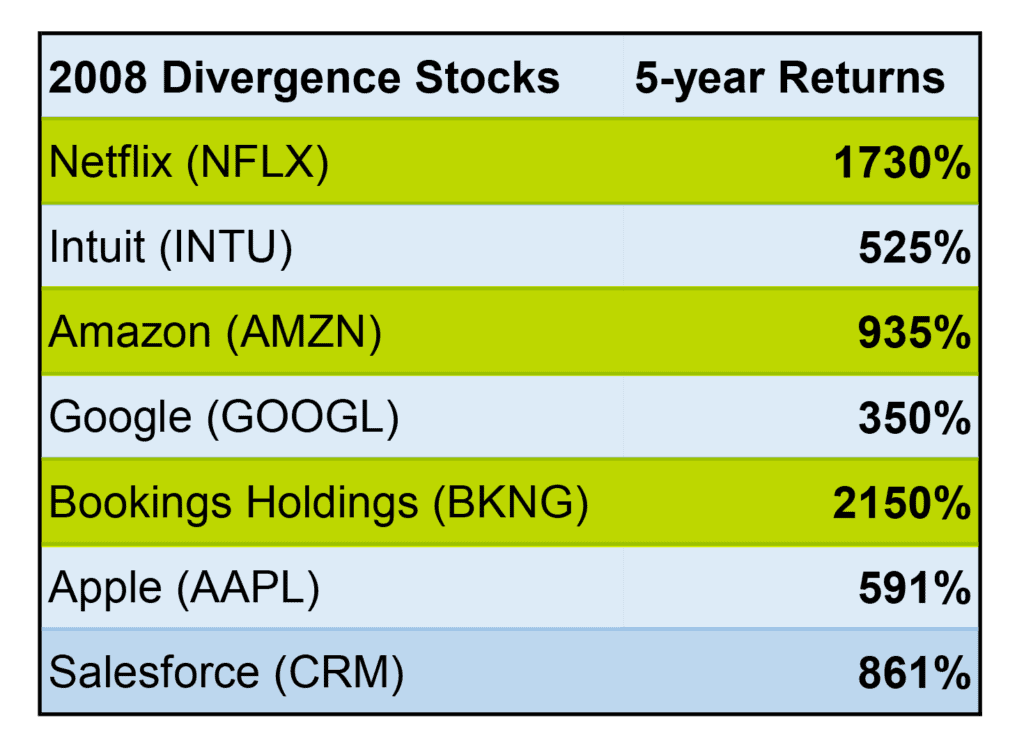

Yes, we identified this pattern in multiple stocks.

And if you got in at the right time after this divergence appeared, you could have seen incredible returns while everyone else was reeling from the crash.

For example, after a divergence appeared in Google, it snapped back with 122% gains in 12 months – that’s more than double your investment.

Apple snapped back with 171% in 12 months…

Netflix saw 202% in 12 months – that’s TRIPLE your investment.

And anyone who held on saw even bigger gains.

Just look at the returns over a five-year period for the examples we discovered in our back tests:

A few of these stocks saw 10X returns at the same time it took the overall market to get back to even.

I can see the look in your eyes, Paul.

They’re getting wide. And they should be.

Because this is the real power of Divergence.

Every time this rare event occurs, regular folks have a chance to put their retirement goals on hyperdrive.

Paul:

Given the fact we’re in a bear market right now, these gains are eye-opening to say the least.

But what’s really striking me is how these stocks don’t just deliver incredible gains in that first year…

It seems like investors who hold for the long run can see massive returns, too.

Luke:

Yes! That’s a great point.

And I actually have the perfect example to highlight this.

Let’s take a look at the very first Divergence event we uncovered. It happened in 1988.

Paul:

That was around the time “Black Monday” happened right?

Luke:

Exactly, you know your history.

The entire market dropped 28% in a single week…

Obviously, a scary time to be an investor.

Paul:

I can only imagine. It was like the March 2020 crash, but the markets didn’t recover nearly as fast.

Luke:

That’s right. It took nearly two years for the markets to recover.

But most folks don’t know that shortly after the crash, in the middle of all this panic and uncertainty…

Several stocks showed a massive Divergence…before they snapped back with incredible gains.

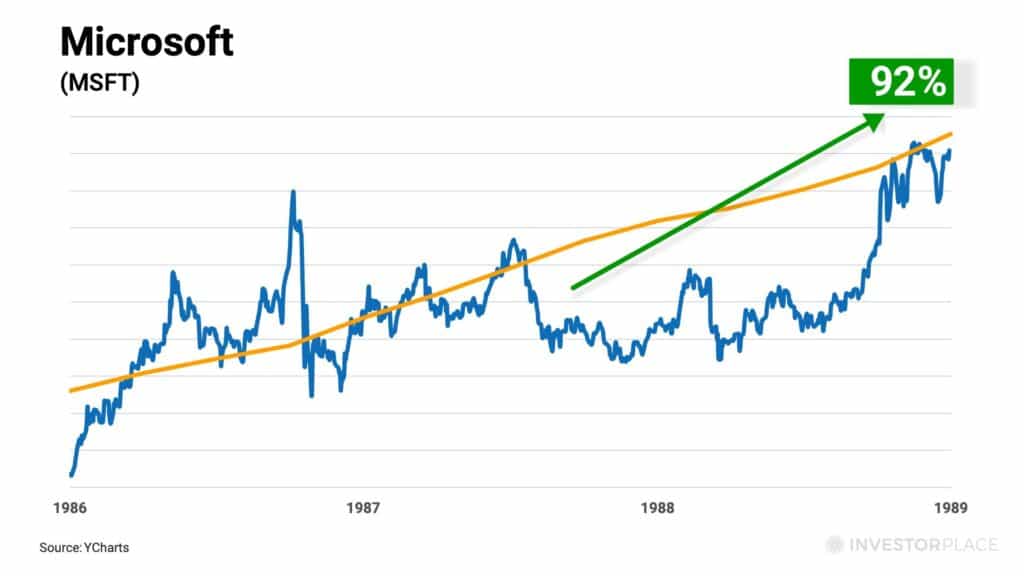

For example, Microsoft shares snapped back 92% in 12 months.

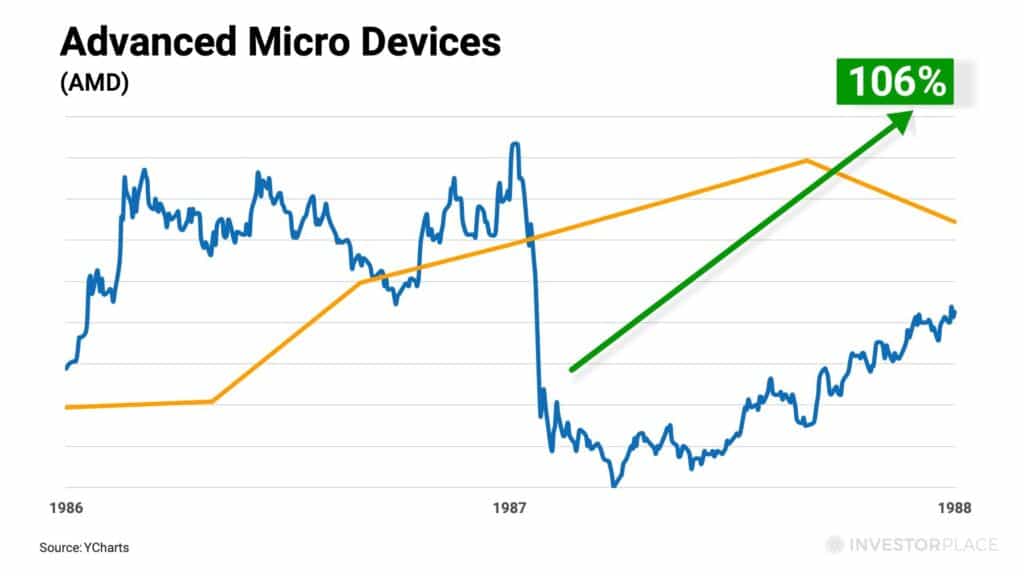

AMD snapped back with 106% gains in 10 months…

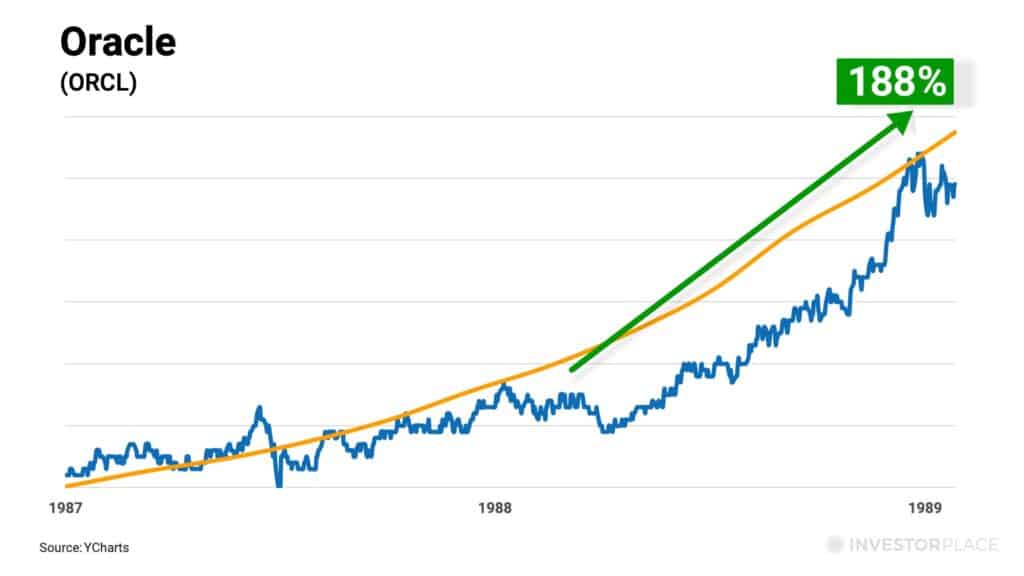

And Oracle skyrocketed an incredible 188%.

What sounds better, wait around for years to make your money back…

Or double your investment – three different times – in 12 months or less?

Paul:

Well, I think I speak for everyone when I’d pick the second option.

Luke:

Of course. But here’s the thing, Paul.

That’s only just a taste of what’s possible when you understand how spot these Divergences and take advantage of them.

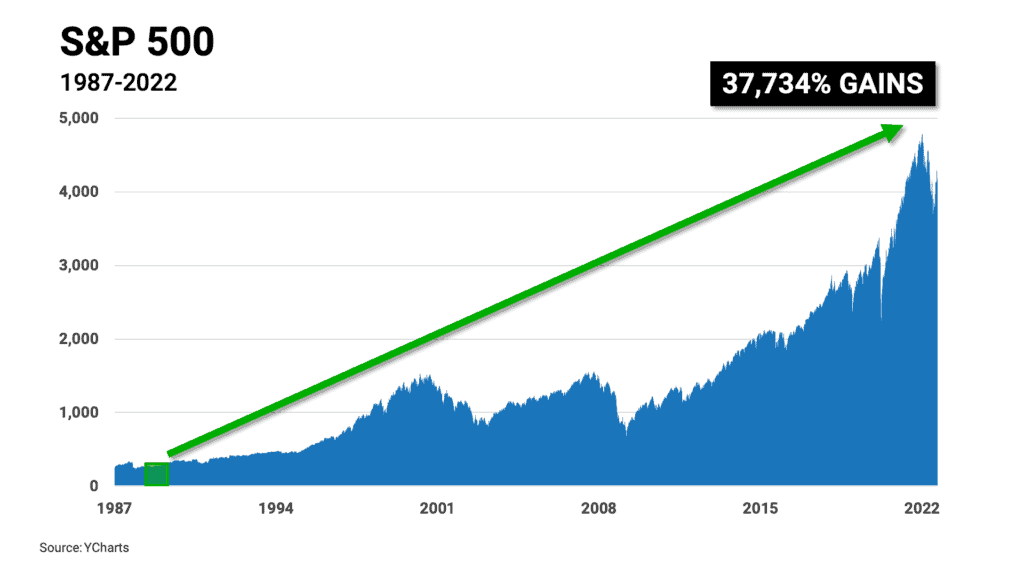

For example, if you simply bought and held all of the stocks we uncovered in our backtest through today, you’d be up an average of… wait for it… 37,734%.

Paul:

Wow…that’s mind boggling.

Luke:

I know – that’s a big number, so let’s contextualize it.

It’s 1988. These rare divergences appear. You put $10,000 into these stocks and you do nothing else for the next 30 years.

Today, you’d have nearly $3.8 million.

Only a few investment decisions would’ve made you a multi-millionaire over time.

For any person – that's a worry-free retirement.

It's a real chance to leave the rat race for good.

Imagine…the financial freedom to buy that boat, take that vacation abroad with your family, actually LIVE the life you want without having to worry about OUTLIVING your money.

Now you can see why I’m so excited this is happening again today.

Paul:

Nearly $3.8 million on a handful of $10,000 investments…

You don’t hear that every day, Luke. It is truly remarkable.

But let's have one more example.

You mentioned there have been three divergence events – what was the third?

Luke:

That’s right.

I showed you the 1988 and 2008 divergence…

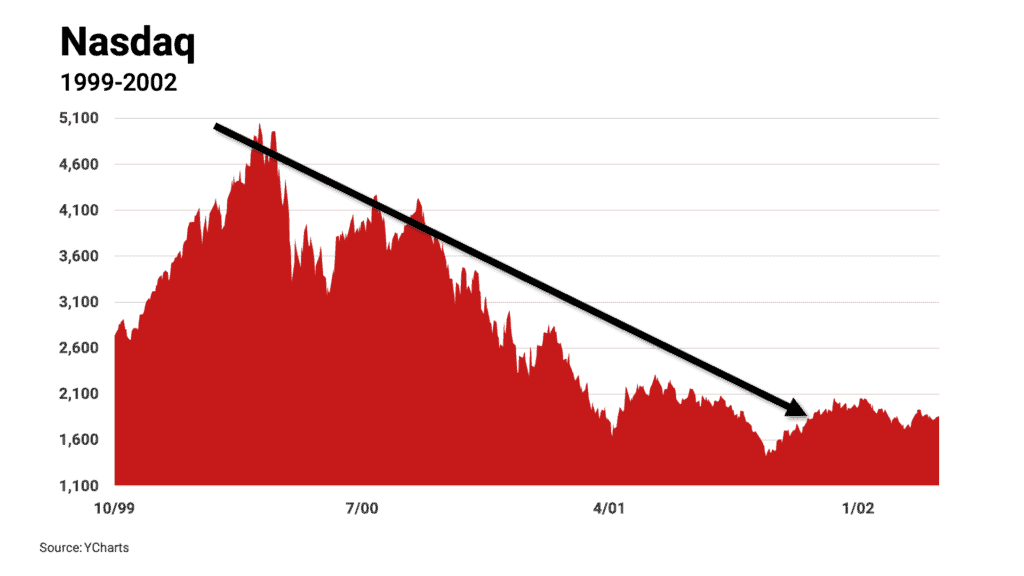

The third one happened in late 2000.

Paul:

2000…the dot com crash.

Luke:

Exactly.

Once again, the markets were full of fear and uncertainty.

We went from a massive tech bull run into market turmoil.

Tech stocks got massacred.

A lot of people who were speculating on internet companies lost their shirts.

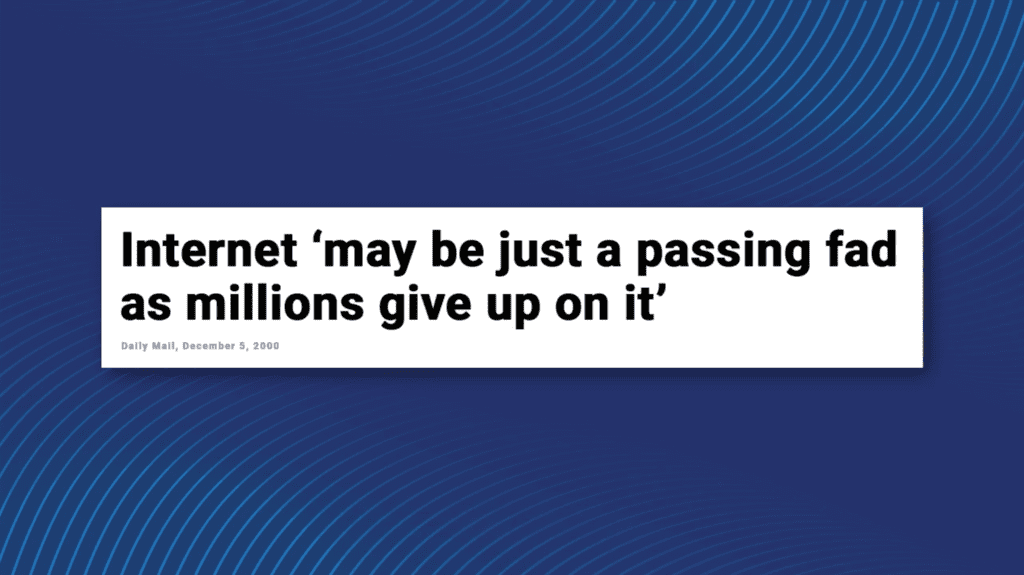

The fallout was so bad, in fact, that the Daily Mail ran the following headline on Dec. 5, 2000

Millions of investors let fear take over and sold off their shares in a panic.

But while the so-called experts in the media were running headlines like these…something else was happening no one else saw.

Can you guess what I’m talking about, Paul?

Paul:

Divergence started appearing in these tech stocks.

Luke:

Bingo. You’re catching on.

The tech stocks everyone loved to hate at the time were showing a massive divergence.

And anyone who saw these divergences appear could have invested BEFORE these stocks snapped back to their true price – with huge gains.

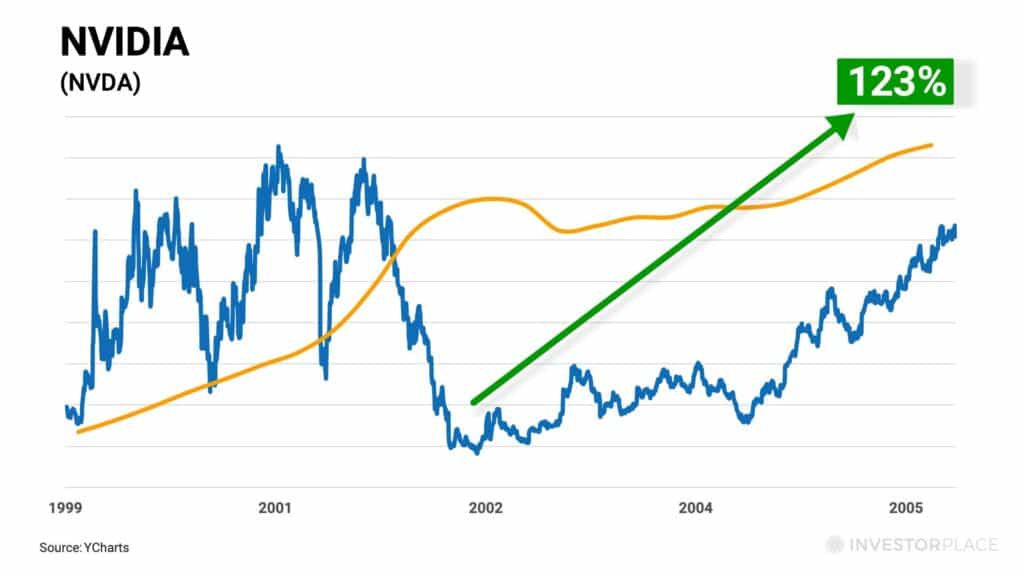

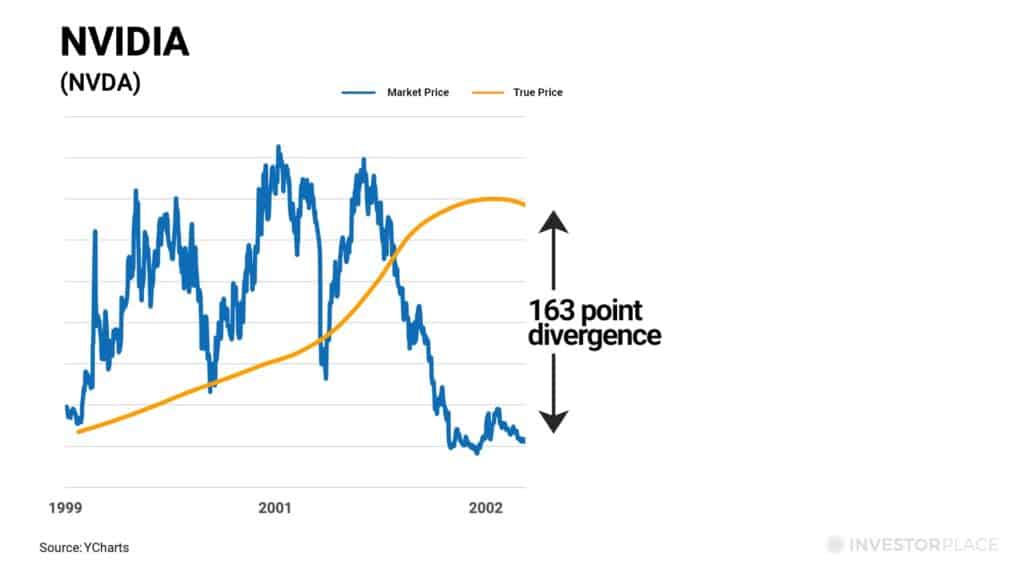

Take Nvidia. Within 12 months….the stock snapped back with 123% gains.

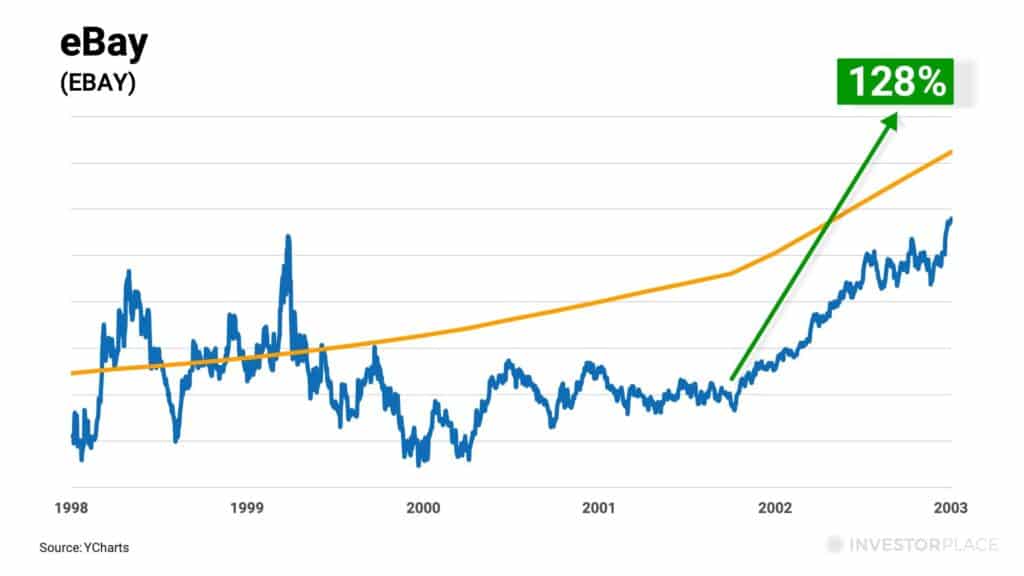

eBay skyrocketed 128%

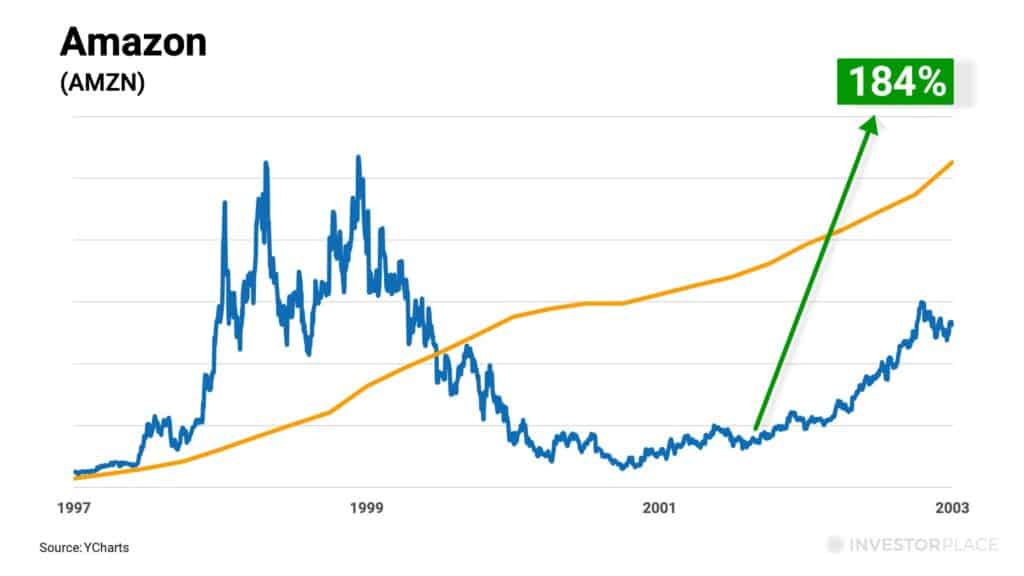

And Amazon…184%

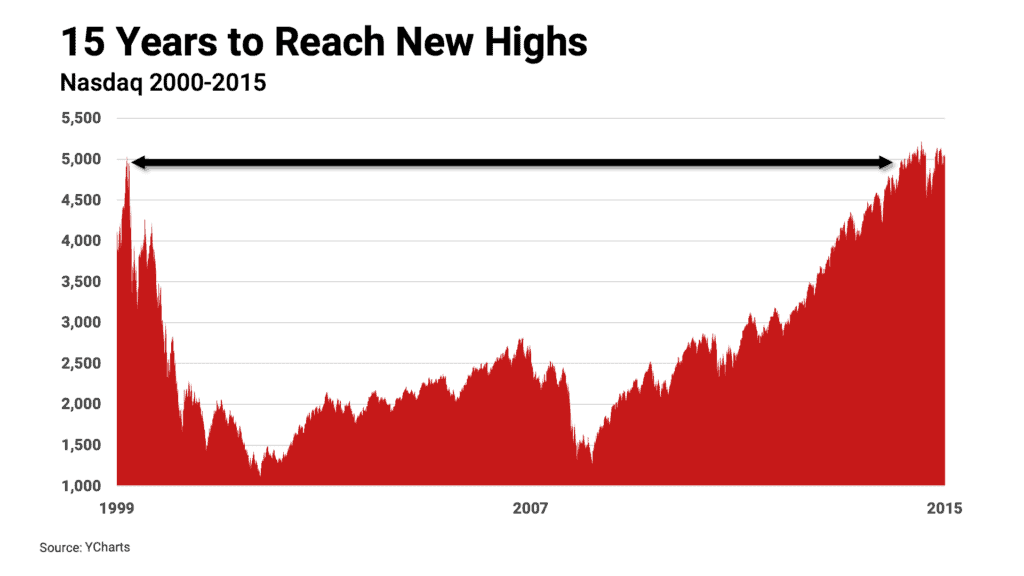

In total, the stocks we identified through our back tests snapped back an average 136% over 12 months.

Over five years…they soared an average 741%

And a 1,527% average return in 10 years.

But if you were like most investors waiting for the tech market to recover, it would have taken you 15 years just to get back to even.

Are you starting to see a pattern here, Paul?

Paul:

I think so, yes.

Seems like whenever the market is in turmoil…this Divergence pattern shows up. And it can deliver big returns when most folks aren’t paying attention.

But one thing I can’t get out of my head is…why is this the first time I’m hearing about this?

I mean, divergence should be front page news!

Luke:

You’re right, Paul. It really should be.

The reason it isn’t is because most people, the media especially, only know and follow one price… the market price.

The Secret to Finding Undervalued Stocks in Bear Markets…

Paul:

You’re talking about the price I see when I log into my brokerage account, or I check a listing on Yahoo! Finance.

Luke:

Or the prices listed in the daily newspaper. Yes.

But the market price is not the only, nor is it the most accurate, measure of a business’ value.

Paul:

It isn’t?

Luke:

Nope. Yet it’s what everyone pays attention to.

You see, the problem is that the market price is only what a large group of people – the market – believe the price should be.

Paul:

But isn’t the market usually right, Luke?

I mean, isn’t this what we learned in Economics 101… basic supply and demand, the market guides the price?

Luke:

Yes. The market is usually right when it comes to pricing shares of businesses. But not ALWAYS.

Remember Paul, the market is made up of people. And people are emotional and reactionary.

We get scared. Worried. Cautious. Fearful.

And these emotions affect our decisions in the market.

People panic and they sell off shares.

But as a mathematician, I crave data, numbers…I want certainty.

I want to know the true value of a business 100% of the time, not MOST of the time.

That’s why I look at a metric I call the “true price.”

Paul:

I’ve heard you mention this a few times now. Can you explain what you mean by the “true price”?

Luke:

The best way is to show you an example.

Let’s look back at Salesforce between 2004 and 2008.

Here you see Salesforce’s market price and “true price” acting in harmony.

Paul:

This is the market getting it right.

Luke:

Yes, but what big event that happened in 2008, Paul?

Paul:

I still remember it well. The market crashed. The economy was in shambles. It was a nightmare.

Luke:

Right. And Salesforce’s market price dropped by more than HALF during that time… from $18 all the way down to $5!

But let me ask you, what do you think happened to Salesforce’s business during this time?

Paul:

I would assume fewer people wanted to do business with them. Sales dropped. They probably had to let go of a bunch of employees. Profits might have gone down.

Luke:

That’s a reasonable assumption, Paul… but completely WRONG.

In 2008, sales GREW. In fact, it was record year for the company. They increased revenues 51% year over year.

2009 was even better!

Does that sound like a business whose true worth was cut in half?

Paul:

I guess not! Then why did the stock fall so much?

Luke:

Because a very large group of people – the market – thought the same way you just did.

They let their emotions – fears, worries, anxieties – get the best of them and oversold shares.

The company didn’t change one bit, except for huge growth.

The only thing that went down was the market’s perception of the business.

Paul:

Which was obviously wrong.

Luke:

Exactly.

The market price separated from the true price, creating the ultimate buying opportunity.

When the investing masses realized their overreaction, they piled back into the stock…and shares quickly snapped back to the true price.

But anyone who saw this divergence and got in the right time could have seen 188% gains in just 12 months…

And 521% gains over the next two years.

That’s SIX TIMES returns on investment, while overall market had not even recovered from the crash yet.

And this is just the start, Paul.

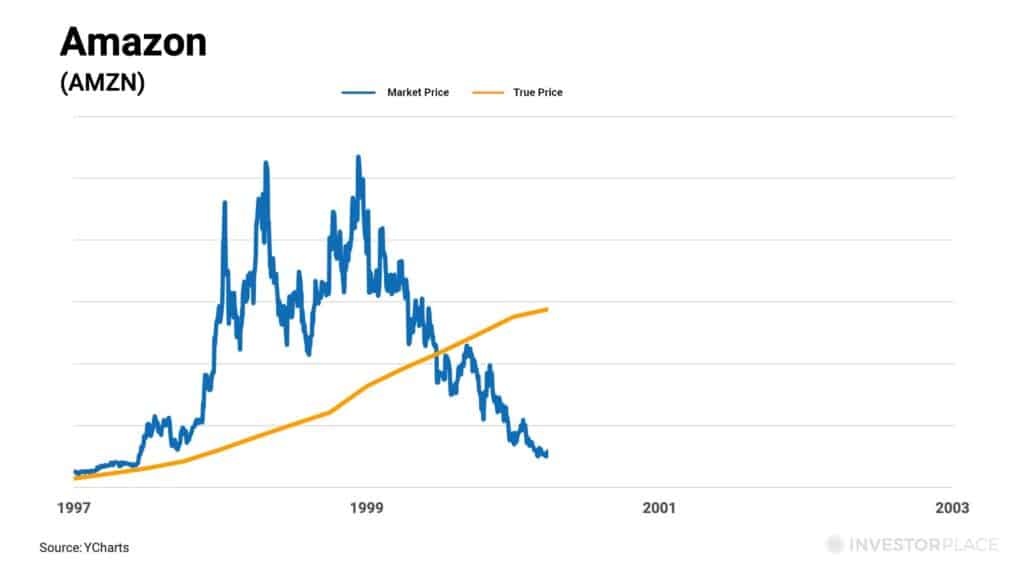

The same thing happened with Amazon in 2000.

The stock got caught up in all the fear surrounding the Dot Com crash.

Panic caused the stock price to drop by 94% – a total massacre.

Amazon was trading for pennies on the dollar! Imagine that.

Most people figured Amazon would never recover.

But let me ask you – do you think people stopped buying things on Amazon during the dot com crash? Do you think the company’s profits went down?

Do you think the business stopped growing – even a little?

Paul:

I’m not sure. A lot of companies got hit hard that year. I would assume its sales got hit a little bit, right?

Luke:

That’s certainly how the market felt.

But it wasn’t reality.

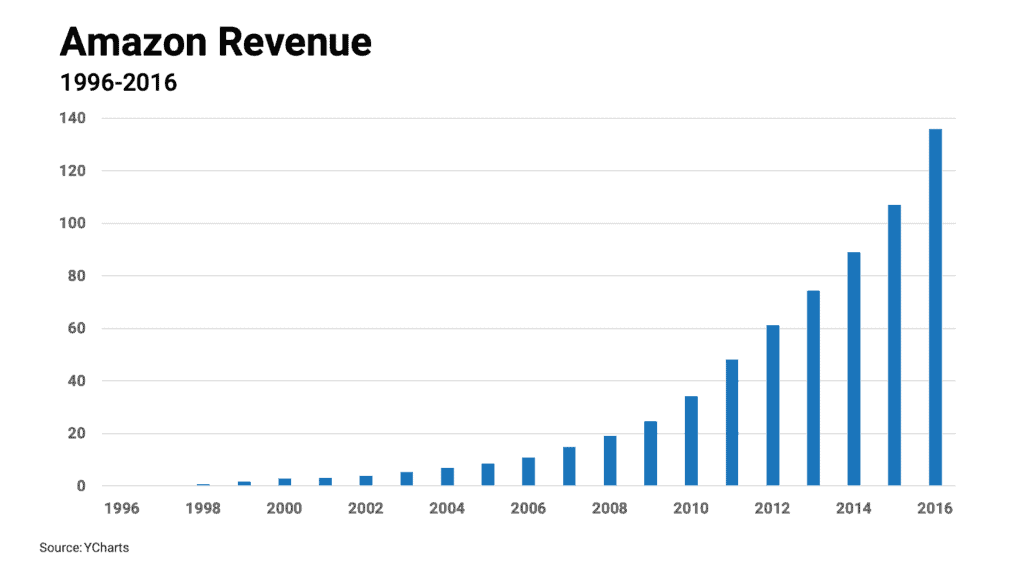

Amazon’s sales grew 90% between 1999 and 2001.

It never even had a down year.

But you would never know that because the market price, an emotional value – fell off a cliff!

Paul:

So you’re saying this mass panic during the Dot Com crash caused the true price and market price to diverge in Amazon. Is that right?

Luke:

Correct.

Once investors realized their overreaction, they piled back into the stock…market price snapped back to its true price.

But had you seen this clear divergence early…you could have gotten in BEFORE shares rose 184% in just 12 months.

And then continued to rise 433% within 5 years.

Am I starting to sound like a broken record, Paul?

Paul:

In the best possible way, yes. It’s all starting to sink in.

The 4th Divergence Event Happening Right Now…

Luke:

I hope so. Because the same thing that happened in 1988, 2000 and 2008 is happening RIGHT NOW.

The 4th Divergence event is unfolding as we speak.

Just look around you, Paul. Uncertainty and fear are everywhere.

We’ve had negative GDP growth for two quarters in a row…a sign that we’re already in a recession…

We’ve seen inflation rates hit 40-year highs…

Gasoline and food prices are soaring with no end in sight…

Consumer sentiment recently hit the lowest reading since 1952 — one of the lowest readings ever in recorded history.

All of this fear and uncertainty has caused the stock market to plummet into a bear market this year.

And we’re already seeing this divergence pattern appear in multiple stocks. It’s happening right now for the first time in 14 years.

Paul:

Normally, news like this scares me.

But now I see the other side of the coin.

Now I get what you meant when you said the more people panic, the better this opportunity gets.

Luke:

Let me make this abundantly clear for everyone watching at home.

We are witnessing the biggest Divergence event I have ever seen – and most people aren’t paying attention at all.

There are literally dozens of amazing, fast-growing, cash-gushing businesses out there trading far below their true price.

That’s why we are REALLY here today.

Because pretty soon, just like we’ve seen happen before, Paul…

Paul:

They could snap back at any moment!

Luke:

Yes, this rare event is already underway.

And it’d be a shame to miss out.

Because it could be decades before we see another opportunity this good.

Investing legend Warren Buffet said it best – big opportunities come infrequently, so when it rains gold, put out the bucket, not the thimble.

But I say forget the bucket.

This opportunity is so good… so rare…why not put out an Olympic-sized swimming pool!?

That’s why I’m giving everyone who’s watching this broadcast my #1 stock to take advantage of this situation right now.

This is a once-in-a-decade shot to potentially double your investment over the next 12 months, just like we’ve seen in the past.

Paul:

I am certainly looking forward to seeing your #1 pick, Luke.

But one final question before we get to that – when this Divergence pattern shows up…how do you know when to invest in these stocks?

How to Find Major Divergences in Stocks, Before They Snapback 100% or More

Luke:

I’m glad you asked that, Paul.

Because timing is a crucial element if you want to secure maximum potential gains when these divergences appear.

That’s why I handpicked a team mathematicians and researchers from the California Institute of Technology – or “Caltech” for short – to help me figure out the perfect strategy.

Paul:

I hear Caltech is consistently ranked #1 science and technology university the world. And you studied there.

Luke:

Yes, my time at Caltech allowed me to connect with some of the brightest minds in the world.

And I wanted the smartest, most able-minded experts to help me identify the perfect buy-in points for these rare occurrences.

Like I said, we spent the last six months doing an in-depth analysis of every divergence event since 1987.

And after running the numbers and spending endless nights working on this project, we engineered a way to best take advantage and potentially rake in massive profits.

We developed a proprietary metric — which we call “divergence magnitude” — to quantitatively calculate the size of a stock’s divergence.

Simply put, it measures the gap between the true price and market price, and then assigns a number to it.

The higher the number, the greater the divergence.

And when we ran this metric across hundreds of stocks…we stumbled across an amazing discovery.

Stocks whose Divergence magnitude scored 40 or higher produced the best results.

And, even better, we discovered that the bigger the divergence is, the bigger the potential returns.

So a stock with a divergence value of 5 wouldn’t signal a buy alert, but a stock with a value of 105 – look out! The snap back could happen fast.

PAUL:

I see. So like you said before, it’s like a rubber band stretching and snapping back.

LUKE:

Exactly.

The greater the distance, the greater the tension… and the bigger the snap back.

Look at what happened with Google back in 2008.

As you can see, shares were plummeting…

But the “true price” kept going up…

Meaning the rubber band was stretching WAY apart.

Our Magnitude indicator showed a massive 104 point divergence – WAY above our 40-point threshold for a buy.

Just like clockwork, the stock snapped back for a 122% gain in just 12 months.

And anyone who held on would have made 350% in 5 years.

Again, this happened during the worst economic crisis since the Great Depression.

Many folks suffered major losses and stayed out of the markets for years.

But using my indicator to spot these rare divergences, we can transform fear and uncertainty into huge opportunities.

Just remember: if the divergence magnitude it’s greater than 40, it’s a buy.

And the bigger the number, the bigger the potential snapback.

Easy, right?

Paul:

I’m with you, Luke. Couldn’t get any easier than that.

Can you show us another example?

Luke:

Absolutely.

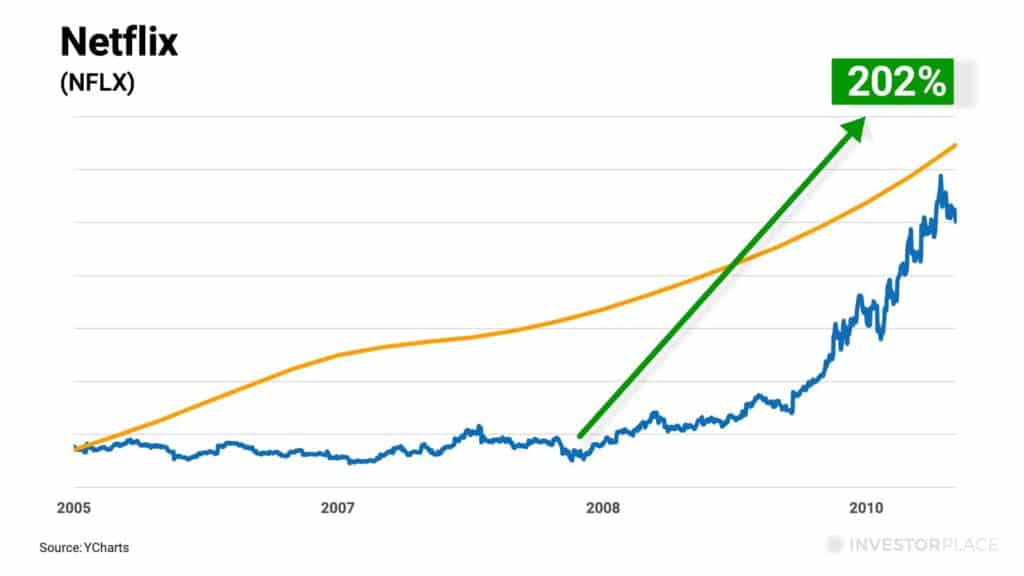

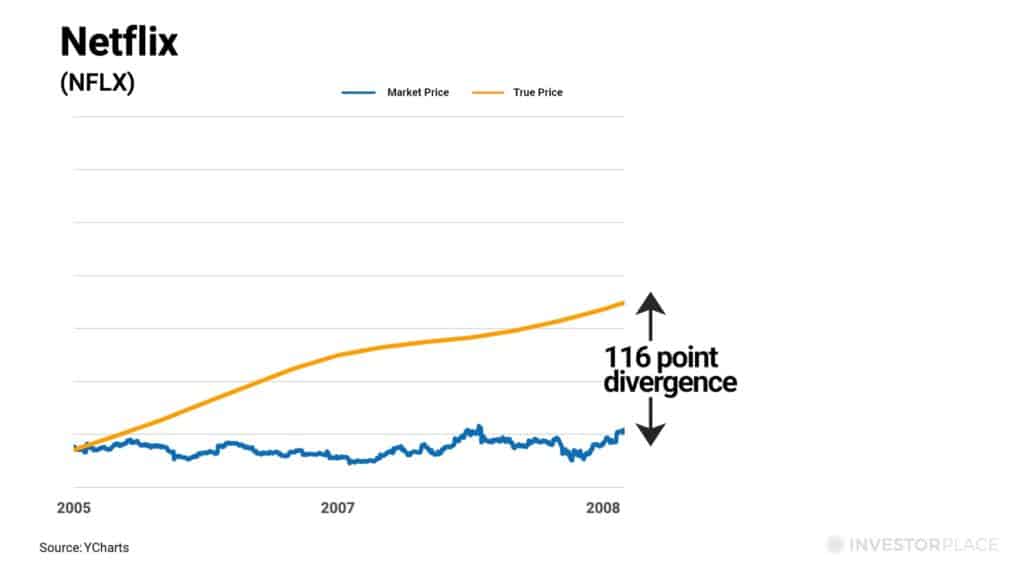

Let’s take a look at Netflix, another example from 2008.

Just looking at the share price, is that a stock you would invest in, Paul?

Paul:

I have a feeling this is a trick question…

It looks like the price of that stock had been static for years.

Knowing just that alone…I probably wouldn’t have touched it at all.

Luke:

Precisely. Why would you?

But as you can see…a massive divergence was forming in this stock.

The true price was skyrocketing UP and UP.

Our magnitude indicator showed a 116 point Divergence – WAY over our 40 point threshold…

Meaning it was bound for a huge snapback.

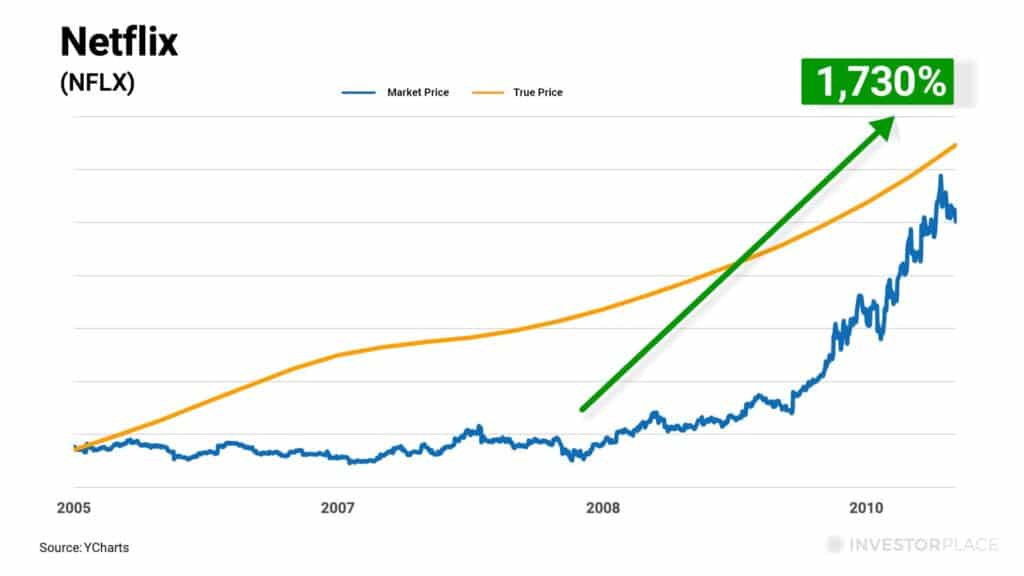

Now look at what happened soon after…

Within 12-months after our indicator would have triggered a buy alert…

Netflix shares skyrocketed 202%.

And for people who held on…1,730% in 5 years – that’s 16 times return on your investment.

Paul, the markets only rise an average 10% a year.

When we’re in a bear market like today or back in 2008, those averages don’t save you. It can take years to make back your investment.

But if you get in when this divergence pattern appears…you can seize potentially huge gains in a short time.

Paul:

Incredible. I’m curious – what’s the biggest Divergence your indicator discovered…and how big were the gains?

Luke:

Now we’re getting to the good part, Paul.

Let me show you REAL power Divergence can bring regular folks.

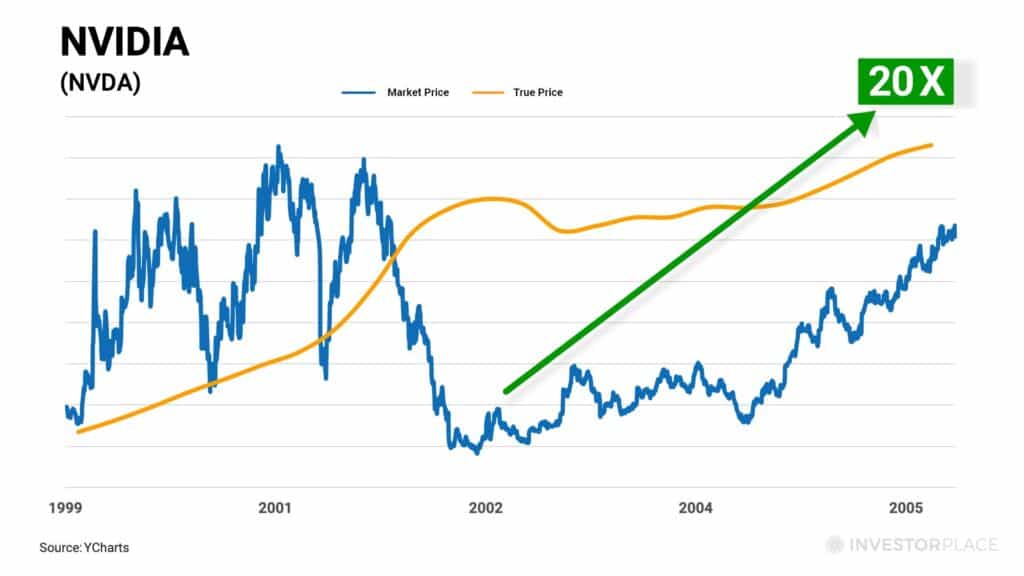

We have to take a look at Nvidia (ticker symbol: NVDA)

Paul:

This is from the dot com crash, right?

Luke:

Exactly.

All of the fear in the markets caused Nvidia’s stock to drop 90%.

It was completely washed out due to panicked sellers.

But look at how wide the Divergence is between the stock price and true price. You see how stretched out it was?

Paul:

Yes that’s probably the biggest one we’ve seen yet. What number did your indicator come up with?

Luke:

Our indicator showed a 163 point divergence at its peak.

Truly unprecedented.

And had you bought at that point…

You would’ve seen a 123% return in 12 months.

That’s quite a snap back. More than double your money.

But it gets even better.

Because if you simply held on, you would have seen over 20X returns within five years.

We’re talking about turning a $10,000 investment into $215,000.

And that’s just one example, Paul.

Paul:

That’s incredible. Is that the biggest Divergence you found?

Luke:

Not even close.

We’re just getting started here.

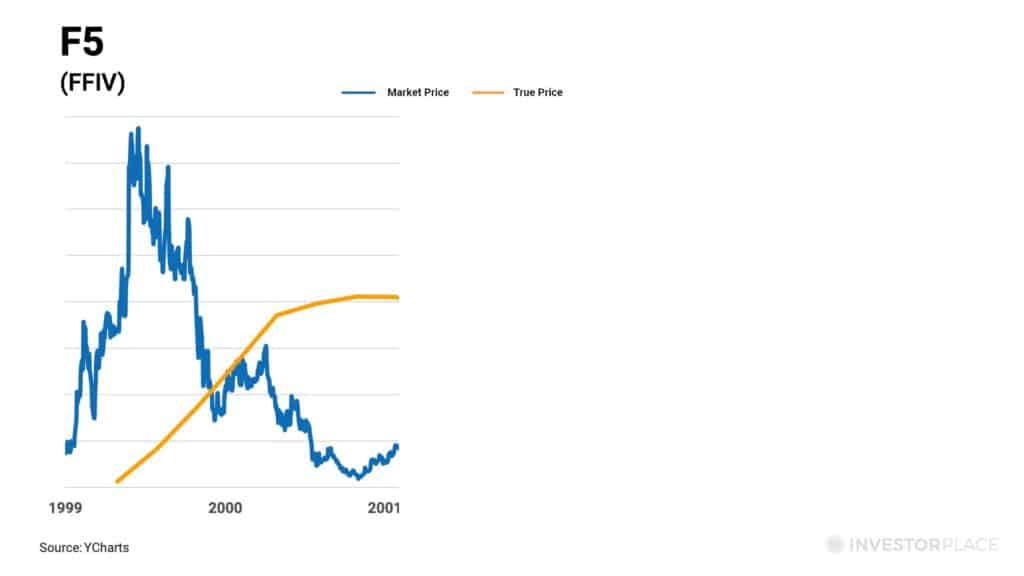

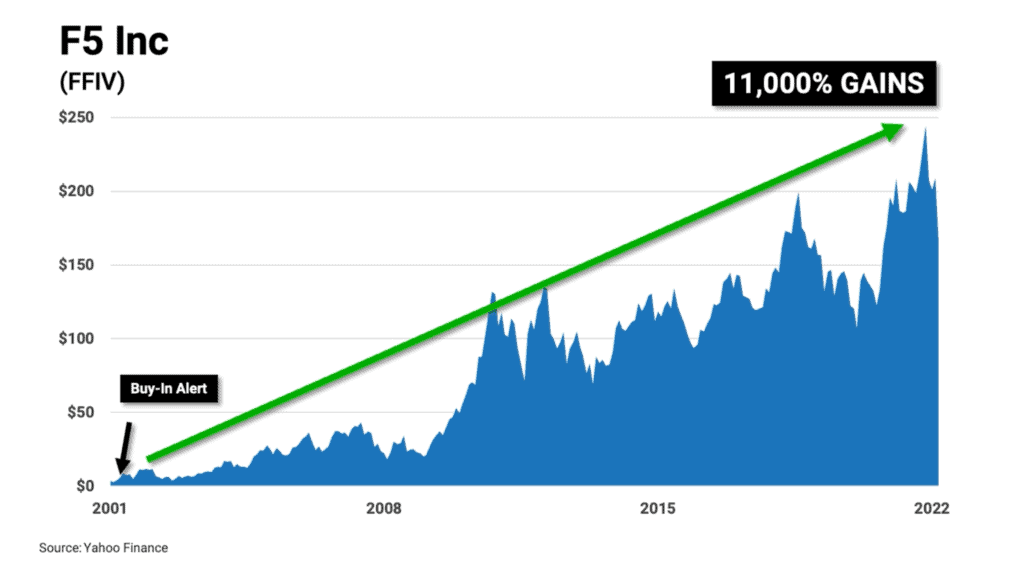

Take a look at F5 Inc.

Few people are familiar with this company.

It was a tech darling of that rode the wave of the Dom Com boom…and one of the many that got hit hard during the bust.

The stock lost 98% of its value. Complete destruction.

Everyone sold it off due to irrational fear and panic selling.

But as you can see…the true price and the stock price are showing a major Divergence…going in complete opposite directions.

Can you guess the number our indicator came up with?

Paul:

I don’t know…200 points?

Luke:

Think bigger, Paul.

Paul:

300?

Luke:

BIGGER PAUL COME ON

Paul:

400!?

Luke:

Almost!

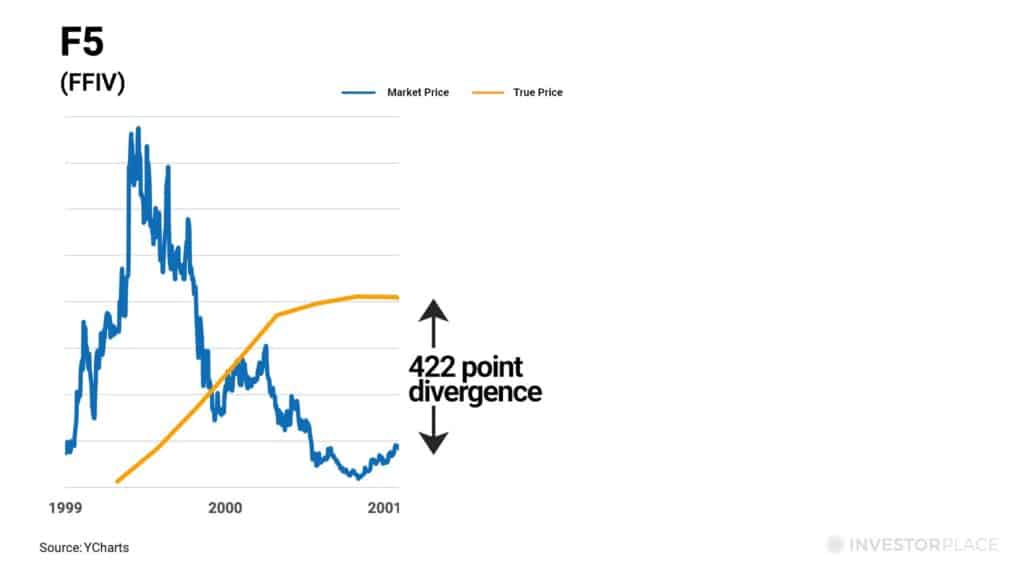

On F5 Inc, our indicator showed a stunning 422-point divergence magnitude.

And as you can imagine…when the stock snapped back in line to its true price, the gains were truly spectacular.

It saw a 357% gain in only 12 months.

That’s more than quadruple your initial investment, Paul.

But here’s the best part…

Anyone who simply bought and held on through this current year, even in the middle of this bear market…

They could have seen – get this – 11,000% gains on F5 Inc today.

That turns a $10,000 investment into $1 million.

How about that, Paul.

Thousands into millions on a single stock. That’s what’s possible here.

Paul:

Incredible. And you’re saying this same situation is happening right now?

Luke:

Yes.

This rare event is happening again right now.

And the divergence magnitudes our indicator have picked up aren’t just run-of-the-mill…

They are some of the BIGGEST we’ve ever seen before.

So you can forget doubling or tripling your money in 12 months…

The opportunity in the Fourth Divergence could be much, much bigger.

But I’m not just saying that…you can see the data with your own eyes.

Take a look at this.

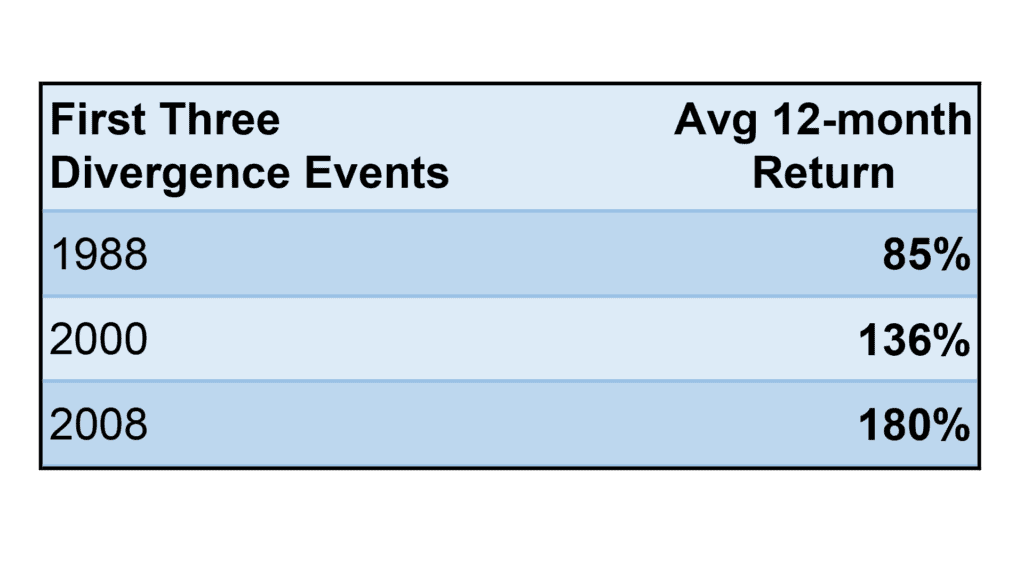

The average one-year gains we’ve identified during each Divergence event has been progressively bigger each time.

That’s why I’m convinced the Fourth Divergence will give investors the chance to double their money over the next 12 months…MINIMUM.

But only if they get in immediately.

I can’t stress enough how urgent this is.

Every day you wait, those gains could shrink exponentially.

The Longer You Wait, The Less You Make…

Paul:

When you say the gains could shrink exponentially, what do you mean by that?

Luke:

It’s simple math, Paul.

Let’s look at an example to keeps things simple.

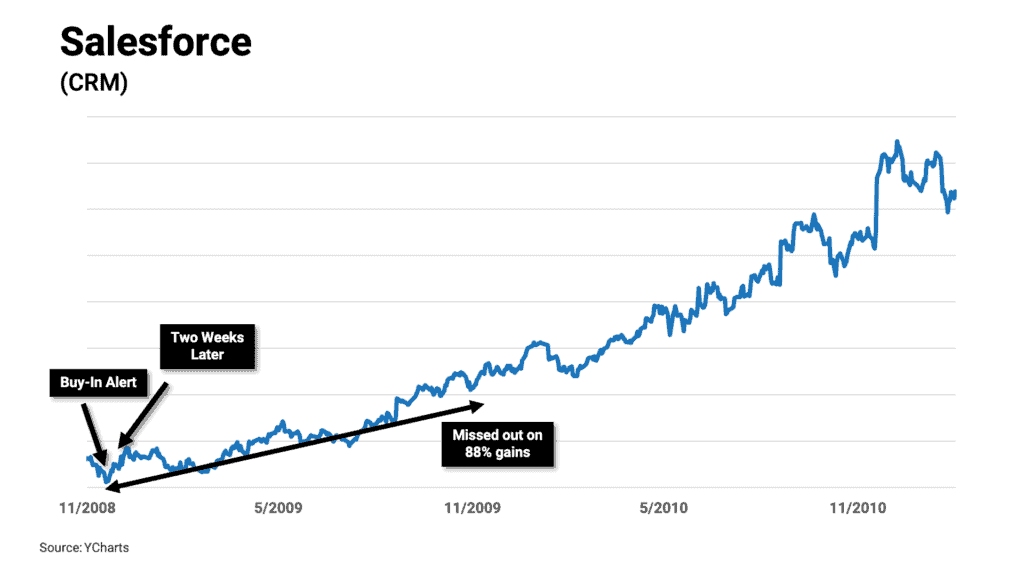

Say you bought Salesforce in 2008 after a divergence appeared in this stock.

Our indicator showed a 90-point peak divergence on this stock.

Again – way over our 40-point threshold for a buy alert.

But had you waited just two weeks to buy shares after that alert, you would have missed out on 88% gains over the next 12 months…

And it gets even worse the longer you hold on.

Instead of making 861% in 5 years, you would have only made 565%.

In other words, you would’ve missed out on one third of the gains that stock had to offer, simply because you waited two weeks to get in.

That’s why it’s so crucial to get in on these stocks immediately.

Paul:

Because even a small increase in share price means risking astronomically smaller gains the further along you go.

Luke:

Exactly. The longer you wait, the less you make.

And according to my research, the stocks I’m looking at right now have reached peak divergence.

Some of the biggest we have ever seen.

The true price and market price of these stocks stretched way apart.

And the snap-back could occur at any time, so I suggest you act immediately.

I don’t want anyone to be left behind.

Paul:

All right, we certainly don’t want our viewers missing out here.

Can you tell us about your #1 pick to play this event right now?

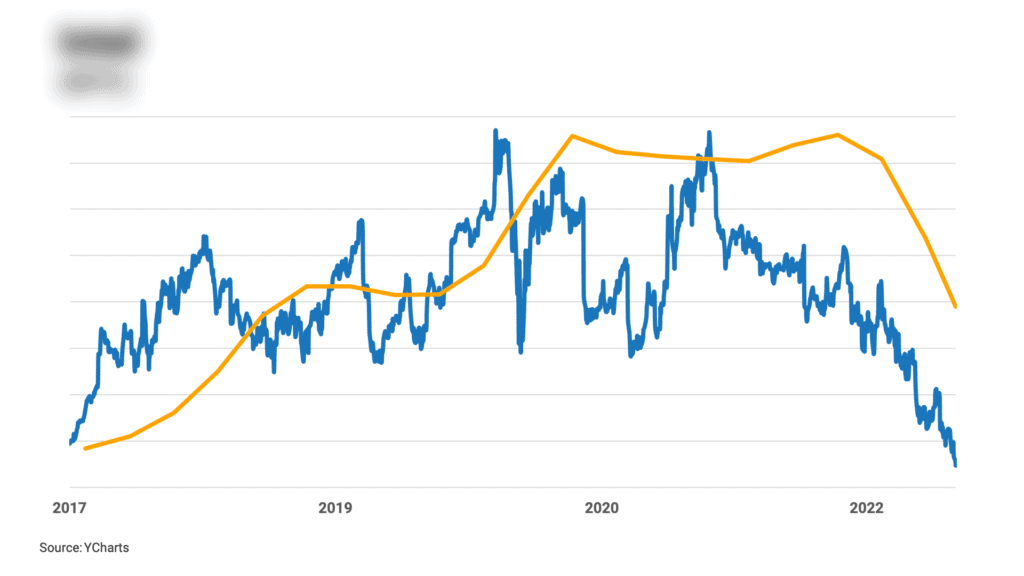

Revealed: Luke’s #1 Stock for the 4th Divergence Event

Luke:

You bet.

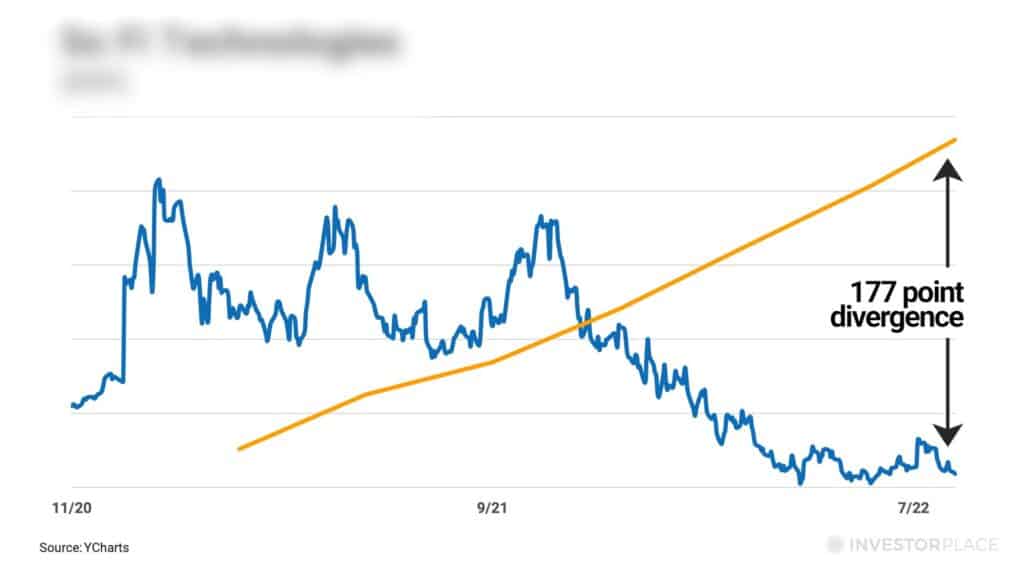

As promised, there is a massive divergence in this stock right now.

Our indicator reads 177 points.

And I believe it’s ready for a huge snap back over the next 12 months.

I’m expecting 100% returns, minimum.

Take a look:

This is not only one of my favorite picks for the Fourth Divergence…

But it’s also one of my favorite long-term buy & hold opportunities, period.

Paul:

There are a lot of stocks out there, Luke.

Why is this one head and shoulders above the rest?

Luke:

Let me put it this way…

If someone were to hold a gun to my head and force me to buy-and-hold one stock for the next five to ten years, I’d pick this one without hesitation.

Because this company is radically changing one of the most important sectors of the American economy.

It will change the lives of me, you and just about everyone else in this country over the coming years.

It’s a fast-growing fintech company that’s on-track to disrupt the legacy banking process as we know it. A process hardly anyone likes.

Just think for a moment about all the issues we have in the banking industry…

Account fees. Clearinghouses. High interest rates. Long phone calls and in-person appointments with bankers.

The entire process is slow, expensive, and inconvenient, mostly because the industry is full of middlemen profit-takers.

But this company bypassing those middlemen altogether…

Creating an all-in-one digital app for banking with technology-driven processes that deliver fast, cheap, and convenient solutions to customers everywhere.

I believe this company will eventually turn into the “Amazon of Finance.”

It will do to Wells Fargo and Bank of America what Amazon did to Sears and J.C. Penney.

And once again, the irrational panic selling we’ve seen this year has caused a huge opportunity to buy up shares in this stock.

In fact, I believe it’s the most irrational sell off I’ve ever witnessed.

But enough backstory, here it is.

The company is SOFI Technologies Ticker symbol: SOFI.

Like I said, there is a massive divergence in this stock right now.

Our indicator reads 177 points.

And I believe it’s ready for a huge snap back over the next 12 months.

Paul:

Excellent. I appreciate you sharing this pick with our viewers, Luke.

But I have to ask…

You mentioned there are stocks showing even bigger divergences right now, according to your indicator.

How can our viewers get a hold of those picks?

Luke:

That’s right.

SOFI is one of my favorite picks for the 4th Divergence, but it’s far from the only one.

In fact, there are multiple stocks we’re tracking right now that have the biggest divergence scores we’ve ever seen…going back all the way to 1987.

Let me show you what I mean.

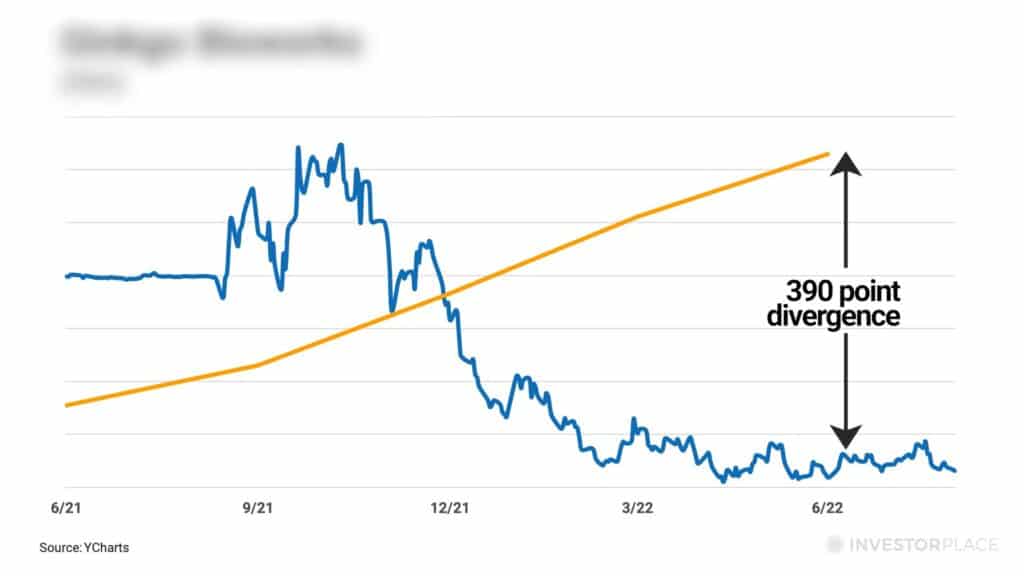

The Biggest Stock Divergence I’ve Ever Witnessed in 35 Years…

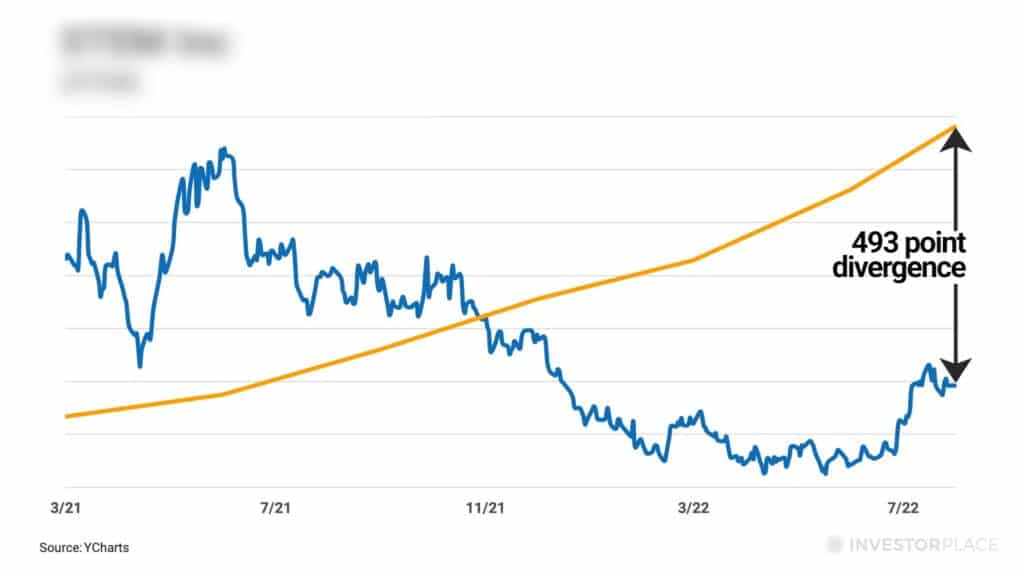

As we sit hit right now, this stock has a 390-point divergence…

This one has a 493-point divergence…

But THIS last stock…this one is in a completely different league, Paul.

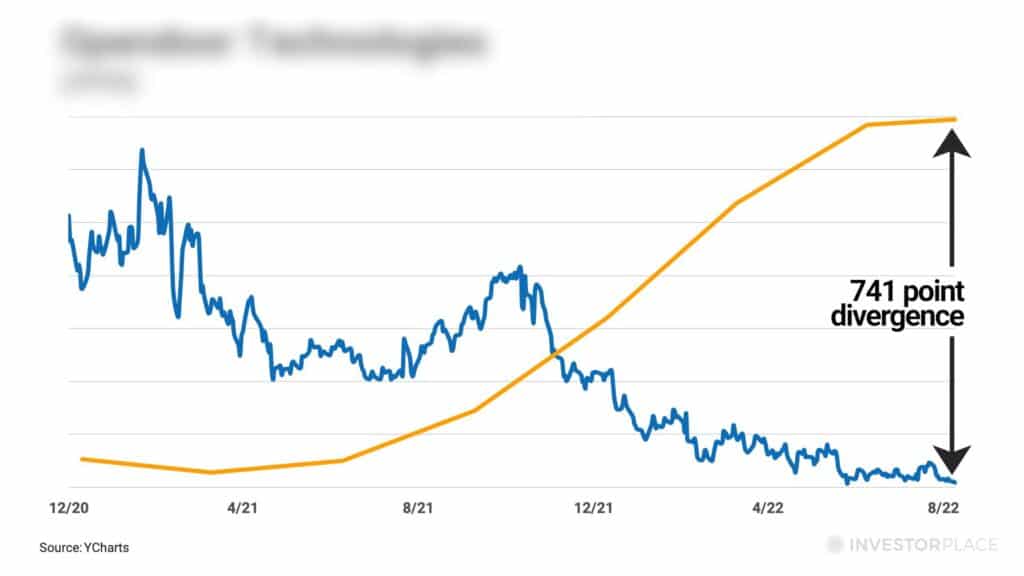

According to our indicator, it’s showing an incredible 741-point Divergence.

Just to be clear, after researching 35 years of back tested data across every Divergence event…we’ve never seen a 741-point divergence.

Not even Amazon after the Dot-com crash or Salesforce in 2008.

Nothing comes close!

The tension between the true price and market price is maxed out.

And you know what that means, Paul…

Paul:

The snapback could happen at any moment!

Luke:

The snapback could be furious!

We’re talking massive upside potential for those who act soon.

100%-300% gains within the next 12 months…

1,000% – 5,000% potential in the medium term…

Over the long term, well… that’s where things get interesting.

I see not only a very real, but probable opportunity to build generational wealth.

Not once, but THREE times over…

And my team and I just put together a special report detailing all three stocks we believe could do that for you.

It’s called: The Fourth Divergence: Three Companies That Could Snap Back 100% or More In Next 12 months

This might be the most valuable investment report I’ve ever put together.

Which is why I want to get a copy in your viewers’ hands today.

Paul:

What can you tell us about this report?

Luke:

Well, obviously, we cover each of the stocks in full detail and give out their names and ticker symbols.

Inside, you’ll also find my breakdown of each Divergence, how we calculated it, what buy-in price we recommend, and how I believe each of these companies can 10X and more over the next few years.

Again, the divergence scores on these stocks are off the charts.

This is something we have NEVER witnessed before, in all of our other examples going back to 1987.

The true price and market price are stretched way apart…

And the snapback could happen any day now.

Paul:

Fantastic.

But I still have one lingering question. I’m sure many of our viewers are wondering the same thing.

What is the true price of a stock?

I do understand why it works. You’ve certainly shown us that.

But you haven’t revealed what it is.

How Do You Know The “True Price” Of Any Stock?

Luke:

Great question.

My team and I have spent hundreds of hours over the last six months quantifying divergence into a simple indicator.

An indicator we use to identify the perfect buy-in times for these Divergence stocks, with minimum risk and maximum reward.

The man hours alone are worth hundreds of thousands of dollars.

But the indicator and strategy we developed, in my opinion, can’t even be defined by a dollar amount. It’s priceless.

Obviously, I can’t share this level of research on a public stage like this.

It’s just too valuable.

But after days of going back and forth with my publisher…

I’ve decided to make available – for a limited time – an exclusive report on my Divergence indicator.

This will teach you everything that goes into my proprietary method for calculating “true price” and finding the best times to buy up shares.

It’s called: True Price: The Secret to Finding Undervalued Companies In A Bear Market.

Paul:

Are you sure your comfortable sharing this information to the public?

Luke:

I’ve thought it over for weeks…

But, frankly, once this Divergence event passes, the indicator itself won’t be very useful to anyone.

Because it’s built for a specific moment in time. And that time is right now.

It could be another decade before we see this happen again.

So I want to give folks what they need to take advantage today.

That said, there’s another opportunity I’ve held off mentioning until now.

A “hidden benefit” we came across while testing this indicator across hundreds of stocks.

I’d like to share that with your viewers, if that’s OK.

Paul:

I’m all ears, Luke. What else do you have for us?

WARNING: Do You Own These Popular Stocks?

Luke:

Well, as you know by now, Divergence gives us a unique way to tell what stocks can explode during times of market turbulence and uncertainty.

But there’s a flip side to this equation as well.

Because tracking the True Price vs. the Market Price of stocks also gives us a clear view to what stocks WILL NOT make it out of the bear market.

Paul:

I see. So these would be stocks where the True Price is also crashing…along with the market price?

Luke:

Could not have said it better myself.

Obviously, there are many people looking to buy up stocks on the cheap right now.

But without seeing what we’re seeing, I believe these people are in for a world of hurt.

Because there are some popular stocks showing the exact opposite of a Divergence.

The true price has plummeted. And you can bet the market price will stay in-line with it for the long-term.

I’ve brought a few examples to show. Take a look.

As you can see, the true price has cratered in these stocks.

These are only a few examples from the ones we found.

But they could blindside investors in the weeks and months ahead.

Paul:

Would our viewers know these stocks?

Luke:

Absolutely.

They’re well-known and widely held among retail investors.

But mark my words: these stocks are dumpster fires.

And folks who already hold them now or buy up shares anytime soon will get burned.

Paul: .

How many examples have you found?

Luke:

A lot more than people would expect, I’ll say that.

That’s why we put together an entire list inside another special report.

This report will tell you the stocks you need to avoid at all costs.

It’s called: The Divergence Portfolio Purge

Paul:

Luke, I’d like to get a copy of that when we’re done here.

Luke:

I’ll make sure you get it.

But before we wrap up, I’d like to show the viewers how they can get their hands on all three of the reports I mentioned…

Along with a special offer and a bonus report I haven’t mentioned yet.

Paul:

By all means. How can we get access to these reports?

Luke:

To be fair to my paid subscribers, I’ve had to keep this research exclusive and available only to them.

But because this situation is so urgent, and I don’t want anyone to let this rare event pass them by…

I’m offering a steep discount to access my research service, including these exclusive reports, to anyone who’s watching today.

Paul:

Great. How does that work?

Luke:

I’ve worked out a special deal with my publisher to offer today’s viewers a 75% discount on my flagship advisory service called Innovation Investor.

Once they join, I’ll send them these three reports immediately by email.

It’ll take less than 5 minutes to have them in your hands.

Paul:

So these reports won’t be available in bookstores, Amazon…or online?

Luke:

No, never.

Only Innovation Investor members have access to these reports, Paul.

My private website is the only place on Earth you will find exclusive research on this Divergence event, the stocks we recommend, and a model portfolio to track their performance.

Paul:

Can you tell us a little about your service? Why is it called Innovation Investor?

Luke:

Great question.

I started Innovation Investor to help everyday people learn how to get in on the ground floor of explosive new technologies happening right now.

Opportunities in artificial intelligence, 5G, blockchain, biotech, supercomputing and more.

It’s like having a front-row seat to all of the technological breakthroughs reshaping our world.

And more importantly – having the chance to be there FIRST and invest in these early-stage companies BEFORE 99% of folks discover them.

Paul:

Great. For folks watching at home who want to learn more about Innovation Investor, you can visit our Details & Disclosures page linked below.

Luke, looking back on the examples you showed us today, I realize now that many of them were tech stocks.

And it’s no secret this sector has been hit hard this year.

Luke:

Exactly.

That’s why we’re seeing divergences appear in these stocks today.

Fear and panic selling have created MASSIVE opportunities in the tech sector.

And thanks to our proprietary indicator, we can identify these undervalued stocks before they have the chance to snap back with huge gains.

We are expecting dozens opportunities to appear within the next 12 months.

But you will not find this research anywhere else on the planet.

Innovation Investor is ground-zero for anyone looking to learn more about this rare event.

Plus, new members will receive much more additional value inside my flagship service.

For example…

We track every stock recommendation inside the Innovation Investor model portfolio. This is where we issue new buy alerts, sell alerts, and constant updates on our current positions. So there is no guesswork at all.

We also issue a new trade idea every single day the market is open. We call this our Idea of the Day update. I send these opportunities to my members daily with step-by-step instructions to take advantage.

By itself please. I know the promo stacks them together here, but since it’s HTML we want to show these graphics invidually, then bundled together later.

On top of that, members also receive my Daily Notes. This is my in-depth market analysis issued daily, Monday through Friday. Every issue includes critical economic and stock market data you need to make informed decisions and see what’s unfolding in the markets in real-time.

To my knowledge, there is not a single newsletter service that delivers daily research like we do. Not even institutional or hedge fund clients receive this level of constant contact and analysis.

Whenever we come across a massive tech megatrend or investment opportunity, we issue an in-depth special research report on the topic, usually once or twice per month. So that you have all the information you need for the chance to make money off that trend or opportunity.

I can go on and on here. This is really only scraping the surface of all the benefits our members receive.

Giving Innovation Investor Members Chances at Massive Profits, Even During This Bear Market

Paul:

How have the stocks in your model portfolio performed so far this year?

Luke:

Great question.

Over the past few months, we’ve issued alerts to our subscribers to rake in massive profits.

I brought examples to show if you want to pull it up on screen.

Paul:

OK great, let’s take a look.

July 19th – 190% gain for ON

108% on CHDN

105% on GLOB…

Luke, all of these alerts came during the bear market we’ve seen this year, is that right?

Luke:

Yes! Even during this choppy market, we’ve found plenty of opportunities to help our subscribers seize incredible profits.

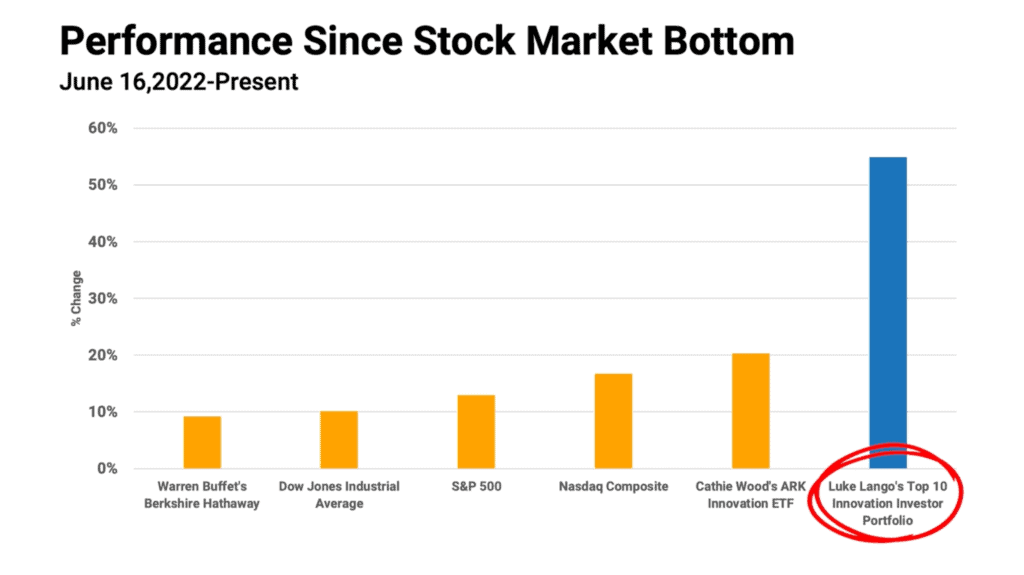

In fact, since the market hit a bottom on June 16th, our Top 10 picks inside our model portfolio have outperformed major ETFs, Index funds, and investment funds.

Take a look at this comparison.

Our Top 10 positions outperformed Cathie Wood’s ARK fund ETF, the S&P 500, Nasdaq, even Warren Buffet’s Berkshire Hathaway.

And I believe our Divergence picks will be the biggest winners yet.

Paul:

I wouldn’t blame anyone for wanting to get in on the action here.

And your offering everyone watching today a 75% discount to join, plus these Divergence reports?

Luke:

Yes, these 3 reports will be FREE for anyone who joins today.

I’ll everyone how to take advantage of this discount in just a moment.

I think you’ll be shocked at the low price we’re offering to people who watch this interview.

But first, I want to sweeten this deal even more.

For anyone who joins in the next few minutes, I’m adding a special bonus.

This is quite possibly the hottest technology investment opportunity on my desk right now.

Your’s FREE: The Hottest Technology Opportunity On My Desk Right Now…

Paul:

What can you tell us about it?

Luke:

Well, after nearly a decade of research and development, Apple is preparing to unveil a brand-new device – unlike anything they’ve ever attempted.

My research indicates it could be 10-times bigger than the iPad, the MacBook and the iPhone combined.

It’s known throughout Silicon Valley insiders as “Project Titan.”

This project at the forefront of Apple’s mission to take over a $46 trillion market.

And my team has identified a “back door” investment to get in on the action.

Everyone knows that Apple is extremely secretive with their new projects, especially when it comes to their suppliers.

But my team and I have spent the last several months piecing together the breadcrumbs…

And identified one under-the-radar company I believe will provide the key technology Apple needs to make “Project Titan” successful.

Bloomberg reports that Apple is already looking for someone to provide the very technology this tiny firm makes…

So a deal could be announced at any moment.

Those who get in early on this company could see 40X gains in the next few years, especially if a partnership deal goes public.

I put all the details inside a special report.

It’s called: The Project Titan Prospectus: How to Cash In on Apple’s Next Potential Trillion-Dollar Product

Inside is everything you need to know on this “backdoor” strategy, plus the name and ticker symbol of the key supplier for Project Titan.

And it’s 100% free when you join as a new member to Innovation Investor today

Paul:

Excellent.

Luke, I just want to do a quick recap of everything you mentioned so far so our viewers know what they’ll receive today.

Tell me if this is correct.

- The 4th Divergence: Three Companies That Could Snap Back 100% or More In Next 12 months

- True Price: The Secret to Finding Undervalued Companies In a Bear Market

- The Divergence Portfolio Purge

- The Project Titan Prospectus: How to Cash In on Apple’s Next Potential Trillion-Dollar Product

- Private 24/7 access to Innovation Investor

- Plus all of the bonus material inside of your service, including your model portfolio, Daily Notes issues, and a library of special reports.

How much will access to everything here cost new members?

Luke:

The price for a 1-year subscription to Innovation Investor is normally $199.

But nobody watching right now will pay anything near that amount.

My publisher has allowed me to offer these special reports for FREE…

Plus, a 75% discount to anyone who joins Innovation Investor today.

That means you get everything – all of the reports and all of the exclusive membership perks inside my service – for $49.

When you do out the math, that’s less than a dollar per week.

Paul:

That’s a lot lower than I expected. And that’s for a full year membership?

Luke:

That’s for an entire year. Just $49 bucks.

The price we’re asking doesn’t even cover our overhead costs, but I’m hopeful that the more people I can help get started, the more it comes full circle.

And those who join today will want to stick around for years to come.

But this is important, Paul. Just to be clear, I’ll address your viewers.

For anyone at home, please do NOT go to our main website.

I repeat do NOT go to our main website.

There, you’ll have to pay full price.

We’ve set up a special page where you can try out Innovation Investor and get all of the reports for $49.

Paul:

Good point.

And for anyone who wants to visit that page now and review everything they will receive, simply click the button on this page and you will be taken a secure, private check out page.

Luke, one more question.

Can our viewers see the reports before they buy?

Luke:

Unfortunately, my publisher won’t allow that.

But here’s what I’ll do.

For anyone who joins today, they can take the next 365 days – the full year of your membership – to simply give it a “test run.”

And if at any time you decide it’s not a good fit, that’s perfectly OK.

Just let our friendly customer service team know, and we’ll send you a refund for every penny.

Paul:

That’s generous, Luke.

So there’s no risk here. Everyone has a full year to try it out and they can cancel and receive a full refund at any time.

Is that right?

Luke:

That’s right. I want to make this an easy decision for anyone who wants to get started and take advantage of this rare opportunity today.

And even if you do cancel and request a refund, you can keep all of the reports I mentioned today for free.

That’s my way of saying “thank you” for giving Innovation Investor a try.

Paul:

Alright, Luke. This has been illuminating. I’ve learned a ton, as I’m sure our viewers have as well.

For those tuning in, click the button on this page to view everything you will receive today at a special low price.

Luke, before you go…do you have any final words for our viewers?

“Luke’s Final Thoughts”

Insert snap shot of Paul and Luke facing camera. 1:00:23

Luke:

Yes.

Paul, I’ll turn here and look at the camera to speak directly to your viewers.

As you know, there is a rare event taking place in the stock market as you watch this right now.

When divergence shows up in stocks, it can be game-changing for regular folks who know what to do.

Because these events have a history of bringing spectacular gains.

And I believe whoever acts on the opportunities presented here today will have a real chance to secure the financial freedom they want.

My team and I have gone to great lengths to put together a comprehensive action plan to take advantage of this Divergence event.

We’ve spent hundreds of hours laboring over this research and assembled everything you need to know inside a few special reports, so you can seize this rare opportunity before it disappears.

I sincerely believe the decision you make today—right now—will either make or break your investing future. For next decade at least.

Does that mean I get it right 100% of the time?

No. Nobody’s perfect.

But consider this for a moment.

If only one of these stocks we detail in these special reports doubles in the next 12 months – as we’ve seen so many times in the past – will you look back and wish you took decisive action today?

Only you know the answer to that.

But I can tell you one thing for certain – doing nothing is guaranteed to get you nowhere.

So here’s what I recommend: Invest $49.

Get a copy of the materials I’ve put together.

Give yourself a chance to act on these massively undervalued companies before they have a chance to they snap back.

Again, you can take the entire year to “test run” my research.

If you don’t think my recommendations were worth it, if you don’t love every aspect my flagship service, I’m happy to reimburse you fully…so there’s no hard feelings.

All you’ve risked is a few minutes of your time to dig in and see for yourself.

But if you stick with me… and you take action… the next 12 months could end up being the most productive (and profitable) year of your life.

You have a rare chance to seize an unfair advantage in the markets that will not be here for much longer. So I hope you take me up on the offer and come join me and my members as we make this year a spectacular one.

Thank you for taking the time to listen.

I hope to see you as a member of Innovation Investor and hear from you personally about your experience.

Paul:

Well said, Luke.

All right, for the folks at home, we’ll be putting a link to the special offer Luke and his team put together for you…his generous 75% discount to Innovation Investor…below this video.

Go ahead and click the button now. Once you do, you’ll be taken to a special page where you can review everything discussed here before you decide to join.

Luke Lango, it’s been a pleasure.

Luke:

Thanks, Paul.

Closing Statement From Paul Ghiringhelli

Paul:

That wraps up today’s edition of Investing Minute.

I think you can see why I invited Luke Lango onto the show.

He was voted the “number one stock picker in the world” by TipRanks in 2020.

He’s recommended 14 different stocks that soared as much as 1,000% or more over the last few years.

Just recently, he closed out two triple-digit winners for his members.

A 108% gain on Church Hill Downs and 105% on Globant.

Right now, Luke says we are witnessing the biggest buying opportunity in the history of the stock market.

Something we will not see again for many years.

That’s why Luke and his team put together a comprehensive set of special reports with a full action plan to take advantage.

Including three stocks with huge upside potential over the next 12 months…

How his proprietary indicator identifies the perfect buy-in moments, for minimal risk and maximum return potential…

And several well-known stocks his research indicates will NOT make it out of this bear market.

He’s offered us special deal to access all of it immediately.

If you try out his flagship research service, Innovation Investor…

You will receive a full-year membership – plus all of these special reports – for just $49.

That’s $150 off the retail price you can put back into your pocket.

But you must act quickly.

As they say, time doesn’t wait for anyone.

The Fourth Divergence is already underway.

And like we saw in 1988, 2001, and 2008, you could be locking in 100% gains or more over the next 12-months. Right now.

I don’t know about you, but when big opportunities come, I’d rather risk a little to get a lot, than do nothing and let it slip by.

To see everything Luke has put together for you, simply click the button below this video and you will be taken a secure, private check out page.

Oh, and one last thing.

You’ll see a special surprise bonus Luke decided to throw in for you.

This is a gift he keeps locked behind a $3,000 pay wall.

But he’s decided to give it to you for free as part of this special offer.

I’m Paul Ghiringhelli. Thank you for tuning in to Investing Minute.

September 2022

For more details, see our disclosures and details page.