Table of Contents:

- Introduction

- Who is Mark Skousen?

- Destroying American Energy Independence

- America’s #1 Energy Stock

- Runway Inflation… and No Choice But to Raise Interest Rates

- America’s #1 Small Business Investment

- Mass Global Shortages

- America’s #1 Chip Crisis Stock

- Forecasts & Strategies – Biden Disaster Plan

- The Choice in Front of You: Panic or Invest with a Plan?

The Biden Disaster Plan

A Disastrous Energy Crisis… Runaway Inflation… Global Shortages…

The Next Two Years Will Be Hard…

But Three Investments are Set to 10X Through the Chaos.

Dear Reader,

What a disaster it’s been…

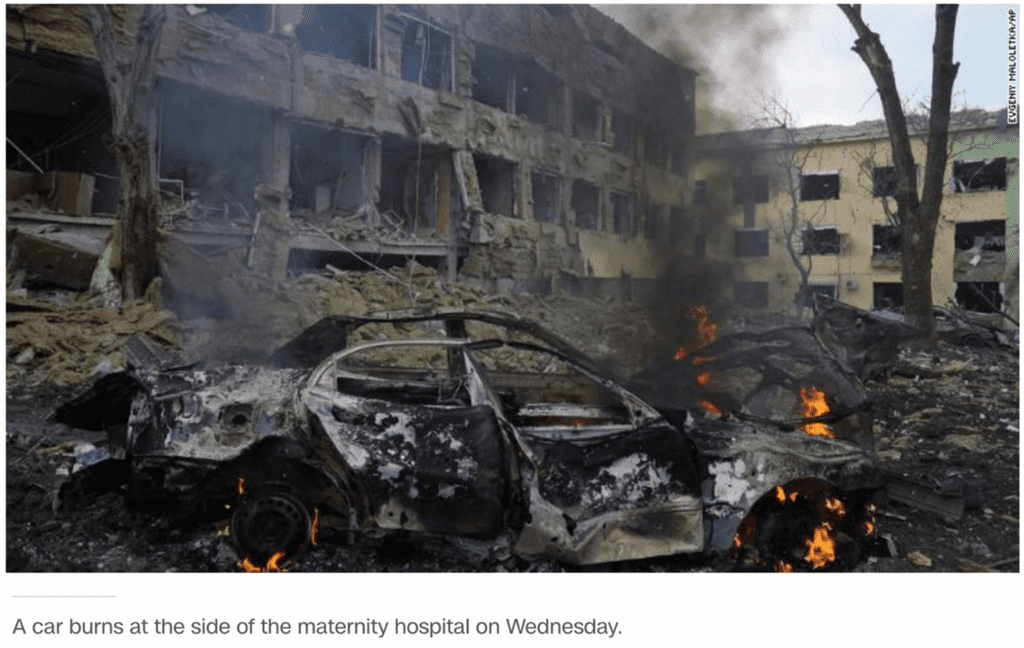

American troops dead in Afghanistan.

War in Ukraine.

A mass exodus of workers from the labor force.

Runaway inflation on cars, food, gas, and more… the highest in 40 years.

Major shortages of coal, paper, cars, computer chips, electronics, and more.

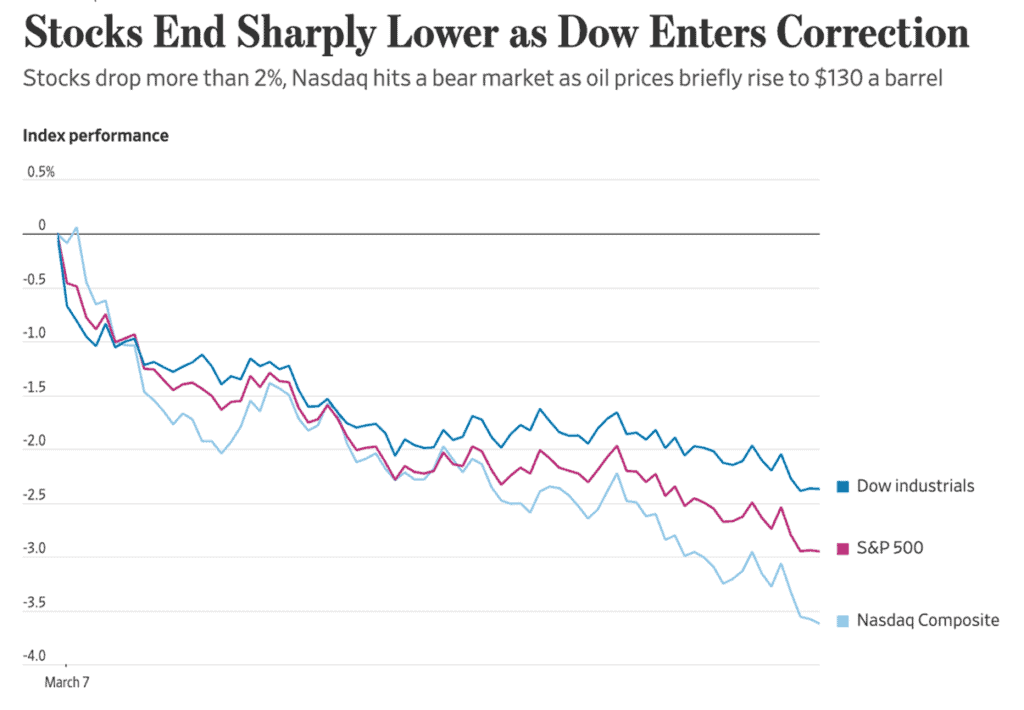

And an end to the longest running bull market in history.

President Biden has driven the car into a ditch… as his former boss used to say.

And Americans are taking the brunt of it.

Real wages are dropping.

Prices are exploding all around us.

And the booming stock market is long gone.

It’s no surprise that Biden’s approval ratings are dropping almost as fast as many of the tech stocks that once dominated the Nasdaq.

And according to my guest today, Dr. Mark Skousen, the next two years are only going to get worse.

In the coming months… he says we will see even more shortages. Prices will rise even faster. And global economic chaos will reign.

There’s no getting past it.

This is going to be a tough time for many Americans.

The money you’ve worked and saved for over so many years is going to be eaten away by inflation.

Many businesses will go under.

And the stock market will get beat up of course.

Certain stocks will completely collapse as a result… ruining unprepared investors.

But Dr. Skousen says that other stocks will thrive precisely because of the Biden disaster that’s unfolding.

He says investors who recognize this situation… and put in place a “Biden Disaster Plan”… are going to do very well indeed.

In fact, Dr. Skousen has three 10X opportunities for us today… each one tailored to rise dramatically as Biden’s disaster gets bigger and bigger.

With that, let’s bring in my special guest, top 20 living economist, Dr. Mark Skousen.

Dr. Mark Skousen has called nearly all of the biggest global economic shifts of the past 40 years.

Mark:

Thanks for having me, Roger. It’s great to be here.

Roger:

We’re lucky to have you Mark… especially at a time like this. Now, some of our audience might not be familiar with your work.

So I want to start with some of your background.

Mark has worked as a CIA economist… he’s taught and lectured at Ivy League schools like Columbia… He’s been the president of the Foundation for Economic Education… He’s published over two dozen books on history, economics and finance.

And Mark, in your 40-year career you’ve also been remarkably accurate in calling some of the biggest global economic shifts that changed the world.

Mark:

My approach is a bit different than most stock analysts. I don’t simply analyze the market financials and company balance sheets.

As a Ph.D. economist, I look at the whole global economic picture.

And I use that to anticipate how the markets are going to react.

Right now, I see some signs that are very troubling for investors. President Biden is creating an unprecedented disaster.

It’s coming in three distinct stages, which we’ll get into.0

The result is going to be very difficult for Americans…and people all over the world.

The runaway inflation we are seeing now… and the volatility in the market… is merely an appetizer for what’s to come.

Roger:

And Mark, you’ve made predictions like this before.

Dr. Skousen predicted the 1987 crash, the fall of the Berlin Wall, the 1990s tech boom, the 2008 housing collapse and more.

Just six weeks before the 1987 market crash, you sent a notice to all your followers with one clear message.

“Get out of stocks now!”

Mark:

I was one of the only analysts to see what was coming.

But because I sent out that notice, my followers were safe prior to the biggest one-day market crash of all-time.

Stocks fell over 20% in a single day!

Roger:

You also called the fall of the Berlin Wall and the collapse of the socialist model in the Soviet Union.

You predicted the roaring tech boom of the 1990’s.

You even warned your followers about the housing crisis in 2008… and then called the exact bottom of the market in 2009… predicting the Dow would rebound to 10,000 by the end of the year.

Mark:

It’s important to note that I didn’t make these predictions thanks to a crystal ball.

Rather, I simply follow the evidence to its logical conclusion.

The signs were all there for the crash in 87 or the collapse of the housing market in 2008. People just didn’t want to believe it. They buried their heads in the sand.

And I think a lot of people are doing the same today.

They don’t want to face the reality we’re in… that Biden is leading us toward an impending disaster through the rest of his presidency.

Now, it’s important to note… what Biden is doing now is not going to be permanent.

I’m an optimist by nature… and the market always finds a way through.

I believe America and the stock market will rebound in the future.

But the next two years are going to be very tough.

Investors need to be prepared.

And so that’s what we’re here for today… to share my Biden Disaster Plan with our audience.

The fact is… There are some investments that are going to do very, very well as the Biden Disaster unfolds.

Investors will have the chance to 10X their money on these investments over the next few years.

And with the way prices are increasing, this is something people really need right now.

Roger:

They sure do.

So Mark, let’s get into it.

Why exactly do you think the next two years are going to be a “Biden disaster” as you’ve put it?

Stage 1 of the Biden Disaster:

Destroying American Energy Independence

Mark:

Ok, absolutely.

As I said. Biden’s disaster is unfolding in three stages.

The first stage is the destruction of American energy independence.

Ruining America’s newfound energy independence started the very day Biden was inaugurated.

It’s important to remember that in January 2021 just before he took office…

For the first time in 50 years, America was producing more oil than it was consuming.

Our energy industry was so strong that we imported no net oil from Saudi Arabia and the rest of OPEC.

None!

America was actually producing more oil and gas than the Russians and the Middle East!

Roger:

That would have been unthinkable years before. Politicians had talked for years about energy independence. And then we finally achieved it.

Mark:

Right. It was an incredible transformation.

But it only took one day to tear down what took years to build.

In One Day, Biden Destroyed America’s Energy Independence

On his first day in office, Biden cancelled the Keystone XL Pipeline.

Then he halted all leasing and permits for oil and gas production on federal lands.

He slammed the brakes on drilling in our most oil rich states like Alaska and Texas.

He set out to crank up the royalty rates, bonding rates, and other fees… making it much more expensive for American drillers.

Roger:

Basically, he did everything in his power to kill the American energy industry.

Mark:

And it worked!

America has gone from a huge surplus in oil to a massive deficit!

We began losing $1 billion per week in economic output because of it.

Roger:

And Americans are the ones paying the price. Energy costs are skyrocketing across America.

Energy Prices are Rising at the Fastest Pace in History!

Mark:

They are.

We’re all facing it at the pump and in our energy bills.

And this was all so predictable.

My friend Steve Moore, co-founder of the Club for Growth, actually called this perfectly back in February 2021.

He wrote an op-ed for the Boston Herald saying that Biden would bring a “death knell to America’s energy independence.”

Here’s what Steve wrote:

“As we produce less oil and gas domestically, two bad things will happen. First, gas prices are going to rise rapidly — perhaps to above $4 a gallon.”

“This certainly isn’t good for the U.S. economy and jobs here at home. But it’s great news for the Saudi oil sheiks, Russia’s Vladimir Putin and the communists in Beijing — all of whom are going to make out like bandits. They can’t believe their good fortune.”

Steve called it almost exactly right.

Roger:

Almost?

Mark:

Yes, the only problem is Steve actually underestimated how bad this situation would become.

Biden’s heel-turn on America’s energy industry undoubtedly led to Putin’s Ukraine invasion.

Putin knew the world’s dependence on Russian energy would make them think twice before intervening.

Roger:

So Biden’s move destabilized the world and emboldened Putin even more than Steve anticipated.

Mark:

And gas prices are now also blowing past Steve’s prediction.

They are rising at the fastest rate in history!

Roger:

And now, as energy prices skyrocket even further than Steve Moore predicted… Biden is scrambling.

Instead of Unleashing America’s Energy Industry… Biden is Turning to Dictators and Despots.

Mark:

Even now, instead of unleashing the full strength of the American energy industry… Biden is turning to dictators and despots… begging them to pump more oil!

He sent a delegation to Venezuela to offer a sweetheart deal to roll back sanctions in exchange for increased production.

And here’s what Venezuela’s dictator Maduro had to say about it:

“The flags of Venezuela and the United States looked nice, united as they should be.”

Yes, that’s what we need. We need to be more united with the socialist dictatorship in Venezuela.

And that was just one stop on Biden’s friendship tour with the axis of evil.

He’s also offering up a new nuclear deal with Iran in the hopes they’ll step up production too.

Biden wants to help another enemy become a nuclear power in order to give us oil he won’t allow Americans to produce!

Through it all… did he even consider the idea of powering up the American energy industry?

Roger:

He sure didn’t.

Mark, I saw a quote from Dan Crenshaw, the Congressman out of Texas, when Biden visited Texas.

He said:

“Joe Biden is in Texas today, and yet he won’t be meeting with energy producers to find out what’s needed to increase production, reduce prices, and reduce dependence on foreign oil. This White House would rather meet with Venezuela and Iran instead.”

Mark:

Biden won’t let states like Texas solve the problem.

And in states run by Biden’s cheerleaders, they are actively trying to make it worse.

Take Michigan.

Governor Gretchen Whitmer is trying to shut down Enbridge’s Line 5 pipeline.

The Line 5 pipeline carries more than half a million barrels of oil and natural gas between Canada and several U.S. states each day.

According to the latest report, a shutdown would mean that refineries in the Midwest could lose almost HALF of their crude oil output.

And under Biden, this sort of anti-energy nonsense is happening all over the country.

Roger:

So what will the impact of all of this be?

Mark:

Biden’s Anti-Energy Policies are Causing Destruction Across the Economy

It’s devastating Roger.

It’s leading us toward a major economic pullback that could crush certain stocks.

You have to remember, energy is the lifeblood of the economy.

Whether it’s travel, retail, food, shipping, power generation… all of it is dependent on the cost of oil and gas.

When costs go up for these industries, it’s devastating to their businesses.

As Fortune notes in a recent story:

“if sky-high gas prices do persist, it could have a significant impact on the U.S. economy, leading to falling demand for all sorts of consumer products.”

And that’s what we are seeing now.

Consider this…

The increases in costs for trucking and ocean freight over the last year were the highest on record.

Filling a semi truck’s gas tank now costs over $1,000!

This means higher prices for package deliveries by Amazon.

It means higher costs of shipping goods like lumber and steel for construction.

It means giving retailers no choice but to jack up the prices on clothing and electronics that come from across the globe.

And consumers are seeing it in their own lives as well.

Heating bills are going up by over 50%.

Gasoline is up 78% in a year.

Roger:

And when costs go up on individuals and businesses, they have to cut back.

Mark:

That’s the scariest part Roger.

Individuals are cutting back on travel. They are going out to eat less. They’re ordering fewer items on Amazon.

Businesses too…

When they see energy costs rise… they have to cut back on hiring or giving out raises.

They have to raise prices, which turns away customers.

And all of this leads to less revenue for companies… and poorer performance for stocks.

James Hamilton, economics professor at UC-San Diego studied this over history. And he found that shocks in energy prices led to global recessions throughout history.

The 1974 Arab oil embargo… the Iranian Revolution… the 1990 Persian Gulf War… and even the spike in energy prices before the 2008 financial crisis.

Each one of these oil shocks led to a global recession.

Billionaire investor Jeff Gundlach has warned that gasoline over $5 per gallon will lead to “dire consequences for the U.S. economy.”

Traditionally, this has been true.

Gasoline prices over $5 leads to something called “demand destruction.”

This is when consumers are spending so much on energy that they have to cut back on spending everywhere else.

And because of this demand destruction…

Over the next two years, we are going to see A LOT of companies totally whiff on earnings.

What Biden has done by destroying our energy independence is setting the stage for a major economic pullback across virtually every industry.

And a lot of stocks are going to get hit.

Yet this is just the first stage in the disaster he’s set in motion.

Roger:

Ok, Mark. But there has to be a way to play all this… some way for our viewers to protect themselves and profit.

Mark:

There is.

First of all, watch out for the really expensive tech stocks.

These companies were driven by unrealistic valuations and future expectations that, thanks to Biden, won’t be coming true.

Some are going to continue to get hit hard.

But there also will be one truly big winner out of this energy crisis.

It’s a company that is going to rake in record revenue quarter after quarter.

And I believe it will give you 10X potential if you buy in now.

Roger:

I can’t wait! Tell us all about it Mark.

The American Energy Company with 10X Potential

Mark:

Ok, you won’t be surprised to find out that it is an American energy company.

Roger:

Really? But isn’t Biden’s attack on energy bad for the U.S. energy industry?

Mark:

It is bad for companies that are trying to develop new oil production… like the poor folks who were trying to bring the Keystone XL pipeline online.

But for the energy businesses already operating existing wells and pipelines…

The ones Biden can’t stop…

The current situation is actually increasing profits at record rates.

With oil and natural gas prices skyrocketing… and with Biden’s restrictions essentially blocking out any new competition… this means more profits and better margins for existing companies.

They can bring their oil and gas to market knowing buyers will pay top dollar.

And I have one company in particular that has the potential to 10X as the Biden disaster unfolds.

Consider some of these facts…

The company set 17 financial and operating records last year.

Because of the rising prices in the oil and gas markets, the company saw record margins in three of its four business segments.

Revenue increased 50% last year… A total jump of $13 billion.

And the yield this company pays out is enormous… almost 10% per year.

And they have increased their dividend every single year since the company IPO’d in 1998.

Roger:

These are some amazing statistics Mark.

How have they been able to pull it off?

Mark:

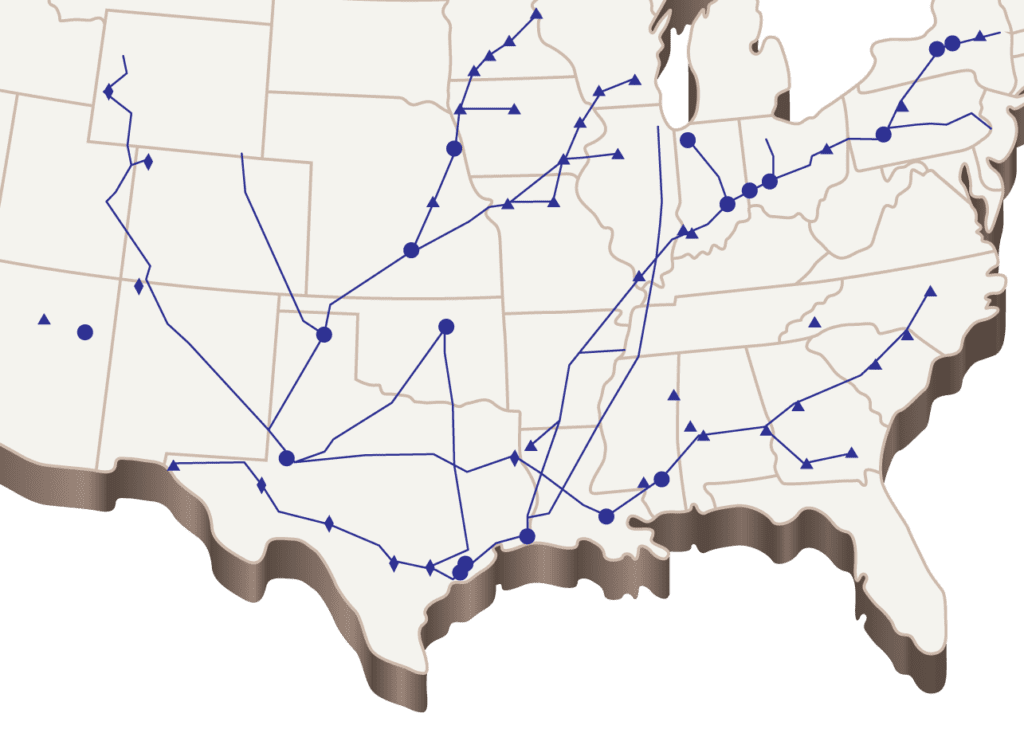

The company operates pipelines, processing plants, storage operations, import/export terminals, and more all across America.

They run over 50,000 miles of natural gas, crude oil, and other pipelines from oil rich regions in Texas and Louisiana to states as far reaching as Wyoming, Wisconsin, and New York.

The company maintains 260 million barrels of refined oil storage. And 14 billion cubic feet of natural gas storage.

They have 19 natural gas processing plants.

And over the years, this company has increased its assets from $715 million to $68 BILLION.

That’s stunning growth of 9,410%.

And here’s the thing… the next few years are likely to be the best ever for the company.

They made a new acquisition that gives them direct access to “one of the most economic and prolific drilling regions in the United States.”

They now have the rights to 1,750 new miles of pipeline… over 1 billion cubic feet of natural gas processing per days…

Roger:

And Biden can’t stop them?

Mark:

No, he can’t. The deal has already gone through. Nothing Biden can do about it now.

And here’s the biggest opportunity of all.

As Europe moves away from buying natural gas from Russia, they need a new source of energy.

And it’s the United States that is filling the void.

The U.S. has now become the largest exporter of liquid natural gas to the European continent.

And this company specifically is gearing up to launch an offshore exporting terminal that would be the first in the United States to serve the largest supertankers.

It would provide Europe with natural gas… and make billions in the process.

Roger:

And you think this is going to happen?

Mark:

I do.

And the people that would know best are loading up on shares.

Roger:

What do you mean?

Mark:

The politicians who have been briefed on Europe’s energy situation are suddenly loading up on shares of this company.

Senator Ted Cruz put hundreds of thousands into the stock… So did Senator Bill Haggerty of Tennessee.

And it’s not just Republicans. Both parties are buying this stock.

Congressmen David Price, Patrick Fallon, Brian Babin, August Pfluger, Tom Malinowski, Pete Sessions.

We’re talking about Democrats and Republicans… all loading up at once.

Why?

Because they realize this company is the primary target to become Europe’s energy provider.

Roger:

Wow, this is incredible.

So this company… that set 17 new financial records… that is expanding all over the United States… and pays a nearly 10% dividend… is also set to take over one of the world’s biggest energy markets in Europe?

No wonder you say this is a stock our viewers need to own now.

Mark:

It certainly is.

It is the first step in The Biden Disaster Plan.

It’s a way to make sure your portfolio keeps growing even in the face of Biden’s many missteps.

You see… Between Biden’s shutdown of new American drilling… as well as the global conflicts that have reduced supply abroad…

This company faces much less competition today.

Americans are looking for somebody to step in and supply the energy shortfall…

And this company is the one that can do it.

It’s in one of the most profitable positions of all-time.

Imagine buying this stock now… and collecting a nearly 10% yield each year in dividends… plus watching it rise 10-fold in value over the next couple of years.

That’s the potential here.

Roger:

Mark, does it worry you at all that other investors will notice this situation, jump in, and drive the price up?

That it won’t be a good deal for much longer?

Mark:

It does worry me.

I don’t think it will be available as cheap as it is today for long.

That’s why I think investors need to move very quickly.

And so I’ve put together a set of detailed instructions informing our viewers how to buy the company.

It’s a report called “America’s #1 Energy Stock.”

In this report, I’ll lay out exactly how to buy this company including the ticker symbol.

I’ll break down their business and why it stands to be so profitable over the next few years.

I’ll show you how to maximize growth and collect the biggest income checks.

This is the first step our audience needs to take today in implementing The Biden Disaster Plan.

I’m going to send out this report for free to some of our viewers at the end of the program today.

Roger:

But there’s more to come.

Mark, you said this disaster is unfolding in three stages.

It starts with the destruction of America’s Energy Independence.

But what is the second stage?

Stage 2 of Biden’s Disaster:

Runway Inflation… and No Choice But to Raise Interest Rates

Mark:

The second stage of this situation is a deadly combination of runaway inflation and rising interest rates.

Every American who’s been to the grocery store recently… or tried to buy a car… or a house… or, as we discussed, a tank of gas…

Has been shocked at the new prices.

The cost of living is skyrocketing in our country.

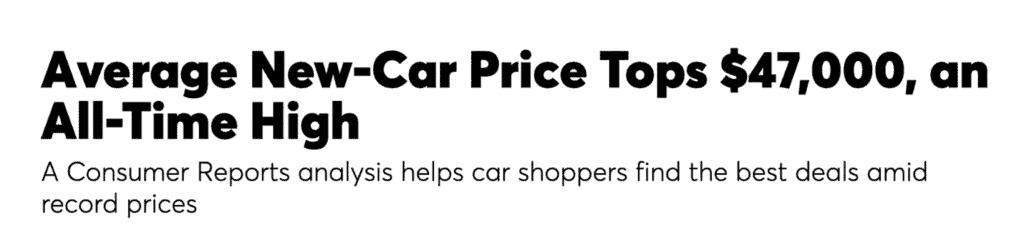

Used car prices ballooned 45% in a year.

Gas prices were $2.38 the day Biden was inaugurated. A little over a year later, they averaged $4.25… an increase of 78%!

It’s happening with food too.

Meat products like bacon and beef are up as much as 25%.

Chicken wings cost 45% more than a year ago.

Roger:

Anyone who’s been to the grocery store recently has been hit with sticker shock.

You can’t get out of there without at least a $200 bill.

Mark:

It’s completely out of control.

And it’s not just food and transportation.

Look at rent!

Across the United States, the average apartment is 20% more expensive today than a year ago.

Not to mention the electric and gas bills.

They are soaring to “historic highs” according to NBC News.

The New York Metropolitan area recently saw a 28% jump in electricity prices in one month!

Roger:

One month. Wow! I’ve never seen anything like it.

Mark:

Nobody has.

It’s the largest jump recorded since they began tracking it all the way back in 1971.

So let me ask you Roger… when people are seeing massive increases in literally every aspect of their lives… food, transportation, rent, energy…

What’s going to be the result of that?

Roger:

Well, I’d venture to say it could leave people in very tough positions.

Mark:

Potentially devastating.

Diana Stanley, who works with people on the verge of homelessness says:

“we’re going to have a massive increase in homelessness. I don’t think we’ve reached the tip of the iceberg on this. And that’s what scares all of us.”

Roger:

So what caused this situation?

Mark:

It’s primarily two things.

The first cause was the pandemic response.

With COVID… instead of weighing the costs and benefits of economic shutdowns… governments instead set about perhaps the greatest (and most costly) social experiment of all time.

We shut down businesses… we sent people home from work… we kept our kids out of school.

And this has had a profound effect on our society.

For one, we had months of lost productivity. This has resulted in fewer products being brought to market.

And that means less supply.

But beyond that, we’ve also significantly reduced the workforce.

Employers are offering more jobs than at almost any time in history. But guess what?

Roger:

They can’t find any workers.

Mark:

Right.

After years living in pajamas on the couch, people just don’t want to work anymore.

Millions have been conditioned to stay at home and live off of government money.

And so even the businesses that want to expand and increase the supply of goods and services can’t.

They don’t have the manpower for it.

It’s an unprecedented shift in modern society… to have so many businesses hiring, but no people willing to take the jobs.

Roger:

And why do you think that is?

Mark:

It gets to the second reason we are seeing massive inflation.

Under Biden, we decided to simply print trillions of dollars to keep the economy afloat.

We handed billions of dollars to businesses to keep them solvent even as the government forced them to shut down.

We sent checks to Americans so they could pay their bills since they couldn’t (or wouldn’t) work.

We gave people rent holidays… and barred landlords from evicting them even if they didn’t pay.

We also closed schools. So people stopped learning many of the job skills needed to enter the workforce in the first place.

At the same time, we cut interest rates to the bone so people would continue buying houses and cars… sending prices for those soaring.

Think about how crazy it is for a minute that during a total economic shutdown… the real estate market absolutely boomed.

Roger:

But it was all based on the free money the government was handing out.

Mark:

Exactly right.

So it’s all very simple.

Under Biden and his fellow lockdown evangelists… the idea was that we could stop business from producing… and instead just print money to cover all the bills.

The result?

Massive inflation.

All the massive price inflation we are seeing today is a direct result of those policies.

And this gets us to the worst part…

What’s going to happen next.

Roger:

Oh boy, and what’s that?

The Fed Has NO CHOICE But to Raise Interest Rates

Mark:

Well, now we are in a tough position.

Inflation is totally out of control.

Real wages can’t keep up. Your average American is now poorer and can’t afford the basic necessities.

So the government has woken up and realized… “We have to do something fast!”

And they are doing the only thing they can to stop inflation.

Roger:

Raise interest rates.

Mark:

That’s right. And raise them as quick as possible.

Fed Chairman Jerome Powell came out and said rates would have to rise “higher and faster” in order to “stop rampaging inflation.”

We’re looking at six or seven increases in the next year. Possibly bigger ones each time too.

But that creates its own problems.

When interest rates rise to 7%… 8%… 10% to buy a home, what happens to the real estate market?

Roger:

It collapses.

Mark:

And what happens to car financing?

Roger:

People can’t afford it and they stop buying cars.

Mark:

And what happens to the stock market?

Roger:

Historically stocks drop when interest rates rise.

Mark:

They do.

When the big institutions have less access to cheap capital… they put less money into the market.

And if less money flows into the market… stocks tend to go down.

So this is Stage Two of the Biden Disaster.

Runaway inflation is forcing the Fed to raise rates much faster than expected.

And this is going to slam the brakes on business across the country and again hurt many stocks.

Roger:

So what do we do?

Mark:

The first thing I suggest is that people be very careful with real estate investments like REITs.

Rising rates are going to hurt those businesses… especially if they are highly leveraged.

I also suggest people watch out for companies that aren’t profitable.

Companies that don’t turn a profit require cheap capital to continue growing.

If it’s not available, the whole thing could come to a grinding halt.

However, there is one investment that I believe is perfect for a rising interest rate environment. It’s one of my 10X opportunities I’m recommending to my followers now.

Roger:

Great, tell us all about it. We need to know!

The Best Way to Profit from a Rising Interest Rate Environment

Mark:

For years now, main street businesses have depended on borrowing money from the government to survive.

But now, the Fed has no choice but to turn off the spigot.

The cheap money will no longer be flowing.

So instead, businesses that want to raise money will have to turn somewhere else.

They’ll need to turn to venture capital.

And so the second investment I’m recommending is a venture capital investment that, even during low-interest rate environments, has been one of the best places investors could put their money.

This venture capital firm is quite unique.

Rather than invest in big silicon valley tech companies… this venture capital firm focuses on REAL America.

They invest in the types of small businesses that are vital to the success of our great country.

And wow, has this business model paid off.

Consider this…

This venture capital firm has grown remarkably consistently over the last three presidencies.

Whether during the Obama years… under Trump… or now Biden… it’s gone virtually straight up.

$10,000 invested at the beginning of Obama’s administration would be worth $124,600 today.

That works out to an increase of almost $9,000 each year on that $10,000 investment.

Think about that for a second.

Getting almost double your money back for each year you hold an investment.

It goes to show you that investing in the REAL America always pays off.

Roger:

Incredible. And it seems the company rewards its shareholders as well.

Mark:

It does.

For one, it pays out a massive amount of income.

Its dividend is almost five times bigger than the average S&P stock.

But beyond

This company has helped over 200 small American businesses grow.

They invest in shooting ranges… power equipment manufacturers… drilling operations… agricultural firms… lumber yards… medical device companies… and much more.

These are the types of businesses that our country depends on.

Roger:

And investing in these types of business leads to big returns?

Mark:

It sure does.

Just look at the last three companies they took profits on.

They exited a software firm after seven years invested in it… and they reported making 7.1X their initial equity investment on it.

Before that, they took profits on a tax services company they invested in back in late 2019.

They profited 2.5X in just two years on that equity investment.

And prior to that, the company closed out of an investment in a clinical research firm.

That play made 15.2X on the equity investment over 10 years.

And listen… I’m not even giving you their best investments.

These are simply the last three they closed out. And each one was a blockbuster.

These guys are flat out unstoppable when it comes to finding good strong businesses and helping them grow.

It’s the reason they’ve done so well as a whole.

In the most recent earnings release, the company reported records in total investment income, net investment income, and distributable investment income.

If you’ve ever wanted to be a part of private equity investing… but you haven’t had access to the best deals… this is the investment for you.

It has crushed the market for over a decade.

It pays a massive dividend today… 5X bigger than the S&P.

And in fact, they just raised the dividend once again.

This investment is the single best way I know to still win in a rising interest rate environment.

Roger:

So how does our audience get the ticker symbol for this one?

Mark:

I’ve put together another report called:

“America’s #1 Small Business Investment.”

Just like my report on the top energy company, this will have all the details you need to buy the stock.

I’ll give you a deeper look into the company and what they do. And I’ll spell out how to maximize income here.

Again, this will be a free report that I’ll be sending our viewers as part of The Biden Disaster Plan.

I’ll show everyone how to get it for free in just a moment.

Roger:

But first, there’s one more stage to the Biden Disaster right?

Mark:

That’s correct.

It’s related to the other two.

Stage 3 of the Biden Disaster:

Mass Global Shortages

When you combine everything we’ve talked about today…

Paying people not to work…

Shutting down the global economy due to COVID…

Adding new restrictions and regulations on businesses…

The destruction of America’s energy independence…

What does that do to the global supply of goods and services?

Roger:

It reduces it.

Mark:

It sure does.

And this brings us to the third stage of the Biden Disaster.

We are looking at prolonged shortages in dozens of industries that will severely impact the American economy going forward.

Much of it is already here.

I’m sure our audience has seen it.

Homebuilders still can’t find basic materials like lumber and steel.

The National Homebuilders Association says that 90% of builders are seeing delays and material shortages.

This obviously drives up costs for everyone.

And of course, Biden added on additional taxes to homebuilders to make it even worse.

Printers too report being unable to get paper, ink, and toner.

Shutdowns in China are leading to massive shortages in smartphones, laptops, televisions and more.

The New York Times did a big expose on the growing shortages everyone is facing.

“Delays, product shortages and rising costs continue to bedevil businesses large and small,” they say.

It’s affecting everything from mundane items like place mats and baking pans… to more serious shortages like supplies needed for blood tests.

Yet what is the New York Times advice for dealing with it?

“Get used to it,” they say.

That’s how tone deaf this administration and it’s supporters in the media are.

Roger:

And there are serious implications to these shortages.

Mark:

Of course there are!

CNN reports we are on the “brink of a food crisis” worldwide.

One of the biggest problems is access to fertilizer.

We have a shortage of Ammonia and Urea, two important agricultural ingredients.

Without those, farmers cannot supply the food we need to avoid this crisis.

The World Economic Forum estimates this could leave 811 million people without access to proper food worldwide.

In Afghanistan, where Biden’s botched exit has led to extreme poverty… the food situation is so bad that people have resorted to selling organs just to get enough money to eat!

That’s as serious as it gets!

Even Biden himself was forced to admit that the global food shortage crisis is “going to be real.”

Well, yeah.

It’s awfully real right now Joe!

The global shortage of goods and services is hammering consumers.

All told, there is approximately $1.14 trillion of economic activity grinding to a halt due to assorted shortages we are seeing.

Perhaps the most disruptive of all is the global computer chip shortage.

Computer chips are in everything now.

Chips are essential to home appliances like air conditioners and refrigerators… construction equipment… package delivery… electronics… air travel.

Virtually every industry in the world.

Look at construction.

Caterpillar announced it will have to scale back it’s equipment deliveries because they don’t have the chips to complete the orders.

This just makes the construction backlog and shortages even worse.

And the car industry is a total disaster.

The average car now has 1,000 computer chips in it… electric cars have 2,000!

And because of the chip shortage, car manufacturers just don’t have the chips needed to build cars.

Tesla isn’t rolling out new models this year because of the chip shortages.

Ford and GM both cut production dramatically due to the lack of chips.

Toyota slashed production by 40%!

Roger:

40%. That’s unheard of.

It’s got to kill the executives at Toyota to do this. Here you have consumers desperate to buy cars.

They know the cars would fly off the lot if they could provide them.

And yet the car companies can’t do a thing to meet demand because they don’t have the computer chips.

Mark:

That’s right.

And this computer chip problem isn’t going away any time soon.

Nvidia CEO Jensen Huang says there are “no magic bullets” to solve the problem.

Intel CEO Pat Gelsinger says it will last at least another year.

They are constructing two Arizona chip manufacturing facilities but they won’t be operational until 2024.

And here’s something that will blow people’s minds.

Biden himself actually discouraged Intel from upping it’s current production.

Roger:

What is he thinking??

Mark:

Clearly, he’s not thinking.

It’s all part of the disaster he is presiding over.

He’s responsible for ending America’s energy independence… creating runaway inflation and rising interest rates… and now a global shortage catastrophe.

Roger:

I can see why getting this message out was so important to you.

These are times when investors need a concrete plan.

Now, you’ve told us about two great 10X opportunities as part of your Biden Disaster Plan.

But I’m guessing you have found another way to help our viewers succeed despite all these shortages.

America’s #1 Chip Crisis Stock

Mark:

I have.

There is one company that I believe is going to 10X as a result of the global chip crisis.

You have to start by thinking about how businesses react in these sort of situations.

When nearly every major corporation worldwide MUST HAVE a single product – in this case computer chips – and those products are in short supply…

They all go into hyper-competitive mode.

The CEOs fight and claw with everything they’ve got to get the chips they need.

And for the few companies that provide these chips… it’s about as great an opportunity as you can get.

Imagine having the most powerful business leaders in the world fighting to pay top dollar for your product.

That’s what is going on in the chip industry.

And I’ve found the single company in the best position to profit.

Roger:

Is it an American company?

Mark:

It is.

It’s a semiconductor and transistor company that provides all things electronic.

And I do mean everything.

Transistors, switches and chips used in smartphone chargers, battery packs, notebooks, desktops, data centers, graphic cards, game boxes, mobile devices, flat-panel TVs and displays, AC adapters, power supplies, motor control, power tools, electric vehicles, solar inverters and industrial welding.

Roger:

And what companies do they provide these products to?

Mark:

As you can guess, in this environment, virtually every major corporation worldwide is banging down their door… begging them for more computer chips.

In the United States, they’ve provided chips to Amazon, Black & Decker, Dell, Microsoft, Google, Facebook, GE… even Nvidia and Intel, rival chipmakers!

In Asia, their customers include LG, Samsung, Nintendo, Sony, Sharp, Toshiba, Panasonic, and more.

In Europe, they are providing products to Braun, Phillips, Solar Edge, Sky, and others.

Roger:

It’s a who’s who of major corporations worldwide.

Mark:

Exactly. All these companies are fighting to get their hands on computer chips during this shortage.

The company I’m recommending can’t make them fast enough!

Roger:

So what has this done to sales for the company you are recommending?

Mark:

Roger, they are skyrocketing.

The company beat sales expectations for four consecutive quarters.

Net income is up… get this… an astounding 660% over the last 12 months alone.

It’s gone from $58 million in profits to $442 million!

Roger:

Wow, that’s incredible!

Mark:

It is.

But here’s what makes it even better.

The stock still trades at an absurdly low valuation.

It’s trading right now at just four times earnings!

Roger:

Four times earnings? You’ve got to be kidding me!

What does the average S&P stock trade at… like 25 times earnings?

Mark:

Currently it’s 26.

Roger:

So that means the stock you are recommending could go up six-fold and still be cheaper than the average S&P stock?

Mark:

That’s exactly right Roger.

It’s an incredible opportunity.

And as we discussed, the chip shortage is likely to go on for several years.

Not to mention… demand for chips will only continue to rise in the future as well.

We are adding more and more chips to everything.

So this company… one of the few operating right here in America… is in perfect position.

That’s why I’ve created a third report as part of The Biden Disaster Plan.

It’s called America’s #1 Chip Crisis Stock.

And just like with the first two, it will include all the instructions on how to profit from this situation.

Roger:

I have to say… all three of these stocks sound fantastic.

Each one is seeing skyrocketing revenue.

And they are perfectly suited to succeed even despite the Biden disaster that’s unfolding.

Mark:

Yes, that’s true.

Listen Roger.

As I said at the start of this program, the next two years are going to be tough.

Biden has done some serious damage.

But it’s important our audience recognizes that the worst thing you can do now is panic.

Rather, what you want to do is recognize the problems… and attack them head on with a plan.

I believe these three stocks are key to succeeding in the months ahead.

Roger:

Alright folks. It’s time to get your hands on the entire Biden Disaster Plan including…

- America’s #1 Energy Stock

- America’s #1 Small Business Investment

- America’s #1 Chip Crisis Stock.

And Mark, you say all three of these are available for free?

Mark:

All three of these reports will be completely free of charge… delivered to our audience within minutes… for everyone who accepts my special offer today.

Roger:

A special offer?

How to Get Your Biden Disaster Plan for FREE

Mark:

Yes… you see, for the past 40 years I’ve published a special advisory called Forecasts & Strategies.

And I’m offering my entire Biden Disaster Plan – FOR FREE – as a bonus to all those who take a risk-free trial today.

Roger:

How can Forecasts & Strategies help our viewers going forward?

Mark:

In each issue, I like to start by talking about the broad economy—interest rates, inflation, growth, trade, taxes, government regulations, and geo-politics.

In my 40 years plus on Wall Street, I’ve seen it all – boom and bust, bull markets, bear markets, and crashes.

I’ve seen massive inflation… energy shocks… negative interest rates… financial meltdown… everything.

I take all of that experience and I share with my followers how to protect themselves and how to profit in any market.

Listen folks, there’s still going to be a lot of twists and turns to Biden’s next two years.

We don’t know what he might do next.

The three stocks I’m giving you will put you on firm footing.

But with Forecasts & Strategies, I aim to help guide you through everything still to come.

In short, as it all unfolds, it’s where I will share my biggest investment ideas directly with you…

Roger:

And you’ve had some great wins over the years Mark.

Some that come to mind include the 301% gain on Janus Triton… the 421% on Fidelity’s Defense and Aerospace play… or the 453% in just TWO MONTHS on Collector’s Universe.

But perhaps what I’ve always been most proud of as your publisher Mark… is the stories of success your subscribers have had.

What Forecasts & Strategies Subscribers Have to Say

Forecasts & Strategies has truly saved lives.

For example, there’s the story of Dr. Lee Husni, who works at the prestigious Cleveland Clinic.

“I think anyone who invests should invest with Dr. Skousen,” he says. “I’ve been studying the investment industry for over 60 years, and Mark Skousen is the #1 man I trust with my investments. Many years ago, I hired a firm to manage my money. I lost 81% of my portfolio, so I signed up with Dr. Skousen. Almost everything he has recommended has gone up. He is a genius in the field.”

You have another subscriber named Jared Kuhnemund. This gentleman has tried over 20 newsletters, going from one to the next searching for something that actually worked… Until he found Forecasts & Strategies.

“Mark Skousen has been the only one to consistently make me money in the 7 years I subscribed to Forecasts & Strategies. He’s the best!” says Jared.

Joshua Johnson had a similar experience. Here’s what he told us:

“Forecasts & Strategies has made me a good deal of money in the last couple of years. No other financial guru seems to have your ability to separate the chaff from the grain. Your newsletter is the greatest!”

Mark, you’ve also developed close relationships with some very well-known and powerful people across the country.

Steve Mariotti, founder of the Network for Teaching and Entrepreneurship, called you “one of the greatest minds of the modern money era.”

Nobel prize winner Milton Friedman called you an “able, imaginative, and energetic economist.”

Steve Forbes even said you should win the Nobel prize in economics yourself!

Mark:

Well I appreciate all of that.

I’ve worked hard for many years to try to educate people about the economic and financial principles that guide our world.

There’s so much people don’t understand.

And my goal is to bring understanding about how the world works directly to everyday Americans in the simplest possible terms.

Roger:

When you look at the experiences your followers have had, I would expect the service to cost thousands of dollars.

But you’ve always been against that.

You want to be sure this service is available to almost everyone.

So you’ve made the price very reasonable.

Mark:

That’s true.

I think our viewers will be very surprised when they see how little it costs.

Plus, as we’ll discuss… it’s all risk free.

And no matter what, The Biden Disaster Plan will be yours to keep at no charge.

Why We’re Doing This…

It’s important to remember, this is a critical moment for investors.

Folks who panic could get left behind.

They might lose a bundle in stocks… and at the same time… inflation will make everything more expensive.

That’s a tough combination.

However, if you move into the right stocks now, there’s a good chance you’ll come out of this disaster in much stronger financial position.

A handful of winning stocks could make all the difference.

That’s why I’m making today’s offer so good.

I want to be sure not one single person gets left behind.

Roger:

As Mark said, we have a special offer available today.

If you join Forecasts & Strategies now, we will send you an email right away with access to every report in The Biden Disaster Plan.

That includes:

- America’s #1 Energy Stock

- America’s #1 Small Business Investment

- America’s #1 Chip Crisis Stock

Beyond that, as part of your subscription, you’ll also get:

- 12 monthly issues of Forecasts & Strategies, conveniently delivered to your mailbox and your inbox every month.

- 52 weekly e-mail Hotline updates, plus urgent e-mail Special Alerts as needed — all of which you can also receive by calling my telephone Hotline!

- 24/7 access to the subscriber-only section of the Forecasts & Strategies website, where you’ll have instant online access to all my current advice, portfolios, special reports, plus archives of back issues and recent articles.

- Exclusive access to invitation-only private meetings with me at the MoneyShows held several times a year around the globe.

- One-on-one discussions with myself and your fellow subscribers during quarterly conference calls to discuss the latest investment information you need to know to profit.

- Investing Master Class from our good friends at Consistent Profits. You’ll learn the seven pillars that can help you rig the markets for your success, three elements to increase your trading results in surprising ways, learn how you can better control your long-term profitability… and more. You’ll also get a 30-45 minute one-on-one coaching session with one of their experts.

- Concierge Service, set to help you with any questions that may arise.

Now Mark, before we share the final offer, I want to talk about risk for a minute.

What should people know to keep them safe?

Mark:

It’s important for people to know that this is the stock market.

There will always be some risk.

Not every stocks works out.

But my subscribers are all smart enough to understand that.

And I have a long track record – 40 + years – of getting the job done.

Roger:

Your current portfolio has 17 stocks in it… and the average gain with dividends is up 57%.

That’s amazing.

And you’ve been remarkably accurate in calling the top stocks each year.

Stephen Halprin, editor of The Stock Advisors runs a stock-picking contest each year between all the leading newsletter publishers. Everyone submits a pick at the beginning of the year… And then Stephen gives out awards at the end of the year.

Here’s what Halprin had to say about your performance in the contest…

“For over 25 years, I have conducted an annual feature asking the nation’s leading newsletter advisors to select their favorite stock for the coming year. Year after year, Mark has consistently been among the top performers in this contest. Indeed, out of some 100 financial advisors, Mark has ranked in the top few spots more than any other.”

Based on that sort of performance, I could see you charging $1,000 a year for access to Forecasts & Strategies.

Mark:

I’m sure I could. But as I said, my goal is to make this available to everyone.

That’s why the price of a one-year subscription to Forecasts & Strategies is just $249.

However, because the Biden Disaster is unfolding so quickly… and so dangerously for the unprepared… I’m making today’s offer even better.

Roger:

Even less than $249?

Mark:

Yes, we’ve set up a special page for today’s viewers. On that page, you can access a special discount of Forecasts & Strategies for as little as $49…

Though I recommend going for the premium level, which is also heavily discounted at just $77, where you get all the benefits including the free Biden Disaster Plan.

Roger:

And that’s for an entire year right?

Mark:

Yes, it is.

Roger:

Alright everyone, this is your big chance to get Dr. Skousen’s insight at the best offer ever available.

A button is popping up on your screen below.

All you have to do is click it and you’ll get the special discount to Forecasts & Strategies… including everything we’ve talked about.

Plus, a totally risk-free guarantee.

Mark, can you tell us about that?

Mark:

Sure.

A lot of our viewers probably want to see my stock recommendations, but perhaps they are on the fence about trying something new.

Totally understandable.

That’s why I authorized a 30-day guarantee to allow everyone to try it out.

Roger:

And how does the guarantee work?

Mark:

Anyone who signs up will have 30 days to review everything.

They get access to my portfolios… all new monthly issues … and the three reports that are part of The Biden Disaster Plan.

If anything doesn’t live up to the billing over 30 days, simply call our U.S. based customer service team, and you’ll get a full refund.

PLUS, even if you do so, you get to keep everything in The Biden Disaster Plan free of charge.

Roger:

So there’s zero risk here.

The Choice in Front of You: Panic or Invest with a Plan?

Mark:

Exactly.

Now, I’d like to address our viewers one last time here.

What’s in front of us is a very dangerous moment for America… and especially investors.

The end of American energy independence threatens to raise costs on consumers, businesses, home owners… virtually everyone.

Inflation, mixed with rising interest rates, could slam the brakes on the real estate market, auto buying, and stocks.

Mass shortages could also push prices higher, cause delays, and reduce economic activity.

The Biden Disaster that is unfolding threatens to send us into a period of economic misery.

So you have a choice ahead of you.

Either go down with the ship.

Or step into a lifeboat and head for shore.

I believe my Biden Disaster Plan is that lifeboat.

And I’d like to guide you to safety.

All you have to do is click the button below to start your risk free trial of Forecasts & Strategies.

With your 30-day trial, all the risk is on my shoulders to deliver.

And I aim to do that for everyone who joins.

Roger:

Mark, you’ve been incredibly generous with your time today. And this offer is unbeatable.

I want to thank everyone for watching.

Again, folks, just click the button below to see a review of everything you’ll get when you join.

I look forward to welcoming you as the newest member of Forecasts & Strategies.

For Dr. Mark Skousen, I am Roger Michalski, signing off.