Table of Contents

- Introduction

- Who is investor Matt McCall?

- What Exactly Is The Flippening?

- Why hasn't life gotten any easier in the last 10 years?

- Why The Next 6 Months Could Change Your Life

- This is our Flippening…

- Take These Steps Immediately…

- The #1 Stock To Buy Today

- Get the Names of My Favorite Flippening Stocks

- Here’s How To Know If This is For You

- How to Get Started Risk Free

PRESENTED BY STANSBERRY RESEARCH

Famed investor who's likely helped more people see 1,000% stock gains than anyone else in America issues warning:

Prepare for a stock market

An unstoppable trend could create more wealth over the next few years than over the entire previous century, but only for a select few. Here's what they don't want you to know.

On a flight from Florida to Baltimore earlier this year, a woman physically shoved me because I pulled my mask down to take a sip of water.

All I could do was laugh.

This is what it’s come to.

And I’m sure you sense it, too.

Americans everywhere are fed up. We’re exhausted.

We’re sick of living through one “unprecedented” event after another…

We’re facing our first simultaneous food and energy crisis since 1973.

The stock market hits new highs one day only to crash the next.

If you have any weaknesses in your investments… the market is finding it.

Inflation is everywhere.

On top of that, the whole world’s streaming a potential world war on their iPhone.

With each new blow we wonder, “Ugh. Now this? This was the year things were supposed to go back to normal! This isn’t the post-COVID euphoria we were promised!”

Perhaps you’re looking at your money – that’s worth less with each passing day – and saying, “I’ve delt with two economic crises in less than 15 years… a recession just two years ago… I’m so sick of this.”

Or maybe you’re the 1 in 2 Americans saying, “Life’s too short. I’m leaving my job.”

1 in 5 health care workers are quitting… 55% of teachers want to… 94% of retailers say they’re having staffing problems.

Have you been to a restaurant lately? Service everywhere has been awful.

The mainstream media calls it, “The Great Resignation.”

To me, it’s a much, much bigger story than that.

It’s what was really behind my co-passenger’s shove.

Let’s call her Nicole.

Something has been building inside Nicole and the rest of us for years…

I call it, “The Great Frustration.”

Just as we finally get the opportunity to dine out and travel again… we’re faced with $6 gasoline… record airline cancellations… and sky-high food prices.

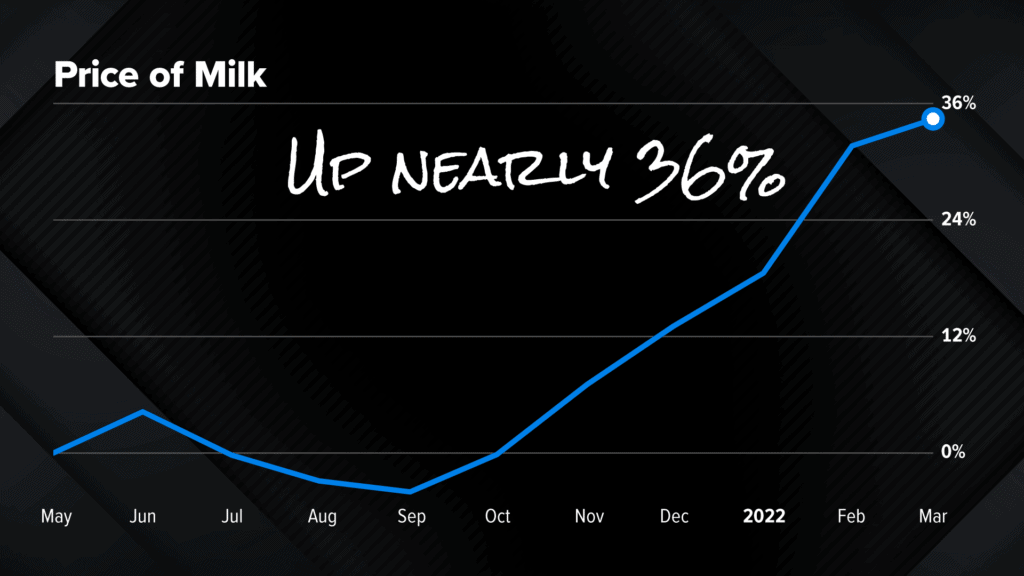

In just the last year milk prices are up nearly 36%!

And egg prices have nearly doubled in just one year!

But it’s far more sinister than that, too, right?

We’re angry enough to start fights on planes… to slap each other on live TV… to storm our houses of government… to loot and riot.

- In 2019 business owners reported $402,000 in property losses due to riots and civil commotion.

- In 2020… that number was $86 million. Let me repeat that – $86 million!

There’s nothing we won’t fight over. And it’s not just liberals vs. conservatives anymore. It’s rich vs. poor… rural vs. urban. It’s sex, race, faith, borders, bathrooms, babies.

It’s everything.

Late last year the Institute of Politics at Harvard's Kennedy School published a poll that found half of voting age Americans under 30 thought our democracy was “in trouble” or “failing.”

A third said they expected there to be “a civil war” within their lifetimes. A civil war!

Americans of all ages are more frustrated and less motivated than ever before.

And you know what, it is hard to get up and go to work when the average Wall Street bonus has gone from $14,000 in 1985 to a whopping $257,000 last year.

That makes me angry, too.

Because while they’re raking it in – if you’re over the age of 50, you’re getting nickel and dimed by the very federal programs that promised you the retirement you worked so hard for.

Meanwhile the benefits you DO get from Social Security have lost 30% of their purchasing power since 2000.

So sure, in many ways our lives are better than at any other time in history, right?

Global incomes are higher… our lifespan is longer. Literacy is up. Poverty is down. Violent crime has dropped in half since the 1990s. Communication is literally 100,000x cheaper than it was 100 years ago.

But simple things – like seeing a doctor or getting your car fixed or simply making more money for the lifestyle you want – are still so frustrating.

- It’s as if everything is amazing, yet nothing ever works the way it’s supposed to.

- Nothing’s efficient.

- No one can seem to do their job correctly.

- The right people are never rewarded.

- And everyone’s always mad at each other.

And as the 5 o’clock news likes to remind us almost daily, we’re also battling a mental health crisis.

Again, everything is “amazing”! But most people are not happy.

Tragically, the percentage of American adults who’ve reported having serious thoughts about suicide has spiked in recent years.

Perhaps it’s because we’ve all been walking around outraged?

These feelings… outrage, despair… they cause people to do weird things and act in weird ways.

Here’s my point: If you’ve felt this deep, collective, national frustration, you’re not alone.

But I want you to please pay close attention to what I am about to say next.

Because I’m going to explain the unprecedented event you’re actually living through.

You see, the root of all these problems is not politics. Or values. Or gender. Or race.

It’s money. It all comes down to economics.

And there’s an economic phenomenon happening right now at the heart of all this.

It’s something that could have more dramatic implications for your money than inflation, Social Security failure, a mental health crisis, or war overseas – combined.

Now, you’ll have to forgive me for talking about something like money. I realize it isn’t very “politically correct.”

Rest assured, I’m not here to talk about politics or social justice issues. All those causes have their own arenas and their own heroes. I’m not one of them.

But as a senior analyst at one of the largest and most successful independent financial research firms in America over the past 25 years, I see something playing out in our country right now that very few people are acknowledging. And the moves you make with YOUR money in the coming weeks could seal your financial fate as it soon comes to a head.

What’s happening is what’s known in some financial circles as “The Flippening.”

It’s the economic phenomenon we’re all experiencing… that’s leading to mass frustrations in every corner of our lives.

Nothing can stop it either. Not recessions or depressions. Not even war.

Once you understand exactly what The Flippening means, so much begins to make sense.

More importantly, so much begins to get better.

All the anger and outrage not only has an explanation, but it can go away.

But if and only if – you know exactly what’s coming, and you prepare ahead of time.

That’s why I’m here, on this stage.

Because the next few years will be radically different from those you’ve already experienced.

Most people aren’t prepared.

For those people, The Flippening will be a bad thing when it comes to their wealth.

Nearly 40% of elite, publicly traded companies… brands you’ve known and used your whole life… will go bankrupt because of The Flippening. And likely lose fortunes for their investors.

But for others… who take the time to understand what I say today… it could mean something very different…

The opportunity to grow an incredible fortune awaits.

In the years to come, I believe that anyone who doesn’t fully understand The Flippening will undoubtedly be left behind in all the ways one can get left behind: financially, socially, even physically.

If you think you’re frustrated now, you can’t even begin to imagine how hard life will be for you and the masses of people who don’t wake up and pay attention to the situation playing out in front of us.

It will be completely devastating.

Sooner than you can imagine, you may not know how to access your money… how to get medical help… how to get groceries… how to talk with your family.

Meanwhile, some are already using The Flippening to amass tremendous wealth.

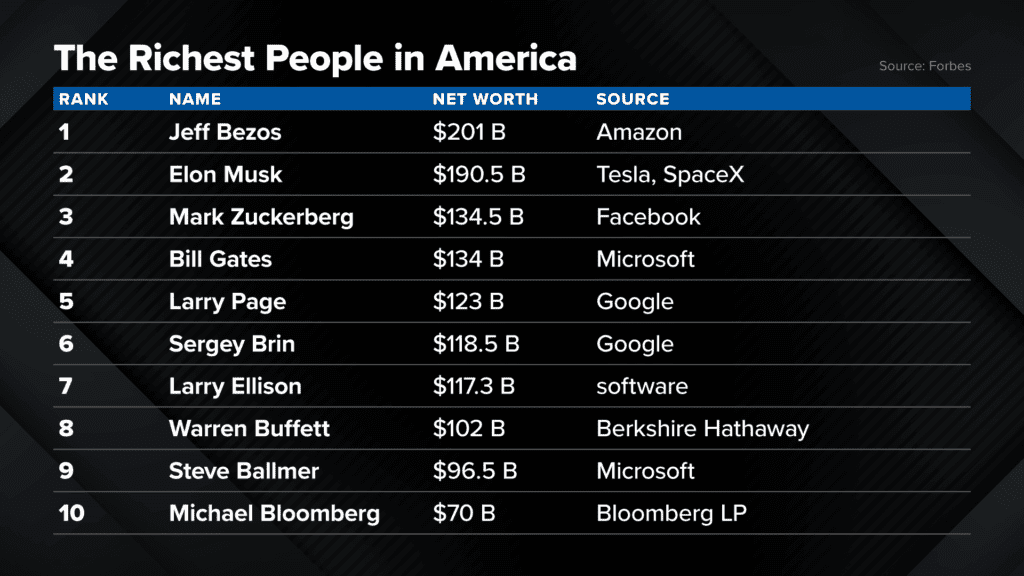

Every single person on Forbes’s list of the wealthiest people in America – with the exception of Warren Buffett – has embraced The Flippening. And as The Flippening accelerates, Buffett’s fallen further and further down the list. (He was No. 3 in 2015.)

Others who’ve embraced it – like Elon Musk – have shot straight to the top. (Musk was No. 100 in 2015.)

The Flippening has created an entirely new class of millionaires and billionaires.

It’s even how I’ve built my own personal wealth…

And yes, I recognize I’m now one of the “1%-ers” people love to hate.(There’s the frustration and outrage again, right? I hope Nicole’s not watching.)

But please don’t mistake me, you don’t have to be anything close to a “1%-er” to have the chance to make a fortune off The Flippening, starting now.

I’m living proof of that.

I wasn’t born into wealth. I was raised by a single mom in a dying Pennsylvania steel town.

And I used to be frustrated, too…

Unlike any politician, the mainstream media, or even social media, I’m going to offer you a solution to your frustration today.

I’ve made it my life’s mission to spread the word about The Flippening.

Most people don’t know the first thing about it. They don’t understand what’s already happened and what’s coming next.

But the reality is, there’s something very simple… not easy… but simple… that you can do to dramatically and immediately improve your wealth and happiness.

I’ve yet to see anyone else cover the story… and I doubt anyone else ever will. Not like I am.

No one else is going to piece it all together for you and hand you essentially a “get rich blueprint” like this. Why would they!? They’re going to keep it for themselves.

I’ll explain why I’m doing this in a minute… I’m even going to give away one of my favorite Flippening stocks that you can buy today, if you choose.

You may be skeptical of my prediction, or even of me. Or you may disagree.

But in the next few months when you see everything I describe today start to play out… I hope you remember you heard it here first.

A Major Shakeup is Coming

@MatthewMcCall

Senior Analyst. Author, The Next Great Bull Market.

My name, by the way, is Matt McCall.

I grew up in a steel town. Bethlehem, Pennsylvania. Home of The Bethlehem Steel Corporation… once the fourth largest company in the country.

I’m the oldest of five. Mom raised us by herself when I turned 12.

We never had much.

But we had it better than a lot of the other families who lived off unemployment checks and welfare when the mill shut down in 1988 and hundreds of men – including my father – were laid off.

Bethlehem’s one of those towns no one ever leaves. I’ve since come to find out that a good number of my high school classmates have died from overdoses or turned to crime.

That was almost my future at one point, too. Before I caught on to The Flippening.

Maybe it was growing up with so many siblings, or becoming the man of the house so young, but I’ve always been ruthlessly competitive. I’ve worked hard my whole life.

I saw firsthand what happens to a person when they lose their income, and their sense of self-worth.

And I vowed to never find myself in the same position.

But, and I cannot stress this enough, I was never the “whiz kid” destined for the Ivy Leagues, or anything like that.

My grades weren’t great and am certainly NOT built like a linebacker. But I got to college on a football scholarship. Tight end, then safety.

The day I graduated I drove across the county to join Charles Schwab, one the largest brokerage firms in America.

There, I became a registered rep – otherwise known as a stockbroker – and got all the financial certifications I could, including the Series 7, 63, and 65, and eventually went on to get the 66, 82 and 24, which allowed me to manage branch activities as a broker dealer.

But I can’t sit still, let alone behind a desk. So, I became the host of a national radio show… then I began traveling and speaking at different investment conferences.

Soon enough I’d made over 1,000 media appearances and had a reoccurring gig on Fox Business. Here I am… almost a decade ago now.

I wrote two books about investing… eventually managed tens of millions for wealthy Americans… and my work often got picked up by the Wall Street Journal.

I started a few companies…

- One called Crowdvest, one of the first equity crowdfunding platforms.

- Another called Crowdvest Securities – a broker dealer.

- And my passion project, a booming fitness concept.

And this was all by my early 40s.

I think what helped me accomplish so much so quickly was my ability to see a clear vision of the future – and show others the simple steps they can take to benefit from huge unstoppable trends.

That’s why I want to do for you today with The Flippening.

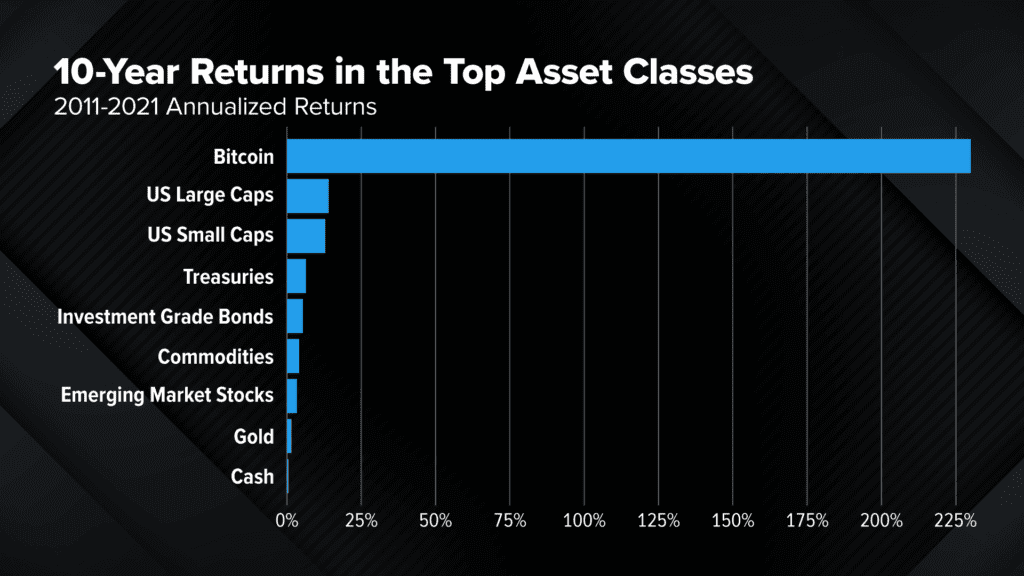

This is how I came to recommend Bitcoin back in 2014 when it was trading for just a few hundred bucks.

In fact, the crypto community is where the term “Flippening” originated.

Let me be clear – no, The Flippening is not all about cryptos. This isn’t a crypto story. They’re a small part of it, but the investment idea I’m giving you today is a stock you can buy in a normal brokerage account.

Instead, what The Flippening is about is seeing specific signs around you…

Seeing how one technology paves the way for the next…

And signs that simple economic realities create incredible wealth building opportunities, but only for some.

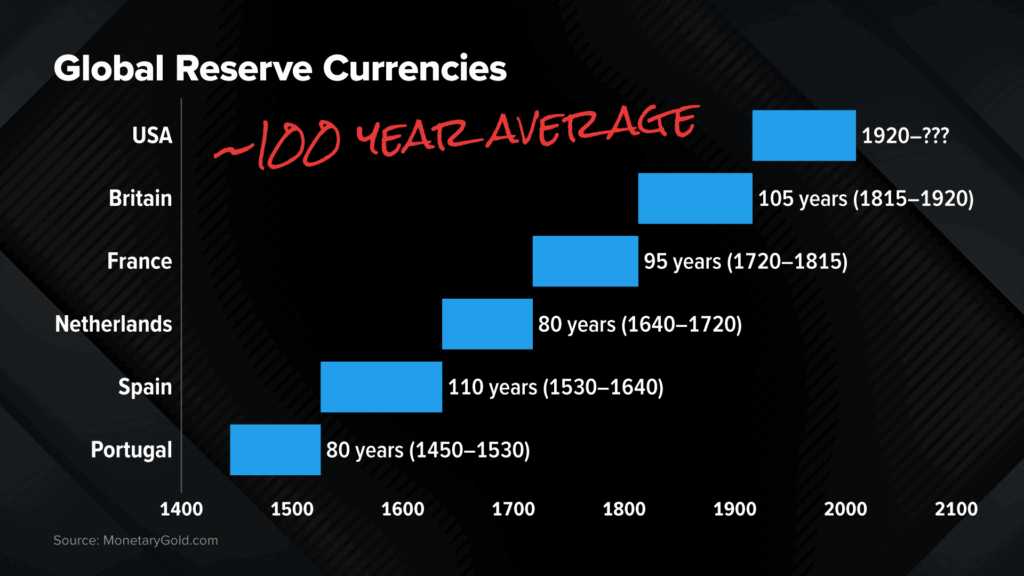

You see, despite a currency that has been falling in value every year since 1913… and despite the fact that most major world currencies only ever last about 100 years…

Instead of getting mad at the U.S. dollar, people got mad at Bitcoin.

People loved to hate Bitcoin. Some still do.

People often get angry when they can’t understand something, or don’t take the time to.

I’m sure you’ve seen that in your own life too, right?

With Bitcoin, outlets like the Washington Post called it a “fake currency” and the worst performing asset class in the world.

But to me, it was obvious crypto would grow more and more popular as the dollar kept getting weaker, and Washington kept fueling the printing machines.

By the way: Bitcoin ended up being the BEST performing asset of the decade. And if you followed my prediction, you could have turned a $1,000 investment into almost $100,000.

And sure, Bitcoin has some wild price swings…

But you can’t deny the impact it’s had on the investment world.

Almost every major bank now has a stake in Bitcoin. Even the ones that thought it was a fraud! But they realized, they’d better get on board or get left behind.

It’s estimated there may now be as many as 100,000 Bitcoin millionaires.

It’s interesting though, that as many as 68% of them were likely high net worth individuals to begin with.

Meaning most people missed out on the opportunity entirely.

The same thing happened when I showed others how to buy into every single one of the now famous “FAANG” stocks. (That’s Facebook, Apple, Amazon, Netflix, and Google.) People were so hung up on the wrong things…

- Why do I need to “like” someone’s picture?

- Why does my cellphone need to be smart?

- How could a search engine make someone so much money?

They were angry because they didn’t understand.

But you could have 10x’d or nearly 10x’d your money if you acted on all my predictions…

Same with my recommendations for Tesla… Starbucks… and Salesforce. All companies people love to poke fun at.

But rather than feeding into the frustration, I saw the money there for the taking.

And again – it’s not because I had a fancy Ivy League education, or because I came from a wealthy and connected background.

I was just following The Flippening.

But look, today’s story actually has very little to do with me.

I’m merely telling you all this to prove I know what I’m talking about. I’ve got the experience. In fact, I can think of over 40 companies I’ve recommended that have since hit the 10x mark – that’s over forty 1,000% gains on my track record

- Bitcoin (BTC)… +10,038%

- Cardano (ADA)… +8,211%

- Advanced Micro Devices (AMD)… +5,624%

- DexCom (DXCM)… +4,295%

- Stamps.com (STMP)… +3,212%

- Mercadolibre (MELI)… +3,100%

- Fulgent Genetics (FLGT)… +2,751%

- Boston Beer Company (SAM)… +2,669%

- Amazon (AMZN)… +2,666%

- Mercadolibre (MELI)… +2,509%

- Ulta Beauty (ULTA)… +2,332%

- NetEase (NTES)… +2,120%

- Insulet (PODD)… +1,924%

- Tesla (TSLA)… +1,854%

- Ilika (IKA.L)… +1,661%

- Salesforce (CRM)… +1,635%

- O’Reilly Automotive (ORLY)… +1,625%

- Workhorse (WKHS)… +1,539%

- ODP Corp. (ODP)… +1,502%

- Heska Corp. (HSKA)… +1,462%

- Axon Enterprise (AXON)… +1,427%

- Ford (F)… +1,423%

- Starbucks (SBUX)… +1,393%

- iRobot Corp. (IRBT)… +1,375%

- Cedar Fair (FUN)… +1,363%

- Bank of America (BAC)… +1,350%

- Align Technology (ALGN)… +1,231%

- American International Group (AIG)… +1,205%

- SVB Financial Group (SIVB)… +1,200%

- American Water Works (AWK)… +1,180%

- EHang Holdings (EH)… +1,163%

- Heska Corp. (HSKA)… +1,159%

- Facebook (FB)… +1,147%

- Atlassian Corp. (TEAM)… +1,132%

- ServiceNow (NOW)… +1,120%

- Apple (AAPL)… +1,107%

- Silvergate Capital (SI)… +1,075%

- Veeva Systems (VEEV)… +1,068%

- Ross Stores (ROST)… +1,062%

- Netflix (NFLX)… +1,056%

- Amazon (AMZN)… +1,053%

- Allergan (AGN)… +1,051%

- Kulicke and Soffa Industries (KLIC)… +1,030%

- Dollar Tree (DLTR)… +1,016%

- Ubiquiti (UI)… +1,011%

*All investments carry risk. These are some of Matt’s best gains; not all investments will perform as well.

Each one of those winners ties into the story I’m telling today.

In recent years my private investment research group has given thousands of people – mostly strangers I’ll never meet – the chance to profit off what I’ve found.

But despite my best effort, most people are never going to hear about, let alone profit off The Flippening.

There is a Facebook page that’s been set up to track it… and some forward-thinking entrepreneurs are already selling “The Flippening” T-shirts on Amazon.

The good news is that it’s not too late to position yourself to potentially make a LOT of money off this. Not by a longshot.

In some big ways, as I mentioned with Bitcoin, The Flippening has already started playing out. The groundwork has been laid.

These next few years will simply be the crescendo. The time when we see the fastest changes and massive wealth creation.

It’s unstoppable.

And it doesn’t matter if tech stocks are at all-time highs… or if they’re selling off when you hear this.

You have to think bigger with this.

I read a great quote recently that said “demand will return for everything that wasn’t destined to die.”

Do you think people aren’t going to use Amazon or go on social media in the next few years? Of course not.

So. if you missed out on all money to be made in the oil stocks of the ‘80s… like Exxon, Texaco, and Gulf…

Then watched the Internet craze blow right by you without loading up on Microsoft… IBM… and Apple…

Only to miss out again with Amazon, Facebook, and Google…

What’s coming next could dwarf all of those opportunities.

In fact, a physician and engineer named Peter Diamandis – who Fortune tapped as one of the World’s 50 Greatest Leaders said,

“If the internet is our benchmark, more wealth could be created over the next 10 years than was over the previous century.”

And he said that two years ago.

So, let’s not waste any more time.

So, What Exactly Is The Flippening?

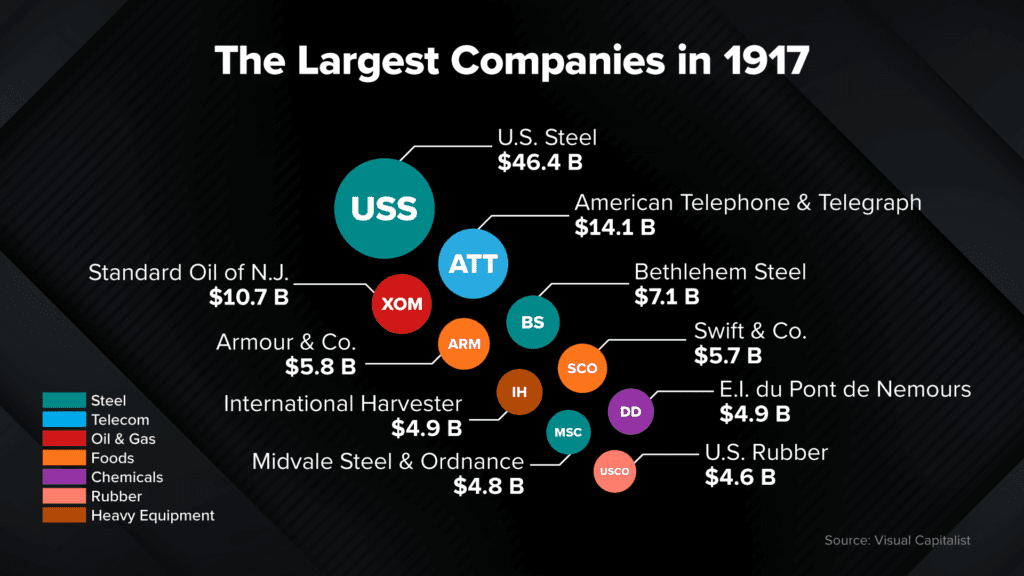

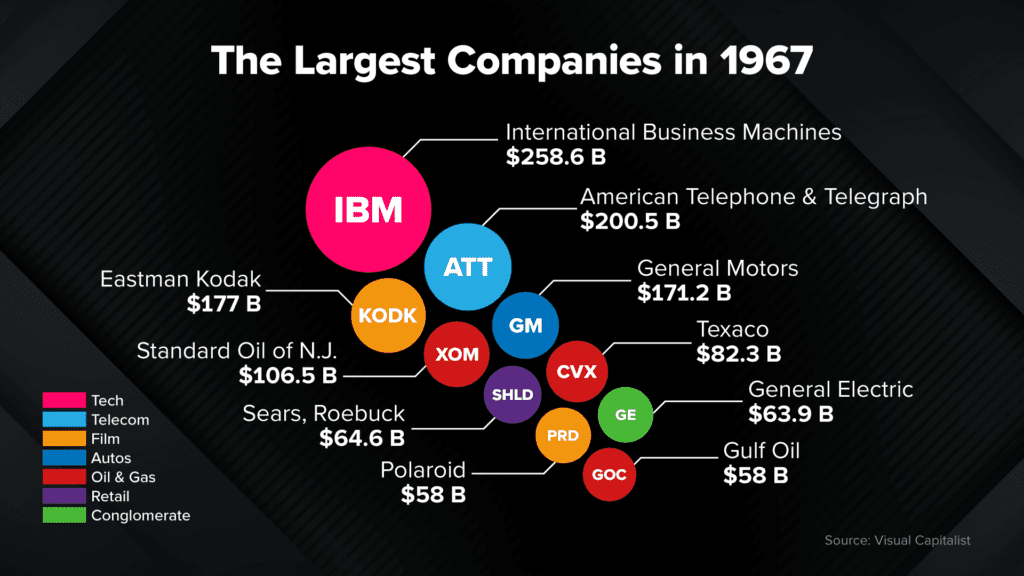

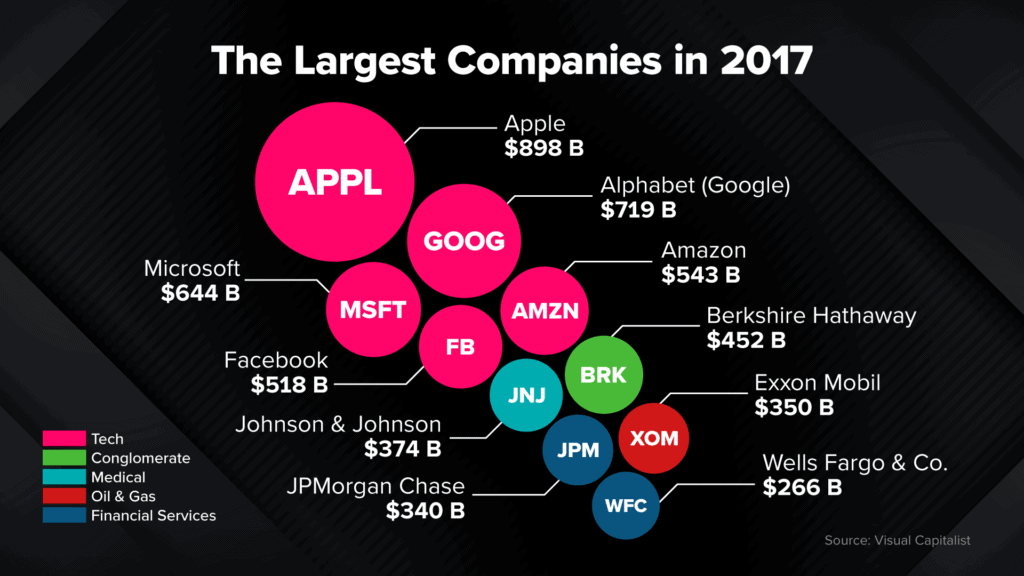

I’m going to show you a series of images now.

I want you to look at them closely.

These were the top companies in 1917, just over 100 years ago.

What do you notice? Oil… rubber… farming equipment. There’s good old Bethlehem Steel.

Fast forward 50 years, what do we have now? Technology explodes onto the scene. Telephones, cameras, cars, electronics. And sure, still some oil.

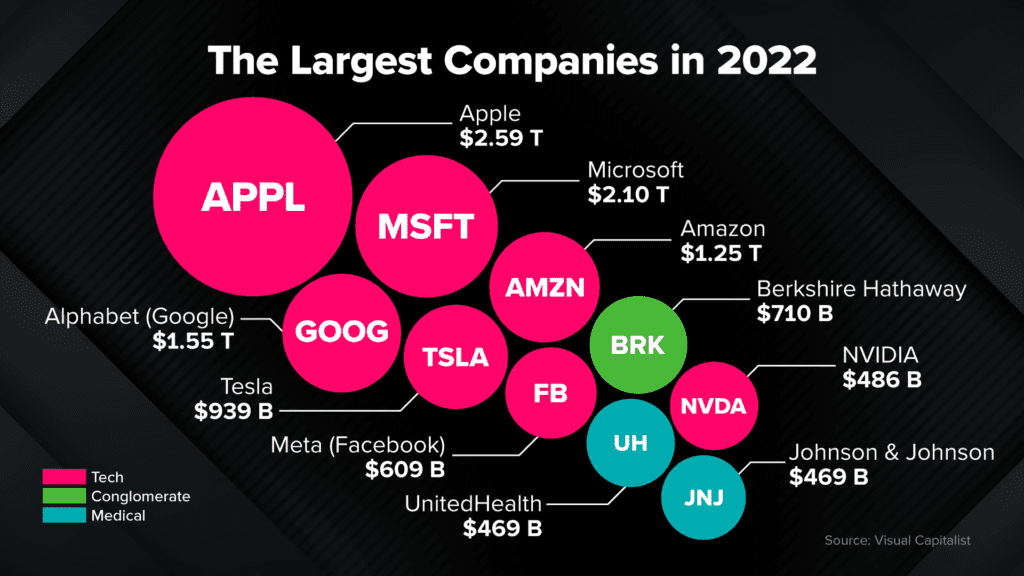

50 more years? Tech, tech, tech, tech, banks, money, medicine.

Just five short years later. We already have three new American powerhouses in the top 10.

What’s new?

- NVIDIA – a tech company that specializes in robotics, artificial intelligence, and gaming. I recommended them back in 2019, by the way. You could have seen gains as high as 450%.

- UnitedHealth – Traditionally an insurance business that acquired a massive information and technology health services arm. You could have more than quadrupled your money after my recommendation on UnitedHealth.*All investments carry risk. These are some of Matt’s best gains; not all investments will perform as well.

- And finally, Tesla. What isn’t Tesla doing? Electric Vehicles, Space Exploration, Batteries, Energy. I told my private investing group to buy Tesla stock back in 2014. You could have turned a $500 stake into close to $10,000 at one point.

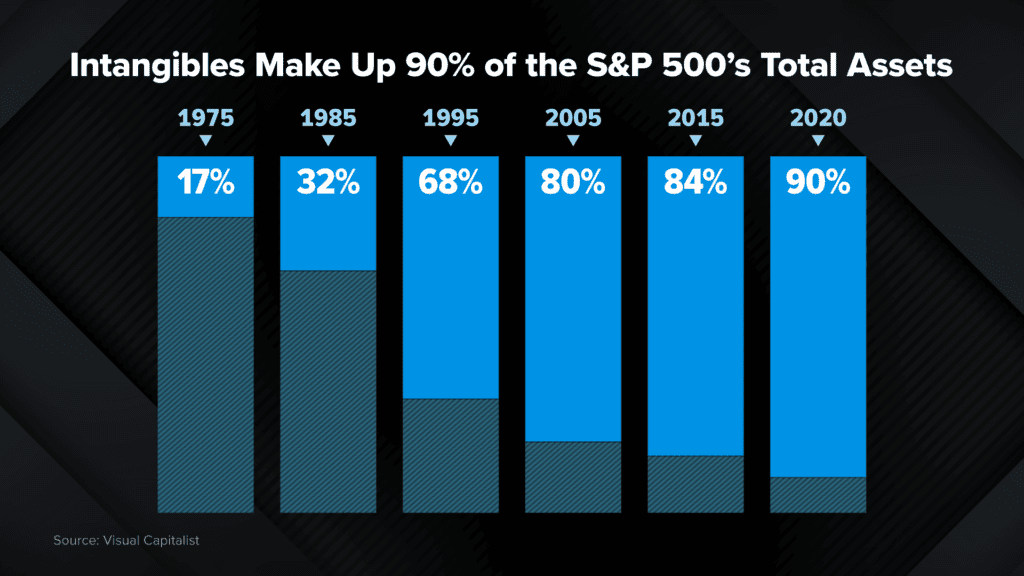

What’s the common thread here? There was a huge shift from companies producing and owning real things like natural resources and inventory… to companies owning mere concepts like data and patents and brands.

In fact, these “intangible” assets now make up 90% of the total assets listed on the balance sheets of the companies in the S&P 500.

Look how dramatically it’s shifted since the mid ‘70s.

It was also during this time that we saw the proportion of people working “white-collar” jobs hit 50% for the first time in American history.

Suddenly, textile operators, farmers, stenographers, and people working in the mills like my dad saw their jobs disappear…

While the need for engineers and computer specialists started to rise… and has only continued since.

“Software developer” is still the most in-demand job in the country, according to Business Insider. And pays an average salary of $110,000. Developers at Amazon are rumored to make closer to $400,000.

But here’s what I mean when I say economics is at the root of many of today’s frustrations.

Think about this…

Remember that the majority of people participating in The Flippening right now are the ultra-wealthy.

They can pay for the education – private preschool, prep school, Ivy League – that gets their kid the high-paying tech jobs without huge student loans…

That kid can then create even more “intangible” assets and innovations, ultimately putting even more midlevel workers out of a job.

There’s a popular statistic that says technology CREATED more jobs than it DESTROYED. And sure, that may be true.

But it DESTROYED jobs for the middle and lower class… and CREATED more jobs for the wealthy.

It makes sense now why when I go home so many people are in one of two places: The Lehigh County Men’s Community Corrections Center… or Holy Savior Cemetery.

They didn’t turn to crime and drugs because they were pissed off at who the president is or was, they did it because the rug was pulled out from underneath them. They got left behind.

The median income in Bethlehem is just over $55,000. Less than 5% of the population makes more than $200,000. The highest paying jobs in a 50-mile radius are still in mining, quarrying, and oil and gas extraction. And even the guys working those dangerous jobs aren’t making six figures!

Unfortunately, these are the people The Flippening will hit the hardest.

That’s why I worked my tail off to get into this world of investing.

Even if I was a total outsider.

It’s the absolute best way to level the playing field for yourself.

Did you know the richest 1% own more than half of all stocks held by American households?

Or how about the fact that more than 40% of our current congressmen and women own individual stocks valued at $225 million… with the most popular being tech stocks.

72 members own stocks… 45 own Alphabet (formerly Google)… and 44 own Amazon.

And I’m sure you won’t be surprised to hear that several dozen of them own shares of Johnson & Johnson and Pfizer.

Yep. The very two companies that just so happened to make the COVID-19 vaccines.

And look, the numbers behind all of this are incredible. If you want to see the sources for the data I’m citing today, simply click on the Details and Disclosures link at the bottom of this page, which will take you to my original sources.

My point is simply that if you find yourself frustrated… it’s not your fault.

You were born into a system rigged against you at every level.

And that may be the ONLY thing people on both the left and right agree on.

I’m sure if you’ve ever gotten to know someone from “across the aisle,” you recognize pretty quickly that you’re talking to another human being.

We’re not so different after all. The biggest difference between us now lies in one place: wealth.

Think about this for a second…

- If you were born into either the upper OR lower middle class in 1940, for example, you had a 90% chance of ending up in a financial situation better than your parents.

- By 1984 that dropped to a 70% chance, but only if you were born in the UPPER middle class…

- If you were in the LOWER middle class, it was just a 35% chance.

Put simply, the American Dream is withering. If not dead.

Millions of people are simply getting left behind. They’ll work harder and harder and see no change.

Meanwhile, incredible moneymaking opportunities, like The Flippening, seem reserved for whoever has the most connections… or political power.

Democrat Speaker of the House, Nancy Pelosi, for example… has raked in as much as $30 million on The Flippening.

And six of the 10 richest people in the world are directly profiting off The Flippening.

It’s no wonder we’re frustrated… but the answer is not handouts. Or socialism.

That only makes things worse.

What we need is a better understanding of how our economy actually works…

So that people have a fighting chance to succeed just like they did 100 years ago.

That’s what I hope to do for you today as I show you how to take advantage of The Flippening.

But to get there, I first need to ask you this important question.

Why hasn’t life gotten any easier in the last 10 years?

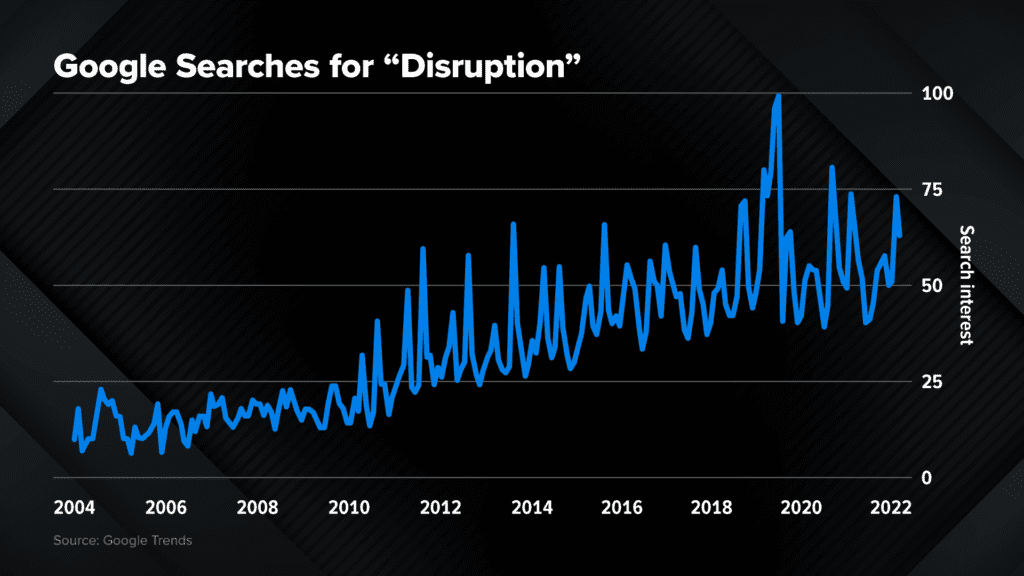

Many people will look at those images I just showed you and wonder… “Is this guy just talking about disruption?“

From a financial perspective, “disruption” refers to the term coined by two Harvard Business School professors – Clayton Christensen and Joseph Bower in 1995.

According to the professors, “Disruption” describes a process whereby a smaller company with fewer resources is able to successfully challenge an established incumbent business.

And I’ll say upfront – This is NOT another story about “disruption.”

It’s so much bigger than that.

I personally think it’s time to retire that word. We’re disrupted. It happened. I just showed you all the examples.

Every startup in America still tries to claim its business is disrupting something.

Isn’t that the whole point of capitalism? Who launches something and says, “Oh we’re just another company that does X. Give us some funding.”

Look at the how many people have searched Google for the term since 2004. It’s become part of the American business lexicon. A tired buzzword that’s about as grating as “synergy” or “new normal” at this point.

The disruption phase in our economic and technological history is over.

We’ve disrupted almost everything… entertainment, communications, transportation, retail, food services, even work.

Smaller companies have knocked out the reigning giants.

But many of the new companies that emerged simply applied the Internet to traditional business models.

Take something like Uber, for example.

In parts of the country like Washington, D.C. and New York City, it’s actually become cheaper and faster just to take a taxicab again! Yellow taxis quickly came up with their own version of the uber software.

Sure, Uber “disrupted” with its promise to give drivers flexible working hours, fast cash, and no moody boss.

But like most flashy promises, it proved too good to be true in the long run.

Sure enough, when you factor in soaring gas prices, taxes, and insurance it’s hardly worth the hustle.

In fact, a study by the Economic Policy Institute showed that the average Uber driver makes below minimum wage!

Or think about Netflix, one of the ultimate disruptors.

Let me ask you this… do you just use Netflix anymore?

I have Hulu, Amazon Prime, HBO Go, Showtime, and Paramount.

According to a new J.D. Power survey, most Americans now subscribe to at least FOUR streaming services and pay an average of $47 per month.

Nobody under the age of 25 can probably even fathom this…

But at that rate, you should have stuck with cable.

So, again, yes…

Disruptive technology changed our lives in many big and important ways.

And as I showed you, it’s certainly made the rich even richer.

But our frustrations haven’t been fixed. If anything, new ones have sprung up.

But what happens next is going to change everything.

Now we move forward. Onto the next phase.

If you thought the world changed a lot with cellphones and the Internet… get ready.

That was like watching a lousy set of previews before the REAL movie begins.

What happens now… where all the big money will be made and lost in the next few years… is The Flippening…

Here’s what you need to know.

Why The Next 6 Months Could Change Your Life

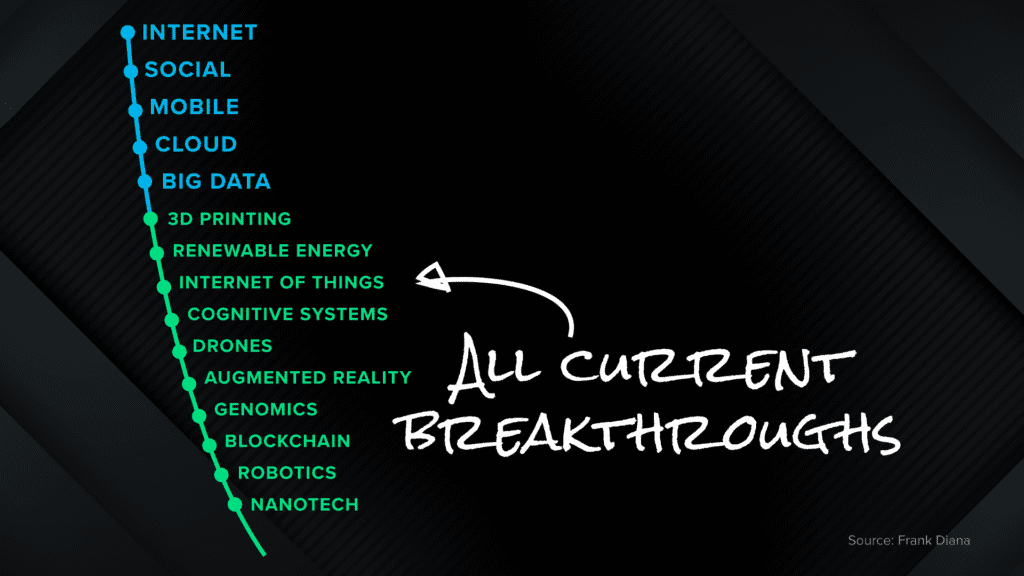

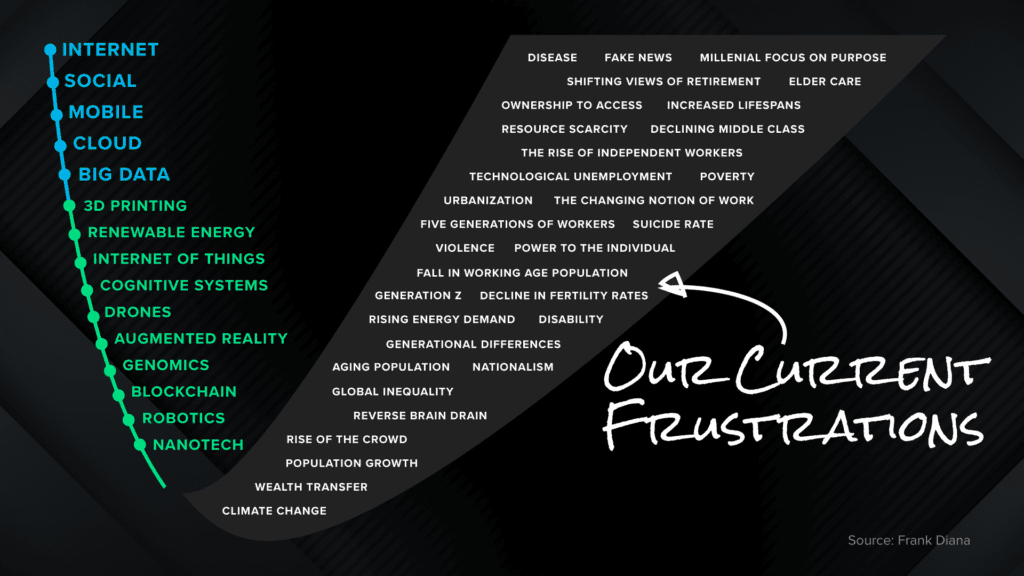

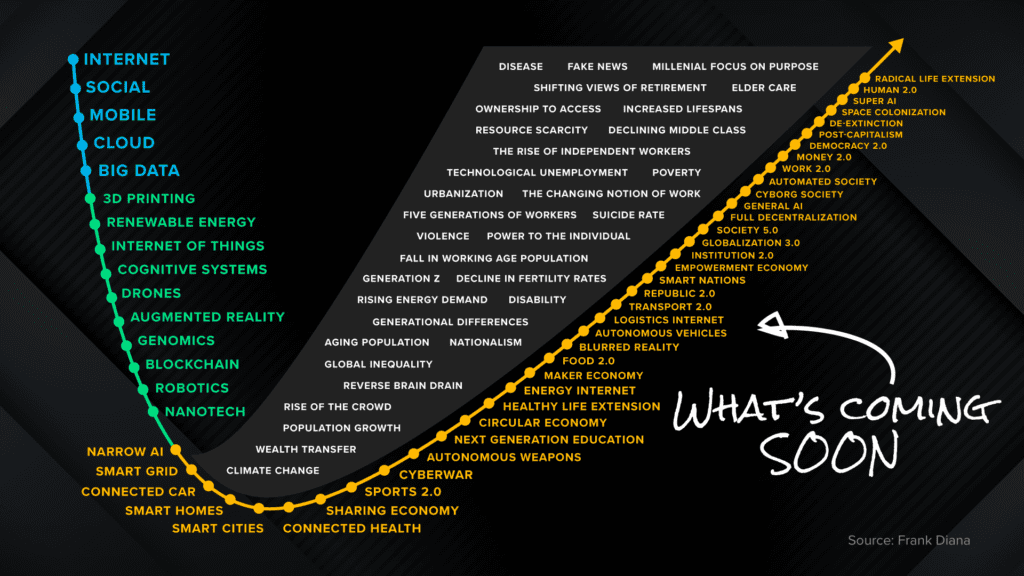

I’m going to show you one more image that ties together everything I’ve said today…

Never before have I seen The Flippening mapped out so beautifully…

This is by a futurist named Frank Diana who’s amassed a huge underground following in recent years.

It contains a tremendous amount of information, but it’s very important for your wealth that you understand this… so let me walk you through it, piece by piece…

First, this blue line maps out big breakthroughs that have already happened… the Internet, social media, the rise of data…

That was our “Age of Disruption.” Checkmark, done.

At each point there were winners and losers.

Facebook vs. MySpace… Apple vs. AT&T…

Next, we enter the green phase…

This is where we are now.

Today, all sorts of technologies are emerging as a result of the foundation laid during the blue phase.

Each point relies on the success of the prior.

And these trends are simply inevitable.

You’d be hard pressed to find many fortunes made in the last 20 years that didn’t involve one of these blue or green technologies.

Take the Internet of things and blockchain, for example.

Earlier I said that Bitcoin, an extension of blockchain, has created at least 100,000 millionaires… And McKinsey says that the Internet of Things could generate AT LEAST $5.5 trillion in wealth over the next few years.

My point is that each one of these dots represent almost unfathomable amounts of money – if you spot them in time and know how to invest in them.

Now here’s the dark side… where the Great Frustration comes back into play.

Everything is amazing, but no one is happy, right?

Well, you may be wondering why the chart appears to be trending downward…

It’s because during the blue and green phases, we also saw the rise of new obstacles.

These are the economic, social, and technological “growing pains” caused by all those blue and green dots. All the pieces that feed into our current state of frustration.

See for yourself now in black.

The decline of the middle class… an aging population… the changing notion of work… fake news… resource scarcity… identify theft…

These are our generation’s biggest problems…

Just as previous generations faced things like factory fires… disenfranchisement… poor nutrition… and limited global mobility and communication.

Eventually people got to a point and said, “It shouldn’t be like this anymore!”

And if there’s one thing history has taught us about technology it’s that fortunes are made whenever you’re able to relieve huge frustrations.

Think about Amazon (AMZN), for example… one of the biggest winners of the blue phase.

I recommended Amazon back in 2009. You could have made over 2,500% since then.

Amazon cured many frustrations around shopping and shipping and selling… it turned millions and millions of people onto online shoppers.

Kiplinger’s suggests that Amazon’s driven (or could drive) as many as 43 companies out of business.

In the last few years, we’ve seen:

- Borders

- Toy R Us

- Modell’s and Sports Authority

- Lord & Taylor

- Kodak

- RadioShack

- SteinMart

- Dressbarn

- And Barney’s…

All file for bankruptcy.

I can’t think of a single thing those companies sell that I couldn’t find on Amazon.

But here’s the most important part…

America repeatedly names Amazon its top or one of its top brands.

Forbes reported that 89% of people are more likely to buy something from Amazon than any other e-commerce site.

And the company reportedly makes $7,385 in revenue PER SECOND.

But it’s not just Jeff Bezos and early investors who are making all the money…

It’s rumored that as many as 40,000 people are making more than a million dollars a year with Amazon.

They’ve embraced the new technology to find themselves on the right side of the wealth gap. And many of their frustrations have disappeared.

We’re about to see the same money-making opportunities… in many of the green phase technologies… as well as what comes next.

We’re going to see more and more companies like Amazon – that just make life easier – pop up in the next few years…

And it’s because all the technologies in the blue and green phase are what’s known as “exponential.”

That means they grow faster than you think possible.

They’re governed by a tech principle known as Moore’s Law.

And it states that every two years computing power grows twice as strong, while its price remains constant.

Put another way, computers are constantly doubling in power.

Moore’s Law is why today’s pocket calculators have more power than the Apollo 11 computers used to send Neil Armstrong to the moon.

That means every two years things like blockchain, robotics, and 3D printing get more and more powerful… without getting exorbitantly more expensive.

Let me give you an example…

We’ve all been hearing about the supply chain issues lately… and how expensive labor and raw materials like lumber are getting.

Look at this…

This is a new neighborhood of multi-story modern homes in Austin, Texas.

They were 3D printed in two days by a company called ICON…

Here’s what one of the homes look like…

Imagine being able to totally upgrade your home without being uprooted for months… dealing with messy construction crews… or missed deadlines and hidden costs.

These homes sold quickly by the way, for around $450,000… which is near the median price for a home in Austin’s hot real estate market.

But the story’s even bigger than that…

Because these exponential technologies are not only doing amazing things in their own realms… but they’re merging with other technologies in ways we never imagined.

Single exponential technologies revolutionize markets – like how your cellphone made your landline essentially worthless.

But when exponential technologies merge… magic happens.

You have to crawl before you can walk, and walk before you can run, right?

That’s why all sorts of industries will be completely reimagined in the next few months and years: travel, health care, communication, work.

For example, right now…

- Big Data and Genomics are merging so you’ll soon know which foods, drugs, and exercises are perfect for YOUR body. You’ll know which diseases you’re likely to get – based on much more than genetics – and exactly what to do to prevent them. No more wasting time on diets or with unhelpful doctors… you’ll have a custom plan.

- The Internet of Things and Robotics are merging so you never have to deal with rude store clerks, missing inventory, or long check-out lines. You could soon walk out of a store with what you want and have your payment process automatically.

- Blockchain and Artificial Intelligence are merging so you can soon move money around, transfer it, lend it, or donate it without ever getting a bank involved. Not only that, but you can do it safely because the blockchain tracks it all and can use artificial intelligence to make sure you’re dealing with other credible users. Did you know you get reported to the government for “suspicious activity” when you take $10,000 of your own money out of the bank? It’s not going to be that way in the future…

The list goes on and on… it’s exponential… and it’s unstoppable.

And so, these blue and green phases are not actually “trending downwards”… instead think of them like an Olympic skier propelling downhill to build momentum and speed before flying off the ramp…

These blue and green phases simply propel us into the next phase of growth.

The pressures and frustrations we’re feeling are their fuel.

This is our Flippening…

Take a look at the next phase now… the orange one… which lists all the new opportunities that are going to emerge during The Flippening.

Things like the smart grid so we’ll no longer have tens of thousands of people out of electricity or heat during weather events like we do every year…

Connected health care that alerts you before you’re about to have a heart attack.

And autonomous and flying vehicles that will make everything from rush hour traffic… to devastating car accidents – a thing of the past.

Right now, that probably sounds as outlandish as the idea of us all carrying tiny smart computers in our pockets did in the ‘90s.

But these innovations ARE coming to relieve our frustrations, and they are going to create fortunes.

That’s right, there’s tremendous upside to our frustrations, if you know where to look.

This is how some of the smartest people I know… millionaires who are incredibly successful in their various fields… are making money right now.

I was actually in London a few weeks ago for the grand opening of the first flying car airport – called a VertiPort. Some of the biggest tech investors and transportation companies in the world were there.

Here I am with one of the flying cars.

Mark my word: all of the world's richest people and companies are pouring money into The Flippening.

They see the opportunities ahead and, like always, are getting there first.

Just to give you a few examples…

- Jeff Bezos is part of a group that invested $10 million into a 3D printing company… and $200 million into an agriculture technology company.

- Mark Cuban is launching an online pharmacy to try to bring about connected health care…

- Tesla, GM, and Ford are spending billions to fully automate their plants… as is Foxconn, the company that manufactures the iPhone.

- $5 billion has flooded the drone and air taxi space recently… funding nearly 130 new companies.

- And billionaire co-founder of PayPal, Peter Thiel, is heavily involved in the artificial intelligence space. Even football Hall of Famer Joe Montana is on the board of a company that’s invested in more than 90 different AI firms.

But perhaps the most astonishing is what Softbank CEO Masayoshi Son is doing…

He is so committed to future technologies that he started a mega-fund called the “Vision Fund.”

It’s said to invest… get this… “one billion dollars per minute” in these Flippening technologies.

To quote Peter Diamandis again,

“Nothing accelerates technological development like money. More cash means more people experimenting, failing, and, eventually, driving breakthroughs.”

Folks like this don’t freeze during temporary dips in the market.

They know that bear markets are normal and tend to be short-lived.

They see it as a tremendous buying opportunity.

People WILL get rich off these ideas. Why not you?

The best part is, you don’t need to put your life savings into any of these ideas. And you shouldn’t. Small, smart investments could lead to tremendous returns.

Put simply, we’re going to witness things in the next few months and years that we never thought possible.

And – mark my words – the same people that tell you this stuff is impossible…

That tech investing is dead.

Or that all the best tech gains have already been made…

Are going to ask you, “How did you do it?”

According to MIT inventor and futurist Ray Kurzweil – who currently works at Google – we’re going to experience 20,000 years of technological change over the next 100 years. And nothing can stop it. Not recessions or wars. Nothing.

Said another way, in just the next decade we’re likely to witness all the changes that happened from the birth of Jesus… to the dawn of the Internet!

And again, it doesn’t matter what the market is doing on any given day… this is truly unstoppable.

Day to day it never seems like our lives change all that much, right?

But all the changes in the blue and green phases happened during our lifetimes.

Yours and mine.

Maybe you’ve profited off them.

But if not, it is okay, you are getting another chance RIGHT NOW.

The exponentials technologies that are merging right now could make millionaires out of those smart enough to put just a little bit of money into them today.

And that’s why I’m up on this stage today.

Take These Steps Immediately

Now, you have all the information…

You know what The Flippening is… you see the types of trends involved… you see the direction the money is headed.

But whether you realize it or not, something is happening in your brain at this very moment.

You see, I could show you statistic after statistic, chart after chart…

But the biological reality is that it is EXTREMELY difficult for you to picture what the world will look like just a few years from now.

The portion of our brain – the medial prefrontal cortex – this part right here – actually SHUTS DOWN when we try to imagine ourselves in the future…

So, when you hear me talk about things like flying cars and think “no way!” that’s normal.

Your brain simply cannot picture it.

It’s something doctors can see in real time during a functional MRI.

This explains why most Americans don’t have $500 saved for emergencies…

Or why people die from diseases like skin or cervical or prostate cancer – which can usually be prevented with regular screenings.

Our brains simply cannot picture the struggling version of ourselves in the future, who we should start taking care of now.

That’s why most people are going to shrug off what I’m saying today… or perhaps get angry at all this technology as it emerges (like they did with the Internet… and social media… and cryptocurrencies).

Meanwhile, those who do have courage and conviction to act will be rewarded.

Even if you act with only a little bit of your money.

So…

Which side will you be on?

You’re likely never going to hear this story anywhere else until it’s far too late. Until all the biggest gains have been made.

Trust me, I spent over a decade of my life in the financial media…

We didn’t tell people the best places to put their money… where it could grow by hundreds or even thousands of percent. We couldn’t. We’d manipulate the market.

And I’ll probably lose some friends for saying this, but the media is one big spectacle. It’s entertainment. It’s there to shock and scare you. It’s a multibillion-dollar industry after all.

If it helped you and fixed your problems, you wouldn’t keep tuning in.

It just feeds your frustration.

That’s why I left that world…

That’s why this presentation is completely independently funded.

I don’t accept a single penny from advertisers, to ensure I’m not beholden to anyone.

I can say what I want without any influence or approval from some higher authority.

That’s why I left the financial news… why I stopped managing money… why I stopped acting as a broker…

I wanted to help more people and empower them to see these trends on their own – so they’re not dependent on anyone.

So many people are going to get left behind that I’ve made it my life’s work to tell The Flippening story… and help as many as I can prepare for what’s ahead.

For years I’ve done just that with the private investment research group I mentioned.

It’s called The McCall Report.

When I first started out, I had no idea how successful it would become.

Today, my passion has grown into a movement that connects tens of thousands of people around the world.

Hundreds join my group every week, desperate for the truth and real actionable research.

As one of my readers said, “I wish I would have found you years ago… I’m now very hopeful for the future.”

In a moment, I’ll show you how you can join – if that’s something you’d like to do – without risking a penny.

Sure, many scientists, economists, and futurists are trying to get this story about exponential technologies out to the masses.

But hardly anyone is connecting the dots and showing real people how to set themselves up to potentially PROFIT from it.

That’s why today, I want to share one of my favorite Flippening investments with you today.

The #1 Stock To Buy Today

I’m sharing it with you completely free of charge… with no loopholes or agendas.

I don’t own any shares of this company and have no affiliation or backdoor deal with them.

I’m simply telling you this as a sample of the types of opportunities and research I find for the members of my group.

I believe this stock could easily double or triple your money in the next few years.

It’s in the perfect position to profit from the Flippening.

That’s because it provides the parts to some of the largest car companies in the world – Ford, GM, and Volkswagen.

Not only that, but it can do something that some traditional auto suppliers cannot…

It can also supply parts for Electric Vehicles.

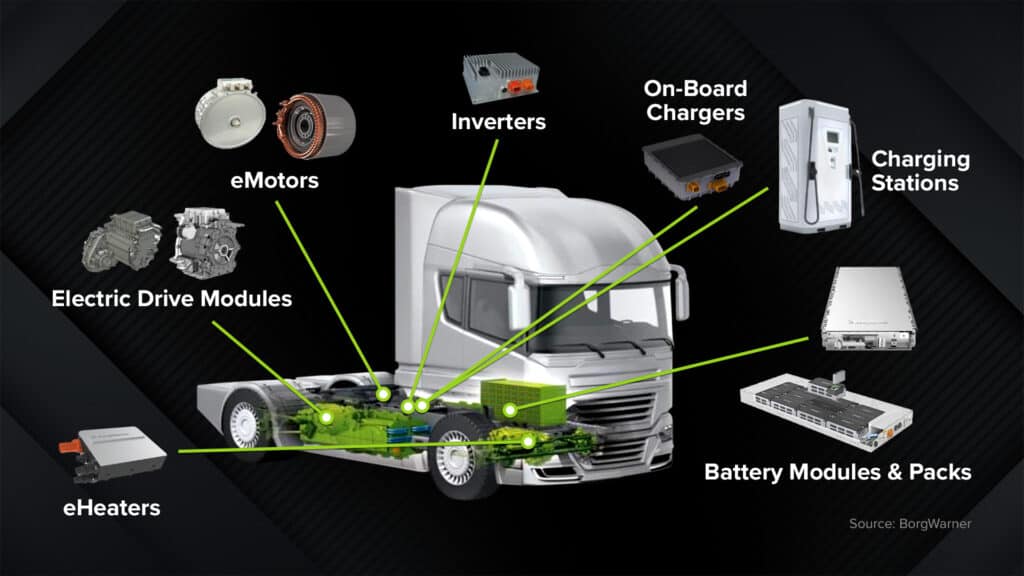

Take a look at this truck…

These are all parts required in an electric vehicle that don’t exist in diesel or gas-powered cars.

And the company I’ve found makes them all.

Many other auto part suppliers are still stuck in the past. They never took the time to master these new products.

I think this stock could easily triple as electric vehicles continue to play a larger and larger part of our lives.

You already see the charging stations all around, right? At the grocery store, the airport, the shopping mall.

You see more and more Teslas on the road.

You may have even seen that Ford just came out with its first EV truck, the Ford Lightning.

Over 44,000 reservations were made in the first 48 hours alone. They had to stop taking orders.

A small investment in this company could help you capitalize on all this demand…

It’s called BorgWarner…

It trades on the New York Stock Exchange under the ticker symbol

B-W-A.

But, look, it’s not going to make you rich.

To do that you’re going to need to more than just double or triple your money on one stock.

More specifically…

You want to own the stocks that could go up 10x or even 20x in the years to come.

They’re certainly out there.

So, I recently put together a list of the top stocks that I predict will AT LEAST 10x your money from here.

The problem of course is that most people won’t recognize these investments until it’s too late…

Just like what happened with Amazon and Bitcoin.

You need to be prepared.

Because you’re going to hear about all sorts of new companies and technologies in the months and years ahead.

It’s going to be difficult to determine which will stand the test of time or make you the most money.

So, here’s what I recommend you do to capitalize on The Flippening.

FIRST: Get the names of my favorite Flippening stocks – that could soar in value this year and potentially for years to come. I’ve included my shortlist in a new report I can send you today risk free called The 2022 Flippening Blueprint.

This report is just about 20 pages long, but it’s one of the most valuable resources in America for anyone who cares about their financial future and is looking to get ahead.

Inside the report I’ll show you:

- The companies I’m tracking today that could EACH soar 1,000% in the years ahead… including the one I think is most likely to see it’s Flippening first. As I mentioned earlier, I’ve identified forty (40) companies during my career that have seen gains as high as 1,000%. This could be the next batch. Each is a leader in the technologies that’ll dominate the Flippening.

- I’m also going to tell you about my favorite personal investment. It has nothing to do with stocks or any orange phase technology… but I believe it will soar right along with them in the months ahead. I’ve helped thousands of people get started with this unique investment, and I’ll show you how to do the same in this report.

- The Blueprint will also cover how to handle big market swings. I’m sure you’ve noticed that technology stocks can rise and fall quite quickly. That’s because, as with all stocks, investing in technology comes with risk. Nobody’s past performance can predict future success. You should never invest money you don’t have to lose. But when you follow the strategy I’ve outlined here, you can mitigate that risk. This may not seem important – but it's absolutely critical to your success and safety. I seriously doubt your financial advisor or broker will ever share this secret with you, but this one simple idea alone might save your retirement.

And here’s the second thing I suggest you do…

As the Flippening plays out, we’re going to see waves of bankruptcies and losses as old industries are destroyed by new technologies.

As I mentioned earlier, Yale’s Richard Foster estimates that 40% of today’s Fortune 500 companies will be eliminated sometime in the next 10 years.

Remember… Bethlehem Steel and others like Eastman, Kodak, and Sears used to be some of the largest companies, too. Right?

Today, they’re totally irrelevant.

And their investors lost fortunes as their stock prices dwindled.

That’s why you need to make sure you’re not holding shares of any of the companies in the direct line of The Flippening.

I’ve identified five (5) well-known companies that are particularly vulnerable.

You may be holding shares in a 401k or IRA account right now.

Some of these are household names.

Reading this second report, called The Flippening Failures, could save you or a family member literally thousands of dollars if you happen to own these.

I’d like to send you a copy of this report right away, too.

If you follow the simple instructions inside, I can all but guarantee you'll escape with any profits you may have made long before things fall apart.

I hope you can see that I want to be there – every step of the way – for those of you who realize the opportunity in front of us with The Flippening.

I’ll send you these two reports right now when you join as a trial subscriber to The McCall Report.

But I understand how important decisions like this are so…

Here’s How To Know If This is For You

My goal with The McCall Report is to bring you opportunities you’re not going to find anywhere else.

Not on the Internet. Not from the financial news. And not even from your financial adviser or broker.

Stocks are my passion – and they have been for as long as I can remember…

25 years ago, I doubled what little money I had to my name in the stock market, and never looked back.

Since then, it’s been my mission to prove to others that if a poor kid from Pennsylvania can get to where I am today, anybody can.

The stock market is the great equalizer.

You live in a rigged system… with everything fighting against you right now.

Inflation… an out-of-control government experiment with money printing… a wild stock market… and decaying entitlement systems that were supposed to protect you.

But the right moves today could make all those problems go away for you.

Just think what my winners could have done for your wealth.

- Bitcoin (BTC)… +10,038%

- Cardano (ADA)… +8,211%

- Advanced Micro Devices (AMD)… +5,624%

- DexCom (DXCM)… +4,295%

- Stamps.com (STMP)… +3,212%

- Mercadolibre (MELI)… +3,100%

- Fulgent Genetics (FLGT)… +2,751%

- Boston Beer Company (SAM)… +2,669%

- Amazon (AMZN)… +2,666%

- Mercadolibre (MELI)… +2,509%

- Ulta Beauty (ULTA)… +2,332%

- NetEase (NTES)… +2,120%

- Insulet (PODD)… +1,924%

- Tesla (TSLA)… +1,854%

- Ilika (IKA.L)… +1,661%

- Salesforce (CRM)… +1,635%

- O’Reilly Automotive (ORLY)… +1,625%

- Workhorse (WKHS)… +1,539%

- ODP Corp. (ODP)… +1,502%

- Heska Corp. (HSKA)… +1,462%

- Axon Enterprise (AXON)… +1,427%

- Ford (F)… +1,423%

- Starbucks (SBUX)… +1,393%

- iRobot Corp. (IRBT)… +1,375%

- Cedar Fair (FUN)… +1,363%

- Bank of America (BAC)… +1,350%

- Align Technology (ALGN)… +1,231%

- American International Group (AIG)… +1,205%

- SVB Financial Group (SIVB)… +1,200%

- American Water Works (AWK)… +1,180%

- EHang Holdings (EH)… +1,163%

- Heska Corp. (HSKA)… +1,159%

- Facebook (FB)… +1,147%

- Atlassian Corp. (TEAM)… +1,132%

- ServiceNow (NOW)… +1,120%

- Apple (AAPL)… +1,107%

- Silvergate Capital (SI)… +1,075%

- Veeva Systems (VEEV)… +1,068%

- Ross Stores (ROST)… +1,062%

- Netflix (NFLX)… +1,056%

- Amazon (AMZN)… +1,053%

- Allergan (AGN)… +1,051%

- Kulicke and Soffa Industries (KLIC)… +1,030%

- Dollar Tree (DLTR)… +1,016%

- Ubiquiti (UI)… +1,011%

*All investments carry risk. These are some of Matt’s best gains; not all investments will perform as well.

These are the opportunities I’m looking for everyday for you.

But it's a BIG job.

So, to help me, I've hired a small team.

I also travel in person… hundreds of thousands of miles in the past few years… investigating my favorite opportunities firsthand.

Just this year I went undercover at one of the country’s largest electric vehicle shows… I was invited to be a VIP at the grand opening of the world’s first flying car airport in the U.K… and I had dinner in Miami with some of the biggest names in the cryptocurrency space.

Plus, I've had the good fortune to meet or consult with some of the brightest minds in the investing world…

Like former U.S. Secretary of Commerce, Wilbur Ross… billionaire hedge-fund manager Leon Cooperman to former GE CEO, Jack Welch.

But nothing makes me happier than hearing from people who’ve come to depend on me and my work.

One of my followers named Eddie said,

“Your concept of investing in exponential companies is revolutionary. I’m up more than $100,000.”

Another named Raven said,

“I have had one 20x, one 10x, and multiple 3x and 5x positions in the past 12 months. Your ideas and conviction have helped guide my conviction to stay invested.”

And one of my followers reached out on Twitter to say:

*The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

I hope to get one of these notes from you one day soon, too.

But if you’re still on the fence about joining me…

I've come up with a way for you to do it totally risk free.

How to Get Started Risk Free

A one-year subscription to The McCall Report, including everything I mentioned here, normally costs $199 per year. That's what many others have paid.

But right now, you can try my research, for OVER HALF OFF the normal rate. You'll pay as little as $49 for an entire year. That's a 75% discount.

Why so cheap?

Well, I only stay in business if my subscribers stick with me for the long term. But I realize you have to try it first too, to see if it's right for you. Like a test drive.

And that's why, since you’re watching this, I want to give you the next 30 days to look at my work risk free… plus my complete library of reports and back issues.

Including:

- The Flippening Blueprint, which names all my favorite stocks to buy right now.

- My new Flippening Failures report, which is going to tell you the five companies to avoid.

- And the McCall Report Investor Handbook. Here’s where you get a deeper look into my investment philosophy and what makes my work so unique.

You’re also going to get immediate access to my Live Quarterly Updates.

Even though I have a podcast with over 400,000 subscribers and tens of thousands of people who follow my Twitter page… this Live Quarterly Update is ONLY for McCall Report subscribers. (It’s where I share all the good stuff.)

I’ll share my latest thoughts on the market, recent news, and what trends and stocks I’m most excited about.

Plus, you’re also going to get instant access to my model portfolio, which includes many more recommendations you can act on right now.

Even better, like I said, you can get all this without risking a penny.

100%-Satisfaction Guarantee

When you take a trial subscription to The McCall Report today… I'm going to give you the next 30 days to check it out and see what you think.

And again, it’s for less than what you’re probably paying for a night of take out… or a month’s worth of streaming subscriptions.

Chances are, if you're like most of my subscribers – you'll never want to stop receiving my research.

But if you decide to cancel for any reason within the first month, you can get a full refund… and keep everything you've received.

In other words, by taking me up on this offer, you are agreeing only to TRY my work to see if you like it.

I hope you take advantage of this opportunity.

We’re at the very beginning of the largest money-making decade of our lives.

No one is talking about The Flippening right now, they’re distracted and they’re frustrated but I promise they will be soon.

It’s very difficult to put together all the pieces like this, and I doubt anyone else will do this for you until all the biggest gains have passed.

The Flippening is going to reimagine every industry… health care, transportation, dining, travel, manufacturing, education, entertainment, finance, shopping, energy… faster than you can even imagine.

Within minutes, you can have access to research that’s going to show you how to relieve your frustrations and set yourself up to profit from it all.

And again, all this is yours to keep, whether you choose to continue with it or not.

You won't risk even a penny to check everything out.

The only question is, will you act this time?

To get started, click the button below.

Here's to exponential gains,

Matt McCall

Editor, The McCall Report

May 2022

Legal Notices: Here is our Disclosures and Details page. ABOUT OUR BUSINESS contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works – both the benefits it might offer you and the inevitable limitations of our products. Although this is not a part of our ” Disclosures and Details” page, you can view our company's privacy policy here.