Presented by TradeSmith

Legendary Stock Picker Who Recently Went 13 Weeks Without A Single Loss:

“In 10 Years, Stocks Will Be Worth the SAME Amount… But These Unusual Trades Could Be Up 1,000% or More.”

Get Our #1 Recession-Proof Investment Disclosed On-Air for FREE

Julie:

If you’ve tuned in today, your timing couldn’t be better.

My guest recently joined the ranks of investing legends…

When for three months straight he didn’t pick a single losing trade.

And he credits this 100% win rate to an investing secret he’ll reveal on camera today.

As we’ll get into, Mike recently dragged himself out of an exciting sabbatical at sea to focus on the crown jewel venture of his lifetime.

If you’re streaming this video, you might recognize Mike from his appearances on CNBC, Fox Business, and Barron’s…

Mike Burnick, thanks so much for taking the time to join us.

Mike:

You’re welcome, Julie. But I should really be thanking you. You’re giving me the megaphone I need to get this message out there at a very critical time.

Julie:

Mike, this is such a weird time we’re experiencing.

Even for someone who’s seen it all, like you.

With 35 years of professional investing experience, you’ve lived through 6 different stock market crashes.

With some highly-publicized, extremely accurate calls I was able to get my hands on…

In November 2008… after the market had fallen 50% to record lows…

CNBC sought you out to ask what investors should do next.

You told them:

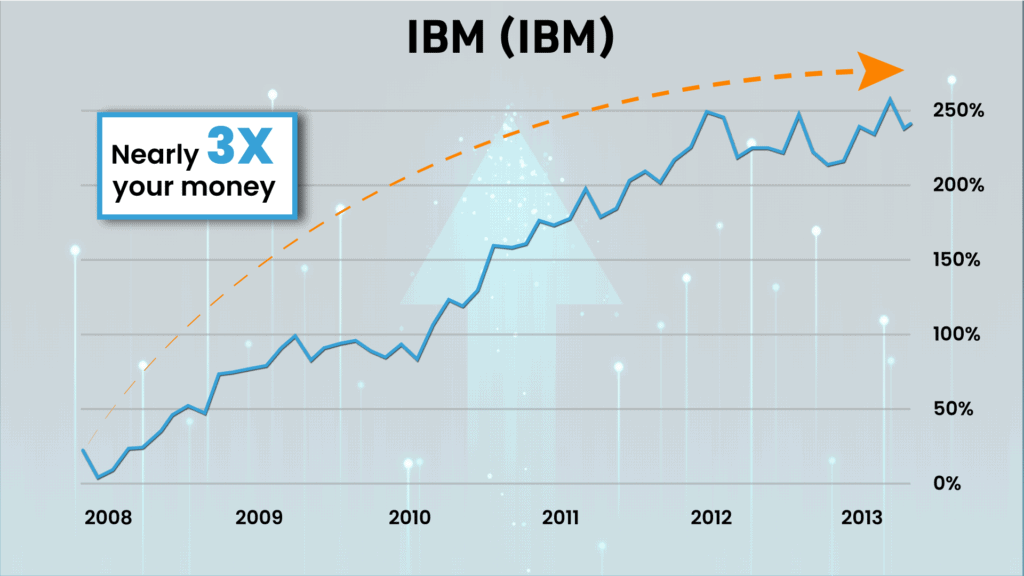

The next day, IBM started an unbelievable march higher. Anyone who listened could have nearly tripled their money.

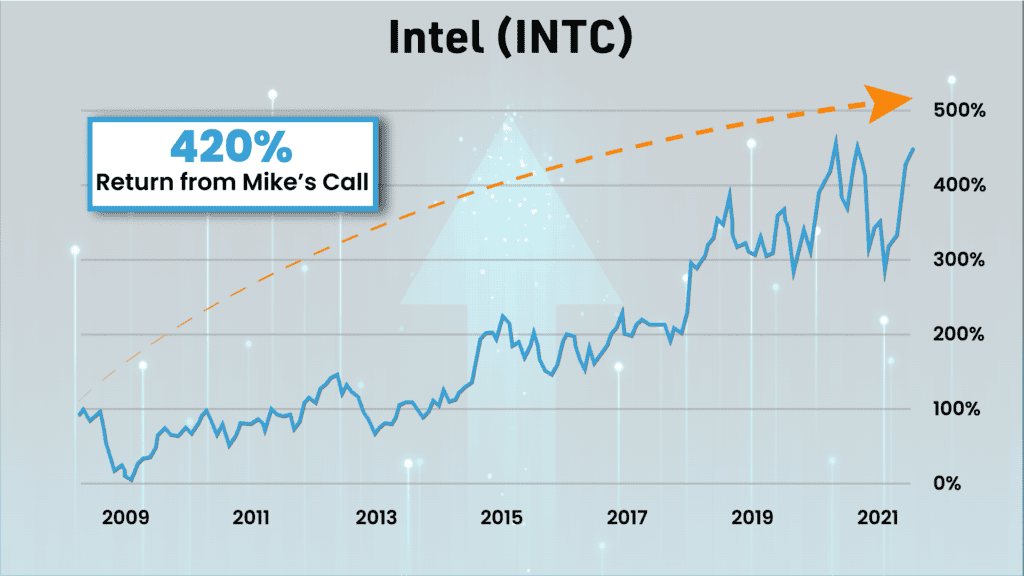

Intel then shot up 420% — enough to turn every $100 into $520.

But Mike, you didn’t stop there, do you remember what else you told CNBC?

Mike:

Well I’m in the media a lot Julie, and that was in 2008, but I think I mentioned a few stocks to steer clear of.

Julie:

Good memory Mike, you said:

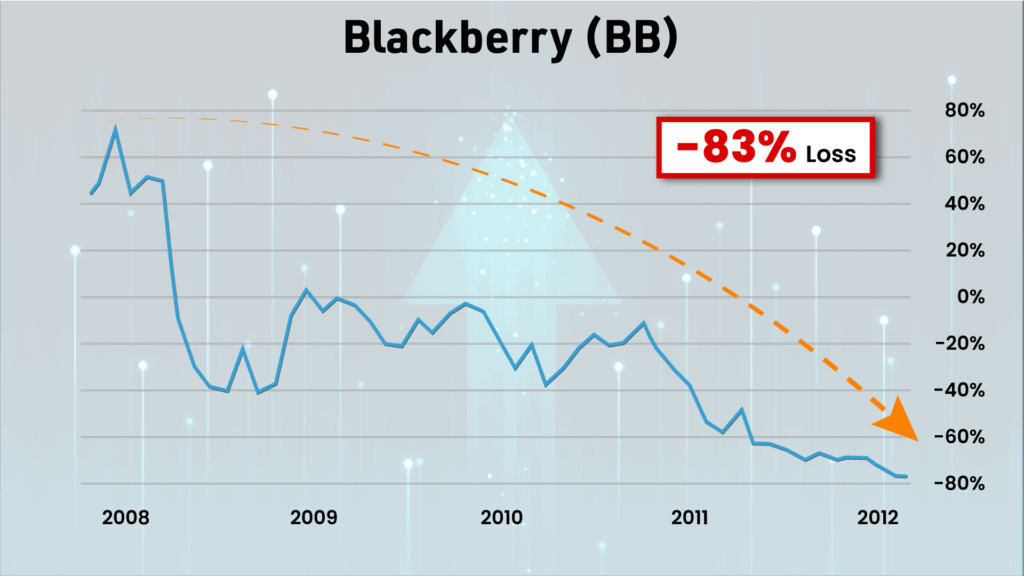

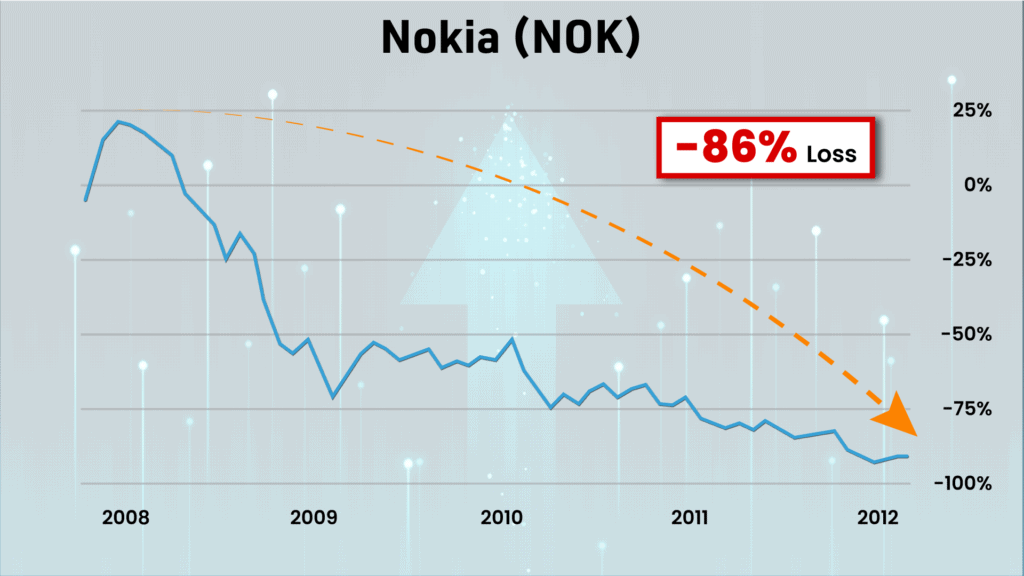

After Mike’s prediction, Blackberry & Nokia plummeted.

Blackberry falling 83%…

And Nokia dropping a gut-wrenching 86%.

Anyone who held these popular stocks & heeded Mike’s warning… would have avoided 2 devastating losses.

Mike:

I’ve got a lot of notches in my belt. So, I hope my 35 years of experience can really help people avoid those kinds of losses right now. Because, to get through this mess, you’re gonna need a steady hand.

Julie:

Absolutely, Mike. And right now, you say anyone watching is going to get your top pick for free? – That’s very generous.

Mike:

Not just that, Julie. I’m also going to give everyone my #1 stock to sell & avoid at all costs. And I’ll share those for free, no strings attached.

Julie:

I can’t wait to hear what they are.

But I have to ask Mike, you left your sabbatical early I kind of expected you to be in full on Tommy Bahama, but here you show up instead with this briefcase. I never pegged you for that kind of formality.

What’s going on, tell us about this thing.

Mike:

Before we’re done here, I’ll let you open it up yourself. Because what’s inside holds the secret to turning this Great Flatline… into tremendous wealth in the months ahead.

Julie:

Now you’ve got me very curious. Before I forget, some of our viewers wanted me to ask you what’s going to happen next.

A lot of folks are fearing a repeat of 2008…

But you’re predicting a very different type of outcome from this bear market, is that right?

Mike:

Julie, we’re in the first inning of what I call “the Great Flatline.”

This is what I’ve coined it, but it’s not just me that’s preparing…

The world’s smartest billionaire investors are all calling for the same thing.

Ray Dalio, the billionaire founder of America’s #1 hedge fund, warns of a “Lost Decade for Stocks”

Charlie Munger, the right hand man & partner of Warren Buffett for the last 30 years… he expects the same:

But while billionaires exit their stock positions at a record pace…

And while the financial media is predicting a “Lost Decade”:

NOBODY is showing ordinary folks how to prepare – let alone how to profit in the weeks and months ahead.

Julie:

But you’re here to show everyday people, the next steps to take and the best stocks to buy – as well as to avoid, right Mike?

Mike:

Absolutely. The nervous nellies are selling everything they can.

The so-called “smart money” is saying “hold” – “do not sell.”

How do you make heads or tails of all this?

I’m going to show you which stocks to SELL – and which ones may be ticking time bombs in your retirement portfolio.

But the even more important thing when it comes to making a lot of money, is knowing which stocks to BUY for potential 10-bagger gains…

Starting with my #1 stock to buy today, a little-known battery company set to soar in the coming weeks.

Remember, we’re entering a shift that will define the next decade of investing gains.

How you position yourself now will have HUGE consequences for your money.

That’s why I’m going to reveal how the secret weapon in this briefcase could let you fight back against the Great Flatline — and win.

Julie:

Now, before the cameras got rolling, you told me there’s a secret to

Predicting which stocks are likely to jump 300%… 500%… even 3,000% — before they go up

Is that right?

Mike:

I know it sounds crazy, but the secret is a formula that reveals one key piece of information about a stock.

See, every stock has an internal switch — call it a “profit switch” — and this switch flips on and off throughout a stock’s lifecycle.

Which is MUCH different than how most people look at stocks.

Most times, people think about a stock as a buy, a hold, or a sell.

At any given time, a stock is always in one of those 3 categories.

Think of it like a traffic light. You’ve got red, green and yellow.

That’s what people see.

But what most people ignore… is the moment when a stock switches from red to green… green to red… etcetera.

And that’s the only moment that really matters.

At least when it comes to making big money over and over as an investor.

And what this secret weapon does – is alert you to the moment that switch “flips” inside a stock.

Julie:

So, simply knowing when a stock flips is the key to making a lot of money in this market?

Mike:

Bingo. And I’d love to show you here and now how to take advantage of knowing that — by giving you an actionable stock pick before we’re finished.

Now, if you’re wondering just how lucrative investing can be when you’re able to pinpoint this “switch” — let me show you some examples I brought.

Julie:

Let’s see them.

Mike:

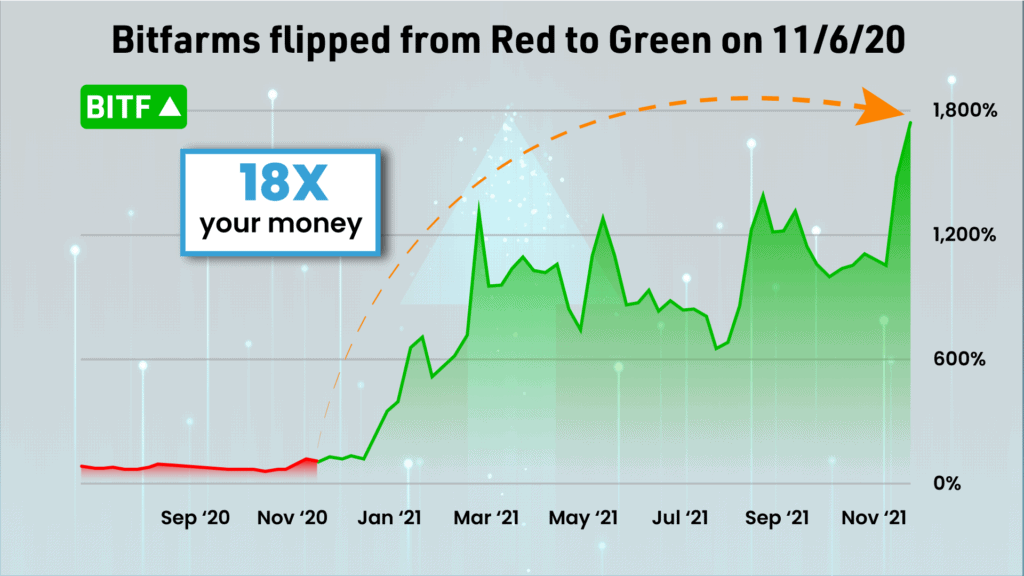

Alright, look at this stock, Bitfarms.

When its profit switch “flipped” on November 6 2020, you could have gotten in for less than $1.

By the next November, it had skyrocketed up 1,700% — that’s more than 18 times your money.

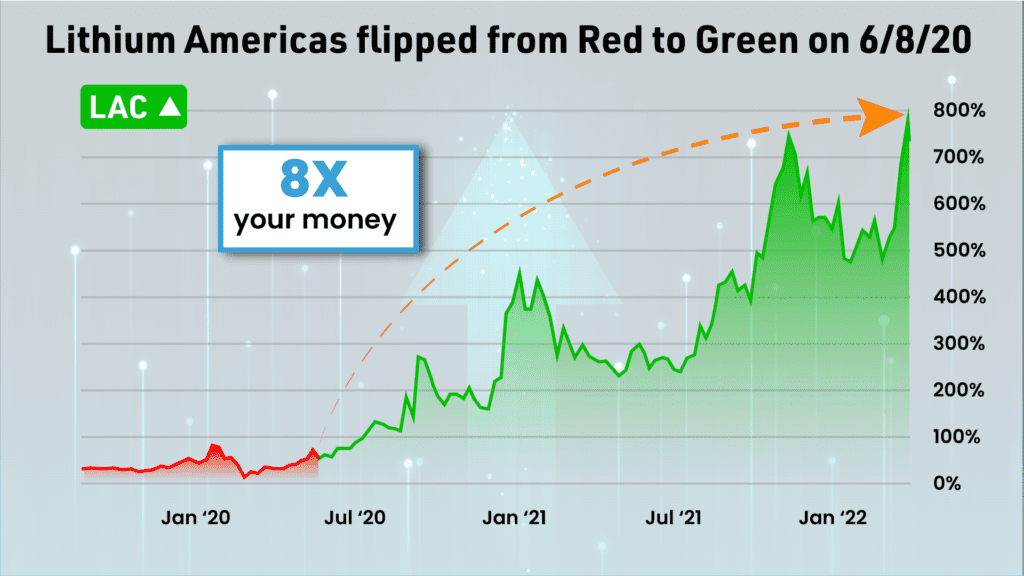

Or take Lithium Americas… shares were less than $5.

Then the stock’ s profit switch flipped from red to green.

Check it out… it then jumped over 700%.

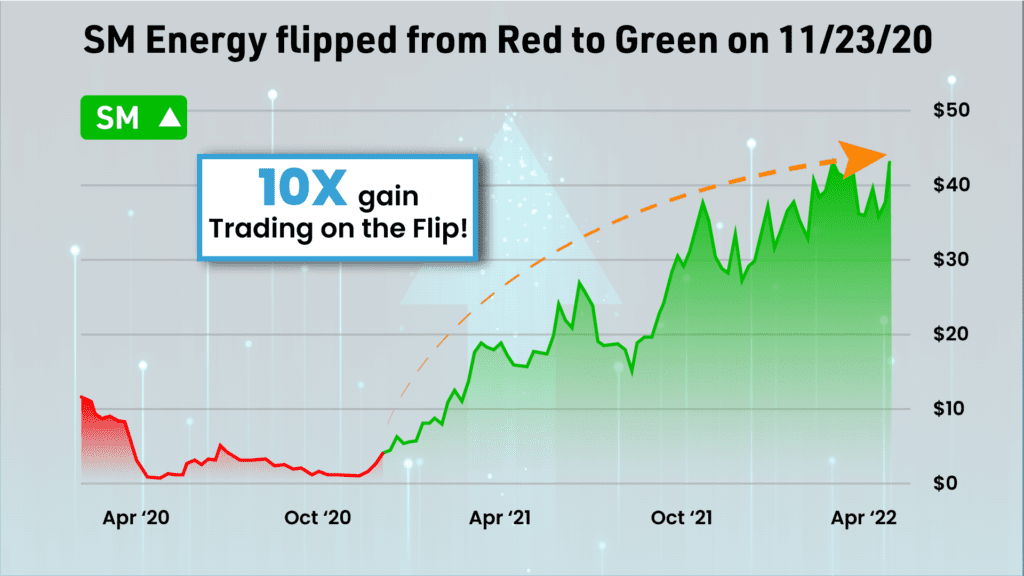

Another stock called SM Energy cost just $4 when it flipped from red to green on November 23, 2020.

After the flip, it surged to $42 a share.

Julie:

From $4 to $42.

10 times your money after the stock’s profit switch “flipped.”

What am I looking at? Somehow these flips are making us money? Clear that up for me here.

Mike:

These “flips”… they are the exact moment in time when a stock mathematically switches from being a sell to a buy… or a buy to a sell.

Effectively, unless a stock is flipping, it’s not doing anything to tell us whether or not we should buy it.

In fact, it’s not doing anything actionable at all.

If you’re trading in those stagnant windows of time, you’re mainly doing “guesswork”.

And that’s not a sustainable way to invest.

Julie:

So if you just pay attention to the moments when stocks flip – red to green or green to red, for example – that’s the key to potentially making money?

Even in a flat or bear market?

Mike:

Exactly.

Julie:

That sounds easy. Green light, go. Red light, stop.

Mike:

Exactly, that’s what I mean. It’s as simple as reading a stoplight.

Julie:

The examples you just showed us, I mean, they’re monster gains….

You always hear “never try to time the market.” But it seems you’ve figured out how to do exactly that.

So I have to ask, how are you able to see when a stock flips?

Mike:

It all comes down to a wildly accurate algorithm I discovered by accident during sabbatical.

It runs millions of calculations on over 150,000 securities, showing me which ones “flip” on a given day… and are likely to grow a LOT in the months ahead.

Julie, if I’m being honest, this algorithm is the sole reason I went back to work after just 5 months…

It’s the reason I’m sitting here now.

Julie:

So this is why Mike Burnick, the legend, dragged himself back into the game.

Mike:

Well, first of all, there’s only so many hours you can spend on the boat fishing…

But really, with a discovery that could, frankly, turn a lost decade into what could be the most lucrative 10 years of my life… why would I spend my days NOT making money?

Julie:

I can’t argue with that, Mike. But you clearly aren’t trying to keep this a secret anymore. Why’s that?

Mike:

Look, Something massive is happening right under our noses.

It’s a sea change I believe we’ll look back on decades from now…

As the moment most Baby Boomers… went bust.

But let me be clear, whether you’re 35, 55, or 75…

This strange & frustrating new era — the “Great Flatline” — will affect everyone

Many will be left behind.

For those who don’t see it coming, enormous financial suffering will follow.

That’s why I’m here, because the secret I’ll reveal could be the only way to turn a decade of pain into a period of massive profits.

Julie:

And you say it all comes down to being able to see the day a stock flips and then taking action.

Mike:

That’s right, and when you understand how these “stock flips” work, I think you can come out of this lost decade okay.

Better than okay.

The secret in this briefcase could hand you ridiculously profitable stock picks every single month.

Not only will you be able to protect your money…

You’ll have chances to lock into dirt-cheap stocks before they jump by 1,000% or more — and that’s not hyperbole.

Boom… bust… or flatline — there’s ALWAYS, always stocks on the verge of a “flip.”

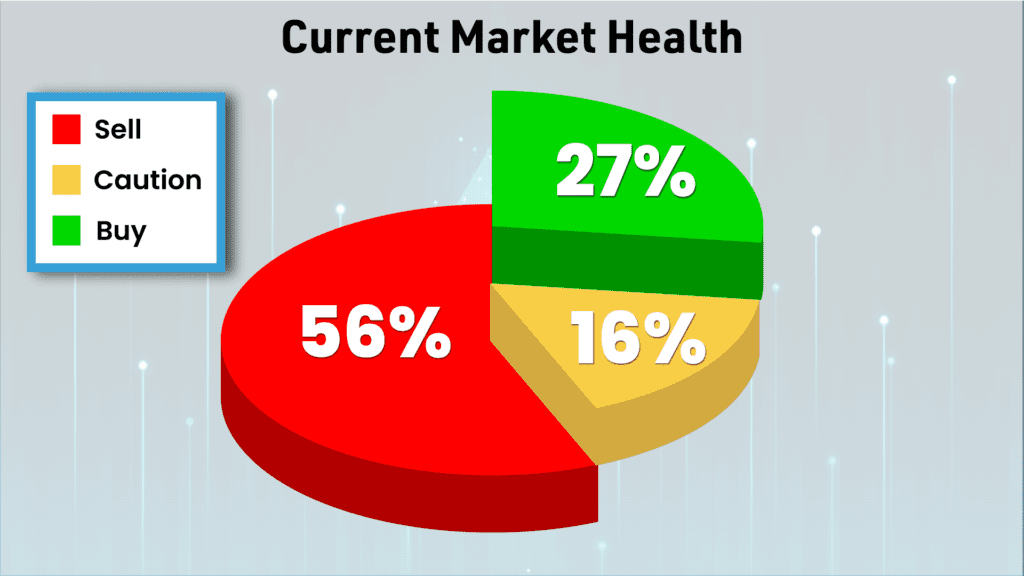

I just looked this up, and as you can see right now…

56% of the market is in the “red zone”… 17% is in the “yellow zone”… and the rest of the market is still sitting pretty in the “green zone.”

Julie:

So even with all this chaos, 27% of the market is still considered to be in a “safe zone”?

Mike:

Exactly. And the key thing to know here is – these zones are being tracked constantly.

So when a stock “flips” from red to green — it sends an alert to buy or sell that stock before a major price move.

And these flips happen weekly, if not daily… so there’s always new opportunities to spot big winners.

Julie:

So, a flip isn’t just a stock changing directions, right? For example, a stock that was going down is now going up?

Mike:

Not at all… basing buys and sells on price changes alone, which a lot of people have been taught to do… is a very bad idea.

The real secret is a set of calculations which run automatically on over 150,000 securities…

And signal when it’s time to decide to get in – and out – for potential gains of 1,000% or more.

These calculations measure a stock’s health in real-time based on both momentum and volatility.

Julie:

Ok, Mike, you managed a LOT of money at your previous fund… and how does this compare to the strategies you used to make your clients money through previous downturns?

Mike:

Well, I’ll say this… our strategies were quite complicated. I’m talking advanced options, credit spreads, things the average investor doesn’t have the time or know-how to execute safely.

That’s why I’m so excited to show you what’s inside this briefcase. It gives you the SAME type of advantage we had, but without the complexity.

Today’s secret all comes down to timing.

It’s simple.

When you get in. And when you get out. Those are the ONLY 2 things that matter… and it’s all you have to master if you’re looking to get rich in the Great Flatline.

There’s no studying 10-K annual reports, setting up a technical options account, or throwing darts at a list of stocks, praying you strike the next Amazon.

It’s much, much simpler… in fact, I think you’re going to be shocked when I let you open this briefcase here in a minute.

Frankly, and it pains me to admit this… but I didn’t discover the contents of this briefcase until 2020…

What’s inside though forced me to abandon the sabbatical I’d been planning for years… after just 5 months.

Julie:

You’re like the Bret Favre of finance, Mike!

Mike:

Ha! You a Packers fan?

Julie:

Wisconsin born and raised!

Now, I know you’re going to share the whole story behind the briefcase today…

Mike:

I am, and I’ll even let you open it too.

Julie:

Ok good, because I’m dying to see what’s inside.

Now, given how crazy things are right now – I think most investors are just hanging on.

Mike:

By their fingernails! Most folks are burying their head in the sand, hoping we get back to normal.

They’re invested in ETFs, indexes, dividend stocks — hoping to squeeze out 8 or 10% a year.

Julie:

But you say what’s in here…

can point you to potential “10-bagger” stocks at just the right time — EVEN IF we’re enduring the curse of the Great Flatline.

It flies in the face of everything I’m hearing in the news.

But you seem so… matter-of-fact about it.

Mike:

It can be hard to wrap your head around at first, but by the time we’re done today… you’re going to think about the stock market in a completely different way.

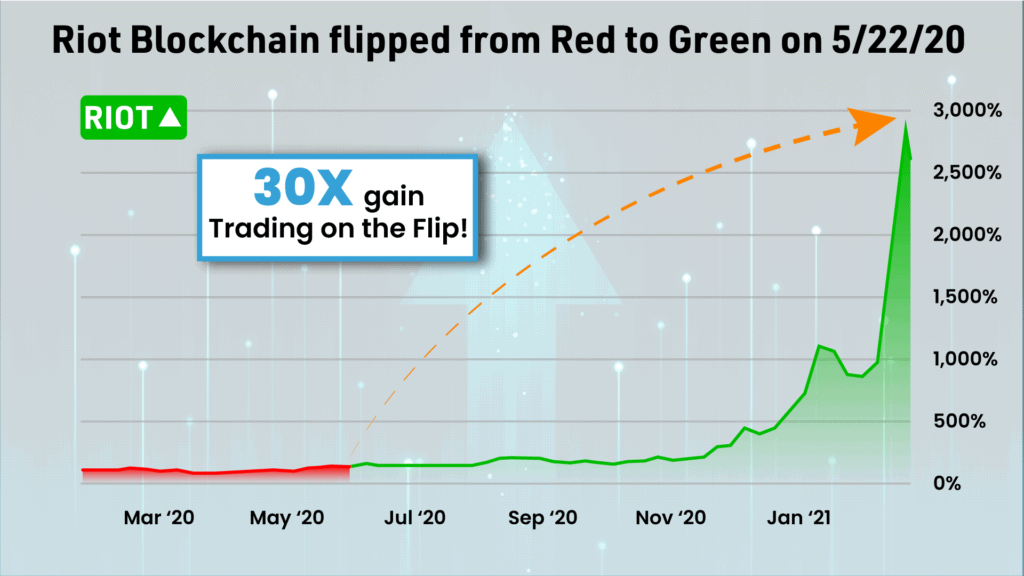

Again, let’s look at what kind of money can be there for the taking when a stock’s profit switch “flips” to green.

For example, on May 22, a stock called RIOT flipped from red to green.

Frankly, I knew nothing about it. They mine cryptocurrency, and most of my finance career was before crypto became popular.

But once RIOT flipped — it exploded from $2.24 per share… to as much as $71 per share.

That’s a 2,984% gain, in less than 12 months.

Julie:

Okay, first of all – wow.

That’s enough to turn…

$5,000 into $154,000 — in less than 12 months

But we are talking about a crypto stock… which still feels like the wild west to a lot of us.

How do we know this wasn’t a lucky strike?

Mike:

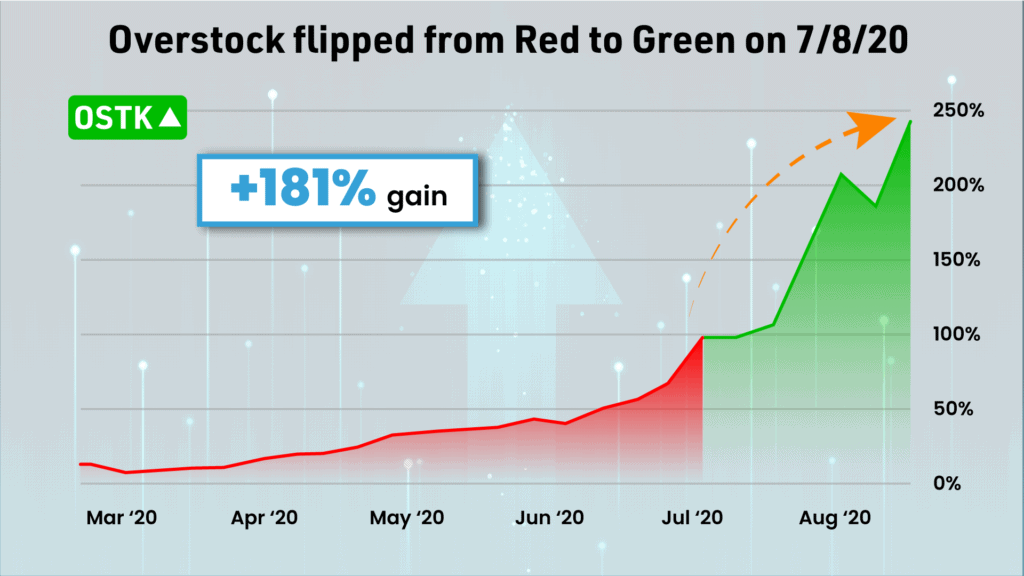

I’m glad you asked, because trading the flip works across every sector.

For instance, let’s look at e-commerce.

Look at the day Overstock’s profit switch flipped from red to green…

It jumped as much as 180% in just over 5 weeks.

Julie:

That wasn’t an option trade or anything? That was just the share price zooming up as soon as the stock flipped?

Mike:

Exactly right. Buy the stock. Sell the stock. That’s all you would have had to do to rake in that gain.

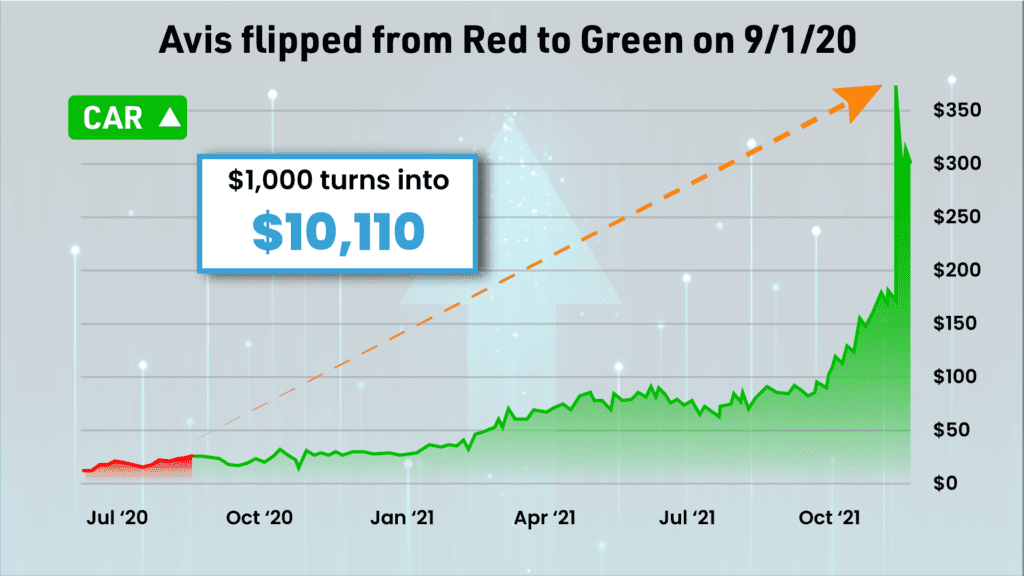

Here’s another one…

Shares of Avis, the rental car company, cost just $35 when the stock flipped from red to green.

A little over a year later… those shares blasted as high as $357

More than 10 times your money.

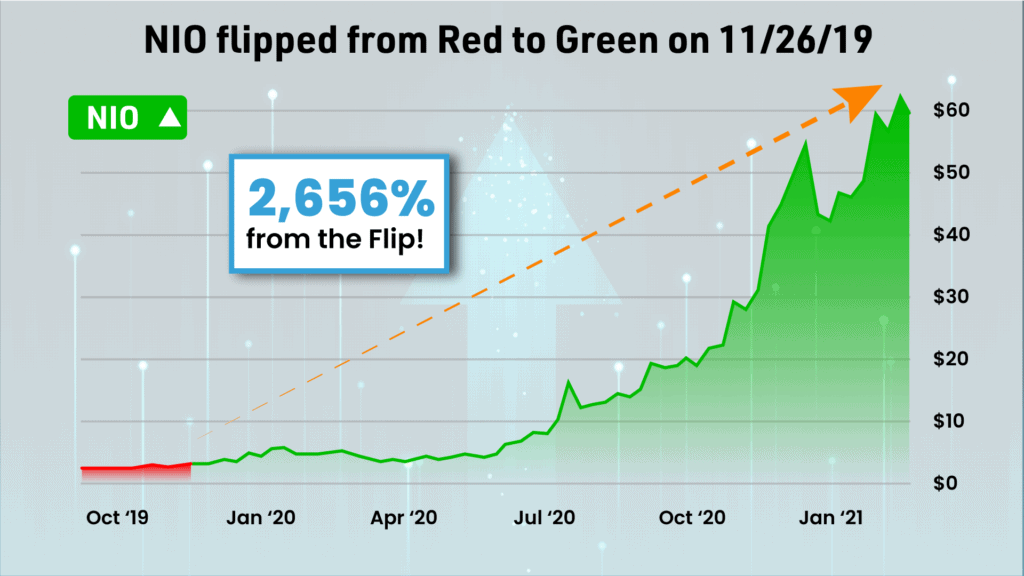

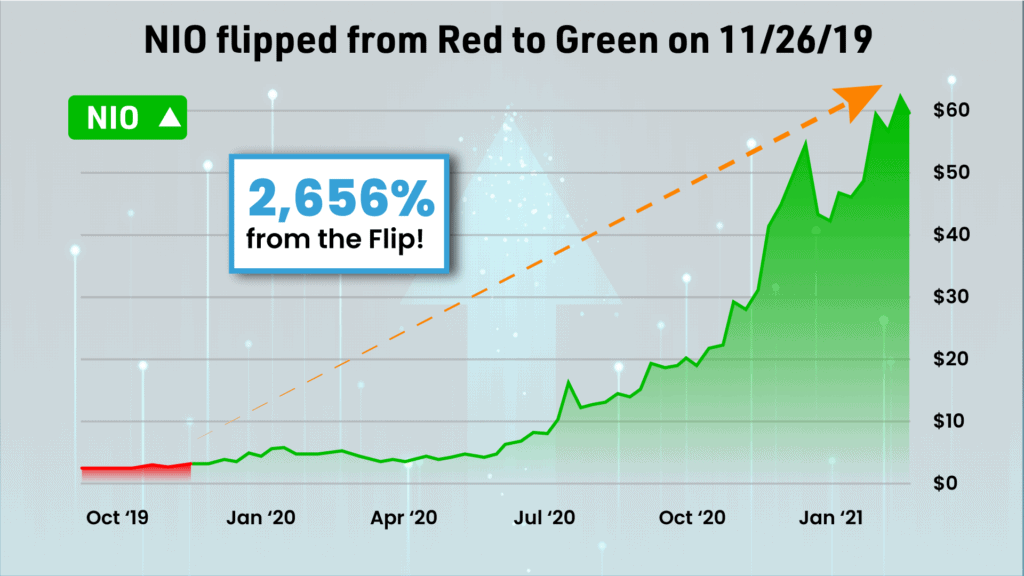

Check out this flip on the EV stock NIO.

You could’ve scooped up shares for just $3…

And cashed out with nearly 20 times your money just over a year later.

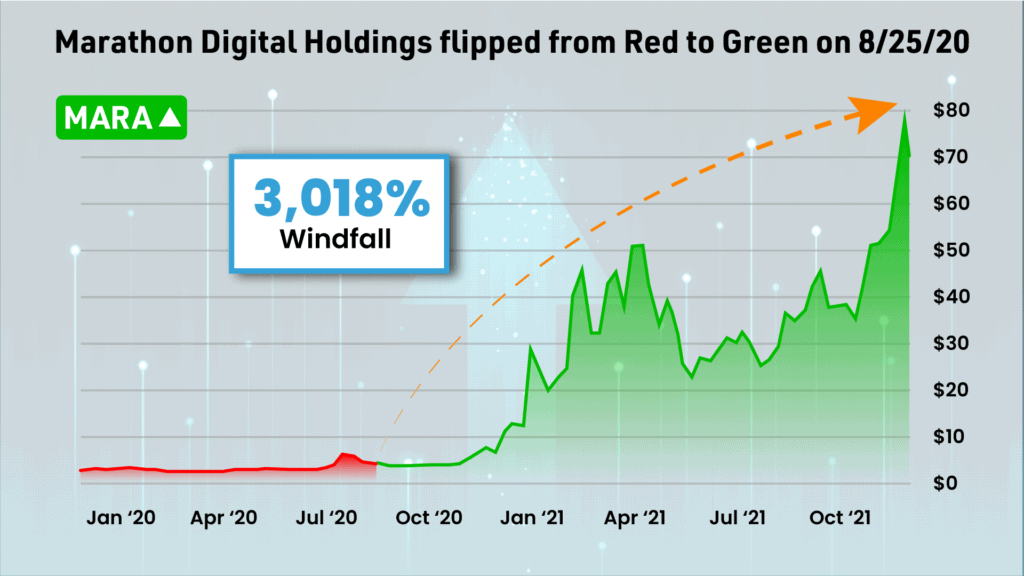

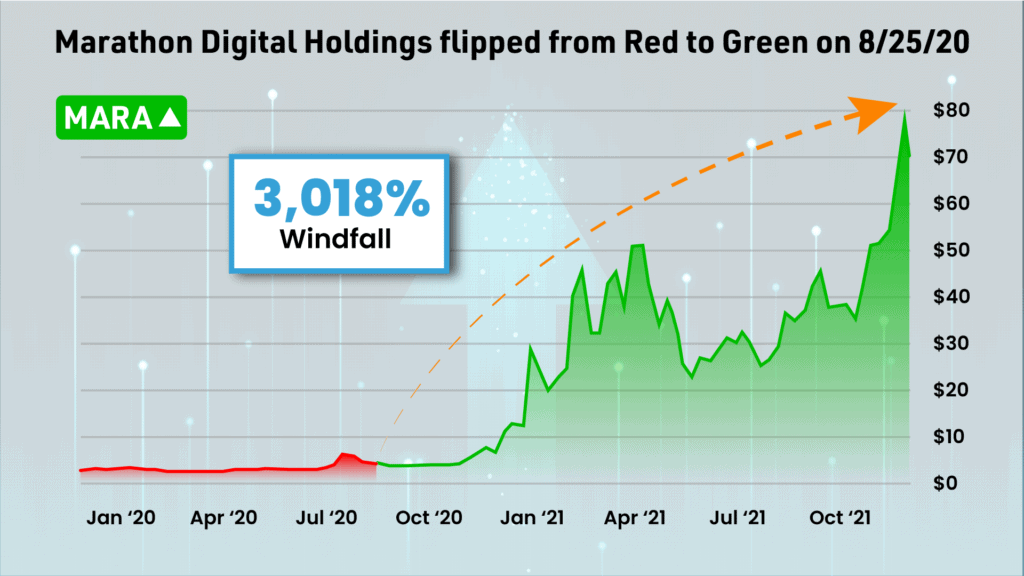

Then there’s digital holdings stock Marathon, ticker MARA.

When it flipped from red to green, shares went for $2.44.

So $500 would’ve gotten you about 200 shares.

This stock went crazy, surging to $10… then $25… and eventually $76.

Julie:

From 2 bucks to 76 bucks… that’s insane. And in how long?

Mike:

In just 14 months…

That little $500 investment would have been worth over $15,000.

On a $5,000 stake, now we’re talking about a payday of $150,000.

Now, of course these are some exceptional wins, and not every flip turns into a 3,000% gainer – but it’s important to understand the potential you unlock when you know how to trade the flip.

Here, take a moment to imagine something… you can go ahead and close your eyes if it helps.

If you’re watching at home, go ahead and play along too.

Ok, imagine how an extra $150,000 would change your life. Really picture it.

Ok Julie, what’d you see?

Julie:

Honestly, I saw a shiny new RV parked in my driveway, ready to hit the road!

Mike:

That’s wonderful Julie! And whatever $150,000 means to you… whether it’s sending someone to college… deleting a pile of debt… or just relaxing in the comfort of knowing your financial situation is covered, no matter what the stock market is doing.

There’s no right or wrong answer, but there IS a smarter way to get there…

This is truly a unique time in our lives, and while the Great Flatline threatens to wipe out years of savings, and leave countless investors behind…

I believe this little secret could turn a strange, unruly market into a money-making machine.

Julie:

If this is as powerful as you’re showing us, I can’t wait to see what it’s saying NOW about what to do NEXT.

I mean, I’ve heard people brag about doubling their money on Apple.

Which is amazing…

But 10… 20… even 30 times your money? These stock “flips” seem like a different breed.

Mike:

Well I’m glad you mentioned Apple… it was founded during the last great flatline of the 1970’s…

But take Uber, Microsoft, Hewlett Packard — these are ALL companies founded during a recession.

Most people understand “diamonds in the rough” exist, even in ugly markets…

But here’s what hardly any investors understand:

You just aren’t nearly as likely to see 1,000-plus percent returns…

UNLESS you catch a stock on the flip… and take action when it goes from red to green.

Julie:

This sounds incredible Mike, but many stocks have already fallen 20%, even 30%…

It feels like there’s nowhere to make money right now.

I think I speak for everyone when I say I’m most interested in seeing if trading the flip works in rocky times.

How has your approach held up recently — in late 2021 through 2022?

Mike:

I’m glad you asked. Because this is when you really need it. When the markets are down, volatile, flat… whenever there’s adverse conditions.

Here’s where trading the flip really shines.

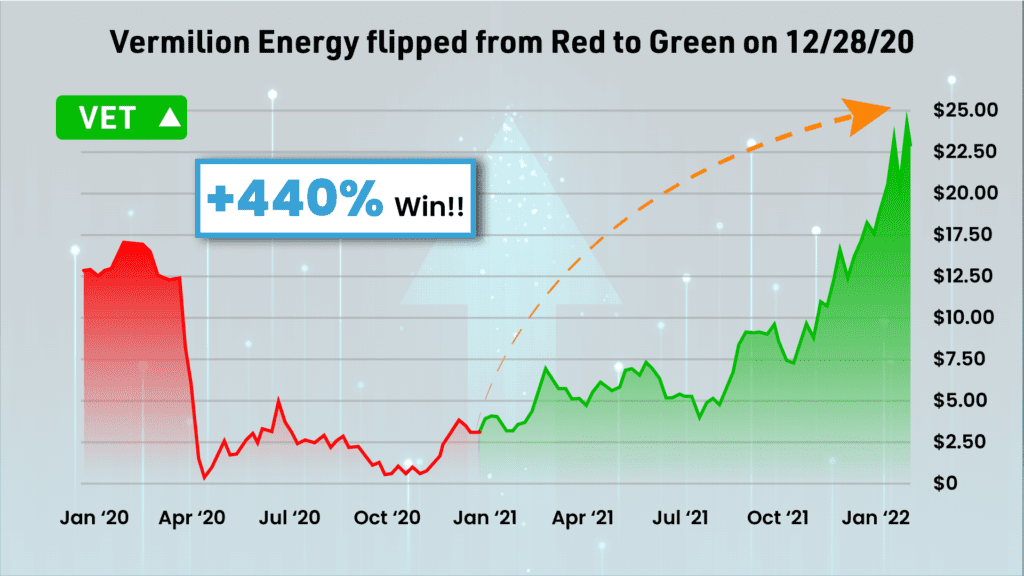

Take, for example, these gems in the energy sector.

When the switch flipped from red to green on this oil stock — shares cost $4.

After the flip – it rocketed from $4 to $23…

Enough to hand you a 440% gains in 14 months.

Julie:

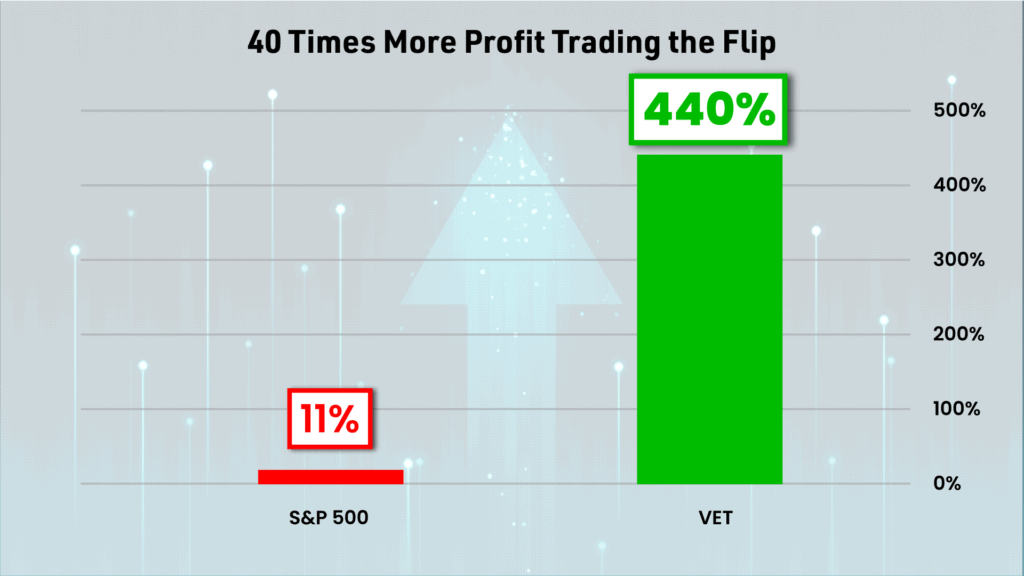

Wow, 5 times your money when the broader market did, well, hardly anything.

During the same hold period, the S&P 500 rose…

Let me see…

Just 11%. Versus 440%.

Wow.

Mike:

Like I said, every time a stock “flips” — you have a chance to crush the broader market…

And stuff years of stock market gains into a very tight window.

In this case, to the tune of 40 times more profit.

Vermilion Energy could have given you:

42 years of stock market gains all in just 14 months

But here’s the thing: when you can get into a stock on the day that it flips from red to green…

And then get OUT when it flips from green to red…

You can run circles around the rest of the market.

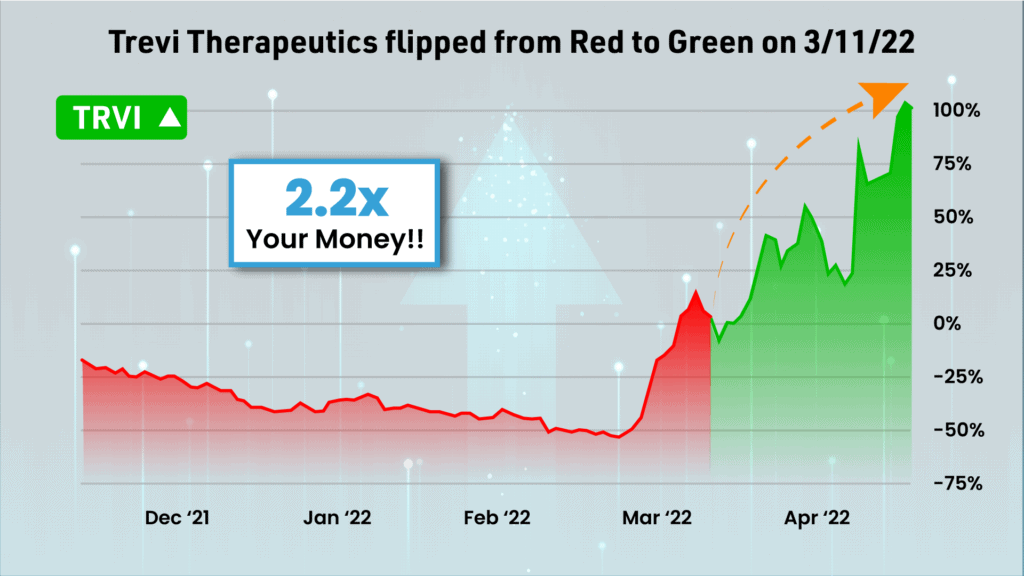

Take Trevi Therapeutics. It flipped from red to green on March 11, 2022.

A clear go signal…

Smack in the middle of the market’s “worst quarter in two years.”

You could have gotten in at a dollar fifty…

And cashed out with a 124% win about 5 weeks later.

Julie:

Wow, so DOUBLE your money in 5 weeks… all from a stock that cost, what did you say, $1.50 to get in?

You could have loaded UP on that one!

Mike:

That’s the beauty of this system. Not only can you “flip” ugly markets into fast cash…

You can spot “obscure” stocks right when they flip, and get in for dirt cheap.

Julie:

I love a bargain.

Mike:

You’ll love this one then.

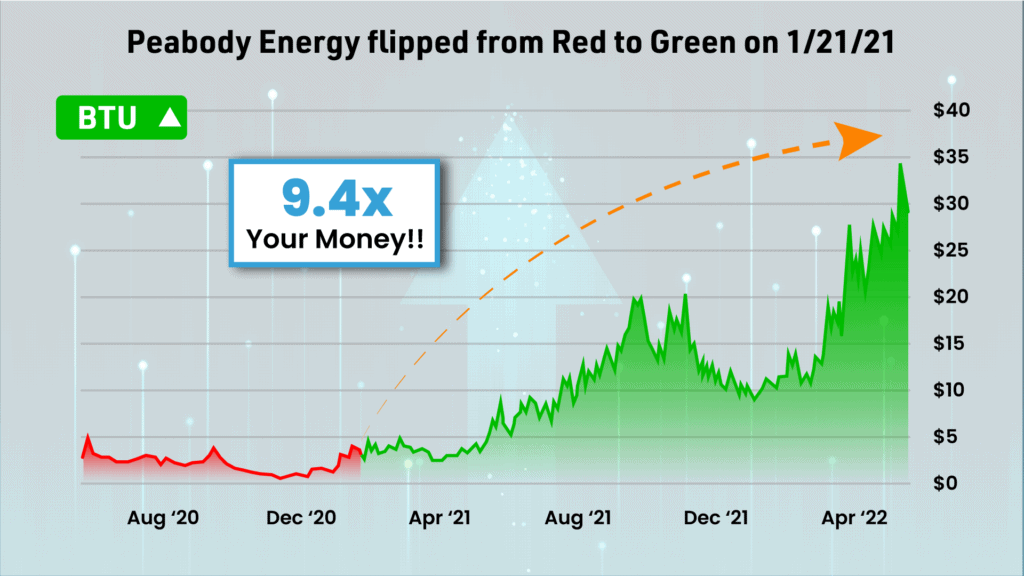

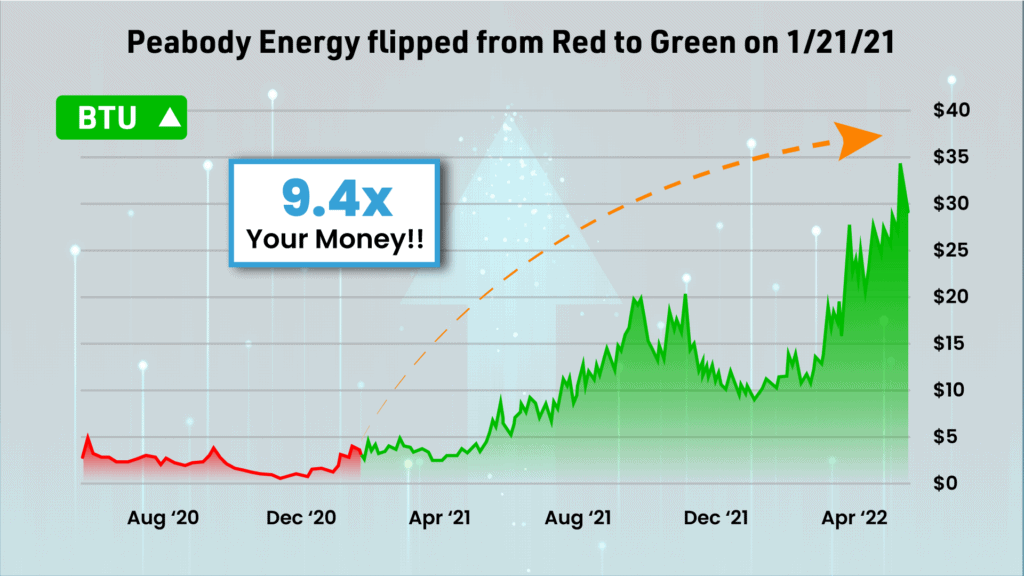

If you’d gotten into Peabody Energy when its profit switch flipped to green on January 21, 2021

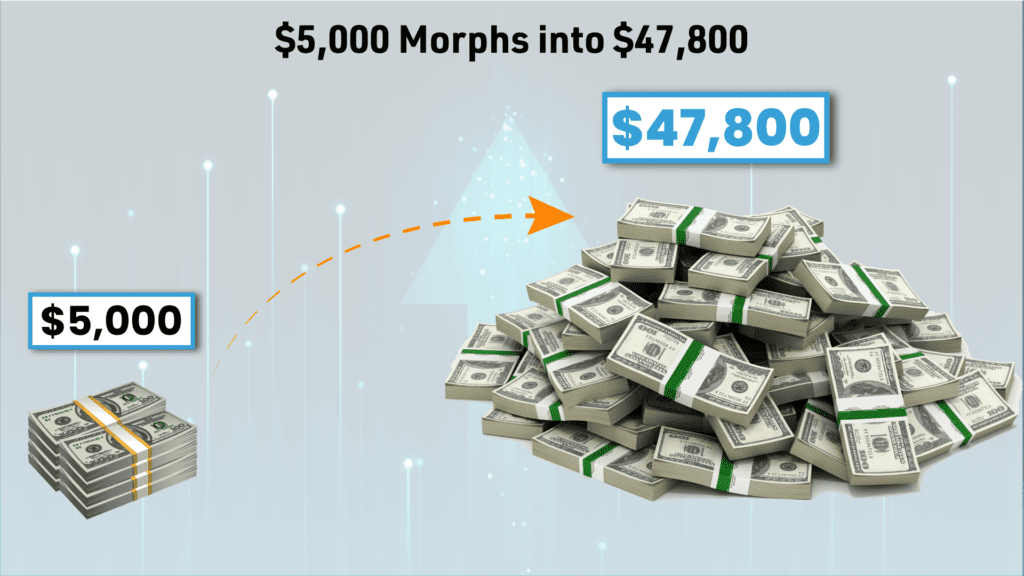

You could’ve cashed out in April 2022 with a whopping 843% gain. And this is a boring coal company!

Now, not every stock that flips will return 843%… after all, nothing in the stock market is ever guaranteed. You already know that.

But on that single stock – a $5,000 investment would have morphed into more than $47,000.

Julie:

Nearly 10 times your money while the market was bleeding out — Wow.

Mike, if I didn’t know your track record, I’m not sure I’d believe it.

I know this briefcase holds the secret you’re about to show us…

But I do want to come back to the free stock picks you mentioned, which I know you’re going to give all our listeners today…

Sorry if I’m jumping ahead, but could your #1 stock to buy be one of these “10 Baggers”?

Mike:

Great question Julie.

The FREE Ticker I’ll Give You Today is The Easiest Way to Flip this “Flatline” into Massive Wealth

Julie:

Flip the Flatline! I like that. That’s exactly what I’d like to do.

Mike:

Great… Because the more chaos we see in the coming decade, the better I predict this stock will do.

Put simply, I believe it’s the ONE stock you’ll want as the cornerstone of your portfolio for the next 10 years…

And for reasons I’ll explain, it could perform incredibly in the next 3 to 6 months.

Julie:

You also have the ticker of a stock we should avoid, right?

Mike:

According to CNBC, this is THE most widely-held stock in 401(k) accounts across America.

At this very moment, it could be threatening to undo years of gains inside your accounts – so stick around and make sure you write it down, because I’ll be giving it away today, no strings attached.

Julie:

The #1 most popular retirement stock – and it’s one everyone should sell.

You definitely don’t want to miss that one

Now Mike, as someone who’s done their research on you, I know picks of this caliber aren’t normally free for the taking.

People pay you good money to get your picks on a regular basis.

And for good reason!

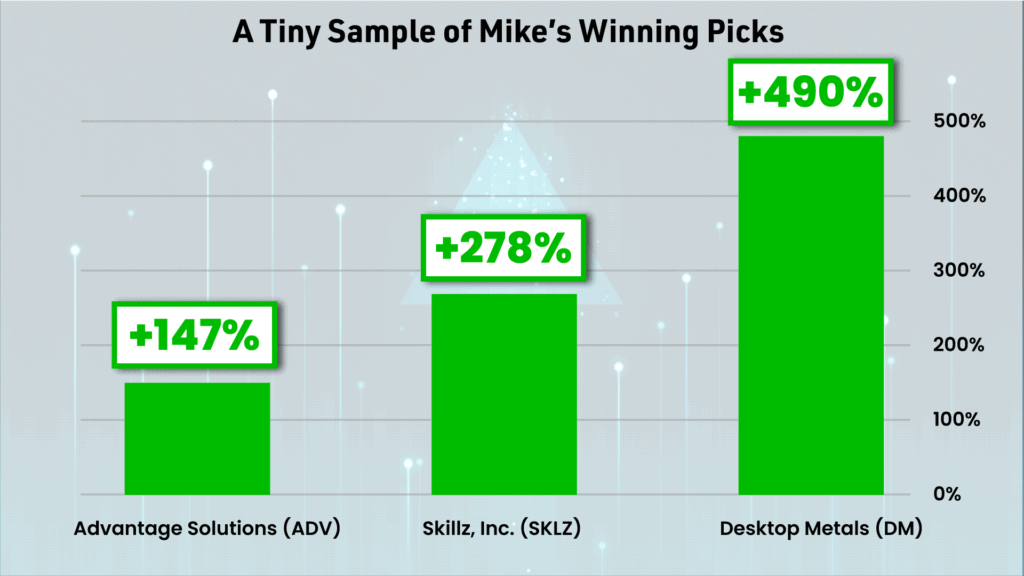

You’ve shown your subscribers to some incredible gains over the years, like a 490% win on this Desktop Metal play…

A 278% gain on this Skillz Inc trade.

And this 147% play on Advantage Solutions, to name a few.

I’ve never even heard of those! Yet you’re finding them right before they go on a triple-digit tear?

So why give away a free pick today?

Mike:

The way we’ve been investing our money for the last 10 years WILL NOT work in the coming decade. Heck, it’s not even working this year!

The funny part is, I never, ever thought I’d be the one delivering this message.

It was never in my plans to be here…

Because I stepped away in 2020.

I’d made my money. I thought that was it for me.

And after ignoring my rod and reel for too long…

It was time to swap out the office chair for a captain’s seat… and log some proper hours on the boat.

But I won’t lie: I was still checking the pulse of the markets…

And it quickly became apparent things were not as they seemed.

As stocks surged higher and higher, I kept coming back to this chart, and the more I looked, the more my palms started sweating.

Julie:

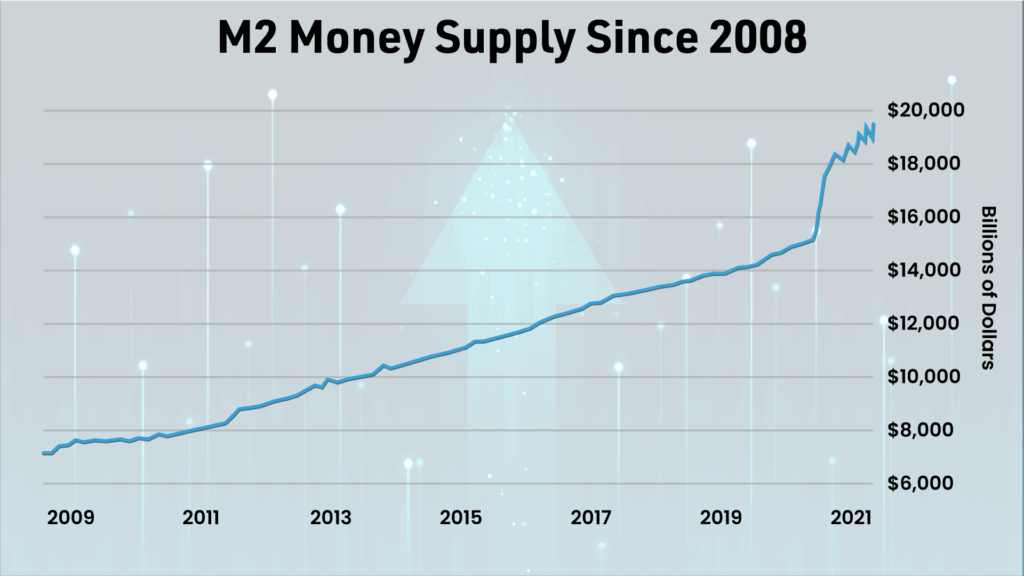

What are we looking at here Mike?

Mike:

This is a measure of the U.S. money supply. It represents all the dollars in our economy – now at a staggering $21 trillion.

See that spike around February 2020?

Julie:

Yes, looks like the line starts to go straight up.

Mike:

That’s the start of the COVID stimulus.

When the Fed started pumping 6 trillion new dollars of new money into the economy.

80% of the dollars in existence were printed since 2020. Basically out of thin air.

And as I’m watching the headlines over my morning coffee – our Fed Chairman Jerome Powell is up there damn-near everyday telling us:

“Everything is fine, inflation is just TRANSITORY.”

That’s when the hairs on my neck are starting to raise…

Because as asset prices are skyrocketing…

And real estate… tech …cryptos… are all blasting off…

All I see is a deadly storm brewing.

Julie:

So you knew the party wouldn’t last, and this chart is why?

Mike:

I knew All that new money would finally catch up to us in the form of crippling, persistent inflation.

Eventually, this would force the Fed to raise rates… slam the brakes on our 13-year price boom… and unleash the worst market flatline we’ve seen in 40 years.

Julie:

So…why now?

Mike:

Julie, the government hasn’t just played down the severity… they’ve been outright LYING to our faces.

By the time most investors figure out what’s REALLY happening – it will be too late.

Especially for anyone hoping to retire in the next 20 years.

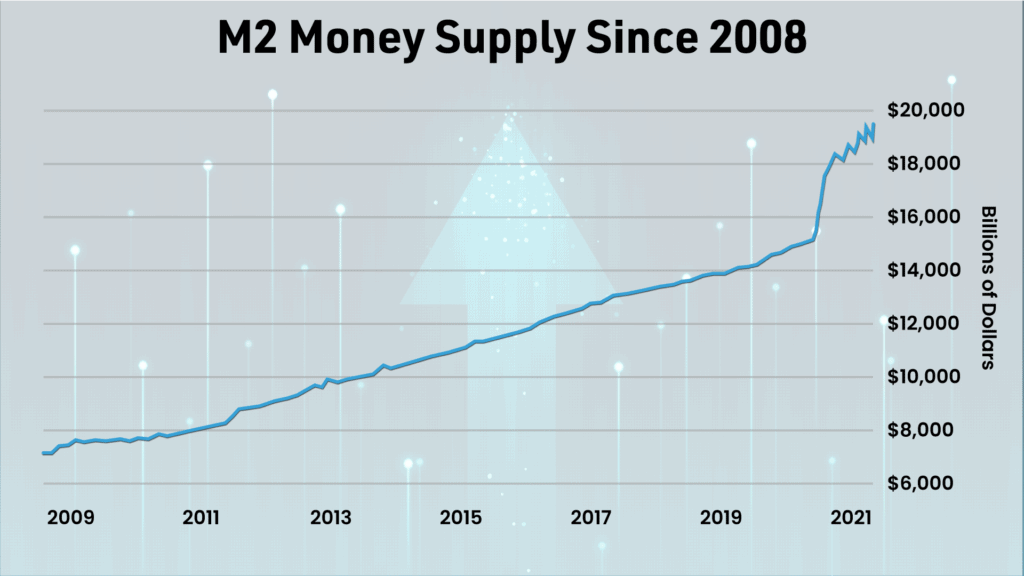

I want everyone to pay close attention to this next chart…

It’s very simple…

But HOW you choose to act on what I show you – could lead you to unbelievable riches…

Or leave you struggling to catch up… potentially for decades to come.

These two lines explain why millions of Americans have fallen behind — and why the “Lost Decade” could mean they NEVER catch up

Do you notice what happened around 1980?

Julie:

Ummm, yeah, the lines are running kind of neck and neck up until then, but yeah, in the 80s, the blue starts to split off and drift higher.

Mike:

Good eye.

That’s when the government changed the metrics on how they compute CPI.

Julie:

Let me stop you for a second…

For those listening who don’t know what CPI is, that’s how inflation is measured. It tracks the fluctuation in how much things we buy everyday cost.

Is that accurate, Mike?

Mike:

Right, the red line is how inflation is measured, and how it’s reported to everyday Americans.

You can see it’s around 8% now, that’s a 40 year high, but here’s the scary part about that number:

It’s a bold-faced LIE… and it has been since 1980.

Julie:

Because the blue line is the REAL inflation number?

Mike:

Exactly.

Julie:

So let me get this straight, you’re saying inflation is actually 17%.

More than double what they’re telling us.

Mike:

Yep.

Julie:

I’d say you’re crazy, but that number actually squares with what I’m living!

With what we’re all experiencing in our day to day lives.

Mike:

I’m right there with you. And sadly, it’s only going to get worse in the months and years ahead.

We could see inflation soar as high as 20… even 30%.

Most people don’t know about the stark difference in REAL inflation and reported inflation.

And again… you can thank our good ol’ Uncle Sam for that.

Because in 1980 our politicians began warping this simple metric to serve their personal agendas.

It’s now surfaced that certain Congressmen were quietly convincing members of the Labor Bureau to manipulate these statistics to their benefit.

And what you’ll notice in the last 30 years… is a growing gap between reporting… and reality.

The red line is smoke and mirrors… a government gimmick to cloak the real impact of loose monetary policy.

But for everyday folks…

The blue line is our hard reality.

Julie:

And this is why so many people feel a gap between where they are now, and where they hope to be.

Mike:

Exactly, I mean, how can “8% inflation” explain paying 71% more for healthcare… 70% more for college tuition… and 50% more for housing than we did in 2008?

Julie:

It doesn’t line up.

So you’re seeing all this play out well before inflation headlines were plastered everywhere…

And you’re thinking… I gotta get this message out… to warn Americans before it’s too late.

Mike:

Not just warn… but share with them the only way I know of to fight back – and win.

I realized millions of hard-working people were sitting ducks.

And the “buy & hold” mantra we all relied on for a safe retirement… simply WOULDN’T work during the Great Flatline.

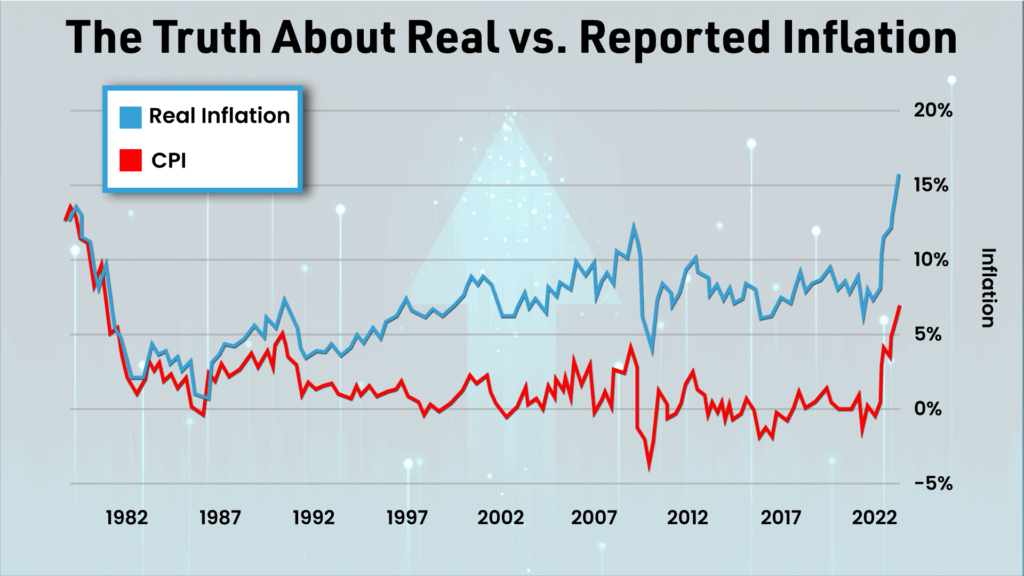

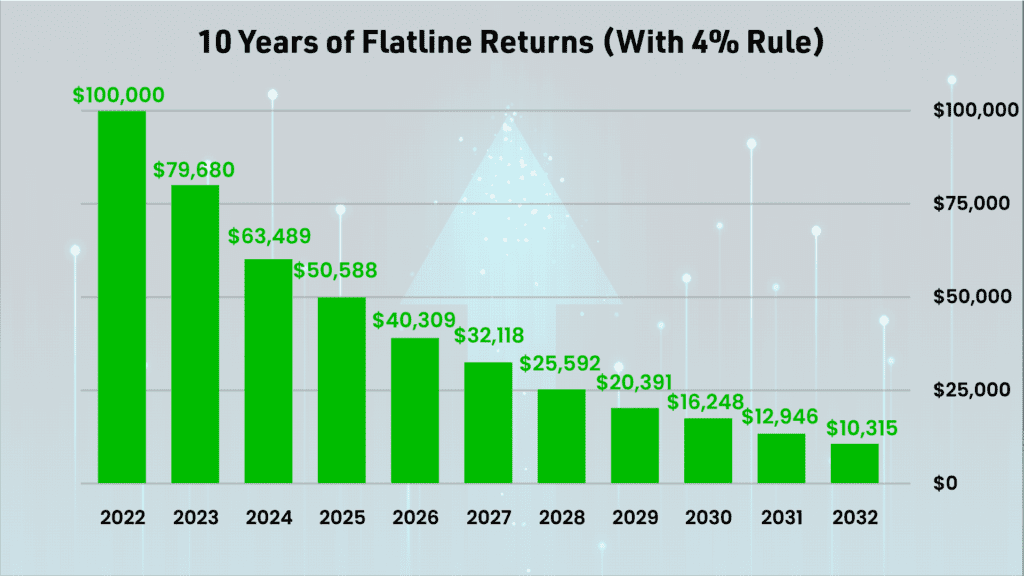

By 2031 I predict many stocks will be worth the same as today — but you’ll have 86% LESS money in your account

Most investors simply haven’t planned for this warped reality.

Julie:

We’ll have 86% less money a decade from now? And not from stock losses?

Mike:

Correct. The best explanation is an example.

Let’s pretend you have this $100,000 in your 401(k) account.

If you don’t withdraw ANY money for ten years…

How much will you have left a decade from now?

Julie:

If I don’t touch the money, I’ll have $100 grand. The same as today, right?

Mike:

Wrong. On paper, sure. But here’s why you won’t – in reality.

As inflation hammers away at your nest egg — that 100 grand Withers down to just $15,000.

Julie:

Whoa Mike, c’mon, $15,000 – that’s all I have left?

Mike:

It’s worse Julie. What if you’re retired and relying on that money to live on?

This chart assumes you’re not taking out anything for living expenses.

Have you heard of the “4% Rule”?

Julie:

Yeah, that’s what most financial advisors recommend..

Withdrawing 4% of your account per year for living expenses.

Mike:

Right. Let’s look at what you’ll have left if you follow the 4% rule.

Can you read that bar on the right Julie?

Julie:

$10,315 — that’s all I have left after 10 years?

Mike:

And that’s if you can somehow manage to live on a few thousand dollars a year.

Julie:

We all know that’s impossible, especially with the cost of things today. But what if someone has $1 million, surely they’ll be fine?

Mike:

The sad fact is, most people don’t.

But let’s say you do have a $1 million dollar account.

Okay, so after 10 years you’re left with $103,000.

For the average person, who wants to be retired for 30+ years…

It’s STILL not enough.

It’s gotten so bad — reports are coming out of people making 6-figure salaries — and STILL living paycheck-to-paycheck.

Julie:

Wow, my first reaction is to say “boohoo, must be rough to have a million bucks. But then you realize if high-income earners are feeling the heat, ordinary Americans are really screwed.

I’ve felt the bite at the gas pump & getting groceries. But I hadn’t realized that it’s going to get so much worse.

Mike:

Things are never going back to normal Julie.

Millions are about to fall behind in a very permanent way.

Many think they have enough saved up, and if they simply “live within their means” they’ll be just fine.

Julie:

It seems rational, smart even. Just “stick it out” until things go back to normal, right?

Mike:

Now you can see why that’s a HUGE mistake!

I started realizing this right as I was supposed to be switching gears & slowing down for retirement.

See, once my nose is on the scent of something big, it’s not in my power to let up…

So I was checking in with my industry contacts constantly – getting on the phone with them to delve into the real-world implications of the 2 charts we just looked at…

At first, I was really discouraged by these conversations, I’ll be honest.

The conclusion was more or less… “we’re screwed here!”, to put it frankly.

But then something happened that changed everything…

And it happened more than once.

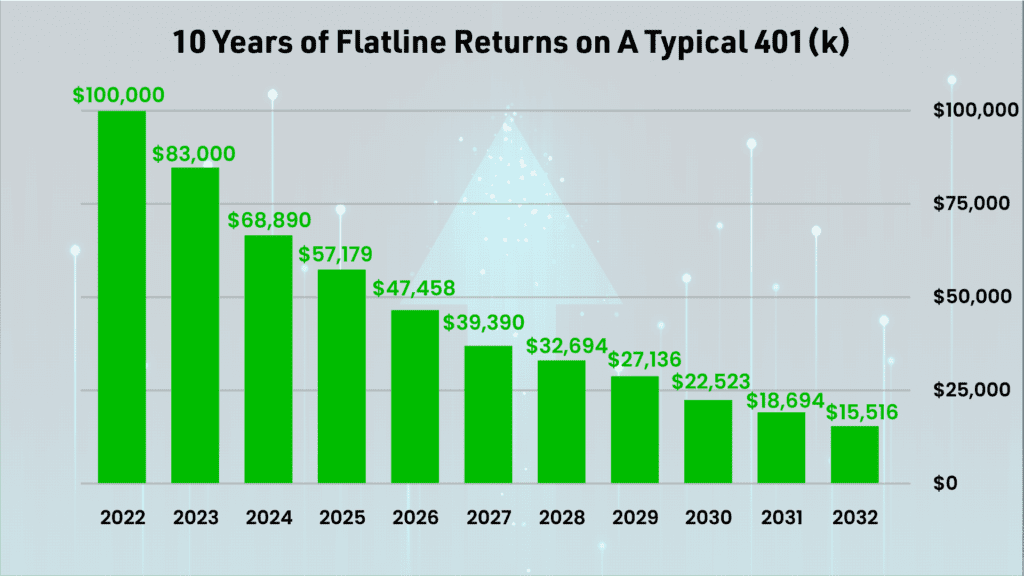

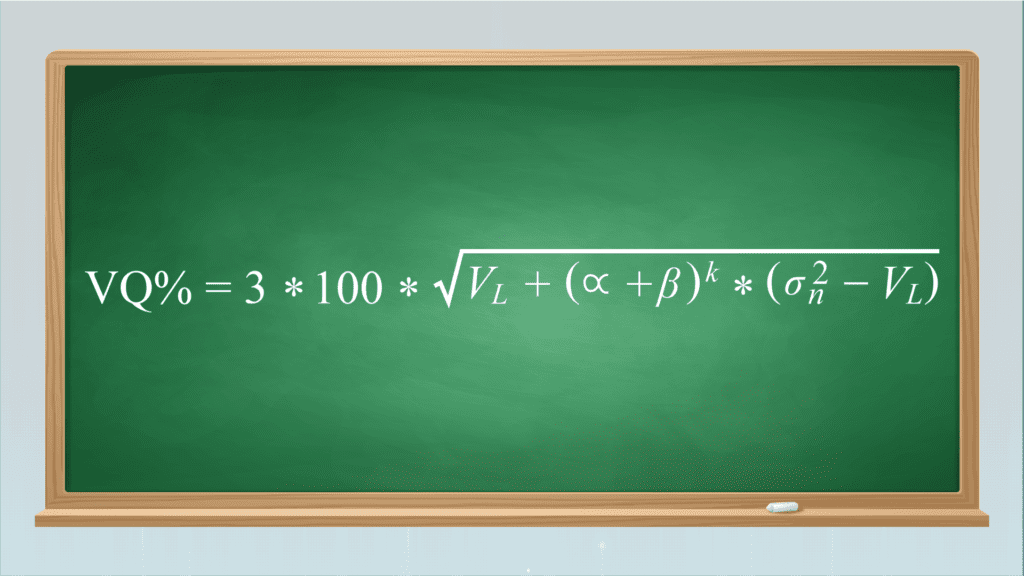

Someone would bring up this mathematical formula called the VQ, or Volatility Quotient.

And the way they were framing it on these calls… it was starting to seem like the only real-world solution for a zero-return decade.

So, I took an interest, because this “formula” obviously had some very smart people sitting up and paying attention.

You can see it right here:

Julie:

Ok, wow. Enlighten me on this one, Mike.

Mike:

This is called the VQ-score. It was developed by a wealth-tech firm out of Baltimore, Maryland…

And what it calculates… Over there on the left, where you see VQ… is the single most important number for any stock…

Because only when you can calculate this number, do you know when a stock’s profit switch flips from red to green and green to red.

Needless to say, this is NOT something companies publish in their SEC filings…

And it’s not even something I’d ever heard of during my 35-year career on Wall Street.

So at first, I didn’t believe it.

Julie:

You thought it was too good to be true?

Mike:

I did. And here’s why…

In March 2020, a story started circulating.

Maybe you saw it on CNN Business.

This man – I think we have a photo – who nobody’d ever heard of…

Started using the VQ score to track the flip on every stock he owned

In this case, he was looking for the “green to red” flip, because he already owned these companies.

And the reason his story spread is — he actually got OUT of the stock market and sold all his positions 24 days before the COVID crash.

Then I find out this guy, his name is Keith, is a no-name software engineer. He’s a geek!

And thanks to this VQ score, he showed how using it to trade the flip could’ve outsmarted and outperformed billionaire investors and high-powered hedge funds.

Julie:

And that formula is the real secret to knowing the exact day to get in and get out of a stock?

Mike:

Right, so… on those calls, that’s what my connections were telling me, and keep in mind: these are my most trusted peers — fund managers… veteran traders… analysts with math PhD’s… and they’re all talking about it.

But it gets crazier.

On March 27, just 4 DAYS after the bottom of the COVID crash.

Keith timed his impeccable entry BACK into the market.

Because of the VQ score, he knew the market’s profit switch had just flipped from red to green.

Julie:

Wait Mike, so it’s not just a profit switch inside stocks that flips? This goes for the entire market too?

Mike:

100% correct. And after Keith traded the flip on the way up, the market roared back to all-time highs… up as much as 89%.

Again, all thanks to what’s inside this briefcase.

As I investigated further, I found out this VQ score was the backbone of a brilliant stock trading tool.

And that wealth-tech startup I mentioned, they owned it…

So I reached out to them directly… I was ready to buy whatever they wanted me to buy just to get my hands on what everyone was talking about.

But we struck up a deal instead. They said I could try it out for free if I’d agree to track my results.

Julie:

But Mike… you’re a pretty legendary stock picker as we’ve seen. You’ve been doing it for 35 years with documented success.

In one year alone, you gave your followers the opportunity to make $156,257 in pure profits if they put a meager $5,000 into each of your trade recommendations.

So, were you still convinced that this VQ formula was going to make a huge difference in your results?

Mike:

Well Julie, I’ve always been a strong stock picker…

But even the best in the world – guys like Warren Buffett & Ray Dalio… they don’t always get the timing right.

That’s where “trading the flip” could make you A LOT more money.

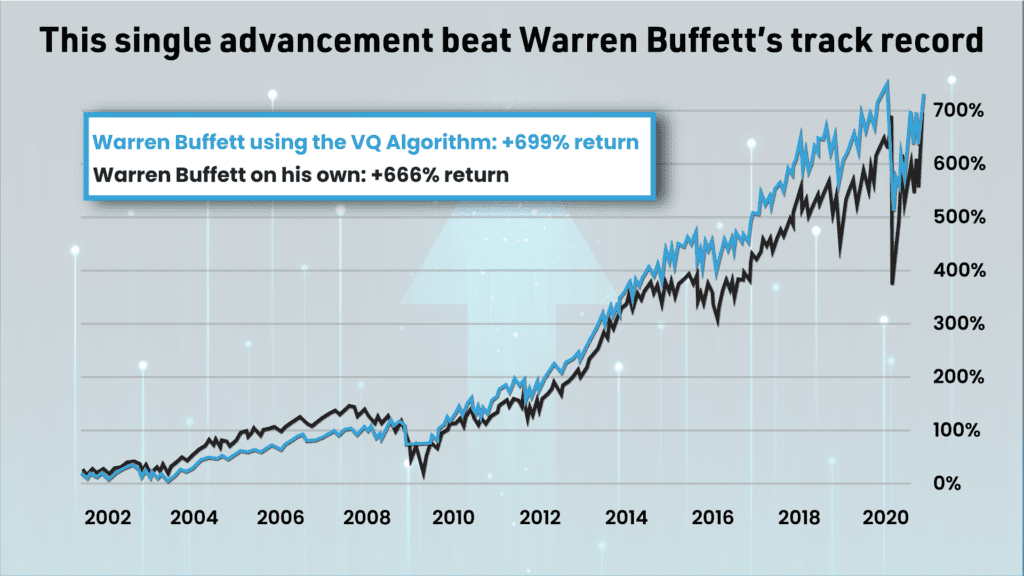

Can This Beat the World’s Smartest Billionaire Investors?

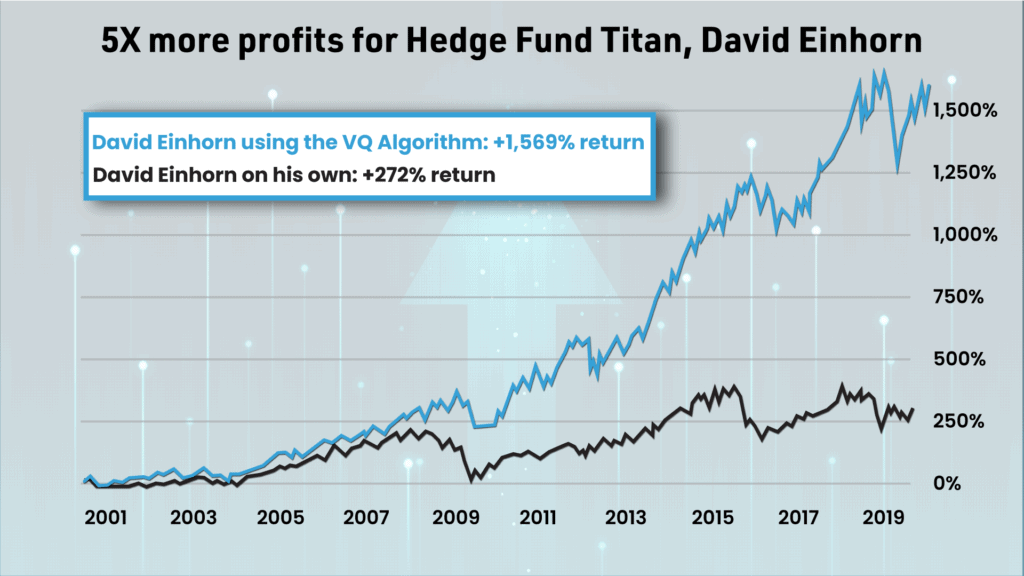

In fact, one of the first things I did during my test drive…

Was study how using the profit switch measured up against the timing of billionaire investors’ trades.

So, we backtested historical trades of billionaires like Warren Buffett, Carl Icahn, David Einhorn, and dozens of others.

Julie:

Wow, so you immediately put this to the test right out of the gate…

Mike:

Take a look: the backtest shows that trading the flip could’ve beat Warren Buffett by a 33-point margin.

It might not look huge, but on a ten-figure portfolio, that’s a MASSIVE difference.

Julie:

Better than Buffett, I’m impressed! What about the others?

Mike:

If David Einhorn would have picked the same stocks yet waited for the flip to signal when to buy and sell… it could have earned him 5 TIMES more profits.

Julie:

You’re kidding…

Mike:

And get this:

On a reported $1.8 billion in assets – he left $8 billion on the table by not knowing the secret contained inside this briefcase.

When I re-ran the portfolios of all these billionaires – and adjusted them to trade the flip…

This VQ algorithm could’ve nearly DOUBLED the profits 26 billionaires made on their own

Julie:

Okay, so if this could beat out billionaires… and make guys like Warren Buffett even richer… I get it — how could you not be interested!?

Now I am curious, how did your own results stack up?

You’ve been recommending winning stocks for three decades… did you backtest any of those picks?

That takes some guts.

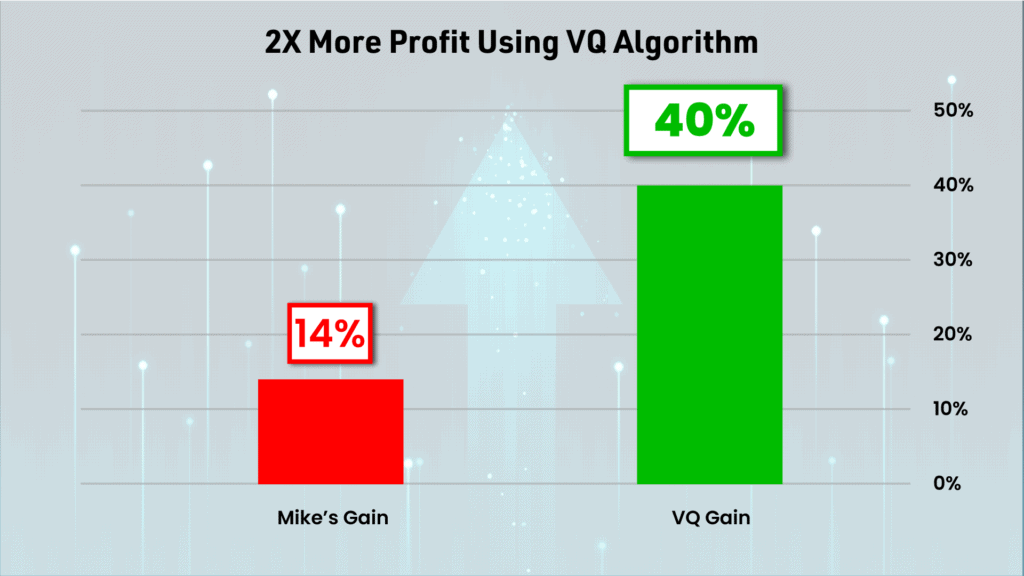

Mike:

That’s exactly what I did! And I’ll be honest, I’m good, but I’m not too proud to add a new tool to my belt.

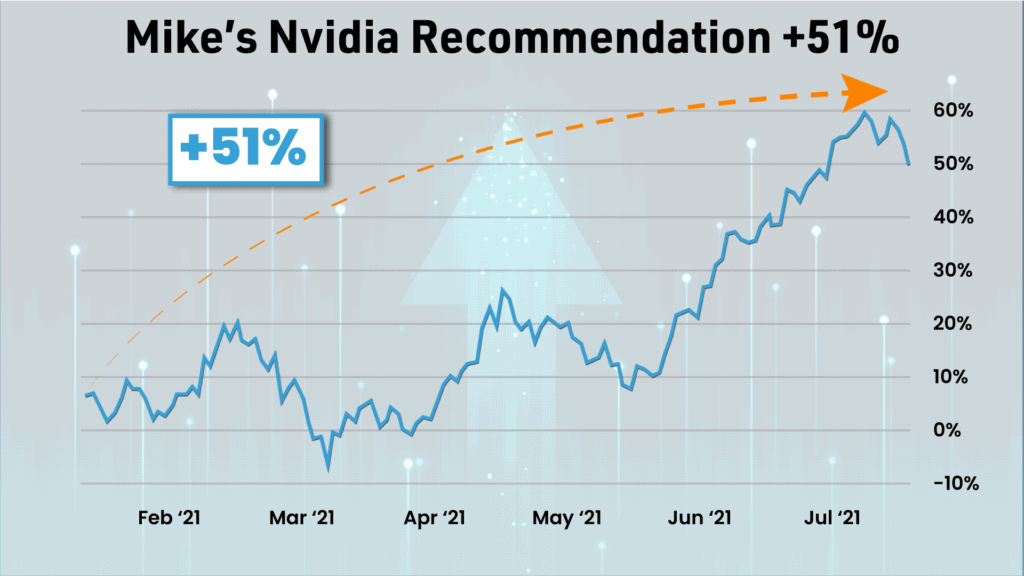

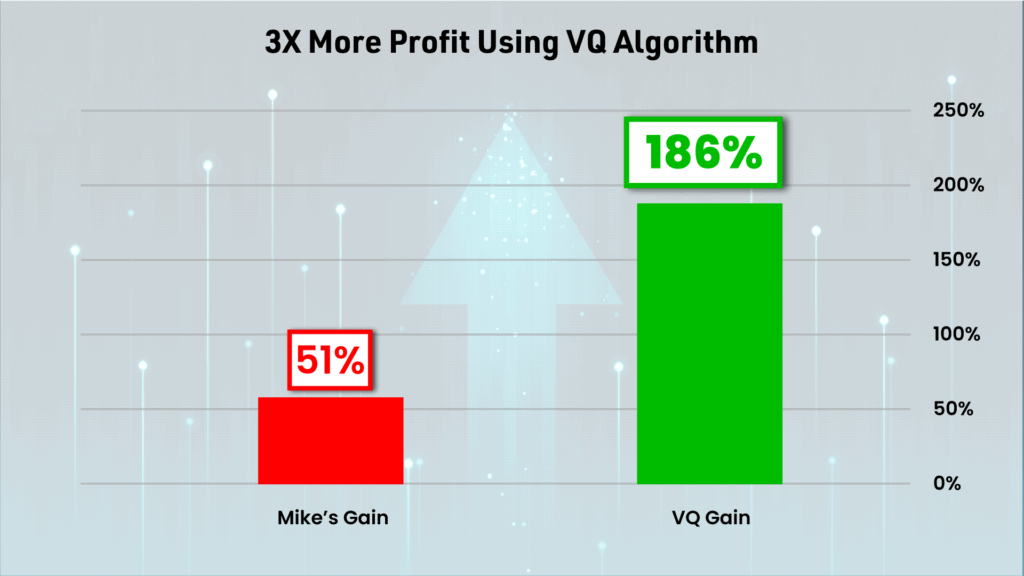

Here’s an example…

This Nvidia trade I recommended to my followers returned 51% in 6 months.

Julie:

Oh wow, that’s a great winner.

Mike:

I agree Julie, I was happy with it. But if I had known about and traded the flip back then, my readers could’ve nearly TRIPLED their profits instead.

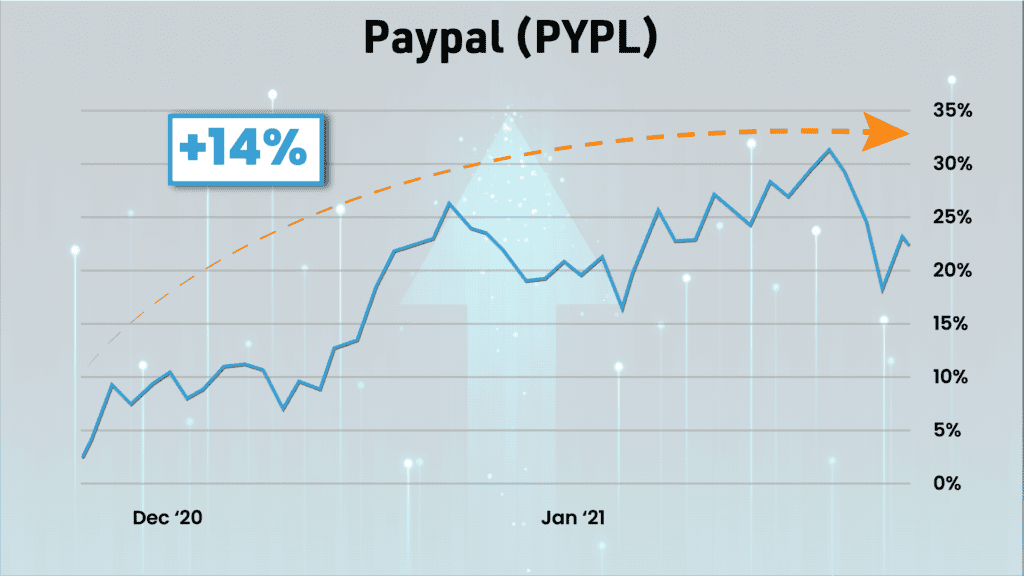

When I went back to one of my recommendations on PayPal…

A nice 14% gain in one month – same thing.

If I’d traded PayPal on the flip — I’d have DOUBLED my gains.

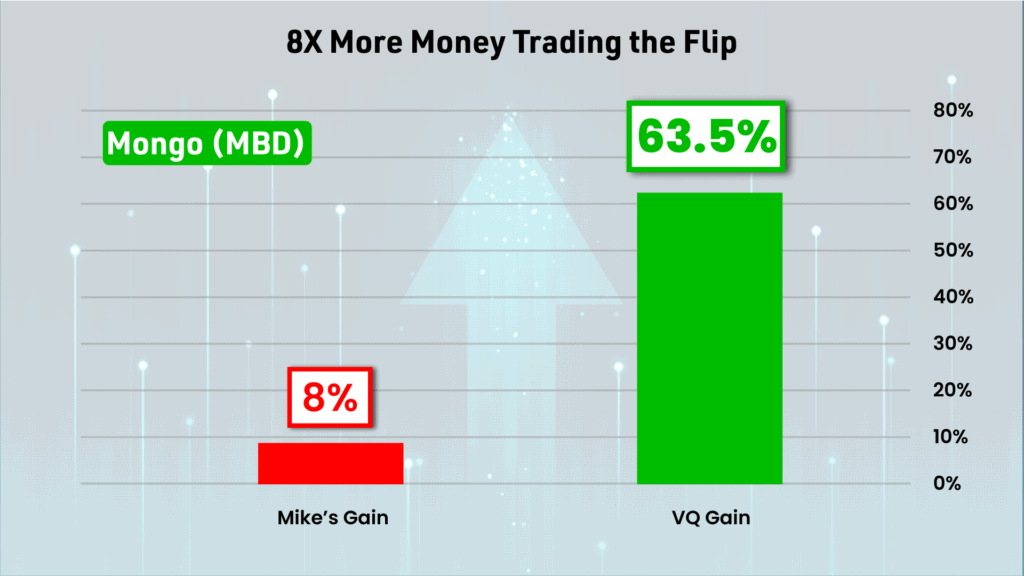

And if my ego wasn’t already bruised, this next one did the trick.

If I’d seen the flip on this software stock, Mongo — I could have banked 8 TIMES more cash.

Julie:

8 times more profit, all from following the flip. This is incredible stuff Mike.

Mike:

THIS is what’s possible when you can leave your guesswork at the door…

And let an algorithm with the ability to run more than 9 thousand calculations a day on any stock…

Alert you when to buy or sell — even if you don’t understand why.

Do that, and you can start TIMING your trades in a way no human can.

Remember I mentioned that the wealth-tech firm in Baltimore… the creators of the VQ… asked me to track my trades once I started using their tools.

Well, that’s when everything fell into place…

When I combined my stock picks with this “stock-flipping” algorithm… I got a 1,100% winner

In the first 30 days

Julie:

What?! That’s wild Mike. I wish I was there with you, I could have turned $1,000 into — what? — $12,000 in a single month?

Mike:

I wish you were too Julie, and I thought it could not get any better than that.

But after I added this algorithm to my approach…

I just kept winning and winning. It was like I couldn’t lose!

For 4 months, I posted a 100% winning trade record .

A personal best.

Julie:

Did I hear you right Mike, when you started tracking these flips inside your model portfolio, you didn’t lose on a single trade.

Mike:

Correct, I went 11 for 11. All winners. And that’s when it really hit me.

“This is too good. And too fun. I’m getting back in the game.”

Because…

I knew I’d uncovered a way to flip a 0% decade — into a 500%… 1,000%… even a 3,000% decade.

Now, I know we don’t have much time left, so will you do the honors of opening this briefcase Julie?

Julie:

Oh, absolutely. Finally!

An iPad?! I don’t know what I was expecting Mike, but it wasn’t this!

Mike:

Well, everything we've talked about today is actually accessible from any device just like this.

Julie:

ANY device?

Mike:

You can access this algorithm using any computer, smartphone, or tablet like this one – and it signals clear-as-day – in red, yellow and green – when to size up another potentially lucrative stock flip.

Back when I used to work on Wall Street, we’d spend days hunting data on Bloomberg terminals…

We’d even dial up CEOs, fly across the country, and take them out to dinner.

Steak dinners!

And all that just to get the kind of buy and sell intelligence you can unlock in a few clicks.

Go ahead and turn it on…

I’ve already got it all queued up.

Julie:

Oh! This is on me to do this? You’re the expert here, Mike!

Mike:

But, anyone can do this… and the simplicity of it is the real magic..

Julie:

Well I know everyone watching has been patiently waiting to witness everything we’re talking about in action.

So Mike, tell me how this is going to work…

Mike:

You bet Julie.

Go ahead and think of a few stocks…

I’ll tell you the ticker symbols – and you’ll type them into the VQ dashboard on the tablet.

When you hit “enter” – we will know exactly when the last stock flip was, along with a red, yellow, or green colored-coded stock reading.

Julie:

Ok, let me think…

Well, this morning I saw one of those Redfin signs in my neighborhood. They’re everywhere.

And since Real estate prices have gone totally crazy…

Maybe a real estate stock is a safe bet.

Mike:

Well let’s look and see.

Julie, you’ll see a blank field where you can type in the ticker for Redfin: which is R-D-F-N.

Go ahead and type that in.

Julie:Okay… *types*… now click “enter”?

Mike:Yep.

Okay Julie, why don’t you tell me what our algorithm says.

Julie:

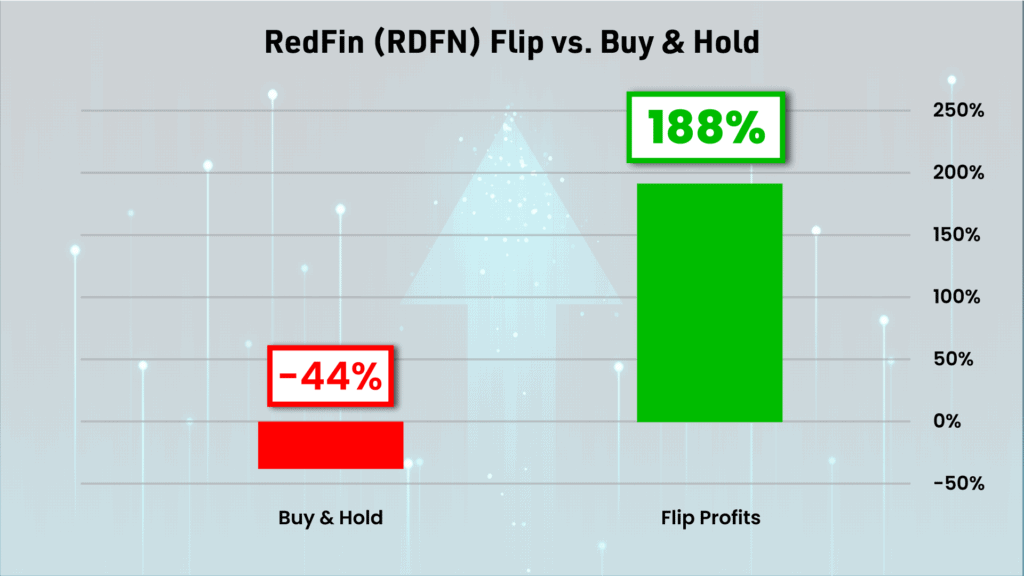

Oh, Redfin is actually red… I can see it flipped from green to red on May 6, 2021.

Mike:

Unfortunately, you’re a little late.

But before we move on, let’s dive into Redfin for a sec.

If you’d invested when the profit switch flipped to green on March 25th 2020…

And then gotten out when it flipped to red on May 6, 2021…

You could have scored a nice 188% profit.

Compare that to buy & hold investors — they saw their stock drop 44%!

Julie:

So they’ve lost nearly HALF their money, while people who traded the flip could have almost tripled theirs?

Mike:

Correct. Adding this one tool to your portfolio could save you tens of thousands of dollars.

Julie:

Tens of thousands, really Mike?

Mike:

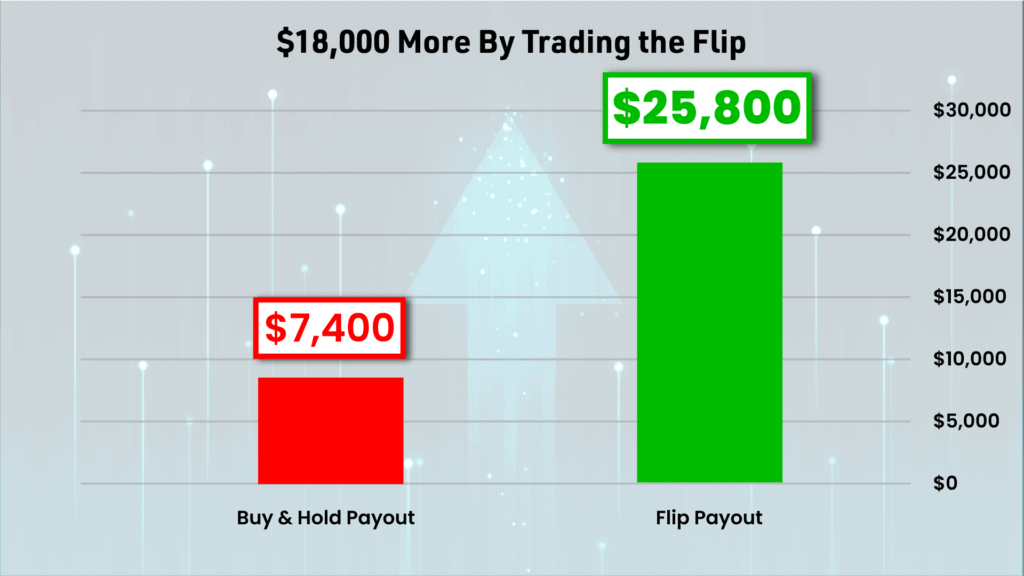

Absolutely, and you know Redfin reminds me of a similar story with the e-commerce stock Sea Limited.

It flipped from red to green at just $15 per share…

Then it took off like a meteor… to $50… $100… then $200…

Anyone who sat back, and followed the flip, could have sold the stock at a price of $197…

For an impressive 1,100% gain.

Now compare that to buy & hold investors…

They missed out on three quarters of the profits…

On a $2,000 investment — that’s a difference of walking away with $25,800 versus $7,400.

Which would you prefer?

Julie:

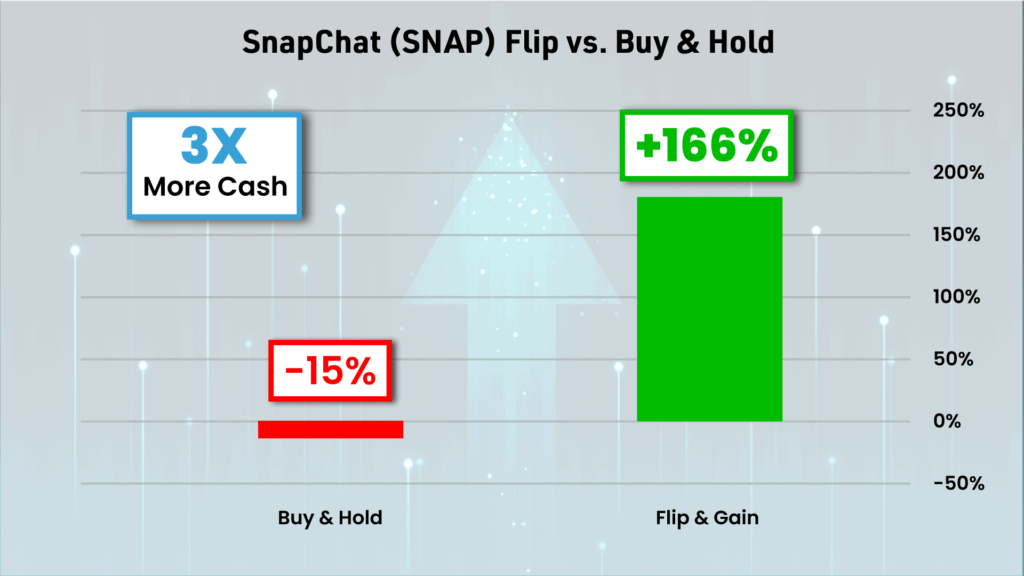

It’s a no brainer…

Now I know Snapchat has been very popular… and I was curious about it maybe being “the next Facebook” or something like that.

Mike:

Ah, Snapchat. For folks who aren’t familiar, this is a social media site popular with Gen Z.

Want to type that one in Julie?

The ticker is ‘SNAP.’

Julie:

Done. Okay SNAP flipped from green to red last December, and it’s been red ever since.

Mike:

Yes, and as you can see…

Folks who traded that flip could have seen a 166% gain.

Anyone who bought & held SNAP without acting on the flip… is sitting on a 15% LOSS.

Now, don’t feel bad if you missed out on SNAP, or any of the examples you just saw.

One thing to remember is: you don’t need to catch the flip the day it happens.

We’re not racing against the clock – you could still bank big profits even if you’re a few days – or even a week from the flip on either end.

Ok, let’s do one last one, because I’d like to share my free ticker for your viewers right after this…

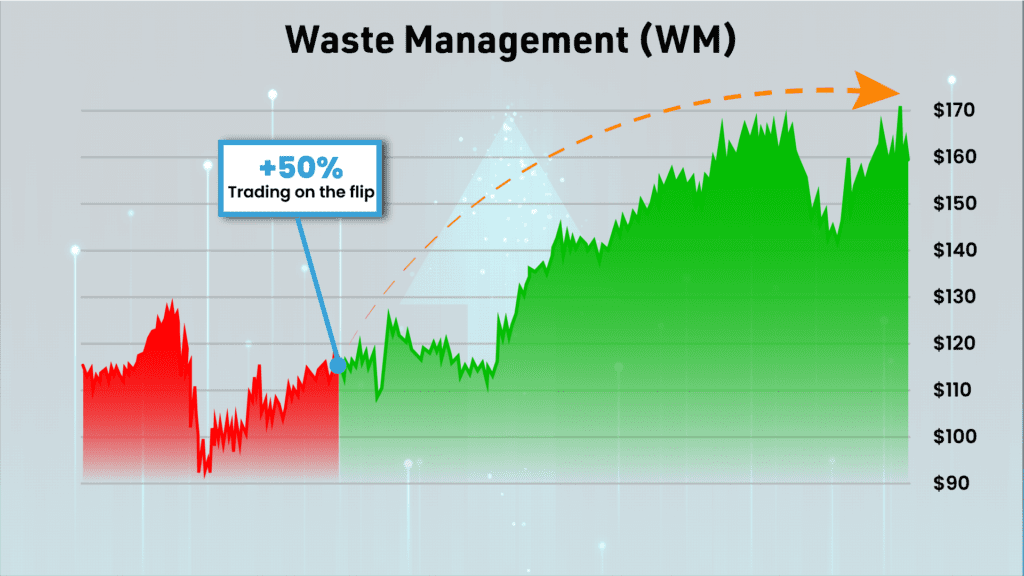

Julie:

Got it. Oh, I’m also interested in Waste Management. I know that’s crazy but no matter what, there’s always trash right?

Mike:

Aha. Great one, ok the ticker is W-M.

Julie:

Ok…Waste Management, yes! It flipped from red to green. So it’s a buy?

Mike:

Since Waste Management is in the green zone, you could consider buying in right now.

In fact, Waste Management belongs to one of my 5 favorite sectors for the flatline decade, which we’ll get to in a moment.

The important thing is, you’re going to want to know when the stock flips from green to red, so you can act to lock in any profits.

Now Julie, I’m curious, how was that? It seems like you figured it out right away.

Julie:

Surprisingly… easy.

Mike:

So you weren’t overwhelmed with the information on the iPad there?

Julie:

Not at all.

Just type in the ticker letters and click “Enter.”

Then it tells you in one neat little box – green is buy, red is sell, yellow is caution.

I also really like how you can see how many days & months have passed since the flip…

Because I feel like the closer you are to the flip, the more “juice” the stock has.

Am I imagining that?

Mike:

Not at all Julie, that’s a great observation.

And it actually ties in with my big announcement today…

I’ve developed a new way to leverage this tool — for consistent chances to score 10 times, 15 times, even 30 times your money…

By buying & selling stocks close to the flip.

Because, as you just observed, THAT’S where the big money opportunities are.

Julie:

Now, I heard you’ve partnered with the wealth-tech firm behind this VQ formula… TradeSmith… to share some of these “stock flip” trade opportunities with your followers, is that true?

Mike:

After achieving the 100% win rate I showed you…

And seeing this could’ve handily beat billionaire trading legends by a factor of double, even quintuple the profits…

How could I not partner with TradeSmith? I still believe this was the only partnership that could pull me back into the game.

I’ve even prepared something special for your viewers who might want to learn more…

A special report I wrote that details all the ins-and-outs of this powerful algorithm.

It’s called The VQ Formula Unleashed: How to Score 10X Stock Gains by “Trading the Flip”

The moment you open it up, you’ll start discovering:

- Exactly how to trade the flip down to the day (and that works for buying AND selling)

- The number 1 thing to look at before you buy or sell a stock

- How to sync your account so automatic “flip alerts” are sent to your email – and you never miss a chance to time your buys and sells for maximum profit potential

Julie:

Now, I know we have a lot of folks watching this edition of ‘Armchair Millionaire’, who can’t wait to tear open your new report…

But we’ve covered a lot of ground today… so will people need anything else to get started?

Mike:

My report shows you a nice 101 breakdown of how the system runs…

But you’re right Julie… to run these calculations yourself… all 9,000 plus…

And repeat it on all the stocks we analyze every day…

It just wouldn’t be possible, even for me alone.

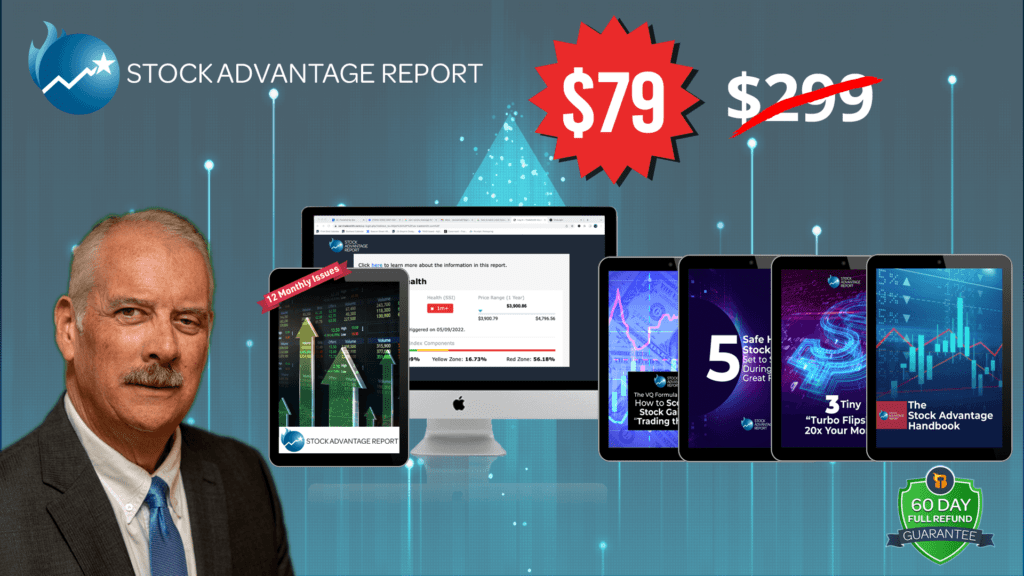

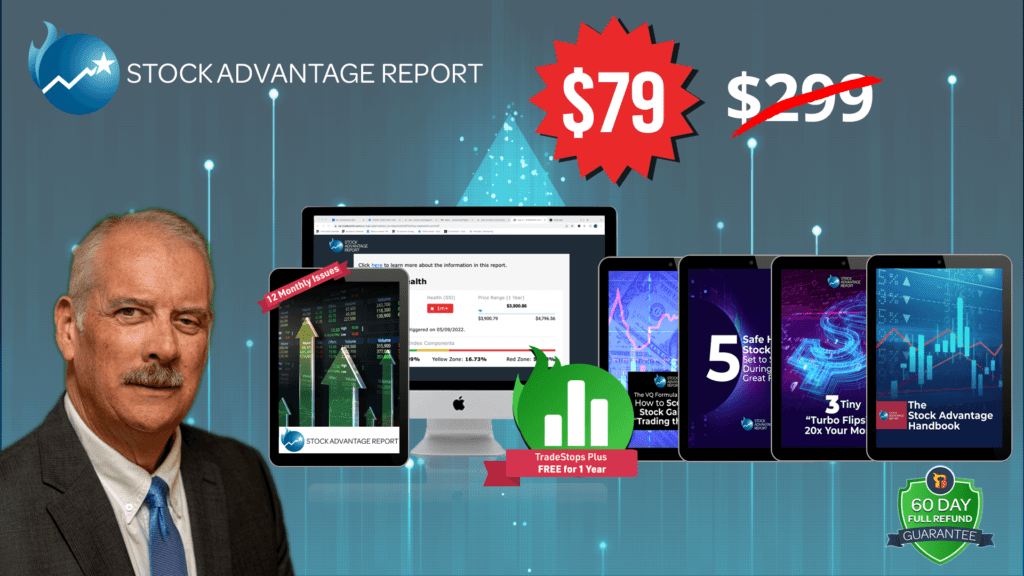

And that’s why today, for the very first time, I’m launching a brand-new research service for regular folks, called Stock Advantage Report.

Minutes from now, you could have the world’s most powerful flip-tracking system right at your fingertips…

Showing you when to ‘trade the flip’… and giving you the best chance to buy low, and sell high every time.

We’ve seen the evidence – the Great Flatline has arrived.

Volatility is here to stay… and it’s forcing investors into a long decade of flat returns.

Julie:

It feels like a “make or break” moment for investors.

Mike:

It is. Millions are about to fall behind…

And you only need to look at what happened in the 1970’s to understand how.

Growing international competition, along with soaring energy prices… were hammering the American economy.

Then, with almost no warning, President Nixon went on TV on August 15th, 1971 to make a massive announcement.

He told everyone that the U.S. dollar would no longer be backed by gold.

Julie:

That’s when America got off the gold standard?

Mike:

Yes, and his announcement triggered a new era known as the “Nixon Shock.”

Which set off America’s most painful ‘Flatline’ since the Great Depression.

Inflation skyrocketed…

And a shockwave hit investing accounts in strange & unexpected ways.

Popular stocks… along with bonds & utilities… got killed.

And after a decade of rollercoaster volatility — including two 25% selloffs…

The Dow Jones went from 809 points in 1970…

To 839 points in 1979.

Julie:

Almost no gain.

Mike:

Buy and hold investors had 0% returns to show for ten years of work.

But as you can see – Energy stocks & real estate soared…

And some very specific assets skyrocketed hundreds & even thousands of percent higher.

Now we are about to see a very similar shift occur.

Julie:

Ok, that’s very interesting. And I can see the parallels clear as day.

But this was 40 years ago.

Where are investors going to find those kinds of gains today?

Mike:

My system just signaled 5 ‘safe haven sectors’ with massive upside.

But I’ve also identified 5 individual stocks – one in each sector – and I’ve laid them out inside a brand new report.

It’s called: 5 Safe Haven Stock Picks Set to Soar During the Great Flatline

Julie:

Tell us about your 5 sectors, and the 5 picks.

Mike:

Safe Haven Sector #1: Inflation-Proof Assets

First, we have Inflation-Proof Assets. These are commodity-producing stocks, and I’ve actually discovered a South-African mining company poised to do extremely well in the coming 3-6 months… AND over the next decade.

Julie:

So a chance to win now AND later, I like it.

Mike:

Exactly. Not only does this stock trade for less than $10 per share…

It operates in a sub-sector that saw 1,000% gains in the 1970’s. This time, it could do even better.

Safe Haven Sector #2: Inflation-Protected Income

The next Safe Haven Sector is Inflation-Protected Income. My pick here is a company you probably drove past on your last shopping run – they’ve been in business for 170 years… they have 9,000+ locations…

And their dividend is more than TRIPLE the S&P 500 average. It’s not Wal-Mart, or Target, or McDonald’s – I think it’s a far better, much more consistent stock with a healthy payout.

Julie:

I like the sound of that… Ok, what’s pick #3?

Safe Haven Sector #3: Pricing Power Players

Mike:

The third pick is in a sector which consists of quality, high-margin stocks. I call them “Pricing Power Players” because they dictate their prices… not the market. Economists call this price inelasticity.

I call it a profit “oasis” because these companies can churn out cash no matter what inflation is doing.

Investopedia even ranks this their #1 recession-resistant industry.

My Pricing Power Player pick is a Chicago food processing stock I’ll lay out inside the report.

But if you join me today, you’ll also get 2 more picks in these sectors: Hidden Value Gems & Inflation Proof Countries…

Julie:

Countries? You can buy a whole country with one stock?

Mike:

Almost nobody knows this except investing professionals, but yes, and they can be extremely profitable during inflation periods, when major exporters dictate pricing.

You’ll get my top inflation-proof country stock… along with 4 other “safe haven” picks — completely free if you take me up on today’s offer.

Julie:

Even for you, 5 free picks seems a bit generous. What’s the deal?

Mike:

We’ve entered the worst inflationary period since the 1970’s…

Stocks like Facebook, Target, and Netflix are down 25… even 35%.

Many more so-called “safe bets” are about to get wrecked.

On the flipside, my 5 safe-haven sectors offer an oasis to protect & potentially grow your money during the lost decade.

Join me inside Stock Advantage Report, and you’ll not only get this report for free…

You’ll also unlock my #1 “flip” stock to buy every month — no matter what the market is doing

Every pick will be vetted and analyzed by the same winning VQ algorithm I used to string together a recent 100% win rate…

Julie:

The same algorithm that beat legendary billionaire investors like Warren Buffett and David Einhorn in backtests.

Mike:

Yes, every month, you get a brand new stock pick, mathematically chosen out 150,000 securities… delivered straight to your email.

Julie:

And this is the FIRST time ever you’re releasing this research to the public, right Mike?

Mike:

It is, and it’s what brought me back to the world of finance in a big way…

To join forces with TradeSmith, the leading wealth technology startup in the country.

With over 69,000 subscribers in 135 countries…

I couldn’t be more proud or excited to partner with them on the boldest venture of my career, Stock Advantage Report.

We don’t just throw a ticker symbol at you and say “good luck” like some of our competitors.

The moment you walk through our doors, we’re waiting to greet you with everything you need, whether you’re a stock market veteran, or you just made your first stock trade last week.

Julie:

Well I have to say Mike, some of the member letters I’m reading from these TradeSmith members, they’re incredible.

Here’s one I love Derick A. says this tool:

“Helped me get out of positions when I needed to, instead of holding on and losing money.”

Frances R. says: “I spent just enough time to identify a few stocks to invest in and am up over $15,000 already!”

** The investment results described in this testimonial are not typical. Investing in securities carries a high degree of risk; you may lose some or all of the investment.

Every month, Mike is going to send you the name of a stock that could make you a lot of money…

And whenever the VQ detects an open position’s profit switch has “flipped” to red he’ll send you a sell alert to close out your position for the biggest potential profits.

But Mike is taking it one step further…

When you join Stock Advantage Report right now, he’s also going to throw in an insanely valuable bonus that could put even more money in your pocket…

And – as he mentioned already – could “Flip the Great Flatline” into an unbelievably profitable time for you.

Mike, can you tell us about that?

Mike:

Yes, through this special offer, I’ve convinced TradeSmith to open up FREE access to its legendary VQ algorithm, for the next year.

Using the very same tool on that iPad… the most powerful stock-timing tool I’ve ever seen in my 35-year career…

You’ll be able to type in a stock ticker… see it’s color-coded reading… and instantly understand what’s actually happening with the stock on a given day.

One of our members, John K. raves about this feature. He says:

“The green (or red / yellow) signals tell me whether to get in, stay in, or get the (blank) out! I sold three stocks last year due to paying heed to your indicators. Three weeks later, those stocks TANKED! You spared me a MAJOR loss!”

And you’ll receive this all through a unique system called TradeStops Plus.

Any smartphone, computer, or tablet lets you access everything in a few clicks.

It’s the same easy-to-use dashboard you just demonstrated for us Julie.

Julie:

I won’t lie Mike, even my 6-year old could figure this out…

I hope everyone watching feels as lucky as I do sitting with you right now Mike…

Now tell me, how much does a one-year subscription to all of this run?

Mike:

Today, our viewers can access Stock Advantage Report for 12 full months — all for just $79. In the future, this system will cost $299. But as a thank you to my new introductory members, I’m offering this launch special for just $79.

Julie:

Ok, so for a full year of access to your picks — plus 12 months access to the VQ algorithm — that comes out to just 22 cents a day?

Mike:

Correct, and I’m backing this offer with my 60-day total satisfaction guarantee.

You can just try it out for 60 days, and if you aren’t 100% thrilled with Stock Advantage Report, just let our friendly support staff know. They’ll refund every cent of your purchase, for any reason at all, no questions asked.

Julie:

Whoa Mike, let me get this straight – folks can read all your special reports… invest in all your top stocks… and get a 2-month test drive on the VQ indicator, where they can instantly pull up the real-time status of over 150,000 securities…

And after all that – even if they don’t – I don’t know – like the color of your online dashboard — they can STILL get a full refund?

Mike:

That’s exactly right Julie, for any reason – as long as it’s within the first 60 days – just call up customer support and you can get all of your money back.

It’s a no-brainer in every sense…

Especially considering the possibilities of scoring nearly 10 times…

20 times…

Even 30 times your money – all by “Trading the flip.”

Of course, there’s some amount of risk in ANY investment, which is why you should think like the pros – and never bank on a past gain as a future guarantee.

But I’m pulling these back up because any one of these trades could cover your subscription cost 100 times over.

Julie:

And there’s no risk to anyone who takes you up on this this offer.

Mike:

That’s exactly right. With the money-back guarantee, you risk absolutely nothing to join Stock Advantage Report. Yet for those who join me today, you could be looking at five chances to score 1,000% gains from my 5 new flatline picks.

It’s the best method I’ve ever seen for trading a stock right when it flips.

Julie:

I know we've covered a lot of ground so far. So just to recap, here’s everything you get when you take Mike up on his risk-free subscription to Stock Advantage Report…

- One Full Year of Stock Advantage Report (Value $299)

- Special Report #1: The VQ Formula Unleashed: How to Score 10X Stock Gains by “Trading the Flip” (Value: $99)

- Special Report #2: 5 Safe Haven Stock Picks Set to Soar During the Great Flatline (Value: $199)

- BONUS #1: 12 Months FREE Access to the VQ Algorithm via TradeStops Plus (Value $588)

- New Monthly Trade Recommendations

- Stock Flip Email Alerts on open positions

- 24/7 Access to the Member’s Only Virtual Portal

You’ll get everything here all for less than the price of a tank of gas. And if you’re not happy for any reason… you can claim a 100% cash refund of everything you pay today.

To get started, click the button below right now.

Mike:

One more thing – when you click the button below – you’re going to see an added mystery gift on the next page.

And while we didn’t have time to get into it today…

This gift alone may be worth the entire value of today’s charter offer, especially if you’re looking for some unique ways to bank serious cash in the coming weeks.

Along with the rest of today’s offer – this added mystery gift comes 100% risk free for anyone tuning in.

Julie:

Okay, now that brings us to the moment we’ve all been waiting for.

Mike, tell us, what are the free recommendations that you promised us today?

Mike:

Everyone take out a pen and jot these down.

My #1 recommendation to buy is Enphase Energy, ticker ENPH.

This solar power provider is booming. New Australian solar safety laws have led to an immediate and rapid adoption of their products down under… and now, with increasing hurricane frequency in the U.S. – demand is skyrocketing in states like Florida. Add in rising sales, cash flow and bulletproof financials – and this under-the-radar stock is poised for sustained price growth in the months & years ahead.

My #1 pick to sell is Apple, ticker AAPL.

This one may come as a shocker, but 46 years after Steve Jobs founded Apple in a garage, the tech monolith has finally matured.

Growth has slowed sharply, yet shares are still trading at a crazy 33 times the company’s book value.

Plus, Apple TV is experiencing an eerily similar “subscriber slump” to Netflix – a stock that dropped 50% in less than a month.

I don’t see a quick fix to any of this, so avoid Apple at all costs.

Julie:

There it is folks. The #1 bullish AND bearish picks for the Lost Decade, from stock picking legend Mike Burnick.

Right now you not only have a chance to lock in his best recommendation to trade the flip every month inside Stock Advantage Report…

If you order right now you’ll get a full 74% OFF the annual membership price.

Plus, FREE access to a copy of Mike’s new report The VQ Formula Unleashed: How to Score 10X Stock Gains by “Trading the Flip”.

Plus, his full comprehensive report: 5 Safe Haven Stock Picks Set to Soar During the Great Flatline.

But that’s not all…

If you join today, you’ll also unlock a full YEAR of access to the VQ Algorithm – a $588 value.

Again, for anyone watching right now, this offer is totally risk-free.

That means you’ll have 60 full days to go through all Mike’s research and reports, and you can even use the VQ algorithm to analyze all the stocks in your own portfolio – or any stock you’re interested in – to see if it’s recently flipped.

Mike:

Just one last thing: all the reports and bonuses included in this charter offer may not be available for long.

Well that’s the nature of these broadcasts.

They can go viral pretty quickly, which is why I can’t promise we’ll be able to keep this offer up for very long…

To ensure you get the best possible deal, click the button below now.

Julie:

I think that wraps up our show for today.

If you’re ready to get started with Mike, just click the button on your screen.

You’ll be taken to another page where you can review Mike’s offer & verify all the details.

I’m Julie Devante, saying thanks for watching, and take care.

June 2022

For full disclosures and details, please click here.