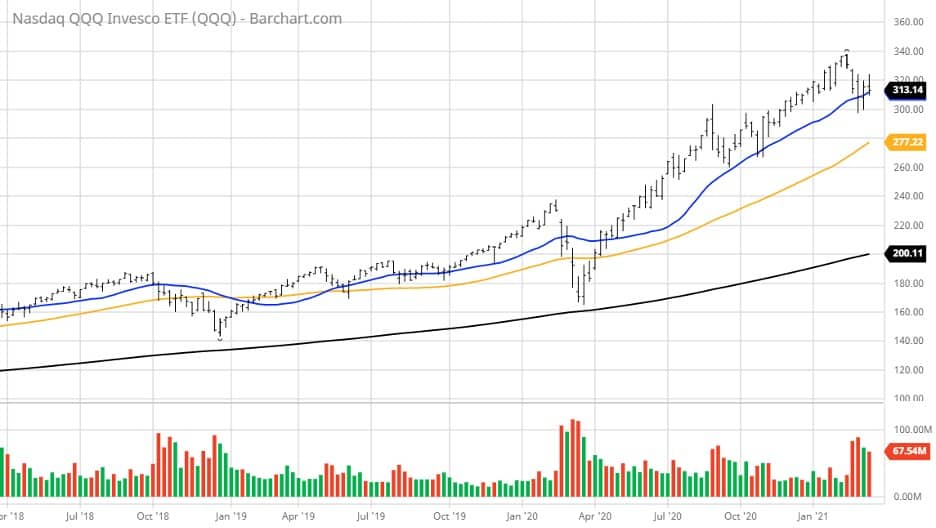

The current correction in the Nasdaq is sizing up to be a textbook consolidation, following a torrid 2020 rally for the tech-heavy Invesco QQQ Trust (QQQ) that traded at a lofty premium to its long-term moving averages.

Reopening euphoria combined with rotation into financials, industrials, materials, energy, transportation and leisure stocks sucked the short-term air out of the tech sector in a classic, mean-reversion-trade scenario. The bond market also has been a source of funds for the value/cyclical trade.

The consolidation within the Nasdaq is in its sixth week as quarter-end window-dressing will likely keep the value and cyclical sectors elevated as fund managers intend on showing broad exposure to these stocks. This month-end dolling up of portfolios comes in light of the fact that most value and cyclical stocks are technically very overbought and due for a sharp pullback like what is now underway in the energy patch.

But leave no doubt, professional fund managers with five-star track records are not wild about owning airline, cruise line, restaurant, hotel and casino stocks — many of which are now trading at higher prices than before the pandemic hit. They are also more likely to rent and not own stocks of commodity-producing companies that face rising raw materials input costs and burgeoning pools of physical labor.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

In the big picture, they want to own tech companies engaged in secular trends that include 5G, Internet of Things (IoT), mobile e-commerce, fintech, electric vehicles (EV), artificial intelligence (AI), cloud, cybersecurity, enterprise, augmented reality, virtual reality, streaming entertainment, remote medical care, robotic manufacturing, clean energy, smart grid, smart cities and smart homes.

There are dozens of other high-tech applications that fall under the broad category of Software as a Service (SaaS), which address everything from the remote workforce and human resources (HR) to marketing and sales, just to name the obvious.

American ingenuity excels in literally every industry and business segment, but it’s the mega-trends in technology with double-digit-percentage, long-term compounded annual growth rates (CAGR) that are of the most interest. Value, cyclical and epicenter companies have streaky sales and earnings growth and it can be reasonably argued that a high percentage of future sales and earnings growth has been priced into reopening stocks.

[Big Money: Google and Microsoft Just Put Over $4 Billion into this New Technology]

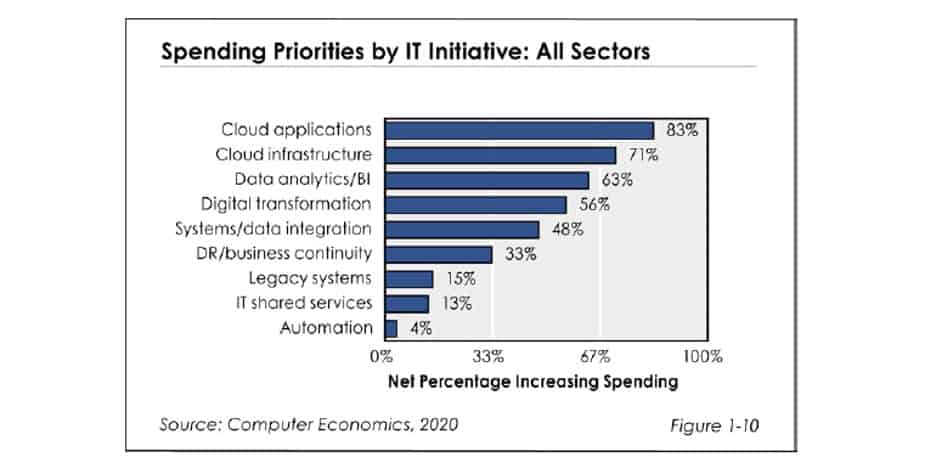

At the same time, as the tech-rich Nasdaq is doing some further back-and-filling, the fundamentals for most of the technology sectors noted are rapidly improving, as evidenced by some channel checks on corporate spending and mid-quarter updates by some leading companies.

When looking at the three-year chart of the QQQ, the blue 20-week moving average shows the bull trend is still intact. Shorter-term charts show high levels of implied volatility, reflecting the multiple contractions of high-beta stocks of companies with soaring sales growth but no or little earnings or price-to-earnings (P/E) ratios yet.

In Kiplinger’s latest business forecast released on March 4, “The pace of capital spending is now 8.7% above its pre-pandemic level, and new orders are 9.7% higher. Purchases of machinery are robust, as are computer sales. Even though many uncertainties about the economy’s progress remain, businesses are apparently deciding to push ahead with expansion plans that had been on hold, in preparation for an eventual recovery. However, surveys indicate that large firms are more enthusiastic than small firms at this time.”

[Read On: Discover What Bill Gates is Calling the “Holy Grail” of Modern Tech]

Some of the likely beneficiaries of bigger spending include makers of industrial robots and 3D printers. Robots eliminate the risks of physical distancing among employees, work 24/7 and don’t require costly benefits packages. And 37% of U.S. assembly plants plan to invest in 3D printers, a record high. Shares of 3D printing maker stocks trade, on average, at 50% off their February highs.

Sales of digital media and marketing software seem to be picking up speed after sector leader Adobe Inc. (ADBE) reported last Tuesday that it expects revenues to accelerate by 23% to $2.78 billion, following three straight quarters of 14% top-line growth. Shares of ADBE topped out at $536 in September 2020 and trade today around $440.

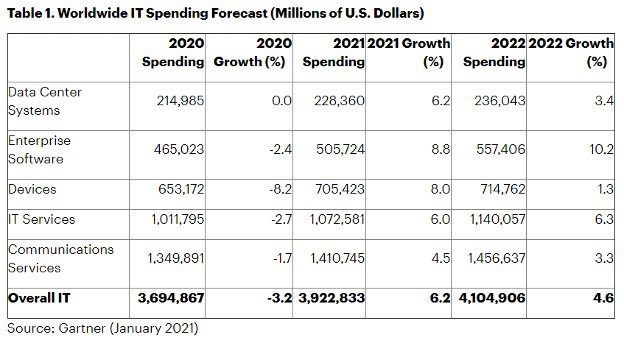

All information technology (IT) spending segments are forecast to return to growth in 2021. Enterprise software is expected to have the strongest rebound (8.8%) as remote work environments are expanded and improved. The devices segment will see the second-highest growth in 2021 (8%) and is projected to reach $705.4 billion in IT spending.

[Breakthrough: The World’s Most Successful Tech Giants are Buying into this Emerging Field]

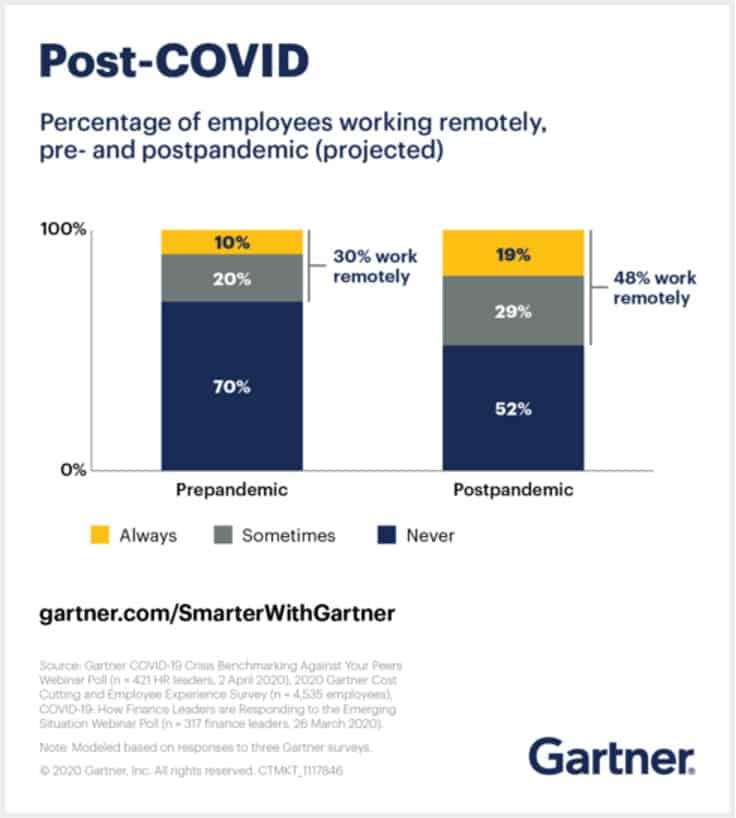

A good portion of the increased spending in IT is to buttress the expanding global remote workforce and to deliver robust performance that can compete with corporate campus infrastructure. Gartner forecasts almost 50% growth in the work-from-anywhere labor force. This is shaping up to be a permanent shift in corporate culture as there is the ongoing risk of future viruses that are now again showing up in Europe.

The acceleration in software and semiconductor spending will show up strongly in first-quarter results, and forward guidance should prove to be the catalyst that puts the Nasdaq back on track to trade to new highs and regain its market leadership by the third quarter, assuming the yield on the 20-year T-Note doesn’t rise above 2.0%, as this is a psychological marker for the algo-driven high-frequency trading crowd.

It has been a tough, and for some stocks, brutal past six weeks in the tech sector. But after every storm, there’s a rainbow. And once the market embraces that the greatest amount of future business spending within the S&P 500 is going to be IT — by a wide margin — then buying the best blue-chip tech stocks on this second Nasdaq pullback might prove to be a very savvy strategy heading into April.

[See Also: 3 Tiny Stocks Set to Soar from America’s Tech Boom 2.0]