I love tech stocks. It’s kind of my thing.

But I don’t like to buy just any tech stocks.

I look for what I call “smart tech.”

These companies develop new technologies, not existing ones.

I’m talking about revolutionary technology like:

- Artificial intelligence.

- 5G.

- Automation.

- Robotics.

This is the future of tech. And these investments are going to pay off big time, not only for the companies creating but for smart investors like you who spot these trends and invest early.

Using chief investment strategist Adam O’Dell’s six-factor Green Zone Ratings system, I found a stock that is forging a strong path into 5G technology. It’s one we are “Strong Bullish” on.

That means it’s positioned to outperform the broader market by at least three times over the next 12 months.

More on that in a bit.

First, here’s why 5G technology is still something to invest in.

The 5G Boom That Hasn’t Happened Yet

COVID-19 put a damper on 5G implementation around the world.

Companies were forced to pare back their work as workers were laid off or furloughed due to the pandemic.

But things are getting back to normal. These companies are ramping up the work halted last year.

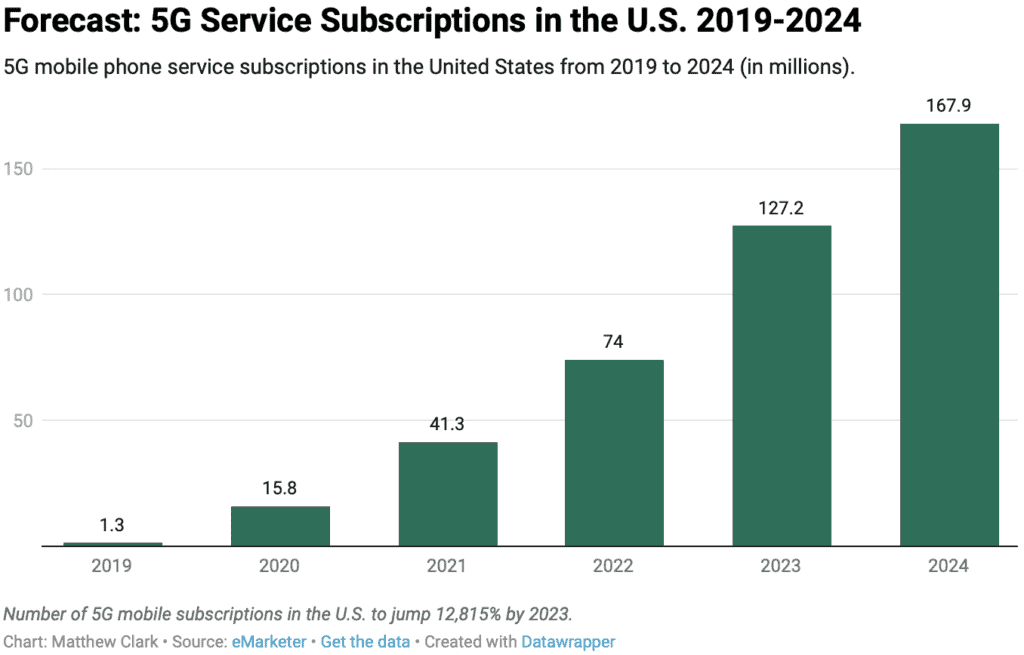

5G Service Subscriptions in the U.S. Set to Explode

And demand for 5G technology is nowhere near its peak.

According to a February 2021 study, the number of 5G phone plan subscriptions will jump 12,815% from 2019 to 2023 … in the U.S. alone.

Companies are rapidly expanding their 5G capabilities, and Americans will rush to take advantage.

I think this is a global trend, not just one in the U.S.

And one company is leading the charge into the 5G revolution.

5G Stock to Buy: Telefonaktiebolaget LM Ericsson Forges Ahead

The 5G stock I found was Telefonaktiebolaget LM Ericsson (Nasdaq: ERIC), or just Ericsson.

The Swedish-based company provides infrastructure, services and software to telecom companies around the world.

[First Look: 99% of Investors Are Clueless About This Game-Changing Technology]

In late April, Ericsson said it was launching a new dual-band radio to help communication service providers increase their 5G capacity.

The new technology allows one radio to support 2G to 5G mobile connections. It will also reduce energy consumption by up to 50%.

It means large 5G providers can use one radio to control just about every aspect of their mobile tower connection … saving them money in equipment and energy costs.

That should translate into a nice boost in sales and revenue for Ericsson.

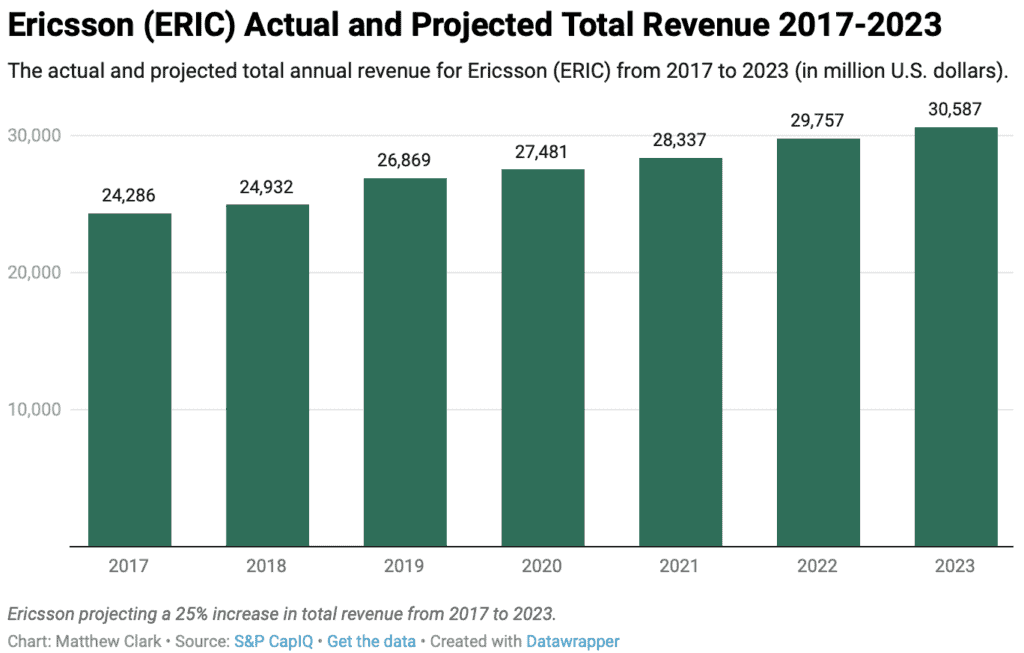

Ericsson Revenue to Increase 25% By 2023

Projected revenue for Ericsson by 2023 is around $31 billion — up from $24 billion in 2017.

Ericsson’s net income from that revenue is expected to go from $2 billion in 2020 to $3.2 billion by 2023 — a 60% increase.

[Alert: You have a rare second chance to get in on the ground floor of a giant tech revolution]

Ericsson Stock Continues to Rise

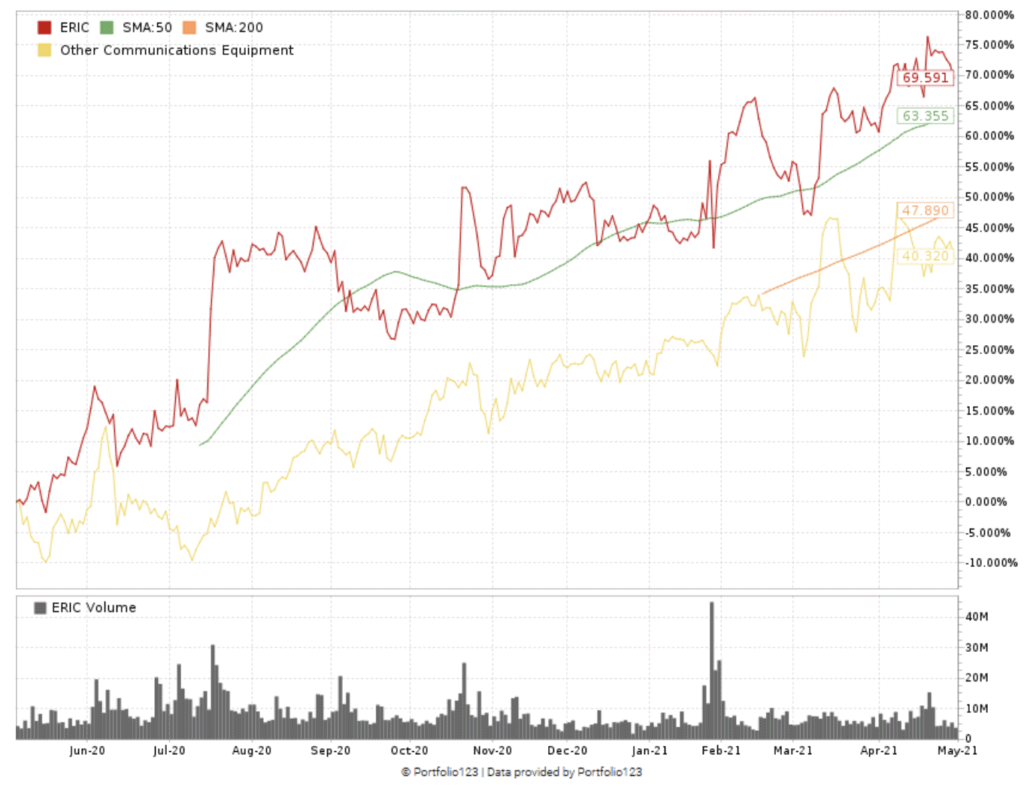

Ericsson stock, like many, was hit hard during the March 2020 coronavirus crash.

Its stock price tumbled to $6.77 at its lowest point.

In the last 12 months, however, the stock has climbed nearly 70% in value to around $14 per share.

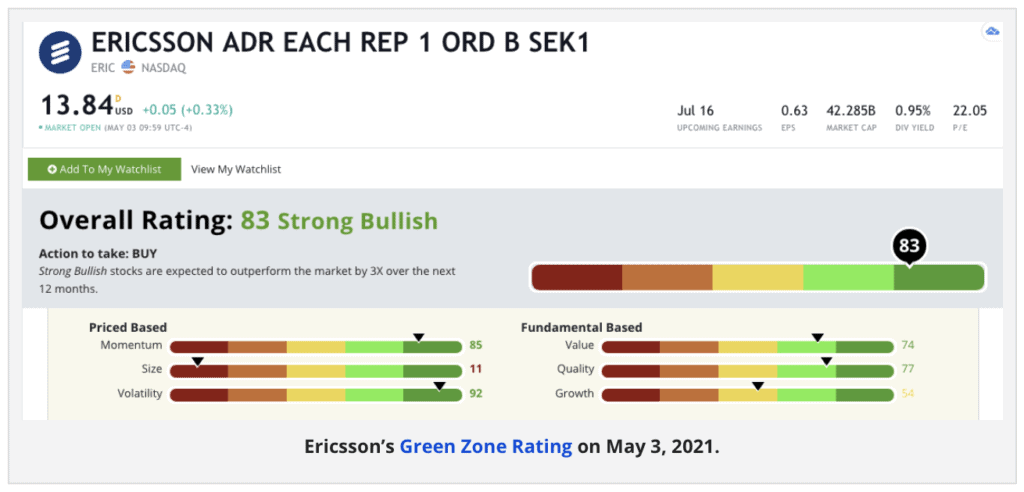

Using Adam’s six-factor Green Zone Ratings system, Ericsson scores an 83 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

It rates in the green in four of our six factors:

Volatility — Ericsson’s upward stock trend has not been adversely impacted by serious downward movement in the last 12 months. It scores a 92 on this metric.

Momentum — The stock has been in a consistent uptrend over the last 14 months, earning it an 85 ranking on momentum.

Quality — The company‘s returns on assets, equity and investments are all higher than the technology industry average. Those returns are all positive, while the industry average is negative. Ericsson ranks a 77 on quality.

Value — Ericsson’s price-to-earnings, price-to-sales and price-to-book ratios are all much smaller than the broader tech industry. That makes it a much better value stock. It ranks a 74 on value.

The stock ranks a 54 on growth with a one-year annual sales growth rate of just 5.1%. But its one-year annual earnings-per-share growth is a whopping 704%!

[Urgent: If you want to become “I bought Apple in 1980” rich, watch this special presentation]

Ericsson is also a very big company with a market cap of just over $43 billion. That earns it an 11 on size.

The company also pays a dividend. Its forward dividend yield is 1.45% which translates to a $0.21 per share dividend annually.

Bottom line: The new 5G technology rolled out by Ericsson last month is a game-changer for the 5G revolution.

It makes upgrading to 5G technology much easier and cheaper for broadband and internet companies.

It’s going to translate into booming sales for Ericsson, not just in the U.S., but globally.

That’s why Ericsson is a solid 5G stock for your portfolio.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

[Marc Chaikin Reveals Biggest Stock Prediction of his 50-year Career on Wall Street]