Bill Gate's Next Big Bet

EXPOSED: The controversial new technology the world’s richest men like Bill Gates, Jeff Bezo, Peter Thiel, and Warren Buffett are quietly pouring hundreds of millions into…

Dear Reader,

If you could go back in time…

And invest with Bill Gates when he started Microsoft

Or Jeff Bezos when he launched Amazon.com…

Or Peter Thiel when he co-founded PayPal…

Would you?

I ask because right now, all across Silicon Valley, something strange is going on.

The world’s best entrepreneurs are quietly investing hundreds of millions of dollars into a controversial new technology.

It started in 2008 when Bill Gates left Microsoft…

The public perception was that he was stepping down as CEO to focus more on his philanthropic endeavors…

But what wasn’t reported by the mainstream media was that he joined the board of a small, Wyoming-based tech start-up.

A company he’s invested more than $750 million into…

And he’s not alone…

Jeff Bezo, Peter Thiel, Warren Buffett, Reid Hoffman, Ken Griffin, Jim Simons, and many other billionaires are investing in this technology too…

Why?

Because they know that this technology is what will make or break the multi-trillion-dollar artificial intelligence market.

You see, all the promises of economic growth and prosperity that have swirled around AI… none of it happens without this one technology.

As Sam Altman, the CEO of OpenAI and the posterboy of the industry warned when asked about artificial intelligence going mainstream:

I don’t see a way for us to get there without [the Keystone].SAM ALTMANCEO, OPEN AI

Yet you’ve never heard this story…

Outside of a few billionaire investors, nobody has connected the dots in the way that I have.

So while millions of people blindly dump money into the latest AI stock or semiconductor firm in the delusional hopes of getting rich quick…

They’re all missing the real opportunity. One that could be among the greatest long-term investment stories you will ever see.

It’s something I call “The AI Keystone” and I believe it could be among the greatest opportunities of the last several decades.

Not only is it the best way to capitalize on the trillion-dollar artificial intelligence market…

But it will also play a critical role in our nation’s future.

As one U.S. government insider says:

[It’s] intrinsically tied to national security.U.S. GOVERNMENT INSIDER

Today, I’m going to expose everything for you.

In this special investigation I’m going to reveal – for the first time ever – the single most important factor in the future of AI

I’ll detail what this Keystone technology is… why it’s so critical to the future of not just AI but mankind…

I’ll name the companies involved…

And I’ll show you everything you need to prepare for what I believe could be one of the biggest financial stories of the next decade.

I guarantee you’ve never seen anything like this.

And believe it or not… but the entire story is contained within this one chart that keeps the smartest men and women in tech up at night…

Hi, my name is Porter Stansberry.

Almost three decades ago, I started a financial research firm with nothing to my name but a borrowed laptop.

Working from the kitchen table of my 3rd-floor apartment in one of Baltimore’s most notorious neighborhoods…

…I wrote about the disruptions, opportunities, and risks I saw in the financial markets.

I had no “right” to do this…

I wasn’t a stockbroker or financial analyst.

I’d never worked for an investment bank or on Wall Street.

And beyond having access to the SEC’s database of financial statements and annual reports, I had no special insights into corporate America.

But from that first report – published in the late 90s – my firm would grow into one of the world’s largest financial research companies.

And while you may not have heard of me or my firm…

For almost 30 years we’ve been on the frontier of the financial markets… accurately predicting many of the world’s most important economic stories.

The 1997 emerging market collapse… the Japanese 1998 banking crisis… The Dot-Com blow-up of the 2000s…

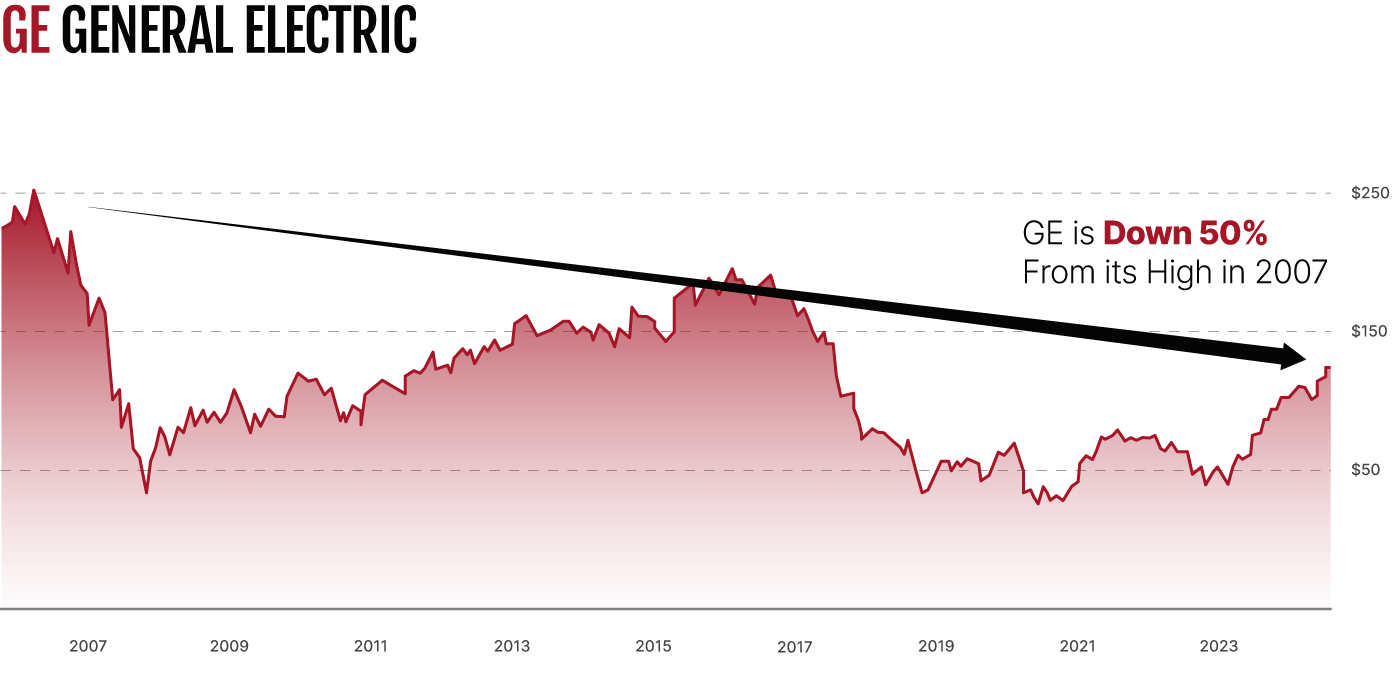

The demise of General Electric… the bankruptcy of General Motors… and the 2008 financial crisis, along with the fall of Fannie Mae & Freddie Mac…

We warned of these catastrophes – and many others – long before Wall Street or mainstream financial media…

That’s why our research has been featured by almost every major media outlet, read by Presidential advisors, leading economists, and even reportedly landed on Warren Buffett’s desk.

Along the way, I also predicted the rise of many of the world’s leading tech companies, including Apple, Amazon, Nvidia, PayPal, and Microsoft.

Despite all this though, I believe the story of The AI Keystone could go down as the most important of my 25-year career.

You see, while many of the claims around artificial intelligence are massively overblown to the point of absurdity…

There is no denying the recent advancements in large language models, neural networks, and generative AI are phenomenal.

And I have no doubt that in the coming years, they will reshape large swaths of our society, economy, and way of life.

Here’s what NOBODY is telling you though…

Without the AI Keystone, the industry is dead in the water

It will never go mainstream.

It will never transform our society.

And it will never deliver the wealth, prosperity, and innovation that you’ll see promised by those in the financial press.

I know that may sound hyperbolic.

As you’ll see though, there’s no escaping the data.

Even Elon Musk has warned that without The Keystone AI won’t scale.

Sam Altman, Bill Gates, Jeff Bezos, and many of Silicon Valley’s most visionary leaders all see the writing on the wall too…

And I believe they’re investing hundreds of millions of dollars to try and solve the problem contained in this one chart…

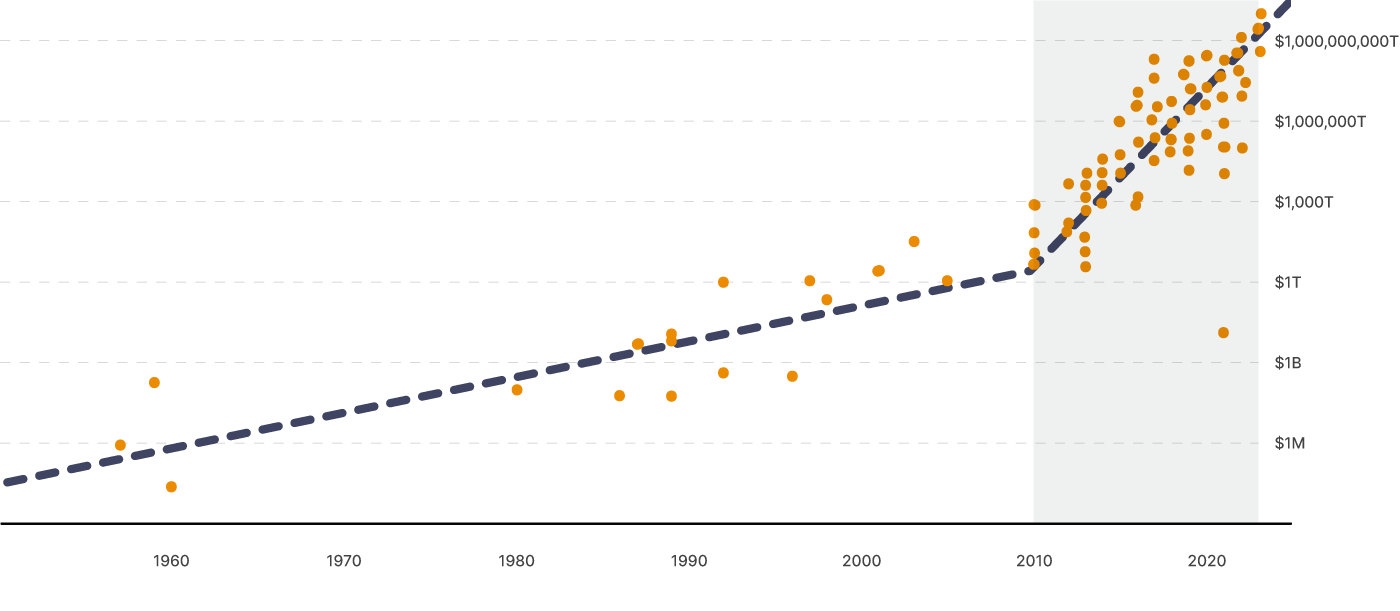

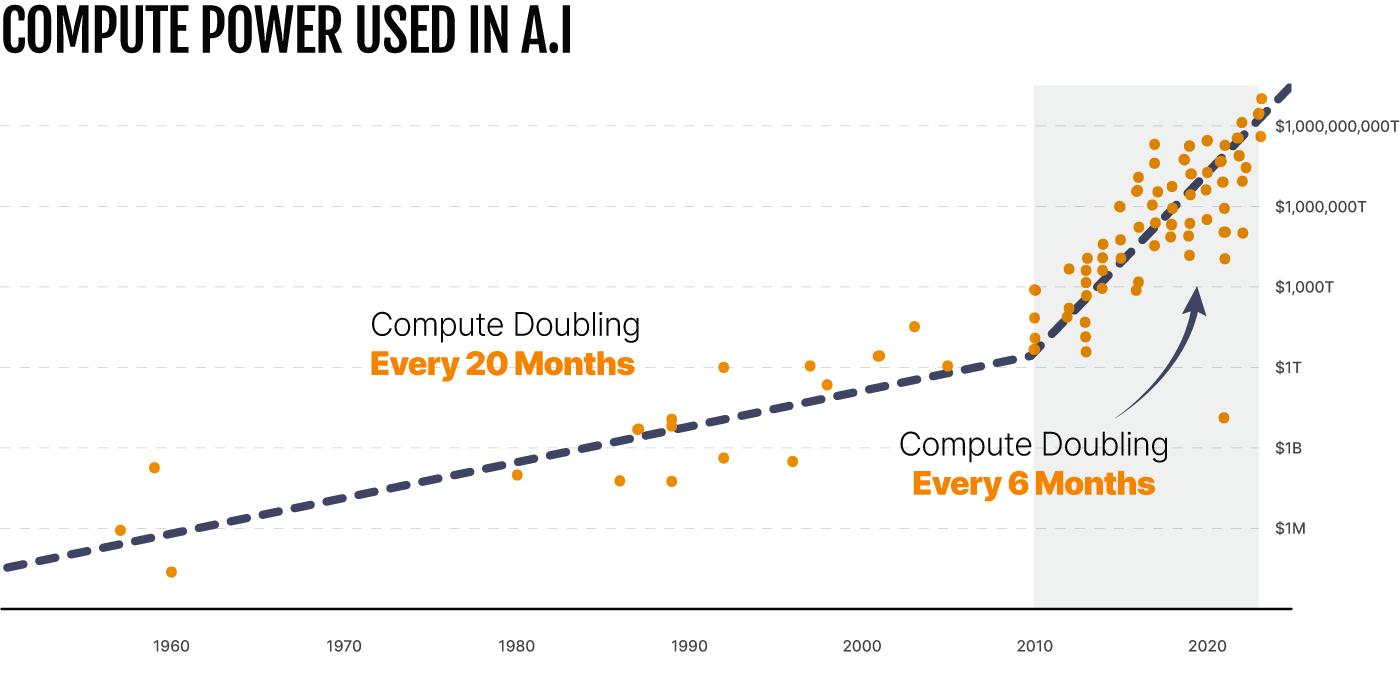

It shows how the amount of processing power required to train and develop AI systems has increased since the 1950s…

As you can see, for decades the power demands closely followed Moore’s Law, doubling roughly every 20 months.

However, Moore’s Law was shattered in 2010.

And the processing power required to train AI went from doubling every 20 months to doubling every six months.

To put this in perspective for you: that's a 16 trillion percent increase over the last 13 years alone…

This growth shows no sign of slowing down.

In fact, Epoch AI, a research institute warns:

The amount of [computing power] developers use to train their systems is likely to continue increasing at its current accelerated rate.EPOCH AI

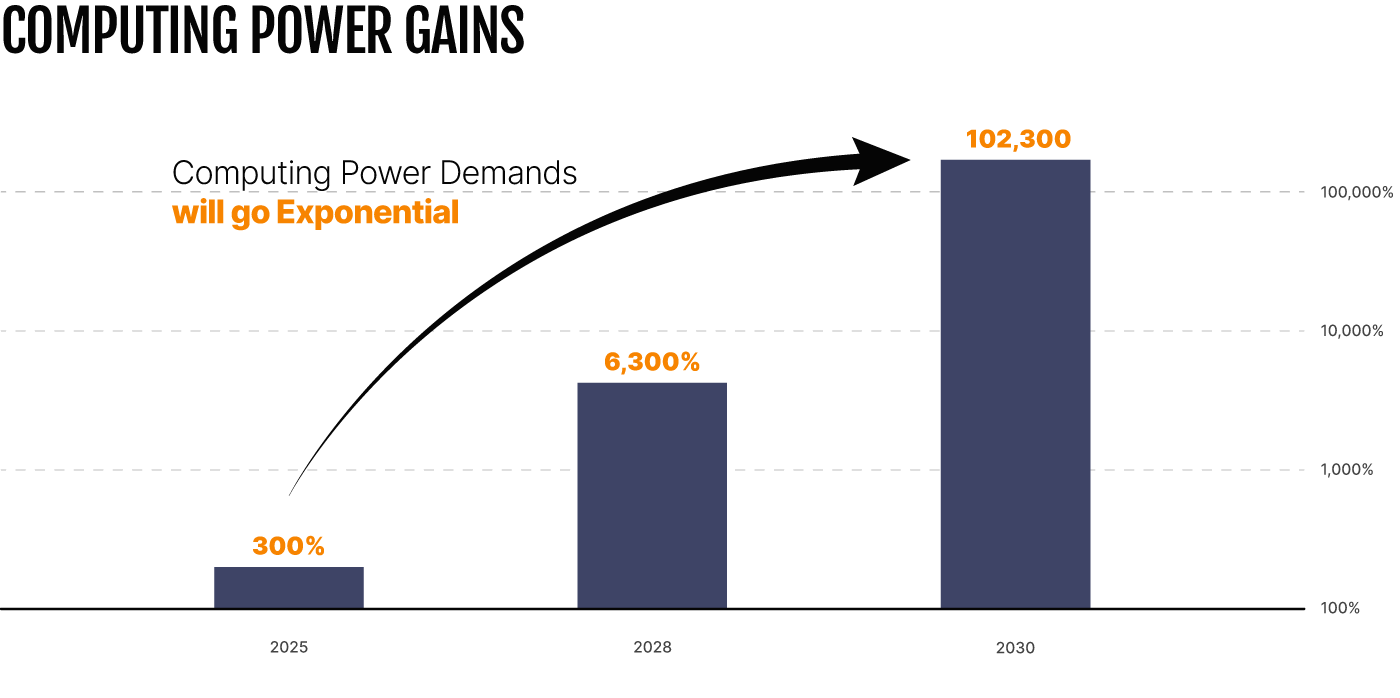

That means in one year, the amount of computing power required to train AI systems will increase by 300%…

In 3 years, by 6,300%…

In 5 years, by a staggering 102,300%.

This is where the problem lies…

Operating and developing new artificial intelligence systems requires unparalleled energy demands… energy demands we cannot currently meet.

Consider this: ChatGPT already receives an average of 10 million queries per day.

That’s roughly 300 million queries per month.

Research from the University of Washington shows it costs around one gigawatt-hour of energy to answer these queries.

One gigawatt-hour is roughly the same energy consumed by 33,000 households! And that’s for only one AI program.

The problems are FAR worse at scale.

You see, The University of Massachusetts Amherst found that “training a single AI model can emit as much carbon as five cars in their lifetimes.”

That’s not operating, just development.

And that’s for just ONE of the thousands upon thousands of AI models that are being trained every single day.

That’s why, The New York Times reported, by 2027 AI servers are predicted to consume as much as 134 terawatt hours annually.

In other words, in less than three years, AI will have the same annual energy consumption as countries like Argentina, the Netherlands, and Sweden.

AI Could Soon Need as Much Electricity as An Entire Country

These energy demands are simply not sustainable.

Especially when AI adoption is at maybe 1% of where we’ll be in the next few years according to industry insiders.

For AI adoption to penetrate just 10% or 20% of the market, we’re looking at it consuming unprecedented amounts of energy.

Now, those on the frontier of the artificial intelligence industry are aware of this problem and they have started to sound the alarm.

If you really want to make the biggest, most capable super intelligent system you can, you need high amounts of energy.SAM ALTMANCEO, OPEN AI

The world is actually headed for a really bad energy crisis because of AI unless we fix a few things.ARIJIT SENGUPTAFOUNDER, AIBLE

And Elon Musk predicts that by 2045 the power demand in the U.S will have tripled from current levels – largely driven by AI’s needs.

They know that unless the insatiable energy demands of artificial intelligence are met, the industry will never go mainstream.

And right now, there is no solution.

Fossil fuels are the primary energy source used to train and operate AI systems and could continue to meet the growing energy demands…

But that would require the woke Silicon Valley tech companies and progressive politicians to turn their backs on the religion of Climate Change.

And with the activists already up in arms about the environmental impact of artificial intelligence, this is untenable to the ruling class.

So they’ll argue that renewables like wind and solar should be used to meet the energy demands of AI…

But the reality is that there is ZERO chance of these renewables producing enough low-cost energy to meet AI’s needs.

As The Manhattan Institute reported:

“Thinking that wind and solar can ever replace fossil fuels is nothing but an “exercise in magical thinking.”

Of course, those who have decided that fossil fuels are quite literally the end of humanity don’t care for these facts.

The Ivy League elites continue to lecture us that wind and solar are the ONLY way forward.

But let’s look at the data:

Recent research has shown that after two decades of intense support for increased clean energy…

The proportion of energy provided by these “clean sources” went from a paltry 13-14% to… get this… 15.7%.

That’s after global investment and spending on these clean energy solutions hit an estimated $1.4 trillion in 2022.

Tell me, after more than twenty years of failure, do you think these green “solutions” will suddenly be able to meet the exponential energy needs of AI

Of course not.

Just consider the projected energy consumption of artificial intelligence we discussed earlier, 134 terawatt hours annually.

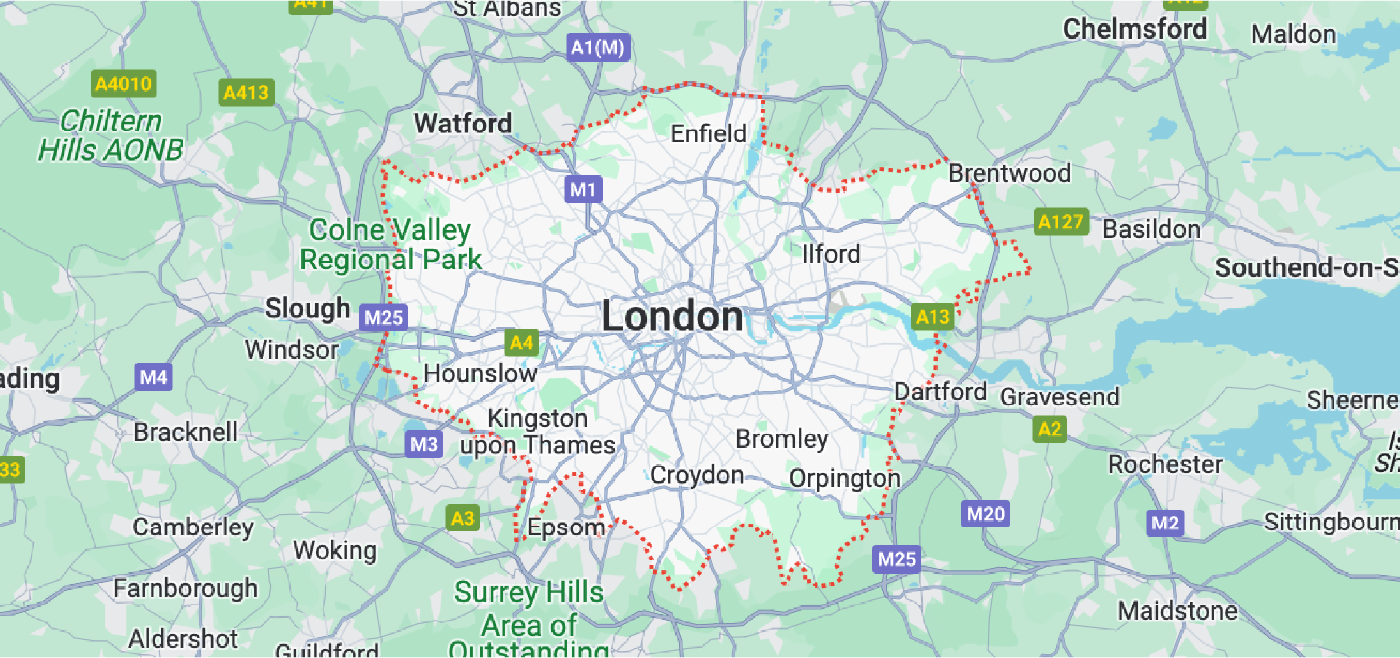

To generate this amount of energy from wind power alone would require almost 17,000 wind turbines.

That would take up roughly 2,284 square kilometers, about 1.5-times the size of London – a city of 8.9 million people.

And that’s assuming all this energy went to AI

This is why it’s obvious to me that renewables like wind, solar, and hydro will NEVER meet the energy demands of AI

And this has created a unique situation…

You see, the economic, social, and geopolitical incentives behind AI are far too powerful to be stopped.

Even the Biden administration is not incompetent enough to halt the progress on AI development and cede power to our rivals like China and Russia.

However, for artificial intelligence development to continue and reach its full potential vast amounts of energy will be required.

And there’s only one solution…

An Asymmetric AI Investment

This has created what I believe could be one of the greatest investment opportunities you’re ever likely to see.

Just as the Keystone in an arch is required to hold the structure together, I believe the entire AI market will rely on a new Keystone technology.

Without this tech, I don’t believe the industry will ever scale or achieve its full economic potential.

In short: it is the future of the entire sector. And I’m not the only one who’s connected the dots on this either…

Jeff Bezos has raised $130 million for a little-known Canadian company developing The AI Keystone.

Peter Thiel, co-founder of PayPal, has pledged $2 million to a company working on The AI Keystone.

Warren Buffett, Reid Hoffman, Ken Griffin, and Jim Simons have all invested in The AI Keystone too.

And while many believe Bill Gates left Microsoft to become a full time philanthropist, that’s not the whole story…

After stepping down as the CEO of Microsoft, he joined a Wyoming-based startup working to develop The AI Keystone.

Since then, he’s invested more than $750 million.

You see, these billionaires know, as I do, that this technology is inexorably linked to the future of AI…

And that whoever is the dominant company in this space could potentially see phenomenal financial returns over the long term.

How do I know?

Because this isn’t the first time I’ve alerted my readers to a huge opportunity at the intersection of the technology and energy markets.

I saw a similar convergence unfolding during the “peak oil” mania.

At the time, all the leading experts warned that the world was running out of fossil fuels.

As Robert U. Ayres, one of America’s most respected economists and scientists, wrote:

No one is questioning the fact that we have either reached or will soon reach peak oil.ROBERT U. AYRESAMERICAN ECONOMIST

He was wrong.

I questioned it.

Loudly and publicly.

Because I saw an entirely different story unfolding…

I saw that thanks to new shale drilling technology, America was on the cusp of an unprecedented boom in oil and gas production.

In fact, I even went so far as to say that America would become one of the world’s largest exporters of cheap shale oil and gas.

I was laughed at for my prediction.

What happened next?

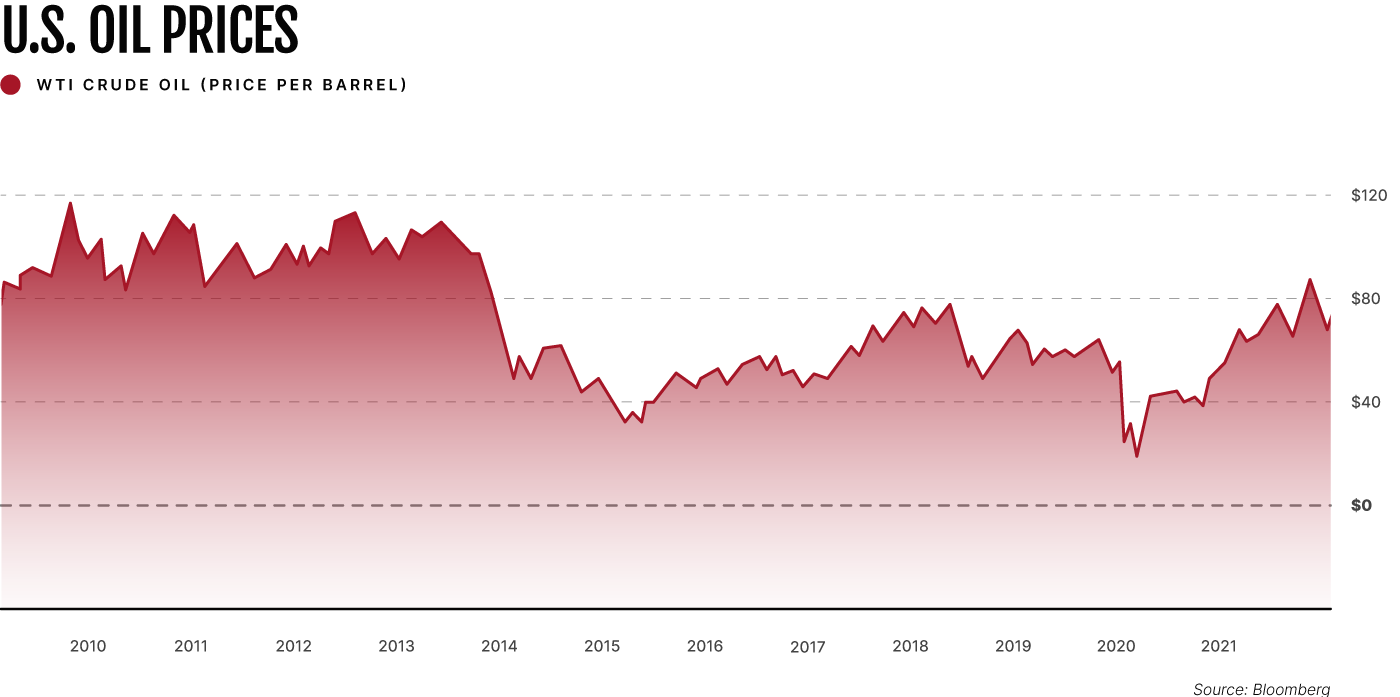

Oil prices plunged from $114 a barrel in 2011 to $29 a barrel in 2016…

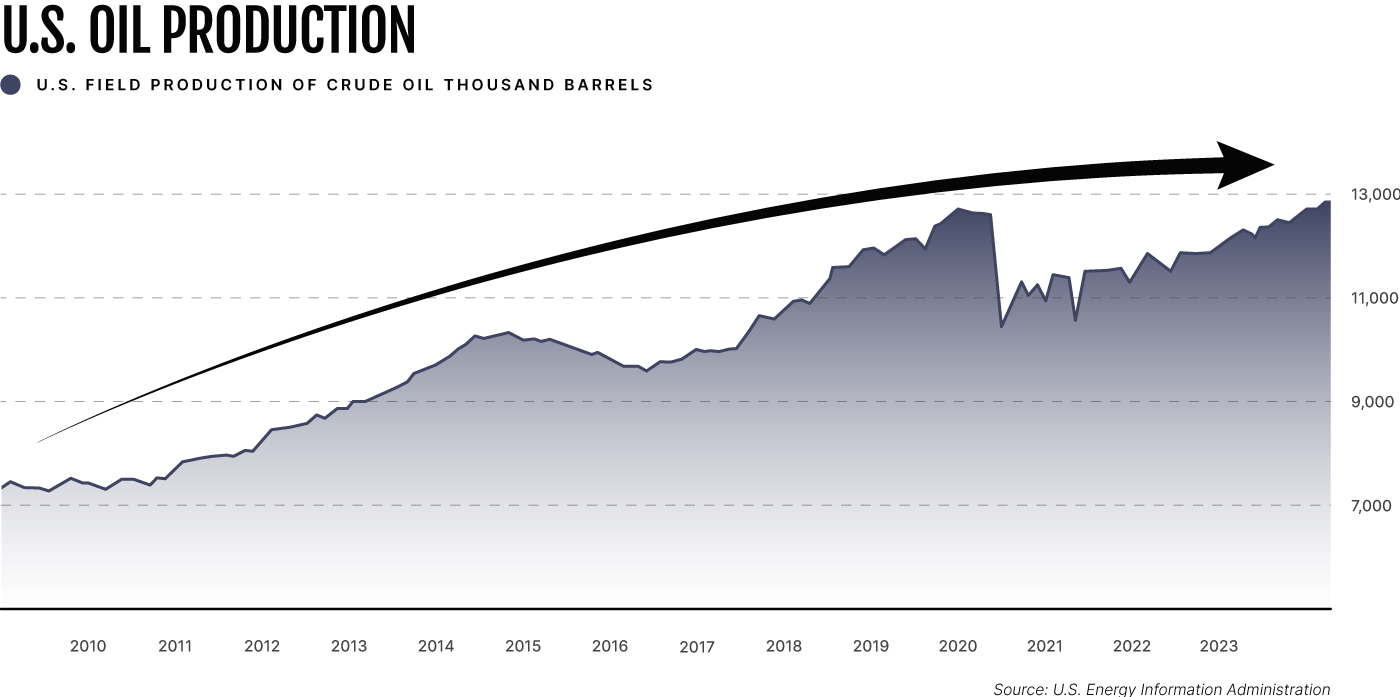

Oil production doubled between 2011 and 2022…

And we continue to uncover vast new reserves of oil and gas so much so that since 2018, we’ve been the largest producer in the world.

This new energy development, however, could be even more impactful as I believe it will be absolutely critical to the future of AI…

The AI Keystone

All the stories you’ve seen about AI…

They’ve likely focused on the companies creating and training the artificial intelligence models like OpenAI, Google, and IBM.

Or companies manufacturing the computer chips that these AI models run on like Nvidia, Intel, and AMD.

And over the past year, investors have dumped billions of dollars into these stocks in an attempt to capitalize on the AI frenzy.

But as you’ve seen today, there’s a far bigger story unfolding… one that nobody on Wall Street or in the financial media is telling you about.

It’s the story of The AI Keystone…

The ONLY energy source that can sustainable meet the insatiable power demands of artificial intelligence.

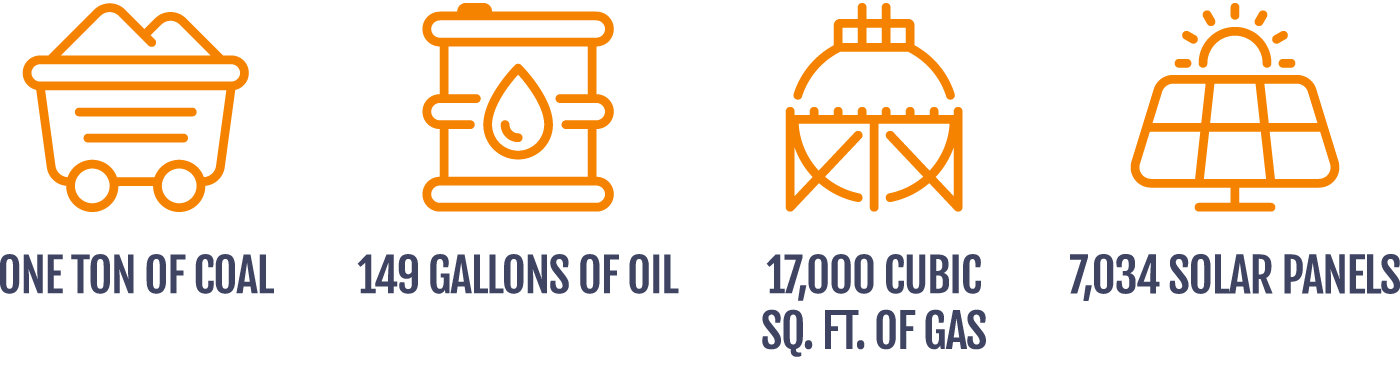

Just one pellet of The AI Keystone – about the size of your fingertip – can produce the same amount of energy as:

All while producing zero emissions.

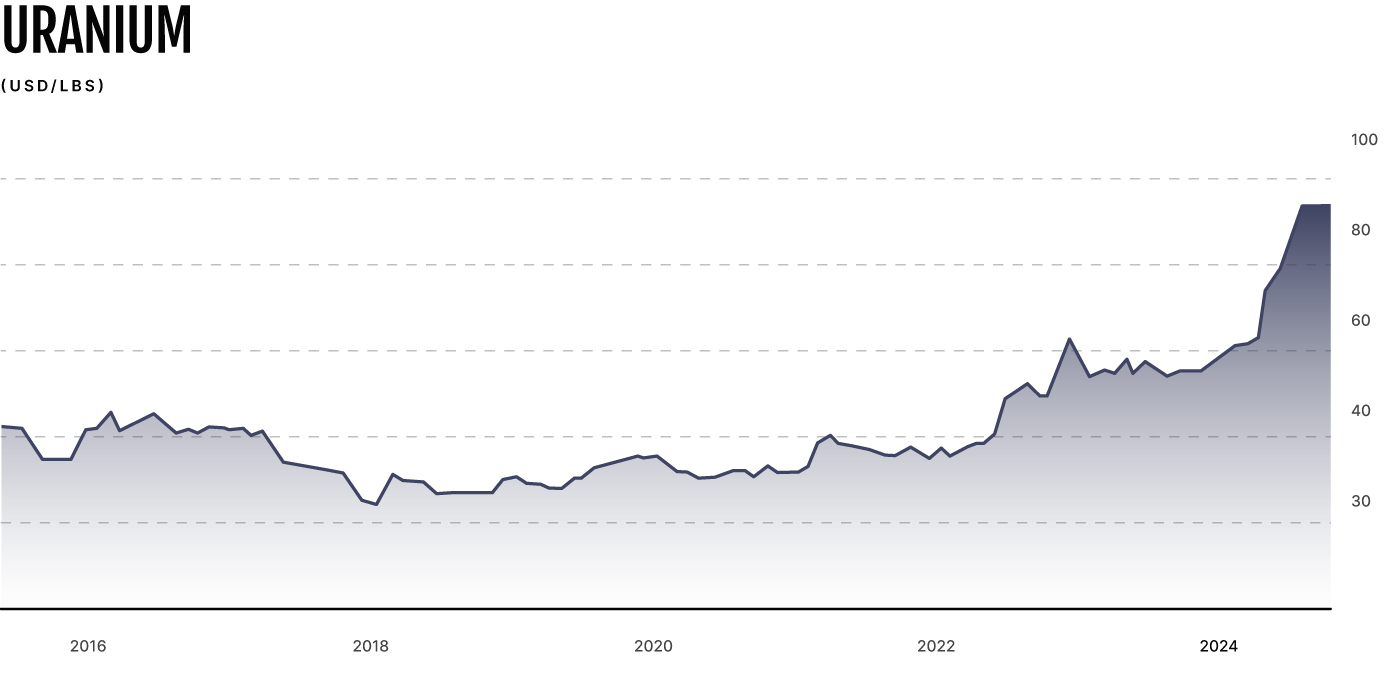

I’m talking, as you might’ve guessed, about uranium.

However, uranium and nuclear energy alone aren’t the answer to the energy demands of artificial intelligence.

That’s why I’m NOT telling you to rush out and buy uranium, mining stocks, or a nuclear energy ETF.

You see, despite uranium and nuclear energy’s resurgence in popularity, it’s not enough to solve AI’s energy needs alone.

Because without the technology that will bridge the gap between nuclear energy and AI – progress and innovation won’t happen.

You see, it takes years and tens of billions of dollars to build a single nuclear power plant.

And after decades of propaganda about the evils of nuclear energy, the U.S. has fallen far behind our geopolitical rivals.

Since 2017, Russia and China have accounted for 87% of newly installed nuclear reactors worldwide…

And by 2030, China is projected to be the world’s leading nuclear-power producer.

At the same time, we’ve built one. It’s pathetic.

The U.S. is getting it's first new nuclear reactor in 40 years

But now, with the green energy delusion collapsing and many politicians coming to the realization that wind and solar cannot replace fossil fuels…

The radical climate activists have finally come to the conclusion that only nuclear power can meet the world’s growing energy demands.

That’s why over the last 12 months or so we’ve seen a shameless 180-degree turn in how the progressives view nuclear power.

Even the High Priestess of climate change, Greta Thurnberg is embracing nuclear after previously calling it…

…extremely dangerous, expensive, and time-consuming…GRETA THURNBERG

It’s not just the activists either.

The U.S. Secretary of Energy, Jennifer Granholm, a radical who makes inane music videos about ending fossil fuels…

…has come to admit that…

the future of nuclear energy is here and should be protected.JENNIFER GRANHOLMU.S. SECRETARY OF ENERGY

Now, the government is moving to adopt nuclear power and recently passed the ADVANCE Act(the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy.)

Its stated mission is to:

“Boost development and deployment of new nuclear technologies, incentivize expansion in America, […] and help position the U.S. as the world’s leader in nuclear energy.”

Miraculously, this is one of the only bills this year that made it through the senate with bipartisan support…

Which highlights the importance of nuclear energy not just for the future of AI but for the country.

In fact, the US Department of Energy recently went so far as to say:

“Nuclear power is intrinsically tied to national security.”

While it’s refreshing to finally see D.C pass legislation that’s grounded in reality and that will benefit the country, there’s a problem.

After decades of negative attention and pressure from the mainstream media, the U.S. has been closing nuclear power plants.

In 1998, the number of operating reactors declined to 104 and remained there through 2013…

When the number then declined even further to 92 in 2022.

On top of that, nuclear power has only provided 20% of total annual U.S. electricity generation from 1990 through 2021- that’s 31 years of stagnation.

In fact, Plant Vogtle in Waynesboro, Georgia, will be America’s first new nuclear plant since the 1990’s.

The only catch?

It took 15 years to build…

And cost more than $30 billion.

Don’t get me wrong, this is a massive milestone for Waynesboro and the country.

The plant is projected to power 500,000 homes and businesses for the next 60 to 80 years… but Plant Vogtle’s story exposes a brutal truth:

Building nuclear power plants is expensive, time-consuming, and complicated.

Just take Bill Gates’ nuclear company as an example.

Started in 2006, TerraPower has yet to produce any nuclear power for the private or public sector.

That’s 17 years with hardly anything to show for it. But in the world of nuclear energy, Gates isn’t alone in his failures.

According to the World Nuclear Industry Status Report, the average time to construct a nuclear power plant is ten years.

This means, traditional nuclear power plants will be unable to meet the exponentially growing energy demands of the AI sector.

It could take decades for the U.S. to build out the necessary infrastructure.

However, thanks to a single decision on February 21 last year…

…a new type of nuclear energy will be able to provide practically endless clean energy all across the country.

A New Nuclear Energy Revolution

For the first time in history, nuclear energy has become scaleable.

A new technology was recently approved by the U.S. government… and it’s THIS technology that will act as the Keystone for the AI industry.

It enables AI companies to use nuclear energy – easily, quickly, and without spending years and billions of dollars to develop power plants.

It’s a revolutionary new technology that allows us to build hundreds, if not THOUSANDS of nuclear facilities all across the country.

At 1/50th the cost and in 1/5th the amount of time.

To say this is an historical development would be an understatement.

It is a generational achievement that, according to former Presidential advisor David Durham is

A game-changing technology.DAVID DURHAMFMR. PRESIDENTIAL ADVISOR

It’s something that former White House Deputy, Matt Bennett, believes will…

Save the world.MATT BENNETTFMR. WHITE HOUSE DEPUTY

So what is this technology that I believe will be the Keystone of the artificial intelligence industry for decades to come?

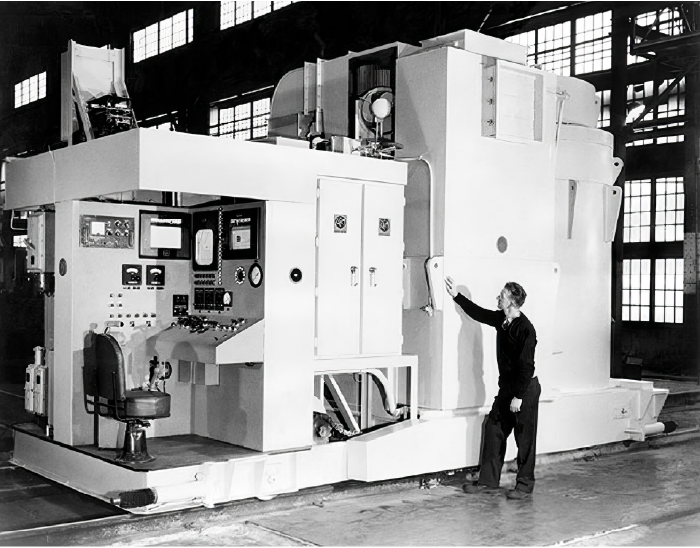

The answer lies in this photo from 1963:

It's a nuclear power plant named after a Nobel-prize winning scientist named Enrico Fermi.

Fermi was one of the greatest geniuses of the last 100 years and is considered the father of nuclear energy.

According to author David Schwartz,

Fermi was probably the last person who could view physics as an integrated hull. He had this comprehensive knowledge of virtually every area of physics.DAVID SCHWARTZAUTHOR

Obviously, the Enrico Fermi reactor was very different from a typical nuclear reactor.

That’s because it was the world’s first small modular nuclear reactor, otherwise known as an SMR.

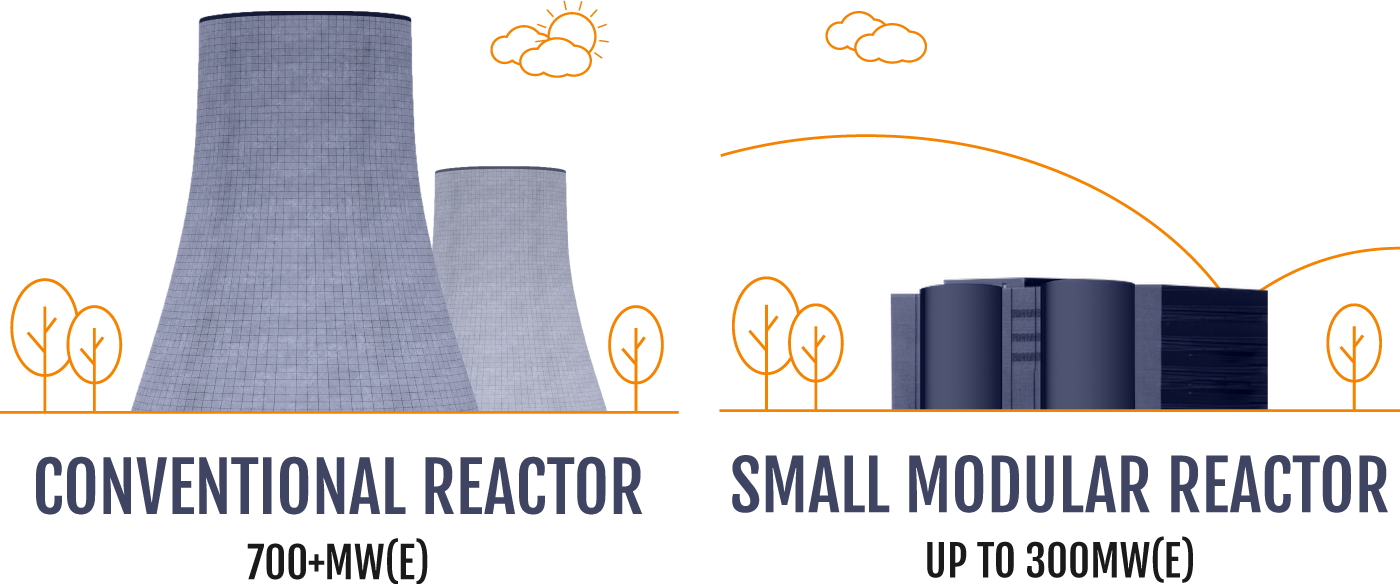

As the name implies, an SMR is a nuclear reactor that produces nuclear energy but is MUCH smaller than a typical reactor.

Which means it has all the advantages of a nuclear reactor, with almost none of the disadvantages.

- It can produce electricity without overheating.

- It can self-regulate.

- It can be paired with renewable resources.

- It can be built in two years (as opposed to ten).

- It can be deployed on top of shuttered coal plants, of which we have 300 in America right now…

- Which is what Bill Gates’ nuclear company – TerraPower – has done. They’ve staked their claim at the site of a retired coal plant.

And…

- An SMR can produce energy for 10 years without being refueled, whereas a typical reactor has to be refueled every 18 to 24 months.

This is why, as our energy needs continue to surge, SMRs are gaining the attention of governments around the world.

They know green energy can’t meet the demands so hundreds of billions of dollars are pouring into the development of SMRs.

Right now, 80 different SMR designs are being developed in 19 different countries.

Three have already begun operating. Others will soon follow. And when they do, the world will never be the same again.

For the first time ever, we will be able to provide nuclear energy to ANYONE, ANYWHERE, AT ANYTIME.

And we’ll be able to do it WITHOUT having to spend billions of dollars on reactors that take a decade to build.

And this is why Small Nuclear Reactors (SMRs) are The Keystone technology to the AI industry.

It’s the ONLY way tech companies can meet the energy demands of artificial intelligence without fossil fuels.

Mark my words…

In five… ten… even fifteen years from now…

When we’re looking back on the craze of the AI boom, the top investments won’t be the company with the best artificial intelligence.

No.

The real winners will be those who master the SMR.

Consider Sam Altman’s SMR startup, Oklo. He plans to take it public this year for upwards of $500 million dollars.

Why?

Well, in his own words:

If the use of artificial intelligence scales up, it will demand a lot of energy… I don’t see a way for us to get there without nuclear.SAM ALTMANCEO, OPEN AI

And that’s why he not only serves as the chairman of Oklo, the startup working to commercialize nuclear fission with microreactors…

But he’s also invested $375 million in Helion – that’s right; another nuclear company – marking the “biggest investment [he’s] ever made”

Helion is a nuclear energy startup working on systems that are “smaller, a lot faster to iterate, and then gets […] to commercially useful electricity […] as soon as possible.”

You see?

The name most analogous with AI – Sam Altman – is ALL-IN on nuclear microreactors.

And it doesn’t stop with him.

In addition to Oklo, a number of other companies are working on “new breeds” of advanced microreactors…

Including GE Hitachi, Holtec, Kairos Power, NuScale Power, TerraPower, and X-energy.

However, despite the potential of these companies, I don’t recommend you go near them. You see, there is one major roadblock each of them faces.

The Nuclear Regulatory Commission (NRC).

And like every government organization, they are doing their best to stifle innovation, slow progress, and police the industry.

Case in point:

In November 2022, the NRC denied “without prejudice” Oklo’s application to build and operate the company’s Aurora microreactor in Idaho.

The reason?

“Failure to provide information on several key topics.”

Vague, confusing, and totally unhelpful – classic bureaucrats!

Bill Gates’ company – TerraPower – hasn’t even submitted an application yet.”

Turns out, no one’s been able to design an SMR that meets the strict criteria of the Nuclear Regulatory Commission of the U.S. government.

That is, until now.

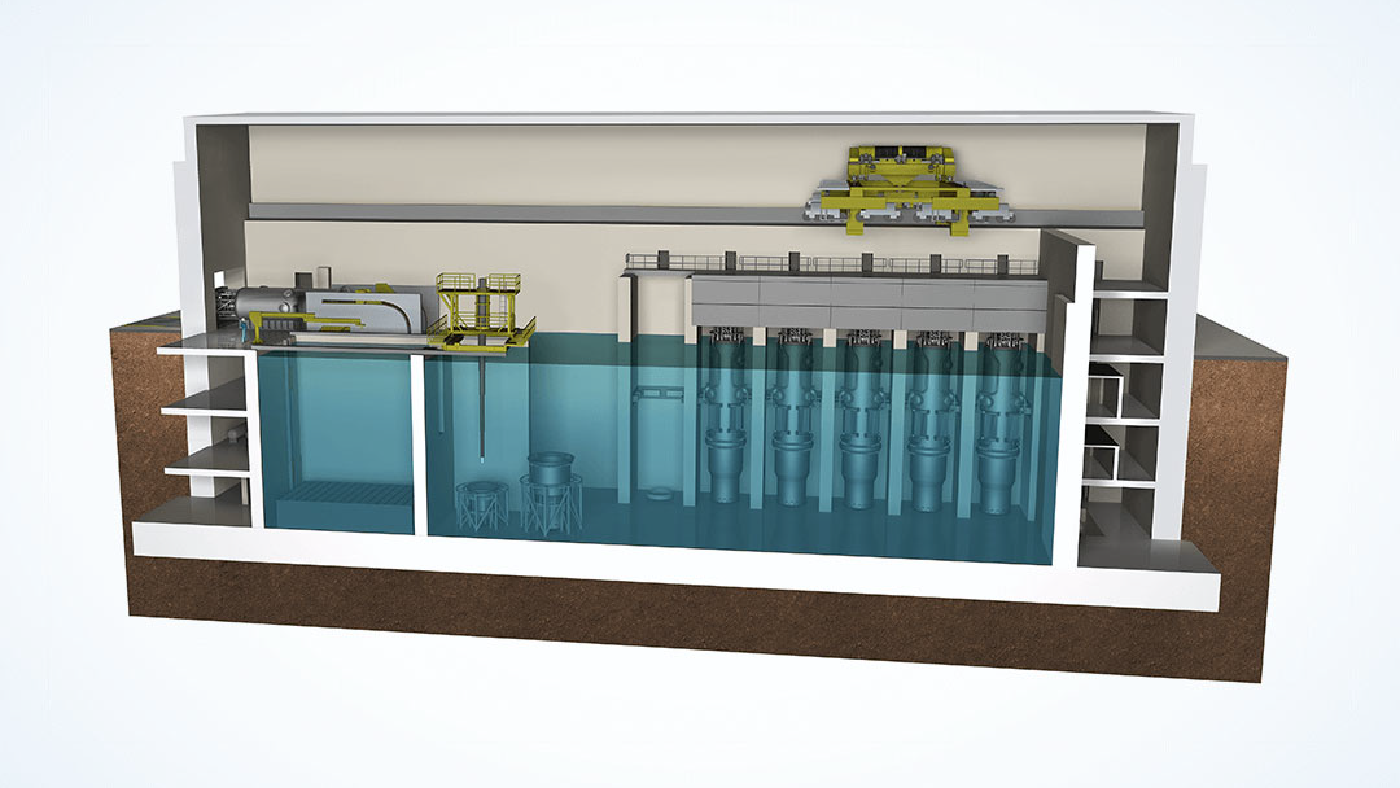

Pictured here is the VOYGR-12:

And in 2023, it became the first ever SMR design to gain regulatory approval by the U.S. government.

This means it has been cleared for use in the United States.

Developed by a company called NuScale Power, the VOYGR-12 can generate 924 megawatts of electricity on 32 acres of land.

To put this into context… you would need 10,880 acres of land to generate that same amount of power using solar panels.

And 60,160 acres of land to generate that same amount of power using wind turbines.

But just so we’re on the same page…

I’m NOT telling you to buy shares of NuScale Power.

You’ll likely hear a lot about this company over the next several months.

And I’m sure a lot of people will tell you to invest in it because the story of NuScale is incredible… it is enough to whet any investors appetite.

It’s a small business out of Portland – with less than 500 employees – that has been approved to build small nuclear reactors that could provide clean energy to millions of people.

Problem is, NuScale doesn’t have any money.

According to analysts, they only have 15 months left of cash to finance their operations.

And until they get the funding they need to build SMRs, we’re still many years away from seeing them become a profitable enterprise.

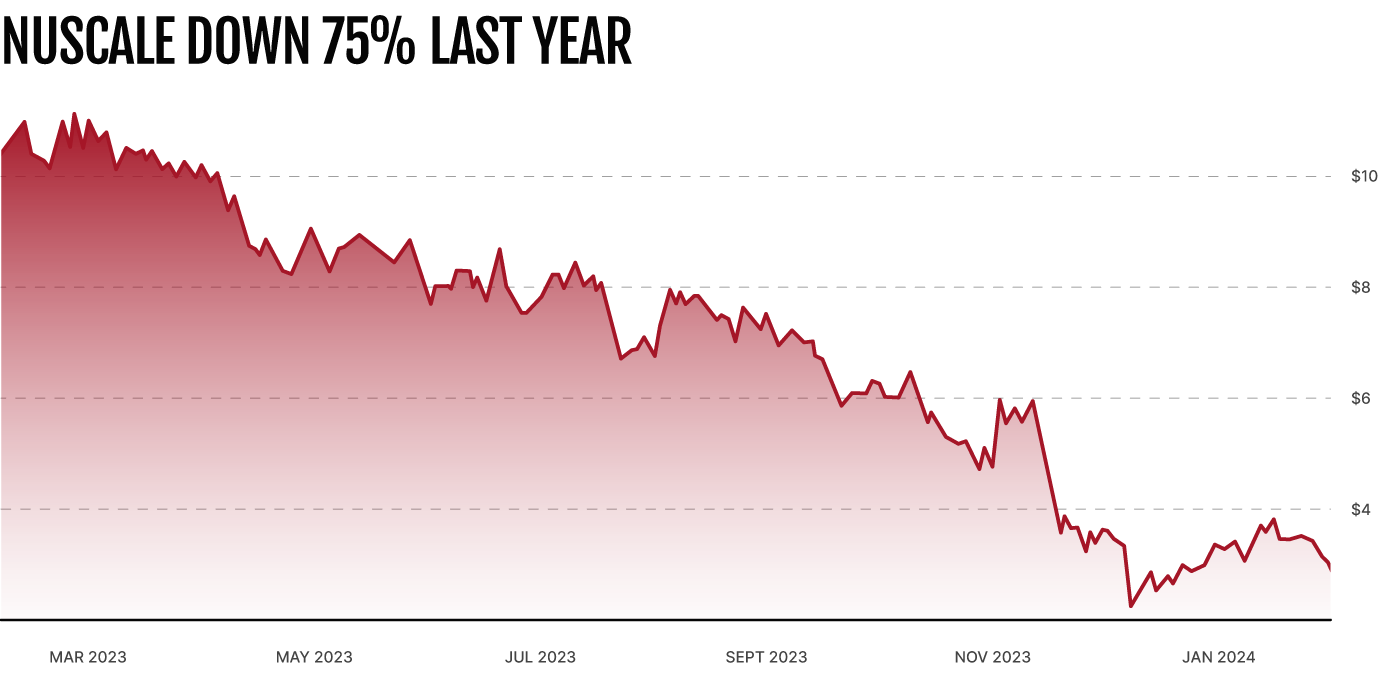

Until that day comes, I wouldn’t suggest you buy a single share of this stock. In fact, their share price is down 75% over the last year.

There is also a far better company than NuScale…

You see, NuScale may be the first company to get the government’s stamp of approval for building SMRs.

But another company is actually building one right now, in real-time and it’s already got the backing of our government.

The Military-Backed AI Keystone Company

This facility is where 2,100 people are building a new type of small reactor called a microreactor.

That’s right. It's the same type of small nuclear reactor that Sam Altman is attempting to build with his company, Oklo.

Except this company has the first one in America.

And what’s most exciting is that this ONE company isn’t some speculative private startup trying to get off the ground…

It’s a publicly traded company with a pipeline of multi-billion-dollar nuclear contracts with the U.S. government, big pharma companies, and major utility providers.

In doing so, this company has strategically locked in their future revenues for the next 25 years.

And I believe all but guaranteed their position as the dominant firm providing nuclear energy to America.

As the former Bureau of Labor Statistics's Economist says,

This company’s future is tied to the future of nuclear power both military and civilian.BUREAU OF LABOR STATISTICS ECONOMIST

This guy doesn’t work for the company.

But he knows, just as I do, that this company:

- Is the sole manufacturer of nuclear reactors for U.S. military aircrafts and submarines.

- Is one of only two providers licensed to store and process uranium for those reactors.

- Has a near-lock on supplying the Navy with critical nuclear inputs, and…

- Delivers almost all of the mechanical equipment for the Navy’s nuclear platforms.

But more importantly, he knows that this company is already building microreactors for the U.S. military.

And as the sole manufacturer of nuclear reactors for the military, I believe this company is an impregnable fortress.

Their multi-decade, government funded contracts also gives them very little exposure to swings in the economy.

So while the other nuclear companies like NuScale, TerraPower, and Oklo are subject to interest rates, investor sentiment, and a myriad of external forces…

This company has their revenues locked in and funded years to come.

I believe the emergence of small nuclear reactors, and microreactors in particular, is the biggest development in energy since fracking.

It’s something Morgan Stanley believes will bring about a “nuclear revival” in America.

And William Becker, a senior official with the Department of Energy says,

[This Technology] could save civilization.WILLIAM BECKERDEPARTMENT OF ENERGY OFFICIAL

And now that the first SMR has finally been approved for use by the U.S. government, these reactors are no longer hypothetical.

They are becoming a reality.

I believe they are going to make nuclear energy the DOMINANT form of clean energy in America within my lifetime.

And as I’ve shown you today, I believe these SMRs will play an absolutely critical role in the future of artificial intelligence…

They are the ONLY viable energy source that can meet the ravenous power demands of widespread AI in a clean, emission-free manner.

And I believe this military-backed SMR manufacturer could be among the most important companies in the AI revolution.

That’s why I want to give you access to my research firm’s investigation into this company. It’s called:

The AI Keystone

It reveals everything you need to know about the nuclear revolution that I believe will not only fuel the AI markets but could also revive our nation.

Inside this briefing:

- You’ll discover how nuclear energy works, and why it is safer, cleaner, and more effective than any other form of energy we have on earth.

- You’ll get a detailed look at the history of SMRs – and microreactors – in particular.

- You’ll see how one company has come to be the sole supplier of nuclear reactors for the military.

- You’ll discover why I believe nuclear energy is the Keystone technology to the AI market and the critical role it plays.

- Plus much, much more.

Typically, for access to my firm’s research, you would need to invest $1,425 per year.

And while we have more than ten thousand members from all over the world, we are well aware that our work is out of reach for many people.

That’s fine. Our research is not for everyone. We typically cater to a smaller, more elite group of readers.

Our members include NASA scientists, hedge fund managers, venture capitalists, billionaires, bank Presidents, and private wealth managers.

However, the story I’ve told you about today is so important I believe everyone should have access to this information.

Because now that we have a government authorized technology that makes it possible to deliver nuclear energy to anyone, anywhere, at any time…

…the biggest problem with nuclear power has been solved and I believe the industry is about to see an unprecedented resurgence.

And I’m not the only one saying this…

- One MIT nuclear scientist calls microreactors “transformative.”

- Award-winning nuclear engineer Caleb Brooks says “they could have a real future in decarbonizing the energy landscape in the U.S.”

- And award-winning PhD engineer, Jean Allain, feels that microreactors can “revolutionize the way we think about energy.”

Guys with credentials like these…

They don’t “hype” things up for no reason. They know that nuclear energy is the key to solving America’s energy crisis.

And as you’ve now seen for yourself, so do America’s billionaires…

- Jeff Bezos has just invested $130 million in nuclear technology.

- Sam Altman has put $375 million into nuclear – the largest investment he’s ever made.

- Hubert Perrodo has invested $208 million into small nuclear reactors.

- Now, so has the U.S. government…

- The DOD has invested $1.2 billion in nuclear technology, and they plan on investing another $5.5 billion over the next decade.

I don’t want the price of my firm’s research to be a barrier to learning more about this incredible company.

So while it’s only our members who’ll get ongoing updates and our buy and sell recommendations… I want everyone to know more about this company.

That’s why instead of investing $1,425 for access to our financial research services… you can get this briefing for just one payment of $199…

That’s an 89% discount.

A savings of more than $1,200.

And that’s all you’ll ever pay. There’s no ongoing fees, no annual subscriptions. Nothing.

To be clear: we invest millions of dollars per year in our research and giving it away for so little is not how we typically operate.

That’s why I suggest you take advantage of this special offer while it’s still available. All you have to do is click the button below now.

You’ll be taken to a secure, encrypted webpage where you can review everything waiting for you and take advantage of this special offer.

On this page, you’ll also find the details of three additional special briefings I have set aside for you…

Your Bonus Briefings

The first briefing I want you to read is one of the most important the team here at Porter & Co. has ever written.

It’s called The AI Illusion.

It’s an exposé into the truth about the AI markets…

You see, as I said earlier, while the recent developments in large language models, neural networks, and generative AI are phenomenal…

The truth about AI has been grossly misrepresented to you by the mainstream media, financial press, and Wall Street.

In an effort to capitalize on the frenzy around artificial intelligence, many companies and pundits have lied to you.

They’re doing it to drum up new investment, inflate their valuations, generate media attention, and enrich themselves.

And unless you know what’s going on… you could see your investment portfolio decimated in the months ahead.

What you’ll discover inside The AI Illusion will contradict EVERYTHING you’ve been told by the mainstream media over the last 12 months…

You’ll get an unflinching view into what’s really going on in the artificial intelligence markets…

Why much of what you’re being told is a lie, and how you can see through the hype.

My analysts and I detail the sector in a way you’ve never seen before…

We analyze the current market (and the key companies in it) with a sober, unbiased view that cuts through the hype and misinformation that is leading most investors down a dangerous path.

We detail the companies you must avoid at all costs… along with the companies who could benefit from AI over the long-run.

These are not investment recommendations but rather firms you want to keep an eye on in the months and years ahead.

The companies my team and I are watching because of how they’re applying advancements in artificial intelligence to strategically grow their already exceptional businesses…

…and that once the mania of the sector crashes and valuations return to earth we will consider buying.

In fact, there are three companies in particular that we’re carefully monitoring… and along with your copy of Artificial Illusion I’d like to send you our research analysis of each.

The first is a fintech company that’s on its way to becoming a $1 trillion powerhouse – an undisputed leader in its field thanks to recent advancements in AI.

The second is a cosmetic firm whose proprietary algorithm has enabled them to grow their earnings nearly every year for the last decade.

The third is an equipment manufacturer that, believe it or not, may end up literally saving the world 20 years from now.

Nobody else – whether it’s the mainstream press, investment bank, Wall Street firm, or independent financial publisher – is telling you this story.

If you have ANY exposure to ANY tech stock right now you must read this special AI Illusion briefing immediately.

I’m also going to add you to an exclusive, private newsletter.

This access-pass costs you nothing but will give you ongoing research from the analysts here at Porter & Co.

Every week you’ll get a briefing exploring the most important, yet often overlooked, factors influencing the markets.

Outside of research teams inside hedge funds, banks, and private equity firms, there’s no one producing research like this.

Our team includes Wall Street legends like Marty Fridson and Tom Carroll, former fund managers and founders, Fortune 100 consultants, and more.

And you’ll get this weekly report sent directly to you – for as long as you want – when you accept today’s special offer.

Finally, you’ll also get access to one more special briefing…

Ticking Time Bombs:

10 Companies You Should Have Sold Yesterday

In this report, we list 10 stocks my team and I have identified and labeled as toxic.

The problem is these are household names.

Try telling any fund manager or financial planner that these iconic American companies are in grave danger, and you’ll get laughed out of the room.

Unfortunately, we’ve been here time and time again.

For example, I warned investors as early as 2002 that General Electric was a house of cards and that it would collapse in an implosion of bad debt.

At the time, GE was the most valuable publicly traded company in the world but we all know what happened next…

A few years later, I wrote an entire series of “Letters from the Chairman of General Motors,” which accurately explained why GM was doomed to bankruptcy beginning in 2006.

The company filed for bankruptcy in 2009.

Then I warned that Fannie Mae and Freddie Mac were “zeros” in June of 2008, shortly before both firms collapsed, despite public officials telling Congress that they were “adequately capitalized.”

Right now, there are 10 companies that are ticking time bombs.

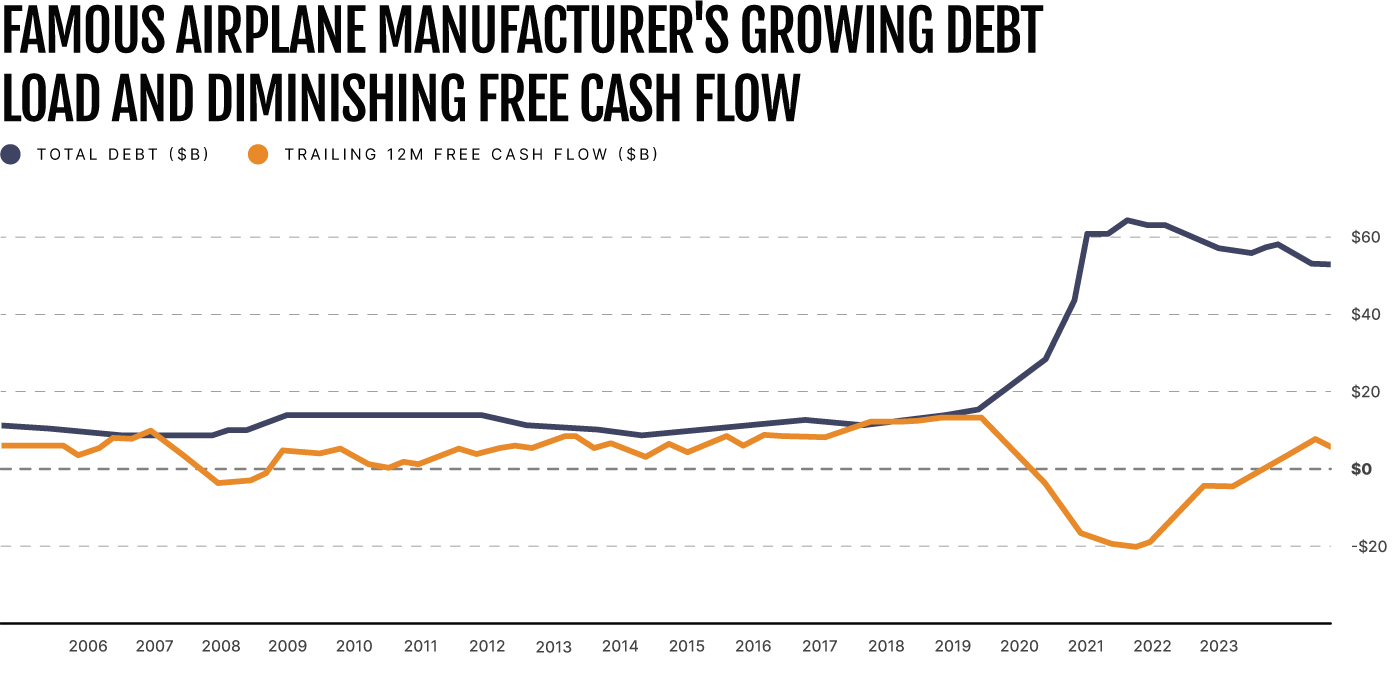

Take the case of this famous airplane manufacturer.

Their debt has exploded by 5x since 2018, yet in the last 12 months they’ve only generated $2.3 billion in free cash flow.

And over the next four years alone, they face a wall of $22 billion in debt maturing. Debt that my research shows they can’t pay.

I predict that this once-great American company will soon find itself in an uncomfortable headlock.

It’ll be incapable of repaying or refinancing these bonds at anything less than exorbitant rates of interest.

Throw in the potential for a sharp recession – bad for travel, worse for airlines – and their financial situation goes from precarious to impossible.

And this is just one example.

There are nine other companies that have painted themselves into a corner by gorging on debt…

And now the era of low interest rates is over, they are balanced on a knife’s edge.

They all have declining sales, growing debt loads, and an unsustainable amount of leverage relative to their earning power and cash on hand.

I believe you need to avoid these companies at all costs… but chances are you probably have exposure to at least some of them.

That’s why I want to ensure you read this special briefing as soon as you get it.

To get your hands on it, all you’ve got to do is take advantage of this special offer.

To recap, here’s everything waiting for you when you take me up on this special offer…

Here's Everything Waiting For You:

Here's Everything Waiting For You:

- 87% DISCOUNT on Porter & Co.’s research

- Saving of more than $1,200 (RRP: $1,425)

- The AI Keystone

- The AI Illusion

- The $1 Trillion Powerhouse

- The Prettiest Stock on Wall Street

- The Apple of Agriculture

- 10 Companies You Should Have Sold Yesterday

- Weekly insights from Porter Stansberry & Co.

Get it now for only $199.

To take advantage of this special discounted offer, simply click the button below now while it’s still available.

Or, if you prefer, you can call my office to speak with my team.

All the details are listed on the next page, so go ahead and click the link below now while this offer is still available.

I look forward to serving you.

Sincerely,

Legal Notices: Here is our Disclosures and Details page. DISCLOSURES ABOUT OUR BUSINESS contains critical information that will help you use our work appropriately and give you a far better understanding of how our business works – both the benefits it might offer you and the inevitable limitations of our products. Although this is not a part of our “Disclosures and Details” page, you can view our company’s privacy policy here.