From the desk of Tim Plaehn, one of America’s top dividend experts: “After 10 years, I’m pulling back the curtain on how to make 6-figures in dividends”

Earn $700,000 of Dividends over the Next Decade!

In the summer of 2014, I quietly recommended 3 no-name dividend stocks to a small group of retired folks…

A decade later… these 3 stocks generated $671,727 of dividends inside an average IRA portfolio

TODAY — I’m releasing a new set of 3 stocks to buy and hold for the next “Decade of Dividends” (and the payouts could be BIGGER)

Hi, my name is Tim Plaehn.

I’m known around the financial industry as the “Dividend Hunter.”

That’s because, over the past decade, I’ve shown over 100,000+ readers every week how to pay your bills for life with just dividend stocks.

I’ve given talks about dividend investing to packed conference rooms and delivered over 120 monthly issues of dividend stock recommendations to folks looking for income.

Today, I’m revealing 3 stocks that could generate over $700,000 in dividends for you over the next decade.

Just buy and hold them. That’s it.

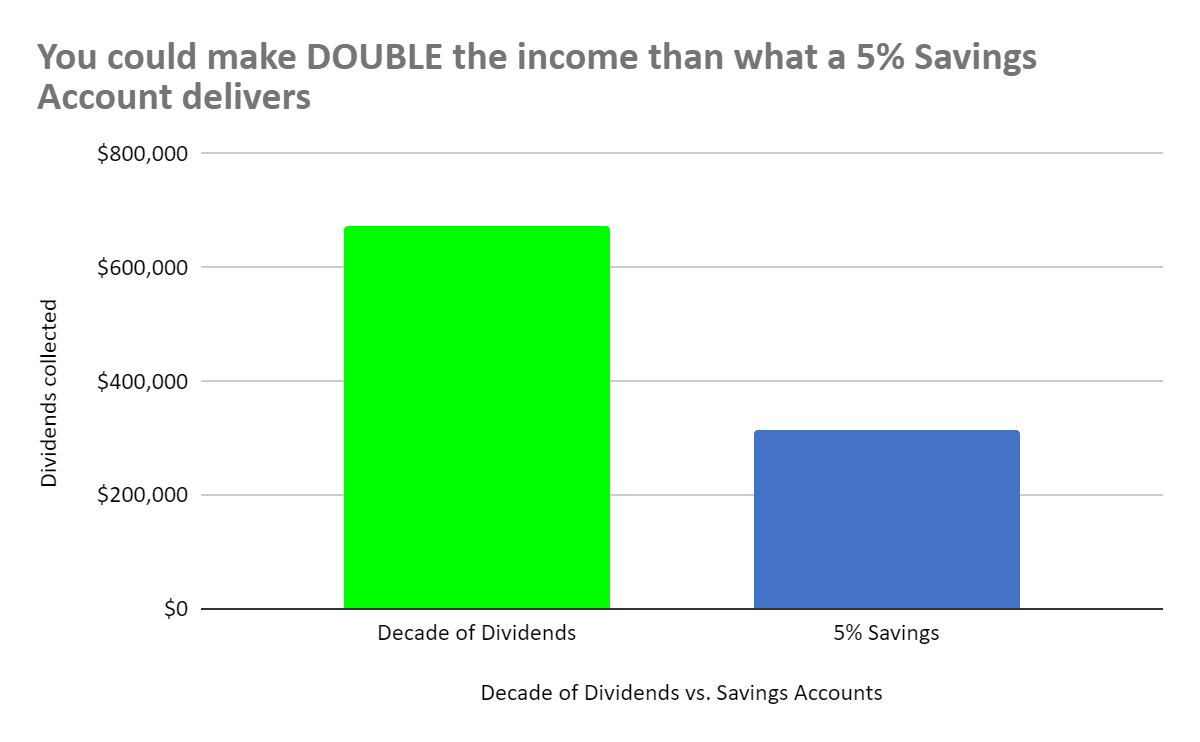

$700,000 is an average of $58,333 of dividends per year hitting your account.

That’s double what you’d get putting your money into a 5% savings account at the credit union or in a Treasury bill right now.

And it’s just as passive. Buy, hold and collect the income.

How do I know this is possible?

I’ve done it before.

Like this real estate dividend stock I recommended June 2014…

Just a decade later…

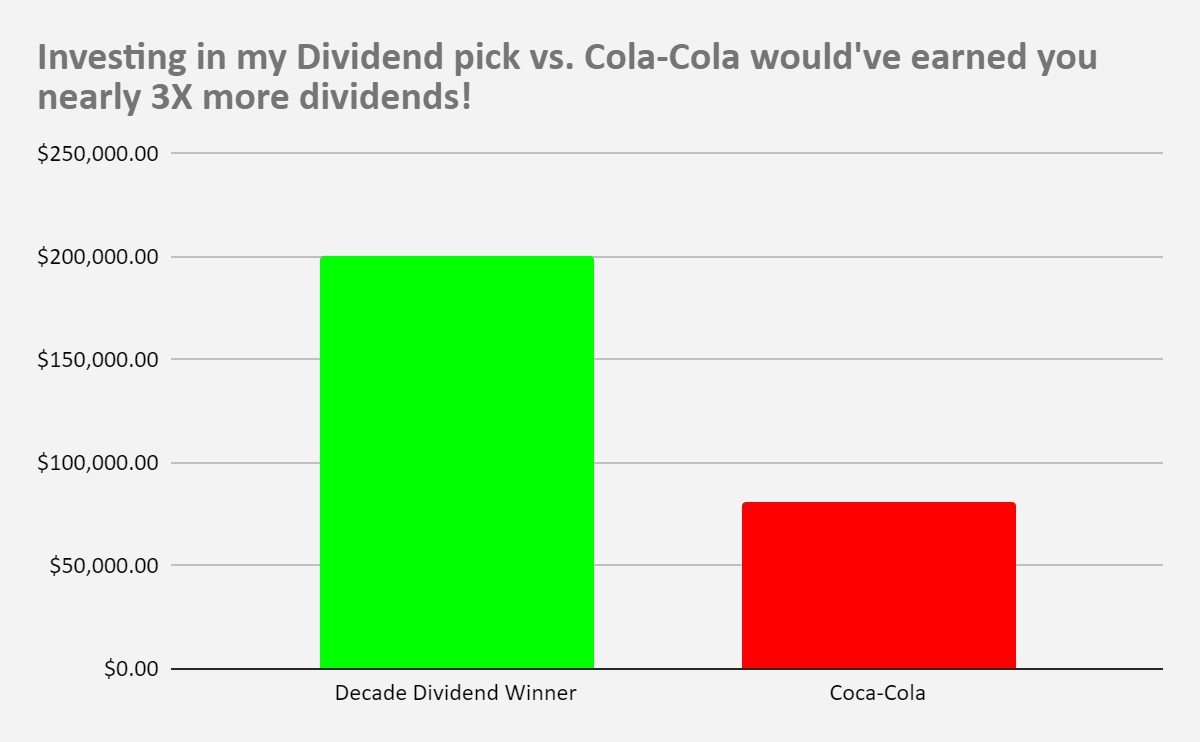

If you put around $166,000 into this stock, you would’ve earned up to $200,553 in dividends alone.

Meaning, you would’ve earned more in dividends than you invested in the stock itself!

Plus, you STILL own all your shares.

It’s like buying a house and someone else paying it off! Except, in this case, you invested in a real estate stock that’s growing and adding new lines of business.

To put $200,553 of dividends into perspective… if you had invested the same $166,000 in 2014 into a popular blue chip dividend stock like Coca- Cola at the exact same time…

You would’ve only earned around $81,235 in dividends.

That’s 59% less than if you had followed my strategy.

To make the same income… you would have to sell about 43% of your Coca-Cola shares to generate the same cash.

Except after you sell, now you own less Coca-Cola shares… meaning you’ll collect even less dividends the next quarter because you own fewer shares.

I don’t recommend this.

I recommend if you wish to earn $700k of dividends over the next decade, you follow what I share today.

No tricky options plays.

No day trading, swing trading, or any of the other risky bets the kids do these days.

You just buy and hold the dang things for a decade.

Here’s the second recommendation I made…

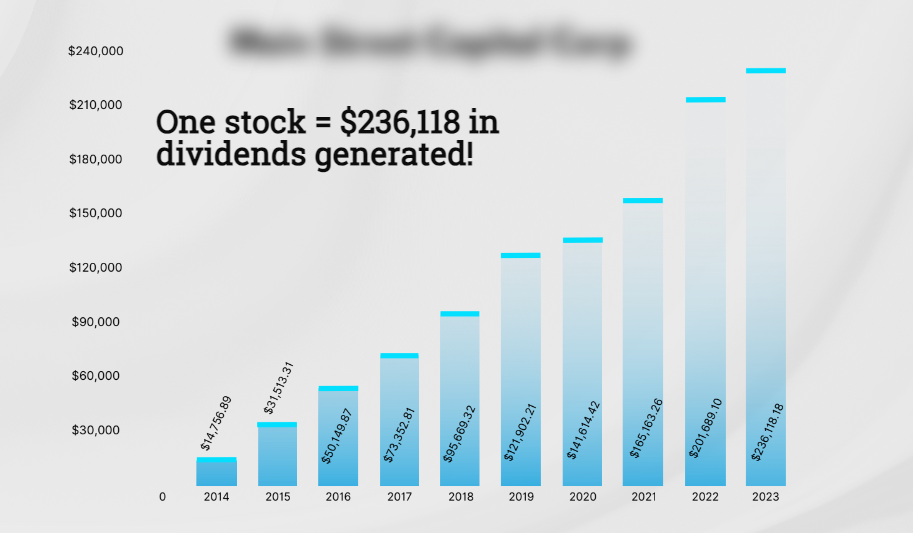

In June 2014, I said “buy this business financing company.” You likely have never heard of them but they pay a nice monthly dividend plus two bonus dividends each year. That’s 14 checks a year, if you’re counting!

You had put around $166,000 in this stock as well…

You could’ve earned up to $236,118 in dividends over the last 10 years.

You could’ve bought the stock in June 2014, forgot about the shares and came back 10 years later and you’d have just as much in dividends.

Again, you keep all your shares still.

Even better, your shares are worth 25% more to boot…

Here’s the third I recommended a decade ago…

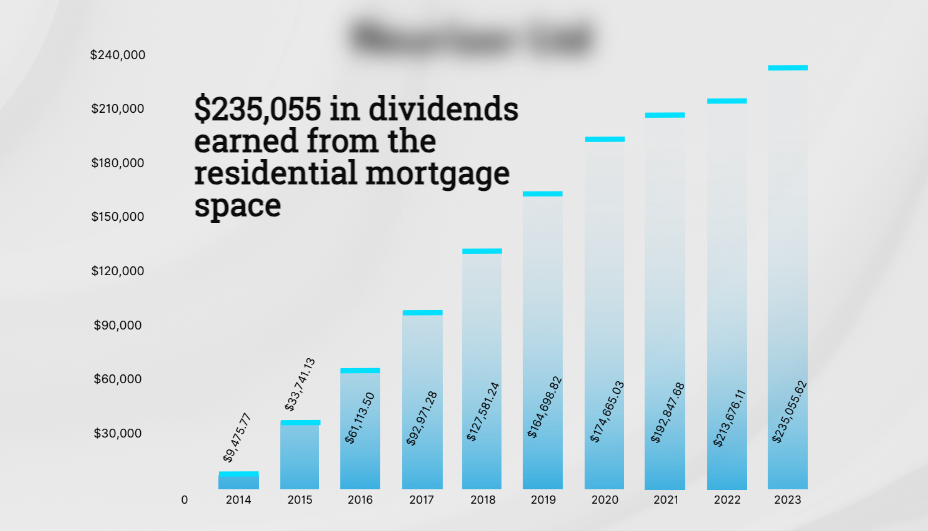

Another real estate company in the residential mortgage space…

You could’ve (again) invested around $166,000… and ended up with about $235,055 in dividends deposited right into your account.

All without lifting a finger.

In total…

If you put around $500,000 into these 3 no-name dividend stocks I recommended in the balmy summer of 2014…

You would’ve ended up with around $671,727 of actual cash in your bank account to take out and spend as you wish. Plus, you still own the shares you bought for $500k.

Over 10 years, the market’s produced six different downturns like in 2016 or the end of 2018, 2022, 2023… to even the flash crashes during covid in 2020.

Through all of them, I guided retirees to continue collecting their dividend checks so you’ll always have income coming in even though you aren’t working anymore.

With rising inflation, taxes, insurance, and tightening your belt on spending…

An extra $671,727 earned would put you ahead of most retirees out there.

You’d have the cash to pay the bills for your mortgage, groceries, doctor’s appointments, spoil the grandkids…

Because $671,727 earned over a decade is an average of $5,597 per month earned or $65,034 per year.

That’s 10% more money than the average person working 40 hours per week in America makes.

Yet, all you did was buy and hold based on my recommendations and strategy.

No job.

No boss.

No stress.

And over the NEXT decade… I believe you could generate over $700,000 during your own “Decade of Dividends” with a portfolio of $500,000.

If $500,000 is too much to put into the 3 stocks…

Even just $75,000 in all 3 of my 2014 picks would’ve earned over $97,552 in dividends over the past 10 years.

You’re still keeping all your shares… earning more dividends, but getting all your cash back out to spend as you wish.

Start with as little or as much as you want.

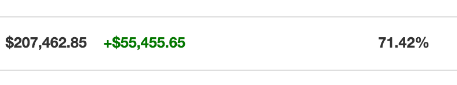

One subscriber, R.C., saw her portfolio jump 71% in under 2 years investing in the dividend stocks I recommend.

She claims: “I’ve never trusted someone in finance more than Tim. Now, I buy his recommendations right away…“

“Put your money into these, they don’t fluctuate a ton and your dividends are growing. Your effective yield will be much higher.” – R.C., subscriber

The big key — she felt she could do it all on her own.

“We hired 5 different money managers. We received mediocre results and high fees. I realized I needed to manage my own money, but didn’t have time.”

Now, 5 years later, she’s still collecting checks.

Another reader, Don, was diagnosed with multiple sclerosis and forced to live off disability at 61.

His disability was set to run out by 67… but, fortunately, he found my dividend strategies and he’s now “more confident than ever” he’ll be able to retire comfortably. “I won’t have to worry anymore”, he claims.

“More confident than ever” he can retire comfortably. – Don, subscriber

(compensated for testimonial sharing his story)

Another reader, Charles, is planning on retiring in a few years… but still paying for his son’s college.

He found me while Googling for a way to generate income after his job was over.

Charles and his wife plan to retire to Europe… and now he can:

“Tim’s dividend stocks provide enough income to give us flexibility on when we can retire.” –

Charles, subscriber (compensated for sharing his story)

Another reader, Ray, uses his dividends to cover everyday expenses: “We had our furnace break recently… cost $12,000 to repair. Having regular dividend income helped take a load off our shoulders. Thank you Tim!”

I love stories like that.

Dividends making ends meet.

These are just a couple of dozens and dozens of readers who are collecting dividends from my recommendations.

I can’t share with you the exact number they’ve told me (my lawyers won’t let me)… but let’s just say, there are many happy retirements in place due to receiving regular dividend checks.

Now, it’s your turn for the next “Decade of Dividends.”

An opportunity to earn up to $700,000 in dividends from an average $500k IRA account.

I’m not guaranteeing anything here.

However, I believe we could surpass the $671,727 we earned the last decade simply due to inflation, higher interest rates, and my strategy getting better.

In a shaky economy like today…

During these uncertain times…

The idea you can have both equity throwing off cash is a mighty security blanket.

Compare that to most folks who count their primary home as their main source of ‘wealth.’

That’s not wealth. That’s just paper money.

I want you to turn your portfolio to actual cash in retirement. You can spend that. And you aren’t taking out debt to do it.

Listen closely…

There’s a catch.

I’m now releasing my NEXT 3 stocks to own for the next decade ahead. (and the dividend payouts are going to be BIGGER)

Today, for the first time ever, I’m releasing my next 3 stocks to buy and hold over the next decade.

New book is a free bonus below!

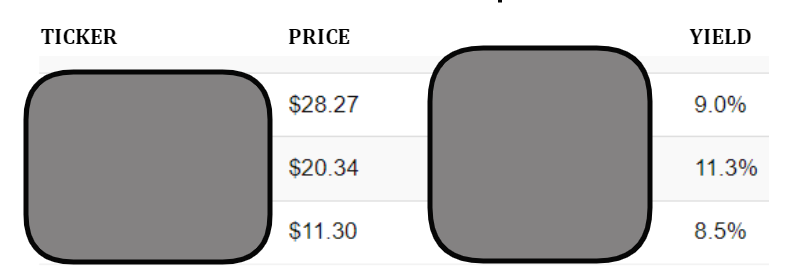

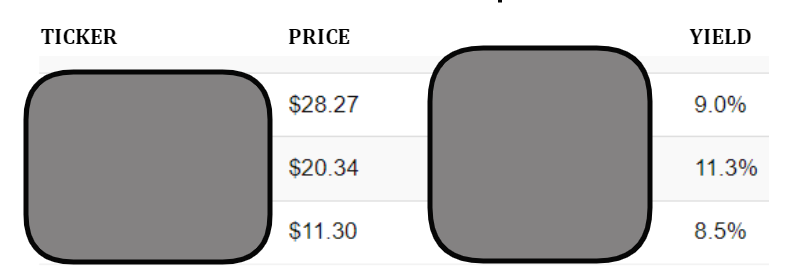

These are them, right here.

You’ll see yields up to 11%…

And share prices all under $30.

They’re trading at bargain prices. Meaning, buying them NOW could not only get you a high yield with some fat checks…

But, your portfolio will be worth a lot more if these plays bounce.

DECADE DIVIDEND OPPORTUNITY #1:

Runs you less than $30… pays a nice 9% yield on your investment.

It’s a closed-end fund in the utility sector.

The board of directors has raised the dividend consistently for the past 20 years.

Meaning, based on history…

Over the next decade… your income should only go up from here!

DECADE DIVIDEND OPPORTUNITY #2:

This stock just hiked their dividend 2X in the past 36 months.

A business development play…

They’re paying a whopping 11.3% yield at the time of this writing.

Fresh off a merger, this business has legs as the Fed stops raising rates and lending loosens over the next 12 months.

DECADE DIVIDEND OPPORTUNITY #3:

How about a dividend value bet here?

This business’ dividend still recovers from the Covid crash… and they’re 50% off their pre-Covid dividend.

With record sales and profit in 2022… these dividends should come roaring back with vengeance.

You’re buying at a cheap multiple… and while the yield remains high.

Fast dividend hikes = more money in your pocket faster.

With higher inflation…

Bond yields soaring to levels not seen in almost 20 years…

Savings accounts paying 5%+ at your local banks…

Companies are already raising their dividends… plus, you’re able to buy when yields are as high as 11%.

If you think you don’t need dividends and can live off your savings or the next ‘hot stock’… things could be tough over the next decade

Research from Morgan Stanley projects stock market returns to be dismal in the years to come.

Over 10 years… they expect the S&P 500 to only go up 2.4%!

Your $500,000 portfolio will deliver $1,200 of gains per year

Barely enough for a 3-day vacation.

Compare that to potentially averaging $58,333/year in dividends… it’s not even close!

Now I know…

Since the bottom of 2009 to the end of 2021… the S&P 500 has gone up a whopping 582%!

If you built most of your retirement gains on the back of that… I’m happy for you.

The problem is, you can’t keep relying on those returns in the future.

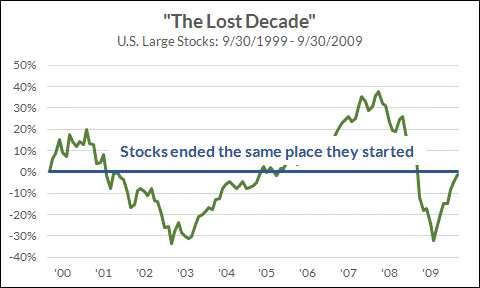

What we may end up seeing… or likely to see… is similar to what happened after the dotcom bubble in 2000.

That’s what this current Fed-printing ‘bubble’ has been compared to.

Valuations bid up high… then crashing.

Here’s what happened to the market after the bubble bursting starting in 1999…

We could be seeing a repeat of this again over the next decade

Stocks went nowhere for 10 years.

It’s called the “lost decade” for stocks.

Billionaire Ray Dalio, chief investment office of the biggest hedge fund in the world, believes we’re due again.

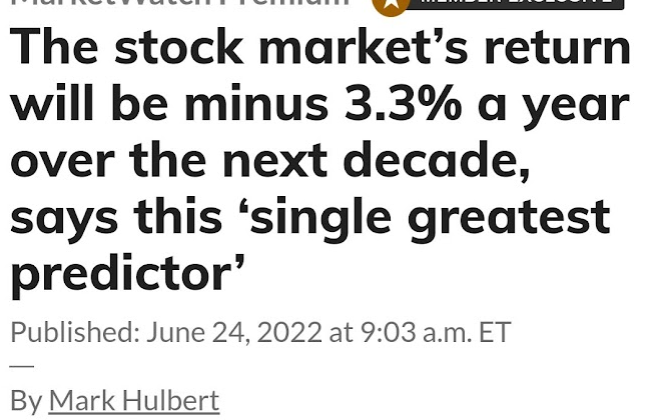

One senior Marketwatch analyst, Mark Hulbert, believes we may even see negative returns over the next decade.

Imagine if your retirement relied on this.

You’d wake up with the sweats living with this kind of volatility.

10 years is a long time for little to no returns.

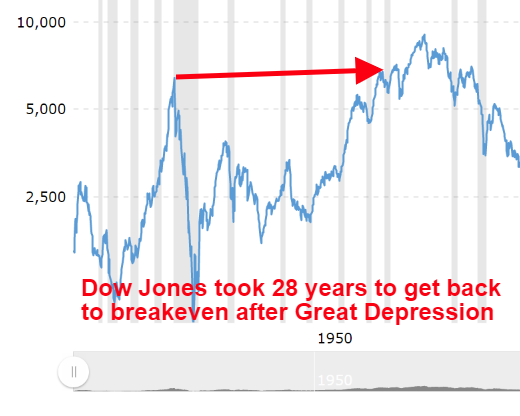

But it may be slow for even longer than 10 years!

After the Great Depression of 1929… the Dow Jones took 28 years to get back to breakeven from its peak!

Can your IRA and 401k save you from financial ruin if stocks returns are low for the next decade?

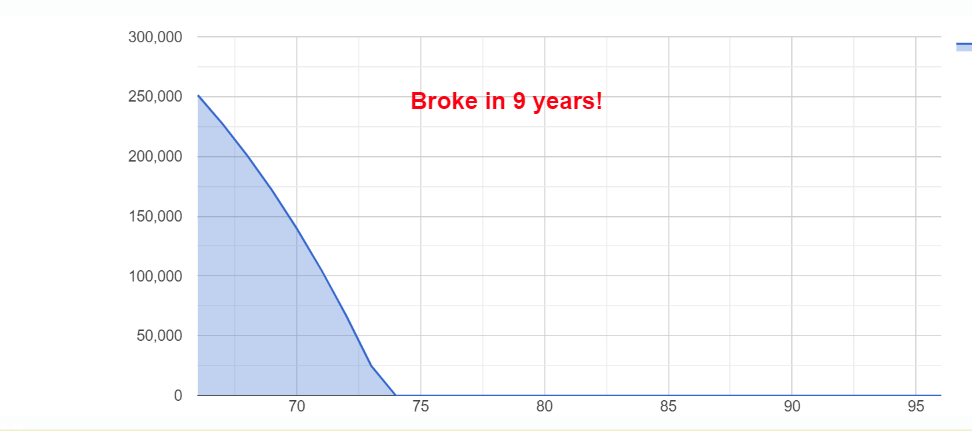

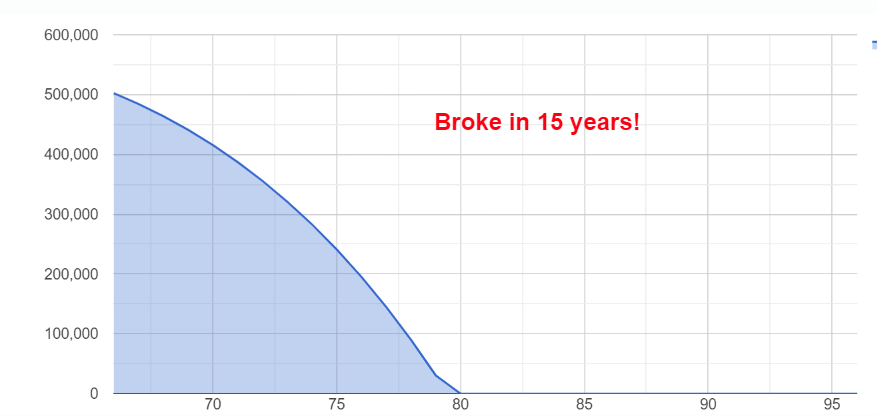

Say you need $4,000 per month to live.

Social Security is pitching in $1,648.

That means you need $2,352 per month to live on… that’s $28,224 per year.

Say, inflation stays around 3-5%…

If stocks only return 2.4% per year like Morgan Stanley predicts… you’re not beating inflation in your returns. You’re actually losing up to 2% per year… eaten away by inflation.

If you have $250,000 in your account…

You’re broke in 9 years.

If you have $500,000…

You’re broke in 15 years.

Remember that’s even with Social Security helping out.

What if returns are a “lost decade” and go nowhere?

What if returns are negative?

The tech bubble saw the Nasdaq crater 81%.

If you lost another 50% on your portfolio…

You’re broke in 4 years.

What if instead of selling off your portfolio to live…

A mistake too many retirees make every day…

What if you instead simply collected checks every single month that could pay your bills each month… but also your income is growing each year.

The 3 stocks I’ve chosen as my next “Decade of Dividends” stocks to buy and hold over the next 10 years all are set to pay consistent dividends for years to come.

I’ve been doing this for decades already… and I’ll show you what to buy.

I’ve been called the “most trusted” man in finance by my readers

| “I’ve never trusted someone in finance more than Tim. Now, I buy his recommendations right away in the service. Put your money into these, they don’t fluctuate a ton and your dividends are growing. Your effective yield will be much higher.”RG, an investor in high yields since 2017 |

Like I said — Before helping folks with their retirements, I was a captain in the Air Force before becoming an advisor.

You could say it was here I got my itch to help others.

A decade ago, I teamed up with Investors Alley.

My publisher, Investors Alley, was founded in 1998, before many mainstream publications including the Motley Fool and MarketWatch.

But rather than focus on the next ‘big thing’ in tech or cryptocurrency or the ‘news of the day’…

We focus on one single area.

An area that makes us far less money than other big-name publications… but makes my readers far more it’s the most important.

We’ve become the leading resource for generating retirement income for the average American.

We send out over 5 million emails every month.

100,000+ retirees just like you have read my retirement income ideas and many have followed along to set themselves up to retire for good.

I’m not on CNBC… you won’t find me on any famous podcast.

In fact, I keep out of the spotlight as it’s not my thing.

My “thing” is roaming through the North Dakota mountains in my Toyota Tacoma with my dog by day…

And camping out by the fire with some Japanese whiskey and a cigar by night.

Very simple living.

I’m not here to get famous, raise money, or peddle worthless books, seminars or newsletters.

I want you to NEVER run out of money in retirement.

99% when they first join me are skeptical because I do not recommend washed-out, ragged advice you see everywhere.

They say, “Tim, my financial advisor doesn’t understand why you recommend this.”

I’ve been recommending energy assets for the past 5 years.

Long before we hit historic oil prices.

Everyone scoffed at oil in 2018 after the 2016 oil crash.

Until one new skeptical reader said he had a chance at 150% gains on a little-known midstream company you’ve never heard of, Antero Midstream.

Recommended oil at bottom of Covid crash… up 150% in a year!

Talking heads want to talk about the “next Amazon.” Not me.

I ignore that guff.

I look where no one else does.

When oil was trading for negative $37, I was still recommending to buy.

I called a trade that would’ve ‘set you up for life.’

Here’s what I’m writing at the BOTTOM of the Covid crash on March 25, 2020

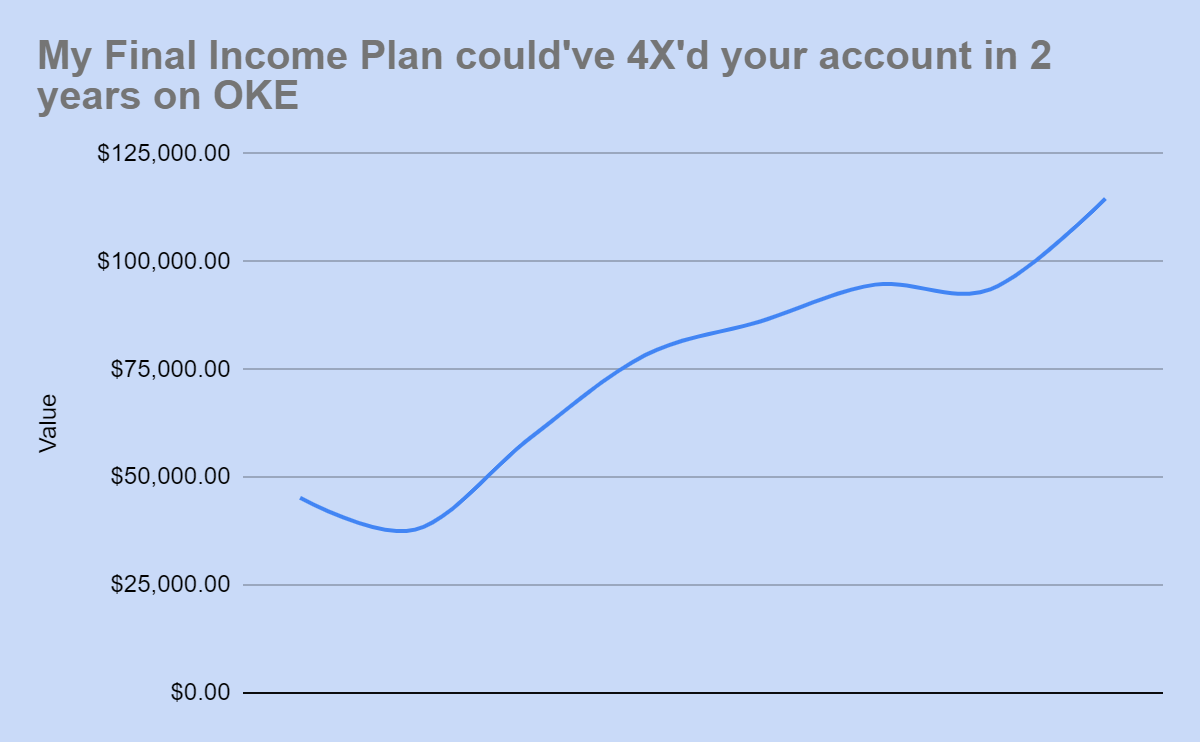

I recommended a little-known oil stock with the symbol, OKE.

Following my strategy…someone who bought OKE starting with $25k would’ve 4X’d their account in 3 years.

Even if you started with $5k, it would’ve worked just the same.

OKE is also at multi-year highs.

This isn’t luck.

It’s taken me decades to hone in my dividend hunting strategy.

I finally went public with it in 2014.

Let me take you back and tell you what was going on at the time.

It’s Summer of 2014… June 2014 to be exact.

The Great Recession was in the rear-view mirror, but the economy was still just getting back on its feet.

I watched many friends and family lose a lot during the years following the Great Financial Crisis.

Real estate prices had just bottomed two years prior and were on an uptick.

While others are doing laps at the pool, tanning at the beach, or on a cruise with their family…

I’m settling down at my computer in my quaint Nevada mountain cabin to start a new chapter in my life.

Having spent years as a financial advisor… I was tired of how financial advisors/the industry “helped” clients. I watched again and again as my industry led clients astray.

Whether putting them in low return investments that NEVER beat the market…

Or, stashing their client’s cash in average index funds or simple investments you could do yourself while charging massive 1-2% management fees and swiping 20% of the profits.

The advisory industry handcuffed what strategies I could share with clients. They had their products they wanted sold, no matter if it was the best option for clients or not.

I was done with it.

On that Summer 2014 day, I created my ‘mini-manifesto’ on how I believe retiree’s should generate income from retirement without selling off your portfolio.

The sun pours in as I draft the first 11-page stock writeup to email to a tiny group of retirees.

Maybe 100 people on the list have read anything I wrote at this point… I was a nobody to them. Just ‘another stock guy.’

I didn’t care. I agonized over every word of that first issue.

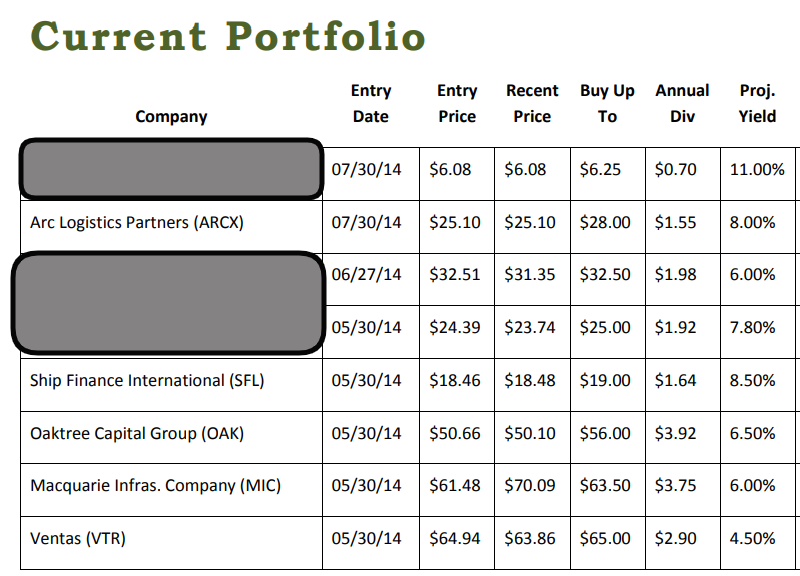

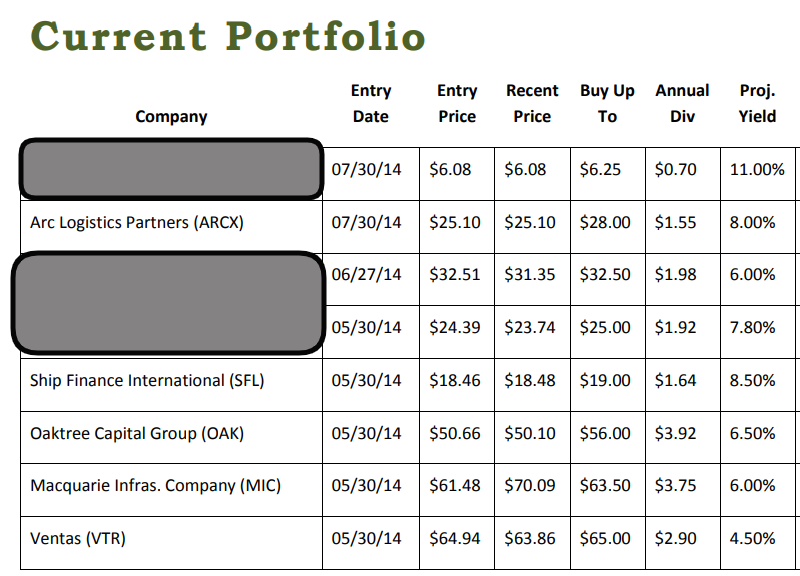

Inside those opening pages of my dividend newsletter… I released these eight stocks.

All 8 are stocks you’ve likely never heard of.

No financial advisory practice would ever allow me to recommend buying these high-yield dividend stocks.

But I saw things in these stocks most wouldn’t.

I’ll tell you what happened to all 8 of these stocks… 5 we sold before the decade mark.

The other 3 generated over half a million in dividends for an average sized retirement account.

As you can see, the yields (in the far right column) start at 6% and jump all the way up to 11%. Those are fairly high yields seeing as a famous dividend stock like Coca-Cola has a paltry 3% yield.

I’ll be honest, here…

I didn’t know if me releasing these picks to readers would amount to anything.

Heck, I didn’t even know if my tiny publication would last 6 months.

After all, I was just an Air Force captain, turned financial advisor, who then turned into a dividend stock analyst for newly retired folks.

These beliefs nagged me for years, honestly.

Yet, 120 issues later, I’m still here sharing my high-yield dividend picks with (now) over 100,000 retirees reading each week.

From 3 of these stocks generated an incredible $671,727 of total dividend income over this past decade.

Meaning, you’d collected an average of $5,597 per month.

The average retirement account in America is around $603,000.

But you could’ve generated all this income from just a $500,000 account.

I recommended 8 stocks…

5 —> we sold over time.

3 —> I still hold.

Take a look again at the first portfolio and the stocks we sold.

I’m guessing you haven’t heard of any of these revealed stocks. Maybe you have.

We sold all five over time. Some we sold quickly… others, like MIC, took until 2020 to sell.

There was only one we didn’t make a profit on from stock gains + dividends. And it was a small loss. The other four, we made money.

These stocks were perfect as America got back on its feet after 2008.

Times are different now.

There’s a bigger opportunity I’m seeing.

That’s why — 10 years later, I’m releasing three new dividend stocks to hold for the next decade (and the payouts will be EVEN BIGGER this time around).

These 3 new stocks could deliver over $500k in dividends over the next decade right to you.

And you won’t have to sell a single share unless we close out the position.

Even though times are different…

All the high-yield plays I recommend, I look for 3 distinct criteria to make them a buy.

They’re the cornerstone to your $700,000 in dividends.

This criteria I follow to the letter still 10 years later… and it weeds out the majority of dividend stocks out there!

CRITERIA #1: Company is in a strong industry that will be around for 100 years

I’m not looking to buy into the ‘latest’ technology. Because, as you know, the ‘latest’ tech can be obsolete in a decade. Blackberries were huge because you could answer emails from them… gone now. DVDs were big. Obsolete.

I need industries I KNOW will be around not only over the next decade… but the next century.

Here’s the 3 industries my last 3 Decade Dividend Winners were in.

| STOCK | CRITERIA #1 100-Year Industry |

| 2014-2023 Decade Dividend Winner #1: | Real estate |

| 2014-2023 Decade Dividend Winner #2: | Real estate |

| 2014-2023 Decade Dividend Winner #3 | Business financing |

Real estate = not going anywhere.

Utilities = we all need energy, gas, etc. The tech can change in the utility space, but the service stays the same.

CRITERIA #2: Company has a unique competitive advantage in said industry

Inside their 100+-year industry, the company must have an advantage over the others in the space.

Take a look at my past 3 winners:

| STOCK | CRITERIA #1 100-Year Industry | CRITERIA #2Competitive advantage |

| 2014-2023 Decade Dividend Winner #1: | Real estate | Leading commercial mortgage servicer. Get first crack at best lending opportunities. |

| 2014-2023 Decade Dividend Winner #2: | Real estate | Massive residential mortgage originator. Capturing market share with more services |

| 2014-2023 Decade Dividend Winner #3 | Business financing | Low risk business development loans and operate at ⅓ the cost of competitors |

Once we know the business model is solid… now we look at the cashflow and financials.

CRITERIA #3: Company pays a high-yield dividend that’s safe from cuts

High-yield dividend stocks aren’t child’s play.

Simply buying a stock because it pays a 20% yield is a dangerous game. You’re at risk of a double whammy.

First, the dividend gets cut.

Second, after the cut, the company’s stock price craters.

You’re then trapped in a stock paying virtually nothing now in dividends and you’re staring at a truckload of unrealized losses.

In order to shield your portfolio from big losses…

While also enjoying thousands per month in dividend payouts…

Dig deep into the SEC filings to see if the company is financially strong and can keep paying their dividends.

| STOCK | CRITERIA #1 100-Year Industry | CRITERIA #2Competitive advantage | CRITERIA #3High dividend that won’t get cut |

| 2014-2023 Decade Dividend Winner #1: | Real estate | Leading commercial mortgage servicer. Get first crack at best lending opportunities. | Paid the same dividend every quarter for the last 10 years! Recorded highest income ever in 2022. Safe dividend. |

| 2014-2023 Decade Dividend Winner #2: | Real estate | Massive residential mortgage originator. Capturing market share with more services | Dividend up 194% since 2014. P/E ratio just 6. Gross margins typically over 80! |

| 2014-2023 Decade Dividend Winner #3 | Business financing | Low risk business development loans and operate at ⅓ the cost of competitors | Raised dividends 11X since 2014. 90% of profits are required by law to be paid to shareholders. |

However, that’s not what I’m here to show you today.

Today, I’m revealing my NEXT THREE DIVIDEND STOCKS

to buy for the coming decade.

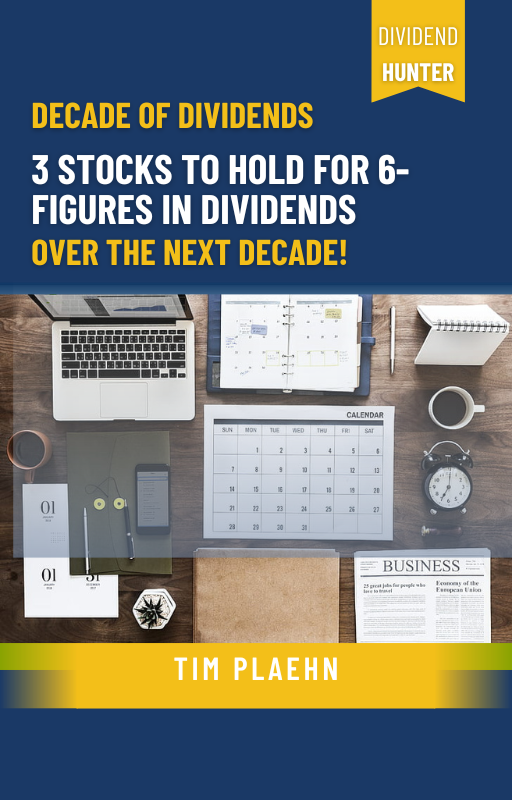

You can find them inside my newly released report, The “Decade of Dividends”. Three stocks to buy to collect 6-figures in income over the coming decade.

Start your journey to $700k now!

You can’t rely on capital gains to guide you through retirement. I’ve shown you it’s possible you’ll run out of money long before you think you will.

Instead, buy strong, fundamentally-sound high-yield dividend stocks and collect 6-figures of income over the coming decade.

All you need to do is claim my brand-new report.

Inside, I share the top secret new dividend stock picks…

Stocks you’ve likely never heard of, but they can pay you safe, steady, growing dividends.

NEW “DECADE OF DIVIDEND” PICK #1:

Markets pounded utilities in 2023 for its worst performance in over 15 years. I’m always pounding the table to my readers… “Buy the Dip in great opportunities.”

This is one of the best out there.

A closed-end fund in an essential service sector. The fund isn’t one specific bet on one utility company.

Formed in 1961, a $3.5 billion dollar fund manages the closed end fund.

$2.4 billion of that funnels into my “Decade of Dividend” utility fund. The fund invests in over a dozen utility companies like Duke Energy, The Southern Co. and others that provide you electricity, gas… essentially everything you must buy each month.

Imagine getting a check every time someone pays the bills to keep the lights on? You can rely on that one every month for life. It’s never going away unless we stop using electricity as a country!

Paying a 9%+ yield… this fund has increased dividends for the past 20 years and the payouts have doubled in that timeframe.

This closed-end fund ticks all the boxes I look for:

#1. Utilities will be around for 100+ more years. Everyone needs energy to power their home. Now, you can benefit.

#2. The competitive advantage is this fund focuses on regulated utilities. Meaning, a business with high barriers to entry, little competition, and historically low chances of bankruptcy. They can raise prices as much as they want.

#3. Their dividend comes from free cash flow and has increased for the past 20 years. As the world consumes more energy each year than the prior, I expect this dividend to keep going up steadily.

Buy this “Decade of Dividends” pick today and start collecting this month!

Because this utility opportunity pays out monthly dividends. Every 30 days, you get a check.

That’s #1.

NEW “DECADE OF DIVIDEND” PICK #2:

Introducing a new business development company, (a “BDC” as they’re known). BDCs provide capital to small businesses, especially those who can’t get funds from a traditional bank.

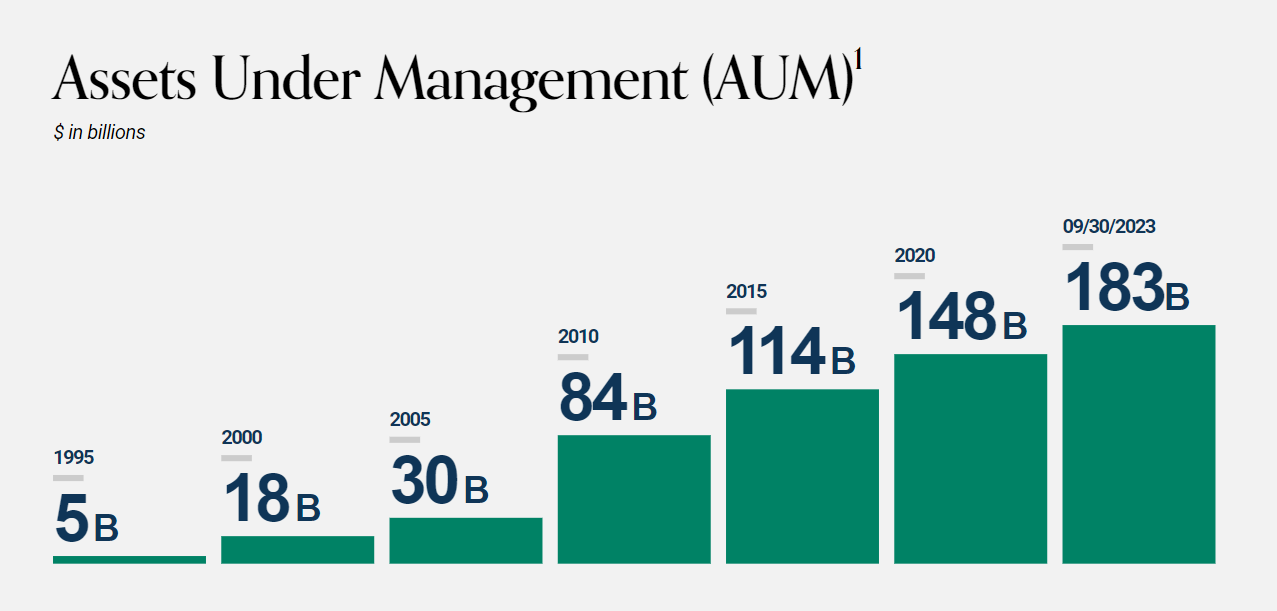

The firm who owns the BDC manages over $170 billion in assets… so they’re no small potatoes.

They’ve grown at breakneck pace.

Following a recent merger internally, the company has seen its dividend 2X over the past three years.

Revenue has grown 50X over the last seven years…

And they’ve posted profits through Covid and rapidly rising interest rates.

I expect their dividend to grow 9-10% each year… which should entice more attention and drive the stock price up.

This BDC follows all 3 of my dividend investing criteria:

#1. Small business financing will be around for the next 100+ years. Businesses start daily. With $170B+ in assets under management (and climbing), this BDC has the equity to weather high interest rates.

#2. Their competitive advantage is the diversity of their strategies. This BDC is different because they don’t pigeon-hole themselves into only the health of the small business. They provide credit, buy equity, but also purchase real assets like real estate and even ‘dip buy’ public stocks on the market. By diversifying, they can weather a recession better than other BDCs who will see more small business defaults.

#3. Dividend just doubled and paid despite economic headwinds. Many dividend payers slashed dividends during Covid. This BDC has doubled them since. Profits are strong which helps with the cashflow to keep paying us our checks.

This is my dividend growth bet over the next decade… and you can buy it now.

The yield is strong at 11.3%. If they keep raising the dividend, more shareholders will push the price up.

I’d get in now while it’s under $30.

That’s #2… here’s the last dividend to buy and hold for the next decade on your way to $700,000+ in dividends.

NEW “DECADE OF DIVIDEND” PICK #3:

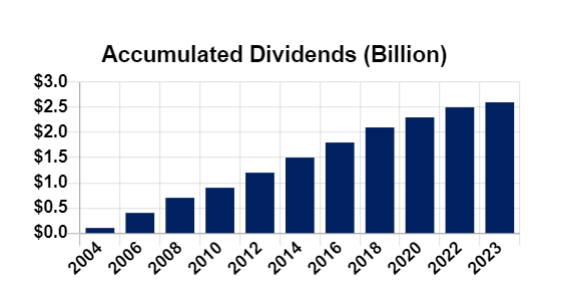

Final pick is a 20-year old dividend payer in the vessel space.

Think crude oil tankers… car vessels… container ships hauling goods from overseas.

Their business runs on long-term contracts with companies needing their product moved. Meaning, they’re the Netflix of the oceans.

Money coming in from contracts each month… and companies paying them month after month… year after year.

The average contract is six years. This stability allows them to build more ships to then lease out.

Record revenue poured in during 2022…along with record profits.

And their accumulated dividends should keep marching upwards.

Due to Covid, they slashed dividends in 2020…

And they’re still 50% below the payouts of 2019. Which gives you yet another “Buy the Dip” opportunity in the high-yield dividend space.

As the dividend grows… you’re earning a high income while buying low… and watching the share price potentially rise.

Like the other two “Decade of Dividend” payers, this stock receives an A+ in my book:

#1. As much as more information goes online, physical goods STILL need transferring over the next 100+ years. You can’t email oil. Those new golf clubs still need manufacturing and shipping.

#2. This vessel stock’s competitive advantage is they’re global and involved in five major industries: Tanker ships, Dry Bulk, Liners, Energy, Car Carriers. A high barrier to entry business requiring 8-10 figures just for building the ships.

#3. The dividend is on the rise as record revenues flow in. This dividend still has more room to run, meaning more potential cash in your pocket. Record profits means cashflow is safe.

These are 3 dividend stocks I’m recommending to add them to your portfolio today.

Get the names of all 3 of these new dividend stocks to hold for the next decade in my new report, Decade of Dividends: 3 Stocks to Hold for 6-Figures in Dividends Over the Next Decade

You’ll receive access to the 3 stocks I’m recommending to hold over the next decade:

- DECADE STOCK #1: Pays a 9% yield and has raised dividends the past 20 years

- DECADE STOCK #2: Pays an 11% yield… and I expect 9-10% bumps every year to that payout. Their revenue has soared 50X over the past few years and growing like a weed.

- DECADE STOCK #3: A value-buy in the cash cow vessel space and has a potential 50% upward move in its dividend coming.

These are my go-to picks to buy and hold and collect over the next 10 years.

They follow my 3 core criteria:

The $500K DECADE OF DIVIDENDS

| STOCK | CRITERIA #1 100-Year Industry | CRITERIA #2Competitive advantage | CRITERIA #3High dividend that won’t get cut |

| NEXT Decade Dividend Winner #1: | Utilities | Regulated utility. High barrier to entry. Low competition. Low chance of bankruptcy. | Massive, growing cashflow. Has raised dividends the past 20 years. As energy use continues to grow = more cashflow for dividend. |

| NEXT Decade Dividend Winner #2: | Business financing | Diversity for a “BDC.” Not only provide financing, publicly invest, buy hard assets to hedge. | Dividend just doubled while other financing businesses are still down post-Covid. Cash flow strong despite high interest rates. |

| NEXT Decade Dividend Winner #3 | Shipping | Global. Involved in 5 major industries. High barrier to entry. | Record revenues recently. Dividend on rise again. Recorded record profits despite retail slowdown. |

I expect if you invested $500k… you would end up with $700k+ in dividends over the next decade.

That’s not a promise or guarantee… but it’s what I project based on my track record over the past decade.

Buy these three stocks today.

Hold onto them…

Don’t panic when they go down. Instead, BUY more when they do.

I’ll even let you know when to buy more of them over the next Decade.

And you’ll know exactly when to start collecting checks.

Every month, I share the exact dates on when to buy these dividend stocks and when you’ll collect your income.

I do it every 30 days for a $0 extra charge

It’s simply a bonus I provide subscribers.

I update the calendar every single month.

If a company changes their ex-dividend or payment date…

Or, I recommend a new stock to add.

It’s all included in this Monthly Dividend Paycheck Calendar report.

This is the ticket to collecting 6-figures in dividend income over the next decade.

This Calendar alone is worth $250/year.

You get it at no extra charge with the offer I share today.

And I’m not going to stop there.

There’s more you need to do to accelerate your income.

Here’s what I ask.

As you can get both of these for no extra charge…

If you simply join me inside my newsletter where I share all these dividend opportunities.

I share all my dividend research inside a special subscription service that goes for a very, very low price.

I’m talking pennies per day…

It’s a service that keeps you on top of your “Decades of Dividends” income without any of the work.

If you’re retired or near retirement, this dividend service is a must as you move from investing in more high-risk stocks gunning for capital gains…

And searching for more predictable cash flow you can spend or reinvest as you need.

The secret to a high monthly income without doing research yourself is my newsletter, The Dividend Hunter.

My “Decade of Dividends” report plus the bonus Dividend Calendar are included at no extra charge with The Dividend Hunter.

All I ask in return is you join my flagship dividend newsletter, read by 20,000+ paying members called The Dividend Hunter.

Our goal is simple = Create monthly dividend income that pays your bills for life.

There’s content every single week about our stocks and beginner dividend investing lessons.

| Here’s what you get as a risk-free member of The Dividend Hunter: 12 months of issues where I update our positions, provide dividend investing tips, economic outlooks and more. These hit your inbox in the first week of the month. Model portfolio of 33 high-yield, low risk stocks: All vetted by me personally and I invest my own money into many of them.Monthly Dividend Paycheck Calendar: Collect your dividends without any work! I show you when to buy and when to collect on one calendar I update monthly. *FREE UPGRADE #1* Weekly Mailbag: Every week, I release a recorded video answering the most pressing questions of the week. Maybe about our portfolio, the stock market, gold, and more. *FREE UPGRADE #2* “Stock of the Week” Buy Recommendations: When one of our stocks goes on sale, you have a shot at buying shares at a nice discount. I’ll tell you which stock is on sale. *FREE UPGRADE #3* New member orientation webinar: Every month, all new Dividend Hunter subscribers are invited to an orientation. It’s 100% optional. I show you how to navigate the Dividend Hunter portal, where to see which stocks to buy first, common start-up questions, and more. 12-Month Money Back Policy: You have a full 12 months to try out the service. If you don’t like it, get a refund for the subscription fee at any point. |

This is a full $1,000 worth of value here…

But you’ll receive a huge discount in just a moment.

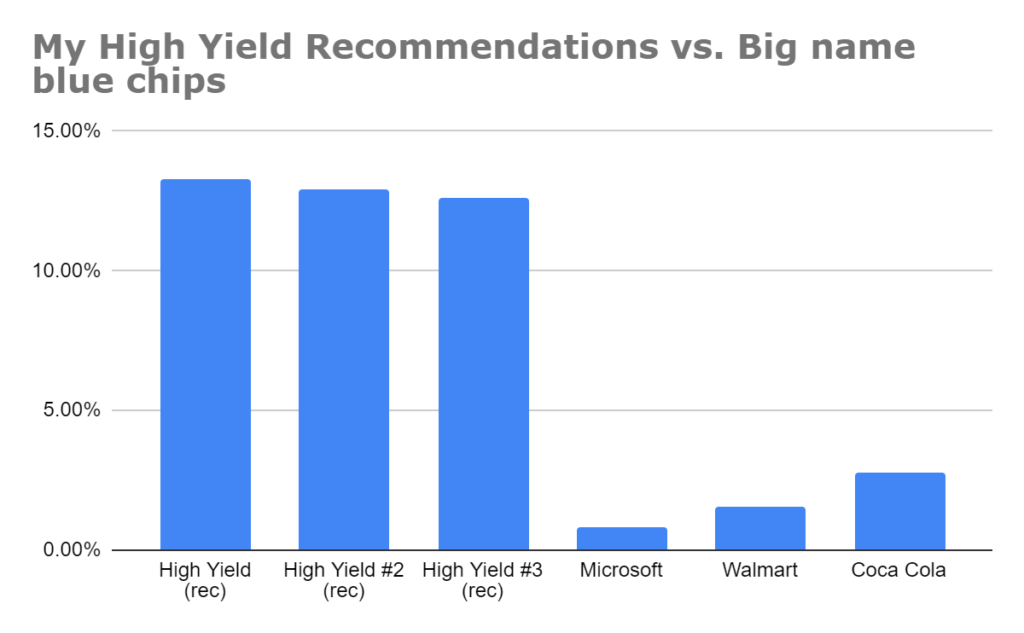

When you compare to normal, “blue chip” dividend stocks… The Dividend Hunter outstrips the dividend yield by a long shot.

My dividend picks beat the yields off the most popular stocks in the world.

Like I said,

20,000+ subscribers like yourself are already members of

The Dividend Hunter. Majority, I’d estimate, are retired or fairly close to retirement. What they’ve said about me has been flattering:

| I am finding that if I stick to following the Dividend Hunter recommended stocks, I have much more success with my investments.So, I’m no longer subscribing to other investment advice publications. Life is much simpler just following your recommendations, enjoying retirement and not having to worry so much about how my portfolio is doing.– Kris B. |

| I have been a subscriber of Dividend Hunter for quite a while now and I must say the issues keep getting better and better. It is my all-time favorite financial newsletter…– Larry S. |

| I cannot remember just how I became acquainted with your Dividend Hunter newsletter, but I am truly thankful. The dividend payouts are like clockwork. Set and forget… Consider me hooked! – Alan F. |

Inside The Dividend Hunter, I’m not just sharing dividend picks. I’m guiding you through the markets… 86% of my main dividend recommendations have beaten the market through 2022’s crash.

Not 100% – I’ll never promise you every investment makes huge yields. You’ll always hear the good and the bad from me.

The bad today being for years you’ve been duped by CEOs collecting big bonuses while you are force-fed amazingly low yields.

Well, those days are over.

Because… through investing in my unique dividend finds… you’re about to be first in line when it comes to collecting dividends.

You don’t need to do any fancy trading. There’s no special paper to sign or using margin-debt to purchase.

Simply buy and hold the right dividend stocks that pay you first.

I collect, on average, 70 checks every single quarter. That’s about 280 dividend checks per year.

Every single day (on average) there is money pouring into my account.

And I’m not worth millions, mind you.

You don’t need millions to enjoy receiving these types of checks. You simply need to know the right dividend stocks to buy.

Because all dividend stocks aren’t equal.

There’s over 4,174 dividend stocks trading on just the US exchanges right now.

But it’s impossible to invest in thousands of stocks.

I’ve figured, if you invest in a handful of dividend stocks… you can get paid a check every month.

I’m getting paid, on average, every day!

Outside of weekends, I’m averaging 1.1 dividend checks per day received.

| When the March 2020 crash happened, I was calm and didn’t panic. Even if the market drops 20-30%, I trust Tim to guide us through it.– Don J.(offered compensation for sharing story) |

| Before Tim, we had all our money under management. Today, we’ve moved (a lot) into Tim’s… recommendations. I love Tim’s conservative approach to the market. I just retired in 2021, so it’s time to generate income from our savings. I still enjoy listening to Tim every week as he’s a great teacher, love his personality, and he cares about his readers.– Mark T. |

| I’ve followed Tim since about 2016. I truly believe he has the best interest of his clientele at heart. Before, I had a financial advisor, but I’ve made so much more with Tim than I did with them. – Mel G.(offered compensation for sharing story) |

Collect dividends every day if you wish in the service.

I have high-yield dividends in the portfolio… I have preferred dividend plays inside The Dividend Hunter model portfolio. It’s all waiting for you.

Join me inside right now.

This is the Best Deal You’ll Find on The Dividend Hunter ANYWHERE

I’m giving you $1,000 of value…

The normal retail rate is $99/year for The Dividend Hunter.

That’s pretty good for 33 stocks, all the bonuses, Weekly Mailbag, Buy of the Week, and more.

However, today, you can grab a 1-year subscription of everything for a mere $79.

$79 right now to unlock a decade of income starting now.

That’s just $0.22 per day.

Getting set up takes just a few minutes…

You could be collecting quarterly and monthly checks like clockwork for a mere $79.

That’s the price of dinner and wine for two people..

It’s not that much.

And I could charge 10X this amount.

If you’re ready to join 20,000+ others, click the “Join Now” button right now. On the next page, you can claim your spot inside.

After you join, you’ll receive information on logging into the portal at InvestorsAlley.com.

100% of my own personal 401k is in Dividend Hunter stocks! My year-over-year income growth is 50%!

I am not someone who writes about stocks for fun.

I send you recommendations I myself am considering.

100% of my 401k is in Dividend Hunter investments.

You know your co-pilot during your retirement isn’t some fancy-talking suit.

It’s someone like you building a retirement.

That’s what you can expect inside The Dividend Hunter. So join now.

During these tough economic times… You need a long-term plan to protect and grow your wealth in retirement.

My Final Income Plan is the most important manual to help you retire and stay retired.

I already shared how many retirees are worried they might not be able to retire anymore.

Not to mention, the projected stock market returns going forward (according to Vanguard) is a mere “3-5%.”

Tiny returns like this mixed with inflation is a recipe for disaster for millions of retirees.

I’ve put together this emergency “Final Income Plan” to help you stay retired.

Inside, discover:

- 2 must-have qualities before I even consider a high-yield dividend stock.

- #1 strategy to automatically boost the size of your dividend checks without lifting a finger

- How I (personally) am doubling my income stream every two years in 6 simple steps

- 4 steps to building wealth for yourself and the next generation (without clipping coupons)

We also could use any extra cash we can… that’s why, as a bonus, you see:

Inside I also share tips on generating extra cash around the house including:

- The goldmine website online to generate $100… $200… even $500 bucks in a single weekend

- The $100’s of dollars stashed in your car (you just need to know where to look)

- Items around your house that buyers fall over themselves to pay you for

- A “cleansweep” trick that could bring $60-$100 to light in one evening

- The one call to your bank that could add a surprise $1,000 in your savings account this year

Most importantly, I also include:

BONUS: 3 dividend stocks to buy and hold for lifetime income

This is a full-blown book.

| *BONUS BOOK* FINAL INCOME PLAN CHAPTERS: CHAPTER 1: Building an Income Portfolio for Both Peace of Mind and an Attractive Return CHAPTER 2: The #1 Strategy That Pays Your Bills for LifeCHAPTER 3: How to grow your dividends automatically without lifting a fingerCHAPTER 4: The 5% Monthly Bonus Income StrategyCHAPTER 5: How I’m Doubling My Income Stream Every Two YearsCHAPTER 6: Bedrock Wealth: How To Get It And How To Keep ItCHAPTER 7: 16 Places to Locate “Extra Cash” in the Next 30 Days |

Not only do you get my Decade of Dividends stocks and the Dividend Calendar…

You receive these 2 in-depth reports and strategies. Dozens and dozens of pages of my very best work… all included here.

It’s a free bonus included with your subscription to The Dividend Hunter.

Incredible $10k Free Bonus

Get $10,000+ worth of Wall Street’s very best tools FOR FREE with your Dividend Hunter subscription

Over the last decade, the most common questions I get are: “How should I structure my portfolio? How much should I allocate to XYZ stock?”

I’m not legally allowed to give personalized investment recommendations. Plus, it’d take all my time with over 21,000+ Dividend Hunter subscribers.

However, recently, our publisher, Investors Alley (a 30+ year fixture in the investment publication industry) was acquired by Magnifi.

Magnifi is a new leader in the personalized investment recommendation space with their patented AI-powered investment software.

Wrapped in their Magnifi platform is $10,000+ worth of Wall Street’s very best tools. I’m talking deep research tools like even Broadridge… an advisor recommendation tool that advisors pay $2,000/year to access.

Because we’re under Magnifi now…

You get access to ALL of these features and Magnifi tools for FREE with your Dividend Hunter subscription.

Non-subscribers must pay $20/month for access to Magnifi.

You = free.

There’s tons you get…

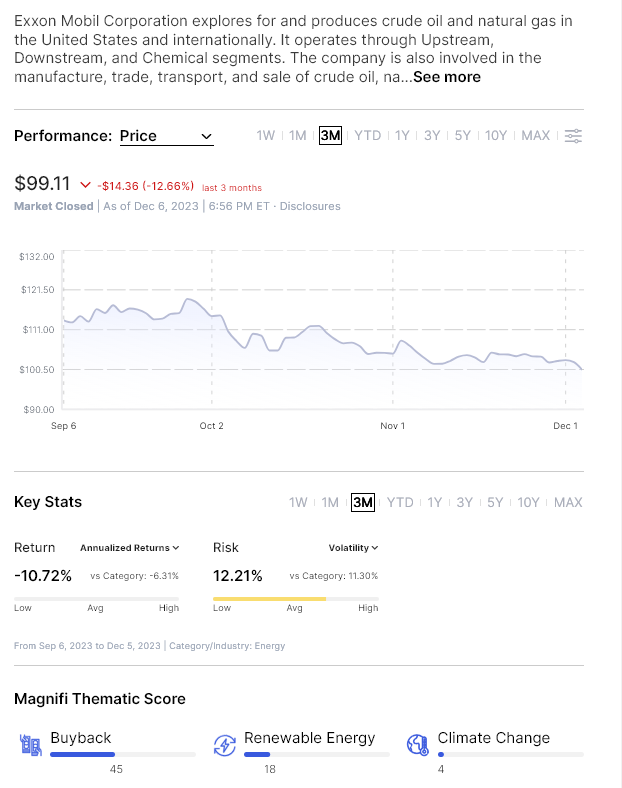

First — research any type of stock you want in an instant.

For example, I want to invest in dividend-paying oil stocks… I type it in…

I get a list of oil plays telling me:

- How volatile the stock is

- The risk %

- How much oil exposure it is

All data pulled from $10k worth of tools Magnifi subscribes to and you get access to.

This piece is amazing for finding new stocks fast.

You can even dive into each stock to get dozens of data points beyond just their return and risk.

You can see how much share buybacks they’re doing… thematic score for their industry and more.

All in a few clicks.

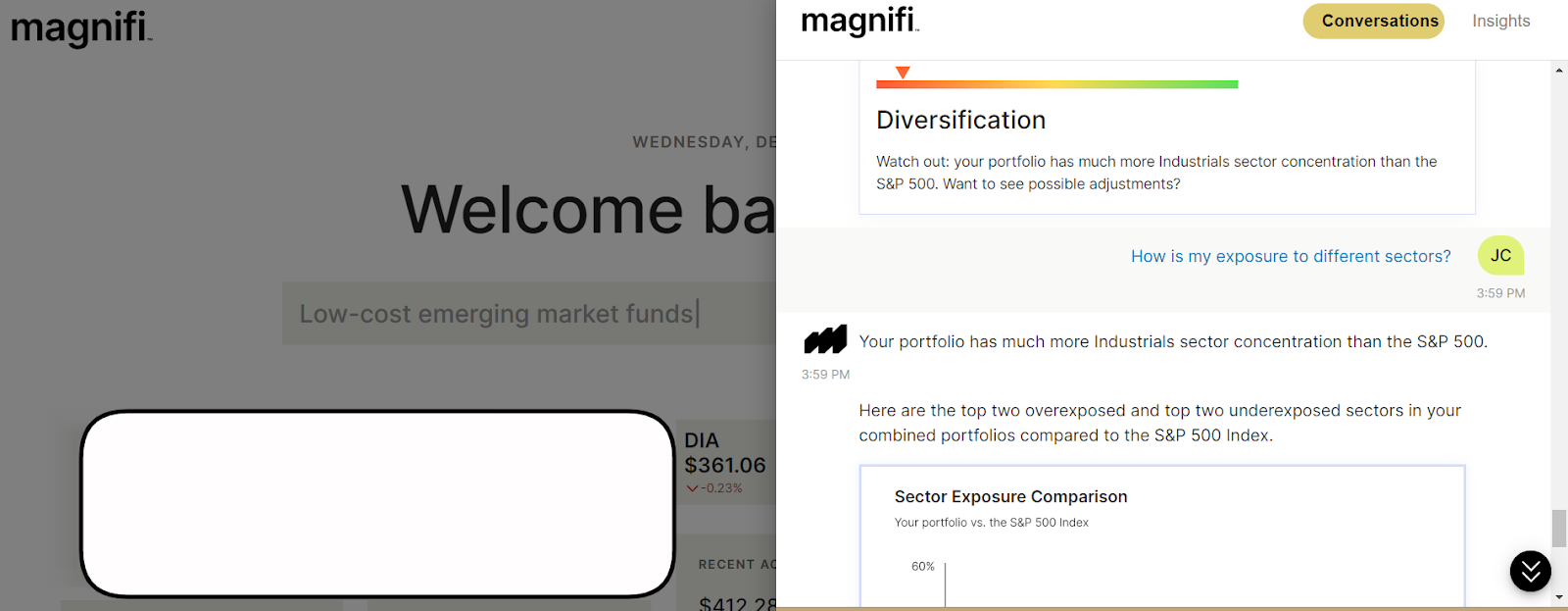

Second — you can securely upload your own portfolios in a few clicks to get real-time data.

Learn if you’re not diversified enough…

How your portfolio compares to the returns of the S&P 500…

How to lower risk in your positions…

You can even get stock recommendations to balance out your portfolio.

No need to switch brokerages or anything. The app, Plaid, is a secure portal built into Magnifi that can connect your brokerage in 3 minutes.

Get personalized portfolio analysis without paying huge fees to a financial advisor.

Get a personalized savings plan… get personalized recommendations based on if interest rates go up or down.

All in a few clicks.

Magnifi is regulated by the SEC so all data and information you provide is 100% secure and protected.

Third — get answers instantly to questions to help you invest with the Magnifi AI chat box.

Ask:

- How is my portfolio performing vs. XYZ sector?

- What are my worst performing stocks this month?

- What’s the latest news on inflation?

- What’s the latest news on XYZ stock?

- How does gold affect my portfolio?

- Help me buy a house.

- Help me plan a vacation.

- What are the holdings inside the SPY index fund?

You get all the analysis and data on stocks personalized for you.

You get it for free inside Magnifi.

Once you click the button below and sign up for The Dividend Hunter… I’ll send you a login to Magnifi.

An incredible $10k bonus for FREE with your subscription.

It’s more research personalized for you.

You could join for 364 days… and still claim a refund.

You can even KEEP my bonus reports shared today as a gift for trying out the service.

You don’t need to consume all the content. You may just want the stock picks. That’s fine.

Or, you may be ready to buy stocks and learn more about our high-yield plays. There’s a ton for everyone.

Join me now.

Income piles up quickly inside The Dividend Hunter.

The dividend checks do as well to keep income coming in.

Start collecting dividend checks over the next 12 months just $0.13 per day.

Is your time worth more than $0.13/hour?

You have two choices now:

Try and find these dividend stocks on your own to get paid over the next decade. To do that, you’ll need to:

- Map out over 4,174 dividend stocks to make sure they’re strong, fundamentally sound companies with unique competitive advantages.

- Research thoroughly each stock’s income statements and cashflow projections to make sure the dividend is strong (and will stay strong).

- Read the quarterly filings of each of the 20-30 stocks you’ll need to buy to keep tabs on the health of the company.

Doing all this work (and more) requires 100’s of hours per year. It’s my full-time job.

Is your time worth more than $0.13/hour?

That’s 61X lower than minimum wage.

Or…

Option #2.

For a mere $79 ($0.22 per day!), let a 30-year investor… someone who’s earned their scars going broke overseas, buying the right and wrong dividend stocks… lead you.

Not only do you get the stocks to buy… but you receive monthly issues, weekly videos, bonus reports, my “Buy of the Week” and more.

Start collecting 6-figures in dividends.

Click the button below to join The Dividend Hunter and gain access to my Decade of Dividends stocks to buy now.

Not only do you get the Stocks to Buy over the Next Decade…

You get the dividend calendar…

And the exact strategies to pay your bills for life daily with dividends

Remember, not only do you get:

The Dividend Hunter:

Receive all the dividend stocks, buy/sell alerts, weekly updates on which stocks are on sale, monthly issues…

You also get access to:

Decade of Dividends: 3 Stocks to Hold for 6-Figures in Dividends Over the Next Decade

I recommended 3 stocks a decade ago that produced $671,727 in dividends.

I now have 3 NEW stocks to buy for the next decade… and the payouts could be just as big.

Monthly Dividend Calendar

Know the exact dates you collect checks and when to buy them

But also:

The exact strategies to:

- Pay your bills for life with dividends

- How to triple your income without potentially having to buy anymore stocks

- Plus, how to protect your money and grow it during tough economic times.

An entire playbook at your fingertips.

$1,000 value…

All for just $79.

PLUS — Claim your free subscription to Magnifi and get personalized help. (with $10,000+ of tools only those on Wall Street get). All included for FREE!

Your first step is to click the button below and join now.

Your first dividend check could be in your account in a matter of days.

Generate up to $700,000 in dividends over the next decade

I’ve shown subscribers how to do it before… and I’ll do it again with BIGGER checks this time!

Those who followed me the last decade had the opportunity to earn up to $650,438 in dividends from an average IRA portfolio.

Now, I have 3 new stocks to share with you and earn you even more!

Why more? How are the checks getting bigger?

Listen closely…

As interest rates top out… but remain elevated (as the Federal Reserve promises)… valuations of tech companies will stay squeezed, real estate will sputter, and 5% savings accounts will stay the same or drop their yield.

Meaning, investors will want a better place for their cash.

They’ll be looking for higher yields than 5%, but don’t want to risk it all in tech as tech got wrecked in 2022.

No — instead, they’ll find strong, solid industries and cash-flowing businesses who can pay out big checks.

All reads will lead to high-yield dividend stocks in the end. It’s coming.

Cash is King in this market.

Don’t spend your retirement hoping for an endless bull market.

Dividend income beats the S&P 500 by double…

Not to mention the peace of mind knowing you’ll have even more cash in your account tomorrow… and the day after… and the day after that.

All that income… the very best dividend stocks… for a low, low price.

Join The Dividend Hunter now, start collecting dividends over the next decade, and I’ll see you inside,

Tim Plaehn

FAQ:

How much do I need to start collecting Dividends over the next decade?

I recommend at least $25,000 to start seeing meaningful income. To get to $500k in dividend income, I recommend $500k. But, you can work up to that amount. Don’t put all your money in at once.

How much do I owe you today?

Just $79. A mere $0.22 per day. That gets you 12 months of The Dividend Hunter, my Monthly Dividend Paycheck Calendar automatically updated each month, multiple bonus reports, weekly mailbag videos and more. It’s a deal.

Is there a money-back policy?

Yes! A 365 day money back policy. And if you don’t like it, keep the special reports as a free gift.

Does this work during a bear market?

Yes! As long as businesses are paying dividends, you can do this. The key is knowing which companies are still growing, which are slowly dying. If they’re dying, you need to get out before they cut their dividend. That’s what I research every single day so you don’t have to.

I can do this myself. I’ll just find the top yielding dividend stocks that pay monthly!

First, there are over 4,174 dividend stocks. Sure, you could screen by yield on a site like Finviz. However, just because a stock pays a high yield DOES NOT mean it’s a stable company. Some have a ‘dividend’ that’s simply a return of capital. (Those are bad).

You need to study the Income and Cashflow statements to determine if the dividend is healthy. You also want to find that it’s growing. Those are great companies. You can do that yourself… but I do this for a living. It’s a full-time job. Instead of spending 100’s of hours per year, you could invest $79. Is your time worth more than $0.04/hour? Not to mention it takes years of practice…