Table of Contents

- Mike Larson Introduction

- Extra income in just seven days

- Inflation is a veritable income emergency

- Four core principles

- “Crash Insurance”

- Less Uncertainty, Less Fear, Less Stress, More Money

- Test it out and practice in real time

- You have a very important choice in front of you…

Weiss Ratings

Weekend Windfalls MasterClass

Exclusive eight-module MasterClass designed to give investors

the tools and confidence to …

- Harness the proven power of the Weiss Stock Ratings, ranked #1 in profit performance in The Wall Street Journal …

- Target extra income of about $1,000 per week …

- With 98% win rate on trades …

- Go for returns that could beat stock dividend yields 20-fold …

- All while rarely touching a single stock.

To join now, click here. Or for the transcript, read on …

Hi, Mike Larson here with some incredible news. Today, I’m unveiling one of the most important projects of my career.

Because let’s face it: If you’re a safety-conscious investor like me, you’re living in one of the trickiest markets in history.

We’re trapped in a world that pays practically zero interest on our savings … AND, at the same time, guts our principal with surging inflation.

But over the next few minutes, I’m going to reveal four core principles that the most profitable Wall Street institutions have been effectively hiding from investors for years.

By learning about them now, investors have the opportunity to go for more consistent wins than they ever dreamed possible … giving them the opportunity to boost their personal portfolios with thousands upon thousands of dollars in what I call “instant payouts.”

How consistent? With my strategy, I’ve documented a win rate of 98%. For every 100 trades, we’ve seen an average of 98 winners.

Consistently. Over a period of five years.

Since seeing is believing, here are just a few real-time examples of instant payouts we’ve seen using this approach …

- $1,020 from Citigroup

- $1,056 from Home Depot

- $1,000 from the iShares Treasury Bond ETF

- $1,040 from Williams-Sonoma

- $999 from Newmont Corp.

- $1,600 on from Williams-Sonoma

- $1,140 from General Mills

- $4,050 from Newmont Corp.

And here’s the thing: These were in weeks when the market was going up AND in weeks when the market was going down. Which makes it especially valuable in a topsy-turvy market.

My strategy is not risk-free, of course. No investment strategy is. But the powerful tools I’ll tell you about in a moment could go a long, long way toward taking most of the risk out of the equation.

This strategy gives average Americans a real opportunity to create a completely independent source of income that does not depend on a job … and equally important, does not depend on the market’s ups and downs.

Let me show you what I mean.

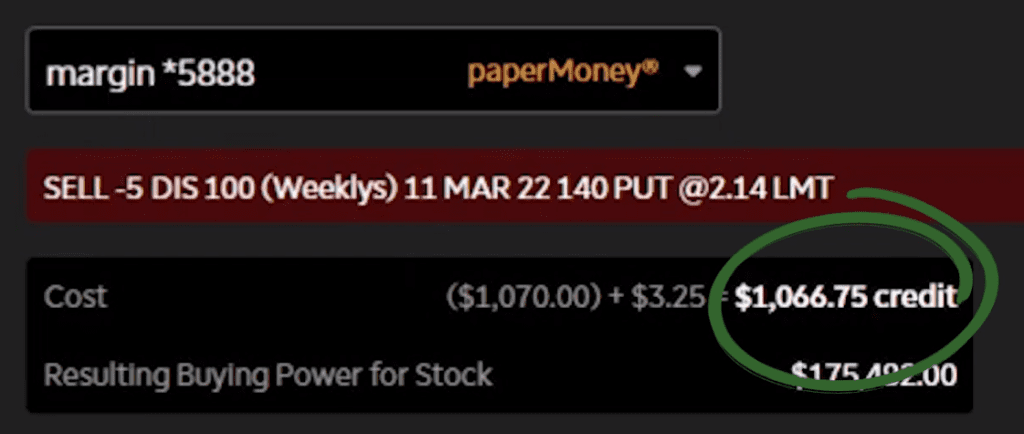

I set up a sample brokerage account for the purposes of this demonstration. It took a few more steps beyond the setup you’d typically need for regular stock or ETF trading. But nothing complicated. Now, I’m going to show you how this works.

I’m going to press a couple of buttons to pull down a credit of about $1,000. That’s right. I’m going to, in effect, pull $1,000 from the market into my account.

There it is! Actually, it’s a bit more than my goal of $1,000 per week — $1,066 to be exact.

Lucky break? Not at all! Luck is so remote from this strategy, I don’t think it’s even worth mentioning, except maybe one or two percent of the time.

Quite to the contrary, all my research tells me that this is as close to scientific investing as you’ll find anywhere.

The tried-and-tested strategy I’m introducing to you today is based on our 52,000 stock ratings, seven TERABYTES of data and $3.2 million in R&D costs on the proprietary algorithms that help guide our strategy.

And it’s working like gangbusters. As I said, it has an incredible 98% success rate.

Let me show you our latest live action results:

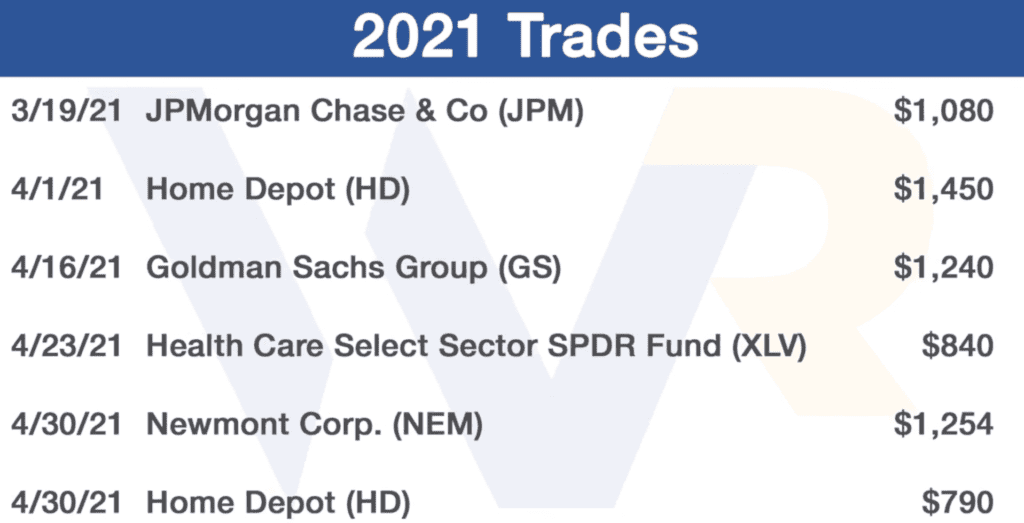

In 2021, in my weekly research service for investors that use this same strategy, we had 29 winners and one loser. Here’s a snapshot of the instant payouts we’ve seen …

And if you think 2021 just happened to be a lucky year, look at 2020:

And in the three prior years, our backtesting of the same methodology shows we would have had 285 winning trades and 1 losing trade.

All told, among a total of 434 trades, 98% were winners and 2% were losers.

Not only do these wins come week after week, one after another …

They also tend to be relatively quick — so usually you don’t tie up your money for more than around 30 days.

And in some cases, you can walk away with the extra income in just seven days, 14 days or 21 days.

This is by design. You see, rather than waiting months or even years for gains, our income strategy allows us to get in — and out — in just a few weeks.

So, how much money could you make? Based on the average portfolio of folks 40 and over, I have found that targeting about $1,000 per week in extra income is very reasonable.

Naturally, the more you invest, the more you stand to make. If you invest less, your weekly payouts could be a few hundred dollars. If you invest more, they could be a few thousand dollars.

Depending on how much is invested and how the account is set up, that could add up to 12 times more annual yield than could be made in corporate bonds and 20 times more than could be made with stock dividends.

Needless to say, that can make a huge difference. Because let’s not forget the dire realities of our times:

Stock dividend yields simply don’t cut it anymore. If you buy the average S&P 500 stock on Jan. 2, the first trading day of the year, all your dividend yields for the year are wiped out by inflation within just 66 days. By March 9, they’re gone, swept away.

If you jump into the cesspool of junk bonds and all the mucky risk that comes with it — sure — you can get more yield. But even that doesn’t last very long. On the average junk bond, at current rates, all your yield for the entire year is down the tubes by Aug. 16, thanks again to inflation.

And if you want the safety of bank CDs, forget it! All your yield for the year is gone in two weeks flat. Then, it’s all downhill from there as inflation eats away at the value of your principal.

It’s a veritable income emergency.

And that’s why I’m having this urgent conversation with you right now.

So, if you're an investor — especially if you're an income investor who doesn’t like to take reckless chances with your money — give me your undivided attention.

Because my mission is to give you all the tools and training you need to implement my revolutionary income strategy so you can crush BOTH the low yields AND the high inflation rates that plague us today.

Today, I will reveal the four core principals I rely on to execute this remarkable strategy. I will give you the TOOLS and the CONFIDENCE you need to begin targeting about $1,000 in extra income per week.

Now, I’d like you to visualize something …

What if you could stroll up to your own private ATM machine every Friday afternoon and withdraw some quick cash for the weekend?

What you do with the cash is up to you.

Maybe you’d like to take your spouse on a surprise trip to a special weekend getaway.

Or, better yet, instead of just a long weekend, what if you could stay a whole month without making a big hole in your savings account?

Or perhaps you don’t want to spend it right now. Maybe you’d prefer to stash most of that money away for the future.

If so, that’s fine, too.

Once you’re set up, you can begin exploiting these extra income opportunities nearly every week with very little work on your part.

Now, before I reveal how it works, let me address something important. It has to do with my relatively conservative investing philosophy.

My firm, Weiss Ratings, is widely known for warning millions of Americans about financial dangers and guiding them toward lower-risk investment strategies.

That helps explain why Weiss Ratings was ranked #1 in The Wall Street Journal in profit performance. We outperformed the research of Goldman Sachs, JPMorgan Chase, Merrill Lynch, Morgan Stanley, Standard & Poor’s, and all other firms covered.

I’m the safe money expert at Weiss Ratings. So, I’m about as far from a wheeling-dealing speculator as you can get.

I do NOT chase hot tips. I do not try to play up-and-down move in the market. I don’t bounce in and out of trades like a ping-pong ball.

That’s why I’ve built this strategy and why I’m here now to tell you all about it.

Consider this time we spend together as your “warm-up session” for a brand-new MasterClass I’ve created to give you all the training I believe you’ll need.

Once you’ve completed this training, you should be able to execute these trades on your own, in your own account.

No, don’t bet the farm. But once you get the hang of it, you may even want to include a portion of your IRA or other retirement money.

You can initiate these trades nearly every Friday by 4 p.m. Eastern. And you can continue doing so, almost like clockwork, week after week — all thanks to the unusually high 98% success rate we’ve documented with five years of testing and real-time recommendations.

One word of warning: Implementing this strategy is not as easy as buying stocks or ETFs online.

But today, I’ll show you how you can start small, aiming for, say, $100 to $200 in instant payouts per week.

Then, once you’re comfortable with the strategy, you could ramp up to $500 per week, $1,000 per week or even more.

Right here and now, I want to make this warm-up session as valuable as I can. So, I’ve decided to give you four core principles that form the basis of my strategy.

For my first core principle …

I’m going to drop a word that you may have a negative reaction to. But don’t let that stop you from hearing what I have to say next.

That word is options.

Don’t worry. I’m not talking about the kind of options trading that most investors are familiar with.

On the contrary, with my strategy, all the magic happens when you turn the typical options trade on its head.

Options buying gets a bad reputation for a simple reason: Options expire! They have a limited lifespan.

So, unless the market moves BEFORE the time is up, investors who BUY options typically lose money.

In fact, based on several studies, about 80% of options expire worthless. So, typically option buyers lose money in four out of five trades.

In other words, when you BUY an option, time is your worst enemy.

Which leads me directly to …

The second core principle of my strategy.

You don’t have to BUY options. Instead, you can SELL options!

Instead of taking the side of the gambler, you take the side of the house.

Instead of time being your worst enemy, time is your best friend.

When you SELL options, time is such a good friend, you not only can make money when the market goes your way …

You ALSO make money when the market goes nowhere.

And sometimes, you can even make money if the market moves against you, provided it does so moderately.

All thanks to the sheer passage of time!

If you’re an options buyer, and the market studies are on target, that means you stand to lose 80% of the time.

But if you’re a seller, it means you stand to WIN 80% of the time.

And THAT’S why the core feature of my strategy is SELLING options.

That way, instead of starting with, say 4-to-1 odds against you, you start with 4-to-1 odds in your favor.

But that’s just your STARTING odds, which leads me to …

The THIRD core principle of my strategy …

As you probably know, there are two kinds of stock options.

The first kind is a call option, which gives the buyer the right to BUY shares of stock. It’s a bet on a rising market.

The second kind is a put option, which gives the buyer the right to SELL shares of stock. That’s a bet on a falling market.

Let’s focus on the put options.

Investors buy put options to make money when the market goes down. And typically, they do it with one basic purpose in mind.

To buy protection against a stock market crash.

I call it “crash insurance.”

In many ways, it’s like insurance on your car. If you get into an accident, or God forbid, there’s a crash, you’re covered.

It’s good protection. But it’s definitely not a good way to make money.

Think about it. When you buy car insurance what happens?

Most of the time, you just pay the premiums month after month. And you rarely, if ever, make a claim, right?

So, you’re not the one making the money on the insurance. It’s the insurance company, the guys who SELL the crash insurance. They’re the ones COLLECTING all those premiums. THEY are the ones who get the steady stream of income.

Well, that’s essentially what we want to do in the stock market. We want to sell the crash insurance and collect the premiums. Week after week. Month after month, which leads me to …

The fourth and MOST IMPORTANT principle of my strategy. We SELL PUT options. And we sell them strictly on the strongest companies.

Imagine you sell car insurance.

Are you going to insure a reckless driver with a long history of accidents, driving a grossly overpriced Ferrari?

Of course not.

You want to sell car insurance to drivers with stellar driving records and reasonably priced cars.

And with my strategy, that’s exactly what we’re doing in the stock market.

When I sell crash insurance — in other words, when I sell put options — I want to sell them exclusively on companies with stellar driving records.

And in my book, that’s a stock with a high Weiss rating!

It’s the high Weiss Stock Ratings that help us pick the lowest-risk stocks in the entire market.

The lowest-risk stocks among 10,000 or more that we review every single week and every single trading day of the year.

It’s the Weiss Stock Ratings, which were ranked in The Wall Street Journal as #1 in the nation for profit performance.

It’s the Weiss Stock Ratings, for which we NEVER have accepted … and never WILL accept … any compensation or favors in any form from the companies we rate.

It’s the Weiss Stock Ratings which are independent, accurate and CONSERVATIVE.

It’s the Weiss ratings that give us an edge, a very critical edge.

And it’s the Weiss ratings that give us the opportunity to boost our winning odds from 80% to 98%.

That means you cut the losing odds by 90% — from 20% to 2%.

It also means average investors don’t need a Harvard MBA to start earning up to $1,000 a week in extra income. And if you’ve followed me this far, you probably already know more about this strategy than most MBAs from Harvard, Princeton or Yale.

You already know the four core principles of my strategy.

You know that, if buyers lose 80% of the time, it means that those on the other side of the trade, the sellers, WIN 80% of the time.

You know that, if buyers lose 80% of the time, it means that those on the other side of the trade, the sellers, WIN 80% of the time.

You know that, thanks to our Weiss Stock Ratings, you can win 98% of the time.

And you know that this high win rate helps give average investors a solid, steady opportunity to generate extra income of $1,000 per week or more.

Despite all the crazy things that are happening in our world today.

That means less uncertainty, less fear, less stress … PLUS more money.

If investors can meet our goal of $1,000 per week, and do so, say, 48 weeks out of the year, that could add to $48,000 per year.

If they invest less, they’d make less. If they invest a lot more, they could make more.

But to put my strategy into practice, there’s still a lot more to learn. And that’s why I want to hand you the keys to my exclusive Weekend Windfalls MasterClass.

I’ve created the MasterClass sessions to make it as simple and straightforward as possible for you to start earning your own Weekend Windfalls.

So let me give you a sneak preview of what’s waiting for you inside my Weekend Windfalls MasterClass:

- Why selling “insurance” in the stock market is the single best way to pull thousands of dollars into your account consistently, week after week.

- The worst and BEST way to sell insurance in the market. Hint: You definitely don’t want to insure a rickety shack in a hurricane zone. (See Module 2, Session 4)

- The SWEET SPOT among the 10,000 stocks we review each day and how to use our Weiss Ratings screen to find it. (Module 3, Session 2)

- Among the scores of options on each stock, how to find the ONE single option for the biggest instant payout and best overall return. (Module 3, Session 2)

- How to sell options not only on stocks but also on ETFs, including ETFs on gold, bonds and other asset classes. (Module 5, Session 2)

- The best way to exit a trade and keep 100% of the instant payout you collected up front. (Module 7, Session 1)

- Plus, much, much more.

Finally, in module 8, I put it all together and get you on your way. So, you can give it a whirl on your own. Don’t worry, you can always go back to any modules where you might have questions.

Throughout the MasterClass, I show you how to spot CONSISTENT trading opportunities, and maximize your income potential on each.

I show you not only how to get into a position, but equally important, how best to get OUT of the position.

So, how much money will you need to test it out and practice in real time?

The answer is ZERO! Not a penny. In my Weekend Windfalls MasterClass, I show you a way to simulate as many weekend windfalls trades as you want without investing a dime on an option … or even spending a penny on broker commissions.

Like playing with monopoly money.

Then, once you get the hang of it, you can start investing some real money.

Using this strategy, weekly payouts can range from a few hundred dollars to a few thousand.

However, the recommended goal for the average person who’s retired — or preparing for retirement — is about $1,000 per trade. And I feel that could be more than enough to make it all worthwhile for most investors.

Whether your main goal is to add more money to your nest egg, or to give yourself the freedom to take more luxurious vacations, or some mix of both …

Based on everything I’ve done and seen in my entire career, I’m fully convinced this is the single best way to get steady, high income out of the stock market.

That could be a godsend to many investors who are losing so much to inflation and getting practically zero interest on their money …

Whose yearly yield on stock dividends is wiped out by inflation in 66 days, whose yield on

Stock dividend yields simply don’t cut it anymore. If you buy the average S&P 500 stock on Jan. 2, the first trading day of the year, all your dividend yields for the year are wiped out by inflation within just 66 days and whose yield on bank CDs is wiped out in two weeks flat.

I don’t know about you. But that doesn’t sound very safe to me. I think my Weekend Windfalls strategy is far, far better.

It takes more work than just the set-and-forget approach of buying a bank CD. But once you learn how to do it, your time investment can be cut to just MINUTES per week.

Assuming you follow the guidelines I provide in my MasterClass, use the moderate leverage I recommend, and achieve the goals I have set forth here today, you have the opportunity to see yields that greatly exceed what’s available almost anywhere in the stock or bond market.

And I think that alone could help make a big difference in the finances of savers and investors.

That’s the goal of my strategy, and my Weekend Windfalls MasterClass is the only one that shows you how. Like I said, it is proven to generate real-time weekly payouts like:

- $1,000 from the iShares Treasury Bond ETF

- $1,040 from Williams-Sonoma

- $999 from Newmont Corp.

- $1,600 from Williams-Sonoma

- $1,140 from General Mills

- $4,050 from Newmont Corp.

And once you join, access to my MasterClass is yours forever.

Just click the button below and you’ll be taken to a registration page with all the details.

As an extra bonus, you get a full year of continuing monthly analysis at no cost whatsoever.

Each month, I send you my in-depth investment research report on the threats and opportunities for income investors.

PLUS, six days per week, you’ll ALSO get our daily e-letter with critical investor news and updates.

And any time of the day, you get direct access to my mailbox for any questions you may have.

That’s a full year’s membership to my continuing education plus on-demand access to the Weekend Windfalls MasterClass FOR LIFE.

All for less than $2 a day!

So, right now, you have a very important choice in front of you …

You can ignore this opportunity to join my Weekend Windfalls MasterClass and continue exactly as you are.

Maybe you're already wealthy and comfortably retired.

Maybe your life is exactly where you want it to be financially, and you really don't need any extra income in your life.

If that's the case, the more power to you!

But if you've made it this far, chances are you could use more income every week of the year.

If that's you, then you're in the right place.

My MasterClass gives you the TOOLS and CONFIDENCE to seize your income opportunity nearly every week of the year.

Just click on the button below to see all the details.

But do it now. Because this opportunity closes very soon.

I look forward to our first session together.

Weekend Windfalls MasterClass

© All rights reserved | 4400 Northcorp Parkway, Palm Beach Gardens, FL 33410 | 855-278-9191