In this Article:

Always look on the bright side. Not only does this put you in a better mood, but it also can help you make money. That's especially true in the current stock market downturn.

We asked three Motley Fool contributors to pick beaten-down stocks to buy right now. Here's why they chose Moderna (MRNA), Pfizer (PFE), and Zoetis (ZTS).

Look beyond the pandemic

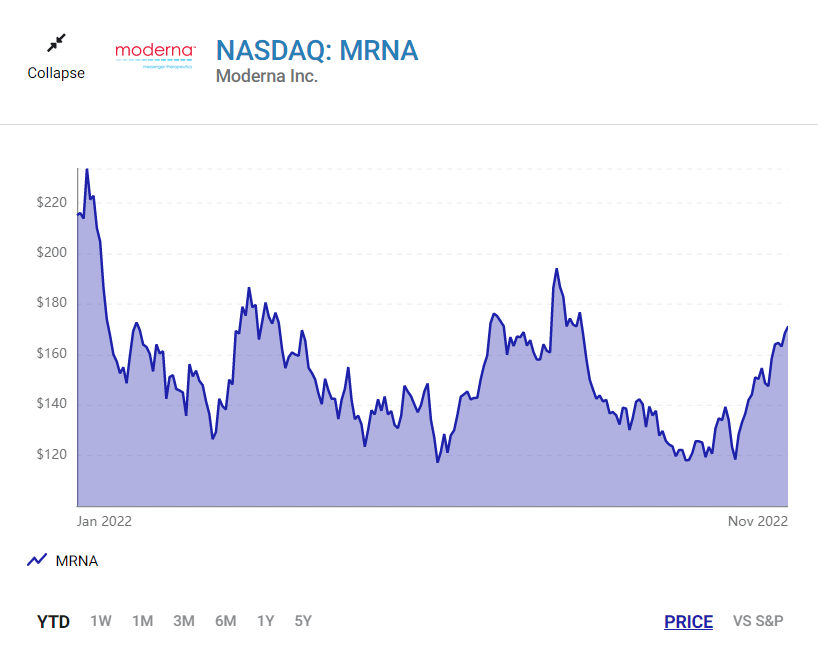

Prosper Junior Bakiny (Moderna): The market is forward-looking. Right now, it sees trouble ahead for companies that rely partly or exclusively on their coronavirus vaccines or medicines to generate revenue. Moderna fits the bill, which is why its shares have dropped substantially this year. Starting in 2023, the company's sales will suffer. To be clear, though, Moderna's revenue won't drop to zero as COVID-19 is almost definitely here to stay.

The biotech has one of the most successful vaccines on the market, and it has targeted variants of the coronavirus with newer versions of its crown jewel. Moderna will remain a leader in the coronavirus booster market.

Equally as important, though, investors should try to look beyond next year. Moderna is generating lots of cash thanks to its coronavirus portfolio; it had $17 billion in cash and equivalents as of Sept. 30. That will allow it to advance its pipeline.

[Alert: Putin Just Screwed Up Royally… Even For Him]

NASDAQ: MRNA

The company has well over a dozen non-COVID candidates, including three that have reached late-stage studies: potential vaccines for flu, cytomegalovirus, and respiratory syncytial virus. Moderna's messenger RNA (mRNA) approach has an advantage because vaccines of this type tend to be faster to manufacture.

Although we shouldn't expect Moderna to be as fast to launch its next products on the market as it was during the COVID outbreak, the company looks set to record important clinical and regulatory wins in the next five years. It should also continue to advance its ambitious early-stage programs such as its vaccines for HIV and vaccines that target various cancers.

Will the company's programs always pan out? Probably not. But with a diverse pipeline and the funds to carry them to approval, Moderna's future still looks bright, despite its poor performance on the stock market this year.

[Exclusive: Collect Thousands From America’s Fastest-Growing Firms]

A big margin of safety

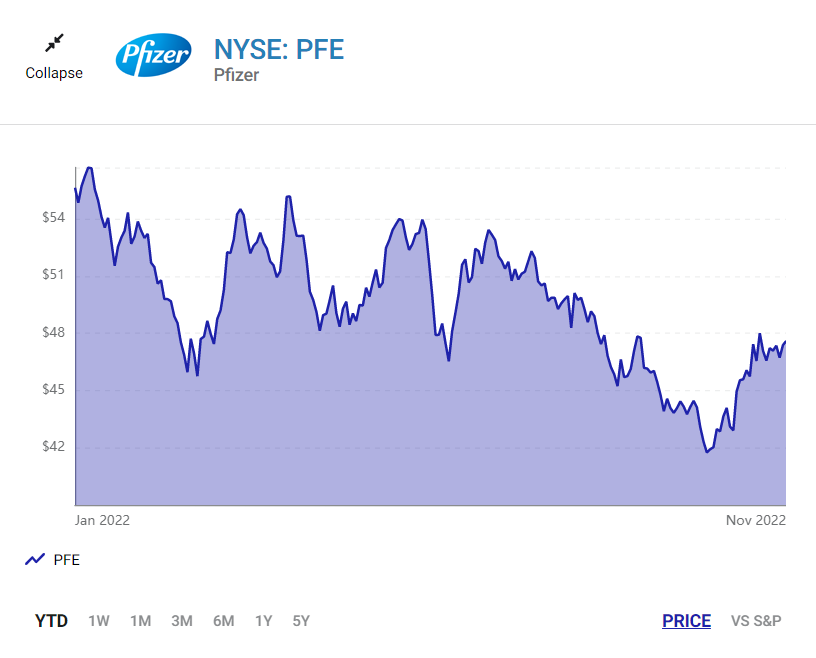

David Jagielski (Pfizer): Having a good margin of safety is something you'll often hear billionaire investors Warren Buffett and Charlie Munger talk about. It's all about giving yourself a buffer between where an investment is valued today versus where you think it ought to be. Pfizer stands out as one stock that I think has a potentially significant buffer.

Shares of this top healthcare company are down close to 20% this year and trade at just nine times trailing earnings. By comparison, the average healthcare stock trades at a multiple of nearly 22. There's a huge buffer there to suggest that even if Pfizer's earnings were to be cut in half, it could still be a good buy.

NYSE: PFE

Investors are clearly bracing for a sharp decline in revenue. With COVID-19 revenue totaling $56 billion and accounting for over half of Pfizer's business this year, a drop-off could be likely as people become less concerned about the coronavirus.

But that's a big assumption since there are concerns that COVID cases could spike this winter. The U.S. government is also looking at whether Pfizer's pill Paxlovid could be an effective treatment for long COVID.

Even if there's a drop-off, it likely won't be as steep as what investors are pricing into the stock's valuation right now. And Pfizer hasn't been sitting idle. It has been making moves to acquire businesses that can improve its long-term potential, including the recent acquisitions of Global Blood Therapeutics (for sickle cell treatment) and Biohaven Pharmaceuticals (migraine therapy).

Pfizer's business is facing some challenges: It will undoubtedly lose some revenue from COVID treatments and products that are losing exclusivity later this decade. But the bearishness surrounding the stock seems to be excessive. This is a company that quickly formulated a coronavirus vaccine, proving how fast it can adapt to change and bring a product to market.

Investors shouldn't dismiss the company's track record for growth. Although there's some risk ahead for the business, there's also plenty of margin of safety at its current valuation to make Pfizer a good stock to buy right now.

[Don't Miss: Crypto Millionaire Abandons Bitcoin After Crash For THIS]

A global leader with bright long-term prospects

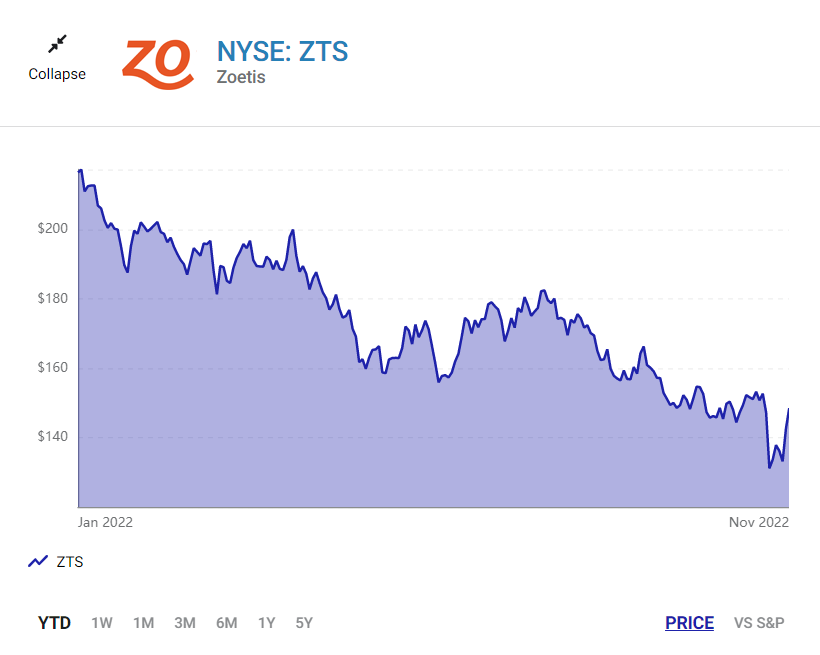

Keith Speights (Zoetis): It's been an especially rough year for Zoetis. Shares of the animal health company have plunged more than 40%. It has faced several headwinds, including supply chain issues, staffing challenges in veterinarians' offices, and the strong U.S. dollar.

NYSE: ZTS

But the long-term prospects for Zoetis remain bright. More than 60% of the company's total revenue comes from products for companion animals. This market should expand significantly as more people adopt pets and spend on the animals' health.

Zoetis' livestock business should also be a solid growth opportunity. The demand for protein in emerging markets, notably China, appears likely to increase as overall income levels grow.

No company is in as strong a position to profit from these trends as Zoetis. It currently ranks as the global market leader in animal health for companion animals, cattle, fish, and swine. And it is No. 5 worldwide in the poultry market.

The company has delivered market-beating revenue growth in recent years. CEO Kristin Peck said in the third-quarter conference call that Zoetis has “the pipeline, market leadership positions, global scale, and financial strength to continue outpacing the market.”

I think she's right. Wall Street seems to believe so, too: The consensus 12-month price target reflects an upside potential of more than 50% for this beaten-down stock.

[Alexander Green: The New King of LNG]

Read more from Keith Speights, David Jagielski, and Prosper Junior Bakiny at Fool.com