The future of tech is “smart.”

Artificial intelligence, 5G, electric vehicles, big data and automation are driving the next wave of tech. Think about all of the devices that you use on a daily basis to make your life easier.

The best smart tech companies are constantly improving these devices. They are at the forefront of developing our future.

These companies are here to stay, and, more importantly, their stocks will continue to grow.

Kulicke and Soffa Industries Inc.

In the spirit of smart tech, I found a pick-and-shovel company that makes semiconductors.

Semiconductors are at the heart of modern electronics. They are essential components of devices used in communications, health care, transportation and clean energy.

Semiconductors are a key ingredient to revolutionary technological advancements.

[Exclusive: The Clock Just Started on the Biggest Stock Market Event in Twenty Years]

Smartphones need semiconductors to access 5G networks.

Autonomous and electric-powered cars need semiconductors to work properly.

Kulicke and Soffa Industries Inc. (Nasdaq: KLIC) is a Singapore-based company specializing in developing equipment used to manufacture semiconductors.

It builds the packaging equipment that connects a semiconductor to its protective casing.

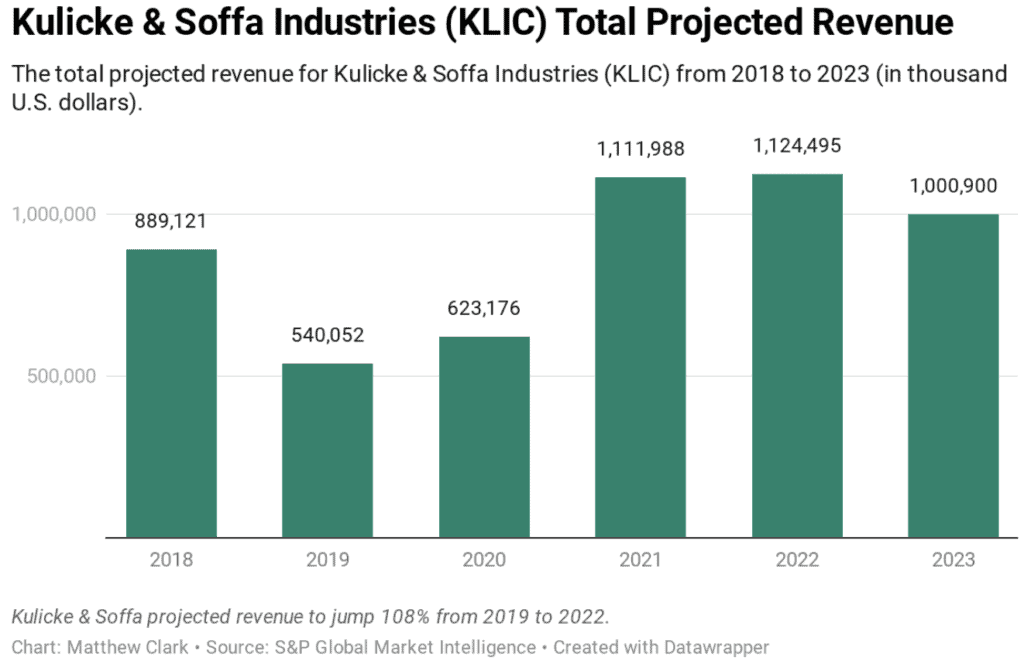

In 2019, the company reported sales of $540 million.

That increased slightly to $623.2 million in 2020.

But the increased demand for 5G chipsets means big business on the horizon for Kulicke.

These new chipsets require more complicated packaging, meaning big semiconductor companies like Taiwan Semiconductor and others will spend top dollar to ensure their products are safe.

That demand is expected to be so great that Kulicke recently increased its fiscal year guidance to $1.1 billion in revenue for 2021.

[Alert: Rare convergence of 3 economic triggers is about to set off a buying frenzy in tech stocks]

Revenue forecasts are for annual revenue to reach $1.12 billion in 2022.

That’s a 108% increase in total revenue from 2019 to 2022.

Demand may soften a bit leading into 2023, but the company still has a projected revenue of more than $1 billion that year as well.

That’s a big bounce from those lean years of 2019 and 2020.

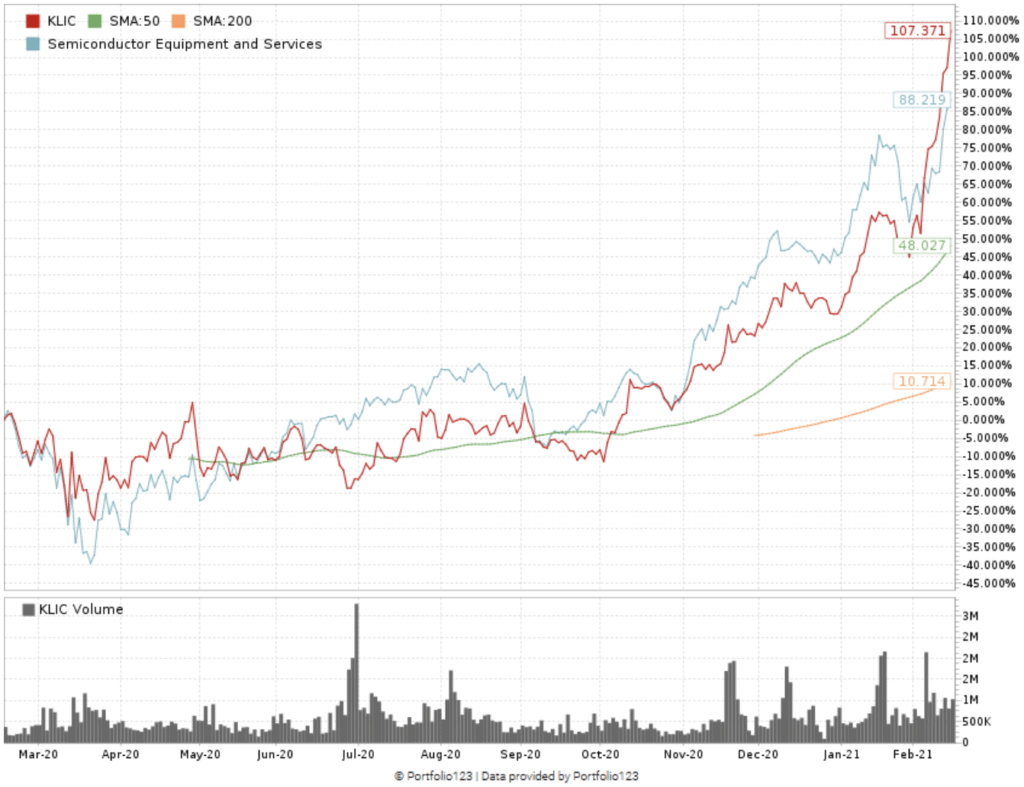

The company’s stock price spent most of 2020 fairly flat — only gaining about 44% off its March 2020 low of $17.83 per share.

KLIC (Red) Grows 194% Since March 2020 Lows

However, starting in November 2020, the stock went into an uptrend.

Kulicke and Soffa’s stock price bounced 194% off its March 2020 lows and trades at more than $52 per share.

In the last 12 months, the stock has gained 107.4%. Compared to the semiconductor equipment and services industry, Kulicke stock is outperforming its peers on a broad level.

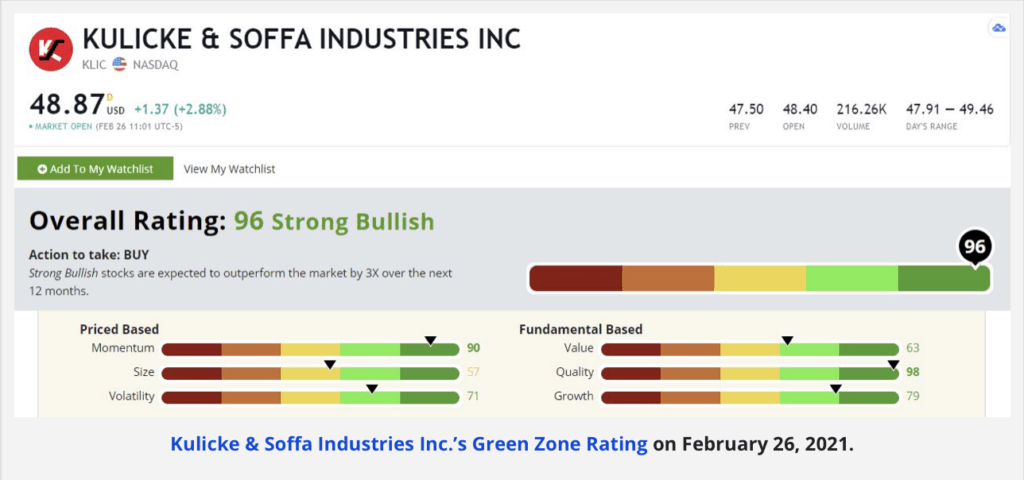

KLIC Performance on Green Zone Ratings System

I looked at Adam’s six-factor Green Zone Ratings system, where Kulicke and Soffa stock ranks a 96 overall. So we are “Strong Bullish” on the stock and expect it to outperform the market by three times over the next 12 months.

Quality — KLIC’s strong returns on investment, equity and assets, along with a 48.4% gross margin, are all better than the industry average, giving the company a 98 on the quality metric.

Momentum — The stock has been in a strong uptrend since November, giving it an 90 on momentum.

Volatility — That momentum has not suffered much in the way of downward movement, so KLIC scores an 71 on volatility.

Bottom Line: KLIC is a high-quality, strong momentum stock that will capitalize on the need for new semiconductors in a big way.

But to realize the potential for three times the market’s returns, you need to get into Kulicke and Soffa Industries now.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

[Alert: Rare convergence of 3 economic triggers is about to set off a buying frenzy in tech stocks]