Can you name the electric vehicle (EV) maker that was in the top 10 stocks by market value owned by Warren Buffett's Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) at the end of 2020? It might help to also know that the Berkshire investment has gone up 25 times in value as of Dec. 31, 2020, since the company initiated the investment in 2008.

It's not Tesla (NASDAQ:TSLA), which Berkshire invested in early, but rather Chinese EV company BYD (OTC:BYDDY). And Berkshire owns more than 8% of the diversified EV and battery manufacturer. Investors may be surprised to know that even though NIO (NYSE:NIO) and others get more press, BYD has by far the most electric vehicle sales in China.

A big lead

Since its founding in 1995, BYD has expanded globally. It has a much bigger business than just battery electric vehicles (BEVs), including batteries, electric commercial buses, trucks, and vans, as well as fossil-fuel-powered vehicles. But even restricting comparisons to BEVs, BYD is the largest Chinese manufacturer.

BYD sold 131,000 battery electric vehicles in 2020, and more than 460,000 total vehicles. By comparison, NIO sold 44,000 vehicles, 113% growth over 2019. NIO also announced a 352% increase in January 2021 deliveries compared to the prior-year period, but that still only totaled 7,225 electric cars.

[Revealed: This Tech Expert Finally Found the Company that’s Behind Elon's New Project]

Buffett's interest

Berkshire purchased its stake in BYD through its MidAmerican Energy subsidiary in 2008, after Buffett's partner Charlie Munger brought it to his attention. He was likely enticed by its broader scope in the electrification industry, beyond just electric cars. In a 2009 interview, Munger told Fortune that BYD founder Wang Chuanfu “is a combination of Thomas Edison and Jack Welch — something like Edison in solving technical problems, and something like Welch in getting done what he needs to do. I have never seen anything like it.”

That potential has been paying off recently around the world. BYD announced it received the largest all-electric bus order outside of China earlier this year. The order is for more than 1,000 municipal buses for the city of Bogota, Columbia.

BYD says its electrified public transportation solutions are currently running in over 300 cities in 50 countries around the world. Just this month, BYD said its new California-built 33-passenger K8M public transit bus set a new high-score record in the Federal Transit Administration (FTA) model bus testing program in Altoona, Pennsylvania. With high marks in structural durability, reliability, maintainability, and safety, the buses can now be purchased by U.S. transit authorities using FTA funding.

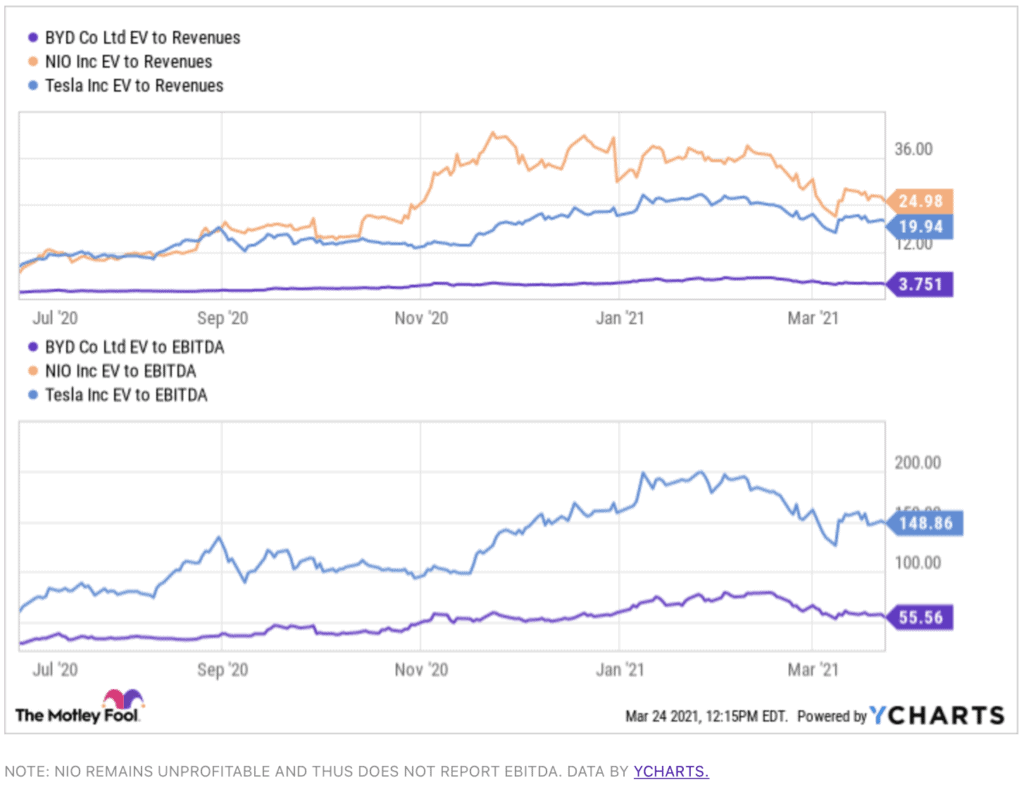

Even today, after the exponential rise in his investment, Buffett likely still must like the valuation compared to BYD's peers. After the huge run in EV makers in 2020, none of them can be considered cheap by traditional measures. But BYD compares very favorably in enterprise value revenue or EBITDA, relative to both Tesla and NIO.

[Breakthrough: This trend is BIGGER than Blockchain, Ai, 5G, Robotics, and the IoT COMBINED!]

Leveraging expertise for future growth

The company is also leveraging its battery technology. As the largest global rechargeable battery maker, its products are used in consumer electronics, electric vehicles, and energy storage. BYD controls the full supply chain from mineral battery cells to completed battery packs. Its business model now includes a focus on renewable energy production, storage, and applications like solar power.

Some investors may not want to be overly aggressive with electric vehicle stocks after the sharp run many of the stocks had in 2020. But for those looking to be in the sector, BYD may be the Chinese EV maker you want to have a stake in. Investors are usually in good company with Buffett and Munger, and BYD shares have dipped almost 20% in 2021, making now a decent time to at least start a position.

Howard Smith owns shares of Berkshire Hathaway (B shares) and BYD. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares), NIO Inc., and Tesla and recommends the following options: short January 2023 $200 puts on Berkshire Hathaway (B shares) and long January 2023 $200 calls on Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.

Your collar on BRKB is an outstanding idea.

However, for the neophytes reading it I think it is important to state that buying calls AND selling puts on the same security

poses the potential of a double whammy if the trade moves against you. I realize this is obvious to most anyone who comes up with the idea, but I’m sure you are more aware than I

that many readers do not possess the same trading expertise. All they see is:”Calls for virtually no cost! Wow!” That sold Put is like a guillotine overhead until the trade either expires or is WELL out of the money.