Economists and analysts often throw around insanely large numbers.

In particular, they do this in areas such as government debt and spending.

“Trillion” gets tossed out in conversation as if anyone can truly grasp its size.

We know what it looks like written out. It’s a 1 with 12 zeros behind it: 1,000,000,000,000.

It doesn’t seem that daunting. But to truly understand the scope of it, consider this…

One million seconds is 12 days. One billion seconds is 31 years. One trillion seconds is 31,688 years.

If you make $40,000 per year, it would take you 25 million years to earn $1 trillion.

Even when we talk about stars in the galaxy, galaxies in the universe or stars in the universe, we don’t use “trillions.” We use “billions,” sure. Or “billions upon billions.” But never “trillions.”

There is one industry, though, where it’s a common unit. In fact, in it, 1 trillion is considered small, or even substandard.

What isn’t small is the opportunity here for investors. Let me show you.

[First Look: 99% of Investors Are Clueless About This Game-Changing Technology]

Two Times Larger Than the Sun

I bought my first terabyte (TB) hard drive more than a decade ago.

A terabyte is 1,000 gigabytes (GB) – or roughly 1 trillion bytes of data.

At the time, it seemed like a massive amount of storage capacity. And I considered it well worth the couple of hundred bucks I spent on it.

Today, USB flash drives can be 1TB. And you can buy 18TB hard drives.

Why the sudden need for more space? Well, every second of every day, we’re producing an exponential amount of data.

In fact, in 2020, every person on the planet created an average of 1.74 megabytes of data every second.

That’s approximately 2.5 exabytes (EB) of data each day!

An exabyte is 1 billion GB of data, or 1 million TB.

My favorite way to comprehend this amount of data is to imagine that if 1GB were equal to the size of the Earth, 1EB would be the sun.

That means we’re creating 2.5 suns each day.

[Alert: You have a rare second chance to get in on the ground floor of a giant tech revolution]

But data is on an exponential incline.

Humans are projected to create 463EB of data on a daily basis by 2025.

That’s a more than 18,400% increase in a mere five years.

Now, plenty of this data will be mundane things, like emails and social media. But the reality is we’ve also digitized entire economies and stock exchanges. Not to mention, there’s the meteoric rise of artificial intelligence, the Internet of Things, autonomous vehicles and virtual reality.

And all of this will be fed by another one of the fastest-growing sectors over the next decade.

The Modern Space Race

Over the past couple of years, I’ve been telling investors to prepare for the coming space race.

But this isn’t between the U.S. and China, Russia, Europe, India or any other country on the planet.

This is a space race between companies.

OneWeb, Project Kuiper, SpaceX and Telesat plan to put more than 46,000 satellites into orbit over the next several years. Though most of that will come from Tesla (Nasdaq: TSLA) CEO Elon Musk’s space venture, SpaceX.

SpaceX is firing tens of thousands of satellites into orbit for its Starlink communications network – which is already up and running in some parts of the world.

[Urgent: If you want to become “I bought Apple in 1980” rich, watch this special presentation]

And this is triggering the rapid expansion – and commercialization – of the space industry.

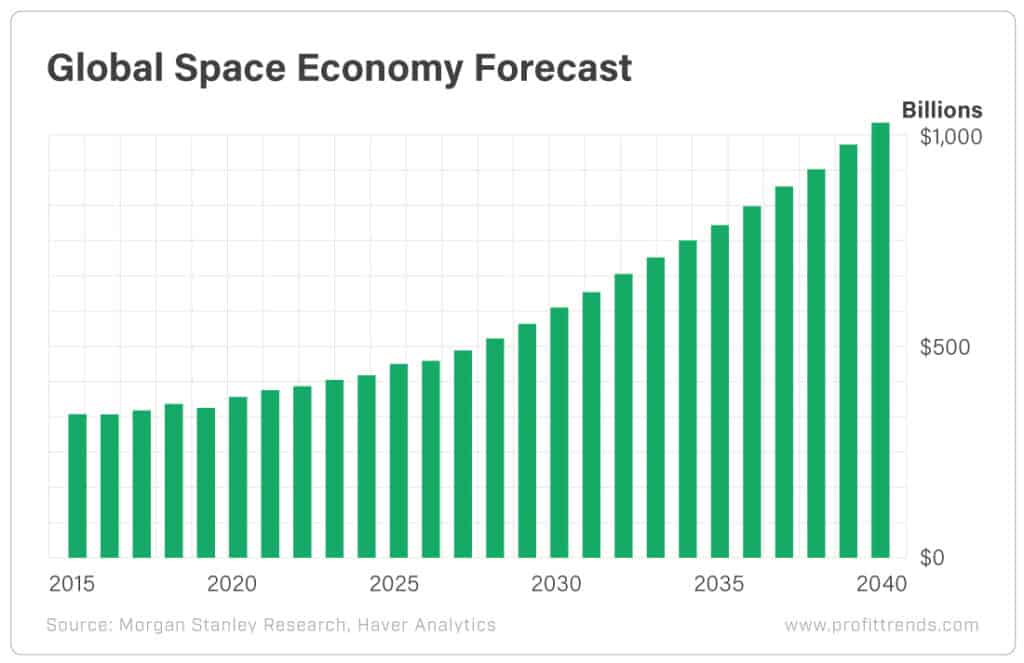

You see, the global space economy is forecast to grow from $350 billion in 2019 to more than $1 trillion by 2040.

And at least 50% of this increase will come from satellite broadband demand because we are consuming data at an exponential rate.

It’s also creating an extremely attractive opportunity in investing.

For instance, year to date, the Procure Space ETF (Nasdaq: UFO) has gained more than 15%. That blasts past the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 Index by more than threefold.

But there’s likely even more upside ahead.

Because insanely large amounts of data – terabytes, exabytes and zettabytes – are fueling this growth.

The world needs satellites, which need to be launched into orbit. And those launches need to take place at spaceports. It’s an entire ecosystem of increasing demand for decades to come… and that’s without getting into asteroid mining or colonizing Mars.

Here’s to high returns,

Matthew

[See Also: How to Make a Killing on Spatial Computing’s “Killer Apps”]