Sometimes, it’s good to see your heroes beaten.

Hear me out… It’s better than it sounds…

Last week, I introduced my two daughters to my personal hero…

A 91-year-old gentleman who embodies so many of the character traits that I strive to emulate, like honesty, integrity and kindness – the kind of qualities I’m instilling in my kids.

I didn’t introduce them to this man in person.

Instead, we watched an hour-and-a-half-long documentary about him on HBO.

My hero is Warren Buffett.

I admire almost everything about him.

In spite of my reverence, it isn’t easy to convince both a 12- and 14-year-old to give up that much of their free time to watch a documentary about a 90-year-old investor.

But I managed to do it, and I’m glad I did.

My kids were captivated by the story of this happy old man.

They agreed that Buffett’s character is one to emulate.

And they couldn’t believe that he plans to donate most of his remaining $100 billion fortune to charity by the end of his life.

Mission accomplished.

[Hot New Tech: This odd-looking machine could be the most transformative innovation in history]

But Even Buffett Can’t Match Up Against This Sector…

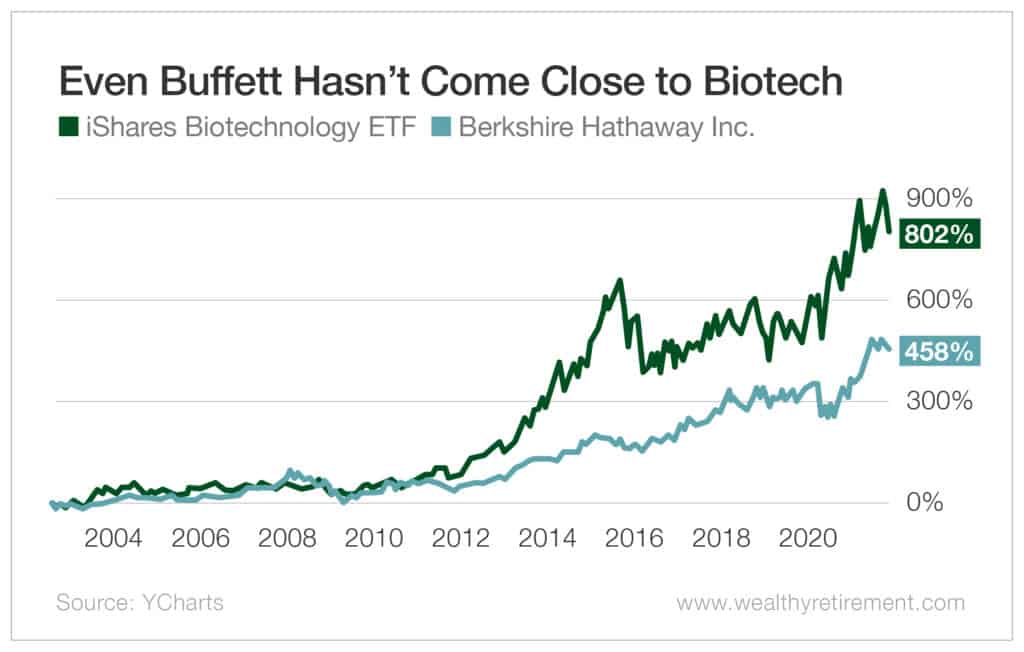

As an investor, I’ve long considered Warren Buffett’s Berkshire Hathaway (NYSE: BRK-B) as my opportunity cost.

For each of my investment ideas, I ask myself, “Is this really a better investment than Berkshire Hathaway?”

I do it because Berkshire’s massive balance sheet and Buffett’s capital allocation, together, equate to an investment that carries minimal risk but offers significant reward over time.

Berkshire is diversified across many industries, has a huge amount of cash and is run by a risk-averse CEO.

It is extremely low-risk for one stock.

But… it is still just one company.

As investors, we need much more diversification than that.

And unfortunately, the more we diversify to reduce risk, the lower our returns are likely to be in most sectors.

But with each passing year, I’m learning that one corner of the market is unlike most sectors…

Biotech is different.

[Discover: The off the radar Small-Cap Stock at the center of an Era-Defining Technology]

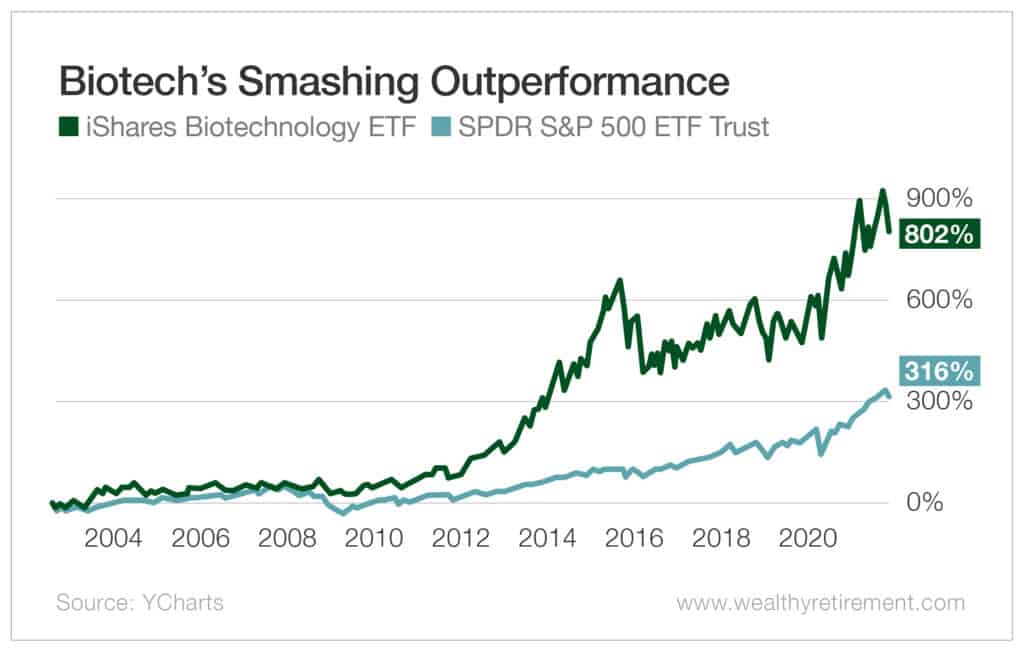

Historical data shows that in biotech, you can build a very diversified portfolio and still outperform by a significant margin.

I’ll use the iShares Biotechnology ETF (Nasdaq: IBB) as an example.

This exchange-traded fund (ETF) is massively diversified, holding 268 different stocks tied to the biotech sector.

Despite that wide diversification, this ETF has had a stunning long-term performance.

Over the past couple of decades, the biotech sector has doubled the performance of the S&P 500.

And it hurts me a little bit to say it…

But the biotech sector has soundly thrashed the performance of Buffett’s Berkshire Hathaway over the past 20 or so years as well.

As investors, we should always look for opportunities to invest with the wind at our backs.

The stocks in the biotech sector have now shown over the long term to have one of the biggest tailwinds in the market.

It is no mystery why…

When these biotech companies succeed, they are massive winners.

They don’t all work out, but the ones that do are so successful that they drive outperformance for the entire sector.

[Breakthrough: Scientists Predict this Industry Could Grow Nearly 200,000% in Just Four Years]

All we have to do is look at a three-year chart of a company like Moderna Inc. (Nasdaq: MRNA) to appreciate how getting just one of these biotech success stories into your portfolio can make a big difference.

When a portion of a portfolio that is allocated to biotech has sufficiently diversified picks, one of those picks can hit its mark and throw the portfolio’s wealth generation into overdrive.

Diversification is the keyword in that sentence.

You can make a concentrated bet on Berkshire Hathaway.

In biotech, you need to diversify.

And while the historical charts for the biotech sector look great, the future for these companies should be even better.

As our understanding of biology is rapidly evolving, so too is our repertoire of biotech tools. This, combined with the urgency of the COVID-19 pandemic, is leading to profound improvements in our ability to diagnose, treat and cure ailments.

The big winners from this wave of scientific breakthroughs will be not only companies in the biotech sector but all of society…

Just as all of society will benefit from Warren Buffett’s $100 billion act of charity.

[Exclusive: “Imperium” The Next Intel – The Microchip Company Powering the 199,000% DNA Mega Trend]