Presented by: Empire Financial Research

The Man CNBC Calls “The Prophet” Issues His Next Urgent Warning:

“If you're hiding out in cash…

you're making a grave mistake…”

By 2pm on December 13th a rare

event will completely blindside anyone holding cash —

get out of cash now, while there’s still time…”

Hi, I’m Whitney Tilson…

It’s important you listen closely to the information I’m going to share with you today…

Because I believe a devastating change is coming to our financial system on or around December 13th of this year.

Mark my words — history will be rewritten with this change, with a whole new chapter reserved for the financial winners and losers here in America.

Whether your name ends up on the victim list… or the profiteer list… depends on the choice you make today after watching this presentation in full.

This change isn’t a new law… it has nothing to do with Joe Biden’s policies… and it’s not about the destruction of the dollar or anything like that.

Yet one man, a 70-year old unelected official, will make an announcement by exactly 2pm on December 13th that could send shockwaves through our financial system.

This is a fact — just as the sun rises in the east and sets in the west…

It’s with 100% certainty that by December 13th at 2pm, a major financial announcement will be made.

And the moment this announcement happens, your retirement accounts, and your savings accounts may never be the same…

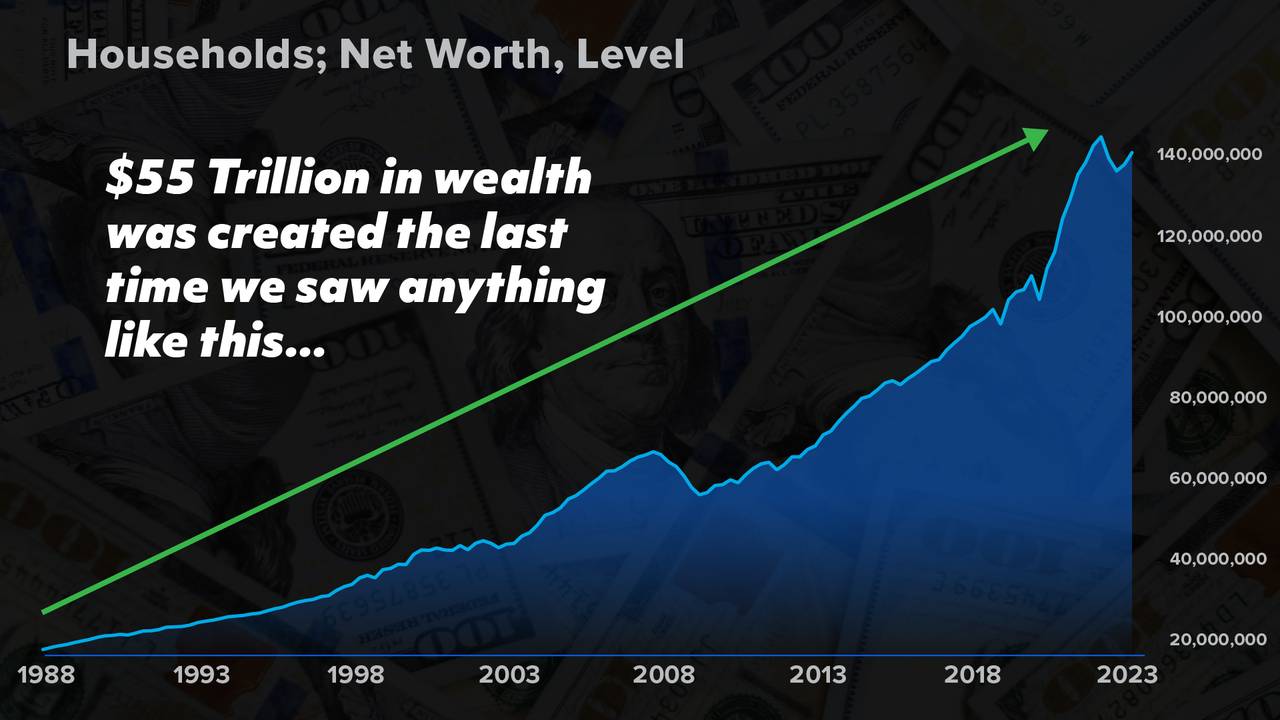

The last time anything like this happened was 15 years ago — and more than $55 trillion in wealth flowed into the pockets of those who were savvy enough to have moved their money before this announcement.

That’s an almost unfathomable amount of money…

But as you’re about to see, it’s already happened before here in America… and I believe it’s going to happen again, starting very soon.

Today I’m going to leverage my 20+ years in the financial markets, and my contacts inside Wall Street, to give you advanced warning of what’s about to happen…

You see, despite the gravity of what’s coming, you’re not hearing nearly enough about this event from the mainstream.

What they’re not telling you is that a historic “cash migration” is already underway right now here in America…

Starting last year, and accelerating during the banking crisis of 2023, Americans have pulled their money out of the stock market at a record pace…

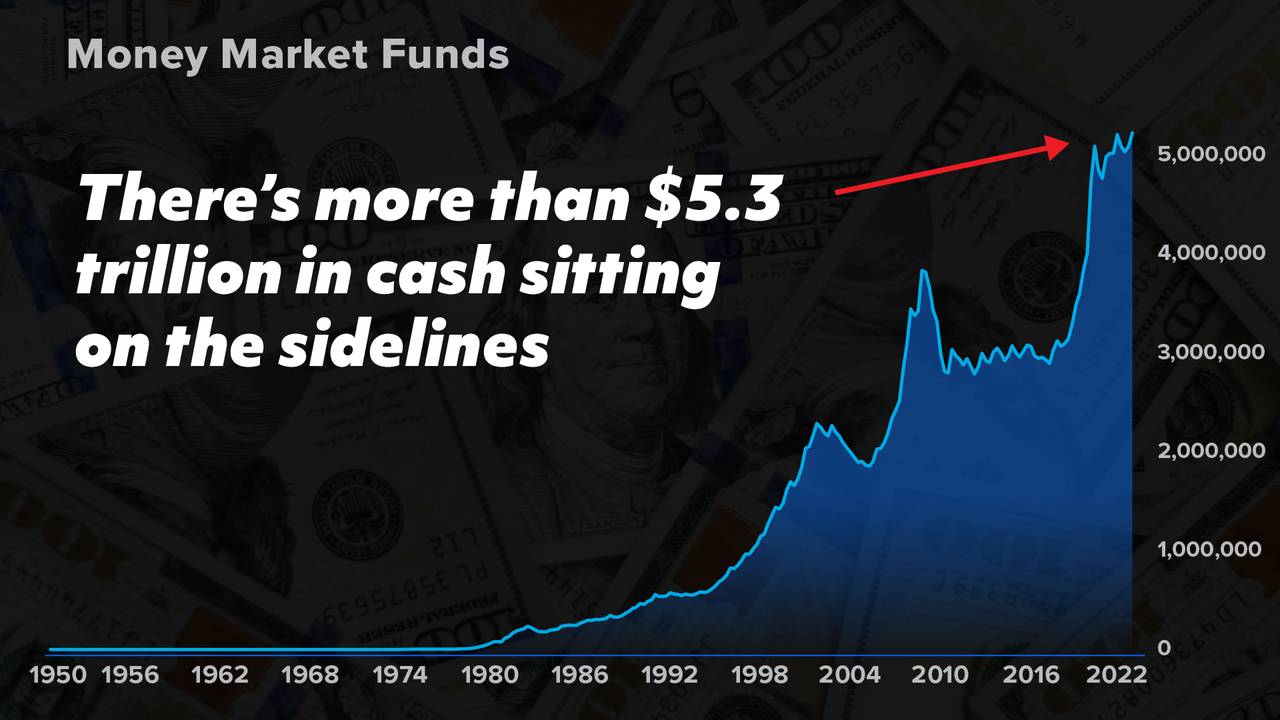

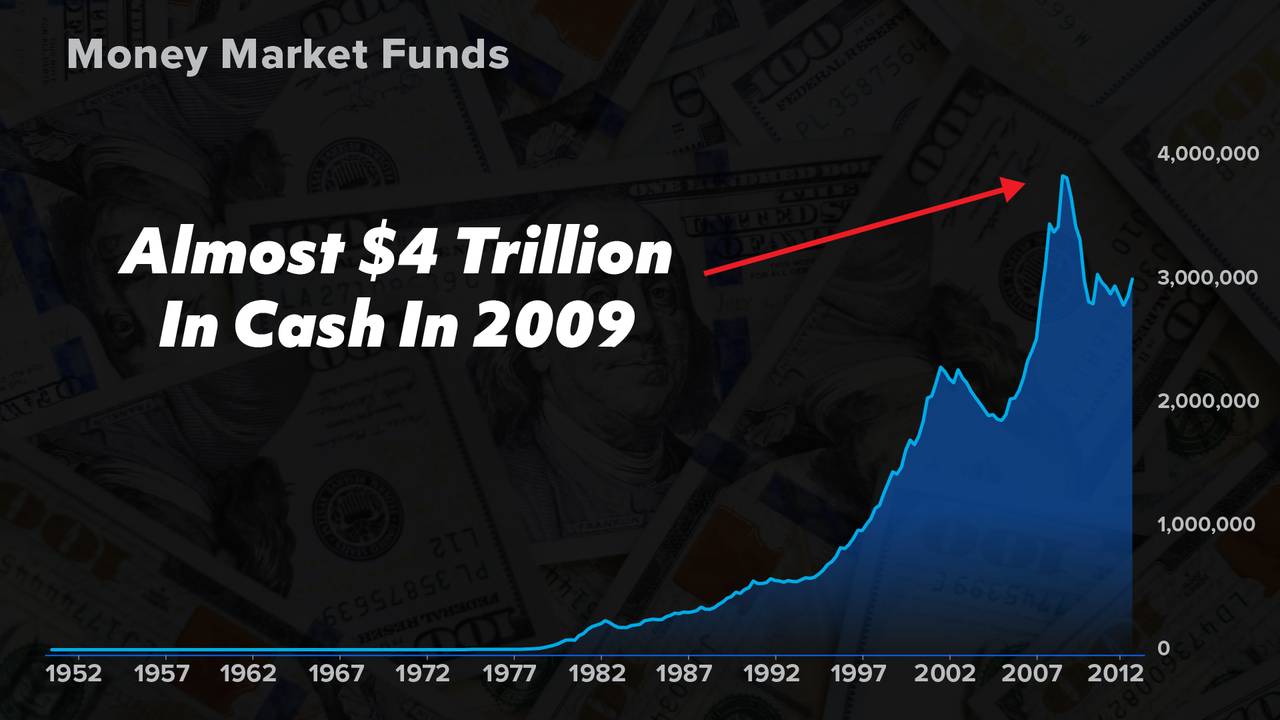

We've now passed more than $5.3 trillion — yes, trillion — sitting on the sidelines in money market funds…

That amount of cash, piling up day after day, is simply astonishing.

If you’re one of the ones who’ve rushed into cash, seeking safety from the stock market, I get it — you’re likely scared of a market crash…

And you’re probably happy with the 4%+ interest you’re now earning.

But I’m here to warn you today: Sitting in cash after December 13th could be one of the absolute worst things you could do for your wealth.

Yet all these trillions sitting in cash is only half of the story today…

Thanks to an extremely rare convergence of two economic forces, we're about to undergo a massive financial reset here in America

Record high cash levels is just one of those forces…

The other force is something you’ll likely never guess…

And by December 13th starting at exactly 2pm, I believe these two forces will collide for the first time in 15 years, triggering instant turmoil in the markets…

Trillions of dollars will begin a “great migration” out of cash…

The stock market will suffer a huge move…

Many Americans will be completely suckered by what's about to happen. They could see the income they've come to count on quickly plummet.

Things like paying their mortgages and car loans… affording health care… will get much, much harder for those that depend on the income from their savings.

Yet, as a veteran of the financial markets for decades, I can confidently say — it's during these rare financial convergences where savvy investors make money hand over fist… growing their wealth to new heights.

While unsuspecting victims suffer huge losses… and get completely left behind.

Where you'll end up will depend on the moves you make right now.

As I'm about to show you, events like this are extremely rare…

If you're lucky enough, you'll have the advantage to capitalize on two, maybe three, of these events in a lifetime…

Given that the last time we saw anything like this was 15 years ago…

This may be the last time in your life that you'll have the chance to take advantage of this rare convergence.

And the stakes couldn’t be higher, because…

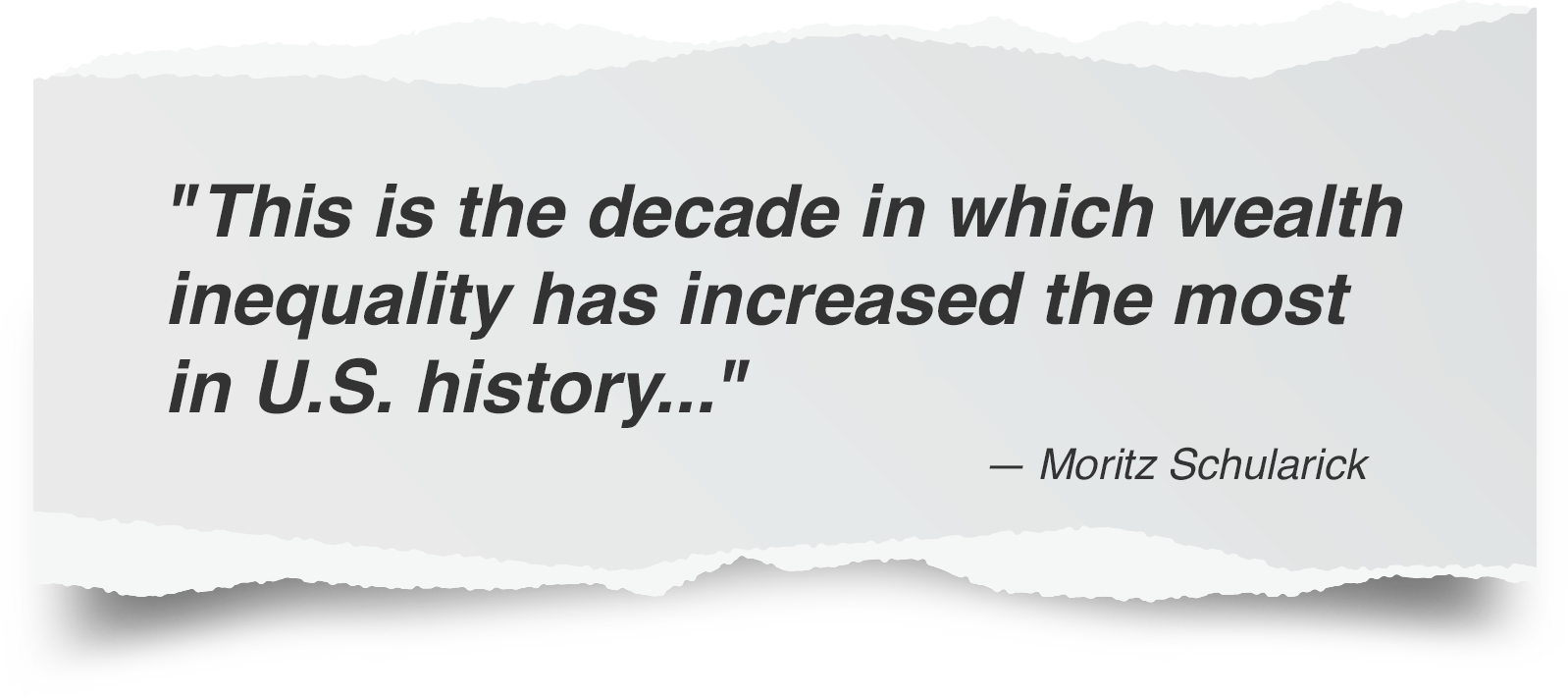

Starting December 13th, the income gap could grow even wider in America…

Ask yourself this question…

Do you feel wealthier since the pandemic broke out?

If you're like most people, these past few years haven't been kind to you…

The Hill reports that a record number of Americans say they’re worse off now than they’ve been in the past:

Maybe you feel the same?

Yet while everyday Americans are suffering, the rich have used economic resets like the one we’re about to see to grow their wealth to new heights…

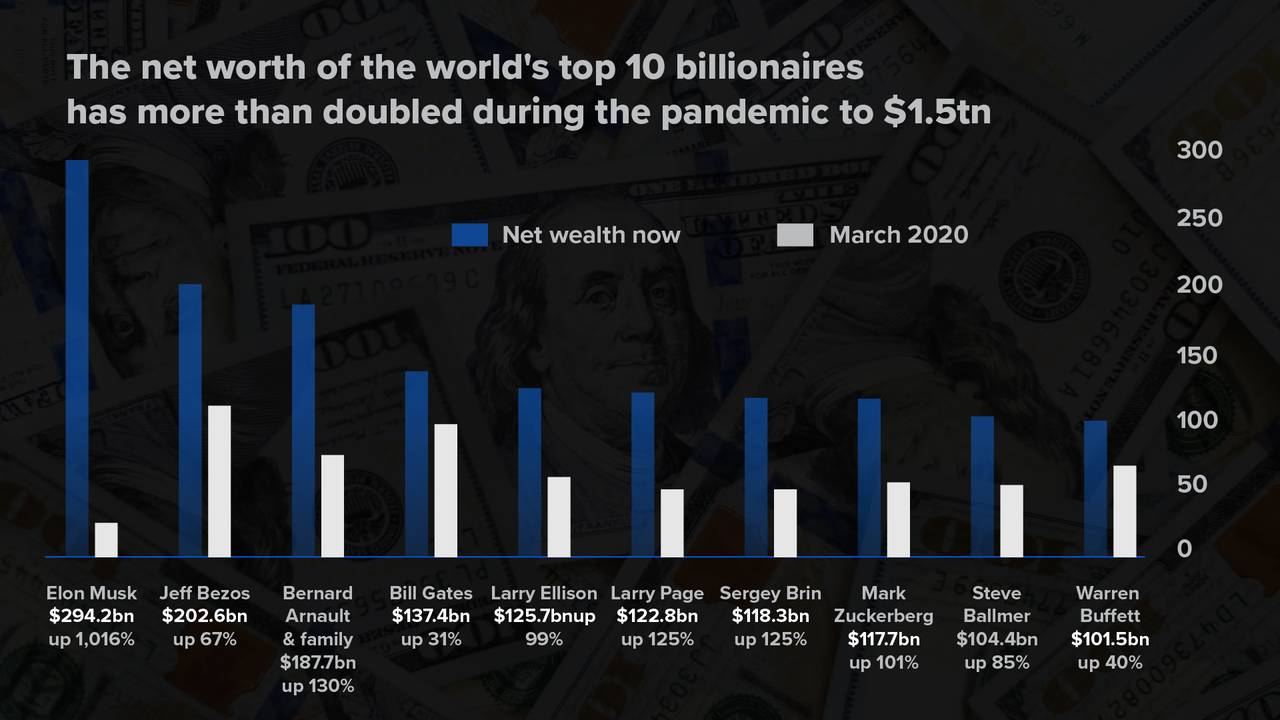

Take a look at this…

Elon Musk has grown his wealth more than 10 times over in just the past three years…

Larry Ellison of Oracle…

And the two co-founders of Google…

They've all more than doubled their wealth over the past three years.

In other words, the rich were getting richer while you were getting left behind.

Do you think they know something about the financial markets that you don't?

Do you think they've had access to information that you haven't?

You're right.

Now, that's the bad news — you’ve been played for a sucker.

But here's the good news…

A similar economic “reset” to the one that's allowed them to grow their wealth to all-time new highs…

And it could play out again by the time the clock hits 2pm Eastern on December 13th.

I’ve made it my mission to help you take advantage of this rare event…

Play this rare convergence the right way and you could make 5x… 10x… maybe more on your money over the years that follow.

Those aren’t made up profit figures, either…

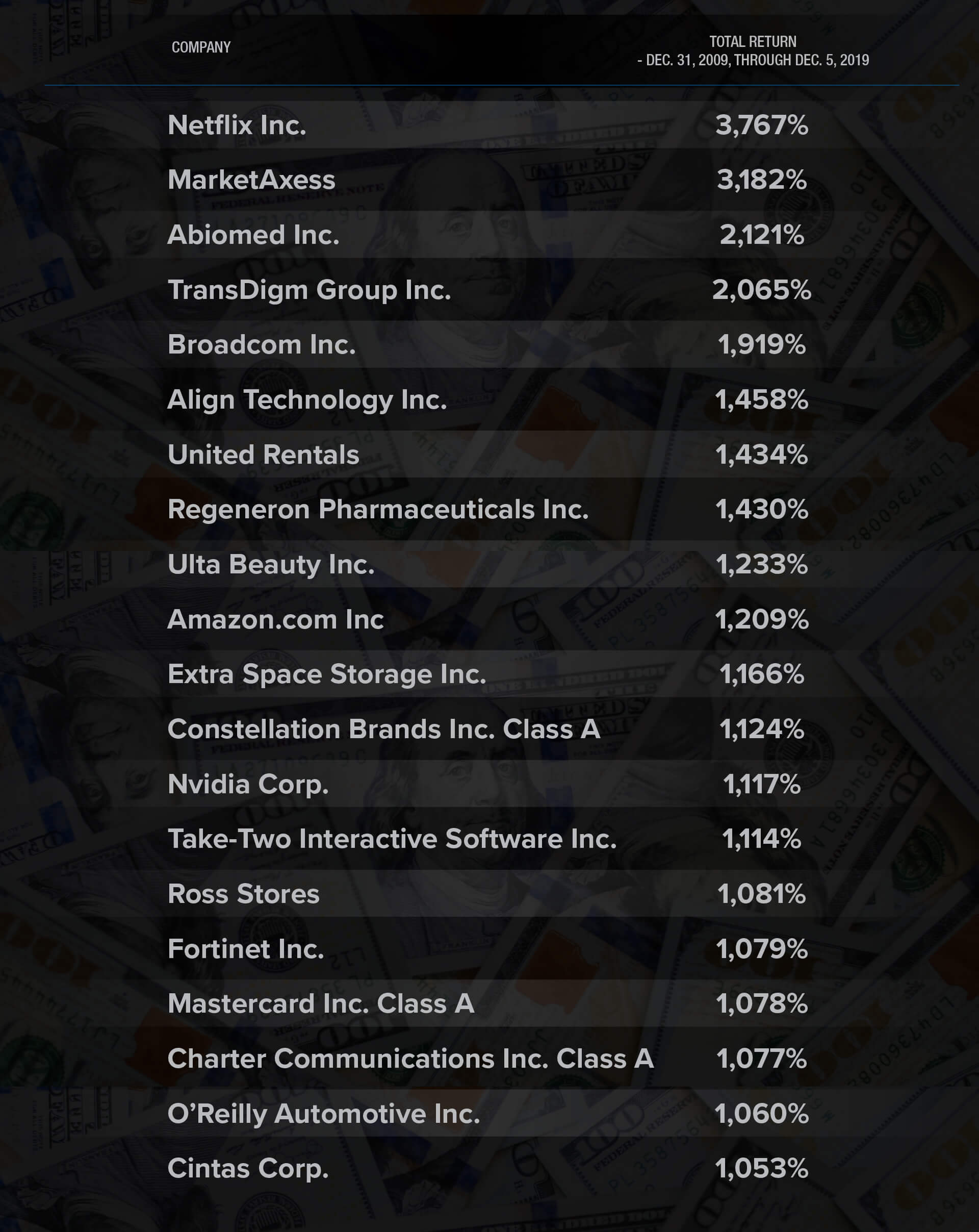

In a moment, I’ll show you proof of 20 different investments that went up 1,000% or more the last time these two economic forces converged.

This time around we could see dozens upon dozens of ways to multiple our wealth with the right moves.

And while I expect the biggest gains to kick off starting December 13th , as you’re about to see, in anticipation of what’s about to happen…

*** The “smart money” has already begun to flow out of cash, and into the same financial assets I’ll show you here today.

That means for everyday you sit on the sidelines… for everyday you don’t move your money… you’re being left behind even more.

For example, shares of a small drug company called Viking Therapeutics have already shot up almost 1,000% since late last year…

Or check this out…

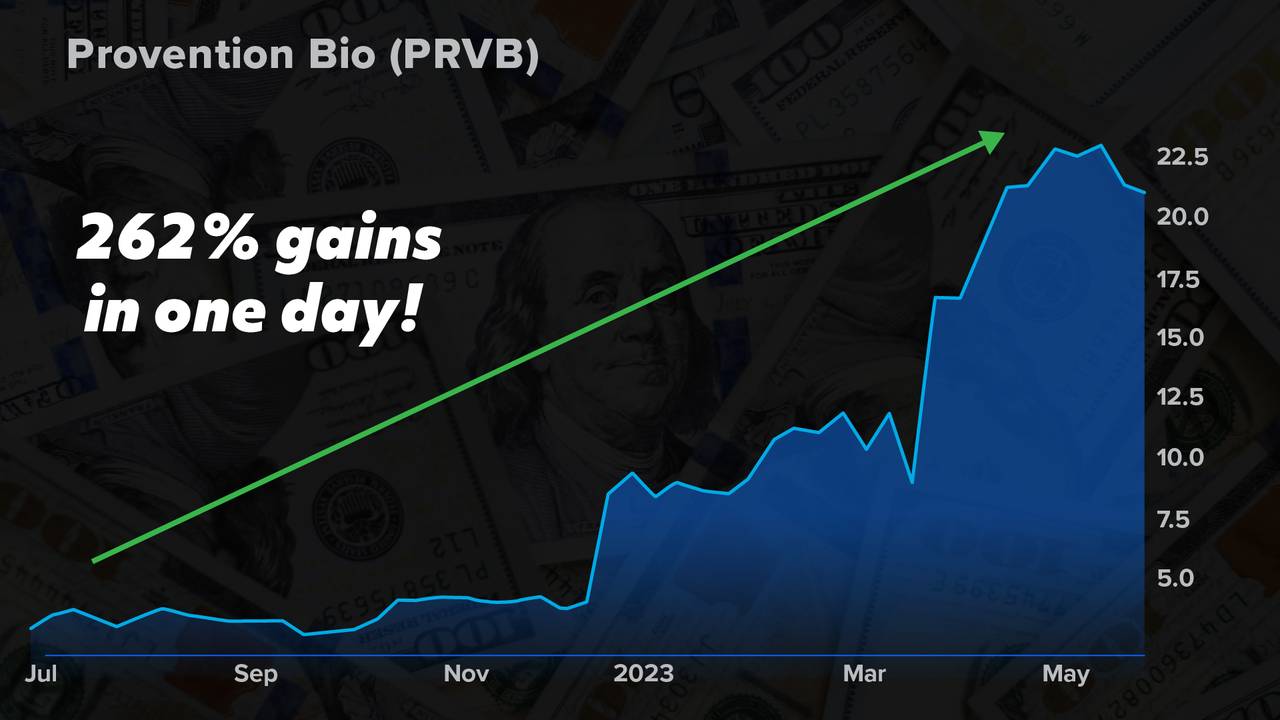

Most people have never heard of a company called Provention Bio…

Yet, just a few weeks ago, shares soared more than 200% in a single day.

And then there's this…

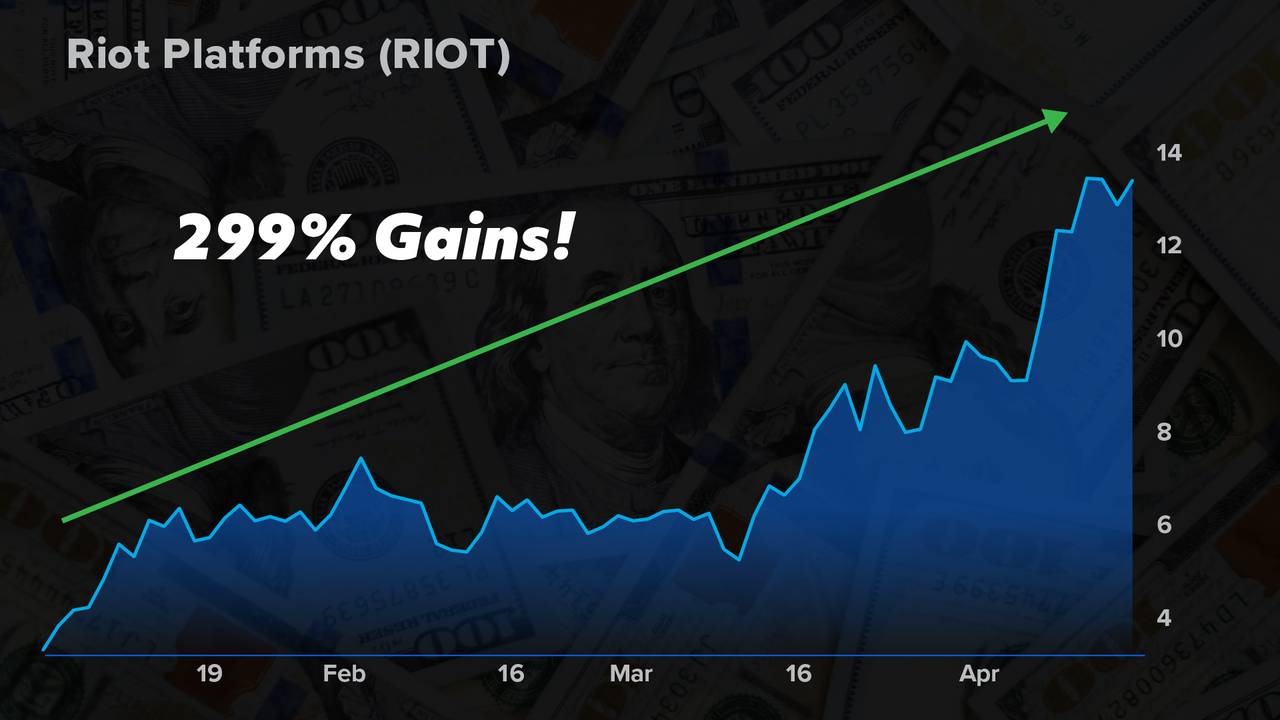

Riot Platforms is a tech company that almost no one’s heard of…

Yet is up four-fold since the start of the year…

A $5,000 investment into each of these companies would have returned $18,000, $25,000 and $55,000 respectively.

Now to be clear, these are extraordinary examples of small cap companies – they aren’t necessarily the kind of opportunities I’m here to tell you about today. But the real question is…

Why are all these stocks soaring?

I can tell you this — it's no coincidence.

See, while most Americans are scared, and racing into cash…

*** Just the anticipation of this rare convergence is already starting to send certain stocks soaring.

And we're just getting started…

The best, as they say, is still to come.

But for the chance to make the most money it’s critical that you make the four simple moves I’ll show you here today. These are the same four moves I’m telling all my friends and family members to make right now.

In a moment I’ll share these four moves with you, too — which are all designed specifically to make sure we come out on top of this next major shift in the financial markets.

The only time in the past 15 years that anything like this happened, it kicked off the largest and longest bull market in history…

More than $55 trillion in new wealth was created.

That’s not a typo, so I’ll repeat…

$55 trillion of wealth is at stake here.

If you didn’t get wealthy the last time… this is your rare second chance.

And, frankly speaking, if you’re over 55 years old… this is probably your last chanceto radically grow your wealth in your lifetime.

Imagine using this rare event to add thousands… even hundreds of thousands… to your net worth this time around…

The possibilities of how you could use this wealth are endless.

But I can't stress enough — if you miss what's coming, you could miss out on the last epic wealth building event of your life.

Why?

Because we're writing history right in front of our eyes…

You see, one of the biggest secrets to growing rich is to spot what I call great “cash migrations”…

And to move your cash ahead of these migrations.

Luckily, if you understand basic finance, you can take advantage of these situations.

You see, there are only a handful of asset classes…

You've got cash, in the form of savings and money market accounts…

You've got stocks…

You’ve got commodities…

You’ve got real estate…

You've got corporate bonds…

And you've got government bonds.

Normally, like a cargo ship that’s balanced its freight so it doesn’t tip over… investors hold equal, diversified stakes in all asset classes.

But on rare occasions, we see huge distortions where money races out of one asset class and into another…

In the financial system, eventually things must rebalance…

Moving your money before the great “cash migration” begins is one of the best ways to grow your wealth…

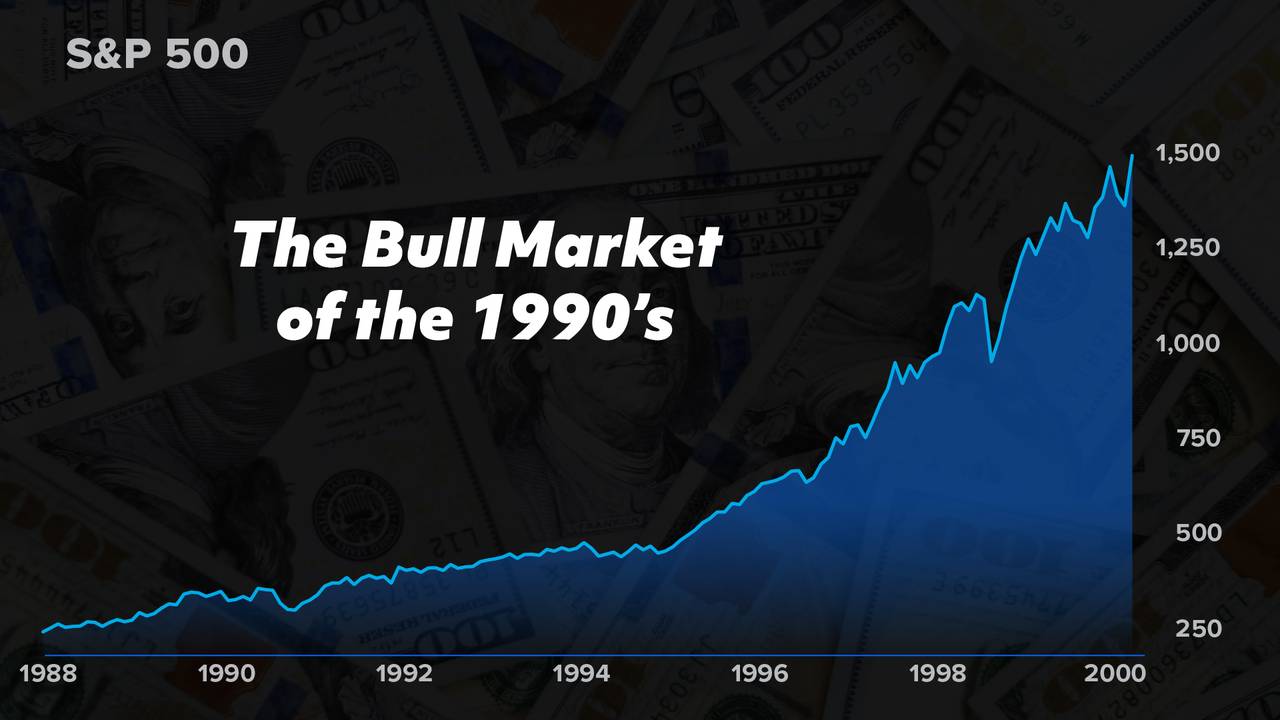

You see, in the past 40 years we've seen two historic bull markets…

Before each of these bull markets began, Americans were imbalanced, sitting heavily in cash… and way underweight in stocks.

Eventually, Americans migrated out of cash and into the stock market…

Kicking off huge booms in the stock market.

Getting ahead of the migration out of cash and into stocks could have allowed you to grow radically rich — if you knew what was happening before it happened.

Consider…

When people dumped cash and migrated into stocks in the 1990s, the bull market lasted for nearly nine and a half years…

During which the S&P 500 shot up 417%.

$10,000 into the S&P before the great cash migration started would have turned into $51,700…

Larger accounts of $100,000 would have turned into more than $500,000.

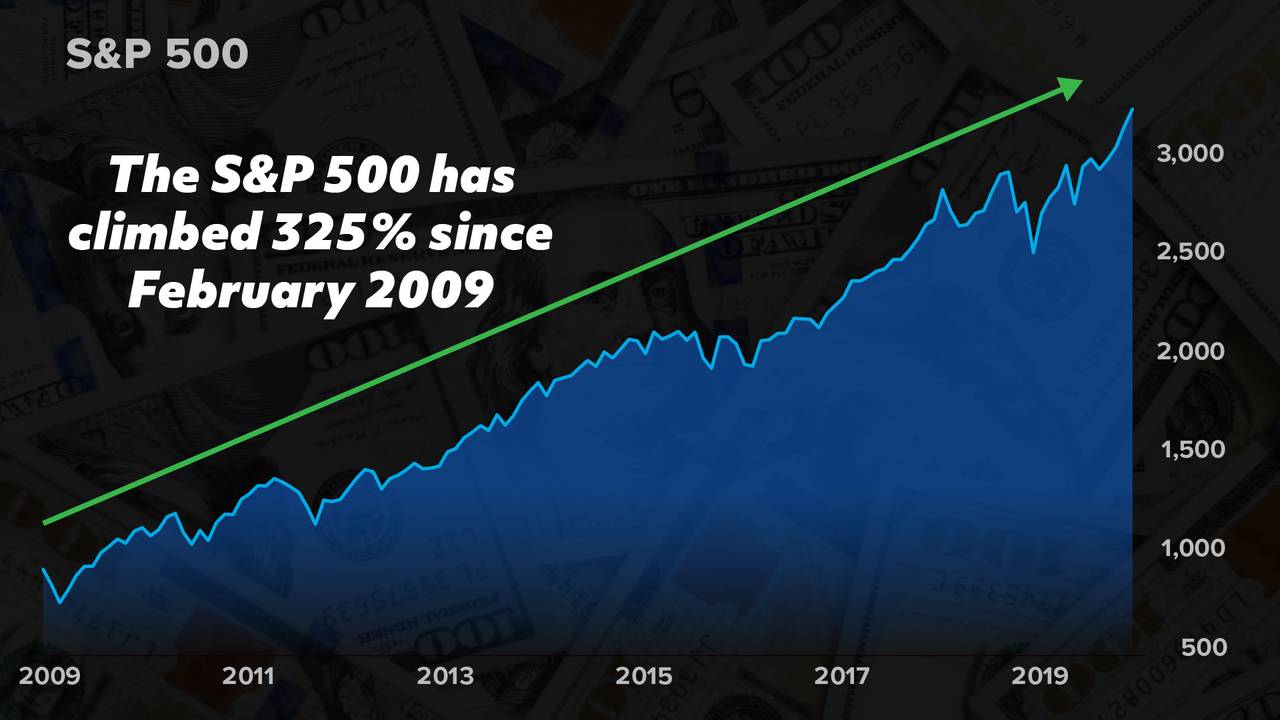

And then, when these two economic trends converged 15 years ago, starting in 2009, we rewrote history again…

A second great cash migration began… kicking off the longestbull market in history, and ushering in a wave of new prosperity here in America…

The last time cash migrated out of savings and money market accounts and intostocks…

The stock market soared…

We saw shares of the world's best companies multiply in value…

And companies that were already huge shot up even more…

Shares of companies like Amazon, Starbucks, and Royal Caribbean all went up more than 1,000% each.

Sure, it's easy for small companies to go up 5 to 10 times during bull markets…

But watching big, iconic companies shoot up 10x or more isn't normal at all.

You only get those types of gains during the rare times that these two economic forces converge.

That’s what’s at stake with this event coming by December 13th.

At this point though, maybe you’re wondering…

Given the recency of this latest bull market…

Why are most Americans feeling poorer, not richer, in America today?

Wall Street left you behind…

It’s no secret that the richest 1%-ers in the world can see massive “cash migrations” like this coming…

They have huge teams of Ivy-league-educated analysts… massive supercomputers… the smartest advisors in the world… and accountants to monitor money flows.

They know well in advance about rare convergences like this, and they take advantage of them to grow richer…

All while everyday Americans, who lack the same resources, get left behind.

Consider this: these same two forces converged in 2009, kicking off the longest bull market in history…

But despite the huge gains that followed, the Christian Science Monitor was left wondering, “Whose bull market is it” anyway?

You know the answer.

It wasn't your bull market.

Remember earlier, when I told you $55 trillion in new wealth was created the last time anything like this happened?

Well…

Most of that wealth didn’t go into your pockets.

It went into the accounts of the world’s richest people.

A professor of economics named Moritz Schularick, who has made it his life's work to study income inequality, reported that…

The choice is simple:

You’re either taking advantage of what’s coming to grow your wealth…

Or you’ll be a victim, left behind… perhaps for good.

That's why it's critical that you listen closely here today…

So why haven't you heard a peep about the huge financial reset that could be coming by December 13th at 2pm? Simple…

You see, if you’re like most Americans, you likely rely on the mainstream news to help you decide what to do with your money.

And that’s a damn shame. Just check this out from CNBC…

Late last October it reported that “there's more upside” in the stock market…

While also reporting — on the exact same day — that “it's time to brace yourself for a downturn”…

Their mixed messages happened again when they reported that Bitcoin could “reach $250,000 next year”…

While also reporting that it could “plunge 70% to $5,000.”

So which one is it? Is Bitcoin about to go up? Or get crushed?

The mainstream “news” is contradictory and confusing enough to make your head spin.

And then there’s the “doom and gloom…”

Turn on the TV and there's always someone warning of the next stock market crash that's right around the corner…

Their “warnings” are enough to scare the bejesus out of you, right?

That’s why everyone’s raced to cash over the past few years.

Added up, there's more than $5.3 trillion in “scared” money sitting in money markets right now…

Yet while everyone’s rushing to cash, completely scared of the stock market…

And while the mainstream’s confusing mom-and-pop investors…

The biggest investors on Wall Street are already taking advantage of what’s coming…

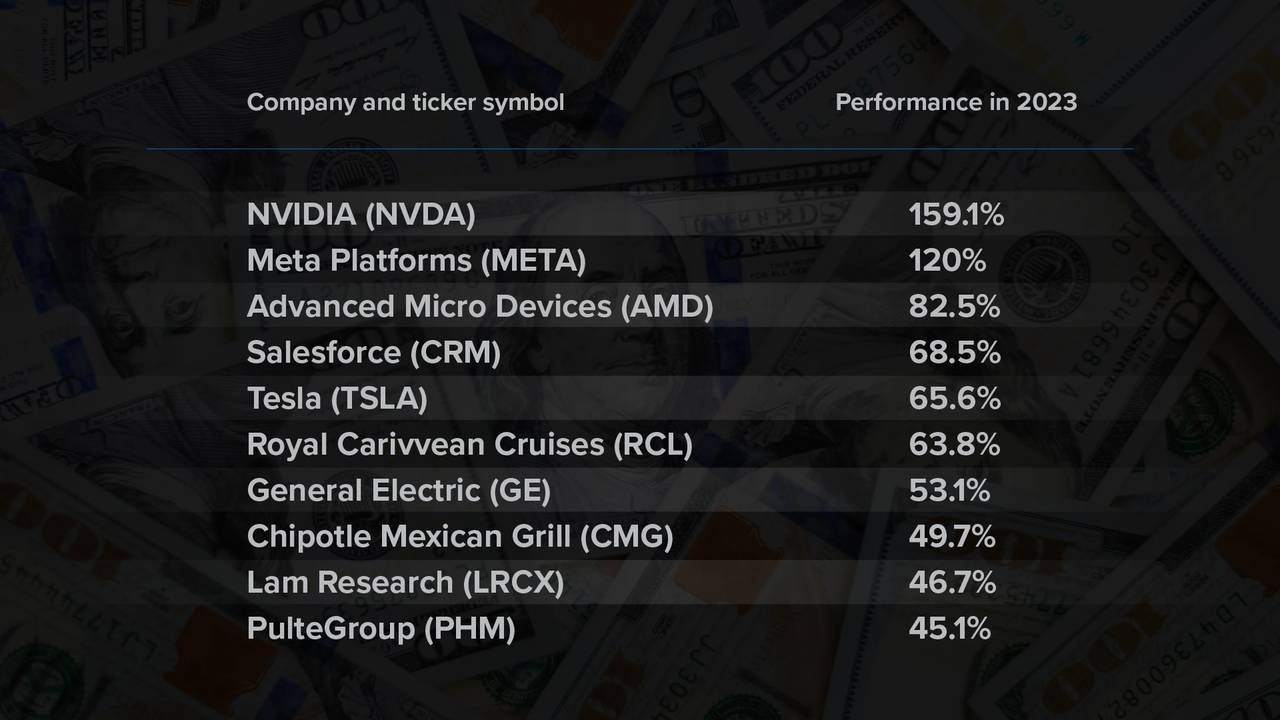

Already shares of Nvidia are up 159%…

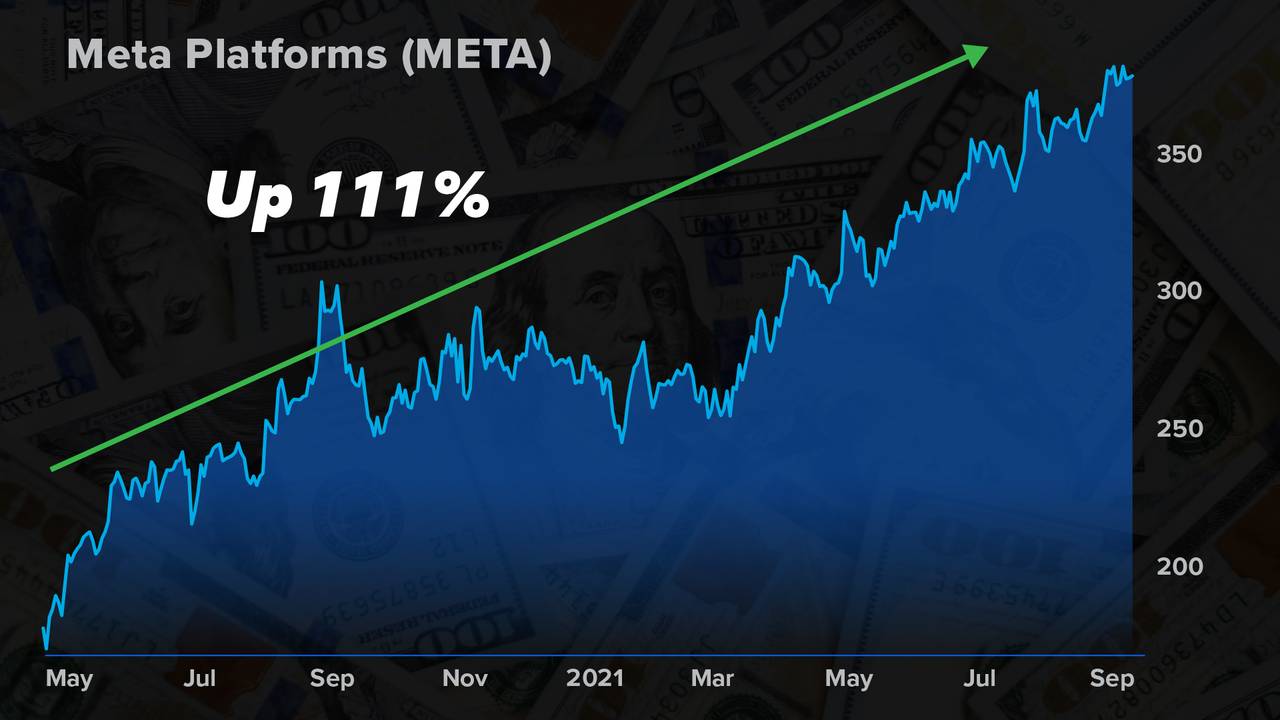

Had you tuned out the mainstream and bought into Facebook at the start of this year, you’d have more than doubled your money…

AMD… Salesforce… Tesla… are all up huge in the first five months of the year

If you're listening only to the mainstream, you'll be missing out on gains like this.

That's why it rests solely on my shoulders to tell you something that they'll never share with you…

Look, not to brag, but I've made my money. I could stop working today, never make a presentation like this for you, and I'll be just fine…

I could hang out all day and play sports with people like tennis-great Andre Agassi, like I am here…

Or, I could retire in the lap of luxury and go to concert after concert, and hang out with musical icons like John Legend…

So why am I doing all this work to share this with you today?

You could say it's in my “DNA…”

See, I didn't grow up wealthy. Far, far from it.

My parents met in the Peace Corps…

Half of my youth was spent living the world, watching my mom and dad teach English to children in underdeveloped nations…

I've grown up on the idea that we should “give back”…

And I've made it my life's mission to help those in need…

Which is why I volunteered with Samaritan's Purse during the first year of COVID helping build field hospitals in NYC…

It's also why I raised millions of dollars, and risked my life to deliver much-needed ambulances and medical equipment to the front lines of the Ukraine war…

I believe a life well lived is about way more than making money.

It's about giving back…

So whether it's helping build hospitals for the sick…

Or donating clothes and medical supplies for the wounded…

Or helping my friends and family take advantage of huge economic trends to grow their wealth, like when I started a hedge fund firm with just $1 million from family and friends…

And grew it into a collection of funds with assets of more than $200 million over the next decade.

It's in my DNA to give back.

And now that you and I have been lucky enough to meet each other today, I'm proud to break this huge story to you right now…

About the incredibly rare event that's I believe is going to play out in America over the coming days…

And then, toward the end of this presentation, I'll detail the exact four steps you need to take to set yourself up to make the biggest gains.

The best part is this — nothing I’ll share with you is complicated. If you can do basic math, and if you understand basic finance, you can take advantage of what’s coming.

I’m going to give you the exact playbook to potentially make the most amount of money in the coming years.

But I'm getting ahead of myself…

So let me backup, and show you the two rare events that will collide by December…

CONVERGENCE CATALYST #1:

Trillions upon trillions in cash has piled up on the sidelines…

There's an old saying on Wall Street that simply explains how money flows from asset class to asset class…

The way it works is brilliantly simple:

Imagine for a moment that you have a stock you like…

The stock price doesn't go anywhere… but it pays a nice little dividend of 2%.

For every $10,000 invested, this company pays you $200 in yearly dividends.

But now imagine that a new bank has come to town promising to pay you a 10% interest rate on your savings…

For every $10,000 in savings, they'll pay you $1,000 in interest — 5x more income than your stock's dividend!

What would you do?

You'd sell your low paying dividend stock in a heartbeat, and move all your savings over the new bank that's paying 10x the interest, right?

In other words, you’d migrate your cash out of stocks and into your savings account, where you’re earning more.

That's what the saying means when it says “money goes where it's treated best…”

Now, that's a simplified version of how it works, of course. But on Wall Street this happens all the time…

Due to interest rate rises and cuts…

Energy shortages and overages…

Real estate booms and busts…

Every few years we see huge cash migrations as money flows out of one asset and into a new asset where it’s treated best.

One the simplest ways to grow wealthy in the markets is to spot when these great cash migrations will begin…

And move your money into the new asset before everyone else.

Follow the cash, reap the profits…

Take the cash migration into the oil markets, for example…

In the 1990s, Congress’ Deepwater Royalty Relief Act allowed royalty-free drilling in the deepest depths of the Gulf of Mexico…

In other words, oil producers didn’t have to pay millions… upon millions… upon millions in royalties to the Gulf’s property owners (the federal government).

Predictably, in the aftermath of that act, money went where it was treated best— flooding into the shares of offshore oil companies…

And sending share prices sharply higher:

Or consider the great cash migration in the aftermath of the COVID-19 pandemic…

All the world’s largest superpowers — The US, China, and Europe — decided to jumpstart their economies by passing gargantuan infrastructure packages.

Not only did demand for steel go vertical…

But the market for metallurgical coal — a key ingredient in the steel-making process — went wild…

Money flooded to where it was treated best, into coal stocks, sending shares of companies up 10x…

Of course, these are historical examples, and past performance is no guarantee for future returns. But….

My point is simple…

Money goes where it’s treated best.

Now, before I show you where I believe money’s going next…

Let’s take a look back through recent history, and let me show you where money’s been the past few years…

Tracking the money flow explains why the markets shot up in 2020-2021… and why they collapsed in 2022

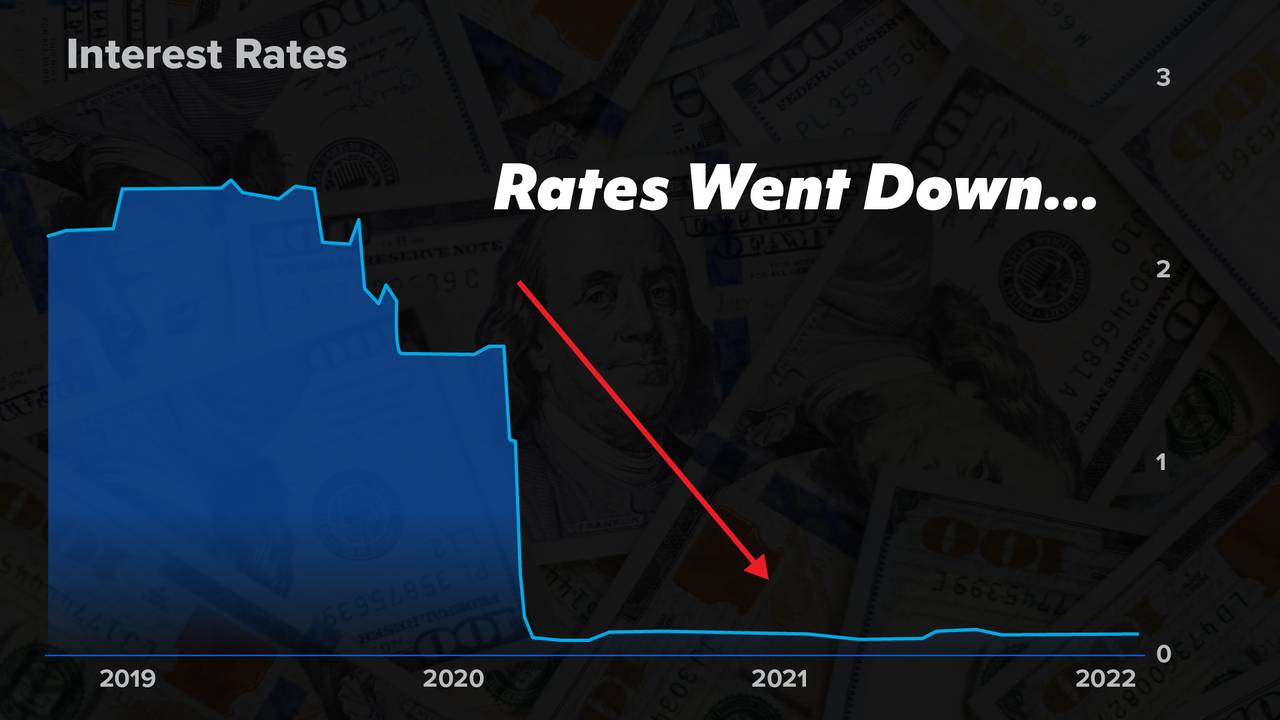

In 2020 and 2021, to jumpstart the economy, the Federal Reserve set interest rates at 0%…

These low rates were terrible for your savings and money market accounts! The interest you received on your savings during this time was next to nothing!

But the stock market loves it when rates are this low.

So money came out of cash… and flooded into tech and growth stocks.

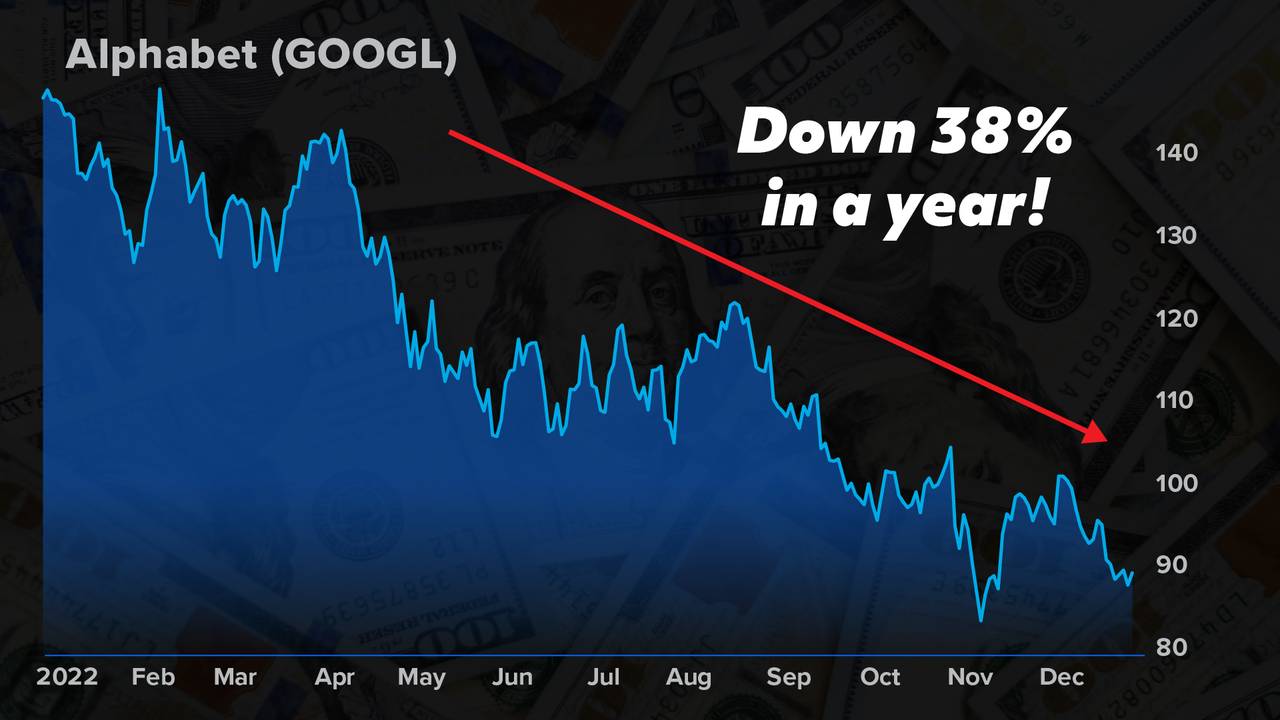

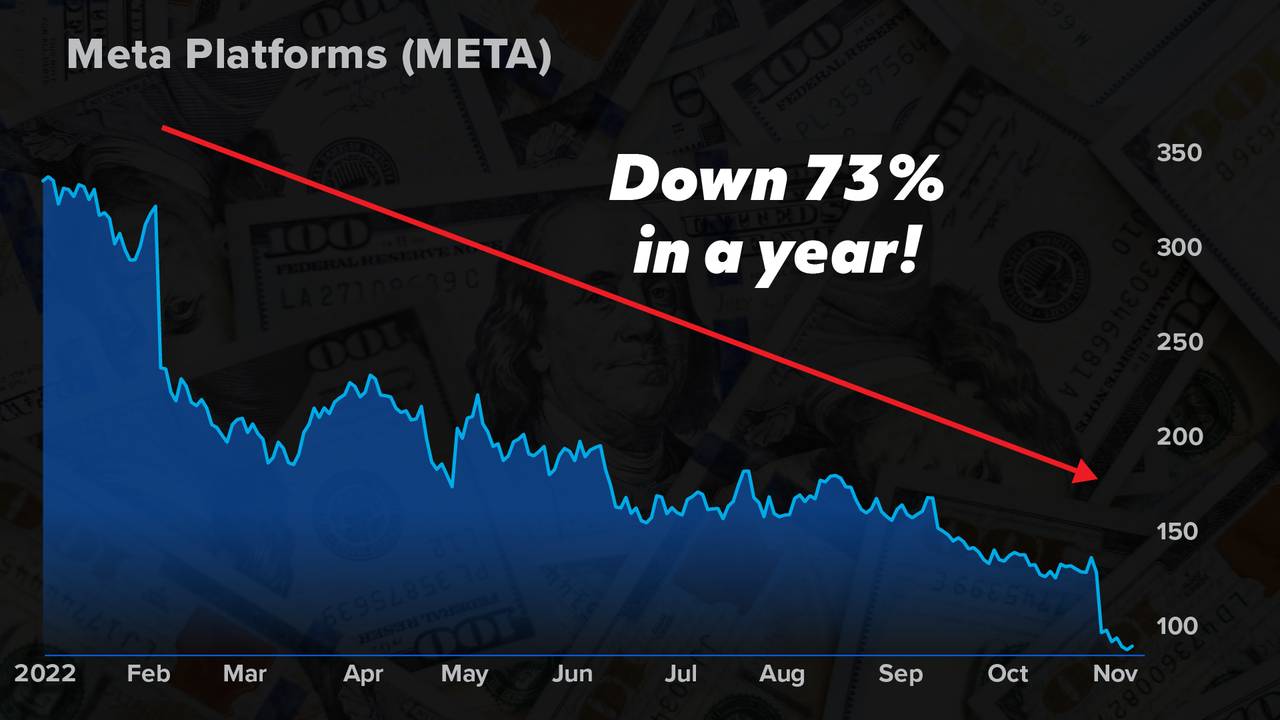

Growth stocks — like Tesla, Facebook, and Google — can borrow money cheaply and easily to fuel their growth…

Which shoots their stocks up…

That’s why shares of Facebook have soared…

It’s why shares of Google were a great place to park your money a few years ago…

And it’s why Tesla soared to all time new highs…

Bottom line: because the Federal Reserve set interest rates to 0%, cash was a terrible place to park your money, and stocks were a great place to grow your money.

Plus, stocks were paying dividends, too…

In fact, the average dividend of the S&P 500 was 10 to 15 times more income than you were getting by parking your cash in a money market account.

So the choice was simple in 2021:

Would you want to buy the stock market, which was growing quickly and paying a dividend 10x to 15x more than the average stock?

Or would you want to sit in cash that was being eaten away by inflation?

You'd be out of “pay nothing” savings accounts… and you’d park your money in growth stocks, of course!

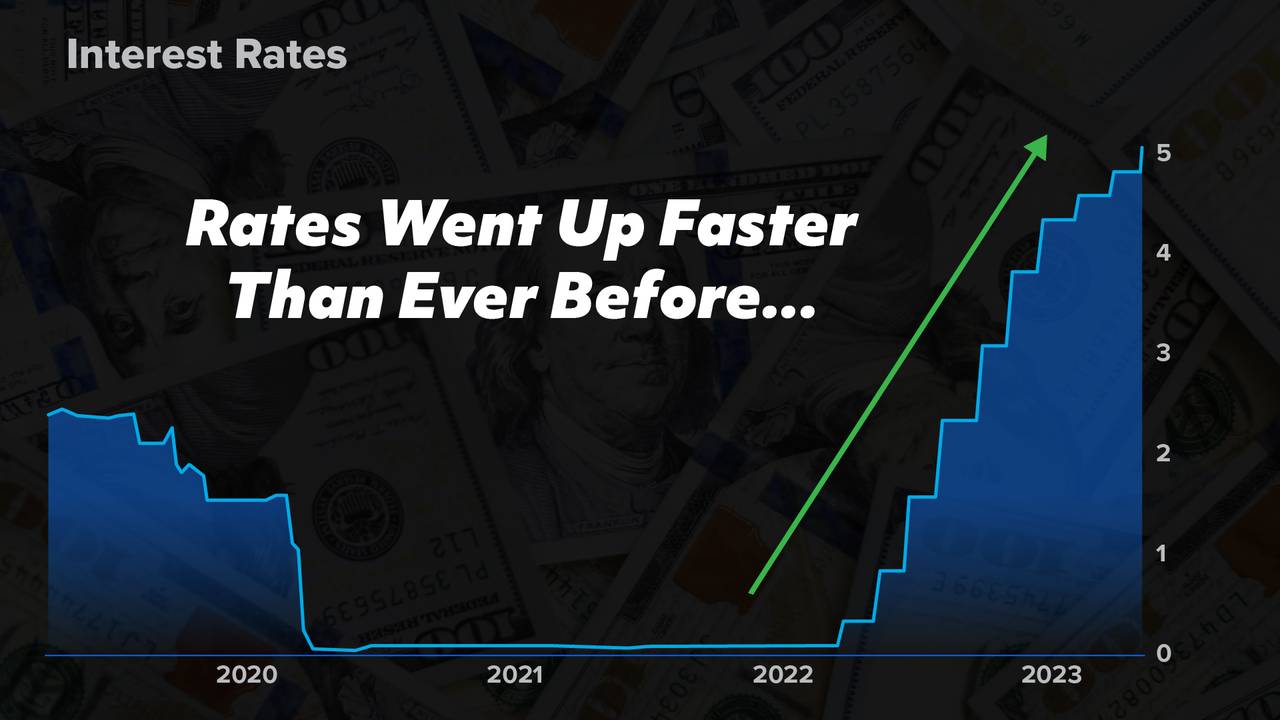

But then inflation kicked in, and the Federal Reserve started raising interest rates faster than any time in history…

This flipped the script, so to speak…

After years of “pay nothing” interest rates, the Fed has raised interest rates from 0% all the way north of 5%.

Because of the Federal Reserve's aggressive rate hikes last year…

Money market accounts are paying a massive 4.83% average interest rate!

To put that into perspective…

That's 480x more income than you'd have earned from money market accounts in 2021…

It's the highest interest rates have been in more than a decade…

And now money market accounts are paying 3x more than the average dividend stock!

Remember…

*** “Money goes where it's treated best…”

This huge rise in rates has caused Americans and businesses to flood out of the stock market and into cash and money market funds.

And get this — because Americans were pulling money out of stocks at a record pace, we now have $5.3 trillion sitting in money market accounts…

That's more money in money market funds than ever before in history.

It's an almost unfathomable amount of money…

In fact, that amount of money could almost fund the entire U.S. government for all of 2023.

It's a silly amount of money.

So if you ever wondered why stocks got crushed in 2022…

Why bonds plummeted at the same time…

And why it was one of the worst times in the stock and bond markets in history…

Now you know.

Last year the “great cash migration” went out of stocks and into money market accounts…

That’s why Axios reported that 2022 was the seventh-worst year for stocks since the late 1920s…

The Morningstar U.S. Market index lost almost 20%…

The bond market had its worst decline in 23 years…

As Americans pulled their money out of high-flying tech stocks like Google and Facebook, shares of the growth companies got crushed… 85]

Google plummeted…

Facebook crashed…

If you're like most people I know, you dreaded the thought of opening your 401k and IRA statement to only see red…

With all your stocks declining, you most likely wondered if you'd have to go back to work, or if you'd ever really be able to retire at all.

Where'd all the money go?

Into cash and money market accounts, of course — pushing the balance to all time new cash highs of $5.3 trillion…

With the recent banking crisis we've seen in the early part of this year, the “rush to cash” trend only accelerated, too…

With Investopedia recently reporting this:

Mark my words: The best way to grow rich in the coming years will be to find out where this “great cash migration” is about to go…

And to get your cash there first.

Luckily, I'm going to show you exactly how I expect this to play out right now…

CONVERGENCE CATALYST #2:

By December 13th at 2pm, Americans will have no choice but to get out of cash and back into stocks…

Here's the thing…

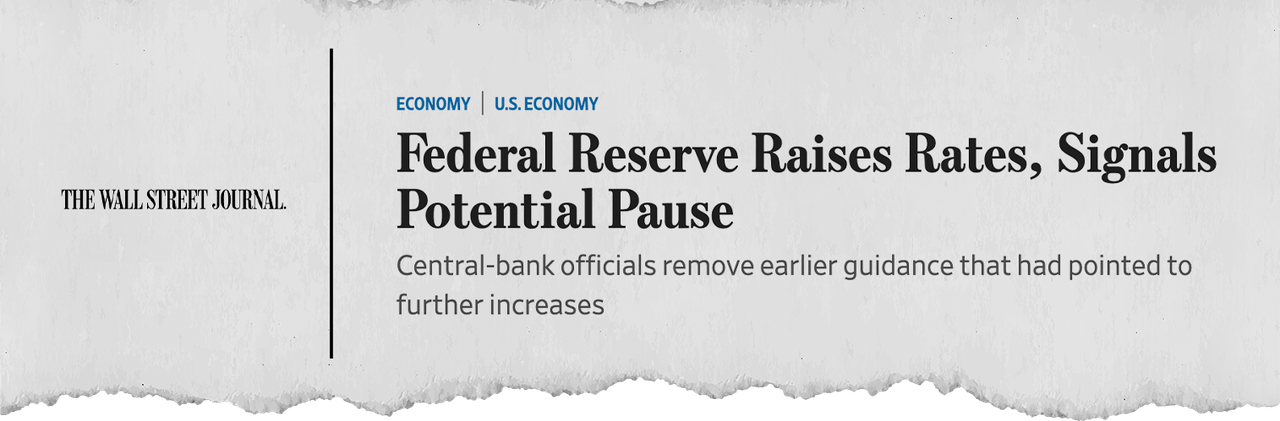

After a year of aggressive Fed rate hikes, Wall Street's now betting that the rate hikes are over…

The Financial Times reports…

And the Wall Street Journal had this to say…

Now, as you may know, the Federal Reserve meets eight times a year on pre-published dates…

After they decide on their interest rate policy, they put out a public release at 2pm on the day of their final meeting.

Now, listen closely because this is critical:

*** I believe there’s a serious chance that by the December 13th meeting, which happens at exactly 2pm Eastern time, the Fed will issue a press release announcing its first interest rate cut since March 2020.

Many of the smartest investment analysts I know are also projecting that rate cuts are coming any day now…

Now, listen…

Like all the big predictions I’ve nailed in my career…

While I’m confident that the Fed will lower rates very soon, I can’t promise I’ll get this timing exactly right…

Maybe the Fed lowers rates at the December meeting…

Or maybe they wait until early next year to lower rates…

Bottom line — I believe a rate cut before the end of the year is very, very possible.

But even if I’m wrong about the timing, I don’t believe I’ll be wrong in the direction of the Fed rate policy… which is heading lower.

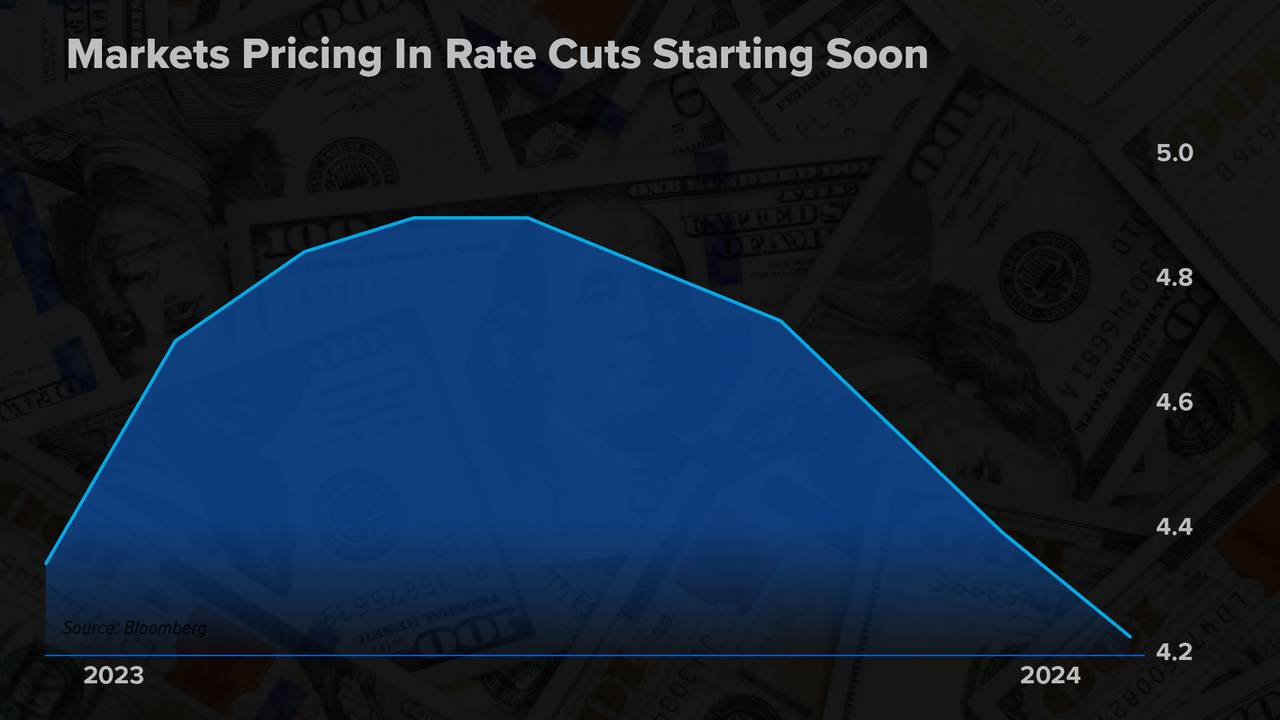

Here’s a chart from Bloomberg, one of the most trusted sources on Wall Street, which shows that Wall Street is expecting interest rate cuts to begin very soon…

And then continue to cut into next year…

So why should you care?

First, if you're sitting in cash, you're going to start earning less on it because rates are heading lower…

Forget about earning 4% interest in a high yielding savings account…

Kiss the 5% yield you're seeing in your money market goodbye…

Over the coming years, as the Fed continues to cut rates, cash holders will be left behind as interest rates go back down.

Savers who depend on interest income to pay their bills will have to seek income someplace else…

Many Americans will have no choice but to pull their money from cash and money markets… and flood back into stocks to seek returns

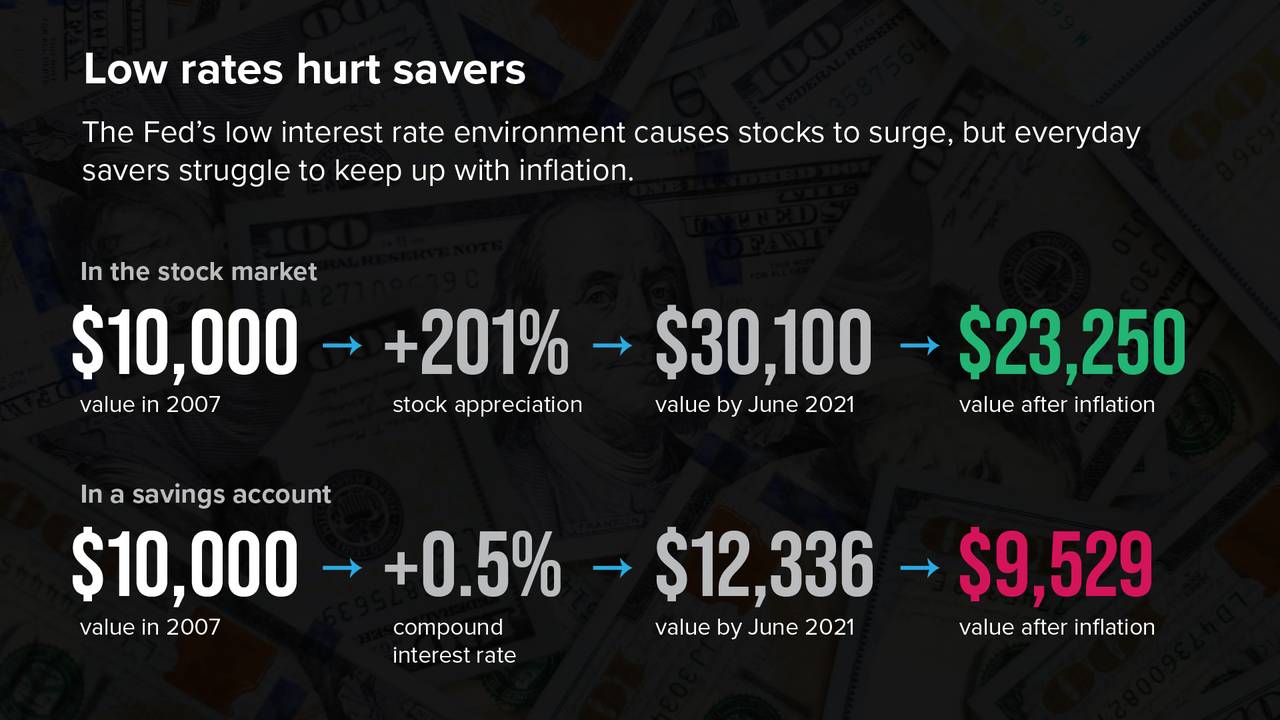

Consider this chart from the New York Times:

Anyone sitting in cash the last time something like this happened actually lostmoney after inflation…

While those in stocks more than doubled their money in low-rate environments.

Therefore, many people will soon realize that they have no choice but to pull their money from cash and flood back into stocks to grow their wealth.

That makes your choice now very, very simple…

To make the most money from this “phase 1” of the new bull market, you need to get your money back into stocks NOW…

Before everyone else floods back into the market.

You see, getting out of cash and back into the stock market after the Fed stops raising interest rates is one of the smartest things you can do to grow your money…

The cycle is one of the most predictable, and repeatable patterns in all of finance.

Just consider this…

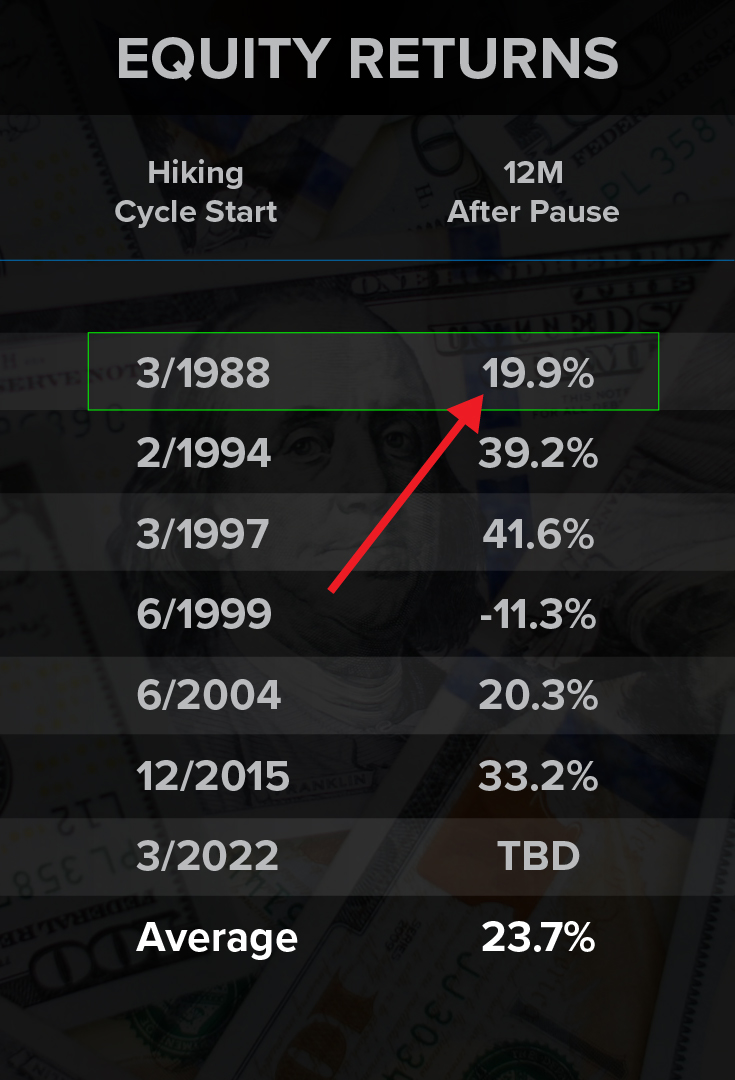

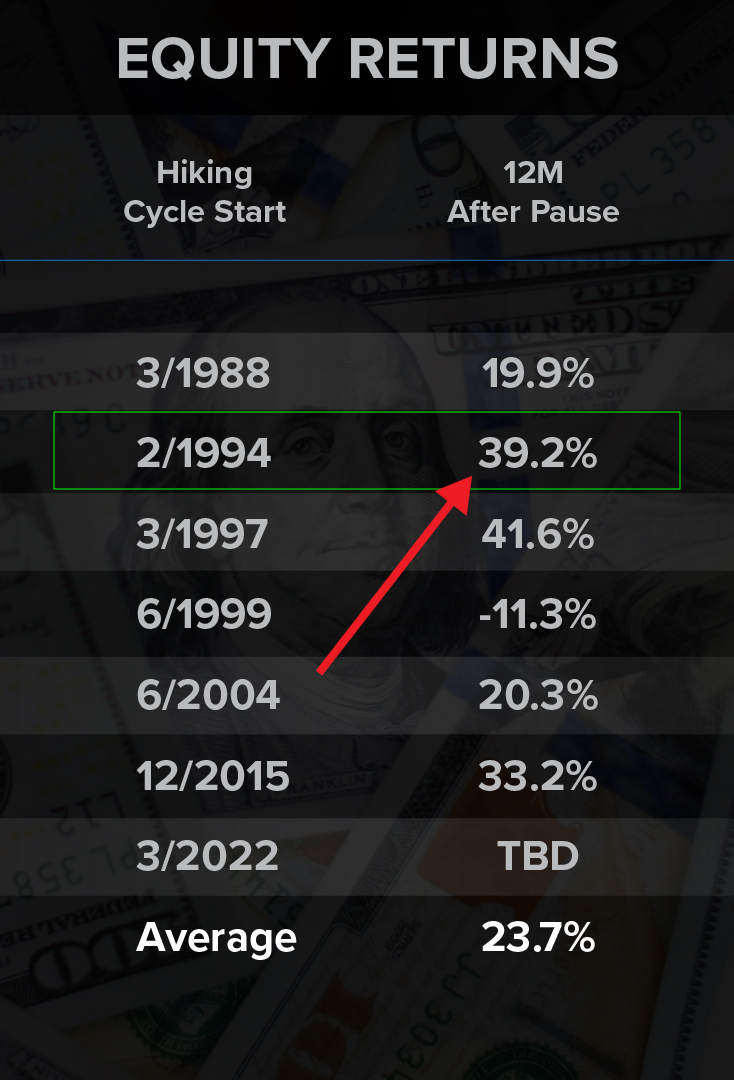

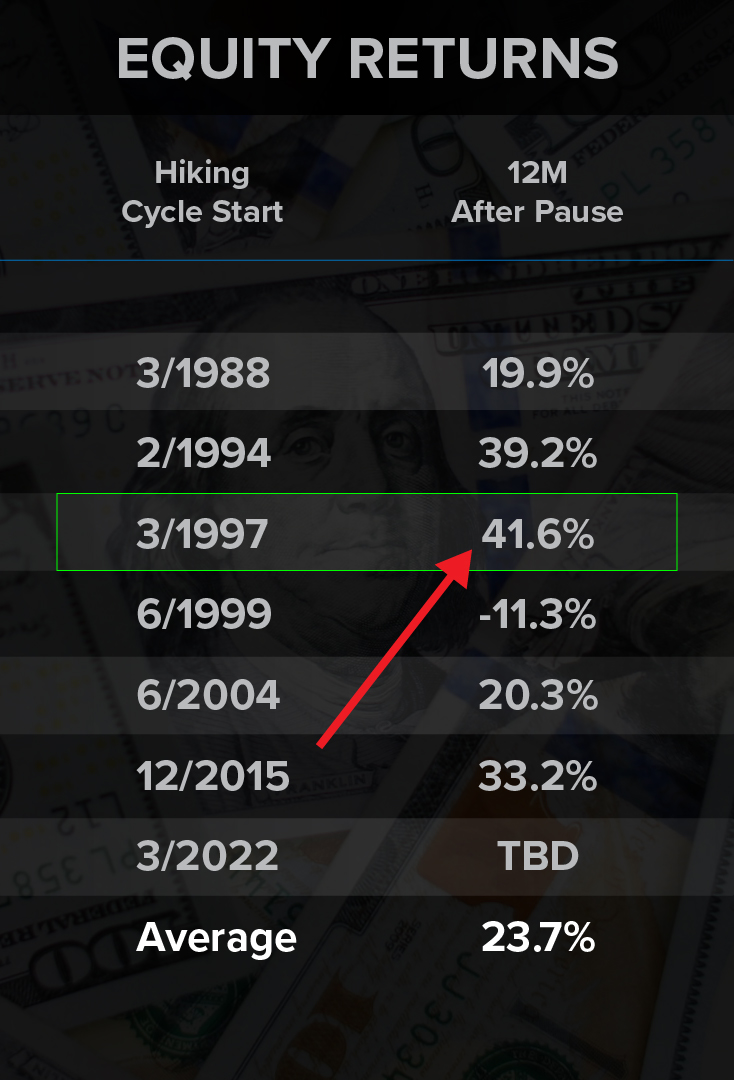

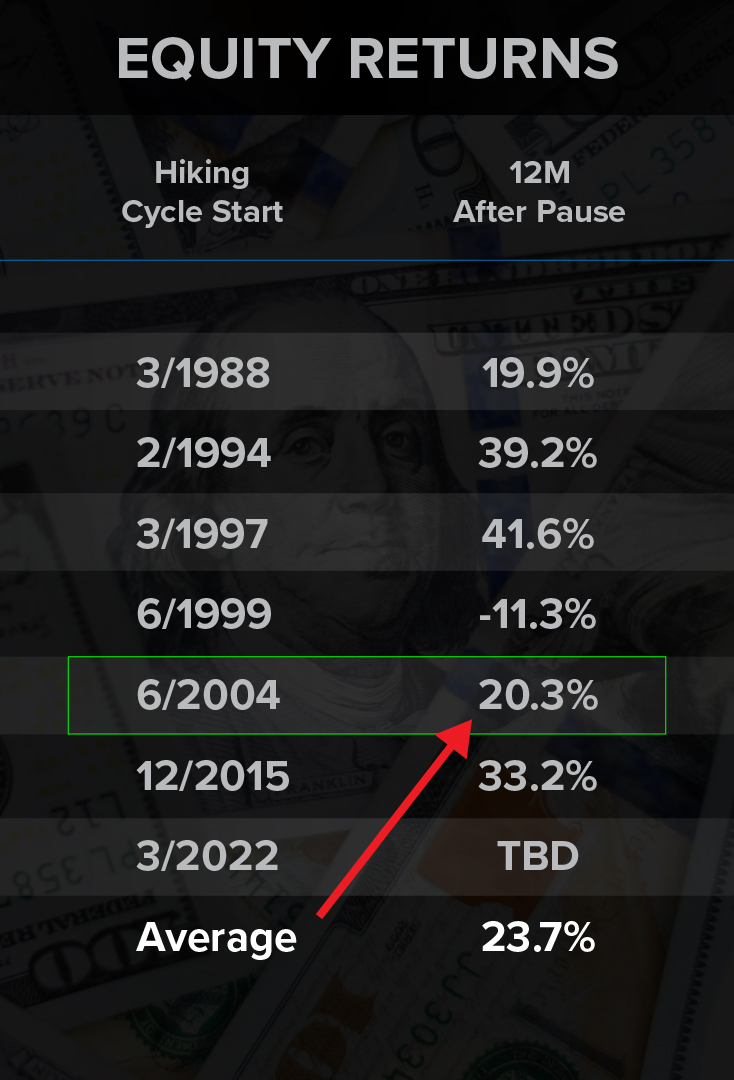

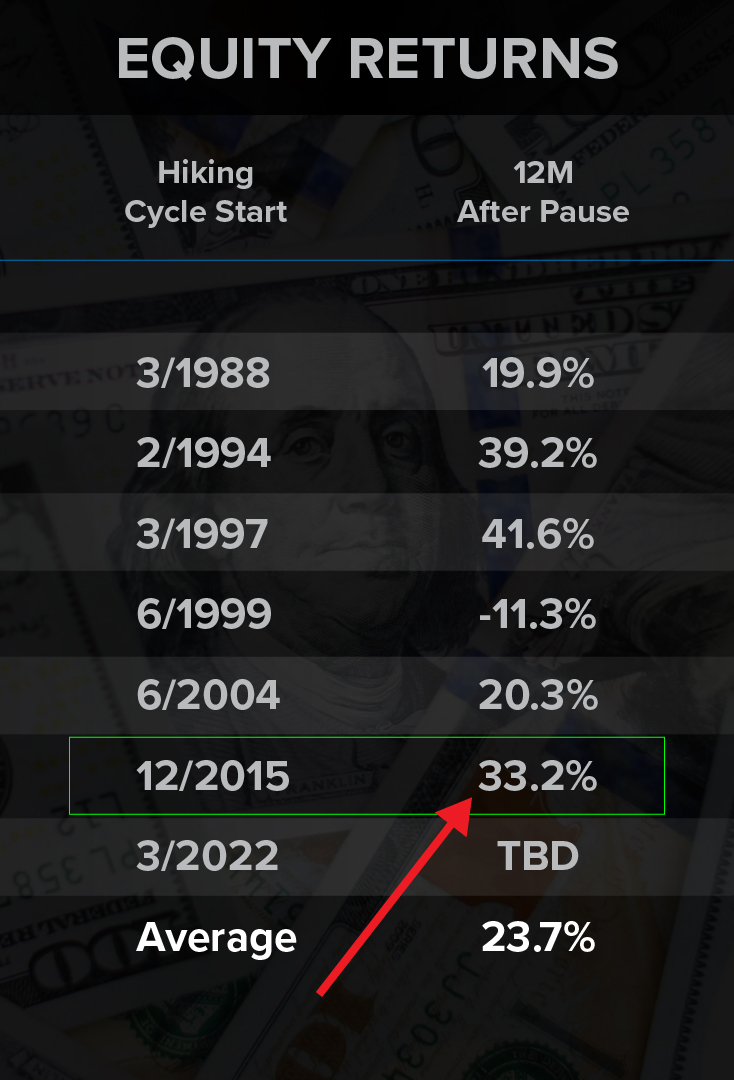

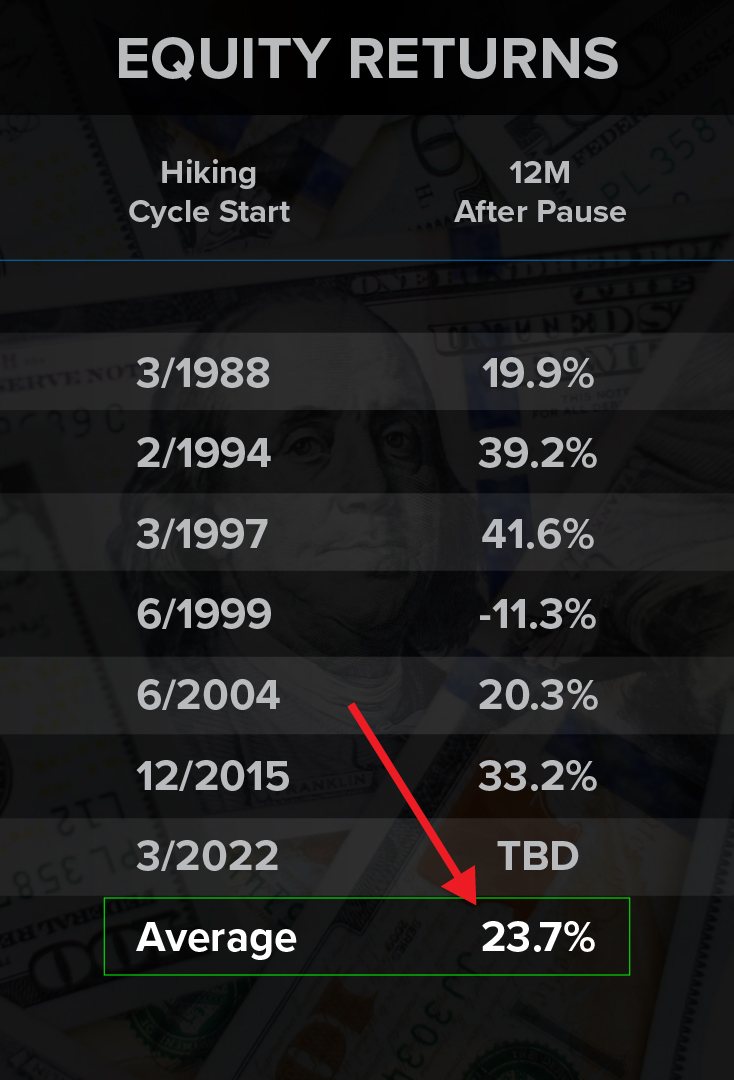

Over the past 35 years, we've had six major rate hike cycles…

*** In five of the six cases after the Fed paused interest rate hikes, the market took off over the next 12 months…

The only losing year was in 2000, when the dot-com bubble burst.

As you can see, after the Fed paused its rate hikes in 1989, the market returned almost 20%…

In 1995 after the hikes stopped, the market boomed — handing investors almost 40% returns in a year…

In 1997 after interest rates were frozen, the market did even better, with an incredible 42% return over the next 12 months…

In 2007 the market returned 20%…

In 2018 after the Fed paused, we saw a 33% return…

On average, had you gotten out of cash and into the stock market after all six Fed hike pauses over the past 35 years, you'd have made an almost 24% return!

Now, if I’m throwing too many numbers at you, please don’t worry — I’ve compiled everything you need to know in our details and disclosures link at the bottom of this presentation.

You can click on it anytime, and you’ll see all the research I’ve done to bring this presentation to you today.

But just to really hammer this point home, consider this:

I believe Warren Buffett is the greatest investor of all time…

He's returned 19.8% annualized gains during his more than half-century career, which is simply incredible…

Yet what’s more incredible is this — you could have exceeded his average returns simply by buying a market index fund after these Fed hikes stopped!

Nothing complicated, right?

Does it sound like something simple enough for you to do?

Remember, we're right there, right now — the Fed just paused its interest rate hikes…

Which means, if history is any indication, it’s plausible that you could get wealthier simply by getting out of cash… and into a basket of stocks!

But before you close this presentation and rush to buy an index fund, there's something even more amazing you need to know…

Remember…

Despite these insanely good returns in previous times…

What's about to come will be an epic wealth event unlike anything we've ever had before. For two critical reasons…

*** #1: We've never had this amount of money sitting on the sidelines, waiting to rush into stocks. Added up, we have a record amount of cash sitting in money markets — more than $5.3 trillion…

*** #2: Those previous gains were all from when the Fed paused interest rate hikes. But December 13th at 2pm, I believe the Fed will actually lower the rates…

Which means we're about to see a rapid acceleration out of cash, back into stocks…

Given all those trillions, the market rally could be enormous!

How big?

Well, we’ve only seen one other time in history like the exact setup that’s happening right now in America…

Could December 13th mark the start of the last bull market of our lifetimes?

In 2009, we had a similar setup to what’s about to play out starting in December…

We had almost $4 trillion in cash sitting on the sidelines in money market funds…

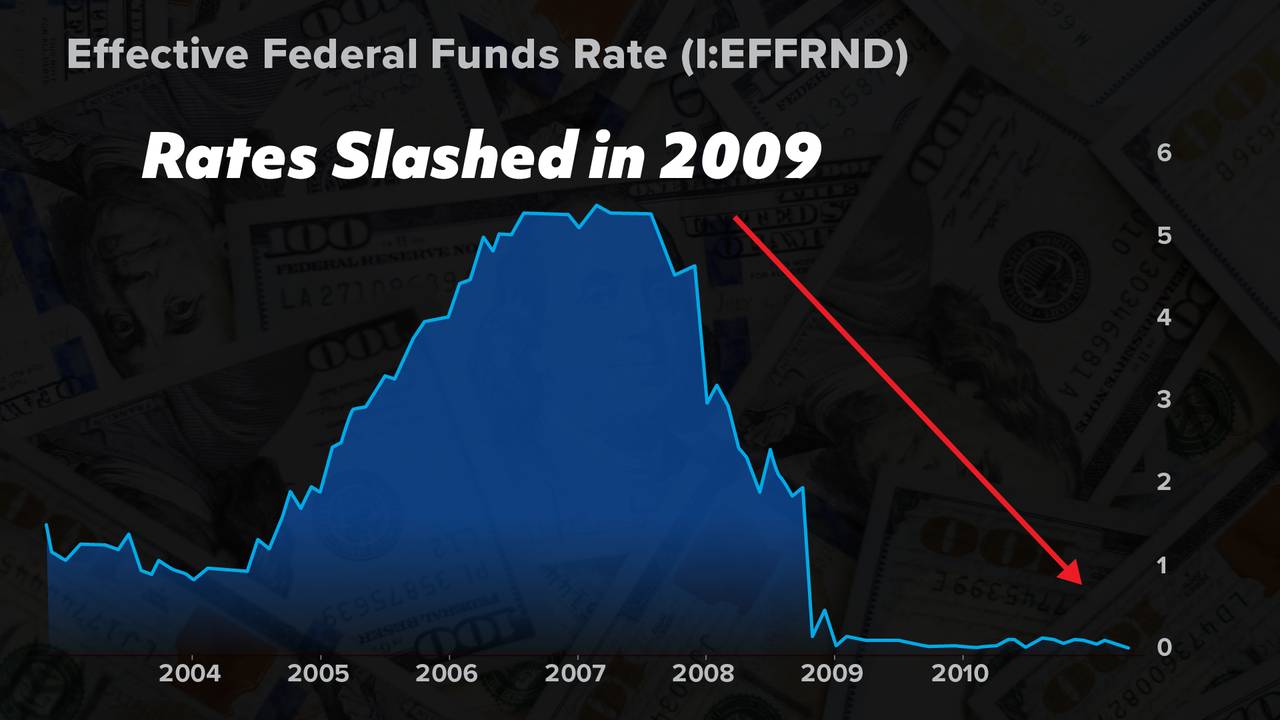

And, after years of rate hikes, the Fed pivoted and began to cut rates…

Eventually slashing rates all the way down to 0%…

Where did money go to get treated well?

*** As interest rates plummeted, more than a trillion dollars came flooding out of money market accounts…

And quickly flooded into the stock market to seek returns!

This rare convergence — record cash on the sidelines meets rate cuts — kicked off the largest, longest bull market in history…

Simply buying the S&P 500 index at the low in 2009, and holding until now, you could have made more than six times your money!

Of course, if you know how to value companies, like I do, you could have seen shares of the best companies on earth shoot up even higher…

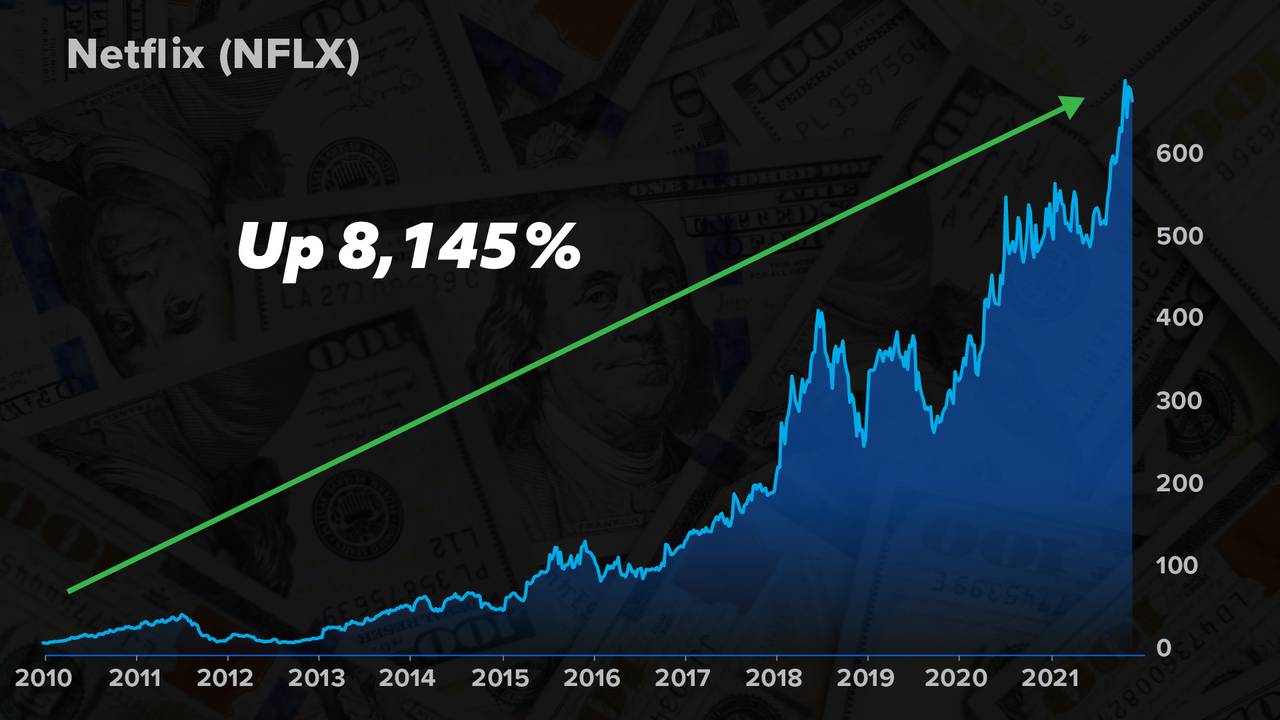

Netflix went up more than 8,145%…

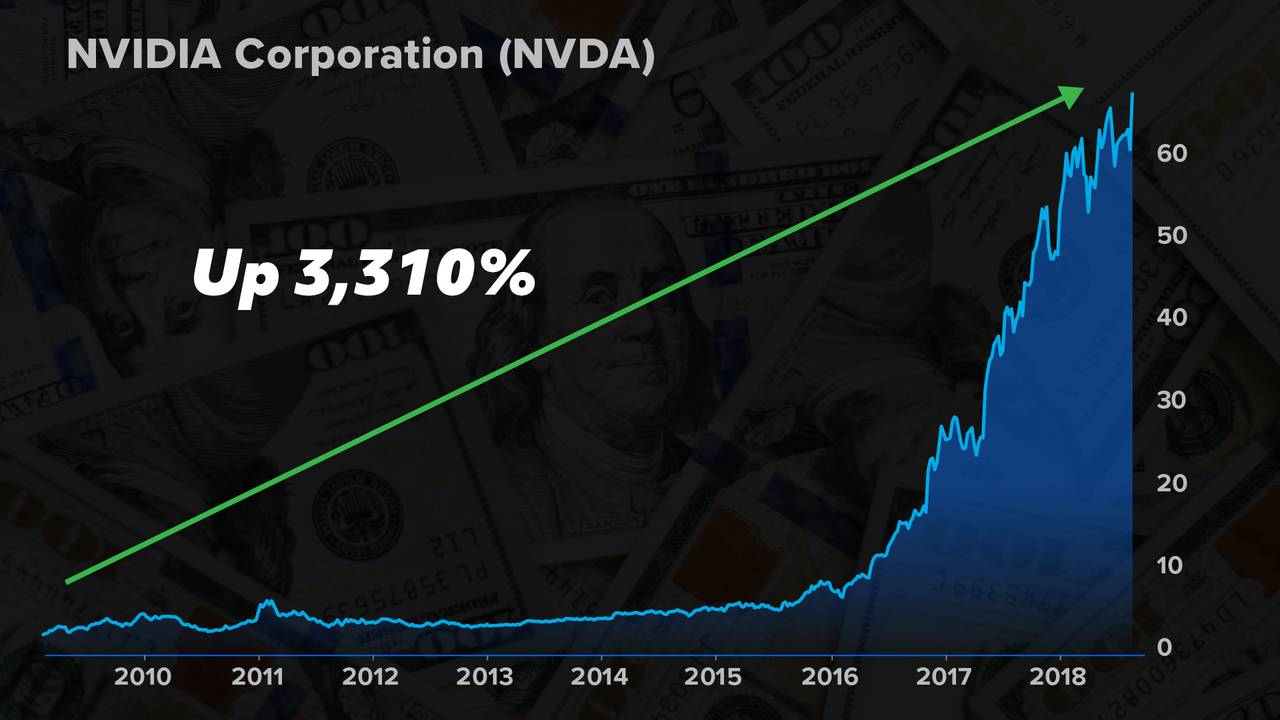

Chip maker Nvidia shot up 3,310%…

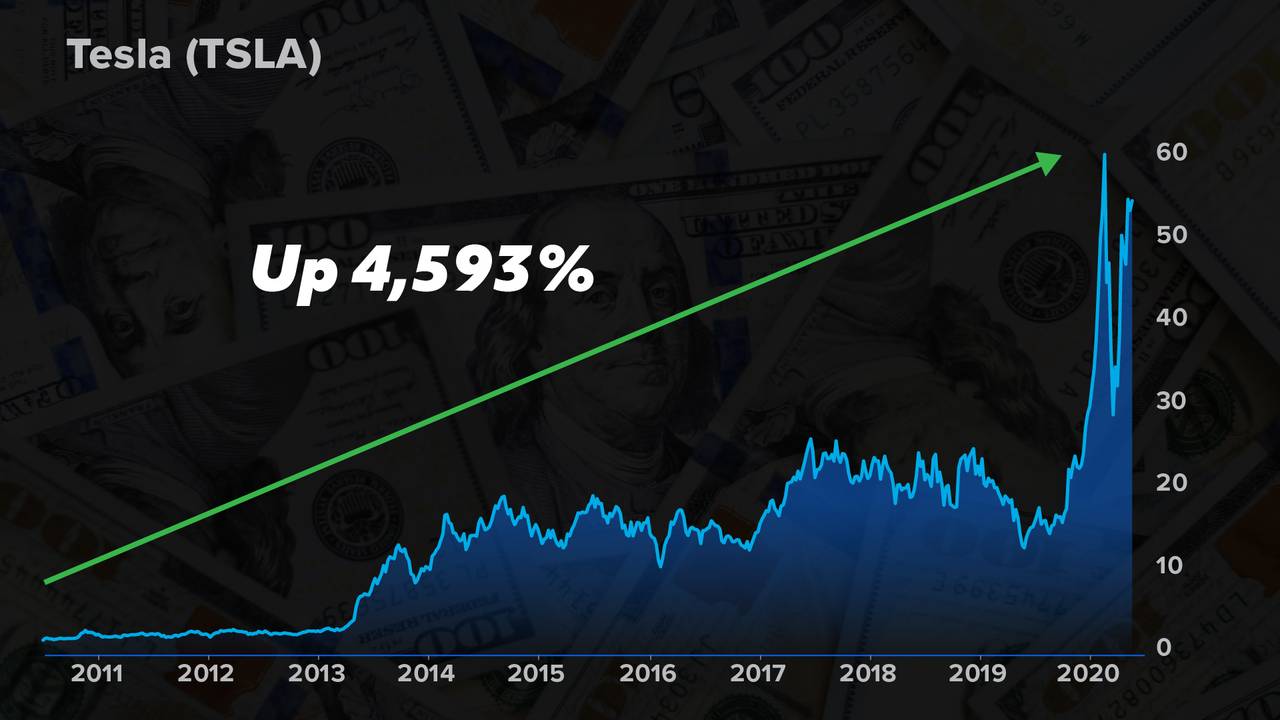

Tesla soared 4,593%…

Had you moved $5,000 out of cash during this convergence event…

And placed that same $5,000 into each of the last three stocks, you could have made profits of $412,376… $170,488 and $234,633.

The list of winners goes on and on…

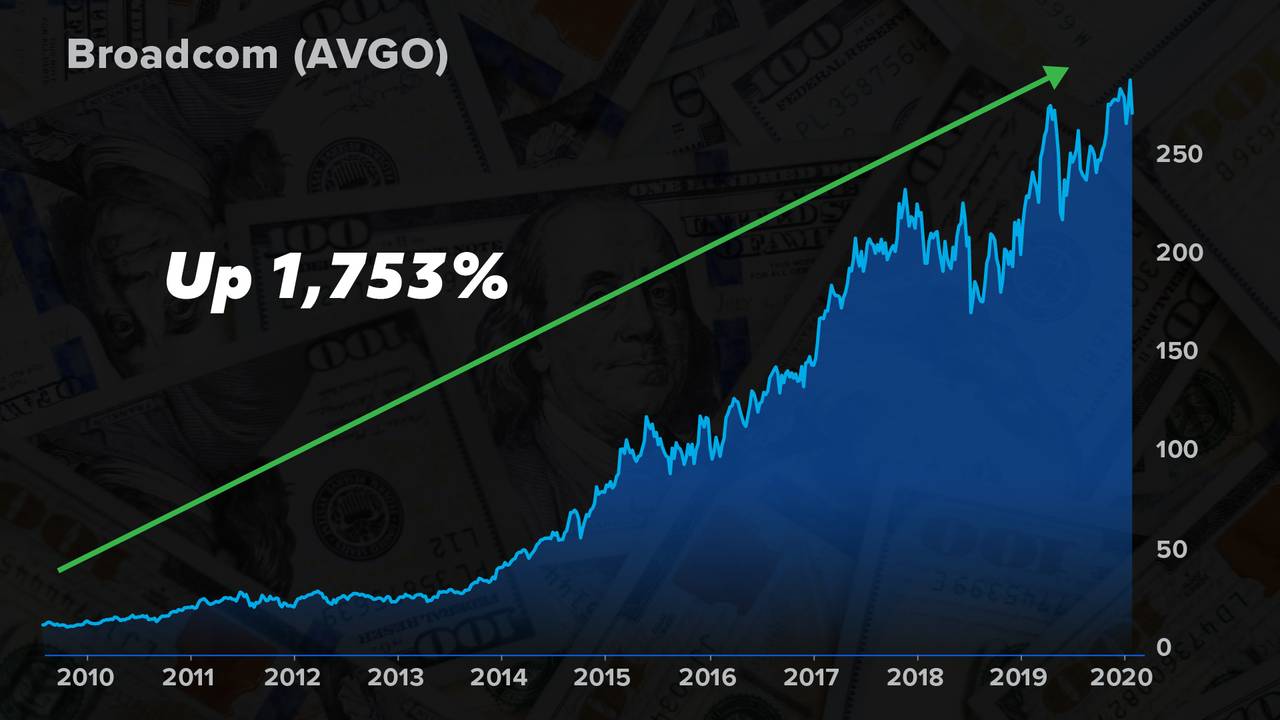

Broadcom went up 1,753%…

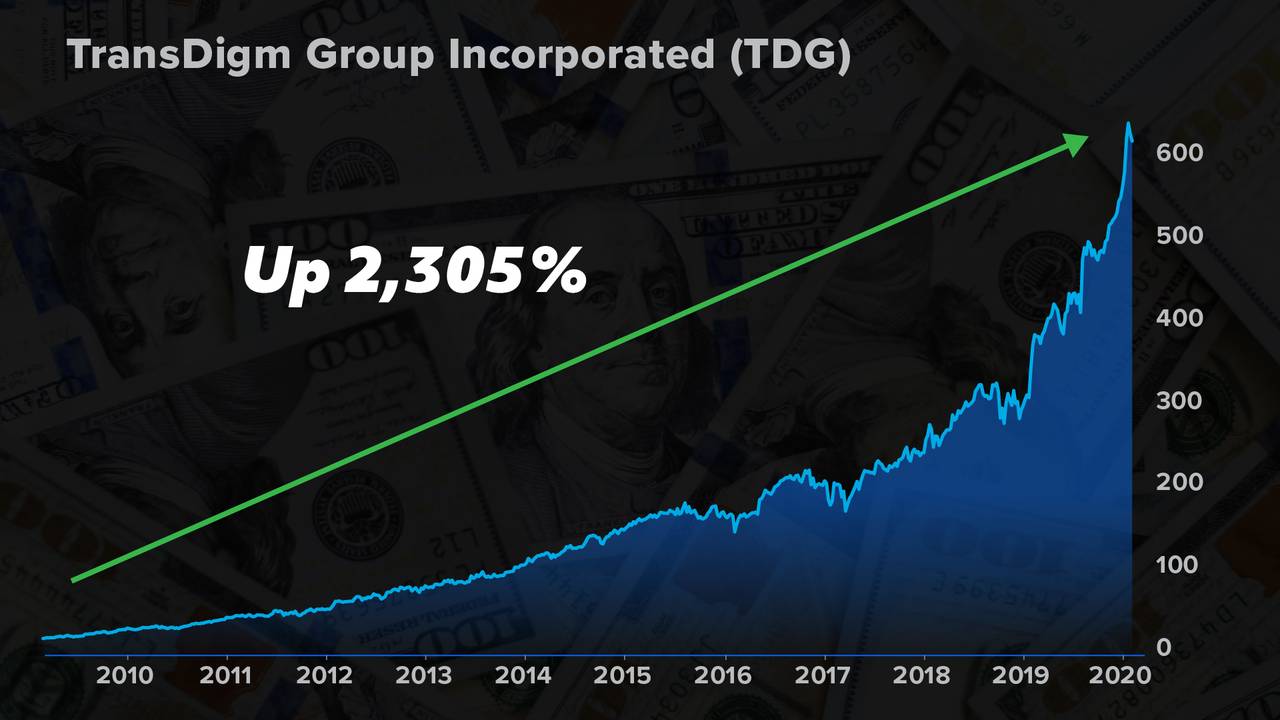

Transdigm went up 2,305%…

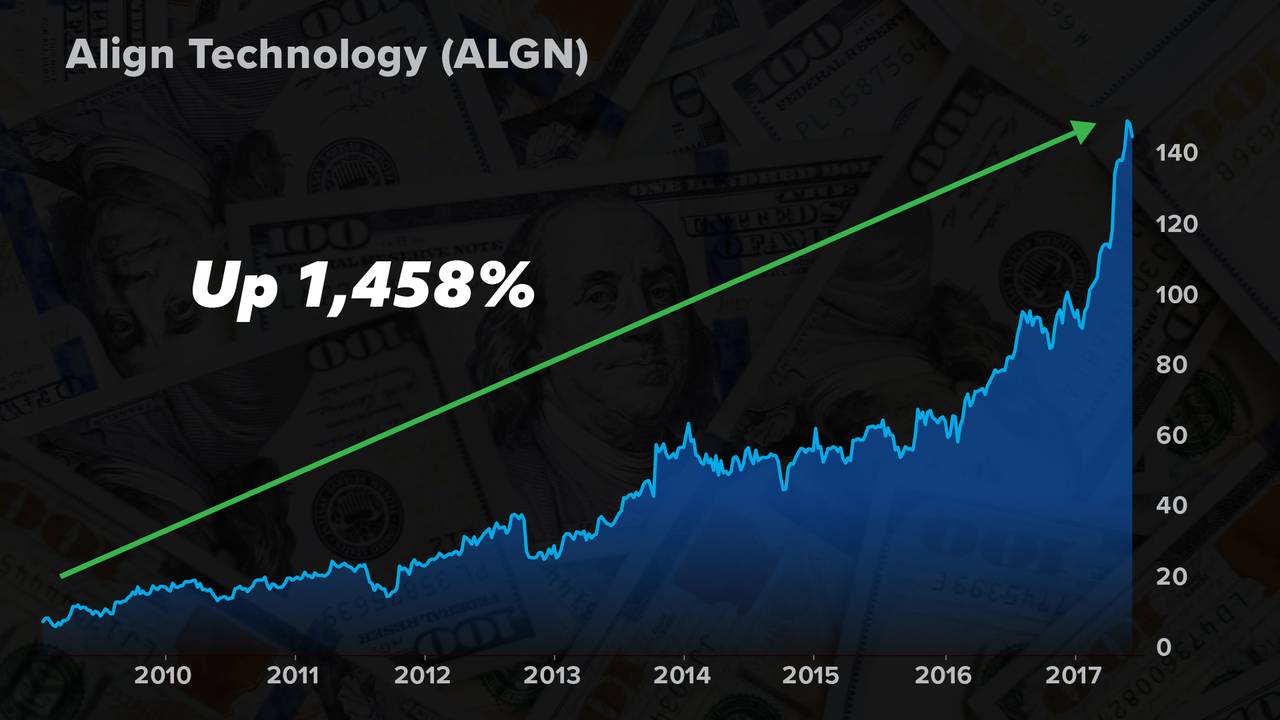

Align Technology went up 1,458%…

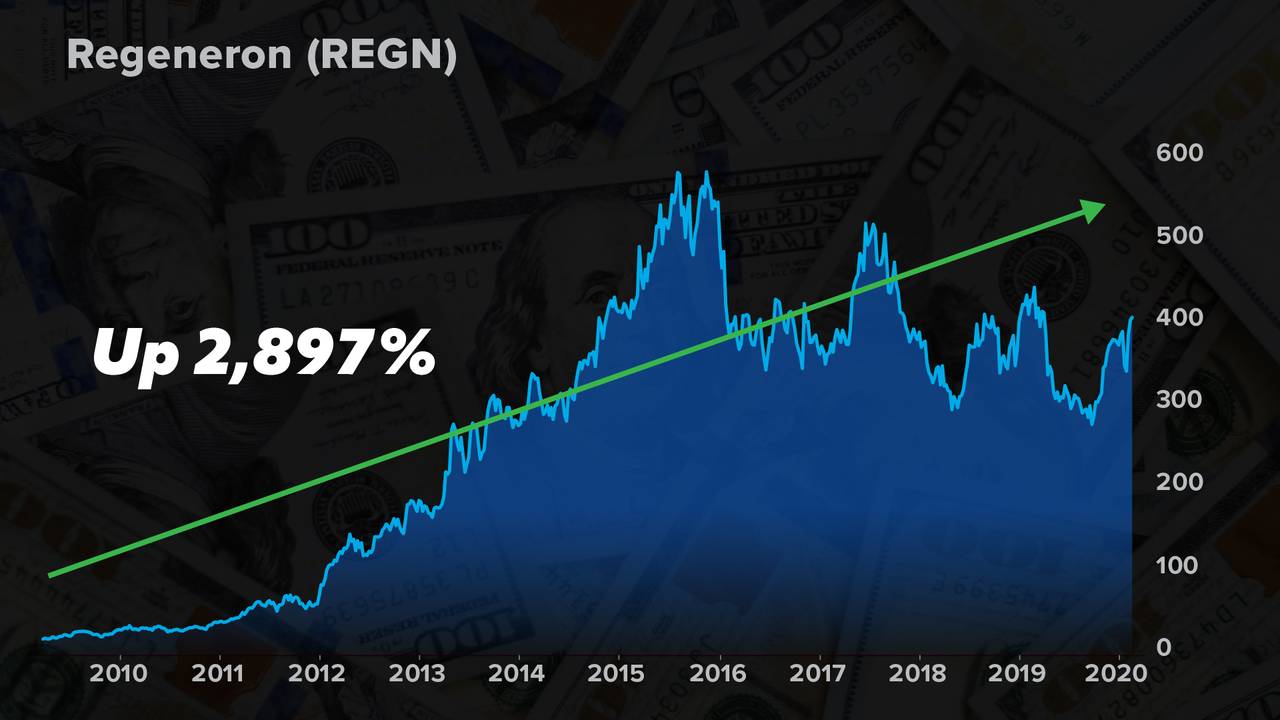

Regeneron shot up almost 2,897%…

In fact, there were more than 20 different stocks that went up 1,000% or more during this epic bull market…

Now, these are extraordinary historical examples. Past performance is no guarantee for future results, of course…

But here’s the question:

Could we be about to see another generational boom in the markets…

With 20 more chances to make 1,000% or more in the coming decade?

I surely think so. But don’t just believe me.

The smartest money on Wall Street is preparing for the coming boom in stocks…

In anticipation of what’s about to happen by December, my rich friends are already getting out of cash and into stocks…

- My college buddy at Harvard, famous investor Bill Ackman, recently loaded up on a nearly $1.3 billion bet on Google…

- My “mentor” Warren Buffett increased his stake in five Japanese companies, and recently added to his Occidental Petroleum stake…

- My tennis companion David Einhorn, who famously bet against some of the world’s worst companies, just bought brand-new positions in software company Black Knight… added to his energy bets… and doubled his position in Tenet Healthcare.

Of course this is all public information, I could go on and on, but you get the point…

The world’s smartest money is already making a move into stocks. So…

Here’s what to do with your money now…

Look, even the mainstream is starting to catch on — with CNBC saying all this extra cash could fuel a major stock market rally…

Bottom line, the great convergence is finally right around the corner… and if the Fed lowers interest rates, which I think they’ll do by December, to capture all the biggest gains, you need to move your money now…

We have:

** CONVERGENCE CATALYST #1: A record amount of cash ($5.3 trillion) sitting on the sidelines…

Colliding with…

** CONVERGENCE CATALYST #2: A reversal in the Federal Reserve’s interest rate policy, to begin lowering rates…

Which means…

*** OUTCOME: Trillions could soon flood out of money market accounts and back into the stock market — kicking off what could be your last chance to grow rich in your lifetime.

Now look, as amazing as these runaway bull markets can be, they can also be downright dangerous, if you don't have someone you trust…

Don't fall victim to the WORST thing you can do…

When stocks start going up like this, all types of charlatans come out of the woodwork…

They try to take advantage of all the mom-and-pop investors who are racing to put their money into stocks.

Unfortunately, you'll soon see pitch after pitch filled with sexy stories of microcap companies that claim to have hit the jackpot on a new gold mine…

Or you'll see BS-filled pitches of some new company that claims to have found the cure for cancer…

Almost all those companies are sure to steal your money, pay their executives lavishly, and likely blow up in the coming years.

Despite the economic forces driving stocks up, many of these companies will go belly up.

Don’t fall victim to these pitches…

So what should you buy?

At worst, if you take nothing away from today, you'll simply want to get out of cash and get into stocks through an index fund.

A great way to do this is to simply purchase SPY or VOO, which track the value of the S&P 500 index, a basket of 500 blue-chip stocks.

Remember, the last time we saw this happen, 15 years ago, the market went on the longest bull run in history…

By simply buying and holding the overall stock market, you could have made more than six times your money.

So if you take nothing else from this presentation today, and if you're looking to potentially make a lot of money in the coming years…

*** Just get out of cash and get into stocks now.

But if you're looking for ways to multiply your money by 5x… 10x… or more, then you'll need to do more than just buy the overall market…

You'll need to buy into specific companies that should go up multiples of the overall market.

To help my friends and family make the most money over the coming years I've come up with something called the “Perfect Portfolio.”

The “Perfect Portfolio” contains just FOUR stocks that I think everyone needs to own to make the most money from this coming bull market…

The “Perfect Portfolio” for getting rich

from the December 13th convergence

Luckily, you don't have to buy risky, speculative investments to have the kind of retirement you've always planned on and deserve.

You just need to be willing to put a big chunk of your money in a few low risk, lucrative, and high-conviction ideas.

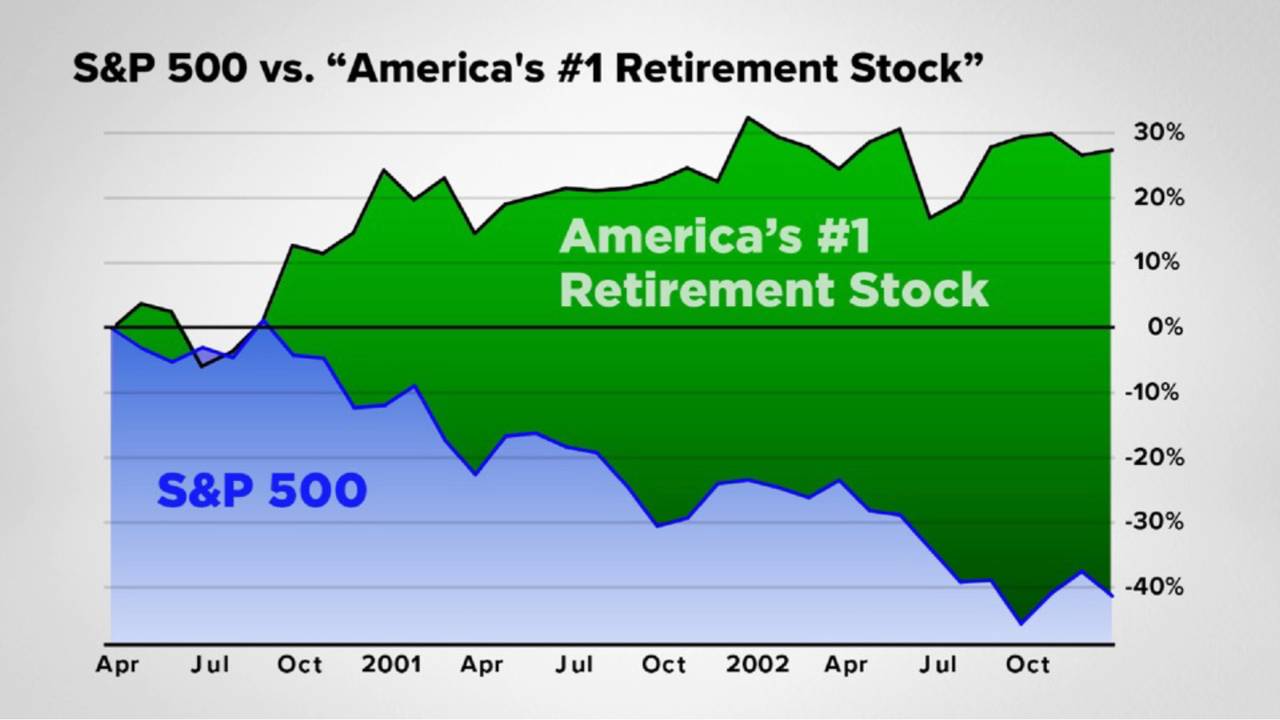

I recommend that everyone looking to grow wealthier in the coming years put a large portion of their portfolio into something I call America's #1 Retirement Stock…

Then, with the remaining part of your portfolio, I recommend you make three additional investments that could make you 5-10x your money in this epic new bull market…

I'd love to tell you a little more about each play, starting with…

Perfect Portfolio Stock #1: Buy America's #1 Retirement Stock

While It’s Still Cheap…

The first stock allows you to have one of the greatest investors in the world work directly for you…

This investor is famous for shunning Wall Street analysts.

He employs fewer than 30 people at corporate headquarters — yet he's been able to deliver his shareholders a total return of 30,000 times their money since he took over the company.

That's enough to turn every $1,000 into $31 million.

I personally know investors who have paid more than $650,000 to have lunch with him…

And today, in a very rare situation, his company has 37% upside over the next year by analysts’ calculations.

This is a HUGE opportunity – one I don't expect to last for long.

You see, I've been following this company for decades…

I first bought the stock when I launched my hedge fund on January 1, 1999 and owned it continuously until I closed down in late 2017. The stock more than quadrupled during that time.

But that's not all…

Since I first bought shares, there have been multiple great buying opportunities to get in.

And I backed up the truck nearly every… single… time.

I've made as much as 6 times my money on some of the early shares I bought.

And today, we have another one of those buying opportunities…

That's why I'm trying to get the word out about this “back up the truck” moment.

I know most people watching this won't take my advice, and I'm afraid they will regret it – but even if I can help alert just a small group of Americans to this opportunity, I know it will be worth the effort.

After these two forces collide, which I expect to happen starting in December…

I believe investors will rush out of cash and buy this stock — potentially sending shares higher.

But what if I'm wrong?

What if my prediction never comes true?

Well, that's the best part…

This stock has a proven history of going up no matter what's happening in the markets!

Even as the market lost $7 trillion after the dot com bubble burst, “America's #1 Retirement Stock” actually rallied by 32% between 2001 and 2002.

It also flies far higher when the market is on the rise.

Consider, over the last 25 years, the S&P 500 would have turned a $1,000 investment into $6,000…

“America's #1 Retirement Stock,” on the other hand, would have turned that same $1,000 into $116,000.

In other words, your nest egg would be more than twice the size if you invested in “America's #1 Retirement Stock” instead of the overall market.

Wouldn't that make a big difference to you?

Imagine if your retirement accounts had more than double the amount of money you have right now… what difference would that make to how and where and when you retire?

That's why I believe there's simply no better stock in the market to be invested in today…

Whether your investing horizon is one, five, or 10 years, it simply doesn't matter.

Even though this stock has more than quadrupled over the last 25 years…

It's still an incredible buy according to my research and analysis.

You simply can't find any stock as conservative and as low-risk as this with that kind of realistic upside in the short term.

One hedge fund I follow closely, Semper Augustus, described this company as an “impenetrable fortress” in its annual letter.

I agree… and that's why I jumped at the opportunity to invest in this stock every time it’s traded well below my estimate of its “intrinsic value.”

You can't hesitate with opportunities like this.

I spent 20 years investing in this company and, like I said, I've bought “America's #1 Retirement Stock” nearly every time it has gotten as cheap as it is today…

And I've made a lot of money when I bought more shares.

In short – I believe there is no better company to put a big portion of your nest egg in today. It has nearly 40% upside over the next year by my estimation.

And more important, it has a Fort Knox balance sheet and has always been run in an extremely conservative fashion…

That's why I view it as the best risk-reward investment in the stock market today.

That's why I recommend you put a large chunk of your investable cash into this play right away..

Now listen — although there are never any guarantees in finance, I believe this is one of the least risky ways to steadily grow your wealth in the years ahead.

For the remaining part of your portfolio, I recommend three additional stocks that I think could have huge growth in the years ahead…

Starting with…

Perfect Portfolio Stock #2: The Company That Could Soon Revolutionize How

Americans Take Care of Their Health

The first stock that I think could make you multiple times your money going forward has its sights set on one of America's most important industries: medicine.

But what's interesting is that this company is not a traditional health care company.

In fact, it's actually about to become the largest delivery service company in America.

Larger than the U.S. Postal Service, UPS, and FedEx.

This might sound unrelated to the medical industry, but it's actually becoming more vital than ever to health care.

This practice could revolutionize primary care all around the world.

CNBC says this company could “remake the entire healthcare supply chain.”

And Business Insider says it “could dominate health care” and ultimately “transform the space.”

I conservatively estimate this company's profits will continue to grow by 70% per year for the next several years…

That level of success could mean huge gains for you over that time.

That may be one reason why billionaire entrepreneur Mark Cuban says he has close to $1 billion invested in this company right now. It's also his biggest holding.

Trust me when I say you'll want to be on board as this growth in profits sends shares ever higher.

It’s the kind of stock I would tell my closest friends and family members to get into, while you still can…

And there’s more:

Perfect Portfolio Stock #3: The Company Dominating the Business Behind AI

While it may sound like something out of a science fiction film, artificial intelligence is being deployed across the world in countless business applications.

Computers and robots guided by AI are already trading securities… diagnosing illnesses… writing many of the articles you read on the Internet… and driving autonomous vehicles.

The AI marketplace is accelerating quickly. Research shows it could be worth a whopping $16 trillion to the global economy by 2030.

This is why the next company I recommend you invest in right now is one I predict will become the dominant player in AI.

Wired even said that “the race to dominate the personal AI space… is closer to being over than most people realize” and that this innovative tech company “is poised to win.”

You see, this company has innovated one of the best machine learning technologies in the world.

And the applications for it are endless…

The company is using it to make it easier for Americans to do things every day – whether it's managing your calendar, checking the weather, playing your favorite music, or finding nearby restaurants.

But it is also using it on farms to keep cows healthy and dairy farms efficient. And it is using it to become the leader in the race to make vehicles drive themselves.

In short, this company has the most state-of-the-art AI among any business in the world, an infinite number of applications to put it to use, and nothing standing in its way to disrupt industries like logistics, health care, and many more.

It's why the Economist says this firm is winning the battle “to dominate artificial intelligence”…

And why this company is one of the most exciting investments of any publicly traded stock in the world today.

I believe it belongs in every retirement portfolio in America, including yours.

In a moment, I’ll show you how to grab the name and ticker symbol of this stock, along with all the others I’ve shown you today.

But there’s one other stock that belongs in the “Perfect Portfolio” right now…

Perfect Portfolio Stock #4: The World’s Greatest Advertising Platform… EVER

“Google is a good advertising vehicle,” a friend of mine, and one of the smartest businessmen I know, told me…

Then his eyes got big: “But [this company] is the greatest advertising platform ever!”

The good news is, because of recent events, we have an amazing opportunity to load up on shares today at cheap valuations…

You see, this company is every politician's favorite whipping boy thanks to a seemingly never-ending stream of negative stories.

Turn on the news and you'll hear how the company is abusing the privacy of its users…

Or how its platform is being used for a wide range of nefarious purposes…

From the Russians manipulating our electorate, to whipping up ethnic hatreds…

The company always seems to find itself under enormous scrutiny.

My job isn't to be the morality police, of course. My job is to show you money making opportunities.

So when I see the stock of the world’s greatest advertising platform — with mouthwatering economic characteristics — trading well below intrinsic value, I'm going to tell you to buy it…

Even if some folks may want to hold their noses.

What makes for this company’s extraordinary economic characteristics?

Just consider this one fact…

In its latest earnings release, the company noted it has more than 3.8 billion monthly users — Incredibly, some 2.8 billion of those people use at least one of those services every day!

In other words, this company reaches more people every month than the world's largest religion (Christianity at 2.4 billion) and more than half of all adults on Earth.

Given the huge user base, it’s no surprise that revenue and operating income shows how the company has grown from almost nothing…

To one of the largest, most profitable businesses on the planet over the past decade…

Meanwhile, the company’s margins are among the highest of any company in the world…

Yet despite these amazing financials, the company is now trading at 16 times forward earnings – a discount to the S&P 500!

For an exceptional company with such incredible growth prospects, I think this is quite cheap and I expect the stock to double in the next three to five years.

That’s why I’m recommending everyone buy shares in this company right now…

Everything you need to know to get on all these

recommendations is in my newest research report

called The Perfect Portfolio.

But before I tell you how to access it, there's one final thing you should understand…

You see, one of the biggest secrets of the hedge fund world is that finding the right stocks to buy is just the first step…

Because even if you own the best companies in the world, it doesn't guarantee that your portfolio will outperform the market.

That's why the second step you take after finding a high-conviction stock idea is deciding how to hold it.

In other words, how much of your portfolio you decide to put into each stock can make an even bigger difference than what stocks you choose.

For example, if you score a 10-bagger but you only have 1% of your portfolio in the stock, your whole portfolio is only going to rise 10%.

And conversely, if you can manage to find a stock that doubles and you have 50% of your money in it, your portfolio will grow by 50% – a much higher return.

Luckily, with the Perfect Portfolio I've created a fully allocated model portfolio that not only gives you the names and ticker symbols of all the stocks I've mentioned today…

But also shows you what percentage of your wealth to put into each investment.

In short – if I was running a fund designed to help people at or near retirement age grow their wealth steadily, this is exactly how I would do it.

Let me show you how to claim access right now…

For the first time ever…

For nearly 20 years, I worked as a hedge fund manager in Manhattan…

My clients were some of the wealthiest people in the world (a handful were billionaires), with access to the best Wall Street hedge funds.

But rather than start another hedge fund, I've decided to do something different.

I'm now taking a very different approach, launching a project that can benefit people from all walks of life: Teachers, doctors, lawyers, small business owners… retirees… you name it.

My new business, Empire Financial Research, is based in Baltimore.

I've teamed up with a group of fellow Wall Street veterans to find low risk and profitable investment ideas, many of which you've probably never heard of and aren't likely to hear about anywhere else.

We're an independent publisher of financial research — which means we don't own or trade the stocks we recommend.

The only way we can stay in business is by giving you great ideas and advice so you can have the chance to achieve great investing results.

To me, this just feels like a much better model compared to charging exorbitant fees to a handful of already wealthy people.

And part of the reason I made this switch is because today I want to share my best ideas with like-minded folks from all walks of life.

This has always been important to me…

I didn't come from money and I'm still one of the most frugal people you'll ever meet. For example: I'm sure I was the only guy from my Harvard Business school class to spend a night at a youth hostel at a recent meet up…

I was also one of the founders of Teach for America… served on the boards of more than a dozen nonprofits… taught introductory economics to high school and college students… and won the John Whitehead Social Enterprise Award from the Harvard Business School Club.

The point is, as part of my new venture, you can access my best ideas at a fraction of what you used to have to pay me as a hedge fund manager.

You don't have to pay me the “2% of assets and 20% of profits” fees hedge funds typically charge.

You don't have to pay the $5,000 I've charged for a single seminar.

Today access to my best money making ideas comes at a pittance — it's the best bargain on or off Wall Street.

For example, at least 5 billionaires currently subscribe to my research.

One of them is Joel Greenblatt, who manages $9 billion at Gotham Capital, who recently said:

Another person on my e-mail list is John Petry, who manages more than $2 billion. He said:

I truly believe my daily e-mail is the best place to find exciting and unique investing ideas in the world today — there's simply nothing else like it.

And when you agree to sample my research today, I'll immediately add you to my daily e-mail list.

Before I give you the pricing details, and show you how to get started… let me tell you about one final investment I think you should make immediately, to take advantage of the massive opportunity before us today…

Take advantage of the hottest trend in all of finance…

Aside from the Perfect Portfolio I’m also targeting a small handful of “perfect speculations” that help us grow our money from the biggest trends in all of finance.

What’s one of the hottest trends right now?

Well, over the next 36 months, I believe we're going to see some of the most exciting “artificial intelligence” (AI) breakthroughs in history.

I can confidently say that because some of these breakthroughs are alreadyhappening before our very eyes…

When OpenAI made its AI chatbot ChatGPT available to the masses in November 2022, a firestorm of activity kicked off.

Within the first two months of its launch, ChatGPT amassed more than 100 million users…

And it brags about having more than 13 million daily visitors as of 2023.

ChatGPT has the capability to:

Answer your questions amid uncanny back-and-forths…

“Author” fiction and nonfiction…

Translate text from one language to another…

Complete a desired phrase, lyric, or text…

Produce computer code…

Summarize texts at the collegiate level…

Anticipate users' various needs…

But ChatGPT is just one of many recent AI breakthroughs…

Microsoft (MSFT) is bringing AI to its Bing search engine so that Bing can provide better search results and answers.

The revamped Bing will even generate personal inspiration for you, be it for planning vacations, creating quizzes for game nights with friends, or any other activity.

Google, meanwhile, has its Muse project – a text-to-image AI tool, which turns users' text prompts into accurate, high-quality images… in just half a second.

Apple is making headway in the direction of text-to-speech AI, so that it can offer AI audiobooks to publishers who would otherwise spend thousands of dollars on a weekslong recording process with a human narrator.

Nvidia's AI eye-contact application simulates eye contact during virtual meets…

Meta Platform's ReVise can read lips by comparing audio and video to perceive language…

And that's just the tip of the iceberg.

I believe there's one company in the AI space that I believe is head and shoulders above the rest for profiting on this trend right now…

And I’ve compiled all my findings into a second special report, called How to Profit From the $87 Trillion AI Wave…

Which I’ll gladly send you when you agree to try my research today…

OK, so I've told you about two special reports so far, which I want to send you right away:

- The Perfect Portfolio

- How to Profit From the $87 Trillion AI Wave

These reports are the first things I want to send you when you start a no-risk, trial subscription to my comprehensive investment research advisory, called the Empire Stock Investor.

On the first Wednesday of every month, I'll send you my latest research and newest money-making recommendations.

My team and I will also show you exactly how to allocate a portfolio across our recommendations to maximize your potential gains, just like I did for my hedge fund clients for nearly two decades.

This way, you will never find yourself wondering what you should do with new stocks I recommend.

Plus, every day the markets are open, I'll send you my daily e-mail, addressing the most important issues affecting you and your money.

You may have read other investing e-mails before…

But I guarantee you've never had access to anything like my daily report.

To sum up, by taking advantage of this offer today, you will receive:

- The Perfect Portfolio

- How to Profit From the $87 Trillion AI Wave

- Monthly issues of Empire Stock Investor – I'll send you new research on a new investment idea and any changes to our model portfolio, on the first Wednesday of every month, for as long as you’re a subscriber…

- My Empire Financial Daily and Whitney Tilson’s Daily e-mails… each day the markets are open. Soon, you'll be part of a small collection of like-minded folks, which includes some of the wealthiest and richest investors in America.

- Plus full access to all of my archived research reports and recommendations…

So, how much does it all cost?

Well, that might be the best part.

Frankly, I believe I could easily sell the package I've put together today for thousands or possibly tens of thousands of dollars.

But I'm on a different type of mission today.

I know there are a lot of people out there — normal people like my mom and dad who met and married in the Peace Corps in 1962 and are both teachers — who don't know what to do with their money right now.

Should they sell all their stocks?

Buy more?

And what should they buy?

Well the first thing for anyone who wants to dramatically grow their wealth in the next few years is to take advantage of all the investment ideas I'm going to send you in the reports I've described.

Now, the regular retail rate for my work is $995 per year — and some of my readers pay as much as $5,000 per year — but you can save a huge amount off the regular rate by taking advantage of this special trial subscription offer.

That means, today, you can get three (3) full months of access to my new research on the coming superboom we're about to see…

Plus, my monthly newsletter, Empire Stock Investor, where I offer investment ideas and update you on any adjustments I make to the model portfolio…

And my daily letter where I share investment ideas from my giant network of contacts in the investing community…

For a 3-month trial rate of just $99.

I promise you — this is by far the best deal in the investment world today.

For about the price of a dinner for two — you can have a chance to radically transform your retirement finances over the next few years.

Even better: This trial subscription is 100% satisfaction guaranteed.

And if you're still on the fence, simply click the “ORDER NOW” button below, where you'll be taken to a secure order form that shows you an even cheaper way to get started…

After reviewing all the options, if you decide in the next 30 days, for any reason, that my research isn't right for you, no problem.

Simply give our member services team a call and they'll promptly refund 100% of your money.

In other words, you have absolutely nothing to lose and a great deal to gain when you take me up on this generous offer today.

Just please keep in mind, all investments carry risk. Past performance is no guarantee for future returns. You should never invest more than you would be willing to lose.

As of 2021, our average gain since inception is 14.9%

Just click the “ORDER NOW” button below to get started…

Before I go, I’ll end with a short little story…

Have you ever heard the story of the Acres of Diamonds?

It’s about a farmer in Africa who heard wild stories of other farmers getting rich from discovering diamonds on their property…

So he sold his land and set out on a life-long search for his own riches…

He explored the world in search of diamonds, but to no avail…

Not finding a single diamond, he died broke.

After his death, the person who bought his land was walking along a creek and noticed something shiny in the water…

He bent down, picked it up, only to find out that it was… a perfect diamond.

Turns out the old-farmer’s land was filled, acre upon acre, with diamonds all along.

So let me ask you…

If you’ve sold out of stocks…

To rush for safety and income in cash…

Did you just sell your own acre of diamonds?

Luckily, you still have time to get back into stocks.

You now have a choice…

Now, the ball's in your court.

Will you ignore everything I've shown you here today?

Will you continue to sit on the sidelines, in cash, and miss out on what could be the last great bull market in your lifetime?

Will you let the rich get richer… adding billions to their wealth…

While you're left earning pennies on the dollar on your savings?

I've done my part.

Now you need to make your own choice…

I look forward to having you on board this new venture together

You may have subscribed to an investment newsletter before, but I promise I'm going to be sharing ideas with you every weekday that aren't anything like what you have ever seen before.

To get started, and to get access to everything I've described here, in a matter of minutes, simply click the “Order Now” button below.

This will take you to a secure order form, where you can review everything here before submitting your order.

You'll have access to all of my reports, research, and my fully allocated model portfolio, in a matter of minutes.

Best regards,

July 2023

© 2022 Empire Financial Research. All rights reserved. Protected by copyright laws of the United States and international treaties. This website may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Empire Financial Research.

Privacy Policy | Terms of Use | Ad Choices | Details & Disclosures | Do Not Sell My Personal Information