The Incredible Dividend Map… Where Stocks Yield 69% a Year

Table of Contents:

- Intro

- Who is Robert Rapier?

- An effective yield of 69% a year — every year

- Here’s the Secret Behind All This Cash

- $1,626,000 in Profits

- Why the Future Looks Event Better

- We’ve Been Making Money this Way for 31 Years Now

- It’s Time to Play it Safe

- No Substitute For What these Stocks Give You

- New Report: The Incredible Dividend Map

Dear Income Seeker,

Quick question…

What’s the highest-yielding stock you’ve ever owned?

Did it pay you 8%… 10%… maybe even 12%?

Well, the stocks on this map blow those numbers out of the water.

Their dividends have risen so fast over the years that they’re now yielding 69% for us… and they pay us in cash.

Of course, that’s an average. Some come in higher and others lower, but overall, that’s what we’re getting.

I urge you to see for yourself how this works. It might change the way you invest forever.

But I’m getting ahead of myself…

My name is Robert Rapier.

I’ve spent the bulk of my career in the energy patch, but now I mostly buy and sell stocks for a living. And I share my research with other people who like to invest the same way I do.

Like any other investor, I try to buy low and sell high…

…but the BIG difference with me is that I like to buy just one kind of stock — and none other.

These unique companies are concentrated in large population centers.

They’re almost always monopolies… selling a product that 152 million customers are virtually addicted to.

And the kicker is, they are mandated by law to make a profit. (The Supreme Court ruled on it back in 1865.)

No other class of stocks enjoys this favorable legal status.

This makes them the safest equities in America. Not a single company in this entire industry has ever gone out of business — ever.

And one last thing: the dividend yields are massive. Especially when you hold onto them for a while.

I have 37 of these cash cows in my portfolio right now… and for every dollar invested in them they are sending us 69 cents in dividends…

That’s an effective yield of 69% a year — every year.

Now before we go any further, I need to make something clear…

The starting yield for a new investor in these stocks won’t be this high.

But over time, there’s nothing stopping you from collecting $690 from a $1,000 stake… $6,900 from a $10,000 investment… and so on. Just like we are right now.

You can find these opportunities all over the country…

Texas has the most of these monster yielders. There are five scattered across the state, paying us an incredible average of 102%.

We have a couple more in Philadelphia, paying us 42%.

A big outfit in New York City is sending us payouts amounting to 67% on our money.

And a small one in Jackson, Mississippi is paying 27%.

Here’s all the states you’ll find these extraordinary companies in…

We’ve got two each in Wisconsin, Oklahoma, New Jersey, Connecticut, Ohio, Indiana, and Massachusetts… plus one apiece in 12 more states.

Some of these firms are massive, others not so much. But they all have one thing in common…

And it’s the key to generating the massive cash flow necessary to pay these remarkable dividends.

I’ll spell it all out for you in just a minute. But first I want to point out that there’s nothing complicated about getting some of this money yourself. These are all just regular stocks you can buy in any account.

In fact, about 15,000 investors are doing this with me right now. And I wouldn’t be surprised to hear more than one of them have become millionaires since starting to invest this way.

Patrick N. says following my advice is “working like a charm” for him. He was able to fully pay for his golf “habit” (three rounds a week!) for a full year. And still had enough left over to take his wife to Florida for a winter vacation.

After seeing how he did it, you might want to join him…

…because when you start getting paid 69% on your money your financial problems pretty much evaporate.

I know it sounds hard to believe but stick with me. Because there’s big money at stake here…

Walter Tower Is Making $108,427 Every Three Months (From Just One of these Stocks!)

The cash adds up fast when you invest in companies that pay out so much.

One of them in Atlanta is paying Edward Albright $371,420 a year. It’s also sending Michael Chambers $285,796 a year… and Walter Tower an incredible $108,427 every three months. That comes to $433,708 per year.

To be clear, Tower is pulling in an unusually large amount. But it’s not the top. Some people are making even more.

Not far away in North Carolina, Lisa Gibbons is pulling in $1,301,121 a year. The same company is sending Sam Yates $356,057 a year… and Jane Joiner $98,261 a year.

You can find another one of these incredible payers on the plains of North Dakota. It’s paying $718,762 a year to Ted Ebert… $233,041 to Daniel Grady… and $66,910 to Pamela Moore.

In Philadelphia, a company that has been around since 1886 is sending payouts to William Logan for $228,054 a year… Sarah Sullivan for $217,169… and Larry Warner for $26,950.

In Madison, Wisconsin, one of our favorites is sending Paula Kramer $319,202 a year… Jack Lamp $75,018 a year… and Joshua Glade $58,753 a year.

Again, we’ve got 37 of these big payers in our portfolio right now. And they are paying us an average of 69% on our investment, year after year.

Here’s the Secret Behind All This Cash

It’s simple: Every single one of these businesses sells something that people refuse to go without.

And when you’re selling something that people insist on buying no matter what, it’s hard to lose.

So that’s our secret: We only invest in companies that provide things people absolutely need… not passing fads.

At the office, we call them “essential-service” stocks.

These companies enjoy the extreme advantage of constant demand.

I mean it literally never stops.

That’s why they never go out of business.

For example, nobody today is going to go without water or electricity if they can help it. It’s a matter of life and death in some areas.

In Arizona, people would literally die without air conditioning.

Same thing with water. You don’t just want water, you need it.

So, it’s no coincidence that some of our biggest money-makers sell water and electric power.

And try spending a winter in North Dakota without heat. No one wants to go through that. So natural gas is another big profit center for us.

These aren’t glamorous enterprises by any stretch. But they’re undeniably lucrative over the long run.

It’s simple to see why: When you’re buying into a business that gets constant revenue from services people will never stop paying for… you’ve got a strong wind at your back.

What’s more, these companies pay generous dividends… and even better, they raise them constantly — because their cash flow keeps rising. So, these cash-generating machines can mail you ever-growing payouts for the rest of your life.

You can hold onto these stocks for decades… because your income keeps rising and there is no reason to sell. In fact, the longer you hold, the better.

Just reinvest your dividends… watch your share count rise… and before long, you could be getting a dividend check that’s bigger than what you started with. There’s no better feeling than “lapping” your stock like that.

I know, because we have five stocks in our portfolio right now that are paying us more than 100% a year on our initial investment. Three of them are paying us more than 400%.

That means we’re getting back four times more money in dividends every year than we put into the stock in the first place!

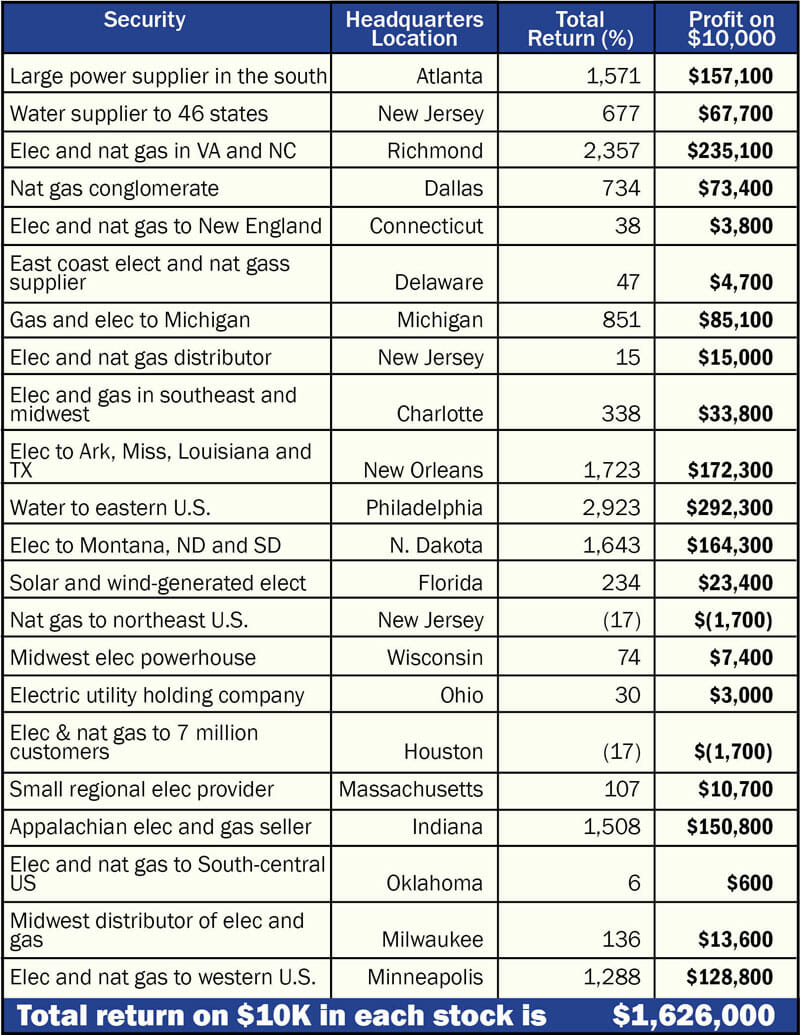

$1,626,000 in Profits

The investors acting on our recommendations are racking up serious profits.

I recently took a snapshot of every utility in our recommended portfolio and calculated their returns. You can see the results below.

You could have made $157,100 with our first pick alone — on a $10k investment.

As you can see, we’re sitting on some massive winners. What’s more, there are just two down positions (even after one the worst market crashes in history!).

If you had put $10k into each of these holdings you’d have been up $1,626,000.

Of course, you can go as big as you want. So, there’s no limit to on how much you could have made.

If you had invested $20k, we’re talking about a gain of $3,252,000 — free and clear of your initial investment.

We’re keeping our picks private here, in fairness to our paying subscribers. But in a minute, you’ll see how to get the full story on every one of them.

Why the Future Looks Event Better

Another thing you should know: this narrow niche of high-payers I’m talking about is expanding fast.

That’s because most people’s list of “must have” services is getting longer and longer.

A few years ago, the idea of calling my daughter’s iPhone an “essential service” was laughable. Now you can’t pry it from her fingers with a crowbar.

Millions of people now refuse to step outside without a smart phone in their hands. So, we are making money in key telecom players.

Likewise, plenty of people would rather eat scraps than go without television. So, we’re showing investors how to collect thousands of dollars a year from that niche too.

And now, with new streaming services like Netflix grabbing hundreds of millions of eyeballs, people are paying for services that didn’t even exist a few years ago.

Just like old-school utilities that sell electricity, water, and natural gas, these new essential services are reliable growers. And they are also pretty much recession-proof.

One big difference is that these newer players aren’t monopolies. And they’re not mandated by law to make a profit.

But that’s OK. Because in today’s world, they are as close to a locked-in money maker as any regulated electric company.

Millions more people are paying for a growing number of services they put on “auto pay” and forget about… transferring millions of dollars a day into the pockets of investors like us.

In fact, I’m convinced that a small handful of stocks we’re tracking will keep banking monthly payments for decades to come, because their customers are going nowhere.

Bottom line, rates keep rising and hundreds of millions of people keep paying…

For example, Comcast has just increased its fee for broadcast television by 54%. And it recently hiked its cable box rental fee, too.

DirecTV just raised its video package rates $8 per month… and Dish Network raised theirs by $5 per month.

Then you’ve got Sling, Hulu, and all the streaming services… collecting $2 to $3 billion per month.

In music, there is Spotify and Pandora… where you have 130 million Americans shelling out $9.99 a month.

In radio, you have 35 million people sending $15.99 a month to SiriusXM. That’s $560 million, every month. We can get a cut of all of it.

Best of all, these are the ultimate “sticky” revenue streams.

Once someone is on board the pay train, it’s tough get off. Try to cancel a cable subscription and see if you don’t start pulling your hair out.

This business model might be an irritating pain in the rear for some, but these never-ending bills mean real profits for us.

Want proof?

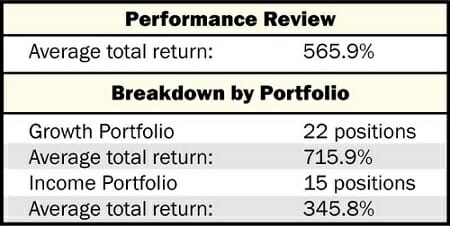

Take a look at our Performance Review in the box here. You’ll see how easy it is to make money in this arena.

This is a snapshot of every stock we currently hold in our recommended portfolio. So not only are we pulling in huge dividends every quarter, but we’re accumulating serious capital gains. Our average total return is 565.9%. That’s more than six times our money!

If you’re interested in joining us, there’s something else I’d like to point out…

We’ve Been Making Money this Way for 31 Years Now

We started doing this way back in 1989… when the Berlin Wall was still standing.

That really means something when you consider that the average lifespan of an investment advisory is something like 22 months.

I’d say about 1,450 newsletters and trading services have come and gone since we opened our doors.

I’ve seen newsletters devoted to dot-coms… day-trading… penny stocks… bitcoin… solar power… biotech… Nanotech… IPOs… gold and silver… emerging market BRICs… it goes on and on.

Every time a new fad pops up on Wall Street, a new “advisory” pops up to capitalize on it. And 95% of them are now extinct.

That’s not us. We are making money the same way since we started out more than three decades ago. We’re about as trendy as Crocs and fanny packs.

But our approach never stops working. Because essential-service stocks never go out of style.

Some of our readers have been with us for decades. And it has paid off…

I already mentioned Patrick N., who’s been able to pay for his three round a week golf “habit,” as well as take his wife on an impromptu vacation to Florida.

I hear from people like Patrick all the time — investors who have been generating cash this way for years and years…

It’s Time to Play it Safe

I have been investing this way since I was 16.

I started with absolutely nothing… never received an inheritance… and I’ve grown my portfolio to seven figures — thanks to the sort of companies I’m telling you about today.

The stock market has been so good to me that I’ve learned to ignore the gloom-and-doomers.

But the coronavirus has changed everything the experts thought they new about stock-market behavior.

In just 16 days, stocks reversed from an all-time high to a bear market. We’ve never seen anything even close to that before.

Three times in six trading sessions, we witnessed the largest single-day point crash in stock-market history.

On March 9th, the Dow set a new record, dropping 2,013 points.

Three days later, it set another record by falling 2,352 points.

Then on March 16th came the biggest crash of them all, with the Dow finishing down 2,997 points. (That’s almost 4x more than it lost in any single day in the entire 2008 financial crisis.)

The Fed is helpless. In their first emergency interest rate cut since 2008, they slashed rates to zero. It was the most dramatic move they’ve made since the financial crisis.

Result? Stock futures hit “limit down,” and ended the day 1,169 points lower. Clearly, the old playbook isn’t working… and we could well be in for more pain ahead.

History isn’t encouraging. The last time the market suffered a shock this severe, Congress stepped in to “help out” and injected $700 billion into the financial system.

But instead of going up, stocks dropped another 31%.

So, I’m skeptical that this latest Congressional stimulus is going to do much for investors either.

Look, I don’t know for sure that stocks are about to crash again — and no one else does either.

All I’m saying is why not play it safe?

If you’ve spent decades building your nest egg, don’t watch it all go poof — especially when you can prevent it so easily.

The stocks I stick to are as close to a bullet-proof hideout for your money as you’ll ever find.

They sell must-have products and services; they are the most crash-proof stocks anywhere.

They shed bear markets like water off a duck… and often actually go up when the rest of Wall Street panics.

Just look at what happened in every serious market reversal of recent years…

When the Dow and S&P 500 each shriveled by about 20% in the fall of 1998, utilities — the ultimate essential-service stocks — rose 4%.

After the market plunged in the dot-com crash of March 2000, these same essential-service stocks were up 42% by the end of the year… and have gone on to rise 400%, quintupling investors’ money.

Then came the most vicious bear market in living memory, the rout of 2008.

By the end of 2009, utility stocks had fully recovered and eked out a small gain. Meanwhile, the S&P 500 was still down 4.4%.

This keeps on happening…

Just two years ago, in March, when the S&P 500 slumped 7.2%, the Dow Utility Average was actually up.

And despite a brutal October for stocks, our portfolio rose in value that month.

I won’t pretend that our picks never dip. They can take on a little water when the market gets stormy. But they bob around like corks on a wave compared to so many stocks that sink like a stone.

We saw more proof of this remarkable resilience just recently…

In 2018, 79% of U.S. stocks were down — but more than half of water, gas, and electric stocks were UP.

Now… even in the middle of this sudden pandemic bear market… our own portfolio is still going strong.

Our batting average stays so high in tough times because we own so many old-school regulated outfits that sell electricity, water, and gas. What other investment can you buy whose profits are mandated by law?

I can’t imagine a more solid, can’t-lose proposition than socking away some money in these high-yielding beauties. And when I say “can’t-lose,” I’m not just blowing smoke.

Because to repeat, no regulated utility has ever gone out of business — EVER!

If that doesn’t impress you, then you’re pretty tough to please… or maybe you know something I don’t. I certainly don’t know any other investment that offers you all this…

- Fat dividends — The average stock in our portfolio now throws off an effective yield of 69%. What’s more, those dividends usually increase faster than inflation every year, so your nest egg is always a step ahead of that silent wealth-killer. These are the best income stocks you can own, bar none.

- Superb total return — Few investors realize it, but with their high dividends and steadily rising prices, these overlooked stocks have beaten the S&P 500 by 1,164 percentage points since the year 2000. Tell that to anyone who says utilities are just stodgy stocks for widows and orphans.

- Predictable stress-free gains — You’ll make your money at a steady pace with much less volatility. As a group, these stocks are half as jumpy as regular stocks.

- Peace of mind — You can buy a handful of these Steady Eddies and lock them away for years.

- Bear-market insurance — Utilities and other essential-service stocks are the most recession-proof stocks you can buy, bar none.

- Retirement security — The vast majority of these constant-cash-generators will mail you bigger and bigger payouts forever. And these payouts grow about twice as fast as Social Security’s meager “COLA” bumps.

No Substitute For What these Stocks Give You

These stocks can get you through anything because, simply put, there is no substitute for them.

Can you picture a day when you call up your power company and say, “No thanks, I’m all good here”?

Or your telephone or Internet provider? How about your water company?

Everyone buys electricity, not to mention heat, water, and phone service, even when money is tight.

They may cancel the Caribbean cruise, but they’re not going to sit around in the dark taking cold showers with rainwater. That unwavering, nonstop demand is a luxury that very few businesses enjoy.

No wonder utilities are kicking the tar out of the market.

I was checking the numbers recently and since the market topped out in early 2000, our “old school” utilities have posted a 1,636% gain… towering above the S&P 500’s 195% and the Nasdaq’s 240%.

Let Me Show You The Best In My New Report

I cover some 200 essential service companies in the U.S. and around the world.

Scores of them should churn out 15% gains like clockwork year after year. But 37 of them — spread across the country in 27 cities — have been such superb performers that they are now averaging a 69% yield for us.

So, with your permission, I’d like to send you a copy of The Incredible Dividend Map: 27 U.S. Cities Where Stocks Are Paying Us 69%.

This special report reveals where our 37 holdings are located across the country… along with a brief profile of each.

This report is your first step on the path to achieving these seemingly impossible yields for yourself.

You’ll see how allowing the steady momentum of compounding to work its magic over time is now giving us a yield of 69% on our investing dollar.

Now as I mentioned before, a new investor won’t pocket that much right off the bat… but every stock in this report can turn into a massive yielder for you, no question.

And there are five in particular that you need to know about ASAP.

These include the ones sending Paula Kramer $319,202 a year… Ted Ebert $718,762… and William Logan $228,054 a year.

I drill down deep on these five specific companies in the report…

- The Minneapolis cash machine (now yielding us 43%) — This company is so profitable it seems almost unfair — until you realize you can get in on the act yourself. The perfect “boring is beautiful” stock, there’s nothing fancy here. It just functions smoothly year after year. And it earns an extremely high grade from our safety rating system. Meanwhile, it has hiked its dividend 28 years in a row and offers one of the surest payouts you’ll ever find. You can buy this one and lock it away for the long haul.

- The Philadelphia water play that’s yielding us 72% — Started in 1886 by a group of college professors to supply water to their town, it now serves more than three million people in eight states. A voracious grower, it’s snapping up smaller competitors at the rate of one every 17 days. This is the one I mentioned up front that’s paying William Logan $228,054 a year in dividends. You just don’t find a surer slam-dunk income play than this. It has already rung up a 3,109% profit for us, and it’s still a strong buy. As a bonus, it will reinvest your dividends for you into more shares at a 5% discount.

- 191 dividends in New Orleans (now yielding us 75%) — On a summer day in 1913, a sawmill operator in rural Arkansas had the idea to burn his sawdust and turn it into electricity. Starting with a $500,000 loan, his backwoods enterprise is now an energy powerhouse worth $20 billion, bringing power to four states. This dynamo just paid its 191st consecutive dividend… and has hiked that dividend for the past 48 years in a row. It offers a remarkable combination of value, yield, and dividend growth.

- The 9-bagger from New York City (now yielding us 67%) — Leading the 5G charge, this telecom pioneer wants to replace the hassle of tapping out text messages with video messaging. It micro-targets 117 million customers with ads that follow them from their TV to their laptops to their smartphones… and is grabbing a chunk of the lucrative mobile advertising market away from Google and Facebook. It’s up 889% since we bought in, and we’re still buyers.

- North Dakota juggernaut yielding us 437% — One of our few investments not located in a major city, this one is paying $718,762 a year to Ted Ebert… $233,041 to Daniel Grady… and $66,910 to Pamela Moore. It generates electricity, builds power plants, and distributes natural gas. We’ve held it for 29 years and it hasn’t disappointed us yet. The real story here is its ability to grow in all markets… and the stunning 1,763% gain it has made us. This overlooked dynamo has raised its payout every year and in every economic climate, shedding bear markets like water off a duck.

These five stocks are legitimate mattress-stuffers, the kind you can buy and forget about — forever, if you want.

They’re growing their dividends so fast that for every dollar you put into them now, you could have two dollars in your pocket a few years down the road… and you’ll be doing it by buying businesses that literally can’t fail.

Like every report we release, The Incredible Dividend Map is the product of our own in-house research team.

That’s what differentiates the work we do from so many financial publishers.

We are 100% independent. We have zero affiliation with any brokerage or investment products.

And we don’t take a nickel from any company we recommend.

Our only mission is to uncover smart ways to make money that our readers would probably never find on their own.

And right now, one of the smartest moves any income investor can make is to put some money into the dividend machines we’ve uncovered in The Incredible Dividend Map.

I’ll send you this list of cash cows — and all my backup research — at no charge.

All I ask is that you accept a trial subscription to the publication that brings opportunities like this to your doorstep every month: Utility Forecaster.

This 12-page monthly bulletin is the only periodical devoted exclusively to making you money in essential-service stocks. There’s nothing else like it anywhere.

What I’ll Do for You Every Month

You can count on me to perform three major tasks in every issue of this unique income advisory:

- I analyze the latest numbers on every essential-service stock in the nation. I project future performance and give you specific recommendations. And I follow up on previous picks.

- I uncover the top growth prospects. Is the company involved in any money-making venture outside its bread and butter business? Is it tapping into new technologies? What kind of risk is it taking for growth?

- I make sure your dividend is SAFE. I put cash flow under a microscope. I dig deep to confirm that a high, double-digit yield isn’t a trap.

This last point is vital, because it means you get an early warning WAY before anything can go south on us.

After all, I’ve got money in these stocks, too.

So, I do everything humanly possible to make sure we never get blind-sided by bad news.

I put every stock through an analytical boot camp before I even think about recommending it to you.

With an average total return of 565.9% on our holdings, it’s safe to say the system works.

While the rating system itself is complex, its results are crystal clear. Your investment life will never be simpler.

I’ll tell you where to put your money and when and where to move it around. You won’t trade much.

Why should we fritter away our money on commissions, taxes, and bid/ask spreads? The idea is for us to get richer, not our brokers.

So… if you prize a high income, steady growth, and, above all, safety, why not join the thousands of investors who are already getting all this from Utility Forecaster?

As you’ll see right from your first issue, I report to no one but my readers. Our entire business is built on making money for them — and they only stay with us if they profit.

And since thousands come back year after year, we must be doing our job pretty well.

Try It Out On Me

I can tell you about all the money we’re making until I’m blue in the face, but you’ll never know if Utility Forecaster is for you unless you give it a shot.

Here’s an idea: Why don’t you just try my service for the next 90 days, on me?

I’ll make it easy for you to get started.

First, I’ll send you The Incredible Dividend Map: 27 U.S. Cities Where Stocks Are Paying Us 69%, which describes in full detail the opportunities I just listed above.

It also includes the first-ever map of where all these income machines are located.

We will never release this report to the public. But I’ll send you a complimentary copy when you take a trial look at the service that brings these tireless wealth-builders to your door every month.

On top of that, I’ll knock 73% off the standard rate to welcome you as a new member of my service.

So instead of the regular price of $149, you can get in for just $39.

It’s the lowest price we’ve ever offered for Utility Forecaster.

Remember, you don’t have to make a final decision right now. Today I’m asking you to just TRY my service.

As soon as I hear from you, I’ll send you the current issue of Utility Forecaster… along with a copy of The Incredible Dividend Map: 27 U.S. Cities Where Stocks Are Paying Us 69%.

You’ll see five extraordinary wealth-builders you should check out ASAP.

You’ll also get an uncensored look at our entire portfolio so you can see for yourself how we’re banking these incredible yields.

And please take your time with all this. There’s no rush.

You have three full months to get to know my service… check out each new issue of Utility Forecaster… go over my portfolio… and maybe even buy a recommendation or two.

That’s plenty of time to kick-start a growing stream of income into your account.

If it isn’t for you, no problem. Just let us know within 90 days and we’ll send you a 100% refund, no questions asked.

I’m not talking about a partial pro-rated refund. I’m talking about the entire fee.

Of course, your copy of The Incredible Dividend Map is yours to keep — no matter what you decide.

So, I hope you give us a try. You can’t lose a penny… and I think you’ll be impressed by the remarkable amount of high-yield research you get for so little.

To get everything immediately, go here now.

Robert Rapier,

Chief Investment Strategist, Utility Forecaster

P.S. You’ll also see how you can get an even better deal with our two-year option. Here are three good reasons why it’s smart to sign up for two years:

1) You save even more. Our introductory two-year offer saves you $220 off the regular rate (compared to $110 off for one year). Since this double-discount is for new subscribers only, it makes sense to get it while you can.

2) You get three additional special reports:

- Old School Stars: 4 Unstoppable Back-to-Basics Utility Stocks

- The Gatekeepers: Three Companies that Control the Future of Natural Gas in America

- Broadband Billions: These Three Powerhouses Are Here to Stay

3) You’re still 100% protected with a full-money-back guarantee. Since you can get all your money back anyway, there’s no reason not to go for two years and get a bigger discount and the bonus investment research.

You get a total of four special investment reports with a two-year term, versus just one when you subscribe for one year. And these reports are yours to keep, no matter what.

You absolutely can’t lose a thing by checking it out. Go here to review my offer and get started immediately.

Copyright © 2022 Investing Daily, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review Investing Daily’s’ terms and conditions and privacy policy pages.